Abstract

Increased transportation and logistical costs in agricultural markets have affected the spatial allocation of production in the agricultural and food sectors of the economy. We develop a spatial model of farm product procurement by a food processor, which is designed to capture the effects of supply-chain disruptions on the spatial procurement of farm products in the processed food sector. We use detailed data on production and procurement from a large California tomato processor to estimate the key parameters of the model, which allow us to calculate the price elasticity of supply for California tomato paste production and describe how changes in energy prices and transportation costs for primary agricultural products affect the supply of processed food.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent supply chain issues that involve shocks in transportation and logistical costs in agricultural markets have played an important role in food price inflation, as rising energy costs and increased trucking rates have affected the spatial allocation of production in the agricultural and food sectors of the US economy. Agricultural products that are used as an input in the production of manufactured or processed food products require matching the production of primary agricultural products that are grown on geographically dispersed farms with the operation of food processors, which rely on the primary farm products to produce wholesale food for downstream markets.

Because primary agricultural products provide the raw material inputs that are used by the food processing industry, farmers who produce agricultural products for the processing sector tend to co-locate with food processing plants (food processing firms typically operate several plants). This raises the issue of how the allocation, pricing, and distribution of primary agricultural products across space in the upstream procurement market affects the supply of manufactured food products in downstream markets.

In this paper, we examine how the spatial delivery of primary agricultural products affects the elasticity of supply in the downstream processed food market. While the importance of spatial delivery costs for agricultural products has been recognized since at least Samuelson (1952) and Takayama and Judge (1971), it is surprising that there has been little development of models to understand how changes in transportation costs for primary agricultural products in upstream markets affects the supply of processed food in downstream markets.Footnote 1 This omission is notable, because agricultural products are generally homogeneous commodities that are traded at publicly-available and observable prices, which provides an important lens to understand the role of transportation and logistical shocks in input procurement on the supply of manufactured goods more broadly in the economy.

Understanding how changes in transportation costs impact consumer prices for manufactured food is particularly important given the increased public attention on energy policies such as carbon taxes that raise fuel prices, and the potential role of such policies on food price inflation and the consumer incidence of commodity price shocks in the agriculture.

Transportation costs for primary agricultural products represent a substantial portion of overall food processing costs. As Durham et al. (1996) observe for the case of processed tomato products, changes over time in the geographic location of tomato production in California caused tomatoes to be hauled longer distances, which increased transportation costs for the industry to a 15–20% share of raw product value. As a result, shocks in the transportation sector have the potential to affect the supply of manufactured food products profoundly.

Among other things, understanding how changes in transportation costs for primary agricultural products affect food processing costs is important for understanding price pass-through in vertically structured industries with an upstream input procurement market and a downstream manufactured product market. In the case of food markets, the literature on wholesale and retail price pass-through has found substantial price rigidity at the wholesale level that reduces pass-through rates and causes delayed pass-through to occur (Nakamura, 2008; Nakamura and Zerom, 2010; Hong and Li, 2017).

Bonnet et al. (2013) point to the potential role of nonlinear pricing contracts and vertical restraints in the manufacturer-retailer portion of the supply chain in explaining wholesale price pass-through in response to cost shocks in primary agricultural product markets; however, such an outcome may be driven instead by changes in transportation costs in the food processing/manufacturing sector when procurement costs rise over distance and upstream shocks in farm prices alter the spatial distribution of deliveries. This is particularly true in cases where changes in food commodity prices coincide with changes in energy prices, as in the case of grain that can be used to produce either manufactured food or biofuel.

We apply our model to examine the production of processing tomatoes in California. The processing tomato industry in California is ideal for studying these effects for several reasons. First, California food processors are responsible for the production of roughly 95 percent of all processing tomatoes in the US and have approximately a 33 percent share of the global market (USDA National Agricultural Statistics Service, 2022b). Second, unlike food manufacturing for highly differentiated food products, the production process for tomato processing is relatively simple: It essentially involves the combination of heat and pressure to a primary agricultural input to produce processed tomato products such as tomato paste.

Third, the tomato processing industry in California relies on a uniform pricing schedule, wherein all sellers of primary agricultural products receive the same posted farm-gate price for processing tomatoes, regardless of the firm with which they contract or their distance from the processing plant (Durham et al., 1996). Unlike the case of free-on-board (FOB) or “mill” pricing under which a food processor pays a constant mill price at the plant gate and sellers are responsible for costs of shipping product to the plant, uniform farm-gate pricing involves a commitment by the food processor’s fully absorbing the shipping costs.Footnote 2

In this paper, we develop a spatial model of primary agricultural product procurement from the California processing tomato sector and use this framework to characterize the processed food supply function for tomato paste. Because farmers and food processors co-locate in geographic space, the model results in the pass-through of higher energy costs that increase transportation costs for primary agricultural products into higher prices for processed food. Predicting how changes in energy prices and transportation rates in the farm sector affect processed food supply is essential to understand how changes in farm product prices pass through to changes in wholesale prices for manufactured foods.

Our model conceives of the food processing firm as relying on capital and labor inputs to operate one or more plants, where the scale of the plant then determines its capacity to process a primary agricultural product into manufactured food products. Firms of this sort must solve not only the usual neoclassical problem of choosing optimal combinations of inputs and scale to maximize profits, taking prices as given, but must also deal with the problem of sourcing the agricultural input over geographic space from dispersed farm operations to the processing plant.

