Abstract

Using a novel combination of mortgage datasets, we analyze the effects of two policy levers influencing the scope of Fannie Mae and Freddie Mac’s (Government-Sponsored Enterprises, GSEs) involvement in the U.S. residential mortgage market. First, we find that small changes in mortgage guarantee fees charged by the GSEs were essentially fully passed through to consumers, with limited effects on mortgage demand. This implies that small fee changes are primarily transfers between mortgage consumers and taxpayers while the GSEs remain in federal conservatorship. Second, the data suggest that marginally lowering maximum conforming loan size limits would cause most affected consumers to reduce their loan amounts to the new maximum. Our findings provide new detailed evidence on how GSE policy shapes mortgage availability and contrast the differing effects on consumers of two potential policy levers to reduce (or increase) the scope of GSE lending. Additional survey data indicate that borrowers’ shopping behavior and incomplete information may also influence the effects of GSE policy changes.

Similar content being viewed by others

Notes

Government support became explicit when the GSEs were taken into conservatorship in 2008. The government guarantee operates through a Senior Preferred Stock Purchase Agreement with the U.S. Treasury Department. See https://www.fhfa.gov/Conservatorship/Pages/History-of-Fannie-Mae%2D%2DFreddie-Conservatorships.aspx.

The Congressional Budget Office has also considered and analyzed proposals to “Raise Fannie Mae’s and Freddie Mac’s Guarantee Fees and Decrease their Eligible Loan Limits” as part of their Options for Reducing the Deficit, December 13, 2018, https://www.cbo.gov/budget-options/2018/54716. For summaries of recent guarantee fee and loan limit changes, see https://www.fhfa.gov/PolicyProgramsResearch/Policy/Pages/Guarantee-Fees-History.aspx and https://www.fhfa.gov/DataTools/Downloads/Pages/Conforming-Loan-Limits.aspx.

There is not a guarantee fee increase during the period covered by our data that would allow precisely identified pass-through and demand estimates, but we argue that marginal guarantee fee increases should also be fully passed through, based on theoretical models and on empirical evidence from other industries that cost increases are passed through to consumers more fully and more quickly than price decreases (Peltzman, 2000; Tappata, 2009). Similarly, in time periods and contexts where prior literature has found incomplete pass-through in credit card (Ausubel, 1991), mortgage (Agarwal et al., 2015; Amromin & Kearns, 2014; Fuster et al., 2013), or financial asset markets (Green et al., 2010), the effects are typically incomplete pass-through of cost decreases attributed to imperfect competition. We acknowledge that large increases in guarantee fees could induce larger credit supply responses, potentially leading to different outcomes.

The data during our study period covers 31 lenders, including many of the largest retail mortgage lenders. A subset of these data are used to populate the Consumer Financial Protection Bureau’s “Explore Interest Rates” tool, https://www.consumerfinance.gov/owning-a-home/explore-rates/.

For additional discussion of underwriting requirements on non-GSE conventional mortgages during this time period, see Chapters 4 and 5 of “Ability-to-Repay and Qualified Mortgage Rule Assessment Report,” Consumer Financial Protection Bureau, January 2019, https://www.consumerfinance.gov/data-research/research-reports/2013-ability-repay-and-qualified-mortgage-assessment-report/.

When including broker transactions, we also find borrowers at the loan limit were more likely to have used a mortgage broker. The differences in shopping behavior hold in samples with and without these broker transactions.

Consistent with prior literature (An & Yao, 2016; Loutskina & Strahan, 2009) our data show clear evidence of limited credit supply for jumbo loans relative to conforming loans. However, we argue that lenders are unlikely to meaningfully change their underwriting rules for jumbo loans (e.g., restrictions on lower credit scores and higher LTVs) in response to a small change in the conforming loan limit, and thus the existing restrictions on jumbo credit supply are likely to drive the effects of a loan limit change.

Our paper does not directly address, for example, the role of mortgage policy and the GSEs in the availability of the 30-year fixed rate mortgage (Fuster & Vickery, 2015), cross-subsidization and redistribution (Gete & Zecchetto, 2018; Hurst et al., 2016), and interactions with home prices (Adelino et al., 2012; An & Yao, 2016; Grundl & Kim, 2021; Johnson, 2020).

The general absence of local pricing in the GSE market has been documented in Hurst et al. (2016). While that study finds evidence of more local price variation in the jumbo loan market, evidence from Loutskina and Strahan (2009, 2011) suggests that this is likely driven by differences in the composition of geographically concentrated lenders in particular markets, rather than localized pricing by national lenders.

For additional details, see Bhutta and Ringo (2015).

We compare our pricing results to averages from the CoreLogic data for robustness, but the price differentials in CoreLogic could result from consumers paying different points and fees.

The NSMO is a quarterly mail survey jointly funded and managed by the Federal Housing Finance Agency (FHFA) and the Consumer Financial Protection Bureau (CFPB). For details, see https://www.fhfa.gov/DataTools/Downloads/Pages/National-Survey-of-Mortgage-Originations-Public-Use-File.aspx.

