Abstract

Recent studies indicate that the ideological stances of government parties no are longer associated with differences in total government spending. At the same time, we observe that political polarization over spending policies has deepened. This paper addresses that puzzle by analyzing government spending behavior for ten expenditure categories during both ‘normal’ times and periods of fiscal consolidation between 1995 and 2015 for 16 OECD countries. Our results indicate that partisan motives prevail in ‘normal’ times: right-wing cabinets spend more on defense and less on education and environmental protection than left-wing governments. On the other hand, in periods of fiscal adjustment, differences between left- and right-wing government expenditures can be observed mostly in different budget categories. For instance, during fiscal consolidations, right-wing governments reduce spending more than their left-wing counterparts on those categories featuring large shares of public employee compensation (i.e., public consumption spending) and small capital-expenditure shares. Hence, a central message of this paper helping to resolve the aforementioned puzzle is that ideological differences remain important after taking a comprehensive look at individual spending categories and distinguishing between periods with and without adjustments.

Similar content being viewed by others

Notes

See also Alesina et al. (2017), who study a sample of 16 OECD countries during the 1978–2015 period, finding that government spending and transfer cuts are less detrimental to future GDP growth than tax increases. While tax adjustments typically complement spending cuts during periods of fiscal consolidation, their magnitude is on average smaller than spending cuts by a factor of almost four.

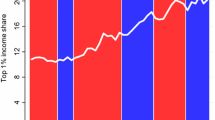

Examples of the recent electoral successes of far-left and -right parties are Die Linke and the Alternative für Deutschland in Germany, the United Kingdom Independence Party in the UK, the Lega Nord in Italy, the Rassemblement National/Front National in France, the Freiheitliche Partei Österreichs in Austria and Podemos and VOX in Spain.

The narrative method identifies consolidation policies by reference to budget documents indicating that the primary policy objective was not to stabilize the economic cycle. Consequently, the fiscal adjustments identified by that approach prove to be uncorrelated with the business cycle (Alesina et al. 2018). Moreover, it has been argued that such narratives do not suffer from weak identification nor reverse causality biases (Guajardo et al. 2014).

For an extensive review of the literature on external and internal adjustments, see Walter (2003).

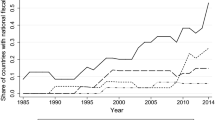

The composition of the sample is explained by the availability of data from distinct sources. Observations on fiscal adjustments are available for the 1980–2014 period. Data on total and disaggregated public spending are available for the 1995–2015 period. See also Tables 1 and 2 for details on measurement, data sources and descriptive statistics.

For example, 2011’s target was reducing budget deficits to 4.8% of GDP for the central government and 1.3% of GDP for the state governments (`Comunidades Autónomas´), thereby demanding a much larger effort from the latter, as the expenditure shares of central and state governments over GDP were almost identical beforehand.

The histogram for a pooled sample of total expenditure growth rates can be found in the Supplementary material to this paper. For the case of Ireland, available data indicate a 34.26% growth of total public expenditures in 2010, followed by a subsequent 30.26% reduction in 2011. Those sharp expenditure changes are explained by strong (upward and downward) shifts (of + 135.35% and − 117.54%, respectively) in the Economic affairs category. To guard against the influence of such outliers on our empirical estimates, we have removed the 2010 and 2011 observations for Ireland from the sample.

If one party holds the majorty in Parliament, ideo is the ideology of that party. In the United States, ideo is the ideology of the President’s party.

Since elec is a weighted variable and election dates are almost uniformly throughout the calendar year, the mean of elec is 0.247. On average, regular elections took place every fifth year. The number of elections in our sample is 89. Among them, the number of irregular elections is 27. In the robustness section of our results, we also use the measurement of the electoral cycle proposed by Schuknecht (2000).

We also have considered estimating random-effect (RE) regression models. However, noticing significant differences among parameter estimates for a few spending categories, we consider FE estimation as more suitable owing to its robustness to eventual correlations between unobservable heterogeneity and our explanatory variables. In qualitative terms, RE and FE models return almost identical regression results (see also the descriptive statistics in Table 2 on the prevalence of sizable within variation). Summary results for Hausman tests comparing FE and RE estimates are given in the notes to those tables that report outcomes for the general regression model in (1).

All empirical conclusions largely remain unaffected by the inclusion or exclusion of first-order dynamics.

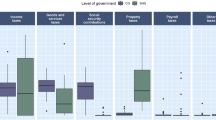

The five categories with the largest shares of employee salaries are: Public order and safety ≈ 70%, Education ≈ 60%, Defense ≈ 50%, Recreation, culture and religion and Health ≈ 30%. Apart from Social protection, capital spending is lowest in Health (≈ 4%), Public order and safety (≈ 5%) and Education (≈ 7%). For details, see Eurostat (2019).

All tables reporting the results of the robustness checks are contained in the online supplementary material to this paper.