Because producing the primary agricultural product (processing tomatoes, milk, corn, sugar beets, etc.) necessarily occurs on agricultural land, and because different land is better or worse suited to the production of particular crops, the food processing firm solves an important co-locational problem when it decides where to construct and operate its plants. Specifically, as long as transporting the agricultural input is costly (either because of the direct costs of moving the inputs, or because of the perishability of the input) the firm has an incentive to locate its plants near productive agricultural land where the primary agricultural product is sourced. The operating scale of the plant, in turn, becomes a scarce factor that generates positive Ricardian (quasi) rents.

We depart from the existing literature by modeling a production process that requires sourcing the primary agricultural product from a procurement market that involves increasing transportation costs over distance. The processor chooses plant operating capacity in the long run, which requires deployment of capital and labor inputs. Then the processor procures a primary agricultural product (e.g., tomatoes), and applies pressure and heat to inputs of raw farm material to produce a finished processed food product (e.g., tomato paste) for sale in the wholesale market. Changes in transportation costs for the primary agricultural product thereby affect the marginal cost of processed food production by altering the geographic extent of the procurement market around the processing plant, which gives rise to an upward-sloping supply function for the manufactured good.

To estimate the long run elasticity of supply for processed tomato products, we combine restrictions from our simple model with proprietary data that we collected from California tomato processing firms to calculate the elasticity of processed tomato supply. Results from the model are as follows: (i) the spatial distribution of primary agricultural products affects the marginal cost of processed food supply; (ii) in terms of the supply elasticity of processed food, greater land productivity and/or a larger land density of farms in the geographic proximity of the processing plant makes food product supply more elastic; (iii) processed food supply becomes less elastic as plant capacity increases; and (iv) higher transportation costs for the primary agricultural product—for example from changes in logistical expenses of contracting loads—make processed food supply less elastic.

We apply the model to examine the elasticity of supply for tomato paste in California with the use of detailed data on the spatial procurement of processing tomatoes. Our estimate of the price elasticity of tomato paste supply is 0.97, which is at the lower end of the range of residual supply elasticity estimates that face food processors that have been calculated by Durham and Sexton (1992). The relative rigidity of tomato paste supply vis a vis processing tomato supply in the upstream farm product market indicates the important role of transportation costs in dampening price responses to output changes in markets with uniform pricing and spatial procurement. We also identify novel effects of transportation cost shocks on the output of processed food, and thereby contribute estimates to the literature on the elasticity of processed food supply with respect to various parameters of the transportation cost function.

The remainder of the paper is organized as follows: In the next section we provide some background detail on the processing tomato market. Section 3 describes our model: We focus first on our novel description of production, and then describe the firm’s inverse supply function given this form of production. The critical element for determining supply and other elasticities is the cost of sourcing the primary agricultural input from across different points in space. We describe how the location of agricultural production on land around the processing plant affects transportation costs, and develop expressions that describe the input cost function in the case where farm products are procured from farms located at varying distances from the processing plant. Section 4 describes our highly granular data on processing tomato transport costs, which we combine with additional data on processing outputs to construct an estimated transport cost function that we use to calculate various supply elasticities. Section 5 concludes.

2 Background

California processed tomato manufacturers are responsible for producing 96 percent of all processed tomato products in the U.S. (11.1 million metric tons (MT) out of 11.6 million MT in 2021) and provide nearly one-third of total world tomato supply: 39.1 million MT in 2021. After California, Indiana, Ohio, and Michigan account for most of the remaining domestic production, while the dominant international producers that compete with California are in China, Italy, and Spain. Processing tomatoes are mostly processed into tomato paste, with a lesser share devoted to whole-peeled and diced tomatoes and various tomato sauces. Tomato paste finds its way into a very wide array of products, including things that obviously involve tomatoes (e.g., tomato juice is generally made from paste), as well as others that may not (e.g., beef jerky).

During the prime processing season in late summer (July–September), tomato processing facilities seek to maximize capacity by running continuously: twenty-four hours a day, seven days a week. Part of the management of this production schedule involves arranging harvest contracts with growers that specify logistics and timing of deliveries. The raw tomatoes are harvested ripe and supplied from farmers’ fields to the processing facility, where they are maintained at the facility for a brief time within the season, and are not kept in cold storage. Processed tomato products such as tomato paste and canned tomatoes are shelf-stable and generally are stored at room temperature on pallets or drums at the plant for sale throughout the year without the need for refrigeration. Thus, storage of both processing tomatoes and processed tomato output requires minimal additional energy beyond that accounted for during production within the facility.

While some Californian processors produce additional specialty products, the dominant products are paste and diced tomatoes, which are either sold in bulk to downstream food manufacturers for further processing into tomato sauce, juice, ketchup, and other food products, or else are sold in retail-ready packaging for consumers (USDA Economic Research Service, 2022).

Within the State of California, the three biggest processing tomato counties are Fresno, Yolo, and San Joaquin, in order of importance, although significant production also occurs in Kings, Colusa, Merced, Stanislaus, Solano, and Sutter counties. While farm production of processing tomatoes is primarily centered in the San Joaquin and Sacramento Valleys, 19 (of 58) counties in the state reported significant processing tomato production in 2021 (see Appendix Table 4).

