Abstract

Using novel data on the pricing for hotel rooms in Paris during the summer of the 2016 European Football Cup, we document the co-existence of uniform and bespoke pricing within the same industry and even within the same firm. Although stay dates have heterogenous potential demand, hotels initially price them uniformly. However, as time goes by, they progressively set customized prices. We show that standard revenue management techniques can explain the shift and find evidence that the inability to form expectations about future demand was a determinant of the initial choice of uniform prices. Finally, we find that firm characteristics have a role in shaping the transition.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A recent literature (Adams and Williams, 2019; DellaVigna and Gentzkow, 2019) has drawn attention to the practice of retail firms charging identical or very similar prices for a good even when facing vastly different demand conditions. Uniform pricing is also a traditional feature of digital music (Shiller and Waldfogel, 2011), pop concerts (Courty and Pagliero, 2014) and movie-theaters (Orbach and Einav, 2007; de Roos and McKenzie, 2014). Such a policy is puzzling. Price discrimination (Varian, 1989; Leslie, 2004; Busse and Rysman, 2005; McManus, 2007; Stole, 2007; Asplund et al, 2008; Borzekowski et al, 2009; Courty and Pagliero, 2011) and capacity constraints (Dana, 1999; Alderighi et al, 2015; Cho et al, 2018) are just two reasons dictating that firms should react to differences in demand or cost conditions when formulating their pricing strategy.

In this paper we document novel facts about the features of the uniform pricing strategy. Whereas uniform prices have usually being observed as a widespread industry characteristic, we report the co-existence of uniform and bespoke pricing strategies within the same industry at a given time. Even more fascinating, we show that, through time, a same firm moves from the former to the latter.Footnote 1 The fact that we observe variation, across and within firms, in the prevalence of uniform pricing allows us to move past the mere description of a phenomenon and attemp to identify the mechanisms behind both the decisions of pricing uniformly and that of departing from uniform pricing.

Our evidence comes from a large sample of hotels in Paris. We observe the evolution of their prices in the months leading to the Summer 2016 when they faced an important demand shock: the 2016 European Football Cup, EURO 2016. Using a novel dataset assembled by scraping the website Booking.com, we compare the prices that a same hotel sets for different stay dates belonging to the same broad category (“days before the tournament”, “eves of match days”, “match days”, etc.) at a given query date.Footnote 2 We document that, for each category, the prices are initially characterized by a high degree of uniformity. For example, in December 2015 the average hotel would sell 70% to 80% of its rooms for stay dates for different match days at the same price. This strategy evolves through time: a customer quering Booking.com in May 2016 for rooms at the same hotel would find bespoke prices assigned to most stay dates.

This finding is all the more striking because of the industry we study, where we would presume that uniform pricing should represent a negligible exception. In fact, online pricing for hotel rooms should entail minimal menu costs and room rates could be easily adjusted through time (Gorodnichenko and Talavera, 2017).Footnote 3 Moreover, different stay dates are heterogeneous in their appeal to tourist, a feature that was amplified by the occurence of Euro 2016. During the tournament, Paris hosted twelve matches, each of them a potential large shock to hotel demand in an already peak Summer time. The matches involved teams with different draw in terms of the crowd of followers they could attract. Hotel managers could use plenty of information to price discriminate the matches. For example, it was common knowledge that the hosting team, France, would have played in the inaugural match on June 10\(^{th}\), and thus attract many potential tourists from other French cities. Similarly, the final is always a great attractor, regardless of the teams involved. Finally, the identity of the teams for the first eight qualifying round matches was revealed on December 12\(^{th}\) 2015 and firms could rely on this information to differentiate prices based on countries’ characteristics, such as population, income, or the Union of European Football Associations (UEFA) ranking position.

After having documented the pricing patterns in our sample, we exploit the variation in the prevalence of uniform pricing across firms and through time for the same firm to identify possible explanations of its two key features: the initial prevalence of uniform pricing and the subsequent departure from it. We start by leveraging information for each hotel-stay date pair on the timing at which rooms are sold out to construct a variable proxing residual room availability. We show that the decline in the share of identical prices can be in large part attributed to the action of revenue management techniques, which dictate to adjust prices in repsonse to residual capacity (Talluri and van Ryzin, 2004; Cho et al, 2018; Abrate et al, 2019).

Next, we turn to explaining why hoteliers resort to a uniform pricing strategy early on. We explore the role of demand uncertainty, which has been suggested as a behavioral explanation for uniform pricing (Orbach and Einav, 2007). In lack of clear information to perform the complex task of setting bespoke room rates based on the expectation of the final demand for each stay date, hotel managers may have found it cost-effective to adopt a simple heuristics where all match days had the same price. We provide support for this mechanism showing that hotels that had not received a definitive signal about their future demand reacted more pronouncedly to the release of information tha could be valuable to forecast it.

Finally, we investigate whether the transition from uniform to bespoke pricing strategies is affected by firm characteristics. In particular, we focus on proxies of managerial quality (star rating, user rating on Booking.com and affiliation to a chain) because the literature has suggested that the quality of management can affect the ability to predict demand and implement optimal pricing (Bloom and Van Reenen, 2007; DellaVigna and Gentzkow, 2019). Although residual capacity is the dominant factor explaining the turn towards bespoke prices, we find that managerial quality plays some role. Hotels with characteristics associated to better management quality are systematically ahead in the transition with respect to those with worse management. However, while this pattern holds regularly, the estimates are quite noisy.

