Abstract

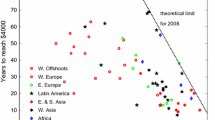

Foreign technological advance unambiguously reduces home welfare in a popular variant of the Melitz (Econometrica 71(6):1695–1725, 2003) model that assumes the presence of a costlessly traded homogeneous (outside) good (Demidova in Int Econ Rev 49(4):1437–1462, 2008). The present paper shows that this result is sensitive to the presence of the outside good and is, in fact, reversed in its absence: foreign technological advance always improves home welfare in the Melitz model without the outside good. Improvement in home welfare occurs via changes in the numbers and prices of domestic and imported varieties. For quantitative analysis of welfare effects, we calibrate an international trade model for the United States and its major trading partners. US is found to gain less from foreign technological improvements than its trading partners from US improvements. In either case, the magnitude of gains is modest.

Similar content being viewed by others

Notes

Felbermayr and Jung (2012) extend DRC analysis to show that the welfare effect of a tariff reduction differs from that of a decrease in (iceberg) import cost. Falvey et al. (2011) use the Melitz model with an outside good to examine the short- and long-run effect of trade liberalization in the presence of a technological gap.

Segerstrom and Sugita (unpublished paper) provide an alternative diagrammatic solution for a multi-sector version of the Melitz model. Their solution can be easily adapted to a one-sector model and has a simple recursive structure, but it does not allow for asymmetry in the shape parameter of Pareto distribution, which is needed for our analysis.

Here we depart from DRC’s simplifying assumption of a static equilibrium where firms last for only one period. Our departure is motivated by the need to use conventional calibration in our numerical analysis and does not affect our basic analytical results.

DRC derive this result for the general case that does not assume a specific form for the productivity distribution.

According to (5), \( {z}_{12}^{*} \) clearly increases in w 1 for a small home economy, in which case \( {z}_{22}^{*} \) is exogenous. For a large home economy, there are also indirect effects via \( {z}_{22}^{*} \), but the relation between \( {z}_{12}^{*} \) and w 1 remains positive after accounting for these effects.

Comparison of downward shifts in the CC and TB curves does not yield a clear-cut result on which shift is bigger, and is thus not informative about whether exporter’s cut-off level would increase or decrease. We use a different approach below to pin down the effect on the cut-off level.

The average prices of home and imported varieties equal \( {w}_1/\left(\rho {\tilde{z}}_{11}\right) \) and \( \left({w}_2{\tau}_{21}\right)/\left(\rho {\tilde{z}}_{21}\right) \), respectively. Divide these prices by w 1 to express them in units of home labor. Proportional changes in these prices can then be readily derived by letting w 2 = 1 and assuming that τ 21 does not change.

Also see Feenstra (2010), who shows that trade liberalization leads to a similar result.

We focus on the non-exporter’s cut-off level here, but note that it is inversely related to exporter’s cut-off level (highlighted in the diagrammatic solution) if home technology is unchanged.

One variation is to add a homogeneous good to the Melitz model but assume that it is nontraded instead of traded costlessly. For this variation, Choudhri and Marasco (2014) use the methodology for model solution in Choudhri and Marasco (2013) to show that in a symmetric equilibrium, small improvement in foreign technology will always improve home welfare.

To reconcile the balanced trade assumption of the model with unbalanced trade in data, the export share is measured as the share of trade (the average value of imports and exports) in GDP.

The value for the variable trade costs is within the range of estimates suggested by direct evidence on tariffs, non-tariff barriers and transportation costs (Anderson and van Wincoop 2004). Estimates of trade costs implied by gravity equations tend to be larger, but these estimates could incorporate both variable and fixed trade costs. Fixed costs for exporters also include the costs of technical trade barriers (Felbermayr and Jung 2011) and may be substantial, but are difficult to disentangle from variable costs. Balisteri et al. (2011) provide estimates of fixed trade costs by origin and destination, which show a wide range of variation. We explored higher and lower values of τ 12 and f 12 , but these changes did not much effect the results on relative welfare effects (discussed in Table 1)

For a given foreign technological change, the competitiveness effect is calculated as the percentage change in z ii determined by (5)–(8) with w 1 held constant at the initial level (i.e., the trade balance Eq. (9) is dropped from the model and w 1 is treated as an exogenous variable). The trade balance effect is determined residually.

