Abstract

We apply recent stability and bifurcation results to provide an analytical characterization of Paul de Grauwe’s chaotic exchange rate model. We prove that the model’s fundamental steady state becomes unstable due to a Neimark-Sacker bifurcation when chartists extrapolate past exchange rate trends too strongly, a phenomenon that gives rise to cyclical exchange rate dynamics. In contrast, fundamentalists’ mean reversion strength only has a stabilizing effect on the model’s dynamics when the exchange rate is out of equilibrium. We also show that agent-based versions of Paul de Grauwe’s exchange rate model may produce endogenous exchange rate dynamics, too.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the early 1990s, a research group led by Paul de Grauwe proposed an inspiring theoretical model of the foreign exchange market that is capable of producing chaotic exchange rate dynamics. See, for instance, De Grauwe and Dewachter (1992, 1993) and, in particular, De Grauwe et al. (1993). For ease of exposition, we call their work “Paul de Grauwe’s chaotic exchange rate model” in our paper. In a nutshell, its basic functioning may be explained as follows. Endogenous exchange rate dynamics arise due to nonlinear interactions between chartists and fundamentalists. Chartists have destabilizing extrapolative expectations. They dominate the foreign exchange market near its fundamental value and regularly set bubble dynamics in motion. In contrast, fundamentalists have stabilizing regressive expectations. They become increasingly relevant for the determination of the exchange rate as its mispricing worsens, driving back the exchange rate to more moderate levels. Since this development automatically leads to a revival of chartism in the foreign exchange market, the exchange rate remains in constant motion. Paul de Grauwe’s chaotic exchange rate model paved the way for numerous financial market models with heterogeneous interacting agents, studying the functioning of stock, commodity and foreign exchange markets, as documented by De Grauwe and Grimaldi (2006), Westerhoff (2009), De Grauwe and Rovira Kaltwasser (2012a), Hommes (2013) and Dieci and He (2018).

The goal of our paper is twofold. First, we apply recent stability and bifurcation results obtained by Lines et al. (2020) and Gardini et al. (2021) to study Paul de Grauwe’s chaotic exchange rate model. Our analytical results reveal that the exchange rate becomes unstable due to a Neimark-Sacker bifurcation, giving rise to cyclical exchange rate dynamics, when chartists’ extrapolation strength is strong. While the local stability of the exchange rate also depends on speculators’ discount factor, it is independent of fundamentalists’ expected mean reversion speed and of the uncertainty surrounding the fundamental value of the foreign exchange market. However, these model elements may affect the out-of-equilibrium behavior of the exchange rate. Our analytical results aim at complementing the current available numerical simulations for this approach. Second, Paul de Grauwe’s chaotic exchange rate model rests on a few simplifying assumptions, typical for this line of research. To address some of these issues, we propose two agent-based versions of Paul de Grauwe’s chaotic exchange rate model that relax these assumptions and show that these setups may produce endogenous exchange rate dynamics, too. Our numerical explorations underline the robustness of the key insights offered by Paul de Grauwe’s chaotic exchange rate model.

We proceed as follows. In Sect. 2, we recall Paul de Grauwe’s chaotic exchange rate model, as presented in Chapter 3 of the influential book by De Grauwe et al. (1993). In Sect. 3, we derive our main results. In Sect. 4, we develop two agent-based versions of Paul de Grauwe’s chaotic exchange rate model and study them numerically. In Sect. 5, we offer some concluding remarks.

2 Paul de Grauwe’s Chaotic Exchange Rate Model

The starting point of Paul de Grauwe’s foreign exchange market model is that the exchange rate in period \(t\) is determined by

where \({X}_{t}\) denotes a reduced form equation capturing structural forces and exogenous influence factors that drive the exchange rate in period \(t\); \({E}_{t}\left({S}_{t+1}\right)\) stands for the aggregate expectations held by speculators in period \(t\) about the exchange rate in period \(t+1\); and \(0<b<1\) is a discount factor.

