Abstract

This paper studies the simultaneous effects of relocation of production (as part of globalization) and institutions on intra- and inter-country wage inequality. Firstly, empirical evidence shows that labor unions act at decreasing inequality, but this shrinking effect tends to be mitigated by globalization. Theoretically, we study the conditions under which this empirical evidence is verified. Unskilled labor-intensive relocations together with (de)unionization processes of the labor force contributed to the increasing path of intra-country wage inequality observed in some of the leading countries. However, most recently, skilled relocations may help to decrease intra-country inequality in leading countries (e.g., the US), but to increase it in follower countries (e.g., China).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

One of the major trends in the global economy over the last decades has been the rapid rise of inter-country transfer of production by worldwide firms (e.g., Feenstra and Jensen 2012; Goel 2017). The dramatic reduction in transportation and communication costs brought up by advances in technologies has enabled firms to fragment their production and move some of their tasks to different countries. By promoting the transfer of production to countries with lower costs, this process has generated strong efficiency gains (hereinafter, relocations) that potentially benefit all workers (e.g., Grossman and Rossi-Hansberg 2008; Rodriguez-Clare 2010). However, it may also have significant distributional effects, since greater imports of cheap unskilled inputs produced by worldwide firms in developing countries tend to reduce the unskilled wage in developed countries, thus increasing the skill premium, that is, the wage gap between skilled and unskilled workers (Feenstra and Hanson 1999; Deardorff 2005; Criscuolo and Garicano 2010). In fact, the process of production reallocation associated with globalization has been pointed out by several authors (e.g. Taylor and Driffield 2005; Chen et al. 2011; Hellier 2019) as an important determinant of the rising trend in wage inequality since the 1980s.

Other dimensions of globalization, such as financial integration and liberalization, have also been shown to contribute to increasing income inequality. For instance, Furceri and Loungani (2018) provide evidence that episodes of account liberalization are associated with persistent increases in the Gini coefficient and in the share of income going to the top. Based on data from developed and developing countries for the period 1970–2011, the authors find that such effect is stronger when financial institutions are weak and access to credit is not inclusive, when account liberalization is followed by a financial crisis, and when the bargaining power of labor falls. Using numerical simulations of a dynamic general equilibrium model of a small open economy, Turnovsky and Wang (2022) conclude that reductions in financial frictions associated to financial liberalization contribute to increasing the wage gap between skilled and unskilled workers in the short run. Ahuja and Marjit (2022) also find a significant positive impact of capital and trade liberalization on the skill premium, especially when skilled sectors are capital intensive relative to unskilled sectors.

In addition to globalization, trade unions have also been pointed out as an important determinant of the evolution of inequality, yet the sign of the effect differs from author to author. For example, Acemoglu et al. (2001) show that de-unionization contributed to the rising wage inequality experienced in the US and the UK. Neto et al. (2019) point to a negative effect of de-unionization on wage inequality but suggest that the effect of trade unions depends on their bargaining power. Using data for 20 advanced economies from 1980 to 2011, Jaumotte and Buitron (2020) find that, in addition to technological progress, globalization and financial deregulation, the erosion of union density has contributed to the rise of both gross and net income inequality, especially at the top of the income distribution.

In this context, it is important to examine how the effect of trade unions on wages has been influenced by the process of globalization. As pointed out by Marginson (2016, p.1), “unions face major challenges in developing effective responses to the growing international scope, integration, and complexity of multinational companies’ operations”. In a globalized economy, one would expect trade unions to be less effective at decreasing wage inequality than in countries less globally connected. In fact, in a closed economy, unions should be able to bargain for better wages, but when companies have outside options in other countries, that bargaining power is expected to decline. In this paper, we aim at further investigating how international production relocation affects the process through which unionization influences the skill premium.

The interaction between globalization and trade unions has been analyzed for a long in political science (see e.g., the seminal article by Blake 1972). In economics, it has been investigated by, for example, Rayp (2013), Casteter (2015), Bastos and Kreickmeier (2009), Egger and Etzel (2009) and Naylor (1998, 1999). While these studies examine the indirect impact of globalization on labor markets through its effects on union’s bargaining power, in the present paper we explore the joint effects of globalization and unionization on wage inequality, in a framework in which unionization is set independently of technological progress. In that sense, we analyze the ex-post effects of unionization on the technological side of the economy and consequently on the skill premium.Footnote 1 Our contribution is thus complementary to that of the papers referred above.

We consider an endogenous directed technical change growth framework (as, e.g., in Acemoglu 2003) with two types of technologies and intermediate goods, which use intensively skilled and unskilled labor. Such a framework allows as to evaluate the effects of different types of possible international relocations of goods’ production: those relatively intensive in unskilled labor and those relatively intensive in skilled labor. In fact, the relocation of production processes across the globe brought up by globalization has translated into important modifications in the absolute advantage of the skilled over the unskilled labor in developed (innovator) and developing (imitator) countries. These changes lead to shifts in the profitability of investing in goods using skilled labor relative to the profitability of investing in goods using unskilled labor, and thus in the technological knowledge bias and in the skill premium. In particular, we analyze both the long-run joint effect of unions’ participation and globalization taking technological progress as given, and the transitional dynamics and long-run joint effect when the dynamics of technology is taken into account. Thus, our contribution simultaneously considers labor trade unions participation and globalization as joint determinants of wage inequality.

In our framework, the skill premium decreases in the follower country and increases in the innovator country due to unskilled relocations. Conversely, it increases in the follower country and decreases in the innovator country due to skilled relocations (e.g., Grossman and Rossi-Hansberg 2008, and Wright 2014). These effects can be smoothed or enhanced by the strength of trade unions. Given that the current process of globalization seems to be based on skilled relocations (e.g., Milanovic 2016; Baldwin 2017), one would expect a decrease in intra-country wage inequality due to increased unionization in innovative countries, such as the US or Sweden. However, as these countries have experienced a fall in labor union participation, which increases intra-country wage inequality, the effect of globalization will enhance this rise. In turn, as in past decades globalization was characterized by unskilled relocations (e.g., Milanovic 2016; Baldwin 2017), it acted by mitigating the shrinking effect of rising unionization, namely in northern Europe.

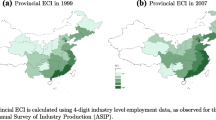

When technological progress is endogenous and taken into account, unskilled tasks relocations (and de-unionization in the labor market) may explain the rising pattern of the wage skill premium observed in some innovator countries, such as the US and the UK. However, in the follower countries, a drop in the skill premium is followed by a smooth increase towards the steady state. This may help explaining the different (and sometimes opposite) skill premium patterns observed in different countries.Footnote 2 Once relocation of skilled tasks becomes predominant, one should expect a reduction in the skill premium in innovator countries, but significant increases in the follower countries. It is interesting to note the consistency of this result with the recent huge increase in the skill premium in China, where the Gini Index increased from nearly 0.15 in the 1990s to 0.5 in 2015.Footnote 3

After this Introduction, the paper proceeds to present the empirical motivation (Section 2) that supports some of the model’s assumptions. In Section 3 the model is derived, and partial equilibrium results are presented. Section 4 presents general equilibrium results. In both theoretical sections, quantitative results are illustrated through calibration. Finally, in Section 5 we present the main conclusions.

2 Empirical Motivation

In this section, we first show the OECD and US trends on income inequality, globalization and labor union participation, just as motivation. Second, we show Granger-causality tests that motivate our approach in the regressions and the model. Third, we present regressions according to which globalization mitigates the negative effect that union participation has on decreasing inequality. The inequality data are the inter-quintile income ratios from the World Income Inequality Database (interquintile 5-1 – i.5-1, interquintile 4-1 – i.4-1, and interquintile 4-2 – i.4-2) and the inter-quintile earning ratios from the OECD Earnings Distribution Database (inter-quintile 9-1 – A.i.9-1 and inter-quintile 5-1 – A.i.5-1).Footnote 4 Data on labor union participation are taken from OECD trade union datasetFootnote 5 and globalization is proxied by the KOF Swiss Institute Globalization Index (Gygli et al. 2018) and its subindexes (economic, trade and financial globalization).

Figure 1 shows the evolution of the three variables since the 1980s. Common to the OECD and the US is the upward trend of globalization and the downward trend in labor union participation. However, while the US shows an upward trend in inequality, the OECD witnessed a downward trend in inequality until the 1990s, a slight increase in the trend up to the 2008 crisis and then a stabilization.

The (unbalanced) panel database includes 661 observations for 36 countries between 1990 and 2016, when income inequality data are used. When we use wage inequality data, the number of observations drops to 446. We proceed the empirical analysis into three steps.

First, we test for unit-roots the three variables of interest using the Levin-Lin-Chu test for panel nonstationarity. The tests reject the null according to which panels include unit roots for all the three variables for globalization, union participation and inequality. The result is expected for inequality which oscillates a lot in most countries but may be surprising for union participation and globalization. However, both the upward trend in globalization and the downward trend in union participation are quite smooth such that the test rejects the presence of nonstationarity. In fact, the presence of unit roots is rejected at the 1% level for all the variables except for trade globalization in which it is rejected at the 10% level.Footnote 6

Second, we test for Granger-causality to validate our approach that the effect of union participation and globalization on inequality is worth studying in this causality direction.

