Abstract

In high-tech industries, firms accumulate increasing amounts of excess resources. Existent research paints an ambiguous picture of these slack resources for innovation: while some slack is integral for innovation as fuel for experimentation, too much slack inhibits innovation by causing inefficiencies. However, firms in high-tech industries cannot develop and sustain competitive advantages in the long run without sufficient and steady investments in innovation. Additionally, the increasing complexities within these highly dynamic industries make it easier for managers to pursue their self-interests—often to the organization’s detriment. Against this backdrop, the role of the board of directors is particularly crucial in high-tech industries, as it determines the efficacy of the board’s governance and resource provisioning functions. This study proposes several board characteristics as moderators of the slack–innovation relationship. The dataset builds on a longitudinal sample of high-tech firms from the Nasdaq-100 Index between 2010 and 2020. The results advance management literature by extending the notion of slack resources as a double-edged sword to high-tech industries. The findings also show that this relationship is contingent on specific board characteristics: larger and more independent boards dampen this relationship, while longer board tenure, more board affiliations, and a larger share of women directors amplify it. Further, the findings caution managers to balance the necessity of slack resources for promoting innovation with its efficiency detriment. The results additionally inform practitioners on determining the optimal board composition in the face of mounting competitive pressures for sustained innovation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

High-tech firms possess an increasing amount of excess liquidity—in some cases, such as Apple and Google, even more than the US Department of the Treasury (Chireka & Fakoya, 2017). These slack resources reduce goal conflicts, relax control mechanisms, and protect organizations from economic downturns (Cyert & March, 2013; Nohria & Gulati, 1997). Previous research has demonstrated that even risk-averse managers allocate organizational slack toward inherently risky innovation endeavors (Shaikh et al., 2018).

Without sufficient and steady investments in research and development (R&D), competitive advantages in high-tech industries will decay in as little as one or two years (Kor, 2006). Firms operating in today’s hypercompetitive economy consequently face high pressure for continuous innovation to ensure their long-term survival (Bouncken, Kraus et al., 2021). Therefore, sustaining a high level of R&D investments is required to develop new products or services, generate intangible capital (e.g., dynamic innovation capabilities), and assure differentiation in the innovation-driven marketplace (Kor, 2006).

At the same time, the growing complexities of high-tech industries make it easier for managers to pursue their self-interest—often to the organization’s detriment. From the agency theory perspective, boards of directors are the central control mechanisms of firms. Directors are ultimately responsible for safeguarding the organization from opportunistic managerial behavior by ensuring the alignment between the potentially conflicting interests of managers (i.e., agents) and shareholders (i.e., principals) (Ashwin et al., 2016; Fama & Jensen, 1983). Beyond its passive monitoring role, the board actively contributes to strategic decision-making (Ashwin et al., 2016; Pfeffer & Salancik, 1978). Following a resource-dependence view, directors provide valuable resources to organizations that may drive innovation. Previous research (e.g., T. Miller & Triana, 2009; Zahra & Garvis, 2000) has shown that heterogeneous boards provide a wider variety of human and social capital to the firm than homogenous boards, allowing directors to facilitate innovation by improving knowledge exchange, idea generation, and decision-making.

The role of the board is particularly pronounced in high-tech industries. Due to the increased complexities of high-tech industries, directors need to assess a vast amount and variety of largely ambiguous information to fulfill their fiduciary roles as monitors (Jensen & Meckling, 1976; Lawson, 2001). Additionally, their role as resource provisioners is crucial in facilitating decision-making and advising managers in these dynamic environments. Based on this argumentation, we propose that the unique composition of the board influences the translation of slack resources into innovation in high-tech industries. More formally:

How does board composition influence the relationship between organizational slack and innovation in high-tech industries?

Findings from a longitudinal sample of firms listed in the Nasdaq-100 Index (NDX) between 2010 and 2020 reveal that organizational slack does not have a linearly positive effect on innovation in high-tech industries as found by previous research (e.g., Lee, 2015; Shaikh et al., 2018). Instead, this study demonstrates that organizational slack benefits innovation up to a tipping point, after which its effect turns negative. The results consequently transfer the notion of organizational slack as a double-edged sword found by previous research (e.g., Chiu & Liaw, 2009; George, 2005; Nohria & Gulati, 1997) to today’s context of high-tech industries. The study additionally provides novel evidence on the mechanisms through which internal corporate governance mechanisms enacted by the board of directors affect the slack–innovation relationship. More specifically, both structural (i.e., board size and board independence) and demographic (i.e., board tenure, board affiliations, and board gender diversity) board characteristics are critical determinants of the ability of directors to monitor managerial decision-making and provide executives with resources, thereby serving as significant influences on the slack–innovation relationship.

The remainder of the paper is structured as follows. In Sect. 2, we outline the theoretical background of our study and deduce six research hypotheses. Subsequently, we describe the data collection, sample, and variable measurements in Sect. 3. We present descriptive statistics, bivariate results, and regression results in Sect. 4. In Sect. 5, we discuss our findings’ theoretical and practical implications. We conclude the article by assessing the limitations of our study and by giving recommendations for further research.

2 Organizational slack and innovation

Innovation generally refers to implementing a newly developed or significantly improved product, service, or process. It may also entail new or improved methods of commercializing products, services, or processes (Damanpour, 1991; Gupta et al., 2007). Highly innovative firms pursue a significant number of new ideas, are more open to novelty and experimentation, and promote more creative processes within and across organizational boundaries than their less innovative counterparts (Bouncken, Ratzmann et al., 2021; Wales et al., 2020). Further, innovative activities call for an open-minded corporate culture in which actors from different functional or hierarchical backgrounds openly exchange their knowledge, expertise, and resources (Anzola-Román et al., 2018). While scholars have traditionally viewed innovation as central to organizational survival and growth, continued efforts toward innovation have become even more integral for sustaining and developing competitive advantages in today’s hypercompetitive marketplace (Hacklin et al., 2018; Kraus et al., 2021).

Organizational slack is “the pool of resources in an organization that is in excess of the minimum necessary to produce a given level of organizational output” (Nohria & Gulati, 1997, p. 604). Firms can draw on these excess resources to invest in uncertain projects—such as innovation—without threatening their survival (H. Kim et al., 2008). We conceptualize organizational slack using the widely employed division into available, recoverable, and potential slack (Tan & Peng, 2003). First, available slack is the most discretionary form of slack, as it represents resources not yet absorbed into the organizational design, such as excess liquidity. In comparison, recoverable slack is less discretionary and reflects the resources already integrated into the organization as excess costs, such as overhead costs. These resources can be recovered during economic downturns and subsequently put to new use. Last, potential slack comprises external resources accessible to organizations, such as outside capital (Bourgeois & Singh, 1983). While many previous studies use a single-proxy indicator for slack (e.g., Nohria & Gulati, 1996, 1997), our study takes a more holistic perspective on slack by using a composite measure that comprehensively captures the complexity of these resources.

2.1 Inverted U-shaped slack–innovation relationship in high-tech industries

The continuous emergence of new digital technologies in high-tech industries provides an ever-expanding plethora of commercial opportunities (Chiesa & Frattini, 2011; Hacklin et al., 2018). Proponents of slack argue that excess resources facilitate innovation by sparking experimentation and creativity. Firms in high-tech industries are pressured by competitive forces to nurture innovation by sustaining an appropriate level of R&D investment (Shaikh et al., 2018). As slack represents surplus resources not required for daily operations, it is a resource cushion that allows firms to absorb potential losses or maintain the level of investment—even or especially in the face of adversity (Bourgeois, 1981; Bromiley, 1991). Corporate practice shows that high-tech firms purposefully integrate slack resources into their organizational design. For example, Google’s 20-percent-time-rule allows employees to spend an entire day of their working week pursuing projects they deem valuable to the company (Page & Brin, 2004). Hence, slack resources are integral for innovation, as they spur an innovative culture by shielding the organization from the uncertainty associated with the general environment and specific creative projects (Bourgeois, 1981; Nohria & Gulati, 1996). Further, disruptions in R&D investments can halt the highly fragile knowledge flows crucial to innovation processes (Dierickx & Cool, 1989). In this vein, Swift (2016) has shown that reducing R&D spending to ensure short-term performance threatens organizational survival in the long run. Finally, slack promotes innovation by increasing the freedom of managerial decision-making. These excess resources relax control systems, placing more resources at the management’s discretion (Cyert & March, 2013; Nohria & Gulati, 1996).

