Abstract

The UN Framework Convention of Climate Change 15th Conference of the Parties Copenhagen Accord has been followed up by national pledges of greenhouse gas emissions reductions in the year 2020 without specifying measures to enforce actions. As a consequence, the capacity of parties to fulfil their obligations is of basic interest. This article outlines the effects of full compliance with pledges on greenhouse gas emissions, economic growth, and trade. The study is based on the global computable general equilibrium model global responses to anthropogenic changes in the environment (GRACE) distinguishing between fossil and non-fossil energy use. Global emissions from fossil fuels in 2020 turn out to be 15 % lower than in a business as usual scenario and 3 % below the global emissions from fossil fuels in 2005. China and India increase their emissions to 1 % and 5 % above business as usual levels in 2020. India and Russia increase their net export of steel corresponding to around 30 and 45 % of their production levels in 2020. In spite of some leakage of energy intensive production also to China, we find that structural change remains the dominant factor behind the rapid reduction of CO2 emission intensity in China towards 2020.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The fifteenth session of the Conference of the Parties (COP15) to the United Nations Framework Convention on Climate Change (UNFCCC), took note of the Copenhagen Accord of 18 December 2009 by way of decision 2/CP.15. The key sentence in this decision is:

«We agree that deep cuts in global emissions are required according to science, and as documented by the IPCC Fourth Assessment Report with a view to reduce global emissions so as to hold the increase in global temperature below 2°Celsius, and take action to meet this objective consistent with science and on the basis of equity.»(§2).

Following this decision, major players have pledged to reduce greenhouse gas emissions or carbon intensity by 2020.Footnote 1 Several developed countries have provided quantified economy-wide emissions targets for 2020, while many developing countries have offered nationally appropriate mitigation actions (NAMAs) for the same year (UNFCCC 2010) often in the form of intensity targets (carbon dioxide (CO2) or greenhouse gas emissions per unit of GDP).Footnote 2

Several reports have analyzed the expected climate impacts of these pledges (Perry 2010; Rogelj et al. 2010; Stern and Taylor 2010; UNEP 2010; den Elzen et al. 2010, 2011a, and UNEP 2010). Generally, they find the pledges to be inadequate with respect to the 2°Celsius target (although the 2°Celsius target is of a longer term nature than the pledges). Nordhaus (2010) have analyzed the longer term implication of the 2° scenario.

In this paper we will, by use of a global computable general equilibrium (CGE) model investigate the effect on global emissions and the economic costs to major players of fulfilling their pledges. McKibbin et al. (2010) has provided the most analogue analysis to ours, followed by more recent studies (Dellink et al. 2010; den Elzen et al. 2011b; Peterson et al. 2011). Jotzo (2010) compares the pledges according to different metrics like absolute emission reductions related to a common base year (2005), reductions in emission intensities, per capita emissions and reductions relative to business as usual emissions pathways.

A broad international agreement would facilitate a market for CO2 emission reductions and modify the costs of mitigation, thus reducing the gap in mitigation costs among countries. COP15 did not reach this kind of agreement and instead countries made their pledges separately and uncoordinated. Parallel and uncoordinated actions might lead to highly different mitigation costs among countries imposing different constraints on economic growth and incentives for international trade than a common price on CO2. Possibly, carbon leakage in terms of shifting polluting industries to countries without binding greenhouse gas emission targets might be more marked. Among countries without binding constraints are those pledging flexible greenhouse gas (GHG) emission targets, like a carbon intensity target, as do China, India and Brazil. China is a country with substantial coal reserves and the capacity to expand its energy intensive industries like steel and cement. India and Brazil are also candidates to taking a higher share of global production and trade in energy intensive goods. Due to such indirect or spillover effects, model based analyses are needed to trace the economic implications and identify the net effects on economic growth and GHG emissions associated with the Copenhagen Accord. The final outcome in terms of global emissions reductions is likely to differ from the sum of the single reduction pledges as implemented.