The rest of the paper is structured as follows. Section 2 discusses the institutional setting and provides an example of an hotel mixing uniform and bespoke pricing. The data used and some descriptive statistics are presented in Section 3. In Section 4 we present our main descriptive result: evidence of systematic co-existence of uniform and bespoke pricing and a consistent dynamic moving firms from the former towards the latter. In Section 5 we investigate the role of revenue management, demand uncertainty and managerial ability in determining the emergence of the pricing strategy mix observed in our data. Section 6 concludes.

2 The EURO 2016

The 2016 European Football Cup took place over one month, from June 10\(^{th}\) to July 10\(^{th}\), involving 51 matches played by 24 teams in nine cities. In total, Paris hosted 12 matches, eight for the qualifying round, and four in the knock-out stage, including the inaugural match and the final.

There were two venues hosting the games: the Stade de France and the Parc des Princes. Their capacity is about 81,000 seats and 49,000 seats, respectively, which was routinely filled for the games of the tournament (see Table 1). As Paris registered about 120,000 daily overnight stays in 2016 (OTCP, 2016), any match was potentially inducing a sizeable positive demand shock. This means that one could expect significant swings in demand between the days before the tournament and those within the tournament period; between days with and without games played in Paris and between game days held at different venues in the city.

The timing of stadium tickets sale by UEFA can shed light on the evolution of demand for accommodation.Footnote 4 The sale of about 2.5 million tickets was organized in different phases, with a total of 1.8 millions reserved for the general public and the remaining 0.7 millions allocated to the UEFA’s commercial partners and to hospitality packages, i.e., exclusive packages combining best seats’ tickets with ancillary services such as high-end catering, parking pass, welcome reception, and access to the lounge, but no accommodation. Although the timing with which these hospitality packages were sold is not known, it is likely that a certain proportion of people who received them also needed to book an hotel.Footnote 5

The first million tickets were offered on sale in phase one, one year before the tournament, from June 10\(^{th}\) to July 10\(^{th}\) 2015, when the qualifying tournament was still ongoing. At this stage consumers could buy tickets for a specific date and city. As the identity of the teams playing was unknown, this sale most likely catered to locally resident football fans, willing to attend a EURO match per se: those fans, however, are less likely to need an accommodation. Thus, hotel occupancy should not have been much affected.

The qualification ended on November 17\(^{th}\) 2015; on December 12\(^{th}\) the official draw assigned teams to six different groups composed by four teams each and determined the city in which each game would be played. Phase two began two days later: the second batch of 800,000 tickets reserved to the supporters of the various teams went on sale until February, 1\(^{st}\) 2016. Following this stage, assuming that ticket holders started booking accommodation concurrently, hotels could have observed an asymmetric distribution of occupancy rates, depending on both the capacity of the stadium and the attractiveness of the different matches; therefore, they potentially faced a stronger incentive to abandon uniform pricing.

The third phase began on March 9\(^{th}\), when a trading platform was opened to allow, until the end of March, customers to sell back bought tickets at the nominal price. This is the time when the different attractiveness among matches, as well as the heterogenous demand of visitors originating from the various hosted nations, may have impacted the occupancy rate across match days differently. Finally, more unplanned sales took place in May 2016, as reported by the French press.Footnote 6

To sum up, the timing of stadium tickets’ sales likely had a differential impact on hotel room bookings. While phase one likely did not contribute to dispelling the demand uncertainty faced by hotel managers, the start of phase two in mid-December should have spurred the implementation of bespoke prices in an industry characterized by revenue management. The knowledge of the teams’ identity facilitated price discrimination based on countries’ demographics and the overall attractiveness of the match and the hotels could start comparing prior demand expectations with actual bookings. However, the team identity for the four knock-out stage matches continued to remain unknown. On the whole, we should expect that by the start of phase three in March, uncertainty over demand had started to decrease and substantial booking activity should have been ongoing.

2.1 A motivating example

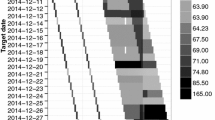

To see how the timing of ticket sales might have affected pricing choices, we consider a representative example of a Parisian hotel manager who has to set in advance the price of her rooms for stays in June and July 2016, i.e., before, during and after the tournament. These prices are then loaded on Booking.com’s reservation system.Footnote 7 Figure 1 clarifies how we measure price uniformity throughout this study. It reports the prices, for the same type of double room, posted by a 4-star hotel on the Monday of different weeks prior to the start of the tournament. It provides a snapshot of the prices that a potential buyer could have retrieved from queries made on the specified weeks-months prior to the stay dates.

On the second week of December 2015, i.e., before the draw that formed the qualifying round groups and revealed the identity of the teams playing in Paris, a search for the room price on any of the 12 match days (denoted as \(M1-M12\)), returned the same value. That is, the different days were priced uniformly, regardless of the importance of the match. The same price was also applied for stays on the day before the match (DBM), and on any intermediate day (ID) during the tournament period, including the days after the match as well as any other day not adjacent to a match day. Stays on days before and post tournament (BT and PT, respectively) were charged less, which is indicative that the hotel set its prices taking the tournament period into account.Footnote 8 At least for the hotel in the example, phase one of tickets’ sales does not seem to have altered the demand expectations for the various matches.

