Abstract

International trade has long been considered a channel of technology transfer. This paper draws from the World Bank’s Enterprise Surveys to provide a sample of 18 developing and emerging economies to investigate whether global value chains (GVCs) are a vehicle for the transfer of technology. It focuses on one specific channel for technology transfer, namely, the licensing of foreign technology. To control for the possible endogeneity of technology licensing, propensity score matching is combined with a difference-in-differences approach. The results show a positive effect of being involved in two-way trading on the licensing of foreign technology. Firms that become two-way traders are significantly more likely to use foreign-licensed technology than firms starting to export or import. This evidence suggests that the complexity associated with the mode of internationalisation determines the licensing of foreign technology. GVC participation also appears to foster firms’ performance, reflecting my findings that the acquisition of foreign technology leads to significant productivity improvements.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent decades have witnessed a dramatic change in international trade and production patterns. Twenty-first-century trade and production are structured around so-called global value chains (GVCs) where stages of a single production process are dispersed internationally. It is often argued that GVCs have offered a new path towards industrial development, since firms from high-technology nations are combining their firm-specific managerial, technical and marketing know-how with the low wages in developing nations (Baldwin 2016). However, little is known about the implications of GVCs in supporting the international transfer of technology to firms in developing countries.

Nowadays, most trade concerns the movement of inputs between and across countries. According to the OECD (2015), three-quarters of world trade involves intermediate and capital goods. The increasing importance of input trade has accompanied a parallel increase in the customisation of products (Antràs and Staiger 2012). As a result, to minimise the transaction costs involved with the production and incorporation of inputs into final goods, the firm leading the supply chain (hereafter ‘the buyer’) may transfer intellectual property rights and know-how to its suppliers.Footnote 1 As Baldwin and Lopez-Gonzalez (2015) states, “When Toyota makes car parts in Thailand, they do not rely on local know-how; they bring Toyota technology, Toyota management, Toyota logistics and any other bits of know-how needed since the Thai-made parts have to fit seamlessly into the company’s production network” (p. 1684).

According to Antràs and Staiger (2012), intermediate input purchases tend to be associated with significant lock-in effects for both buyers and sellers. For example, differentiated intermediate inputs are frequently customised to meet the needs of their intended buyers and hence embody a disproportionate amount of relationship-specific investments (Nunn 2007), which may be difficult to recoup when transacting with various parties. Moreover, offshoring often involves a costly search for suitable foreign suppliers or foreign buyers, making separations expensive and thereby providing another source of lock-in. The competitive pressure imposed on firms participating in a supply chain is crucial for firms in developing countries.Footnote 2 Rigo (2017) argues that the fragmentation of production processes has significantly affected manufacturing firms in developing nations, showing that a common set of technologies and capabilities correlate with firms’ participation in complex international activities.

While global buyers, which to date reside overwhelmingly in developed countries, take great care to protect their technologies or product innovations, they may be willing to share their knowledge with their foreign suppliers in developing countries to reduce the costs and uncertainty of trading intermediate goods along global or regional supply chains.Footnote 3 This paper tests for this prediction by investigating whether GVCs may incentivise the transfer of foreign technologies to firms in developing countries. My findings contribute to the literature in three respects. First, I examine the implications of international trade on an empirically unexplored channel of technology transfer, namely, foreign licensing.Footnote 4 Based on a representative sample of manufacturing firms for 130 developing nations, Rigo (2017) shows that those firms using foreign-licensed technology account for 30% of employment (on average), similar to the figure for foreign-owned firms. This evidence suggests that foreign licensing may be an essential and alternative channel to foreign direct investment (FDI) for the transfer of international technologies to developing countries. Second, I investigate whether the complexity of the firm’s trading status affects the licensing of foreign technology to firms in developing countries. The literature has shown that the transfer of technology through international trade may depend on several factors, but this is the first paper, to the best of the author’s knowledge, that distinguishes between simple traders (defined as exporters-only or importers-only) and complex traders (two-way traders) in studying the international transfer of technology. Third, I consider the implications of acquiring a foreign-licensed technology on firms’ performance.

The empirical analysis is based on a sample of 3340 manufacturing firms from the World Bank’s Enterprise Surveys. These surveys are harmonised to construct a two-year panel data set for 18 developing and emerging economies covering the period 2006-2016.Footnote 5 To control for the potential endogeneity embedded in the relationship between international trade and technology adoption, my empirical strategy combines a propensity score matching (PSM) technique with a difference-in-differences (diff-in-diff) approach. As a first step, I use a PSM technique to match each firm participating in a GVC (treatment group) with a synthetic counterfactual (control group). This matching process pairs up each firm that will start a complex trading activity in the future (i.e. firms becoming two-way traders) with a domestic plant or a simple trader having very similar observable characteristics. I then calculate the average difference in the probability of using foreign-licensed technology between firms becoming involved in complex trading activities and their matched control firms. This strategy allows controlling for observable time-variant and unobservable time-invariant firm characteristics.Footnote 6

The results show a positive effect of being involved in complex trading activity on the licensing of foreign technology. Firms becoming two-way traders are significantly more likely to use foreign-licensed technology than firms starting to export or import. This evidence suggests that the complexity associated with the mode of internationalisation determines the licensing of foreign technology. The second part of my empirical analysis investigates the impact of acquiring foreign-licensed technology on firm-level productivity. Using once again a PSM diff-in-diff approach, I find that foreign licensing leads to large increases in total factor productivity (TFP) and labour productivity. The improvement is on the order of 88% for TFP and 50% for labour productivity. These findings suggest that GVC participation through access to foreign technologies fosters firms’ performance.