In this paper our main purpose is to assess the effects of the Copenhagen Accord pledges on global and regional CO2 emissions from fossil fuel use and further to assess the mitigation costs by countries and regions. As a complementary exercise we compare our results with results from other studies and look at changes in trade of energy intensive goods.

We compare the results of implementing the Copenhagen Accord pledges with a business as usual scenario roughly corresponding to the reference scenario as presented in World Energy Outlook 2009 (IEA 2009). For this purpose we use the GRACE model developed at Center for International Climate and Environmental Research–Oslo (CICERO) for integrated air quality and climate policy analysis (Aaheim and Rive 2005).

2 The GRACE model

The GRACE model is an 8 region, 15 sector computable general equilibrium model (CGE) of global economic development, energy use and GHG emissions. A CGE describes the supply and demand by producers and households in markets for goods and services, based on prices and cost. In each period (year) it is assumed that equilibrium is achieved in the sense that supply equals demand in all markets and that all available resources are utilized. Basic assumptions are also that producers maximize profit and consumers maximize utility from consumption of goods and services. The strength of such model approaches is giving us the opportunity to assess policy changes in a consistent way, taking limitations of resources (labour, produced capital, natural resources), future technological change and responses to price changes into account.

Within each region and time period the endowment of production factors, i.e. labour, capital and natural resources are exogenous. Labour is floating freely among production activities within a region, whereas capital and natural resources are activity-specific and cannot be reallocated among sectors. The model assumes full utilization of all available resources within each region.

For our study we have introduced a worldwide, disaggregated electricity sector with specific technologies for power generation based on coal, gas, oil, or a non-fossil option (hydro, nuclear, solar, bio and wind). Fixed input–output factors and sunk capital costs in each of the 4 electricity producing sectors modify the short term response to price variation on fossil fuel consumption.

An updated version of GRACE is described in a recent application by Rive (2010) and used in this paper. The GRACE model is calibrated around the global trade analysis project (GTAP) v7 database with 2004 as a base year (Badri and Walmsley 2008), named after the Global Trade Analysis Project of Purdue University, the basis for a network compiling statistics on trade, production and consumption (GTAP 2012). We limit our study to consider only CO2 emissions from fossil fuels combustion and use emission data from an auxiliary database provided by GTAP (Lee 2007). The 8 regions are USA, Canada, EU, Japan, China, India, Russia and the rest of the world (RoW). The 15 aggregated production sectors are listed in Table 3 in the Appendix.

Trade is modelled as bilateral with substitution among regional contributions. The substitution elasticities are based on those in the Massachusetts Institute of Technology (MIT) emissions prediction and poplicy analysis (EPPA) model (Paltsev et al. 2005).

Income to a region includes fixed income shares of the remuneration to the primary factors of production (labour, capital and natural resources) and direct and indirect taxes collected by the regional governments.

Saving is a fixed share of total income by region. A virtual global bank collects all savings and allocates investments to regions and sectors with the highest observed returns to capital. The reallocation is subject to elasticities of transformation. The returns to capital are equalized in the long run.

Economic growth is mainly driven by savings and investments, but is also determined by population growth, change in the availability of natural resources and technological change. The regional rates of technological change are assumed to be the same for both the baseline scenario and a policy scenario where the Copenhagen Accord is implemented. This is clearly a simplification, as climate policies normally would affect the rate of technological change, in particular the rate of energy efficiency improvement. However, the time horizon of this study is relatively short. A major share of the fossil fuels is used in electricity production and heavy industries where plants have long lifetimes and new capital formation takes years and even decades to materialize. On this background we consider the technology of 2020 only modestly affected by the Copenhagen Accord pledges of 2010. Political uncertainty surrounding the prospects of implementation might be another reason why technology might not differ substantially between a business-as-usual scenario and the Copenhagen Accord scenario. Hence newly developed technology in response to current policies might be expected to affect emissions predominantly at a later stage.

