Abstract

A substantial part of production and trade now takes place through global value chains (GVC), making it an essential conduit of knowledge spillover and technology transfer. Yet, extant studies examining how countries become productively efficient and catch-up to the global efficiency frontier through international trade have ignored the possible role of GVC in fast-tracking this process. This paper provides the first empirical evidence that fills this knowledge gap. We propose a two-stage empirical strategy to this end. First, we use a data envelopment analysis (DEA) approach to compute a measure of productive efficiency—defined herewith as a country’s relative productive efficiency to the global productive efficiency frontier. Second, we use the productive efficiency index as an outcome variable in a reduced-form equation that controls for GVC participation and its interaction with country characteristics that influence the gains from GVC participation. In addition to using the panel fixed effect method, we estimate the reduced-form equation with the difference-GMM to address endogeneity issues, and the Tobit and Fractional Response models to address the bounded nature of the productive efficiency index. We find strong evidence suggesting that GVC participation enables technology-lagging countries to become more productively efficient as well as catch-up to the global efficiency frontier. We also find that the productive efficiency and catch-up gains from GVC participation accrue more strongly to countries that have a high human capital stock, a well-functioning financial market, maintain stable macroeconomic conditions, and specialize in downstream activities in the value chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

One of the most prominent aspects of the current wave of globalization is the fragmentation of production stages into different tasks that are performed sequentially across multiple national borders. This phenomenon, which is now popularly known as the global value chain (GVC), has offered numerous benefits to both developed and developing countries. Extant studies indicate that through GVC participation, countries—or more specifically, firms—are provided with essential opportunities to specialize in core tasks that contribute positively to productivity growth (see Amador and Cabral 2015).Footnote 1 GVC participation also provides countries with opportunities to acquire productive and technological capabilities (Hausman 2014; Pahl and Timmer 2020; Ndubuisi and Owusu 2021; Owusu 2021). Other things equal, these opportunities should trickle down into better productive efficiency and, in turn, contribute to the convergence of countries towards the global productive efficiency frontier. This argument is consistent with erstwhile studies suggesting that productive and technological capabilities are an important determinant of productive efficiency and global productivity convergence (Benhabib and Spiegel 1994; Tzeremes 2014; Danquah and Ouattara 2015; Danquah 2018; Das and Drine 2020; Ndubuisi et al. 2022).

GVC can, therefore, be considered a strong predictor of productive efficiency and convergence. For instance, both knowledge spillovers and outright technology transfer through GVC favor a parsimonious accumulation of productive and technological capabilities that engender a more efficient technique of production across borders. A similar benefit emanates from both the disciplinary competition effects and the specialization in core competencies associated with GVC. Baldwin (2016) hints at this in his book, noting that the unbundling of GVC has led to the “great convergence”. He alludes further that GVC has led a selected number of emerging economies to industrialize and enlarge the scale of manufacturing activities to kickstart their convergence journey, sometimes converging to the income levels of advanced economies. A similar view underscores the recent endorsement of GVC by development agencies and international organizations as an easier route to unlock the long-awaited economic transformation of developing countries (e.g., UNIDO 2018; World Bank 2020; Abreha et al. 2021). Despite these, the GVC literature is yet to empirically examine the productive efficiency and convergence effects of GVC.

At best, existing studies have predominantly focused on GVC’s effect on income per capita or productivity growth (Criscuolo and Timmis 2017; Constantinescu et al. 2019; Ignatenko et al. 2019; Pahl and Timmer 2020; Owusu 2021; Jangam and Rath 2021). Furthermore, these studies have to a greater extent proceeded with an implicit assumption that the income per capita or productivity gains from GVC are automatic. This is evident by their predominant neglect of country idiosyncrasies that act as enablers or inhibitors of productivity gains from GVC. However, a long-standing view in the literature is that gains from GVC are not automatic and depend on a host of other factors such as firm, industry, and country characteristics (Morrison et al. 2008; Sampath and Vallejo 2018; Amendolagine et al. 2019; Mazzi et al. 2020; Ndubusi and Owusu 2021). Admittedly, two important exceptions to the literature on the productivity growth effects of GVC are Pahl and Timmer (2020) and Owusu (2021). In addition to examining the linear relation between GVC and productivity growth, these papers examine how this relationship is influenced by a country’s natural resource endowment.

Against this backdrop, the objective of this paper is twofold. First, we deviate from the predominant focus on income per capita or productivity growth and examine the effect of GVC participation on productive efficiency—defined herewith as a country’s relative productive efficiency to the global productive efficiency frontier. Hence, our study does not just capture how GVC participation enables a country to become productively efficient, but how it expedites the country’s catch-up process to the global efficiency frontier. The importance of operating at the global efficiency frontier cannot be overemphasized. Among others, countries that are able to operate at the global efficiency frontier compete effectively in the global market, increase their market reach by targeting high-growth markets, increase the complexity of their export bucket, and increase the incomes and welfare of citizens (Yang et al. 2021). Hence, understanding the factors that drive productive efficiency as per bridging a country’s productive efficiency gap to that of the global frontier is of utmost policy importance. In the second objective of this paper, and inspired by the view that the gains from GVC are not automatic, we investigate how a country’s macroeconomic conditions shape the nature of the relationship between GVC and productive efficiency. For this we focus on the role of human capital, macroeconomic distortions, financial development, and the country’s position in value chains—a contribution as far more expansive than Pahl and Timmer (2020) and Owusu (2021).

To address our research objectives, we use country-level data across 126 developed and developing countries for the period 2000–2016. Countries can participate in GVC through backward and/or forward linkages. Hence, we follow recent developments in the GVC literature that measures the extent of GVC participation as the sum of the share of foreign value-added used in a country’s exports (we call this backward GVC participation) and the share of a country’s domestic value‐added that enters as an intermediate input in the value‐added exported by other countries (we call this forward GVC participation) (see Amendolagine et al. 2019; Carril‐Caccia and Pavlova 2020; Ndubuisi and Owusu 2021). Our empirical approach is a two-stage strategy. In the first stage, we use a data envelopment analysis (DEA) approach to compute a measure of productive efficiency. The DEA method is a non-parametric linear programming method that has become a workhorse tool to examine differences in productive performance and efficiency. In this regard, one of its goals is to distinguish countries that are on the global production frontier from lagging countries (Enflo and Hjertstrand 2009). Originally used for efficiency analysis at the micro-level, DEA has gained prominence as a non-parametric approach to studying productive performance and convergence at the meso and macro-level.

As a non-parametric method, DEA provides several advantages over alternative approaches to studying productive performance and convergence. For instance, unlike the growth accounting and the stochastic frontier analysis (SFA) approach, it neither requires any functional form specification nor assumption about market structure and optimization behavior (Margaritis et al. 2007; Enflo and Hjertstrand 2009). The DEA method also has the advantage that it endogenously computes a virtual frontier. It uses this to derive country-specific indicators, thus capturing the distance of each country to the virtual frontier that can then be used in a reduced-form equation. This negates making any assumption that leads to defining a country (or countries) as operative at the frontier. It also leads to an index that can be used in a reduced-form equation, providing a more flexible framework to track country characteristics that may influence the effect of the explanatory variable of interest (in our case, GVC participation) on the outcome variable. Knitted closely to this advantage, the second stage of our empirical approach involves regressing the productive efficiency index (obtained from the DEA analysis) on indicators of GVC and a host of other country characteristics. In line with our second research objective, we also regress the productive efficiency index on sets of interaction variables comprising GVC participation and the country characteristics of interests as aforementioned.