In line with empirical evidence, Paul de Grauwe’s chaotic exchange rate model considers two types of speculators: chartists and fundamentalists. Chartists use past movements of the exchange rate as an indicator of market sentiment and extrapolate them into the future. Fundamentalists have regressive expectations and believe that the exchange rate will return to its fundamental value. See Menkhoff and Taylor (2007) for empirical evidence of these two archetypical trader types. Speculators’ aggregate exchange rate expectations are defined as

where \({E}_{t}^{C}\left({S}_{t+1}\right)\) is the forecast made by chartists, \({m}_{t}\) is the weight of chartists, \({E}_{t}^{F}\left({S}_{t+1}\right)\) is the forecast made by fundamentalists, and \({1-m}_{t}\) is the weight of fundamentalists. Note that speculators predict the exchange rate for period \(t+1\) at the beginning of period \(t\) on the basis of information available to them up to the end of period \(t-1\).

Chartists employ a simple moving average rule to forecast the evolution of the exchange rate. In particular, chartists expect an increase (decrease) in the exchange rate when a short-term moving average of the exchange rate crosses a long-term moving average of the exchange rate from below (above). Their predictions are represented by \({E}_{t}^{C}\left({S}_{t+1}\right)={S}_{t-1}{\left(\frac{SMA\left({S}_{t-1}\right)}{LMA\left({S}_{t-1}\right)}\right)}^{2\gamma }\), where \(SMA\left({S}_{t-1}\right)=\frac{{S}_{t-1}}{{S}_{t-2}}\) is a short-term moving average of the exchange rate and \(LMA\left({S}_{t-1}\right)={\left(\frac{{S}_{t-1}}{{S}_{t-2}}\right)}^{0.5}{\left(\frac{{S}_{t-2}}{{S}_{t-3}}\right)}^{0.5}={\left(\frac{{S}_{t-1}}{{S}_{t-3}}\right)}^{0.5}\) is a long-term moving average of the exchange rate. Chartists’ extrapolation strength is captured by parameter \(\gamma >0\). Accordingly, chartists’ expectations are equivalent to

and depend on the exchange rate in periods \(t-1\), \(t-2\) and \(t-3\). As we will see, the exchange rate is thus driven by a three-dimensional dynamical system.

Fundamentalists calculate the fundamental value of the exchange rate \({S}_{t}^{*}\) via (1) by setting \({S}_{t}^{*}={S}_{t}={E}_{t}\left({S}_{t+1}\right)\), yielding \({S}_{t}^{*}={\left({X}_{t}\right)}^{\frac{1}{1-b}}\). Since fundamentalists expect the exchange rate to return to its fundamental value, their forecasts read

Parameter \(0<\alpha <1\) denotes fundamentalists’ expected mean reversion speed. For simplicity, De Grauwe et al. (1993) set \({X}_{t}=1\). Hence, the fundamental value of the exchange rate is equal to \({S}_{t}^{*}=1\).

The key building block of Paul de Grauwe’s chaotic exchange rate model concerns the setup of the weights of chartists and fundamentalists. Quite realistically, its creators take into account that fundamentalists have heterogeneous views with respect to the fundamental value of the exchange rate. For simplicity, they assume that these views are normally distributed around the (true) fundamental value of the exchange rate and develop the following train of thought.

-

When the exchange rate is equal to its fundamental value, half of the fundamentalists will find that the exchange rate is too low, whereas the other half will find that it is too high. In such a situation, fundamentalists do not influence the foreign exchange market – their foreign exchange market transactions neutralize each other – and the exchange rate depends solely on the expectations of chartists.

-

As the exchange rate starts to deviate from its fundamental value, however, fundamentalists’ expectations become relevant. When the exchange rate is overvalued, for instance, a majority of fundamentalists believe that the exchange rate is too high. Accordingly, the impact of fundamentalists’ expectations on speculators’ aggregated exchange rate expectations will increase when the exchange rate departs from its fundamental value.

