Abstract

The discounted stock price under the Constant Elasticity of Variance model is not a martingale when the elasticity of variance is positive. Two expressions for the European call price then arise, namely the price for which put-call parity holds and the price that represents the lowest cost of replicating the call option’s payoffs. The greeks of European put and call prices are derived and it is shown that the greeks of the risk-neutral call can substantially differ from standard results. For instance, the relation between the call price and variance may become non-monotonic. Such unfamiliar behavior then might yield option-based tests for the potential presence of a bubble in the underlying stock price.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The elasticity of the variance of returns to the stock price under Geometric Brownian Motion (GBM) is zero and returns thus are assumed to have constant variance. This assumption was challenged in, for instance, Black (1976) and became the main argument behind the development of the Constant Elasticity of Variance (CEV) option pricing model in Cox (1975). The discounted stock price is a martingale under the CEV process with negative or zero elasticity, but is not a martingale for positive values of the elasticity parameter as was first noted in Emanuel and MacBeth (1982) and Lewis (2000) . Cox and Hobson (2005) and Heston et al. (2007) interpreted this loss of the martingale property under positive elasticity of variance as evidence for the presence of a bubble in the underlying stock price. As a result, there are (at least) two candidate prices for the call option, namely the price for which the put-call parity holds and the price that represents the lowest cost of replicating the payoff of the call (see Heston et al. 2007).

This paper calculates the greeks of European put and call options under CEV with positive elasticity of variance and interprets them as potential indicators for the presence of bubbles in the underlying. It is shown that the greeks for the risk-neutral call can reveal behavior that is in sharp contrast with the standard results as suggested earlier in Cox and Hobson (2005), Ekström and Tysk (2009) and Pal and Protter (2010). For instance, risk-neutral call prices can be non-monotonic functions of the remaining time to maturity in which increasing time initially increases the call’s price but after some point starts to depress the value of the call. Detecting such pattern then might point to the presence of a bubble in the stock price. Indeed, the bubble may in the short run inflate further and thus step up option prices, but the likelihood of its collapse grows for longer time horizons causing the call price then to decrease in the time to maturity. Additional tests could be based on a similar non-monotonic relation between the risk-neutral call price and the variance of the underlying as well as the potential concave relation between call and stock prices.

The remainder of this paper is organized as follows. Section 2 discusses the loss of the martingale property for the discounted stock price under CEV with positive elasticity of variance. Section 3 calculates the European call and put prices. Section 4 discusses the sensitivities of the option prices to their underlying parameters and interprets their behavior as potential indicators of bubbles in stock prices. Section 5 concludes.

2 The loss of the martingale property under CEV with positive elasticity of variance

The stock price is assumed to follow a CEV diffusion process with risk-neutralized drift rS and diffusion coefficient \(\sigma ^{2}S^{2\alpha }\), respectively

with r being the positive, constant risk-free interest rate. The elasticity of the variance of returns to the stock price equals \(\alpha -1\) and GBM thus emerges as the limit for \(\alpha =1\). This paper focuses on positive elasticity of variance, i.e. \(\alpha >1\), and for brevity the acronym CEV from now on refers to CEV with positive elasticity of variance.

The transition probability density function \(p\left[ S_{T},T;S_{t},t\right] \) is derived in Emanuel and MacBeth (1982) asFootnote 1

with

-

\(k = \dfrac{r}{\sigma ^{2}\left( 1-\alpha \right) \left( \exp \left[ 2r\left( 1-\alpha \right) \left( T-t\right) \right] -1\right) }>0,\)

-

\(z_{t} = kS_{t}^{2\left( 1-\alpha \right) }\exp \left[ 2r\left( 1-\alpha \right) \left( T-t\right) \right] ,\)

-

\(z_{T} = kS_{T}^{2\left( 1-\alpha \right) },\)

-

\(I_{q} =\) the modified Bessel function of the first kind of order q.

