Abstract

We analyze how rising labor costs contribute to economic restructuring in China. In a panel of prefectural cities and industries, spanning the years 1999-2007, we employ instrumental variables to identify the effect of increasing local wage levels. We find adverse effects on performance of (low-skilled) labor intensive industries in China’s advanced regions. Consistent with cost-saving industry relocation, such industries expand in other locations, where wages are comparatively low. Comparing locations where such industries expand to those where they do not, we find that both economic complexity and subsequent per capita income increased faster in the former group.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Supply shortages in the labor market increase wages and thereby production costs of firms. The debates revolving around the end of cheap Chinese labor since the early 2000s suggest such a mechanism being at play. Industries which once were the driving force behind China’s export-led growth now face higher wage than productivity growth (e.g. Ceglowski and Golub 2007; Li et al. 2012).

Not much is known about the consequences of this trend, however. While one could expect that sectors with excessive wage growth lack competitiveness and gradually disappear, outcomes might actually be different in China. The reason is China’s sheer size, both in terms of its population and its surface. Different regions in China range at different stages of economic development. Combined with limited labor mobility across regions this might result in China resembling a country that resides in multiple cones of diversification.Footnote 1 Wage growth in more advanced regions would induce production relocation towards less developed regions within China, rather than denoting a general end to cheap Chinese labor.

Several factors, including demographic and structural change, could produce labor supply shortages. Sometimes they are confined to specific sectors or jobs. In the case of China, the specificity of labor supply shortages might materialize less across industries but mainly across regions. Given its combination of large internal distances and institutional barriers to internal migration (i.e., the so-called hukou system), China shares few characteristics with a typical national labor market where distances are moderate and mobility is high (Poncet 2006). Accordingly, also the end of cheap Chinese labor might be a regionally concentrated phenomenon and other regions might benefit from the relocation of such industries. Instead of observing that labor moves to the location where production takes place, high migration costs could induce firms and industries to relocate into a region where specific skills are abundant. The logic of this mechanism is comparable to models of the international relocation of production, where certain activities are shifted into locations with lower relative wages (e.g. Feenstra and Hanson 1997).

In this paper, we seek to trace such patterns empirically. We analyze how wage dynamics — driven by local aggregate conditions — influence the composition of China’s manufacturing sector across regions and industries. We use data from a panel of Chinese industry production during the period 1999-2007 and exploit information on the location of the industry to obtain differences in their exposure to rising wage levels. To avoid capturing reverse causality effects or wage dynamics that reflect specific industry productivity shocks, we employ the average local wage rate of all industries. Moreover, we use instrumental variables to isolate the exogenous component of the variation in average wages over time.

Our results suggest that, after controlling for the local industry’s own wage rate and value added per worker, a higher average wage level in a location reduces production, employment and firm counts. Such adjustments, however, are not generally observed. They reveal mostly where the overall wage level is already high to begin with. Moreover, industry output, employment, and number of firms are most affected in low-skill and labor-intensive industries. This is in line with theories of comparative advantage.

To investigate cross-regional relocation, we identify industries experiencing a relative decline due to wage growth in China’s high-wage locations and analyze whether these same industries expand in other places. We find that a relative expansion of such industries reveals in places that are geographically proximate to China’s high-income regions and where the relative wage in these industries is low. Also this pattern is in line with theories of comparative advantage, after conditioning on geographic factors.

Finally, we ask how locations that appear to attract industry activity from the high-income regions perform in terms of economic complexity (Hidalgo and Hausmann 2009; Hausmann et al. 2014) and find a positive relationship. “Attractive” locations experience a significantly faster increase in the economic complexity index (ECI) during the period of our sample, by about 0.10-0.15 standard deviations. We estimate that through this channel, they also experienced faster per capita income growth.

Our paper contributes to the debate about the end of cheap Chinese labor (Ceglowski and Golub 2007; Li et al. 2012), which has been investigated recently by Donaubauer and Dreger (2018) and Xiong and Zhang (2016), for FDI flows and exports respectively. Most papers, however, remain general when it comes to cross-regional heterogeneity within China and we argue that this distinction is important. Our evidence suggests that rising labor costs may indeed be an obstacle for China’s manufacturing industries, but the end of cheap labor seems to be true only for a number of highly-developed regions. The rest of China still offers competitive locations and might even benefit from wage growth in the more advanced regions.Footnote 2 This in line with conjectures by Li and Xu (2008); Lemoine et al. (2015) and Jain-Chandra et al. (2018), who document declining regional disparity in China. We observe that cost heterogeneity within a country can effectively promote the relocation of industries, and thus diversification, especially when labor costs increase in more developed regions.

Our research also relates to findings of Bernard et al. (2008), who use factor-endowment theory to study the location of industries in the United Kingdom (UK). In contrast to their static (cross-sectional) approach, we highlight in our work a mechanism where, over time, specific activities decline in one region and emerge in another. Although Bernard et al. (2008) document that changes in relative factor costs are related to changes in industry composition, they remain general where our paper documents the direction of such adjustments across regions and within narrow industries. Conceptually, our paper also relates to the work of Konings and Murphy (2006), who investigate whether multinational enterprises shift certain activities to their lowest-cost locations, and to a more general literature on the location choice of firms and industries (e.g. Forslid and Wooton 2003; Amiti and Javorcik 2008; Handley 2012).

Finally, our paper contributes to research, which finds that adopting new (and increasing the range of) activities can be a key ingredient for countries’ economic growth and development (Imbs and Wacziarg 2003; Klinger and Lederman 2006; Koren and Tenreyro 2007; Cadot et al. 2011; Mau 2016). We show that this holds also for the case of regional development within a country. Moreover, although we cannot establish causality between rising wages in one and ECI growth in other regions, our results suggest that cost-saving industry relocations due to comparative advantage does not necessarily undermine economic complexity. While the related literature points out that economic diversification must take place in the “right” industries (Hidalgo and Hausmann 2009; Hausmann et al. 2014), our case illustrates that the cost-induced shifts in regional production patterns can result in such desired outcomes. These findings are also relevant from a transnational viewpoint. In line with recent conjectures of Hanson (2020), China’s continuous technological upgrading in the early 21st century appears to be accompanied by labor-heavy activities moving into its less populated and expensive inner regions, instead of relocating fully into other developing economies.

In the following section, we present additional background information about China’s recent economic performance and highlight its regional economic heterogeneity. We describe the data and our empirical strategy in Sect. 3, while Sect. 4 presents our findings for the relationship between wage growth and industry performance. In Sect. 5 we evaluate patterns of industry relocation in greater detail and analyze its repercussions for the evolution of economic complexity and subsequent per capita income growth. Section 6 concludes.

2 Economic Performance Across Chinese Regions

2.1 General Background

China’s recent economic history witnessed an unprecedented increase in living standards and production capabilities. Following reforms initiated in the late 1970s, the country gradually transitioned towards a market-based economy where its performance was fuelled by a large labor force, low wages, and international trade integration. As China’s economy continued to develop, the view that the age of cheap Chinese labor is coming to an end became increasingly popular (Li et al. 2012).

A closer look, however, reveals that levels of economic development differ greatly across regions. Substantial intra-national wage differences could be observed already in the 1990s and earlier years (e.g. Gustafsson and Shi 2002). Also today, most economic activity is concentrated in the provinces located alongside China’s eastern and southeastern coastline. More recently, China’s inner regions catch up, which may be attributed partly to dedicated efforts of the central government, but also to transfers of capital and technology (Lemoine et al. 2015; Brandt et al. 2018) and the relocation of industries into these regions.

