Abstract

We assess the impact of regional differences related to energy transition on average costs and allowed revenues for a panel of Dutch electricity distribution system operators (DSOs) subject to yardstick competition. Yardstick competition entails that the allowed revenues of DSOs are based on the average costs of the entire industry, which requires that these DSOs are comparable. This comparability requirement is challenged by the penetration of distributed generation and other distributed energy resources, which may cause regional differences among DSOs. Estimating an average-cost function for the entire population of Dutch DSOs for the period 2012–2020, we find that the installed capacity of solar PV, installed capacity of on-shore wind and number of public electric-vehicle charging points have a significant effect on unit costs of DSOs. If yardstick competition does not take these effects into account, the allowed revenues for some DSOs (having above-average shares of energy-transition variables) are too low, whereas allowed revenues for other DSOs (having below-average shares of energy-transition variables) are too high. We find that taking the impact into account can change the price caps of individual DSOs with a percentage up to around 20%.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Electricity DSOs are generally considered to be natural monopolists and, therefore, their revenues are regulated by regulators. The aim of this revenue regulation is to provide DSOs with incentives to produce at an efficient cost level, to set the tariffs are reasonable levels and to improve or maintain their quality of service, while also providing DSOs with a sufficient reimbursement for their incurred costs. In this problem, there exists a fundamental issue of asymmetric information between the regulator and regulated DSOs. First, the regulator does not know the true efficient cost levels of the regulated firms. Second, the regulator cannot observe the managerial effort made to reduce costs or improve quality of service (Joskow, 2014; Laffont & Tirole, 1993; Vogelsang, 2002).

Regulators have introduced price-cap regulation in order to incentivize managerial effort. In price-cap regulation, the regulator sets ex ante (fixed) price caps, and allows firms to retain the rents created by producing at a cost level below these caps. Hence, the managers of regulated firms have an incentive to choose the optimal effort level to reduce costs to an efficient cost level (Joskow, 2014; Shleifer, 1985). However, although optimal managerial effort is ensured, regulators still need information to determine the level of the price caps. For each DSO, its price caps should just allow for the recovery of efficient costs. If price caps are set too high compared to the efficient cost levels, firms are able to capture substantial rents at the expense of customers. If price caps are too low, firms may fail to recover their costs.

Yardstick competition is a specific type of price cap regulation that provides a straightforward way to compare costs of individual firms and to determine the level of efficient costs (Shleifer, 1985). In yardstick competition, price caps of individual regulated firms are set equal to the average costs of a group of comparable regulated firms (Shleifer, 1985). The fixed price caps ensure that firms choose optimal effort to reduce their costs. In doing so, firms signal to the regulator what their efficient cost level is. The regulator can use this information to set price caps (and readjust them over time) to reflect efficient cost levels.

Although yardstick competition (in theory) results in both optimal managerial effort and cost recovery, it requires that DSOs, which generally operate in different geographical areas, are comparable (Shleifer, 1985; Weyman-Jones, 1995). This means that they should be similar in terms of output composition and operating environment. However, previous research found that there are several output characteristics and environmental factors can cause heterogeneity among DSOs and affect their distribution network costs (Filippini & Wild, 2001; Hattori et al., 2005; Neuberg, 1977; Hirschhausen et al., 2006; Yang & Pollitt, 2009). When the costs of DSOs depend on the specific environment in which they operate, the yardstick cost level used to inform price caps may no longer reflect efficient costs of individual DSOs. To solve this issue, yardstick price caps can be adjusted to take into account the impact of output characterises and environmental factors on average costs (Filippini & Wild, 2001; Shleifer, 1985).

In the current energy transition, the large-scale integration of distributed generation (DG) and distributed energy resources (DERs) in distribution networks could be a new factor driving distribution network costs. Several engineering studies find that integration of DG and DERs in distribution networks can result in large costs, depending on the penetration level and local network conditions such as network topology and characteristics of load (De Joode et al., 2009; Gupta et al., 2021). However, the empirical evidence using real cost data to validate the effect of DG and DERs on distribution network costs is still limited. Höfer and Madlener (2021) use a spatial regression analysis to study the effect of installed capacities of renewable energy sources (RES) on curtailment costs and find a significant and positive effect. Wangness et al. (2021) study the effect of EV adoption on total distribution network costs, using data on Norwegian DSOs, and find that EV adoption causes higher costs.

In this paper, we study the effect of various energy-transition variables on average costs of the entire population of Dutch DSOs subject to yardstick competition. Our contribution lies in the fact that we include multiple energy-transition variables, such as the installed capacity of solar PV, installed capacity of on-shore wind, and the number of EV charging points. Furthermore, we relate our findings to the application of yardstick competition and use coefficient estimates to adjust individual DSO price caps to take into account the impact of significant energy-transition variables.

Our results show that all included energy-transition variables have a significant impact on average distribution-network costs. This indicates that these variables are important cost drivers, which should be taken into account in a yardstick competition framework. When we adjust individual DSO price cap to take these factors into account, substantial distributional effects arise. Some DSOs see an down- or upward adjustment in their price caps of about 0–10%. There is one DSO, with above-average installed capacity of on-shore wind, for which the price cap is raised by around 20%. Overall, this suggests that increased penetration for energy-transition variables challenges the application of uniform yardstick competition, which provides some DSOs with too little revenues, whereas other DSOs receive too much revenues.

The outline of this paper is as follows. In Sect. 2 we discuss the relevant literature, in Sect. 3 we lay out method of research and describe the specification of the average-cost function, in Sect. 4 we describe our data, in Sect. 5 we report and discuss the results and calculate individual price-caps, and in Sect. 6, finally, we conclude. In the Appendix 1, we report returns to scale and returns to customer density. More information on data collection and a correlation matrix of variables included are available as Online Resource 1.