The distributional relations in Schroder (1989) allow to specify the following two integral expressions that facilitate calculation of the below results

and

where \(Q\left[ a,b,c\right] \) is the complementary non-central chi-square distribution evaluated at a with b degrees of freedom and non-centrality parameter c.Footnote 2

The conditional expectation for the CEV process (1), \(E\left[ S_{T},T;S_{t},t\right] \), then is

given that \(Q\left[ a,b,+\infty \right] =1\) as can be inferred from definition 26.4.25 in Zelen and Severo (1964). The conditional expectation (3) thus falls below \(S_{t}\exp \left[ r\left( T-t\right) \right] \) since \(Q\left[ 2z_{t},\dfrac{1}{\alpha -1},0\right] \) is a distribution. As a result, the discounted stock price is not a martingale.Footnote 3 Cox and Hobson (2005) and Heston et al. (2007) interpreted this loss of the martingale property as evidence that the stock price has a bubble and as a result is expected to decrease in the future.

3 European call and put option prices

The risk-neutral value of a European put option with exercise price K and time to maturity \(T-t\), \(P_{t}\), is given by

which corresponds with the put price that is derived in Hull (2006).

The risk-neutral expected discounted value of the payoff to the European call option, in short the risk-neutral call price \(C_{t}\), is

The call price (5) corresponds with the price \(G^{2}\left( S,t\right) \) that was obtained in Heston et al. (2007).

Emanuel and MacBeth (1982) reported a second expression for the call price, denoted by \(C_{t}^{EM}\), that can be obtained via the put-call parity. Plugging the risk-neutral put price (4) into the put-call parity yields

This price is documented in, amongst others, Schroder (1989), Davydov and Linetsky (2001), Hull (2006) and is specified as \(G^{1}\left( S,t\right) \) in Heston et al. (2007).

The relation between the call prices (5) and (6) is

Hence, \(C_{t}^{EM}\) exceeds \(C_{t}\).Footnote 4 The call price \(C_{t}^{EM}\) thus has a bubble given that it exceeds the cost of a strategy that replicates the payoffs of the call option (see Heston et al. 2007 for more detail).

4 The greeks of European put and call option prices

It is possible to calculate the greeks for the above option prices for general values of \(\alpha \) as definition 26.4.25 in Zelen and Severo (1964) expresses the non-central chi-square distribution as an infinite sum of chi-square distributions. The required derivatives then be computed via relation 26.4.19 in Zelen and Severo (1964) and relation 6.5.25 in Davis (1964). But, the resulting expressions become too elaborate for a meaningful analysis. However, option prices and their greeks can be expressed in (surprisingly) compact and easy-to-interpret form for particular values of \(\alpha \). For \(\alpha =2\), the density function (2) can be simplified via the identity \(I_{\frac{1}{2}}\left( x\right) =\sqrt{\dfrac{2}{\pi x}}\sinh \left[ x\right] \) (see Polyanin 2002) intoFootnote 5

The conditional expectation then is

where \(q_{1}=\sqrt{2k}S_{t}^{-1}\exp \left[ -r\left( T-t\right) \right] \) and \(\Phi \left[ q\right] =\dfrac{1}{\sqrt{2\pi }} {\textstyle \int \limits _{-\infty }^{q}} \exp \left[ -\frac{1}{2}x^{2}\right] dx\) is the standard normal distribution function.

The risk-neutral put price, \(P_{t}^{\alpha =2}\), emerges as

where \(q_{2}=\sqrt{2k}\big \{ S_{t}^{-1}\exp \big [ -r\big ( T-t\big ) \big ] -K^{-1}\big \} \), \(q_{3}=\sqrt{2k}\big \{ S_{t} ^{-1}\exp \big [ -r\big ( T-t\big ) \big ] +K^{-1}\big \} \) and \(\phi \big [ q\big ] =\dfrac{1}{\sqrt{2\pi }}\exp \big [ -\frac{1}{2} q^{2}\big ] \).