To illustrate this regional economic transformation, we present two snapshots of provincial economic complexity measures reflected in occupation-based ECI scores (Fig. 1). The ECI of a region measures its relative position in the entire (Chinese) economy, based on its degree of economic diversification as well as the ubiquity of the economic activities in which it is involved. A high level of complexity indicates that a region has a comparative advantage in many and/or rarely observed manufacturing sector activities. A low level of complexity suggests that a region has a comparative advantage in only very few and/or widely observed activities. Generally, a higher level of economic complexity is associated with better economic growth and development prospects (Hausmann et al. 2014).Footnote 3 Not surprisingly, China’s coastal provinces represent the most advanced regions. Comparing 1999 and 2007, we observe that economic complexity increased the most in regions that are geographically proximate to the coastal provinces. One explanation could be that segmented labor markets and rising wages in advanced regions induced relocation of production to cheaper, yet nearby, locations in inner China.

2.2 Regional Variation and Trends

We consider Chinese cities as the main unit of analysis in our paper. They denote the second layer of China’s administrative division, below the province level. At this level of disaggregation, we can observe heterogeneity in economic performance across regions and over time for 289 locations on China’s mainland.

2.2.1 Cross-Sectional Patterns

Table 1 displays regional contributions to total manufacturing output production, employment and value added in 1999. Most industry activity concentrates in coastal provinces, where numbers range between 69 percent for employment and 76 percent for output production.Footnote 4 In terms of firm population, output and employment, central provinces follow with contributions between 14 and 18 percent, whereas western and northeastern provinces account for about 5 percent. Variation coefficients indicate cross-city dispersion for each variable within these regions. Comparing coastal and central provinces to the western and northeastern regions, we observe greater dispersion across cities in the latter group. This means that some cities in western and northeast China are economically much larger than others and that such differences are less pronounced in the coastal and central Chinese provinces.

Our data also reveals regional differences in terms of employee compensation, which we compute by dividing the total wage bill in a city by the number of employees. Combining this with city-level information on local minimum wage rates and average service sector wages, we can rank cities based on their two highest scores in these individual rankings and split them into five equally sized groups. We refer to these groups as “cost-quintiles” or simply “quintiles” in the remainder of this paper.Footnote 5

In Table 2, we observe that the two highest cost-quintiles combined account for about 80 percent of industry output in our sample, and for about 73 and 93 percent of employment and exports respectively. The table also shows that city-level wage rates differ across locations within the same industries, such as cement manufacturing (CIC 3111). Top-quintile city wages in this industry are 36 percent above the median city wage, while bottom-quintile wages are about 10 below the median. The last column indicates that 47 of the 57 top-quintile cities reside in a coastal province. 69 out of the 85 coastal-province cities belong at least to the fourth cost quintile. This suggests that the economically most advanced regions in terms of economic size and complexity also tend to have the highest average wage levels.

2.2.2 Differential Developments Across Chinese Regions

Before turning to the econometric model, we describe some patterns that are suggestive of the mechanism we seek to identify. Figure 2a shows the evolution of coastal China’s contribution to total output, employment, and firm count over time. Figure 2b shows the same for top-quintile locations. Although ranging at different levels, trajectories are similar. Coastal and top-quintile cities strive during the late 1990s and early 2000s, until their expansion slows down and reverses around the year 2004. This implies that the rest of China begins to catch up.

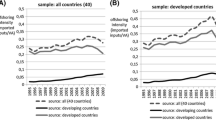

To explore potential reasons for this, we compare both wage levels and their average growth rates across these groups. As can be seen in Fig. 3, coastal (or top cost-quintile) cities have substantially higher average wage rates than their comparison group throughout the sample period. At the same time, we observe that the average annual growth rates of manufacturing sector wages are fairly comparable between these regions, but typically somewhat higher in the lower wage regions. Hence, if wages are the reason why regional production patterns are changing, this must be because their increase is driven or accompanied by productivity growth across industries.Footnote 6

3 Data and Empirical Approach

3.1 Chinese Manufacturing Survey Data

We exploit information from a Chinese firm-level data set, known as the Annual Survey of Industry Production (ASIP). This data has been widely used by researchers to study China’s economy. A comprehensive description is provided by Brandt et al. (2014).Footnote 7 Since we are interested in the dynamics and patterns of regional industry performance, we focus on a more aggregate level, namely, the local economy of prefecture-level cities, which represents the second layer of the administrative division in China.Footnote 8

Since any city-level variable we investigate reflects aggregates of several firms, we pay attention to identifying their location carefully. In most cases, this information can be inferred via the first four digits of the so-called “dq-code” in the data, which identifies a city. In some cases (about 4 percent of the firms), this information is inconsistent over time. We impute consistent location codes based on the firm’s reported zip code and other information in the original data set. Eventually, we obtain unique city-level dq4-codes for all except 35 firms in our sample.

We also undertake basic cleaning of our data. Following Jefferson et al. (2008), we remove firms if they report, in any year, zero, negative, or missing figures for employment, total wage payments, output production, input use, net value of fixed assets, or paid-in capital. We also remove firms with fewer than eight employees, as they often report inconsistent information (Mayneris et al. 2018). Moreover, firms’ value-added to sales ratio must range between 0 and 1, and firms’ value-added per worker and capital must range within four standard deviations from the annual mean. After these steps, we observe 300,100 individual firms during the period 1998-2007. As we aggregate our data, we obtain an unbalanced panel with information at the city-industry level. Since a significant number of cities does not report any data in the year 1998, we restrict our sample to the period 1999-2007, and maintain only those cities and industries that report information throughout the sample. We further exclude four autonomous provinces (Inner Mongolia, Tibet, Xinjiang, and Ningxia), as well as Hainan province, which is an island. Cities in these provinces reveal only very little industry activity in terms of their number of industries and firms. In total, we observe 289 prefecture-level cities and distinguish 404 industries, classified according to the 4-digit CIC nomenclature.

Our empirical analysis will be divided into several steps. In this section, we focus exclusively on our approach to identify the relationship between city-level wage growth and industry-level performance within a city. The results of our analysis are presented in the next section and suggest that wage growth has inhibited relative industry performance primarily for labor- and skill-intensive activities in coastal high-income locations. After establishing this relationship, Sect. 5 identifies industries that experience a relative contraction in these locations and investigates their evolution in the rest of China to infer suggestive evidence of industry relocation. Eventually, we explore which cities in inner China reveal a relative expansion in such activities and to what extent this entails changes in economic complexity. To maintain tractability, the econometric specifications and identification issues for these subsequent steps are discussed at the beginning of the respective sections and subsections.

3.2 Baseline Specification

Evaluating the relationship between economic performance and wages is challenging. Depending on the performance measure taken into consideration, wages set in a competitive environment are typically expected to reflect (at least partly) a direct or indirect outcome of it. Any empirical analysis is therefore subject to concerns regarding endogeneity and reverse causality. Nevertheless, an impact of wages on economic performance is possible if the former are not exclusively determined by the latter. This could be the case in the presence of market imperfections (e.g. Hirsch et al. 2020), example when labor supply is scarce. The “end-of-cheap-Chinese-labor” debate purports such a scenario.

