Abstract

The impact of climate change is devastating in developing countries where flood protection and insurance schemes are limited. Certain parts of Ho Chi Minh City, Vietnam are under the constant threat of inundation due to sea-level rise. We integrate the hedonic property model in a difference-in-differences framework and spatial econometric analysis into a single analytical framework to estimate the economic effect of pluvial flooding. We find prices for affected houses were discounted by 9% after a large flood event on 30 September 2017. This research contributes to the existing literature as follows. First, we study the economic impact of pluvial floods, which has received less attention in existing studies where large and irregular floods are their focus. Second, the inclusion of legal status as a control variable accounts for the unique character of the Vietnamese housing market. Third, we also identify the recovery of house prices after the flood event.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Sea level rise is a constant threat to many shorelines around the world, especially in dense urban areas. Vojinović (2015) differentiates pluvial floods from fluvial and coastal ones. Fluvial floods break or overflow levees and enter the city while coastal floods follow storm surges and enter the city by sea or delta. Pluvial floods happen in large towns where the amount of rainfall is greater than the ability of towns to drain surplus water. Another difference is they may not result in long lasting property damage, but instead cause inconveniences at the time of impact. Flooded houses may not have a visible damage; therefore, without knowing about the flood, buyers may not not take into consideration the discount when buying the affected property.

In Ho Chi Minh City (HCMC), Vietnam, the housing market has been negatively affected by the increased risk of flooding. Table 1 shows the historical flood events in HCMC during 2011–2015. Each flood event in these years resulted in considerable damage to a wide area of the city. Damage from natural disasters between 2000 and 2010 has been estimated at $12.6 million (ADB, 2010). On 30 September 2017, very heavy rain, thunderstorms, and lightning caused Ho Chi Minh City with more than 40 flooding points. It was considered the biggest flood since the beginning of the rainy season (Quang & Tam, 2017). The objective of this study is to examine the spatial impact of a pluvial flood that occurred on 30 September 2017 on house prices; hence, proximity to the river is included to separate tidal flooding impact from pluvial flooding.

Methods used to monetise risk differ across studies. Direct price discount is common (Bin & Polasky, 2004; Rabassa & Zoloa, 2016; Turnbull et al., 2013). Flood insurance is an alternative option (Bosker et al., 2014; Nyce et al., 2015). Properties have not been insured against flooding because house owners prefer the status quo due to the full-dike and cluster effect, the endowment effect, wishful thinking, and moral hazard (Binh et al., 2017). As flood insurance is not available to all properties in urban areas in Vietnam, we focus on the direct price discount.

Basic hedonic models assume that marginal prices of housing attributes are equally important across the landscape and do not incorporate spatial dynamics of local housing markets (Can, 1990). Spatial econometric techniques have improved the performance of hedonic models (Anselin, 2010; Hill, 2013; LeSage, 1999; LeSage & Pace, 2009). Gröbel and Thomschke (2018) suggest the use of spatial models on housing data with a spatial structure “as an explanation for contradictory findings in literature”. Results from Stamou et al. (2017) also show that the spatial general model is the most appropriate simultaneous autoregressive model when studying spatially autocorrealted prices of housing properties data, indicating ‘spatial dependence’ or ‘spatial autocorrelation’ cannot be ignored in real estate market (Pace et al., 2009). However, the temporal impact of pluvial flood events has received little attention. Pryce et al. (2011) point out that flood risk perception could decrease properties prices, and flood risk discounts would begin to fade after some time. They first discovered the issue that researchers couldn’t capture the time effects of flooding impacts. Later, this issue was solved by Atreya and Ferreira (2015) using a difference-in-differences (DD) framework to extract the actual flood impact out of information effects since properties near each other usually suffer the same information effects. Furthermore, to deal with spatial indirect treatment effects, Delgado and Florax (2015) used Monte Carlo simulations to demonstrate the spatial DD estimator embedding with time-varying covariates is superior when both spatial sorting and spatial interaction exist in treatment responses. We adopt the DD model because it can better estimate flood risk discounts by separating flood experience from public information.

Numerous studies have estimated the impact of flood risk on property prices in developed countries (Atreya & Ferreira, 2015; Bin & Landry, 2013; Bin & Polasky, 2004; Filatova et al., 2011; Morgan, 2007). However, there is limited evidence from developing countries.

The impact of these floods has been examined by different econometric methods; for instance, hedonic price models with spatial data (Bartosova et al., 2000), surveying with questionnaire (Lamond & Proverbs, 2008), and meta-regression (Daniel et al., 2009), sales price comparison (Eves & Wilkinson, 2014), repeat-sale (Beltrán et al., 2019).

Correlation between flood events and house prices is mixed. Most studies find a negative impact of floods on house prices (Nyce et al., 2015; Posey & Rogers, 2010; Samarasinghe & Sharp, 2010) except for Morgan (2007). Estimates of the price decrease range from 2% (Turnbull et al., 2013) to 48% (Atreya & Ferreira, 2015), with most estimates fall within 5–10% (Bin & Polasky, 2004; Posey & Rogers, 2010; Rabassa & Zoloa, 2016; Rambaldi et al., 2013; Samarasinghe & Sharp, 2010).

Although extensive research has been carried out on fluvial and coastal floods, there is a lack of in-depth studies on pluvial floods in developing countries, possibly due to lower reported damage and casualty. Therefore, this study offers several unique contributions to the existing literature. First, the impact of a pluvial flood event on house prices is examined in a developing-country context. Second, DD analysis and spatial econometric approaches are integrated in a single analytical framework to investigate the impact of flooding. Inclusion of legal status as a control variable accounts for the unique character of the Vietnamese housing market. Unlike existing literature, where almost all observed properties in other countries possess these legal documents, therefore, the effect of the legal status on property price is not significant (Atreya & Ferreira, 2015; Bin & Landry, 2013). In Vietnam, property prices are determined by the level of legalised documents. We examine this effect in this study, and results are expected to provide policy guidance from standardizing those documents. Third, alternative spatial econometric models, with postestimation and various auxiliary tests, are used to choose the robust spatial model for interpretation. We also identify the recovery of house prices after the flood event. Seeing the environmental damage from pluvial floods, the government should manage new residential projects at a macro level to avoid building them on existing channels and waterways.