The empirical literature has long considered international trade a channel of technology transfer. Exposure to international markets may bring several advantages (better quality inputs and higher revenues), which may lead to productivity gains (Amiti and Konings 2007; Topalova and Khandelwal 2011; Halpern et al. 2015) and motivate firms to invest further in upgrading their technology (Bustos 2011; Lileeva and Trefler 2010). Moreover, firms that export are expected to absorb new knowledge from foreign markets and buyers. However, learning by exporting is far from guaranteed and is conditional on several factors. For instance, such learning tends to occur more when firms are exporting to advanced economies (De Loecker 2007), when they are exporting multiple products or to multiple destinations (Masso and Vahter 2015), or when firms are involved in knowledge-intensive activities (Benkovskis et al. 2020). Coherently with this literature, I show that GVC participation may unlock the international transfer of knowledge to a further degree.

This paper also relates to the recent empirical literature studying the impact of GVCs on economic development. Recent macro evidence points to the beneficial role of GVCs in developing nations’ industrial development (Kummritz 2016; Constantinescu et al. 2019; Altomonte et al. 2018). More closely related to my paper, Piermartini and Rubinova (2014) provide evidence that GVCs are a much stronger facilitator of knowledge spillovers than final goods trade. Coherently, this paper reveals that GVC participation can enhance developing countries’ learning possibilities through the introduction of new foreign technologies. A related body of empirical literature using firm-level data shows that GVC participation fosters firms’ performance in developing countries (Gereffi 1999; Pietrobelli and Saliola 2008; Atkin et al. 2017; Del Prete et al. 2017; Benkovskis et al. 2020). My paper extends this literature, illustrating how through foreign licensing, GVC participation generates significant productivity gains in manufacturing firms in developing and emerging economies.

Finally, FDI represents another major channel of international technology transfer (see Javorcik (2013) for a review of the literature). Studies indicate that multinational enterprises are responsible for the majority of technology advancements, which they can bring to their host countries (Arnold and Javorcik 2009; Jiang et al. 2018), especially through supply chain linkages. Newman et al. (2015) show that multinational enterprises transfer their technology and methods to their operations in destination markets through supply chain activities. Alfaro-Urena et al. (2019) find that firms in Costa Rica experienced strong and persistent improvements in performance after starting to supply multinationals. My paper complements this literature, suggesting that through foreign licensing multinational enterprises might transfer international technology to their suppliers located in developing countries.

The paper is structured as follows: Sect. 2 presents the data and discusses measurement issues, Sect. 3 lays out the empirical strategy and presents the main findings and Sect. 4 summarises the conclusions.

2 Data

This paper is based on a sample of 3340 manufacturing firmsFootnote 7 from the World Bank’s Enterprise Surveys. These surveys are harmonised to construct a two-year panel data set for 18 developing and emerging economies covering the period 2006-2016. Firms in different countries are evaluated in different time periods, with an average time span between the two surveys of 4 years.Footnote 8

2.1 Main variables of interest

The aim of my analysis is to identify whether foreign technology is transferred to firms participating in GVCs. This exercise entails two main challenges: measuring technology transfer and identifying firms participating in international supply chains.

First, the transfer of technology is measured by whether the firm uses foreign-licensed technology. The World Bank’s Enterprise Surveys define a technology license as the intellectual property right necessary to create and market a product that complies with a technical standard or specification.Footnote 9 In my analysis, foreign licensing implies that a buyer licenses its technology to a foreign supplier in support of a consistent production process or specialised equipment to manufacture a product. For instance, a global manufacturer of photovoltaic panels may license the process for depositing silicon on its solar panels to a firm in a developing country.

Since the survey provides no information about either the duration or type of licensing agreement, I am not able to quantify the strength of the transfer of technology. Licensing agreements may offer rights to produce for a given period of time and may involve performance requirements, such as non-disclosure mandates, non-compete clauses for personnel and grant-back provisions on adaptive innovations (Maskus 2004), which may reduce the possibility of technology transfers. However, the fact that firms acquiring foreign-licensed technology enjoy significant productivity gains (as shown in Sect. 3.4) downplays this concern. Another potential shortcoming is the lack of information on the technology owner (i.e. the firm licensing the foreign technology). However, it seems reasonable to assume that the majority of licensing owners reside in advanced economies and possess superior technologies.

Second, few empirical studies distinguish between GVC firms and non-GVC firms. Nadvi (2008) and Del Prete et al. (2017) identify GVC firms as traders (exporter-only, importer-only or two-way traders) with a quality certification. This definition is based on the idea that global standards reduce transaction costs across firms by ensuring the codifiability of information. However, the definition is overly general because it includes any type of trading firms, even those involved in traditional trade activities. Instead, my condition sine qua non to participate in GVCs is to be a two-way trader (i.e. exporting and importing at the same time) because this is the only measurable category that includes all firms with internationally fragmented production processes.Footnote 10 In particular, my definition sets apart a firm that imports and exports at the same time from a firm that is either importing or exporting. I exclude the latter groups of firms because importing and exporting at the same time has economic implications that are qualitatively distinct from being engaged in only one activity (Damijan et al. 2013; Rigo 2017; Bernard et al. 2018).Footnote 11 My definition is in line with Benkovskis et al. (2020) that, using detailed customs data for Latvia and Estonia, look at different types of participation in GVCs, including firms importing and exporting the same product. This definition is also consistent with the recent macro literature that has emphasised that a GVC is defined as involving production sharing between two or more countries (i.e. when intermediate goods are both imported and exported) (Los et al. 2016; Baldwin and Lopez-Gonzalez 2015; Koopman et al. 2014).Footnote 12

