Abstract

We study optimal timing of regulated investment in a real options setting, in which the regulated monopolist has private information on investment costs. In solving the ensuing agency problem, the regulator trades off investment timing inefficiency against the dead-weight loss arising from high price caps. We show that optimal regulation is implemented by a price cap that decreases as a function of the monopolist’s chosen investment time.

Similar content being viewed by others

Notes

For example, UK regulator Ofgem issued the Transmission Operator Incentives programme to provide a funding framework for some 5 billion pounds of transmission investments by the regulated incumbents, aimed at strengthening the existing grid. These are necessary to accommodate the generation connections that are part of the UK government’s 2020 targets for ensuring a transition to a low-carbon electricity sector.

See e.g. Pollitt (2008) for an estimate of investment requirements for the regional distribution monopolies in the UK, resulting from the country’s renewable support schemes.

We assume that only the regulated monopolist can make the required investment, for instance because of interdependencies between existing infrastructure and the new network components. This is the practically relevant situation in for instance the case of reinforcement of electricity transmission grids to accommodate new generation, upgrades of local electricity or gas distribution networks, or transition of existing urban fixed-line telecom networks, in particular the ‘last-mile’ bottlenecks, into next-generation systems. This assumption excludes cases where multiple firms can compete in making the investment, as might for instance be the case with (more lightly regulated) mobile telecom networks.

This follows from the envelope theorem: if gross consumer surplus from consuming \(q\) units equals \(u(q)\), then \(v(p)=\max _{q} u(q)-pq\), and hence \(\frac{dv}{dp}=-q\).

Since \(A_t\) enters as a multiplicative factor, elasticity at price \(p\) is independent of \(A_t\). Hence, it is welfare-optimal to charge a constant price \(p\) after investment.

Inclusion of marginal costs into the analysis is relatively straightforward, but leads to less transparent expressions for the optimal scheme. See Appendix 2.

i.e., \(\lambda \) satisfies \({\textstyle {1\over 2}}\sigma ^2\lambda (\lambda -1)+\mu \lambda =r\).

See e.g. Laffont and Tirole (1993, Appendix 1.2).

As will become clear, the monotonicity constraint (13) on \(\bar{A}\) will hold by virtue of the monotone hazard rate assumption on \(f\). Absent this assumption, the optimum would involve “bunching”, where some range of cost-types will invest at identical thresholds \(\bar{A}\). See Guesnerie and Laffont (1984) for the general technique.

If the regulator optimizes a weighted version of welfare, with a lower weight \(\alpha < 1\) on producer surplus \(\Pi \), he would have an additional motivation for minimizing information rents. That, in turn, leads to a greater emphasis on distorting the investment timing. Quantitatively, this is borne out by a straightforward adaptation of the proof of Proposition 2: results are the same as in Proposition 2, except for the ‘virtual cost’-expression \(\left(c+\eta \frac{F}{f}(c)\right)\) which now is replaced by the (larger) expression \(\left(c+(1-\alpha +\alpha \eta )\frac{F}{f}(c)\right)\). Hence the optimal \(\bar{A}\) increases for all cost types \(c>c_L\).

We sketch the quantitative changes for these cases in Appendix 2.

For one interpretation of increasing the hazard rate at costs \(c\), consider an increase in asymmetric information in the form of a multiplicative spread of the probability distribution, that holds the value of \(F(c)\) (measured at the chosen value of costs \(c\)) constant. Such a spread decreases the density, \(f(c)\), and hence increases \(F/f\) at this point.

This is a common assumption in the regulation literature, though exceptions exist (see e.g. Lewis and Sappington 1988).

References

Armstrong, M. (2002). The theory of access pricing and interconnection. In M. Cave, S. Majumdar, & I. Vogelsang (Eds.), Handbook of telecommunications economics. Amsterdam: North-Holland.

Baron, D. P., & Myerson, R. B. (1982). Regulating a monopolist with unknown costs. Econometrica, 50(4), 911–930.

Cambini, C., & Jiang, Y. (2009). Broadband investment and regulation: A literature review. Telecommunications Policy, 33, 559–574.

Dixit, A., & Pindyck, R. (1994). Investment under uncertainty. Princeton: Princeton University Press.

Dobbs, Ian M. (2004). Intertemporal price cap regulation under uncertainty. The Economic Journal, 114, 421–440.

Evans, L. T., & Guthrie, G. A. (2005). Risk, price regulation, and irreversible investment. International Journal of Industrial Organization, 23, 109–128.

Evans, L. T., & Guthrie, G. A. (2012). Price-cap regulation and the scale and timing of investment. Rand Journal of Economics, 43, 537–561.

Grenadier, S. R., & Wang, N. (2005). Investment timing, agency, and information. Journal of Financial Economics, 75, 493–533.

Guesnerie, R., & Laffont, J.-J. (1984). A complete solution to a class of principal-agent problems with an application to the control of a self-managed firm. Journal of Public Economics, 25, 329–369.