In determining the sign of ∂h 22/∂θ 2, we make use of the implication of the Pareto distribution that \( \ln \left({b}_2/{z}_{21}^{*}\right)<0 \) and \( \ln \left({b}_2/{z}_{22}^{*}\right)<0 \) .

The countries included in the US trading partner group are: Canada, Mexico, China, Japan, Germany, U.K., South Korea, France, Taiwan, Brazil, Netherlands, Singapore, Venezuela, Saudi Arabia, and India.

References

Anderson, JE, van Wincoop E 2004 “Trade Costs,” NBER Working Paper No. 10480

Baldwin RE, Forslid R (2010) Trade liberalization with heterogeneous firms. Rev Dev Econ 14(2):161–176

Baldwin RE, Okubo T (2009) Tax reform, delocation, and heterogeneous firms. Scand J Econ 111(4):741–764

Balisteri E, Hillberry RH, Rutherford TF (2011) Structural estimation and solution of international trade models with heterogeneous firms. J Int Econ 83:95–108

Bernard AB, Jonathan E, Bradford Jensen J, Kortum S (2003) Plants and productivity in international trade. Am Econ Rev 93(4):1268–1290

Bernard AB, Redding SJ, Schott PK (2007) Comparative advantage and heterogeneous firms. Rev Econ Stud 74(1):31–66

Chor D (2009) Subsidies for FDI: implications from a model with heterogenous firms. J Int Econ 78:113–125

Choudhri EU, Marasco A (2013) Heterogeneous productivity and the gains from trade and FDI. Open Econ Rev 24:339–360

Choudhri EU, Marasco A 2014 Asymmetric technological change in the Melitz model: are foreign technological improvements harmful? Carleton Economic Papers CEP 14–04

Demidova S (2008) Productivity improvements and falling trade costs: boon or bane? Int Econ Rev 49(4):1437–1462

Demidova S, Rodriguez-Clare A (2013) The simple analytics of the Melitz model in a small economy. J Int Econ 90(2):266–272

Falvey R, Greenaway D, Yu Z (2011) Catching up or pulling away: intra-industry trade, productivity gaps and heterogeneous firms. Open Econ Rev 22:17–38

Feenstra RC (2010) Measuring the gains from trade under monopolistic competition. Can J Econ 43(1):1–28

Felbermayr GJ, Jung B (2011) Sorting it out: technical barriers to trade and industry productivity. Open Econ Rev 22:93–117

Felbermayr G, Jung B (2012) Unilateral trade liberalization in the Melitz model: a note. Econ Bull 32(2):1724–1730

Helpman E, Melitz MJ, Yeaple SR (2004) Export versus FDI with heterogeneous firms. Am Econ Rev 94(1):300–316

Helpman E, Melitz MJ, Rubinstein Y (2008) Estimating trade flows: trading partners and trading volumes. Q J Econ 123(2):441–487

Hsieh C-T, Ossa R 2011 A global view of productivity growth in China, NBER Working Paper, 16778

Melitz MJ (2003) The impact of trade on aggregate industry productivity and intra-industry reallocations. Econometrica 71(6):1695–1725

Melitz MJ, Ottaviano GIP (2008) Market size, trade, and productivity. Rev Econ Stud 75:295–316

Melitz MJ, Redding SJ (2014) New trade models, new welfare implications. Am Econ Rev 105(3):1105–1146

Acknowledgments

The authors would like to thank an anonymous referee for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Sections 2.2–2.4