Based on these considerations, the weight of chartists in Paul de Grauwe’s chaotic exchange rate model is approximated by the weighting function

where parameter \(\beta >0\) controls how rapidly the weight of chartists declines as the mispricing of the foreign exchange market increases. Its creators regard parameter \(\beta\) also as a measure of the degree of divergence of fundamentalists’ estimates of the fundamental value of the exchange rate. For instance, a low value of parameter \(\beta\) reflects a lot of uncertainty in the foreign exchange market concerning the fundamental value of the exchange rate. A given mispricing then has a relatively low impact on their weight.Footnote 1

3 Main Analytical Results

Combining (1)-(5) and recalling that \({S}_{t}^{*}=1\) enables us to express Paul de Grauwe’s chaotic exchange rate model in the form of a three-dimensional nonlinear map, given by

where \({m}_{t}=\frac{1}{1+\beta {\left({S}_{t-1}-1\right)}^{2}}\) and \({X}_{t}\) and \({Y}_{t}\) are auxiliary variables. De Grauwe et al. (1993) state that dynamical system (6) precludes an analytical treatment due to its multiple nonlinearities and high dimension, which is why they resort to the messy world of numerical experiments. Due to recent results by Lines et al. (2020) and Gardini et al. (2021), however, we are able to conduct a rigorous local stability and bifurcation analysis of the dynamical system (6).

By applying the set of equilibrium conditions \(\overline{S }={S}_{t}={S}_{t-1}={X}_{t-1}={Y}_{t}\), straightforward computations reveal that map (6) possesses only one economically meaningful steady state, namely

Since the exchange rate corresponds to its fundamental value when the dynamics is at rest, we may regard this steady state as a fundamental steady state. Obviously, this steady state implies that the weight of chartists is equal to \(\overline{m }=1\), i.e. fundamentalists’ market impact is zero at the model’s fundamental steady state. This observation allows us understand our main analytical results.

To study the local stability properties of the model’s steady state, we have to evaluate the Jacobian matrix of (6) at the \(FSS\), yielding

from which we get the characteristic polynomial

where \({a}_{1}=-b\left(\gamma +1\right)\), \({a}_{2}=2b\gamma\) and\({a}_{3}=-b\gamma\).

Using the stability results derived in Lines et al. (2020), we can conclude that the model’s steady state loses its local stability if one of the following three stability conditions becomes broken: (i) \(1+{a}_{1}+{a}_{2}+{a}_{3}>0\), (ii) \(1-{a}_{1}+{a}_{2}-{a}_{3}>0\) and (iii)\(1-{a}_{2}+{a}_{1}{a}_{3}-{{a}_{3}}^{2}>0\). Moreover, Gardini et al. (2021) demonstrate that a separate violation of stability condition (i), (ii) or (iii), while the other two stability conditions hold, is associated with the emergence of a fold, a flip and a Neimark-Sacker bifurcation, respectively.

Since stability conditions (i) and (ii) require that \(1-b>0\) and \(1+b\)(4 \(\gamma +1)>0\), respectively, they are always satisfied. Stability condition (iii) necessitates that \(1-b\gamma \left(2-b\right)>0\). Solving this stability condition for parameter \(\gamma\) results in

If this inequality becomes violated, the model’s steady state loses its stability via a Neimark-Sacker bifurcation, giving rise to cyclical exchange rate dynamics. Accordingly, only two model parameters affect the local stability of the model’s fundamental steady state: chartists’ extrapolation strength \(\gamma\) and speculators’ discount factor \(b\). Put differently, the local stability of the model’s fundamental steady state does not depend on fundamentalists’ expected mean reversion speed \(\alpha\) or on the weighting parameter \(\beta\). The following proposition summarizes our main analytical results.

Proposition 1: The fundamental steady state of Paul de Grauwe’s chaotic exchange rate model loses its local stability due to a Neimark-Sacker bifurcation if the inequality \(\gamma <{\gamma }_{crit}^{NS} :=\frac{1}{b(2-b)}\) becomes violated, an outcome that is associated with the emergence of endogenous cyclical exchange rate dynamics.