Nevertheless, control systems may become too lax with increasing slack levels (Jensen, 1986; Leibenstein, 1969). High levels of slack will cause managers to fund projects with elevated risks and uncertain payoffs while making the subsequent termination of unprofitable projects even more challenging to justify. Excess resources may provide managers with elevated opportunities to pursue pet projects or make non-value-maximizing investment choices—all to the organization’s detriment (Nohria & Gulati, 1997; Staw et al., 1981). Therefore, more relaxed negotiations and lower pressures for (immediate) success may threaten competitive advantages. Loosened control systems may also alleviate managers’ perseverance in pursuing challenging yet value-promising innovation projects (Nohria & Gulati, 1996). These adverse effects on innovation are enhanced by the declining marginal returns from innovation at very high levels of R&D investment, making subsequent investments increasingly harder to justify (Shaikh et al., 2018). Organizational economists have consequently viewed organizational slack as a “reflection of managerial self-interest, incompetence, and sloth rather than as a buffer necessary for organizational adaptation” (Nohria & Gulati, 1996, p. 1248).

Based on this argumentation, and strengthened by empirical evidence (e.g., Chiu & Liaw, 2009; George, 2005; Nohria & Gulati, 1996), we regard slack resources as a double-edged sword: some slack is necessary to fuel experimentation integral for innovation; too much slack, however, will open the door to opportunistic behavior detrimental to innovation by overly relaxing control mechanisms. This argumentation leads to the following first hypothesis:

Hypothesis 1

In high-tech industries, organizational slack has an inverted U-shaped effect on innovation.

2.2 Moderating effects of board characteristics

Following agency theory, boards of directors are one of the primary firm-internal mechanisms to align potentially conflicting interests by supervising executives (Blair & Stout, 2001; Dalton et al., 2007). As the “apex of decision control systems of organizations” (Fama & Jensen, 1983, p. 311), the board of directors is responsible for safeguarding the interests of shareholders from opportunistic managerial behavior (Daily et al., 2003; Jensen & Meckling, 1976; Miroshnychenko & De Massis, 2020).

Beyond their supervisory role, boards are legitimized to make critical staffing and compensation decisions and are needed to ratify significant strategic decisions (Fama & Jensen, 1983; Rubino et al., 2017). Innovation investments are particularly vulnerable to agency problems due to their high risks and long-term payoff (Kor, 2006). Therefore, the efficacy of the board’s actions—such as their control or monitoring function and the design of incentive mechanisms—may drive or inhibit innovation (Zahra, 1996).

While corporate governance research has significantly progressed by taking an agency view (Dalton et al., 2003; Miroshnychenko & De Massis, 2020), it requires adaptation to the more complex nature of the modern-day marketplace. Hence, we propose a multi-theoretical approach by defining corporate governance as “the determination of the broad uses to which organizational resources will be deployed and the resolution of conflicts among the myriad participants in organizations” (Daily et al., 2003, p. 371). This definition complements agency theory with the resource dependence view by highlighting directors’ active roles in shaping strategic decision-making and allocating appropriate resources (Pfeffer & Salancik, 1978). Due to their boundary-spanning role, directors can actively promote strategic initiatives—such as innovation—and reduce risks by supplying internal or external resources (Dalton et al., 2003; Kor, 2006; Sierra-Morán et al., 2021).

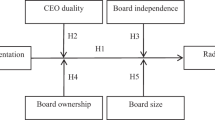

Empirical studies have shown that board characteristics consequently influence the deployment of slack resources (Ashwin et al., 2016; Lu & Wong, 2012). Building on this research stream, we identified five key board characteristics that potentially influence the slack–innovation relationship in high-tech industries. These fall into two categories: structural characteristics refer to group attributes of the board (i.e., board size and board independence), while demographic characteristics mirror the attributes of individual directors (i.e., board tenure, board affiliations, and board gender diversity) (Sierra-Morán et al., 2021). The research model is summarized in Fig. 1.

2.2.1 Structural board characteristics: Board size

Innovation in high-tech industries requires the constant investment of resources into R&D (O’Brien & Folta, 2009; Shaikh et al., 2018). Following resource dependency theory, we argue that larger boards cause a more consistent level of innovation than smaller boards, as larger boards promote the firm’s ability to obtain (critical) resources from the environment (Chowdhury & Wang, 2020; Goodstein et al., 1994; Pfeffer & Salancik, 1978). Innovation investments in firms with larger boards consequently do not depend on slack resources as much as in firms with smaller boards. Additionally, larger boards are more proficient monitors of management. Through informing directorial judgments with more heterogeneous perspectives, an increase in directors promotes the board’s ability to monitor and control executives (Larmou & Vafeas, 2010; Pucheta-Martínez & Gallego-Álvarez, 2020; Rubino et al., 2017). Smaller boards lack the variety of communication channels between the firm and external actors (e.g., research institutes or competitors) available to larger boards (Elsayed, 2011; Hillman et al., 2009; Pfeffer & Salancik, 1978). Increasing board size consequently expands the pool of knowledge and capabilities available within the firm (Chowdhury & Wang, 2020; Goodstein et al., 1994; Nguyen et al., 2016). In high-tech industries, we expect larger boards to be more skilled to offset the detrimental impact of slack on innovation. An increase in directors may promote the board’s ability to monitor and control top-level executives by informing its judgments with more diverse and potentially converging perspectives (Pucheta-Martínez & Gallego-Álvarez, 2020).

Some scholars paint a more critical picture of larger boards by arguing that more directors may increase agency and coordination problems (Dalton et al., 1999; Yermack, 1996). However, empirical studies have failed to corroborate this resentment against large boards due to the varying research settings in which the relationships were tested (Cheng, 2008; Dalton et al., 1999). Therefore, we adopt a contingency perspective on the slack–innovation relationship. Due to the demanding nature of high-tech industries, larger boards improve decision-making quality by providing diverse perspectives and indispensable capacities to process a growing amount and variety of information. Based on this argumentation, the increased knowledge pool of larger boards is beneficial for resource provisioning and monitoring in high-tech industries, thereby flattening the inverted U-shaped effect of slack on innovation. More formally:

Hypothesis 2

In high-tech industries, board size moderates the inverted U-shaped relationship between organizational slack and innovation in such a way that this relationship will be less pronounced in firms with larger boards than in firms with smaller boards.

2.2.2 Structural board characteristics: Board independence

In line with agency theory, it is a best practice to equip boards primarily with outside directors to promote board independence (Kang et al., 2007; Nainggolan et al., 2022). Outside directors are either independent directors or non-executive directors. While the former have no significant relationship with the firm besides serving on its board, the latter possess no management responsibilities but are linked to the firm by being, for example, suppliers or customers (Dalton et al., 2007).

Past research shows that outside directors are more likely to be proficient monitors of managers since their interests are more aligned with those of shareholders rather than managers (Hillman & Dalziel, 2003; Mahadeo et al., 2012; Rubino et al., 2017). Additionally, resource dependence theory proposes that firms appoint outside directors not only for their superior monitoring abilities but also for their valuable resources and access to resources embedded within their social network (Hillman et al., 2000; Lepore et al., 2022).

We hypothesize that a higher ratio of outside board directors dampens the inverted U-shaped slack–innovation relationship in high-tech industries. The positive effect of slack on innovation might be less pronounced at low levels of slack due to four mechanisms. First, outside directors have less access to firm-specific information than inside directors, which is why their influence on the allocation of slack is limited (H. Kim et al., 2008). Relatedly, a higher share of outside directors—who are less informed about the firm than their counterparts—may cause inertia by hampering decision-making speed and quality (Mahadeo et al., 2012). Third, outside directors may impede the investment of slack resources in innovation due to their focus on supervision, cost-cutting, and effectiveness rather than risk-taking (Dalziel et al., 2011; Kor, 2006). Last, a high ratio of outside directors may offset the necessity to invest slack resources in innovation, as outside directors provide access to financial and other resources from firms’ environments (Pfeffer & Salancik, 1978). At high levels of slack, outside directors’ superior monitoring and control abilities become particularly critical in counteracting the harmful effects of slack on innovation. Consequently, board independence will lead to a more objective evaluation of innovation alternatives (Chou & Johennesse, 2021), while these boards are better skilled in identifying and discouraging any self-interested behavior of management (Nicholson & Kiel, 2007). Based on this argumentation, we formulate the third hypothesis as follows:

Hypothesis 3

In high-tech industries, board independence moderates the inverted U-shaped relationship between organizational slack and innovation in such a way that this relationship will be less pronounced in firms with boards composed of a higher ratio of outside directors than in firms with boards composed of a lower ratio of outside directors.