The rest of the paper is laid out as follows. Section 2 sets the theoretical framework integrating the DD analysis and spatial econometric approaches. Section 3 describes the data and key variables. Section 4 presents the empirical results. Section 5 draws on several areas for the discussion. Finally, Section 6 concludes the study.

Research Method

This paper integrates the hedonic property model in a DD framework with spatial econometric techniques to investigate the impact of a pluvial flood event. The former helps to identify the causal effect of a flood event on house prices, while the latter can examine spillover effects.

The Hedonic Property Model in a DD Framework

Based on the DD model used by Atreya and Ferreira (2015) to identify the duration of the effect caused by a large inundation event on the price of houses, we develop the hedonic model as follows.

Table 2 provides details for the variables. \(Ln\_Price\) denotes the natural logarithm of house prices. The dummy variable D_POST is used to determine which period the house price belongs to (before or after the heavy flooding incident). The coefficient \({\beta }_{1}\) of variable D_POST reflects the difference of house prices in the control group from before to after the event. D_TR, on the other hand, lists the houses located within one kilometre of the flooded streets. The coefficient \({\beta }_{2}\) of variable D_TR is used to study the effect of a flood event on house price. The interaction term of the two variables D_POST and D_TR is the variable of interest. The coefficient \({\beta }_{3}\) of variable D_POST x D_TR is used to identify the actual impact of the event. The sum \({\beta }_{1}+{\beta }_{3}\) is used to estimate the difference of house prices in the treatment group from before to after the event. The coefficient \({\beta }_{3}\) is the difference between another two differences \({\beta }_{1}\) and\({\beta }_{1}+{\beta }_{3}\). Therefore, \({\beta }_{3}\), is of key interest as it is used to examine the difference (in differences) of house prices between the treatment and control group from before to after the event. This flooding event is taken as the largest for the season and we use it as a “treatment” for using DD analysis on the effect of the flood event. Other explanatory variables X include house characteristics, locations and legal status.

Spatial Models

The use of spatial econometric techniques has enhanced the performance of hedonic models (Anselin, 2010; Hill, 2013; LeSage & Pace, 2009). ‘Spatial dependence’ or ‘spatial autocorrelation’ cannot be ignored in the real estate market (Pace et al., 2009). Although there is a significant amount of research that have applied spatial econometric models to study house prices, less research is on the spatial impact of a pluvial flood on house prices. In particular, we further develop the hedonic property model in a DD framework in Eq. (1) by integrating the alternative spatial models. However, the difficulty is to provide an analysis of which the spatial effect is economically important (Osland, 2010). Therefore, this research, as one of the first studies to apply spatial models using data from the HCMC housing market, attempts to identify the most suitable spatial model and use it to interpret the impact of a pluvial flood event on house prices.

We follow the hierarchy of spatial models suggested by Golgher and Voss (2016). First, we consider a standard linear model as follows:

where P is the matrix of all Ln_Price and X the matrix of all independent variables in Eq. (1). We integrate the DD model in Eq. (1) with the following spatial models.

Model (2) is upgraded into the following spatial error model (SEM):

and the spatial lag (of the dependent variable) model, also as known as the spatial autoregressive model (SAR):

where W is the spatial weights matrix and ρ and \(\lambda\) are the spatial coefficients. Model (3) was applied under the assumption that there was a spatial spillover effect in the residuals while, with Model (4), we assumed that house prices might affect those of nearby ones.

Model (5) examines whether the flood event impact on a house could have an influence on that of an adjacent one. The model with a spatial lag of the independent variable (e.g. D_TR) can be used for estimation with the spatial coefficient \(\gamma\) (SLX):

Combining (4) and (5), the spatial Durbin model (SDM) assumes that the spatial lag is applied to both price and flood impact:

Adding (3) to (5) and then (4), we obtain the spatial Durbin error model (SDEM) and the Kelejian-Prucha model (SAC), respectively:

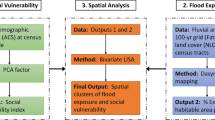

The specification of the spatial lag model captures house prices affected by its nearby ones (e.g. the SAR model in Eq. (4), the SDM model in Eq. (6) and the SAC model in Eq. (8)). And the specification of the spatial error model lies in its error term which considers the effect of the error term in its neighbouring region via a spatially weighted error structure. This can be expressed in Eq. (3) for the SEM model, Eq. (7) for the SDEM model and Eq. (8) for the SAC model. We use a contiguity weight matrix in which the element is assigned weight as one if there is an adjacent property, 0 otherwise. All models were estimated using maximum likelihood with robust standard errors. The relationship between different spatial models is reflected in Fig. 1.

Data and Variable Measurement

Data

To overcome the lack of publicly available housing data, Stamou et al. (2017) advocate the utilisation of datasets from real estate websites. We collected house price data from www.batdongsan.com.vn, which is managed by Ringier AG (Switzerland). This database was considered the “largest” (Phan, 2015) and “most popular” (Huynh, 2015) for real estate advertisement and purchases in Vietnam. We select HCMC, District 7, as the study area since it is more likely to expose flood risk than other districts. The total number of observations was 2,367 collected from July 2017 to January 2018. We examine house prices three months before and three months after the flood event. Figure 2 illustrates the study area.

Map of flooded roads on 30 September 2017. Notes: The study area consists of a large urban area south of HCMC. House projects (white dots) are located across the three districts District 7, Binh Chanh, and Nha Be. The central business district, District 1, is a red bold dot in the north. Sections of flooded roads are shown as pink lines

In Vietnam, property rights associated with a villa or townhouse differ from those of an apartment. In 1994, Decree 60-CP specified a legal title known as Building Ownership and Land-Use-Rights Certificate (BOLURC) used for both building and land ownership. However, market price reflects the difference between house types. Villas or townhouse ownership rights include house ownership and land use rights, while apartment ownership rights only cover apartment ownership and use rights of a portion of the land upon which the whole block is built. Hence, a villa or townhouse commands a higher price in the market ceteris paribus.

