Abstract

This paper addresses the research gap in understanding the role of intra-firm reverse technology transfers for building output versus innovation capabilities. While we understand that some firms use external sources to create new technology before they are able to build internal innovation capability, the role of bridging lack of innovation capability through internal reverse technology transfers has not been explored in this context. We analyze the technology transfer strategy in the case of Huawei Technologies through a mixed methods design combining quantitative survival analysis of patents and qualitative interviews to understand and contextualize its mechanisms. The results show that the company strategically transferred ideas for new and complex technologies from centers of state-of-the-art technology towards its domestic Chinese locations. Tapping into offshore innovation capability is done by hiring experienced personnel that transfers innovative ideas to China instead of developing new products abroad. We find that this systematic transfer of complex ideas enabled Huawei to build output capability by bridging its lack of domestic innovation capability. This might be a way for growing firms to become competitive on the world market before having to build innovation capability at home first.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Dynamically growing firms from East Asia have recently been gaining market shares by building technology capabilities through so-called reverse knowledge transfers from centers of state-of-the-art technology, often located in established Western countries, towards the firm’s headquarters (Ambos et al., 2006; Luo & Tung, 2007; Mathews, 2002, 2006; Nair et al., 2016; Poon et al., 2006; Rammal et al., 2023). The capability to transfer technology has been discussed as a key competitive advantage in the international business literature (Feinberg & Gupta, 2004; Kogut & Zander, 1992). Nevertheless, accessing external technology through spillovers, collaborations or acquisitions can be difficult to maintain (Cohen & Levinthal, 1990; Marino et al., 2020). In order to improve their position in the long run, firms would need to go beyond absorbing and produce globally competitive technology themselves (Mudambi, 2008), requiring their R&D activities to change from adapting to innovating by building innovation capabilities (Awate et al., 2012).

However, transferring all capabilities necessary for the innovation process is a lot more difficult and time-consuming than transferring its results (von Hippel, 1994). Awate et al. (2012) point out that there is an inherent difference between output and innovation capability in this regard. They show that creating innovative products is not necessarily a sign that a company has managed to obtain innovation capability, the ability to invent products that push the technological forefront, as it can instead be achieved through relying on external innovative input through which the company gains so-called output capability, which describes the ability to produce state-of-the-art products (Awate et al., 2012, 2015). This distinction of capabilities made by Awate et al. (2012) is vital to understanding different approaches to gaining innovativeness. The bridging of gaps in innovation capabilities is also in line with Luo and Tung (2018), who propose that springboard MNEs might use knowledge resources abroad directly to compensate for what they are not good at.

Unravelling what this means for organizational learning makes it necessary to distinguish between the concepts of knowledge and ideas, where knowledge can be learned and accumulated, while ideas are outlines for new, innovative technologies that can be codified but require absorptive capacity built from prior knowledge to understand (Andersson et al., 2016; Cohen & Levinthal, 1990; Johnson et al., 2002). In the case of a firm that gained output capability, indicating that there is no lack of knowledge about how state-of-the-art technology is produced, we would therefore expect a preference for new ideas that push the technological frontier to be transferred within the firm instead of knowledge.

The literature so far has advanced our understanding of technological and organizational capability building (Anand et al., 2021), but there is still a gap when it comes to more contextualized insights into the role and specific mechanisms of intra-firm reverse technology transfers for innovation versus output capability building. Therefore, we ask how firms are able to build innovation capabilities through intra-firm reverse technology transfers in order to leap from being a technology follower to being a technology leader. We further investigate which type of information is exchanged and if this is stable over time.

In order to shed light onto these questions, we analyze the innovation capability building of a Chinese company that managed to build a competitive technology base: Huawei Technologies. Despite the geopolitical struggles concerning the roll-out of its 5G technology (Lattemann et al., 2020), the Chinese company came a long way between its first large-scale international research activities in Sweden around 2003 (Fan, 2011; K. Lee et al., 2016) and becoming the largest applicant of international patents today (WIPO, 2023). Huawei uses an unusual strategy for capability building as it does not mainly rely on acquiring technologically advanced companies, but rather uses greenfield investments to directly hire technological experts to gain specific expertise in-house (Chang et al., 2017; Schaefer, 2020) and conducts its highest-impact research abroad rather than in China (Schaefer & Liefner, 2017). This way the company was able to leverage the start of a new technology cycle (Lee & Malerba, 2017), the development of 4G, in order to jump ahead of competitors (Schaefer, 2020). The case of Huawei is remarkable because it is among the few Chinese companies that have managed to become leaders in their industries despite very high liabilities of origin (Fiaschi et al., 2017). It’s development between 2000 and 2020 is therefore a highly interesting case for studying organizational learning and capability-upgrading processes on a global scale.

In order to analyze how Huawei’s global R&D organization contributes to creating innovative technology, this article combines patent and interview data to understand the configuration of Huawei’s spatial innovation strategy and the mechanisms of capability upgrading resulting from it. We start out discussing the literature on organizational learning and reverse technology transfers. We then provide an overview of the mixed methods study design followed by a detailed discussion of the quantitative data and models we use. Following this, we test hypotheses about the transfer of new technologies within the company using survival-analysis, and retrieve insights from examining the direction, speed and characteristics of transferring new ideas. In the following, we combine this with a qualitative analysis that inductively generates findings from interviews with the patent inventors, which provides more in-depth context and fills in for the micro-level mechanisms that we miss when analyzing patent data alone. This part integrates the findings from both methodologies. Finally, we derive conclusions to gain deeper insights into the orchestration of reverse technology transfers for creating innovative technologies.

The findings show that Huawei taps into local knowledge pools by hiring experienced personnel that is strongly incentivized to only share ideas with the company’s domestic locations. Compared to knowledge transfers, which are used to build a knowledge base, ideas fulfill a different role as outlines of new, breakthrough technologies that require profound absorptive capacity on the receiving side, in order to be used. These particularly technologically complex ideas are strategically transferred between research abroad and development in China which works most effectively if absorptive and transfer capacity are in place. The case of Huawei shows that building effective international technology transfer abilities seems to be a spatial knowledge strategy that can at least temporarily bridge lack of innovation capabilities at home.

Bearing in mind limitations arising from patent data only disclosing codified ideas and the potential noise introduced by measuring ideas as new combinations of patent technology groups, the article contributes to our understanding of the role of reverse technology transfers for building innovation capabilities by combining patent and interview data in a mixed methods setting that fills in typical patent data blind spots. Moreover, the combined results shed light onto the issue, which role reverse technology transfers can have for a firm moving from absorbing technology towards being a technology leader, and make contributions to the literature on intra-firm technology transfer, organizational learning and innovation capability building.

2 Conceptual background and literature review

In the following section, we summarize the literature background of this study in order to give an overview of the concepts and gaps to which we are contributing. We discuss the literature and present the hypotheses derived from it.

