Abstract

Various decision contexts require the calculation of smaller recurring changes accumulated over time and their comparison to larger one-time changes (e.g., $100 periodic increase in monthly rent every year vs. a $1000 increase in rent at the end of 5 years). In both hypothetical and incentivized studies, we demonstrate an inaccuracy of estimations involving total cumulations of smaller recurring changes and single lump sums. We document this effect when individuals process increasing or decreasing changes in gains or losses (e.g., raises in wages or rent, discounts in membership fees). Importantly, these biases occur even when the changes are provided to the consumers as clear absolute dollar values as opposed to complex percentages. We discuss the theoretical contributions of our study as well as its implications for consumers, managers, and policy makers.

Similar content being viewed by others

1 Introduction

“Banking rent increases” is a popular practice in big US cities where landlords who do not make regular annual rent increases are permitted to “bank” these skipped raises and impose a large one-time increase (SFRB, 2018). Consider a college student who wants to lock in a 4-year non-renewable rental contract during college to avoid any fluctuations in rental payments. Landlord-A charges $10 K annual rent with recurring $1 K/year increases in rent over 4 years. Conversely, landlord-B charges $10 K annual rent for 3 years promising no increases until year-4 but a $5 K/year increase in the final year (i.e., banking rent increases). We predict that most people will be reluctant to take landlord-B’s generous offer as they misestimate the cumulation of smaller $1 K increases over time. In fact, over 4 years, landlord-A charges $1 K more (with annual rents of $10 K + $11 K + $12 K + $13 K = $46 K) compared to landlord-B ($10 K + $10 K + $10 K + $15 K = $45 K).

Importantly, the phenomenon we are interested in differs from compounding interests, which involve fixed percentage changes on an increasing base and thus translate into variable absolute dollar amounts over time. For example, people have difficulty calculating 10%APR on $1000 for 2 years because they think the effect of 10% stays the same. By ignoring changes in the base, people inaccurately calculate the accumulation as 20% (or $1200 final total) instead of 21% (growing from $1000 to $1100 and to $1210) (Lewin, 2019; Lusardi & Mitchell, 2014). Note that the underestimation that occurs for compounding interests easily resolves when percentages are replaced with absolute values (i.e., $100 return in first year and $110 return in the second year as opposed to recurring 10%). However, the misestimation of the accumulations we study is not limited to use of percentages but applies to absolute values as well, as illustrated in the above example.

In what follows, we briefly review related biases documented in the literature and present our hypothesis about how failing to factor in the time component and accumulation can mislead individuals’ estimations. We then test the misestimation of smaller recurring changes in three studies.

2 Misestimation of accumulation

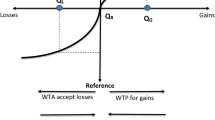

In many decisions individuals need to estimate the accumulation of small changes (increases/decreases) over time, such as those in contractual payments (e.g., income, rent), time management (e.g., workout-scheduling), or progression of COVID-19 cases. Product and service pricing often incorporates multiple percentage discounts (Chen & Rao, 2007) , while b-to-b contracts require estimations of long-term progressive changes in prices and delivery amounts that will occur over long periods of time. Similarly, investment decisions involve estimation of cumulative returns of financial instruments over time (Tsiros & Chen, 2017).

Past research has shown that consumers tend to misestimate the total of multiple percentage discounts (Chen & Rao, 2007; Davis & Bagchi, 2018; Gong et al., 2019). For example, 30% off $100 plus an extra 50% off (or a 50% off $100, plus an extra 30%) is wrongly calculated as a $80 total discount instead of the actual $65. Because time is not a factor in this calculation, the misestimation of multiple percentage discounts documented in previous research can get easily resolved when absolute dollar values are provided. For example, when expressed as “a $35 discount followed by another $30” or “a $30 discount followed by another $35,” consumers can clearly see that the total discount is $65 and the final price is $35 in both cases.

Recent research by Gunasti and Chen (2022) introduced a cumulative impact neglect bias in how individuals process sequential changes by demonstrating what happens when cumulative effects over time become a factor. For example, if you are paying a $100 monthly utility bill, “a $35 discount next month followed by another $30 the following month” leads to a series of $100, $65, and $35 bills totaling $200, whereas the more preferred progressive “$30 discount next month followed by another $35 the following month” leads to $100, $70, and $35 bills totaling $205. Thus, although the final bills are equal ($35), consumers end up paying $5 more over the 3 months with the latter option; and yet they prefer this option over the former. The authors explained this bias by documenting individuals’ focus on naïve trends of income and payments.

