Abstract

In a nutshell, price cap regulation is meant to establish a quid pro quo: regulators are obliged by law to intervene only at rare, previously defined points in time, and only by imposing an upper bound on prices; firms are meant to justify regulatory restraint by adopting socially beneficial innovations. In the policy debate, a potential downside of the arrangement has featured less prominently: the economic environment is unlikely to be stable while the cap is in place. If regulators take this into account, they have to decide under uncertainty and also anticipate how regulated firms will react. In a lab experiment, we manipulate the degree of regulatory uncertainty. We compare a baseline when regulators have the same information as firms about demand with treatments wherein they receive only a noisy signal and another when they know only the distribution from which demand realizations are taken. In the face of uncertainty, regulators impose overly generous price caps, which firms exploit. In the experiment, the social damage is severe, and does not disappear with experience.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Public choice theory has been a highly successful enterprise. It assumes that public officials maximize personal utility, and that they strive for office in light of that opportunity. There is also substantial experimental support (for an overview see Druckman et al. 2011). Public choice theory has also been interested in the exercise of public power by bureaucrats (see only Niskanen 1971; Tullock 1965), and by regulators in particular (e.g. Appelbaum and Katz 1987; Kohli and Singh 1999; McCormick and Tollison 2012; Peltzman 1976; Shughart and Thomas 2015; Shughart 2008; Shughart and Thomas 2017; Stigler 1971). In this paper, we make an experimental contribution to this literature, testing one of the cornerstones of regulatory politics.

Many legal orders constrain regulatory agencies. Agencies may impose only an upper limit on price, and they may do so only at defined intervals of time. In our experiment, we test whether, from a behavioral perspective, such price cap regulation has a downside that one overlooks when assuming that regulators hold standard preferences. Specifically we wonder whether forcing regulators to decide under imperfect information, and preventing them from correcting their decisions if they turn out unwise, makes them overly cautious.

When price cap regulation was invented, many observers thought that it was an ingenious solution to a thorny normative problem (Vogelsang 2002). If firms hold a monopoly, or at least a dominant position that is unlikely to erode—because the conditions for a natural monopoly are fulfilled, for instance—firms use their entrepreneurial skills to exploit consumers. As a consequence, some form of regulatory intervention is hard to avoid. Yet, for many reasons, government is a poor entrepreneur (Milgrom and Roberts 1992; for an early statement see von Hayek 1945; Zenger et al. 2011). Seemingly, price cap regulation cuts the Gordian knot. While the cap is in place, firms benefit from regulatory certainty. Under the umbrella of the current cap, they can engage in innovation and cut costs to their own benefit. They may be certain that the regulator will not deprive them of the benefit from their innovation by reducing the cap.

Yet, a firm’s profit is not only a function of its own entrepreneurial activity. Exogenous influences, like shifts in demand, changes in the cost of raw materials, macroeconomic policy fluctuations, or legislative intervention that is unrelated to the regulated industry likewise can affect profitability. If the price cap is fixed by law, the regulator must (at least partly) respond to environmental changes behind a veil of ignorance. If the environment develops more favorably than expected, firms can gain rents. But if the environment develops less favorably than expected, firms may be forced to incur a loss, or may even have to exit the market. Regulators might be overly sensitive to this risk.

Price cap regulation also deprives regulators of opportunities for learning. They may have misread the evidence in the first place; they may have underestimated or overestimated the reaction of the firm to their intervention; they may not try out interventions at an affordable cost for the firm and welfare. Knowing that they cannot fine-tune their intervention may also make regulators overly cautious.

In the field, regulators have indeed been believed to be overly generous (Shughart 2008). Yet, observers have been tempted to explain generosity with regulatory capture: powerful firms have found ways to impose their will on regulators, to the detriment of society (Dal Bó 2006; Laffont and Tirole 1993; Stigler 1971). Firms may even team up with regulators in the interest of closing markets (Holcombe and Holcombe 1986). Regulation may also be an instrument to prevent the efficient relocation of an industry (Yandle 1983). One might also explain such findings with superior knowledge of firms that leaves them an information rent. Our experiment rules out all these explanations. In particular, we exclude any negotiations between the regulator and the firm and, a fortiori, corrupt side-payments. The experiment isolates a potential additional source of distortion: the excessive hesitation of regulators in the face of uncertainty about market conditions.

In the field, this concern would be difficult, if not impossible, to study (for attempts at estimating the cost of regulation using field data see e.g. Posner 1975; Stigler and Friedland 1962; also see the surveys by Jordan 1972; Shughart and Thomas 2015). One cannot hold the volatility of the environment constant, nor the degree by which regulators are informed about this volatility. In the field, we could only compare industries before and after the introduction of price cap regulation. Moreover, such industries are not randomly selected. Frequently the set-up of an independent regulatory agency even coincides with the introduction of price cap regulation. In that case, even the comparison at the time before and after regulatory change is meaningless (Shughart 2008). In the interest of making the effect visible and, more importantly even, of having a chance to randomize and thereby cleanly to identify the effect, we go to the lab. In the lab, we can also exclude confounds by defining a perfectly homogeneous product, the quality of which is fully observed by the regulator.

For this choice of method, we have to pay the usual price. While randomization guarantees internal validity, lab experiments always have limited external validity. One has to extrapolate from an artificially clean situation to a much more complex real-world context. Moreover, as is standard in the experimental literature, in our experiment regulators and firms are represented by students. In the field, obviously, both are heavily institutionalized and historically embedded corporate actors (Engel 2010). Arguably students have no professional experience in either trading or regulating. Yet, all of these qualifications also hold for the hundreds of lab experiments on competition (for an overview see the meta-study by Engel 2015).

We nonetheless readily acknowledge the many limitations inevitably inherent in our method. We induce preferences. The only incentive given to firms is to maximize profit. We thus abstract from competing goals of management. Likewise, our regulators are induced to maximize welfare. They have no monetary incentive for any competing goal, like supporting government in the next election. Neither do we confine the regulators’ normative goal to consumer welfare, as one school of antitrust advocates. We treat firms and regulators as unitary actors. We thus abstract from the entire economic, legal, and political debate on corporate governance. We do not distinguish either between the legislator, government and regulatory agencies. We thus abstract from the microstructure of the political system. Most importantly, in the interest of isolating the behavioral effect of different information about volatility in the regulatory environment, we deliberately remove the expected advantage of price cap regulation that carries most weight in the policy debate: innovation. If our hypothesis holds true and regulators are overly generous, policy makers face a tradeoff: successful innovation has the potential to increase welfare; but if caps are systematically too generous, the welfare loss from monopoly power may be larger than expected.

Given these limitations inherent in our set-up, we do not mean to make a recommendation about the overall desirability of price-cap regulation. All we want to contribute to the debate is evidence on one concern: price-cap regulation forces the regulator to fix a cap for an extended period of time despite uncertainty about the development of decision-relevant factors during the regulatory period.