Table 1 shows overwhelming evidence according to which both globalization and union participation Granger-cause inequality but inequality does not Granger-causes globalization or union participation.Footnote 7 This occurs both when income inequality (first three columns of the table) and when wage inequality (last two columns) are considered. Thus, although some economic mechanisms can be thought to be in action from inequality to globalization and union participation, empirical analysis does not point in that direction; instead, it strongly suggests that the causality direction runs from globalization and union participation to inequality, which further validates and motivates our interest in building a theoretical model that examines in more detail the impact of globalization and unionization on inequality.

Third, we estimate the isolated and the joint impacts of union participation and globalization on inequality. Table 2 shows that labor union participation has a direct shrinking effect on income and wage inequality, and all the four indexes of globalization also have a negative impact on it. In particular, we should note the very strong effect of union participation, which is significant at 1% in most regressions. However, looking at the interaction effect between the two variables, an important conclusion arises: both globalization and unionization are independent (negative) determinants of inequality, but globalization also acts through decreasing the shrinking effect of labor union participation on inequality. As shown in the different regressions of the table, this result holds for all indexes of globalization and for most measures of inequality, indicating that it is valid for different dimensions of globalization and for different parts of the income distribution.Footnote 8 Due to the significance of the interaction term, it also becomes clear that the effect of unionization and globalization on inequality should be studied together, rather than separately as has been approached in the literature so far. To further check the robustness of these results, we add Total Factor Productivity (TFP) as a control variable in the inequality regression. TPF is a broad measure that captures some factors that are potential determinants of inequality, namely those related to technological progress, production efficiency, or institutional quality (for a comprehensive empirical analysis of the determinants of inequality, please see Furceri and Ostry 2019). The estimation results, which are reported in Table 6 clearly confirm the key conclusions of the baseline regression.

3 The Model

This section describes the economic set-up of the world economy composed by two countries, the Innovator (\(s=I\)) and the Follower (\(s=F\)), with a fixed endowment of skilled, \(H^{I}\) and \(H^{F}\), and unskilled, \(L^{I}\) and \(L^{F}\), workers, respectively. Moreover, it is assumed that I is relatively abundant in skilled labor, \(\frac{H^{I}}{L^{I}}>\frac{H^{F}}{L^{F}}\), and that labor is internationally immobile. We emphasize the interactions among economic agents, and the dynamic general equilibrium in which (i) households and firms are rational and solve their problems, (ii) unskilled workers can be organized in a labor union, (iii) free-entry R&D conditions are met, and (iv) markets clear.

Infinitely-lived households supply labor, maximize utility of consumption and invest in the firm’s equity. Unskilled workers might be organized in a labor union, which can act as a monopoly seller of labor and decide unilaterally the unskilled wage, or as a managerial union that bargains wage and employment with the employers’ federation, which represents firms (e.g., Neto et al. 2019). The inputs of the final good, which are used for consumption and investment, are two intermediate final goods, each produced by a large number of competitive firms that produce a continuum of varieties: the unskilled sector, L-sector, and the skilled sector, H-sector. The continuum of varieties in each intermediate final-good sector, \(i=L,H\), uses, in addition to the specific labor, a continuum of specific non-durable quality-adjusted intermediate goods, \(J_{i}\). As \(H^{s}>0\) and \(L^{s}>0\), both countries produce a certain number of varieties in each sector. However, production in F can be conducted by domestic firms and by firms resulting from relocation of production from I to F due to international vertical outsourcing, vertical offshoring or by vertical foreign-direct investment (FDI). The word “vertical” means that firms perform different production in different countries. Each intermediate-goods sector consists of a continuum of industries, \(j\in (0,J_{i}]\), and is characterized by monopolistic competition: the monopolist in industry j uses a design – sold by the R&D sector in I and protected by a patent – and aggregate final good to produce at a price that maximizes profits. Each new quality-adjusted intermediate good is thus introduced in I, but can be transferred to F, after paying a fixed cost of relocation, if the location in this country is more profitable.

Each quality-adjusted intermediate good is produced by a single monopolist, either in I or in F. In the R&D sector, activity performed in I, each potential entrant devotes numeraire to invent successful vertical designs to be supplied a new monopolist intermediate-goods firm/industry; i.e., the R&D sector allows increasing the quality of intermediate-goods industries \(J_{i}(t)\) and thus the technological knowledge.

In the context described, some endogenous technological knowledge complements skilled workers whereas other complements unskilled workers (e.g., Acemoglu and Zilibotti 2001). There are no barriers to international trade of intermediate final goods, and trade is driven by differences in relative factor endowments, as in the Heckscher-Ohlin model, and by technological-knowledge differences, as in Ricardian models.

3.1 Preferences and Technology

Infinitely-lived households obtain utility from the consumption of a unique aggregate final good, C, and disutility from labor level supplied, \(i=L,H\). They collect income from investments in financial assets (equity) and from labor. They inelastically supply labor to the L-sector or to the H-sector. Preferences are identical across countries, \(s=I,F\), and workers/sectors, \(i=L,H\). Thus, the world economy admits a representative household with preferences at time \(t=0\) given by \(U=\int _{0}^{\infty }\left( \frac{C(t)^{1\mathop{-}\theta }-1}{1\mathop{-}\theta }-\frac{\sum _{i\,=\,H,\,L}i(t)^{1\mathop{+} \frac{1}{\gamma }}}{1\mathop{+} \frac{1}{\gamma }}\right) e^{-\rho t}dt\), where \(\theta >0\) is the inverse of the inter-temporal elasticity of substitution, \(\gamma\) is the Frisch labor supply elasticity, \(\rho >0\) is the subjective discount rate, and subject to the flow budget constraint \(\dot{a}(t)=r(t)\cdot a(t)+\sum _{s\,=\,I,\,F}w_{L}^{s}(t)\cdot L^{s}+\sum _{s\,=\,I,\,F}w_{H}^{s}(t)\cdot H^{s}-C(t)\), where a denotes household’s real financial assets holdings, r is the real interest rate, and \(w_{i}\) is the wage for labor employed in the i-sector. The initial wealth level a(0) is given and the non-Ponzi games condition \(lim_{t\,\rightarrow \,\infty }e^{-\int _{0}^{t}r(s)ds}a(t)\ge 0\) is imposed. In this context, the representative household chooses the path of final-good aggregate consumption \(\left[ C(t)\right] _{t\,\ge\, 0}\) to maximize the discounted lifetime utility, resulting, respectively, the following optimal consumption path Euler equation and optimal relative labor supply curve,

Moreover, the transversality condition is also standard: \(\underset{t\,\rightarrow\, \infty }{lim}\, e^{-\rho t}\cdot C(t)^{-\theta }\cdot a(t)=0\). The aggregate financial wealth held by the representative households is composed of equity of intermediate goods producers \(a(t)=\sum _{i\,=\,L,\,H}a_{i}(t)\), taking into account the profits seized by the producers of the top quality of the different intermediate goods. The aggregate flow budget constraint is equivalent to the final product market equilibrium condition \(Y(t)=C(t)+X(t)+Z(t)\), where Y(t) is the aggregate final good (or numeraire), X(t) is the total investment in intermediate goods production and Z(t) is the aggregate R&D expenditures. Final-good producers are competitive and Y is produced with a CES aggregate production function of unskilled and skilled final goods:

where: \(Y_{L}\) and \(Y_{H}\) are the total outputs of the L-sector and the H-sector, respectively (i.e., the intermediate final goods); \(\chi _{L}\) and \(\chi _{H}\), with \(\sum _{j\,=\,L,\,H}\chi _{j}=1\), are the distribution parameters, measuring the relative importance of the inputs; \(\varepsilon \ge 0\) is the elasticity of substitution between the two inputs, wherein \(\varepsilon >1\) \(\left( \varepsilon <1\right)\) means that sectors are gross substitutes (complements) in the production of Y.Footnote 9 We normalize the price of the aggregate final good at unit, \(P_{Y}\equiv 1\);Footnote 10 thus, \(P_{Y}\equiv 1=\left[ \sum _{i\,=\,L,\,H}\chi _{i}^{\varepsilon }P_{i}^{1\mathop{-}\varepsilon }\right] ^{\frac{1}{1\,-\,\varepsilon }}\), where \(P_{L}\) and \(P_{H}\) are the world prices of the outputs of, respectively, the L-sector and the H-sector, and the right-hand side of the expression is the unit cost of production. This normalization together with the assumption of competitive final-good firms imply the following maximization problem: \(Max\,\Pi =Y-\sum _{i\,=\,L,\,H}P_{i}Y_{v_{i}}\). From the first-order conditions emerge the following inverse demand for \(Y_{v_{i}}\), \(i=L,H\): \(P_{i}=\left( \frac{Y}{Y_{v_{i}}}\right) ^{\frac{1}{\varepsilon }}\). Thus, the relative price of the H-sector (in terms of the L-sector) is:

i.e., the relative price of the H-sector is an increasing function of the relative importance of the sector’s output, \(\frac{\chi _{H}}{\chi _{L}}\), and a decreasing function of the relative output of the sector, \(\frac{Y_{v_{H}}}{Y_{v_{L}}}\). We interpret the output of each intermediate final-goods sector, \(Y_{v_{i}}\)(\(i=L,H\)), as a continuum mass of unskilled and skilled varieties indexed, respectively, by \(v_{L}\in \left[ 0,1\right]\) and \(v_{H}\in \left[ 0,1\right]\). Since countries have different labor endowments, we consider, for each sector \(i=L,H\), that each perfectly competitive variety is produced by either I or F; the world output of variety \(v_{i}\), \(Y_{v_{i}}\), at time t is

where the contribution to production of variety \(v_{i}\) in sector \(i=L,H\) is given by global quality-adjusted intermediate goods, the first term on the right-hand side, and by country specific labor, the second and third terms. We reflect in (4) the country F-specific term \(\Re _{i}\ge 1\), related with relocations since global firms increase the local labor productivity in follower country (e.g., Branstetter 2006). Thus, this parameter reflects the increase in productivity that global firms – either L- or H-oriented – induce in the foreign country, F.