As a robustness check, I benchmark my measure of GVC participation (as the share of two-way traders in total employment) with a measure of GVC participation widely used in the literature (as the share of foreign value added in exports). The latter GVC measure is calculated at the country-industry level using the OECD inter-country input-output (ICIO) tables.Footnote 13 The analysis considers only the developing economies available in the OECD ICIO data. The correlation between these two measures is at 35% and significant at the 1% level. Notably, the correlations between the share of exporters-only or importers-only in total employment and the foreign value added in exports are weaker and not significantly different from zero (at the 10% level).Footnote 14

Finally, I provide some stylised facts on the link between GVC participation and foreign technology licensing. Table 1 breaks down firms according to their trade orientation and use of foreign-licensed technology. The table highlights the presence of a hierarchy in the adoption of foreign-licensed technology, with trading firms characterised by higher shares than non-traders. Among trading firms, those active in multiple modes of internationalisation (i.e. two-way traders) are more likely to use foreign technology. Rigo (2017) provides similar evidence for a wide set of developing and emerging economies, showing that two-way traders are the most likely group of firms to possess foreign-licensed technologies. This finding reflects either the positive selection of firms into two-way trading or the presence of a learning mechanism (as highlighted by Alcacer and Oxley (2014) and Benkovskis et al. (2020)). Table 2 illustrates that selection matters, with two-way traders being the largest firms in these economies. On average, two-way traders have twice and four times the number of employees compared to exporters-only and importers-only, respectively. To control for the fact that size may determine both participation in GVCs and foreign licensing, my empirical strategy compares firms conditional on their initial number of employees and on the growth in employees over the past three years.

2.2 Firm-level variables

Table 3 presents descriptive statistics for the firm-level variables used in the empirical analysis.Footnote 15 Exporters-only and importers-only account for 5 and 34% of the sample, respectively. Exporters are defined as those firms directly exporting part of their sales. Instead, firms indirectly exporting via third parties are considered as non-traders. Importers are those firms purchasing part of their material inputs or supplies from a foreign country. My measure of GVC participation, importing and exporting at the same time, consequently sets out those firms importing final goods. Firms active in two-way trading represent 21% of the sample. As a result, non-traders make up the remaining 40% of firms. Moreover, foreign-owned firms account for 11% of the sample, where foreign-owned firms are defined as firms that are controlled more than 10% by a foreign individual, company or organisation.

As a measure of firm-level productivity, I use labour productivity, as value added per worker, and total factor productivity (TFP), calculated following the methodology developed by Wooldridge (2009).Footnote 16 The employment variable is defined as the number of permanent full-time workers, while employment growth rate is derived over the past three years.Footnote 17 Other firm-level variables used in the empirical analysis include the age of the firm in years, a measure of skill intensity as the share of non-production workers over total workers, a measure of capital intensity as total assets (net book value of machinery, equipment, land and buildings) per worker and a measure of average wage as labour costs (including wages, salaries, bonuses and social security payments) per worker.

3 Empirical strategy and results

This section sheds light on whether GVC participation facilitates the transfer of foreign technologies to firms in developing countries. First, I identify the variables used in matching control and treated firms for implementing the PSM technique. Second, I estimate the effect of becoming a two-way trader on the probability of using foreign-licensed technology and I present the main findings. Third, to further increase confidence in my results, I compare firms active in multiple modes of internalisation and simple traders. Finally, I investigate the relationship between acquiring a foreign-licensed technology and firm-level productivity.

3.1 Matching strategy

To implement the PSM, I need to model the probability of joining a GVC. I do so by estimating a probit model of a firm becoming a two-way trader with firm characteristics as explanatory variables, all of which are included in the initial year and thus refer to the pre-treatment period.

This analysis is implemented by estimating the following specification:

where i denotes the firm, j the industry and c the country. \(Switch_{ijc}\) is a dummy variable indicating firms, the ‘switchers’, becoming two-way traders from one year to another.Footnote 18 Not considered in the analysis are two categories of firms: the ‘quitters’, which are firms that cease to be engaged in two-way trading, and firms that are always two-way traders in both years.Footnote 19 Similarly to previous studies, \(X_{ijc}\) includes the following firm-level measures: labour productivity (log),Footnote 20 skill intensity (share), employment growth, age, a dummy for exporters-only, a dummy for importers-only and a dummy for foreign-owned firms.Footnote 21 In addition, the specification uses industry and country fixed effects. The latter allow for the isolation of potential differences across countries in GVC participation and industrial development. Meanwhile, industry fixed effects account for differences across industries such as the level of competition, technology use, market demand and trade intensity. The results are based on a probit model, being the dependent variable a binary outcome.Footnote 22 All estimation results are based on robust standard errors.