Our baseline approach broadly follows this line of reasoning by exploiting different levels of disaggregation in our data. That is, we consider the average prevailing wage rate in a city rather than the wage rate in a city’s specific industry as our main variable of interest. Doing so, we assume that variation in local average wages reflects aggregate local labor market conditions that are independent of the performance in individual industries. Moreover, we implicitly assume that workers are mobile across industries within a city. Whenever an industry’s own productivity growth lags behind local average wage growth it faces upward pressure on its labor costs, which threatens its competitiveness. Higher average wage levels should then be associated with lower economic performance in individual industries after controlling for productivity. We translate this into the following estimation equation:

In our baseline specification, the outcome variable measures (the log of) output produced in city c, industry i, and year t. Alternative outcome variables measure employment and firm population. Our main variable of interest is the local wage level \(W_{ct-1}\) which proxies aggregate labor market conditions reflected in labor costs. To compute this variable we divide a city’s total wage bills by its total employment. We include it with a one year lag to address reverse causality concerns.Footnote 9

Following our reasoning above we expect \(\hat{\beta }<0\). We control for other determinants of city-industry performance that are summarized in the remaining terms. To avoid that \(\hat{\beta }\) picks up confounding effects that are directly related to industry i, the variable vector \(\mathbf {X}_{ict}\) includes the industry-location specific wage rate (\(w_{ict}\)) as well as value added per employee (\(vadd_{ict}\)) as a measure of productivity. Finally, the two summation terms in Eq. (1) denote different sets of fixed effects. Industry-year fixed effects control for aggregate industry dynamics, such as demand shocks, price shocks or changing production technology. The second set of fixed effects are included to allow for city-industry specific intercepts that reflect time-invariant cross-regional differences in sectoral productivity and specialization. Since we focus on a variable that varies at the city-year level, we adjust standard errors for clustering along this dimension.

3.3 Identification and Instrumental Variables

Despite measuring our variable of interest at a more aggregate level than our outcome variable, the fact that wages are determined by complex interactions between labor demand, supply, and general labor market conditions calls for further scrutiny. In fact, higher aggregate wages can reflect generally higher labor productivity, so that firms would be willing to expand industry activity in such locations. In that case, our OLS specification would partly rely on confounding factors and bias our estimates upwards; especially in high-cost locations where labor productivity and other productive amenities are assumed to be higher.Footnote 10 We therefore turn to an instrumental variable (IV) approach that should accommodate causal inference through appropriate identification of the activity-deterring labor cost channel.

3.3.1 Instrumental Variables

Instrumental variable estimation can help establish empirical evidence on the existence, direction and magnitude of a causal relationship. A challenge, however, are the identifying assumptions that must be satisfied for an appropriate interpretation. A valid approach requires that the instrument is correlated with the endogenous regressor (i.e. the average city-level wage rates) and uncorrelated with the dependent variable through any other channel. Although statistical tests inform about the likeliness that these conditions are met, their interpretation requires caution especially with regard to the exclusion restriction that no other link exists between the dependent variable and the employed instrument. We therefore consider alternative potential instruments and specifications.

Minimum-Wage Reform

We first consider an instrument that relates to a specific policy intervention that plausibly captures the intended mechanism (i.e. rising labor costs) and also satisfies the exclusion restrictions. In 2004, the Chinese government tightened the law for the regulation and implementation of minimum wages. This required more frequent realignment to local aggregate conditions and higher penalties for firms that violate the minimum wage standard. Effects of this minimum wage reform have been recently studied by Gan et al. (2016) and Mayneris et al. (2018).

A convenient feature of the minimum wages is that they are set according to threshold intervals. Hence, their levels differ across clusters of cities, while individual cities within a cluster can still face diverse economic circumstances. To employ this instrument, we adopt an approach similar to Mayneris et al. (2018) and compute, for each city, the fraction of firms paying wages below the prevailing minimum rate during two years before the reform. We then interact this cross-sectional variable with a dummy variable, which switches from zero to one in the years 2004 and after:

Cities where more firms paid below the minimum wage are expected to be more exposed to the reform and consequently experience a faster increase in local average wage levels.

Labor Supply Proxies

To capture supply-sided labor market developments, we consider local demographic factors, such as the age structure of the local resident population as an alternative instrument. Unfortunately, we cannot observe such data directly, so we proxy for demography using the number of students enrolled in primary education.Footnote 11

In contrast to enrolment in higher education, we believe that primary school students are more likely to live with their parents (in the same city) who would in turn supply to the local labor market. A persistent trend in the number of students can then be used as a rough approximation for the overall age structure and labor supply in a city. Increases in the number of students should be negatively related to changes in local average wages.

In addition to primary student counts, we proxy supply-sided local labor market conditions by counting official policy documents that promote measures to attract qualified labor. We conducted an online search in a repository for official city- and province-level policy documents that mention the keyword “attract talent” for each year of our sample and reaching back to 1997.Footnote 12 Counting the number of such documents at the city level for the years 1997-2000, we obtain a rough picture of which cities explicitly promoted policies to attract labor at the beginning of our sample period. We interact this measure with a linear time trend to infer the effect of such measures on wage levels through labor supply.

Assuming that such policies have been successful, cities promoting these measures might face fewer labor supply shortages and slower wage growth during our sample period.

Privatization of the State-Owned Sector

Finally, we consider the gradual expansion of the private sector in China as an exogenous predictor of aggregate wage dynamics.

We do so by measuring the fraction of state-owned or state-controlled firms in a location and generically refer to such firms as state-owned enterprises (SOEs). An SOE is identified based on the combined state- or collectively-owned share of paid-in capital, applying a threshold of 50 percent.

There are several reasons to assume that privatization of the local economy has an impact on aggregate wage levels. First, the presence of state-owned firms is associated with local protectionism, which undermines economic development and the activities of private enterprises (Lu and Tao 2009; Bai et al. 2009). Accordingly, the expansion of the private (or contraction of the state-owned) sector in China should be associated with general economic expansion and increased demand for labor. This would result in relative supply shortages. Second, compensation schemes of SOEs typically rely less on productivity than in privately managed firms, and productivity is generally lower (Driffield and Du 2007). Hence, we expect that private-sector expansion in China induced increases of local average wages as returns to education increase (Li et al. 2012). Industries that cannot keep up with these adjustments face upward pressure on their production costs and should experience a relative decline in their performance.

Finally, privatization can have a negative effect on wage levels if state-owned enterprises overpaid their employees. In that case cost-saving measures taken after privatization are likely to reduce wages. While this introduces ambiguity on the sign of the overall effect, empirical evidence from eastern European transition economies suggests that the positive expansion-driven effects on wages clearly prevail among internationally oriented firms (Brown et al. 2010). Since privatization in China has not been followed by any major contractions of industry activity and coastal regions are highly export oriented, we expect that the expansion-driven positive effect of privatization on wages will dominate.

3.3.2 Descriptive Patterns and Caveats

Relevance and Identifying Variation

Figure 4 illustrates how the identifying variation of our four proposed instruments relates to cities’ average wage levels. In panel (a) we depict cities’ exposure to the minimum wage reform as the fraction of firms initially paying below their threshold. The scatter plot indicates a negative relationship with wage levels, suggesting that cities with higher wages will receive systematically milder treatment. This might cause in an identification problem in locations where the number of compliers is too low to induce any economically significant changes in average wage levels. As similar concern arises in Panel (c), where the instrument also relies primarily on exploiting cross-sectional variation in the prevalence of talent attraction policies. The dispersion of such activities is much large in higher-income regions, but values are mostly zero and almost always below five in the rest of the country. A relationship with labor cost trends wages might therefore be less robust in most parts of the country, although potentially sufficient in our core regions of interest.

The identifying variation for the instruments shown in Panels (b) and (d) is not limited to the cross-sectional dimension, so we plot their changes over time against cities’ average wage levels. There is a weak positive correlation between changes in primary school enrolment and average manufacturing sector wage levels, which is driven by a small number of cities.Footnote 13 Cross-city variation in this variable appears to be large in higher wage percentiles. A positive correlation is also found for the change in relative SOE populations across cities, where the decline is more pronounced among lower-wage locations.Footnote 14 Variation in these changes seem fairly similar across average wage percentiles, so that the relevance of this instrument should also be similar.