3 The business as usual (BAU) scenario

The baseline or business-as-usual (BAU) scenario depicts a plausible path of future economic development with average annual growth rates of Gross Domestic Product (GDP) during 2004–2020 as reported in Table 1. The BAU scenario assumes no new carbon abatement policy by any region and serves as a reference for the policy analysis associated with regional pledges in the Copenhagen Accord.

China and India are assumed to have average annual growth rates above 5 % over the period to 2020. The industrialized regions have on the other hand average annual growth rates between 1 and 2 %. Russia falls in the middle with an average annual growth rate of 3.5 %. Globally, the economic growth is 2.3 % per year on average in BAU.

The CO2 emissions from fossil fuel combustion by regions in our BAU scenario are reported in Fig. 1. All regions emit more in 2020 compared with 2005 in the baseline scenario, although Japan barely so.

Changes in CO2 emission intensities (emissions per unit GDP) in the various regions in our BAU scenario are reported in Fig. 2. We notice a general improvement in emission intensities of about 1 % per year in many regions. Russia and India are above that level, with India having an improvement of more than 2 % per year, but the real outlier is China, where the intensity improvement in the BAU scenario is close to 5 % per year for the period to 2020. We will come back to a discussion of this in Section 6.

4 The Copenhagen Accord scenario (SN1)

The Copenhagen Accord scenario, which we designate SN1, reflects a situation where no binding international agreement is reached, but where major economies and emitters follow their own independent climate policies to fulfil their pledges relating to the Copenhagen Accord as shown in Table 2. Some of the pledges cover other aspects than emission levels or emission intensities. For instance China has put forward a target related to the share of non-fossil energy in their primary energy mix, and also a reforestation target. Here, we only take into account the pledges made with regard to the overall emissions levels or emissions intensities as shown in the last column of Table 2.

The basis for these voluntary mitigation efforts is the shared understanding of the climate change issues and need for action. In this scenario, the European Union (EU), the United States of America (USA) and China behave as leaders and implement their commitments to the UNFCCC. We assume that India, Japan, Canada, and Russia follow up, accepting the leaders’ actions to be sufficient basis for their conditional commitments as stated in their pledges (UNFCCC 2010). The rest of the world (RoW) is assumed to keep the emissions at the same level as in the BAU scenario.

The regional pledges are implemented by introducing local competitive carbon markets within each region. These carbon markets are assumed to be economic efficient in the sense that mitigation takes place where it is most economical marginal costs until the marginal cost of CO2 emissions reductions are the same for all sectors within the region. However, the marginal costs of reducing the CO2 emissions (CO2 price in the regional carbon market) is expected to differ among regions as they have different ambitions and potential for mitigation.

4.1 EU

The overall target of EU is a 20 % reduction of CO2 emissions from 1990 level by 2020 and 30 % reduction conditional on behaviour of other parties. In the model we adopt 30 % reduction for sectors participating in the emission trading system (EU-ETS) and 10 % for other sectors. Sectors allowed to trade CO2 are iron and steel, cement, other manufacturing, electricity generation, crude oil, gas, coal mining, air, sea and other transportation. All carbon allowances in the power sector are assumed to be 100 % auctioned from 2010 whereas other sectors in EU-ETS will receive transitional allowances free of charge according to EU rules. Free allowances will be phased out and auctions implemented progressively from 12 % in 2010, 20 % in 2013 to 70 % in 2020. Sectors that do not participate in ETS, among them households, face the target of 10 % reduction from the 2005 level by 2020 and the target will be achieved by a carbon tax.

4.2 USA

The target of the USA is a 17 % reduction in CO2 emissions compared to the 2005 level. A cap and trade system (C&T) by assumption covers the same sectors as the EU-ETS and provides the potential advantage of an upper bound of 25 USD per ton CO2. If the carbon price in the C&T goes above 25 USD per ton CO2, the participants only pay 25 USD and the government will pay the difference. For other sectors, the 17 % target is achieved by a carbon tax.

4.3 China

China will reach the target of 40–45 % reduction of carbon intensity by 2020 compared with the 2005 level. The other targets for non-fossil share of primary energy use and forest are not considered here.