2 Literature review

2.1 Yardstick competition

Yardstick competition is a form of average benchmarking, in which the performance of a regulated firm is compared to the average performance of a group of comparable regulated firms within the same industry (Jamasb & Pollitt, 2001). In the uniform design of yardstick competition, the tariff a regulated firm is allowed to charge is equal to the average cost level of a group of comparable firms, including the firm itself (Mulder, 2023). Instead of the uniform design, a discriminatory design can be chosen, in which case the tariff that an individual firm can charge depends on the average unit costs of all other firms (Shleifer, 1985). In the case of multiple products, the average cost level can be calculated as the total costs divided by the weighted sum of the produced quantities for each product (Joskow, 2014; Joskow & Schmalesee, 1986).

The merit of yardstick competition is that it induces competition among regulated firms resulting in a tariff level (i.e. the yardstick) which compensates for the average costs of each firm, in the case where these firms are comparable. Because the allowed tariff levels are (at least in part) decoupled from a firm’s reported own costs, each firm has an incentive to reduce costs, although this incentive power depends on how the yardstick is determined. In general, a discriminatory yardstick regime has a higher incentive power than a uniform regime, since each DSOs’ tariff is fully decoupled from its own costs (Mulder, 2023). In relation to this, cost reductions are more or less translated into tariff reductions, such that customers benefit (Mizutani et al., 2009; Shleifer, 1985). Therefore, it is said that yardstick competition mimics market competition among regulated firms (Joskow, 2014).

The implementation of yardstick competition also has limitations. First, there may be a risk of collusion between regulated firms (Dijkstra et al., 2017; Weyman-Jones, 1995). Second, implementation of yardstick competition requires a set of regulated firms with comparable production technologies and demand functions, in order to determine the average cost level (Burns & Weyman-Jones, 1996; Joskow & Schmalesee, 1986). With regard to the second issue, the implementation of yardstick competition has been challenged by incomparability of regulated firms in various industries, such as electricity distribution, water service and telecommunications (Façanha & Resende, 2004; Filippini & Wild, 2001; Kridel et al., 1996; Resende, 2002; Sawkis, 1995; Tupper & Resende, 2004; Weyman-Jones, 1995).

In this paper, we focus on the requirement of comparability of DSOs subject to yardstick competition. This requirement can be violated when the exogenous output characteristics and environmental factors cause heterogeneity among firms and affect the costs of electricity distribution (Growitsch et al., 2012; Neuberg, 1977). If such factors are not (sufficiently) taken into account, the yardstick cost level (i.e., the average cost level of the comparator group) used to determine price or revenue caps does not necessarily reflect the efficient cost level of individual DSOs. As a consequence, application of yardstick competition can result in arbitrary profits and losses, depending on exogenous factors that are not taken into account. Filippini and Wild (2001) studied this issue for a sample of Swiss DSOs subject to yardstick competition. The authors found that factors such as customer density and service area significantly affected electricity distribution costs and they proposed that coefficients from their analysis could be employed to account for the impact of these factors (Filippini & Wild, 2001).

In this study, we focus on the question whether environmental factors related to energy transition have a significant effect on average distribution-network costs. The integration of integration of distributed generation (DG) and distributed energy resources (DERs) in the distribution network could be a new cost driver, which may be unevenly distributed among DSOs (Jenkins & Perez-Arriaga, 2017). If this cost driver is not sufficiently taken into account, an uniform yardstick competition regime that directly compares regulated firms would lead to inappropriate price caps and revenue caps.

2.2 Energy transition

In the transition towards a zero-carbon energy system, distribution networks play a crucial role. Traditionally, centralized generation was connected to transmission networks and distribution networks were designed to connect predictable amounts of load to the electricity system. Today, large amounts of generation based on RES are connected to medium- and low-voltage distribution networks, resulting in a surge of so-called DG (Ruester et al., 2014). On top of that, adoption of DERs such as electric vehicles, heat pumps and other electric technologies is associated with a substantial increase in electricity demand, resulting in increases in both total and peak load in distribution networks (Ruester et al., 2014).

The integration of DG and DERs can result in several technical challenges for distribution networks (Huda & Živanović, 2017). Large-scale integration of DG can result in overloading of various network components and reverse power flows, potentially causing issues voltage control, power quality and network safety and reliability (Huda & Živanović, 2017). These issues may particularly occur when DG penetration is high and current grid capacity is low and dispersed, which is the case in rural areas (Gupta et al., 2021). With regard to DERs, the peak load associated with adoption of EVs and heat pumps is expected to result in potential voltage rises and overloading of network components in low- and medium-voltage distribution networks (Veldman & Verzijlbergh, 2014; Verzijlbergh et al., 2012).

Consequently, large-scale integration of DG and DERs is likely to cause substantial integration costs. These costs can comprise of capital costs related to network expansions, such as upgrading of circuits, substations, switchboard and distribution transformers and replacement of communications and control equipment (Cossent et al., 2011; Horowitz et al., 2018). Also, integration of DG and DERs may require additional operational costs related to active network management and congestion alleviation (Höfer & Madlener, 2021; Ruester et al., 2014).

Several studies have aimed to quantify the costs related to DG and DER integration. Horowitz et al. (2018) have reviewed the literature on solar PV integration costs and have argued that distribution network costs may rise substantially when penetration levels surpass a certain threshold. Below this threshold, distribution network costs may remain relatively stable. The integration costs of solar PV above the threshold are mainly related to network expansions (Horowitz et al., 2018). Cossent et al. (2011) have used a reference network model (RNM) to study the impact of DG on distribution network costs for three real grid areas in the Netherlands, Spain and Germany. For each case, the authors used 2008 levels of demand and DG as input data for the reference network, and then simulated various scenarios for load growth and DG adoption until 2020, considering solar PV, on-shore wind and combined heat and power. In all cases, higher levels of installed DG capacity are associated with higher integration costs. Gupta et al. (2021) have used a network model of two large-scale distribution grid areas in Switzerland, covering both urban, suburban and rural grid areas. The authors have studied the adoption of solar PV, heat pumps and electric vehicles and have found that all three increased reinforcement costs.

