Abstract

We employ the directional technology distance function approach and present estimates of profit efficiency in the 25 European Union (EU) member states over the period 1998–2008. This method decomposes profit efficiency into its technical and allocative components. We investigate potential efficiency differences across the old EU region and the new EU member states, across countries and across banks of different size. Our results indicate a significant level of profit inefficiency for the EU region, which is predominantly attributed to allocative inefficiency. Our findings also suggest that banks operating in the old EU region are, on average, more profit efficient than credit institutions in the new EU member states. Overall, we observe considerable variation of efficiency scores across countries and different patterns in efficiency change over time, as well as a negative relationship between bank size and efficiency.

Similar content being viewed by others

Notes

DEA models based on Shephard distance functions have been used extensively in EU banking studies (see for example, Pastor et al. 1997; Casu and Molyneux 2003; Lozano-Vivas et al. 2001, 2002; Grigorian and Manole 2002; Casu and Girardone 2006). To our knowledge, Devaney and Weber (2002) were the first to use a directional technology distance function approach to estimate profit efficiency for U.S. banks and Koutsomanoli-Filippaki et al. (2009a, b) for CEE banks.

Studies that have investigated efficiency in the European banking industry, and particularly focus on cross-country comparisons, include Allen and Rai (1996), Altunbas et al. (2001), Lozano-Vivas et al. (2001, 2002), De Guevara and Maudos (2002), Maudos et al. (2002), Vander Vennet (2002), Casu and Molyneux (2003), Casu and Girardone (2004), and Koutsomanoli-Filippaki et al. (2009a, b).

According to Molyneux et al. (1996) “greater efficiency might be expected to lead to improved financial products and services, a higher volume of funds intermediated, greater and more appropriate innovations, a generally more responsive financial system, and improved risk-taking capabilities if efficiency profit gains are channelled into improved capital adequacy positions”.

It is assumed that the technology satisfies the axioms listed in Färe and Primont (2003), among which are convexity and free or strong disposability of outputs and inputs.

The Shephard output distance function optimizes over output quantities, but not inputs. Hence if the directional vector g is set at (0, y) then the directional (output) distance function is equal to the reciprocal of the Shephard output distance function minus one. Similarly, the Shephard input distance function optimizes over input quantities but not outputs and if we set g = (x, 0) then the directional (input) distance function is equal to one minus the reciprocal of the Shephard input distance function.

Note that the normalization in (6) means that this profit inefficiency measure is independent of units of measurement and is also well defined even if observed profit is zero or negative. The choice of normalization is not arbitrary; rather it coincides with the value of the Lagrangean multiplier associated with constrained profit maximization as defined in (8) below.

This database reports published financial statements from banks worldwide, homogenized into a global format, which are comparable across countries and therefore suitable for a cross-country study.

For each year the respective figures for the number of banks are: 2,270 (1998); 2,414 (1999); 2,508 (2000); 2,867 (2001); 2,829 (2002); 2,851 (2003); 2,176 (2004); 3,021 (2005); 3,004 (2006); 2914 (2007); 2733 (2008). The additions to the sample are not necessarily new market entrants, but rather successful banks that are added to the database over time. Exits from the sample are due primarily to either mergers with other banks or bank failures.

Note that our efficiency estimates are based on unconsolidated data and thus are bank-specific and do not take explicitly into account the way the production is organized at the conglomerate level. However, Berger et al. (2000) argue that despite the fact that it is not possible to determine the extent to which transfer pricing, shared inputs, and other intra-organizational arrangements might impact efficiency assessments, most evidence suggests that this potential bias is not significant.

A variety of approaches have been proposed in the literature for the definition of bank inputs and outputs; yet, there is little agreement among economists as what unequivocally constitutes an acceptable definition, mainly as a result of the nature and functions of financial intermediaries. See Berger and Humphrey (1997) for a review of studies on financial institution efficiency and the various methods used to define inputs and outputs in financial services.

It was not possible to use the number of employees as a measure of labor for each bank due to incomplete data on the number of employees in the BankScope database. However, we have used this information to construct the labor price data as explained below.

Note that recent studies (e.g. Clark and Siems 2002; Isik and Hassan 2003; Casu and Girardone 2005) introduce off-balance-sheet activities as an additional output, as arguably these activities may have an effect on bank performance measures. However, the IBCA database does not provide detailed information on off-balance sheet activity and hence the inclusion of this variable would result in a significant reduction of our sample. In addition, Becalli et al. (2006) argue that the great variability in accounting practices across countries, especially with respect to the treatment of off-balance-sheet activities, may introduce a remarkable sample bias if off-balance-sheet data are used in cross country studies.