A month later (January 16), well into the second phase of ticket sales, only the final match and its eve (M12 and DBM12, not reported but pooled into DBM) have a different price, with the other 11 match days (and eves) still priced uniformly. ID prices are now different but still higher than the BT and PT. The January pattern of uniform pricing continues unabated until the end of March, well after phase three started. The observed price uniformity begins to break down in April, when matches appear to be priced in clusters. Finally, in May uniform pricing disappears: most of the match dates now exhibit a different rate, which is in some cases lower than in previous months, consistent with a last-minute sale to dispose of unsold capacity (Möller and Watanabe, 2010; Cho et al, 2018; Abrate et al, 2019).

For the purpose of this study, uniformity is measured by comparing the prices of equivalent events holding the query date as fixed. Even though the price level of the same room-day changes between December and February, the fact that it changes by the same amount for all the match days implies that the hotel is sticking to a uniform pricing approach.

The figure exemplifies a strategy mixing uniform with bespoke pricing. When the rooms go on sale, prices are initially identical even on stay dates that we would not expect to be homogeneous. As time elapses, the picture changes completely. By early May, each stay date has a different price. The analysis in Section 4 shows that this surprising pattern holds in general for the hotels in our sample.

3 Data

The empirical investigation is based on a novel dataset of online prices and other establishments’ information retrieved using an “electronic web-crawler" scraping daily the website of one of the largest Online Travel Agent (OTA) in the world, Booking.com. The information includes the posted prices together with the establishment’s name, its overall customers’ rating, the type of rooms offered (double, triple, studio, etc) and associated services (breakfast and cancellation). We also collected firm characteristics such as type (hotel, motel, B &B, etc), capacity as measured by the number of rooms, whether it is part of a chain, number of stars and geographical coordinates which we use to calculate the distance from the nearest stadium. As the crawler was operating from the U.K. prices were retrieved in British pounds (£).Footnote 9

Our sample consists of price queries between November 1\(^{st}\) 2015 and June 9\(^{th}\) 2016 for stay dates from June 1\(^{st}\) until July 14\(^{th}\) 2016. The first match of EURO 2016 was played on June 10\(^{th}\) and the final on July 10\(^{th}\). We do not consider price queries during the tournament as we aim at comparing prices across all the 12 match dates. Our sample construction applies two restrictions in order to make the type of service offered homogeneous. First, we focus only on hotels and exclude other forms of establishments (e.g., motels, B &Bs). Second, we restrict the sample to hotels located at a reasonable distance from the city center. We only retain hotels within a 10 km radius from the centre.

Some hotels have missing information for some query dates, either due to glitches in the crawler’s operation or because they did not post a price. Since we observe that Parisian hotels vary room prices very infrequently during the query period - in line with the findings in Melis and Piga (2017) for Mediterranean hotels - to limit the issue of missing values for each stay date we take the median posted price in a given query week w.Footnote 10 The final dataset includes over 1M price queries.

Table 2 reports the overall number of hotels posting each month and the breakdown by stars, as well as some statistics on the capacity and distance from the match venues. Although we observe some entry over the period, the distributions of size, distance from the venues and star rating remain very stable.

4 Descriptive evidence on pricing behavior

To inspect the extent of uniform pricing in our data, we choose as a synthetic indicator the share of (nearly) identical prices, henceforth NIP, set on the same query date. As in Fig. 1, we group the stay dates into the following categories: days before the tournament (BT); days before match (DBM), match days (M); in-between days (ID); and post-tournament days (PT). Each group E contains a varying number of dates, denoted by \(j_E\); for example, there were 12 match days, but only 9 eves of match days, as some matches were held on consecutive days. We calculate the share of NIP as the fraction of prices for different stay dates within the same event class E that are equal to the modal price for the class in a given query date. For example, if a hotel sets the same price for all match days, as it is the case for the month of December in Fig. 1, the value of NIP is one. We disregard small differences between prices (hence the label “nearly identical”). These may be induced by the exchange rate used by the OTA to convert prices expressed in the national currency of the hotel, the Euro and not by deliberate pricing decisions by the hotel.

Whereas this measure is in the spirit of DellaVigna and Gentzkow (2019), there is a key difference in the behavior we are trying to capture. DellaVigna and Gentzkow (2019) look for uniformity in the pricing of a same product (e.g., toothpaste) across geographically differentiated stores of the same retail chain. We document the proportion of identical room rates across different days posted by the same hotel. In DellaVigna and Gentzkow (2019), price uniformity is puzzling as prices of different stores should reflect the different demand conditions of the area where they are located. By the same token, one would expect hotel prices to incorporate the different degree of attractiveness of match days.

The monthly averages of the share of NIP are reported in Table 3. Interestingly, the share of (nearly) identical prices for stays during the tournament is generally quite high. Until March, over 60% of the match days were priced uniformly. As the tournament approaches, the share of identical prices drops rapidly.