Each intermediate good \(j\in \left[ 0,J_{i}\right]\) used in the production of \(v_{i}\) is quality-adjusted; i.e., the quality upgrade is \(q>1\), and k is the top-quality rung at time t.Footnote 11 The quantity of j with quality k at t can be produced by either I, \(x_{v_{i}}^{I}(k,j,t)\), after a successful innovation, or F, \(x_{v_{i}}^{F}(k,j,t),\) after adoption.Footnote 12 Thus, the quality level of j rises due to the R&D innovative activity driven by I, but both countries use the top-quality intermediate goods; i.e., \(k=k^{I}\ge k^{F}\), which can be produced domestically or not. In the latter case, countries import the top quality of j. The terms \((1-\alpha )\in \left( 0,1\right)\) and \(\alpha \in \left( 0,1\right)\) are, respectively, the aggregate intermediate-goods and labor input shares. The foreign (innovator) F (I) produces the varieties indexed by \(v_{i}\le \overline{v}_{i}\) \((v_{i}>\overline{v}_{i})\); i.e., in the production function (4), \(i_{v}^{I}=0\) for \(0\le v_{i}\le \overline{v}_{i}\) and \(i_{v}^{F}=0\) for \(\overline{v}_{i}<v_{i}\le 1\);Footnote 13 and the demand for intermediate good j, by the representative producer of \(v_{i}\), is \(x_{v_{i}}^{s}(k,j,t)=\left( 1-v_{i}(t)\right) \cdot \Re _{i}\cdot i_{v}^{F}\left[ \frac{P_{v_{i}}(t)\cdot (1\,-\,\alpha )}{p_{i}(j,\,t)}\right] ^{\frac{1}{\alpha }}q^{k(j,\,t)\left[ \frac{1\mathop{-}\alpha }{\alpha }\right] }\) if \(v_{i}\) is produced in F or \(x_{v_{i}}^{s}(k,j,t)=v_{i}(t)\cdot i_{v}^{I}\left[ \frac{P_{v_{i}}(t)\cdot (1\,-\,\alpha )}{p_{i}(j,\,t)}\right] ^{\frac{1}{\alpha }}q^{k(j,\,t)\left[ \frac{1\mathop{-}\alpha }{\alpha }\right] }\) if \(v_{i}\) is produced in I, where \(P_{v_{i}}(t)\) is the price of variety \(v_{i}\) at time t and \(p_{i}(k,j,t)\) is the price of the intermediate good j used to produce varieties \(i=L,H\), with quality k at time t – these prices are given for the perfectly competitive producers of the final-good varieties. Plugging these demand functions into the production function (4), the world supply of \(v_{i}\) is:

where \(Q_{i}(t)\equiv \int _{0}^{J_{i}}q^{k(j,\,t)\left( \frac{1\mathop{-}\alpha }{\alpha }\right) }dj\) is the aggregate quality index of the technological-knowledge stock in sector \(i=L,H\).Footnote 14 The production function of each variety merges complementarity between inputs with substitutability between countries, and clearly shows that the economic growth rate is driven by the technological-knowledge progress in I, \(Q_{i}\) (e.g., Acemoglu and Zilibotti 2001; Afonso 2012), as will be clear later on.

Adapting the modeling strategy used by, for example, Acemoglu and Zilibotti (2001) and Afonso (2012), a relative productivity advantage of labor in each country, \(s=I,F\), is captured by the adjustment terms \((1-v_{i})\) and \(v_{i}\); i.e., these adjustment terms transform the index \(v_{i}\) into an ordering index, meaning that \(i^{F}\) (\(i^{I}\)) is relatively more productive in varieties indexed by \(v_{i}\) close to 0 (1). Since \(v_{i}\in \left[ 0,1\right]\), there is a threshold variety, \(\overline{v}_{i}\), endogenously determined, which implies that the switch of production from one country to another becomes advantageous. In this sense, \(\overline{v}_{i}\) defines the structure of intermediate final-good varieties – at each time t there are \(\overline{v}_{i}\) varieties produced in F and \((1-\overline{v}_{i})\) varieties produced in I – and is, thus, an endogenous indicator of the competitiveness of each country.

The optimal choice of the producer country is reflected in the equilibrium threshold \(\overline{v}_{i}\), which, since both countries have access to the same technological knowledge, depends only on country-specific productivity-adjusted aggregate labor (e.g., Acemoglu and Zilibotti 2001, Afonso 2012),Footnote 15

That is, the endogenous threshold variety of the aggregate intermediate final good i comes from profit maximization (by perfectly competitive intermediate final-goods producers and by monopolist producers of intermediate goods) and full employment equilibrium in factor markets, given the labor supply and the current state of technological knowledge. Moreover, \(\overline{v}_{i}\) implies that the switch from one country to the other becomes advantageous. An increase in \(\overline{v}_{i}\) would mean a larger space for production in F, thus evaluating its relative competitiveness. The previous assumptions about the net absolute productivity advantage of labor in I over labor in F, \(\Re _{i}\), and labor endowments results in a given \(\overline{v}_{i}\) and thus in a given number of varieties produced in each country. In particular, an increase in \(\Re _{i}\) increases the country’s F competitiveness, which is the competitiveness induced by global firms. In particular, the access to the state-of-the-art intermediate goods in I, coupled with the relative scarcity of skilled labor in F, implies that relatively more L-technology final goods are produced in F; i.e., \(\overline{v}_{L}>\overline{v}_{H}\).

The threshold variety of the aggregate intermediate final good \(i=L,H\), \(\overline{v}_{i}\), is small, implying that the fraction of varieties produced in I is large (strong competitiveness of I), when the relative employment of labor, \(\frac{i^{I}}{i^{F}}\), is large and the absolute advantage of labor in I, \(\Re _{i}^{-1}\), is strong. Hence, countries’ F competitiveness is greater the greater the productivity of relocated opportunities, \(\Re _{i}\), and, by depending on employed labor level, it relies on the functioning of the labor market – see Eq. (6).

Since the aggregate output, Y, is the input in the production of the top quality k of each intermediate-good firm \(j\in \left[ 0,J_{i}\right]\), \(i=L,H\), and final varieties/goods are produced in perfect competition, the marginal cost of producing j is one. The production of the top quality k of j requires a start-up cost of R&D to reach the new design, which can only be recovered if profits at each date are positive for a certain time in the future. This is assured by a system of Intellectual Property Rights (IPRs) that protect the leader firm’s monopoly, while at the same time, disseminating, almost without costs, acquired technological knowledge to other firms. Hence, each firm that holds the patent for the top quality k of j at t supplies all respective varieties in each \(i=L,H\) and gets \(\pi _{i}(k,j,t)=\left[ p_{i}(k,j,t)-1\right] \cdot x_{i}^{s}(k,j,t)\), where \(x_{i}^{s}(k,j,t)=\int _{0}^{1}x_{v_{i}}^{s}(k,j,t)dv_{i}\) since all varieties use the same technology, face the same input prices and choose the same input ratios. The profit-maximization price of the monopolistic intermediate good firms yields \(p_{i}(k,j,t)=p(j)=p=\frac{1}{1\mathop{-}\alpha }>1, \, \alpha\, \in \, \left( 0,1\right)\), which represents a mark-up since it is greater than one. The closer it is to zero, the smaller the mark-up and thus there is less room for monopoly pricing. This mark-up is constant over time, across intermediate goods and for all quality grades, which makes the problem symmetric. Since the leader firm is the only one legally allowed to produce the highest quality, it will use pricing to wipe out sales of lower quality. Depending on whether \(q(1-\alpha )\) is greater or less than marginal cost, the leader firm will use either the monopoly pricing or the limit pricing, respectively, to capture the entire market. Like Grossman and Helpman (1991, Ch. 4), for example, we assume that limit pricing strategy is binding and, thus, is used by all firms. Since the lowest price that the closest follower can charge without negative profits is one, the leader can successfully capture the entire market by selling at a price slightly below \(q\equiv \frac{1}{1\,-\,\alpha }\), as q is the quality advantage over the closest follower. Thus, q is also an indicator of the market power of the incumbent firm in each intermediate good.