Combining the findings about consumers’ tendency to naïvely add consecutive percentage changes with the time component introduced by Gunasti and Chen (2022), we show that the effect of recurring smaller changes over time is misestimated partially due to the tendency to focus on naïve totals. Our findings contribute to the marketing literature by expanding the research stream on numerical biases in processing percentages that have focused exclusively on the final (vs. cumulative) outcome (Ertekin et al., 2019; Kruger & Vargas, 2008; Chen & Rao, 2007).

Below, we present three empirical studies. Study 1 examines the misestimation of the cumulation of rent increases and gauges the magnitude of the misestimation. Study 2 demonstrates the downstream implications of the misestimation on survey-takers’ actual choices of compensation. Study 3 focuses on the accumulation of decreasing payments and sheds some light on the underlying process for the misestimations of recurring changes.

3 Study 1—banking rents

Misestimation of smaller changes accumulating over time and of one-time lump sum options has important public-policy implications for millions of consumers renting in coastal states where rent-control laws limit rent increases (e.g., 3%/year). Landlords have the option to either raise the rent by the allowed amount each year or “bank” the raises over time and impose a lumpsum increase all at once (e.g., no increase for 5 years but 15% increase in year 5). The fact that consumer advocacy groups complain about the “unfairness” of this practice (Arroyo, 2019) hints at the presence of inaccurate estimations. In fact, banking works in the tenants’ interest compared to annual increases (even more so if we consider time value). For example, the tenants’ complaint that CA landlords who banked rent raises for 37 years are allowed to impose a lump sum increase of 95% (Arroyo, 2019) misses the fact that landlords could have collected cumulative totals of 200% + via regular annual increases. Conversely, from the landlords’ perspective, the ability to bank the increases is inaccurately perceived as more desirable than having regular increases, although it leaves a lot of money on the table. In this study, we examined the role of misestimations in this important context.

We recruited 116 mTurkers (45% female, MAge = 36.8) via Cloudresearch.com (Litman et al., 2017) and randomly assigned them to two conditions. All participants were presented with the following scenario: “You are a landlord renting your house for 5 years. After the contract is over you plan to sell your house. There are two lease contract options.” Next, they saw two contract options, one with an annual increase and another with a lumpsum increase in the final year (see Appendix). In the lumpsum condition, participants were asked to determine a lumpsum increase in the final year that was equally desirable as an annual increase of $1000 over 5 years. In the annual increase condition, they determined the annual increase for 5 years that would be equally desirable as a $10,000 lumpsum increase in the final year.

We expect people to neglect the cumulative effect of recurring annual increases and thus overestimate the annual increase and underestimate the lumpsum increase that would equalize the two options. Specifically, an annual increase of $1000 in rent has a cumulative impact of $10,000 over a span of 5 years (with four sequential increases from the first year; $1 + $2 + $3 + $4 = $10 K), but we expect inferred values to be smaller than $10,000 in the lumpsum condition and larger than $1000 in the annual increase condition.

3.1 Results

We first compared the matching values provided by participants with the objectively correct ones. As predicted, more participants entered higher values (than the correct $1000) in the annual increase condition than participants who entered higher values (than the correct $10,000) in the lumpsum condition (MAnnual = 71.9% vs. MLump sum = 25.4%, χ2 = 26.1, p < 0.001). Thus, annual increases were overestimated (71.9% > 50%, χ2 = 10.97, p < 0.001), whereas lumpsums were underestimated compared to chance (25.4% < 50%, χ2 = 14.25, p < 0.001, Fig. 1).

For a more direct comparison, we normalized the values inferred by dividing them by the correct amounts required to match (i.e., 1000 or 10,000). There was a significant difference between these relative measures in the two conditions (MAnnual = 6.6 vs. MLump sum = 0.62, F(1,114) = 39.3, p < 0.001, η2 = 0.26). To put these findings in perspective, in the lumpsum condition, the average value entered was 38% ($3767) lower than the correct $10,000 (MLump sum = $6233 (sd = 7638) < $10,000, t56 = 5.80, p < 0.001). Conversely, in the annual condition, the average value entered was 6.6 times (or $5568 more than) the correct $1000 (MAnnual = $6568 (sd = 7245) > $1000, t58 = − 3.79, p < 0.001). Both the under-estimation of the lumpsum and the over-estimation of the annual amount indicate a lack of accounting for cumulative effects. As a robustness check, we replicated the results after removing potential outliers in the data (see the Appendix).