Validity of the Instruments

While we have seen that our proposed instruments might reveal differential relevance in different specific contexts, our SOE-based instrument might also raise concerns regarding the validity of exclusion restrictions. Indeed, our outcome variables might be affected by privatization through channels other than wages, such as increased firm entry (i.e. Brandt et al. 2018). This is a plausible concern and the bias resulting from a violation of the exclusion restriction would render the expected negative effect of wages less significant.

Nevertheless, private sector expansion can be an important determinant of wage dynamics. First, increasing firm entry and economic expansion after privatization could still affect wages through increased labor demand, induces relative labor supply shortages. Moreover, if we interpret aggregate wages as a proxy for general changes in local economic conditions, our core mechanism of a shifting comparative advantage inducing cross-regional industry relocation remains operational. Privatization-induced economic expansion could raise average wages through a bias towards skill-intensive activities. Any negative effect of wages on industry activity should then materialize primarily among the lower-skill and labor-intensive activities, which subsequently relocate to inner Chinese regions. We will test this prediction in our subsequent analysis and experiment with alternative combinations of instruments to infer how they impact our findings.

4 Local Average Wages and Industry Performance

4.1 Pooled Sample

4.1.1 Industry Output Production

Table 3 reports our first set of results for industry-level output, estimated for the full sample. Columns (1) and (2) report OLS results, which suggest a negative and statistically significant relationship between the average local wage rate and industry production. Precision of the estimate increases if we include lagged industry wage as an additional control variable. The coefficients imply that a 10 percent increase in local average wage rates lowers industry output by about 0.8-1.2 percent. Looking at the average increase of local wage levels during our sample period, and taking into account the variation explained by our control variables and fixed effects, we find that a one standard deviation increase in local wage levels (about 11 percent) corresponds to a 0.9-1.3 percent reduction in local industry output.

Columns (3)-(6) report second-stage results for our IV specifications. Coefficients for our main variable of interest are throughout negative and statistically significant. However, they differ in terms of magnitude. As expected, estimated IV and OLS coefficients differ, which suggests that our instruments capture only part of the variation in our main variable of interest.Footnote 15 Considering the variation of the predicted average wage rate from column (4), we calculate that a one standard deviation increase corresponds to a 3.4 percent decrease in local industry production. The corresponding number for column (6) suggests a 3.8 percent decrease in industry production. These numbers indicate that increases in local average wage rates impose a comparatively larger obstacle for industry development, if wages are driven by factors related to the local supply of labor, privatization-induced economic restructuring, and the minimum wage reform in 2004.

Considering the relevant test statistics for validity of the identifying assumptions in our IV estimation, we see that all specifications pass the Kleibergen-Paap test statistics. Whenever we use more than one instrument, we can also test the validity of the exclusion restrictions. In the present sample, the are rejected at the ten percent level, when we use all four instruments. That test passes comfortably in column (4), where we employ our two labor supply proxies.

4.1.2 Industry Employment and Firm Population

In addition to industry output, we analyze industry employment and firm population. Table A1 reports these results in the same fashion as Table 3. The first two columns show OLS results. Columns (3)-(6) present the second-stage estimation for the different sets of instruments.Footnote 16 The upper panel of Table A1 shows results for employment. They are comparable to those for industry output, but statistically more significant and overall somewhat more consistent across specifications. Using our specification with all four instruments in column (6), we calculate an implied reduction by about -4.1 percent in average industry employment due to increasing average wages.

In the lower panel of Table A1, estimated adjustments in city-industry firm populations suggest a very similar pattern. As before, OLS results suggest a more modest contraction due to wage growth. The predicted decline amounts to 4.2 percent, according to our IV specification in column (6). In contrast to the previous specifications, the Hansen-J test statistic for overidentification is not rejected in this model. Overall, the similarity of the results across our three different outcome variables suggests that the estimated relationship is quite uniform. We cannot identify any obvious pattern that would suggest a substitution effect of labor for other production inputs or that only certain types of firms (i.e., very large or very small firms) drive this relationship.

4.1.3 Robustness Checks

Although our main strategy for inferring the relation between industry performance and wages relies on instrumental variable estimation, we consider two robustness checks that relate to our OLS models. The first test addresses the potential bias that might result from a mechanical link between the dependent variable and out main variable of interest. Since average local wages are calculated based on all industries m that are present in city c, \(\ln W_{ct-1}\) also includes information from industry i. Any potential mechanical relationship resulting from this approach might induce endogeneity bias, so that we calculate an industry-specific average wage rate that represents the local average wage in all industries except i: \(\ln W_{ct-1}^{\ne i}\). Using this variable, we obtain further evidence in support of our proposed mechanism, as we show in Table A2. Regardless of which dependent variable we use, our initial results are confirmed and strengthened.

We also consider the possibility that wage dynamics in other cities \(\ne c\) affect industry activity in c. In fact, the main hypothesis of this paper is that this contributes to economic restructuring at a broader scale. We test this mechanism in a more general setting by including an additional control variable that measures the average wage in other cities and consider definitions of “other cities”. The first definition takes considers wages in the five most proximately located cities to c. The second definition considers wages in all other cities \(\ne c\), while the third definition considers only wages in coastal top-quintile locations. In all cases, we account for the bilateral distances between k and c to measure other cities’ wage rates as a proximity weighted city-specific average. Our results in Table A3 suggest indeed that wages in proximately located other cities contribute to the competition on local labor markets. Their coefficient is negative and marginally significant, similar to the one found for our baseline specifications. The relationship becomes statistically weaker if we consider proximity-weighted wage dynamics in all other cities, as shown in columns (3) and (4), and suggests that local economic activity is not generally shaped by country wide trends. However, columns (5) and (6) indicate a large positive and statistically significant relationship between industry activity in c and distance-weighted wage dynamics in coastal high-income cities. This lends support to our proposed mechanism which we will explore in greater detail below.

4.2 Regional Subsamples and Industry Heterogeneity

Our baseline analysis considered all Chinese cities from our sample to estimate the relationship between local wage levels and industry performance. In the following, we explore whether particular regions and industries drive this relationship.

4.2.1 Outcomes Across Chinese Regions

We start by dividing China broadly into two regions, coastal China and inner China, expecting that responses to wage growth differ based on initial conditions (see Sect. 2). If wages are an important determinant of industry competitiveness, locations where wages are already high might experience greater adjustment pressure. In fact, wage growth in less developed and inner Chinese regions might reflect economic catch-up rather than competitiveness-impeding labor cost growth.

Table 4 presents our results for output production in different regions. We first compare coastal and non-coastal locations, then distinguish top versus remaining quintiles (within coastal provinces). IV results for two different sets of instruments are reported. Columns (1)-(4) show the set which we used to proxy labor supply only. Columns (5)-(8) use the full set of instruments. Considering the subsample for inner China in columns (1) and (5), we find no support for the relationship obtained earlier from our baseline specification. Point estimates are much smaller and statistically insignificant. By contrast, columns (2) and (6) focus on coastal provinces and show results similar to those reported in Table 3. Breaking the coastal subsample further down to compare top-quintile with other locations, we find that only for the former group a statistically significant and negative coefficient is reported.

While splitting up samples sacrifices precision in our estimates, comparing estimated signs and magnitudes of the coefficients across sub-samples suggests that the initially estimated relationship is most likely driven by the top-quintile locations in coastal China. Also first-stage results of this sample are most consistent with those reported for the full sample. The quantitatively smaller coefficient estimate in column (8) may indicate that the privatization of SOEs and the effect of the minimum wage reform in China have less uniform effects on industry output in the top-quintile locations, but in contrast to Table 3, the test statistics support both relevance and validity of the instruments.Footnote 17

4.2.2 Outcomes Across Types of Industries

Our results so far provide evidence in support of a negative relationship between the local wage rate and industry performance. While we found heterogeneous responses across Chinese regions, we still pooled our samples across industries. It is likely, however, that not all industries respond in the same way, so we briefly explore this issue here.

