Abstract

We present a comprehensive analysis of the shock absorption role of external positions using the currency exposures dataset by Bénétrix et al. (2020). While the literature has frequently studied how the net international investment position and its currency composition determine the direction and scale of valuation effects, we focus on their amplitude. This is of central importance for global financial stability given the large and increasing scale of external balance sheets. To that end, we propose an indicator showing the extent to which external positions absorb or amplify exchange rate shocks. Analysing a set of 50 countries over the period 1990-2017, we find the external shock absorption role to be present for advanced economies, while this was initially not the case for emerging markets economies (EMEs). In recent years, however, EMEs’ external positions increasingly showed a shock absorption capacity. Our regression-based analysis reveals that the level of economic and financial development is associated with a greater capacity to absorb exchange rate shocks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

What is it needed for an economy’s external financial position to act as a shock absorber? Is it enough to run small external imbalances? What is the role of its currency composition, geography, and sectoral breakdown? Are external financial positions safer now than before the Global Financial Crisis? What are the main macro-financial and institutional factors associated with the amplitude and volatility of valuation effects?

These are key questions at the centre of the global financial stability debate that the empirical literature has mainly addressed in two ways. One is to focus on net and gross external positions from a flow or stock perspective. The other is to study the contribution to financial stability of specific dimensions of external positions, such as the currency and sectoral composition or its geography.

There is a large body of literature taking the first approach. This includes papers like Frankel and Rose (1996), Eichengreen et al. (1996), Kaminsky et al. (1998) and Kaminsky and Reinhart (1999) on early warning systems.Footnote 1 It also includes works on sudden stops in financial flows, where net foreign liabilities serve as a metric to proxy financial vulnerabilities. Other papers like Catão and Milesi-Ferretti (2014) show that debtor positions are strongly related with crisis risk, while studies such as Reinhart and Reinhart (2009) focus on capital flow bonanzas and how these relate with global variables.

For the second group of papers, the currency composition of external positions has taken a central role. Research in this field looks at the mechanical effects of exchange rate fluctuations on the value of external assets and liabilities. A well-known branch of this research is the “original sin” literature initiated by Eichengreen and Hausmann (1999), Eichengreen et al. (2003), Hausmann and Panizza (2003), Burger and Warnock (2007), Eichengreen and Hausmann (2010) and Eichengreen et al. (2023), among others.

Motivated by the destabilising role of negative valuation effects, this literature studies the reasons why some countries are unable to borrow internationally in domestic currency. Key factors include poor institutions, policies and weak economic fundamentals.Footnote 2 Combining gross stocks and currency of denomination, Cubeddu et al. (2021) show that gross external debt and its foreign currency share have a direct impact on the crisis probability of emerging and developing economies.

Beyond the potentially stabilising or destabilising roles resulting from large exchange rate changes, valuation effects can be key for the sustainability of external imbalances. A clear example is the US, exhibiting cumulative current account deficits larger than its net liability position. This is explained by positive valuation effects on its external position associated with its composition and currency of denomination (Lane and Milesi-Ferretti 2001; Tille 2003; Lane and Milesi-Ferretti 2007; Gourinchas and Rey 2007; Lane and Milesi-Ferretti 2009; Lane and Milesi-Ferretti 2018).

Our paper links with this last group of studies. It focuses on the combined role of external stock imbalances, their currency of denomination and how they co-move with each other. Our contribution relies on data developments initiated by Lane and Shambaugh (2010a), and is motivated by the stylised fact uncovered by Bénétrix et al. (2015) documenting an improvement in the cross-country distribution of foreign-currency exposures. This contributed to limiting the negative impact of valuation effects following the outbreak of the Global Financial Crisis.Footnote 3 Using an enhanced version of this data set including 50 countries for the period 1990-2017, Bénétrix et al. (2020) confirm the continued improvement in currency exposures. A decomposition of the key elements driving its dynamics showed that changes in net external positions had a greater role than changes in their currency composition.

Motivated by these findings, we focus on the relation between net positions and currency of denomination to assess the extent to which they reduce or amplify the effects of exchange rate movements on the value of external assets and liabilities. We refer to this as the shock absorbing role of external positions. More precisely, we focus on the properties of external positions that reduce the amplitude of exchange rate-related valuation effects. Thus, we take a global financial stability, rather than a country-specific stabilisation perspective.

We find the shock absorption property of external positions to be present in advanced economies. While this was initially not the case for emerging markets, we observe a shift towards shock absorption capacity in recent years.

Our regression-based analysis shows that more developed countries have a higher capacity to absorb exchange rate shocks via the currency mix of their net external positions. This holds both in terms of the general level of economic development and in terms of domestic financial development, in particular within emerging market economies, but also between the advanced and emerging country groups. The underlying mechanism behind enhanced shock absorption capacity is that countries with larger net external funding requirements need to be able to fill the funding needs by issuing more domestic currency liabilities. Before the crisis, external balance sheets were growing and imbalances rising, while domestic currency issuance by EMEs was not very wide-spread.

We report that the capacity to absorb shocks increased over time, which is consistent with the evidence presented in Bénétrix et al. (2015). This is important from a global financial stability perspective as large capital gains for one country could mean large, and potentially destabilising, losses to others. This capacity to dampen the amplitude of large financial wealth redistributions across countries is a desired feature of a stable global financial system. This has become of paramount importance in recent decades as a result of the large and increasing scale of external financial positions.

Our paper is structured as follows. First, we present the conceptual framework to lay the grounds for the proposed shock absorption indicator. Then, we characterise its distribution across countries and time. This section is followed by a bivariate and multivariate assessment of how our proposed measure relates with conditioning factors. The last section concludes.