Guthrie, G. (2006). Regulating infrastructure: The impact on risk and investment. Journal of Economic Literature, 44, 925–972.

Guthrie, G., Small, J., & Wright, J. (2006). Pricing access: Forward-looking versus backward-looking cost rules. European Economic Review, 50, 1767–1789.

Hori, K., & Osano, H. (2009). Optimal timing of management turnover under agency problems. Journal of Economic Dynamics and Control, 33, 1962–1980.

Laffont, J.-J., & Tirole, J. (1993). A theory of procurement and regulation. Cambridge: MIT Press.

Lewis, T., & Sappington, D. (1988). Regulating a monopolist with unknown demand. American Economic Review, 78(5), 986–996.

McDonald, R., & Siegel, D. (1986). The value of waiting to invest. Quarterly Journal of Economics, 101.

Moretto, M., Panteghini, P., & Scarpa, C. (2008). Profit sharing and investment by regulated utilities: A welfare analysis. Review of Financial Economics, 17(4), 315–337.

Pollitt, Michael G. (2008). The future of electricity (and gas) regulation in a low-carbon policy world. The Energy Journal, 29(S2), 63–94.

Roques, F. A., & Savva, N. S. (2009). Investment under uncertainty with price ceilings in oligopolies. Journal of Economic Dynamics and Control, 33(2), 507–524.

Schmalensee, R. (1989). Good regulatory regimes. Rand Journal of Economics, 20, 417–436.

Shibata, T. (2009). Investment timing, asymmetric information, and audit structure: A real options framework. Journal of Economic Dynamics and Control, 33, 903–921.

Vogelsang, I. (2012). Incentive regulation, investments and technological change. In G. R. Faulhaber, G. Madden, & J. Petchey (Eds.), Regulation and the performance of communication and information networks. Northampton, MA: Edward Elgar.

Acknowledgments

We thank the referees for their detailed comments and suggestions. Furthermore, we have benefited from useful comments from the TREIN working group, participants in the Mannheim CLEEN 2012 workshop, the EARIE 2012 conference in Rome, the 2012 Brescia workshop on the economics of irreversible choices, and the 2012 BAEE research workshop in Utrecht, as well as from Jan Boone, Victoria Shestalova and Bert Willems. We gratefully acknowledge the financial support of Agentschap NL.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: proofs

Proof of lemma 2

For future reference, we solve the slightly more general problem where the monopolist’s discounted expected profits (i.e. revenues minus investment costs) at time 0 are constrained to be at some non-negative fixed level \(\Pi \ge 0\), rather than zero. We have to solve the programme

s.t.

With \(\nu \) the Lagrange multiplier on the constraint, the first-order condition for \(p\) yields

For the first-order condition for the threshold demand level \(\bar{A}\) we find

Substituting \(\nu \) we obtain the desired second-best threshold \(\bar{A}^{sb}\) (9) from the lemma, which turns out to be independent of the value of \(\Pi \). The optimal price \(p\) then follows from substituting this threshold \(\bar{A}^{sb}\) in the constraint, and setting \(\Pi =0\).\(\square \)

Proof of Proposition 1

Consider a price cap \(p_c\le \bar{p}\). The monopolist will choose investment threshold \(\bar{A}\) to optimize his expected profits

and solving the first-order condition gives

Comparing with second-best, (9), we find \(\bar{A}\ge \bar{A}^{sb}\), with equality only when \(p_c=\bar{p}\). The optimal price cap involves trading off timing inefficiency against lower ex-post pricing, maximizing social surplus:

with \(\bar{A}(p_c)\) the solution to (22). Solving the first-order condition for \(p_c\) gives

\(\square \)

Proof of lemma 3

The proof of the lemma follows standard arguments (see e.g. Laffont and Tirole 1993, Sect. 1.4). Suppose the monopolist has costs \(c\). By choosing the contract designed for a monopolist with costs \(\hat{c}\) (which may be different from his real costs \(c\)), the monopolist’s profits are

Note that, in this expression, the contract parameters are governed by the monopolist’s choice \(\hat{c}\), while his actual cost upon investing equals his true cost \(c\). Incentive compatibility of the scheme means that the monopolist maximizes his profits by announcing his true costs, \(\hat{c}=c\). But this implies, by the envelope theorem, that

Using the short-hand notation

this proves that incentive compatibility requires condition (12). To show the need for condition (13), we observe that

Combining this with a similar inequality where \(\hat{c}\) and \(c\) are reversed,

we obtain

Since \(\lambda >1\), if \(\hat{c}>c\) then \(\bar{A}(\hat{c})\ge \bar{A}(c)\), or

\(\square \)

Proof of Proposition 2

For convenience we recall the programme to be solved:

s.t.