3.2 Discussion

This study shows that misestimations lead to suboptimal choices with non-intuitive implications for the practice of “banking” rent increases. We observe that participants significantly underestimate the cumulative impact of annual increases, while overestimating the annual “share” of a lumpsum increase.

4 Study 2—actual payments to survey takers

The main purpose of this study was to demonstrate a downstream consequence of the misestimations in an incentive-compatible setting. Furthermore, we used a cumulative context that did not involve a time component where the cumulation naturally occurred in a single period.

A total of 441 mTurkers (51% female, MAge = 41.2) were informed that they “needed to complete all four short surveys” to get paid and they chose between two compensation options. Option-A paid 10¢ for survey-1 and kept increasing the pay by another 10¢ for each consecutive survey. Option-B also started with 10¢ for survey-1 and paid the same amount for all consecutive surveys without any incremental increases but provided an additional 50¢ bonus after the final survey (see the Appendix).

Note that option-A eventually paid 100¢ (10¢–20¢–30¢–40¢) while option-B paid 90¢ (10¢–10¢–10¢–60¢). As mTurkers are sensitive to small amounts of monetary compensation and they are experts in managing seconds for cents (Mason & Suri, 2012), this 10% difference may be non-trivial for them. Yet, we expected that participants would ignore the cumulation of small changes and overestimate the larger increase, thus wrongly preferring option-B. After making their choices, participants were provided with the identical stimuli with one exception. We replaced the 50¢ bonus in option-B with “X” and asked them to indicate the “minimum X cents” bonus amount that would make them prefer option B over option A. Those who preferred option-A earlier were given a sliding scale ranging 0–100¢, while those who picked option-B earlier were given a sliding scale 0–50¢ as they have already indicated that they preferred the 50¢ bonus before. Finally, participants completed three unrelated surveys.

4.1 Results

Overall, only 54% of the participants chose the higher paying option-A and choice accuracy was not significantly different from chance (χ2 = 2.11, p < 0.15). The distribution of the estimations for the X bonus amount required for choosing option-B over option-A is provided in Fig. 2. On average participants demanded 53¢, which was significantly lower than the minimum 60¢ required to equalize the two options (t = − 5.47, p < 0.001). Overall, the majority of the participants (62.4%) demanded 60¢ or less, further illustrating the over-estimation of the impacts of lumpsum bonuses and the underestimation of the accumulation of incremental changes.

We believe that having provided the 50¢ bonus option earlier in the choice question might have anchored the participants in a way that helped partially resolve the bias and thus it provided a conservative test of our effect. Specifically, if participants had not been shown the 50¢ bonus earlier, their estimations might have been much lower than 50¢, further reinforcing our results. And yet, even after that exposure, almost 2/3 of the participants required significantly less than the breakeven bonus amount.

4.2 Discussion

Misestimations of the accumulating pays vs. lumpsum bonuses effectively led to a 10% compensation loss for half the participants (but we paid everyone $1 due to ethical considerations). Overall, even when real money was at stake, people could not overcome the problem of misestimating the cumulative effect of recurring changes.

5 Study 3—misestimating discounts

The studies we conducted so far mainly focused on recurring “increases” in both loss (rent increases) and gain (pay increases) contexts. Thus, one purpose of this last study was to replicate the misestimation effect in a recurring “decrease” context (discounts on membership fees). Based on past research, we have speculated that misestimations of recurring changes might be occurring due to people engaging in the calculation of naïve totals ignoring cumulation. Accordingly, in this study we assessed the effects of estimation accuracy on preferences, shedding further light on the underlying process.

Two hundred and two mTurkers (48% female, MAge = 40.9) were randomly assigned to two conditions in a single factor (lumpsum vs. recurring) between-subjects design. We had an attention check at the beginning of the study. While 5 participants failed this check, they were only given a warning to read more carefully and allowed to continue and complete the survey.

All participants were given the following common scenario: “Imagine that your child is on a swimming team and needs to train for 4 months (May, June, July, August) over the summer. There is an Aquatic Center near you. Its regular fee is $100/month, but when you sign up for 4-months it offers a promotional plan as follows:” In the lumpsum condition, the promotion plan read, “You will pay the regular $100 fee in May, June and July, but you will have a $50 discount in August.” In the recurring condition, the promotion plan read, “You will pay the regular $100 fee in May, but every month you will pay $10 less than the previous month until the end of August (e.g., you will pay $90 in June, etc.).” In all conditions participants were asked “How much will this promotion save you compared to paying the full fees every month?” (choice options ranged $10–100 on a 10-point scale). Note that the recurring option saves $60, which is 20% more in savings compared to the lumpsum option that saves only $50.