As pointed out by an anonymous referee, caution needs to be exercised with the use of the physical capital input in banking, as the value of fixed assets included in bank balance sheets may be underestimated when physical resources are leased and not owned. These variations in the ownership-leasing mix coupled with differences in accounting practices for fixed assets across countries will also have some effect on price measures defined in relation to fixed assets. This may in part explain the significant variation in the price of capital across countries observed in Table 1.

German banks as well as banks from Luxembourg are more thinly capitalized holding on average about half of the equity needed to support their assets compared to other EU banks.

This is consistent with the higher interest margin observed in EU-10 countries compared to EU-15 banking systems as discussed above.

Through an intense process of restructuring and growth in the enlarged market, EU-10 banks adopted strategies aimed at improving efficiency, expanding output and increasing the range of services offered (Goddard et al. 2001).

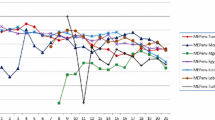

These countries, with the exception of Germany, also exhibit the largest dispersion in profit efficiency scores as measured by the coefficient of variation over the sample period 1998–2008. In particular, according to our estimates, Latvia has experienced a substantial drop in profit efficiency post 2005.

Following an anonymous referee’s suggestion and given that our sample is dominated by small and medium sized German banks, we recalculated average profit inefficiency for banks of different size-classes excluding German banks from our sample in order to assess whether the over-performance of small banks is due to the institutional/regulatory structure of Germany and not because of their small size. Overall, our conclusions remain valid and average inefficiency estimates for small and medium-sized banks remain broadly unchanged. Nevertheless, when excluding German banks, average profit inefficiency for large banks increases.

References

Aigner D, Lovell C, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econom 6:21–37

Alam IMS (2001) A non-parametric approach for assessing productivity dynamics of large banks. J Money Credit Bank 33:121–139

Allen L, Rai A (1996) Operational efficiency in banking: an international comparison. J Bank Financ 20:655–672

Altunbas Y, Gardener EPM, Molyneux P, Moore B (2001) Efficiency in European banking. Eur Econ Rev 45(10):1931–1955

Becalli E, Casu B, Girardone C (2006) Efficiency and stock performance in European banking. J Bus Financ Account 33:245–262

Berg S, Forsund F, Jansen E (1992) Technical efficiency of Norwegian banks: the nonparametric approach to efficiency measurement. J Product Anal 2:127–142

Berger A, Bonaccorsi di Patti E (2006) Capital structure and firm performance: a new approach to testing agency theory and an application to the banking industry. J Bank Financ 30:1065–1102

Berger A, Humphrey D (1997) Efficiency of financial institutions: international survey and direction of future research. Eur J Oper Res 98:175–212

Berger A, Mester L (1997) Inside the black box: what explains differences in the efficiencies of financial institutions? J Bank Financ 21(7):895–947

Berger A, Mester L (2003) Explaining the dramatic changes in performance of US banks: technological change, deregulation, and dynamic changes in competition. J Financ Intermed 12:57–95

Berger AN, DeYoung R, Genay H, Udell GF (2000) Globalization of financial institutions: evidence from cross-border banking performance. In: Litan RE, Santomero A (eds) Brookings-Wharton papers on financial services No. 3

Casu B, Girardone C (2004) Large banks’ efficiency in the single European market. Serv Ind J 24(6):129–142

Casu B, Girardone C (2005) An analysis of the relevance of off-balance sheet items in explaining productivity change in European banking. Appl Financ Econ 15:1053–1061

Casu B, Girardone C (2006) Bank competition, concentration and efficiency in the Single European banking market. Manch Sch 74:441–468

Casu B, Molyneux P (2003) A comparative study of efficiency in European banking. Appl Econ 35(17):1865–1876

Chambers R, Chung YH, Färe R (1996) Benefit and distance functions. J Econ Theory 70:407–419

Clark JA, Siems TF (2002) X-efficiency in banking: looking beyond the balance sheet. J Money Credit Bank 34:987–1013

Cuesta RA, Orea L (2002) Mergers and technical efficiency in Spanish saving banks: a stochastic distance function approach. J Bank Financ 26:2231–2247

De Guevara JF, Maudos J (2002) Inequalities in the efficiency of the banking sectors of the European Union. Appl Econ Lett 9:541–544