We use our data to test more formally the transition between different pricing strategies over time. We regress the share of (nearly) identical prices, NIP, on a full set of month dummies. More precisely, we estimate the following equation:

where NIP is computed for each hotel i, and each booking week w, across different stay dates for the same event group E. The \(\delta _{i}\)s are firm-specific pricing effects, as each firm might be adopting its own pricing scheme, based on non-observable components such as its past history, managerial skills, etc. We estimate the model for the different event groups separately, to disentangle whether hotels display different dynamics in their pricing behavior and we only look at double rooms to concentrate on a fairly homogenous product. The coefficients on the month dummies document the extent to which the share of identical prices evolves over time, relative to the base month of November.

Figure 2 plots the point estimates of the month dummies (and their 95% confidence interval) for each category of stay dates.Footnote 11 Across events, the month dummies have negative coefficients, which grew in absolute value with the passing of time. This means that prices became progressively less uniform between November 2015 and June 2016. We also notice that the decline accelerates in time and it is faster for stay dates on the eve or on the day of a match.

Next, we explore whether the timing of the transition varies according to hotels characteristics. In particular, we focus on observables that may be correlated with the quality of the hotel management such as the number of stars, the rating received by users of the platform and whether or not the hotel is affiliated to a chain. Figure 3 plots coefficients and the 95% confidence intervals of the monthly dummies of models like that in Eq. 1 estimated separately by star rating (panel A), for hotels with user rating above and below the median (panel B) and for hotels affiliated and unaffiliated to a chain (panel C).Footnote 12

Estimated coefficients of monthly dummies. Notes: Coefficients are obtained regressing NIP on month dummies Eq. 1. Estimates are on different categories of stay dates. The shaded area represents the 95% confidence interval

Estimated coefficients of monthly dummies: Heterogeneity in hotel quality. Notes: Coefficients are obtained regressing NIP on month dummies Eq. 1. Estimates are on different categories of stay dates. The whiskers represent the 95% confidence interval

We find some indication that the transition towards bespoke prices is more pronounced in hotels with higher classification, especially in the case of match days, where zero, one and two star hotels retain a larger proportion of NIP above the sample average line for most query months, and in particular from April onward. High-starred hotels generally adopted bespoke prices sooner more markedly. Likewise, hotels with above median rating and chain hotels abandon uniform pricing earlier than independent hotels, in particular for match days.

To gauge the robustness of our findings, we explore two alternative measures of price uniformity. First, we considered the absolute log price difference measure, proposed in DellaVigna and Gentzkow (2019) (reported in Table A.3 in the Appendix). This index is computed by taking the difference between any (log) price pair for stay dates belonging to the same event class by a given hotel on a given booking day. These log price differences are then averaged for any hotel-booking week-event combination. Table A.3 in the Appendix reports the monthly averages of the log price differences. We still observe the same pattern of price uniformity giving way to bespoke pricing gradually over the query period.

Second, we provide complementary evidence that comes from the comparison of fitted prices obtained by estimating a pricing equation. The aim of this approach is to inspect the similarity of prices across stay dates, for a given hotel, by testing the equality of the coefficients estimated for the various match day dummies (M). The pricing equation we estimate is therefore:

where \(p_{iwt}\) is the median price posted by firm i on week w for a given stay day t, \(\delta _{i}\) are the firm fixed effects, \(\phi _w\) is a set of query date weekly dummies and \(e=\left\{ BT,DBM,M,ID,PT\right\} \) denotes the set of event groups. More specifically, we include 1 BT dummy, 9 DBM dummies, 12 M dummies, 1 ID dummy and finally 1 PT dummy; thus, \(N=24\). Standard errors are clustered at the firm level. We obtain \(\theta \)s that are conditional on the star level and the month of posting, by running separate regressions.

We focus on the equality of the coefficients of the match days. With 12 M dummies, we would have \({12 \atopwithdelims ()2}=66\) unique pairwise comparisons tests of estimated coefficients to inspect. More conveniently, we can implement the multiple comparison tests among means (Dunn, 1961), which provide simultaneous confidence intervals for a plurality of distribution of predicted prices. These tests are equivalent to testing the equality of each pair of \(\theta _{n}\) cofficients, with the additional advantage of identifying those distributions of predicted prices that are not significantly different at the 5% level.Footnote 13

We can thus summarize the information conveyed by the multiple comparisons tests of match day prices into a share of statistically non-different prices: we call it the share of statistically identical prices, SIP, to distinguish it from the share of nearly identical prices, NIP, computed on the sample prices. This setting allows to gauge the prevalence of different pricing strategies in each month within each star group, as well as to compare SIP, which ranges from 0 to 1, with higher values reflecting stronger price uniformity, with the descriptive statistics on the NIP in Table 4. The top panel reports the share of identical prices with the SIP approach, which follows the same patter we obtain with the NIP in the raw data.

5 Mechanisms

In the previous section we documented that uniform and bespoke pricing strategies co-exist within a same firm. In particular, hotels tend to price stay dates uniformly at first and then progressively move towards more customized pricing over time. We also found that certain hotel characteristics seem to help explain the timing of such transition.

In this section, we aim at shedding some light on the drivers of this phenomenon. Namely, we seek to understand what influences the progressive decline in price uniformity and why prices were uniformly set to begin with. Whereas the bulk of the literature on uniform pricing documented it in industries where such strategy is dominant, in the application we study we observe firms in the same sector relying to different extents on uniform and bespoke pricing. Even more unique, we see the same firm using uniform pricing to a different degree as time goes by. Therefore, we can identify factors leading to a uniform pricing strategy by comparing firms acting within the same industry or even the same firm at different points in time. This gives us a sizeable advantage in identifying the mechanism behind the shift compared with confronting the behavior of firms operating in different sectors.

