Abstract

We build on recent work that analyzes consumers’ ability to save by exploiting price dispersion in grocery stores. We show that store expensiveness varies across consumers depending on the basket they consume, meaning that consumers can save more by shopping at a store that is cheaper for their basket rather than at a store that is cheaper overall. We incorporate this insight into a new price variance decomposition that is a refinement of existing approaches. Our results show that the ability to buy products from the store where they are cheapest is much less important than previous work had found; rather, the ability to choose the cheapest stores for one’s basket is a more important source of variation in the prices consumers pay. Our approach also provides an informal test for competing theories modeling consumers as either shopping for products or shopping for categories, and finds support for both. We conclude that the idea of consumers choosing the right store for their basket has substantial traction and is a useful addition to our arsenal of models of consumer search behavior.

Similar content being viewed by others

Availability of data and material

Data are easily accessible from IRI, the company that we obtained them from.

Code availability

The analysis was performed in Stata using our own code.

Notes

The literature is discussed in Section 2.

These fractions are approximate averages across several specifications.

Kaplan and Menzio ([13]), p. 24.

We use the IRI Marketing Data Set, which is similar to the Kilts-Nielsen Consumer Panel used by KM (see Section 3).

We discuss the link between the decomposition and the search literature further in Section 4.3.

These implications derive formally from Proposition 1 in Section 4.

Griffith et al. ([8]), p. 100.

We use the terms panelist, consumer and household interchangeably.

We say that a product is available in a given store and quarter if the store records a positive quantity for that product-quarter (see Online Appendix).

The difference with the product level computation is that at the transaction level a product that is purchased many times will be counted every time, as opposed to just once per market-quarter. There is substantial variation in product availability across markets (lower in Pittsfield than in Eau Claire), product categories (lower for milk and yogurt, higher for carbonated soft drinks) and product popularity (higher for products with larger market shares).

The average is across consumer-quarter. TSSS report very similar figures for their UK data: 71% and 94%.

Another way to measure the extend to which store unavailability prevents price comparison, it to use the notion of pairwise price comparison. A pairwise price comparison is possible for a purchased product and a store visited different from the one where the product was purchased, if the product is available in that other store. The ratio of all possible pairwise price comparisons, to the maximum number of possible pairwise price comparisons, were purchased products available in all stores visited, is 80.2%. This demonstrates that product availability does not prevent consumers from comparing prices.

\(\sum _{i} \alpha _{i} p_{i}=1\) for \({\alpha_{i}} = \frac{{\sum_{j,s}}{P_{j}}{q_{i,j,s}}}{{\sum_{i,j,s}}{P_{j}}{q_{i,j,s}}}\).

A dot ‘.’ in a variable’s subindex means that the variable is summed over that subindex, i.e. \(\omega _{i,.,s}= \sum _{j} \omega _{i,j,s}\).

Store-specific baskets in this calculation are reweighed to account for partial product availability; Appendix A explains how this is done.

We bring back the transaction component when we discuss robustness in Section 5.4.

There are 1517 store-pair-quarter observations: both stores in the pair are one of the top two stores by expenditure for at least one panelist in that quarter (the upper bound is 36 store-pairs times 48 quarters = 1728). After filtering out store pair-quarters with fewer than 50 panelists, we end up with 954 observations.

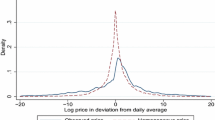

The spike at zero on Fig. 1 says that a bit more than 9% of store-pair quarters have 3.2% (bin size of .032) or fewer panelists having different rankings.

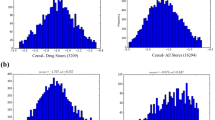

Across all market-quarters, 29% of consumers have a zero store-good component. Note that the bar at zero has been trimmed in order to display the rest of the distribution more clearly – see graph.

Interestingly, TSSS find a smaller role for multi-store sourcing at the category level: “Across all consumers (whether one- or multi-stop) the share of category spending in the category’s second store is 4 percent (panel A3, p.2317).”

As a technical point, the consumer may not purchase goods in the same proportion in the store-basket and store-good indexes.