After making their estimations, participants were reminded of the offer by the Aquatic Center and introduced to the option in the other condition as a competitor. For example, the recurring condition read, “Remember that Aquatic Center X offered the following promotion: You will pay the regular $100 fee in May, but every month you will pay $10 less than the previous month until the end of August (e.g., you will pay $90 in June, etc.). Now imagine that there is also a competitor Aquatic Center Y near you, and it offers the following promotion: You will pay the regular $100 fee in May, June, and July, but you will have a $50 discount in August.” Then, they were asked to indicate their preferences between the two options on a 10-point scale. We coded this variable such that lower (higher) number means a preference for the lumpsum (recurring) option. This two-step procedure allowed us to both measure misestimations and collect preferences.

6 Results

6.1 Accuracy of estimations

When we compare the estimated savings in each condition with the actual savings, we observed that in the lumpsum condition, participants estimated an average savings of $50.8, which was not significantly different from the actual $50 savings (t = 1.469, p = 0.15). On the other hand, in the recurring condition, they estimated $51.9 which was significantly lower than the actual $60 savings (t = − 4.52, p < 0.001).

Almost all the participants (94.1%) in the lumpsum condition correctly estimated their savings compared to only 62.0% in the recurring condition (χ2 = 33.3, p < 0.001). We further examined the distribution of the estimations to see why 38% of the participants in the recurring condition got it wrong. We observed that the misestimations partially stemmed from taking the naïve total of recurring discounts. Specifically, 20% of the participants who got it wrong (more than half of the 38%) estimated the savings to be only $30 (i.e., 10 + 10 + 10), the naïve total ignoring the cumulation—compared to only 1% who got it wrong in the lump sum condition (χ2 = 23.5, p < 0.001, see Fig. 3).

6.2 Preferences

To examine how the estimations affected the preferences, we ran a regression where the accuracy of estimations served as the main predictor, the condition was included as a control, and the preferences served as the dependent variable. While there was a significant effect of condition (b = 2.61, se = 0.54, t = 4.85, p < 0.001), more critical for our purpose there was a significant and positive effect of estimation accuracy on preference (b = 4.07, se = 0.65, t = 6.25, p < 0.001).

To shed light on this result, we regressed preference on the naïve misestimations of the recurring changes (coded as a dummy variable) and included condition (lump sum vs. recurring) as a control. While the condition was again significant (b = 2.29, se = 0.52, t = 4.37, p < 0.001), naïve misestimations significantly decreased the preference for the economically superior option (i.e., the recurring discounts) (b = − 5.18, se = 0.86, t = − 6.03, p < 0.001). Overall, these results indicated that misestimations due to the neglect of the cumulation were at least partially responsible for participants’ suboptimal choices.

7 General discussion

Our research contributes to past work on biases related to the processing of percentages where it has been shown that multiple discounts are “overestimated” by consumers (Chen & Rao, 2007; Davis & Bagchi, 2018; Gong et al., 2019). A recent study by Gunasti and Chen (2022) demonstrated the choice implications of the trend formed by earlier vs. later changes in a sequence. We extend these findings by documenting the underestimation of the totals reached by recurring changes that cumulate over time. While our studies used absolute values to demonstrate the robustness of the effect, given the difficulty of understanding cumulation even with clear dollar values, we would only expect the effect to get stronger if percentage changes were to be presented instead.

In addition, past research on compounding interest has examined consumers’ lack of understanding of exponential growth caused by fixed percentage increases over time (Lewin, 2019). Related biases including compounding bias have been shown to get resolved when absolute dollar values are used. However, our research demonstrates that the direct use of absolute values can still lead to misestimations of incremental changes accumulating over time. Furthermore, in a separate study not reported here, we demonstrate that the misestimations are not limited to monetary contexts; they apply to progressive changes that might define diverse phenomena such as the spread of COVID-19 cases over time. Importantly, unlike the case of compound interests which requires complex calculations and often financial calculators as well as understanding various terms such as net present value or time value, the simple misestimations we demonstrated can take place even over a few time periods and make a difference even without factoring in the additional effects of the time value of money.