1.1.1 Derivation of Relations (1)–(4)

Let p ij (z) and r ij (z) denote, respectively, the price set and the revenue generated by a firm in country i with productivity z in country j’s market. Given the consumer demand based on Dixit-Stiglitz preferences, the optimal price and the corresponding revenue equal

where \( {P_j}^{1-\sigma }={\displaystyle \sum_{i=1,2}\frac{M_i^e}{\delta_i}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty }{p}_{ij}{(z)}^{1-\sigma }d{G}_i(z)}} \) is country j’s price index. Since the price is a constant markup over marginal cost, variable profits (of a firm in country i selling in country j) equal r ij (z)/σ. Thus the break-even condition for cut-off levels is

Using (A1) and (A2), we can readily drive (1).

The free entry condition implies that

where the LHS represents expected profits for entrants. Since \( \frac{r_{ij}(z)}{r_{ij}\left({z}_{ij}^{*}\right)}={\left(\frac{z}{z_{ij}^{*}}\right)}^{\sigma -1} \) from (A1), we can use (A2) to derive \( \frac{r_{ij}(z)}{\sigma }={w}_i{f}_{ij}{\left(\frac{z}{z_{ij}^{*}}\right)}^{\sigma -1} \). Using this condition, we can determine

Using (A3) and (A4), we obtain (2). For use below, we also have

Let M ij denote the mass of successful entrants in country i selling in country j. The aggregate firm revenue equals \( {\displaystyle \sum_{j=1,2}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty}\frac{M_{ij}{r}_{ij}(z)}{1-{G}_i\left({z}_{ij}^{*}\right)}\kern0.5em }}d{G}_i(z) \). Free entry implies that aggregate revenue equals total wage income. Noting that \( \left[1-{G}_i\left({z}_{ij}^{*}\right)\right]{M}_i^e={\delta}_i{M}_{ij} \) in steady state equilibrium, we can express this condition as

Use (A5) and (A6) to get (3). As each country’s exports equal aggregate firm revenue from sales abroad, balanced trade in steady state equilibrium implies that\( \frac{\sigma {M}_1^e}{\delta_1}{\displaystyle {\int}_{z_{12}^{*}}^{\infty}\frac{r_{12}(z)}{\sigma}\kern0.5em }d{G}_1(z)=\frac{\sigma {M}_2^e}{\delta_2}{\displaystyle {\int}_{z_{21}^{*}}^{\infty}\frac{r_{21}(z)}{\sigma}\kern0.5em }d{G}_2(z) \). This condition and (A5) give (4).

1.1.2 Shifts in the CC and TB Curves

First consider the CC relation (10). For this relation, we have \( \frac{\partial RHS}{\partial {w}_1}={\tau}_{12}{\left[\frac{f_{12}}{f_{22}}\right]}^{1/\left(\sigma -1\right)}{\left({w}_1\right)}^{1/\rho}\left\{\frac{\partial {h}_{22}}{\partial {z}_{21}^{*}}\frac{\partial {h}_{21}}{\partial {w}_1}+{z}_{22}^{*}\left(1/\rho \right){\left({w}_1\right)}^{-1}\right\}>0 \), since \( \frac{\partial {h}_{22}}{\partial {z}_{21}^{*}}<0 \), and \( \frac{\partial {h}_{21}}{\partial {w}_1}<0 \). Also,\( \frac{\partial RHS}{\partial {b}_2}={\tau}_{12}{\left[\frac{f_{12}}{f_{22}}\right]}^{1/\left(\sigma -1\right)}{\left({w}_1\right)}^{1/\rho}\frac{\partial {h}_{22}}{\partial {b}_2}>0 \),\( as\ \frac{\partial {h}_{22}}{\partial {b}_2}>0 \),and\( \frac{\partial RHS}{\partial {\theta}_2}={\tau}_{12}{\left[\frac{f_{12}}{f_{22}}\right]}^{1/\left(\sigma -1\right)}{\left({w}_1\right)}^{1/\rho}\frac{\partial {h}_{22}}{\partial {\theta}_2}<0,as\ \frac{\partial {h}_{22}}{\partial {\theta}_2}<0 \).Footnote 16 If \( {z}_{12}^{*} \) is held constant, RHS of (10) does not change, and w 1must fall as b 2 increases or θ 2 decreases. Thus an improvement in country 2’s productivity shifts the CC curve down (or to the right as it slopes upwards).

The TB relation (11) can be written as \( \frac{w_1{L}_1}{L_2}=\frac{\varPhi_1}{\varPhi_2} \), where \( {\varPhi}_1=1+\frac{f_{11}}{f_{12}}{\left(\frac{z_{12}^{*}}{h_{11}\left({z}_{12}^{*},{b}_1,{\theta}_1\right)}\right)}^{\theta_1} \), and \( {\varPhi}_2=1+\frac{f_{22}}{f_{21}}{\left(\frac{h_{21}\left({w}_1,{h}_{11}\left({z}_{12}^{*},{b}_1,{\theta}_1\right)\right)}{h_{22}\left({h}_{21}\left({w}_1,{h}_{11}\left({z}_{12}^{*},{b}_1,{\theta}_1\right)\right);{b}_2,{\theta}_2\right)}\right)}^{\theta_2} \). Since \( \frac{\partial {h}_{11}}{\partial {z}_{12}^{*}}<0 \),\( \frac{\partial {h}_{22}}{\partial {z}_{21}^{*}}<0 \), and \( \frac{\partial {h}_{21}}{\partial {z}_{11}^{*}}>0 \), \( \frac{\partial {\varPhi}_1}{\partial {z}_{12}^{*}}=\frac{\theta_1{f}_{11}}{f_{12}}{\left(\frac{z_{12}^{*}}{z_{11}^{*}}\right)}^{\theta_1-1}\left(\frac{z_{11}^{*}-{z}_{12}^{*}\partial {h}_{11}/\partial {z}_{12}^{*}}{{\left({z}_{11}^{*}\right)}^2}\right)>0 \), and \( \frac{\partial {\varPhi}_2}{\partial {z}_{12}^{*}}=\frac{\theta_2{f}_{22}}{f_{21}}{\left(\frac{z_{21}^{*}}{z_{22}^{*}}\right)}^{\theta_2-1}\left({z}_{22}^{*}\frac{\partial {h}_{21}}{\partial {z}_{11}^{*}}\frac{\partial {h}_{11}}{\partial {z}_{12}^{*}}-{z}_{21}^{*}\frac{\partial {h}_{22}}{\partial {z}_{21}^{*}}\frac{\partial {h}_{21}}{\partial {z}_{11}^{*}}\frac{\partial {h}_{11}}{\partial {z}_{12}^{*}}\right){\left({z}_{22}^{*}\right)}^{-2}<0 \). We also have \( \frac{\partial {\varPhi}_1}{\partial {b}_2}=0 \), \( \frac{\partial {\varPhi}_2}{\partial {b}_2}=\frac{\theta_2{f}_{22}}{f_{21}}{\left(\frac{z_{21}^{*}}{z_{22}^{*}}\right)}^{\theta_2-1}\left(\frac{-{z}_{21}^{*}\partial {h}_{22}/\partial {b}_2}{{\left({z}_{22}^{*}\right)}^2}\right)<0 \), \( \frac{\partial {\varPhi}_1}{\partial {\theta}_2}=0 \) and \( \frac{\partial {\varPhi}_2}{\partial {\theta}_2}=\frac{f_{22}}{f_{21}}{\left(\frac{z_{21}^{*}}{z_{22}^{*}}\right)}^{\theta_2}\left\{\left(\frac{-{z}_{21}^{*}\partial {h}_{22}/\partial {\theta}_2}{{\left({z}_{22}^{*}\right)}^2}\right)\frac{\theta_2{z}_{22}^{*}}{z_{21}^{*}}+ \ln \left(\frac{z_{21}^{*}}{z_{22}^{*}}\right)\right\}>0 \), as \( \frac{\partial {h}_{22}}{\partial {b}_2}>0 \), \( \frac{\partial {h}_{22}}{\partial {\theta}_2}<0 \) and \( \ln \left(\frac{z_{21}^{*}}{z_{22}^{*}}\right)>0 \). It follows that for the TB relation, \( \frac{\partial RHS}{\partial {z}_{12}^{*}}>0 \), \( \frac{\partial RHS}{\partial {b}_2}>0 \) and \( \frac{\partial RHS}{\partial {\theta}_2}<0 \). If w 1 is held constant, the RHS of the TB relation remains unchanged, and an increase in b 2 or a decrease in θ 2 must be offset by a decrease in \( {z}_{12}^{*} \) . Thus the TB curve shifts leftwards in response to productivity improvement in country 2.

1.1.3 Proof of Proposition 1

To prove proposition 1, we show that in the new equilibrium with a higher b 2 or a lower θ 2, \( {z}_{12}^{*} \) must decrease because a different outcome would lead to contradiction. First, note that (5) and (6) imply that \( \frac{z_{21}^{*}}{z_{22}^{*}}={\tau}_{12}{\tau}_{21}{\left(\frac{f_{12}{f}_{21}}{f_{11}{f}_{22}}\right)}^{1/\left(\sigma -1\right)}\frac{z_{11}^{*}}{z_{12}^{*}} \) . Using this relation to substitute for \( \frac{z_{21}^{*}}{z_{22}^{*}} \) in the TB relation, we get

Now suppose that \( {z}_{12}^{*} \) increases or does not change in the new equilibrium. In this case, \( {z}_{11}^{*} \) decreases or is unchanged according to (7), and the ratio \( {z}_{12}^{*}/{z}_{11}^{*} \) increases or remains the same. It follows that the RHS of (A7) would increases or not change. This result clearly holds in the case of an increase in b 2. To see that it also holds in the case of a decrease in θ 2, note that the expression in the square bracket equals \( {\left(\frac{z_{21}^{*}}{z_{22}^{*}}\right)}^{\theta_2} \) and a lower θ 2 would further decrease this expression as \( \frac{z_{21}^{*}}{z_{22}^{*}}>1 \). The above result that the RHS of (7) increases or does not change, however, is not possible because the LHS of (A7) must decrease as w 1 falls in the new equilibrium. Thus an increase in b 2 or a decrease in θ 2 would cause a decrease in \( {z}_{12}^{*} \), and hence an improvement in country 1’s welfare.