Table 4 presents the coefficients of my model.Footnote 23 While most firm-level variables are not significant, the probability of becoming a two-way trader is mainly determined by size and by being an exporter or an importer in the pre-treatment year. The predicted probability of joining a GVC forms the basis of the matching procedure. Matching is performed at the initial period, before receiving the treatment, and firms are also matched within the same country and the same industry. This approach eliminates the possibility that a difference in foreign-technology adoption across countries and industries influences the estimated effects. Moreover, choosing the minimum number of matches required leads to a trade-off between bias (higher number higher bias) and variance (higher number lower variance) (Caliendo and Kopeinig 2008). I decided to minimise the bias in estimating the effect of GVC participation by requiring at least one match in the baseline results. The matching framework, as defined, creates a ‘third group’ of firms, consisting of each treated firm’s matched counterfactual used as control group in the diff-in-diff analysis.

A crucial assumption in using the PSM technique is that treated and matched firms must have the same distribution of observable characteristics, conditional on a given propensity score. I test this assumption by implementing the following procedure. First, I divide treated and untreated firms into 8 groups based on their propensity scores. Second, within each group, I test whether the mean of each variable is significantly different between treated and untreated firms.Footnote 24 I find no statistically significant differences between treated and untreated firms for any matching variable. Unfortunately, with two-period data, I am not able to test for the parallel trends assumption, requiring that the difference between treated and untreated firms should be constant in the pre-treatment period. However, given that my analysis excludes firms possessing a foreign-licensed technology in the pre-treatment period (\(t-1\)), the parallel trends assumption would be violated only if treated or untreated firms possessed a foreign technology in \(t-2\) (or in previous years) that they eventually ‘lost’ in \(t-1\). The fact that firms losing foreign-licensed technology over time are a minority in my sample (accounting for 10% of total sales) gives me confidence that my empirical strategy is not affected by differences in pre-trends.

3.2 Results for foreign-licensed technology

This section presents the results of the effect of joining an international supply chain on the probability of using foreign-licensed technology. The average treatment effect on treated (ATT) is defined as

which is the difference between the probability of having foreign-licensed technology for those firms joining GVCs (first term) and the analogous outcome of the same firms had they not started participating in GVCs (second term).Footnote 25 Logically, the latter outcome cannot be observed, and I rely on a matching technique to construct the missing counterfactual (Rosenbaum and Rubin 1983). The underlying assumption for the validity of the matching procedure is that, conditional on a set of observable characteristics, treatment status and potential outcomes are independent. Under these assumptions,

These equations imply that

where the second difference in the equation represents the selection bias, which is assumed to be zero conditional on X. This approach leaves only the causal effect. One potential concern is that the PSM diff-in-diff procedure is not able to control for time-variant unobservable factors that simultaneously may affect the decision to join a GVC and use a foreign-licensed technology. Therefore, my empirical strategy relies on the assumption that the unobserved differences between treated and untreated firms are time-invariant.Footnote 26

The combination of PSM and a diff-in-diff approach means that my empirical strategy looks for divergence in the paths of probability in having foreign-licensed technology between the treated firms and the matched control firms that have similar characteristics in the initial year. The advantage of focusing on firms observed before and after becoming two-way traders is that differencing over time allows to eliminate the influence of all observable and unobservable time-invariant firms’ characteristics (e.g. quality of management). Because my dependent variable is a binary outcome, by taking the first difference, I want to compare firms that started using licensed technology from one year to another, with firms that never had any foreign-licensed technology. Hence, I exclude firms possessing foreign technology in both years and firms that ‘lost’ such technology from one year to another. As a result, both treated and untreated firms do not possess foreign-licensed technology in the pre-treatment period.

Table 5 presents the results of the PSM diff-in-diff estimation.Footnote 27 Firms are matched based on the probability of participating in GVCs, conditional on firms’ characteristics in the initial period. In particular, in column (1), firms are matched within country and industry, and by level of employment, FDI dummy, exporter dummy and importer dummy; in column (2), firms are matched within country and industry, and by level of employment, FDI dummy, exporter dummy, importer dummy, skill intensity, age, labour productivity and employment growth.Footnote 28 The matching is performed over two different sets of variables because some firm-level measures present several missing values. Consequently, I regard the estimates in column (1) as my baseline results.

Table 5 confirms the prediction that becoming a two-way trader has a positive impact on the licensing of foreign technology to firms in developing countries. In column (1), the ATT is equal to 0.16, indicating that firms, after joining GVCs, have a 16% higher probability of using foreign-licensed technology. This effect is statistically significant at the 1% level. This finding holds when requiring the matching over a larger set of firms’ characteristics (in column (2)) and when setting the maximum difference in probability between matched pairs of firms (i.e. the caliper) at 10%.Footnote 29 This analysis hints at the presence of transfers of foreign technologies along international supply chains to developing and emerging economies. The result is consistent with firm-level studies finding that GVC participation fosters knowledge transfers and productivity improvements in firms in developing countries (Atkin et al. 2017; Del Prete et al. 2017; Benkovskis et al. 2020; Alfaro-Urena et al. 2019).

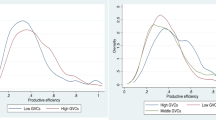

Finally, I look into whether the intensity of engagement in an international supply chain may affect the previous results. Case studies on GVCs (Gereffi 1999; Gereffi et al. 2005; Pietrobelli and Saliola 2008) suggest that different levels and types of buyer involvement with a supplier are crucial for the upgrading of firms in developing countries. To measure the firm’s engagement with GVCs, I create two dummy variables: one for high-intensity GVCs, when the firm exports more than 50% of its sales and imports more than 50% of its supplies and materials, and one for low-intensity GVCs, including the remaining two-way traders. Thus, using a PSM diff-in-diff approach, I study the impact of joining high- versus low-intensity GVCs on the licensing of foreign technology. The estimates in Table 6 indicate that the probability of acquiring foreign-licensed technology is equivalent between firms joining high- or low-intensity GVCs. A potential explanation for these results is that the licensing of technology is a one-off activity happening simultaneously with the firm joining an international supply chain. As shown by case studies on GVCs (see World Bank 2020 for a review), the crucial source of lock-in is that GVC participants make relationship-specific investments, such as providing specialised equipment and customising products via technology licensing. As a result, the operational constraint for participating in GVCs is to possess the technology of the buyer leading the supply chain, independently from the level of involvement with the buyer.