4.4 India

India will reduce the emission intensity of its GDP by 20–25 % by 2020 in comparison to the 2005 level. This is to be achieved by a tax on CO2 by industries and private households.

4.5 Canada, Japan and the Russian federation

In spite of Canada’s exit from the Kyoto Protocol we include the somewhat hypothetical assumption that Canada will reduce its carbon emissions by 17 % compared with the 2005 level. Japan will reduce by 25 % relative to the 1990 level; and Russia by 15 % of 1990 level, following their pledges. For the rest of the world, the emissions in the policy scenario do not exceed the level in the BAU scenario.

5 Results and analysis

First, comparing annual average GDP growth over the period 2005–2020 in our policy scenario (SN1) and the business-as-usual scenario (BAU), we find that the impacts of the Copenhagen Accord on average annual GDP growth rates are very small, less than one tenth of a percentage point. USA, EU, Canada, Japan, the Russian Federation, as well as the Rest of the World (RoW) all experience a slight decline in growth rates. Perhaps counter intuitively, the GDP growth of both China and India increase slightly as the policy measures are introduced. The reason for this is that the pledges of China and India are fulfilled already in the BAU scenario due to rapid economic growth and efficiency improvement. This holds even though we have a lower economic growth for China in BAU than the other studies we compare with. Hence, the intensity targets of China and India are not binding in our Copenhagen Accord scenario. Also, the slightly constrained economic growth of other regions is not large enough to reduce their GDP by harming their export. Rather, when other large regions introduce stricter emission policies, the economies of China and India tends to grow because of cheaper fossil fuels and carbon leakage of high emitting industries.

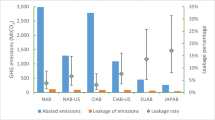

Figure 3 shows the emissions levels in 2020 in the two scenarios (BAU and SN1) together with 2005 emissions. Only China and India emit more in the Copenhagen Accord scenario than in the BAU scenario since they have higher economic growth and only flexible targets of carbon intensity. The global emissions from fossil fuel combustion in 2020 decrease with 4.6 GtCO2 or 15 % compared with the baseline scenario, from 30.2 to 25.6 GtCO2.

The pledges are related to the base years 1990 or 2005. Even with the same base year and pledges the economic growth potentials of regions might differ and determine how strict the carbon policies are felt regionally. When looking at the reduction of emissions in 2020 compared with the BAU in 2020, Japan is by far undertaking the largest reduction with 38 %. Then follows EU with 30 %, Canada and USA with 22–24 % and the Russian Federation with a little less than 10 %. Having flexible targets, the emissions levels of China and India are relatively unpredictable. India is increasing its emissions by 5 %, which is far from complying with India’s pledge to reduce emissions to at least 7 % below BAU level in 2020, as BAU is depicted in our study. China’s emissions are only slightly increased to approximately 1 % above the BAU level in 2020.

The development of the regional emission intensities in the BAU and the policy scenario are shown in Fig. 4. Reductions in emissions intensity comes from energy efficiency improvements, fuel switch and structural changes in the economy. Moving away from more energy intensive industries towards service industries is a rapidly on-going process in developing countries with a high share of manufacturing as in China. We note that emission intensity reductions from the BAU to the policy scenario are quite considerable in most regions, in Japan in particular, while we detect a slight increase in emission intensity in China and India, although their pledges on energy intensity are still fulfilled. These increases reflect that China and India take a higher share of emission intensive industries like steel and cement in a global context, and that this effect on energy intensity of the Copenhagen Accord dominates the effect of an increased share of service industries in their slightly increased GDPs.Footnote 3

What are the costs for each region of implementing the Copenhagen Accord? Since China and India already meet their pledges of reduced energy intensity in the BAU scenario, there are no costs for them–they actually benefit from the implementation of the Copenhagen Accord in terms of an increase in GDP. The other regions may suffer to different extent from their pledges. This can be illustrated by virtual carbon market prices or marginal costs of carbon reduction by region in 2020, see Fig. 5. Japan has the highest marginal costs of reducing carbon emissions (114 USD/tCO2) and Russia has the lowest (10 USD/tCO2). The differences in marginal costs are moderate for the other four regions: EU, USA, Canada, and the rest of the world, all within the range of 21–27 USD/tCO2−

Interestingly, the cost of CO2 reductions in the US stays below the (hypothetical) upper limit (USD 25) of the quota price in the US carbon trading market. Hence, subsidies to keep emissions low may seem unnecessary, which is convenient for a debt ridden US economy.