This is an optimal control problem with constraints, with \(\Pi (c)\) the state variable. To solve it, we consider the related Hamiltonian \(H\), with a co-state variable \(\omega (c)\) that is adjoint to the state variable \(\Pi (c)\). Furthermore, we use a Lagrange multiplier \(\nu (c)\) for the definition of \(\Pi (c)\) in terms of the control variables \(\bar{A}(c),p(c)\) (as we did before, in the proof of lemma 2). Optimization in this Hamiltonian framework then requires

as well as the first-order conditions for \(p(c)\) and \(\bar{A}(c)\). Considering first the first-order condition for \(p(c)\):

or

Hence

Secondly, the first-order condition for \(\bar{A}(c)\) is

which reduces to the desired optimal threshold

Note that as a result of the assumed monotonicity of \(F/f(c), \,\bar{A}(c)\) is duly increasing in \(c\). Given \(\bar{A}(c)\), we can next explicitly compute \(p(c)\) from the constraint,

\(\square \)

Proof of Corollary 2

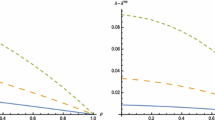

Note first that the menu of contracts \(\bar{A}(c),p(c)\) from Proposition 2 defines a parametrized curve that is described by a function \(p(\bar{A})\), since \(\bar{A}(c)\) is strictly increasing in \(c\).

To prove that \(p(\bar{A})\) is downward sloping, since \(\bar{A}\) is increasing in \(c\), it is sufficient to show that \(p(c)\) is downward sloping. Combining (28) and (29) we write

with \(\tilde{c}(c)=c+\eta \frac{F}{f}(c)\) the virtual cost function. Taking derivatives on both sides, we find that decreasing \(p(c)\) is equivalent to

To verify that this inequality holds, note that since \(\bar{p}>p(c)\), we have

so that

Since \(\tilde{c}(c)>c\) this implies inequality (30) and we conclude that \(p(\bar{A})\) is downward sloping. \(\square \)

Appendix 2: extensions

In this appendix we briefly sketch how our main result, the optimal regulatory scheme outlined in Proposition 2, is affected if we relax some of the assumptions on the model.

The assumption of Geometric Brownian motion for demand process \(A_t\), Eq. (2), allowed us to express the results in simple closed form. If we allow for more general stochastic processes (but excluding explicit time-dependence of the coefficients of the process), it will in general not be possible to obtain such explicit expressions. In this case, though, we may reach similar conclusions. Let us introduce the shorthand

so that aggregate net consumer welfare at the moment of investment equals \(v(p)\mathcal{A}\). Note that in our main model, \(\mathcal{{A}}(\bar{A})=\bar{A}/ (r-\mu )\). In the general case, replication of the proof of Proposition 2 leads us to the first-order equation for the investment threshold

where we defined virtual costs \(\tilde{c}=c+\eta \frac{F}{f}(c)\). For the case of Geometrical Brownian motion considered in the paper, substituting the expression for the expected discount factor, Eq. (5), together with the appropriate \(\mathcal{A}\) as above, leads to the familiar expression from Proposition 2. In the general case, again the optimal investment under asymmetric information occurs at a threshold that would be (second-best) efficient for a firm for which costs would equal \(\tilde{c}\), rather than \(c\) itself. Hence at the lower cost bound, where \(\tilde{c}_L=c_L\), the threshold replicates the (second-best) real option result for general stochastics. For all higher cost types, since virtual costs \(\tilde{c}\) rise monotonically in \(c\), investment is delayed until demand hits a threshold that would be efficient for a firm with costs strictly above those actual costs.

Next consider what happens if we instead relax the assumption of constant elasticity demand: we consider more general forms of net consumer surplus \(v(p)\), with demand \(q(p)\) satisfying \(v^{\prime }(p)=-q(p)\), and elasticity \(\eta (p)=-\frac{p}{q}\frac{dq}{dp}\) in general price-dependent. Again, we can redo the analysis of Proposition 2 to find the condition for optimal \(\bar{A}\):

while \(p(c)\) is determined jointly with this equation to make sure that the firm’s surplus satisfies the incentive compatibility constraint. Comparing with the constant elasticity result, we see two effects of allowing general elasticities. On the right-hand side of the equation, the expression for the virtual costs is more complex, reflecting also the changes in elasticities for the lower types. On the left-hand side, with general consumer surplus, the combination of consumer surplus does not reduce to the simple, \(p\)-independent expression that we found for the constant elasticity case.

Finally, we assumed that variable costs after investment are zero. In fact, expressions for the situation with positive marginal costs of production \(m\) are related to those without such costs by a transformation of the surplus, \(v(p)\rightarrow v(p+m)\), and hence, \(q(p)\rightarrow q(p+m)\). Starting from the base case with constant elasticity demand, after the marginal cost shift the analysis becomes equivalent to one with non-constant elasticity, as considered above.

Rights and permissions

About this article

Cite this article

Broer, P., Zwart, G. Optimal regulation of lumpy investments. J Regul Econ 44, 177–196 (2013). https://doi.org/10.1007/s11149-013-9214-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-013-9214-y