3.3 Complex versus simple traders

To further increase confidence in my results, in this section, I replicate the PSM diff-in-diff estimation in two different samples. First, I exclude all non-traders from the control group, to compare two-way traders with firms involved in simple international activities. Second, I consider non-traders becoming two-way traders as treated firms and non-traders becoming either exporters-only or importers-only as control firms. These two analyses allow testing for the presence of a ‘pecking order’, i.e. whether firms active in multiple modes of internationalisation (two-way traders) are more likely to use foreign-licensed technology compared to exporters-only and importers-only.

Regarding the first analysis, the PSM procedure looks for a match only within the sample of trading firms. The the top panel of Table 7 presents the results of this analysis. The ATT in column (1) is equal to 0.121, indicating that firms becoming two-way traders are 12% more likely to use foreign technology than exporters-only and importers-only. This result implies that while treated firms do not differ from exporters-only and importers-only before receiving the treatment, they are significantly more likely to use foreign-licensed technology after becoming two-way traders. This finding also suggests that the positive relationship between foreign licensing and GVC participation is not driven by the presence of non-traders in the control group.

In the second analysis, I compare non-traders becoming two-way traders with non-traders becoming either exporters-only or importers-only. The ATT in the bottom panel of Table 7 is positive and significant at the 5% level (in column (3)).Footnote 30 This result suggests that non-traders becoming two-way traders are more likely to use foreign-licensed technology than non-traders starting to export or import. Thus, the evidence supports the idea that accessing international supply chains provides more opportunities for the transfer of foreign technologies to developing countries than simpler modes of internationalisation.

3.4 Foreign technology and productivity gains

This section complements the previous findings by establishing a link between technology licensing and firm-level productivity. So far, I have shown that participating in GVCs fosters the licensing of foreign technology to firms in developing countries. However, it is not clear whether using foreign-licensed technology improves firms’ performance.

Some empirical studies find a positive correlation between technology licensing and firm-level productivity. Using a survey of Chilean manufacturing plants from 1990 to 1996, Alvarez et al. (2002) show that plants using foreign-licensed technologies are positively associated with higher total factor productivity growth and capital accumulation. In addition, Yasar and Paul (2007), using a sample of Turkish manufacturing plants, find that licensing foreign technology is positively related to higher productivity levels. To move beyond these evidence based on correlations, I use a PSM diff-in-diff approach to test whether acquiring a foreign-licensed technology leads to productivity gains. This procedure directly compares the productivity of firms with and without a foreign-licensed technology with otherwise similar characteristics, allowing me to disentangle the causal effect of foreign licensing on firm-level productivity. In particular, firms are matched within country and industry, and by level of employment, FDI dummy, exporter dummy, importer dummy, skill intensity, age, employment growth and initial productivity levels. Finally, by taking the first difference of the dependent variable allows controlling for time-invariant firms’ observable and unobservable characteristics.Footnote 31

Table 8 shows the results for productivity. Column (1) presents the results for TFP, calculated following Wooldridge (2009)’s methodology, and column (2) displays the results for labour productivity, calculated as value added per worker. The estimates are large and significant at the 1% level. The ATT for TFP equals 0.88, indicating that firms acquiring foreign-licensed technology experience a rise of 88% of their TFP. This finding holds by requiring at least 3 or 5 matches for each treated firm and by setting the caliper at 10%.Footnote 32 Finally, column (2) illustrates that the ATT is positive and statistically significant at the 1% level, though smaller at 0.50.

These large effects may be due to the presence of an initial productivity boost from the acquisition of foreign technology and subsequently to learning by participating in GVCs. Benkovskis et al. (2020) and Alfaro-Urena et al. (2019) document the presence of strong and persistent productivity gains after firms join an international supply chain. My results are also in line with Del Prete et al. (2017), establishing a causal link between GVC participation and firm-level productivity for a sample of North African manufacturing firms. Finally, this finding, combined with my previous results, suggests that interactions with foreign firms through GVC participation may foster the transfer of technology and knowledge to suppliers in developing countries, consistent with Atkin et al. (2017).

4 Conclusions

The literature has highlighted the importance of international trade as a channel for the international transfer of technology. Empirical studies show that trading across borders may bring several advantages to firms in developing countries, particularly for those exporting to advanced economies. As a result, many developing countries are striving to participate in GVCs in the hope of stimulating economic growth through knowledge transfer. However, a consensus is lacking on the role of GVCs in affecting developing and emerging economies (UNCTAD 2013; Backer et al. 2014; Taglioni and Winkler 2016, World Bank 2020). A prevalent worry is that manufacturing firms in developing countries are remaining stuck in labour-intensive low-value-added activities, such as product assembly or processing trade.