We start by explaining the movement towards bespoke pricing observed in the data. We then propose a rationalization for the original prevalence of uniform pricing. Finally, we revisit the role of firm characteristics in shaping the transition.

5.1 The transition towards bespoke prices

The hotel industry is one of the many sector that is known to resort to revenue management techniques to determine price setting. These practices are at odds with the adoption of uniform prices (Melis and Piga, 2017; Cho et al, 2018; Abrate et al, 2019). Therefore, we begin by investigating whether the application of revenue management principles can explain the steady decline of uniform pricing observed in our data.

We focus on one specific pillar of revenue management techniques, capacity pricing. This is widely applied in airlines (Alderighi et al, 2022, 2015) and dictates that the pricing of a particular seat on a flight must depend on the flight’s load factor. Seats on fuller flights sell at a higher fare than those on flights with plenty of capacity available. On the flip side, when there is plenty of unsold capacity and the date of the flight is near, capacity pricing prescribes that prices be reduced (Gale and Holmes, 1993; Möller and Watanabe, 2010). Moving from the premise that capacity pricing is also adopted in the hotel industry (Cho et al, 2018; Abrate et al, 2019; Piga and Melis, 2021), we show that variation in the spare capacity for a given stay date is a key predictor of a hotel pricing strategy.

To accomplish this task, we need data on sold capacity which is not available on Booking.com. Instead, we leverage a source of information present in our data to proxy for room availability. We observe quotes for each hotel-date only until the hotel has exhausted all of its capacity. After that, it stops posting quotes on the platform because it can no longer host customers. Hence, by tracking the time at which each hotel-stay date pair ceases to be quoted, we can infer the occurrence and the timing of sold outs. Although most rooms sell out only in close proximity to the event, there is still some variation, with some hotel-date pair filling up as early as December.

We exploit this information to estimate a Cox proportional hazard rate duration model where the probability of sold out for a hotel-stay date pair depends on the average price posted up to that point,Footnote 14 dummies for whether the date of stay is a match day or a weekend, stars and rating of the hotel as well as the total number of rooms originally available.

The estimates of this model (marginal effects are reported Table A.4 in the Appendix) line up with intuition: dates that were priced higher are less likely to be sold out and so do those in hotels with more rooms to offer. Stays on match days or weekends and in hotels with more appealing locations sell out more quickly.

We use the parameters of the duration model to construct a predicted probability of each hotel-stay date pair being sold out. Such probability varies by date of search and can be interpreted as a proxy of the number of rooms available. Hotel dates with a high probability of going sold out in a certain search date imply that many of the available rooms for that date have already been booked. If a hotel date has low probability of being sold out, it means that, at that search date, it did not have many customers booked yet.

The variable capturing the stock of bookings for each room allows us to test whether declining room availability is a relevant factor leading hoteliers to adjust their prices, in line with the standard predictions of revenue management. We estimate the model below:

The dependent variable is the same as in the model in Eq. 1 and captures the share of nearly identical prices. Instead of regressing it on a full set of month dummies, though, we use a flexible (cubic) polynomial in the probability of sold out to explain the variation. The model includes also hotel-room fixed effects.

We contrast the fit of this model with that of the model in Eq. 1 and find that for each type of stay date (“Before Tournament”, “Day before Match”, etc.) the \(R^2\) of the two models is nearly identical. Moreover, Fig. 4 shows that the evolution of the share of uniform prices predicted using either model is very similar. On paper, we would expect a model using month dummies to track the evolution through time of the dependent variable to have a clear advantage over specifications that do not make explicit use of time variables to account for the same variation. We take the fact that the model factoring the probability of sold out does so well as revealing about the relevance of room occupancy rates in explaining hoteliers pricing choices. However, this statement must be interpreted with caution, since we cannot rule out the presence of third factors influencing at the same time the propensity to adjust prices and demand for hotel stays.

5.2 Demand uncertainty and uniform pricing

Even once we have accounted for a determinant of the shift towards bespoke prices, the puzzle remains of why hotels set such homogeneous prices to begin with.Footnote 15 Following Orbach and Einav (2007), we explore the possibility that this is due to lack of information on potential demand. If managers found it hard to gauge their prospective appeal in advance, they would not be able to pick bespoke prices for each individual match.

Our test of this theory exploits the Euro 2016 draw, which took place on December 12, 2015 and sorted qualified teams into groups, making the teams playing each of the group stage matches known. This event has two key ingredients. First, it arguably represents a shock to the potential demand for the different match dates. To the extent that a game featuring Germany is likely to draw visitors than one involving a less heralded team, hoteliers should have had material to update their expectations on the number (and the willingness to pay) of the visitors interested in each match date stay.Footnote 16

The second appealing feature of the draw is that it occurs early in the process of booking. This is important in the light of what we discover investigating the role of available capacity in explaining hoteliers’ pricing choices. In fact, the degree of room occupancy mechanically affects the degree to which a hotelier is uncertain about its future demand, as each booking amounts to a partial realization of the final demand for a certain room-stay date. Therefore, we expect only hotels who have not obtained yet a strong signal about their final demand (i.e., those with low sold out probability) to react to the disclosure of news that may help predict such demand. We are more likely to find hotels in such predicament when the booking process is in its early stages.