Two common certificates for property ownership are the “red" book (the certificate for land use rights) and the “pink” book/BOLURC (the certificate for both land use rights and house ownership). The transparent title means that listings with pink books command a higher price. Transactions of houses with pink books are also smoother as there should be no legal disputes. For example, houses in HCMC listed with pink books are sold at about 11% higher prices (Kim, 2007).

The southern area of HCMC has many newly-established residential areas which contribute to the risk of flooding by blocking existing channels, but the average property price in this area is still among the highest citywise. Although empirical evidence suggests that house prices are negatively impacted by flood risk, Vietnamese still appear to accept flood risk and pay the asking price due to high demand for houses.

Variable Measurement

Table 2 describes the variable measurement. Ln_Price was calculated using the natural logarithm of house prices (million Vietnam Dong).

We choose to proceed with asking prices among the three choices: transactions from sales data (Atreya & Ferreira, 2015), rents (Attakora-Amaniampong et al., 2016), and asking prices from listings (Pommeranz & Steininger, 2020). In Vietnam, it is challenging to collect transparent sales data. First, most property transactions data are not digitally available. Besides, it is still common practice for house owners in Vietnam to reduce the prices reported to the tax office so that they could enjoy a lower tax for the transactions. As a result, most selling prices on purchases and sales agreements are made up for taxes reduction purposes. Second, the number of rents in the listings amounts to less than 5% of the dataset; therefore, we focused on asking prices. Third, unlike most countries, the unique character of the primary housing market in Ho Chi Minh City is that property purchasers are price takers without any negotiation power (Nguyen et al., 2021). Listing (asking) price is regarded as a “leading indicator” of selling price (Knight et al., 1994). Therefore, we use asking prices as a suitable proxy index measure of true sale prices under this circumstance.

Affected roads were calculated based on the Vietnamese general guidance of safe travel through flooded areas. Specifically, roads where inundation depth is greater than 20 cm are not trafficable. The radius of one kilometre was chosen for these affected roads because they are arterial and connect large residential blocks (approximately one square kilometre on average). The detailed explanation refers to Fig. 5.

Flood risk is calculated based on the proximity of houses to the affected streets Nguyen Huu Tho, Nguyen Thi Thap, Pham Huu Lau, and Huynh Tan Phat on 30 September 2017 (Duy, 2017a, b; Quang & Tam, 2017). Figure 6 shows an inundation map. If a house is within one kilometre of one of these roads, then D_TR value is 1; otherwise, D_TR equals 0. This radius was chosen because connected residential blocks are approximately one square kilometre on average.

Traffic volumes are expected to affect property prices; hence, we include the distance to traffic congestion due to the concentration of shops and offices in the study area (Hou, 2017). In addition, the impact of distance to the nearest park is also considered (Rambaldi et al., 2013).

The total area and the number of bedrooms and bathrooms are the main controls that were measured in various studies (Han & Strange, 2016; Rambaldi et al., 2013). The distance to CBD (Waights, 2018) and the floor level (Rambaldi et al., 2013) are also important characteristics of a property. Therefore, these variables were examined in the sample. Because the topography of HCMC terrain is primarily flat, adding property elevation is of little significance and is excluded in the analysis.

Two time periods (July–September and November-January) enclose the flood on 30 September 2017. House prices normally took one month to be updated; hence, the disappearance of October, which was not available. The first period had D_POST = 0, and the second had D_POST = 1. The annual pluvial flooding cycle in HCMC explains the six months’ time. Vietnam-southerners usually experience a typical six-month rainy season, and pluvial flooding events tend to happen in the last three months.

Descriptive statistics are reported in Table 3. Geodesic distance was used for measurement.

The variable CBD measures the distance from properties in the study area (District 7) to District 1, HCMC. The range 2.8–9.1 km shows that it is quite close to the centre (easy for motorbike travels). Several congestion points (within 0.2–3.5 km) can become another difficulty in travelling during floods.

The average size of properties is around 100 square metres (the size of a two-bedroom apartment). The average bedroom count (2.33) reflects Vietnamese population control policies (2 children max). More legalised properties (over 51%) are recognised as a good sign in the market as illegal housing transactions were common in the past. About 67% of properties don’t list the direction the house faces. Listers may consider it less important than factors like size or number of rooms.

Table 4 presents the summary statistics by sub-groups. The mean listing price is higher in the treatment group than others. Several attributes such as ownership and use rights, close to school, park and CBD, and large floor area contribute to the high value of the properties.

Empirical Results

Preliminary Check

We use the “move in tandem” test suggested by Gertler et al. (2016) to compare the trends of the prices before the event between the control group and the treatment group and report results in Table 5. The variable ‘Time’ describes the listing date. Using an OLS model on time series data with house prices about three months before the event, we find the rate of increase in logarithm of house prices for the control sample is about two times the rate of increase for the treatment group. However, after the event, prices in the control group continued their upward trend, while prices in the treatment group decreased.

The Impact of Pluvial Flood on House Prices

Alternative spatial models were applied to estimate the impact of pluvial flood on house prices. Before executing the spatial DD model, a series of tests are used to check the existence of spatial correlation and spatial dependence. Wen et al. (2020) detailed step-by-step tests when studying the spill-overs of wind generation on electricity prices. Thus, we follow Wen et al. (2020)’s procedure to conduct the empirical analysis. First, Moran’s I test is used to identify the existence of spatial autocorrelation in house prices. Results from Moran’s I test reject the null hypothesis of no spatial dependence, indicating that there is a clustering effect which confirms that a spatial econometric model should be applied. Second, the classic Lagrange Multiplier (LM) tests proposed by Anselin (1988) and LR tests based on Elhorst (2014) are further used to justify an appropriate spatial model which performs better than others. The auxillary test results are reported in Appendix Table 9. We proceed with the alternative hypothesis that residuals are correlated with nearby residuals as defined by the matrix W following guidance presented in StataCorp (2017). We use the same spatial weights matrix for both the spatial lag and the spatial error.