Moreover, from the expressions for \(Y_{H}\) and \(Y_{L}\), the ratio in (3) can be written as:

where: \(\mathbb {\mathcal {Q}\equiv }\frac{Q_{H}}{Q_{L}}\) measures the technological-knowledge bias. Hence, an increase in the absolute advantage of the skilled labor over the unskilled, \(\frac{\Re _{H}}{\Re _{L}}\), due to the action of global firms or an increase in the technological-knowledge bias, \(\mathcal {Q}\), decreases the relative price of the skilled goods.

3.2 Labor Market

3.2.1 Perfect Competition

In perfect competition, unskilled and skilled wages are equal to their marginal productivity and full-employment in the labor market, implicit in \(\overline{v}_{i}\), yielding the following equilibrium wages:

where \(i=L,H\) and \(w_{i}^{F}(t)\) and \(w_{i}^{I}(t)\) are, respectively, wages per unit of labor type i in F and in I, respectively; thus, an increase in the presence of global firms and/or in the absolute labor productivity in these firms affect(s) positively the wage in F and in I; i.e., \(\frac{\partial w_{i}^{F}}{\partial \Re _{i}}>0\) and \(\frac{\partial w_{i}^{I}}{\partial \Re _{i}}>0\), but the effect is strong in F; i.e., \(\frac{\partial w_{i}^{F}}{\partial \Re _{i}}>\frac{\partial w_{i}^{I}}{\partial \Re _{i}}>0\) – see (8) and (9) substituting (5).Footnote 16 In turn, since p(k, j, t) is independent of j, k and t, and is the same for all js, the intra-country wage inequality (skill premium) in each country is given by: \(\frac{w_{H}^{F}(t)}{w_{L}^{F}(t)}=\left( \frac{P_{H}}{P_{L}}\right) ^{\frac{1}{\alpha }}\cdot \left[ \frac{\Re _{H}\mathop{+}\left( \Re _{H}\mathop{\cdot} \mathcal {H}\right) ^{\frac{1}{2}}}{\Re _{L}\mathop{+}\left( \Re _{L}\mathop{\cdot} \mathcal {L}\right) ^{\frac{1}{2}}}\right] \cdot \mathcal{Q}(t)\) and \(\frac{w_{H}^{I}(t)}{w_{L}^{I}(t)}=\left( \frac{P_{H}}{P_{L}}\right) ^{\frac{1}{\alpha }}\cdot \left[ \frac{1\mathop{+}\left( \Re _{H}\mathop{\cdot} \mathcal {H}^{-1}\right) ^{\frac{1}{2}}}{1\mathop{+}\left( \Re _{L}\mathop{\cdot} \mathcal {L}^{-1}\right) ^{\frac{1}{2}}}\right] \cdot \mathcal{Q}(t)\), where: \(\mathcal {H}\equiv \frac{H^{I}}{H^{F}}\) and \(\mathcal {L}\equiv \frac{L^{I}}{L^{F}}\) are the relative abundance of skilled and unskilled labor in I, respectively. These equations show that the skill premium is increasing in the relative price, thus bearing in mind (7), it can be written as:

Regardless of the country, the skill premium, \(\frac{w_{H}^{s}}{w_{L}^{s}}\), is greater when: (i) the technological-knowledge bias, \(\mathcal {Q}\), is higher; (ii) the importance of the skilled intermediate final good over unskilled intermediate final good, \(\frac{\chi _{H}}{\chi _{L}}\), is higher; (iii) the abundance (scarcity) of unskilled (skilled) labor in the country is higher; (iv) the abundance of the skilled (unskilled) labor in the other country is higher, if \(\alpha \varepsilon >1\); i.e., under substitutability between the L-sector and the H-sector (results are reversed under weak substitutability or complementarity between sectors, i.e., if \(\alpha \varepsilon <1\)).

Furthermore, from (1), the relative supply wage is \(\left( \frac{w_{H}^{s}}{w_{L}^{s}}\right) _{Supply}=\left( \frac{H^{s}}{L^{s}}\right) ^{\frac{1}{\gamma }}\). Thus, the perfect equilibrium in the labor market, \(\left( \frac{w_{H}^{s}}{w_{L}^{s}}\right) _{Demand}=\left( \frac{w_{H}^{s}}{w_{L}^{s}}\right) _{Supply}\), is given by

where Eq. (12) is obtained by substituting (11) into (10), and \(\frac{H^{s}}{L^{s}}\) and \(\frac{w_{H}^{s}}{w_{L}^{s}}\) in (11) and (12) are the equilibrium solutions of the variables at each period of time. They are used as a baseline to determine the solutions of the bargaining case below.

3.2.2 The Bargaining Labor Market

The efficient bargaining model was first proposed by McDonald and Solow (1981) – see Layard and Nickell (1990) for a critical review. In this case, labor unions and firms decide together the amount of working hours (e.g., Johnson 1990). Through a generalized Nash bargaining problem, we assume that labor unions and the employers’ federations negotiate simultaneously over (unskilled) wages and employment, considering the demand of final goods firms. In fact, e.g., Hirsh and Schumaker (1998) argue that most literature report that union wage effects are larger for workers with low measured skills. Formally, in line with Chang and Hung (2016) and Chang et al. (2007), the optimization problem can be written as

where: \(\mu \in \left( 0,1\right)\) is the bargaining power of the labor unions that is dependent on the share of labor that belongs to the trade union \(\theta\), which for simplification we assume to be independent of the quantity of labor; \(\widetilde{w}_{L}^{s}\) corresponds to the bargaining wage; \(\pi _{v_{L}}^{s}=\pi _{L}^{s}\) is the final-variety firm’s profits using the L-technology; \(\overline{\Phi }_{L}^{s}\) and \(\overline{\pi }_{v}^{s}\) are the disagreement points of, respectively, the labor unions and the representative final-good firm. Following Chang et al. (2007), we assume that, without reaching an agreement, the employment level regarding unskilled workers would be zero and, therefore, \(\overline{\Phi }_{L}^{s}=0\), and \(\overline{\pi }_{L}^{s}=\pi _{H}^{s}\), where \(\pi _{H}^{s}\) corresponds to the final-variety firm’s profit using only the H-technology. Hence, by maximizing Eq. (13) with respect to \(\widetilde{w}_{L}^{s}(t)\) and \(L_{v}^{s}(t)\) and considering the expression for profits, we get, with some manipulations, the optimal condition for the unskilled wage:

where: \(\Xi =1+\frac{1}{\alpha }\frac{\mu (\theta )\eta \left( 1\mathop{-}RtS\right) }{\left( 1\mathop{-}\mu (\theta )\right) \mathop{+}\mu (\theta )\eta }\ge 1\) and RtS measures the returns to scale in (4). That is, the unskilled bargaining wage, \(\widetilde{w}_{L}^{s}\), is also a mark-up over the perfect competition wage without constant returns to scale, \(0<RsT<1\), and corresponds to the perfect competition wage under constant returns to scale, \(RsT=1\). In the latter case, \(\Xi =1\) and thus \(\widetilde{w}_{L}^{s}\) is independent of the bargaining power, \(\mu\).Footnote 17 Following the rationale used in the previous cases, the bargaining skill premium in each country is:

where \(\frac{w_{H}^{s}(t)}{w_{L}^{s}(t)}\) is given by Eq. (12); and the bargaining employment ratio will be determined on the contract curve, which in relative terms can be defined as \(\left( \frac{\widetilde{w}_{L}^{s}(t)}{w_{H}^{s}(t)}-\frac{w_{L}^{s}(t)}{w_{H}^{s}(t)}\right) =\left( \frac{1\mathop{-}\eta }{\eta }\right) \left( \frac{\Xi \cdot w_{L}^{s}(t)}{w_{H}^{s}(t)}-\frac{w_{L}^{s}(t)}{w_{H}^{s}(t)}\right)\). The markup is crucially determined by the percentage of unionized labor that controls the bargaining power: as \(\frac{\partial \Xi }{\partial \theta }=\frac{1}{\alpha }\frac{\mu '(\theta )\eta \left( 1\mathop{-}RtS\right) }{(\left( 1\mathop{-}\mu (\theta )\right) \mathop{+}\mu (\theta )\eta )^{2}}>0\), the percentage of unionized labor helps to shrink wage inequality.

Proposition 1

For a given technological-skill bias, wage inequality depends on both labor union participation and globalization. In particular, globalization changes the shrinking effect that labor union participation has on wage inequality.