To preview our results, we find that GVC participation has an unambiguously positive effect on productive efficiency—that is, it enables countries to catch-up to the global productive efficiency frontier. We also find that the productive efficiency gains from GVC participation work through backward and forward linkages in GVC. Our analysis of the intermediatory roles of country characteristics reveals that the productive efficiency gains from GVC participation are higher for countries that invest more in human capital have a stable macroeconomic environment and a well-developed and well-functioning financial market. When we consider the role of position along the value chains, we find that both participation and position in GVC matter decisively for improving productive efficiency. However, the productive efficiency gains from GVC participation are higher for countries with downstream specialization—i.e., countries that are closer to the final demand stage. Finally, further analysis of two subsamples comprising developed and developing countries reveals that the productive efficiency gains from GVC are stronger for developing countries. Overall, our results underscore the importance of GVC as a veritable channel of catching-up to the global productive efficiency frontier, especially for technology-lagging countries and countries that invest effectively in human capital stock, maintain stable macroeconomic conditions, have a well-developed financial market, and can specialize in higher value-added downstream activities of the value chains.

The rest of the paper is organized as follows: Section “Literature review” reviews the related literature, further providing theoretical insights underlining the relationships of our study. The research design, including the description of data sources, computation of variables, and descriptive statistics, is presented in Section “Research design“. Section “Results and discussion” presents and discusses the results. Section “Conclusion” concludes.

2 Literature review

2.1 GVC and productive efficiency

Productive efficiency, otherwise known as technical efficiency, is an important determinant of economic growth and development. Descriptively, productive efficiency is the effectiveness with which a given set of inputs are used to produce an output relative to the maximum attainable output that can be produced given the same inputs. In a global setting, a productively efficient country will be operating at the global best-practice frontier. Such a country also stands to experience enormous output and productivity growth, and ultimately, economic development. These benefits associated with productive efficiency have led to an expansive literature on its drivers. A strand of this literature focuses on the productive efficiency gains of international trade (Wang and Wong 2012; Danquah and Ouattara 2015; Kounetas and Napolitano 2018; Danquah 2018; Das and Drine 2020).Footnote 2 In general, evidence from the above literature shows an unambiguously positive relationship between cross-border trade and productive efficiency.

Although these extant studies provide important insights into the nexus between cross-border trade and productive efficiency, they use a limited sample and are focused on traditional gross trade flow. Falling tariffs and advances in transportation and communication technologies have led to the unbundling of production stages. Hence, tasks that were previously performed within a country or the same facility are now performed sequentially at different locations across national borders (Baldwin 2012). According to the recent World Bank Development Report, GVC accounts for almost 50% of global trade today (World Bank 2020). Hence, the country-centric view of production requiring a full range of domestic industries to assemble a final good has simply become outdated and by extension, data on traditional gross trade flows provide misleading figures of the current trade exchanges. This has stimulated researchers to develop alternative statistics based on the value added in trade, which captures the global fragmentation of production.

Our study contributes to the literature by being the first to examine the relationship between GVC trade and productive efficiency by using a productive efficiency measure that is computed with a (global) sample comprising almost all the countries in the world.Footnote 3 Conceptually, we argue that GVC participation, both through backward and forward linkages, would lead to improvement in productive efficiency arising through multiple channels. For instance, the emergence of GVC has enabled a new global production system where countries specialize in those tasks they have core competence and competitive advantage. Other things equal, this leads to more efficient usage of limited production resources and contributes positively to productive efficiency. Through GVC, countries now engage in the global market and are exposed to global best practices. Akin to this, GVC integration enables these countries to acquire knowledge and technology either through technology transfer from global lead firms or by learning from and interacting with other value chain actors in an integrated production process to boost productive efficiency. The pro-competitive effect of GVC also forces domestic firms to become more efficient while driving out the least efficient ones, thus contributing positively to productive efficiency at the country level.

2.2 GVC and productive efficiency: the role of country characteristics

Although our discussion in the preceding subsection suggests an unambiguously positive relationship between GVC participation and productive efficiency, one of the long-standing views in the literature is that the gains from GVC are not automatic with extant studies suggesting that reaping the gains from GVC depends on a host of other factors. For instance, Amendolagine et al. (2019) show empirically that while participation and upstream specialization in GVC is associated with a higher share of inputs sourced locally by foreign investors, this effect is larger in countries with stronger rule of law and better education. Ndubuisi and Owusu (2022) show that the wage effect of participation and upstream specialization in GVC depend on labor market regulation and the type of activities performed in GVC. Against this backdrop, another contribution of our study is to investigate how the productive efficiency gains through GVC participation are influenced by other country characteristics vis-à-vis human capital, macroeconomic distortion, and financial development.

Beginning with human capital, differences in the skilled endowment of labor across countries are a strong predictor of how countries participate and specialize in GVC. For instance, low-skilled labor in lower-income countries is largely responsible for specialization in downstream assembly-type activities in the value chain (Fernandes et al. 2022). It also explains why these countries’ upstream specialization pattern is characterized by the supply of raw materials with little or no value-addition (Ndubuisi and Owusu 2022). However, low-skilled labor endowment constrains participation in knowledge-intensive and complex tasks in GVC, which are more economically rewarding and offer the potential for social and economic upgrading. Furthermore, GVC has been underscored as a revolutionary conduit of knowledge and technology transfer and the accumulation of productive capabilities (Hausmann 2014; Ndubuisi and Owusu 2021; Pahl and Timmer 2020). Hausmann (2014) argues that GVC participation enables a parsimonious accumulation of productive capabilities. Such knowledge and technology assimilation as well as accumulation of productive capacities in GVC requires a considerable level of human capital endowment and by extension, unlocks productive efficiency gains through GVC participation. The latter argument is consistent with the view that human capital is an important factor that determines the capacity to absorb and implement new technology (Borensztein et al. 1998; Ali et al. 2016), as well as help achieve productive efficiency and convergence (Benhabib and Spiegel 1994; Nelson and Phelps 1966; Tzeremes 2014; Danquah and Ouattara 2015). Taken together, countries lacking in human capital may be locked in low value-added tasks that offer fewer opportunities for productive efficiency gains. There is also a lesser opportunity for those countries to appropriate knowledge spillover from the value chains in which they are integrated.

The distortionary impact of macroeconomic instabilities on productive economic activities is well-established in the literature (Ndubuisi et al. 2022). A stable and well-functioning macroeconomic environment is key for active business activities and efficient business functioning. The inflation rate variability, black market premium, and interest rate variability are widely used proxies for macroeconomic conditions. Existing studies have shown that poor macroeconomic conditions, as measured by these indicators, disincentivize economic actors from engaging in productive economic activities or reaping the benefits thereof (Kandil 1992; Ćorić and Pugh 2010; Ndubuisi et al. 2021; Zheng et al. 2021). It also prevents the economy from adjusting effectively to technological change. Hence, poor macroeconomic conditions may limit the productive efficiency gains through GVC participation as it constrains the ability of economic actors to adjust to technological change or engage in complementary investments that could help appropriate the knowledge and technology embodied in or transferred through GVC. In this case, this would moderate the observed positive effect of GVC participation on productive efficiency, leading to GVC participation producing less than the optimal productive efficiency gain.

Extant studies suggest that access to finance is an important determinant of international trade: unlike domestic producers, international trade is well associated with huge variable costs and upfront fixed costs that make it more vulnerable to credit market frictions (Amiti and Weinstein 2011; Manova 2013; Konte and Ndubuisi 2021). The vulnerability of international trade—export in particular—to credit market friction is further exacerbated by the relatively long period receipt from export sales takes compared to domestic sales. While erstwhile studies have predominantly discussed this by focusing on traditional trade, Fernandes et al. (2022) argue that the relationship is stronger for GVC trade because GVC firms face both sunk entry costs to export and import inputs. Access to credit also requires a well-functioning and well-developed financial market. In this case, a country’s financial development may strongly matter for GVC participants. Akin to this, access to finance or financial development is also important in reaping the gains from GVC, including those linked to productive efficiency. They enable GVC participating firms to engage in complementary investments that are essential for the gains of GVC to materialize. Such complementary investment includes, but is not limited to, investment in the labor force such as training and acquisition of specialized skills as well as capital investments. Hence, access to credit and financial market development becomes a necessary condition for effective participation in GVC as well as in reaping the gains from GVC.