Japan’s pledge involves almost 40 % reduction compared with the 2005 emission level. Japan is the only country expected to have a negative annual growth in primary energy use. In the IEA reference scenario the decline is 0.2 % per year. A reduction in primary energy use will initially hold back the costs of reducing CO2 emissions, but as ambitions for emissions reductions rise it will become increasingly expensive. The emission intensity in Japan’s BAU scenario is falling approximately 1 % per year–about the same as in EU, US and Canada, while in the policy scenario, Japan’s emission intensity is reduced 4.5 % per year on average, about as fast as China’s (Fig. 4). RoW represents countries with a low energy intensity, hence emissions reductions also turn out to be relatively expensive (23 USD/tCO2).

Generally, purchaser prices on fossil fuels differ across regions due to market regulations and regional policies with regard to taxes and subsidies. Figure 6 shows the effects on regional fossil fuel prices in 2020 in going from the BAU to the policy scenario. Prices are reduced relative to the BAU paths in all regions for all of the fossil fuels, generally most for coal, followed by gas and oil. China differs from the other regions in experiencing a lower reduction in coal and gas price growth as compared with the price reduction of oil. Also, the price reductions are less in China, Russia and India than in other regions, as demand for these fuels are reduced modestly or even increased as a consequence of the pledges made in the Copenhagen Accord. These costs occur in spite of the option to switch from fossil to non-fossil fuel as feedstock in electricity production. However, due to linear technologies in electricity production and sunk capital costs, this substitution effect is a time consuming process and does not offer an easy escape from mitigation costs during the time horizon of this study.

The fall in fuel prices encourage energy intensive industries in countries without binding emissions constraints even further. An illustration of this carbon leakage is shown in Fig. 7a, depicting changes in net export in value terms of steel and cement in 2020 going from the BAU scenario to the policy scenario (SN1). Figure 7b shows change in net export as a percentage of the BAU domestic production in 2020. We see that net export of steel is reduced in most countries, but increases in China, Russia and India. RoW is losing export markets, being less able to compete with more rapidly growing economies with high investment levels and capacities to phase in more efficient technologies. This occurs in spite of RoW experiencing larger reductions in regional prices of coal and gas than China, India and Russia. For cement the picture is more mixed, as cement is not traded globally to the same degree as steel.

Russia undertakes the largest expansion of steel exports relative to their BAU production in 2020, with more than 40 % increase. India comes next with nearly 30 % increase for steel and 25 % for cement. Leakages to China are also positive, but of a smaller relative size.

6 Energy intensities: history and pledges

Results as presented above are influenced by the fact that the pledges made in the Copenhagen Accord are not binding for China and India. This is again a partial reflection of the assumptions made in formulating their BAU scenarios. For instance, the average annual reduction in CO2 emission intensity in our BAU scenario for China is close to 5 % per year (cf. Fig. 2) ensuring that the Copenhagen pledge of China is not a binding constraint. A reasonable question then is whether this rate of emission intensity reduction is realistic. We will approach this question by comparing the rate of intensity reduction in the BAU scenario for China with historical data and with similar data from some other recent studies.

Looking at history we get a mixed answer. Figure 8 shows emission intensity reductions in regions over various time periods. Most regions show reduction rates of 1–3 % per year China is one of the exceptions, with an average reduction rate of more than 5 % per year for the period 1980–2000. Thereafter, however, the reduction in China is reversed to a (small) increase for the period 2000–2007 and the whole period 1980–2007 saw a reduction in emission intensity of somewhat less than 4 % per year. Clearly continued improvement in emission intensity of the order of 4–5 % per year is not coming ‘automatically’. Hence, the experience over the last decade could lead us to question if China’s pledges are feasible based only on efficiency improvements as depicted in our BAU-scenario.