In our experiment, participants are randomly assigned the roles of a firm and a regulator. They stay together in the same group of two for the entire experiment. The firm holds a monopoly. The regulator has the power to impose a price cap. The firm earns her profit. The regulator earns a fraction of welfare. We first play the game one-shot. After a surprise restart, we repeat the game for announced 10 periods. Participants know that demand will change once during this phase. The firm learns demand every period, and may adjust her price. In the Baseline, the regulator has the same option. In the Upfront and Signal treatments, the regulator must intervene before she knows actual demand. In the Signal treatment, she receives a noisy signal. In the repeated game, this signal is true demand when introducing the cap, but the regulator does not know when and in which ways demand will change over the next 10 periods. After the end of the second part of the experiment, we have another surprise restart, keeping the original pairs of principal and agent in place. Again, within 10 periods one shock occurs, leading to another draw from the lottery of business opportunities. In the third phase, we expose regulators to the opposite of the regime they had been in before. If they were in the Upfront or in the Signal regime, they now are in the Baseline. If they were in the Baseline, they now are either in the Signal or in the Upfront regime. By this manipulation, we investigate the effects of regulatory reform.

Qualitatively, standard theory is supported. The point predictions assuming standard preferences significantly explain the choices of regulators and firms. However, prices are considerably higher and consumer rent is considerably lower than predicted by theory. This is chiefly due to the fact that regulators set overly generous caps. Interestingly, caps are also too high if regulators are completely informed.

The remainder of the paper is organized as follows. In the next section, we relate our paper to the literature. In Sect. 3, we present the design of the experiment and develop hypotheses. Section 4 is the results section. Section 5 concludes with discussion.

2 Related Literature

The introduction of a price cap has chiefly been motivated with inducing firms to engage in socially beneficial product or process innovation (Beesley and Littlechild 1983; Crew and Kleindorfer 1986; Laffont and Tirole 1993). We do not question this bright side of price-cap regulation, but wonder how important is its dark side.

The drawback potentially results from the fact that price-cap regulation constrains agencies to occasional intervention in the light of imperfect information. Some legislators have been sensitive to the challenge.Footnote 1 Price cap regulation sometimes allows for a cap with a “Z factor”, i.e., adjustments to unexpected circumstances beyond the control of the regulated firm. But legislators tend to confine such exceptional adjustments to changes they may be sure to be exogenous, like new legislation or natural disasters (Sappington et al. 2001; Sappington and Weisman 2010). This may be wise in the interest of not giving regulated firms an easy way out. But regulators might also want to react to volatility in the economic environment that is not necessarily outside the firm’s control, like changes in demand. An alternative regulatory strategy is a price cap with an option for regular adjustments.Footnote 2 This addresses the concern, but weakens the quid pro quo between a guaranteed planning horizon and constraint on pricing. Our experiment explores this tradeoff under strictly controlled conditions. While this literature, and legislative reactions to it, address the volatility of context factors, they are not interested in the behavioral effect of the anticipated volatility of market conditions on regulatory choice. Investigating this behavioral effect is our contribution.

A second debate to which our paper is linked is that of regulatory choice. In essence this literature is concerned with the sequencing of price regulation. Two generic approaches are distinguished (Sibley and Bailey 1978; see also Bawa and Sibley 1980; Klevorick 1971; Sappington and Sibley 1988). In the first approach, the regulator anticipates the complete future and sets prices such that a long-term objective function is maximized. In the second approach, the regulator is myopic and sets prices in reaction to the difference between a target level of returns and the firm’s actual rate of return at this point in time. Our experiment contributes to this debate by manipulating the information set at the moment when the regulator decides. Note, however, that our regulators are not myopic in a strict sense. They do not disregard future consequences of today’s decisions. Rather (in some treatments), when they decide, they lack the information necessary for taking the exact future effects into account. Information about a distribution and, in one treatment, a noisy signal, is all they can rely on.

A third stream of literature to which our paper is connected is economic experiments on regulatory issues (Eckel and Lutz 2003). Normann and Ricciuti (2009) survey this literature, including experiments concerning public utilities. More specifically, Staropoli and Jullien (2006) and Kiesling (2005) survey the use of laboratory experiments for the design of energy market regulation. These experiments inform regulatory politics about the comparative advantages and disadvantages of competing proposals for intervention, and aim at spotting unanticipated counterproductive effects before a new policy is implemented (fine examples include Brandts et al. 2008; Henze et al. 2012; Kench 2004; Rassenti et al. 2003; Vossler et al. 2009). Our approach differs in that we endogenize the regulator.

Our experiment is finally linked to the general experimental literature on principal-agent problems resulting from project contracts (Cox et al. 1996; Healy et al. 2007) and to the debate in law and economics over rules vs. standards (Agoglia et al. 2011; Feldman and Harel. 2008; Wright et al. 2011). While conventionally it is argued that rules create greater predictability than standards, experiments question this. Our experiment gives room for the development of a trust relation between the regulator and the regulatee. Whether trust emerges might be critical for the performance of the competing regulatory regimes.

3 Design and Hypotheses

3.1 Design

The experiment has three parts. The first part is a one-shot game. In the second part, after a surprise restart, the same groups of two participants repeat the game for 10 announced periods. In the third part, after another surprise restart, constant groups of two participants are exposed to a regime change.

In the first part of the experiment, participants are randomly assigned to be “firms” or “regulators”, and randomly matched into economies of one firm and one regulator. In line with the experimental literature on monopoly and oligopoly, we thus use a market frame, rather than just exposing participants to the opportunity structure. We do so for reasons of internal and external validity. It is much easier to understand the opportunity structure if it is framed as the interaction between a firm and a regulator. With the frame we thus have less reason to fear that participants do not understand the task. Moreover, if regulators know they are setting the stage for a firm, they learn that they are responsible for governing an industry. Behavioral effects of knowing that one has this task might affect their choices, as well as the reactions of firms to such intervention.

The firm holds a monopoly. The regulator receives 50% of welfare as her incentive. In the instructions, we explain how welfare is calculated, and that consumer rent is factored in. We do so in the interest of making participants understand the nature of the normative conflict. Inverse demand is given by \(p = a - q\). Supply is characterized by \(p = q\). Consequently, welfare \(w\) is given by

where the first two terms define producer rent \(pr\), and the third term defines consumer rent \(cr\).

The intercept \(a\) of demand is randomly drawn from the uniformly distributed interval \(\left[ {1,201} \right]\).Footnote 3 The regulator moves first. She has power to impose any price cap she deems fit. The firm moves second. She chooses price \(p\), but may not exceed the price cap.

Note that we implement a market without fixed cost. In reality most regulated markets are characterized by high (if the market is a natural monopoly: prohibitively high) fixed cost that can moreover be sunk cost. High fixed cost shields incumbents from market entry, especially since incumbents have an incentive to bid aggressively to deter entry and to protect their upfront investment. In the interest of cleanly identifying the behavioral effect we are interested in, we abstract from this additional source of inefficiency and exclude market entry by design. This is analogous to a legally protected monopoly (which, in the past, was characteristic for many utilities). Consequently, additional welfare loss from “ruinous” competition and the duplication of investment is outside the scope of this paper.

We have a Baseline and two treatments. In the Baseline, the regulator knows \(a\). In the Upfront treatment, the regulator only knows the distribution. In the Signal treatment, she receives a signal that is correct with probability 50%. With a counterprobability of also 50%, the actual intercept of the demand function is (another) random draw from the distribution.

