Abstract

Trade economists traditionally study the effect of lower variable trade costs. While increasingly important politically, technical barriers to trade (TBTs) have received less attention. Viewing TBTs as fixed regulatory costs related to the entry into export markets, we use a model with heterogeneous firms, trade in differentiated goods, and variable external economies of scale to sort out the rich interactions between TBT reform, input diversity, firm-level productivity, and aggregate productivity. We calibrate the model for 14 industries in order to clarify the theoretical ambiguities. Overall, our results tend to suggest beneficial effects of TBT reform but also reveal interesting sectoral variation.

Similar content being viewed by others

Notes

Note that this exercise does not describe mutual recognition, since then importers would not face any regulatory costs at all.

The generalization is already discussed in the working paper version of the Dixit and Stiglitz (1977) paper and has been revived by Benassy (1996). Variants of it have been adopted by Blanchard and Giavazzi (2003), Egger and Kreickemeier (2009), Corsetti et al. (2007), or Felbermayr and Prat (2007).

This is possible because, in equilibrium, each input is produced by one firm only and the distribution of φ is assumed to have no mass points.

This assumption is not necessary for many properties of the model; see Melitz (2003). However, it allows to understand the importance of industry dispersion to sort out the potentially ambiguous effects of various forms of trade liberalization on industry productivity.

The assumption γ h > σ h − 1 makes sure that the equilibrium sales distribution converges.

See Melitz (2003), p. 1700.

Derivations of analytical results are detailed in the working paper version of this article; see Felbermayr and Jung (2008).

See, e.g., Baldwin and Forslid (2006).

Noting that Eq. 13 relates \(p_{h}^{x}\) to exogenous variables.

Note that harmonization of standards need not be a TBT reform if regulatory costs increase for foreign firms.

Recall that changes in the regulatory component directly translate into changes in total market access costs, i.e. \(\hat{f}_{h}^{d}=\widehat{\tilde{f }}_{h}^{d}\).

This result holds for all productivity distributions.

A similar explanation has been put forward by Baldwin and Forslid (2006).

T h > ( < ) 1 is a necessary condition for input diversity to decrease (rise), whereas for average productivity to increase (drop) it is a sufficient condition. The necessary condition would be less strict and depend on the skewness of the productivity distribution.

Total sales abroad are given by \(X_{h}^{cif}=nM_{h}^{x}r^{x}\left( \tilde{ \varphi}_{h}^{x}\right)\). Recall that \(M_{h}^{x}=p_{h}^{x}M_{h}^{d}\). Using Eqs. 4, 17 and 18 one finds that \(X_{h}^{cif}=L_{h}np_{h}^{x}T_{h}/\left( 1+np_{h}^{x}T_{h}\right) ,\) and \(\partial X_{h}^{cif}/\partial T_{h}<0.\)

For detailed information on the calibration of the degree of external economies of scale, \( \eta _{h}/\left( \sigma _{h}-1\right) \), and the level of competitive disadvantage of importers, T h , see the Appendix.

In the present model, this is a natural assumption since countries are symmetric.

It may be feasible to reduce beyond harmonization and eliminate \( \tilde{f_{h}^{x}}\) such that T h goes below unity. However, since we have no data on the components of \(f_{h}^{d}\) and \(f_{h}^{x},\) we cannot calibrate the lowest feasible level of \(\bar{f}_{h}^{d}.\) Also note that our numerical analysis does not require calibration of \(f_{h}^{e}\) or δ h since those parameters drop out when comparing equilibrium outcomes at T h = 1 to those obtained under the benchmark calibration.

The welfare-theoretic results obtained by Benassy (1996) for arbitrary η h and homogeneous firms continue to hold in the presence of productivity heterogeneity.

Results may differ from a local analysis due to non-linearities.

From a social planner’s perspective, there is over-supply of varieties also under \(T_{h}^{\ast }\) as η h < 1. However, even if Δ%M h > 0, the over-supply of varieties relative to the planner’s solution is smaller for \(T_{h}^{\ast }\) than for T h .