Some papers have focused on the distribution-network integration costs related to EV charging. Verzijlbergh et al. (2012) have studied this for a large LV- and MV-voltage distribution network area in the Netherlands. Verzijlbergh et al. (2012) have found that net present value of total distribution network costs increases with 24–29%, for a scenario of 75% EV adoption by 2040. Using a similar case study, Veldman and Verzijlbergh (2014) have found that total grid costs increase by 25% by 2030. These results are based on uncontrolled charging strategies, meaning that households charge their EV immediately upon arrival at home and at maximum charging power. Currently, this is indeed the dominant charging strategy. However, when smart charging is applied to reduce peak demand, the increase in grid costs can be reduced by 10–20% points (Veldman & Verzijlbergh, 2014; Verzijlbergh et al., 2012). On the contrary, charging based solely on wholesale electricity prices can aggravate impact on the grid, resulting in total distribution network costs increases of 40%, since individual load profiles become more correlated when they are more responsive to electricity market prices (Veldman & Verzijlbergh, 2014).

Although the above-described engineering network models have indicated that DG and DERs can have a substantial effect on distribution network costs for various scenarios, there are only a few studies that have used econometric methods and real cost data to quantify and explain these effects. Höfer and Madlener (2021) have studied the impact of RESs on German DSOs’ curtailment costs. They have found that curtailment costs increase by 0.7% per GW of installed capacity of on-shore wind. Wangness et al. (2021) have used data of Norwegian DSOs to study the effect of EV adoption rates on distribution grid costs. They have found that increased EV adoption caused an increase in grid costs: a 1% increase in EV stock resulted in a 0.02% increase in grid costs. In this paper, we proceed on these types of studies by exploring the impact of various energy-transition related variables on the costs of distribution-grid operators.

3 Method of research

3.1 Model of electricity distribution costs

To investigate the cost structure of electricity distribution, previous studies have used parametric cost functions (Jamasb & Pollitt, 2001). The costs are described as a function of output levels, input prices and output characteristics. The output characteristics (or attributes) are added because the output produced by DSOs can be heterogeneous (Filippini & Wild, 2001). Also, service area characteristics can be included as control variables.

In this study, we estimate an average-cost function that includes several energy-transition related variables. These variables are included as characteristics of output. We assume that the regulated firm minimizes total costs, given its output level, exogenous output characteristics and input prices. For electricity distribution, this seems a suitable model because DSOs are obliged to meet demand and are not able to determine their own output (Jamasb & Pollitt, 2001).

In our cost function, we include a single output measure (i.e. number of customers) and one input price (i.e. wage). We include three energy-transition related variables: installed capacity of solar PV per 1000 customers, installed capacity of on-shore wind per 1000 customers, number of public EV charging points per 1000 customers. We also include two other output characteristics, the energy delivered in MWh per connection and the maximum demand at the MV/HV voltage level in MW per connection.

We also include other control variables: customer density to describe the service area, the System Average Interruption Index (SAIFI) to take into account interruptions in supply, and a linear time trend to control for neutral technological developments.

The resulting average-cost function can now be described as:

where AC is an average-cost measure,Footnote 1 which is equal to: C total costs divided by Y number of connections; PL is the input price of labour; ED and MD are energy delivered per 1000 customers and maximum demand at MV/HV voltage level per 1000 customers, respectively; PV is the installed capacity of solar PV per 1000 customers; WIND is the installed capacity of wind per 1000 customers; EV is the number of public charging points per 1000 customers; CD and SAIFI are the customer density and the System Average Interruption Index, respectively, and T is a linear time trend.Footnote 2

This function represents a long-run cost function, where both inputs can be adjusted to minimize costs. This is justified because we cover a moderately long time period. It is also in line with the Dutch incentive regulation, which covers both operational and capital expenditures since 2002.

With regard to the functional form, we employ a quadratic cost function to represent average-cost function (1). The quadratic function is a flexible form that imposes no a priori restrictions on returns to scale and elasticities of substitution (Martinez-Budria et al., 2003). It allows for straightforward estimation of panel data methods, taking into account unobserved heterogeneity between DSOs (Farsi et al., 2008). Another advantage of the quadratic form also allows for direct estimation with zero values, whereas alternative flexible forms such as the standard translog form can only be estimated with strictly positive values. This issue could be addressed using a ‘hybrid’ translog using a Box-Cox transformation, but this complicates the application of panel data methods (Fetz & Filippini, 2010). Therefore, we opt for the quadratic functional form over the translog form in our analysis. The quadratic form has the drawback that linear homogeneity cannot be imposed by parameter restrictions. To address this, the function can be normalized by dividing costs and input prices by one factor price (Martinez-Budria et al., 2003). However, we decided to apply the non-normalized function, since we only have one input and are primarily interested in the ad hoc empirical relation between energy-transition cost drivers and DSOs’ average costs. The specification of the quadratic cost function can be described as follows:

where the subscript \(i\) and \(t\) denote respectively the regulated firm and year. The dependent variable is average costs \(AC\), the intercept \({\alpha }_{0}\) measures average costs of producing at the sample mean. The number of connections \(Y\) and the customer density CD are included in both a linear and a quadratic way. All output characteristics (including energy-transition variables), the labour price PL, and time trend \(T\) are included in a linear way. Given the purpose of this paper, which is to identify the impact of output characteristics related to the energy transition, we want to use a somewhat straightforward specification and restrict the number of parameters required for a fully flexible specification.

In Eq. (2), the error term is denoted as \({U}_{it}\) and can be decomposed into two terms:

where we have a constant individual-firm effect \({u}_{i}\) that captures unobserved heterogeneity and a random error term \({\varepsilon }_{it}\). We estimate Eq. (2) using both pooled OLS and a fixed-effect estimation. The fixed-effect estimator utilizes the panel structure of our data and controls for unobserved time-invariant firm effects \({u}_{i}\). It takes into account heterogeneity that is not captured by control variables, such as unobserved differences in service area and constant inefficiency over time.