2 Conceptual Framework

Key to our analysis is the amplitude of exchange rate induced valuation effects (\(VALXR_{i,t}^U\)) given by net capital gains on the international investment position of countries as a percentage of their GDP. For our assessment, we follow the definition by Bénétrix et al. (2015)

where \(IFI_{i,t}\) is the international financial integration indicator proposed by Lane and Milesi-Ferretti (2001, 2007, 2018) defined by \(IFI_{i,t}=(A+L)/GDP\), with A denoting external assets and L external liabilities. \(IFI_{i,t}\) captures the scale of the international investment position which has a direct impact on the the size of the valuation effect. \(\%\triangle E_{i,t}^{U}\) records a uniform change in the exchange rate, for instance, a depreciation of the domestic currency vis-à-vis all other foreign currencies. This is captured by the percentage point change in the effective exchange rate index. The latter is traditionally based on weights from bilateral trade (Schmitz et al. 2013) or more appropriately for this exercise on the currency of denomination of external positions, as proposed by Lane and Shambaugh (2010a).

\(FX_{i,t}^{AGG}\) is the aggregate foreign currency exposure indicator that we use to develop our shock absorption measure. Our analysis does not focus on the role of \(IFI_{i,t}\) which only has a proportional effect on the scale of valuation effects, but does not alter its sign. \(IFI_{i,t}\)’s properties and determinants have been extensively studied by the literature initiated by Lane and Milesi-Ferretti (2001). We do not focus on \(\%\triangle E_{i,t}^{U}\) either. While the exchange rate affects both the direction and size of the valuation effect, a large body of literature provides evidence on its determinants, levels and dynamics.

Instead, we focus on \(FX_{i,t}^{AGG}\) which is key to both the direction and the magnitude of valuation effects and a crucial factor for the assessment of the shock absorption properties of international investment positions. The aggregate foreign-currency exposure indicator is defined as follows:

where \(w_{Ai,t}^{F}\) and \(w_{Li,t}^{F}\) are the proportions of assets and liabilities denominated in foreign currency, \(s_{i,t}^{A}\) is the relative importance of external assets \(A/(A+L)\) while \(s_{i,t}^{L}\) captures the relative importance of liabilities \(L/(A+L)\).

As discussed in Bénétrix et al. (2015) and Bénétrix et al. (2020), the \(FX_{i,t}^{AGG}\) indicator ranges from -1 to +1. The former denotes the extreme case of a country “short foreign currency” with all external liabilities denominated in foreign currency and assets in domestic currency. The latter is the extreme case where all external liabilities are denominated in domestic currency, while all assets are in foreign currency. A home currency depreciation generates negative valuation effects if \(FX_{i,t}^{AGG}\) is below zero and positive ones if \(FX_{i,t}^{AGG}\) is above zero.

Fundamental to our assessment are two dimensions. First, countries exhibiting the same proportions of assets and liabilities denominated in foreign currency, may still be exposed to exchange rate risk via their overall net external position. If the proportions of assets and liabilities in foreign currency are the same (\(w_{Ai,t}^{F}=0.7\) and \(w_{Li,t}^{F}=0.7\)) and the country is a net debtor (\((A_{i,t}-L_{i,t})/(A_{i,t}+L_{i,t})=-0.5\)), then the \(FX_{i,t}^{AGG}\) indicator will be negative (\(-\)0.35) and a currency depreciation will generate a valuation loss. Second, countries exhibiting a balanced net external position (\(s_{i,t}^{A}=s_{i,t}^{L}=0.5\)), but showing differences in the proportions of assets (\(w_{Ai,t}^{F}\)) and liabilities (\(w_{Li,t}^{F}\)) denominated in foreign currency, will exhibit different valuation effects for the same exchange rate movement.

In order to isolate these two channels it is possible to reformulate \(FX_{i,t}^{AGG}\) as

where \(w_{Ai,t}^{DC}\) and \(w_{Li,t}^{DC}\) are the proportions of external asset and liabilities denominated in domestic currency.Footnote 4 Expression (3) can be re-written as

From here onward, we refer to \(\frac{(A-L)}{(A+L)}\) as the “net position” and to \(FX_{o}^{AGG}\) as the “currency mix”. The latter is the net external liability position in domestic currency relative to size of the external balance sheet. \(FX_{o}^{AGG}\) can also be interpreted as the pure currency exposure which is independent of the sign of the aggregate net position (i.e. independent of the country being an external creditor or debtor).

These two terms are at the centre of our shock absorption indicator which studies their interrelation to provide information on the capability of countries to hedge exchange rate risk in their external balance sheet via the currency composition. Assuming that the three terms defined in Eq. (4) can be considered as random variables, our goal of finding the conditions that reduce \(VALXR_{i,t}^U\) fluctuations for given \(IFI_{i,t}\) and \(\%\triangle E_{i,t}^{U}\), can be based on the last term of the equation:

While fluctuations in net positions and the currency mix affect the direction and magnitude of valuations effect, we zoom in on how the hedging of currency risks of external positions affects valuation effects. To that end we interpret that a country’s external position has shock absorption properties via hedging exchange rate risk when the net position and the currency mix co-move negatively. Hence, for the remainder of the paper we state that the external position absorbs shocks when

The existing literature centres around the stabilising or destabilising roles of valuation effects by considering aggregate foreign currency exposures, which indicate the direction and size of the change in external imbalances resulting from exchange rate shocks. However, this approach is not useful to study the way in which changes in net positions and currencies contribute to the amplitude of the valuation effect. Having shock absorber properties in external positions is a desired feature to reduce the impact of exchange rate shocks on global imbalances.

The example below illustrates that looking at aggregate net external positions and currency exposures may not be enough. These indicators can mask undesired features of countries’ international investment positions associated with how net positions and currency weights evolve and co-move.

Take for instance the US and Chile. Both countries are long foreign currency, with an average 1990-2017 \(FX_{i,t}^{AGG}\) indicator of 0.19 and 0.15, respectively. In addition, they have been net debtors throughout the analysed period. Average net positions \((A-L)/(A+L)\) are \(-\)0.09 and \(-\)0.17 for the US and Chile, respectively. While both countries are similar in terms of their negative external positions and long foreign currency exposure, they differ in their hedging capabilities via the currency mix \(FX_{o}^{AGG}\).