This study aims to shed light on this issue by examining the causal relationship between GVC participation and firms’ performance in developing countries. I identify causality, controlling for the possible endogeneity of GVC participation by using a difference-in-difference approach in combination with a propensity score matching technique. My analysis extends the literature in three ways. First, I look at a previously unexplored channel of technology transfer, namely, foreign licensing. As shown by Rigo (2017), foreign licensing is potentially a critical channel for the transfer of international technologies, comparable to FDI. Second, I investigate whether the complexity of the mode of internationalisation may affect the transfer of technology to firms in developing countries. The literature has shown that the transfer of technology may depend on several factors, but based on the author’s knowledge, this is the first paper that distinguishes between simple and complex traders. Finally, I study whether acquiring a foreign-licensed technology leads to productivity gains.

These are my main findings. First, I identify a positive impact of becoming a two-way trader on the licensing of foreign technology. Worth noting, I find that technology licensing involves a ‘pecking order’, with two-way traders more likely to acquire a foreign license than exporters-only and importers-only. This evidence suggests that the complexity associated with the modes of internalisation determines foreign technology licensing. Second, the results for productivity show that acquiring foreign-licensed technology leads to large productivity improvements at the firm level. The combination of these results suggests that the transfer of foreign technology along international supply chains might explain these productivity gains. Based on these findings, governments might consider implementing policies that facilitate firms’ participation in GVCs. Policies designed to support entry in GVCs may represent a vital tool for enhancing firms’ learning possibilities through the introduction of new foreign technologies. My findings strengthen the view that GVC participation may be crucial for the success of a country, fostering industrialisation and economic development.

Future research should look for detailed information on buyer-supplier relationships to precisely identify different types of GVC participation and their impact on the transfer of technology. The form and organisation of a supply chain are essential dimensions that should be considered when studying the implications of GVC participation for suppliers in developing and emerging economies. As shown by case studies on GVCs, the intensity of the buyer’s involvement with local suppliers may foster further the transfer of technology and know-how to firms in developing countries.

Notes

Close to zero defects and delivery on time require sophisticated process design, supply chain management software, high-speed telecoms networks and effective transport and logistics services. Each day of delay in exporting has a tariff equivalent of 1 percent or more for time-sensitive products (Hummels et al. 2007). Slow and unpredictable land transport keeps most of Sub-Saharan Africa out of the electronics value chain (Christ and Ferrantino 2011).

As documented by World Bank (2020) for the apparel, textile and information and communication technology industries in Ethiopia and Vietnam, buyers are more willing to share knowledge and know-how with their suppliers in GVC relationships.

According to the World Intellectual Property Organization (WIPO), licensed technology must constitute a partnership between an intellectual property owner and a licensee who is authorised to use such rights under certain conditions. The licensee is manufacturing a product for which it has been granted production rights under specific conditions, while the licensor retains ownership of the associated intellectual property. In some cases, the licensor supplies the necessary technical data, prototypes and/or machine tools to the licensee. Licensing agreements determine the form and scope of compensation to the intellectual property owner, which usually takes the form of a flat licensing fee or a running royalty payment derived from a share of the licensee’s revenue.

Studying a large set of developing and emerging economies, covering all continents of the world, provides confidence in the generalisability of my findings.

One potential concern is that the PSM diff-in-diff procedure is not able to control for time-variant unobservable factors that may affect simultaneously the decision to join a GVC and to use foreign-licensed technology. My empirical strategy thus relies on the assumption that the unobserved differences between treated and untreated firms are time-invariant.

Formal (registered) companies with 5 or more employees are targeted for interview. Firms with 100% government/state ownership are not eligible for interview.

See Table 9 in the “Appendix” for the list of surveys.

The question in the survey is as follows: “Does this establishment at present use technology licensed from a foreign-owned company, excluding office software?”

The literature is converging on using two-way trading as the firm-level measure of GVC participation, as documented in World Bank (2020).

This category may also include firms operating in special economic zones involved in processing trade. However, those firms exporting all their sales and importing all their intermediate inputs account for only 1 percent of my sample and are excluded from the empirical analysis.

A potential limitation of my definition is that some two-way traders may be only weakly participating in international supply chains, such as those firms importing raw materials and exporting final products. Unfortunately, I am not able to disentangle different types of GVC participation because the data do not include the product classification of imports/exports.

See this link for further information on the OECD ICIO tables: https://www.oecd.org/sti/ind/inter-country-input-output-tables.htm.

To put this finding in perspective, standard measures of firm performance, such as the number of employees, total sales or total costs of goods sold, correlate between 10 and 20% with one another (at the country-industry level of aggregation).

The following shares are based on the pooled sample of firms.

The estimation assumes a Cobb-Douglas production function in which value added is the output variable. I use the number of full-time employees as a proxy for labour costs, while tangible capital is the net book value of fixed assets (machinery, equipment, land and buildings), and cost of materials is the total annual cost of raw materials and intermediate goods used in production. The estimation is performed at the country level, as the number of observations is not enough to perform separate country-industry estimations and no industry-specific deflator is available. I also derived firm-level TFP estimates using the Levinsohn and Petrin (2003) procedure. Since the results are quantitatively and qualitatively equivalent, I follow previous studies (CompNet 2014; Borin and Mancini 2016; Del Prete et al. 2017) and use Wooldridge (2009) TFP estimates as my main measure of productivity. The pairwise correlations among these three productivity measures are high, close to 90%.

It is possible to retrieve this variable thanks to a question in the questionnaire asking the firm to report the total number of permanent full-time workers three years earlier.

When working with yearly- or monthly-level customs data, re-entry into two-way trading might be a concern. Nevertheless, given the longer time frame (with an average of 4 years) used in my analysis, this issue should play a minor role. In my analysis, I am looking at an organisational change at the firm level, rather than some form of seasonality or temporary idiosyncratic shock.