Table 6 reports the spatial estimation results from alternative spatial models. The interaction (D_POST × D_TR) was negative and significant at the 1–10% level, indicating that there was an effect of the flooding event on house prices in the affected area. Combined with the significantly positive sign at 1% level from the other cases (D_POST = 1), it could be interpreted as that even though there was an upward trend in the prices, the flooded area still experienced a relative decrease in its house prices.

Based on the results of LR and LM tests in Table 9 and the Akaike information criterion (AIC) and Bayesian information criterion (BIC) in Table 6, the SAC model performs best among alternative spatial models. Therefore, SAC is selected to interpret the results and conduct further analysis. The SAC model has also been employed to study house price determinants in Athens (Efthymiou & Antoniou, 2013; Stamou et al., 2017).

Delgado and Florax (2015) concluded that the spatial DD estimator embedding with time-varying covariates is superior when both spatial sorting and spatial interaction exist in treatment responses. Based on the spatial DD model used in Delgado and Florax (2015), our model also accounts for house prices affected by its nearby ones (\(\rho WP\)). According to the Auxiliary test results in Table 9, we found global spillovers, i.e., ρ = 0 is rejected. Furthermore, coefficients of W*Ln_Price are significant in SAR and SAC in Table 6, indicating house prices are affected by their neighbouring house prices.

We follow the standard routine of a DD analysis in which the first difference between house prices in the control group through the event is determined. Then we examine the second difference between house prices in the treatment group during the same interval of time. And lastly, the difference between the second and the first is calculated.

For example, in the case of the SAC model, these differences are calculated as follows. First, the coefficient of the variable D_POST is significantly positive and indicates that house prices increase from before to after the event among the control group (houses outside of the affected roads). Due to the fact that there is a high demand of properties in the area (Truong & Perera, 2011) and these houses are located outside the affected roads, the owners enjoy an increase of 7.4%.

Second, the sum of the coefficients of the variable D_POST and the interaction term (D_POST × D_TR) reflects the estimated mean difference in house prices among the treatment group from before to after the event. Because these houses lie within the radius of the affected roads, their prices were reduced 1.6% (= 0.075—0.091).

Last, based on the coefficient of the DD term, house prices among the treatment group experienced a discount by 9.1% compared to the control group from before to after the event. A difference-in-differences plot is used to show the parallel trends (Di Maggio et al., 2019). Thus, Fig. 3 is provided to illustrate the results of the difference-in-differences estimation for the flood event on 30 September 2017.

Results in Table 6 reveal that house prices are determined by house characteristics. For example, house prices are expected to increase with proximity to the city centre. It is desirable to stay far away from traffic congestion spots, nearer to large parks and schools, and inside secured areas. The directions views to west and southwest boost house prices. Listings in the red book, which indicates houses with land use rights and ownership, are expected to command a higher price.

The current interpretation of direct impacts can be improved further. To identify the total effect of flood risk on house prices, we consider the spillover effect which assumes that house prices and/or flood risk of a certain property may have an impact on nearby ones. As discussed previously, the SAC model is used to interpret the impact. Thus, we continue to use the SAC model to adjust the price discount interpretation under the spillover effects.

The decomposition estimation results are reported in Table 7 where the spillover and total effects of all variables are significant and concur with the fact that significant coefficients of the spatial weight matrix W in the case of the SAC model as shown in Table 5. Our empirical evidence in Table 7 is consistent with the conclusion drawn by Delgado and Florax (2015) in which an appropriate spatial estimator should be used when both spatial sorting and spatial interaction exist in treatment responses.

Direct and indirect effects indicate the rate of price discount that houses in the flooded areas were facing. Separating indirect effects from total effects helps to differentiate between how much the reduction is from being affected by the floods and how much it is caused by staying near inundated areas. Understanding this can aid when formulating a tax policy. The amount accounted for a direct effect could be attributed to real estate companies that built properties on exiting waterways of the city. This is compensation for harming the environment and affecting people’s lives. On the other hand, tax revenue equal to the indirect effect might be used for informing the residents of flood risk areas, thus raising the awareness of flood risk.

Therefore, house prices increase 7.7% from before to after the event among the control group relative to a 1.7% (= 0.077—0.094) decrease in house prices among the treatment group during the same time span. Converting from the logarithm form, the effect of the pluvial flood on house prices was reflected by a discount by 9% of the treatment group compared to the control group from before to after the event. This discount rate could be used as a foundation for proposing an environmental tax (more details are in conclusion). Our results (9% price discount) are consistent with results obtained from other studies (e.g. 5.7%—Bin and Polasky (2004), 8.6%—Posey and Rogers (2010), 10.3%—Rabassa and Zoloa (2016), 6.7%—Rambaldi et al. (2013), and 6.2%—Samarasinghe and Sharp (2010)).

Price Recovery After the Flood

More analyses are carried out to examine whether houses regain their value. The original dataset used in Table 5 is added with more observations for several months after the flood. Specifically, compared to the original D_POST in Table 5, the new variable DPOST_5m in Table 8 keeps the same three months before the event (value = 0 for the date of listing from 01-Jul-2017 to 30-Sep-2017) and adds two more months after the event (value = 1 for 01-Nov-2017 and 01-Apr-2018). Similarly, DPOST_6m, DPOST_7m, DPOST_8m, DPOST_9m, and DPOST_10m include data 6 months, 7 months, 8 months, 9 months, and 10 months respectively after the flood. The housing market was inactive as Vietnamese people were taking a break for Lunar New Year; hence the disappearance of DPOST_4m.

Table 8 shows the recovery of house prices after the flood. Table 8-Panel A represents the direct effect in the SAC model while Table 8-Panel B reports the spillover and total effects. The positive and significant spillover effects indicate house prices are not only affected locally but also by neighbouring inundated areas. Results in Table 8-Panel B help to conclude that the negative effect from the flood event on house prices slowly diminishes as the houses regain their value from month to month. Based on the total effects, houses in the treatment group increased their prices gradually from 4.6% to 5.1% compared to those in the control group, if the duration of after-effect months is extended from 3 to 7–10 months.