The US net position and currency mix co-move negatively (\(corr = -0.75\)). Its external position has a shock absorber role: an increase in its net liability position is associated with an increase (decrease) in the proportion of liabilities denominated in domestic (foreign) currency. This reduces the potential scale of aggregate valuation effects associated with US dollar movements. The deterioration in the net foreign asset position is partially hedged by the change in the currency mix. On the other hand, Chile’s net positions and currency mix positively co-move (\(corr = +0.20\)). An increase in its net liability position is associated with a decrease (increase) in the proportion of liabilities denominated in domestic currency (foreign) currency. This increases the potential scale and volatility of valuation effects generated by movements of the Chilean Peso. In line with this, valuation effects volatility was much larger for Chile than for the US. Their standard deviation during the 1990-2017 period was 0.54 and 2.51 for the US and Chile, respectively.

3 Descriptive Evidence

Figure 1 illustrates the unconditional correlation between the volatility of exchange rate induced valuation effects (based on its standard deviation) and the correlation between the net position and currency mix (with all variables being computed over the 1990-2017 period). Overall, there is evidence of a positive correlation between the two variables.Footnote 5 Hence, a lower (i.e. more negative) correlation between the net position and the currency mix is associated with lower volatility in the valuation effect. This finding supports the conjecture that our indicator takes the role as a shock absorber or amplifier.

However, Fig. 1 also reveals that there are additional factors at play in explaining valuation effect volatility. For instance, Turkey and the Netherlands show low positive correlations between net positions and the currency mix, while the valuation effect volatility is much higher for Turkey.

Table 1 shows the mean, median and interquartile range of the shock absorption indicator (i.e. the correlation coefficient between \((A - L)/(A + L)\) and \(FX^{AGG}_o\)) for the advanced and emerging country groups over different time periods: the full period 1990-2017, 1990-1999, 2000-2007, and 2008-2017.Footnote 6 Since there are fundamental differences between these two country groups in terms of their institutions, economic policies and international role of the domestic currencies, we present these statistics both for the full sample and separately. We consider the 1990-1999 period as the “pre-euro” period, while 2008 marks the year of the Global Financial Crisis (GFC) and we hence refer to 2000-2007 and 2008-2017 as the pre-crisis and post-crisis periods, respectively. The post-crisis period in particular is crucial because of the heterogeneous retrenchment in international capital flow across type of flows, regions and nationality.Footnote 7

For the full period, advanced countries show negative mean and median correlations between the net position and the currency mix, implying that larger (smaller) net external liabilities are associated with a higher (lower) proportion of domestic currency in liabilities than in assets. This suggests that external positions are able to absorb exchange rate shocks since the currency risk of external positions is hedged via the currency of denomination of assets and liabilities. However, this is not the case for emerging economies (EMEs) which show positive mean and median correlations between \((A - L)/(A + L)\) and \(FX^{AGG}_o\). Larger net external liabilities are hence associated with a lower proportion of domestic currency in liabilities than in assets. Here, the external position exacerbates the valuation shocks resulting from exchange rate movements. However, small negative correlations emerge in the interquartile range indicating that net position and currency mix have a negative correlation at least for some EMEs.

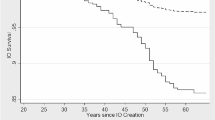

Another way of analysing the shock-absorption properties of external positions across countries is by plotting the cumulative distribution of our indicator as reported in Fig. 2. In line with the evidence previously discussed, almost half of the countries show a negative correlation, while most countries with positive correlations are EMEs.

In terms of differences across time, Table 1 shows that in all periods, the mean and median correlations are negative for advanced countries. In the pre-euro period, the interquartile range is wide with correlations from \(-\)0.67 at the 25th percentile to 0.18 at 75th percentile. For the pre-crisis period, we observe the highest negative mean (\(-\)0.54) and median (\(-\)0.75) correlations. Hence, the external position acts consistently as a shock absorber for advanced countries. For EMEs, the mean correlations are negative, but small, in the pre-euro and pre-crisis periods, while the medians are positive. In the post-crisis period however, the weak negative mean correlation becomes stronger, while the median correlation even turns from positive to negative. Hence, the external positions of EMEs show shock absorption properties towards the end of our sample period.

As a complement to the evidence presented in Table 1, Fig. 3 reports the cumulative cross-country distribution during the pre-euro and post-crisis subperiods. At the full distribution level, we observe a significant shift in the role of external imbalances towards shock absorption across time, with a much higher proportion of countries showing negative correlations toward the end of the sample period. On the one hand, Fig. 3 shows that 54 percent of countries showed negative correlations, with 36 percent of the whole sample exhibiting strongly negative correlations of less than \(-\)0.5 in 1990-1999. On the other hand, the period 2008-2017 is characterised by 74 percent of the sample showing shock-absorption properties in their external positions, with 52 percent of countries exhibiting a negative correlation below \(-\)0.5. EMEs where the main driver of this shift: while 12 out of the 29 EMEs covered in our sample had negative correlations in 1990-1999, this number increases to 20 in 2008-2017.Footnote 8

3.1 Discussion

The first question resulting from the descriptive evidence is which factors can explain the observed difference between advanced and emerging economies. The correlation between net positions and the currency mix is highly related to the ability to borrow from foreigners in domestic currency. EMEs with negative net external positions are deemed inherently riskier, which reduces their ability to issue liabilities in domestic currency. Country risk is generally related to the levels of economic and financial development, international integration and the quality of policies and institutions.Footnote 9

The theoretical literature emphasises the critical roles of the credibility of policies as well as inflation and real exchange rate fluctuations in determining the currency composition of external balance sheets.Footnote 10 In EMEs in particular, the government and the corporate sector face the issue that issuing liabilities in domestic currency is associated with incentive problems. These problems relate to higher cost of debt resulting from investors’ demand for a risk premium and governments’ tendency to pursue loose economic policies ex-post, leading to higher inflation and thereby decreasing the real value of domestic currency debt. Firms can minimise their default probability only in an environment of credible monetary and fiscal policies. Moreover, there is a strong preference by international investors to hold assets in the major international currencies, in particular the US dollar which is the dominant currency in bank funding, corporate borrowing and central bank reserve holdings (Maggiori et al. 2020; Gopinath and Stein 2021; Laser and Weidner 2022; Iancu et al. 2023) as well as for invoicing international trade. The large global demand for the US dollar makes borrowing in US dollars cheaper than in local currency,Footnote 11