3 Research design

3.1 Variables and data sources

3.1.1 Indicators of the global value chain

We source indicators of GVC participation from Ndubuisi and Owusu (2021).Footnote 4 The original data used to compute the variables are from the EORA MRIO I-O database (Lenzen et al. 2013), while the decomposition methods used to arrive at the final variables follow Hummels et al. (2001), Koopman et al. (2011), Koopman et al. (2014), and Aslam et al. (2017). To this end, our study follows existing studies (see Amendolagine et al. 2019; Carril‐Caccia and Pavlova 2020; Ndubuisi and Owusu 2021) to define country i’s GVC participation level in period t in the cross-national intermediate and value-added trade as:

where FVAit is the share of foreign value-added used in a country’s export, DVXit is the share of a country’s domestic value-added that enters as inputs in the exports of other countries, and TEt is country i′s gross export. The first term in the right-hand side of the equation (FVA) captures the extent of the country’s backward integration in GVC, while the second term (DVX) captures the extent of its forward GVC integration. Equation 1 is considered a standard measure of GVC participation in the nascent GVC literature as it acknowledges that a country participates in GVC either as a “buyer” and/or “seller” of intermediate inputs, with higher values of the resulting index (0-1) indicating more intense GVC participation. As indicated in the introduction, our study also considers whether the productive efficiency effect of GVC participation depends on the country’s position in GVC. To operationalize a country’s position in GVC, we follow the extant literature that measures a country’s relative upstreamness position in the value chain (see Koopman et al. 2011; Amendolagine et al. 2019; Ndubuisi and Owusu 2022).Footnote 5 Higher values of the index indicate specialization in upstream activities of the value chain, while lower values indicate specialization in activities that are more downstream. A country is upstream if it primarily supplies inputs to others, while it lies downstream if it uses a large portion of intermediates from others to produce final goods for exports (i.e., activities closer to final demand).

3.1.2 Measuring productive efficiency

We use the data envelope analysis (DEA) to compute our (relative) productive efficiency measure. The DEA is a non-parametric linear programming method used for assessing the efficiency and productivity of units, otherwise called decision-making units (DMU)—where, for our context, DMU includes each country in our sample. The method compares the efficiency of each DMU with that of the others to construct a convex cone or piecewise hull that envelops the data (Kumar and Russel 2002; Van Dijk and Szirmai 2011). The upper boundary of the convex cone represents the best-practice production function or technology frontier and comprises all productively efficient DMU in the dataset under consideration. Therefore, this method constructs a global virtual production function or technology frontier for the sample of countries in our dataset and the associated efficiency level of each country relative to the global virtual frontier. This implies that our productive efficiency measure is neither a measure of technical change (shifts of the frontier) nor absolute productive efficiency.Footnote 6 It is a measure of relative productive efficiency—defined herewith as a country’s relative productive efficiency to the global efficiency frontier, with the latter characterized as the global best practice. The resulting index ranges from zero and one. Productively efficient countries are those operating on the global frontier, and thus have an efficiency score of 1, while productively inefficient countries have an efficiency score of less than 1.

The DEA model is subdivided into two: the input-oriented DEA and the output-oriented DEA. An input-oriented DEA model measures the input efficiency by looking at minimizing inputs for a given level of output, while an output-oriented DEA model measures the output efficiency by looking at maximizing the output for a given level of input. The choice of an output-oriented or input-oriented DEA approach is more of a researcher’s discretion and has little or no strong statistical underpinning (also see Coelli et al. 1998; Coelli and Perelman 1999; Huguenin 2012). Inspired by past studies (see Van Dijk and Szirmai 2011; Danquah 2018; Ndubuisi et al. 2022), the DEA model we employ assumes that output is produced by two inputs: labor and capital.Footnote 7 We assume that under technology T, the data are such that output y is producible by a set of inputs x. The technology is fully characterized by its production possibility set that is given as P(x) ≡ {y: (x, y) ∈ T}, where P(x) is the smallest convex free-disposal hull that envelops the observed data, the upper boundary of which is a piecewise linear estimate of the true best-practice frontier of P(x) (Badunenko and Mozharovskyi 2016). Therefore, for any given data (y, x) among a set of DMU, the output-oriented productive efficiency is computed by solving the following linear programming problem;

Subject to:

where column vector xi is the set of inputs—i.e., labor and capital, yi represents output for the i-th country (out of I). The j and q inequalities capture the free disposability of inputs and output and represent the jth inputs and qth output for countries, respectively. τ is I × 1 is a vector with the intensity coefficient, indicating which countries are on the best practice (non-zero n-values). This means the linear problem has to be solved I times, to obtain a value of θ for each country in the sample. Finally, productive efficiency, θ, is computed as 1/θ with the inverse being the efficiency score which varies between zero and one. If θi = 1, the country is on the frontier. A country is below the frontier if θi < 1.

The assumption of the returns to scale is very important in DEA specification as the efficiency estimates could vary under different returns to scale assumptions. We compute productive efficiency under the various returns to scale assumptions and test for the returns to scale assumption under which each country is scale efficient. These productive efficiency measures computed under the various returns to scale are used to then calculate the scale efficiency for each DMU as originally proposed by Färe and Grosskopf (1985). To impose and choose the right returns to scale assumption, we follow Simar and Wilson (2002) and use the scale efficiencies to compute the test statistics. We then test and choose the right returns to scale assumption under the null hypothesis that the technology is globally constant returns to scale (CRS) versus the alternative hypothesis that it is globally variable returns to scale (VRS). In the case, the null hypothesis is rejected (that is, if technology is not CRS everywhere), a less restrictive null hypothesis is conducted whereby the null hypothesis is that the technology is globally non-increasing returns to scale (NIR) versus the alternative hypothesis that it is globally VRS.

To avoid bias, a bootstrapping procedure is often used in calculating the above tests (see Simar and Wilson 2000, 2011). The bootstrapping method for output-oriented efficiency tests whether all the DMU in the sample are similar in terms of technology and characteristics (homogeneous) or dissimilar (heterogeneous). In the case of the former, the smoothed homogeneous bootstrap procedure is used in the statistical test, while a heterogenous bootstrap procedure is preferred in the case of the latter. Application of the bootstrapping procedure to our data to calculate the above test statistics reveals that a homogenous bootstrap can be used to perform the output-oriented productive efficiency under the assumption of CRS.Footnote 8 Hence, our preferred efficiency scores are those under CRS specifications. Finally, to correct for potential bias in the computed productive efficiency scores due to sampling error (see Simar and Wilson 2000), we follow the bias correction bootstrapping technique of Badunenko and Mozharovskyi (2016) using heterogeneous bootstrapping to correct the bias in the computed productive efficiency scores under the assumption of CRS.

3.1.3 Control variables

In addition to the variables described above, we source variables that we use as controls from three databases: Penn World Table, IMF database, and World Development Indicators. Specifically, we source data on human capital from the Penn World Table, while data on the inflation rate and financial market development are sourced from the IMF database. Data on other variables are taken from the World Development Indicators. While we include these variables in our model to minimize potential endogeneity (particularly those arising from omitted variable bias) their inclusion is guided and inspired by the broader literature on the drivers of productivity growth and performance (see Nelson and Phelps 1966; Benhabib and Spiegel 1994; Das and Drine 2020; Ndubuisi et al. 2022).