A potential disadvantage of the fixed-effect model is that the coefficients of independent variables can become imprecise, if there is little variation over time, i.e., variation is primarily between regulated firms (Cameron & Trivedi, 2005). In our case, we are see that there is considerable variation for our energy-transition variables both across regulated firms and within firms over time. For other variables, including number of customers and customer density, the lack of variation over time within DSOs can potentially lead to imprecise fixed-effect point estimates.Footnote 3

3.2 Taking output characteristics factors into account in yardstick price caps

Following Shleifer (1985), we can use our regression results to take into account the impact of output heterogeneity among DSOs on unit costs. For this purpose, we use the following formula:

where \({p}_{i,t}\) is the individual price cap of DSO \(i\) in year \(t\). The variable \({\alpha }_{t}\) is the mean average cost level in year \(t\), which can be seen as the uniform yardstick cost level for that year. The vector \(\widehat{b}\) is the estimated coefficient for a significant output characteristics, which is assumed to be exogenous (i.e., outside the influence of DSOs). The \({q}_{i,t}\) indicates the observed individual level of the output characteristic for DSO \(i\) in year \(t\), whereas \({\overline{q} }_{t}\) is the mean level for this variable in year \(t\).

The inclusion of (statistically significant) output characteristics leads to an adjustment of individual DSOs’ price caps, causing a reallocation of revenues among DSOs. This reflects the effect of output heterogeneity on average costs, which should be taken into account in yardstick competition. Compared to the (unadjusted) uniform yardstick, DSOs with above-average levels in \({q}_{i,t}\) will see an upward adjustment of their price cap, and DSOs with below-average levels in \({q}_{i,t}\) will see a downward adjustment. If there is zero variation among DSOs, the term \(({q}_{i,t}-{\overline{q} }_{t})\) is zero for all DSOs and all individual yardstick price caps are equal to the average cost level.

4 Data

4.1 Dutch uniform yardstick competition

The tariff regulation of Dutch DSOs was introduced in the year 2000, based on the Electricity Act 1998, article 41. Tariff regulation is executed by the national regulatory authority, the Authority for Consumers & Markets (ACM). In 2004, for the second regulatory period, the ACM implemented uniform yardstick competition to determine allowed revenues of Dutch DSOs. In this yardstick regime, the allowed revenues of DSOs are determined by the average costs level of the entire Dutch electricity-distribution sector. In this subsection, we describe the Dutch regulatory regime.Footnote 4

The Dutch electricity distribution industry can be described as follows. Each DSO \(i\) supplies a portfolio of \(j\) products in year\(t\). These products are supplied with quantities \({q}_{i,1,t}\), …,\({q}_{i,j,t}\), and, charged with tariffs \({p}_{i,1,t}\), …,\({p}_{i,j,t}\). The aggregated output \({Y}_{i,t}\) of each DSO \(i\) in year \(t\) is equal to the product of quantities and tariffs, summed over all products \(j\) included in the aggregate output:

In the Dutch regulatory yardstick regime, the aggregate output consists of three output categories: (a) the connection service, (b) the transportation service, and (c) feed-in. The categories (a) and (b) consist of more than 40 individual products, for which the regulator collects data on produced volumes and regulated tariff levels. The last output category (c), capturing feed-in by distribution-network users, was added to aggregated output from 2014 onwards. The feed-in output category was added to compensate DSOs for the increasing costs related to this output.

In the Dutch yardstick regime, this aggregate output is used to calculate the average costs of the entire Dutch electricity-distribution sector, which is defined as the total costs of all DSOs divided by the total aggregate output of all DSOs. This is the uniform yardstick cost level against which the performance of individual DSOs is compared. The calculations are performed in a backward-looking manner, using cost and output data from a specified number of previous years. The exact number of years used in this calculation may vary between regulatory periods. The Eq. (6) calculates the yardstick cost level based on three previous years:

Using the uniform yardstick cost level \({P}_{0}\), the revenue cap in the base year of the next regulatory period is calculated for each DSO. This revenue cap \({RC}_{it}\) is calculated by multiplying the uniform yardstick \({P}_{0}\) with each DSO’s average output in the specified previous years \({Y}_{i,0}\) (which serves as a proxy for future output):

This revenue cap \({RC}_{i,0}\) provides a remuneration to DSOs according to their expected output level and the average cost level of all DSOs. It is important that the aggregated output, which is used to calculate average costs in Eq. (6), is a properly weighted sum of all produced outputs and associated network costs. In the ideal case, the aggregated output measure includes (in principle) all relevant cost drivers for electricity distribution in the Netherlands and properly weighs and sums them together. In that case, any increase in distribution-network costs is associated with a proportional increase in aggregated output, such that the total costs per unit of output remain the same.

To determine allowed revenues in the subsequent years of the regulatory period, the ACM adjusts revenue caps for DSO \(i\) according to the following RPI-x formula:

where \(cpi\) stands for Consumer Price Index and is used to give compensation for inflation, \(x\) stands for the so-called x-factor which is calculated to adjust the allowed revenues for sectoral efficiency improvements and also make DSO-specific adjustments during the regulatory period, and \(q\) stands for the DSO-specific q-factor which provides a financial bonus or malus for the relative quality performance of DSOs. Each year, Dutch DSOs can propose their own tariff levels \({p}_{i,1,t}\), …,\({p}_{i,j,t}\). The national regulator approves the proposed tariffs if the expected revenues do not exceed the allowed revenues \({RC}_{i,t}\) for that year.

4.2 Descriptive statistics

The data used in this study covers the entire population of Dutch DSOs over the period 2012–2020. In the period 2012–2015, the data covers eight active DSOs. Due to a merger during the sample period, the period 2016–2020 covers seven DSOs. This results in an unbalanced panel of 67 observations.