We estimate the following variation of the model in Eq. 3:

where postDraw is a dummy switching to 1 for the period after the draw has taken place and HAvailability is a dummy that takes value 1 for the hotels-dates that were in the bottom 20% of the distribution of the probability of being sold out in the week leading to the draw. This dummy is singling out hotel-stay dates for which managers still have high availability of rooms and, hence, lack a clear signal from early bookings on the strength of demand.Footnote 17

The results are reported in Table 5. The interaction term is negative and significant for stay dates before, on the day of or between matches. This means that hotels with low early booking and, therefore, with little information to rely on to form their expectations about demand do react to the information about the identity of the teams playing on a specific match day by customizing their prices. The effect is more significant for match day prices and eves of match days than for days between matches. The interaction coefficient is even smaller in magnitude and less significant for post tournament dates and not significant for stay dates before the start of the tournament. This squares with the fact that those periods should not have been directly impacted by the information revealed in the draw.

Estimates coefficients of monthly dummies controlling for capacity: Heterogeneity in hotel quality. Notes: Coefficients are obtained regressing NIP on month dummies and a flexible (cubic) polynomial in the probability of sold out. Estimates are on different categories of stay dates. The whiskers represent the 95% confidence interval

Overall, this exercise reveals that lack of information to conjecture the strength of future demand contributes to hoteliers’ decision to stick to a simple, uniform pricing strategy. As we documented before, as soon as capacity starts filling in, hotels incorporate the information into their pricing decision and we observe a more and more pronounced customization of prices.

5.3 Heterogeneity in managerial quality

We documented that hotels with different stars ratings, the platform user rating or whether or not they are affilated to a chain transition at different speed from uniform to bespoke prices. One explanation for this finding is that those characteristics proxy for the quality of the management running the hotel. The ability to monitor market conditions for the tournament period and determine the appropriate timing and size of price changes is a necessary condition to observe a transition toward bespoke pricing. When match days are distant in time, managers might focus their resources on nearer and more urgent events, e.g., the Paris fashion week in January, Easter holidays, etc., thus postponing decisions for the tournament period. Hence, managerial frictions could explain a delayed emergence of bespoke pricing (Ellison et al, 2018) and, more generally, managerial decision-making costs can contribute to our understanding of the observed transition between pricing strategies. Higher quality hotels may be better equipped to face these costs, as they can rely on a more sophisticated organizational architecture which can more effectively integrate information available in various hotel’s functions, such as marketing, front-office, or sales (Melis and Piga, 2017).

Furthermore, the development of sophisticated pricing strategies requires a sizable investment in Information Technology infrastructure as well as dedicated managerial resources to acquire new information, process it and implement relevant changes, which must be coordinated with other managerial practices (Zbaracki et al, 2004; Cho et al, 2018). These costs exhibit increasing returns to scale and may be lower for chain hotels, whose members may share information about specific stay dates, leading to a faster revision of each event’s price (Hollenbeck, 2017).

The evidence presented in Fig. 3, however, did not account for the degree of capacity utilization. Since quality proxies could be correlated with the pace at which rooms fill up, those plots confound the effect of room availability with that of managerial quality. We revisit the argument by estimating a model including both month dummies and a cubic polynomial in the probability of being sold out and doing so separately for different star ratings, hotels above and below median user rating and for chain and non chain affiliated hotels.

The results are displayed in the Fig. 5.Footnote 18 Two main conclusions can be drawn from these results. First, the point estimates of the month dummies are much smaller, in absolute value, now that we also control for room availability. This confirms that revenue management is the driving force of the movement towards bespoke pricing and confines differences in hotel quality to a residual role. Second, we still observe that estimates of the month dummies for hotel with characteristics proxing higher quality (more stars, above median rating, chain affiliation to a lesser extent) are systematically more negative than those for lower quality hotels. To the extent that we can believe that the star ratings and the other hotel characteristics we have analyzed proxy for managerial quality, this is consistent with managerial quality having some influence in the ability of firms to transition toward customized pricing.Footnote 19

6 Conclusions

This study investigates the online pricing behavior of firms facing date-specific demand shocks, by focussing on hotels in Paris during the 2016 European Football Cup. We observe firms during eight months prior to the tournament period, and retrieve the prices they posted online for stays during the tournament as well as the preceding and following days. Using a measure of price uniformity in the spirit of DellaVigna and Gentzkow (2019), we document that, even within a same firm, there is a co-existence of radically different pricing strategies. Whereas initially we see a strong prevalence of uniform pricing, later on in the query period hotels turn to setting bespoke prices.

We show that the trend towards more customized prices can be explained by the response to incoming bookings through standard revenue management practices. We also test a rationale explaining why prices feature such a high degree of uniformity at the beginning of the booking period. We provide evidence that managers likely turn to a simple rule-of-thumb (price equally all the stay dates) when they do not have enough information to exploit more sophisticated heuristics.