2.2.3 Demographic board characteristics: Board tenure

We propose that an increasing tenure of directors threatens the board’s ability and motivation to supervise executives (Hillman et al., 2011). Longer-tenured directors will become more reluctant to implement discontinuous strategies due to being increasingly biased and constrained in their actions by established routines (Bravo & Reguera-Alvarado, 2017; Golden & Zajac, 2001). Over time, directors gradually form more social relationships within the firm—for example, by befriending managers (Vafeas, 2003). These long-term relationships between directors and managers will cause directors to prioritize the interests of managers, thereby putting the shareholders—whom they are supposed to serve—at a disadvantage (Byrd et al., 2010; Niu & Berberich, 2015). Research has shown that long-tenured directors reinforce group conformity by being more unwilling to appoint new directors to the board than their shorter-tenured counterparts (Kor, 2006; Libit & Freier, 2015).

Longer-tenured directors ultimately cause boards to be more inert toward change (Golden & Zajac, 2001) or make decisions that question their firm-internal power and skills (Staw et al., 1981). Therefore, long-tenured boards provide more opportunities for managers to pursue their self-interests and are more reluctant to reverse unproductive investments in innovation. Altogether, managers are likely to have more discretion over slack resources in firms with longer-tenured directors. As deduced in Hypothesis 1, lower pressure for success due to lax supervision and an increasing reinforcement of established practices on long-tenured boards (Hambrick, 1995) increases the managerial leverage over the allocation of resources. Consequently, board tenure amplifies the inverted U-shaped relationship between organizational slack and innovation. More formally:

Hypothesis 4

In high-tech industries, board tenure moderates the inverted U-shaped relationship between organizational slack and innovation in such a way that this relationship will be more pronounced in firms with a higher average board tenure than in firms with a lower average board tenure.

2.2.4 Demographic board characteristics: Board affiliations

As the first component of board capital (Hillman & Dalziel, 2003), we conceptualize the number of directors’ other corporate affiliations as external social capital, which can be accessed to leverage their own or the firm’s resources (Adler & Kwon, 2002; Kim, 2005). Past research highlights three main benefits of social capital in innovation. First, social ties provide access to valuable tangible and intangible resources from the environment—such as capital and various types of information, respectively (Barroso-Castro et al., 2016). Second, board members can reduce environmental uncertainties through their boundary-spanning role, as communication channels to external actors promote the exchange of information, knowledge, and resources (Barroso-Castro et al., 2016; Kiel & Nicholson, 2006). Third, the presence of highly connected directors signals organizational legitimacy (Pfeffer & Salancik, 1978; Zahra & Pearce, 1989) and fosters inter-organizational support (Hillman et al., 2000; Kiel & Nicholson, 2006).

Conversely, board affiliations may also be detrimental to the efficacy of corporate governance at high levels of slack, as multiple board memberships significantly increase the workload for these directors (Kiel & Nicholson, 2006). By serving on too many boards simultaneously, directors may become ‘overboarded’—in other words, too busy to properly monitor the management (Harris & Shimizu, 2004; Johnson et al., 2013). Due to the demanding nature of high-tech industries, we posit that overboarded directors cannot live up to the “bourgeoning responsibility of the modern director” (Kiel & Nicholson, 2006, p. 531). Serving on many boards hampers efficient board functioning, as directors cannot gain the necessary in-depth understanding of the firm’s unique strategy and governance problems (C. B. Carter & Lorsch, 2003). Additionally, multiple board memberships might cause reluctance among directors to monitor executives due to norms of reciprocity within elite networks and the associated fear of social sanctions (Koenig et al., 1979; Westphal & Khanna, 2003). If directors have or are currently serving as executives in other organizations, they might generally be more empathetic to managers and reluctant to criticize their actions (Hillman et al., 2008). Lastly, directors are often explicitly selected because of their preexisting social ties (Adams & Ferreira, 2007; Zajac & Westphal, 1996).

In light of this argumentation, we propose that an increasing number of board affiliations may promote innovation in high-tech industries due to the enhanced access to complementary resources, information, and capabilities of external actors at low levels of slack. At the same time, more affiliations are likely to compromise boards’ monitoring function by rendering directors passive. We predict that the decreased monitoring of these boards will likely amplify the adverse effects of slack on innovation. More formally:

Hypothesis 5

In high-tech industries, board affiliations moderate the inverted U-shaped relationship between organizational slack and innovation in such a way that this relationship will be more pronounced in firms with a higher average number of other corporate affiliations among its directors than in firms with a lower average number of other corporate affiliations among its directors.

2.2.5 Demographic board characteristics: Board gender diversity

Nasdaq is the first US-based stock exchange that has taken explicit measures to encourage more diversity in the boardroom (Nasdaq, 2021b). Practitioners have received this market-induced push for diversity with great enthusiasm, as firms with gender-diverse boards are generally perceived to be more progressive and better adapted to emerging challenges (Kelly, 2021; Saggese et al., 2021).

Academia generally supports the idea that gender-diverse boards drive innovation and provide competitive advantage (Erhardt et al., 2003; Galia & Zenou, 2012; Kaczmarek & Nyuur, 2022; Rubino et al., 2017). In this vein, studies show that gender differences may translate into differences in human capital and social capital among directors (Miller & Triana, 2009; Terjesen et al., 2009, 2016). Expanding the talent pool by including female directors will benefit the firm by providing the board with fresh perspectives, enhanced creativity, and new forms of social capital. At the same time, board gender diversity might also threaten board effectiveness, as gender diversity may impair efficient decision-making and cooperative board functioning by causing non-functional conflicts, discouraging the build-up of interpersonal trust, promoting closed-mindedness through isolation, and decreasing information exchange (Adams & Ferreira, 2004; Miller et al., 1998). Especially if firms appoint women to boards as mere tokens, female influence in the boardroom is minimal at best (Abdullah, 2014; Adams & Ferreira, 2004; Bruna et al., 2019; Mahadeo et al., 2012). Therefore, both lines of research concur that female representation in the boardroom influences the type of information underlying decision-making and how the board reaches its decisions (Post & Byron, 2015; Terjesen et al., 2016).

In the specific context of the slack–innovation relationship in high-tech industries, we hypothesize that the benefits of gender-diverse boards may outweigh their potential detriments for innovation. On the whole, women seem superior in their directorial abilities to men, as women are better monitors of management and provide more potentially valuable resources to the firm (R. B. Adams & Ferreira, 2009; D. A. Carter et al., 2010; Hillman et al., 2007). Regarding their monitoring ability, women tend to be more well-reasoned in their decision-making than men: they assess a broader range of information, promote idea exchange by inducing participative behavior (R. B. Adams and Ferreira, 2004; Gul et al., 2011; Hoogendoorn et al., 2013), and are less overconfident in their decisions (Huang & Kisgen, 2013; Nadeem et al., 2019). Women directors may also affect the behavior of the entire board through positive spillover effects (R. B. Adams & Ferreira, 2009). We conclude that a higher share of female directors promotes boards’ monitoring function by fostering an in-depth understanding of nonroutine issues, enabling a more holistic assessment of investment decisions (Nadeem et al., 2019), and imposing a greater demand on managers to be accountable for their actions (Gul et al., 2011).

Regarding their resource provisioning role, more gender-diverse boards can provide managers with more heterogeneous resources through the different perspectives women bring to the boardroom (Hillman et al., 2007; Miller & Triana, 2009). Inherent to female directors are also beneficial differences in the social capital and resources embedded in these networks (Miller & Triana, 2009; Saggese et al., 2021). Perrault (2015) has demonstrated that women directors can also reduce managerial self-opportunism by breaking up all-male networks. Altogether, gender diversity seems beneficial for board effectiveness in high-tech industries, where board tasks are primarily complex, unstructured, and nonroutine (Gul et al., 2011; Kravitz, 2003).