3.2 Model specification

As noted earlier, our first research objective is to examine the effect of GVC participation on productive efficiency, while the second objective is to examine the country characteristics that influence this relationship. Inspired by past studies that examine the determinants of productive efficiency (see Nelson and Phelps 1966; Benhabib and Spiegel 1994; Das and Drine 2020; Ndubuisi et al. 2022), the baseline equation that guides our first objective is the following:

where PDi,t+1 is a measure of relative productive efficiency—defined herewith as country i’s productive efficiency gap to the global productive efficiency frontier at period t + 1. Although we argue that GVC participation predicts productive efficiency, it may well be that productive efficiency drives GVC participation positively by reducing the fixed costs associated with international trade. This scenario results in a case of contemporaneous endogeneity. Hence, we expressed the outcome variable—that is, PDi,t+1—in a lead form to minimize this econometrics problem. Moreover, the premise upon which we hypothesize that GVC is associated with productive efficiency is because of the knowledge and technology acquired through GVC. Such knowledge and technology acquired through GVC require time to assimilate as well as recombine into tasks that yield efficiency gains, implying that the relationship between GVC participation and productive efficiency entails a lead-lag relationship and is not contemporaneous. Hence, our expression of the outcome variable in a lead form is also intended to capture the envisaged nature of this relationship.

Moving on, β0 in Eq. 3 is the intercept, while GVCi,t is a country-level measure of GVC participation of country i at period t. In line with our first research objective, it follows that β1 is the parameter of interest and thus we expect that β1 > 0. That is, higher GVC participation enables countries to bridge their productive efficiency gap to the global efficient frontier. As discussed in the previous section, X′i,t is a vector of time-varying country characteristics used as control variables. Following past studies (see Nelson and Phelps 1966; Benhabib and Spiegel 1994; Das and Drine 2020; Ndubuisi et al. 2021) this includes human capital, inflation rate, natural resource rent, population density, and financial market development. We also include full sets of country (λi) and time (λt) dummies, respectively, as their omission may bias our results. The country dummies capture unobserved time-invariant country-specific characteristics such as culture, while the time dummies capture time-specific shocks such as the global financial crises that are common across countries. μi,t is the error term.

The second research objective requires augmenting Eq. (3) to account for the interaction between GVC and country characteristics. Hence, the baseline Equation that guides our second research objective is the following:

where all variables are as defined in Eq. (3), ℤi,t is a country characteristic of interest, and GVCi,t × ℤi,t is an interaction term comprising GVC participation and a country characteristic of interest. The total effect of GVC participation on productive efficiency in Eq. (4) is captured by \(\frac{{\partial \left( {PD_{i,t + 1}} \right)}}{{\partial \left( {GVC_{i,t}} \right)}} = \alpha _1 + \alpha _3{\Bbb Z}_{i,t}\). However, we are more interested in the differential productive efficiency effect of GVC participation given the level of a country’s characteristic. This is given by the parameter α3. Hence, α3 is our key parameter of interest in Eq. 4. In line with our discussion in Section “GVC and productive efficiency: the role of country characteristics”, we expect α3 > 0 in the case of an interaction term comprising GVC participation and either human capital or financial development. A statistically significant positive coefficient in this case indicates that the productive efficiency gains of GVC participation increase as the level of human capital or financial development rises. In the case of the interaction term comprising GVC participation and inflation rate, we expect α3 < 0 implying that the productive efficiency gains of GVC participation decrease at higher levels of macroeconomic distortion as proxied by the inflation level. Finally υi,t is the error term.

3.3 Estimation strategy

Our empirical approach is a two-stage strategy. The first stage consists of using the DEA method to compute a productive efficiency index as described in Section “Variables and data sources”. The second stage regresses the productive efficiency index on indicators of GVC participation, country characteristics variables, and the interaction term comprising GVC participation and a country characteristic of interest (see Eqs. (3) and (4)). Concerning the latter, Eqs. 3 and 4 have two unique characteristics that require careful consideration to avoid biased estimation. The first characteristic stems from the bounded nature of the productive efficiency index. By construction, the index is censored to range between zero and one, implying that the mere adoption of linear estimation methods leads to model misspecification and dubious statistical inference. To guard against this and to solve the boundary problem, past studies complement linear regression with Tobit regression (Ji and Lee 2010; Pereira and Marques 2022). Hence, we employ the Tobit regression as our preferred estimation strategy and also show in the appendix section results obtained using the panel fixed-effect method. In addition, we show results from the fractional response model. Among others, the fractional response model is developed for regression models like ours that have an outcome variable that is bounded between zero and one (see Papke and Wooldridge 1996, 2008).

The second characteristic that requires careful consideration is the endogeneity issue. Our discussion in Section “Model specification” has already highlighted one source of such a problem: simultaneity bias. Although we argued that expressing the outcome variable in a lead form minimizes this bias, we adopt a formal econometric approach to address it. Moreover, our empirical specification is subject to another source of endogeneity—omitted variable bias. To be fair, the inclusion of country and time fixed-effects expunge part of this endogeneity bias—especially for those arising from macroeconomic shocks that are common across countries (e.g., the global financial crisis) and (un)observed time-invariant country-specific characteristics. However, both equations are still susceptible to bias that may result from omitted time-varying factors. We formally address these endogeneity concerns by employing the difference generalized method of moments (GMM) proposed by Arellano and Bond (1991). Successful implementation of the method requires a re-specification of the original (static) equation into a dynamic form, and then the estimation proceeds in two steps: time differencing of the dynamic equation (to remove the country fixed-effects) and instrumenting the endogenous variable with its previous values (Roodman 2009). It is important to note that while the difference-GMM addresses our endogeneity concerns, it does not address the boundary problem discussed earlier. Hence, our preferred estimate remains those obtained from Tobit regressions.

3.4 Descriptive statistics and preliminary analysis

Table 1 shows the basic summary statistics of the variables used in our analysis, including those—i.e., output, capital, and labor—used to compute productive efficiency. Panel A shows these statistics for the full sample, while Panels B and C show the statistics for two subsamples: developed and developing economies. Our definition of developed and developed economies follows the IMF classification. IMF defines countries as either advanced markets, emerging markets, or low-income countries. Relatedly, we define developed countries as advanced markets, while developing countries include emerging markets and low-income countries. The full sample comprises 126 countries for 17 years beginning from the year 2000 to 2016. We, however, lose one period of observation because of the lead form we adopt in the model specification. Hence, we are left with a total number of 2016 observations (=126*16). The total number of observations for developed (developing) economies is 528 (1488) and it comprises 33 (93) countries. Table 7 in the appendix provides further descriptive statistics on the temporal dimension of the indicators used in our analysis for three consecutive periods: 2000–2004, 2005–2009, and 2010–2016.

Table 2 shows the pairwise correlation. From the table, productive efficiency is weakly correlated with the other variables. Its highest correlation is with human capital which is merely about −0.18. The aggregate GVC participation index (which is our main explanatory variable) also correlates weakly with the control variables, although not as weak as in the case of productive efficiency. Its highest correlation with the controls is still human capital with 0.40. This is followed by financial development (0.38). Among the GVC indicators, the aggregate GVC participation correlates strongly with forward GVC (about 0.77), but is weakly correlated with backward GVC (about 0.21). A strong correlation between forward GVC and aggregate GVC is expected since, by construction, the latter is computed using the former. We expected a similarly strong correlation with backward GVC, but this turned out otherwise. Backward and forward GVC is also not perfectly correlated, showing only a negative correlation of about -0.45. This corroborates the view that countries—or more specifically, firms, participate in GVC through backward and/or forward linkages, suggesting that focusing only on one subcomponent provides an incomplete picture of a country’s overall GVC participation. The GVC position correlates weakly with aggregate GVC (about 0.43) but strongly with backward (about 0.79) and forward (about 0.90) GVC. The strong correlation with the GVC subcomponent is not surprising since the position index is nothing other than the ratio of the two subcomponents. Because of the strong correlation, we do not consider the position measure jointly with either of the GVC participation subcomponents in our regression model. We do introduce it with the aggregate GVC participation, but we only do this where we consider interactions.