Table 5 shows OLS and 2SLS estimation results with industry-specific interaction terms for our main variable of interest. The sample is restricted to cities residing in coastal provinces and belonging to the top cost-quintile, as explained above. Those cities were found to be most likely to experience adverse effects of local average wage growth.

In columns (1)-(3) of the table, we interact with the local average wage rate with an industry-specific (time-invariant) measure of low-skill intensity. We obtained this measure from data used by Amiti and Freund (2010), which relies on information from the Indonesian manufacturing census.Footnote 18 By inverting this measure we obtain the fraction of production workers in total employment. The estimated coefficients indicate that the negative relationship with industry output is significantly more pronounced in low-skill intensive industries. In columns (4)-(6), we consider an alternative time-invariant indicator of industry characteristics. Computing, for the year 1999, the industry-specific labor share in production (i.e., total wage payments divided by total output), we find that industries using labor intensively at the beginning of our sample period experience a significantly larger reduction in output when the local average wage level increases.

Altogether, these findings confirm that aggregate wage dynamics have different effects on industries, depending on how intensively they make use of (low-skilled) labor in the production. While this result is not surprising and follows standard economic theory, we interpret this as reassuring evidence that supports our econometric identification strategy.

5 Relocation of Industry Activity

In this section we explore the repercussions of wage growth for the organization of industrial production across China. We proceed in three steps. First we identify the individual industries for which output production is negatively related to average local wage growth in the coastal top-quintile locations. Second, we focus on the remaining sample of Chinese cities and estimate whether such industries reveal a significantly different performance than industries that do not reveal such negative relationships. Third, we will investigate which locations are most likely to attract such industries and how they perform relative to other locations in inner China.

5.1 Shrinking Industries in High-Cost Locations

In order to conduct the first step of our analysis, we re-estimate our baseline estimation equation for the subsample of coastal top-quintile locations. Instead of estimating the average relationship with local wage levels, we now allow each CIC4 industry to have an individual coefficient. That is, we interact our main variable of interest \(\ln W_{ct-1}\) with an industry-specific dummy. Moreover, instead of including \(\ln W_{ct-1}\) directly into our estimation equation, we use its predicted value as obtained from our 2SLS specification with all four instruments. The reason to do so is that we intend to capture the variation in average wages that is driven by a broad set of local aggregate conditions. We have reported the baseline result for this specification in column (8) of Table 4 and now augment it as follows (control variables and fixed effects remain the same as before):

Estimating this equation produces 402 estimates of \(\beta ^{i}\).Footnote 19 Whenever an estimated coefficient \(\beta ^{i}\) is negative and statistically significant at the five percent level, we consider this industry as “shrinking” in coastal top-quintile locations. This classification applies to 103 industries, which means that about a quarter of the industries in our sample experience a significant relative reduction of output.

An aggregated overview of these industries is presented in Table A5. It states the absolute number of industries observed across sector groups, as well as the number and fraction of industries classified as shrinking according to our estimation. The largest fraction of shrinking industries can be found in the rubber and plastic product sectors, followed by different kinds of equipment manufacturing, and the textile, clothing, and apparel industries. Much lower fractions are reported for agricultural products industries, for instance. Inspecting some key attributes of these industries, we confirm our previous findings that the set of shrinking industries are on average less skill-intensive and more labor intensive than other industries in coastal top-quintile locations (Fig. A2). We also find that shrinking industries are on average less populated by state-controlled firms and that they have a lower value-added share in production.Footnote 20

5.2 Relocation of Industry Activity to Inner China

To conduct the second step of our analysis, we set up an estimation equation to inspect whether industries marked as shrinking perform differently than other industries in inner China. That is, we regress the log of output production using only the sample of cities which we had excluded in the previous step:

In order to identify a differential performance for these industries, we interact the industry-specific marker \(shrink_{i}\) with a time trend. We control for city-industry effects as well as city-year effects in order to capture aggregate local trends and variation. An estimate of \(\xi >0\) will indicate that industries that experience a relative decline in coastal top-quintile locations, expand relatively faster in the rest of China.Footnote 21

Our results are presented in Table 6. The first column suggests that there is no general relationship between output production in inner China and industries marked as shrinking in the coastal top-quintile locations. In column (2), we assume that cities which already reported activity in shrinking industries at the beginning of our sample period are more likely to attract those activities from the coast. We therefore construct a city-level variable, \(coverage_{c}^{99}\in [0,1]\), which measures the fraction of shrinking industries i that were active in city c at the beginning of our sample period. Interacting this new variable with our original variable of interest results in an increased point estimate. Yet, no general trend can be detected at conventional levels of statistical significance.Footnote 22 Finally, we allow for the possibility that the relocation of industry activity takes some time, and reveals only in later years of our sample. We therefore include an additional interaction with a period dummy, which takes a value equal to one in years 2004 and after, and zero otherwise. These results, shown in columns (3)-(5), suggest that activity in the marked industries increased significantly relative to the rest of the local manufacturing sector.Footnote 23

In order to interpret the quantitative meaning of the results reported in the final four columns of Table 6, we multiply the point estimates with an average city’s value of \(coverage_{c}^{99}\). It measures the fraction of the total number of industries marked as shrinking that were also active in inner China’s city c in 1999. In an average city this fraction was about 0.12, so that we can infer from column (3) that these industries expanded by about (\(0.12\times 0.261\approx\)) 3 percent, on average and relative to other industries since 2004. The corresponding number for industry employment range in a similar order of magnitude, whereas the percentage increase in the number of firms is statistically weaker and estimated to be about 1.8 percent.Footnote 24

5.3 Relocation of Industry Activity to Individual Cities

Our results from the previous subsection suggests that industry activity might have gradually diffused from coastal top-quintile locations to other locations in China. Yet we do not know which cities these are, and whether the relocation promotes or inhibits their economic performance and development. We explore these questions in the following paragraphs.

5.3.1 Identification of Attractive Cities

In order to answer the question to which cities industry activity potentially diffuses, we adopt a generic approach that is similar to the one used before to identify the set of shrinking industries. That is, we augment Equation (3) by including an additional interaction term:

The coefficient \(\xi ^{0}\) is equivalent to \(\xi\) of the previous equation and captures the trend for industries marked as shrinking. The newly inserted interaction term captures the city-specific change in these industries since 2004. For any city where \(\hat{\xi }^{c}\) is positively and significantly different from zero, we may assume that it attracts industries marked as shrinking from coastal top-quintile locations.

We present our results graphically for two different outcome variables in Fig. 5, based on a threshold of 10 percent statistical significance. “Attractive” cities are indicated by the green shading, whereas yellow shading indicates that cities did not produce a significantly positive estimate of \(\xi ^{c}\). Comparing the patterns in panels (a) and (b), we note that they are not identical.Footnote 25 Yet, we observe some regional clusters mainly in the southern and central regions of China. In some cases also cities in northeastern China appear to expand activity in these industries. Overall, 18 percent of the 242 observed inner Chinese cities appear expand manufacturing activity in industries that experience a relative decline in China’s high-cost locations.