Where lenders do not offer a rate with exactly zero points, we estimate the rate at zero points by linearly interpolating between the two nearest rates offered with points just above and just below zero.

The general pattern of our results is also robust to alternative weighting approaches, including using a subsample of HMDA and CoreLogic originations that can be matched on loan characteristics.

Anecdotally, the same loan types without rates in the Informa data also generate messages stating they are unavailable when entered into rate calculators on lenders’ websites.

These changes, studied in Fisher et al. (2021) and Hogan (2016), generally applied to the GSEs’ portfolios as a whole with limited observable variation across loan or borrower types. See “Guarantee Fee History,” FHFA, available at https://www.fhfa.gov/PolicyProgramsResearch/Policy/Pages/Guarantee-Fees-History.aspx.

See “FHFA Seeks Input on Fannie Mae and Freddie Mac Guarantee Fees,” June 5, 2014, available at https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Seeks-Input-on-Fannie-Mae-and-Freddie-Mac-Guarantee-Fees.aspx.

See “Results of Fannie Mae and Freddie Mac Guarantee Fee Review,” FHFA, April 17, 2015, available at https://www.fhfa.gov/Media/PublicAffairs/Pages/Results-of-Fannie-Mae-and-Freddie-Mac-Guarantee-Fee-Review.aspx.

While the rates are the same, borrowers with an LTV above 80 are typically required to purchase Private Mortgage Insurance, increasing the cost of their loan.

Authors’ calculations from publicly available Fannie Mae Single-Family Loan Performance Data, Data Dynamics online tool, https://capitalmarkets.fanniemae.com/tools-applications/data-dynamics, accessed Oct. 13, 2021. Data include fixed-rate, fully documented, fully amortizing loans delivered to Fannie Mae. Additional documentation available here: https://capitalmarkets.fanniemae.com/media/8921/display.

This large mass of LTVs above 80 is observed even if the sample is restricted to loans near the conforming loan limit.

For borrowers below the new limit, or above the old limit, the counterfactual only removes an unchosen option from their choice set. We ignore the possibility that, given jumbo rates below conforming, the limit reduction could induce some borrowers below the new limit to shift upward.

Although our model predicts that Low Credit Score jumbo borrowers pay about 21 basis points less than those who bunch, this reflects an extremely small population and is based on the rates of fewer than 10% of Informa lenders who offer these loans. The average rate for the High Credit Score borrowers reflects a large number of low LTV borrowers paying essentially equal rates, and a small number with higher LTVs paying significantly more.

For a more detailed history of the GSEs, see “A Brief History of the Housing Government Sponsored Enterprises,” available at https://www.fhfaoig.gov/Content/Files/History%20of%20the%20Government%20Sponsored%20Enterprises.pdf.

The government split off part of Fannie Mae at that time to continue buying and securitizing loans guaranteed by the FHA. That part, Ginnie Mae, remains within the federal government.

The term GSEs sometimes also includes the Federal Home Loan Bank System, which we do not study in this paper.

For additional detail, see “Fannie Mae and Freddie Mac Single-Family Guarantee Fees in 2017,” December 2018, available at https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/GFee-Report_12-10-18.pdf.

The most applicable data available for studies during this period was often survey-based, including the Mortgage Interest Rate Survey (MIRS) dataset. This monthly survey, administered by the Federal Reserve at the time, asked selected lenders for loan-level information on terms, conditions, and consumer and loan characteristics for loans made on a common set of the days during the month. The methodology used in these early studies often included a regression model fitting observed pricing on a combination of consumer and loan characteristics, at times restricted to a particular state (e.g., California) and a particular loan type (e.g., 30-year fixed) to limit heterogeneity. The models typically included a jumbo indicator (whether the loan amount is above the conforming loan limit) that was the coefficient of interest.

See also an earlier report by the Congressional Budget Office (2010) suggesting similar measures.

The other two were increasing private capital and winding down the GSEs’ investment portfolio.

In addition to using a semi-parametric function of consumer and loan characteristics, as opposed to the parametric functional forms in the literature described above, the authors use the appraisal value of the house as an instrument for jumbo loan status, as in Kaufman (2014). The bunching technique used follows Kleven and Waseem (2013).

The Y-14 M data are described at https://www.federalreserve.gov/apps/reportforms/reportdetail.aspx?