Tomato is a warm-season crop: either planted by sowing seeds directly into the ground during late January or early February, or grown in greenhouses until they are ready to be planted in the spring (Naeve, 2015). The tomato harvest season typically lasts nineteen weeks with the major portion of the harvest occurring between July and September. The harvest period typically begins in mid-July, and operates at full capacity throughout August and September, with the harvest season generally winding down in mid-October (Trueblood et al., 2013).

While some processing plants manufacture pulp-based products such as stewed and diced tomatoes, most initial processing is done by firms that manufacture raw paste. Almost all processing tomato production in California is forward-contracted between the grower and the processing firm, rather than sold on the open market, with prices that are settled contractually well before the season starts.

In terms of processed food production, bulk tomato paste comprises roughly 50–60% of processed tomato output, followed by canned tomatoes and sauces, with a small share sold as whole peeled tomatoes (USDA National Agricultural Statistics Service, 2022b). Thus, tomato paste is the most important processed tomato product produced in California, which is either sold in bulk form to downstream food manufacturers or else used as an intermediate input in production of catsup and sauces. After tomato paste, various sauces including puree, diced tomatoes, chili, and pizza comprise the next largest sales category, followed by whole peeled tomatoes.

Processing tomatoes are unique in that a single bargaining association—the California Tomato Growers Association (CTGA)—represents the majority of growers, and negotiates prices in contracts with each of the nine tomato processors that operate in the state. CGTA prices for processing tomatoes are contracted prior to the growing season, so as to ensure the participation of growers in the market; as a result, a given tomato processor pays all California farmers approximately the same farm-gate price for tomatoes in delivery contracts each season (though this price varies slightly across processors), with transportation arranged and paid for by the processing plant.

In our analysis of the processing tomato market, we view the decision of farmers and processing plants to produce in a given region as a co-location decision. Economic shocks that increase production costs or shift consumer demand after the growing season commences thus affect regional economic activity at both stages of production jointly.

Specifically, food processing plants and the farmers that support them tend to exit the market together when the margin between the consumer price and farm price narrows in relation to margins that are available elsewhere. For this reason, the transfer of processed food production out of a particular region is closely tied to the land allocation decision of farmers in the region, the long-run price elasticity of farm supply, and the ability to trans-ship processed goods into the consumer market from other regions to meet consumer demand.

3 The Model

Our analysis of processing tomato supply is based on a spatial model of procurement in which food processors face increasing transportation costs over distance to deliver farm products to the nearest processing plant. We first describe a parametric production function for a representative food processor that operates a single plant—this analysis generalizes to multiple plants—and then provide a specification of transportation costs that are faced by the firm given its plant’s location. Finally, we combine these elements to derive the cost function for a food processing firm under spatial procurement of the farm input and derive an expression for the inverse supply function for the case of a price-taking firm.

3.1 The Production Function

The production function of the food processor has two components: (i) labor and capital that are required to operate one or more plants, which depend on the operating capacity selected for each plant before the growing season; and (ii) energy and heat that are used for cooking the agricultural input, which depends on seasonal procurement of the agricultural input. Based on prevailing output prices for the processed food product, the procurement decision of each plant—and therefore the supply of processed food across all processing plants in the market—is thus determined by farm product prices and transportation costs at the individual plant level.

First consider the operating capacity of a representative food processing plant. In our interpretation of the problem, the firm uses capital (K) and labor (L) to operate a plant, where the size of the plant then provides the firm capacity to process the agricultural input. For a firm that uses energy and raw material inputs to process an agricultural input, the size of the plant then defines its capacity. We assume that plant construction involves a standard Cobb-Douglas production function, with capacity equal to

where \(\beta \) and \(\gamma \) are the usual curvature parameters in the Cobb–Douglas production function, and where B is a productivity parameter.

Next consider the cooking technology for the agricultural input. Given a plant of a particular capacity, food processing in many relevant agricultural industries is quite literally a matter of using energy to heat the agricultural input. At the individual plant level, we therefore model the food processing sector with fixed-proportions technology.

Let x denote the quantity of agricultural input. Processing a single unit of the agricultural input is assumed to require \(1/\alpha \) units of energy e, so that (given a plant of sufficient capacity) output is given by

Combining the “plant operation” and “cooking” technologies that we described above yields an overall production function for the firm that depends on four inputs: energy (e), the agricultural input (x), labor (L), and capital (K). The production function is assumed to yield an output y, and takes the form

where, in addition to the parameters and variables defined above, A is a productivity parameter. This production function can be seen to allow for substitution between capital and labor in the operation of the plant, while the cooking process within the plant relies on Leontief technology, which we believe captures the nature of the actual production processes that are employed by many food processors.

3.2 The Firm’s Problem

Now consider the problem that faces a price-taking, profit-maximizing firm that operates the production function described above and that has to deal with the transportation costs of the agricultural input. Irrespective of the nature of the firm’s profit-maximization problem, all firms that maximize profits must also solve the cost minimization problem that is associated with production.

Given the Leontief technology for converting energy and material inputs into processed food output, cost minimization implies that the firm will choose energy e, the agricultural input x, labor L and capital K such that

Because energy is related to the use of the agricultural input via

we have \(x=BL^\beta K^\gamma \).

We are now ready to describe the firm’s decision as to how much labor and capital to employ. Specifically, we compute the most efficient way to process a quantity of agricultural input x (given labor cost w and capital cost r), which solves:

The solution to this problem is to choose

Given the need to process a quantity x of the input, the total ‘overhead’ costs of capital and labor for the cost-minimizing firm can be written

This expression provides us with the minimum overhead that is involved in operating a plant capable of processing x units of the agricultural input.