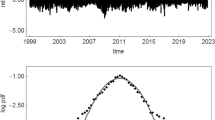

Let us briefly illustrate our main analytical results. Figure 1 displays a bifurcation diagram for parameter \(\gamma\), assuming that \(b=0.95\), \(\alpha =0.65\) and \(\beta =\mathrm{10,000}\). As predicted by Proposition 1, we observe a Neimark-Sacker bifurcation at \({\gamma }_{crit}^{NS}\approx 1.0025\). For \(0<\gamma <{\gamma }_{crit}^{NS}\), the exchange rate converges towards its fundamental value. At \(\gamma ={\gamma }_{crit}^{NS}\), a Neimark-Sacker bifurcation occurs, triggering endogenous cyclical exchange rate dynamics. As parameter \(\gamma\) increases further, additional (global) bifurcations emerge, during which the amplitude of the exchange rate fluctuations tends to increase, underlining the destabilizing role played by chartists’ extrapolation behavior.

These outcomes are also visible in Fig. 2, which portrays the dynamics of Paul de Grauwe’s chaotic exchange rate model in the time domain for specific values of parameter \(\gamma\), again using \(b=0.95\), \(\alpha =0.65\) and \(\beta =\mathrm{10,000}\). We depict the dynamics for 160 periods, after a single one-percent exogenous shock has hit the foreign exchange market in period \(t=1\). The left panels of Fig. 2 show the evolution of the exchange rate and the right panels the corresponding weights of chartists. For \(\gamma =0.95\) (top panels), the exchange rate converges towards its steady-state value \(\overline{S }=1\), implying that the weight of chartists eventually approaches its maximum value \(\overline{m }=1\). For \(\gamma =1.05\) (middle panels), the exchange rate is subject to endogenous cyclical dynamics, an outcome that we also find for the weights of chartists. Since mispricing of the exchange rate remains rather small for \(\gamma =1.05\), the weight of chartists remains relatively high. For \(\gamma =3\) (bottom panels), the exchange rate displays chaotic motion, and the weight of chartists fluctuates wildly, too. The latter parameter setting, i.e. \(b=0.95\), \(\alpha =0.65\), \(\beta =\mathrm{10,000}\) and \(\gamma =3\), is the lead parameter setting in De Grauwe et al. (1993).

We may summarize the functioning of Paul de Grauwe’s chaotic exchange rate model as follows. When the exchange rate is near its fundamental value, fundamentalists disagree about the question whether the foreign exchange market is overvalued or undervalued. Consequently, chartists dominate the dynamics of the foreign exchange market. As is clear from Proposition 1, chartists’ extrapolation behavior pushes the exchange rate away from its fundamental value, provided that stability condition (10) is violated. Far away from the fundamental value, however, fundamentalists rule the dynamics of the foreign exchange market. When the exchange rate is relatively high (low), a majority of fundamentalists conclude that the exchange rate is overvalued (undervalued). Fundamentalism now matters and exercises a stabilizing effect on the dynamics of the foreign exchange market, driving the exchange rate closer towards its fundamental value. Unfortunately, this (desirable) movement of the exchange rate is responsible for a comeback of the destabilizing behavior of chartists, and the above pattern repeats itself, either in a cyclical or in a chaotic manner, depending on chartists’ extrapolation strength.

4 Agent-Based Simulations

Recall that there are two types of speculators in Paul de Grauwe’s chaotic exchange rate model: heterogeneous fundamentalists and homogeneous chartists. Fundamentalists are heterogeneous because their estimates of the fundamental value of the exchange rate are normally distributed around the true fundamental value of the exchange rate. This natural assumption has been used to motivate (the powerful) switching function (6), which, in turn, enters the expression that defines speculators’ aggregate exchange rate expectations, i.e. (2). In this section, we propose agent-based versions of Paul de Grauwe’s chaotic exchange rate model that do not rely on this approximation. In fact, 30 years after its invention, modern computers and software tools allow us to state and explore the behavior of heterogeneous fundamentalists exactly as envisioned by its creators.