Finally, we consider star level, hotels’ membership to a chain and customers’ rating as proxies of managerial quality to show that firms with lower managerial quality tend to abandon uniform pricing less that those with better management. This implies that managerial decision-making costs could contribute to heterogenous patterns in the transition from uniform to bespoke prices.

Notes

Another form of price uniformity could arise by tracking the price of the same match day over consecutive query periods. Such a comparison is less meaningful because the information set available to the hotel manager changes as the tournament date nears.

The setting to control prices on the platform is similar to that described by Huang (2021) for Airbnb. Prices are stored in a spreadsheet-like webpage and the hotelier can tick boxes to include options such as breakfast or free cancelation. A price could be changed in a matter of seconds.

The information discussed hereafter was collected from the UEFA website, as well as the press, e.g., Le Monde, one of the main French newspapers, and L’Équipe, the most important sports newspaper in France, among others.

See https://uelf.hospitality.uefa.com/packages/ for the most recent hospitality packages available for UEFA tournaments’ finals.

All phases had stringent requirements to avoid scalping, such as a maximum of four tickets per match per customer, and identification of the customers through an identity document.

For an overview of how Booking.com’s partner hotels operate, consult https://partnerhelp.booking.com/hc/en-gb

Stay dates other that Match days are surveyed individually, but reported as a group to simplify the readability.

In Cavallo (2017), the repeated queries generated by web scraping do not lead to dynamic updating of product prices. The following procedure made sure this was also the case in our setting. First, the cookie folder was cleaned daily; second, using different computers located in countries different from the venue of the data collection, we issued manual queries whose results we compared with the corresponding prices scraped by the crawler. No noticeable difference could be found, suggesting that Booking.com does not price discriminate depending on the location of the query.

We select the median out of a maximum of seven weekly observations. This may artificially reduce the degree of price uniformity, as the median values may be collected on different days of the week. We also experimented by taking the first price posted price in a query week, finding no significant difference in results.

Full estimates are reported in Table A.1 in the Appendix.

The figure only plots estimates for stay dates on match days or days before match days. Full results are reported in the Appendix Figs. A.1, A.2 and A.3. Further evidence that the star rating is a source of heterogeneity can be found in Table A.2 in the Appendix, where average prices by stars and events are shown. Although mean prices are quite different across star categories, they are rather uniform within each star group when comparing the different match dates, M.

We obtain the predicted prices and the multiple comparison tests among means using the margins command in Stata 15 with the bonferroni option. We follow Dunn (1961) and use the Bonferroni’s method, which adjusts the comparison-wise error rate based on the upper limit of the Bonferroni inequality. A similar approach has been adopted by Guizzardi et al (2019) to gauge the impact of geographical distance on the intensity of pairwise competition among hotels in Milan.

The rationale for using this variable, that takes the average of the posted prices in all the query dates antecedents to a particular observation, is that the probability of going sold out depends on the stock of bookings. Hence, past prices are likely to be more relevant predictors than current ones.

One possible explanation would rest on the hypothesis that hoteliers’ recourse to revenue management practices is only triggered at some point when rooms are on sale (Cho et al, 2018). Without direct knowledge of the revenue management routines of the hotels in our sample, this theory is untestable with our data.

In Table A.5 in the Appendix we show that this premise is borne in the data as hoteliers, in their shift towards bespoke prices, revised up more games involving teams from richer and more popolous countries. The distance of the capital from Paris and the FIFA ranking of the teams, instead, had no significant impact.

Implicitly, this assumes that lack of booking many months before the stay date cannot be necessarily interpreted by the managers as a negative signal about the final demand.

The figure only shows the results for days before matches and match days. Full results are in Figs. A.4, A.5 and A.6 in the Appendix.

It is worth pointing out that the monthly dummies are now also much more noisily estimated. This was to be expected: we already showed that the polynomial controlling for room availability capture much the same variation that contributed to the identification of the time dummies. However, even in lack of strong statistical significance, the pattern appears too consistent to be simply attributable to noise.

References

Abrate, G., Nicolau, J. L., & Viglia, G. (2019). The impact of dynamic price variability on revenue maximization. Tourism Management, 74, 224–233.

Adams, B., & Williams, K. (2019). Zone pricing in retail oligopoly. American Economic Journal: Microeconomics, 11(1), 124–156.

Alderighi, M., Gaggero, A. A., & Piga, C. A. (2022). Hidden prices with fixed inventory: evidence from the airline industry. Transportation Research Part B: Methodological, 157, 42–61

Alderighi, M., Nicolini, M., & Piga, C. A. (2015). Combined effects of load factors and booking time on fares: Insights from the yield management of a low-cost airline. Review of Economics and Statistics, 97, 900–915.

Asplund, M., Eriksson, R., & Strand, N. (2008). Price discrimination in oligopoly: Evidence from regional newspapers. Journal of Industrial Economics, 56(2), 333–346.

Bloom, N., & Van Reenen, J. (2007). Measuring and explaining management practices across firms and countries. The Quarterly Journal of Economics, 122(4), 1351–1408.

Borzekowski, R., Thomadsen, R., & Taragin, C. (2009). Competition and price discrimination in the market for mailing lists. Quantitative Marketing and Economics, 7, 653–683.

Busse, M., & Rysman, M. (2005). Competition and price discrimination in Yellow Pages advertising. Rand Journal of Economics, 36, 378–390.