References

Alesina, A. (1987). Macroeconomic policy in a two-party system as a repeated game. The Quarterly Journal of Economics, 102, 651–678.

Alesina, A., Ardagna, S., & Trebbi, F. (2006). Who adjusts and when? The political economy of reforms. IMF Staff Papers, 53(Special Issue), 1–29.

Alesina, A., Azzalini, G., Barbiero, O., Favero, C. A., Giavazzi, F., Karamysheva, M., Miano, A., & Paradis, M. (2018). Fiscal adjustment plans. Dataset. Retrieved November 20, from, 2018. http://www.igier.unibocconi.it/folder.php?idfolder=306&vedi=306&tbn=albero.

Alesina, A., Baqir, R., & Easterly, W. (1999). Public goods and ethnic divisions. The Quarterly Journal of Economics, 114, 1214–1284.

Alesina, A., Barbiero, O., Favero, C., Giavazzi, F., & Paradisi, M. (2017). The effects of fiscal consolidations: Theory and evidence, NBER working paper no. 23385.

Alesina, A., Favero, C., & Giavazzi, F. (2015). The output effect of fiscal consolidation plans. Journal of International Economics, 96, S19–S42.

Alesina, A., Roberto, P., & Tavares, J. (1998). The political economy of fiscal adjustments. Brookings Papers on Economic Activity, 29, 197–266.

Alesina, A., Roubini, N., & Cohen, G. D. (1997). Political cycles and the macroeconomy. Cambridge: The MIT Press.

Bakker, R., de Vries, C., Edwards, E., Hooghe, L., Jolly, S., Marks, G., et al. (2015). Measuring party positions in Europe: The Chapel Hill expert survey trend file, 1999–2010. Party Politics, 21, 143–152.

Benoit, K., & Laver, M. (2006). Party policy in modern democracies. New York: Routledge.

Brender, A., & Drazen, A. (2005). Political budget cycles in new versus established democracies. Journal of Monetary Economics, 52, 1271–1295.

Brender, A., & Drazen, A. (2013). Elections, leaders, and the composition of government spending. Journal of Public Economics, 97, 18–31.

Cameron, D. R. (1978). The expansion of the public economy: A comparative analysis. The American Political Science Review, 72, 1243–1261.

CHESDATA. (2018). Datasets on party positions across Europe. http://chesdata.eu

Cusack, T. R. (1997). Partisan politics and public finance: Changes in public spending in the industrialized democracies, 1955–1989. Public Choice, 91, 375–395.

Cusack, T. R., & Beramendi, P. (2006). Taxing Work. European Journal of Political Research, 45, 43–73.

Devries, P., Guajardo, J., Leigh, D., & Pescatori, A. (2011). A new action-based dataset of fiscal consolidation. IMF Working Papers, 11/128, 1–90.

Döring, H. & Manow, P. (2018). Parliaments and governments database (ParlGov): Information on parties, elections and cabinets in modern democracies. Retrieved November 5, from, 2018. http://parlgov.org.

Drazen, A., & Easterly, W. (2001). Do crises induce reform? Simple empirical tests of conventional wisdom. Economics and Politics, 13, 129–158.

Drazen, A., & Eslava, M. (2010). Electoral manipulation via voter-friendly spending: Theory and evidence. Journal of Development Economics, 92, 39–52.

Easterly, W. (2006). The white man’s burden: Why the West’s efforts to aid the rest have done so much ill and so little good. Oxford, UK: Oxford University Press.

Eurostat. (2019). Government expenditure by function—COFOG. https://ec.europa.eu/eurostat/statistics-explained/pdfscache/10912.pdf.

Franzese, R. J. (2000). Electoral and partisan manipulation of public debt in developed democracies. In R. R. Strauch & J. von Hagen (Eds.), Institutions, politics and fiscal policy (Vol. 2, pp. 1956–1990)., ZEI studies in european economics and law Boston, MA: Springer.

Garrett, G., & Mitchell, D. (2001). Globalization, government spending and taxation in the OECD. European Journal of Political Research, 39, 145–177.

Guajardo, J., Leigh, D., & Pescatori, A. (2014). Expansionary austerity? International evidence. Journal of the European Economic Association, 12, 949–968.

Herwartz, H., & Theilen, B. (2014a). Partisan influence on social spending under market integration, fiscal pressure and institutional change. European Journal of Political Economy, 34, 409–424.

Herwartz, H., & Theilen, B. (2014b). Health care and ideology: A reconsideration of political determinants of public healthcare funding in the OECD. Health Economics, 23, 225–240.

Herwartz, H., & Theilen, B. (2017). Ideology and redistribution through public spending. European Journal of Political Economy, 46, 74–90.

Hibbs, D. A., Jr. (1977). Political parties and macroeconomic policy. The American Political Science Review, 71, 1467–1487.

Hibbs, D. A., Jr. (1987). The political economy of industrial democracies. Cambridge, MA: Harvard University Press.