Chartists, following expectation rule (3), are homogenous because they have identical expectations. Since we do not have any clear guidance on how to turn homogeneous chartists into heterogeneous chartists, we explore two different agent-based versions of Paul de Grauwe’s chaotic exchange rate model. What both versions have in common is that the market impact of heterogeneous chartists decreases when the exchange rate becomes more turbulent, the latter being captured by either stronger mispricing or stronger volatility, which has an additional stabilizing effect on the dynamics of the foreign exchange market.Footnote 2

Finally, we remark that our agent-based versions of Paul de Grauwe’s chaotic exchange rate model contain a finite number of speculators, while there is a continuum of speculators in the original model. As we will see, the number of speculators may have an impact on the dynamics of the exchange rate as well.

To be more precise, we modify Paul de Grauwe’s chaotic exchange rate model as follows. As before, we set \({X}_{t}=1\), implying that the exchange rate in period \(t\) obeys

where \({E}_{t}\left({S}_{t+1}\right)\) stands for the aggregate expectations held by speculators in period \(t\) about the exchange rate in period \(t+1\); parameter \(0<b<1\) reflects speculators’ discount factor; and \({S}_{t}^{*}=1\) denotes the fundamental value of the exchange rate.

There are \(n\) speculators in total, consisting of \({n}^{C}\) chartists and \({n}^{F}=n-{n}^{C}\) fundamentalists. Each speculator has their own individual exchange rate expectation, a defining feature of an agent-based financial market model. Speculators’ aggregate exchange rate expectations now read as

where \({E}_{t}^{C}\left({S}_{t+1}\right)\) and \({E}_{t}^{F}\left({S}_{t+1}\right)\) are the aggregate expectations of chartists and fundamentalists, respectively. We still assume that speculators’ exchange rate expectations in period \(t\) about the exchange rate in period \(t+1\) depend on information they have collected up to period \(t-1\).

In line with the original model, fundamentalists’ aggregate exchange rate expectations are defined as

where \({E}_{t}^{F,i}\left({S}_{t+1}\right)\) reflects the exchange rate expectations of fundamentalist \(i\), given by

As in Paul de Grauwe’s chaotic exchange rate model, we assume that fundamentalists’ expectations about the fundamental value are normally distributed around \({S}_{t}^{*}=1\). However, we are now able to express this as

where the random variable \({\varepsilon }^{i}\sim N\left(0,{\sigma }^{F}\right)\) captures fundamentalist \(i\)’s constant individual perception error with respect to the fundamental value of the exchange rate. Note that (15) implies that fundamentalist \(i\) does not change their erroneous belief about the fundamental value of the exchange rate over time. Alternatively, we could assume that fundamentalist \(i\) perceives a different fundamental value of the exchange rate in every period, i.e. that

where the random variable \({\varepsilon }_{t}^{i}\sim N\left(0,{\sigma }^{F}\right)\) now reflects fundamentalist \(i\)’s individual time-varying perception error with respect to the fundamental value of the exchange rate. In our numerical investigations, we explore both scenarios. Importantly, (15) does not add exogenous noise to the dynamics –fundamentalists’ perception errors manifest once and remain constant – while (16) does so. Note that, in contrast to the original model, the above setup does not rest on weighting function (6). Moreover, (14) now implies that each fundamentalist believes in a different fundamental value of the exchange rate, while (4) is based on \({S}_{t}^{*}\).Footnote 3 Of course, parameter \(0<\alpha <1\) still denotes fundamentalists’ expected mean reversion speed.

Chartists’ aggregate exchange rate expectations are defined as

where \({E}_{t}^{C,j}\left({S}_{t+1}\right)\) reflects the exchange rate expectations of chartist \(j\). We consider that chartists are heterogeneous with respect to their extrapolation strength. The exchange rate expectations of chartist \(j\) thus read as