Historical and future (BAU) average annual changes in emission intensities. Source: http://cait.wri.org/ and own calculations

The 12th five-year plan adopted for the period 2011–2015 in China, stipulates as one target a 17 % reduction in emissions intensity. The BAU reduction in emissions intensity corresponds closely to this target.

Generally the main focus of both policy and analysis is on the impact of technical energy efficiency improvements. However, in a rapidly developing economy like China’s and India’s, structural changes might also contribute to reductions in overall emission intensities.

In Fig. 9 we illustrate to what extent reductions in carbon intensities rely on technology versus structural change related to impacts of income growth, consumer preferences and trade as emerging through general equilibrium effects. The direct contribution to a reduction in carbon intensity is associated with what happens if sector composition of GDP is fixed as in the base year and the economy and the scale of each activity is adjusted in line with GDP growth. In this frozen technology scenario the energy use is adjusted for annual energy efficiency improvements only. The other component is the effect via changes in sector composition and represents the energy intensity impact that results from higher income levels and changes in consumer demand, and effects via domestic and international price changes.

As shown in Fig. 9, there is a considerable structural component in China’s carbon intensity reduction. The contrast to India is marked. Whereas the direct energy efficiency components are fairly similar, the structural component of China reduces intensity by 38 percentage points, for India only 23 percentage points.

In the EU the reduction in CO2 intensity is predominantly from structural change, whereas USA, Canada and Japan hardly are supported by structural change when reducing their carbon intensity.

7 Comparison with other studies

When comparing our results with those from other studies, it is necessary to take into account the differences embedded in the BAU scenarios and the underlying models. Figure 10 compares the economic growth rates of our BAU scenario with some BAU scenarios from other reports. The comparison cannot be exact because of somewhat different definitions of regions and time period in the various reports. Nevertheless, Fig. 10 provides some insights and references for our BAU-assumptions. In the figure, GWA refers to this study, MMW refers to McKibbin et al. (2010), International Energy Outlook (IEO) refers to U.S. Energy Information Administration (2009) as reported by McKibbin et al. (op. cit.), den Elzen refers to den Elzen et al. (2010), Jotzo refers to Jotzo (2010) and China Council for International Cooperation on Environment and Development (CCICED) BAU refers to China Council for International Cooperation on Environment and Development (2009) providing a BAU economic growth rate only for China. Among the more rapidly growing large economies, the largest variation in relative terms among studies is found for Russia. Japan has the largest gap between growth forecasts. Interestingly, for China we find a larger discrepancy among assumed or calculated economic growth rates than for India. The overall impression from Fig. 10 is otherwise that our study assumes a lower economic growth than most other reports and studies except for Japan. This is likely to contribute to relatively lower economic costs of attaining the emission targets pledged in the Copenhagen Accord in our study.

Figure 11 compares our BAU-emissions growth rates with those of other BAU emission scenarios reported in the literature. Emission growth estimates vary considerably for China, India and Russia. Our growth rates for China is at the lower end, for India more in line with an average of the other studies, whereas we (GWA) find a much higher growth in Russian emissions than the other studies.

Combining GDP growth rates and emission growth rates, we can compare how emission intensities vary among the studies. This is depicted in Fig. 12.

We note that the relatively high emissions growth rates in McKibbin et al. (MMW) (Fig. 11) is due to both a high economic growth rate and a low reduction rate in emission intensities (Fig. 12). Among the studies covered here, emission intensities vary most for China, Russia and India.

McKibbin et al. (MMW) operate implicitly with an annual reduction in energy intensity of 1.3 % per year on average, whereas our study has 2.0 % per year.

The scope for energy efficiency in Russia has been huge, as overconsumption was built into the Soviet industrial infrastructure (IEA 2009). In 2007, after more than 5 % per year steady decline since year 2000, the energy intensity in Russia was still 3 times higher than the Organisation for Economic Co-operation and Development (OECD) Europe average although 2/3 of the gap had been closed between 1998 and 2007 (IEA 2009). On that background a future annual reduction of 1.3 % as in our study may seem somewhat low, U.S. Energy Information Administration (IEO) assume a rate of 3.5 % per year.

8 Conclusions

The Copenhagen Accord seems to be the bottom-up climate regime for the time being, with no measures for ensuring compliance beyond the good intentions of nations to mitigate climate change. However, several political factors support a core of realism of these intentions. In particular there is substantial concern in many countries about energy security issues and local air pollution, both providing good reasons for reducing greenhouse gas emission intensities in addition to the concerns about climate change. The question is how much it will cost.

Our study of the case when mitigation efforts are directed towards fossil fuel use shows that costs are moderate. Implementation of the Copenhagen Accord leads to less than 0.1 percentage point reduction in average annual economic growth during 2005–2020. All regions except China and India experience declines in growth rates.

We estimate low costs to most regions as measured by the decline in GDP in 2020. Japan seems the most vulnerable combining a high marginal cost of CO2 reduction with ambitious pledges. Thus the marginal cost of CO2-reductions in Japan reaches above 100 USD/tCO2 in 2020. The recent accident at the Fukushima nuclear power plant and associated setback of the nuclear power industry might, however, undermine this already challenging emission target. For USA, EU and Canada the marginal CO2 cost settles around 21–27 USD/tCO2.

Global emissions of CO2 from fossil fuel combustion will be 15 % or 4.6 Gt below BAU in 2020 as a result of the Copenhagen Accord and 3 % below the 2005 emission level. India and China raises emissions by 5 %, and 1 % respectively.

Emission intensities tend to be slightly higher in China and India under the Copenhagen Accord, but declines in all other regions, above all in Japan. For China, structural changes in the economy contribute twice as much to the 5 % annual reduction in emission intensity as do energy efficiency improvement and general technological change.

We estimate some carbon leakages, but not to a serious and game changing extent. India, China and Russia increase their net export of steel as share of production with more than 40 % by 2020, India with close to 30 %. Still, structural change in China and India remains the dominating source factor behind their reductions in emissions intensities.

Notes

The total number of Parties that have expressed their intention to be listed as agreeing to the Accord is 140. See http://unfccc.int/home/items/5262.php (accessed December 13. 2010)

For further details, see http://unfccc.int/home/items/5265.php

Note that India’s pledge to reduce emissions to 7 % below BAU in 2020 is not implemented in our policy scenario.

References

Aaheim HA, Rive N (2005) A model for global responses to anthropogenic changes in the environment (GRACE). CICERO Report 2005:05, Oslo, Norway

Badri NG, Walmsley TL (Eds) (2008) Global trade, assistance, and production: the GTAP 7 data base, center for global trade analysis, Purdue University, http://www.gtap.agecon.purdue.edu/databases/v7/v7_doco.asp

China Council for International Cooperation on Environment and Development (2009) China’s pathway towards a low carbon economy, CCICED Policy Research Report 2009

Dellink R, Briner G, Clapp C (2010) Costs, revenues, and effectiveness of the Copenhagen Accord emission pledges for 2020, OECD Environment Working Papers, No. 22, OECD Publishing. http://dx.doi.org/10.1787/5km975plmzg6-en

den Elzen M, Hof A, Beltran AM, Roelfsema M, van Ruijven B, van Vliet J, van Vuuren D, Höhne N, Moltmann S (2010) Evaluation of the Copenhagen Accord: chances and risks for the 2 °C climate goal. Policy study from Netherlands Environmental Assessment Agency (PBL). http://www.pbl.nl/en/publications/2010/Evaluation-of-the-Copenhagen-Accord-Chances-and-risks-for-the-2C-climate-goal.html

den Elzen M, Hof A, Roelfsema M (2011a) The emissions gap between the Copenhagen pledges and the 2 °C climate goal: options for closing and risks that could widen the gap. Glob Environ Chang 21(2):733–743. doi:10.1016/j.gloenvcha.2011.01.006

den Elzen M, Hof A, Mendoza Beltran A et al (2011b) The Copenhagen Accord: abatement costs and carbon prices resulting from the submissions. Environ Sci Pol 14(1):28–39. doi:10.1016/j.envsci.2010.10.010