Standardised data on total costs, output, service area and quality of service was collected from the webpage of the Dutch regulator (ACM). All cost data is deflated to 2020 price levels, using the Dutch Consumer Price Index (CPI) published the the Netherlands Statistical Office (CBS). For the output characteristics related to the energy-transition, we have collected municipality-level data from various sources and merged this data with the legal service areas of Dutch DSOs. The descriptive statistics of the variables are presented in Table 1. More information on data collection and a correlation matrix are available as Online Resource 1.

We note that we have one DSO in our sample with very distinct features: Westland Infra Netbeheer. This is a relatively small DSO with around 64.000 connections, covering a service area of just two municipalities. This DSO has a disproportionate share of commercial customers, which are mainly active in greenhouse horticulture (an important economic sector in the Netherlands). Looking at our data, we note that the energy delivered per connection and the maximum demand per connection at MV/HV are generally 3–4 times larger than the sample mean for this DSO. The total costs per connection are generally 2 times larger than the sample mean.

4.3 Variation in energy-transition variables

Before we turn to the regression results, we investigate the variation between DSOs for our energy-transition variables. For all Dutch DSOs, we show the data for the first and last year of our sample, 2012 and 2020.

Between 2012 and 2020, there was a substantial increase in the installed capacity of solar PV per 1000 customers for all DSOs (see Fig. 1). In 2012, the installed capacity of solar PV per 1000 customers was below 0.2 MW for all DSOs. In 2020, most DSOs have between 1 and 1.5 MW of solar PV capacity per 1000 customers. Stedin, the DSO with the lowest level of solar PV, had installed about 0.5 MW per 1000 customers in 2020. Hence, there is also some variation between DSOs.

For the installed capacity of on-shore wind per 1000 customers (see Fig. 2), we see a more moderate increase in installed capacities overall. There is one DSO who had a substantially larger installed capacity of on-shore wind per 1000 customers in both 2012 and 2020. Enduris had more than 1 MW installed capacity of on-shore wind per 1000 customers in 2012, and in 2020, this number increased to about 2.5 MW. Other DSOs installed between 0.15 and 0.75 MW of on-shore wind capacity per 1000 customers in 2012 and 2020. Some other DSOs installed zero (e.g. Coteq, Endinet, RENDO) or negligible (e.g. Westland) amounts of on-shore wind in both years.

Installed capacity of on-shore wind in MW per 1000 customers per DSO in the years 2012 and 2020. For Endinet, there exists no data for the year 2020, due to a merger with Enexis in 2015. For Coteq and RENDO the installed capacity was zero in both years, while for Endinet it was zero in 2012. Data source is Statistics Netherlands

For the number of public EV charging points (see Fig. 3), we see an increase in the number of charging points between 2012 and 2020 for all DSOs. There is also some variation between DSOs in 2020. The DSO with the largest (relative) amount of charging points, Westland, has connected 6 public charging points per 1000 customers, whereas several DSOs connected less than 4 public charging points per 1000 customers.

5 Results

5.1 Regression results

In Table 2, the pooled OLS and the fixed-effect (FE) estimates of the average-cost Eq. (2) are presented. We have estimated this equation for our unbalanced panel of 67 observations over the period 2012–2020. The output characteristics ‘energy delivered per connection’ and ‘maximum demand per connection at MV/HV level’ showed very high correlation, so we dropped the latter to avoid multicollinearity issues. The results are not affected by the choice for this specific variable.Footnote 5

We find that the estimates generally carry the expected sign and are often significant. We note that there are differences in the size of the coefficients between our models, which may be caused by the influence of unobserved individual effects. The intercept captures the unit costs at the sample mean and is equal to almost €295,- per connection. For all output characteristics related to the energy-transition, we find a positive relationship with unit costs. Most notably, the installed capacity of on-shore wind per connection has a large and strongly statistically significant effect in both the OLS and FE estimation. For solar PV and public charging points, the size of the effect and significance of coefficients differs between models.

For our output measure, the number of customers, we find a negative linear relationship with unit costs in both models. For the quadratic term, the coefficient carries a positive sign. For customer density, we have a different sign between our two models. The FE estimate may be imprecise for this variable, since there is little variation within DSOs. We have calculated returns to scale and returns to customer density for both, the results are presented in Table 5 (see Appendix 1). For our OLS model, we find that returns to scale is equal to 0.99 at the sample median and returns to customer density is equal to 0.94 at the sample median.

For the remaining variables, the coefficients contain the expected sign. The wage has a positive relationship with unit costs. The SAIFI has a negative relationship with unit costs. DSOs with higher service reliability (i.e., lower outrage duration) have higher unit costs. The linear time trend has a negative and strongly significant coefficient.

As discussed in the Data section, there is one DSO in our sample with very distinct features. We suspect that the inclusion of this DSO might affect the performance of our model estimates. Therefore, we also have also estimated Eq. (2) after excluding the DSO Westland Infra from the sample. The estimation results are presented in Table 3. In this sample, we are able to include all variables, since there is no longer a multi-collinearity issue. Looking at the results, we find that excluding Westland improves the performance of our model estimates. The coefficients still have the expected sign, but are more often significant. Furthermore, we find that almost all coefficients have roughly the same size in our two models.Footnote 6

5.2 Using results to adapt the yardstick on individual-DSO level

In this section, we use regression estimates to take into account the heterogeneity in output characteristics due to energy-transition factors. We predict the unit costs for observed levels of solar PV, on-shore wind and public charging points. All other variables are kept constant at their sample mean. Table 4 shows the percentiles of the predicted unit cost levels. We find that the predicted cost levels at the 20th and 80th percentiles are about 5% below/above the mean unit cost level of €266 per connection.