In our experiment, marginal cost increases in quantity (we set \(c = \frac{1}{2}q^{2} )\), which means that the firm makes a positive profit even if it sets the market clearing price \(p^{**} = \frac{1}{2}a\). The main reason for this specification of the supply function is experimental. Had we chosen constant marginal cost, or marginal cost decreasing in quantity, if regulators maximize welfare firms make zero profit. We would have had to compensate experimental firms by a substantial show-up fee. Profit would only have had a negligible impact on their payoff.Footnote 4 In the field, regulating firms in markets with increasing marginal cost is not infrequent either. The social benefit from regulation results from the difference between monopoly price and the welfare-maximizing price. A practical illustration is monopoly resulting from the fact that one firm has superior access to the scarce input that causes marginal cost to increase in quantity. This is characteristic for an “essential facility”, a frequent object of regulatory oversight.Footnote 5

In regulatory practice, the authority does not pocket in half the welfare. But the authority knows full well that it is in charge of balancing out consumer and producer interests. This is why we explicitly tie the authorities’ payoff to consumer and producer rent. We want to incentivize regulators so that their choices are credible. And we want to make sure that they earn approximately the same amount as firms to minimize fairness concerns. It is not far-fetched that actual regulators have an incentive to care about the performance of regulated industries. The more they visibly do a good job, the more they are likely to maintain, if not increase, their powers, and to be better equipped. This design feature has the additional advantage that we need not be concerned about collusion between the regulator and the firm. (In expectation) the regulator has nothing to gain from being overly generous with the firm. The design also excludes side-payments, so that there is no room for bribery.

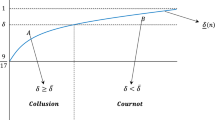

If unregulated, the firm sets monopoly price \(p^{*} = \frac{2}{3}a\).Footnote 6 In anticipation, the regulator imposes cap \(c^{b} = p^{**} = \frac{1}{2}a\). The regulator prevents the firm from exceeding the welfare-maximizing price. At the expected value of \(a\), i.e., at \(a = 101\), the regulator sets \(c = 50.5\). Since the monopoly price is strictly above this price, the regulatory constraint binds.

In the Upfront regime, the regulator only knows that \(a \in \left[ {1,201} \right]\), and that all realizations of the intercept of the demand function are equally likely. In the face of this uncertainty, welfare is given by (2).Footnote 7

The first term captures welfare if the cap is not binding and the firm sets the monopoly price. The second term captures welfare for all realizations of \(a\) for which the given cap \(c\) binds. Maximizing this objective function leads to an optimal cap of \(c^{u} = 80.4\). With this cap, expected welfare is at 3248.24, while it would be 3383.58 in the first-best. Society loses (some) welfare since it lacks a technology for completely hindering the firm from earning a monopoly rent. The welfare loss results from the institutional constraint imposed by price cap regulation. With regulation, however, the economy is still better off than with laissez-faire. When unregulated, the firm would always set the monopoly price, and the economy would expect to earn only 3007.63.

From (1), and solving for \(p\), we learn that producer rent turns negative whenever \(p < \frac{1}{3}a\). Producers would have to serve a demand that is too large to leave them a profit. Negative profits of regulated firms are unlikely, if not illegal, in regulatory practice, and impractical in the lab. We therefore cut profit at 0 by imposing \(p = \hbox{max} \left\{ {p_{regulated} ,\frac{1}{3}a} \right\}\). However, we do not have to adjust the regulator’s problem (2) to this fact.Footnote 8 As we have seen, if she maximizes her payoff, the regulator sets \(p = 80.40\). With this cap, the firm never makes a negative profit. Hence in equilibrium the regulated price is never so low that it is replaced by \(\frac{1}{3}a\).

In the Signal regime, the regulator receives a signal \(a_{s}\) that is correct with probability 50%. With counterprobability 50%, the true value of \(a\) is a random draw from the uniform distribution. The regulator maximizes expected welfare

which leads to

The chosen price cap depends on the signal \(a_{s}\). If the signal is at the expected value of \(a\), i.e., at 101, the regulator sets \(p^{rs} = 65.45\).Footnote 9

Provided regulators are risk-neutral and maximize rent, we thus predict price caps as in Table 1.

At the beginning of the experiment, we play this game one-shot. At the end of this period, participants receive feedback about choices, payoffs, welfare, and consumer rent. After a surprise restart, we repeat the experiment 10 announced times. In each period, ex post both the firm and the regulator are informed about the current realization of \(a\), and about payoffs. However in the Upfront and in the Signal treatments, the regulator may only once set a price cap, before the firm takes her first decision. At this point, in the Upfront treatment the regulator only knows the distribution of \(a\). In the Signal treatment, the regulator is informed that, initially, \(a = a_{s}\). The regulator further knows that in every period, with probability \(.1,\) there is a random shock, and \(a\) is replaced by a new draw from the distribution (which may, of course, also be \(a_{s}\)). It is common knowledge that, during these 10 periods, no more than one shock occurs. Provided both the firm and the regulator hold standard preferences and this is common knowledge, repetition does not change best responses and hence equilibria. However, comparing the one-shot experiment with the repeated experiment, we see whether having to decide for an extended duration has a separate effect.

After 10 periods, we have another surprise restart. We keep pairs fixed. Pairs that were in the Baseline are now either in the Upfront or in the Signal regime. Pairs that were in the Upfront or in the Signal regime are now in the Baseline. The intercept of the demand curve a is newly determined at random. It again changes once during the following 9 periods. After the regime change, money-maximizing regulators adjust to the new opportunity structure.

Demand is represented by the computer. This avoids the confound with the motivational effect of harming passive experimental participants.

We use three combined approaches to make sure that all participants understand the game. In the instructions, we explain the opportunity structure in words, equations, and graphs (see Appendix). In the control questions, we have participants calculate simple examples. They are only allowed to participate in the experiment after they have answered all questions correctly. In each period, each participant has access to a simulator.Footnote 10 Participants may try out as many combinations of parameters as they like. Participants heavily use the tool. In the first period, in the Baseline, firms on average use the tool 22.17 times, and regulators use it 13.96 times. In the Signal treatment, firms on average use the tool 17.42 times, and regulators 12.75 times. Finally, in the Upfront treatment, firms on average use it 20.42 times, and regulators 15.92 times. In the second period (and pooled over treatments), firms on average run 16.15 simulations, and regulators run 15.42 simulations. In period 12, i.e., after the second restart, these numbers are 10.69 and 9.02 simulation runs. The simulator calculates quantity, firm, and authority payoff and consumer rent for them.

3.2 Hypotheses

With common knowledge of rationality, we predict

H 1

Regulators and firms play best responses.

Despite all the safeguards for making sure participants understand the structure of the game, a first potential qualification is cognitive. Regulators and firms might nonetheless need experience to find their preferred choices. Moreover, the standard framework assumes that the firm maximizes profit under the constraint of the cap. In reality this need not be true either. Consequently, the regulator not only faces stochastic, but also strategic uncertainty. The regulator would benefit from gaining a sense of the firm’s behavioral traits, and adjusting its intervention. For these reasons, the Baseline may have the advantage of easing regulatory learning. A motivational effect points in the same direction. It may be couched in fairness terms: the more an agent is powerful, the more she may feel the urge to respect the legitimate interests of others under her spell. In all fairness, power comes with responsibility. It has been shown that this effect is quite pronounced (Engel and Zhurakhovska 2017). In the Upfront and Signal treatments, the regulator has the power to expose the firm to a risk of not making any profit that neither of them overlooks. This yields

H 2

In the Baseline, caps are closer to the prediction from standard theory than in the Signal and in the Upfront treatments.