Proof

Combining (12) with (15) and the result in the previous paragraph we obtain that the effect of H-biased relocation opportunities (H-biased globalization) is the following:

If the sign of (16) is positive, then H-biased globalization will enhance the (shrinking) effects of union participation on wage inequality. On the contrary, if the sign of (16) is negative, then H-biased globalization will decrease the (shrinking) effects of union participation on wage inequality. Since, by (12), \(\frac{\partial \left[ \frac{w_{H}^{s}(t)}{w_{L}^{s}(t)}\right] }{\partial {\Re _{H}}}>0\) for I under a level of substitutability such that \(\alpha \varepsilon >1\), and \(\frac{\partial \left[ \frac{w_{H}^{s}(t)}{w_{L}^{s}(t)}\right] }{\partial {\Re _{H}}}<0\) under complementarity or low substitutability (\(\alpha \varepsilon <1\)), H-biased globalization reduces the shrinking effect of labor union participation in the innovator country only under complementarity or a low degree of substitutability. By analogy, and considering the analysis of (12), L-biased globalization reduces the shrinking effect of labor union participation in the innovator country only under a level of substitutability such that \(\alpha \varepsilon >1\). In the follower country (F), the value of the derivative of (12) is higher than in the innovative country (I), increasing the positive effect of H-biased globalization when \(\alpha \varepsilon >1,\) and increasing the effect of H-biased globalization when \(\alpha \varepsilon <1\). By analogy, and considering the analysis of (12), L-biased globalization reduces the shrinking effect of labor union participation in the follower country only when \(\alpha \varepsilon >1\), and this negative effect is higher than in the innovator country. \(\square\)

Since the empirically most plausible case is \(\alpha \varepsilon >1\) (see also Table 1) then L-biased globalization reduces the shrinking effect of labor union participation in the innovator country, but not H-biased globalization. This implies that if globalization occurs in the US by the relocation of skilled activities, the shrinking effects of union participation will be amplified. Given that the current process of globalization seems to be based on skilled relocations, one should expect a decrease of wage inequality due to increased unionization in innovative countries such as the US or Sweden. However, if those countries experience a fall in labor union participation, which will increase inequality, the effect of globalization will amplify this rise in inequality. In recent decades, however, globalization was characterized by unskilled relocations, meaning that it acted against the shrinking effect of rising unionization, namely in northern Europe.

The following Table 3 summarizes the main results of globalization on the effect of unionization in diminishing wage inequality for a level of substitutability such that \(\alpha \varepsilon >1,\) given the value of the skill-biased technological change (i.e., \(\mathcal {Q}\) is constant). Globalization can either amplify or mitigate the shrinking effect of unionization on wage inequality.

These results also imply that in the case of a reduction in unionization (and, consequently, an increase in wage inequality), H-biased globalization amplifies the increasing path of wage inequality, an effect that is even stronger in the Follower country. On the contrary, L-biased globalization would counter-influence the increasing path of wage inequality due to the decrease in labor unionization, an effect that is also stronger in the Follower country.Footnote 18

The following Table 4 summarizes the main results of globalization on the effect of unionization in diminishing wage inequality for low substitutability or complementarity (when \(\alpha \varepsilon <1\)).

This means that under low substitutability or complementarity, the net effect of globalization on the effect of unionization on wage inequality is uncertain and can only be guessed quantitatively.

Then, by combining (14), (10 and (12), we reach the bargaining employment ratioFootnote 19:

Since \(\frac{\mu (\theta )\eta \left( 1\mathop{-}RtS\right) }{\left( 1\mathop{-}\mu (\theta )\right) \mathop{+}\mu (\theta )\eta }\ge 0\), if \(\eta \gtrless \frac{1}{2}\) then \(\left( \frac{1}{1\mathop{-}\frac{1\mathop{-}2\eta }{1\mathop{-}\eta }\frac{1}{\alpha }\frac{\mu (\theta )\eta \left( 1\mathop{-}RtS\right) }{\left( 1\mathop{-}\mu (\theta )\right) \mathop{+}\mu (\theta )\eta }}\right) \lessgtr 1\). Hence, the bargaining employment ratio is influenced by labor union’s preferences: if the labor union is employment (wage) oriented, \(\eta >\frac{1}{2}\) \(\left( \eta <\frac{1}{2}\right)\), the unskilled employment is higher (lower) than the level achieved under the perfect competition and as a result \(\frac{H^{s}}{\widetilde{L^{s}}}<\frac{H^{s}}{L^{s}}\) \(\left( \frac{H^{s}}{\widetilde{L^{s}}}>\frac{H^{s}}{L^{s}}\right)\). In line with Chang et al. (2007), the contract curve is upward or downward sloping in the \(\left( w_{L},L\right)\) plan if and only if the labor union is employment-oriented or wage-oriented, i.e., \(\eta >\frac{1}{2}\) or \(\eta <\frac{1}{2}\).Footnote 20

3.2.3 Calibration and Steady-state Effects

In the following lines, we assess quantitatively the effects highlighted in Proposition 1 for plausible sets of parameters and variables.Footnote 21 To be more specific, we calculate the value of the derivative in equation (16) for different values of labor union participation \((\theta )\). The challenge here is to empirically assess \(\mu (\theta )\) i.e., the functional form of bargaining power responding to labor union participation. Both Bryson (2007) and Kim (2014) support that unions’ bargaining power depends positively on labor unions’ participation but are unclear about how this function behaves. As the literature does not seem to shed light on this issue, we consider two different functions \(\mu (\theta )\), both limited between 0 and 1 and increasingly nonlinear in \(\theta\): the first is simply \(\mu (\theta )=sin(\theta )\),Footnote 22 and the second is inspired in an entropy function \(\mu (\theta )=2({1-(1+\theta )^{-1}})\). Both functions approach 1 as \(\theta\) increases. The main difference between both functional forms is that while the sin function approaches 1 more slowly than the labor union participation \(\theta\), the second function approaches the limit faster than the labor union participation. Thus, apart from their limits, the unions’ bargaining power is greater than labor participation in unions for the second function, whereas it is smaller for the first one.

Figure 2 shows the effect that H-biased globalization has in shrinking the effect of unionization on wage inequality. As said above, H-biased globalization contributes to further shrinking the gap between skilled and unskilled wages. Depending on the bargaining function, the quantitative effects oscillate between nearly 1% and nearly 4%. However, for a level of union participation of 30% (an empirically reasonable level), the model estimates an increase of 1% to 1.5% in the shrinking effect of unionization due to globalization. As predicted by the model, effects in the innovator country are considerably less (nearly 0.3%).

Figure 3 presents the effect of L-biased globalization, which mitigates the (shrinking) effect unionization has on wage inequality. This means that both phenomena may have contributed to the rising trend in wage inequality observed in the data. In fact, the increase in union participation mainly in the northern European countries helped to decrease wage inequality. At the same time, increases in globalization should soften this effect and may explain the rising trend in wage inequality.

However, as Fig. 1 shows, in most countries and namely in the US, labor unions’ membership has been falling over decades and globalization has been increasing during the same period. This means that while the path of unions’ membership has increased inequality, L-biased globalization has tended to decrease it. Thus, perhaps contrary to the common wisdom, until now globalization characterized by unskilled labor relocations has acted as a stabilizer of the negative effects of de-unionization on wage inequality. Quantitatively these effects are greater than those of the H-biased globalization, approaching -3% in the follower country and \(-\)0.60% in the innovator country.

Nevertheless, nowadays, H-biased relocations seem to be occurring more than L-biased relocations (e.g., Milanovic 2016; Baldwin 2017) while fewer and fewer workers are members of trade unions. This means that we may expect that this type of globalization contributes to further increase wage inequality.

3.3 Inter-country Unskilled Wages

In this section the aim is to assess the effect of globalization on the effects of unionization on inter-country wage inequality. Recall that the labor terms include the quantities employed in the production of the variety \(v_{i}\), \(L_{v}^{F}\) and \(L_{v}^{I}\) or \(H_{v}^{F}\) and \(H_{v}^{I}\) - see (5). We focus on unskilled wages since the distortions occur in the unskilled labor market as explained above.

The threshold variety, \(\overline{v}_{i}\), (see 6) in each \(i=L,H\), can be implicitly expressed in terms of index prices. This is achieved by taking into account that in the production of the threshold variety \(v_{i}=\overline{v}_{i}\) both countries should break even. This turns out to yield, at each t, the following ratio of index prices of \(i=L,H\) varieties produced by I and F:

where \(P_{i}^{I}\) and \(P_{i}^{F}\) are the price indexes of \(i=L,H\) varieties produced by I and F, respectively; i.e., the relative price of i-varieties produced by I and F, \(\frac{P_{i}^{I}}{P_{i}^{F}}\), in (18), is low when the threshold variety, \(\overline{v}_{i}\), is small. The equilibrium aggregate resources devoted to intermediate-goods production, \(X_{i}(t)=X_{i}^{I}(t)+X_{i}^{F}(t)=\int _{0}^{1}\int _{0}^{J_{i}}x_{v_{i}}(k,j,t)djdv_{i}=\exp \left( -1\right) \cdot \left[ P_{i}\cdot \left( \frac{1\mathop{-}\alpha }{q}\right) \right] ^{\frac{1}{\alpha }}\cdot Q_{i}\cdot \left( \left( \Re _{i}\cdot i^{F}\right) ^{\frac{1}{2}}+i^{I^{\frac{1}{2}}}\right) ^{2}\), and the equilibrium aggregate intermediate final good ‘summing-up’ homogeneous physical quantities – i.e., the world production of the i-intermediate final good –, \(Y_{i}(t)=Y_{i}^{I}(t)+Y_{i}^{F}(t)=\int _{0}^{1}P_{v_{i}}(t)Y_{v_{i}}(t)dv_{i}=X_{i}\cdot \frac{q}{1\mathop{-}\alpha }\), are thus expressible as a function of the currently given factor levels (\(Q_{i}\), \(i^{I}\), and \(i^{F}\)), prices (P(j), \(P_{i}^{I}\), and \(P_{i}^{F}\)) and parameters (\(\alpha\) and \(\Re _{i}\)) – see Appendix A2.1;Footnote 23 moreover, this representation features constant (equal to 2) elasticity of substitution between the same type of labor in both countries.Footnote 24 Therefore, \(Y_{i}\) (or \(Y_{v_{i}}\)) is nonetheless a weighted average of the F’s and the I’s endowments of i-type labor, with weights depending on the presence of global firm levels, which, in turn, positively affect the world production: \(\frac{\partial Y_{i}}{\partial \Re _{i}}>0\).

