Abstract

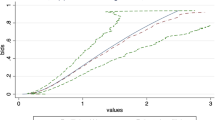

What can we learn from auction data when the seller submits shill bids to inflate the auction price? I study identification in an incomplete model of an English auction with shill bidding in the context of independent private values. I show that the distribution of valuations is partially identified (as is the optimal reserve price), and I provide bounds for the distribution of valuations that hold even when the seller is not engaging in shill bidding. I apply these results to a sample of eBay auctions.

Similar content being viewed by others

Notes

Shill bidding is also considered a riminal fraud in the UK and US (Kauffman & Wood, 2005).

See, for example, “3 Men Are Charged With Fraud In 1,100 Art Auctions on EBay,” The New York Times, March 9, 2001, “Phony Bids Pose Difficulties, Putting eBay on the Defensive,” The Wall Street Journal, May 24, 2000, “Officials Accuse Three in Scam To Drive Up Prices in eBay Bids,” The Wall Street Journal, February 8, 2002, and “How do you catch online auction cheats?,” BBC News, July 5, 2010..

See, e.g., “Lawsuit accuses Auction.com of using ‘shill bidder”’, New York Post, December 25, 2014.

The optimal reserve price can vary with the number of bidders in a number of cases. With independent private values, this may occur whenever the distribution of valuations F(v) is such that \(v - (1-F(v))/F'(v)\) is not monotone increasing (see the discussion in Wang et al. (2001)). With affiliated private values, the valuations may depend on a common factor (e.g., market conditions), which may also affect the seller’s valuation for the object (i.e., the value from a future sale if the object does not sell in the auction).

See, for example, (Hasker & Sickles, 2010) for a survey of the use of eBay data in the economic literature.

These inequalities accommodate the case in which the top two bids differ by less than the minimum bid increment. See Hickman et al. (2017) for a treatment of this case in the context of a complete model of electronic auctions.

Runner-ups are defined as all players except for the one with the highest bid.

The same argument can be used if the legitimate bidders with the top k valuations all have valuations within \(\Delta \) dollars of each other and the bidder with the highest valuation places a bid that is fourth highest or lower.

The proposition resembles theorems 1 and 2 in Haile and Tamer (2003) but must take into account that the shill bidder may win the auction.

Another specification test that relies on properties of order statistics is proposed in Kim and Lee (2014), which requires the econometrician to observe multiple bids. Their test is based on comparing estimates of the distribution of valuations obtained using multiple pairs of order statistics. The test I propose is implementable in settings where the econometrician has more limited data, as it requires observing the winning bid only.

Depending on the dimensionality of the vector of covariates X, the econometrician may prefer to specify a single-index model so that the distribution of valuations only depend on the covariates through an index that depends on X and some vector of parameters \(\beta \) (e.g., \(X'\beta \)). See Paarsch and Hong (2006) for a discussion on single-index models.

Assuming, of course, that the shill bidder draws an exit point from a distribution that is not equal to the legitimate bidders’ distribution of valuations.

The bootstrapped confidence intervals are based on 2,500 replicates.

Haile and Tamer (2003) discuss consistency of bootstrapped confidence intervals in a similar setting.

References

Anderson, T.W. (1962). On the distribution of the two-sample Cramer-von Mises criterion. The Annals of Mathematical Statistics, pp.1148–1159.

Andreyanov, P., & Caoui, E.H. (2020). Secret reserve prices by uninformed sellers. Technical report, Working paper, University of Toronto.

Aradillas-López, A., Gandhi, A., & Quint, D. (2013). Identification and inference in ascending auctions with correlated private values. Econometrica, 81(2), 489–534.

Asker, J. (2010). A study of the internal organization of a bidding cartel. American Economic Review, 100(3), 724–762.

Athey, S., & Haile, P. A. (2002). Identification of standard auction models. Econometrica, 70(6), 2107–2140.

Athey, S., & Haile, P. A. (2007). Nonparametric approaches to auctions. Handbook of Econometrics, 6, 3847–3965.

Austin, D., Seljan, S., Monello, J., & Tzeng, S. (2016). Reserve price optimization at scale. In 2016 IEEE International Conference on Data Science and Advanced Analytics (DSAA), (pp. 528–536), IEEE.

Baldwin, L., Marshall, R., & Richard, J. F. (1997). Bidder collusion at forest service timber sales. Journal of Political Economy, 105(4), 657–699.

Brendstrup, B., & Paarsch, H. J. (2006). Identification and estimation in sequential, asymmetric, English auctions. Journal of Econometrics, 134(1), 69–94.

Cesa-Bianchi, N., Gentile, C., & Mansour, Y. (2014). Regret minimization for reserve prices in second-price auctions. IEEE Transactions on Information Theory, 61(1), 549–564.