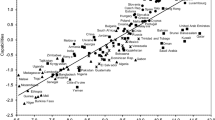

Finally, Fig. 1 shows the kernel density plot of productive efficiency across different levels of GVC participation. Beginning with the first figure, comprising two plots, we pool the data on aggregate GVC participation across countries and years and then split it into two groups using the 50th percentile as the cutoff. Hence, “High GVC” equals GVC participation for all observations at the 50th percentile and above, while “Low GVC” equals GVC participation for all observations below the 50th percentile. From the kernel density plot, we observe that the distribution of “High GVC” is further to the right while that of the “Low GVC” is to the left. In Table 3, we present t tests for differences in means between the two groups. The productive efficiency mean of the “Low GVC” sample is about 0.40 while that of the“High GVC” sample is 0.44. This difference in means is statistically significant, as shown in the t-tests in Table 3. This first piece of evidence suggests that higher GVC participation is associated with higher productive efficiency gains.

In the first figure, comprising two plots, “high GVC” equals GVC participation for all observations at the 50th percentile and above, while “low GVC” equals GVC participation for all observations below the 50th percentile. In the second figure, comprising three plots, “high GVC” equals GVC participation for all observations at the 75th percentile and above, while "low GVC" equals GVC participation for all observations at the 25th percentile and below. “Middle GVC” corresponds to GVC participation for all observations below the 75th percentile and above the 25th percentile.

For the second figure, comprising three plots, we also pool the data on aggregate GVC participation across countries and years. This time, however, we create three groups comprising: (i) “High GVC” which equals GVC participation for all observations at the 75th percentile and above, (ii) “Low GVC” which equals GVC participation for all observations at the 25th percentile and below, and (iii) “Middle GVC” that corresponds to GVC participation for all observations below the 75th percentile and above the 25th percentile. Again, we observe that the distribution of “High GVC” is further to the right. This is followed by “Middle GVC”, and then the “Low GVC”. To check the mean difference among the three groups, we conduct differences in means t-test for three pairs: (i) “High GVC” vs “Middle GVC”, (ii) “High GVC” vs “Low GVC”, and (iii) “Middle GVC” vs “Low GVC”. The result of this exercise is reported in Panel B of Table 3. In general, there is a statistically significant difference in the productive efficiency between the groups “High GVC” and “Middle GVC”, and “High GVC and “Low GVC”. However, there is no statistically significant difference between the productive efficiency of the groups of “Middle GVC and Low GVC”.Footnote 9 This may be signaling that countries belonging to these two groups benefit equally from GVC participation. Finally, to simultaneously perform a difference test among the three groups, we perform an analysis of variance relying on the ANOVA test. The result of this exercise is reported in Panel C of Table 3. The p-value of 0.000 suggests that there are statistically significant differences in the productive efficiency score between the three groups, at the 1% significance level.

4 Results and discussion

This section proceeds in three steps. First, we present regression results for the linear effects of GVC participation on productive efficiency. Second, we examine potential non-linearity in the relationship between GVC participation and productive efficiency. The third section presents the regression results for two subsamples: developed and developing countries.

4.1 GVCs participation and productive efficiency: a linear model

Table 4 shows the Tobit regression results of the effect of GVC participation on productive efficiency. Column 1 shows the result when we regress productive efficiency on the aggregate GVC participation index conditioning on time and country fixed effects. The estimated coefficient of GVC participation turns out positive and is statistically significant at the 1% significance level, indicating that countries that participate intensively in GVC catch-up to the global productive efficiency frontier. Column 2 shows the result when we include the control variables. The estimated coefficient of GVC participation remains positive and is statistically significant at all conventional significance levels.

Countries may participate in GVC through either backward or forward GVC integration. Hence, columns 3–5 show the results when we consider the effect of backward and forward GVC integration. Column 3 particularly shows the result when we regress productive efficiency only on backward GVC integration, while column 4 shows the result when we regress productive efficiency only on forward GVC integration. Column 5, on the other hand, shows the result when we regress productive efficiency jointly on both indexes of backward and forward GVC participation. In all cases, we observe a significant positive effect of backward and forward GVC participation, indicating that participating in GVC through both channels is a pathway by which technology-lagging countries catch-up to the global productive efficiency frontier. This result is in line with Piermartini and Rubínová (2021) who used a sample comprising 25 developed and emerging countries to test whether GVC spurs innovation through knowledge spillover and if this effect works through backward and forward GVC integration. In general, the results reported in Table 4 suggest that GVC participation is a strong predictor of productive efficiency.

Regarding the control variables, we observe that the estimated coefficient of human capital is consistently positive across all the columns in the table indicating the important role of human capital in the catch-up process. The result is also consistent with the broader literature on productive efficiency and convergence (see Nelson and Phelps 1966; Benhabib and Spiegel 1994; Das and Drine 2020). In line with past studies (see Ćorić and Pugh 2010; Ndubuisi et al. 2021), the estimated coefficient of the inflation rate is consistently negative. This suggests macroeconomic instabilities exert a distortionary impact on productive economic activities. We consistently obtain a negative estimated coefficient for natural resource rent, indicating a potential negative association between resource dependence and productive efficiency, a result that is somewhat in line with the resource course literature (see Sachs and Warner, 2001; Gylfason 2001). We also obtain a negative statistically significant coefficient for population density at all conventional significance levels. This result is consistent with the view that high population density puts a strain on public infrastructure and leads to both resource exploitation and degradation of environmental quality that tend to impact negatively on productivity (see Hakeem 2017). Finally, we obtain a statistically insignificant effect of financial market development.

Next, Table 8 in the appendix presents robustness results using different estimation strategies as discussed in Section “Estimation strategy”. Columns 1 and 2 report the results from the fractional response method, while columns 3 and 4 report results from the panel fixed-effect method. On the other hand, columns 5 and 6 report the results from the difference-GMM method. Across all the columns in the table, the results on the variables of interest are consistent with those reported in Table 4. Assessment of the validity of the GMM estimates is achieved using the second-order autocorrelation test and the over-identification restriction test for which the tests are reported on the last panel of Table 8. Regarding the second-order autocorrelation test, we observe that across all the columns the p value of AR(2) is statistically insignificant at all conventional significance levels. This indicates the absence of second-order autocorrelation. Furthermore, the p values of the Hansen-J test are also statistically insignificant at all conventional significance levels across the four columns, suggesting that the internally generated instruments for the endogenized variables are exogenous. We are, therefore, confident in the validity of our instruments as both tests validate a proper specification of our model. Put together, the results presented in Table 8 corroborate our previous conclusion that GVC participation is a strong predictor of productive efficiency. Moreover, these additional results suggest that our conclusion is not driven by our choice of model specification or estimation strategy and it is also not susceptible to endogeneity issues.

4.2 Heterogeneous effect of GVC participation on productive efficiency: the role of country characteristics

The results and discussions from the previous section suggest a positive association between GVC participation and productive efficiency. Following our second research objective, this section further probes whether this relationship is conditional on other characteristics of the country. Table 5 reports the Tobit regression results for this exercise. We begin by exploring potential non-linearity in GVC participation. We achieve this by augmenting Eq. (3) with a squared term of the index of GVC participation alongside its linear term in column 1. As the results show, while the estimated coefficient of the linear term of GVC participation remains positive (albeit, now statistically insignificant) the squared term is significantly positive at all conventional significance levels. Therefore, the result on the squared term of GVC participation suggests that the productive efficiency effect of GVC participation increases as the level of GVC participation increases. In this case, intensifying GVC participation is important in catching-up to the global productive efficiency frontier.