Iversen, T. (2001). The dynamics of the welfare state expansion: Trade openness, de- industrialization, and partisan politics. In P. Piersson (Ed.), The new politics of the welfare state (pp. 45–79). Oxford: Oxford University Press.

Jensen, C. (2011). Capitalist systems, de-industrialization, and the politics of public education. Comparative Political Studies, 44, 412–435.

Katsimi, M., & Sarantidis, V. (2012). Do elections affect the composition of fiscal policy in developed, established democracies? Public Choice, 151, 325–362.

Kayser, M. A. (2009). Partisan waves: International business cycles and electoral choice. American Journal of Political Science, 53, 950–970.

Kittel, B., & Obinger, H. (2003). Political parties, institutions, and the dynamics of social expenditure in times of austerity. Journal of European Public Policy, 10, 20–45.

Meltzer, A. H., & Richard, S. F. (1981). A rational theory of the size of government. Journal of Political Economy, 89, 914–927.

Meltzer, A. H., & Richard, S. F. (1983). Tests of a rational theory of the size of government. Public Choice, 41, 403–418.

Mulas-Granados, C. (2003). The political and economic determinants of budgetary consolidation in Europe. European Political Economy Review, 1, 15–39.

Nordhaus, W. D. (1975). The political business cycle. Review of Economic Studies, 42, 169–190.

Norris, P. (2005). The Radical Right: Voters and parties in the electoral market. New York and Cambridge: Cambridge University Press.

OECD. (2011). Divided we stand: Why inequality keeps rising. Paris: OECD.

OECD. (2018). Government at a glance—2017 edition. Retrieved November 20, from, 2018. https://stats.oecd.org/.

Perroti, R., & Kontopoulos, Y. (2002). Fragmented fiscal policy. Journal of Public Economics, 86, 191–222.

Persson, T., Roland, G., & Tabellini, G. (2007). Electoral rules and government spending in parliamentary democracies. Quarterly Journal of Political Science, 2, 155–188.

Persson, T., & Tabellini, G. (1994). Is inequality harmful for growth? The American Economic Review, 84, 600–621.

Persson, T., & Tabellini, G. (2000). Political economics. Explaining economic policy. Cambridge: The MIT Press.

Potrafke, N. (2009). Did globalization restrict partisan politics? An empirical evaluation of social expenditure in a panel of OECD countries. Public Choice, 140, 105–124.

Potrafke, N. (2010). The growth of public health expenditure in OECD countries: Do government ideology and electoral motives matter? Journal of Health Economics, 29, 797–810.

Potrafke, N. (2011). Does government ideology influence budget composition? Empirical evidence from OECD countries. Economics of Governance, 12, 101–134.

Rogoff, K. (1990). Equilibrium political budget cycles. The American Economic Review, 80, 21–36.

Rogoff, K., & Sibert, A. (1988). Elections and macroeconomic policy cycles. The Review of Economic Studies, 55, 1–16.

Romer, C. D., & Romer, D. H. (2010). The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks. The American Economic Review, 100, 763–801.

Schuknecht, L. (2000). Fiscal policy cycles and public expenditure in developing countries. Public Choice, 102, 113–128.

Shelton, C. A. (2007). The size and composition of government expenditure. Journal of Public Economics, 91, 2230–2260.

Tepe, M., & Vanhuysse, P. (2009). Are ageing OECD welfare states on the path to gerontocracy? Evidence from 18 democracies, 1980–2002. Journal of Public Policy, 29, 1–28.

Tsebelis, G. (1995). Decision making in political systems: Veto players in presidentialism, parliamentarism, multicamerialism and multipartyism. British Journal of Political Science, 25, 289–325.

Tsebelis, G., & Chang, E. C. C. (2004). Veto players and the structure of the budget in advanced industrialized countries. European Journal of Political Research, 43, 449–476.

Walter, S. (2003). Financial crises and the politics of macroeconomic adjustments. New York: Cambride University Press.

Whitten, G. D., & Williams, L. K. (2011). Buttery guns and welfare hawks: The politics of defense spending in advanced industrial democracies. American Journal of Political Science, 55, 117–134.

Acknowledgements

We cordially acknowledge helpful suggestions from four anonymous referees, the editor in chief, William F. Shughart II, and the participants of the International Conference on Public Economic Theory (PET 2019) in Strasbourg. The second author acknowledges financial support from the Spanish Ministerio de Economía, Industria y Competitividad and the European Union under project ECO2016-75410-P (AEI/FEDER, UE) and Universitat Rovira i Virgili and Generalitat de Catalunya under projects 2017PRF-URVB2-B3 and 2017GR770. We thank Dr. Viet T. Tuan for computational assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Herwartz, H., Theilen, B. Government ideology and fiscal consolidation: Where and when do government parties adjust public spending?. Public Choice 187, 375–401 (2021). https://doi.org/10.1007/s11127-020-00785-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-020-00785-7

Keywords

- Fiscal consolidation

- Government ideology

- Public spending categories

- Central government expenditures

- Narrative identification