We discuss two formalizations of \({\gamma }_{t}^{j}\). With our first formalization, we explicitly seek to mimic the dynamics of Paul de Grauwe’s chaotic exchange rate model. For this reason, we model chartists’ extrapolation strength as

with \({\gamma }_{0},{\gamma }_{1}>0\). The first term on the right-hand side of (19) indicates that chartists extrapolate the exchange rate less aggressively when it starts to deviate from its long-run average, given, for simplicity, by \(\tilde{S }=1\).Footnote 4 Put differently, chartists are maximally extrapolating the exchange rate when \({S}_{t-1}=\tilde{S }\). We have two specifications in mind when it comes to setting up chartists’ heterogeneity. Assuming

reflects constant individual differences between chartists’ extrapolation strength, controlled by parameter \({\sigma }^{C}>0\), while

entails time-varying individual differences between their extrapolation behavior. Similar to (15), (16) and (20) does not add exogenous noise to the dynamics, while (21) does so. We thus obtain a deterministic agent-based version of Paul de Grauwe’s chaotic exchange rate model when we use (15) and (20), and a stochastic one when we use (16) and (21). Note also that – due to the above setup – there may be occasions where some chartists act as contrarians.

Figure 3 portrays simulations of our first agent-based version of Paul de Grauwe’s chaotic exchange rate model. Its left panels present the exchange rate in the time domain, while its right panels report the dynamics in phase space. As usual, a larger transient period has been erased. To have a reference point, we recall the dynamics of Paul de Grauwe’s chaotic exchange rate model once again in the top panels of Fig. 3, assuming that \(b=0.95\), \(\alpha =0.65\), \(\beta =\mathrm{10,000}\) and \(\gamma =3\). Due to the butterfly effect (sensitive dependence of chaotic trajectories on initial conditions), each short-run chaotic time series plot appears differently. However, the strange attractor, visible in the top right panel of Fig. 3, summarizes the complex long-run characteristics of Paul de Grauwe’s chaotic exchange rate dynamics quite well.

The first agent-based scenario. The left (right) panel shows the exchange rate in the time domain (phase space), assuming that \(\beta =\mathrm{10,000}\) and \(\gamma =3\) (top, original model), \({n}^{F}={n}^{C}=500\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{0}=5\) and \({\gamma }_{1}=\mathrm{10,000}\) (middle, deterministic scenario) and \({n}^{F}={n}^{C}=500\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{0}=5\) and \({\gamma }_{1}=\mathrm{10,000}\) (bottom, stochastic scenario). Remaining parameters: \(b=0.95\), \(\alpha =0.65\)

We now turn to the question of whether we can mimic the dynamics of Paul de Grauwe’s chaotic exchange rate model. Let us start with our deterministic scenario, i.e. (15) and (20). The simulations depicted in the central panels of Fig. 3 rest on \(b=0.95\), \(\alpha =0.65\), \({n}^{F}={n}^{C}=500\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{0}=5\) and \({\gamma }_{1}=\mathrm{10,000}\). As can be seen, the deterministic scenario of our first agent-based version of Paul de Grauwe’s chaotic exchange rate model produces similar dynamics as the original model. Although the simulations reported in the bottom panels rests on the same parameter setting, the behavior of chartists and fundamentalists is subject to exogenous shocks, as formalized by (16) and (21). Obviously, the dynamics of the stochastic scenario of our first agent-based version of Paul de Grauwe’s chaotic exchange rate model is close to the original model, too.

Endogenous exchange rate dynamics may also arise when we model chartists’ heterogeneity in a different way. Inspired by the regime-switching approach employed in the empirically supported behavioral exchange rate model by Manzan and Westerhoff (2007), let us next assume that

where parameters \({\gamma }_{H}>{\gamma }_{L}>0\) control the extrapolation strength of chartists. Now, chartists extrapolate the exchange rate less aggressively when it changes by more than \(r>0\) percent between periods \(t-1\) and \(t-2\).Footnote 5 Moreover,

reflects individual and constant differences between chartists, controlled by parameter \({\sigma }^{C}>0\), while

allows us to consider individual and time-varying differences between chartists. We obtain a deterministic version of Paul de Grauwe’s chaotic exchange rate model when we use (15) and (23), and a stochastic one when we use (16) and (24). Moreover, there may be occasions where some chartists act as contrarians.