The risk-neutral value of the call option, \(C_{t}^{\alpha =2}\), is given by

and the relation between the risk-neutral put and call prices, i.e. the risk-neutral put-call parity, is

The call price of Emanuel and MacBeth (1982), \(C_{t}^{EM,\alpha =2}\), can be obtained by plugging \(P_{t}^{\alpha =2}\) into the put-call parity

The call price of Emanuel and MacBeth (1982) exceeds the risk-neutral call price given that

4.1 Delta

The delta of the risk-neutral put price (8) can be calculated as

It is not possible to analytically show that the delta of the put has the familiar negative value. However, an extensive grid search confirmed that the delta is always negative.Footnote 6 The delta of the put together with the risk-neutral put-call parity (10) then specifies the delta of the risk-neutral call as

The grid search showed that the delta of the risk-neutral call always had the familiar positive sign. The delta for the call price of Emanuel and MacBeth (1982) can most easily be obtained via the put-call parity (11) as

The latter expression is always positive given that the sum of the first three terms on the right-hand side is positive and this also holds for the remaining term.

Both call prices increase in the value of the underlying stock price. However, the delta of the call price of Emanuel and MacBeth (1982) exceeds the delta of the risk-neutral call price as, for instance, relation (13) implies

4.2 Gamma

The risk-neutral put price (8) is characterized by the familiar convexity in the stock price given that

Combining the latter result with the put-call parity (11) implies that the call price of Emanuel and MacBeth (1982) is a convex function of the stock price

The gamma for the risk-neutral call price follows from the risk-neutral put-call parity (10) as

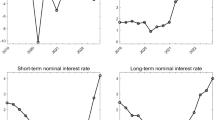

The gamma of the risk-neutral call thus falls below that of the put in view of \(k>0\). Moreover, the gamma will be negative for \(K=0\) in view of the zero value of the gamma of the put and the positive value of k. The limiting case of \(K=0\) thus produces a concave relation between the risk-neutral call price and the stock price as noted in Cox and Hobson (2005) and Ekström and Tysk (2009). However, larger values for K may create more intricate patterns in which for instance the familiar convex relation turns into a concave relationship for larger stock prices. Panel (a) in Fig. 1 illustrates this for the parameter values \(K=5,r=0.03,T-t=0.75\) and \(\sigma =0.2\).

This unfamiliar behavior of the gamma of the risk-neutral call could be of interest for the identification of bubbles. In fact, detecting concavity in the call option price might indicate that the underlying stock price has a bubble. Furthermore, observing a larger gamma for the put than for an identical call might also point to the presence of a bubble in the stock price.

4.3 Vega

The standard result of a positive relation between option prices and \(\sigma \) is present for the risk-neutral put price as well as for the call price of Emanuel and MacBeth (1982) since

and

The vega of \(C_{t}^{\alpha =2}\) then can be obtained via the risk-neutral put-call parity (10) as

The vega of the risk-neutral call thus falls below the vega of the identical put. Also, a strictly negative vega for the risk-neutral call arises for \(K=0\). However, the relation between \(C_{t}^{\alpha =2}\) and \(\sigma \) actually can grow non-monotonic as is illustrated in Panel (b) of Fig. 1 for the parameter values \(S_{t}=5,K=5,r=0.03\) and \(T-t=0.75\). This non-monotonic relation between the risk-neutral call price and \(\sigma \) can be interpreted against the background of the presence of a bubble in the underlying stock price. Initially, a rise in \(\sigma \) for low values of the latter may further inflate the bubble and thus boost the call price. However, after some critical level of \(\sigma \) is reached, further rises in \(\sigma \) (sharply) increase the likelihood that the bubble will burst through which the call price must decrease.

Ekström and Tysk (2009) used an advanced treatment of partial differential equations to show that convexity (concavity) of the call in the stock price automatically implies a positive (negative) relation between the call option price and volatility. This direct link is confirmed for the present CEV process given that the vega of the above three prices can always be obtained by multiplying the corresponding gamma with the positive term \(\dfrac{S_{t}^{4}\exp \left[ 2r\left( T-t\right) \right] }{2k\sigma }\).

The analysis of the vega thus may offer an additional option-based test for the potential presence of a bubble in the underlying stock price. Such bubble might be present if the call price decreases in response to an increase in volatility or increases to a smaller degree when compared with the reaction in the price of an identical put.