The second question emerging from the descriptive analysis relates to the reasons for the observed striking changes in the correlation of EMEs when moving from the pre-crisis period to the post-crisis period. Importantly, EMEs have frequently adopted managed exchange rate flexibility, inflation targeting, a prudent management of international reserves and macroprudential policies in the late 1990s and 2000s, which softened the negative impact of the Global Financial Crisis of 2008. After the crisis, the US and the euro area embarked on expansionary monetary policies, while investors searched for yield globally. These developments alleviated the “original sin” and improved emerging countries’ borrowing capabilities in both hard and domestic currency (Aizenman et al. 2020; Hale and Juvenal 2020; and Hale et al. 2020). Furthermore, as pointed out by Ottonello and Perez (2019), there is a degree of cyclicality in the currency composition of external debt, implying that the share of debt denominated in local currency is higher during economic booms. Consistent with this theory, the post-crisis period saw economic growth and disinflation in emerging economies, while the share of debt denominated in local currency increased, both for governments and private sector borrowers.

4 Analytical Framework

Exchange rate fluctuations are key determinants for valuation effects associated with cross-border financial positions and international risk sharing patterns. This is a central takeaway in Lane and Shambaugh (2010b) from which we borrow their analytical framework to motivate our empirical analysis.

To that end, we reproduce their adaptation of Davis et al. (2001)’s small open economy model to motivate our choice of explanatory variables. A key assumption of this two-period endowment model is that the first period endowment is fixed and the second period endowment is stochastic. This is well aligned with textbook models to study international risk sharing.

More precisely, the process determining the endowment in the second period is given by

where S is the rate of depreciation in the second period, \(\beta _y\) is the regression coefficient of \(y_2\) on S and \(\epsilon\) is the stochastic shock. As assumed in Davis et al. (2001), there are two assets available in this economy and consumption takes place in period 2 only. The first asset (D) is denominated in domestic currency while the second (F) is denominated in foreign currency. The gross return of the domestic currency asset is fixed (\(R_D=\bar{R}\)) while the domestic currency return of the asset denominated in foreign currency is equal to

\(\beta _F\) is the regression coefficient of \(R_F\) on S and \(\nu\) is the orthogonal shock.

This simple framework is useful to derive the foreign-currency denominated equilibrium holdings of asset F as a function of the regression coefficients \(\beta _y\) and \(\beta _F\) in Eqs. (7) and (8), respectively.

Since consumption takes place in period 2 only, the representative agent maximises the following utility function

where \(\beta\) is the subjective discount factor, A is the coefficient of absolute risk aversion and \(c_2\) is given by

\(\omega _D\) and \(\omega _F\) are the domestic currency denominated and foreign currency denominated portfolio allocations. Since the second period output \(y_2\) and the return in the foreign currency denominated are jointly normally distributed, the optimality condition can also be written as

where RP stands for the risk premium. Thus, the optimal portfolio allocation implies that the equilibrium consumption in the second period can then be written as

where \(\beta _c=\frac{RP}{AV(R_F)}\) is the representative agent’s desired exposure to the foreign currency denominated asset and \(V(R_F)\) is the variance of the return on the foreign-currency asset. An implication of Eq. (12) is that when the foreign currency asset offers a risk premium the representative agent will want some positive exposure to that asset. If the risk premium is zero, the representative agent will prefer a consumption profile with no currency risk. Equation (7) above indicates that the agent’s endowed exposure to the foreign currency asset is \(\beta _y\). Thus, the optimal portfolio allocation to the foreign asset is

where

This means that the optimal foreign-currency position in the portfolio depends positively on the risk premium offered by the foreign currency denominated asset and the volatility of the exchange rate and negatively on the degree of risk aversion, the foreign-currency asset return volatility and the covariance between output in the second period and the exchange rate. The latter means that when the covariance between output and exchange rate is negative (e.g. a depreciating currency when output is low), the optimal portfolio share for the foreign currency denominated asset is positive, regardless of whether the risk premium is zero or not. if the covariance between the exchange rate and output is positive, the representative agent can be short in the foreign currency denominated asset even if its risk premium is positive.

According to Eq. (14), the foreign currency position should be a function of the covariance between output and the exchange rate as well as the volatility of the exchange rate. Moreover, to explicitly differentiate the role of real and nominal exchange rate, volatility of inflation should be accounted for.

5 Empirical Analysis

5.1 Bivariate Evidence

In this section, we assess the extent to which the shock absorption role is associated with a set of macroeconomic variables, in particular to macroeconomic risks, economic development, financial integration and the quality of policies and institutions. As a first step we inspect visually the unconditional correlations between the shock absorption measure and relevant macroeconomic variables.Footnote 12

Following the previous analytical framework, we assess the role of macroeconomic risks by focusing on GDP volatility, the covariance between the exchange rate and GDP, the volatility of inflation, and the exchange rate over the non-overlapping periods 1990-1999, 2000-2007 and 2008-2017. Volatility is measured by the coefficient of variation.Footnote 13 Moreover, we include GDP per capita as a proxy for the level of economic development.Footnote 14 To measure financial integration, the financial institutions index (FIX) and the IFI indicator are employed. FIX, calculated by Sahay et al. (2015), summarises how developed financial institutions are in terms of size, access to markets and efficiency.Footnote 15 Rule of law (RL) and regulatory quality (RQ), compiled by Kraay et al. (2010), are used as indicators for the quality of policies and institutions. While RL captures perceptions of the extent of confidence in the rules of the society, the quality of contract enforcement and property rights, RQ captures the ability of governments to formulate and implement sound policies and regulations. RL and RQ are computed by taking the mean over each period.