Labour productivity, as value added per worker, is my preferred measure for productivity because TFP is not available for the whole sample. Nevertheless, using TFP as a productivity measure does not affect the estimates in Table 4.

Capital intensity and average wage are not included in the set of matching variables because they are highly collinear with labour productivity.

The results are quantitatively and qualitatively equivalent when using a logit model. Regression tables are available upon request.

The average marginal effects of the discrete differences in probability are reported. For instance, in Table 4, the coefficient of Exporter indicates the difference in probability between exporters-only and non-traders.

This procedure is based on Becker and Ichino (2002) and excludes the observations outside the common support.

The notation reads as follows. Subscripts describe when the outcome is observed: \(Y_1\) denotes the outcome for firms joining GVCs (with treatment), and \(Y_0\) is the outcome for firms not joining GVCs (without treatment). In addition, \(GVC=1\) indicates that the outcome is measured only for those firms joining GVCs. Meanwhile, \(GVC=0\) denotes that the outcome is measured for the control observations.

A potential limitation of my empirical strategy is that I do not know whether the participation in GVCs happens before the licensing of foreign technology. If this is not the case, my empirical strategy would be incorrect since foreign licensing could be causing participation in GVCs and not the other way around (as argued in this paper). However, as emphasised by case studies on GVCs, the firm leading the supply chain makes relationship-specific investments (such as providing specialised equipment to suppliers or customising products via licensing) to minimise the costs of production and maximise its revenues. As a result, the transfer of technology should be concurrent with the firm joining the supply chain. Section 3.2 provides further evidence supporting this argument.

This procedure is implemented in Stata employing the command teffects psmatch, using the nearest-neighbour matching with one neighbour. This command implements a matching with replacement, i.e. it allows using untreated firms as a match more than once. Similar baseline estimates are obtained by using the inverse probability weighting approach (teffects ipw) and radius matching (psmatch2, radius). The latter methodology is especially useful for preventing errors in matching treated and untreated firms within the same country-industry. However, the command psmatch2 is not used because its standard errors are incorrect, not taking into account that the propensity score is estimated.

The results are consistent by using TFP à la Wooldridge (2009) as an alternative measure for firm-level productivity. These results are available upon request.

The ATT in column (4) loses significance, but this may be due to the smaller sample of firms.

The main limitation of this empirical strategy is that I do not know when the firm acquires the foreign-licensed technology. With an average time span over the two periods of 4 years, firms could acquire a foreign-licensed technology after a period of sustained productivity growth due to factors unrelated to GVC participation. In these cases, productivity improvement would be the factor driving the acquisition of foreign-licensed technology rather than the opposite, as this paper argues. However, a recent study by Alfaro-Urena et al. (2019) finds, for firms in Costa Rica, no evidence of selection in supplying to multinational enterprises, strengthening the validity of my identification strategy.

These results are presented in Table 13 in the “Appendix”.

References

Alcacer, J., & Oxley, J. (2014). Learning by supplying. Strategic Management Journal, 35, 204–223.

Alfaro-Urena, A., Manelici, I., & Vasquez, J. P. (2019). The effects of joining multinational supply chains: New evidence from firm-to-firm linkages. SSRN 3376129.

Altomonte, C., Bonacorsi, L., & Colantone, I. (2018). Trade and growth in the age of global value chains. (Baffi-Carefin Working Paper, (2018-97)).

Alvarez, R., Crespi, G., & Ramos, J. (2002). The impact of licenses on a “late starter” LDC: Chile in the 1990s. World Development, 30(8), 1445–1460.

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–38.

Antras, P. (2015). Global production: Firms, contracts, and trade structure. Princeton: Princeton University Press.

Antràs, P., & Staiger, R. W. (2012). Offshoring and the role of trade agreements. American Economic Review, 102(7), 3140–3183.

Arnold, J. M., & Javorcik, B. S. (2009). Gifted kids or pushy parents? Foreign direct investment and plant productivity in Indonesia. Journal of International Economics, 79(1), 42–53.

Atkin, D., Khandelwal, A. K., & Osman, A. (2017). Exporting and firm performance: Evidence from a randomized experiment. The Quarterly Journal of Economics, 132(2), 551–615.

Baldwin, R. (2016). The great convergence. Cambridge: Harvard University Press.

Baldwin, R., & Lopez-Gonzalez, J. (2015). Supply-chain trade: A portrait of global patterns and several testable hypotheses. The World Economy, 38(11), 1682–1721.

Becker, S. O., & Ichino, A. (2002). Estimation of average treatment effects based on propensity scores. The Stata Journal, 2(4), 358–377.

Benkovskis, K., Masso, J., Tkacevs, O., Vahter, P., & Yashiro, N. (2020). Export and productivity in global value chains: Comparative evidence from Latvia and Estonia. Review of World Economics, 156, 557–577.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2018). Global firms. Journal of Economic Literature, 56(2), 565–619.

Borin, A., & Mancini, M. (2016). Foreign direct investment and firm performance: An empirical analysis of Italian firms. Review of World Economics, 152(4), 705–732.

Bustos, P. (2011). Trade liberalization, exports, and technology upgrading: Evidence on the impact of MERCOSUR on Argentinian firms. American Economic Review, 101(1), 304–340.

Caliendo, M., & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of Economic Surveys, 22(1), 31–72.