4.4 Rho

The rho of the risk-neutral put price is given by

Combining the latter result with the put-call parity (11) allows to express the rho of the call price of Emanuel and MacBeth (1982) as

A grid search showed that the familiar positive (negative) rho for calls (puts) also holds for these two option prices.

The rho for the risk-neutral call is given by

The latter expression typically returns a positive value. However, it can turn negative for options that are deep in-the-money as is illustrated in Panel (c) of Fig. 1 where \(K=0.5,S_{t}=5,\sigma =0.2\) and \(T-t=0.75\).

4.5 Theta

The expression for the sensitivity of the risk-neutral put to the remaining time until maturity, theta, is

and this derivative, as in the standard case of GBM, may be positive or negative. The put-call parity (11) then specifies the theta of the call price of Emanuel and MacBeth (1982) as

The term \(rK\exp \left[ -r\left( T-t\right) \right] \) guarantees that the theta of the call of Emanuel and MacBeth (1982) is negative given that the terms \(\phi \left[ q_{2}\right] -\phi \left[ q_{3}\right] \) and \(\Phi \left[ q_{3}\right] -\Phi \left[ q_{2}\right] \) both are positive.

The theta for the risk-neutral call is

Adding the second term on the right-hand side then actually can generate a positive value for the theta of the risk-neutral call. The possibility of encountering a positive theta was discussed in Pal and Protter (2010) within the context of the inverse Bessel process. Note that the relationship between \(C_{t}^{\alpha =2}\) and \(T-t\) can be non-monotonic as is illustrated in Panel (d) of Fig. 1 for \(K=5,S_{t}=5,r=0.03\) and \(\sigma =0.2\). Such sequence of an initial rise of the call price in the remaining time until maturity followed by a decline might be compatible with the presence of a bubble in the underlying. In fact, the bubble may grow further in the short run causing the call to increase in value. However, longer time horizons make it more likely that the bubble will collapse which then negatively impacts upon the price of the call.

The above findings for the theta of the call may be useful within the search for bubbles in the underlying stock on two accounts. First, a negative link between European call prices and the remaining time until maturity might point to the presence of a bubble in the stock price as noted earlier. Second, a negative relation between the European call price and its time to maturity immediately implies that the early-exercise feature of the identical American call option will now have positive value even when no dividends are paid (Cox and Hobson 2005; Pal and Protter 2010). Hence, observing prices for American calls on stocks that pay no dividends being in excess of prices of otherwise identical European call options might likewise signal the presence of a bubble in the underlying.

5 Conclusions

The Constant Elasticity of Variance (CEV) model allows for a more elaborate specification of the volatility of returns. Option pricing under the CEV process with positive elasticity of variance, however, is complicated by the fact that the discounted stock price no longer is a martingale as was first noted in Emanuel and MacBeth (1982) and Lewis (2000). This loss of the martingale property under positive elasticity of variance was interpreted as evidence of stock-price bubbles in Cox and Hobson (2005) and Heston et al. (2007) . Heston et al. (2007) proceeded by showing that such bubbles generate (at least) two candidate prices for the call option, namely the price for which put-call parity holds and the price that represents the lowest cost of replicating the option’s payoffs.

This paper calculates and illustrates the greeks of European put and call options under CEV with positive elasticity of variance and discusses their potential role in testing for the presence of bubbles in the underlying stock price. It was found that the greeks of the risk-neutral call may exhibit behavior that deviates considerably from the standard results. For instance, call prices may become non-monotonic in the variance of the underlying stock. Detecting such patterns then might indicate the presence of a bubble in the underlying as low levels of variance may further inflate the bubble and step up option prices whereas the likelihood of a collapse in the bubble and the option price sharply increases for larger dispersion.

Notes

The expression for the transition probability density function in (7) in Heston et al. (2007) contains a misprint as the term \(\left( xz^{1-\alpha }\right) ^{\frac{1}{4-\alpha }}\) should be \(\left( xz^{1-4\alpha }\right) ^{\frac{1}{4\left( 1-\alpha \right) }}\). Also, the numerator in the first fraction in the term u on p. 367 should be r rather than 2r.