Figure 4 illustrates the correlation between the absorption role of external positions (i.e. the correlation between the net position and the currency mix) and the risk block indicators. Figure 4a shows a positive – although insignificant – correlation (0.05) between shock absorption and GDP volatility with an insignificant coefficient of 0.16 from the bivariate regression. Figure 4b illustrates a positive correlation between shock absorption and covariance of GDP and exchange rate, with a significant slope coefficient of 0.72 from a bivariate regression.Footnote 16 Fig. 4c presents the correlation between inflation volatility and shock absorption. We observe a positive correlation with a statistically significant slope coefficient (resulting from a bivariate regression) of 0.18.Footnote 17 In Fig. 4d we find a positive correlation between the shock absorption indicator and NEER volatility, with a slope from a bivariate regression of 1.11. Hence, destabilising shock absorption is associated with high exchange rate volatility.

Figure 5 shows the unconditional correlation between the absorption indicator and GDP per capita. Since the correlation between these two indicators is negative (the slope term of bi-variate regression is \(-\)0.16 and statistically significant), a higher level of economic development is associated with an increased shock absorption role. Figure 6a illustrates that the correlation between the shock absorption indicator and the financial institutions index (FIX) is negative (with a statistically significant coefficient of \(-\)1.03). Hence, higher domestic financial development level is associated with a shock absorber role of external positions. We also find a statistically significant negative correlation (\(-\)0.18) for the IFI indicator, implying that the shock absorption role of external positions is increasing with international financial integration (Fig. 6b).

Finally, for institutional quality Fig. 7 shows a negative correlation between the shock absorption indicator and RL and RQ with statistically significant slope coefficients of \(-\)0.19 and \(-\)0.21, respectively. A greater capacity for shock absorption is hence associated with higher institutional quality.

All in all, the evidence from a simple correlation analysis suggests that the shock absorption capacity of external positions is higher for economically and financially developed countries, for those more financially integrated with the rest of the world, with a higher level of institutional quality and lower exchange rate volatility.

5.2 Regression Models

Next we analyse the role of risk characteristics, the development level, financial integration and institutional factors for the shock absorption indicator in a cross-country regression setting. We run regressions of the form

where the dependent variable is the correlation between the net external position \((A-L)/(A+L)\) and the currency mix \(FX^{AGG}_{o}\) for the periods between 1990 and 1999, 2000 and 2007, and 2008 and 2017. \(R_{i}\) is the risk block matrix, including GDP volatility, the covariance between GDP and exchange rate, inflation volatility, and exchange rate volatility. \(D_{i}\) is the development block, including GDP per capita. \(F_{i}\) is the financial integration block, including the financial institutions index and international financial integration. \(I_{i}\) is the institutions block, including the rule of law indicator.Footnote 18

We follow a two-step approach. First, we analyse the full sample using data pooled over the full time period and the key subperiods presented before. Second, we perform separate regressions for the advanced and emerging country groups.

In Table 2, higher GDP volatility is associated with a greater capacity for shock absorption. When GDP volatility is larger, the shock absorption indicator is more negative. This relation emerges when data for the full 1990-2017 period are included. However, it varies across sub-periods, with the pre-crisis period (2000-2007) explaining the bulk of this relation, while the pre-euro (1990-1999) and the post-crisis (2008-2017) periods show negative but insignificant coefficients.

A second measure in the risk block is the covariance between GDP and exchange rate and it is statistically insignificant for the full and sub-periods. A third dimension capturing macroeconomic risk is inflation volatility. While this variable is insignificant for the full time period, a very interesting pattern emerges in the sub-period analysis. During the pre-crisis period 2000-2007, higher inflation volatility is associated with a shock amplifier role for external positions, while this relation becomes negative from 2008 onward. Inflation volatility is hence negatively linked with the absorption measure indicating that in the latter years of the sample countries with a higher inflation risk had external positions with better shock absorbing capacity. The final measure in the risk block is nominal exchange rate volatility for which do not find a statistically significant relation, neither in the full nor in the different sub-periods.

We find a negative and statistically significant coefficient for the level of economic development (as proxied by GDP per capita). This suggests that more developed economies exhibit structures in their cross-border positions that mitigate the effect of exchange rate shocks via valuation effects. Column (1) of Table 2 shows that this is the case for the full period, while column (2), (3) and (4) reveal that this relation is mostly driven by the 2000-2007 sub-period.

With regard to the role of financial development and financial integration, we find that the former is positively associated with enhanced shock absorption capacity over the full period, driven mostly by the latter part of the sample. On the other hand, more financial integration seems to have contributed to a destabilisation role of external positions in the pre-crisis period when international balance sheets were building up rapidly.

Finally, we consider the institutions block, which is proxied by the rule of law indicator. The positive coefficient for the full time period yields a counterintuitive result, which contrasts with the evidence presented in the bi-variate scatter plots, as it suggest that higher institutional quality is associated with a destabilisation role of external positions.Footnote 19

Next, we investigate the country group dimension as reported in Tables 3, 4 and 5. There is only weak evidence of our variables having a statistically significant impact for advanced economies which could be due to the small sample size and relatively high homogeneity across the country sample. For the full period, we find that higher GDP and inflation volatility are associated with a larger shock absorbing role of external positions. This is also found for exchange rate volatility, but only in the post-crisis period. Again, rule of law shows a marginally significant counter-intuitive coefficient.

For emerging market economies (Table 4) we first observe – as for advanced economies – that higher GDP volatility is associated with a larger shock absorbing role of external positions, which is driven by the time period until the outbreak of the crisis. Second, higher inflation volatility is a shock amplifier for external positions since the pre-crisis period. This may suggest that advanced economies’ external balance sheets have become more capable of absorbing larger swings in the exchange rate in the latter part of the sample. Third, GDP per capita is significant during the 2000-2007 period with the expected negative sign (i.e. more developed economies have external balance sheets with a higher shock absorbing capacity). Forth, domestic financial development is statistically significant from 2008 onward and conducive to absorbing exchange rate shocks. Fifth, rule of law effect is only significant in the full period and during the early part of the sample, again with a positive coefficient.

