Abstract

This paper argues that econometric analysis of housing price indexes before 2006 generated forecasts of future long-term price growth and low estimated probabilities of extreme price decreases. These forecasts of future increases in home-loan collateral values may have affected both the demand and the supply of mortgages. Standard time series models using repeat-sales indexes suggest that positive trends had a long half-life. Expectations based on such models could lead to an asset bubble. Analysis of data from the HMDA loan database and LoanPerformance.com at the MSA level and at the loan level substantiates the effects of past price trends on the demand and supply of subprime mortgages. On the demand side, at the MSA level, past home price increases are associated with more subprime applications, higher loan to income ratios and lower loan to value ratios of applications for both prime and subprime mortgages. This is consistent with the notion that households not only borrowed more but also invested more in home equity conditional on greater past house price increases. On the supply side, past home price appreciation had a significantly greater impact on the approval rate of subprime applications than the approval rate of prime applications. Loan level analysis indicates that past home price appreciation increased the approval rate of subprime applications but did not affect the approval rate of prime applications. Further, approved HMDA subprime loans had higher loan to income ratios in MSAs with greater past house price trends.

Similar content being viewed by others

Notes

For example, the conventional housing tenure choice models, such as Henderson and Ioannides (1983), indicate that owning is more attractive than renting with higher expected capital gain of home values. Further, in a standard mortgage default decision model, changes in home prices are an important explanatory variable. Deng et al. (2000) provide a survey of the literature on these models.

C.f. Goetzmann and Spiegel (2002)

c.f. Doms et al. (2007)

For example, a positive shift in demand may bring less creditworthy investors to the mortgage market, which would result in a lower approval rate if underwriting standards do not change. However supply effects might cause a loosening of credit standards, leaving the approval rate unchanged or higher.

C.f. Bailey et al. (1963).

C.f. Geltner (1997).

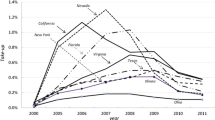

These intersect by construction, in 1995.

The details of the estimation may be found in the documentation for the R statistical language. Shumway and Stoffer (2006) point out inconsistencies in the use of the R ARIMA code for differenced series estimation, and offer a modified code to overcome these issues. This paper used their code available at http://www.stat.pitt.edu/stoffer/tsa2/index.html. The prediction uses a Kalman filtering method, and does not take into account parameter uncertainty associated with the time-series model.

Eight MSAs were estimated with ARIMA(18,1,3), five with ARIMA(12,1,3), one with ARIMA(6,1,3), two with ARIMA(3,1,3) and four with ARIMA(3,1,0).

The time series for Dallas is too short to estimate the ARIMA model.

Available from www.ffiec.gov/hmda/hmdarawdata.htm#by_msa. Avery et al. (2007) estimate that 80% of all home lending in the U.S. is covered by the 2006 HMDA data set. All data in this paper uses loans marked for home purchase. We also define “approved” loans as those that are ultimately originated to avoid double counting loans approved by multiple institutions.

Available from www.huduser.org/datasets/manu.html

Susan Wachter also documents this correlation for housing and mortgage data in 2002 in her presentation to the Evolving Housing Finance Marketplace Roundtable, January 16, 2008.

An important exception to this is the triple A standard for money market funds and the investment grade standard for regulated institutional portfolios such as banks and insurance companies.

Cf. Calhoun (1996)

Some readers will not count themselves among these market observers. There were certainly contrarian views.

References

Avery, R. B., Brevoort, K. P., & Canner, G. B. (2007). The 2006 HMDA Data. Federal Reserve Bulletin, 93, A73–A109.

Bailey, M., Muth, R., & Nourse, H. (1963). A regression method for real estate price index construction. J. Amer. Statist. Assoc., 58, 933–942.

Brunnermeier, M., & Julliard, C. (2008). Money illusion and housing frenzies. Review of Financial Studies, 21(1), 135–180.

Calem, P. S., Gillen, K., & Wachter, S. M. (2003). The neighborhood distribution of subprime mortgage lending. U of Penn, Inst for Law & Econ Research Paper 03–39.

Calhoun, C. A. (1996). OFHEO House Price Indexes: HPI Technical Description. Office of Federal Housing Enterprise Oversight.

Caplin, A, Chan, S., Freeman, C., & Tracy, J. (1999). “Household Asset Portfolios and the Reform of the Housing Finance Market,” TIAA-CREF Research Dialogues.

Capozza, D. R., Kazarian, D., & Thomson, T. A. (1997). Mortgage default in local markets. Real Estate Economics, 25(4), 631–655.

Case, K. E., & Shiller, R. J. (1989). The efficiency of the market for single-family homes. The American Economic Review, 79(1), 125–37.

Case, K. E., & Shiller, R. J. (2003). Is there a bubble in the housing market? Brookings Papers on Economic Activity, Economic Studies Program, The Brookings Institution, 34(2), 299–362.

Clayton, J., Miller, N., & Peng, L. (2008). Price-Volume Correlation in the Housing Market: Causality and Co-movement. Journal of Real Estate Finance and Economics, forthcoming.

Crews Cutts, A., & Van Order, R. (2005). On the economics of subprime lending. The Journal of Real Estate Finance and Economics, 30, 167–196.

Dell’Ariccia, G., Igan, D., & Laeven, L. (2009). “Credit Booms and Lending Standards: Evidence from the Subprime Mortgage Market,” IMF Working Papers.

Demyanyk, Y., & Van Hemert, O. (2011). Understanding the Subprime Mortgage Crisis. Review of Financial Studies, 24(6), 1848–1880.