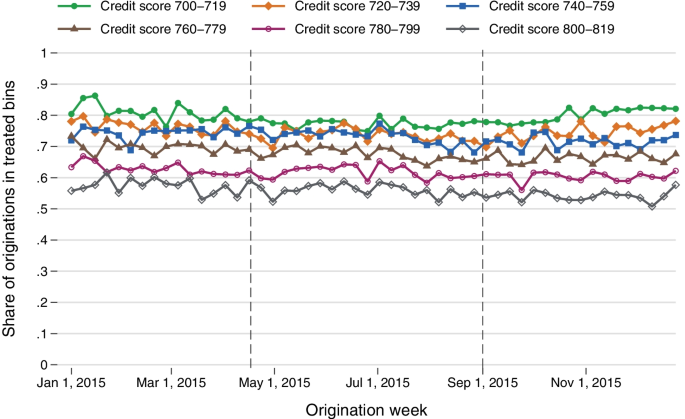

Across all credit scores, the share of loans in the treated category is about 70% across all weeks.

While we primarily expect intensive margin adjustments for the small interest rate reductions studied here, the model would also pick up changes in total originations in treated bins relative to untreated bins.

Bhutta et al. (2020) study data containing the length of rate locks, finding 30 and 45 days to be the most common choices.

Appendix Table 8 shows comparable results for the rate and term refinance loans originated by the same set of lenders.

Appendix Table 10 presents estimates for the same demand model but adds to the sample loans originated through the correspondent or wholesale channels. Relative to the retail-only estimates, we find slightly stronger effects when excluding originations within 45 days of the fee change. The estimates are statistically significant at the 95% level and indicate a 3.3- to 3.5-percentage point increase in the share of loans originated in treated bins. One explanation for these results could be comparable timing and pass-through of guarantee fee changes among loans originated through the correspondent and wholesale channels, with potentially stronger demand effects. However, not all lenders participate in the correspondent and wholesale channels, so these results may also reflect differences in price sensitivity across lenders, products, or other factors.

We round LTVs, l, up to the nearest whole number, and additionally impose that borrowers cannot choose loans for which we observe no rates in the Informa data. This results in only a small change relative to the empirical distribution of LTVs and allows us to calculate counterfactual rates.

References

Acharya, V. V., Richardson, M., Van Nieuwerburgh, S., & White, L. J. (2011). Guaranteed to fail: Fannie Mae, Freddie Mac, and the debacle of mortgage finance. Princeton University Press.

Adelino, M., Schoar, A., Severino, F. (2012). Credit Supply and House Prices: Evidence from Mortgage Market Segmentation, Working Paper 17832, National Bureau of Economic Research. https://doi.org/10.3386/w17832.

Agarwal, S.,Amromin, G., Chomsisengphet, S., Landvoigt, T., Piskorski, T., Seru, A., Yao, V. (2015) Mortgage Refinancing, Consumer Spending, and Competition: Evidence from the Home Affordable Refinancing Program, Working Paper 21512, National Bureau of Economic Research. https://doi.org/10.3386/w21512.

Alexandrov, A. & Koulayev, S.(2017). No Shopping in the US Mortgage Market: Direct and Strategic Effects of Providing Information, Consumer Financial Protection Bureau Office of Research Working Paper No. 2017–01. https://doi.org/10.2139/ssrn.2948491

Allen, J., Clark, R., & Houde, J.-F. (2014). Price dispersion in mortgage markets. The Journal of Industrial Economics, 62, 377–416.

Amromin, G. & Kearns, C. (2014). Access to Refinancing and Mortgage Interest Rates: HARPing on the Importance of Competition, Working Paper 2014–25, FRB of Chicago. https://doi.org/10.2139/ssrn.2539772.

An, X., & Bostic, R. W. (2008). GSE activity, FHA feedback, and implications for the efficacy of the affordable housing goals. The Journal of Real Estate Finance and Economics, 36, 207–231.

An, X. & Yao, V. (2016). Credit Expansion, Competition, and House prices. https://doi.org/10.2139/ssrn.2833542

Anenberg, E., Hizmo, A., Kung, E., & Molloy, R. (2019). Measuring mortgage credit availability: A frontier estimation approach. Journal of Applied Econometrics, 34, 865–882.

Angelides, P., Thomas, B., et al. (2011). The Financial Crisis Inquiry Report: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States (Revised Corrected Copy). Government Printing Office.

Ausubel, L. M. (1991). The failure of competition in the credit card market. The American Economic Review, 50–81 https://www.jstor.org/stable/2006788

Avery, R. B., & Brevoort, K. P. (2015). The subprime crisis: Is government housing policy to blame? Review of Economics and Statistics, 97, 352–363.

Bhutta, N. (2012). GSE activity and mortgage supply in lower-income and minority neighborhoods: The effect of the affordable housing goals. The Journal of Real Estate Finance and Economics, 45, 238–261.

Bhutta, N., Fuster, A., Hizmo, A. (2020) Paying too much? Price dispersion in the US mortgage market, FEDS Working Paper No. 20202–62. https://doi.org/10.17016/FEDS.2020.062

Bhutta, N., & Hizmo, A. (2021). Do minorities pay more for mortgages? The Review of Financial Studies, 34, 763–789.

Bhutta, N., & Ringo, D. R. (2015). The 2014 home mortgage disclosure act data. Federal Reserve Bulletin, 101.