We hypothesize that increasing board gender diversity dampens the inverted U-shaped relationship between slack and innovation in high-tech industries. Women directors are more risk-averse than their male counterparts; they avoid excessive risk-taking and manage existing risks. In this vein, a higher share of women directors seems to strengthen the board’s analysis of investment opportunities and may reduce information asymmetries between directors, managers, and shareholders (Nadeem et al., 2019; Nielsen & Huse, 2010). Women directors may be more considerate of how slack resources are invested in innovation. At the same time, an increasing share of female directors is likely to improve board effectiveness through its positive effects on both the board’s supervisory and resource provisioning functions. Increasing female representation in the boardroom seems particularly crucial in high-tech industries. Due to significantly higher competitive forces that necessitate constant innovation, the pressure for firms to appoint women directors may be higher due to the augmented imperative to access new forms of board capital and signal increased legitimacy to the stakeholders (T. Miller & Triana, 2009). In light of these arguments, we formulate the following hypothesis:

Hypothesis 6

In high-tech industries, board gender diversity moderates the inverted U-shaped relationship between organizational slack and innovation in such a way that this relationship will be less pronounced in firms with a larger share of female directors on the board than in firms with a smaller share of female directors on the board.

3 Methodology

3.1 Data collection and sample

Our sample contains all companies listed in the NDX between 2010 and 2020. We selected this growth index due to its inclusion of today’s forefront 100 non-financial companies that drive innovation worldwide—including, for example, Apple, Alphabet, and Tesla (Nasdaq, 2021a). The year 2010 was chosen as the starting date for data collection to obtain a sufficiently large sample size for statistical analysis and to circumvent possible direct influences of the Global Financial Crisis of 2007 and 2008. We gathered company data using Thomson Reuters’ Refinitiv Eikon database. We included all companies listed in the NDX during the study period to avoid survivorship bias, yielding an initial sample of 193 companies. In the last step and as summarized in Table 1, we removed duplicate companies (e.g., due to the renaming of shares) and firms with missing data from the initial sample. Our final sample is an unbalanced panel of 93 unique companies with 682 observations from 2010 to 2020.

3.2 Measurement of variables

3.2.1 Dependent variable

We measure innovation using the widely employed proxy of R&D intensity (Adams et al., 2006; Wrede & Dauth, 2020). Operationalized as R&D expenditures divided by total sales, R&D intensity captures the strategic importance firms attribute to innovation (Hill & Snell, 1988; Kor, 2006). It hence reflects the resource allocation decisions of the board (T. Miller & Triana, 2009). The input measure of R&D intensity captures the board’s intent to pursue innovation better than output measures (e.g., patents) for two main reasons (Wrede & Dauth, 2020). First, a wide range of actors and actions influence output measures of innovation (Ahuja et al., 2008). Second, directors’ decision-making influences the deployment of resources toward innovation (Barker & Mueller, 2002; Helfat & Martin, 2015). Due to our longitudinal data analysis, we can consider the time-delayed nature of investment decisions. This approach consequently bypasses potential problems associated with reserve causality (Wrede & Dauth, 2020).

3.2.2 Independent variable

In line with previous studies (e.g., Duan et al., 2020; Marlin & Geiger, 2015), we calculated the average amount of organizational slack for each firm by proxying its three underlying dimensions (Bourgeois & Singh, 1983). First, we measured available slack using three indicators: (1) current ratio (total current assets divided by total current liabilities), (2) quick ratio (total cash and short-term investments plus accounts receivable divided by total current liabilities), and (3) working capital (total current assets minus total current liabilities divided by total sales). Second, we operationalized recoverable slack as selling, general, and administrative expenses divided by sales (Marlin & Geiger, 2015). Third, our measurement of potential slack consists of three measures: (1) total debt to total equity, (2) total debt to total sales, and (3) total debt to total assets (Bourgeois & Singh, 1983; Marlin & Geiger, 2015). The composite variable organizational slack thus represents the average level of slack across all three dimensions.

3.2.3 Moderating variables

We analyzed a total of five moderating variables to capture the composition of the board (see Fig. 1). First, we included board size, which we measured as the total number of board members at the end of the fiscal year. Second, the ratio of outside directors was measured as the share of non-executive and independent directors on firms’ boards. Third, we considered board tenure, defined as the average number of years directors had been members of the respective board. Fourth, board affiliations are the average number of other corporate affiliations each director has. Fifth, board gender diversity is the percentage of female directors on the firm’s board.

3.2.4 Control variables

We controlled for several variables that potentially influence innovation. On the firm level, we first included firm size, calculated as the natural logarithm of the average number of employees during the respective financial year (Leiponen & Helfat, 2010). We included firm size due to its possible effects on innovation. Larger firms typically have a bigger pool of resources that directors can deploy toward innovation and a broader customer base facilitating innovation commercialization (Leiponen & Helfat, 2010; Traore, 2004), while smaller firms can benefit from swifter decision-making due to less bureaucracy and inertia (Chandy & Tellis, 2000; Dean et al., 1998). Second, we controlled for firm age (focal year minus founding year). Previous studies have shown that firm age negatively impacts innovation by causing the formalization and standardization of structures and processes, as well as a greater tendency to adhere to obsolete value offerings (Audia & Greve, 2006). Following previous research (Daines, 2001; Singhal et al., 2016), we operationalized firm performance using Tobin’s q ratio, which is defined as market value divided by asset replacement costs. This performance measure was included in our model as it potentially affects innovativeness by determining the availability of slack resources in current and future periods (Bourgeois, 1981). Fourth, we controlled for a firm’s financial leverage (ratio of total debt to total assets of the firm) as a possible influence on R&D investments (Singh & Faircloth, 2005). We included stock return volatility as a fifth control variable in our model because prior research shows that stock return volatility, a proxy for uncertainty (Pástor & Veronesi, 2006), influences innovation (Mazzucato & Tancioni, 2013). Further, we included three control variables to capture firms’ ownership structures as possible influences on innovation. We modified the original tripartite categorization proposed by Francis and Smith (1995) according to more recently defined ownership thresholds within literature (see, e.g., Faleye, 2007; Lilienfeld-Toal & Ruenzi, 2014; Randøy & Nielsen, 2002): (1) CEO-held firm: the CEO holds at least 10% of the firm’s voting stock; (2) Insider-held firm: the CEO and chairman own less than 5% of the voting stock, while the firm’s entire management holds more than 10% of the voting stock; (3) Outsider-held firm: management holds less than 5% of the voting stock, while a single outside investor (i.e., no management affiliation) holds more than 10% of the voting stock. These criteria need to be fulfilled for both the start and end dates (i.e., years 2010 and 2020) of the data collection period (Francis & Smith, 1995). In case firms were founded after 2010 or ceased to exist before 2020, we categorized these firms based on their ownership structure in their first or last year during the study period. Finally, our model included year- and industry dummies to capture possible differences between years and industries, respectively (Kennedy, 2008).

We controlled for two variables at the board level to capture the intensity of board activity (Vafeas, 1999). First, we included the number of board meetings during a given financial year as a control. Second, we used the average attendance of board meetings during a given financial year to calculate board meeting attendance. Previous studies point to the potentially ambiguous nature of board activity. One line of research emphasizes the importance of high board activity due to its positive effect on board effectiveness (Conger et al., 1998; Lipton & Lorsch, 1992). Opposing scholars argue that board meetings are associated with high costs (e.g., time and travel expenses) (Vafeas, 1999), while they are mainly concerned with routine tasks (Jensen, 1993). Therefore, more board meetings would not necessarily increase the knowledge exchange required to promote innovation (Kogut & Zander, 1992; Vafeas, 1999). Due to these theoretically ambiguous effects of board activity on innovation, we included the number of board meetings and board meeting attendance as proxies of board activity in our model.

3.3 Statistical model

We analyzed our data using a random effects model to allow for the inclusion of time-invariant variables. The variance inflation factor (VIF) test calculated a maximum VIF value of 1.35 and a mean value of 1.14, which are well below the recommended cut-off values (James et al., 2013; Johnston et al., 2018; Menard, 2002). Additionally, correlation coefficients are all below 0.80 (Kennedy, 2008). Therefore, there is no evidence for the existence of multicollinearity. Further, we used robust standard errors to control for heteroskedasticity (James et al., 2013; Kennedy, 2008).

4 Results

4.1 Descriptive statistics and bivariate results

The sample mainly consists of US-based companies (88.17%) from three main sectors: Manufacturing (52.69%); Information (22.58%); and Professional, Scientific, and Technical Services (17.20%).

Table 2 displays descriptive statistics, means, and correlations of all variables. The average company within the sample is 27.78 years old and spends 18.61% of its total sales on R&D while possessing 0.84 units of organizational slack. The average board has 9.97 directors, with 83.97% of them being outside directors and 19.69% women. In our sample, the average director has served on the board for 8.91 years and has 1.08 other corporate affiliations. The average board meets 7.92 times during a given financial year, with an attendance rate of 77.52%.