Coey, D., Larsen, B. J., Sweeney, K., & Waisman, C. (2021). Scalable optimal online auctions. Marketing Science, 40(4), 593–618.

Coey, D., Larsen, B., & Sweeney, K. (2019). The bidder exclusion effect. The Rand Journal of Economics, 50(1), 93–120.

Einav, L., Farronato, C., Levin, J., & Sundaresan, N. (2018). Auctions versus posted prices in online markets. Journal of Political Economy, 126(1), 178–215.

Feinstein, J., Block, M., & Nold, F. (1985). Asymmetric information and collusive behavior in auction markets. American Economic Review, 75(3), 441–460.

Graham, D. A., Marshall, R. C., & Richard, J.-F. (1990). Phantom bidding against heterogeneous bidders. Economic Letters, 32, 13–17.

Grether, D., Porter, D., & Shum, M. (2015). Cyber-shilling in automobile auctions: evidence from a field experiment. American Economic Journal: Microeconomics, 7(3), 85–103.

Haile, P. A., & Tamer, E. (2003). Inference with an incomplete model of English auctions. Journal of Political Economy, 111(1), 1–51.

Hasker, K., & Sickles, R. (2010). eBay in the economic literature: Analysis of an auction marketplace. Review of Industrial Organization, 37(1), 3–42.

Hendricks, K., & Porter, R. H. (2007). An empirical perspective on auctions. Handbook of Industrial Organization, 3, 2073–2143.

Hickman, B. R., Hubbard, T. P., & Paarsch, H. J. (2017). Identification and estimation of a bidding model for electronic auctions. Quantitative Economics, 8(2), 505–551.

Kauffman, R. J., & Wood, C. A. (2005). The effects of shilling on final bid prices in online auctions. Electronic Commerce Research and Applications, 4, 21–34.

Kim, K.l., Lee, J. (2014). Nonparametric estimation and testing of the symmetric IPV framework with unknown number of bidders. Technical report, Michigan State University working paper.

Manski, C. F., & Tamer, E. (2002). Inference on regressions with interval data on a regressor or outcome. Econometrica, 70(2), 519–546.

Marmer, V., Shneyerov, A.A., Kaplan, U. (2016). Identifying collusion in english auctions. Available at SSRN 2738789.

Milgrom, P.R., & Weber, R.J. (1982). A theory of auctions and competitive bidding. Econometrica: Journal of the Econometric Society, pp. 1089–1122.

Mohri, M., & Medina, A.M. (2014). Learning theory and algorithms for revenue optimization in second price auctions with reserve. In International conference on machine learning, pp. 262–270, PMLR.

OFT (2007) Internet Shopping. An OFT market study.: http://www.oft.gov.uk/shared_oft/reports/consumer_protection/oft921.pdf.

Paarsch, H.J., & Hong, H. (2006). An introduction to the structural econometrics of auction data: The MIT Press.

Porter, R., & Zona, D. (1993). Detection of bid rigging in procurement auctions. Journal of Political Economy, 101(3), 518–538.

Porter, R., & Zona, D. (1999). Ohio school milk markets: An analysis of bidding. RAND Journal of Economics, 30(2), 263–288.

Rhuggenaath, J., Akcay, A., Zhang, Y., & Kaymak, U. (2019). Optimizing reserve prices for publishers in online ad auctions. In 2019 IEEE Conference on Computational Intelligence for Financial Engineering & Economics (CIFEr), pp. 1–8, IEEE.

Riley, J. G., & Samuelson, W. F. (1981). Optimal auctions. The American Economic Review, 71(3), 381–392.

Rudolph, M.R., Ellis, J.G., & Blei, D.M. (2016). Objective variables for probabilistic revenue maximization in second-price auctions with reserve. In Proceedings of the 25th International Conference on World Wide Web, pp. 1113–1122.

Song, U. (2004). Nonparametric estimation of an eBay auction model with an unknown number of bidders.

Tang, X. (2011). Bounds on revenue distributions in counterfactual auctions with reserve prices. The Rand Journal of Economics, 42(1), 175–203.

Wang, W., Hidvégi, Z., & Whinston, A.B. (2001). Shill bidding in English auctions. Working Paper.

Acknowledgements

I thank Günter Hitsch (Editor), Jeff Ely, Álvaro Parra, Rob Porter, two anonymous referees, and workshop participants at Northwestern University for helpful comments and suggestions. I am supported in part by funding from the Social Sciences and Humanities Research Council (Canada). The author has no competing interests to declare that are relevant to the content of this article. The data and code that support the findings of this study are available from the author (guillermo.marshall@sauder.ubc.ca). All errors are my own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Omitted proofs

Proof of Proposition 2

We first have that by the Glivenko-Cantelli theorem,

uniformly in t, for all \(n+1 \in \Omega \).