Figure 4 shows simulations for our second agent-based version of Paul de Grauwe’s chaotic exchange rate model, where the left (right) panels depict the exchange rate in the time domain (phase space). In the top panels of Fig. 4, we assume that \({n}^{F}={n}^{C}=500\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{L}=1.4\), \({\gamma }_{H}=1.7\) and \(r=0.025\). Note that the deterministic version of our second agent-based version of Paul de Grauwe’s chaotic exchange rate model is able to generate endogenous exchange rate dynamics, too. In the middle panels of Fig. 4, we assume the same parameter setting. However, we now focus on the stochastic version of our second agent-based version of Paul de Grauwe’s chaotic exchange rate model. As can be seen, the image of the previous strange attractor becomes more blurred, yet the main features of the dynamics stay intact. In the bottom panels of Fig. 4, we repeat this experiment, except that we reduce the number of chartists and fundamentalists to \({n}^{F}={n}^{C}=50\). Obviously, idiosyncratic shocks tend to cancel out when the number of chartists and fundamentalists increases, or, put differently, more erratic exchange rate dynamics emerge when the number of chartists and fundamentalists is low.

The second agent-based scenario. The left (right) panel shows the exchange rate in the time domain (phase space), assuming that \({n}^{F}={n}^{C}=500\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{L}=1.4\), \({\gamma }_{H}=1.7\) and \(r=0.025\) (top, deterministic scenario), \({n}^{F}={n}^{C}=500\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{L}=1.4\), \({\gamma }_{H}=1.7\) and \(r=0.025\) (middle, stochastic scenario) and \({n}^{F}={n}^{C}=50\), \({\sigma }^{F}={\sigma }^{C}=0.05\), \({\gamma }_{L}=1.4\), \({\gamma }_{H}=1.7\) and \(r=0.025\) (bottom, stochastic scenario). Remaining parameters: \(b=0.95\), \(\alpha =0.65\)

5 Conclusions

Paul de Grauwe’s chaotic exchange rate model is one of the first behavioral exchange rate models featuring nonlinear interactions between chartists and fundamentalists. Since chartists, dominating the foreign exchange market near the fundamental value of the exchange rate, employ destabilizing extrapolative expectations, and fundamentalists, reigning the foreign exchange market far away from the fundamental value of the exchange rate, adhere to stabilizing mean-reversion expectations, this seminal model is able to produce endogenous exchange rate dynamics. Depending on the strength of the chartists’ extrapolation parameter, the dynamics of the exchange rate may be stable, regular or chaotic.

Given its multiple nonlinearities and high dimension, however, an analytical treatment of Paul de Grauwe’s chaotic exchange rate model was not possible when it was initially proposed in the literature by De Grauwe and Dewachter (1992, 1993), and De Grauwe et al. (1993), leaving numerical simulations as a last resort. In this paper, we utilized recent stability and bifurcation results established by Lines et al. (2020) and Gardini et al. (2021) to close this gap. Most importantly, we have proven that the model’s fundamental steady state may become unstable due to a Neimark-Sacker bifurcation when chartists extrapolate past exchange rate changes too strongly, triggering endogenous cyclical exchange rate dynamics. Moreover, we proposed two agent-based versions of Paul de Grauwe’s chaotic exchange rate model and demonstrated that they are capable of producing chaotic exchange rate dynamics, too.

We hope that our results facilitate understanding of the functioning of Paul de Grauwe’s chaotic exchange rate model, lending this beautiful approach – with its natural and realistic assumptions – additional momentum for research activities that provide us with deeper insights into the complex behavior of the foreign exchange market.

Notes

The bell-shaped weighting scheme (5) may also be reconciled with a setup in which speculators switch between heterogeneous expectation rules. The main argument goes as follows. If the exchange rate is near its fundamental value, the majority of speculators opt for an extrapolative expectation rule, hoping to benefit from the current momentum of the exchange rate. As the mispricing of the foreign exchange market increases, however, more and more speculators conclude that a fundamental price correction is about to set in and, consequently, favor a regressive expectation rule. See Westerhoff (2003) for an example.