4.2 Empirical results

In Hypothesis 1, we proposed a curvilinear, inverted U-shaped relationship between organizational slack and innovation. As summarized in Table 3, the effect of organizational slack on innovation is positive and significant (b = 1.547, se = 0.382, p < 0.001), and the effect of the squared term is negative and significant (b = − 1.330, se = 0.169, p < 0.001). While the significant coefficients are a necessary precondition, they are insufficient to establish a quadratic relationship between slack and innovation (Haans et al., 2016). Following Lind and Mehlum’s (2010) three-step procedure, we determined the significance of the inverted U-shaped relationship to ensure the correct interpretation of our results. First, we conducted Sasabuchi’s (1980) test, which significantly confirmed the inverted U-shaped relationship for organizational slack (p < 0.001; for this and the following, see Table 4). Second, we calculated the extreme point of the organizational slack effect, which we found to be at 0.582 units of slack. Third, we calculated confidence intervals based on Fieller’s standard errors [0.374; 0.738]. The extreme point lies within the limits of the 95% confidence interval. We further corroborated these findings by confirming the joint significance of the control variables (p < 0.001) and all variables in the research model (p < 0.001). Altogether, the empirical results strongly support the inverted U-shaped effect of organizational slack on innovation.

We presumed that board size dampens the inverted U-shaped relationship between organizational slack and innovation in Hypothesis 2. We find strong support for this hypothesis, as the interaction between organizational slack squared and board size is positive and significant (b = 0.028, se = 0.003, p < 0.001; for this and the following, see Table 3).

In Hypothesis 3, we predicted that a higher share of outside directors dampens the inverted U-shaped effect of organizational slack on innovation. Our data support this hypothesis, as the interaction term between organizational slack squared and the ratio of outside directors is positive and significant (b = 0.022, se = 0.002, p < 0.001).

In Hypothesis 4, we argued that board tenure amplifies the inverted U-shaped relationship between organizational slack and innovation. Our findings confirm this hypothesis (b = − 0.041, se = 0.004, p < 0.001).

The empirical findings back Hypothesis 5, which stated that an increasing number of board affiliations amplifies the inverted U-shaped relationship between organizational slack and innovation (b = − 0.276, se = 0.019, p < 0.001).

In Hypothesis 6, we predicted that an increasing share of female board members flattens the inverted U-shaped effect of organizational slack on innovation. Our analysis reveals the opposite effect, as board gender diversity is found to amplify this effect (b = − 0.008, se = 0.001, p < 0.001). Therefore, we reject Hypothesis 6. We summarized the empirical results in Table 5.

Additionally, we tested for potential effects of year- and industry-specific factors that may have affected the empirical results. Regression analysis demonstrates that there are no significant differences between the years and industries present in our data (see Table 5). Thus, we can rule out any potential concerns that, for example, the COVID-19 pandemic has caused a structural break in the time series.

5 Discussion

5.1 Theoretical implications

The results support the fundamental argumentation that slack resources have an inverted U-shaped effect on innovation. Our study thus adds further evidence to the literature stream that documented a trade-off between the level of slack and organizational outcomes (e.g., Chiu & Liaw, 2009; George, 2005; Nohria & Gulati, 1997). We attribute these findings to two counteracting mechanisms: First, slack is a facilitator of experimentation and investments in inherently uncertain innovation projects; and, second, slack relaxes control systems and lowers expectations on returns from innovation (Nohria & Gulati, 1997). Our results show that at low levels of slack, the benefits of slack for experimentation outweigh its detriments for monitoring; thus, slack resources benefit innovation. Too much slack, however, will reverse the advantageousness of slack for innovation. Consequently, the findings support the theoretical proposition that high levels of slack cause overly lax control systems, which reinforce managerial opportunisms rather than promote beneficial experimentation (Nohria & Gulati, 1996). In contrast to studies that found only weak correlations (e.g., Lee, 2015) or tested a monolithically positive relationship between slack and innovation in high-tech firms (e.g., Shaikh et al., 2018), our findings evince the ambiguous nature of slack resources in dynamic environments. Firms in high-tech industries need to be particularly vigilant toward their resource orchestration: to stay competitive, they need to pursue innovation constantly, which requires some level of slack; simultaneously, they need to be efficient, which requires the reduction of excess resources. By demonstrating the existence of these two counteracting forces, our results show that the effect of slack on innovation depends on the level of slack resources, as slack can be both beneficial and harmful for innovation (Chiu & Liaw, 2009).

Further, the study investigates board characteristics as potential moderators of the slack–innovation relationship in high-tech industries. Regarding the moderating effect of board characteristics, the findings corroborate that the board—as one of the central internal corporate governance mechanisms—shapes whether slack resources are translated into innovation. The analysis confirms all theoretically deduced board characteristics as contingency factors of this relationship.

In line with theoretical arguments, our findings show that increasing the size of the board and the ratio of outside directors are beneficial to the efficacy of corporate governance mechanisms. Both contingencies hamper the investment of slack in innovation at low slack levels while reducing the adverse effects of high slack levels on innovation. The findings, therefore, provide support for both an agency and resource-dependence perspective by demonstrating that larger and more independent boards lead to more efficient monitoring of executives (Pucheta-Martínez & Gallego-Álvarez, 2020) and enhance the board’s ability to provide resources that benefit innovation (Goodstein et al., 1994; Pfeffer & Salancik, 1978).

Conversely, our analysis reveals that increases in board tenure and board affiliations amplify the inverted U-shaped effect of slack on innovation. Hence, both board characteristics shape the ability and willingness of directors to monitor executives vigilantly and provide resources to the firm. For one, these findings corroborate previous literature highlighting the increased inertia (e.g., Golden and Zajac, 2001; Hambrick, 1995) and decreased monitoring (e.g., Bravo and Reguera-Alvarado, 2017; Hillman et al., 2011; Niu & Berberich, 2015) of longer-tenured directors. For another, the results suggest that increasing board affiliations do not benefit innovation as assumed by previous researchers (e.g., Barroso-Castro et al., 2016; Hillman et al., 2000; Kiel & Nicholson, 2006) but support the research stream that highlights the detriments of more directorial affiliations for corporate governance efficacy (e.g., Harris & Shimizu, 2004; Johnson et al., 2013; Kiel & Nicholson, 2006). These findings echo the increased complexity of strategic decision-making in high-tech industries, in which directors need to be deeply involved to efficiently supervise managers while providing appropriate resources and advice that support the realization of strategic initiatives.

In conflict with our theoretical rationale, the findings demonstrate that increasing the share of women directors does not dampen the inverted U-shaped effect of slack on innovation but amplifies it. The data show that while female representation on boards has more than doubled in the sample since 2010, appointing more women to boards might not be as universally beneficial as widely presumed (e.g., R. B. Adams & Ferreira, 2004; Arora, 2022; Erhardt et al., 2003; Galia & Zenou, 2012; Kaczmarek & Nyuur, 2022). The findings show that increasing board gender diversity amplifies the harmful effects of slack on innovation, as gender diversity may conversely lead to an increased social division on the board that reduces information sharing, collaboration, and trust while being conducive to non-functional conflicts and narrow-mindedness (Adams & Ferreira, 2004; Miller et al., 1998; Ryan & Haslam, 2007). According to this body of literature, increasing gender diversity may trigger the formation of a male group, typically more numerous and powerful, and a female group, typically less numerous and powerful, on a firm’s board. Additionally, the dominant male group of directors is likely to give managers more freedom to allocate resources. These all-male networks typically extend to executives of the firm. Hence, increasing board gender diversity fuels the formation of gender-specific networks that may extend their loyalty, trust, and reciprocity to predominantly male managers (Ryan & Haslam, 2007; Terjesen et al., 2016). Based on these findings, we find support for the notion that increasing female representation on boards amplifies rather than dampens the detrimental effect of high slack levels on innovation.

Altogether, our study contributes to the literature in the following ways. First, we demonstrated that the inverted U-shaped relationship between slack and innovation extends to high-tech industries. Second, we provided evidence that the strength of this relationship is contingent on specific board characteristics. More specifically, our findings revealed that the board’s structural (i.e., board size and independence) and demographic characteristics (i.e., board tenure, affiliations, and gender diversity) are crucial influences on directors’ monitoring and resource provisioning functions in the context of innovation.