Wage inequality for \(i=L,H\) is given by:

Recall that \(\frac{\partial \Xi }{\partial \theta }=\frac{1}{\alpha }\frac{\mu '(\theta )\eta \left( 1\mathop{-}RtS\right) }{(\left( 1\mathop{-}\mu (\theta )\right) \mathop{+}\mu (\theta )\eta )^{2}}>0\) and so \(\frac{\frac{\partial \left| \frac{\partial \frac{w_{L}^{I}(t)}{\widetilde{w}_{L}^{F}(t)}}{\partial \frac{\theta ^{I}}{\theta ^{F}}}\right| }{\partial {\Re _{L}}}}{<}0\). This means that the inter-country unskilled wage inequality is higher, the higher is the bargaining power of labor in the innovative country vis-à()-vis the bargaining power in the follower country. Thus the L-biased globalization decreases the influence that different labor market institutions (e.g., their bargaining power) have on the wages.

Our main objective in the next sections is to assess the dynamics of the effect of labor unions participation after a shock in globalization such as the entrance of China in the WTO.

3.4 Research and Development Sector

Research and development drives the rate and the direction of the technological knowledge, and thus wages, intra-country wage inequality and the global economic growth. Following Acemoglu (2003) we consider, as previously mentioned, that only I performs innovative R&D that result in designs for the manufacture of new qualities of the intermediate goods so that producers in F have access to the designs invented in I – thus F has access to the same technological knowledge as I in both sectors, \(Q_{L}^{I}\) and \(Q_{H}^{I}\) – by costless technological-knowledge adoption.Footnote 25

The designs are domestically and internationally patented and the leader firm in each intermediate-goods industry – the one that produces according to the latest patent – uses limit pricing to assure monopoly. Concerning the degree of international IPRs protection, we assume, in line with Gancia and Bonfiglioli (2008) and international-finance models, that producers of intermediate goods in F; i.e., adapters, have (just) to pay a fixed royalty fee in terms of the aggregate output to the original innovator for the use of the design. Thus, each adopter is granted by monopoly power in producing the adopted intermediate good. Since the innovative R&D is costly and the adoption royalty fee is positive, it is profitable for just one firm to use the new design; thus, for example, adoption activities do not affect the equilibrium market structure: if, by hypothesis, the same intermediate good is adopted by more than one firm in F, Bertrand competition would lower its price to the marginal cost and no firms will be able to recover the fixed cost associated with these activities; as a result, anticipating negative profits, a second adapter will not enter.

The value of the leading-edge patent depends on the profit-yields accruing during each period t to the monopolist, and on the duration of the monopoly power. The duration, in turn, depends on the probability of a new innovation, which creatively destroys the current leading-edge design.Footnote 26 The probability of successful innovation is, thus, at the heart of the R&D activity. Let \(\mathcal {I}_{i}(j,t)\) denote the instantaneous probability at time t in \(i=L,H\) – a Poisson arrival rate – of successful innovation in the next higher quality \(\left[ k(j,t)+1\right]\) in intermediate-goods industry j,

where: (i) \(y_{i}(k,j,t)\) is the flow of domestic final-good resources devoted to R&D in intermediate good j, belonging to \(i=L,H\), which defines our framework as a lab-equipment model (Rivera-Batiz and Romer 1991); (ii) \(\beta\) \(q^{k(j,\,t)}\), \(\beta >0\), represents learning-by-past domestic R&D, as a positive learning effect of accumulated public knowledge from past successful R&D (Grossman and Helpman 1991, ch. 12; Afonso 2012); (iii) \(\zeta ^{-1}q^{-\alpha ^{-1}k(j,\, t)}\), \(\zeta >0\), is the adverse effect – cost of complexity – caused by the increasing complexity of quality improvements (Kortum 1997; Dinopoulos and Segerstrom 1999; Afonso 2012);Footnote 27 (iv) \((i^{s})^{-\xi }\), \(i=L,H\), \(\xi \ge 0\), is the adverse effect of market size, capturing the idea that the difficulty of introducing new quality intermediate goods and replacing old ones is proportional to the market size measured by the respective employed labor level and thus dependent on the functioning of the labor market; thus, \(s=I\) or \(s=F\) if the final-good variety is currently produced in I or F, respectively. Through this term the scale benefits on profits can be partially (\(0<\xi <1\)), totally (\(\xi =1\)) or over counterbalanced (\(\xi >1\)) and therefore allows us to remove scale effects on the economic growth rate. That is, for reasons of simplicity, we reflect in R&D the costs of scale increasing, due to coordination among agents, processing of ideas, informational, organizational, marketing and transportation costs, as reported by works such as Dinopoulos and Segerstrom (1999) and Dinopoulos and Thompson (1999).Footnote 28

4 General Equilibrium

Having characterized the economic structure, we now proceed by endogenizing the technological-knowledge progress and direction, which, respectively, drives economic growth and wage dynamics. The interaction between different types of firms as a result of outsourcing, offshoring, and multinational branches in F, in addition to the domestic ones, plays a crucial role in the dynamic general world equilibrium and, thus, this interaction is endogenized. The (baseline) analysis throughout the section is first performed considering perfect competition in the labor market, but then the employed labor levels will be adjusted under efficient bargaining case for the rest of the analysis.

4.1 R&D Equilibrium

To determine the aggregate spending in R&D, we must understand how R&D is carried out in I. We need to determine which firms conduct R&D activities and the value of a design to introduce a new quality of one intermediate good, as well as to derive the laws of motion of \(Q_{L}(t)\) and \(Q_{H}(t)\). Since the probability of successful R&D is equal for incumbent and entrant firms, it is more profitable to introduce a new quality of j by an entrant firm than by the incumbent monopolist since, due to the “replacement or Arrow effect” (e.g., Aghion and Howitt, 1998, chap. 2), the change in profits of an entrant is higher: \(\triangle \pi _{i,entrant}(k,j,t)=\pi _{i}(k,j,t)-0>\triangle \pi _{i,incumbent}(k,j,t)=\pi _{i}(k,j,t)-\pi _{i}(k-1,j,t)\) – see also, e.g., Aghion and Howitt (1992) and Barro and Sala-i-Martin (2004, ch. 7).

Concerning the profitability of a new innovator in I (Eq. 21), we first need to take into account that the new quality-adjusted intermediate good can be used in the production of an intermediate final-good variety either in I or F:

The market value of the monopolistic firm or the value of the patent, \(V_{i}\left( k,j,t\right)\), depends on \(\pi _{i}^{I}(k,j,t)\). Let \(\tau +d\left( \tau \right)\) be the time when a (new) intermediate-good firm introduces the quality of j, \(q^{k(j)\mathop{+}1}\). The innovator that introduces \(q^{k(j)}\) is the monopolist between \(\tau\) and \(\tau +d\) and earns a sum of profits given by \(V_{i}\left( k,j,t\right) =\int _{\tau }^{\tau \mathop{+}d}\pi _{i}^{I}(k,j,t)\cdot \exp \left[ -r(t)\right] dt\), which is the market value of the monopolistic firm or the value of the patent. Since, in equilibrium, the interest rate is constant between \(\tau\) and \(\tau +d\), the expected value of \(V_{i}\left( k,j,t\right)\) is:

Equation (22) can be re-arranged to be clearly seen as the no-arbitrage condition, where \(V_{i}\left( k,j,t\right) \cdot r\left( t\right)\), the expected income generated by a successful innovation at time t on rung \(k^{th}\), equals the profit flow, \(\pi _{i}^{I}(k,j,t)\), minus the expected capital loss, \(V_{i}\left( k,j,t\right) \cdot \mathcal {I}_{i}\left( k,j,\tau \right)\), where the expected payoff generated by the innovation in j should be equal to the R&D spending to improve j:

The real benefits of innovation and relocation need to consider the effective cost of the new quality-adjusted intermediate good. Combining Eqs. (22) and (23), the equilibrium i-specific probability of successful R&D, \(\mathcal {I}_{i}\), given r and \(P_{i}\), is obtained and the equilibrium can be translated into the path of technological knowledge; i.e., in the law of motion of \(Q_{i}(t)\). For that, suppose that a new quality of intermediate good j is introduced. Everything else remaining equal, the change in the corresponding aggregate quality indexes is given by \(\triangle Q_{i}=\left( q^{k(j)\mathop{+}1}\right) ^{\frac{1\mathop{-}\alpha }{\alpha }}-q^{k(j)\left( \frac{1\mathop{-}\alpha }{\alpha }\right) }=q^{k(j)\left( \frac{1\mathop{-}\alpha }{\alpha }\right) }\left[ q^{\left( \frac{1\mathop{-}\alpha }{\alpha }\right) }-1\right] .\) The following expression for the equilibrium i-specific growth rate (where \(\mathcal {I}_{i}\), given r and \(P_{i}\), is included) isFootnote 29