Two comments are in order. First, after conducting numerous additional simulations, it appeared to us that either the exchange rate approaches its fundamental value or it explodes when we abstain from taming chartists’ behavior. Note that a similar taming device is present in the original model – chartists’ impact on the aggregate exchange rate expectations of the foreign exchange market diminishes with the current mispricing. Second, as stated in footnote 1, weighting function (5) is consistent with a setup in which speculators switch between extrapolative and regressive expectation rules. It seems worthwhile to us to develop agent-based versions for that scenario, too. Preliminary simulations suggest that they may be able to replicate key statistical properties of the foreign exchange market quite well.

Hence, chartists’ behavior does not depend on the fundamentals of the foreign exchange market, e.g. because they are not aware of them or because they simply do not care about them. See Day and Huang (1990) for a similar assumption. Of course, we could also condition chartists’ aggressiveness on foreign exchange market mispricing, bringing (19) more in line with (5). Since \({S}_{t}^{*}=\tilde{S }=1\), we would observe the same dynamics.

We carried out a number of robustness checks in which we considered chartists’ reaction to foreign exchange market volatility being formulated in different ways, e.g. by assuming that they do not react to the most recent exchange rate change, but to exchange rate changes that involve more lags. These formulations were able to produce endogenous exchange rate dynamics, too.

References

Day R, Huang W (1990) Bulls, bears and market sheep. J Econ Behav Organ 14:299–329

De Grauwe P, Dewachter H (1992) Chaos in the Dornbusch model of the ex-change rate. Kredit Und Kapital 25:26–54

De Grauwe P, Dewachter H (1993) A chaotic model of the exchange rate: the role of fundamentalists and chartists. Open Econ Rev 4:351–379

De Grauwe P, Dewachter H, Embrechts M (1993) Exchange rate theory - chaotic models of foreign exchange markets. Blackwell, Oxford

De Grauwe P, Grimaldi M (2006) The exchange rate in a behavioral finance framework. Princeton University Press, Princeton

De Grauwe P (2011) Animal spirits and monetary policy. Econ Theor 47:423–457

De Grauwe P, Rovira Kaltwasser P (2012a) The exchange rate in a behavioral finance framework. In: James J, Marsh I, Sarno L (eds) Handbook of exchange rates. Wiley, Hoboken, pp 111–132

De Grauwe P, Rovira Kaltwasser P (2012b) Animal spirits in the foreign exchange market. J Econ Dyn Control 36:1176–1192

Dieci R, He X-Z (2018) Heterogeneous agent models in finance. In: Hommes C, LeBaron B (eds) Handbook of computational economics: heterogeneous agent modeling. North-Holland, Amsterdam 257–328

Gardini L, Schmitt N, Sushko I, Tramontana F, Westerhoff F (2021) Necessary and sufficient conditions for the roots of a cubic polynomial and bifurcations of codimension-1, -2, -3 for 3D maps. J Differ Equations Appl 27:557–578

Hommes C (2013) Behavioral rationality and heterogeneous expectations in complex economic systems. Cambridge University Press, Cambridge

Lines M, Schmitt N, Westerhoff F (2020) Stability conditions for three-dimensional maps and their associated bifurcation types. Appl Econ Lett 27:1056–1060

Manzan S, Westerhoff F (2007) Heterogeneous expectations, exchange rate dynamics and predictability. J Econ Behav Organ 64:111–128

Menkhoff L, Taylor M (2007) The obstinate passion of foreign exchange professionals: technical analysis. J Econ Lit 45:936–972

Westerhoff F (2003) Speculative markets and the effectiveness of price limits. J Econ Dyn Control 28:493–508

Westerhoff F (2009) Exchange rate dynamics: a nonlinear survey. In: Rosser JB (ed) Handbook of research on complexity. Edward Elgar, Cheltenham 287–325

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical Statement

The authors declare that they have no relevant or material financial interests that relate to the research described in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mignot, S., Westerhoff, F. Revisiting Paul de Grauwe’s Chaotic Exchange Rate Model: New Analytical Insights and Agent-Based Explorations. Open Econ Rev 34, 155–169 (2023). https://doi.org/10.1007/s11079-022-09667-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-022-09667-5

Keywords

- Foreign exchange markets

- Exchange rate dynamics

- Chartists and fundamentalists

- Stability and bifurcation analysis

- Agent-based modeling