Normalized prices take only two values in the following example: (a) all stores pay the same cost for each product, possibly varying from product to product, and then each store chooses a markup for each product that may be low or high; and (b) stores sell the same quantity share of low and high products. Since there is no temporal variation, we can omit without loss of generality the i sub-index on the transaction price \(P_{j,s}\), and we also have \(\mu _{i,j,s}=\mu _{j,s}\). Statement (a) says that stores charge price \(P_{j,s}=c_{j} \alpha _{e}\) for expensive products and \(P_{j,s}=c_{j} \alpha _{c}\) for cheap ones, where \(c_{j}\) is the cost of product j and \(\alpha _{e}>\alpha _{c}\) are the markups. Denote by \(E_{j}\) the set of stores where product j is expensive. Applying KM2 (see Eq. 1), we have \(P_{j} = c_{j}(\alpha _{e} {x_{e}^{j}} + \alpha _{c} (1-{x_{e}^{j}}))\), where \({x_{e}^{j}}=\frac{\sum _{i,s\in E_{j}}q_{i,j,s}}{\sum _{i,s}q_{i,j,s}}\) is the quantity share of product j sold at an expensive price. According to statement (b) \({x_{e}^{j}}\) is constant across j, \({x_{e}^{j}}=x_{e}\). Applying KM1, we obtain that the normalized prices are \(\mu _{j,s}=\frac{\alpha _{e}}{x_{e} \alpha _{e}+(1-x_{e})\alpha _{c}}\equiv e\) for expensive products and \(\mu _{j,s}=\frac{\alpha _{c}}{x_{e} \alpha _{e}+(1-x_{e})\alpha _{c}} \equiv c\) for cheap ones.

To show that \(\mu _{s}=1\), applying Eq. 4, we have \(\mu _{s}= e \frac{\sum _{i,j \; s.t.\; s\in E_{j}} P_{j,s}q_{i,j}}{\sum _{i,j,s} P_{j,s}q_{i,j,s}}+c \frac{\sum _{i,j \; s.t.\; s\notin E_{j}} P_{j,s}q_{i,j,s}}{\sum _{i,j} P_{j,s}q_{i,j,s}}\) which does not depend on s because the expenditure share of expensive products, \(\frac{\sum _{i,j,s\in E_{j}} P_{j,s}q_{i,j,s}}{\sum _{i,j} P_{j,s}q_{i,j,s}}\), is constant across stores. Moreover, plugging the above formula for \(\mu _{s}\) in the weighted average \(\sum _{s} \frac{\sum _{i,j} P_{j,s}q_{i,j,s}}{\sum _{i,j,s} P_{j,s}q_{i,j,s}} \mu _{s}\), we obtain that \(\sum _{s} \frac{\sum _{i,j} P_{j,s}q_{i,j,s}}{\sum _{i,j,s} P_{j,s}q_{i,j,s}} \mu _{s}=1\) and conclude that \(\mu _{s}=1\).

The store-specific basket price index is \(p_{i,s}=\sum _{j} \mu _{j,s} \omega _{i,j,.}\) and by assumption \(\omega _{i,j,.}=\frac{1}{n}\) for n products and \(\omega _{i,j,.}=0\) for the remaining ones. We also have \(\mu _{j,s}=c\) for a single purchased product j and \(\mu _{j,s}=e\) for the remaining \(n-1\) products in the consumer’s basket. The store-specific basket is \(p_{i,s}=\frac{1}{n}c+\frac{n-1}{n}e\) for each store and this is also the value of \(p^{sb}_{i}\).

We also merge the PL products sold in stores that belong to same chain (this applies to two pairs of stores in Pittsfield). All remaining PLs (PLs from different chains) are treated as different products.

References

Aguiar, M., & Hurst, E. (2007). Life-cycle prices and production. American Economic Review, 97(5), 1533–1559.

Bronnenberg, B. J., Kruger, M. W., & Mela, C. F. (2009). The IRI marketing data set. Marketing Science, 27(4), 745–748.

Ching, A. T., & Osborne, M. (2020). Identification and estimation of forward-looking behavior: The case of consumer stockpiling. Marketing Science, 39(4), 707–726.

Clerides, S., & Courty, P. (2017). Sales, quantity surcharge, and consumer inattention. The Review of Economics and Statistics, 99(2), 357–370.

DellaVigna, S., & Gentzkow, M. (2019). Uniform pricing in U.S. retail chains. The Quarterly Journal of Economics, 134(4), 2011–2084.

Dubois, P., & Perrone, H. (2019). Price dispersion and informational frictions: Evidence from supermarket purchases. unpublished manuscript.

Erdem, T., Imai, S., & Keane, M. (2003). Brand and quantity choice dynamics under price uncertainty. Quantitative Marketing and Economics, 1(1), 1–64.

Griffith, R., Leibtag, E., Leicester, A., & Nevo, A. (2009). Consumer shopping behavior: How much do consumers save? Journal of Economic Perspectives, 23(2), 99–120.