Figure 4 shows house price changes for the control and treatment groups after the flood event on 30 September 2017. First, we find that house prices (red line) in the treatment group are higher than those (black line) in the control group. This is because houses in the treatment group are close to the city centre, with easy access to the hospital, inside secured areas and are more likely to list with pink book-the certification for both land use rights and house ownership based on the summary statistics by sub-groups in Table 4. Second, in the first four months after the flood event, house prices were reduced in the treatment group and increased in the control group, indicating that flood risk in the affected area may trigger more sales and less buying and vice versa for the unaffected area. No significant effects are found in the treatment group during the fifth and sixth months after the flood event. House prices experienced a decline for both the treatment and control groups but recovered from the ninth month onwards.

Some may argue that the price recovery in Table 8 could result from house repairs done by the owners. However, this should not be the case in our sample. Firstly, townhouses were only flooded for a few hours; and when the water drained, it left virtually no structural damage, which differs from the damage caused by storm surges. Secondly, for apartments located from the second floor upward, the flood would only affect their residents’ travel.

Discussion

The coefficients of main control variables such as Area, Number of Bedrooms and Bathrooms, Distance to CBD, School, and Hospital are significant and concur with previous research. Good facilities like Secured Area and Washing Machine positively affected the price.

By including legal status in the model, our results provide new insights into the effect of a property’s legal status on price in Vietnam. In other developed markets, sellers’ possession of legal documents is compulsory and standardised, and there would be little need to include this variable. In contrast, the impact of having legal documents (e.g. 3 = pink book) on property prices in Vietnam was found to be significant and positive. An explanation is that people tend to purchase the house with sufficient legal documents to avoid property fraud. Some land or houses which were abandoned by owners during the last days of the Vietnam War are now legally occupied by war veterans. However, proof of residence is missing, and transactions regarding these properties have potential risks of future disputes. Moreover, obtaining only a building permit is not enough to significantly increase the price.

The views to the west, and southwest were believed to be the best direction to have for a home. The north view looks towards the energetic city centre, while the west and southwest views show the peaceful green reserve of HCMC—the value-of-a-view perspective (Luttik, 2000; Samarasinghe & Sharp, 2008).

Possible explanations for the negative sign of the swimming pool variable include the concerns for either hygiene (in shared pools of apartments) and high maintenance costs (in villas or townhouses). Vietnamese house buyers realised the inconvenience of a swimming pool and later preferred a playground for their children or an in-house garden for their parents.

The sign of the floor level variable also differs from expectation. In contrast to a Westerner’s perspective, Vietnamese like to reside in lower floors for the convenience of mobility. The structure of Vietnamese households, in general, includes children and elderly parents who would feel safer when they can stay closer to the ground.

Unlike other countries, installed fibre connection surprisingly has a negative impact on house prices. Most building contractors in Vietnam work with an internet provider to set up the fibre system. House owners need to connect to a predestined provider; therefore, it restricts their freedom of choice of providers. In the recent years, the freedom of choice has been improved for other new projects. Further research need to be done to validate the outcome of this situation.

Although this study adopts the basic DD model by Atreya and Ferreira (2015), we have further developed the DD model by integrating spatial models. In doing so, we can examine the spillover effect, i.e. if residential property prices are affected by neighbouring house prices and if flood event impact on a certain zone might influence house prices of bordering zones. Since this paper studies the impact of a flood event on house prices and the model does not control for the inundated property directly as done in Atreya and Ferreira (2015); thus, results are different from those of Atreya and Ferreira (2015) in which inundated floodplain properties were discounted by 48% immediately after the flood. We find that the effect of the pluvial flood on house prices among the treatment group experienced a discount by 9% compared to the control group from before to after the event. We also study if houses retain their value after a temporary reduction caused by the flood, which has not been included in Atreya and Ferreira (2015).

Residents in HCMC usually experience a typical six-month rainy season, and pluvial flooding events tend to happen in the last three months. Therefore, we select the four months after the flood event as the post period. However, it may raise the concern that the short period – four months after the event- may not be sufficient to isolate the impact of flood risk on house prices due to several plausible alternative explanations from the demand and supply sides of the housing market. For instance, potential buyers might want to postpone purchasing homes in an area affected by flooding due to other reasons such as access, unavailability of labour to do necessary repairs, and sellers needing time to repair the affected homes. Moreover, sellers who sold homes straight after the flood event could be the liquidity-constrained sellers who needed to sell as quickly as possible. For example, these sellers could be the ones who had committed to purchasing another house and were therefore forced to sell at low prices in a bad market. In our future research, the propensity score matching technique (Papadogeorgou et al., 2019) can be employed to account for selection bias in affected houses in the housing market by using houses with similar characteristics.

Conclusion

This study sets out to determine the impact of a large pluvial flood event on house prices within the southern area of HCMC, Vietnam. The results of this investigation show that houses exposed to the flood event experienced a significant price discount by 9% after a large flood event on 30 September 2017.

The paper extends our knowledge by estimating the impact of a pluvial flood event on house prices in Vietnam. It contributes to the literature by shifting the focus towards the context of developing countries and challenging the issue of data availability. In the past, pluvial floods have received little attention, even though the cumulative costs from constantly disrupting the people’s daily travel are relatively high compared to a single large flood. This is the reason why we choose pluvial floods to be the main focus of the present study. The methodology of the integrated hedonic model and spatial economic approach into a single analytical framework is the first attempt to be applied to estimate the economic impact of pluvial floods, and it can be applied extensively. The findings of the study provide insights to design effective insurance policies.

The evidence from this study can be used as a reference for policymakers to design a flood insurance scheme. Without sufficient capital to properly repair the houses after the flood, owners can become even more vulnerable. The scheme can help financially-difficult people in high-risk zones. The premium price could also act as a source of risk information for both owners and sellers.

Blocking the existing channels with new residential areas led to frequent flooding. Now being constantly under the threat of inundation, even when it is not raining, the city is considering a four-billion-USD flood prevention project (Vietnamnet, 2018). Housing projects built on top the channels should be taxed based on the converted land area to fund flood protection infrastructure.

Another important practical implication is that estimates of price discount due to flood risk could be used to justify flood prevention policies by the government. Many flood protection measures in HCMC are criticised as to their cost-effectiveness. For example, the city hired an expensive pump for removing surplus water on Nguyen Huu Canh Street (Huu, 2018). Therefore, further research around the costs and benefits of different flood protection measures is worthy of being investigated.