Bhutta, N., & Ringo, D. R. (2021). The effect of interest rates on home buying: Evidence from a shock to mortgage insurance premiums. Journal of Monetary Economics, 118, 195–211.

Congressional Budget Office. (1996). Assessing the public costs and benefits of Fannie Mae and Freddie Mac. https://www.cbo.gov/publication/10339. Accessed 9 May 2022.

Congressional Budget Office. (2010). Fannie Mae, Freddie Mac, and the federal role in the secondary mortgage market. https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/12-23-fanniefreddie.pdf. Accessed 9 May 2022.

Damen, S., & Buyst, E. (2017). Mortgage shoppers: How much do they save? Real Estate Economics, 45, 898–929.

DeFusco, A. A., & Paciorek, A. (2017). The interest rate elasticity of mortgage demand: Evidence from bunching at the conforming loan limit. American Economic Journal: Economic Policy, 9, 210–240.

Elenev, V., Landvoigt, T., & Van Nieuwerburgh, S. (2016). Phasing out the GSEs. Journal of Monetary Economics, 81, 111–132.

Favilukis, J., Ludvigson, S. C., & Van Nieuwerburgh, S. (2017). The macroeconomic effects of housing wealth, housing finance, and limited risk sharing in general equilibrium. Journal of Political Economy, 125, 140–223.

Fisher, L. M., Fratantoni, M., Oliner, S. D., & Peter, T. J. (2021). Jumbo rates below conforming rates: When did this happen and why? Real Estate Economics, 49, 461–489.

Frame, W. S., Gerardi, K., Willen, P. (2015). The failure of supervisory stress testing: Fannie Mae, Freddie mac, and OFHEO, FRB Atlanta Working Paper.

Freddie Mac. (2015). Freddie Mac update: Investor presentation, September 2015.

Fuster, A., Goodman, L. S., Lucca, D. O., Madar, L., Molloy, L., & Willen, P. (2013). The rising gap between primary and secondary mortgage rates. Economic Policy Review, 19.

Fuster, A., & Vickery, J. (2015). Securitization and the fixed-rate mortgage. Review of Financial Studies, 28, 176–211.

Fuster, A., & Zafar, B. (2021). The sensitivity of housing demand to financing conditions: Evidence from a survey. American Economic Journal: Economic Policy, 13, 231–265.

Gete, P., & Zecchetto, F. (2018). Distributional implications of government guarantees in mortgage markets. The Review of Financial Studies, 31(3), 1064–1097.

Green, R. C., Li, D., & Schürhoff, N. (2010). Price discovery in illiquid markets: Do financial asset prices rise faster than they fall? The Journal of Finance, 65, 1669–1702.

Grundl, S., & Kim, Y. S. (2021). The marginal effect of government mortgage guarantees on homeownership. Journal of Monetary Economics, 119, 75–89.

Gurun, U. G., Matvos, G., & Seru, A. (2016). Advertising expensive mortgages. The Journal of Finance, 71, 2371–2416.

Hendershott, P. H., & Shilling, J. D. (1989). The impact of the agencies on conventional fixed-rate mortgage yields. The Journal of Real Estate Finance and Economics, 2, 101–115.

Hogan, J. P. (2016). An empirical analysis of government-sponsored enterprise policy. Ph.D. Dissertation, Columbia University. https://www.proquest.com/docview/1749034882

Hurst, E., Keys, B. J., Seru, A., & Vavra, J. (2016). Regional redistribution through the US mortgage market. The American Economic Review, 106, 2982–3028.

Jeske, K., Krueger, D., & Mitman, K. (2013). Housing, mortgage bailout guarantees and the macro economy. Journal of Monetary Economics, 60, 917–935.

Johnson, S. (2020). Mortgage Leverage and House Prices. https://doi.org/10.2139/ssrn.3538462

Kaufman, A. (2014). The influence of Fannie and Freddie on mortgage loan terms. Real Estate Economics, 42, 472–496.

Kleven, H. J., & Waseem, M. (2013). Using notches to uncover optimization frictions and structural elasticities: Theory and evidence from Pakistan. The Quarterly Journal of Economics, 128, 669–723.

Laufer, S., & Paciorek, A. (2022). The effects of mortgage credit availability: Evidence from minimum credit score lending rules. American Economic Journal: Economic Policy, 14(1), 240–276.

Lehnert, A., Passmore, W., & Sherlund, S. M. (2008). GSEs, mortgage rates, and secondary market activities. The Journal of Real Estate Finance and Economics, 36, 343–363.

Loutskina, E., & Strahan, P. E. (2009). Securitization and the declining impact of bank finance on loan supply: Evidence from mortgage originations. The Journal of Finance, 64, 861–889.

Loutskina, E., & Strahan, P. E. (2011). Informed and uninformed investment in housing: The downside of diversification. The Review of Financial Studies, 24, 1447–1480.

MacDonald, D. (2019). The effect of the 2014 Federal Housing Administration Loan Limit Reductions on homeownership decisions. Housing Policy Debate, 29, 380–396.