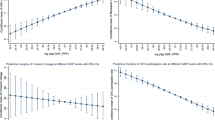

Next, we consider the interaction between GVC participation and some country characteristics that are imperative for effective GVC participation and in reaping the gains thereof. We begin by considering the interaction between GVC participation and human capital. Column 2 of Table 5 shows the baseline result for this exercise. The estimated coefficient of the interaction variable is positive and statistically significant at all conventional levels, indicating that countries with higher human capital experience a better productive efficiency gain from GVC participation. Hence, the result is consistent with our conjecture in Section “Model specification” regarding the importance of human capital as a determinant of GVC participation and in providing the opportunity for those countries to appropriate knowledge spillover in the value chains in which they are integrated. More generally, the results are also in line with the broader literature suggesting that human capital is an important factor that determines the capacity to absorb and implement new technology (Borensztein et al. 1998; Ali et al. 2016). To show this, we graph the marginal effects of the changes in GVC participation by different levels of human capital for the results in column 2 in Fig. 2a. It shows that the effect of GVC participation on productive efficiency is positive and significantly different from zero for all values of human capital, with the effect being higher at higher levels of human capital.

Next, we consider the role of macroeconomic distortion as captured by the inflation rate. Colum 3 of Table 5 shows the baseline result of this exercise. Although the estimated coefficient of the interaction variable is not statistically significant at conventional significance, it is negative. This suggests that macroeconomic distortions reduce the positive effect of GVC participation on productive efficiency. Hence, the result, albeit weak, supports our conjecture in Section “GVC and productive efficiency: the role of country characteristics” that poor macroeconomic condition limits the productive efficiency gains from GVC participation. This occurs because it constrains the ability of economic actors to engage in complementary investments that could help in appropriating the knowledge and technology embodied in or transferred through GVC. In Fig. 2b, we graphically represent this relationship. The graph shows that the positive effect of GVCs participation on productive efficiency decreases as the inflation rate (our measure of macroeconomic instability) rises. In this case, as a country intensifies its GVC participation levels in pursuit of catching-up to the global productive efficient frontier, it must also improve its macroeconomic environment.

As discussed in Section “GVC and productive efficiency: the role of country characteristics”, economic actors require access to finance to engage in complementary activities that enable them to reap the productive efficiency gains from GVC. Column 4 shows the Tobit regression result when we test this view. The estimated coefficient of the interaction variable is positive and statistically significant at all conventional levels, indicating that countries with a well-functioning and well-developed financial market gain more in terms of improvement in productive efficiency from GVC participation. Hence, the result strongly supports our conjecture in Section “GVC and productive efficiency: the role of country characteristics” that access to credit and financial market development is a necessary condition for effective participation in GVC as well as in reaping the productive efficiency gains from GVC. We graph this result in Fig. 2c, with the figure showing the complementarity between GVC participation and finance in the effect of GVC participation on productive efficiency at all levels of financial development.

The analysis thus far has focused on GVC participation. Consistent with the view that position along the value chain may also matter in determining the social and economic outcomes of engagement in GVC (see Amendolagine et al. 2019; Ndubuisi and Owusu 2022b), we introduce the indicator of relative upstreamness as well as its interaction with GVC participation in column 5 of Table 5. The estimation coefficient of the newly introduced variable, including its interaction with GVC participation, is negative and statistically significant at all conventional levels. On the one hand, the statistically significant estimated coefficient of the interaction variable supports the idea that the position in GVC matters. On the other hand, and considering the sign of the estimated coefficient of the interaction variable, it implies that the productive efficiency gain from GVC participation is higher for countries with downstream specialization—i.e., countries that are closer to final demand. Figure 2d graphs this result and shows that the result holds to a greater extent for most of the GVC position index that is skewed towards downstream specialization.

Finally, the results presented in this section have relied on contingent variables. As a last robustness exercise, we re-estimate Eq. (4) where we consider these contingent variables in their dummy form. For each country characteristic, we consider as a contingent variable, we transform it into a dummy variable using its sample median. The dummy variables take the value of 1 for higher values above the sample median, and zero otherwise. In Table 9, found in the appendix, we report the regression results of using the dummy form of these contingent variables to compute interaction variables. Particularly, the table reports the results obtained from a Tobit regression—i.e., columns 1 to 4—and panel fixed-effect regression—i.e., columns 5 to 8. In general, the directions of the results are largely consistent with previous the results we obtained when the contingent variables are considered in their continuous form. The two exceptions are the interaction variable comprising GVC participation and the dummy of the financial development level, and the interaction variable comprising GVC participation and the dummy of the inflation rate. For the former, the interaction variable remains positive but turns statistically insignificant. For the latter, the interaction variable remains negative but turns statistically significant.

4.3 Heterogeneous effect of GVC participation on productive efficiency: differences in development levels

In this section, we extend our analysis by considering the productive efficiency effects of engagement in GVC for both developed and developing countries. The Tobit regression result for this analysis is reported in Table 6. As noted earlier, our definition of developed and developed countries follows the IMF classification. IMF defines countries as either advanced markets, emerging markets, or low-income countries. Following this classification, we define developed countries as advanced market, while developing countries comprises emerging market and less-income countries. Columns 1 to 3 in Table 6 show the results for the sample comprising developed countries, while columns 4 to 6 show the results for the sample comprising developing countries. Interestingly, we find that neither participation nor position in GVC matters for productive efficiency in developed countries. In developing countries, however, both participation and position in GVC matter decisively for productive efficiency. Particularly, the results show that for technology-lagging developing countries, intense GVC participation (especially through specialization in downstream activities) matters for catching up to the global productive efficient frontier.

The non-statistically significant result we find for the developed country sample in our dataset is not surprising. This is because, in contrast to developing countries developed countries are already operating at or near the global productive efficient frontier and hence have limited scope for further catch-up. Thus, engagement in GVC offers these advanced countries little or no further gain in this regard. However, they require engagement in GVC for technological change to enable them to either remain at the global productive efficient frontier or to define a new one (a shift of the frontier). GVC participation, on the other hand, offers developing countries opportunities of catching up to the global efficiency frontier. This argument is consistent with the erstwhile findings of Ndubuisi and Owusu (2021) that GVC participation leads to quality upgrading of exported products (a measure of technological efficiency) for developing countries. It is also consistent with the empirical findings of Tajoli and Felice (2018) which show a significant positive effect of GVC participation on the innovation performance of developing countries.

5 Conclusion

The reorganization of production through global value chains (GVC) has changed the nature of cross-border trade. Goods that used to be produced within one country are now fragmented and distributed globally, across a global supply chain. Over the past three decades, this new way of organizing global production has seen substantial growth both in terms of depth and breadth, and it connects even marginalized developing countries in trade. It is widely believed that integrating into this new global production network benefits countries through multiple channels that favor a parsimonious accumulation of productive and technological capabilities. Other things equal, this engenders a more efficient technique of production across borders and by extension, contributes to productive efficiency. While this view is currently shared among development institutions and some scholars, there is no study to our best knowledge that has empirically examined this relationship. In this paper, we addressed this knowledge gap by examining how GVC participation affects productive efficiency. We also examine how a country’s characteristics shape the nature of such a relationship. Our analysis relied on panel data comprising 126 developed and developing countries and covers the period 2000–2016.