We now turn our attention to the question of the cost minimizing way to produce y units of processed output: If we let p denote the energy price and q(x) denote the cost of sourcing x units of the agricultural input, the firm’s cost function is

Noting that this problem is necessarily the same as

and since (using the last constraint) \(x=y/A=\alpha e\), we have

Turning finally to the profit maximization problem, we obtain

where v is the price of the processed output. The solution is characterized by the first-order condition

The right-hand side of this optimality condition represents the firm’s marginal cost, including both short run costs associated with sourcing the input x as well as the longer-run costs associated with overhead. Accordingly, this expression characterizes the solution to the firm’s inverse supply function in the competitive case that is the focus of our attention here.

Notice that the marginal cost of processed food production depends on the marginal cost of procurement, \(q'(x)\), which in turn depends on whether the pricing arrangement with growers is freight on board (FOB) destination (at the processing plant) or uniform pricing (FOB origin) at the farm gate. In the case of uniform pricing at the farm-gate, the procurement cost for the processor depends on the spatial distribution of farms that are in proximity to the processing plant. Moreover, because farmers that produce primary agricultural products for processed foods markets tend to co-locate with processing plants in geographic space, marginal procurement cost under a uniform (farm-gate) pricing schedule depends on the distance between the processing plant and the extensive margin of farm production, which is endogenously determined by the processing plant.

3.3 Procurement Cost for the Agricultural Input

Equation (3) gives a solution to the processor’s supply conditional on the marginal cost of procurement, \(q'(x)\). Sourcing the agricultural input involves using a transportation network to move the primary agricultural product from the land where it is produced to the processing plant that receives it. A processing plant that wishes to acquire greater farm product inputs must procure the agricultural product from greater distances, and it follows that the marginal cost depends on the spatial distribution of farms around the processing plant. Thus, when spatial procurement costs increase over distance from the processing plant, rising transportation costs over distance results in upward-sloping supply for processed food even in the case of constant returns to scale in the operating capacity of a plant. This section presents a simple spatial model of procurement on an agricultural landscape around the processing plant that determines the procurement cost function: q(x).

We conceive of the plant as being located in an agricultural landscape, where the surrounding agricultural land can vary in its productivity for producing the raw material input. We introduce a productivity function \(\mu (m)\) to index land productivity as a function of the distance m from the plant. The productivity of agricultural land near the processing plant determines how much of the raw product may be transported from within a given distance to the plant, which in turn determines the rate at which the processing plant must expand procurement over distance to increase its output level.

Suppose that transportation costs for delivering the raw product to the processing plant are increasing in the distance between the processing plant according to a quadratic transportation technology. In particular, the cost of hauling a single load of tomatoes m units of distance from the farm gate to the processing plant is given by

The “fixed cost” \(\tau _0\) can be thought of as the time that is required to load, grade, and unload the processing tomatoes at the plant—all of which are independent of the distance m. The second parameter \(\tau _1\) captures costs that are linear in the distance that is traveled: for instance, fuel costs. The third parameter \(\tau _2\) governs the quadratic term, which we motivate by noting that travelling more miles may not mean a linear increase in time spent on the road. Greater distance increases the probability of encountering traffic congestion,Footnote 3 while at the same time creating more routing options (e.g., more travel on highways) which may reduce time. It may also be the case that the handful of tomato processors in California are sufficiently large that they face an upward-sloping supply curve for drivers of the specialized tomato gondola trailers that are used in the industry.

A given processor faces the cost of moving tomatoes from an entire region of production. We define this region by supposing that a given processing plant sources all of the tomatoes within a distance \(\bar{m}\). Then the cost of transporting all of the tomatoes in this region is given by the expression

The distance that is traveled to procure loads of the farm input is incidental to the problem that is faced by the food processor of sourcing x units of the primary agricultural product, but since \(x=\int _0^{\bar{m}}\mu (m)dm\) (with \(\mu (m)\ge 0\) for all \(m>0\)), we can think of the processor choosing the total amount of input x, constrained by the distance \(\bar{m}\) necessary to source that amount, which determines a function \(\bar{m}(x)\). Note, then, that by the inverse function theorem \(\bar{m}'(x)=1/\mu (\bar{m}(x))\). If the uniform price paid to growers per load of tomatoes is \(q_0\), then the total cost of sourcing and transporting x tons of tomatoes is given by

while the corresponding marginal cost is given by

where the second line follows from the fundamental theorem of calculus and the inverse function theorem. We further have the second derivative of the cost function

Notice that even in the case in which processing plants are competitive and operate constant-returns-to-scale production technologies, the need to source tomatoes at increasing costs over distance seen in (6) implies that supply curves are not perfectly elastic: Ownership of the scarce land factor creates rents to land owners that materialize over distance from the processing plant, while ownership of plants with the capacity to process additional agricultural output is a scarce factor that generates a Ricardian (quasi) rent. In this case, the uniform farm-gate pricing that is employed within the tomato processing industry implies that rents accrue to the owners of land more distant from (but within a distance \(\bar{m}\)) the processing plant.

4 Empirical Analysis

In this section, we illustrate how the model and spatially indexed cost function can be used to estimate the supply elasticity for tomato processors in California. We use actual production data that were provided to us for three California tomato processing plants to estimate parameters of our production model and then use equation (8) to calculate the elasticity of supply at the plant level for processed tomatoes in California.