The standard framework assumes all agents to be risk-neutral. In reality this need not be the case. Since in our design firms can directly adjust to any new development, risk preferences do not lead to the prediction of treatment differences for firms. Regulators might, however, dread two risks: By setting a cap that is too stringent, from an ex post perspective they may have reduced welfare, and hence their own payoff. Moreover, the cap may have cut into the firm’s profit (down to forcing the firm to make zero profit). The risk may materialize in the Signal treatment provided the signal is below \(a_{s} = 107.2\). This leads to

H 3

In the Signal treatment, caps are more lenient than predicted by standard theory.

In the standard framework, conditional on the realization of \(a\), the regulator can predict the firm’s choices with certainty. If the regulator sets a generous cap, or no cap at all, the regulator knows the firm will exploit the opportunity. Experimental work on the “hidden costs of control” suggests that this might not be true (Falk and Kosfeld 2006). If the regulator gives the firm more leeway than it must, the firm might feel obliged to reciprocate by not abusing this freedom. Hence regulators might succeed in transforming the interaction into a gift-exchange relationship. In the Baseline, the regulator has enough information to impose perfectly the solution that is best for her. In the remaining treatments, the regulator is unable to observe the current state of the world. If the regulator sets a generous cap, this may be an attempt at creating a trust relationship. Yet for the firm this signal is more difficult to interpret. A generous cap may also result from a lack of understanding, or from risk aversion. In anticipation, investment into a trust relationship is a less attractive strategy in the Signal and Upfront regimes. Moreover, if firms abuse the trust regulators put on them, in the Baseline regulators can strike back in the next period by reducing the cap, potentially even by imposing an overly severe cap as a punishment. None of this is possible in the remaining regimes. This leads to a competing hypothesis:

H 4

In the Baseline, the regulator is most likely to set an overly generous cap. In the Baseline, firms are most likely to react to a generous cap by setting a price below the monopoly price.

3.3 Post-experimental tests

The main experiment is followed by a standard trust game (Berg et al. 1995), with money sent by the trustor to the trustee tripled. Participants first play this game with authorities in the role of trustor, but participants newly matched to groups of two. At this point they do not know that another trust game is to follow with roles swapped, and again new partners. We rematch participants, since otherwise we would not measure their general propensity to trust, or to be trustworthy, but a lasting reaction to experiences made with a concrete interaction partner. We further administer the standard test for risk aversion by Holt and Laury (2002) and a questionnaire with demographic questions, the Big5 personality test (Rammstedt and John 2007) and a measure for justice sensitivity (Schmitt et al. 2005).

The experiment was conducted in the Bonn EconLab. It was fully computerized, using the software zTree (Fischbacher 2007). Participants were invited using software ORSEE (Greiner 2004). 96 students of various majors participated. In each sequence of treatments (Baseline-Signal, Baseline-Upfront, Signal-Baseline, Upfront-Baseline), we had 24 participants, i.e., 12 randomly composed groups of one firm and one regulator.Footnote 11 55 participants (57.29%) were female. The mean age was 24.40 years. The experiment lasted approximately 2 hours. Participants on average earned 22.27 € (28.66 $ on the days of the experiment), range [4.64, 45.68 €].

4 Results

We have designed the experiment such that we can first observe choices of inexperienced participants with no shadow of the future (subsection 4.1). In the second part, we study choices of experienced participants (subsection 4.2). In the third part, we investigate the effects of regime change (subsection 4.3).

4.1 One-shot interaction

Given that for each pair of participants another intercept of the demand function is randomly selected, the raw data would not be informative. In the left panel of Fig. 1, we normalize choices by this intercept, i.e., by variable \(a\).Footnote 12 Welfare is maximized at \(a = .5\) (the lower line). The monopoly price is \(a = .67\) (the upper line). As one sees, irrespectively of the treatment, on average caps are not binding; caps are even above the monopoly price. Specifically, the cap only binds in 20.83% of all cases in the Baseline, 41.67% in the Signal treatment, and 16.67% in the Upfront treatment. In the Baseline, actual prices are on average slightly above the welfare-maximizing level, but clearly below the monopoly price. In the Signal treatment, prices are on average fairly close to the monopoly price. In the Upfront treatment, prices are on average even above the monopoly price.

In the right panel of Fig. 1, we report how these choices translate into earnings and rents.Footnote 13 In this panel, we normalize by the rent in the case welfare is maximized. On average, producer rent differs very little across treatments, despite the fact that prices are on average fairly distinct. This follows from the fact that, in treatment Upfront, prices are quite frequently even above the monopoly price.

Using a non-parametric Mann–Whitney test, we find that (normalized) consumer rent is significantly lower if authorities do only know from which distribution demand is drawn (Baseline vs. Upfront, N = 36, p = .0136).Footnote 14 (Normalized) caps (p = .0357) and actual (normalized) prices are significantly higher (p = .0136).

This gives us

Result 1: Authorities set higher caps and firms set higher prices if the authorities only know the distribution of the demand function.

4.2 Experience

As Fig. 2 demonstrates, by and large the results from the one-shot game replicate in the repeated game (periods 2–11). Caps are on average still too high. However, in period 2, in the Baseline, the cap already binds in 50% of all cases. In period 11, this fraction is up to 66.67%. By contrast, in the Signal treatment, in period 2, the cap is only binding in 16.67% of all cases, and in period 11 this holds for 25%. In the Upfront treatment, this fraction is even as low as 8.33% in both periods. Nonetheless, even in the Baseline, the average cap is close to the monopoly price. Caps are now straightforwardly ordered. Caps are lowest in the Baseline, higher in the Signal treatment, and highest in the Upfront treatment. The less the authority knows, the more generous the cap. This is what our behavioral theory expected: authorities shy away from the risk that they set an overly stringent cap, and cause the firm not to make a profit. In the Signal and in the Upfront treatments, caps are on average even substantially above the monopoly price. On average, prices set by experienced firms do not exceed the monopoly price. Prices are the higher the higher the cap, despite the fact that the average cap is not binding in any treatment. On average, firms make an excessive profit in all treatments; yet, the effect is most pronounced in the Upfront treatment, where consumers suffer most. On average, they receive little more than 50% of the rent they would have had if the market clears. In this treatment, authorities visibly do a poor job.

Non-parametric tests over means per all 10 periods support the visual impression. (Normalized) caps are significantly higher in the Upfront treatment than in the Baseline (Mann–Whitney, N = 36, p = .0003).Footnote 15 The difference between the Signal treatment and the Baseline is weakly significant (p = .0513). (Normalized) prices are significantly higher in the Upfront treatment than in the Baseline (p = .0014). (Normalized) consumer rent is significantly lower in the Upfront treatment than in the Baseline (p = .0003). Normalized welfare in the Baseline is significantly higher than in the Signal treatment (p = .0292), and weakly significantly higher than in the Upfront treatment (p = .0810). The dark side of price cap regulation does thus not disappear with experience, or with a shadow of the future, which gives us

Result 2: The detrimental effect of forcing the authority to impose a price cap under imperfect knowledge about future development of the environment on caps, prices, consumer rent, and welfare does not disappear with experience.

As Table 2 shows, we do find a strong effect of limiting information to just the distribution on the authorities’ choices. In the Upfront treatment, authorities set caps that are considerably and significantly more generous than predicted by standard theory (which already predicts a substantially higher cap, Table 1). Also note the strong and (weakly: p = .053) significant constant. If caps were in line with standard theory, the constant should be zero. We thus observe two effects: in the Baseline and all treatments caps are higher than predicted by theory; in the Upfront treatment, this excess is especially strong.Footnote 16

We thus have support against H 1 and for H 2 : in the Upfront treatment, caps exceed the prediction from standard theory. We next investigate whether the forces we expected to drive this result are actually present.

Table 3 shows that risk aversion has very little explanatory power.

In the Baseline, we now have scope for exploring the competing hypothesis H 4 . In that hypothesis, we expected authorities to exploit the right to intervene in every period for establishing a trust relationship by setting a generous cap. Table 4 shows that actually the opposite is true.Footnote 17 Irrespective of the opportunity structure (i.e., when controlling for the intercept of demand, or parameter \(a\)), we do not find a negative, but a positive effect of the fact that the cap is above the monopoly price. If there is room for exploiting the opposite market side, firms seize that opportunity.Footnote 18

This leads to

Result 3: There is no trust relationship between the regulator and the firm.

4.3 Regime change

In the final 10 periods of the experiment, we test how authorities and firms react to an unexpected regime change – think of the legislator imposing a change in rules, for instance in reaction to experiences made in other jurisdictions.

As Fig. 3 shows, on average caps are still not binding, irrespectively of treatment. Descriptively caps are still somewhat higher if the authority is incompletely informed. Yet, after the regime change, firms no longer exploit the opportunity structure to their benefit. Descriptively, prices are even lowest when caps are most generous. This translates into consumer rent being highest when the authority is least informed. After the regime change, non-parametric tests over means do not show any significant differences between treatments, neither with respect to caps or prices, nor with respect to consumer rent.

How can we explain this surprising finding? Figure 4 gives a hint. Irrespectively of the sequence, (normalized) prices are fairly close after the regime change to where they were before the change.

The regression in Table 5 provides a statistical test.Footnote 19 Obviously this combination of parameters explains prices in the final phase of the experiment very well. All regressors are significant at the highest possible level.

Seemingly we have a puzzling finding. The main effect of the severity of the cap in the second part of the experiment is negative, not positive. It might seem as if, instead of a carry-over from the second part, we have firms distancing themselves from what they have experienced in the previous part of the experiment. Yet, the main effect of the cap in the previous 10 periods is reversed by the interaction effect as soon as the mean cap was above 43.Footnote 20 As Fig. 2 shows, this was frequently the case.Footnote 21

This gives us

Result 4: After a regime change, firms are positively guided by the severity of regulatory intervention before the regime change if the old environment was not particularly stringent.

5 Discussion

Public officials are less competent than managers to direct firms. They do not bear the pecuniary consequences of their decisions. And, most importantly, by limiting regulatory intervention to rare, legally defined moments, firms keep incentives for engaging in socially beneficial innovation. We do not deny any of these benefits, but point to a dark side of price cap regulation that has featured less prominently in the policy debate.

If regulators lack experience, caps are overly generous, even if regulators have been completely informed about the opportunity structure. If they only know from which distribution the determinants of the environment are drawn, caps are even more generous. In such a setting, prices are higher and consumer rent is lower. These detrimental effects do not disappear with experience. We find no signs of authorities establishing a trust relationship with firms. We do, however, see that the right to intervene at any point in time eases regulatory learning. Interestingly, after a change in the regulatory regime, we find a carry-over effect. Prices remain close to where they had been before the regime change. Generous price caps engender a serious welfare problem.

One may ask whether there are opposing forces which counterweigh the welfare-reducing behavior of regulators. Those forces might indeed exist. Beesley and Littlechild (1989) point to the fact that generous price caps might trigger market entry. This would, however, presuppose that there are no legal barriers to entry for newcomers (Shughart 2008).

In the interest of cleanly identifying the hypothesized behavioral effect, our design has abstracted from further contextual factors that may well matter in regulatory practice. We exclude negotiations between the firm and the regulator. Firms might use this opportunity to share their superior knowledge about market conditions with the regulator, which would alleviate the problem. But regulators might worry that the firms’ statements are strategically biased. If firms offer side-payments, one would even be in the realm of corruption. Our experiment excludes real losses (since they are not practical in the lab). In the field, they are of course possible, and would exacerbate the policy problem.

Yet, in the light of our evidence, the dark side of price cap regulation should not be taken lightly. Ironically, price cap regulation might be least effective when it seems most attractive: in a very dynamic environment. For often the dynamic character of an industry will not be confined to the socially desirable scope for innovation. If innovation goes along with a volatile environment (partly) beyond the control of regulated firms, given our findings regulators are likely to set caps that are too generous. As our model demonstrates, a detrimental effect is even to be expected if firms and regulators perfectly maximize profit. We find unequivocal support for this model prediction in our experimental data. If policymakers want to debate external validity, they should focus on the effects in excess of standard theory that we have found.

We deem it not unlikely that such effects are relevant in regulatory practice. This is, for instance, what the 1999 review of electricity regulation in the UK suggests. Overall the incentive regulation scheme was regarded to be quite successful. But between the Initial and the Final Regulation Proposals (Ofgem 1999, 2000a, b), the benchmarks that electric utilities had to achieve had to be relaxed (Pollitt 2005). These changes were explicitly motivated by a concern that an overly stringent efficiency benchmark might put companies at the risk of bankruptcy. This relaxation of the benchmark allowed firms to retain more revenue (Pollitt 2005), at the expense of consumers.

Finally, our experiment not only points to a concern with price cap regulation. It also serves as a case study for the relevance of behavioral effects in regulators, and bureaucrats more generally. Note that our experimental regulators did not reduce welfare because they were overly selfish, or because they pursued some policy goal that diverges from the policy elected government wanted to implement. Rather, they were overly anxious to use the powers bestowed upon them. We do not mean to generalize this specific effect. It may well be that, in other contexts, behavioral effects induce bureaucrats to become hyperactive, or unpredictable, or discriminating between addressees in normatively undesirable ways. Yet, our experiment shows the possibility that bureaucratic intervention is at odds with the legislator’s intentions just because bureaucrats exhibit systematic behavioral effects. There is reason to investigate the behavior of public officials, no less than the behavior of market participants or voters.

Notes

Economic Regulation of Privatised Water Authorities, 25 January 1986, reprinted in Oxford Review of Economic Policy 4 (1988) 43–67 (57).

Report (footnote 1), 57.

If we regress a on treatment interacted with the phase of the experiment, we do not find any significant effects. Randomization has thus worked as desired.

With constant marginal cost, all treatments would even have collapsed. If cost is common knowledge, p = c would always have maximized welfare, irrespective of a.