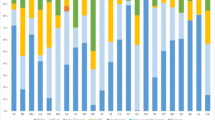

We have also used our results to calculate the impact of energy-transition variables on the unit costs of each DSO for the year 2020, using Eq. (4) from Sect. 3.2. We evaluate the changes in unit costs compared to the mean cost level in the year 2020, which can be seen as the uniform yardstick cost level. We find that the energy-transition variables cause cause a change in unit costs of around 0–10% for most DSOs compared to the uniform yardstick (see Fig. 4). We note that there is one DSO, Enduris, which faces a substantially larger increase of unit costs of about 20%. When we decompose the change into individual energy-transition variable effects, we see that this large change is caused by above-average installed capacity of on-shore wind (see Fig. 5). In yardstick competition, the results can be used to inform a bonus/malus scheme, where DSOs with above-average levels of energy-transition are allowed to charge higher price caps, and DSOs with below-average levels are obliged to charge a lower price cap.

Total percentage change in average cost compared to the uniform yardstick cost level for the year 2020, taking into account the impact of energy-transition variables. Own calculations using the fixed-effect coefficient estimates from Table 4

Decomposed percentage change in average cost compared to the uniform yardstick cost level for the year 2020, taking into account the impact of energy-transition variables. Own calculations using the fixed-effect coefficient estimates from Table 4. Decomposed into the individual effects of installed capacity of solar PV, installed capacity of on-shore wind and number of public charging points

5.3 Discussion

Our analysis indicates that energy-transition variables can have a significant and substantial impact on the unit costs of DSOs. As the penetration level of distributed generation (e.g., solar PV and on-shore wind) and EVs increases, this suggests that DSOs have to make considerable integration costs. This finding is line with engineering studies that have shown that factors related to the energy transition raise the costs of electricity distribution. Investigating actual standardized cost data from a population of Dutch DSOs, we can confirm this hypothesis. Previously, Hinz et al. (2018) and Höfer and Madlener (2021) have also provided empirical evidence that on-shore wind energy increased costs of electricity distribution. Wangsness and Halse (2021) show that EV penetration causes higher regional grid costs in Norway.

Our findings carry implications for yardstick competition and incentive regulation in general. It has long been recognised that the composition of output must be taken into account to ensure comparability of DSOs subject to yardstick competition. Our study reveals that integration of energy-transition factors adds a novel dimension to this issue, which can challenge the application of conventional output measures. A similar point is made by Filippini and Sánchez (2014), who argue that increased levels of distributed generation cause additional costs for electricity distribution, while the grid-delivered energy stays constant (or even decreases). Our analysis underscores the importance of integrating new changes in output composition within regulatory frameworks.

This study also has some limitations. Although we have collected data for the entire population of Dutch DSOs over the period 2012–2020, our sample size is relatively small. This limited the number of parameters that could be included in our analysis. For example, we did not consider any non-linearity within the energy transition factors or interaction effects with other variables. Future research could test alternative specifications when more years of data become available. Alternatively, an international comparison of DSOs could increase the sample size, although this also would create potential issues with data availability and comparability (Estache et al., 2004).

6 Conclusion

We have estimated an average-cost function over the period 2012–2020, using data covering the entire population of Dutch DSOs subject to yardstick competition. The main purpose was to investigate whether energy-transition factors have a significant impact on average costs of distribution grid operators, and whether this could challenge the comparability requirement of Dutch DSOs subject to yardstick competition.

Our main finding is that installed capacity of solar PV, installed capacity on-shore wind and number of public charging points can have a significant impact the average costs of DSOs. The resulting cost differences between DSOs can be substantial. When we use regression estimates to take energy-transition factors into account in a regulatory framework based on yardstick competition, we observe 0–10% changes in individual price caps for most DSOs (compared to the uniform cost level). For one DSO, the price cap increases with 20%.

Our analysis underscores the challenges posed to incentive regulation of distribution operators by increased penetration levels of energy-transition variables. Incentive regulation plays an important role in achieving regulatory objectives regarding cost recovery and maintaining reasonable tariffs, while providing incentives for cost effectiveness. As energy-transition penetration levels increase, the output composition as well as the use and management of distribution networks undergo a transformation. Consequently, the emerging cost drivers should be incorporated into regulatory frameworks that are used to set allowed revenues and tariffs. When performance comparison of DSOs is used to set tariffs, whether through direct yardstick comparison or through the use of statistical benchmarking models, the individual-firm heterogeneity arising from energy-transition variables should therefore carefully be taken into account.

Data availability

The datasets analysed during the current study are available from the corresponding author on reasonable request.

Notes

In the literature, there are several examples of average or unit cost functions, where costs are expressed as total costs divided by total output (e.g., Filippini & Wild, 2001; Pollitt, 1995; Yatchew, 2000). In his seminal paper on yardstick competition, Shleifer (1985) proposed that the regulator can use a multivariate average-cost function to correct the yardstick cap for observed heterogeneity of output and service area characteristics.

In previous specifications of the model, we considered a variable that captures the maximum feed-in on the medium and high-voltage network levels. However, we excluded this variable because of near-multicollinearity with energy delivered per connection and maximum demand per connection at MV/HV levels.

See Data Sect. 4.3, for an investigation of variation for our energy-transition variables.

The ACM describes the regulatory regime that is used to determine allowed revenues before each regulatory period. This is done in the so-called method decisions, which are published on the regulator’s webpage. The two most recent method decisions, for regulatory periods 2017–2021 and 2022–2026 respectively, can be found at the following links:

https://www.acm.nl/nl/publicaties/gewijzigd-methodebesluit-rnbs-elektriciteit-2017-2021 and https://www.acm.nl/nl/publicaties/methodebesluit-regionaal-netbeheer-elektriciteit-2022-2026.

We have estimated all models using Newey-West robust standard errors. Wooldridge’s test indicates no presence of unobserved individual DSO and/or year effects. The Breusch-Pagan test indicates that our models do not suffer from heteroskedasticity. We find evidence for serial correlation using the Durbin-Watson test. There are not explanatory variables for which we suspect endogeneity issues, and we did not pursue this matter further.