We find a robust positive association between GVC participation and productive efficiency. We also find that the productive efficiency gains from GVC participation work through backward and forward linkages in GVC, implying that it matters less whether a country is integrated into GVC through backward or forward linkages for these efficiency gains to accrue. Our results on the role of country characteristics as enablers or inhibitors of the productive efficiency gains from GVC participation reveal that the productive efficiency gains from GVC participation arise mostly in countries that invest effectively in human capital, have a well-developed and well-functioning financial market, maintain stable macroeconomic conditions, and specialize in downstream activities in the value chain. Finally, results on the two subsamples: developed and developing countries reveal that the productive efficiency gains from GVC participation accrue more strongly in developing countries. As our productive efficiency indicator is a relative efficiency measure, this result is consistent with the conventional thinking that countries at an early stage of development are usually further from the technological frontier and, therefore, have more scope to benefit from knowledge transfers or spillovers to catch up to the global efficiency frontier.

Overall, the findings of the paper suggest that GVC participation offers technology-lagging countries a premium in terms of a productive efficiency gain (which represents a reasonable pathway to closing the global productivity gap). This does require, however, complementary policies and interventions that either unluck or fast-track this premium. From a policy perspective, this calls for active trade-and-industrial related policies to achieve stronger insertion into GVC and in reaping the benefits thereof. Along this line, our results showing a strong positive association between GVC participation and productive efficiency, and especially among developing countries, calls for policies aimed at removing restrictions to cross-border trade. Among others, this includes tariff liberalization and reduction of non-tariff barriers such as increasing border efficiency. It also calls for national industrial policies targeted at skill upgrading. This could be achieved through improvements in schooling curriculum, building a national capability for targeted value chains—thereby enabling integration or upgrading into higher value-added tasks in value chains.

Furthermore, our results showing that the effects of GVC participation on productive efficiency depend on country characteristics underscores the importance of implementing complementary policy instruments. Among others, this includes policies that support the strategic (re)positioning of countries to upgrade into complex value chains and high-value-added tasks and industries that are downstream of the value chain. This requires investment to build more infrastructure to strengthen connectivity to global lead firms and established suppliers in the value chain. A set of active policy reforms to improve the business climate are also needed. In particular, they are needed to attract multinationals (FDI) that can act as conduits of technology generation and diffusion in the value chain. Further results from our findings suggest the need for an additional battery of policies that range from improving micro and macroeconomic stability and efficiency to instruments that support investment in skills enhancement that are aligned to the demands of competitive GVC integration. Additional policies are needed to promote financial market development—to address the financial bottlenecks that firms face and that run counter to competitive GVC integration.

We conclude with three potential areas for further research. First, while our study focuses on productive efficiency, future studies can focus on technological change (i.e., a shift of the frontier over time). Although we find no strong evidence that developed countries experience productive efficiency gains through GVC participation, it may well be that they have successfully shifted the global frontier through GVC participation. This is of particular importance as multinational enterprises from the global North have primarily exploited the GVC for pure efficiency (factor cost minimization) gains. Second, the complexity of the value chain network a country is embedded in determines the quantity and quality of the technology that could be derived from or shared. Whether the value chain has the global North or South as the end market also determines the quantity and quality of the technology that could be derived from or shared in such a network. The latter also entails exposure to diverging production practices and consumer preferences that shape the firm’s productive capability. Therefore, future studies can examine whether the productive efficiency gains through GVC participation depend on the complexity and end market of the value chain. Third and finally, our empirical analysis of how country characteristics influence the productive efficiency gains through GVC participation can be expanded more formally to explore the role of the country’s national innovation system (NIS).

Notes

The underlying argument here is that participation in GVC offers firms the opportunity to outsource activities they have a less comparative advantage and concentrate on core activities where they have a competitive advantage while using limited production resources more efficiently.

Among others, these studies also examine the role of human capital. Although not directly relevant to our study, other studies have examined the role of information technology (Ndubuisi et al. 2022), institutions and market conditions (Jayasuriya and Wodon 2005), and public capital (Puig‐Junoy 2001).

We achieve this using the Penn World Table that contains indicators for output, labor, and capital for almost all countries in the world.

See Ndubuisi and Owusu (2021) for a detailed discussion on this.

We particularly define the index as: \(GVC\,Position_{it} = \ln \left( {1 + \frac{{DVX_{it}}}{{TE_{it}}}} \right) - \ln \left( {1 + \frac{{FVA_{it}}}{{TE_{it}}}} \right)\).

For more on this see Pereira et al. (2021).

The output and input data we use to compute the productive efficiency is from the Penn World Table. We use all the countries in the dataset to compute the productive efficiency index after which we selected observations for 126 countries due to data limitations of other control variables used in the second stage of our empirical strategy.

The p-value of our null hypothesis Ho: that the Debreu-Farrell output-based measure of technical efficiency under the assumption of CRS can be used is 0.0706, we, therefore, fail to reject the null hypothesis. The corresponding direct output of the test also shows homogeneous bootstrap can be used when performing the output-based technical efficiency measurement under the assumption of CRS technology.

In an unreported result, we also split the sample into two groups using the 75th percentile as the cutoff, considering observations at the 75th percentile and above as “High GVC”, while observations that are below as “Low GVC”. The results including the mean difference t-test are largely in line with those obtained from the first figure.

References

Abreha K, Lartey E, Mengistae T, Owusu S, Zeufack A (2021) Industrialization in Sub-Saharan Africa: seizing opportunities in global value chains. World Bank Group, Washington DC

Ali M, Cantner U, Roy I (2016) Knowledge spillovers through FDI and trade: The moderating role of quality-adjusted human capital. J Evolut Econ 26:4

Amador J, & Cabral S (2015) Global value chains, labor markets, and productivity. In J Amador & D Filippo (Eds.), The age of global value chains. CEPR Press, London, UK

Amendolagine V, Presbitero AF, Rabellotti R, Sanfilippo M (2019) Local sourcing in developing countries: the role of foreign direct investments and global value chains. World Dev 113:73–88

Amiti M, Weinstein D (2011) Exports and financial shocks. Q J Econ 126(4):1841–1877

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Aslam A, Novta N, & Rodrigues-Bastos, F (2017) Calculating trade-in value-added. IMF Working Papers #178

Badunenko O, Mozharovskyi P (2016) Nonparametric frontier analysis using Stata. Stata J 16(3):550–589

Baldwin R (2012) Trade and industrialization after globalization’s 2nd unbundling: how building and joining a supply chain are different and why it matters. In Feenstra R & Taylor A (Eds) Globalization in an age of crisis: multilateral economic cooperation in the twenty-first century (pp 165–215)

Baldwin R (2016) The great convergence: information technology and the new globalization. Belknap, Cambridge, MA

Benhabib J, Spiegel MM (1994) The role of human capital in economic development evidence from aggregate cross-country data. J Monet Econ 34(2):143–173

Borensztein E, De Gregorio J, Lee JW (1998) How does foreign direct investment affect economic growth? J Int Econ 45(1):115–135

Carril‐Caccia F, Pavlova E (2020) Mergers and acquisitions & trade: a global value chain analysis. World Econ 43(3):586–614

Coelli T, Prasada Rao DS, Battese GE (1998) An introduction to efficiency and productivity analysis. Kluwer Academic Publishers, Boston, MA

Coelli TJ, Perelman S (1999) A Comparison of parametric and non-parametric distance functions: with application to European Railways. Eur J Oper Res 117(2):326–339

Constantinescu C, Mattoo A, Ruta M (2019) Does vertical specialization increase productivity? World Econ 42(8):2385–2402

Ćorić B, Pugh G (2010) The effects of exchange rate variability on international trade: a meta-regression analysis. Appl Econ 42(20):2631–2644