“Such a facility is equivalent to a so-called ‘natural monopoly,’ and to control the use of monopoly power by the owner of the facility, society is faced with the same unappetizing alternatives available in any public utility context: public ownership, regulation in the classic "rate-base/rate-of-return" mold, incentive regulation, and various in-between solutions familiar to policy makers and students of this problem.” See Lipsky and Sidak (1999).

With actual \(a > \frac{3}{2}c\) the firm cannot do better than setting \(p = c\).

The upper boundary of the first and the lower boundary of the second integral follow from the fact that the optimal cap is 1/2 of the actual intercept of the demand function \(a\). Yet, the authority takes into account that, with actual \(a > \frac{3}{2}c,\) the firm cannot do better than setting \(p = c\).

In the instructions, we explain that the regulator’s payoff is based on welfare in case the firm had set the price as high that it would make a negative profit.

Note that, depending on the signal, payoff-maximizing regulators may set price caps that, depending on the later realization of \(a\), would lead to a negative profit for firms. We do not adjust the regulator’s payoff function to this fact for two reasons. The first reason is experimental. We would otherwise have two changes between the Upfront and the Signal treatment, one concerning the information environment, the other concerning the payoff function for the regulator. Moreover, plausible adjustments of the regulator’s payoff function have undesirable properties. If we were to remunerate the regulator based on total welfare, i.e., on consumer rent only if producers make 0 profit, she would be indifferent between all possible caps. If we were to set her payoff to 0 in case the firm makes 0 profit, we would have a corner solution. Regulators would want to avoid this event at all cost by choosing \(p = 201\), i.e., by setting a non-binding price cap.

Since we vary parameter \(a\) in the interval [1,201], payoff tables would not have been practical.

12 independent observations per treatment condition are at the higher end of what is standard in the literature on experimental oligopoly. The 753 treatments covered by the meta-study of Engel (2015) had on average 6.18 independent observations; only 14.07% had 12 or more independent observations.

For this reason, differences in \(a\) are neutralized anyway. To be on the safe side, however, we also tested for treatment differences on a, but did not find any.

Readers might be surprised that, in the Baseline, actual average consumer rent is precisely 1, and higher than the regulator’s rent (although the regulator’s rent is a fraction of welfare). The reason is that some firms stay below the market clearing price (and therefore leave consumers a normalized rent above 1). With experience, this effect disappears; see next section.

All statistical tests are two-sided.

To be on the safe side, we again have checked for treatment differences in \(a\), but do not find any.

We replicate the result from Table 2 for every single period of phase 2 if we do not study means over periods 2–11, but compare the choices in the Signal and Upfront treatment from period 2 with the choices authorities make in any individual period of phase 2. Note that, either way, we use a single data point per regulator/market. Therefore we do not have to correct standard errors for the fact that the choices of individual participants are correlated over time.

In this specification, we use 10 data points per regulator. The individual random effect takes care of the dependence within individuals.

Since we already learn from the choice data that there is no trust relationship, we do not use the data from the post-experimental trust games for explanation.

We do not use p/a in the second phase of the experiment to guard against the statistical problems inherent in dynamic panels. As is well known, they are inconsistent, which would force us to use instrumentation, along the lines of Arellano/Bond. Results look very similar if we add controls for treatments. These control variables turn out insignificant.

.385/.009 = 42.78.

Recall that caps in Fig. 2 are normalized by the randomly selected a, and that a is taken from the interval [1,201].

References

Agoglia, C. P., Doupnik, T. S., & Tsakumis, G. T. (2011). Principles-based versus rules-based accounting standards. The influence of standard precision and audit committee strength on financial reporting decisions. Accounting Review, 86(3), 747–767.

Appelbaum, E., & Katz, E. (1987). Seeking rents by setting rents. The political economy of rent seeking. Economic Journal, 97, 685–699.

Bawa, V. S., & Sibley, D. S. (1980). Dynamic behavior of a firm subject to stochastic regulatory review. International Economic Review, 21(3), 627–642.

Beesley, M., & Littlechild, S. (1983). Privatization: Principles, problems and priorities. Lloyds Bank Review, 149(7), 1–20.

Beesley, M., & Littlechild, S. (1989). The regulation of privatized monopolies in the United Kingdom. Rand Journal of Economics, 20, 454–471.

Berg, J., Dickhaut, J., & McCabe, K. (1995). Trust, reciprocity, and social history. Games and Economic Behavior., 10, 122–142.

Brandts, J., Pezanis-Christou, P., & Schram, A. (2008). Competition with forward contracts. A laboratory analysis motivated by electricity market design. Economic Journal., 118(525), 192–214.

Cox, J. C., Isacc, R. M., Cech, P.-A., & Conn, D. (1996). Moral hazard and adverse selection in procurement contracting. Games and Economic Behavior, 17(2), 147–176.

Crew, M. A., & Kleindorfer, P. R. (1986). The economics of public utility regulation. Cambridge, MA: MIT Press.

Dal Bó, E. (2006). Regulatory capture: A review. Oxford Review of Economic Policy, 22, 203–225.

Druckman, J. N., Green, D. P., Kuklinski, J. H., & Lupia, A. (2011). Cambridge handbook of experimental political science. Cambridge: Cambridge University Press.

Eckel, C., & Lutz, N. (2003). What role can experiments play in research on regulation? Journal of Regulatory Economics, 23(2), 103–107.

Engel, C. (2010). The behaviour of corporate actors. A survey of the empirical literature. Journal of Institutional Economics., 6, 445–475.

Engel, C. (2015). Tacit collusion. The neglected experimental evidence. Journal of Empirical Legal Studies., 12, 537–577.

Engel, C., & Zhurakhovska, L. (2017). You are in charge. Experimentally testing the motivating power of holding a judicial office. Journal of Legal Studies., 46, 1–50.

Falk, A., & Kosfeld, M. (2006). The hidden costs of control. American Economic Review, 96, 1611–1630.

Feldman, Y., & Harel, A. (2008). Social norms, self-interest and ambiguity of legal norms. An experimental analysis of the rule vs. standard dilemma. Review of Law and Economics, 4(1), 81–126.

Fischbacher, U. (2007). z-Tree. Zurich toolbox for ready-made economic experiments. Experimental Economics., 10, 171–178.

Greiner, B. (2004). An online recruiting system for economic experiments. In K. Kremer, & V. Macho (Eds.), Forschung und wissenschaftliches Rechnen 2003. (pp. 79–93). GWDG: Göttingen.

Healy, P. J., Ledyard, J. O., Noussair, C., Thronson, H., Ulrich, P., & Varsi, G. (2007). Contracting inside an organization. An experimental study. Experimental Economics, 10(2), 143–167.

Henze, B., Noussair, C., & Willems, B. (2012). Regulation of network infrastructure investments. An experimental evaluation. Journal of Regulatory Economics, 42(1), 1–38.

Holcombe, R. G., & Holcombe, L. P. (1986). The market for regulation. Journal of Institutional and Theoretical Economics, 142, 684–696.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92, 1644–1655.

Jordan, W. A. (1972). Producer protection, prior market structure and the effects of government regulation. Journal of Law and Economics, 15(1), 151–176.