Hendel, I., & Nevo, A. (2006). Measuring the implications of sales and consumer inventory behavior. Econometrica, 74(6), 1637–1673.

Hendel, I., & Nevo, A. (2013). Intertemporal price discrimination in storable goods markets. American Economic Review, 103(7), 2722–2751.

Hitsch, G. J., Hortaçsu, A., & Lin, X. (2021). Prices and promotions in U.S. retail markets. Quantitative Marketing and Economics, 19, 289–368.

Hosken, D., & Reiffen, D. (2004). Patterns of retail price variation. The RAND Journal of Economics, 35(1), 128–146.

Kaplan, G., & Menzio, G. (2015). The morphology of price dispersion. International Economic Review, 56(4), 1165–1206.

Kaplan, G., Menzio, G., Rudanko, L., & Trachter, N. (2019). Relative price dispersion: Evidence and theory. American Economic Journal: Microeconomics, 11(3), 68–124.

Lach, S. (2002). Existence and persistence of price dispersion: An empirical analysis. The Review of Economics and Statistics, 84(3), 433–444.

Lal, R., & Matutes, C. (1989). Price competition in multimarket duopolies. The RAND Journal of Economics, 20(4), 516–537.

Moen, E. R., Wulfsberg, F., & Aas, Ø. (2020). Price dispersion and the role of stores. The Scandinavian Journal of Economics, 122(3), 1181–1206.

Neslin, S. A. (2002). Sales promotion. In B. Weitz & R. Wensley (Eds.), Handbook of Marketing (pp. 310–338). SAGE Publications.

Pesendorfer, M. (2002). Retail sales: A study of pricing behavior in supermarkets. Journal of Business, 75(1), 33–66.

Pires, T. (2016). Costly search and consideration sets in storable goods markets’’. Quantitative Marketing and Economics, 14(3), 157–193.

Pratt, J. W., Wise, D. A., & Zeckhauser, R. (1979). Price differences in almost competitive markets’’. The Quarterly Journal of Economics, 93(2), 189–211.

Seiler, S. (2013). The impact of search costs on consumer behavior: A dynamic approach. Quantitative Marketing and Economics, 11, 155–230.

Sorensen, A. T. (2000). Equilibrium price dispersion in retail markets for prescription drugs. Journal of Political Economy, 108(4), 833–850.

Thomassen, Ø., Smith, H., Seiler, S., & Schiraldi, P. (2017). Multi-category competition and market power: A model of supermarket pricing. American Economic Review, 107(8), 2308–51.

Varian, H. R. (1980). A model of sales. American Economic Review, 70(4), 651–659.

Acknowledgements

We thank Marina Antoniou and Ružica Savčić for research assistance and Christis Tombazos for helpful comments. We gratefully acknowledge funding by the University of Cyprus (internal research grant “Consumer Planning”) and Mitacs through its Globalink Research Internship program.

Funding

University of Cyprus (internal research grant “Consumer Planning”) and Mitacs through its Globalink Research Internship program.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest/Competing interests

None

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix A: Computations of consumer store baskets weights

To compute the store-basket price index, we first compute a store-specific household price index, \(p_{i,s}\) (see Eq. 10 for the definition). To deal with the case where a product purchased by consumer i, is not available in another store visited by consumer i, we assume that the consumer purchases the goods in her basket that are available each store visited, in the same relative proportions as the basket’s proportions (see Table 7).Footnote 22

Appendix B: Proof of Proposition 1

Proposition 1

A consumer has zero store-good savings, \(p_{i}^{sb} = p_{i}^{sg}\), when: (a) she visits a single store; (b) store-good prices \(\mu _{j,s}\) do not vary across stores visited; or (c) she purchases the same share of each good in all stores visited (\(\frac{\omega _{i,j,s}}{\sum _{j} \omega _{i,j,s}}\) constant across s).

Proof

Combining the definitions of \(p_{i }^{sg}\) and \(p_{i }^{sb}\) (Eqs. 8 and 10), we obtain

To prove claim (a), denote by \(s_{i}\) the single store visited by consumer i. We have \(\omega _{i,j,s_{i} }=\omega _{i,j,. }\), \(\omega _{i,j,s }=0\) for \(s \ne s_{i}\), and \(\omega _{i,\cdot ,s_{i} }=1\). We obtain \(p_{i }^{sg}- p_{i }^{sb}=\sum \limits _{{j}}\mu _{j,s_{i} } \left( \omega _{i,j,s_{i} } - \omega _{i,\cdot ,s_{i} } \omega _{i,j,\cdot } \right) =\sum \limits _{{j}}\mu _{j,s_{i} } \left( \omega _{i,j,. } - \omega _{i,j,\cdot } \right) =0.\)