Criscuolo C, Timmis J (2017) The relationship between global value chains and productivity. Int Prod Monit 32:61–83

Danquah M, Ouattara B (2015) What drives national efficiency in sub-Saharan Africa. Econ Model 44:171–179

Danquah M (2018) Technology transfer, adoption of technology and the efficiency of nations: empirical evidence from sub–Saharan Africa. Technol Forecast Soc Change 131:175–182

Das GG, Drine I (2020) Distance from the technology frontier: How could Africa catch-up via socio-institutional factors and human capital? Technol Forecast Soc Change 150:119755

Enflo K, Hjertstrand P (2009) Relative sources of European regional productivity convergence: a bootstrap frontier approach. Reg Stud 43(5):643–659

Färe R & Grosskopf S (1985) A nonparametric cost approach to scale efficiency. Scand J Econ 594–604

Fernandes AM, Kee HL, Winkler D (2022) Determinants of global value chain participation: cross-country evidence. World Bank Econ Rev 36(2):329–360

Gylfason T (2001) Natural resources, education, and economic development. Eur Econ Rev 45:847–59

Hakeem MA (2017) Effect of population density on the level of development. MPRA Paper No. 82301

Hausmann R (2014) In search of convergence. Project Syndicate, 20 August 2014

Huguenin JM (2012) Data envelopment analysis (DEA). A pedagogical guide for decision-makers in the public sector, Swiss Graduate School of Public Administration, Lausanne

Hummels D, Ishii J, Kei-Mu Y (2001) The nature and growth of vertical specialization in world trade. J Int Econ 54(1):75–96

Ignatenko A, Raei F, Mircheva B, & Papi L (2019) Global value chains: what are the benefits and why do countries participate? IMF Working Paper, 2019(018)

Jangam BP, Rath BN (2021) Do global value chains enhance or slog economic growth? App Econ 53(36):4148–4165

Jayasuriya R, Wodon Q (2005) Measuring and explaining the impact of productive efficiency on economic development. World Bank Econ Rev 19(1):121–140

Ji Y-B, Lee C (2010) Data envelopment analysis. Stata J 10(2):267–280

Kandil M (1992) Interest rate variability and economic performance: some international evidence. Appl Econ 24(2):175–191

Konte M, Ndubuisi G (2021) Financial constraint, trust, and export performances: firm-level evidence from Africa. J Inst Econ 17(4):583–605

Koopman R, Powers W, Wang Z, & Wei SJ (2011) Give credit where credit is due: tracing value-added in global production chains. NBER Working Paper No. 16426

Koopman R, Wang Z, Wei S-J (2014) Tracing value-added and double counting. Am Econ Rev 104(2):459–494

Kounetas K, Napolitano O (2018) Modeling the incidence of international trade on Italian regional productive efficiency using a meta-frontier DEA approach. Econ Model 71:45–58

Kumar S, Russell RR (2002) Technological change, technological catch-up, and capital deepening: relative contributions to growth and convergence. Am Econ Rev 92(3):527–548

Lenzen M, Moran D, Keiichiro K, Geschke A (2013) Building EORA: a global multi-region input-output database in high country and sector resolution. Econ Syst Res 25(1):20–49

Manova K (2013) Credit constraints, heterogeneous firms, and international trade. Rev Econ Stud 80(2):711–744

Margaritis D, Färe R, Grosskopf S (2007) Productivity, convergence, and policy: a study of OECD countries and industries. J Prod Anal 28(1):87–105

Mazzi CT, Ndubuisi G, & Avenyo EK (2020) Exporters and global value chain participation: firm-level evidence from South Africa. WIDER Working Paper No. 2020/145

Morrison A, Pietrobelli C, Rabellotti R (2008) Global value chains and technological capabilities: a framework to study learning and innovation in developing countries. Oxford Dev Stud 36(1):39–58

Ndubuisi G, Otioma C, & Tetteh GK (2021) Digital infrastructure and employment in services: evidence from Sub-Saharan African countries. Telecommun Policy, 102153

Ndubuisi G, Otioma C, Owusu S, Tetteh GK (2022) ICTs quality and technical efficiency: an empirical analysis. Telecommun Policy 46(10):102439

Ndubuisi G, Owusu S (2021) How important is GVC participation to export upgrading? World Econ 44(10):2887–2908

Ndubuisi G, Owusu S (2022) Wage effects of global value chains participation and position: an industry-level analysis. J Int Trade Econ Dev 31(7):1086–1107

Nelson RR, Phelps ES (1966) Investment in humans, technological diffusion, and economic growth. Am Econ Rev 56(1/2):69–75

Owusu S (2021) Powering structural transformation and productivity gains in Africa: the role of global value chains and resource endowments. UNU-MERIT Working Paper No. 2021-022

Pahl S, Timmer MP (2020) Do global value chains enhance economic upgrading? A long view. J Dev Stud 56(9):1683–1705

Papke LE, Wooldridge JM (1996) Econometric methods for fractional response variables with an application to 401 (k) plan participation rates. J Appl Econ 11(6):619–632

Papke LE, Wooldridge JM (2008) Panel data methods for fractional response variables with an application to test pass rates. J Econometr 145(1-2):121–133

Pereira MA, Camanho AS, Marques RC, Figueira JR (2021) The convergence of the World Health Organization Member States regarding the United Nations’ Sustainable Development Goal ‘Good health and well-being’. Omega 104:102495

Pereira MA, Marques RC (2022) Technical and scale efficiency of the Brazilian municipalities’ water and sanitation services: a two-stage data envelopment analysis. Sustainability 14(1):199

Piermartini R, Rubínová S (2021) How much do global value chains boost innovation? Can J Econ 54(2):892–922

Puig‐Junoy J (2001) Technical inefficiency and public capital in US states: a stochastic frontier approach. J Reg Sci 41(1):75–96

Roodman D (2009) How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J 9(1):86–136

Sachs J, Warner AM (2001) The curse of natural resources. Eur Econ Rev 45(4-6):827–838

Sampath PG, Vallejo B (2018) Trade, global value chains and upgrading: what, when and how? Eur J Dev Res 30(3):481–504

Simar L, Wilson PW (2011) Performance of the bootstrap for DEA estimators and iterating the principle. In: Cooper WW, Seiford LM, Zhu JHandbook on data envelopment analysis (Second, Vol. 164, International). Springer, US pp 251–270

Simar L, Wilson PW (2000) A general methodology for bootstrapping in non-parametric frontier models. J Appl Stat 27(6):779–802

Simar L, Wilson PW (2002) Non-parametric tests of returns to scale. Eur J Oper Res 139(1):115–132

Tajoli L, Felice G (2018) Global value chains participation and knowledge spillovers in developed and developing countries: an empirical investigation. Eur J Dev Res 30(3):505–532

Tzeremes NG (2014) The effect of human capital on countries’ economic efficiency. Econ Lett 124(1):127–131

UNIDO (2018) Global value chains and industrial development: lessons from China, South-East and South Asia

Van Dijk M, Szirmai A (2011) The micro-dynamics of catch-up in Indonesian paper manufacturing. Rev Income Wealth 57(1):61–72

Wang M, Wong MS (2012) International R&D transfer and technical efficiency: evidence from panel study using stochastic frontier analysis. World Dev 40(10):1982–1998

World Bank (2020) World Development Report 2020: trading for development in the age of global value chains. World Bank, Washington, DC

Yang S, Lancheros S, Milner C (2021) Technological catch-up to the national and regional frontier: firm-level evidence for India. J Dev Stud 57(8):1303–1320

Zheng Z, Huang CY, Yang Y (2021) Inflation and growth: a non-monotonic relationship in an innovation-driven economy. Macroecon Dyn 25(5):1199–1226

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions