Abstract

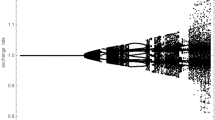

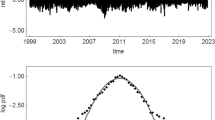

A monetary model of the exchange rate is constructed in which “fundamentalists” and “chartists” interact. It is shown that the non-linearity of this speculative dynamics leads to chaotic motion of the exchange rate. The model is also capable of generating some of the stylized facts of exchange rate dynamics.

Similar content being viewed by others

References

Allen, H. and M. Taylor (1989) “Charts, Noise and Fundamentals: A Study of the London Foreign Exchange Market,” CEPR Discussion Paper No. 341.

Baumol, W. and Benhabib (1989) “Chaos: Significance Mechanism and Economic Applications,”Journal of Economic Perspectives 3, 77–105.

Bollerslev. T. (1987) “A Conditional Heteroskedastic Time Series Model for Speculative Prices and Rates of Return,”The Review of Economic and Statistics, 542–547.

Brock, W. and A. Malliaris (1989)Differential Equations, Stability and Chaos in Dynamic Economics. Amsterdam: North Holland.

Cutler, D., J. Poterba, and L. Summers (1990) “Speculative Dynamics,” NBER Working Paper No. 3242.

De Grauwe, P. (1989) “On the Nature of Risk in the Foreign Exchange Market: Evidence from the Dollar and the EMS Markets,”CEPR Discussion Paper No. 352. CEPR, London.

De Grauwe, P. and K. Vansanten (1990) “Determinstic Chaos in the Foreign Exchange Market,”CEPR Discussion Paper No. 370.

Delong, B., et al. (1990) “Noise Trader Risk in Financial Markets,”Journal of Political Economy 98, 703–737.

Devaney, R. (1989) “An Introduction to Chaotic Dynamical Systems”, 2nd ed. Menlo Park: Addison Wesley.

Dornbusch, R. (1976) “Expectations and Exchange Rate Dynamics,”Journal of Political Economy 84, 1161–1176.

Engle, C. and J. B. Hamilton (1990) “Long Swings in the Dollar: Are They in the Data and Do Markets Know it?”American Economic Review 80, 689–713.

Engle, R. F. and T. Bollerslev (1986) “Modelling the Persistence of Conditional Variances,”Econometrics Review 5, 1–50.

Fama, E. (1984) “Forward and Spot Exchange Rates,”Journal of Monetary Economics 14, 319–338.

Frankel, J. and K. Froot (1986) “The Dollar as a Speculative Bubble: A Tale of Chartists and Fundamentalists,” NBER Working Paper No. 1854.

Frankel, J. (Winter 1989–90) “Chartists, Fundamentalists and Trading in the Foreign Exchange Market,” NBER Reporter 9–12.

Frankel, J. and M. Mussa (1985) “Asset Markets, Exchange Rates and the Balance of Payments.” In Ronald W. Jones and Peter B. Kenen (eds),Handbook of International Economics. Amsterdam: North Holland.

Goodhart, C. (1990) “News and the Foreign Exchange Market,” LSE Financial Market Group Discussion Paper No. 71.

Grandmont (1985) “On Endogenous Competitive Business Cycles,”Econometrica 53, 995–1045.

Koedijk, K., M. Schafgans, and C. de Vries (1990) “The Tall Index of Exchange Rate Returns,”Journal of International Economics 29, 93–108.

Levich, R. (1985) “Empirical Studies of Exchange Rates: Price Behavior, Rate Determination and Market Efficiency,” In Ronald W. Jones and Peter B. Kenen (eds),Handbook of International Economics, Vol. II. Amsterdam: North Holland.

Meese, R. and K. Rogoff (1983) “Empirical Exchange Rate Models of the Seventies: Do They Fit Out-of-Sample?”Journal of International Economics 19, 3–24.

Mussa, M. (1984) “The Theory of Exchange Rate Determination.” In John F.O. Bilson and Richard C. Marston (eds),Exchange Rate Theory and Practice Chicago: University of Chicago Press, 13–78.

Scheinkman, J and B. Lebaron (1989) “Nonlinear Dynamics and Stock Returns,”Journal of Business 62, 311–337.

Schiller, R. (1984) “Stock Prices and Social Dynamics,”Brookings Papers on Economic Activity 2, 457–498.

Schulmeister, S. (1987) “An Essay on Exchange Rate Dynamics,”Discussion Paper IIM/LMP, Wissenshaftzentrum Berlin fur Sozialforschung, Berlin 87–88.

Schulmeister, S. (1989) “Currency Speculation and Dollar Fluctuations,”Banca Nazionale del Lavoro 3, 343–365.

Schuster H. (1985)Deterministic Chaos. Weinheim: Physik-Verlag.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

de Grauwe, P., Dewachter, H. A chaotic model of the exchange rate: The role of fundamentalists and chartists. Open Econ Rev 4, 351–379 (1993). https://doi.org/10.1007/BF01011136

Issue Date:

DOI: https://doi.org/10.1007/BF01011136