McKenzie, J. A. (2002). A reconsideration of the jumbo/non-jumbo mortgage rate differential. The Journal of Real Estate Finance and Economics, 25, 197–213.

McLean, B. (2015). Shaky ground: The strange Saga of the U.S. mortgage giants. Princeton University Press.

Park, K. A. (2017). Temporary loan limits as a natural experiment in Federal Housing Administration Insurance. Housing Policy Debate, 27(3), 449–466. https://doi.org/10.1080/10511482.2016.1234501

Park, K. A. (2021). Housing choice under borrowing constraints. Housing Policy Debate, 31, 342–372.

Passmore, W. (2005). The GSE implicit subsidy and the value of government ambiguity. Real Estate Economics, 33, 465–486.

Passmore, W., Sherlund, S. M., & Burgess, G. (2005). The effect of housing government-sponsored enterprises on mortgage rates. Real Estate Economics, 33, 427–463.

Peltzman, S. (2000). Prices rise faster than they fall. Journal of Political Economy, 108, 466–502.

Pradhan, A. (2018). “Why are jumbo loans cheaper than conforming loans?” CoreLogic insights blog, Aug. 22. https://www.corelogic.com/intelligence/why-are-jumbo-loans-cheaper-than-conforming-loans/. Accessed 9 May 2022.

Tappata, M. (2009). Rockets and feathers: Understanding asymmetric pricing. The Rand Journal of Economics, 40, 673–687.

Treasury Department and HUD. (2011). Reforming America’s housing finance market: A report to congress. https://archives.hud.gov/news/2011/housingfinmarketreform.pdf. Accessed 9 May 2022.

Woodward, S. E., & Hall, R. E. (2012). Diagnosing consumer confusion and sub-optimal shopping effort: Theory and mortgage-market evidence. American Economic Review, 102, 3249–3276.

Acknowledgements

We thank Brian Bucks, Scott Frame, Ryan Kelly, Nuno Mota, Eva Nagypal, Nicola Pavanini, Wenlan Qian, Judith Ricks, several anonymous referees, and participants at the AREUEA-ASSA Conference, CFPB Research Conference (poster session), EARIE Annual Conference, Federal Housing Finance Agency seminar, and International Industrial Organization Conference for helpful comments. Nicholas Schwartz provided excellent research assistance.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors have no relevant financial or non-financial interests to disclose. All authors performed the majority of their work on this manuscript while employed at the Consumer Financial Protection Bureau. The views expressed are those of the authors and do not necessarily reflect those of their present or former employers, the Consumer Financial Protection Bureau, or the United States.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Background and Detailed Literature Discussion

GSEs Before the Early 2000s

The federal government took substantial steps during the 1930’s to promote homeownership and liquidity in housing finance markets, creating the Federal Home Loan Banking System, the Federal Housing Administration (FHA), and Fannie Mae (Federal National Mortgage Association).Footnote 27 Fannie Mae, originally a federal agency created to purchase and sell FHA-insured loans, was eventually fully privatized in 1968 and Freddie Mac was created with a similar private structure in 1970.Footnote 28 Changes at this time also allowed Fannie Mae and Freddie Mac to purchase mortgages not secured by the FHA or by any other government agency.Footnote 29 These non-FHA loans purchased and securitized by the GSEs are known as “conforming” loans and continue to be used as collateral for mortgage backed securities. In exchange for assuming the credit risk on these loans, the GSEs charge two types of guarantee fees; ongoing monthly fees that are largely fixed at the lender-level, and publicly-posted upfront fees which depend on the risk characteristics of a loan (e.g., credit score and LTV).Footnote 30

Although they were not government agencies, the GSEs’ debt was often treated as close to par with the debt of federal agencies, due to a widely held perception that the GSEs were effectively backed by the U.S. government.

As the GSEs’ market share grew, there was considerable research into the interest rate spread between conforming and jumbo loans—which were non-conforming due to their size—starting from at least the late 1980s (Hendershott & Shilling, 1989) and continuing through the early 2000s (Congressional Budget Office, 1996; Lehnert et al., 2008; McKenzie, 2002; Passmore, 2005; Passmore et al., 2005). The more recent papers estimated that jumbo loans were priced approximately 15–30 basis points per year above conforming loans during this period.Footnote 31

GSEs From the Early 2000s, and the 2015 Guarantee Fee Changes

The GSEs’ role in the housing boom and financial crisis has been analyzed extensively, with large losses leading them to be placed in conservatorship in 2008.Footnote 32 The Federal Housing Finance Agency (FHFA) acts as conservator, with the U.S. Treasury Department effectively receiving all GSE profits during conservatorship.