Before investigating the relative performance of attractive vis-à-vis other cities in inner China, we present a brief summary of their key characteristics in appendix Table A7. We see in column (1) the total number of cities in four major geographic regions. Column (2) indicates the number of cities for which we obtained a significantly positive estimate of \(\xi ^{c}\) for both of our outcome variables. This is the case in 31 cities overall. Column (3) denotes the respective fraction, obtained from dividing column (2) by (1). It indicates that both in absolute and relative terms industries appear to have diffused mostly to central and western regions. Columns (4) and (5) suggest that an average city in coastal China has a more diversified industry base than its counterparts in other regions. It is also more active in industries marked as shrinking. Nevertheless, coastal cities are not generally more successful in attracting such industries. In the final two columns, (6) and (7), we report relative wages across industries and within cities. Computing the ratio of average wages paid in \(shink_{i}=1\) to \(shink_{i}=0\) industries, for each city and year, and comparing these ratios across cities based on whether they were found to attract industries or not, suggests that relative wages tended to be lower in the former group. The pattern is especially evident in the central and western regions and suggests that they might attract industries because of lower relative wages, i.e., a greater abundance of the labor and skills needed for their production.Footnote 26

5.3.2 Relocation of Industry Activity and Economic Complexity

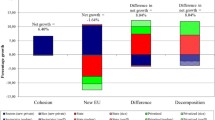

Our finding that only some locations in inner China appear to have attracted industry activity enables us to inspect their relative economic performance. Relating back to Fig. 1, which suggested that some regions in inner China experienced notable increases in economic complexity, we ask whether these patterns are related to our estimates of industry attraction. To evaluate this, we estimate a linear cross-sectional regression for the change in cities’ economic complexity between 1999 and 2007 (\(\Delta ECI_{c,99-07}\)):

The first parameter, a, denotes a constant, whereas \(b_{1}\) denotes the importance of the initial level of economic complexity in city c. Our main interest lies in the parameter \(b_{2}\), which will indicate whether ECIs increased faster in cities found to attract industry activity. Generally, we define a city as attractive, if its previously obtained estimates of \(\hat{\xi }_{c}\) were positive for all three of our outcomes variables (i.e., output, sales, and employment), but we also investigate cities that are attractive in terms of each these outcome variables, separately. We include province fixed effects, \(\eta _{p}\), to capture cross-regional heterogeneity that can be attributed to other, yet, unobserved economic and political developments. Thus, our estimate of \(b_{2}\) informs about the increase in economic complexity of cities expanding activity in \(shrink_{i}=1\) industries, relative other cities in the same province. A statistically significant estimate of \(b_{2}>0\) lends support to the hypothesis that industry relocation contributed to an increase in cities’ economic complexity.

Main Findings

Our baseline results are reported in Table 7, where we consider the alternative definitions of cities’ attractiveness as described above. ECIs are standardized and computed based on either cities’ output or occupation structure (i.e., \(ECI_{Y}\) and \(ECI_{L}\)). We report results for our benchmark definition in the two final columns, whereas Columns (1)-(2) report the findings for cities previously found to expand in terms of industry production, as shown in Fig. 5a. Columns (3)-(4) show findings for cities found to expand in terms of employment.

In all specifications, increases in ECIs appear to depend on the initial level of economic complexity. This indicates unconditional convergence across China and is in line with previous findings for industry production and labor productivity (Lemoine et al. 2015). Our estimates of \(b_{2}\) are significantly positive for locations found to expand industry production, but not for attracting activity in terms of employment. An explanation could be that China’s strict internal migration regulations lead to distortions in the allocation of labor and, therefore, to a less precise estimate for this outcome.Footnote 27 Another explanation could be that increases in economic complexity follow only, if industries increase actual production, irrespective of employment. This might imply a transfer not only of activities but also of the related knowledge, technology, and capital so that labor productivity in these sectors increases as well.Footnote 28 Overall, a quantitative interpretation of these results suggests that cities found to attract industry activity from coastal top-quintile regions appear to have experienced an increases in ECI by about 0.11-0.12 standard deviations relative to other cities in the same province.

Robustness

In order to see whether these estimates reflect some general (unobserved) attributes of attractive cities, we attempt to validate our findings with a placebo regression. That is, we construct city-level ECIs based on a subset of industries, selecting only those which were not marked as shrinking (i.e., \(shrink_{i}=0\)). If attractive cities had generally higher ECI growth, estimates of \(b_{2}\) should be positive and significant also in this subset. We present the results for this specification in Table A8 and find that this is not the case. We conclude that our baseline findings of faster ECI growth may indeed originate from the cost-saving relocation of industry activity to inner China.

We are also interested in seeing whether the potential number of attracted industries matters for subsequent ECI performance. We therefore interact with our indicator variable \(DumGrow_{c}\) with the number of \(shrink_{i}=1\) industries in which city c is active during our sample period. For this test, we consider the most conservative classification for an attractive city, so that \(DumGrow_{c}=1\), if the previously city-specific estimate of \(\hat{\xi }_{c}\) was positively significant for both outcome variables. The results are presented in Table A9, where estimated coefficients appear to be quantitatively smaller, yet, highly statistically significant across all our specifications. This suggests that the more industries a city potentially attracts, the faster is also its ECI growth.Footnote 29 According to the point estimates reported in columns (2) and (4), each additional industry that potentially diffused to a city is associated with a 0.005 standard deviations increase in economic complexity. With an average attractive city being active in about 30 \(shrink_{i}=1\) industries, this implies that economic complexity increased by about 0.15 standard deviations, relative to other cities in the same province. This average estimated effect is slightly higher but still within one standard error of the corresponding point estimate from our baseline specification.

5.3.3 Relocation of Industry Activity and Subsequent Per Capita Income Growth

We finally investigate to what extent increasing economic complexity facilitates the economic development of China’s local economies. To investigate this question, we first estimate the contribution of city-level ECI changes (between 1999 and 2007) to a city’s growth in per capita GDP during subsequent years (between 2007 and 2014). Based on this estimate, we then compute the implied contribution of industry relocation.

We adopt a specification similar to Hidalgo and Hausmann (2009) and Hausmann et al. (2014) to estimate the overall relationship between ECI changes and subsequent per capita GDP growth:

We control for the initial income level in 2007 (\(\ln PGDP_{c,07}\)), economic complexity in 1999 (\(ECI_{c,99}\)), and the change in economic complexity between 1999 and 2007, which was our dependent variable in Eq. (5). The results are presented in Table 8.

Besides strong support for unconditional convergence, indicated by the negative coefficient for \(\ln PGDP_{c,07}\), we also find a significant and positive relationship with economic complexity eight years before. This suggests that the growth-facilitating effect of economic complexity is quite persistent, so that an economy can benefit from it also in the medium- to long-run. Moreover, after controlling for unobserved province-level characteristics, we find for both output- and occupation-based ECIs that past increases in this measure significantly contribute to the city’s per capita GDP growth in later years. The quantitative interpretation is that a one standard deviation increase corresponds to a 10-12 percent increase in the growth of per capita GDP between 2007 and 2014, or about 1.4-1.7 percent per year.Footnote 30 Combining these numbers with our estimates reported in Tables 8 and A9, we calculate that the cost-saving relocation of industries may have contributed an additional increase by about (\(0.11\times 0.103=\)) 1.3 to (\(0.15\times 0.121=\)) 1.8 percent to GDP per capita growth in cities that attracted industry activity.

To put these numbers into perspective and assess their economic magnitude, we can relate them to the actually observed increase in per capita GDP. In cities that attracted industry activity, we observe that per capita income grew by about 68% between 2007 and 2014. The contribution of cost-saving industry relocation then amounts to approximately 1.9-2.6 percent of this growth rate. Inner Chinese cities that did not attract industry activity had about 66% per capita income growth during this period. This means that our estimated contribution of cost-saving industry relocation to economic complexity explains between 65-90% of the difference between these cities’ per capita income growth.