Understanding the organization of global R&D activities is a vital part of understanding the direction of technology transfer within a firm and therefore its role in capability upgrading. Scholars have studied the relationship between headquarters and subsidiaries distinguishing between home-base exploiting and home-base augmenting strategies (Birkinshaw & Hood, 1998; Cantwell & Mudambi, 2005; Kuemmerle, 1999). Home-base exploiting means equipping offshore subsidiaries with knowledge transferred from domestic locations, and home-base augmenting means acquiring knowledge at offshore locations to enhance the capabilities of the home base. Home-base exploiting strategies require effective knowledge flows from the home base to the offshore production sites, whereas home-base augmenting strategies require knowledge flows from offshore research units to the home base.

Those strategies cause so-called reverse knowledge transfers from subsidiaries to headquarters. Reverse knowledge transfers have been increasingly studied in the context of emerging or emerged market multinationals (Lee et al., 2023) and has more recently also been looking at established firms (Munjal et al., 2021) as a means for knowledge accumulation. The literature concerned with reverse knowledge transfers as a means for sourcing knowledge from foreign subsidiaries so far mainly focuses on acquired subsidiaries than on greenfield investments (Munjal et al., 2021; Nair et al., 2016). Studies such as Gassmann and von Zedtwitz (1998) and von Zedtwitz and Gassmann (2002) focus more on the configuration of research versus development between home and host countries and the resulting global patterns of R&D organization. They point out that accumulating core capabilities at home reduces the risks associated with internationally operating R&D and should therefore be preferred. A crucial core capability in this regard is innovation capability, which needs to be safeguarded as a central source of competitive advantage (Mudambi, 2008).

Prior research has well established how crucial an open innovation strategy is for many firms for building competitive advantage (Rammal et al., 2023). However, we know less about the mechanisms of internalized reverse technology transfers when it comes to understanding capability building. This adds a new perspective to the literature on output versus innovation capability, because output capability is usually linked with using external sources of innovative input instead of an internal division of capability (Awate et al., 2012, 2015). For analyzing how firms are able to create innovative output, we therefore zoom in on the configuration of intra-firm reverse technology transfer activities of our case study company Huawei by using technology and location information from patent data. For this, we operationalize innovative ideas within the company as new combinations of distinct technologies that are created through combinative capabilities based on a firm’s prior knowledge (Kogut & Zander, 1992). This conceptualization has been highly influential for research on capability building.

Scholars have pointed out that determining the exact type of knowledge or information is crucial in order to understand its properties, for instance its transferability (Ambos et al., 2006; Johnson et al., 2002; Nair et al., 2016). We argue that for understanding capability upgrading, we need to distinguish between knowledge and ideas. Here, we follow Andersson et al. (2016) in their definition of knowledge as the understanding of facts, information or skills, that might for instance be obtained from education or experience. We further define ideas as outlines for new technologies that might lead to innovations in the future. It is therefore a precursor for what Andersson et al. (2016) defines as innovation.

Following the literature describing technological upgrading as a time sensitive process, particularly regarding very short technology life cycles in the telecommunications industry, we analyze the speed of transfer as a proxy for intent and success of strategically directed technology flows over distance. Based on the typical reverse technology transfer organization outlined above, we assume a firm such as Huawei directs innovative technology faster and more systematically towards its headquarters since absorbing new ideas is key to establishing the firm as a technology leader. We therefore propose:

Hypothesis 1

Ideas from abroad are transferred faster to the headquarters’ location than in the opposite direction.

Lyles et al. (2022) point out that we still lack insights into the important question of how Chinese firms’ learning and innovation through OFDI evolves over time. Some scholars have argued that learning processes are usually incremental since catching-up firms need to follow established technological paths (Hobday, 1994, 1995; Mathews, 2002). Both incremental learning and springboard perspectives share that catching-up seeks to fill gaps in the technology portfolio (Luo & Tung, 2018). Luo and Tung (2018) explain that so-called springboard multinationals use an upward spiral of self-improvement needing to build a knowledge base before tapping into critical technologies. Therefore, successful knowledge acquisition depends heavily on the absorptive capacity of the receiving unit that need to be built over time (Cohen & Levinthal, 1990; Lee & Lim, 2001). Only at later development stages firms increasingly target entirely novel ideas (Wang et al., 2014).

Following the concept of an upward spiral of capability accumulation (Luo & Tung, 2018), over time firms are expected to improve their capability to properly orchestrate idea creation and transfer, which becomes an intangible asset for them (Andersson et al., 2016). This ability to adapt to ever changing capability demands is a central source of competitive advantage in the dynamic capabilities perspective (Teece, 1977; Teece et al., 1997). The literature on knowledge transfer suggest that experience is a decisive factor for the success of this transfer (Szulanski, 1996). We therefore expect Huawei to become increasingly capable of smoothly transferring ideas through building organizational capabilities over time. Therefore, we arrive at the following hypothesis:

Hypothesis 2

The time it takes to transfer ideas within the company is expected to significantly decrease with increasing company experience.

The effectiveness of the knowledge transfer process is currently understood as being shaped by the transfer intention, the ability of the sender and the recipient as well as characteristics of the knowledge itself (Minbaeva, 2007; Teece, 1977), which can either facilitate and speed up or hamper and slow down the transfer. While impediments related to senders and recipients can be manageable, the characteristics of the knowledge to be transferred has effects that cannot be completely canceled out. The complexity of the technology and the degree of novelty decrease the scope for codification, incurring higher costs or requiring more time, and making it harder to transfer (Haldin‐Herrgard, 2000). The growing body of research on the complexity of technology argues that complex technologies offer greater economic benefits (Mewes & Broekel, 2020), but are also more difficult to imitate (Rivkin, 2000) as well as more difficult (Sorenson et al., 2006) and slower (Balland & Rigby, 2017) to diffuse. For complex technologies to be transferred successfully, the company’s transfer mechanisms need to compensate for these disadvantages. Similarly, novel ideas are more difficult to transfer because engineers and researchers are unfamiliar with their specifications (Szulanski, 1996). It therefore takes more time to understand and apply those ideas, making it more difficult to transfer them. Therefore, we propose:

Hypothesis 3

The technological complexity and novelty of ideas significantly slows down the transfer process.

3 Mixed methods case study design

We choose Huawei as a case study because it represents a unique example of a firm reaching global player status relatively recently through creating innovative technology, which enables us to study recent upgrading processes as proposed by Hernandez and Guillén (2018). This provides us unique insights into organizational learning and capability upgrading. Using a single case-study design has the advantage to enable much deeper insights than comparative studies (Yin, 2014). In this study, we combine insights from different offshore R&D locations of the firm increasing contextual variation and validity.

In order to answer our research questions, we mix sources from inside and outside the firm by using patent data as well as interviews with current and former employees in order to avoid what Tokatli (2015) calls the “‘dark side’ of firm-centric case studies”: sticking to the corporate narrative. The case study follows an embedded mixed methods design to study the spatial configuration and mechanisms of reverse technology transfers in Huawei’s upgrading-process. The data types are considered equal and the parallel nature of the chosen exploratory approach provides deeper insights into the research topic (Creswell & Plano Clark, 2011; Hurmerinta et al., 2015; Hurmerinta-Peltomäki & Nummela, 2006). For the study, we collected patent data to identify active R&D locations and to analyze quantitative patterns of technology transfer within the company. In addition, we conducted 40 interviews between February and October in 2017 with inventors who represent a subgroup of the inventors listed on the patents used for the quantitative analysis. They were selected to represent the different offshore locations and the diverse professional and cultural backgrounds of the interviewees, thus providing multiple perspectives on the company’s offshore R&D activities (Yin, 2014). The timing of the interviews in 2017 is crucial to study the company’s transition towards creating innovative technologies as it fully covers the company’s catch-up process while still being close enough to the events that accompanied it for the interviewees to be able to provide detailed insights.

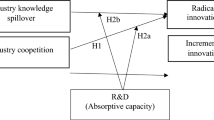

Figure 1 shows how the findings from both analyses were integrated to draw conclusions. The quantitative part observes spatial patterns and changes over time, while the qualitative part unveils the underlying mechanisms of transnational innovation, bridging a blind spot typical for patent-data-based research and providing contextualization.

4 Quantitative analysis

For the quantitative analysis, we use Huawei’s patent data up until 2017 from the United States Patent and Trademark Office (USPTO) retrieved in March 2019 using the PatentsView application-programming interface.Footnote 1 This approach has advantages over patents obtained from the China National Intellectual Property Administration (CNIPO). First, it provides us with information on the origin country of the inventors, which is not available from the CNIPO data. Second, using patents from USPTO provides only new-to-the-world patents and patents that fulfill international quality standards. Because patent applications are usually submitted to multiple patent offices, the USPTO data set covers patents created not only in the US, but from all over the world, giving insights into ideas originating from China and Europe. The USPTO coverage of R&D activities in Europe is higher than or very similar to that of the European Patent Office (EPO) as shown on a sample of Huawei patents at USPTO and EPO between 1990 and 2014 in Table 1.

To operationalize new ideas, we use the first-time combination of technological components as a proxy for new-to-the-firm ideas. We count every pair of components appearing on the same patent as a combination. This approach has been used in the literature before, where the novelty of ideas is measured as unusual or new combinations of technology (sub)classes on patents (Fleming, 2001; Kim et al., 2016). Even if not every single new combination necessarily represents a breakthrough innovation, this approach enables us to look at the bigger picture of the distribution of new ideas within the company.

The classification we use is the Cooperative Patent Classification (CPC) developed by the EPO and USPTO to harmonize patent classifications. The components are the technology groups listed on the patents. Groups are more fine-grained than subclasses, but still represent technological components, compared to the even more detailed subgroups, which also include application mechanisms of components. Table 2 provides an example of a typical technology on which Huawei’s inventors work. The subclass classification “Telephone communication” is still relatively broad, whereas the group “Substation equipment” describes a more specific technological component. The subgroup describes a mechanism for the component.

We use the inventor addresses to determine whether the idea was created in China or at one of Huawei’s offshore locations. Following our research design, we distinguish between the categories domestic or offshore location. Using the priority date of the patent, we then calculate how long it takes the idea to be transferred across location categories. The priority date is the first time a patent is submitted to a patent office worldwide, which means that even if we find the patent via the USPTO, we use the date of its first application in China or Europe to trace its origin. We consider an idea as transferred once an inventor team at the opposite location has been able to apply the idea for an invention. Therefore, we exclude patents with mixed offshore and domestic inventor teams, as they do not provide further insights regarding our question. Table 8 in the Appendix provides an overview of the country of origin for inventors in offshore and mixed teams. We also exclude years after 2017 because of a potential time lag in patent applications with Chinese inventor teams filed first at the CNIPA. These could bias our data in favor of patents originating from US teams, which would appear in the data set earlier. We also filter “born-global” ideas, which are ideas that appear at the exact same time at a domestic and offshore location when observed for the first time. Therefore, we cannot observe where they appeared first and as they appear simultaneously, they do not represent a transfer. We categorize patents created in Hong Kong as domestic only because of its spatial proximity to Huawei’s headquarters in Shenzhen.

4.1 Time-to-event analysis

We use a survival or time-to-event analysis to analyze the time new ideas take to be transferred within the company. This method is commonly used in medical studies to model the influence of covariates on patient survival time as the dependent variable. This type of analysis is regularly used in technology transfer analysis for example when studying the survival of firms or the diffusion of innovations (Ardito & Svensson, 2023; Block et al., 2022; Honjo & Kurihara, 2023). The advantage of using time-to-event analysis over an ordinary least square (OLS) approach is that the Cox or Weibull distributions are a better fit to model time as a dependent variable, as time is non-negative, and residuals are usually not normally distributed. Moreover, it enables us to consider observations that did not experience the event, in our case the ideas that are not transferred, to correctly estimate the time to event.

The event \({e}_{i}\) in our model is the first time an idea appears at a location category opposite to the one from which it originates. The observation period starts when the idea appears for the first time \({s}_{i}\) and ends at the transfer or the last time it appears in the data, which is called “right-censoring”. Figure 2 displays the calculation of our dependent variable time until transfer (time-to-event) and other independent time-related variables.

The baseline hazard function for the Weibull model, which is the instantaneous failure rate with all covariates being zero if the observation has not yet experience the event (Moore, 2016), is given by

with the scale and shape parameters \(\lambda \) > 0 and \(\gamma \) > 0 as well as 0 \(\le \) t < ∞. The proportional hazards model, which in our case describes the hazard of transfer at time t for the ith idea, is

with i = 1, 2, …, n. The unit of observation in our model is ideas, measured as combinations of technology groups. The dependent variable for the model is the time until transfer of the idea, as described above. Table 3 provides a detailed description of the independent variables. The variable origin of idea is dichotomous, taking a value of one for offshore locations and zero for domestic locations in China. The variable labeled company experience measures the company’s age at the creation of the idea. Furthermore, we include the knowledge complexity of the idea built upon the structural diversity index by Broekel (2019). Global novelty is measured as the reversed time between the first appearance of the idea among all USPTO patents and the first appearance at Huawei. Finally, we include control variables for the transfer capacity of the idea as the intensity of application at the sending location and the absorptive capacity as the familiarity with each component of the idea at the receiving location as well as the international expansion of Huawei’s R&D activities. Table 9 in the Appendix provides an overview of the descriptive statistics of the variables and Table 10 provides the correlation matrix of the independent variables, showing low correlations between the independent variables.

4.2 Quantitative results

For data processing and statistical computing, we use RStudio.Footnote 2 Table 4 shows the average values for the dependent variable for the origin of ideas and the state of the transfer. Looking at the average time until transfer already gives us an idea of the difference of transfer speed between the locations. Considering the complete observation period, while ideas from domestic locations take 4.37 years on average to be transferred to offshore locations, transferring ideas from offshore to domestic locations takes only 2.3 years. Table 11 in the Appendix further differentiates this by time periods.