References

Anderson J, van Wincoop E (2004) Trade costs. J Econ Lit 42(3):691–751

Ardelean A (2007) How strong is love of variety? Mimeo: Purdue University

Baldwin RE, Forslid R (2006) Trade liberalization with heterogeneous firms. NBER working paper 12192

Beghin J (2008) Non-tariff barriers. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of economics, 2nd edn. Palgrave Macmillan, New York

Benassy J-P (1996) Taste for variety and optimum production patterns in monopolistic competition. Econ Lett 52:41–47

Blanchard O, Giavazzi F (2003) Macroeconomic effects of regulation and deregulation in goods and labor markets. Q J Econ 118(3):879–907

Corcos G, Del Gatto M, Mion G, Ottaviano GIP (2007) Productivity and firm selection: intra- vs international trade. CORE discussion paper no. 2007/60

Corsetti G, Martin P, Pesenti P (2007) Productivity, terms of trade and the ’home market effect’. J Int Econ 73:99–127

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308

Eaton J, Kortum S, Kramarz F (2004) Dissecting trade: firms, industries, and export destinations. Am Econ Rev 94(2):150–154

Egger H, Kreickemeier U (2009) Firm heterogeneity and the labour market effects of trade liberalisation. Int Econ Rev 50(1):187–216

Felbermayr G, Jung B (2008) Sorting it out: technical barriers to trade and industry productivity. FIW working paper no. 14

Felbermayr G, Prat J (2007) Product market regulation, firm selection and unemployment. IZA discussion paper no. 2754

Gibson MJ (2006) Trade liberalization, reallocation, and productivity. Mimeo, University of Minnesota

Gwartney J, Lawson R, Sobel RS, Leeson PT (2007) Economic freedom of the world 2007 annual report. Fraser Institute, Vancouver

Hanson G, Xiang C (2004) The home-market effect and bilateral trade patterns. Am Econ Rev 94(4):1108–1129

Helpman E, Melitz MJ, Yeaple SR (2004) Export versus FDI with heterogeneous firms. Am Econ Rev 94(1):300–316

Ilzkovitz F, Dierx A, Kovacs V, Sousa N (2007) Steps towards a deeper economic integration: the internal market in the 21st century. European economy, Economic papers no. 271, European Commission

Kee HL, Nicita A, Olarreaga M (2006) Estimating trade restrictiveness indices. World Bank policy research working paper 3840

Krugman PR (1980) Scale economies, product differentiation, and the pattern of trade. Am Econ Rev 70(5):950–959

Maskus KE, Wilson JS, Otsuki T (2000) Quantifying the impact of technical barriers to trade. A framework for analysis. World Bank policy research working paper 2512

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Popper SW, Greenfield V, Crane K, Malik R (2004) Measuring economic effects of technical barriers to trade on U.S. exporters. National Institute of Standards and Technology

Rodríguez F, Rodrik D (2000) Trade policy and economic growth: a skeptic’s guide to the cross-national evidence. In: Bernanke BS, Rogoff K (eds) NBER macroeconomics annual 2000. MIT, New York

Acknowledgements

We are grateful to the editor and an anonymous referee, to Daniel Bernhofen, Peter Egger, David Greenaway, David Hummels, Wilhelm Kohler, Julien Prat, Davide Sala, Zhihong Yu, and seminar participants at the OeNB Workshop 2007 on International Trade and Domestic Growth in Vienna, the 1st FIW research workshop in Vienna, the 7th GEP Annual Postgraduate Conference, the Spring 2008 Midwest International Economics Meeting, and at seminars at the universities of Leicester, Nottingham, and Tübingen for comments and discussion. All remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

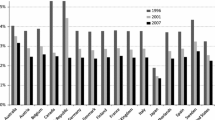

Variable trade costs, τ h , come from Hanson and Xiang (2004). The parameter η h is taken from Ardelean (2007). T h is calibrated to meet export participation rate \(p^x_h\) from Eaton et al. (2004), and n is calibrated to meet openness of 40%. Elasticities of substitution, σ h , are imputed from shape parameters estimated by Corcos et al. (2007), and sales dispersion measures from Helpman et al. (2004).

Table 2 shows how we map industry classifications. If two categories of the source classification fall into one class of our classification, we compute means across source classifications, in case of more than two, we use medians across source classifications. Table 3 reports the estimates we take from the literature and the calibrated parameters.

Rights and permissions

About this article

Cite this article

Felbermayr, G.J., Jung, B. Sorting It Out: Technical Barriers to Trade and Industry Productivity. Open Econ Rev 22, 93–117 (2011). https://doi.org/10.1007/s11079-009-9114-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-009-9114-z

Keywords

- Heterogeneous firms

- International trade

- Single European market

- Technical barriers to trade

- Regulatory costs