6 Conclusion

In this paper, we take a novel view on regional economic development in a large emerging economy. We investigate how industry restructuring in China’s economically most advanced prefectural cities offers new opportunities for industry growth in less developed regions. By focusing on a specific mechanism where manufacturing industries respond to wage dynamics, induced by changes in aggregate local conditions, we find that low-skill and labor-intensive activities gradually decline in China’s high-income regions. Such industries appear to expand in some of inner China’s locations, where relative industry wages are comparatively low and where the distance to the coastal high-income locations is relatively small. We link these patterns to the evolution of cities’ overall economic complexity and address the question of whether such cost-saving relocation of industry activity undermines or promotes the economic development of these regions. Our findings indicate that the latter is the case, and that this also transmits to an increase in the growth rate of per capita GDP in subsequent years.

Yet, while this mechanism of cost-saving industry relocation adds to the general dynamics of unconditional regional economic convergence, we find that its overall economic magnitude is limited. We attribute this to two aspects that should be borne in mind when interpreting our results. First, we analyze a relatively early time period (1999-2007). During these years, China benefited largely from its integration into the global economy, especially after its accession to the WTO and the dismantlement of trade and investment barriers. The issue of rising labor costs and the eroding competitiveness of some industries in China has likely become much more relevant in recent years, which we do not observe in our sample. An extension of our analysis to include later years would therefore be useful. Second, our data does not contain any information on transactions between Chinese cities. We adopt a consistent empirical approach to address this challenge, by first using instrumental variables to identify industries that shrink in some locations, and then investigating whether these industries expand in other locations. Nevertheless, measurement error cannot be fully ruled out. Both the early time period and potential measurement error might induce a downward bias on our estimates. We therefore interpret our results as indicative for a lower bound. Future research might address these issues and provide further insights on the validity of our findings also for other countries and time periods.

Overall, we emphasize that the “end of cheap labor”, called out by commentators across academia, business, and politics does not necessarily imply a rising disadvantage for China’s manufacturing sector production. In fact, rising wages appear to sort out the least productive and competitive industries in China’s striving regions, where resources are shifted to more sophisticated economic activities. This restructuring appears to pay off as a positive externality also in the less developed regions, in which such activities expand. To the extent that institutional and geographical frictions still impede the cost-saving relocation of industry activities, policymakers may take influence to reduce them. China’s regional heterogeneity and its unique feature of occupying several cones of diversification might also foster economic resilience to sectoral shock and to disruptions of international supply chains.

Notes

In international trade theory, cones of diversification denote the range of products a country can produce. Its relative position within such a cone is determined by the country’s endowment structure and determines its comparative advantage.

Ruan and Zhang (2014) report similar trends of production relocation within China in the textiles and apparel sector, using a two-regions framework (Eastern vs. non-Eastern provinces).

In this paper, all our computations of ECIs are performed with the user-written command “ecomplexity”, available for use in Stata at https://github.com/cid-harvard/ecomplexity. An output-based ECI reveals similar patterns to the ones presented here.

We assign provinces as follows: Coast: Beijing, Fujian, Guangdong, Hebei, Jiangsu, Shandong, Shanghai, Tianjin, Zhejiang; Central: Anhui, Guangxi, Henan, Hubei, Hunan, Jiangxi, Shanxi; West: Chongqing, Gansu, Guizhou, Shaanxi, Sichuan, Yunnan; Northeast: Heilongjiang, Jilin, Liaoning. Qinghai province has been excluded due to too few observations.

Indeed, Fig. A1 presents comparative patterns for average productivity-adjusted wages (i.e., unit-labor costs). While they decrease across China during the early years of our sample, they begin to diverge in later years and result in a relative labor cost advantage in inner and lower-wage regions.

By using this data, we limit our analysis to the manufacturing sector. Moreover, the firms reported in this dataset represent mostly large enterprises with annual sales of at least 5 million yuan (about 600,000 US dollars). State-owned firms are included, regardless of their size. Overall, aggregated values of key variables, such as the number of firms, sales, output, and employment, are close to numbers reported in country-level statistics that are published in the China Statistical Yearbooks (see Brandt et al. 2014, fordetails).

The first layer below China’s central government represents Chinese provinces, of which there are 31, including four municipalities and five autonomous regions. Special administrative regions (SAR), such as Hong Kong and Macau, as well as Taiwan, are excluded from the survey.

In our baseline measure, total wage bills and employment include also industry i. This can create bias, so we control for industry-level wages in all our specification and carry out a robustness check where we calculate city-level wages as the average for all industries, except i. Our main results and conclusions are robust to these alternative modelling choices.

This is related to the intuition in Rosen (1979) and Roback (1982) spatial equilibrium models that are widely used in the urban economics literature. In the context of our paper, higher wages can either reflect productive amenities that attract industry activity or indicate scarcity of labor and deter industry activity. Our aim is to identify the latter mechanism.

We collected this data from various editions of the China City Statistical Yearbook.

The online database for official documents is Beida Fabao-Laws & Regulations Chinese Database. The URL is http://www.pkulaw.cn/.

The three cities with the largest growth are Dongguan and Shenzhen (both located in the province of Guangdong) as well as Nanning, which is the capital of Guanxi province.

This can be explained by initially higher fractions of SOEs in such locations, so that the scope for privatization using this measure is determined by the prevalence of SOEs at the beginning of our sample period.

Another reason could be that instrumental variable estimation reduces measurement error, which typically induces attenuation bias on OLS coefficients.

Since we only change our dependent variable, first stage results are the same as before and no longer reported.

We also experimented with other combinations of IVs for the coastal top-quintile subsample. Results appear to be stronger when we exclude the minimum wage reform (as we expected based on our discussion in the previous section) The IV coefficient increases to \(-1.182\) and becomes statistically significant at the 5 percent level. The p-value of the corresponding Hansen-J statistic increases to 0.305. Excluding the fraction of state owned enterprises (while keeping the minimum wage reform) appears to weaken the absolute size and statistical significance for our coefficient of interest in the second stage of our estimation. We report the latter results for various city samples and subsamples in Table A4.

This data is disaggregated at the 6-digit level of the Harmonized System nomenclature (HS6). We concord this data to our 4-digit CIC industry classification using a dataset from China Customs, which reports both CIC and HS codes. Based on total value and frequency ranking, we created a crosswalk to assign each HS6 product to a unique CIC4 industry code.

No estimate could be obtained for two industries, due to too few observations. We assign them a value equal to zero.

All except the latter relationships are statistically significant at the 5 percent level in a probit estimation. The relationship for value-added share in production becomes strongly statistically significant in later years of our sample (i.e., since 2004). This might suggest that firms in shrinking industries have increased their share of manufactured intermediate inputs.

Although we cannot fully rule out the possibility of reverse causality in this specification, we recall that the marking of industries as shrinking is based on an IV specification, which predicted variation in average wages with aggregate local developments in coastal top-quintile locations. We argue that such developments are unlikely to be determined by industry dynamics in inner China.

We note that clustering at the industry level reflects the most conservative approach. Clustering at the city-industry or industry-year level results in a significant coefficient in column (2), while the one reported in column (1) remains insignificant.

We present a robustness check for these results in Table A6, where we explore whether our results are driven by general trends in skill- or labor-intensive industries. In both cases this cannot be confirmed.

We attribute this divergence to the fact that the number of firms operating in a region not necessarily reflects its economic size. In the following, we focus on outcomes in production and employment.

A possible explanation could be internal migration frictions, which distort an efficient allocation of labor.

We ran linear regressions of the relative wage on a city-specific dummy indicating whether the location attracted industries or not. In the case of an attractive city, the relative wage is 4.8-6.5 percentage points lower, depending on whether no, regional, or province-level fixed effects were included. In all specifications this difference was estimated to be statistically significant at the 10 or 5 percent level.