Cavallo, A. (2017). Are online and offline prices similar? Evidence from large multi-channel retailers. American Economic Review, 107(1), 283–303.

Cho, S., Lee, G., Rust, J., & Yu, M. (2018). Optimal dynamic hotel pricing. Mimeo.

Courty, P., & Pagliero, M. (2011). The impact of price discrimination on revenue: Evidence from the concert industry. Review of Economics and Statistics, 94(1), 359–369.

Courty, P., & Pagliero, M. (2014). The pricing of art and the art of pricing: Pricing styles in the concert industry. In V. A. Ginsburgh, & D. Throsby (Eds.), Handbook of the economics of art and culture, (volume 2, pp. 299–356). Elsevier Science, New York, USA.

Dana, J. D. (1999). Equilibrium price dispersion under demand uncertainty: The roles of costly capacity and market structure. Rand Journal of Economics, 30(4), 632–660.

de Roos, N., & McKenzie, J. (2014). Cheap Tuesdays and the demand for cinema. International Journal of Industrial Organization, 33, 93–109.

DellaVigna, S., & Gentzkow, M. (2019). Uniform pricing in U.S. retail chains. The Quarterly Journal of Economics, 134(4), 2011–2084.

Doraszelski, U., Lewis, G., & Pakes, A. (2018). Just starting out: Learning and equilibrium in a new market. American Economic Review, 108(3), 565–615.

Dunn, O. J. (1961). Multiple comparisons among means. Journal of the American Statistical Association, 56(293), 52–64.

Ellison, S. F., Snyder, C., & Zhang, H. (2018). Costs of managerial attention and activity as a source of sticky prices: Structural estimates from an online market. Working Paper 24680, National Bureau of Economic Research.

Gale, L. I., & Holmes, T. J. (1993). Advance-Purchase Discounts and Monopoly Allocation capacity. American Economic Review, 83(1), 135–146.

Gorodnichenko, Y., & Talavera, O. (2017). Price setting in online markets: Basic facts, international comparison, and cross-border integration. American Economic Review, 107(1), 249–282.

Guizzardi, A., Pons, F., & Ranieri, E. (2019). Competition patterns, spatial and advance booking effects in the accommodation market online. Tourism Management, 71, 476–489.

Hollenbeck, B. (2017). The economic advantages of chain organization. Rand Journal of Economics, 48(4), 1103–1135.

Huang, Y. (2021). Pricing frictions and platform remedies: The case of airbnb. Working paper.

Huang, Y., Ellickson, P. B., & Lovett, M. J. (2022). Learning to Set Prices. Journal of Marketing Research.https://doi.org/10.1177/00222437211068527

Leslie, P. (2004). Price discrimination in broadway theatre. Rand Journal of Economics, 35, 520–541.

McManus, B. (2007). Nonlinear pricing in oligopoly markets: The case of specialty coffee. Rand Journal of Economics, 38, 512–532.

Melis, G., & Piga, C. A. (2017). Are all hotel prices created dynamic? An empirical assessment. International Journal of Hospitality Management, 67, 163–173.

Möller, M., & Watanabe, M. (2010). Advance purchase discounts and clearance sales. Economic Journal, 120, 1125–1148.

Orbach, B. Y., & Einav, L. (2007). Uniform prices for differentiated goods: The case of the movie-theater industry. International Review of Law and Economics, 27, 129–153.

OTCP. (2016). Le tourisme á Paris - Chiffres clés. Office du Tourisme et des Congrés de Paris.

Piga, C., & Melis, G. (2021). Identifying and measuring the impact of cultural events on hotels’ performance. International Journal of Contemporary Hospitality Management, 33(4), 1194–1209.

Shiller, B., & Waldfogel, J. (2011). Music for a song: An empirical look at uniform pricing and its alternatives. Journal of Industrial Economics, LIX(4), 630–660.

Stole, L. (2007). Price discrimination and competition. In M. Armstrong, & R. Porter, (Eds.), Handbook of industrial organization, (volume III, pp. 2221–2299). Elsevier Science, North Holland, Amsterdam.

Talluri, K. T., & van Ryzin, G. J. (2004). The theory and practice of revenue management. New York: Springer.

Varian, H. (1989). Price discrimination. In R. Schmalensee & R. Willig (Eds.), Handbook of Industrial Organization, (volume I, pp 597–654). Amsterdam: Elsevier Science, North Holland.

Zbaracki, M., Ritson, M., Levy, D., Dutta, S., & Bergen, M. (2004). Managerial and customer costs of price adjustment: Direct evidence from industrial markets. Review of Economics and Statistics, 86(2), 514–533.

Acknowledgements

We wish to thank Basile Grassi, Kim Kaivanto, Gabriele Lepori, Andrea Mantovani, Carlo Reggiani, Tom Schmitz, the Editor and two referees for their valuable comments

Funding

Open access funding provided by Universitá degli Studi di Pavia within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

All authors declare that there are no financial or non-financial interests that are directly or indirectly related to the work submitted for publication.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nicolini, M., Piga, C.A. & Pozzi, A. From uniform to bespoke prices: Hotel pricing during EURO 2016. Quant Mark Econ 21, 333–355 (2023). https://doi.org/10.1007/s11129-023-09264-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-023-09264-x