Figure 3 shows the Kaplan–Meier Curves of the survival probability over time, comparing the origin categories of ideas. The two distinct curves show that the transfer from offshore is faster at any point in time and that the two lines are mostly parallel, confirming the proportional hazards assumption underlying the model.

Table 5 displays the main results from the Weibull model as hazard ratios with upper and lower boundaries instead of asterisks, following a recent call by Wasserstein et al. (2019) on how to responsibly report model results. The table includes the complete model (1) and we then split the data along the origin of the idea into a model for ideas originating from offshore locations (2) and one for ideas from domestic locations (3). Figure 4 visually compares the coefficients of models 2 and 3 and the upper and lower boundaries of their confidence intervals. The coefficients and asterisks corresponding to Table 5 are reported in the Appendix in Table 12.

Models (1)–(3) report hazard ratios that show the percentage change in hazard rate for every additional unit of the independent variable, allowing us to investigate the temporal properties of the transfer. We also control for transfer and absorptive capacity to better understand the transfer process itself. Turning to hypothesis one, model (1) shows that ideas from offshore locations have a hazard ratio of 1.311, showing an increase in the hazard of transfer at a point estimate of 31.1% at a 95% confidence interval between 15.6 and 48.8% at any point in time compared to the ideas from China. This confirms the hypothesis that the transfer of ideas from offshore to domestic locations is faster and more successful.

Turning towards the second hypothesis on experience, model (1) shows that while the company gains experience, the hazard of transfer is estimated to increase by 12%, meaning the transfer takes less time. This confirms hypothesis 2 about the transfer process becoming faster over time with growing company experience. This also puts the average number of years it takes to transfer ideas in perspective, as it covers the complete observation period, meaning that more recent transfers can be expected to happen much quicker. It further shows that the transfer of ideas from domestic locations clearly becomes faster with increasing experience, indicating that over time, domestic locations might start to create valuable ideas that are taken to offshore locations to build upon.

Next, we assess hypothesis three on knowledge characteristics. Model (1) shows that in terms of speed, knowledge complexity increases the hazard of transfer by 18.7%. Ideas from offshore locations arrive at domestic locations faster if they have a higher complexity. The effect is similar in both directions. This result is contrary to our initial hypothesis and means that Huawei is able to overcome the obstacles associated with transferring technology that is more complex and therefore transfers the most valuable ideas faster. Concerning the global novelty of the idea, we find in model (1) that the hazard rate decreases the younger and therefore closer to the current state of development the idea is. This effect holds for both directions of transfer in models 2 and 3. This shows that novelty of an idea decreases the speed of transfer. Therefore, we can only partly confirm hypothesis 3 that complexity and novelty decrease the speed of transfer.

We perform a number of robustness and sensitivity checks. The shape parameter for the ideas originating offshore and domestically confirm similar distributions. The diagnostics plots in Fig. 5 show generally parallel and non-crossing lines for the two groups of idea origins, suggesting that a proportional hazards Weibull model is adequate for analyzing the data. We also compare our results to the results of other survival models as well as an OLS model in Table 13 in the appendix. The results show mostly slightly smaller effects sizes but the same direction of effects on the dependent variable. The Log Likelihood and AIC measures of the models confirm that the Weibull model has the best fit. Moreover, to test potential biases caused by time period restrictions, we limit the period for transfer after the first appearance of the combination to 5 years in Table 14, excluding cases in which the combination appears again after many years. The results show that the magnitude and direction of the results remain robust.

In summary, the results can be considered robust and the choice for the Weibull model is justified. The findings show that ideas from offshore locations are transferred to Huawei’s domestic locations faster than in the other direction. It also shows that the transfer of ideas within Huawei increases speed with growing experience. The speed and success of transfer depends on transfer capacity, in particular for ideas from domestic locations. Concerning the characteristics of ideas, the results show that complex technologies are transferred faster. This means that the strategic intent of the company to absorb these particularly valuable ideas overcomes the obstacles associated with transferring ideas that are more complex.

5 Qualitative analysis

In order to bridge the blind spots, we usually have when analyzing patent data and in order to provide contextualization we use qualitative interviews with the offshore patent inventors. We conducted interviews between February and October 2017 with former and current employees at Huawei’s offshore R&D centers. To gain a more nuanced understanding of the knowledge transfer mechanisms, of the 233 experts contacted, we interviewed 40 from eight different offshore locations of the company, representing the biggest and most active ones in terms of patent application: San Jose, Dallas, San Diego, Chicago, Bridgewater, Ottawa, Stockholm and Munich. Two experts were not assigned to a specific location as they mostly worked remotely. We selected the experts via their patenting activity for Huawei and their assigned location outside of China. The sample contains mostly industry experts with prior work experience from established competitors and academia but also two of the interviewees had worked for Huawei China before. Moreover, six of the interviewees were of Chinese origin. Including the perspective of inventors who have a cultural insider perspective on China or on Huawei in China is a very valuable addition to the sample. Sixteen out of the 40 interviewees were still working for Huawei at the time of the interview while 24 had either changed jobs or retired. Table 7 in the Appendix provides an overview of the interviews. Following ethical guidelines, the interviewees have been anonymized and details potentially leading to their identification have been kept confidential.

In the qualitative analysis, we particularly studied the mechanisms of intra-firm technology transfer. Therefore, the main questions for the semi-structured interviews address the tasks of the offshore experts and the communication within the company. An overview of typical questions for the interviews is provided in the appendix. Some questions changed throughout the interview period according to new insights from the interviews. For example, we initially asked how the interviewees provide access to the local knowledge base for the company and how that knowledge is then transferred. We found out early that the interviewees have only little professional exchange outside of the company once they work for Huawei. Therefore, the offshore experts are not so much connectors to knowledge from outside, but rather the main source of knowledge themselves. Following this finding, we shifted our focus away from their outside connections towards the interviewees themselves.

We analyzed the interviews using the qualitative analysis software MaxQDA. The coding process took place in three steps. First, we sorted the material into broader, partly overlapping fields of interest to make it more accessible, such as personal education and career background, tasks at Huawei as well as external and internal connections. We derived the questions listed in Table 6 about the role of Huawei’s offshore R&D in upgrading the company’s technology from the quantitative analysis representing the knowledge gaps that needed to be filled through qualitative analysis. These were then used for the second round of coding, this time using an inductive coding procedure to keep an open mind towards the perspectives of the interviewees. This enabled us to pick up concepts from the interviewees themselves, such as specifying that the transfer of technology was specifically a transfer of ideas rather than knowledge. The third step was the consolidation of the inductive codes to see which statements refer to the same phenomenon. The text passages in the consolidated codes were then split along the interviewee variables shown in Fig. 6, using the segment matrix in MaxQDA. This enabled us to contextualize the coded fragments while analyzing. We then used the tables and coding memos to summarize our findings and answer the questions.