5.2 Practical implications

The findings of this study can also guide practitioners to promote innovation by designing appropriate organizational structures. We generally advise firms in high-tech industries not to eliminate slack resources entirely but rather to retain a low level of slack at all times. Nevertheless, the documented inverted U-shaped relationship between slack and innovation should also serve as a cautionary tale to organizations holding high levels of slack. This paradox illustrates the dual pressures for careful resource management in high-tech industries: to be simultaneously innovative and efficient (Chandrasekaran et al., 2012; Chiu & Liaw, 2009).

Further, our results have substantial implications for the design of corporate governance policies. We recommend that shareholders take the staffing of the board of directors seriously, as board characteristics decisively shape to which extent slack resources are translated into innovation. Dependent upon the level of slack, our analysis reveals that specific board characteristics are preferable to others. Board characteristics should therefore be considered in the face of the level of slack endowments: At low levels of slack, the positive effects of excess resources for innovation are promoted by a higher average board tenure, a higher average number of board affiliations, and a more gender-diverse board; at high levels of slack, increasing the size of the board and the number of outside directors are two configurational options to reduce the detrimental impact of slack on innovation.

5.3 Limitations and recommendations for future research

Our study faces several limitations that, in turn, can serve as fruitful pathways for future research. First, our analysis relies on financial data alone. Future research could supplement these objective indicators with subjective measures to gain a more comprehensive picture of how slack affects innovation (Chiu & Liaw, 2009). Second, we operationalized innovation using the input measure of R&D intensity. While input measures reflect directors’ intentions in pursuing innovation, they do not account for their actual ability to realize those intentions. Therefore, future studies could test the effect of slack on output measures of innovation (e.g., patent count, new product development) and how this relationship is affected by board characteristics (Ashwin et al., 2016). Third, our study focused on US-based companies. Future research must examine if the results are reproducible in more stakeholder-oriented corporate governance systems, such as the German two-tiered board (Shaikh et al., 2018). Fourth, our study is limited to the time frame between 2010 and 2020. While the period examined is more lengthy than in most previous studies (e.g., Chiu & Liaw, 2009; Tan, 2003), the dynamics of slack resources might constantly evolve due to the ever-changing demands of new technologies. Last, our research is limited to high-tech firms. Future research could test whether the nature of the slack–innovation relationship and the influence of specific board characteristics on this relationship differ between more and less dynamic industries.

Data availability

The data sets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abdullah, S. N. (2014). The causes of gender diversity in Malaysian large firms. Journal of Management and Governance, 18(4), 1137–1159. https://doi.org/10.1007/s10997-013-9279-0.

Adams, R. B., & Ferreira, D. (2004). Gender diversity in the boardroom. Finance Working Paper, 57. https://www.cfr-cologne.de/download/researchseminar/SS2006/genderECGI.pdf.

Adams, R. B., & Ferreira, D. (2007). A theory of friendly boards. The Journal of Finance, 62(1), 217–250. https://doi.org/10.1111/j.1540-6261.2007.01206.x.

Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291–309. https://doi.org/10.1016/j.jfineco.2008.10.007.

Adams, R., Bessant, J., & Phelps, R. (2006). Innovation management measurement: A review. International Journal of Management Reviews, 8(1), 21–47. https://doi.org/10.1111/j.1468-2370.2006.00119.x.

Adler, P. S., & Kwon, S. W. (2002). Social capital: Prospects for a new concept. The Academy of Management Review, 27(1), 17–40. https://doi.org/10.2307/4134367.

Ahuja, G., Lampert, C. M., & Tandon, V. (2008). Moving beyond Schumpeter: Management research on the determinants of technological innovation. Academy of Management Annals, 2(1), 1–98. https://doi.org/10.5465/19416520802211446.

Anzola-Román, P., Bayona-Sáez, C., & García-Marco, T. (2018). Organizational innovation, internal R&D and externally sourced innovation practices: Effects on technological innovation outcomes. Journal of Business Research, 91, 233–247. https://doi.org/10.1016/j.jbusres.2018.06.014.

Arora, A. (2022). Gender diversity in boardroom and its impact on firm performance. Journal of Management and Governance, 26(3), 735–755. https://doi.org/10.1007/s10997-021-09573-x.

Ashwin, A. S., Krishnan, R. T., & George, R. (2016). Board characteristics, financial slack and R&D investments. International Studies of Management & Organization, 46(1), 8–23. https://doi.org/10.1080/00208825.2015.1007007.

Audia, P. G., & Greve, H. R. (2006). Less likely to fail: Low performance, firm size, and factory expansion in the shipbuilding industry. Management Science, 52(1), 83–94. https://doi.org/10.1287/mnsc.1050.0446.

Barker, V. L., & Mueller, G. C. (2002). CEO characteristics and firm R&D spending. Management Science, 48(6), 782–801. https://doi.org/10.1287/mnsc.48.6.782.187.

Barroso-Castro, C., del Villegas-Periñan, M. M., & Casillas-Bueno, J. C. (2016). How boards’ internal and external social capital interact to affect firm performance. Strategic Organization, 14(1), 6–31. https://doi.org/10.1177/1476127015604799.

Blair, M. M., & Stout, L. A. (2001). Director accountability and the mediating role of the corporate board. Washington University Law Quarterly, 79(2), 403–447. https://doi.org/10.2139/ssrn.266622.

Bouncken, R., Kraus, S., & Roig-Tierno, N. (2021). Knowledge- and innovation-based business models for future growth: Digitalized business models and portfolio considerations. Review of Managerial Science, 15, 1–14. https://doi.org/10.1007/s11846-019-00366-z.

Bouncken, R., Ratzmann, M., & Kraus, S. (2021). Anti-aging: How innovation is shaped by firm age and mutual knowledge creation in an alliance. Journal of Business Research, 137, 422–429. https://doi.org/10.1016/j.jbusres.2021.08.056.

Bourgeois, L. J. (1981). On the measurement of organizational slack. Academy of Management Review, 6(1), 29–39. https://doi.org/10.5465/AMR.1981.4287985.

Bourgeois, L. J., & Singh, J. V. (1983). Organizational slack and political behavior among top management teams. Academy of Management Proceedings, 43–47. https://doi.org/10.5465/AMBPP.1983.4976315.

Bravo, F., & Reguera-Alvarado, N. (2017). The effect of board of directors on R&D intensity: Board tenure and multiple directorships. R&D Management, 47(5), 701–714. https://doi.org/10.1111/radm.12260.

Bromiley, P. (1991). Testing a causal model of corporate risk taking and performance. Academy of Management Journal, 34(1), 37–59. https://doi.org/10.2307/256301.

Bruna, M. G., Dang, R., Scotto, M. J., & Ammari, A. (2019). Does board gender diversity affect firm risk-taking? Evidence from the french stock market. Journal of Management and Governance, 23(4), 915–938. https://doi.org/10.1007/s10997-019-09473-1.

Byrd, J., Cooperman, E. S., & Wolfe, G. A. (2010). Director tenure and the compensation of bank CEOs. Managerial Finance, 36(2), 86–102. https://doi.org/10.1108/03074351011014523.

Carter, C. B., & Lorsch, J. W. (2003). Back to the drawing board: Designing corporate boards for a complex world. Harvard Business Press.

Carter, D. A., D’Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review, 18(5), 396–414. https://doi.org/10.1111/j.1467-8683.2010.00809.x.

Chandrasekaran, A., Linderman, K., & Schroeder, R. (2012). Antecedents to ambidexterity competency in high technology organizations. Journal of Operations Management, 30(1), 134–151. https://doi.org/10.1016/j.jom.2011.10.002.

Chandy, R. K., & Tellis, G. J. (2000). The incumbent’s curse? Incumbency, size, and radical product innovation. Journal of Marketing, 64(3), 1–17. https://doi.org/10.1509/jmkg.64.3.1.18033.

Cheng, S. (2008). Board size and the variability of corporate performance. Journal of Financial Economics, 87(1), 157–176. https://doi.org/10.1016/j.jfineco.2006.10.006.

Chiesa, V., & Frattini, F. (2011). Commercializing technological innovation: Learning from failures in high-tech markets. Journal of Product Innovation Management, 28(4), 437–454. https://doi.org/10.1111/j.1540-5885.2011.00818.x.

Chireka, T., & Fakoya, M. (2017). The determinants of corporate cash holdings levels: Evidence from selected south african retail firms. Investment Management and Financial Innovations, 14(2), 79–93. https://doi.org/10.21511/imfi.14(2).2017.08.

Chiu, Y., & Liaw, Y. (2009). Organizational slack: Is more or less better? Journal of Organizational Change Management, 22(3), 321–342. https://doi.org/10.1108/09534810910951104.