Deng, Y., Quigley, J., & Van Order, J. (2000). Mortgage terminations, heterogeneity, and the exercise of mortgage options. Econometrica, 68(2), 275–308.

Doms, M., Furlong, F., & Krainer, J. (2007) Subprime Mortgage Delinquency Rates. Federal Reserve Bank of San Francisco Working Paper 2007–33

Downing, C., Stanton, R., & Wallace, N. (2005). An empirical test of a two-factor mortgage valuation model: how much do house prices matter? Real Estate Economics, 33(4), 681–710.

Fisher, J., Gatzlaff, D., Geltner, D., & Haurin, D. (2003). Controlling for the impact of variable liquidity in commercial real estate price indices. Real Estate Economics, 31(2), 269–303. 06.

Gabriel, S., & Rosenthal, S. (2007). “Secondary Markets, Risk, and Access to Credit: Evidence from the Mortgage Market,” Working Paper, Syracuse University.

Gatzlaff, D. H., & Haurin, D. R. (1997). Sample selection bias and repeat-sales index estimates. The Journal of Real Estate Finance and Economics, 14(1–2), 33–50.

Geltner, D. (1997). Bias and precision of estimates of housing investment risk based n repeat-sales indexes: a simulation analysis. Journal of Real Estate Finance and Economics, 14, 155–171.

Glaeser, E. L., Gyourko, J. E., & Saks, R. E. (2005). Why have housing prices gone up? The American Economic Review, 95(2), 329–333.

Goetzmann, W. N. (1992). The accuracy of real estate indexes: repeat sales estimators. Journal of Real Estate Finance and Economics, 5, 5–53.

Goetzmann, W. N., & Peng, L. (2006). Estimating house price indexes in the presence of seller reservation prices. The Review of Economics and Statistics, 88(1), 100–112.

Goetzmann, W. N., & Spiegel, M. I. (2002). “Policy Implications of Portfolio Choice in Underserved Mortgage Markets,” in Low-Income Homeownership: Examining the Unexamined Goal by Nicolas P. Retsinas and Eric S. Belsky.

Goetzmann, W. N., & Valaitis, E. (2006). “Simulating Real Estate in the Investment Portfolio: Model Uncertainty and Inflation Hedging,” Yale ICF Working Paper No. 06–04

Henderson, J. V., & Ioannides, Y. M. (1983). A model of housing tenure choice. The American Economic Review, 73, 98–113.

Ioannides, Y. M., & Rosenthal, S. S. (1994). Estimating the consumption and investment demands for housing and their effect on housing tenure status. The Review of Economics and Statistics, 76, 127–141.

Keys, B. J., Mukherjee, T. K., Seru, A., & Vig, V. (2008). “Did Securitization Lead to Lax Screening? Evidence from Subprime Loans,” SSRN Working Paper.

Lin, Z., & Vandell, K. D. (2007). Illiquidity and pricing biases in the real estate market. Real Estate Economics, 35(3), 291–330.

Loutskina, E., & Strahan, P. E. (2006) “Securitization and the Declining Impact of Bank Finance on Loan Supply: Evidence from Mortgage Acceptance Rates,” SSRN working paper.

Mayer, C., & Pence, K. (2008). “Subprime Mortgages: What, Where, and to Whom?” Finance and Economics Discussion Series, Federal Reserve Board.

Mian, A., & Sufi, A. (2008). “The Consequences of Mortgage Credit Expansion: Evidence from the 2007 Mortgage Default Crisis,” working paper, University of Chicago.

Rajan, U., Seru, A., & Vig, V. (2008). “ The Failure of Models That Predict Failure: Distance, Incentives and Defaults,” Working paper

Shumway, R. H., & Stoffer, D. (2006). Series Analysis and Its Applications: With R Examples, Springer Texts in Statistics.

Sinai, T., & Souleles, N. S. (2005). Owner-occupied housing as a hedge against rent risk. Quarterly Journal of Economics, 120, 763–789.

Wachter, S. M., Russo, K., & Hershaff, J. E. (2005) “Subprime Lending: Neighborhood Patterns Over Time in US Cities.” U of Penn, Inst for Law & Econ.

Further reading

Case, K., & Shiller, R. (1987). Prices of single-family homes since 1970: new indexes for four cities. New England Economic Review, 87(1987), 45–56.

Case, K. E., & Shiller, R. J. (1988). The Behavior of Home Buyers in Boom and Post-Boom Markets. New England Economic Review pp. 2–46, November/December. 36.

Case, K. E., & Shiller, R. (1990). Forecasting prices and excess returns in the housing market. AREUEA J., 18, 253–273.

Dhar, R., & Zhu, N. (2006). Up close and personal: investor sophistication and the disposition effect52(5). Management Science, 52(5), 726–740.

Pennington-Cross, A., & Chomsisengphet, S. (2007). Subprime refinancing: equity extraction and mortgage termination. Real Estate Economics, 35, 233–263.

Shiller, R. (1991). Arithmetic repeat sales price estimators. Journal of Housing Economics, 1, 110–126.

Acknowledgements

Thanks to Justin Haaheim for research support. We thank Yan Chang, Donald Haurin, C.F. Sirmans, Kerry Vandell and participants of the 2009 Summer Real Estate Symposium, the 2010 AREUEA annual conference, and the 2010 Florida State University Symposium for their constructive comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Goetzmann, W.N., Peng, L. & Yen, J. The Subprime Crisis and House Price Appreciation. J Real Estate Finan Econ 44, 36–66 (2012). https://doi.org/10.1007/s11146-011-9321-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9321-4