5.1 Innovation capability gap

The first part of the qualitative analysis focuses on what kind of capability gap creates the need for reverse technology transfers within the company in the first place. During the interviews, it became apparent that we need to distinguish between the concepts of knowledge, ideas, and organizational knowledge. In the terms of the interviewees, knowledge refers to technological knowledge often obtained from university that is needed to understand state-of-the-art technology and develop such products. In contrast, ideas are outlines for new technologies beyond the current state of development that require profound knowledge and understanding of the technology, but also creativity and industry experience. From the interview material, we also identify a third category, organizational knowledge, to which the interviewees refer mostly indirectly, describing for instance the ability to put together and manage innovative teams.

When asked about the capability of domestic and offshore inventors, the interviewees see a gap between Huawei’s offshore and domestic R&D, claiming that employees in China have caught up on technological and organizational knowledge while still struggling to create new ideas. As one interviewee puts it: “I had to go to Shenzhen, Shanghai or Beijing to discuss new products. […] I got the impression that they mainly wanted to transfer how we come up with new ideas, how we come up with something novel.” (US04: 103–104). The interviewees claim that the engineers in China have the technical skills, but do not know what to do, a question often left to the offshore experts, who state that their colleagues in China need to “think outside the box”. As one interviewee puts it: “they mainly have to learn how to be innovative, not only the technological knowledge, but more the way to [create innovations]” (EU05: 45). Another interviewee describes the role of ideas in initiating the development of new products as follows: „The Chinese don’t know what to do but they know how to do it. We help them “what” to do, we give them the requirements and then they know how to do it. They are ramping up very quickly.” (US16: 120–122).

Overall, we find that the R&D conducted in China mostly aims for more incremental improvements, while research abroad creates more breakthrough novelties. Because these ideas are more valuable to the firm, we observe a faster transfer towards the domestic locations than the other way round, as the quantitative analysis shows. It becomes apparent from the interviews that the main reason for this capability gap is the pool of mainly young graduates from university, often the best of their cohorts, with only limited work experience or exposure to the global industry, from which Huawei is able to hire in China. An interviewee states about his Chinese colleagues: “there is no shortage of smart people in China, but they are very inexperienced and fresh out of school. I explained to them things like “don’t believe everything only because it is written in a paper, think it through yourself, there might be mistakes” and things like that, which you only learn from experience in working.” (CA05: 53–54). In contrast, Huawei’s offshore employees are mostly experienced senior engineers that have been working for one of Huawei’s big competitors or in academia for a minimum of five years. Another factor influencing the work done abroad and at home comes from different methods of approaching tasks. The engineers in China often employ a trial-and-error approach from which they learn. These results show that the offshore experts’ seniority and education offer a greater pool of industry-specific experience and better training to search for new ideas compared to domestic engineers. This is in line with the finding from the quantitative analysis, that the offshore locations are the main generators of ideas, emphasized by the finding that the transfer of ideas from offshore to the domestic locations takes 2.3 years on average, compared to 4.4 years in the opposite direction.

Concerning the development over time, the interview material indicates the need for high-quality research developed only in the later phase of Huawei’s internationalization. Some offshore experts report that in the early days of internationalization, the engineers in China were even resistant to new technical approaches and ideas at first, when technology underlying the ideas were unfamiliar to them. By building absorptive capacity at the Chinese locations, the technological knowledge gap between them and the offshore locations closed and the appreciation for new ideas increased. This provides an explanation why the transfer of ideas towards China derived from the quantitative analysis still takes on average 2.3 years, as this is an average for the complete period. The analysis shows that in the beginning of Huawei’s international patent activity the time it took to transfer ideas was 4.05 years, while in the last 6 year period of the sample, this had accelerated to 1.4 years (see Table 11, Appendix).

The first step was to catch up on state-of-the-art knowledge, which was done in the earlier phase of internationalization through the transfer of technological as well as organizational knowledge. Interviewees with a long employment history at Huawei emphasize how fast their colleagues in China caught up on state-of-the-art technology. Nevertheless, the interviewees point out that the capability of the Chinese R&D varies between different fields, as Huawei works on a broad range of technologies from analogous to digital in-house.

From the interviewee’s perspectives on capability endowment discussed above, we find that the offshore and domestic R&D locations fulfill different tasks in Huawei’s innovation process. Ideas from abroad have to be taken to China, where the larger and less costly workforce takes over the more work-intensive tasks, aligning development with production. The lack of experience for idea creation at home is the main reason for accessing ideas abroad, as transferring all capabilities necessary for the innovative process itself is a lot more difficult than transferring results. To bridge this lack of innovativeness, Huawei splits its R&D activities between research in established industry locations abroad and development in China for immediate access to innovation capabilities. The interviewees claim that today, the gap in experience between offshore and domestic engineers might be slowly closing.

5.2 Systematic exchange between locations

Turning towards the organization of exchanging new ideas, we find that Huawei’s headquarters hierarchically control the flow of information, directing all communication between offshore R&D locations through China. All offshore locations work closely with Huawei’s respective technology hubs in China, where Shenzhen, for example, would be more oriented towards telecommunications and Beijing more towards internet. The interviewees state that working with the respective locations in China is strongly encouraged by Huawei, while competition within the company hinders the exchange of ideas between offshore locations. In a few cases, engineers from different offshore locations worked together, but the interviewees claim that this kind of exchange was not encouraged by headquarters. An interviewee from a US location states: “It is more rare to work with other Huawei offices outside of China. I did it once […] but only on smaller projects. You might share ideas with other offices, but you always have to come back to the headquarters and that’s exhausting for us, that’s why we don’t do it as much. We mostly work with China.” (US19: 92–95). Another interviewee from a European location states: “I hated the trips to China, [they were] exhausting. […] They would bring everybody associated in the area. The dinners were fantastic. […] The only thing that was interesting for us: to exchange ideas with other inventors from different [offshore] locations. We discussed with […] [inventors from other offshore locations] and even tried to start a project without initiation from the headquarters, but that was impossible.” (EU03: 190–194). The direction of exchange is therefore very clear. The interviewees claim that the offshore side is expected to meticulously report their work to China, while the domestic side is more restricted: “There was a larger group working on architecture too, in Shanghai. They were directly connected to the products […]. They were very secretive about their ideas but they wanted to know everything that we did.” (US18: 60–63). This explains why the unintended transfer of ideas towards offshore locations is a lot slower than the intended transfer towards the company’s domestic locations.