As a final exercise, we compare the country groups in Table 5 by including a country dummy for emerging countries and reporting its coefficient together with those for the interactions with all conditioning factors. For the full period, the only statistically relevant difference is for inflation volatility. Advanced economies with higher inflation volatility are associated with a stronger shock absorption capacity of the external position than emerging economies. As regards the sub-periods, we find that the link with GDP volatility is different for EME as higher GDP volatility is associated with more absorption capacity in 1990-1999. The final period yields interesting differences too. Emerging economies with higher GDP volatility are associated with a stronger shock absorption capacity of the external position than advanced economies. In addition, for advanced economies, exchange rate volatility is strongly associated with more shock absorption via external positions while for EMEs it relates with a destabilising role. This is also the case for inflation volatility as relative to advanced economies, it is associated with a destabilising role in the full and latest period for EMEs.

Overall, we find evidence that more developed countries have a higher capacity to absorb exchange rate shocks via the currency mix of their net external positions. This holds both in terms of the general level of economic development and in terms of domestic financial development, in particular within emerging market economies, but also between the advanced and emerging country groups. The underlying mechanism behind enhanced shock absorption capacity is that countries with larger net external funding requirements need to be able to fill the funding needs by issuing more domestic currency liabilities. Before the crisis external balance sheets were growing and imbalances rising, while domestic currency issuance by EMEs was not very wide-spread.

5.3 Robustness Checks

In order to check the validity of the main results in Tables 2 to 5, we conduct a number of robustness tests.

Our default standard errors are robust. However, we also run the main specifications using conventional standard errors which does not change the confidence levels considerably. Only the coefficients of the risk block variables for advanced countries (Table 3) become statistically insignificant if we use conventional standard errors.

To test the robustness of our specifications to potential variable omission, we add to the regressions two variables separately. First, we add the Chicago Board Options Volatility Index (VIX). This variable is a proxy for global risk aversion in which lower values indicate greater tolerance for risk-taking. By including the VIX, we take into account the global market risk and investment sentiment. This variable is calculated by taking its mean for the non-overlapping windows of sub-periods. The VIX is a time-varying variable common across countries. Therefore, we include it only in the regressions that cover all three sub-periods (i.e. in the first columns of Tables 2, 3 and 4). We do not find a statistically relevant link between the absorption role of external position and VIX. Moreover, we add an EMU membership dummy variable, which takes the value 1 if the country is a member of the European Monetary Union, and 0 otherwise. Although exchange rate volatility captures the movements in the exchange rates from an ex-post perspective, it might not be enough to capture expectations on exchange rate movements from an ex-ante perspective. Since all EMU members are advanced countries, we only include this variable in the regressions for the full sample and in those for advanced countries. However, the EU membership dummy remain insignificant in these estimations.

Robustness is also checked with respect to alternative indicator for exchange rate volatility. We consider the domestic currency per US dollar exchange rate as an alternative to the NEER for exchange rate volatility measurement across all specifications from Tables 2 to 5.Footnote 20 As in the case of NEER volatility, we do not find a statistically significant relation, neither in full nor in the different sub-periods. The results do not change for the different county groups.

In our main results, the relationship between the shock absorption and an index of rule of law compiled by Kraay et al. (2010) is not robust to the inclusion of other variables such as GDP per capita. Thus, we also experiment by using an index of creditor rights assembled by Djankov et al. (2007) which is more directly related to credit market imperfections. This yields similar results with positive coefficients for the full sample and advanced country group, although the sample size is more limited, covering only 1990-2002. However, it is only significant for the advanced country sample. This is not surprising, given the fact that indices of institutional quality are strongly correlated with the level of development.

We also check the sensitivity of our estimates by excluding the outliers in terms of inflation volatility. We drop Japan, Peru, Poland, Russia and Brazil from the sample, but do not observe any significant changes in the full period (1990-2017). However, for the regressions in the period 1990-1999, both inflation volatility and exchange rate volatility turn from insignificant to significant for the full country sample as well as for the emerging country sample. While higher inflation volatility is linked to a stabilisation role for external positions, exchange rate volatility is linked to a destabilisation role for external positions during 1990-1999, once we exclude the outliers.

6 Conclusions

This paper offers a number of contributions by studying how external imbalances and their currency mix determine the amplitude of valuation effects. More specifically, we put the focus on how net external positions are hedged against exchange rate shocks via their currency composition. We study how this property evolved over time across country groups, as well as how it is linked with key macro-financial factors.

We document that advanced economies exhibited shock absorption properties in their external positions throughout the full 1990-2017 period. The currency structure of their external positions contributed to reducing the amplitude of valuation effects. By contrast, emerging market economies showed external positions that contributed to increasing the amplitude of valuation effects. However, this pattern changed since the Global Financial Crisis with most EME countries clearly exhibiting shock absorption properties since.

Our regression-based assessment shows that more developed countries have a higher capacity to absorb exchange rate shocks via the currency mix of their net external positions. This holds both in terms of the general level of economic development and in terms of domestic financial development, in particular within emerging market economies, but also between the advanced and emerging country groups. The underlying mechanism behind enhanced shock absorption capacity is that countries with larger net external funding requirements need to be able to fill the funding needs by issuing more domestic currency liabilities. Before the crisis external balance sheets were growing and imbalances rising, while domestic currency issuance by EMEs was not very wide-spread.

While related research has mainly focused on large net debtor positions and the direction of valuation effects, our paper is the first to systematically include the currency composition into a cross-country framework to study the way in which it affects the amplitude of valuation effects. In light of the continuously increasing size and complexity of cross border financial positions, such studies have become central for the assessment of global financial stability.

Data Availability

All data used are publicly available.