4.1 Data

We obtained proprietary data from three large tomato processing firms operating in California. From all three firms we obtained highly detailed firm-level data on costs and revenues from shipped tomato products. These data include (i) monthly records of revenue and quantity shipped; (ii) detailed data on inventory and costs including raw material procurement costs; (iii) energy costs; (iv) transportation costs; and (v) labor costs. From one of the three firms we also obtained data on every single load of tomatoes sourced by the firm, including (i) the particular plant to which the load was taken; (ii) the net weight of the load; (iii) the procurement cost for the load; (iv) the distance the load was transported; and (v) the total transportation cost for the load.

Table 1 shows summary statistics of the revenue and cost data that have been provided by the firms.Footnote 4 Transportation costs are expressed in units of dollars per load. Transportation costs for raw tomatoes, on average, are $0.17 per ton mile, or $4.47 per load-mile (each load comprises about 26.3 tons). A firm may operate several plants: The average plant in our data produces 261,000 tons of tomato paste from processing tomatoes that are sourced an average of 58.95 miles away.

We use these data to estimate parameter values and then calculate an elasticity of supply for processed tomatoes in California. To estimate transport costs (the \(\tau _i\) parameters) and the land productivity function (\(\mu \)), we use detailed data from three processing plants (in a single firm) on all loads of raw tomatoes purchased from farms and transported by truck to the processing plants during the period covered by our date (see footnote 4). Our firm data also provide the average price per ton of raw tomatoes (\(q_0\)), while we observe output of 461 pounds of paste per ton of tomatoes; an average of 26.3 tons per load) to calculate the parameter \(A\approx 6.06\) tons of paste per load of tomatoes.Footnote 5

4.2 Returns to Scale in Plant Operation

The expression for the long-run supply elasticity is greatly simplified if the tomato processing plants utilize a constant returns-to-scale production technology for plant operation so that \(\beta + \gamma = 1\). Interpreting the plant’s operation through the lens of our model makes this interpretation plausible. Recall that our model decomposes the process of “cooking” the agricultural input from the employment of capital and labor inputs for operating a plant at a given nameplate capacity, so that the production function with which we are immediately concerned is just the operation (and amortized cost of construction) of a facility that can apply heat and pressure to raw material (up to this capacity) to make tomato paste.

We corroborate this intuition by estimating the Cobb-Douglas production function with no restriction on \(\beta \) and \(\gamma \) using the cost and production data that were provided by the three firms. Our sample size is small (39 observations), because our monthly production data are limited to having observations from only three to four months each year at each firm (see footnote 4). Based on that regression, our estimate of \(\beta + \gamma \) is 0.928 (std. error = 0.106), which yields a 95% confidence interval of [0.71, 1.14].Footnote 6 Thus, we fail to reject the hypothesis that \(\beta + \gamma = 1\), and we accordingly proceed under the assumption of a constant returns-to-scale production function.

4.3 Estimating the Transportation Cost Function

The input cost function, q(x), consists of two parts: (i) the price per unit paid by the processor to procure the raw tomatoes (\(q_0\)); and (ii) the transport costs of raw tomatoes to the processing plant. We take \(q_0\) to be simply the average price per ton paid to growers in 2012: $58.01.

To estimate the parameters \(\tau _i\) in the function that describes the transport cost per ton of raw tomatoes as a function of distance, we utilize the data provided for every truckload of tomatoes that was transported by three tomato processing plants (operated by a single firm) during our sample period. For each load these data include the total farm-gate payment, the total transport cost, the weight, and the distance that the load was transported.

Table 2 shows the results of a quadratic model that regresses transport cost on distance so as to estimate the coefficients \((\tau _0,\tau _1,\tau _2)\) in our expression for the (per ton) transport costs \(\tau (m)=\tau _0 + {\tau _1}m + {\tau _2}m^2\).

We estimate two different specifications of the transport cost function: One is the general quadratic specification that we assumed above; and one that restricts the transport costs to be linear. The quadratic term that is estimated in column (2) of Table 2 is significant and negative, but the implied value of \(\tau _2=-0.000189\) is so small in magnitude that it explains little additional variation in transport costs relative to the linear specification (note that the \(R^2\) statistics for the two specifications are equal to three digits).

Either specification suggests that transportation costs for raw tomato loads include a fixed cost component (\(\tau _0\)) of about $58 per load (or about $2.30 per ton), and a linear term (\(\tau _1\)) of about $2.68 per mile. The quadratic term indicates that transportation costs increase at a slightly less than linear rate.Footnote 7

Total acquisition cost for the processing plant depends on the fixed price that is paid at the farm gate to acquire raw processing tomatoes (\(q_0\)), the transportation cost per mile (the \(\tau _i\)), and the land productivity function (\(\mu \)) which accounts for the spatial distribution of loads in proximity to the plant.

We have yet to put any structure on the function \(\mu (m)\), which determines how many tomatoes can be obtained from farms m miles away from the plant. However, there are certain key features it should satisfy. First, by construction \(\mu (m)\) should be non-negative. Second, the integral \(x(\bar{m})=\int _0^{\bar{m}}\mu (m)dm\) should equal total loads of tomatoes sourced per plant that we observe in the data for values of \(\bar{m}\) around the maximum distances we observe in the data. Third, it seems natural to expect that plants and farms would be co-located so that \(\mu (m)\) is a decreasing function.

