Abstract

This paper estimates, using a simultaneous equation model, the determinants of mortgage, including as a variable the tax saving due to the treatment of mortgage payments in Spanish income tax. We use an unusually rich data set obtained from a housing market intermediary with franchisers throughout the majority of the Spanish provinces. We observe that the income tax credit increased riskier borrowing during the housing boom years. Increasing by one percentage point the ratio of the present value of the stream of explicit tax savings to the price of the property, the mortgage amount granted increases by 1.6 %, whereas it causes a 2 % decrease in the term. This in turn, implies that the time discount factor increased in our sample by about 0.7–1.1 percentage points causing individuals to borrow riskier amounts of mortgage for shorter terms. This observation has important policy implications for governments wishing to foster real estate markets growth.

Similar content being viewed by others

Notes

Before 1992, mortgage interests were deductible from Italian income tax.

The main reason for the difference is that, although the sample begins in 2004, the observations for 2004 and 2005 do not contain term as a variable and were dropped.

Following Onrubia and Sanz (1999) and Sanromán (2006), the annual mortgage amount payable was calculated using the information on the total mortgage amount, the term and the interest rate granted, applying the finance law corresponding to a fixed instalment mortgage. This same finance law was subsequently applied to obtain the discounted value of the stream of tax savings.

Domínguez and López-Laborda (2001) present another alternative to evaluate the incentive effect of personal income tax with regard to housing decisions, using the net present value of the tax saving.

It is assumed in the calculation of the variable ‘tax saving’ that individuals take advantage of the provisional arrangements in compensation for income tax reform as stipulated in Law 35/2006 (in the sample there is no property eligible for the provisional arrangements as stipulated in Law 40/1998).

The discount rate at 5 % is the usually assumed level which corresponds to the long term state bonds at a particular moment in time (in our case it corresponds to the year 2007).

It is a complex task to translate this percentage into a quantity in absolute values of annual explicit tax saving, as it depends on both the price of the property and the mortgage amount and term. For an individual whose mortgage has an amount, term and appraisal value exactly equal to the average sample values, the increase in annual explicit tax saving would be approximately €180.

For statistics on the housing market in Spain see: http://www.bde.es/webbde/es/estadis/infoest/si_1_6.pdf

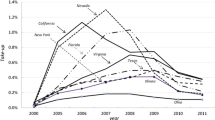

The bank default rate in Spain grew from 0.5 % in 2007 to 5.56 % in 2010.

References

Akin, O., Montalvo, J., García Villar, J., Peydró, J.-L., & Raya, J. (2014). The real estate and credit bubble: evidence from Spain. SERIEs, 5(2–3), 223–243. doi:10.1007/s13209-014-0115-9.

Alm, J. & Follain, J. R. (1987). Consumer demand for adjustable rate mortgages. House Finance Review, 6, 1–16.

Basten, C., & Koch, C. (2014). The causal effect of house prices on mortgage demand and mortgage supply. University of Zurich, Department of Economics.

Ben-David, I. (2011). Financial constraints and inflated home prices during the real estate boom. American Economic Journal: Applied Economics, 3(3), 55–87. doi:10.1257/app.3.3.55.

Bover, O. (1993). Un modelo empírico de la evolución de los precios de la vivienda en España (1976-1991). Investigaciones Económicas, 17, 65–86.

Brueckner, J. K. (1994). The demand for mortgage debt: some basic results. Journal of Housing Economics, 3(4), 251–262. doi:10.1006/jhec.1994.1012.

Domínguez, F. & López-Laborda, J. (2001). Una metodología para la utilización óptima de los incentivos por adquisición de vivienda habitual en el IRPF. Hacienda Pública Española, 159(4), 115–134.

FEDEA (2009). Algunas consideraciones sobre el problema de la vivienda en España. FEDEA.

Follain, J. R., & Dunsky, R. M. (1997). The demand for mortgage debt and the income tax. Journal of Housing Research, 8, 155–200.

García, J., & Raya, J. (2006). La fiscalidad de la renta y el régimen de tenencia de la vivienda, un análisis empírico para el caso español. Papeles de Economia Española, 109, 198–213.

García-Montalvo, J., & Raya, J. (2012). What is the right price of Spanish residential real estate? SEFO-Spanish Economic and Financial Outlook, 1(3), 22–28.

Hansen, J. D., & Skak, M. (2008). Adaptation investments and homeownership. Journal of Housing Economics, 17(1), 102–115. doi:10.1016/j.jhe.2007.09.003.

Hendershott, P. H., & Shilling, J. D. (1982). Capital allocation and the economic recovery tax act of 1981. Public Finance Review, 10(2), 242–273.

Hendershott, P. H., & Won, Y. (1992). Introducing risky housing and endogenous tenure choice into a portfolio-based general equilibrium model. Journal of Public Economics, 48(3), 293–316.

Hendershott, P. H., Ong, R., Wood, G. A., & Flatau, P. (2009). Marital history and home ownership: evidence from Australia. Journal of Housing Economics, 18(1), 13–24. doi:10.1016/j.jhe.2008.09.002.

Henderson, J. V., & Ionnides, Y. M. (1986). Tenure choice and the demand for housing. Economica, 53(210), 231–246.