Devaney M, Weber WL (2002) Small-business lending and profit efficiency in commercial banking. J Finan Serv Res 22(3):225–246

European Central Bank (2003) Structural analysis of the EU banking sector: year 2002. (ECB, November)

European Central Bank (2005) Banking structures in the new EU member states. (ECB, January)

European Central Bank (2010) Report on EU banking structure. (ECB, September)

Färe R, Grosskopf S (2004) New directions: efficiency and productivity. Kluwer Academic, Boston/London/Dordrecht

Färe R, Primont D (2003) Luenberger productivity indicators: aggregation across firms. J Product Anal 20:425–435

Färe R, Grosskopf S, Weber W (2004) The effect of risk-based capital requirements on profit efficiency in banking. Appl Econ 36:1731–1743

Färe R, Grosskopf S, Margaritis D (2008) Efficiency and productivity: Malmquist and more. In: Fried HO, Lovell CAK, Schmidt SS (eds) The measurement of productive efficiency and productivity growth. Oxford University Press, New York

Goddard J, Molyneux P, Wilson J (2001) European banking: efficiency, technology and growth. John Wiley & Sons LTD, West Sussex, England

Grigorian D, Manole V (2002) Determinants of commercial bank performance in transition: an application of data envelopment analysis. The World Bank, Working Paper, No. 2850

Holo D, Nagy M (2006) Bank efficiency in the Enlarged European Union. MNB working papers 2006/3

Hughes J, Moon C (1995) Measuring bank efficiency when managers trade return for reduced risk. Working Paper (Department of Economics, Rutgers University)

Hughes JP, Lang W, Mester LJ, Moon C (1996) Efficient banking under interstate branching. J Money Credit Bank 28:1045–1071

Isik I, Hassan MK (2003) Financial deregulation and total factor productivity change: an empirical study of Turkish commercial banks. J Bank Financ 27:1455–1485

Kosak, M, Zajc P (2009) The East-West efficiency gap in European Banking. In: Morten et al. (eds) Competition and profitability in european financial services-strategic, systemic and policy issues. Routledge

Koutsomanoli-Filippaki A, Margaritis D, Staikouras C (2009a) Efficiency and productivity growth in the banking industry of Central and Eastern Europe. J Bank Financ 33:557–567

Koutsomanoli-Filippaki A, Margaritis D, Staikouras C (2009b) Profit efficiency in the banking industry of Central and Eastern Europe: A directional technology distance function approach. Manage Financ 35(3):276–296

Lozano-Vivas A, Pastor JT, Hasan I (2001) European bank performance beyond country borders: what really matters? Eur Financ Rev 5:141–165

Lozano-Vivas A, Pastor JT, Pastor JM (2002) An efficiency comparison of European banking systems operating under different environmental conditions. J Product Anal 18:59–77

Maudos J, Pastor JM, Perez F, Quesada J (2002) Cost and profit efficiency in European banks. J Int Financ Mark Inst Money 12:33–58

Mertens A, Urga G (2001) Efficiency, scale and scope economies in the Ukrainian banking sector in 1998. Emerg Mark Rev 2:292–308

Molyneux P, Altunbas Y, Gardener E (1996) Efficiency in European banking. Wiley, Chichester

Pastor JT, Lozano-Vivas A, Pastor JM (1997). Efficiency of European banking systems: a correction by environmental variables. Working Paper WP-EC 97-12. Instituto Valenciano de Investigaciones Económicas, S.A

Sealey C, Lindley J (1977) Inputs, outputs and a theory of production and cost of depository financial institutions. J Financ 32:1251–1266

Sheldon G (1999) Costs, competitiveness and the changing structure of European banking. Fondation Banque de France pour la Recherche Working Paper, France

Shephard RW (1970) Theory of cost and production functions. Princeton University Press, Princeton

Vander Vennet R (2002) Cost and profit efficiency of financial conglomerates and universal banks in Europe. J Money Credit Bank 34(1):254–282

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Koutsomanoli-Filippaki, A., Margaritis, D. & Staikouras, C. Profit efficiency in the European Union banking industry: a directional technology distance function approach. J Prod Anal 37, 277–293 (2012). https://doi.org/10.1007/s11123-011-0261-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-011-0261-z

Keywords

- Profit efficiency

- Technical efficiency

- Allocative efficiency

- European Union

- Data envelopment analysis

- Directional distance functions