A specification that is both convenient and which has these features is to take

This parameterization integrates to \(\bar{T}\), which can be interpreted as the total loads of tomatoes available as \(\bar{m}\rightarrow \infty \). We also have \(\mu (m) = \bar{T}f(m)\), where f(m) is the pdf of the half-normal distribution. It may seem odd to be treating \(\mu (m)\) as though it is proportional to a probability density, so instead think of f(m) as the density of tomatoes grown across space. Or to preserve the probability interpretation: if we draw a random load from the set of all tomato loads grown, the probability that it is located within \(\hat{m}\) miles from the plant is given by \(\int _0^{\hat{m}}f(m)dm\).

An important virtue of this specification of \(\mu (m)\) is that estimation of the unknown parameters \((\sigma ,\bar{T})\) is extremely simple. Let \(i=1,\dots ,N\) index an observed load in our data, and let \(m_i\) be the distance that load was transported. The maximum likelihood estimator of \(\sigma \) is simply \(\hat{\sigma } = \sqrt{\frac{1}{N}\sum _{i=1}^Nm_i^2}\), the standard deviation of distances, which in this case is equal to 67.2 miles. We next estimate \(\bar{m}\) by simply computing the average of the largest observed values of \(m_i\) across plants and years; this gives us \(\bar{m}=163.5\). Then finally we have \(\bar{T}=\hat{x}/F(\bar{m})\), where \(\hat{x}\) is the observed average number of loads per plant-year, and where \(F(\bar{m})=\int _0^{\bar{m}}f(m)dm\) is just the half-normal cumulative distribution function. This gives an estimated value of \(\bar{T}=43,708\) available loads of tomatoes.

Finally, we calculate the parameter A (tons of output per load of tomatoes) by using the conversion ratio from fresh (farm) weight with the use of a factor of 5.432 for tons of tomatoes to make one ton of tomato paste, the ratio observed in our data. This implies a value of A that is equal to 4.84 tons of tomato paste per load of processing tomatoes.

Putting together our estimates of \(q_0\), \(\mu \), and the \(\tau _i\) parameters of the transportation cost function allows us to specify the input cost function as (with the use of (4))

4.4 Estimated Supply Elasticities

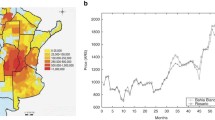

A central goal of this paper is to express the elasticity of the supply curve for processed tomato products in a form that allows us to consider the impact of changes in the costs of transportation—the parameters of the transportation cost function—on the supply of tomato paste. Because the processor’s technology is consistent with constant returns to scale (see Fig. 1), the first-order conditions from the processor’s problem (3) that equates marginal cost to price defines a simpler inverse supply curve for the firm:

Differentiating this expression with respect to y and exploiting the inverse function theorem allows us to assert that \(\partial y/\partial v = A^2/q''(y/A)\), so that the price elasticity of the supply function takes the form

Now we can make use of \(q''\) that we calculated above for the case of spatial farm product procurement.

Notice that the fixed costs of transport that involve \(\tau _0\) do not play any direct role in determining the elasticity (with respect to price) of the processed food supply function. Variable costs related to total travel depend on \(\tau _1\) and \(\tau _2\), and each of these play a role.

4.4.1 Elasticity Estimates

Collecting values of the estimated parameters in Table 2 above and incorporating them in equation (8) provides our estimate of the long-run supply elasticity for processed tomato paste (see Fig. 2).

Our results have several implications for the effect of agricultural commodity price shocks on consumer prices for manufactured foods. First, empirical models of price pass-through in food markets that fail to account for changes in the transportation sector that occur concurrently with changes in agricultural commodity prices may be misspecified. Second, because our estimated supply elasticity of tomato paste is considerably less elastic than previous estimates of the residual supply elasticity of processing tomatoes in the farm sector, our results suggest that food processors play an important role in dampening food price inflation, as the incidence of food price shocks in the farm sector on consumer food prices decreases with inelastic supply. Third, because changes in transportation costs that affect the variable components of transportation costs tend to decrease the elasticity of processed food supply, the tax incidence of energy policy such as carbon taxes that raise fuel prices will have consequences for processed food supply. Finally, disruptions in the food supply chain that are caused by pandemics and natural disasters have the potential to alter linear and quadratic transportation cost components of raw product procurement for food processors. This results in essential implications for the consumer incidence of commodity price shocks in agricultural markets that have the potential to exacerbate food price inflation.

At the level of a competitive firm, inverse supply can be interpreted instead as the marginal cost function for the processing firm, which generates implications for backwards pass-through as well. Backwards pass-through, which can occur when processing plants have bargaining power in setting the annual contract price to growers, depends on the curvature of the marginal cost function. Our estimated marginal cost function is concave, which suggests that the potential for greater than one-to-one pass-through of tomato paste prices into processing tomato prices in the upstream farm product market.

Moreover, while farm-gate prices do not affect the supply elasticity in the case that we consider here, one could relax the assumption of perfectly elastic supply of the raw farm output (tomatoes), which would allow the farm price to vary with the procurement level so as to reflect varying opportunity costs of land. We suppress this consideration here to focus the model on the effect of changes in transportation cost on processed tomato supply.

On their own, these transportation costs suffice to make competitive firms’ supply curves upward sloping: This is a result that stands in sharp contrast to the textbook case in which a competitive firm with a constant returns to scale production technology has perfectly elastic supply. Here, because the marginal cost of sourcing tomatoes across space is increasing over distance, “nearby tomatoes” that are available for procurement will always be a scarce factor.