Condition (b) says that \(\mu _{j,s }=\mu _{j}\) for all (j, s). We obtain \(p_{i }^{sg}- p_{i }^{sb}=\sum \limits _{{j}}\mu _{j } \left( \sum \limits _{{s}} ( \omega _{i,j,s } - \omega _{i,\cdot ,s } \omega _{i,j,\cdot } )\right) =\sum \limits _{{j}}\mu _{j } ( \omega _{i,j,\cdot } - \omega _{i,j,\cdot } )=0 .\)

To prove claim (c) note that condition \(\frac{\omega _{i,j,s}}{\sum _{j} \omega _{i,j,s}}\) constant across s is equivalent to \(\omega _{i,j,s } = \omega _{i,\cdot ,s } \omega _{i,j,\cdot }\). We conclude that \(p_{i }^{sg}= p_{i }^{sb}=\sum \limits _{{j,s}}\mu _{j,s } \left( \omega _{i,j,s } - \omega _{i,\cdot ,s } \omega _{i,j,\cdot } \right) =0\).

The conditions stated in Proposition 1 are influenced by both consumer and store behavior, in the sense that the attribution of consumer savings to the store-basket or store-good component depends on the number of stores visited and on store pricing and product assortment policies. To illustrate, consider a simplified market where: (a) products are sold at normalized prices that vary across products and stores and can take only one of two values, \(\mu _{j,s}=c\) for cheap or \(\mu _{j,s}=e\) for expensive, and (b) all stores sell the same expenditure share of expensive products.Footnote 23 This latter assumption implies \(\mu _{s}=1\) for all stores and there is no store component, \(p^{s}=1\).Footnote 24

With this as background, we now consider a consumer who buys n cheap products from n different stores. We have \(p^{sg}=c\) and the consumer savings are \(p^{s}-p^{sg}=1-c\). In one scenario, each product is cheap in only one of the visited stores. If the consumer spends the same amount on each product, we obtain that her store-specific basket (see Eq. 5) is composed of \(\frac{1}{n}\) and \(\frac{n-1}{n}\) of cheap and expensive products respectively in any of the stores she visits, and \(p^{sb}=\frac{1}{n}c+\frac{n-1}{n}e\).Footnote 25 The store good component, \(p^{sb}-p^{sg} = \frac{n-1}{n}(e-c)\), increases as the consumer visits more stores. This is as it should be, since buying cheap products requires more cross-store shopping as the number of stores visited increases. In an alternative scenario, where cheap products are cheap in all stores visited, consumer savings are explained by the store-basket component alone, since there is no pure store-good component, \(p^{sg}-p^{sb}=0\). This demonstrates that the attribution of consumer savings to the store-basket and store-good components depends both on consumer behavior (store visited and purchase choices) and store pricing policies (whether store prices are correlated across stores).

Appendix C: Replication of KM decompositions

We replicate (using the IRI dataset) the KM decompositions for the transaction prices (KM equation 7 in Section 3) and for the household price indexes (KM equation 14 in Section 4, corresponding to Eq. 11 using CCM notation).

1.1 Appendix C.1 Replication of KM price decomposition

Table 8 reports the results of the KM price decomposition with the IRI data (column 1) and with the Nielsen data (column 3, copied from KM p. 14, Table 3, column 3). Columns 2 and 4 re-normalize the variances and covariance after ignoring the transaction component.

The price decompositions are fairly similar across the two datasets. The share of the transaction component is large in both datasets (65% in IRI versus 62% in Nielsen), and similar in both IRI markets (63% in Eau Claire and 66% in Pittsfield), suggesting that promotions play a similar role for our five products categories as it does for the much wider set of products included in KM’s analysis.

1.2 C.2 Replication of KM household price index decomposition

Table 9 replicates the KM decomposition with the transaction component using the IRI data. Column 1 presents the result for the decomposition with the transaction and store-basket components (a combination of Eqs. 11 and 13). Column 2 re-normalizes the components to obtain the KM decomposition (Eq. 11). For comparison purposes, column 3 copies the values of these components using the data from Nielsen (see KM p. 25, Table 7, column 3). The main difference between the KM decomposition applied to the two different datasets is a significantly higher transaction component in the IRI dataset (51% instead of 16%). This was pointed out in the introduction and was discussed further in Section 5.5.

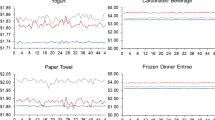

Table 10 shows that the large transaction component is present in both markets and in all five categories. The first column copies column 2 from Table 9 as a baseline. Columns 2 and 3 report the decomposition for the two markets separately. The next five columns replicate the baseline column for the five product categories (carbonated soft drinks, cold cereal, milk, salty snacks and yogurt). The transaction component has the same magnitude in all columns. The same holds if we filter out panelist-quarter observations with fewer than 20 purchases per quarter.

It is difficult to explain why the temporal component explains a larger share of consumer saving in the IRI dataset. Appendix C.1 has shown that the temporal component explained the same share of price variation in the two datasets. It is not the case that households can take advantage of greater temporal variations (e.g. more frequent or deeper promotions) for the set of products selected from IRI dataset. One explanation could be that households represented in the IRI dataset are more heterogeneous in their ability to take advantage of promotions.

Appendix D: Results of robustness tests

Table 11 presents the results of the decomposition computed separately for single-store shoppers and multi-store shoppers. As expected, the pure store-good component of multi-store shoppers is larger than for the whole sample. But it is still substantially smaller than the store-good component from the KM decomposition (32% versus 54%) and the store-basket component (32% versus 43%). Households visiting a single store have about the same store and store-basket components (58% and 52% respectively). For these households, the store-basket component is attributed to the store-good component under the KM decomposition. The misallocation of the 52% store-basket component to the store-good component for 27.9% of households explains roughly half of the 31% difference in store-good components between the KM and CCM decomposition.

Table 12 replicates the decomposition presented in Table 5 and reports the results of seven robustness tests. For each of these tests, the variances of the KM store-good and the CCM pure store-good components are reported in the last two rows. The ‘Baseline’ scenario (first column in Table 12) corresponds to the CCM decomposition from Table 5.

The ‘Filter’ column reports results obtained when we filter out panelist-quarter observations with fewer than 20 purchases per quarter. The concern being addressed is that the average purchase count in IRI is smaller than in Nielsen. We want to check that the results do not change when we increase the purchase count per panelist-quarter.

A limitation of the data is that we cannot tell if two private label (PL) UPCs with the same characteristics but sold in two different stores are the same product or not (see detailed explanation in Section A.6 of the Online Appendix.) The baseline column assumes that they are the same product. Alternatively, we could assume that they are different products, although it is important to keep in mind that doing so is unlikely to change our main results because PL purchases represent a small fraction (less than 11 percent) of all purchases for most product categories (the exception is milk for which 37.6 percent of purchases are PL). The results do not change when we merge only non-PL products (see column ‘PL’).Footnote 26

Columns ‘Eau’ and ‘Pitts’ show results for each of the two markets separately. Nielsen contains 54 geographically dispersed markets. One concern is that our two markets may not be representative of the average Nielsen market. Although we are limited in what we can do about this, we can at least check that the results are not driven by a single market. Both markets point to the same conclusion: the KM store-good component is more than twice the size of the CCM pure store-good component.

Columns ‘SW2’ and ‘SW3’ report estimates using alternative store-good weights to the weight \(w_{i,j,\cdot ,t}\) and \(w_{i,\cdot ,s,t}\) used in the definition of \(p_{i,t}^{sb}\) (Eq. 10) to weight the store-good prices in the calculation of the store-basket price index. A problem with these weights is that they overestimate the store-basket price index if a good in the panelist’s basket has an abnormally high price in a store visited by the panelist. The good may never be bought by the panelist in that store, and for that matter, by most consumers. SW2 assumes that the panelist purchases each good in her basket proportionally to how the average consumer in the market would purchase the good among the stores visited by the panelist. This method takes care of the problem presented above. Another concern is that the panelists’ baskets vary from quarter to quarter because the one-quarter window is too short. SW3 computes the weights for the goods in a consumer’s basket, \(w_{i,j,.,t}\), using a centered three-quarter window.

Finally, the last column considers a different way to aggregate the variance decompositions across markets and quarters. The method reported in the baseline column follows KM’s approach: the variance decomposition is conducted by quarter and then aggregated over quarters. The method reported in column ‘1VD’ computes a single variance decomposition for all panelist-quarter observations.

The results are broadly similar across all seven columns in Table 12. The last two rows of the table show that in every case, the variance of the CCM pure store-good component is substantially smaller than the variance of the KM store-good component, about half the size in several cases.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Clerides, S., Courty, P. & Ma, Y. Store expensiveness and consumer saving: Insights from a new decomposition of price dispersion. Quant Mark Econ 21, 65–94 (2023). https://doi.org/10.1007/s11129-022-09258-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-022-09258-1