Hilber, C. A. L., & Liu, Y. (2008). Explaining the black–white homeownership gap: the role of own wealth, parental externalities and locational preferences. Journal of Housing Economics, 17(2), 152–174. doi:10.1016/j.jhe.2008.02.001.

Ioannides, Y. M. (1989). Housing, other real estate, and wealth portfolios: an empirical investigation based on the 1983 Survey of Consumer Finances. Regional Science and Urban Economics, 19(2), 259–280. doi:10.1016/0166-0462(89)90006-9.

Jaén, M., & Molina, A. (1994). Un análisis empírico de la tenencia y demanda de vivienda en Andalucía. Investigaciones Económicas, 18, 143–164.

Jappelli, T., & Pistaferri, L. (2007). Do people respond to tax incentives? An analysis of the Italian reform of the deductibility of home mortgage interests. European Economic Review, 51(2), 247–271.

Jones, L. D. (1993). The demand for home mortgage debt. Journal of Urban Economics, 33(1), 10–28. doi:10.1006/juec.1993.1002.

Jones, L. D. (1995). Net wealth, marginal tax rates and the demand for home mortgage debt. Regional Science and Urban Economics, 25(3), 297–322. doi:10.1016/0166-0462(94)02082-R.

King, M. (1980). An econometric model of tenure choice and demand for housing as a joint decision. Journal of Public Economics, 14, 137–159.

Leece, D. (2006). Testing a theoretical model of mortgage demand on UK data. Applied Economics, 38(17), 2037–2051. doi:10.1080/00036840500426959.

Ling, D. C., & McGill, G. A. (1998). Evidence on the demand for mortgage debt by owner-occupants. Journal of Urban Economics, 44(3), 391–414. doi:10.1006/juec.1997.2079.

López-García, M. A. (1996). Precios de la vivienda e incentivos fiscales a la vivienda en propiedad en España. Revista de Economía Aplicada, 12, 37–74.

López García, M. A. (1994). Precios de la vivienda e incentivos fiscales a la vivienda en propiedad en España: Fundación Fondo para la Investigación Económica y Social.

López García, M. A (2000). Una valoración de los efectos de la reforma del IRPF sobre la vivienda. In VII Encuentro de Economía Pública: hacienda pública y recursos humanos (pp. 8).

López García, M.-Á. (2010). La propuesta de reforma estructural del mercado de vivienda de FEDEA: una evaluación. Revista de Economía Aplicada, 18(52), 153–175.

Lopez-Garcia, M.-A. (2004). Housing, prices and tax policy in Spain. Spanish Economic Review, 6(1), 29–52.

Meen, G. P. (1990). The removal of mortgage market constraints and the implications for econometric modelling of UK house prices. Oxford Bulletin of Economics and Statistics, 53, 1–23.

Montalvo, J. G. (2007). Algunas consideraciones sobre el problema de la vivienda en España. Papeles de Economía Española, 113, 138–153.

Onrubia, J., & Sanz, J. F. (1999). Análisis de los incentivos a la adquisición de vivienda habitual en el nuevo IRPF a través del concepto de ahorro fiscal marginal. Hacienda Pública Española, 148, 227–244.

Onrubia, J. F., Romero, D. J., & Sanz, J. F. S. (2004). Compensación de incentivos a la adquisición de vivienda en la reforma del IRPF de 1999. Revista de Economía Aplicada, 12(35), 105–124.

Onrubia, J., Rodado, M. C., & Ayala, L. (2009). How do services of owner-occupied housing affect income inequality and redistribution? Journal of Housing Economics, 18(3), 224–232. doi:10.1016/j.jhe.2009.07.006.

Ortega, E., Rubio, M., & Thomas, C. (2011). House purchase versus rental in Spain. Banco de España.

Poterba, J. M., & Sinai, T. (2008). Tax expenditures for owner-occupied housing: deductions for property taxes and mortgage interest and the exclusion of the imputed rental income. American Economic Review: Papers and Proceedings 2008, 98(2), 84–89.

Raya, J. M., & Garcia Villar, J. (2006). La fiscalidad sobre la renta y el régimen de tenencia de la vivienda: un análisis empírico para el caso español. Papeles de Economía Española, 109, 198–213.

Rosen, H. (1979). Housing decisions and the U.S. income tax. Journal of Public Economics, 11, 1–23.

Rosenthal, E. (2011). A pricing model for residential homes with Poisson arrivals and a sales deadline. Journal of Real Estate Finance and Economics, 42(2), 143–161. doi:10.1007/s11146-009-9191-1.

Sanromán, G. (2006). Vivienda y fiscalidad, un análisis empírico. Investigaciones Económicas, 30(1), 33–54.

Sanz, J. F. (2000). Las ayudas fiscales a la adquisición de inmuebles residenciales en la nueva ley del IRPF: un análisis comparado a través del concepto de coste de uso. Hacienda Pública Española, 155, 149–176.

Skinner, J. (1996). The dynamic efficiency cost of not taxing housing. Journal of Public Economics, 59(3), 397–417.

Taltavull, P. (2000). Los condicionantes de la inversión en vivienda. Madrid: en Vivienda y Familia, Colección Economía Española XIII, Fundación Argentaria, pp. 287–318.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Raya, J.M., Kucel, A. Did Housing Taxation Contribute to Increase Riskier Borrowing?. J Real Estate Finan Econ 53, 90–113 (2016). https://doi.org/10.1007/s11146-015-9519-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9519-y