As a robustness check, we have also run our model after excluding the observation for DSO RENDO in the year 2020, because there is a potential measurement issue with the depreciation costs for this observation (see Online Resource 1). The results are robust to the exclusion of this observation.

References

Baumol, W. J., Panzar, J. C., & Willig, R. D. (1982). Contestable markets and the theory of industry structure. Hartcourt Brace Jovanovich.

Burns, P., & Weyman-Jones, T. G. (1996). Cost functions and cost efficiency in electricity distribution: A stochastic frontier approach. Bulletin of Economic Research, 48(1), 41–64. https://doi.org/10.1111/j.1467-8586.1996.tb00623.x

Cameron, A. C., & Trivedi, P. K. (2005). Microeconometrics: Methods and applications. Cambridge University Press.

Cossent, R., Olmos, L., Gómez, T., Mateo, C., & Frías, P. (2011). Distribution network costs under different penetration levels of distributed generation. European Transactions on Electrical Power, 21(6), 1869–1888. https://doi.org/10.1002/etep.503

de Joode, J., Jansen, J. C., Van der Welle, A. J., & Scheepers, M. J. J. (2009). Increasing penetration of renewable and distributed electricity generation and the need for different network regulation. Energy Policy, 37(8), 2907–2915. https://doi.org/10.1016/j.enpol.2009.03.014

Dijkstra, P. T., Haan, M. A., & Mulder, M. (2017). Industry structure and collusion with uniform yardstick competition: Theory and experiments. International Journal of Industrial Organization, 50, 1–33. https://doi.org/10.1016/j.ijindorg.2016.10.001

Estache, A., Rossi, M. A., & Ruzzier, C. A. (2004). The case for international coordination of electricity regulation: Evidence from the measurement of efficiency in South America. Journal of Regulatory Economics, 25(3), 271–295. https://doi.org/10.1023/B:REGE.0000017750.21982.36

Façanha, L. O., & Resende, M. (2004). Price cap regulation, incentives and quality: The case of Brazilian telecommunications. International Journal of Production Economics, 92(2), 133–144. https://doi.org/10.1016/j.ijpe.2003.10.015

Farsi, M., Fetz, A., & Filippini, M. (2008). Economies of scale and scope in multi-utilities. The Energy Journal, 29(4), 6. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol29-No4-6

Fetz, A., & Filippini, M. (2010). Economies of vertical integration in the Swiss electricity sector. Energy Economics, 32(6), 1325–1330. https://doi.org/10.1016/j.eneco.2010.06.011

Filippini, M., & Sánchez, L. O. (2014). Applications of the stochastic frontier approach in the analysis of energy issues. Economics and Business Letters, 3(1), 35–42.

Filippini, M., & Wild, J. (2001). Regional differences in electricity distribution costs and their consequences for yardstick regulation of access prices. Energy Economics, 23(4), 477–488. https://doi.org/10.1016/S0140-9883(00)00082-7

Growitsch, C., Jamasb, T., & Wetzel, H. (2012). Efficiency effects of observed and unobserved heterogeneity: Evidence from Norwegian electricity distribution networks. Energy Economics, 34(2), 542–548. https://doi.org/10.1016/j.eneco.2011.10.013

Gupta, R., Pena-Bello, A., Streicher, K. N., Roduner, C., Farhat, Y., Thöni, D., & Parra, D. (2021). Spatial analysis of distribution grid capacity and costs to enable massive deployment of PV, electric mobility and electric heating. Applied Energy, 287, 116504. https://doi.org/10.1016/j.apenergy.2021.116504

Hattori, T., Jamasb, T., & Pollitt, M. (2005). Electricity distribution in the UK and Japan: A comparative efficiency analysis 1985–1998. The Energy Journal, 26(2), 23. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol26-No2-2

Hinz, F., Schmidt, M., & Möst, D. (2018). Regional distribution effects of different electricity network tariff designs with a distributed generation structure: The case of Germany. Energy Policy, 113, 97–111. https://doi.org/10.1016/j.enpol.2017.10.055

Höfer, T., & Madlener, R. (2021). Locational (In) efficiency of renewable energy feed-in into the electricity grid: A spatial regression analysis. The Energy Journal, 42(1), 171. https://doi.org/10.5547/01956574.42.1.thof

Horowitz, K. A., Palmintier, B., Mather, B., & Denholm, P. (2018). Distribution system costs associated with the deployment of photovoltaic systems. Renewable and Sustainable Energy Reviews, 90, 420–433. https://doi.org/10.1016/j.rser.2018.03.080

Huda, A. N., & Živanović, R. (2017). Large-scale integration of distributed generation into distribution networks: Study objectives, review of models and computational tools. Renewable and Sustainable Energy Reviews, 76, 974–988. https://doi.org/10.1016/j.rser.2017.03.069

Jamasb, T., & Pollitt, M. (2001). Benchmarking and regulation: International electricity experience. Utilities Policy, 9(3), 107–130. https://doi.org/10.1016/S09571787(01)00010-8

Jenkins, J. D., & Pérez-Arriaga, I. J. (2017). Improved regulatory approaches for the remuneration of electricity distribution utilities with high penetrations of distributed energy resources. The Energy Journal, 38(3), 63. https://doi.org/10.5547/01956574.38.3.jjen

Joskow, P. L. (2014). Incentive regulation in theory and practice: electricity distribution and transmission networks. Economic regulation and its reform: What have we learned?, pp. 291–344.

Joskow, P. L., & Schmalensee, R. (1986). Incentive regulation for electric utilities. Yale J on Reg, 4, 1.

Kridel, D. J., Sappington, D. E., & Weisman, D. L. (1996). The effects of incentive regulation in the telecommunications industry: A survey. Journal of Regulatory Economics, 9, 269–306. https://doi.org/10.1007/BF00133477

Laffont, J. J., & Tirole, J. (1993). A theory of incentives in procurement and regulation. MIT press.