1.2 Section 2.5

1.2.1 Derivation of (13) and (14)

Using (A1), we have \( {P_j}^{1-\sigma }={\displaystyle \sum_{i=1,2}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty}\frac{M_{ij}{p}_{ij}{(z)}^{1-\sigma }}{1-{G}_i\left({z}_{ij}^{*}\right)}d{G}_i(z)}}={\displaystyle \sum_{i=1,2}{M}_{ij}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty }{\left(\frac{w_i{\tau}_{ij}}{\rho z}\right)}^{1-\sigma}\frac{1}{1-{G}_i\left({z}_{ij}^{*}\right)}d{G}_i(z)}} \). Letting \( {\tilde{z}}_{ij} \equiv {\left({\displaystyle {\int}_{z_{ij}^{*}}^{\infty}\frac{z^{\sigma -1}}{1-{G}_i\left({z}_{ij}^{*}\right)}d{G}_i(z)}\right)}^{\frac{1}{\sigma -1}} \) we readily obtain (13). Next, totally differentiating (13) and simplifying, we get \( \frac{d{P}_j}{P_j}=\frac{1}{P_j}{\displaystyle \sum_{i=1,2}{M}_{ij}{\left(\frac{w_i{\tau}_{ij}}{\rho {\tilde{z}}_{ij}}\right)}^{1-\sigma}\left(\frac{d{w}_i}{w_i}-\frac{d{\tilde{z}}_{ij}}{{\tilde{z}}_{ij}}-\frac{1}{\sigma -1}\frac{d{M}_{ij}}{M_{ij}}\right)} \), which can be expressed as (14) with \( {s}_{ij}={M}_{ij}{\left(\frac{w_i{\tau}_{ij}}{\rho {\tilde{z}}_{ij}}\right)}^{1-\sigma}\div {\displaystyle \sum_{i=1,2}{M}_{ij}{\left(\frac{w_i{\tau}_{ij}}{\rho {\tilde{z}}_{ij}}\right)}^{1-\sigma }} \). Note that the share of country i’s sales in country j’s market equals \( {M}_{ij}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty}\frac{r_{ij}{(z)}^{1-\sigma }}{1-{G}_i\left({z}_{ij}^{*}\right)}d{G}_i(z)}\div {\displaystyle \sum_{i=1,2}{M}_{ij}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty}\frac{r_{ij}{(z)}^{1-\sigma }}{1-{G}_i\left({z}_{ij}^{*}\right)}d{G}_i(z)}} \), which simplifies to the above expression for s ij [using (A1)].

1.2.2 Variety and Price Effects in the Paper’s Model

Using (1) and the Pareto distribution assumption, we get

where \( {\xi}_i \equiv {\left(\frac{\theta_i}{\theta_i-\sigma +1}\right)}^{\frac{1}{\sigma -1}} \). In this case, for j = 1, w 2 = 1 and \( {\widehat{\xi}}_1=0 \), using (A8) to determine \( {\displaystyle \sum_{i=1,2}{s}_{ij}{\widehat{\tilde{z}}}_{ij}} \) and substituting this value in (14), we derive the variety channel effect as \( \frac{s_{11}}{\sigma -1}{\widehat{M}}_{11}+\frac{s_{21}}{\sigma -1}{\widehat{M}}_{21}={s}_{21}\left(\frac{1}{\sigma -1}{\widehat{w}}_1-{\widehat{\xi}}_2\right) \). Also, using (6), we have

Using (A9), we can express the price channel effect as \( {s}_{11}{\widehat{\tilde{z}}}_{11}+{s}_{21}\left({\widehat{w}}_1+{\widehat{\tilde{z}}}_{21}\right)={\widehat{z}}_{11}^{*}+\left[{s}_{21}\left({\widehat{\xi}}_2-\frac{1}{\sigma -1}{\widehat{w}}_1\right)\right] \). The price channel now contains an additional term in square brackets, which exactly offsets the variety effect.

1.2.3 Truncated Pareto Distribution

Let b Li and b Hi be the lower and higher bounds for the truncated Pareto distribution for country i. Then the country’s CDF is given by \( {G}_i(z)=\frac{1-{b_{Li}}^{\theta_i}{z}^{-{\theta}_i}}{1-{b_{Li}}^{\theta_i}{b_{Hi}}^{-{\theta}_i}} \). For this case, the relation between average productivity and the cut-off level can be derived as \( {\tilde{z}}_{ij}={\left\{\left(\frac{\theta_i}{\theta_i-\sigma +1}\right)\left[\frac{1}{{\left({z}_{ij}^{*}\right)}^{-{\theta}_i}-{\left({b}_{Hi}\right)}^{-{\theta}_i}}\right]\left[{\left({z}_{ij}^{*}\right)}^{-{\theta}_i+\sigma -1}-{\left({b}_{Hi}\right)}^{-{\theta}_i+\sigma -1}\right]\right\}}^{\frac{1}{\sigma -1}} \). Totally differentiating this relation and (1) and using the resulting expressions, we can express