The interviewees mention various channels for the transnational transfer of knowledge and ideas. Many project teams consist of offshore and domestic engineers to ensure that results are directly transferred to China. Table 8 in the Appendix shows the country of origin of inventors in these mixed teams from a patent data perspective, while the interviews show that Chinese colleagues might also take on observing roles in these teams and might not show up in the patent data therefore. The interviewees state that the particular transfer channel depends on how complex the technology is. A lot of knowledge exchange happens via personal contact. Many of the interviewees travel regularly to the respective technology hub in China, which in some cases helped to establish personal relationships to Chinese co-workers and improve communication between domestic and offshore locations. Visitors usually give presentations, explain the newest technology in detail to their co-workers in China and distribute the slides containing the technical details. The exchange via documents and slides is feasible over distance and helps to overcome language barriers by using universally understood mathematical formulas and technical drawings. Other forms of communication over distance include video conferences, desktop sharing and electronic messaging. Some experts say that it was sometimes difficult to collaborate with co-workers in China because of the cultural and language barriers as well as spatial distance and the time difference that requires nighttime phone conferences. Moreover, there are certain technologies, in particular those of military relevance, which fall under export control rules, which means that those technologies cannot be transferred to China, as some interviewees explained.

In terms of development of transfer channels, we find that in the initial stages of Huawei’s R&D internationalization, offshore experts bridged the knowledge gap between themselves and the global industry. The offshore experts were sent to represent Huawei in standardization and EU-financed research projects or to talk to customers. Their role changed when Huawei caught up on state-of-the-art knowledge and aspired to become an industry leader. Now they provide the company with innovative ideas, for which they draw on their long-term experience. One of the interviewees describes the requests from China this way: “We were very often invited to Shenzhen, every two to three month. We had to present and participate in seminars […] [and] they would always say “give us ideas”.” (EU03: 186–189). This shows that the main ideas for innovative products often come from abroad, while the engineers in China do the fine-tuning. Transferring their ideas to China causes discontent for some offshore engineers, because they are not involved in bringing their own idea to the market, which many of them are used to from working for established competitors. Another mechanism for transferring technology that was changed over time is engineer expatriates from China working for one to three years at the offshore location. Their task is to help with the communication with China by translating and transferring the knowledge they acquire abroad back to China. However, this practice is used less frequently now, as some interviewees report.

In summary, we find that the reverse technology transfers Huawei uses is costly and requires a lot of effort, as the offshore experts need to travel to China regularly to give workshops and explain ideas that are not codifiable to their Chinese colleagues directly. Transferring ideas to China has required Huawei’s domestic locations to catch up on technological knowledge, which the company achieved through knowledge absorption in the initial phase of R&D internationalization. Gaining absorptive capacity enabled the domestic locations to use the offshore experts’ ideas to develop state-of-the-art technology as, even if the company’s R&D in China has caught up on technological and organizational knowledge and still struggle to create innovative ideas because of a lack of experience on the part of the young Chinese employees, as shown in Fig. 7. Therefore, the company accesses experience in the form of hiring senior experts abroad and transfers their ideas for new technologies via strategically created channels to its domestic R&D, where the development of products takes place. This strategy enables the company to access innovative ideas abroad while reducing the risks of knowledge spillovers.

6 Conclusion

Huawei managed to use reverse technology transfers to gain output capability despite aiming for more difficult to transfer, complex ideas. Huawei’s unique strategy of greenfield R&D internationalization leads to internalized innovation capability and therefore poses a special case of achieving output capabilities without external (to the firm) innovative output. However, because this means the firm still relied on input from its R&D offices abroad instead of building innovation capabilities at home, the strategy remains risky and resembles more strongly what the literature describes as output than innovation capability (Awate et al., 2012). This configuration provides new insights into the distinction between output and innovation capabilities and how firms might be able to use internal reverse technology transfer for creating innovative output.

Our study shows how Huawei’s strategically orchestrated transfer of new ideas for complex technologies from offshore to domestic locations shaped its ability to produce innovative output. This shows that R&D internationalization employing differentiated R&D strategies at home versus host locations has the potential to bridge a lack of innovation capabilities if strategic knowledge transfer, matching spatial configurations and absorptive domestic R&D capabilities are in place without requiring domestic innovation capabilities. Huawei’s knowledge flow orchestration was based on establishing R&D offices in technologically leading host regions and transferring distant technology back to its domestic locations to synthesize with internal, seemingly less competitive, capabilities. However, those offshore locations are not used as typical listening posts from where the company constantly taps into the local knowledge pool through building local linkages. Instead, tapping into local capability pools in this case means internalizing knowledge by hiring experienced personnel that is strongly incentivized to only share ideas within the company with extremely limited knowledge exchange with actors outside the firm. In fact, Huawei directed this kind of exchange specifically towards its domestic locations and put up barriers against other directions of exchange.

A limitation of this paper’s approach is that the data used for the quantitative model is not suited to provide a causal relationship. The model aims mainly at revealing the larger patterns found in the patent data, which only become meaningful in combination with the qualitative insights. Moreover, the quantitative section focuses on patents, which only represent the codifiable elements of knowledge and ideas, while the results from the qualitative section refer to the interviewees’ individual experiences with concepts of knowledge and ideas. In addition, a potential bias that might arise from sampling interviewees is that particularly employees that felt confident enough to talk about their experiences accepted our invitations. Therefore, employees that had a very tense relationship to their (former) employer might be more reluctant to answer our interview requests. This might cause us to miss extreme cases. Moreover, employees at the beginning of their career might be less inclined to answer our request, as they might not have enough confidence to talk to outsiders about their experiences. This group might also not feel addressed by our request as they might feel that they do not have enough experience to contribute any insights, which we tried to avoid by explicitly stating that we are interested in their unique role as industry experts. Another point is that we measure ideas as an abstract concept in the form of new combinations of technology groups listed on patents. This approach, while being increasingly used in the literature (Fleming, 2001; Kim et al., 2016), might also capture some noise. Future research should address these shortcomings, expand the generalizability of our findings, and look further into innovation capability generation over space.

Regarding our theoretical and managerial contributions, our findings confirm the literature in that Huawei first needed to fill its knowledge gaps and build a knowledge base in order to be able to transfer novel ideas (Luo & Tung, 2018; Wang et al., 2014). This is supported through our model that shows that the technology transfer picks up speed and that absorptive capability is key for transferring ideas, as well as through the findings from the interviews that show the firm moving from the transfer of knowledge towards a transfer of ideas over time. These insights add to the literature on reverse knowledge transfer the notion that we need to pay more attention to which kind of information is exchanged in which phase of the company’s development, as it has different implications for the transfer process. While knowledge can be learned but needs more in-depth interaction, ideas can be more easily codified if the receiving side has the needed absorptive capacity. It also shows that building absorptive capacity is different from building innovation capability, but that absorptive capacity might be used in an intra-firm setting with strategic technology transfer in place in order to leapfrog innovation capability building and create innovative output sooner. The case shows that building effective technology transfer abilities seems to be a spatial configuration that can at least temporarily bridge a lack of innovation capabilities at home.