Kench, B. T. (2004). Let’s get physical! Or financial? A study of electricity transmission rights. Journal of Regulatory Economics, 25(2), 187–214.

Kiesling, L. (2005). Using economic experiments to test electricity policy. Electricity Journal., 18(9), 43–50.

Klevorick, A. K. (1971). The “optimal” fair rate of return. Bell Journal of Economics and Management Science., 2, 122–153.

Kohli, I., & Singh, N. (1999). Rent seeking and rent setting with asymmetric effectiveness of lobbying. Public Choice, 99(3), 275–298.

Laffont, J.-J., & Tirole, J. (1993). A theory of incentives in procurement and regulation. Cambridge, MA: MIT Press.

Lipsky, A. B., & Sidak, J. G. (1999). Essential facilities. Stanford Law Review., 51, 1187–1248.

McCormick, R., & Tollison, R. D. (2012). Politicians, legislation, and the economy. An inquiry into the interest-group theory of government. Berlin: Springer Science & Business Media.

Milgrom, P. R., & Roberts, J. (1992). Economics, organization and management. Englewood Cliffs, NJ: Prentice-Hall.

Niskanen, W. A. (1971). Bureaucracy and representative government. Routledge: Transaction Publishers.

Normann, H. T., & Ricciuti, R. (2009). Laboratory experiments for economic policy making. Journal of Economic Surveys., 23(3), 407–432.

Ofgem. (1999). Reviews of public electricity suppliers 1998–2000: Distribution price control review final proposals. https://www.ofgem.gov.uk/ofgem-publications/78992/review-oes-1998-2000-dpcrpdf.

Ofgem. (2000a). The transmission price control review of the national grid company from 2001. Draft proposals. https://www.ofgem.gov.uk/ofgem-publications/79319/transmission-price-control-review-national-grid-company-2001-initial-thoughts-consultation-document-3103.pdf.

Ofgem. (2000b). The transmission price control review of the national grid company from 2001. Transmission asset owner. Final proposals. https://www.ofgem.gov.uk/ofgem-publications/79312/transmission-price-control-review-ngc-2001-transmission-owner-final-proposals-2709-pdf.

Peltzman, S. (1976). Toward a more general theory of regulation. Journal of Law and Economics, 19(2), 211–240.

Pollitt, M. (2005). The role of efficiency estimates in regulatory price reviews. Ofgem’s approach to benchmarking electricity networks. Utilities Policy, 13(4), 279–288.

Posner, R. A. (1975). The social costs of monopoly and regulation. Journal of Political Economy, 83(4), 807–827.

Rammstedt, B., & John, O. P. (2007). Measuring personality in one minute or less. A 10-item short version of the big five inventory in English and German. Journal of Research in Personality, 41, 203–212.

Rassenti, S. J., Smith, V. L., & Wilson, B. J. (2003). Controlling market power and price spikes in electricity networks. Demand-side bidding. Proceedings of the National Academy of Sciences, 100(5), 2998–3003.

Sappington, D. E. M., & Sibley, D. S. (1988). Regulating without cost information. The incremental surplus subsidy scheme. International Economic Review., 29, 297–306.

Sappington, D. E., & Weisman, D. L. (2010). Price cap regulation. What have we learned from 25 years of experience in the telecommunications industry? Journal of Regulatory Economics, 38(3), 227–257.

Sappington, D. E., Pfeifenberger, J. P., Hanser, P., & Basheda, G. N. (2001). The state of performance-based regulation in the US electric utility industry. Electricity Journal., 14(8), 71–79.

Schmitt, M., Gollwitzer, M., Maes, J., & Arbach, D. (2005). Justice sensitivity: Assessment and location in the personality space. European Journal of Psychological Assessment., 21(3), 202–211.

Shughart, W. F. I. (2008). Regulation and antitrust. In C. K. Rowley & F. Schneider (Eds.), Readings in public choice and constitutional political economy (pp. 447–480). Berlin: Springer.

Shughart, W. F., & Thomas, D. W. (2015). Regulatory rent seeking. In R. D. Congleton & A. L. Hillman (Eds.), Companion to the political economy of rent seeking (pp. 167–186). Cheltenham: Edward Elgar Publishing Ltd.

Shughart, W. F. I., & Thomas, D. W. (2017). Interest groups and regulatory capture. In R. Congleton, B. Grofman, & S. Voigt (Eds.), Oxford handbook of public choice. Oxford: Oxford University Press.

Sibley, D. S., & Bailey, E. E. (1978). Regulatory commission behavior. Myopic versus forward looking. Economic Inquiry, 16(2), 249–256.

Staropoli, C., & Jullien, C. (2006). Using laboratory experiments to design efficient market institutions. The case of wholesale electricity markets. Annals of Public and Cooperative Economics, 77(4), 555–577.

Stigler, G. J. (1971). The theory of economic regulation. Bell Journal of Economics and Management Science., 2, 3–21.

Stigler, G. J., & Friedland, C. (1962). What can regulators regulate? The case of electricity. Journal of Law and Economics, 5, 1–16.

Tullock, G. (1965). The politics of bureaucracy. Washington: Public Affairs Press.

Vogelsang, I. (2002). Incentive regulation and competition in public utility markets. A 20-year perspective. Journal of Regulatory Economics, 22(1), 5–27.

von Hayek, F.-A. (1945). The use of knowledge in society. American Economic Review, 35, 519–530.

Vossler, C. A., Mount, T. D., Thomas, R. J., & Zimmerman, R. D. (2009). An experimental investigation of soft price caps in uniform price auction markets for wholesale electricity. Journal of Regulatory Economics, 36(1), 44–59.

Wright, E. W., Ellinghaus, M. P., Close, N. M., & Heathcote, A. (2011). The effect of rule determinacy on deciding contract disputes. Experimental Data and Network Simulation.

Yandle, B. (1983). Bootleggers and baptists. The education of a regulatory economists. Regulation, 7, 12–16.

Zenger, T. R., Felin, T., & Bigelow, L. (2011). Theories of the firm–market boundary. Academy of Management Annals, 5(1), 89–133.

Acknowledgements

Open access funding provided by Max Planck Society. Helpful comments by Carmine Guerriero and Andreas Nicklisch, as well as audiences at the symposium in the honor of Werner Güth, the Amsterdam Law and Economics Center, the Hamburg Law and Economics School, the International Society of the New Institutional Economics Conference, the Cologne Social Science Area Conference, and the Max Planck Institute for Research on Collective Goods are gratefully acknowledged. Funding by the Max Planck Society (through the regular budget of the Bonn Max Planck Institute) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix: Instructions

Appendix: Instructions

1.1 Introduction

Welcome to the experiment! In this experiment, you can earn money. How much you earn depends on your decisions and the decisions of a second participant.

We would ask you please to switch off your cell phone and no longer to communicate with the other participants from now on. If you have a question about the experiment, please raise your hand. We will then come to you and answer your question.

This experiment consists of seven parts. The instructions for the first part can be found below. The instructions for the subsequent parts will be distributed after completion of the respective previous parts. You will see the instructions for the last two parts on your screen. As we will explain to you at a later stage, participants can play different roles in the course of the experiment.