Christ, N., & Ferrantino, M. J. (2011). Land transport for exports: The effects of cost, time, and uncertainty in Sub-Saharan Africa. World Development, 39(10), 1749–59.

CompNet. (2014). Micro-based evidence of EU competitiveness: The CompNet database. (ECB Working Paper No. 1634).

Constantinescu, C., Mattoo, A., & Ruta, M. (2019). Does vertical specialization increase productivity? The World Economy, 42, 2385–2402.

Damijan, J. P., Konings, J., & Polanec, S. (2013). Pass-on trade: Why do firms simultaneously engage in two-way trade in the same varieties? Review of World Economics, 149(1), 85–111.

De Backer, K., & Miroudot, S. (2014). Mapping global value chains. (ECB Working Paper No. 1677).

De Loecker, J. (2007). Do exports generate higher productivity? Evidence from Slovenia. Journal of International Economics, 73(1), 69–98.

Del Prete, D., Giovannetti, G., & Marvasi, E. (2017). North African countries and firms in international production networks. Review of World Economics, 153(4), 675–701.

Gereffi, G. (1999). International trade and industrial upgrading in the apparel commodity chain. Journal of International Economics, 48(1), 37–70.

Gereffi, G., Humphrey, J., & Sturgeon, T. (2005). The governance of global value chains. Review of International Political Economy, 12(1), 78–104.

Halpern, L., Koren, M., & Szeidl, A. (2015). Imported inputs and productivity. American Economic Review, 105(12), 3660–3703.

Hummels, D., Minor, P., Reisman, M., & Endean, E. (2007). Calculating tariff equivalents for time in trade. Technical report, Nathan Associates for U.S. Agency for International Development.

Javorcik, B. S. (2013). International technology transfer and foreign direct investment. In G. Caprio (Ed.), The evidence and impact of financial globalization, chapter 21 (pp. 311–319). New York: Academic Press.

Jiang, K., Keller, W., Qiu, L. D., & Ridley, W. (2018). International joint ventures and internal vs. external technology transfer: Evidence from China. (NBER Working Paper No. 24455).

Koopman, R., Wang, Z., & Wei, S.-J. (2014). Tracing value-added and double counting in gross exports. American Economic Review, 104(2), 459–494.

Kummritz, V. (2016). Do global value chains cause industrial development? (CTEI Working Paper No. 2016-01). The Graduate Institute, Geneva.

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. The Review of Economic Studies, 70(2), 317–341.

Lileeva, A., & Trefler, D. (2010). Improved access to foreign markets raises plant-level productivity...For some plants. The Quarterly Journal of Economics, 125(3), 1051–1099.

Los, B., Timmer, M. P., & de Vries, G. J. (2016). Tracing value-added and double counting in gross exports: Comment. American Economic Review, 106(7), 1958–66.

Maskus, K. E. (2004). Encouraging international technology transfer (Issue Paper No. 7). Geneva: International Centre for Trade and Sustainable Development.

Masso, J., & Vahter, P. (2015). Exporting and productivity: The effects of multi-product and multi-market export entry. Scottish Journal of Political Economy, 62(4), 325–350.

Nadvi, K. (2008). Global standards, global governance and the organization of global value chains. Journal of Economic Geography, 8(3), 323–343.

Newman, C., Rand, J., Talbot, T., & Tarp, F. (2015). Technology transfers, foreign investment and productivity spillovers. European Economic Review, 76, 168–187.

Nunn, N. (2007). Relationship-specificity, incomplete contracts, and the pattern of trade. The Quarterly Journal of Economics, 122(2), 569–600.

OECD (2015). Trade policy implications of global value chains. Technical report. OECD.

Piermartini, R., & Rubinova, S. (2014). Knowledge spillovers through international supply chains. (WTO Working Paper No. 2014-11).

Pietrobelli, C., & Saliola, F. (2008). Power relationships along the value chain: Multinational firms, global buyers and performance of local suppliers. Cambridge Journal of Economics, 32(6), 947–962.

Rigo, D. (2017). A portrait of firms participating in global value chains. (CTEI Working Paper No. 2017-01). The Graduate Institute, Geneva.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Taglioni, D., & Winkler, D. (2016). Making global value chains work for development. Washington, DC: World Bank.

Topalova, P., & Khandelwal, A. (2011). Trade liberalization and firm productivity: The case of India. Review of Economics and Statistics, 93(3), 995–1009.

UNCTAD (2013). Global value chains: Investment and trade for development. World Investment Report 2013. New York, Geneva: United Nations.

Wooldridge, J. M. (2009). On estimating firm-level production functions using proxy variables to control for unobservables. Economics Letters, 104(3), 112–114.

World Bank (2020). World development report 2020. Washington, DC: World Bank.

Yasar, M., & Paul, C. J. M. (2007). International linkages and productivity at the plant level: Foreign direct investment, exports, imports and licensing. Journal of International Economics, 71(2), 373–388.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank Richard Baldwin and Céline Carrère for their invaluable advice and support. I am also indebted to the editor and one anonymous referee for their insightful comments and suggestions.

Appendix: Additional tables

Appendix: Additional tables

See Tables 9, 10, 11, 12 and 13.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Rigo, D. Global value chains and technology transfer: new evidence from developing countries. Rev World Econ 157, 271–294 (2021). https://doi.org/10.1007/s10290-020-00398-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-020-00398-8

Keywords

- Global value chains

- International technology transfer

- Developing countries

- Technology licensing

- Productivity