Huawei split its R&D activities between research in established industry locations abroad and development in China for immediate access to innovation capabilities. Through this spatial configuration of technology transfer the company achieved output capability before reaching innovation capability at home (Awate et al., 2012). Following this spatial knowledge strategy the company had to deal with the issue of having to continuously transfer ideas caused by the immobility of the innovation capability needed to create them (von Hippel, 1994). The core issue here is that highly innovative inventors will not move easily from abroad to China and moving all capabilities necessary for the innovation process is very difficult and time-consuming. This is why the company needed to keep the reverse technology transfer channels open to create innovative products. Nevertheless, even if the current market position of the firm marks the successful transformation from a follower to a technology leader, we find that the company had not yet managed to conduct its most innovative R&D at its domestic locations due to a lack of innovation capability available in China during that time. Relying on this strategy might create a dependency on technology absorption, and a competitive advantage that depends on lower wages and production costs at home might not be sustainable (Gereffi & Lee, 2012). Therefore, we need to better understand how sustainable the approach of bridging lack of innovation capability through reverse technology transfers is, as it might make the firm depend on its offshore location’s R&D activities for competitive advantage. We know that this approach might be less safe and more costly than concentrating the most crucial R&D activities at home (Gassmann & von Zedtwitz, 1998; von Zedtwitz & Gassmann, 2002) and therefore building innovation capability there. For instance, the blockage of Huawei’s activities by some Western governments shows, this approach can be risky if transferring ideas leads to a dependency on offshore activities in potentially hostile environments. However, particularly the quantitative results show the gradual and systematic accumulation of experience at Huawei’s domestic locations and therefore possibly changing roles in the spatial configuration of tasks. This might be a sign that Huawei’s global R&D organization is on its way to ambidexterity (Dodourova et al., 2023; He & Wong, 2004), upgrading the role of its domestic R&D within its R&D network.

References

Ambos, T. C., Ambos, B., & Schlegelmilch, B. B. (2006). Learning from foreign subsidiaries: An empirical investigation of headquarters’ benefits from reverse knowledge transfers. International Business Review, 15(3), 294–312. https://doi.org/10.1016/j.ibusrev.2006.01.002

Anand, J., McDermott, G., Mudambi, R., & Narula, R. (2021). Innovation in and from emerging economies: New insights and lessons for international business research. Journal of International Business Studies, 52(4), 545–559. https://doi.org/10.1057/s41267-021-00426-1

Andersson, U., Dasí, À., Mudambi, R., & Pedersen, T. (2016). Technology, innovation and knowledge: The importance of ideas and international connectivity. Journal of World Business, 51(1), 153–162. https://doi.org/10.1016/j.jwb.2015.08.017

Ardito, L., & Svensson, R. (2023). Sourcing applied and basic knowledge for innovation and commercialization success. The Journal of Technology Transfer. https://doi.org/10.1007/s10961-023-10011-3

Awate, S., Larsen, M. M., & Mudambi, R. (2012). EMNE catch-up strategies in the wind turbine industry: Is there a trade-off between output and innovation capabilities? Global Strategy Journal, 2(3), 205–223. https://doi.org/10.1111/j.2042-5805.2012.01034.x

Awate, S., Larsen, M. M., & Mudambi, R. (2015). Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46(1), 63–86. https://doi.org/10.1057/jibs.2014.46

Balland, P.-A., & Rigby, D. (2017). The Geography of Complex Knowledge. Economic Geography, 93(1), 1–23. https://doi.org/10.1080/00130095.2016.1205947

Birkinshaw, J., & Hood, N. (1998). Multinational subsidiary evolution: Capability and Charter Change in Foreign-Owned Subsidiary Companies. Academy of Management Review, 23(4), 773. https://doi.org/10.2307/259062

Block, J. H., Fisch, C., & Diegel, W. (2022). Schumpeterian entrepreneurial digital identity and funding from venture capital firms. The Journal of Technology Transfer. https://doi.org/10.1007/s10961-022-09973-7

Broström, G. (2012). Event history analysis with R. CRC Press. https://doi.org/10.1201/9781315373942

Cantwell, J., & Mudambi, R. (2005). MNE competence-creating subsidiary mandates. Strategic Management Journal, 26(12), 1109–1128. https://doi.org/10.1002/smj.497

Chang, L.-C., Ho, W.-L., Tsai, S.-B., Chen, Q., & Wu, C.-C. (2017). Dynamic organizational learning: A narrative inquiry into the story of Huawei in China. Asia Pacific Business Review, 23(4), 541–558. https://doi.org/10.1080/13602381.2017.1346910

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152. https://doi.org/10.2307/2393553

Creswell, J. W., & Plano Clark, V. L. (2011). Designing and conducting mixed methods research (2nd ed.). SAGE Publications.

Dodourova, M., Zhao, S., & Harzing, A.-W. (2023). Ambidexterity in MNC knowledge sourcing in emerging economies: A microfoundational perspective. International Business Review, 32(2), 101854. https://doi.org/10.1016/j.ibusrev.2021.101854

Fan, P. (2011). Innovation, globalization, and catch-up of latecomers: Cases of Chinese Telecom Firms. Environment and Planning a, 43(4), 830–849. https://doi.org/10.1068/a43152

Feinberg, S. E., & Gupta, A. K. (2004). Knowledge spillovers and the assignment of R&D responsibilities to foreign subsidiaries. Strategic Management Journal, 25(89), 823–845. https://doi.org/10.1002/smj.396

Fiaschi, D., Giuliani, E., & Nieri, F. (2017). Overcoming the liability of origin by doing no-harm: Emerging country firms’ social irresponsibility as they go global. Journal of World Business, 52(4), 546–563. https://doi.org/10.1016/j.jwb.2016.09.001

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132. https://doi.org/10.1287/mnsc.47.1.117.10671

Gassmann, O., & von Zedtwitz, M. (1998). Organization of industrial R&D on a global scale. R&D Management, 28(3), 147–161. https://doi.org/10.1111/1467-9310.00092

Gereffi, G., & Lee, J. (2012). Why the World suddenly cares about global supply chains. Journal of Supply Chain Management, 48(3), 24–32. https://doi.org/10.1111/j.1745-493X.2012.03271.x

Haldin-Herrgard, T. (2000). Difficulties in diffusion of tacit knowledge in organizations. Journal of Intellectual Capital, 1(4), 357–365. https://doi.org/10.1108/14691930010359252

He, Z.-L., & Wong, P.-K. (2004). Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organization Science, 15(4), 481–494. https://doi.org/10.1287/orsc.1040.0078

Hernandez, E., & Guillén, M. F. (2018). What’s theoretically novel about emerging-market multinationals? Journal of International Business Studies, 49(1), 24–33. https://doi.org/10.1057/s41267-017-0131-7

Hlavac, M. (2018). stargazer (Version R package version 5.2.1) [Computer software]. https://CRAN.R-project.org/package=stargazer

Hobday, M. (1994). Export-led technology development in the four dragons: The case of electronics. Development and Change, 25(2), 333–361. https://doi.org/10.1111/j.1467-7660.1994.tb00518.x

Hobday, M. (1995). East Asian latecomer firms: Learning the technology of electronics. World Development, 23(7), 1171–1193. https://doi.org/10.1016/0305-750x(95)00035-b

Honjo, Y., & Kurihara, K. (2023). Target for campaign success: an empirical analysis of equity crowdfunding in Japan. The Journal of Technology Transfer. https://doi.org/10.1007/s10961-023-10010-4

Hubeaux, S., & Rufibach, K. SurvRegCensCov (Version R package version 1.4) [Computer software].