Third, past research on inter-temporal choices has often praised patience for delayed larger payments as the more virtuous choice than going for smaller earlier payments which are often perceived as impulsive, near sighted, or myopic (Frederick & Loewenstein, 2008; Loewenstein, 1987; Loewenstein & Prelec, 1993). In our context, however, we show that when recurring changes are involved, patience for a larger later increase in payments may backfire as people tend to overestimate the one-time lumpsum increase while underestimating the multiplicative power of recurring smaller increases. Thus, our findings also contribute to this literature by illustrating dynamic situations in which patience may strengthen the bias of misestimating future changes. Finally, we contribute to the overall numerical cognition literature by identifying a hitherto undocumented bias with numerical information (Davis & Bagchi, 2018; Gunasti & Ozcan, 2016, 2019; Gunasti & Ross, 2010).

7.1 Substantial implications

Our findings have vital implications for both tenants and landlords, as well as for any buyers and sellers that engage in long-term contractual relationships involving fixed price increases or decreases over time vs. large one-time changes. Thus, service providers and their customers, as well as employers and employees who negotiate salary increases over time, could all benefit from the insights provided. From a policy perspective, our findings also imply that communications from governing authorities about pandemic projections can easily lead to misestimations by the public. For example, when we are exposed to news about the increases in COVID-19 cases, it is very easy to underestimate a seemingly small increase of 100 additional daily cases than the day before (i.e., 100, 200, 300, etc.), which can quickly reach 7000 total cases by the end of the month.

Our results suggest the vulnerability of the public to the underestimations of smaller changes spread over time and overestimations of larger lumpsum presented to consumers. Accordingly, policymakers, employee unions, health professionals, and consumer advocacy groups can leverage our findings to identify appropriate warnings and training to at-risk populations.Footnote 1

Data availability

De-identified data and survey materials for all studies are available at: https://osf.io/2bgvx/?view_only=7f741e37bfeb441199dd50ea01b5b4b2.

Notes

Note that the results of the studies replicated when numeracy skills of participants (Weller et al., 2013) were collected and controlled for, further indicating the overall vulnerability of the public to this bias.

References

Arroyo, N. (2019) Cities grapple with banked rent hikes, San Francisco Public Press (Sep 16). [https://sfpublicpress.org/news/2019-09/cities-grapple-with-banked-rent-hikes] Accessed March 2022

Chen, H., & Rao, A. (2007). When two plus two is not equal to four: Errors in processing multiple percentage changes. Journal of Consumer Research, 34(October), 327–340.

Chen, H., Marmorstein, H., Tsiros, M., & Rao, A. (2012). When more is less: Base value neglect and consumer preferences for changes in price and quantity”. Journal of Marketing, 76(4), 64–77.

Davis, D., & Bagchi, R. (2018). How evaluations of multiple percentage price changes are influenced by presentation mode and percentage ordering: The role of anchoring and surprise. Journal of Marketing Research, 55(5), 655–666.

Ertekin, N., Shulman, J., & Chen, H. (2019). On the profitability of stacked discounts: Identifying revenue and cost effects of discount framing. Marketing Science, 38(2), 317–342.

Frederick, S., & Loewenstein, G. (2008). Conflicting motives in evaluations of sequences. Journal of Risk and Uncertainty, 37(2/3), 221–35.

Gong, H., Huang, J., & Goh, K. (2019). The illusion of double-discount: Using reference points in promotion framing. Journal of Consumer Psychology, 29(3), 483–491.

Gunasti K., & Ross, W. (2010). How and when alphanumeric brand names affect consumer preferences. Journal of Marketing Research, 47(December), 1177–1192.

Gunasti, K., & Chen, A. H. (2022). Cumulative impact neglect in processing sequential changes. Journal of Consumer Psychology. https://doi.org/10.1002/jcpy.1294

Gunasti, K., & Ozcan, T. (2016). Consumer reactions to round numbers in brand names. Marketing Letters, 27(2), 309–322.

Gunasti, K., & Ozcan, T. (2019). The role of scale-induced round numbers and goal specificity on goal accomplishment perceptions. Marketing Letters, 30(2), 207–217.

Kruger, J., & Vargas, P. (2008). Consumer confusion of percent differences. Journal of Consumer Psychology, 18(1), 46–61.

Lewin, C. (2019). The emergence of compound interest. British Actuarial Journal, 24, E34.