where the coefficients α ij and β ij depend on the initial values of θ i and \( {z}_{ij}^{*} \). Using (A10) to evaluate \( {\displaystyle \sum_{i=1,2}{s}_{ij}{\widehat{\tilde{z}}}_{ij}} \) and substituting this value in (14), we can determine the net effect of the variety channel for the home country (j = 1,\( {\widehat{w}}_2=0 \), \( {\widehat{\theta}}_1=0 \)) as \( \frac{s_{11}}{\sigma -1}{\widehat{M}}_{11}+\frac{s_{21}}{\sigma -1}{\widehat{M}}_{21}=-\left(\overline{\beta}-1\right)\left({\widehat{w}}_1-{\widehat{P}}_1\right)-{s}_{21}\left(1-\frac{\sigma {\beta}_{21}}{\sigma -1}\right){\widehat{w}}_1-{s}_{21}{\alpha}_{21}{\widehat{\theta}}_2 \), where \( \overline{\beta}={s}_{11}{\beta}_{11}+{s}_{21}{\beta}_{21} \). Using (A10) again and noting that \( {\widehat{z}}_{21}^{*}=-\frac{\sigma }{\sigma -1}{\widehat{w}}_1+{\widehat{z}}_{11}^{*} \), we can derive the net effect of the price channel as \( {s}_{11}{\widehat{\tilde{z}}}_{11}+{s}_{21}\left({\widehat{w}}_1+{\widehat{\tilde{z}}}_{21}\right)={\widehat{z}}_{11}^{*}+\left[\left(\overline{\beta}-1\right)\left({\widehat{w}}_1-{\widehat{P}}_1\right)+{s}_{21}\left(1-\frac{\beta_{21}\sigma }{\sigma -1}\right){\widehat{w}}_1+{s}_{21}{\alpha}_{21}{\widehat{\theta}}_2\right] \). The term in the square brackets exactly offsets the net variety effect.

1.3 Section 3.1

1.3.1 Derivation of (19)

Country i’s share of exports in income equals \( e{s}_i=\left[\frac{\sigma {M}_i^e}{\delta_i}{\displaystyle {\int}_{z_{12}^{*}}^{\infty}\frac{r_{ij}(z)}{\sigma}\kern0.5em }d{G}_i(z)\right]\div \left[\frac{\sigma {M}_i^e}{\delta_i}{\displaystyle \sum_{j=1,2}{\displaystyle {\int}_{z_{ij}^{*}}^{\infty}\frac{r_{ij}(z)}{\sigma }}}\kern0.5em d{G}_i(z)\right] \), with i ≠ j in the first square bracket. Using this condition and (A5), and noting that \( {J}_i\left({z}_{ij}^{*}\right)+1-{G}_i\left({z}_{ij}^{*}\right)=\frac{\theta_i}{\theta_i-\sigma +1}{\left(\frac{b_i}{z_{ij}^{*}}\right)}^{\theta_i} \), we get (13).

1.3.2 Data

Steady-state values of the relative wage (w 1) and the labor supply ratio (L 1/L 2) are measured, respectively, as weighted averages of GDP per capita (in US dollars, averaged over 2001–2010) and population (also averaged over 2001–2010) of major US trading partners relative to US levels. The trading partners group includes 15 leading US trade partners accounting for 73.4 % of US imports and 71.5 % of US exports.Footnote 17 The weights used to compute averages for this group are based on the share of US trade (average of imports and exports) with each partner in the total trade with the group. The source of the data for GDP per capita and population is the World Development Indicators 2011 (from the World Bank) and for trade flows is the US Census Bureau.

Rights and permissions

About this article

Cite this article

Choudhri, E.U., Marasco, A. Is Foreign Technological Advance Harmful in the Melitz Model?. Open Econ Rev 28, 149–166 (2017). https://doi.org/10.1007/s11079-016-9417-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-016-9417-9