Since, by assumption, both countries have access to the same state-of-the-art intermediate goods and the same technology of production of final goods,Footnote 30 the steady-state growth rate must be the same as well. Indeed, all macroeconomic aggregates (Y, X, Z, C and also, for example, \(\frac{w_{H}}{w_{L}}\)) can be expressed as multiples of \(Q_{L}\) and \(Q_{H}\), and the path of all relevant variables outside the steady state depends on the single differential equation that governs the path of technological-knowledge bias, i.e., \(\frac{\dot{\mathcal {Q}}}{\mathcal {Q}}=\frac{\dot{Q_{H}}}{Q_{H}}-\frac{\dot{Q_{L}}}{Q_{L}}\). Thus, using (24), (3), the expressions for \(Y_{i}(t)\), and the unique probability condition \(\Re _{i}=\left( \frac{i^{I}}{i^{F}}\right) ^{1\mathop{-}\xi }\) (see Eq. 24), we obtain the required expression:

which can be used to quantitatively analyze the impact of some shocks – for example in \(\Re _{i}\), and \(i^{s}\) – on the technological-knowledge bias and, consequently, on intra-country wage inequality.

4.2 Wage Inequality Dynamics

In this section we assess the wage inequality dynamics and present a transitional dynamics simulation for the impact of a shock in globalization on the effect that labor union participation has on intra-country wage inequality. Using (12) and (25), we obtain the following dynamic equations for the intra-country wage inequality:

and

We set \(g_{\Xi }=0\) and analyze the effect of shocks in \(\Re _{H}\) and \(\Re _{L}\) in the growth rate of wage inequality for different levels of initial \(\frac{w_{H}^{F}(t)}{\widetilde{w}_{L}^{F}(t)}\) and \(\frac{w_{H}^{I}(t)}{\widetilde{w}_{L}^{I}(t)}\), which depend also on the different initial levels of labor union participation.

In the following we present the dynamics of the economy (skill-biased technical change and wage inequality) following globalization and labor union participation shocks. These results are crucially different from those presented in Section 3.2.3, as they are now general equilibrium results incorporating the technological-knowledge bias response to the shocks.Footnote 31 We first consider the effects of skilled-biased globalization (an increase in the skilled absolute advantage \(\Re _{H}\) from 1 to 1.5) and the effects of unskilled-biased globalization (an increase in \(\Re _{L}\) from 1 to 1.5) on the technological-knowledge bias \(\mathcal {Q}\) and on wage inequality \(\frac{w_{H}^{i}(t)}{\widetilde{w}_{L}^{i}(t)}, i=I, F.\)

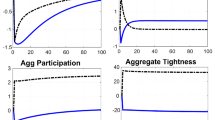

A shock in the skill absolute advantage (\(\Re _{H}\)) will decrease the bias toward skilled technology (represented by the grey line in Fig. 4) meaning that skill-biased relocation opportunities will decrease the bias toward domestic production that uses intensively skilled resources. On the contrary, a shock in the unskilled absolute advantage (\(\Re _{L}\)) will reduce the bias toward unskilled technology (and thus increase the skill bias represented by the thin black line in Fig. 4).

In the Follower country (Fig. 5a), a globalization shock toward skill relocation opportunities increases the wage inequality favoring skilled labor on the shock, but overshoots the long-run result. This means that once the globalization shock occurs, it hits wage inequality upwards, but only as long as technological skill bias decreases, since skilled activities begin to be relocated. In the Innovator country (Fig. 5b) the evolution is smoother – note that in (12), the last term is 1 in the Innovator – and it strictly follows that evolution of technology-skill bias, \(\mathcal {Q}\). In particular, a globalization shock toward skill relocation decreases wage inequality toward a lower steady-state level. Intuitively, this means that the Innovator country will produce fewer skilled-intensive intermediate goods.

Now, we want to assess the effect of a shock in labor union participation followed by the globalization shocks already mentioned. Consider a shock that lowers the level of labor union participation. In particular, we consider that the union participation drops from 60% to 20% at one time.Footnote 32 This represents a drop in \(\mu (\theta )\) from 0.75 to 0.33. In the follower country, the effect of unskilled relocation (see Fig. 6a - thin black line) is a sudden drop in intra-country wage inequality, followed by a smooth increase toward a level that is similar to the pre-shock level. With a higher shock in de-unionization, the final intra-country wage inequality may even be higher than its pre-shock level. The effect of skilled relocation (see Fig. 6a - grey line) is an increase in wage inequality that is significantly greater than in the situation without a de(unionization) shock. Initially, intra-country wage inequality jumps from nearly 1.35 to 1.75, but experiencing the same subsequent overshooting effect as in Fig. 5.

In the Innovator country, the effect of unskilled relocation (see Fig. 6b - thin black line) is a sudden increase in the skill premium, which is followed by a smooth further increase. This effect may mimic the evolution of the skill premium between the 1980s and 2000s in the most developed countries, such as the US and the UK, and is explained simultaneously by (unskilled) globalization and de(unionization). Note also that quantitatively the wage inequality (or skill premium) is consistent with the levels pointed out by Goldin and Katz (2007) for the US. Finally, skilled relocations followed by de(unionization) shocks are expected to decrease inequality in the innovator country (see Fig. 6b - thin grey line).

5 Conclusions

Globalization and (de)unionization in the labor market have probably been some of the most remarkable stylized facts of the 20th century and the decades that followed. Both phenomena have clear implications on intra-country wage inequality, which have been investigated separately in the literature. A remarkable example is the article by Acemoglu et al. (2001), which examines the effects of (de)unionization on the skill premium (the wage inequality between skilled and unskilled workers) but ignores the globalization channel. Other contributions that argue that both phenomena influence wage inequality ignore technological progress, which may mediate those triggers of the skill premium.

We first show empirically that both globalization and labor trade unions’ participation have in fact an influence on the skill premium. In particular, globalization tends to mitigate the shrinking effect that labor unionization has on wage inequality.

We then develop an open-economy general equilibrium growth model to analyze the joint effects of unionization and globalization on the skill premium. The model features two countries, both using skilled and unskilled labor in production. The country labeled as the Innovator is assumed to be skilled-labor abundant. In the labor market of unskilled workers of each country, there is a trade union that bargains with employers.

The model predicts that, for empirically acceptable levels of input substitutability and no technological progress, a reduction in unionization increases the skill premium. In the presence of skill-biased globalization, such an increase tends to be amplified, especially in the follower country, whereas in the presence of unskilled-biased globalization it tends to be mitigated. As in the past decades globalization was characterized by the relocation of unskilled-intensive activities, it contributed to mitigate the shrinking effects of unionization on wage inequality, namely in Northern Europe, where trade unions are stronger.

When we consider endogenous technological progress, unskilled relocations together with the process of reduction in unionization of the labor force explain the rising pattern of the skill premium observed in some innovator countries, namely the US and the UK. However, in the follower countries, a drop in the skill premium is followed by a smooth increase towards the steady state. Once relocation of skilled tasks becomes predominant, a reduction in the skill premium in innovator countries occurs, but a significant increase in the follower countries is expected. The results of the model help explaining the different trajectories of the skill premium observed in different countries over the last decades.

Notes

Richardson (1995), among others, emphasizes the need to understand the trend of intra-country wage inequality between skilled and unskilled labor in a context of strong technological progress in different countries.

For example, the Netherlands experienced a reduction in the skill premium with a simultaneous increase in the relative skilled labor supply between the early 1980s and mid-1990s (Acemoglu 2003). Similarly, in Mexico wage inequality fell between 1994 and 2002, while in the same period the relative number of skilled workers increased (Robertson 2004). In the Czech Republic and in Hungary the skill premium increased between 1993 and 2004, but the relative employment of skilled workers fell (Crino 2005). And in Canada, the rise in the skill premium in the 1990s was accompanied by stability in the relative supply of skilled labor (Acemoglu 2003). An upward trend in globalization is apparent for most countries until the 2008 subprime crisis and a stabilization is visible afterwards. Concerning union participation, most countries show a decreasing pattern.

Results with interdeciles measures of inequality would yield results in line with those shown in the paper. They are available upon request.

The number of net union members (i.e., excluding those who are not in the labor force, unemployed and self-employed) as a proportion of the number of employees.

Detailed results are available upon request.

The results would be broadly similar using interdecile measures of inequality. Results are available upon request.

The exception is the regression that uses as the dependent variable the inter-quantile wage ratio 9-1, in which none of the variables is statistically significant, although the coefficients keep the expected sign. However, given that the residuals are not stationary, less importance should be give to this regression

In particular, cases where \(\varepsilon =0\), \(\varepsilon =1\) and \(\varepsilon =+\infty\) we have, respectively, a Leontief, a Cobb-Douglas and a Linear production function.