4.5 Transportation Cost Elasticities

So far, we have constructed estimates of the supply elasticity with respect to the price of output v, and we can see how this elasticity depends on parameters of the transport cost function. This relationship is interesting because it sheds some light on the ways in which we might expect the supply of tomato paste (and related products) to be affected by disruptions to transport or logistical issues that affect raw material procurement. However, a more direct question involves the elasticity of supply with respect to the transportation cost parameters. We explore this in this section: We construct expressions for elasticities with respect to each of the three transport-cost parameters, and graph those elasticities at different levels of output in Fig. 3.

We obtain these elasticities by recalling that the first-order condition for the firm implies that \(v=\frac{p}{\alpha A} +q'(y/A)/A\). Differentiating both sides of this first order condition with respect to \(\tau _i\) (for \(i=1,2,3\)) allows us to solve for the partial derivatives \(\partial y/\partial \tau _i\) via implicit differentiation. Further, note that the elasticity \((\partial y/\partial \tau _i)(\tau _i/y) = (\partial x/\partial \tau _i)(\tau _i/x)\). Then calculation of the relevant elasticities simply involves substituting the expression for \(q'\) into the first order conditions, and differentiating with respect to the parameter of interest.

These elasticities are given by:

- \(\tau _0\):

-

\(\varepsilon _{\tau _0} =\frac{-A\tau _0\mu (\bar{m}(y/A))}{y[\tau _1 + 2\tau _2\bar{m}(y/A)]}\);

- \(\tau _1\):

-

\(\varepsilon _{\tau _1} =\frac{-A\tau _1\bar{m}(y/A)\mu (\bar{m}(y/A))}{y[\tau _1 +2\tau _2\bar{m}(y/A)]}\);

- \(\tau _2\):

-

\(\varepsilon _{\tau _2} =\frac{-A\tau _2\bar{m}(y/A)^2\mu (\bar{m}(y/A))}{y[\tau _1 +2\tau _2\bar{m}(y/A)]}\).

Figure 3 shows the value of these elasticities for variation in output. The shaded areas are pointwise 95% confidence intervals (all three elasticity curves have these, but the intervals are too small to be easily visible). Elasticities for all three parameters go to zero as output approaches its maximum \(\bar{T}\) (at which point all available tomatoes are being used).

Focusing on the different transportation parameters, changes in fixed costs captured by \(\tau _0\) have a modest effect on supply at all output levels. As one would expect, these fixed costs have a larger effect when processing plants operate at relatively low output levels.

The parameter \(\tau _1\) is associated with per-mile costs such as fuel or driver’s time, and this has the largest effect on supply, with an elasticity of \(-0.106\) at the observed level of paste output. Aside from fuel costs, this is the main channel via which changes in things like wages or gasoline taxes would affect processed food supply. Thus, policies such as carbon taxes that raise fuel prices can result in considerable reductions in the supply of processed food, particularly in cases where processing plants operate at low capacity. In cases of relatively inelastic demand for manufactured food products in the consumer market, an elastic response of food supply to changes in fuel prices can result in sharp increases in processed food prices in ways that are not accounted for in models of tax incidence that focus exclusively on fuel markets.

In contrast the parameter \(\tau _2\) governs quadratic cost elements; this is an effect that can be driven by road congestion costs. We estimate a small but negative effect on costs, which can be interpreted as evidence that longer trips encounter less congestion overall (perhaps there is more travel on major highways). But while this ratio is significantly less than zero, it is still small: It reduces transportation costs for a load of tomatoes by about thirty-three cents at the average distance of about fifty-nine miles, and at the maximum distance of 163.5 miles reduces costs by about two and a half dollars.

5 Conclusion

In this paper we have constructed a model to estimate changes in food processing supply that accounts for spatial procurement costs. Processing plants are conceived to be located in an agricultural landscape in which the surrounding agricultural land produces a primary agricultural product for the processing sector by farmers who are spatially located around each processing plant. Higher processing costs result in lower farm prices for the input, which shrinks the distances for deliveries to the processing plant; and we characterize how the change in spatial procurement alters the marginal cost of food processing.

Using detailed production and procurement data from three processing tomato firms in California, we estimate the long-run price elasticity of tomato paste supply to be 0.97. We also derive elasticities with respect to the various transportation cost parameters that represent changes in fixed (loading) cost, linear cost, and quadratic cost components.

We find that the spatial distribution of primary agricultural products affects the price elasticity of processed food supply—with greater nearby density of the input and greater plant capacity making processed food product supply more elastic. Higher transportation costs for the primary agricultural product also alter the supply elasticity of processed foods, with the portion of transportation costs which is linear in distance reducing the elasticity of processed food supply. In particular, changes in unit transportation costs over distance, for instance due to changes in diesel fuel prices, have the largest impact on the supply elasticity of processed foods.

Our results demonstrate the important role of the transportation sector in determining the output and price effects of a food processing sector that relies on the spatial procurement of farm products as a material input for production. Further research is needed to identify how shocks in the transportation sector affect the price of manufactured food products in vertical food markets that have the potential for imperfectly competitive price adjustment.

Notes

A notable exception is Chavas et al. (1998).

Uniform farm-gate pricing, for this reason, has been noted as a form of price discrimination in which nearby growers cross-subsidize more distant growers (Durham et al., 1996) This is price discrimination in the sense that (despite the uniform farm-gate price) the near-to-the-processing-plant growers would receive a premium if mill pricing instead were the norm.