References

ADB. (2010). Ho Chi Minh City adaptation to climate change. Philippines: Asian Development Bank. Retrieved from https://www.adb.org/publications/ho-chi-minh-city-adaptation-climate-change-summary-report on 1 November 2018.

Anselin, L.(1988). Spatial Econometrics: Methods and Models. Kluwr Academic Publishers.

Anselin, L. (2010). Thirty years of spatial econometrics. Papers in Regional Science, 89(1), 3–25.

Atreya, A., & Ferreira, S. (2015). Seeing is Believing? Evidence from Property Prices in Inundated Areas. Risk Analysis, 35(5), 828–848. https://doi.org/10.1111/risa.12307

Attakora-Amaniampong, E., Owusu-Sekyere, E., & Aboagye, D. (2016). Urban floods and residential rental values nexus in Kumasi, Ghana. Ghana Journal of Development Studies, 13(2), 176. https://doi.org/10.4314/gjds.v13i2.10

Bartosova, A., Clark, D., Novotny, V., & Taylor, K. S. (2000). Using GIS to evaluate the effects of flood risk on residential property values. Economics Faculty Research and Publications, 131. https://epublications.marquette.edu/econ_fac/131

Beltrán, A., Maddison, D., & Elliott, R. (2019). The impact of flooding on property prices: A repeat-sales approach. Journal of Environmental Economics and Management, 95, 62–86.

Bin, O., & Landry, C. E. (2013). Changes in implicit flood risk premiums: Empirical evidence from the housing market. Journal of Environmental Economics and Management, 65(3), 361–376. https://doi.org/10.1016/j.jeem.2012.12.002

Bin, O., & Polasky, S. (2004). Effects of flood hazards on property values: Evidence before and after Hurricane Floyd. Land Economics, 80(4), 490–500.

Binh, P. T., Zhu, X., Groeneveld, R., & Van Ierland, E. (2017). The flood insurance market in Vietnam: challenging but potentially profitable. Proceedings of the EEPSEA Research Report No. 2017-RR10. Economy and Environment Program for Southeast Asia.

Bosker, E. M., Garretsen, H., Marlet, G., & van Woerkens, C. (2014). Nether Lands: Evidence on the Price and Perception of Rare Flood Disasters (Vol. 10307): C.E.P.R. Discussion Papers. https://repec.cepr.org/repec/cpr/ceprdp/DP10307.pdf

Can, A. (1990). The Measurement of Neighborhood Dynamics in Urban House Prices. Economic Geography, 66(3), 254–272. https://doi.org/10.2307/143400

Clapp, J. M., Nanda, A., & Ross, S. L. (2008). Which school attributes matter? The influence of school district performance and demographic composition on property values. Journal of Urban Economics, 63(2), 451–466. https://doi.org/10.1016/j.jue.2007.03.004

Daniel, V. E., Florax, R. J. G. M., & Rietveld, P. (2009). Flooding risk and housing values: An economic assessment of environmental hazard. Ecological Economics, 69(2), 355–365. https://doi.org/10.1016/j.ecolecon.2009.08.018

Delgado, M. S., & Florax, R. J. (2015). Difference-in-differences techniques for spatial data: Local autocorrelation and spatial interaction. Economics Letters, 137, 123–126.

Di Maggio, M., Kalda, A., & Yao, V. (2019). Second chance: Life without student debt (No. w25810). National Bureau of Economic Research. http://giadinh.net.vn/xa-hoi/tp-hcm-trieu-cuong-dang-cao-noi-thanh-ngap-nang-2008121508131425.htm on 21 June 2022.

Dong, S. (2012). Roads are flooded, spark plug cleaners are free to cut and slash. Retrieved from https://nld.com.vn/thoi-su-trong-nuoc/duong-ngap-nuoc--tho-lau-bu-gi-thoa-suc-chat-chem-20121016052110846.htm on 9 June 2022.

Dong, T. (2011). Heavy rain, high tide HCMC “slightly flooded” 10 points. Retrieved from https://nld.com.vn/thoi-su-trong-nuoc/mua-lon--trieu-cuong-tphcm-ngap-nhe-10-diem-2011111107349341.htm on 9 June 2022.

Dröes, M. I., & Koster, H. R. A. (2016). Renewable energy and negative externalities: The effect of wind turbines on house prices. Journal of Urban Economics, 96, 121–141. https://doi.org/10.1016/j.jue.2016.09.001

Duy, P. (2017a). TP.HCM: Mưa lớn, nhiều tuyến đường ngập nặng [HCMC: Heavy rain, lots of streets inundated]. VOV. Retrieved from https://vov.vn/tin-24h/tphcm-mua-lon-nhieu-tuyen-duong-ngap-nang-677359.vov on 5 July 2018.

Duy, T. (2017b). Đường Sài Gòn ngập sâu trong mưa lớn, nhiều người ngã nhào [Saigon streets water deep, people slipped]. VNExpress. Retrieved from https://vnexpress.net/tin-tuc/thoi-su/duong-sai-gon-ngap-sau-trong-mua-lon-nhieu-nguoi-nga-nhao-3649098.html on 5 July 2018.

Efthymiou, D., & Antoniou, C. (2013). How do transport infrastructure and policies affect house prices and rents? Evidence from Athens, Greece. Transportation Research Part a: Policy and Practice, 52, 1–22.

Elhorst, J. P. (2014). Spatial econometrics: from cross-sectional data to spatial panels: Springer.

Engle, R. F., Lilien, D. M., & Watson, M. (1985). A dymimic model of housing price determination. Journal of Econometrics, 28(3), 307–326. https://doi.org/10.1016/0304-4076(85)90003-X

Eves, C., & Wilkinson, S. (2014). Assessing the immediate and short-term impact of flooding on residential property participant behaviour. Natural Hazards, 71(3), 1519–1536. https://doi.org/10.1007/s11069-013-0961-y

Filatova, T., Mulder, J. P. M., & van der Veen, A. (2011). Coastal risk management: How to motivate individual economic decisions to lower flood risk? Ocean and Coastal Management, 54(2), 164–172. https://doi.org/10.1016/j.ocecoaman.2010.10.028

Gertler, P. J., Martinez, S., Premand, P., Rawlings, L. B., & Vermeersch, C. M. (2016). Impact evaluation in practice: World Bank Publications.