Conservatorship was intended as a temporary arrangement, and early reform proposals aimed to “pave the way for a robust private mortgage market by reducing government support for housing finance and winding down Fannie Mae and Freddie Mac on a responsible timeline” (Treasury Department and HUD, 2011).Footnote 33 Two of the four suggested actions were increasing guarantee fees and reducing conforming loan limits.Footnote 34

More Recent Literature on GSEs, Mortgage Pricing, and Loan Limits

More recent research has used applied econometric techniques to measure borrowers’ sensitivity to fee changes, rate differences, or loan limit adjustments for mortgages guaranteed by the GSEs or the FHA. DeFusco and Paciorek (2017) use bunching at the GSEs’ loan limit to derive the elasticity of mortgage demand to changes in interest rates. The authors estimate a pricing difference between jumbo and non-jumbo loans using CoreLogic data, finding a difference of 18 basis points per year—a result consistent with the previous literature, but higher than our estimates on the order of 5 basis points.Footnote 35 The difference is likely explained by the time period studied (we analyze 2015, while DeFusco and Paciorek (2017) analyze the early 2000s) and by the differences in data (CoreLogic has interest rates, but neither points nor fees that the consumer paid). Important changes over time are demonstrated by Fisher et al. (2021), who identify increased bank supply of jumbo loans and higher guarantee fees as direct causes of the reduced jumbo-conforming spread in recent years. Bhutta and Hizmo (2021) highlight the importance of controlling for discount points in pricing comparisons, finding that interest rate differences across racial groups can be explained in part by borrower sorting along pricing menus with trade-offs between interest rates and upfront points paid. By analyzing offered retail interest rates, we provide updated findings on rate spreads and pass-through not possible in prior studies.

Grundl and Kim (2021) study the effects of GSE and FHA loan limit increases in the wake of the financial crisis, finding small effects on overall homeownership levels despite substantial increases in loan volume backed by the federal government. These findings are consistent with related literature studying FHA loan limit changes, indicating that borrowers may respond to such constraints by adjusting home size (Park, 2021) and location (MacDonald, 2019), depending on the availability of alternative—in this case conventional—products (Park, 2017). We find many borrowers are constrained by the conforming loan limits despite small pricing differences, suggesting changes in these limits may substantially shift borrowers’ sorting into homes and locations.

Other recent studies have also measured credit availability through a focus on underwriting constraints, rather than pricing. Laufer and Paciorek (2022) and Anenberg et al. (2019) both study the characteristics of observed loan originations to infer the boundary or frontier of credit availability, the former focusing on the role of credit scores and the latter taking a more holistic, multi-variate approach. Both find important roles for lender underwriting restrictions on non-pricing dimensions. This paper complements these approaches, measuring credit availability not just through the boundary of originated loans, but through the boundary of loans offered according to lenders’ rate sheets.

Demand Model Details and Results

Our demand analysis uses a dataset of Informa rates merged to the Y-14 M supervisory loan-level data collected as part of the Federal Reserve’s Comprehensive Capital Analysis and Review.Footnote 36The Y-14 M data have the benefit of containing both credit scores (unlike HMDA) and also lender identifiers (unlike CoreLogic). We thus use a matched sample of 15 lenders that appear in both the Informa and Y-14 M datasets to estimate demand effects from lender-specific changes in relative prices. The Federal Reserve Y-14 M data contain information for loans held on portfolio or serviced by large banks and bank holding companies. While not representative of the market as a whole, reporting is mandatory for banks meeting the asset threshold, so the data provide complete portfolio coverage for the matched lenders. Our sample includes all 2015 one-to-four unit, conventional purchase loans originated through the retail channel by lenders in our matched Y-14 M-Informa sample.

We interpret any changes as likely a demand—rather than supply—response given the evidence of full pass-through and the widespread availability of conforming loans at these credit score and LTV levels (as shown in Table 1).

Figure 5 shows the share of loans in the treated category—those with a guarantee fee decrease— by week of origination. Because LTV is the key choice variable for consumers, treated share is shown separately by credit score bin. The share of loans in the treated category is quite consistent across all weeks, ranging from about 80% of sample originations for credit scores between 700 and 719 down to 55% for credit scores between 800 and 819.Footnote 37 The stability of these shares confirms there were no large demand shifts due to the guarantee fee change.

Share of Loans Originated with a Credit Score and LTV Combination that had a Guarantee Fee Decrease in 2015. Note: 2015 Y-14 M first-lien, conventional purchase mortgage originations by lenders in the Informa data (identified by lender name). The vertical line at April 17th indicates the announcement date of the upfront guarantee fee change, while the vertical line at September 1st indicates the effective date. Within credit score bin, treated share determined by variation in LTVs. For credit scores below 700, treated share equals 1. See Table 2 for grid of treated credit score and LTV combinations

To more precisely estimate possible demand effects, we estimate regression models mirroring those for our pass-through estimates (specifications 4 and 5) but where the unit of observation is an originated loan and the outcome is an indicator equal to one for loans within a treated combination of credit score bin and LTV bin.