In this experiment, the currency ECU (Experimental Currency Unit) is used. All amounts in ECU are always rounded to whole numbers. At the end of the experiment, the sum of all amounts in ECU is converted into Euro. In the first five parts of the experiment, the conversion rate is:

The converted rate, plus a show-up fee of 4 €, will be paid to you in cash at the end of the experiment.

All decisions in this experiment, as well as the amount of the payoffs at the end, are anonymous. Please do not discuss them with any of the other participants at the end of the experiment.

1.2 First part

In this part of the experiment, you are randomly matched with one other participant. One participant is given the role of a firm, and the other is given the role of a regulatory body. You act together once.

The firm has no competition. It offers one single product. The following graph illustrates the demand and the supply. Production of the first unit costs 1/2 ECU. It costs 1 ECU more to produce a further unit. Each further unit costs 1 ECU additionally. The development of the costs is shown in red in the graph. The firm determines a price \(P\). If it determines a price that is higher than \(A\), it sells 0 units. The higher the price is, the less demand there is. This correlation is shown by the green line and can also be expressed by the following equation:

or, inversely:

The firm can only sell all available units at the same price. For each unit sold, the firm’s profit consists of the difference between the price and the cost.

The regulatory body can determine a maximum price. The firm is told this maximum price. Higher prices are not accepted by the computer.

1.2.1 Additionally in Upfront treatment

The price at which the amount sold is 0, i.e., the parameter \(A\), is uncertain. \(A\) is at least 1 and 201 at the very most. At the beginning of this part of the experiment, the computer randomly draws \(A\). All values of \(A\) are equally likely. The regulatory body has to make a decision on the upper limit without knowing the concrete value of \(A\).

1.2.2 Additionally in Signal treatment

The price at which the amount sold is 0, i.e., the parameter \(A\), is uncertain. \(A\) is at least 1 and 201 at the very most. At the beginning of this part of the experiment, the computer randomly draws \(A\). All values of \(A\) are equally likely. The regulatory body only receives a signal. With a likelihood of 50%, it is the true value of \(A\).

1.2.3 For all treatments

When determining the price, the firm knows the true value of \(A\).

If the chosen or determined price leads to the firm making a book loss, the chosen or determined price is replaced by the price at which the firm’s profit is 0. Losses are therefore impossible.

The payoff by the regulatory body depends on how high the welfare is. In which way, shall be explained in a moment. In the following graph, you can see an example. Let us assume that the firm has determined price \(P\). From the way demand progresses, we see that amount \(Q\) is sold. Welfare results from the green triangle (this part of the welfare goes to the consumers) and from the red area (this part of the welfare goes to the firm).

You do not have to perform any calculations in this experiment. Before you decide, you may enter any values \(P\) and \(A\) at the computer at your leisure. The computer will then calculate \(Q\), the welfare share that goes to the firm, the welfare share that goes to the consumer, and the proceeds of the regulatory body. You may use as many different combinations of both parameters as you wish before deciding.

The payoff of the regulatory body is calculated according to the following formula:

Should the chosen or determined price be so low that the firm would make a negative profit, the payoff of the regulatory body is calculated on the basis of the chosen or determined price, rather than on the actual price. Once this part of the experiment has ended, the computer will inform you about the price, the amount, the two welfare components, and the payoff both for you and the second player.

1.3 Second part

The second part of the experiment differs from the first in only very few ways. You continue to play with the same participant. Your roles remain unchanged. The second part consists of 10 rounds. Each round is payoff-relevant. The firm can still determine a price in each round. The regulatory body can still determine an upper limit. The payoffs of the firm are calculated in the same way. At the beginning, the computer randomly chooses a value between 1 and 201 as the parameter \(A\). Once in the course of the ten rounds the computer chooses a new parameter \(A\) in the same way. This is equally likely to happen in any round.

1.3.1 Baseline

The regulatory body can change the upper limit for the price in each round, after it has been informed of the current level of \(A\).

1.3.2 Upfront treatment

The regulatory body can determine an upper limit only once. It is valid for all 10 rounds. When making its decision, the regulatory body knows only the distribution of \(A\).

1.3.3 Signal treatment

The regulatory body can determine the upper limit only once. It is valid for all 10 rounds. When making its decision, the regulatory body knows the value of \(A\) in the first period. Once, in the course of the following periods, the computer randomly draws a new value of \(A\). This occurs with the same likelihood in each period.

1.3.4 Same for all treatments

The payoff of the regulatory body is calculated according to the following formula:

Should the chosen or determined price be so low that the firm would make a negative profit, the payoff of the regulatory body is calculated on the basis of the chosen or determined price, rather than on the actual price.

In this part of the experiment, you may also enter any values \(P\) and \(A\) in each period before you decide. The computer will then calculate \(Q\), the two welfare components, and the proceeds both for you and the second player. You are given this information after every period, including information on the \(A\) and \(P\) actually chosen by the firm.

1.4 Third Part

The third part of the experiment is exactly the same as the second. You continue to play with the same participant. Your roles remain unchanged. The firm can still determine a price in each round. The regulatory body can still determine a maximum price. The payoffs of the firm and the regulatory body are calculated in the same way. Each round is payoff-relevant. Once again, the computer randomly chooses a value between 1 and 201 as the parameter \(A\). Once in the course of the ten periods, the computer chooses a new parameter \(A\) in the same way.

1.4.1 Baseline

In this part of the experiment, however, the regulatory body can determine the upper limit only once. At this point in time, it has no information on the actually drawn value of \(A\).

1.4.2 Signal and Upfront treatments

In this part of the experiment, however, the regulatory body can change the upper limit in every round, after it has been informed of the current value of \(A\).

1.4.3 Same for all treatments

In this part of the experiment, you may also enter any and as many values \(P\) and \(A\) as you wish in each period prior to deciding. The computer will then calculate \(Q\), the two welfare components, and the proceeds both for you and the second player. You are given this information after every period, including information on the \(A\) and \(P\) actually chosen by the firm.

1.5 Fourth Part

In this part of the experiment, the computer randomly matches you with another test person. This person is not the person with whom you played in the first three parts of the experiment.

If, in the first three parts of the experiment, you had the role of the regulatory body, in this part of the experiment you will receive an endowment of 500 ECU. You have the possibility to send any sum between 0 and 500 ECU to a second person who had the role of the firm in the first part of the experiments. The computer will multiply this figure by three. So if, for instance, you sent 20 ECU, the other participant receives 60 ECU. If you sent 100 ECU, the other participant receives 300 ECU. The participant who had the role of the firm in the first three parts of the experiment can retain the sum received or return part of it, or indeed the entire sum, to you.

We will inform you about the result of this part of the experiment at the end of the entire experiment.

1.6 Fifth Part

This part of the experiment is exactly the same as the fourth part. However, if you made the first decision in the fourth part, you will now make the second decision. If you made the second decision, you will now make the first decision. The computer will randomly match you with another test person for this part of the experiment. This person is not the person with whom you played in earlier parts of the experiment. We will inform you about the result of this part of the experiment at the end of the entire experiment.

[The sixth and seventh parts are questionnaires. The wording is available from the authors upon request.]

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Engel, C., Heine, K. The dark side of price cap regulation: a laboratory experiment. Public Choice 173, 217–240 (2017). https://doi.org/10.1007/s11127-017-0473-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-017-0473-5