Notes

These studies identify the macroeconomic variables that help predict currency crises and document the size of the current account deficit as one of the leading indicators of external crises. Phillips et al. (2013), Cubeddu et al. (2019) and Turrini and Zeugner (2019) also consider (cumulative) current account balances together with benchmark levels and their relation with the stability of external imbalances. This is usually studied in conjunction with cyclical factors, macroeconomic fundamentals, and policy variables. In these studies, current account models build on the extensive literature on the macroeconomic determinants of saving and investment decisions (Debelle and Faruqee 1996; Chinn and Prasad 2003; Lee et al. 2008; Coutinho et al. 2018).

More recently, Du and Schreger (2016) document an increase in the domestic currency borrowing of sovereigns in the last decade by using the dataset of 14 emerging markets.

Bénétrix et al. (2015) report that the average valuation loss across all countries in their sample would have been 5.7 percentage points of GDP larger if the currency exposure would have been that of 1996.

The slope coefficient from a bivariate regression for the complete country sample is statistically significant and equal to 1.42. The slope coefficients for the advanced and emerging country samples are statistically significant and equal to 0.82 and 2.62, respectively, while the \(R^2\)s are 0.47 and 0.57 for advanced countries and EMEs, respectively.

For comparability purposes, we use the Advanced-Emerging country classification from Bénétrix et al. (2020). We also compute Table 1 including Korea, Singapore, Hong Kong, Israel (reclassified by the IMF as advanced in 1997) and Czech Republic (reclassified by the IMF as advanced in 2009) in the advanced country group. Table 1 based on this classification produces similar results.

The crisis brought a more persistent and sharper decline in capital inflows for countries with large pre-crisis external liabilities, especially for advanced economies (Milesi-Ferretti and Tille 2011; McQuade and Schmitz 2017; McCauley et al. 2019) report the central role of European banks in driving the retreat of international lending after 2007.

The only EMEs for which the correlations turn from negative to positive are Argentina, Singapore and Tunisia. On the contrary, the correlations change from positive to negative for Turkey, South Africa, Brazil, Mexico, Peru, Sri Lanka, India, Pakistan, Thailand, Russia, and Poland. Only 6 out of 21 advanced countries (Denmark, France, Sweden, Japan, Greece, and New Zealand) had a positive correlation in period 1990-1999, while this number drops to 4 in the period 2008-2017. Advanced countries with positive correlations for this period are Denmark, the Netherlands, Sweden and New Zealand.

One can also make a reverse causality argument borrowed from the "original sin" literature (e.g., Eichengreen and Hausmann 2010) as countries that cannot issue debt in domestic currency are riskier.

Moreover, EMEs tend to accumulate foreign exchange reserves as a protection against external shocks (Alfaro and Kanczuk 2019), in particular in US dollars because of precautionary motives and exchange rate management considerations.

Table 7 provides a list of the sources for all variables used in the analysis.

Exchange rate volatility is based on the monthly nominal effective exchange rate.

GDP per capita is computed by taking the logarithm of the ratio between the sum of GDP and the sum of the population for each period.

Unlike indicators such as the ratio of private credit to GDP or stock market capitalization to GDP, FIX takes into account the complex multidimensional nature of financial development. IFI is computed by taking the log of the ratio of the sum of external assets and liabilities to the sum of GDP for each period.

When Turkey and Brazil are omitted from the sample as outliers, the significance of the coefficient increases.

When omitting Brazil, Japan, Peru, Poland and Russia as outliers with excessive inflation volatility, we lose significance, but the coefficient turns negative (\(-\)0.07). Japan’s relatively high volatility results from a low mean (0.45) rather than a high standard deviation (1.19) for the period 1990-2017.

Since RL and RQ are highly correlated governance indicators, we include only RL, which proves to be more significant than RQ.

The inclusion of GDP per capita changes the rule of law coefficient from negative to positive as rule of law and GDP per capita are strongly correlated.

For the US, domestic currency per Deutsche Mark and euro is used for the pre-euro and euro periods, respectively.

References

Aizenman J, Jinjarak Y, Park D, Zheng H (2020) Good-bye original sin, hello risk on-off, financial fragility, and crises? Tech. rep, National Bureau of Economic Research

Alfaro L, Kanczuk F (2019) Debt redemption and reserve accumulation. IMF Economic Review 67(2):261–287

Bénétrix AS, Lane PR, Shambaugh JC (2015) International currency exposures, valuation effects and the global financial crisis. J Int Econ 96:S98–S109

Bénétrix AS, Gautam D, Juvenal L, Schmitz M (2020) Cross-border currency exposures: new evidence based on an enhanced and updated dataset

Burger JD, Warnock FE (2007) Foreign participation in local currency bond markets. Rev Financ Econ 16(3):291–304

Catão LA, Milesi-Ferretti GM (2014) External liabilities and crises. J Int Econ 94(1):18–32

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59(1):47–76

Coutinho L, Turrini A, Zeugner S, et al. (2018) Methodologies for the assessment of current account benchmarks. Tech. rep., Directorate General Economic and Financial Affairs (DG ECFIN), European

Cubeddu LM, Krogstrup S, Adler G, Rabanal MP, Dao MC, Hannan SA, Juvenal L, Buitron CO, Rebillard C, Garcia-Macia D, et al. (2019) The external balance assessment methodology: 2018 Update. International Monetary Fund

Cubeddu LM, Hannan SA, Rabanal P et al (2021) External financing risks: How important is the composition of the international investment position? Tech. rep, International Monetary Fund

Davis S, Nalewaik J, Willen P (2001) On the gains to trade in risky financial assets. Tech. rep., mimeo, University of Chicago

Debelle G, Faruqee H (1996) What determines the current account? a cross-sectional and panel approach

Djankov S, McLiesh C, Shleifer A (2007) Private credit in 129 countries. J Financ Econ 84(2):299–329

Du W, Schreger J (2016) Sovereign risk, currency risk, and corporate balance sheets. Harvard Business School BGIE Unit Working Paper (17-024)