Identification comes from variation in the implementation date of the fee change across lenders, as shown in Fig. 1. We estimate the following model specifications for the 13 lenders in the Y14M-Informa matched sample where we can identify the exact date the fee change was implemented:

where yi is an indicator equal to one for loans within a treated combination of credit score (f) and LTV (l) bins, Postjt indicates dates after the fee change implementation by a given lender (j) and fixed effect controls for lender, state (s), credit score bin, and origination week (w(t)).Footnote 38 The second specification includes credit score bin-week interacted fixed effects θfw.

The treatment coefficient of interest, β1, captures changes in the probability that an originated loan falls within a treated bin after the originating lender implements the guarantee fee decrease. Seasonal effects and persistent differences in loan choices are controlled for with week, lender, state, and credit score bin fixed effects. The specifications with interacted credit score bin-week fixed effects (θfw) control for possible differential time trends among borrowers with high and low credit scores.

This model assumes all loans originated after the guarantee fee change are subject to the new lower rates. To account for the possibility that some borrowers use rate locks—thereby potentially choosing their loan prior to the fee decrease coming from the guarantee fee change—we also estimate specifications in which we drop all loans originated within the 45 days following a lender’s fee implementation date.Footnote 39 We refer to this as the Alternative Post (Alt. Postjt) definition in these specifications:

For all specifications, we assume that borrowers do not manipulate their credit score bin in anticipation of or in response to the fee change, and thus the choice variable for consumers is largely restricted to LTV. With the included fixed effects, the identifying variation then comes from changes over time in the distribution of LTVs within lender, state, and credit score bin.

Identification also requires that the implementation date for a given lender is not strategically chosen based on anticipated demand patterns across loan types. In practice, all lenders appear to implement fee changes across all loan types simultaneously, suggesting the timing may be driven by lenders’ expected turnaround time to securitize the loans with the GSEs (when the guarantee fee is actually paid, as discussed in Hogan (2016)) or operational constraints.

Appendix Table 7 presents the estimated demand effects of the guarantee fee change on retail purchase originations.Footnote 40 For the sample including all originations (columns (1)–(2)), the 95% confidence intervals range from a 1-percentage point decrease to a 4-percentage point increase in the probability that an originated loan is made in a treated category. The estimates are larger for the alternative sample which excludes loans originated during the 45 days following the fee change to account for the possible use of rate locks (columns (3)–(4)), with 95% confidence intervals encompassing a null effect and a 5-percentage point increase.Footnote 41 Stronger effects for this alternative sample would be consistent with rate locks preventing some borrowers from responding to the price decrease.Footnote 42

We find no statistically significant demand effects, but the point estimates have the expected positive sign for a demand response to a fee decrease and imply price sensitivities comparable to those found in prior studies.Footnote 43 For our preferred specification which accounts for borrowers’ use of rate locks, the point estimates suggest a 2.5 percentage point increase in the share of originations in treated bins, from a base of 77%.

Conforming Loan Limit Simulation Details

Counterfactual Loan Limits

Our model is estimated to minimize the difference between the missing mass of borrowers just above the limit and the excess mass bunching at the limit.

For our calculations, all dollar loan amounts are measured in logs and normalized to zero at the conforming loan limit in the county of origination. All loans are assigned to bins j = {−J,...,L,...,0,...,U,...,J}, reflecting their distance from the loan limit, in intervals of a fixed width. We use a flexible polynomial of degree p to fit the distribution of loan counts nj within each bin, with additional indicator variables for those bins immediately surrounding the loan limit, {mL,...,mU}, to estimate the amount of bunching relative to the smooth polynomial. The full regression is

The estimated polynomial, excluding the indicators, yields the predicted smooth distribution of loan amounts without bunching

Both the missing mass of borrowers above the limit, \(\hat{M}\), and the excess mass of borrowers bunching at the limit, \(\hat{B}\), are calculated as differences between the borrower counts predicted by the smooth distribution and the data:

and \(\hat{B}=\sum_{j=L}^0\left({n}_j-{\hat{n}}_j\right)=\sum_{j=L}^0{\hat{\gamma}}_j\).

After estimating the above model separately for borrowers with low, medium, and high credit scores, we use the smooth polynomial distribution of loan amounts and the indicator coefficients γk to calculate the fraction of borrowers missing from each of the U bins above the limit:

These fractions trace out the dip in originations above the existing loan limit and form the basis for our counterfactual predictions.

Our counterfactual shifts the loan limit downward by S bins, using fk to model the number of borrowers bunching at given distances from the new loan limit. We assume that borrowers now bunch from the full range of loan sizes in {−S + 1,...,U}. Given the larger interval of loan sizes covered, we define a wider set of bins jc = {1,...,U} such that it covers the same interval as j = {−S + 1,...,U}, and then apply the fractions fk to these wider bins. This method traces out our counterfactual dip, and then allocates the total counterfactual mass of missing loans,

below the new loan limit on the interval from j = {L − S, …, −S}. Like our estimation algorithm, this counterfactual does not allow for the extensive margin choice to not take out a mortgage.