Martínez-Budría, E., Jara-Díaz, S., & Ramos-Real, F. J. (2003). Adapting productivity theory to the quadratic cost function: An application to the Spanish electric sector. Journal of Productivity Analysis, 20, 213–229. https://doi.org/10.1023/A:1025184306832

Mizutani, F., Kozumi, H., & Matsushima, N. (2009). Does yardstick regulation really work? Empirical evidence from Japan’s rail industry. Journal of Regulatory Economics, 36(3), 308–323. https://doi.org/10.1007/s11149-009-9097-0

Mulder, M. (2023). Regulation of energy markets: Economic mechanisms and policy evaluation (2nd ed.). Springer International Publishing. https://doi.org/10.1007/978-3-030-58319-4

Neuberg, L. G. (1977). Two issues in the municipal ownership of electric power distribution systems. The Bell Journal of Economics, 8, 303–323. https://doi.org/10.2307/3003501

Pollitt, M. G. (1995). Ownership and performance in electric utilities: The international evidence on privatization and efficiency. Oxford University Press.

Resende, M. (2002). Relative efficiency measurement and prospects for yardstick competition in Brazilian electricity distribution. Energy Policy, 30(8), 637–647. https://doi.org/10.1016/S0301-4215(01)00132-X

Ruester, S., Schwenen, S., Batlle, C., & Pérez-Arriaga, I. (2014). From distribution networks to smart distribution systems: Rethinking the regulation of European electricity DSOs. Utilities Policy, 31, 229–237. https://doi.org/10.1016/j.jup.2014.03.007

Sawkins, J. W. (1995). Yardstick competition in the English and Welsh water industry Fiction or reality? Utilities Policy, 5(1), 27–36. https://doi.org/10.1016/0957-1787(95)00011-N

Shleifer, A. (1985). A theory of yardstick competition. The RAND Journal of Economics, 16, 319–327. https://doi.org/10.2307/2555560

Tupper, H. C., & Resende, M. (2004). Efficiency and regulatory issues in the Brazilian water and sewage sector: An empirical study. Utilities Policy, 12(1), 29–40. https://doi.org/10.1016/j.jup.2003.11.001

Veldman, E., & Verzijlbergh, R. A. (2014). Distribution grid impacts of smart electric vehicle charging from different perspectives. IEEE Transactions on Smart Grid, 6(1), 333–342. https://doi.org/10.1109/TSG.2014.2355494

Verzijlbergh, R. A., Grond, M. O., Lukszo, Z., Slootweg, J. G., & Ilic, M. D. (2012). Network impacts and cost savings of controlled EV charging. IEEE Transactions on Smart Grid, 3(3), 1203–1212. https://doi.org/10.1109/TSG.2012.2190307

Vogelsang, I. (2002). Incentive regulation and competition in public utility markets: A 20 year perspective. Journal of Regulatory Economics, 22, 5–27. https://doi.org/10.1023/A:1019992018453

von Hirschhausen, C., Cullmann, A., & Kappeler, A. (2006). Efficiency analysis of German electricity distribution utilities–non-parametric and parametric tests. Applied Economics, 38(21), 2553–2566. https://doi.org/10.1080/00036840500427650

Wangsness, P. B., & Halse, A. H. (2021). The impact of electric vehicle density on local grid costs: Empirical evidence from Norway. The Energy Journal, 42(5), 149. https://doi.org/10.5547/01956574.42.5.pwan

Weyman-Jones, T. (1995). Problems of yardstick competition in electricity distribution. In M. Bishop, J. Kay, & C. Mayer (Eds.), The regulatory challenge (pp. 423–443). Oxford University Press.

Yang, H., & Pollitt, M. (2009). Incorporating both undesirable outputs and uncontrollable variables into DEA: The performance of Chinese coal-fired power plants. European Journal of Operational Research, 197(3), 1095–1105. https://doi.org/10.1016/j.ejor.2007.12.052

Yatchew, A. (2000). Scale economies in electricity distribution: A semiparametric analysis. Journal of Applied Econometrics, 15(2), 187–210.

Acknowledgements

The authors thank the participants of CEnBER seminars at the University of Groningen and participants of a concurrent session at IAEE 2022 European Conference in Athens for valuable comments. The authors also thank regulatory experts from the Netherlands Authority of Consumers & Markets (ACM) and other stakeholders in the sounding board of this projectfor comments on draft versions of this paper. This research was financially supported by the ACM. The contents of this paper do not constitute any obligation on the ACM. Of course, the authors are responsible for any remaining shortcomings.

Author information

Authors and Affiliations

Contributions

Conceptualization: FvM, PD, MM; Methodology: FvM, PD, MM; Data collection and analysis: FvM; Writing—original draft preparation: FvM; Writing—review and editing: PD, MM; Funding acquisition: PD, MM; Supervision: PD, MM.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Conflict of interest

We declare no competing financial and non-financial interests. Partial financial support was received from the Netherlands Authority for Consumers and Markets (ACM), which is a.o. the national regulator of energy markets.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Supplementary file 1

(PDF 207 KB)

Appendix 1 Returns to scale and customer density

Appendix 1 Returns to scale and customer density

Following Baumol et al. (1982) we can calculate the returns to scale (RS) and returns to customer density (RCD) as follows:

Table 5 presents the results from calculation of RS and RCD using our regressions results. We find decreasing returns to scale in both the OLS and the fixed-effect model. For the returns to customer density, we see different results for the OLS and the fixedeffect model. We believe that the OLS model gives the best estimate. The coefficient for the customer density variable is likely to be imprecise in our fixed-effect model, caused by a lack variation for this variable within DSOs (Cameron & Trivedi, 2005).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

van Montfoort, F., Dijkstra, P.T. & Mulder, M. The impact of energy transition on distribution network costs and effectiveness of yardstick competition: an empirical analysis for the Netherlands. J Regul Econ 65, 85–107 (2024). https://doi.org/10.1007/s11149-024-09471-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-024-09471-8