Chowdhury, S. D., & Wang, E. Z. (2020). Board size, director compensation, and firm transition across stock exchanges: Evidence from Canada. Journal of Management and Governance, 24(3), 685–712. https://doi.org/10.1007/s10997-019-09481-1.

Conger, J. A., Finegold, D., & Lawler, E. E. (1998). Appraising boardroom performance. Harvard Business Review, 76(1), 136–148.

Cyert, R. M., & March, J. G. (2013). A behavioral theory of the firm. Martino Fine Books.

Daily, C. M., Dalton, D. R., & Cannella, A. A. (2003). Corporate governance: Decades of dialogue and data. Academy of Management Review, 28(3), 371–382. https://doi.org/10.5465/amr.2003.10196703.

Daines, R. (2001). Does Delaware law improve firm value? Journal of Financial Economics, 62(3), 525–558. https://doi.org/10.1016/S0304-405X(01)00086-1.

Dalton, D. R., Daily, C. M., Johnson, J. L., & Ellstrand, A. E. (1999). Number of directors and financial performance: A meta-analysis. Academy of Management Journal, 42(6), 674–686. https://doi.org/10.5465/256988.

Dalton, D. R., Daily, C. M., Certo, S. T., & Roengpitya, R. (2003). Meta-analyses of financial performance and equity: Fusion or confusion? Academy of Management Journal, 46(1), 13–26. https://doi.org/10.5465/30040673.

Dalton, D. R., Hitt, M. A., Certo, S. T., & Dalton, C. M. (2007). The fundamental agency problem and its mitigation. Academy of Management Annals, 1(1), 1–64. https://doi.org/10.5465/078559806.

Dalziel, T., Gentry, R. J., & Bowerman, M. (2011). An integrated agency–resource dependence view of the influence of directors’ human and relational capital on firms’ R&D spending. Journal of Management Studies, 48(6), 1217–1242. https://doi.org/10.1111/j.1467-6486.2010.01003.x.

Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555–590. https://doi.org/10.2307/256406.

Dean, T. J., Brown, R. L., & Bamford, C. E. (1998). Differences in large and small firm responses to environmental context: Strategic implications from a comparative analysis of business formations. Strategic Management Journal, 19(8), 709–728. https://doi.org/10.1002/(SICI)1097-0266(199808)19:8%3C709::AID-SMJ966%3E3.0.CO;2-9.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504–1511. https://doi.org/10.1287/mnsc.35.12.1504.

Duan, Y., Wang, W., & Zhou, W. (2020). The multiple mediation effect of absorptive capacity on the organizational slack and innovation performance of high-tech manufacturing firms: Evidence from chinese firms. International Journal of Production Economics, 229(3), 107754. https://doi.org/10.1016/j.ijpe.2020.107754.

Elsayed, K. (2011). Board size and corporate performance: The missing role of board leadership structure. Journal of Management and Governance, 15(3), 415–446. https://doi.org/10.1007/s10997-009-9110-0.

Erhardt, N. L., Werbel, J. D., & Shrader, C. B. (2003). Board of director diversity and firm financial performance. Corporate Governance: An International Review, 11(2), 102–111. https://doi.org/10.1111/1467-8683.00011.

Faleye, O. (2007). Does one hat fit all? The case of corporate leadership structure. Journal of Management & Governance, 11(3), 239–259. https://doi.org/10.1007/s10997-007-9028-3.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law & Economics, 26(2), 301–325. https://doi.org/10.2139/ssrn.94034.

Francis, J., & Smith, A. (1995). Agency costs and innovation some empirical evidence. Journal of Accounting and Economics, 19(2), 383–409. https://doi.org/10.1016/0165-4101(94)00389-M.

Galia, F., & Zenou, E. (2012). Board composition and forms of innovation: Does diversity make a difference? European J of International Management, 6(6), 630. https://doi.org/10.1504/EJIM.2012.050425.

George, G. (2005). Slack resources and the performance of privately held firms. Academy of Management Journal, 48(4), 661–676. https://doi.org/10.5465/amj.2005.17843944.

Golden, B. R., & Zajac, E. J. (2001). When will boards influence strategy? Inclination × power = strategic change. Strategic Management Journal, 22(12), 1087–1111. https://doi.org/10.1002/smj.202.

Goodstein, J., Gautam, K., & Boeker, W. (1994). The effects of board size and diversity on strategic change. Strategic Management Journal, 15(3), 241–250. https://doi.org/10.1002/smj.4250150305.

Gul, F. A., Srinidhi, B., & Ng, A. C. (2011). Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics, 51(3), 314–338. https://doi.org/10.1016/j.jacceco.2011.01.005.

Gupta, A. K., Tesluk, P. E., & Taylor, M. S. (2007). Innovation at and across multiple levels of analysis. Organization Science, 18(6), 885–897. https://doi.org/10.1287/orsc.1070.0337.

Haans, R. F. J., Pieters, C., & He, Z. L. (2016). Thinking about U: Theorizing and testing U- and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37(7), 1177–1195. https://doi.org/10.1002/smj.2399.

Hacklin, F., Björkdahl, J., & Wallin, M. W. (2018). Strategies for business model innovation: How firms reel in migrating value. Long Range Planning, 51(1), 82–110. https://doi.org/10.1016/j.lrp.2017.06.009.

Hambrick, D. C. (1995). Fragmentation and the other problems CEOs have with their top management teams. California Management Review, 37(3), 110–127. https://doi.org/10.2307/41165801.

Harris, I. C., & Shimizu, K. (2004). Too busy to serve? An examination of the influence of overboarded directors. Journal of Management Studies, 41(5), 775–798. https://doi.org/10.1111/j.1467-6486.2004.00453.x.

Helfat, C. E., & Martin, J. A. (2015). Dynamic managerial capabilities: A perspective on the relationship between managers, creativity and innovation in organizations. In C. Shalley, M. A. Hitt, & J. Zhou (Eds.), The Oxford Handbook of Creativity, Innovation, and entrepreneurship: Multilevel linkages (pp. 421–429). Oxford University Press.

Hill, C. W. L., & Snell, S. A. (1988). External control, corporate strategy, and firm performance in research-intensive industries. Strategic Management Journal, 9(6), 577–590. https://doi.org/10.1002/smj.4250090605.

Hillman, A. J., & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review, 28(3), 383–396. https://doi.org/10.5465/amr.2003.10196729.

Hillman, A. J., Cannella, A. A., & Paetzold, R. L. (2000). The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. Journal of Management Studies, 37(2), 235–256. https://doi.org/10.1111/1467-6486.00179.

Hillman, A. J., Shropshire, C., & Cannella, A. A. (2007). Organizational predictors of women on corporate boards. Academy of Management Journal, 50(4), 941–952. https://doi.org/10.5465/amj.2007.26279222.

Hillman, A. J., Nicholson, G., & Shropshire, C. (2008). Directors’ multiple identities, identification, and board monitoring and resource provision. Organization Science, 19(3), 441–456. https://doi.org/10.1287/orsc.1080.0355.

Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource dependence theory: A review. Journal of Management, 35(6), 1404–1427. https://doi.org/10.1177/0149206309343469.

Hillman, A. J., Shropshire, C., Certo, S. T., Dalton, D. R., & Dalton, C. M. (2011). What I like about you: A multilevel study of shareholder discontent with director monitoring. Organization Science, 22(3), 675–687. https://doi.org/10.1287/orsc.1100.0542.

Hoogendoorn, S., Oosterbeek, H., & van Praag, M. (2013). The impact of gender diversity on the performance of business teams: Evidence from a field experiment. Management Science, 59(7), 1514–1528. https://doi.org/10.1287/mnsc.1120.1674.

Huang, J., & Kisgen, D. J. (2013). Gender and corporate finance: Are male executives overconfident relative to female executives? Journal of Financial Economics, 108(3), 822–839. https://doi.org/10.1016/j.jfineco.2012.12.005.

James, G., Witten, D., Hastie, T., & Tibshirani, R. (2013). An introduction to statistical learning: With applications in R. Springer.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323–329. https://doi.org/10.2139/ssrn.99580.

Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831–880. https://doi.org/10.1111/j.1540-6261.1993.tb04022.x.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X.

Johnson, S. G., Schnatterly, K., & Hill, A. D. (2013). Board composition beyond independence: Social capital, human capital, and demographics. Journal of Management, 39(1), 232–262. https://doi.org/10.1177/0149206312463938.