Consider \(\hat{L}_{T}(t)\). Since \(\phi _2^{-1}:[0,1] \rightarrow [0,1]\) is a uniformly continuous function for all n, it follows from Lemma 2 that

uniformly in t, for all \(n+1 \in \Omega \). Since the \(\max \) function is continuous, it follows from the continuous mapping theorem that

Finally, that the convergence of \(L_{T}(t)\) to L(t) is a.s. uniformly in t, follows from the following inequality

The rest of the proof follows by applying analogous arguments.

Proof of Proposition 3

The proof follows from the arguments provided in the text.

Proof of Proposition 4

The proof follows from arguments that are analogous to those in the proof of Proposition 1.

Proof of Proposition 5

Fix \(n \in \aleph \). Define

where \(F_v(\cdot )\) is the true but unobserved distribution of valuations, and take

It is true that

since \(\pi _n^U(t) \ge \pi _n(t)\ge \pi _n^L(t), \forall t\).

Suppose \(r_n^* \notin H[r^*]\). That implies, in particular, that \(r_n^* \notin \left\{ r: \pi _n^U(r)\ge \sup _{ a \in [\underline{v},\bar{v}]}\right. \) \(\left. \pi _n^L(a) \right\} \). If \(r_n^* \notin \{r: \pi _n^U(r)\ge \pi _n^L(r_n^L)\}\), then

But then by making use of Eqs. 12 and 13, we reach the following contradiction

Proof of Proposition 6

Part a) follows from Lemma 4 in Appendix A. Part b) follows from Proposition 5b in Manski and Tamer (2002).

Appendix B: Additional results

Lemma 1

Let \(\phi _1(\cdot |n)\) and \(\phi _2(\cdot |n)\) be the distribution functions of the first- and second-order statistics, defined as

The inverse functions \(\phi ^{-1}_1(x|n)\) and \(\phi ^{-2}_1(x|n)\) are increasing in n for \(x \in (0,1)\).

Proof

I first show that \(\phi _2^{-1}(x|n) \le \phi _2^{-1}(x|n+1) \) for \(x\in (0,1]\). Call the left-hand side expression, \(y_{n}\), and the right-hand side expression, \(y_{n+1}\). From the expression for the second-order distribution function, \(\phi _2(\cdot |n)\), we note that \(y_n\) and \(y_{n+1}\) are implicitly defined as

By setting these expressions equal, and by using the fact that \(x \in [0,1]\), we obtain the following inequality

where the inequality follows from \(y_{n+1} \in (0,1]\). The inequality can be rewritten as

Since \(\phi _2(\cdot |n)\) is a strictly increasing function, the result follows.

Consider next \(\phi ^{-1}_1(x|n)\). By taking the derivative of \(\phi _1^{-1}(x|n) = x^{1/n}\), one can show that the function is increasing in n for \(x \in (0,1)\). \(\square \)

Lemma 2

Take a sequence of functions \(\{g_T(\omega ,\theta )\}\), \(g_T:X \rightarrow Y\), that converges to \(g(\theta )\) a.s. uniformly in \(\theta \in \Theta \), that is,

Take a uniformly continuous function \(\psi :Y \rightarrow Y\). Then \(\{\psi (g_T(\omega ,\theta ))\}\) converges to \(\psi (g(\theta ))\) a.s. uniformly in \(\theta \in \Theta \).

Proof

Fix any \(\varepsilon >0\). By uniform continuity of \(\psi \), \(\exists \delta >0\) such that for any \(x,y \in X\), \(|x-y|<\delta \) implies \(|\psi (x)-\psi (y)|<\varepsilon \).

By convergence a.s. uniformly of \(g_T\),

that is, \(\exists \, T_{\delta }\) such that \(\forall \, m \ge T_{\delta }\)

By uniform continuity of \(\psi \), we conclude that \(\forall m \ge T_{\delta }\)

Since this holds for any \(\varepsilon >0\),

The result follows since

\(\square \)

Lemma 3

\(\pi _{T,n}(r) \overset{a.s.}{\rightarrow }\pi _n(r)\) uniformly in r.

Proof

Note that

where \(K_1\) and \(K_2\) are constants, and \(\psi _1:[0,1] \rightarrow [0,1]\) and \(\psi _2:[0,1] \rightarrow [0,1]\) are uniformly continuous functions. Since \(F_T(x) \overset{a.s.}{\rightarrow }F(x)\) uniformly in x, the result follows from Lemma 2. \(\square \)

Lemma 4

\(Q_{T}(t) \overset{a.s.}{\rightarrow }Q(t)\) uniformly in t.

Proof

Note that

Since \(\pi _{T,n}(r) \overset{a.s.}{\rightarrow }\pi _n(r)\) uniformly in r, the result follows from Lemma 2. \(\square \)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Marshall, G. Identification in english auctions with shill bidding. Quant Mark Econ 22, 193–222 (2024). https://doi.org/10.1007/s11129-023-09274-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-023-09274-9