Golgher, A. B., & Voss, P. R. (2016). How to Interpret the Coefficients of Spatial Models: Spillovers, Direct and Indirect Effects. Spatial Demography, 4(3), 175–205. https://doi.org/10.1007/s40980-015-0016-y

Gröbel, S., & Thomschke, L. (2018). Hedonic pricing and the spatial structure of housing data–an application to Berlin. Journal of Property Research, 35(3), 185–208.

Han, L., & Strange, W. C. (2016). What is the role of the asking price for a house? Journal of Urban Economics, 93, 115–130. https://doi.org/10.1016/j.jue.2016.03.008

Hanoimoi. (2013). Ho Chi Minh City: Many roads are submerged in water. Retrieved from http://hanoimoi.com.vn/Tin-tuc/Xa-hoi/637758/tpho-chi-minh-nhieu-tuyen-duong-ngap-sau-trong-nuoc on 9 June 2022.

Helbich, M., Brunauer, W., Vaz, E., & Nijkamp, P. (2014). Spatial Heterogeneity in Hedonic House Price Models: The Case of Austria. Urban Studies, 51(2), 390–411. https://doi.org/10.1177/0042098013492234

Hill, R. J. (2013). Hedonic Price Indexes for Residential Housing: A Survey, Evaluation and Taxonomy. Journal of Economic Surveys, 27(5), 879–914. https://doi.org/10.1111/j.1467-6419.2012.00731.x

Hou, Y. (2017). Traffic congestion, accessibility to employment, and housing prices: A study of single-family housing market in Los Angeles County. Urban Studies, 54(15), 3423–3445. https://doi.org/10.1177/0042098016675093

Huu, N. (2018). TP HCM chi 10 tỷ đồng thuê máy bơm chống ngập đường Nguyễn Hữu Cảnh [HCMC pay 10 billions to hire pump against flooding on Nguyen Huu Canh Street]. VNExpress. Retrieved from https://vnexpress.net/tin-tuc/thoi-su/tp-hcm-chi-10-ty-dong-thue-may-bom-chong-ngap-duong-nguyen-huu-canh-3839686.html on 22 November 2018.

Huynh, D. (2015). Phu My Hung New Urban Development in Ho Chi Minh City: Only a partial success of a broader landscape. International Journal of Sustainable Built Environment, 4(1), 125–135.

Kim, A. M. (2007). North versus South: The Impact of Social Norms in the Market Pricing of Private Property Rights in Vietnam. World Development, 35(12), 2079–2095. https://doi.org/10.1016/j.worlddev.2007.01.006

Knight, J. R., Sirmans, C. F., & Turnbull, G. K. (1994). List price signaling and buyer behavior in the housing market. The Journal of Real Estate Finance and Economics, 9(3), 177–192. https://doi.org/10.1007/BF01099271

Lamond, J., & Proverbs, D. (2008). Flood insurance in the UK: a survey of the experience of floodplain residents.

Le Goix, R. (2007). The impact of gated Communities on property values: evidence of changes in real estate markets-Los Angeles, 1980–2000. Cybergeo: European Journal of Geography. https://doi.org/10.4000/cybergeo.6225

LeSage, J. P. (1999). The theory and practice of spatial econometrics. University of Toledo. Toledo, Ohio, 28, 33.

LeSage, J. P., & Pace, R. K. (2009). Introduction to Spatial Econometrics (Statistics, textbooks and monographs): CRC Press.

Luttik, J. (2000). The value of trees, water and open space as reflected by house prices in the Netherlands. Landscape and Urban Planning, 48(3), 161–167. https://doi.org/10.1016/S0169-2046(00)00039-6

Molnar, G., Savage, S. J., & Sicker, D. C. (2015). Reevaluating the broadband bonus: Evidence from neighborhood access to fiber and United States housing prices. Fiber to the Home Council Americas. http://scandiainternet.com/documents/FTTH%20Study.pdf

Morgan, A. (2007). The impact of Hurricane Ivan on expected flood losses, perceived flood risk, and property values. Journal of Housing Research, 16(1), 47–60.

Nguyen, H. T. B., Miller, N. G., Pham, N. K., & Truong, H. T. (2021). Flood risk and buyer search behavior in Ho Chi Minh City. International Journal of Housing Markets and Analysis. https://www.emerald.com/insight/content/doi/10.1108/IJHMA-05-2021-0060/full/html

Nyce, C., Dumm, R. E., Sirmans, G. S., & Smersh, G. (2015). The Capitalization of Insurance Premiums in House Prices. Journal of Risk and Insurance, 82(4), 891–919. https://doi.org/10.1111/jori.12041

Osland, L. (2010). An Application of Spatial Econometrics in Relation to Hedonic House Price Modeling. Journal of Real Estate Research, 32(3), 289–320. https://doi.org/10.5555/rees.32.3.d4713v80614728x1

Pace, R. K., LeSage, J., & Zhu, S. (2009). Impact of Cliff and Ord on the housing and real estate literature. Geography Analysis, 41, 418–424.

Papadogeorgou, G., Choirat, C., & Zigler, C. M. (2019). Adjusting for unmeasured spatial confounding with distance adjusted propensity score matching. Biostatistics, 20(2), 256–272.

Phan, L. (2015). The housing bubble and consumer buying behavior-A research in Vietnamese residential market. https://www.theseus.fi/handle/10024/92259

Pommeranz, C., & Steininger, B. I. (2020). Spatial Spillovers in the Pricing of Flood Risk: Insights from the Housing Market. Journal of Housing Research, 29, S54–S85.