To simplify notations, we suppress the time argument t and will do so throughout.

In equilibrium, only the top quality for every industry j is produced and used.

Without loss of generalization, F adopts the new technology at no costs.

The threshold variety also ensures that varieties that are relocated will not be produced in I.

It should be stressed that the technological-knowledge gap is always favorable to I: \(Q_{i}^{I}(t)\equiv Q_{i}(t)=\int _{0}^{J_{i}}q^{k(j,\,t)\left( \frac{1\mathop{-}\alpha }{\alpha }\right) }>Q_{i}^{F}(t)\equiv \int _{0}^{J_{i}}q^{k^{F}(j,\,t)\left( \frac{1\mathop{-}\alpha }{\alpha }\right) }dj\). If we start from an autarky situation, the available technological-knowledge level in F is just the domestic one. The improvement in the available technological-knowledge level in F – by access to the state-of-the-art intermediate goods of I – is a static gain of trade: F enjoys an immediate absolute and relative (to I) benefit in terms of aggregate output and factor prices since the marginal productivity of labor increases with \(Q_{i}\). Moreover, the structure of final-goods production is also affected, but in both countries: in autarky each country produces all varieties, while after there is a specialization determined by differences both in labor endowments and materialized relocation opportunities – see (6).

See Appendix B1 for a more technical derivation.

An increase in the presence of global firms in F such that \(\Re _{i}\) increases, implies that: (i) the labor demand increases in F and the labor supply increases in I, affecting positively wages in F and negatively in If labor effect; (ii) the global efficiency in production increases due to the efficiency effect, which expands the labor demand in both countries and, thus, wages. Under inter-country elasticity of substitution of each labor type equal to 2 (as occurs in our case), the efficiency effect, \(\frac{\partial Y_{i}}{\partial \Re _{i}}>0\), is so strong that global firms also raise the wage in I.

Regarding the bargaining power, under constant returns to scale in production \(\frac{\partial \left( \widetilde{w}_{L}^{s}(t)\mathop{-}w_{L}^{s}(t)\right) }{\partial \mu }=0\). In turn, in Neto et al. (2019), the assumption of decreasing returns to scale allows the firm to have a positive profit, which facilitates the bargaining process and, therefore, the unskilled wage is (also) a markup over the perfect competition wage.

As \(\xi \ge 1\), \(\frac{w_{H}^{s}(t)}{\widetilde{w}_{L}^{s}(t)}\le \frac{w_{H}^{s}(t)}{w_{L}^{S}(t)}\), since the unskilled wage tends to be higher under the bargaining context.

If the labor union is employment-oriented, its members will agree to decrease their reservation wage, determined on the supply curve, to increase the level of employment beyond the perfect competition equilibrium. Intuitively, during the bargaining process, each worker is willing to give up “part” of his/her wage on the condition that the firm hires more workers. On the other hand, if the labor union is wage-oriented, its members will agree to demand a higher wage for the same labor amount, but they would be willing to give up “part” of the employment level to achieve that wage increase. In this case, the bargaining solution would be placed on the left of the perfect competition equilibrium, but on the right of the demand curve. Interestingly, even though the labor union is wage-oriented, the employment level would be higher than in the monopoly case, but lower than the perfect competition solution. This can be explained by the fact that in this scenario, (i) the labor union still has some preferences regarding employment since \(\eta >0\); (ii) labor unions and firms decide jointly both the level of wage and employment.

The specific choices of parameters and variables to perform this quantitative exercise are detailed in . In this exercise we consider the endogenously determined level of technological-knowledge bias \(\mathcal {Q}\), of which the analytical expression is determined below.

For \(\theta =1, \sin (\theta )=0.84\).

An appropriate taxonomy for our countries I and F would be developed versus developing, rather than developed versus underdeveloped. Moreover, in the context with a common market, prices of goods tend to be very similar. Therefore, the contribution of I for \(Y_{i}\) will be greater than the contribution of F, if \(i^{I}>I^{F}\) and \(1>\Re _{i}\).

Hence, in the context of our model, the elasticity of substitution between varieties produced in I and F in each sector (or between skilled, \(H^{F}\) vs. \(H^{I}\), or unskilled labor, \(L^{F}\) vs. \(L^{I}\)) is 2, whereas the elasticity of substitution between sectors L and H is \(\varepsilon\).

This is in line with the empirical evidence that detects strong technological-knowledge progress driven by a small number of R&D intensive countries – our stylized I – strong economic growth in developed and also in developing countries, and strong technological-knowledge transfer (e.g., Coe and Helpman 1995; Machin and Van Reenen 1998; Acemoglu 2003; Robertson 2004; Avalos and Savvides 2006).

This complexity cost is modeled in such a way that, together with the positive learning effect (ii), exactly offsets the positive influence of the quality rung on the profits of each leader intermediate good firm – calculated below; this is the technical reason for the presence of the production function parameter \(\alpha\) in the expression – see also Barro and Sala-i-Martin (2004, ch. 7).

Dinopoulos and Thompson (1999), in particular, provided micro foundations for this effect in a model of growth through variety accumulation.

In Eq. (24), it is considered that the final-good variety is produced in I or in F, when, in the first branch within the term in large brackets, appears, respectively, \((i^{I})^{1\mathop{-}\xi }\) or \(\Re _{i}\cdot (i^{F})^{1\mathop{-}\xi }\).

Except for the employed labor levels, \(i^{I}\) and \(i^{F}\), affected by the labor-market structure and absolute (dis)advantage of labor in F, \(\Re _{i}\), due to global firms in intermediate final-good varieties production function (4), implying differences in the levels, but not in the growth rates.

Note that results in Section 3.2.3 are comparative static results for steady-states and taking skill bias technological change as constant.

We use the entropy-type function to characterize the functional form of bargaining power dependent on participation.

This corresponds to the mean plus 3 standard-deviations found by Voigtlander (2014). The author studies the skill intensity across sectors in the US. As we want to focus on skilled sectors versus unskilled sectors, we use a value in the upper bound of the distribution.

References

Acemoglu D (2003) Patterns of skill premia. Rev Econ Stud 70(2):199–230

Acemoglu D, Aghion P, Violante G (2001) Deunionization, technical change and inequality. Carn-Roch Conf Ser Public Policy 55:229–264

Acemoglu D, Zilibotti F (2001) Productivity differences. Quart J Econ 116:563–606

Ahuja R, Marjit S (2022) Liberalizing trade and capital flows and the wage gap: does sequencing matter? Open Econ Rev 33(2):375–389

Ang JB, Madsen JB (2015) What drives ideas production across the world? Macroecon Dyn 19:79–115

Afonso O (2012) Scale-independent North-South trade effects on the technological-knowledge bias and on wage inequality. Rev World Econ 148(1):181–207

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–352

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press, Cambridge, MA

Avalos A, Savvides A (2006) The manufacturing wage inequality in Latin America and East Asia: openness technology transfer, and labor supply. Rev Dev Econ 10(4):553–576

Baldwin R (2017) The great convergence information technology and the new globalisation. Harvard University Press

Barro R, Sala-i-Martin X (2004) Economic Growth, MIT Press, 2nd edn. Massachusetts, Cambridge

Bastos P, Kreickemeier U (2009) Unions, competition and trade in general equilibrium. J Int Econ 79:238–247

Blake D (1972) Trade unions and the challenge of the multinational corporation. Annals Am Acad Pol Soc Sci 403:34–45

Branstetter L (2006) Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. J Int Econ 68(2):325–344

Bryson A (2007) The effect of trade unions on wages. Reflets et Perspectives XLV I(2–3):33–45

Casteter E (2015) Labor unions and economic inequality in the wealthy democracies. PhD Dissertation, University of Tennessee

Chang J-J, Hung H-W (2016) Trade unions, unemployment, economic growth, and income inequality. Macroecon Dyn 20(1):404–428

Chang J-J, Shaw M-F, Lai C-C (2007) A managerial trade union and economic growth. Eur Econ Rev 51(2):365–384

Chen Z, Ge Y, Lai H (2011) Foreign direct investment and wage inequality: evidence from China. World Dev 39(8):1322–1332

Coe D, Helpman E (1995) International R &D spillovers. Eur Econ Rev 39:859–897

Crinó R (2005) Wages, skills and integration in Poland, Hungary and Czech Republic: an industry-level analysis. Trans Stud Rev 12(3):432–459

Criscuolo C, Garicano L (2010) Offshoring and wage inequality: using occupational licensing as a shifter of offshoring costs. Am Econ Rev 100:439–443

Deardorff AV (2005) A trade theorists take on skilled labor outsourcing. Int Rev Econ Financ 14(3):259–271

Dinopoulos E, Thompson P (1999) Scale effects in Schumpeterian models of economic growth. J Evol Econ 9:157–85

Dinopoulos E, Segerstrom P (1999) A Schumpeterian Model of protection and relative wages. Am Econ Rev 89(3):450–72

Egger H, Etzel D (2009) The impact of trade on employment, welfare and income distribution in a unionized general oligopolistic equilibrium. CESIfo working paper 2895