During the busy harvest season traffic on the two-lane highways of the Central Valley is often delayed by the large number of tomatoes being moved about, just as traffic in Napa Valley is delayed some months later during the grape crush.

The data are composed of two firms that operated for four months of the year over the period 2010–2012 and a third firm that operated three months of the year over the period 2009–2013.

We have plant and load-level data only for one firm, which operates three plants. Figures in the table which are expressed in per plant or per load terms thus use data only from those three plants, observed over three years.

Because \(\tau _1\) depends on things such as fuel costs, one might be concerned that \(\tau _1\) is time-varying. As we are estimating a static model, our \(\tau _i\) estimates are some weighted average of fuel costs and other factors that vary over the time period analyzed. To consider the importance of variation in fuel costs over the time period analyzed, we also estimated the regression in Table 2 with the use of interactions of year dummy variables with \(\tau _1\) so that we get separate estimates for each year 2010–2012. Estimates of the annual parameters varied by less than 3% across years.

References

Bonnet, C., Dubois, P., Villas Boas, S., & Klapper, D. (2013). Empirical evidence on the role of nonlinear wholesale pricing and vertical restraints on cost pass-through. Review of Economics and Statistics, 95(2), 500–515.

Chavas, J., Cox, T., & Jesse, E. (1998). Spatial allocation and the shadow pricing of product characteristics. Agricultural Economics, 18(1), 1–19.

Durham, C. A., & Sexton, R. J. (1992). Oligopsony potential in agriculture: Residual supply estimation in California’s processing tomato market. American Journal of Agricultural Economics, 74(4), 962–72.

Durham, C. A., Sexton, R. J., & Song, J. H. (1996). Spatial competition, uniform pricing, and transportation efficiency in the California processing tomato industry. American Journal of Agricultural Economics, 78(1), 115–125.

Hong, G., & Li, N. (2017). Market structure and cost pass-through in retail. Review of Economics and Statistics, 99(1), 151–166.

Naeve, L. (2015). Tomatoes.

Nakamura, E. (2008). Pass-through in retail and wholesale. American Economic Review, 98(2), 430–37.

Nakamura, E., & Zerom, D. (2010). Accounting for incomplete pass-through. The Review of Economic Studies, 77(3), 1192–1230.

Samuelson, P. (1952). Spatial price equilibrium and linear programming. American Economic Review, 42, 283–303.

Takayama, Y., & Judge, G. G. (1971). Spatial and temporal price and allocation models. North-Holland.

Trueblood, A. J., Wu, Y. Y., & Ganji, A. R. (2013). Potential for energy, peak demand, and water savings in California tomato processing facilities. Unpublished Ms.

USDA Economic Research Service. (2022). Vegetables & pulses: Tomatoes.

USDA National Agricultural Statistics Service. (2022a). 2021 California processing tomato county estimates.

USDA National Agricultural Statistics Service. (2022b). California processing tomato report.

Acknowledgements

Funding for this research was provided by the Giannini Foundation of Agricultural Economics, and by the University of California Berkeley College of Engineering and the USDA AI Institute for Next Generation Food Systems (AIFS), USDA award number 2020-67021-32855. Special thanks to David Sunding for his leadership of an earlier related project that was funded by the California Air Resources Board that generated the firm-level data that we exploit in this paper. Thanks also to Sofia Berto Villas-Boas, Richard Sexton, Meredith Fowlie, John Larrea, and Rob Neenan for helpful comments. We also thank Matt Thomson, Meredith Brown, Anca Todor, and Lauren Beauchamp for research assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Estimation of Production Function

In this appendix, we provide results from estimating a production function that is based on monthly production data (production occurs seasonally from July to October) from three processing firms over several years. The monthly plant-level data include output, labor expenditures, and capital expenditures.

Production from two of the three firms runs from July to October, and our data include the years 2010–2012 for each of these two firms. The third firm operates from July to September and provided data from 2009–2013. We therefore have thirty-nine monthly observations across the three processing firms. Because capital expenditures occur in advance of production, we aggregate all capital expenditures from the end of the previous season to the beginning of the new season to create the baseline level of capital for the year. Then we adjust this baseline each month during the production season based on additional expenditures.

We assume that the parameters of the Cobb-Douglas production function are the same across all tomato processing firms and that w and r are constant across the time period in the sample. Therefore, we use labor expenditures and capital expenditures in a regression to find the best fit production function:

This regression yields values for \(\beta \), \(\gamma \), and \(\widehat{B} = \frac{B}{w^{\beta }r^{\gamma }}\).

The estimate of \(\beta +\gamma \) is 0.928 (std. error = 0.106), which yields a 95% confidence interval of [0.71, 1.14]. Thus, we fail to reject the hypothesis that \(\beta +\gamma =1\), a constant returns-to-scale production function. These outcomes are shown in Table 3.

1.2 County-Level Production Statistics for 2021

The following Table 4 reproduces production statistics from USDA National Agricultural Statistics Service (2022a), adding information on the area (in square miles) of the corresponding counties. “Other counties” in the table are San Benito and Santa Clara counties.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hamilton, S., Kjorlien, S., Ligon, E. et al. Spatial Procurement of Farm Products and the Supply of Processed Foods: Application to the Tomato Processing Industry. Rev Ind Organ 64, 11–33 (2024). https://doi.org/10.1007/s11151-023-09939-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-023-09939-5