Posey, J., & Rogers, W. H. (2010). The Impact of Special Flood Hazard Area Designation on Residential Property Values. Public Works Management and Policy, 15(2), 81–90. https://doi.org/10.1177/1087724x10380275

Pryce, G., Chen, Y., & Galster, G. (2011). The Impact of Floods on House Prices: An Imperfect Information Approach with Myopia and Amnesia. Housing Studies, 26(2), 259–279. https://doi.org/10.1080/02673037.2011.542086

Quang, K., & Tam, D. (2017). Người Sài Gòn khốn khổ trong đêm mưa ngập nặng nhất mùa [Saigonese suffered from the worst rainy night of the season]. Tuoi Tre Online. Retrieved from https://tuoitre.vn/nguoi-sai-gon-khon-kho-trong-dem-mua-ngap-nang-nhat-mua-201709302030003.htm on 5 July 2018.

Rabassa, M. J., & Zoloa, J. I. (2016). Flooding risks and housing markets: a spatial hedonic analysis for La Plata City. Environment and Development Economics, 21(4), 464–489. https://doi.org/10.1017/S1355770X15000376

Rambaldi, A. N., Fletcher, C. S., Collins, K., & McAllister, R. R. J. (2013). Housing Shadow Prices in an Inundation-prone Suburb. Urban Studies, 50(9), 1889–1905. https://doi.org/10.1177/0042098012465904

Samarasinghe, O., & Sharp, B. (2010). Flood prone risk and amenity values: A spatial hedonic analysis. Australian Journal of Agricultural and Resource Economics, 54(4), 457–475. https://doi.org/10.1111/j.1467-8489.2009.00483.x

Samarasinghe, O. E., & Sharp, B. M. H. (2008). The value of a view: A spatial hedonic analysis. New Zealand Economic Papers, 42(1), 59–78. https://doi.org/10.1080/00779950809544413

Shimizu, C. (2014). Estimation of Hedonic Single-Family House Price Function Considering Neighborhood Effect Variables. Sustainability, 6(5), 2946.

Sirmans, G. S., MacDonald, L., Macpherson, D. A., & Zietz, E. N. (2006). The Value of Housing Characteristics: A Meta Analysis. The Journal of Real Estate Finance and Economics, 33(3), 215–240. https://doi.org/10.1007/s11146-006-9983-5

Stamou, M., Mimis, A., & Rovolis, A. (2017). House price determinants in Athens: A spatial econometric approach. Journal of Property Research, 34(4), 269–284.

StataCorp. (2017). Stata Spatial Autoregressive Models Reference Manual (Release 15) Stata: Release 15. StataCorp LLC.

Thanh, T. (2014). More than 50 points in Ho Chi Minh City are heavily flooded due to high tides. Retrieved from https://vov.vn/doi-song/hon-50-diem-o-tp-hcm-ngap-nang-do-trieu-cuong-356974.vov on 9 June 2022.

Thu, T. (2015). Today, high tide in Ho Chi Minh City reached the highest level. Retrieved from https://vov.vn/tin-24h/hom-nay-trieu-cuong-tai-tp-hcm-len-muc-cao-nhat-445231.vov on 9 June 2022.

Truong, T.T., Perera, R. (2011). Consequences of the two-price system for land in the land and housing market in Ho Chi Minh City, Vietnam. Habitat International, 35 (1):30–39. https://doi.org/10.1016/j.habitatint.2010.03.005

Tse, R. Y. C. (2002). Estimating Neighbourhood Effects in House Prices: Towards a New Hedonic Model Approach. Urban Studies, 39(7), 1165–1180. https://doi.org/10.1080/00420980220135545

Turnbull, G. K., Zahirovic-Herbert, V., & Mothorpe, C. (2013). Flooding and Liquidity on the Bayou: The Capitalization of Flood Risk into House Value and Ease-of-Sale. Real Estate Economics, 41(1), 103–129. https://doi.org/10.1111/j.1540-6229.2012.00338.x

Vietnamnet. (2018). HCM City needs over 4 bln USD for flood prevention, wastewater treatment. Vietnamnet. Retrieved from https://english.vietnamnet.vn/fms/society/206701/hcm-city-needs-over-4-bln-usd-for-flood-prevention--wastewater-treatment.html on 29 October 2018.

Vojinović, Z. (2015). Flood Risk: The Holistic Perspective: From Integrated to Interactive Planning for Flood Resilience. Water Intelligence Online, 14. https://doi.org/10.2166/9781780405339

Waights, S. (2018). Does the law of one price hold for hedonic prices? Urban Studies, 0042098017749403. https://doi.org/10.1177/0042098017749403

Wen, L., Sharp, B., & Sbai, E. (2020). Spatial Effects of Wind Penetration and its Implication for Wind Farm Investment Decisions in New Zealand. The Energy Journal. 41(2). https://doi.org/10.5547/01956574.41.2.lwen

Witte, A. D., Sumka, H. J., & Erekson, H. (1979). An Estimate of a Structural Hedonic Price Model of the Housing Market: An Application of Rosen’s Theory of Implicit Markets. Econometrica, 47(5), 1151–1173. https://doi.org/10.2307/1911956

Zhang, L., Liu, H., & Wu, J. (2017). The price premium for green-labelled housing: Evidence from China. Urban Studies, 54(15), 3524–3541. https://doi.org/10.1177/0042098016668288

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Table

9, Figs.

Map of houses on arterial road. Notes: This study uses only the houses located on arterial roads within a radius of one kilometre. Each of these roads is at least 1 km different from the others. If the arterial road is flooded, there is no chance that the small roads connect to it can stay dry since arterial roads are built higher than smaller roads connected to them

5,

Inundation map for District 7. Notes: Yellow lines are roads; black areas are residential; black lines are boundaries; light blue areas are rivers and channels; blue shaded areas are flooded zones of 20 cm, 20–40 cm and over 40 cm; and white areas are non-flooded. District 7 boundary is the red bold line. Reprinted from Applications of remote sensing and GIS on flood risk mapping in District 7, HCMC by Pham, 2013, HCMC: STINFO.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bui, N., Wen, L. & Sharp, B. House Prices and Flood Risk Exposure: An Integration of Hedonic Property Model and Spatial Econometric Analysis. J Real Estate Finan Econ (2022). https://doi.org/10.1007/s11146-022-09930-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-022-09930-z