GTAP (2012) https://www.gtap.agecon.purdue.edu/#2

IEA (2009) World energy outlook 2009. International Energy Agency, Paris

Jotzo F (2010) Comparing the Copenhagen emissions targets. CCEP working paper 1.10. Centre for Climate Economics & Policy. Crawford School of Economics and Government. The Australian National University, Canberra

Lee H-L (2007) An emissions data base for integrated assessment of climate change policy using GTAP: GTAP Resource #1143, Latest update (1108/1106/2007)

McKibbin W, Morris AJ, Wilcoxen PJ (2010) Comparing climate commitments: a model-based analysis of the Copenhagen Accord. Discussion Paper 2010–35, Cambridge, Mass.: Harvard Project on International Climate Agreements, June 2010

Nordhaus WD (2010) Economic aspects of global warming in a post- Copenhagen environment. Proc Natl Acad Sci 107(26):11721–11726. doi:10.1073/pnas.1005985107

Paltsev S, Reilly JM, Jacoby HD, et al. (2005) The MIT Emissions Prediction and POPlicy Analysis (EPPA) model: version 4. Report Number 125, MIT Global Change Joint Program (2005)

Perry M (2010) Copenhagen number crunch, Nature Reports Climate Change 4, 18–19, February 2010, http://www.nature.com/reports/climatechange

Peterson EB, Schleich J, Duscha V (2011) Environmental and economic effects of the Copenhagen pledges and more ambitious emission reduction targets. Energ Pol 39(6):3697–3708. doi:10.1016/j.enpol.2011.03.079

Rive N (2010) Climate policy in Western Europe and avoided costs of air pollution control. Econ Model 27(1):103–115

Rogelj J, Nabel J, Chen C, et al. (2010) Copenhagen Accord pledges are paltry, Nature 464, 1126–1128 (22 April 2010), doi:10.1038/4641126a; Published online 21 April 2010

Stern N, Taylor C (2010) What do the appendices to the Copenhagen Accord tell us about global greenhouse gas emissions and the prospects for avoiding a rise in global average temperature of more than 2 °C? Policy Paper, March 2010, Grantham Research Institute on Climate Change and the Environment, London. http://www2.lse.ac.uk/GranthamInstitute/publications/Policy/docs/PPCOPAccordSternTaylorMarch10.pdf

UNEP (2010) The emissions gap report. Are the Copenhagen Accord pledges sufficient to limit global warming to 2 °C or 1.5 °C? A Preliminary Assessment. http://www.unep.org/publications/ebooks/emissionsgapreport/pdfs/The_EMISSIONS_GAP_REPORT.pdf

UNFCCC (2010) Information provided by parties to the convention relating to the Copenhagen Accord. Retrieved 23 March, 2010, from http://unfccc.int/home/items/5262.php

U.S. Energy Information Administration (2009) International energy outlook 2009. http://www.eia.doe.gov/oiaf/ieo/index.html

Acknowledgements

We thank three anonymous referees for comments on previous versions of this paper. The research was conducted under the project “Domestic and petroleum sector implications of different international climate regimes”, funded by Statoil. This study was also part of activities of the centre for “Strategic Challenges in International Climate and Energy Policy” (CICEP) mainly financed by the Research Council of Norway.

Open Access

This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Glomsrød, S., Wei, T. & Alfsen, K.H. Pledges for climate mitigation: the effects of the Copenhagen accord on CO2 emissions and mitigation costs. Mitig Adapt Strateg Glob Change 18, 619–636 (2013). https://doi.org/10.1007/s11027-012-9378-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11027-012-9378-2