The complementary chi-square distribution arises if the non-centrality parameter equals 0. See Zelen and Severo (1964) for more detail on the (non-central) chi-square distribution.

Note that result 26.4.11 in Zelen and Severo (1964) implies that \(Q\left[ 2z_{t},\dfrac{1}{\alpha -1},0\right] =0\) for \(\alpha =1\). The discounted stock price then is a martingale in line with the fact that \(\alpha =1\) yields GBM.

Both expressions for the call price satisfy the valuation partial differential equation of Black and Scholes (1973) and its boundary conditions as discussed in Heston et al. (2007) and Ekström and Tysk (2009) . Heston et al. (2007) and Ekström and Tysk (2009) furthermore argued that the multiples of the difference (7) also satisfy the valuation equation such that actually an infinite number of solutions arises.

The identities in Polyanin (2002) and Schroder (1989) can be combined to yield similar simplifications for various other values of \(\alpha \). Cox and Hobson (2005) and Ekström and Tysk (2009) also focused on the case of \(\alpha =2\) but with the added restriction of \(r=0\) in order to express the stock price as the reciprocal of the radial part of a 3-dimensional Brownian motion.

The grid search used values for \(S_{t}\) between 0.01 and 10, K ranged between 0.01 and 15, r moved between 0.02 and 0.1, \(\sigma \) between 0.15 and 0.45 and \(T-t\) ranged from 0.1 to 5. The total number of cases that was evaluated was at 1,048,576.

References

Black, F. (1976). Studies of stock price volatility changes. In Proceedings of the 1976 meetings of the American statistical association, business and economic statistics section, pp. 177–181.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–654.

Cox, J. C. (1975). Notes on option pricing I: Constant elasticity of variance diffusions. Unpublished manuscript, Stanford University.

Cox, A. M. G., & Hobson, D. G. (2005). Local martingales, bubbles and option prices. Finance and Stochastics, 9, 477–492.

Davis, P. J. (1964). Gamma function and related functions. In M. Abramowitz & I. A. Stegun (Eds.), Handbook of mathematical functions (pp. 253–294). New York: Dover Publications.

Davydov, D., & Linetsky, V. (2001). Pricing and hedging path-dependent options under the CEV process. Management Science, 47, 949–965.

Ekström, E., & Tysk, J. (2009). Bubbles, convexity and the Black–Scholes equation. Annals of Applied Probability, 19, 1369–1384.

Emanuel, D. C., & MacBeth, J. D. (1982). Further results on the constant elasticity of variance call option pricing model. Journal of Financial and Quantitative Analysis, 17, 533–554.

Heston, S. L., Loewenstein, M., & Willard, G. A. (2007). Options and bubbles. Review of Financial Studies, 20, 359–390.

Hull, J. C. (2006). Options, futures, and other derivatives. Upper Saddle River: Prentice Hall.

Lewis, A. L. (2000). Option valuation under stochastic volatility. Newport Beach: Finance Press.

Pal, S., & Protter, P. (2010). Analysis of continuous strict local martingales via h-transforms. Stochastic Processes and their Applications, 120, 1424–1443.

Polyanin, A. D. (2002). Handbook of linear partial differential equations for engineers and scientists. Boca Raton: Chapman & Hall/CRC.

Schroder, M. (1989). Computing the constant elasticity of variance option pricing formula. Journal of Finance, 44, 211–219.

Zelen, M., & Severo, N. C. (1964). Probability functions. In M. Abramowitz & I. A. Stegun (Eds.), Handbook of mathematical functions (pp. 925–995). New York: Dover Publications.

Author information

Authors and Affiliations

Corresponding author

Additional information

I am very grateful to the anonymous referee whose constructive comments allowed me to remove erroneous claims and to greatly enhance the focus of the paper. The usual disclaimer applies.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Veestraeten, D. On the multiplicity of option prices under CEV with positive elasticity of variance. Rev Deriv Res 20, 1–13 (2017). https://doi.org/10.1007/s11147-016-9122-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-016-9122-2