Simulation Details - Counterfactual LTV Ratios

As with the distribution of loan amounts, we assume that the LTV distribution of jumbo loans immediately above the new limit would equal the distribution observed immediately above the existing limit, f(l,above), using observed LTVs for loans from $417,001 to approximately $480,000.Footnote 44 We similarly assume that the LTV distribution of conforming loans below the new limit would equal the observed distribution below the existing limit, f(l,below), using observed LTVs for loans from approximately $404,000 to $417,000. While this method does not model loan choice at the borrower level, it provides an aggregate sense of where borrowers are switching from and switching to relative to the observed data.

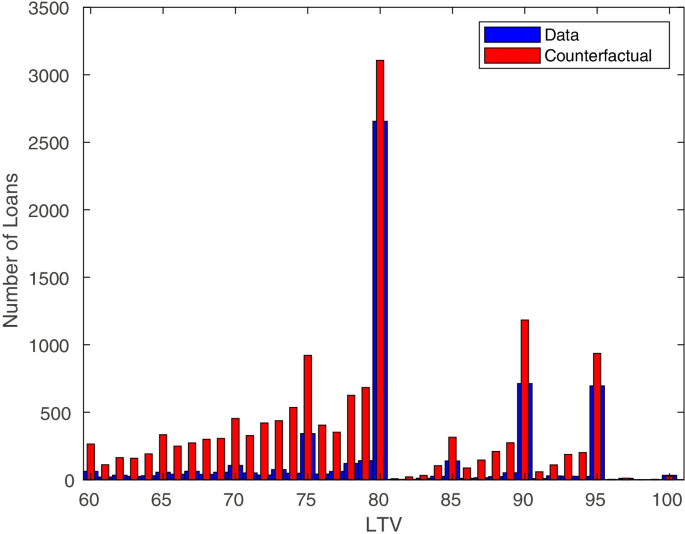

Consider the high credit score borrowers observed choosing loan amounts between the new and existing loan limits. In our counterfactual, 19% of these borrowers remain between the limits after the simulated policy change. We allocate these borrowers according to f(l,above), as shown in Fig. 6 alongside the observed distribution. In this simulation, 75% of borrowers with an LTV of 80 or less would adjust their loan amounts as a result of the shift, compared to 95% of those with higher LTVs. Among borrowers with good credit, the GSEs have a larger effect on the availability of high LTV loans. However, many borrowers at lower LTVs adjust as well, suggesting that unobserved factors like stricter underwriting or incomplete information are economically important even for those with good credit.

LTV Distribution for Borrowers Between Counterfactual and Existing GSE Conforming Loan Limits, High Credit Score Borrowers. Note: Data and simulations based on single-family, conventional, 30-year, fixed rate loan originations in 2015 CoreLogic data. Sample restricted to high credit score borrowers below existing conforming loan limit, and above new, counterfactual loan limit. For counterfactual, total number of borrowers is the model prediction from loan amount counterfactual, distributed according to the observed LTV distribution of jumbo loans above the existing loan limit

To see what loans switching borrowers obtain, we apply the same method to assign LTVs to all borrowers bunching below the new limit in our counterfactual, based on the distribution observed just below the existing limit, f(l,below). Note that if the purchase price of homes is held constant, our counterfactual limit reduction of four percentage points would force any bunching borrowers to reduce their loan amount (and hence LTV) by at most four percentage points. Figure 7 shows that the counterfactual distribution has less pronounced peaks at the focal values of 80 and 95, and increased mass elsewhere. The regions where the number of counterfactual loans exceeds that in the data are suggestive of the LTVs that bunching borrowers would choose. First, the simulation shows an increase in loans taken out with LTV above 80, but below 95. This would be expected from the population of borrowers who preferred high LTV conforming loans near the old limit, and now must marginally reduce their loan amount to maintain conforming status. The second region where we observe substantial numbers of bunching borrowers is at LTVs below 80. This would reflect many of the borrowers already bunching at the old limit, who would reduce their loan size even further. Based on credit score and LTV, these borrowers are eligible for jumbo loans priced at or below conforming rates.

LTV Distribution for Borrowers Below New Counterfactual GSE Conforming Loan Limit, High Credit Score Borrowers. Note: Data and simulations based on single-family, conventional, 30-year, fixed rate loan originations in 2015 CoreLogic data. Sample restricted to high credit score borrowers immediately below new, counterfactual conforming loan limit. For counterfactual, total number of borrowers is the model prediction from loan amount counterfactual, distributed according to the observed LTV distribution of conforming loans immediately below the existing loan limit

Rights and permissions

About this article

Cite this article

Alexandrov, A., Conkling, T.S. & Koulayev, S. Changing the Scope of GSE Loan Guarantees: Estimating Effects on Mortgage Pricing and Availability. J Real Estate Finan Econ (2022). https://doi.org/10.1007/s11146-022-09910-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-022-09910-3