Johnston, R., Jones, K., & Manley, D. (2018). Confounding and collinearity in regression analysis: A cautionary tale and an alternative procedure, illustrated by studies of british voting behaviour. Quality & Quantity, 52(4), 1957–1976. https://doi.org/10.1007/s11135-017-0584-6.

Kaczmarek, S., & Nyuur, R. B. (2022). The implications of board nationality and gender diversity: Evidence from a qualitative comparative analysis. Journal of Management and Governance, 26(3), 707–733. https://doi.org/10.1007/s10997-021-09575-9.

Kang, H., Cheng, M., & Gray, S. J. (2007). Corporate governance and board composition: Diversity and independence of australian boards. Corporate Governance: An International Review, 15(2), 194–207. https://doi.org/10.1111/j.1467-8683.2007.00554.x.

Kelly, J. (2021, August 11). New policy requires diversity on corporate boards for Nasdaq-listed companies. Forbes. https://www.forbes.com/sites/jackkelly/2021/08/11/new-policy-requires-diversity-on-corporate-boards-for-nasdaq-listed-companies/.

Kennedy, P. (2008). A guide to econometrics (6th ed.). Wiley-Blackwell.

Kiel, G. C., & Nicholson, G. J. (2006). Multiple directorships and corporate performance in australian listed companies. Corporate Governance: An International Review, 14(6), 530–546. https://doi.org/10.1111/j.1467-8683.2006.00528.x.

Kim, Y. (2005). Board network characteristics and firm performance in Korea. Corporate Governance: An International Review, 13(6), 800–808. https://doi.org/10.1111/j.1467-8683.2005.00471.x.

Kim, H., Kim, H., & Lee, P. M. (2008). Ownership structure and the relationship between financial slack and R&D investments: Evidence from korean firms. Organization Science, 19(3), 404–418. https://doi.org/10.1287/orsc.1080.0360.

Koenig, T., Gogel, R., & Sonquist, J. (1979). Models of the significance of interlocking corporate directorates. American Journal of Economics and Sociology, 38(2), 173–186. https://doi.org/10.1111/j.1536-7150.1979.tb02877.x.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397. https://doi.org/10.1287/orsc.3.3.383.

Kor, Y. Y. (2006). Direct and interaction effects of top management team and board compositions on R&D investment strategy. Strategic Management Journal, 27(11), 1081–1099. https://doi.org/10.1002/smj.554.

Kraus, S., Jones, P., Kailer, N., Weinmann, A., Chaparro-Banegas, N., & Roig-Tierno, N. (2021). Digital transformation: An overview of the current state of the art of research. SAGE Open, 11, 1–15. https://doi.org/10.1177/21582440211047576.

Kravitz, D. A. (2003). More women in the workplace: Is there a payoff in firm performance? Academy of Management Perspectives, 17(3), 148–149. https://doi.org/10.5465/ame.2003.19198794.

Larmou, S., & Vafeas, N. (2010). The relation between board size and firm performance in firms with a history of poor operating performance. Journal of Management and Governance, 14(1), 61–85. https://doi.org/10.1007/s10997-009-9091-z.

Lawson, M. B. (2001). (Buff). In praise of slack: Time is of the essence. Academy of Management Perspectives, 15(3), 125–135. https://doi.org/10.5465/ame.2001.5229658.

Lee, S. (2015). Slack and innovation: Investigating the relationship in Korea. Journal of Business Research, 68(9), 1895–1905. https://doi.org/10.1016/j.jbusres.2014.12.009.

Leibenstein, H. (1969). Organizational or frictional equilibria, X-efficiency, and the rate of innovation. Quarterly Journal of Economics, 83(4), 600–623.

Leiponen, A., & Helfat, C. E. (2010). Innovation objectives, knowledge sources, and the benefits of breadth. Strategic Management Journal, 31(2), 224–236. https://doi.org/10.1002/smj.807.

Lepore, L., Landriani, L., Pisano, S., D’Amore, G., & Pozzoli, S. (2022). Corporate governance in the digital age: The role of social media and board independence in CSR disclosure. Evidence from italian listed companies. Journal of Management and Governance. https://doi.org/10.1007/s10997-021-09617-2.

Libit, W. M., & Freier, T. E. (2015). Director tenure, retirement and related issues. Insights, 29(3), 2–11.

Lilienfeld-Toal, U. V., & Ruenzi, S. (2014). CEO ownership, Stock Market Performance, and managerial discretion. The Journal of Finance, 69(3), 1013–1050. https://doi.org/10.1111/jofi.12139.

Lipton, M., & Lorsch, J. W. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 48(1), 59–77.

Lu, L. H., & Wong, P. K. (2012). Financial slack, board composition and the explorative and exploitative innovation behavior of firms. Academy of Management Proceedings, 2012(1), 1–1. https://doi.org/10.5465/AMBPP.2012.35.

Mahadeo, J. D., Soobaroyen, T., & Hanuman, V. O. (2012). Board composition and financial performance: Uncovering the effects of diversity in an emerging economy. Journal of Business Ethics, 105(3), 375–388. https://doi.org/10.1007/s10551-011-0973-z.

Marlin, D., & Geiger, S. W. (2015). A reexamination of the organizational slack and innovation relationship. Journal of Business Research, 68(12), 2683–2690. https://doi.org/10.1016/j.jbusres.2015.03.047.

Mazzucato, M., & Tancioni, M. (2013). R&D, patents and stock return volatility. In A. Pyka & E. S. Andersen (Eds.), Long term economic development: Demand, finance, organization, policy and innovation in a Schumpeterian perspective (pp. 341–362). Springer. https://doi.org/10.1007/978-3-642-35125-9_15.

Menard, S. (2002). Applied logistic regression analysis. SAGE Publications. https://doi.org/10.4135/9781412983433.

Miller, T., & Triana, M. D. C. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management Studies, 46(5), 755–786. https://doi.org/10.1111/j.1467-6486.2009.00839.x.

Miller, C. C., Burke, L. M., & Glick, W. H. (1998). Cognitive diversity among upper-echelon executives: Implications for strategic decision processes. Strategic Management Journal, 19(1), 39–58. https://doi.org/10.1002/(SICI)1097-0266(199801)19:1%3C39::AID-SMJ932%3E3.0.CO;2-A.

Miroshnychenko, I., & De Massis, A. (2020). Three decades of research on corporate governance and R&D investments: A systematic review and research agenda. R&D Management, 50(5), 648–666. https://doi.org/10.1111/radm.12432.

Nadeem, M., Suleman, T., & Ahmed, A. (2019). Women on boards, firm risk and the profitability nexus: Does gender diversity moderate the risk and return relationship? International Review of Economics & Finance, 64, 427–442. https://doi.org/10.1016/j.iref.2019.08.007.

Nainggolan, Y. A., Prahmila, D. I., & Syaputri, A. R. (2022). Do board characteristics affect bank risk-taking and performance? Evidence from indonesian and malaysian islamic banks. Journal of Management and Governance. https://doi.org/10.1007/s10997-022-09625-w.

Nasdaq, I. (2021a). Nasdaq 100 Index (NDX) market cap information. https://www.nasdaq.com/nasdaq-100.

Nasdaq, I. (2021b). Nasdaq’s board diversity rule: What Nasdaq-listed companies should know. https://listingcenter.nasdaq.com/assets/Board%20Diversity%20Disclosure%20Five%20Things.pdf.

Nguyen, P., Rahman, N., Tong, A., & Zhao, R. (2016). Board size and firm value: Evidence from Australia. Journal of Management and Governance, 20(4), 851–873. https://doi.org/10.1007/s10997-015-9324-2.

Nicholson, G. J., & Kiel, G. C. (2007). Can directors impact performance? A case-based test of three theories of corporate governance. Corporate Governance: An International Review, 15(4), 585–608. https://doi.org/10.1111/j.1467-8683.2007.00590.x.

Nielsen, S., & Huse, M. (2010). The contribution of women on boards of directors: Going beyond the surface. Corporate Governance: An International Review, 18(2), 136–148. https://doi.org/10.1111/j.1467-8683.2010.00784.x.

Niu, F., & Berberich, G. (2015). Director tenure and busyness and corporate governance. International Journal of Corporate Governance, 6(1), 56–69. https://doi.org/10.1504/IJCG.2015.069766.

Nohria, N., & Gulati, R. (1996). Is slack good or bad for innovation? Academy of Management Journal, 39(5), 1245–1264. https://doi.org/10.2307/256998.