Local citizenship in China population is administered under the hukuo system, which distinguishes rural and urban citizenship. Due to this system, migration to a different region entails substantial impediments for access to basic public services, such as health, insurance, or education. Recently, the hukuo system regulations have been reformed in some Chinese cities, which has been found to have a significant impact on local labor markets (Zhao 1999; Meng 2012; Bosker et al. 2012). The economic costs of factor misallocation in China have been found to be substantial (Hsieh and Klenow 2009).

Recall that we found, for the later years of our sample, that industries marked as shrinking also decreased their value-added share of production in our coastal top-quintile locations. This might indicate that manufactured intermediate inputs are now sourced from inner China and from locations that are able to meet requirements for the quality of these inputs. Since we cannot observe any flows between Chinese cities, this explanation remains speculative. Yet, it fits the patterns we document here.

We highlight that our industry-count measure reflects only potentially attracted activities, because we cannot observe which (subset) of the 103 \(shrink_{i}=1\) industries actually do expand. Our previous estimates only indicate that this group of industries has expanded significantly faster than the group of other (\(shrink_{i}=0\)) industries.

These numbers are similar to the estimate of Hausmann et al. (2014), who find an average effect of 1.6 percent.

References

Amiti M, Freund C (2010) The Anatomy of China’s Export Growth. China’s Growing Role in World Trade. National Bureau of Economic Research Inc, NBER Chapters, pp 35–56

Amiti M, Javorcik BS (2008) Trade costs and location of foreign firms in China. J Dev Econ 85(1):129–149

Bai CE, Lu J, Tao Z (2009) How does privatization work in china? J Comp Econ 37(3):453–470

Bernard AB, Redding SJ, Schott PK, Simpson H (2008) Relative wage variation and industry location in the united kingdom*. Oxf Bull Econ Stat 70(4):431–459

Bosker M, Brakman S, Garretsen H, Schramm M (2012) Relaxing hukou: Increased labor mobility and china’s economic geography. J Urban Econ 72(2–3):252–266

Brandt L, Van Biesebroeck J, Zhang Y (2014) Challenges of working with the Chinese NBS firm-level data. China Econ Rev 30(C):339–352

Brandt L, Kambourov G, Storesletten K (2018) Barriers to entry and regional economic growth in china. 2018 Meeting Papers 954, Society for Economic Dynamics

Brown DJ, Earle JS, Telegdy A (2010) Employment and wage effects of privatisation: Evidence from hungary, romania, russia and ukraine. Econ J 120(545):683–708

Cadot O, Carrère C, Strauss-Kahn V (2011) Export diversification: What’s behind the hump? Rev Econ Stat 93(2):590–605

Ceglowski J, Golub S (2007) Just how low are china’s labour costs? World Econ 30(4):597–617

Donaubauer J, Dreger C (2018) The End of Cheap Labor: Are Foreign Investors Leaving China? Asian Economic Papers 17(2):94–107

Driffield N, Du J (2007) Privatisation, state ownership and productivity: evidence from china. Int J Econ Bus 14(2):215–239

Feenstra RC, Hanson GH (1997) Foreign direct investment and relative wages: Evidence from Mexico’s maquiladoras. J Int Econ 42(3–4):371–393

Forslid R, Wooton I (2003) Comparative Advantage and the Location of Production. Rev Int Econ 11(4):588–603

Gan L, Hernandez M, Ma S (2016) The higher costs of doing business in China: Minimum wages and firms’ export behavior. J Int Econ 100(C):81–94

Gustafsson B, Shi L (2002) Income inequality within and across counties in rural china 1988 and 1995. J Dev Econ 69(1):179–204

Handley K (2012) Country Size, Technology and Manufacturing Location. Rev Int Econ 20(1):29–45

Hanson GH (2020) Who will fill china’s shoes? the global evolution of labor-intensive manufacturing. Working Paper 28313, National Bureau of Economic Research

Hausmann R, Hidalgo CA, Bustos S, Coscia M, Simoes A, Yildirim MA (2014) The atlas of economic complexity: Mapping paths to prosperity. Mit Press

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. Proc Natl Acad Sci 106(26):10570–10575

Hirsch B, Jahn EJ, Manning A, Oberfichtner M (2020) The urban wage premium in imperfect labor markets. LSE Research Online Documents on Economics 106728, London School of Economics and Political Science, LSE Library. https://ideas.repec.org/p/ehl/lserod/106728.html

Hsieh CT, Klenow PJ (2009) Misallocation and Manufacturing TFP in China and India. Q J Econ 124(4):1403–1448

Imbs J, Wacziarg R (2003) Stages of diversification. Am Econ Rev 93(1):63–86

Jain-Chandra MS, Khor N, Mano R, Schauer J, Wingender MP, Zhuang J (2018) Inequality in China-Trends. Drivers and Policy Remedies, International Monetary Fund

Jefferson GH, Rawski TG, Zhang Y (2008) Productivity growth and convergence across china’s industrial economy. J Chin Econ Bus Stud 6(2):121–140

Klinger B, Lederman D (2006) Diversification, innovation, and imitation inside the global technological frontier, world bank policy research. Tech Rep Working Paper 3872 (April). https://doi.org/10.1596/1813-9450-3983

Konings J, Murphy AP (2006) Do multinational enterprises relocate employment to low-wage regions? evidence from european multinationals. Rev World Econ 142(2):267–286

Koren M, Tenreyro S (2007) Volatility and development. Q J Econ 122(1):243–287

Lemoine F, Poncet S, Ünal D (2015) Spatial rebalancing and industrial convergence in china. China Econ Rev 34(C):39–63. https://EconPapers.repec.org/RePEc:eee:chieco:v:34:y:2015:i:c:p:39-63

Li H, Li L, Wu B, Xiong Y (2012) The End of Cheap Chinese Labor. J Econ Perspect 26(4):57–74

Li S, Xu Z (2008) The trend of regional income disparity in the people’s republic of china. Tech. rep., ADB Institute Discussion Papers

Lu J, Tao Z (2009) Trends and determinants of china’s industrial agglomeration. J Urban Econ 65(2):167–180

Mau K (2016) Export diversification and income differences reconsidered: The extensive product margin in theory and application. Review of World Economics (Weltwirtschaftliches Archiv) 152(2):351–381

Mayneris F, Poncet S, Zhang T (2018) Improving or disappearing: Firm-level adjustments to minimum wages in china. Journal of Development Economics 135:20–42. https://doi.org/10.1016/j.jdeveco.2018.06.010, http://www.sciencedirect.com/science/article/pii/S0304387818304620

Meng X (2012) Labor market outcomes and reforms in china. J Econ Perspect 26(4):75–102

Poncet S (2006) Provincial migration dynamics in China: Borders, costs and economic motivations. Reg Sci Urban Econ 36(3):385–398

Roback J (1982) Wages, rents, and the quality of life. J Polit Econ 90(6):1257–1278

Rosen S (1979) Wages-based indexes of urban quality of life. In: P M, M S (eds) Current Issues in Urban Economics, John Hopkins University Press, Baltimore, pp 74–104

Ruan J, Zhang X (2014) “Flying geese” in China: The textile and apparel industry’s pattern of migration. J Asian Econ 34(C):79–91

Xiong Y, Zhang S (2016) The Impact of Rising Labor Costs on Commodity Composition of Manufactured Exports: Evidence from China. Tech. rep., AEA Conference Paper

Zhao Y (1999) Leaving the countryside: rural-to-urban migration decisions in china. Am Econ Rev 89(2):281–286