Du W, Pflueger CE, Schreger J (2020) Sovereign debt portfolios, bond risks, and the credibility of monetary policy. J Financ 75(6):3097–3138

Eichengreen B, Hausmann R (1999) Exchange rates and financial fragility. Tech. rep, National bureau of economic research

Eichengreen B, Hausmann R (2010) Other people’s money: debt denomination and financial instability in emerging market economies. University of Chicago Press

Eichengreen B, Rose AK, Wyplosz C (1996) Contagious currency crises. Tech. rep, National Bureau of Economic Research

Eichengreen B, Hausmann R, Panizza U (2003) Currency mismatches, debt intolerance and original sin: why they are not the same and why it matters. Tech. rep, National Bureau of Economic Research

Eichengreen B, Hausmann R, Panizza U (2023) Yet it endures: The persistence of original sin. Open Econ Rev 34(1):1–42

Engel C, Park J (2018) Debauchery and original sin: The currency composition of sovereign debt. Tech. rep, National Bureau of Economic Research

Frankel JA, Rose AK (1996) Currency crashes in emerging markets: An empirical treatment. J Int Econ 41(3–4):351–366

Gopinath G, Stein JC (2021) Banking, trade, and the making of a dominant currency. Q J Econ 136(2):783–830

Gourinchas PO, Rey H (2007) International financial adjustment. J Polit Econ 115(4):665–703

Hale GB, Juvenal L (2020) Currency-induced external balance sheet effects at the onset of the covid-19 crisis

Hale GB, Jones PC, Spiegel MM (2020) Home currency issuance in international bond markets. J Int Econ 122:103256

Hausmann R, Panizza U (2003) On the determinants of original sin: an empirical investigation. J Int Money Financ 22(7):957–990

Iancu A, Anderson G, Ando S, Boswell E, Gamba A, Hakobyan S, Lusinyan L, Meads N, Wu Y (2023) Reserve currencies in an evolving international monetary system. Open Econ Rev 1–37

Jeanne MO (2003) Why do emerging economies borrow in foreign currency? International Monetary Fund

Kaminsky GL, Reinhart CM (1999) The twin crises: the causes of banking and balance-of-payments problems. Am Econ Rev 89(3):473–500

Kaminsky GL, Lizondo S, Reinhart CM (1998) Leading indicators of currency crises. Staff Papers 45(1):1–48

Kraay A, Kaufmann D, Mastruzzi M (2010) The worldwide governance indicators: methodology and analytical issues. The World Bank

Lane PR, Milesi-Ferretti GM (2001) The external wealth of nations: measures of foreign assets and liabilities for industrial and developing countries. J Int Econ 55(2):263–294

Lane PR, Milesi-Ferretti GM (2007) The external wealth of nations mark ii: Revised and extended estimates of foreign assets and liabilities, 1970–2004. J Int Econ 73(2):223–250

Lane PR, Milesi-Ferretti GM (2009) Where did all the borrowing go? a forensic analysis of the us external position. J Jpn Int Econ 23(2):177–199

Lane PR, Milesi-Ferretti GM (2018) The external wealth of nations revisited: international financial integration in the aftermath of the global financial crisis. IMF Economic Review 66(1):189–222

Lane PR, Shambaugh JC (2010a) Financial exchange rates and international currency exposures. Am Econ Rev 100(1):518–40

Lane PR, Shambaugh JC (2010b) The long or short of it: Determinants of foreign currency exposure in external balance sheets. J Int Econ 80(1):33–44

Laser FH, Weidner J (2022) Currency compositions of international reserves and the euro crisis. Open Econ Rev 1–28

Lee MJ, Ostry MJ, Prati MA, Ricci ML, Milesi-Ferretti MG (2008) “Exchange rate assessments: Cger methodologies”. IMF Occasional Paper 261

Maggiori M, Neiman B, Schreger J (2020) International currencies and capital allocation. J Polit Econ 128(6):2019–2066

McCauley RN, Bénétrix AS, McGuire PM, von Peter G (2019) Financial deglobalisation in banking? J Int Money Financ 94:116–131

McQuade P, Schmitz M (2017) The great moderation in international capital flows: A global phenomenon? J Int Money Financ 73:188–212

Milesi-Ferretti GM, Tille C (2011) The great retrenchment: international capital flows during the global financial crisis. Econ policy 26(66):289–346

Ottonello P, Perez DJ (2019) The currency composition of sovereign debt. Am Econ J Macroecon 11(3):174–208

Phillips MS, Catão ML, Ricci MLA, Bems MR, Das MM, Di Giovanni MJ, Unsal MF, Castillo M, Lee J, Rodriguez J, et al (2013) The external balance assessment (EBA) methodology. International Monetary Fund

Reinhart C, Reinhart V (2009) Capital flow bonanzas: An encompassing view of the past and present. In: NBER international seminar on macroeconomics 2008, University of Chicago Press, pp 9–62

Sahay R, Čihák M, N’Diaye P, Barajas A (2015) Rethinking financial deepening: Stability and growth in emerging markets. Revista de Economía Institucional 17(33):73–107

Schmitz M, De Clercq M, Fidora M, Lauro B, Pinheiro C (2013) Revisiting the effective exchange rates of the euro. J Econ Soc Meas 38(2):127–158

Tille C (2003) The impact of exchange rate movements on us foreign debt. Curr Issues Econ Financ 9(1)

Turrini A, Zeugner S (2019) Benchmarks for net international investment positions. J Int Money Financ 95:149–164

Acknowledgements

We thank the Editor George Tavlas, an anonymous referee for comments and Joe Kopecky for constructive comments. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank.

Funding

Open Access funding provided by the IReL Consortium.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bénétrix, A., Demirölmez, B. & Schmitz, M. The Shock Absorbing Role of Cross-border Investments: Net Positions Versus Currency Composition. Open Econ Rev 35, 363–394 (2024). https://doi.org/10.1007/s11079-023-09728-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-023-09728-3

Keywords

- Currency composition

- International investment position

- Foreign currency exposures

- Valuation effects

- Global imbalances