Litman, L., Robinson, J., & Abberbock, T. (2017). TurkPrime.com A versatile crowdsourcing data acquisition platform for the behavioral sciences. Behavior Research Methods, 49(2), 433–442. https://doi.org/10.3758/s13428-016-0727-z

Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. Economics Journal, 97, 666–684.

Loewenstein, G., & Prelec, D. (1993). Preferences for sequences of outcomes. Psychological Review, 100, 91–108.

Lusardi, A., & Mitchell, O. (2014). The economic importance of financial literacy Theory and evidence. Journal of Economics Literature, 52(1), 5–44.

Mason, W., & Suri, S. (2012). Conducting behavioral research on Amazon’s mechanical turk. Behavioral Research Methods, 44(1), 1–23.

SFRB – San Francisco Rent Board (2018) Topic No: 053 Banked rent increases [https://sfrb.org/topic-no-053-banked-rent-increases] Accessed March 2022

Tsiros, M., & Chen, H. (2017). Convexity neglect in consumer decision making. Journal of Marketing Behavior, 2(4), 253–290.

Weller, J. A., Dieckmann, N., Tusler, M., Mertz, C., Burns, W., & Peters, E. (2013). Development and testing of an abbreviated numeracy scale: A Rasch analysis approach. Journal of Behavioral Decision Making, 26(2), 198–212.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics approval

All studies have been conducted via mturk.com and cloudresearch.com following ethical standards.

Consent for publication

There is no external funding to report besides authors’ regular research budgets. None of the studies presented in this paper have been published or currently under review at another journal.

Conflict of interest

There are no conflicts of interest.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

1.1 Study 1—banking rent increase matching task

You are a landlord renting your house for 5 years. After the contract is over you plan to sell your house. There are two lease contract options:

Lump sum increase condition |

i) $20,000 annual rent in the first year There will be a regular $1,000 increase in annual rent every year (i.e., in years 2–3-4–5) ii) $20,000 annual rent in the first year with no increases in annual rent in years 2–3-4 There will be an increase of $X in annual rent in year 5 |

Annual increase condition |

i) $20,000 annual rent in the first year There will be a regular $X increase in annual rent every year (i.e., in years 2–3-4–5) ii) $20,000 annual rent in the first year with no increases in annual rent in years 2–3-4 There will be an increase of $10,000 in annual rent in year 5 |

Assuming that the tenant is very reliable and will abide with either contract, what would be the amount of $X that will make the contracts equally desirable for you: ___ |

Results in study 1 when outliers are excluded

As the standard deviation was very high and there were many outliers, we repeated the analysis removing all the entries one standard deviation above the mean in the annual condition. We observed that about 2/3 of the participants (64%) inferred higher values compared to only 25% in lumpsum condition (X2 = 16.2, p < 0.001). Moreover, relative values also remained significantly different between the two conditions (MAnnual = 3.21 vs. MLump sum = 0.62, F(1,102) = 33.5, p < 0.001, η2 = 0.153), with overestimation in the annual condition (MAnnual = $3208 (sd = 3322) > $1000, t44 = 4.46, p < 0.001) and underestimation in the lumpsum condition (MLump sum = $6233 (sd = 7638) < $10,000, t56 = 5.80, p < 0.001). Removing entries 2 or 3 standard deviations from the mean yields the same conclusions.

Study 2—mTurker payment stimulus

We will ask you to complete 4 short surveys consisting of several questions each. You will only get paid if you complete all mini surveys. The whole study should take about 6–7 min. There will be filtering questions so please read carefully.

We have two compensation options. Option A offers a 10-cent increase in pay for each consecutive survey as shown below, whereas option B offers no incremental increases but a large bonus pay at the end:

-

A—incremental increase option

-

Survey 1: Pays 10 cents

-

Survey 2: Pays 10 cents more than survey 1.

-

Survey 3: Pays 10 cents more than survey 2.

-

Survey 4: Pays 10 cents more than survey 3.

-

B—bonus increase option

-

Survey 1: Pays 10 cents

-

Survey 2: Pays same as survey 1

-

Survey 3: Pays same as survey 2

-

Survey 4: Pays same as survey 3 plus there is a 50 cents* final bonus

* Note that for the estimation task the 50 cents final bonus in option B was replaced with “X cents” and participants indicated the minimum amount of X that would make them prefer option B over option A.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Gunasti, K., Chen, H.(. Consumer misestimations of small recurring changes vs. a single large lump sum. Mark Lett 34, 605–617 (2023). https://doi.org/10.1007/s11002-023-09669-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11002-023-09669-4