Hurmerinta, L., Nummela, N., & Paavilainen-Mäntymäki, E. (2015). Opening and closing doors: The role of language in international opportunity recognition and exploitation. International Business Review, 24(6), 1082–1094. https://doi.org/10.1016/j.ibusrev.2015.04.010

Hurmerinta-Peltomäki, L., & Nummela, N. (2006). Mixed methods in international business research: A value-added perspective. Management International Review, 46(4), 439–459. https://doi.org/10.1007/s11575-006-0100-z

Johnson, B., Lorenz, E., & Lundvall, B.-A. (2002). Why all this fuss about codified and tacit knowledge? Industrial and Corporate Change, 11(2), 245–262. https://doi.org/10.1093/icc/11.2.245

Kassambara, A., & Kosinski, M. (2018). survminer (Version R package survminer version 0.4.5) [Computer software]. https://CRAN.R-project.org/package=survminer

Kim, D., Cerigo, D. B., Jeong, H., & Youn, H. (2016). Technological novelty profile and invention’s future impact. EPJ Data Science, 5(1), 721. https://doi.org/10.1140/epjds/s13688-016-0069-1

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397. https://doi.org/10.1287/orsc.3.3.383

Komárek, A., Lesaffre, E., & Hilton, J. F. (2005). Accelerated failure time model for arbitrarily censored data with smoothed error distribution. Journal of Computational and Graphical Statistics, 14(3), 726–745. https://doi.org/10.1198/106186005X63734

Kuemmerle, W. (1999). Foreign direct investment in industrial research in the pharmaceutical and electronics industries—results from a survey of multinational firms. Research Policy, 28, 179–193.

Lattemann, C., Alon, I., & Zhang, W. (2020). Final Reflections: Connectivity, Innovation, Transformation, and Global Challenges. In W. Zhang, I. Alon, & C. Lattemann (Eds.), Palgrave Studies of Internationalization in Emerging Markets. Huawei Goes Global (pp. 365–372). Springer International Publishing. https://doi.org/10.1007/978-3-030-47579-6_16

Lee, K., Joo, S. H., & Oh, C. (2016). Catch-up strategy of an emerging firm in an emerging country: Analysing the case of Huawei vs. Ericsson with patent data. International Journal of Technology Management, 72(1/2/3), 19. DOI: https://doi.org/10.1504/IJTM.2016.10001555

Lee, E. S., Liu, W., & Yang, J. Y. (2023). Neither developed nor emerging: Dual paths for outward FDI and home country innovation in emerged market MNCs. International Business Review, 32(2), 101925. https://doi.org/10.1016/j.ibusrev.2021.101925

Lee, K., & Lim, C. (2001). Technological regimes, catching-up and leapfrogging: Findings from the Korean industries. Research Policy, 30(3), 459–483. https://doi.org/10.1016/S0048-7333(00)00088-3

Luo, Y., & Tung, R. L. (2007). International expansion of emerging market enterprises: A springboard perspective. Journal of International Business Studies, 38(4), 481–498. https://doi.org/10.1057/palgrave.jibs.8400275

Luo, Y., & Tung, R. L. (2018). A general theory of springboard MNEs. Journal of International Business Studies, 49(2), 129–152. https://doi.org/10.1057/s41267-017-0114-8

Lyles, M. A., Tsang, E. W., Li, S., Hong, J. F., Cooke, F. L., & Lu, J. W. (2022). Learning and innovation of Chinese firms along the paths of “Bring In” to “Go Global.” Journal of World Business, 57(5), 101362. https://doi.org/10.1016/j.jwb.2022.101362

Marino, A., Mudambi, R., Perri, A., & Scalera, V. G. (2020). Ties that bind: Ethnic inventors in multinational enterprises’ knowledge integration and exploitation. Research Policy, 49(9), 103956. https://doi.org/10.1016/j.respol.2020.103956

Mathews, J. A. (2002). Competitive advantages of the latecomer firm: A resource-based account of industrial catch-up strategies. Asia Pacific Journal of Management, 19, 467–488. https://doi.org/10.1023/A:1020586223665

Mathews, J. A. (2006). Dragon multinationals: New players in 21st century globalization. Asia Pacific Journal of Management, 23(1), 5–27. https://doi.org/10.1007/s10490-006-6113-0

Mewes, L., & Broekel, T. (2020). Technological complexity and economic growth of regions. Research Policy. Advance online publication. DOI: https://doi.org/10.1016/j.respol.2020.104156

Minbaeva, D. B. (2007). Knowledge transfer in multinational corporations. Management International Review, 47(4), 567–593. https://doi.org/10.1007/s11575-007-0030-4

Moore, D. F. (2016). Applied survival analysis using R. Springer International Publishing. https://doi.org/10.1007/978-3-319-31245-3

Mudambi, R. (2008). Location, control and innovation in knowledge-intensive industries. Journal of Economic Geography, 8(5), 699–725. https://doi.org/10.1093/jeg/lbn024

Munjal, S., Andersson, U., Pereira, V., & Budhwar, P. (2021). Exploring reverse knowledge transfer and asset augmentation strategy by developed country MNEs: Case study evidence from the Indian pharmaceutical industry. International Business Review, 30(6), 101882. https://doi.org/10.1016/j.ibusrev.2021.101882

Nair, S. R., Demirbag, M., & Mellahi, K. (2016). Reverse knowledge transfer in emerging market multinationals: The Indian context. International Business Review, 25(1), 152–164. https://doi.org/10.1016/j.ibusrev.2015.02.011

Poon, J. P., Hsu, J.-Y., & Jeongwook, S. (2006). The geography of learning and knowledge acquisition among Asian latecomers. Journal of Economic Geography, 6(4), 541–559. https://doi.org/10.1093/jeg/lbi021

Rammal, H. G., Rose, E. L., & Ferreira, J. J. (2023). Managing cross-border knowledge transfer for innovation: An introduction to the special issue. International Business Review, 32(2), 102098. https://doi.org/10.1016/j.ibusrev.2022.102098

Rivkin, J. W. (2000). Imitation of complex strategies. Management Science, 46(6), 824–844. https://doi.org/10.1287/mnsc.46.6.824.11940

Schaefer, K. J. (2020). Catching up by hiring: The case of Huawei. Journal of International Business Studies, 51, 1500–1515. https://doi.org/10.1057/s41267-019-00299-5

Schaefer, K. J., & Liefner, I. (2017). Offshore versus domestic: Can EM MNCs reach higher R&D quality abroad? Scientometrics, 113(3), 1349–1370. https://doi.org/10.1007/s11192-017-2533-5

Sorenson, O., Rivkin, J. W., & Fleming, L. (2006). Complexity, networks and knowledge flow. Research Policy, 35(7), 994–1017. https://doi.org/10.1016/j.respol.2006.05.002

Szulanski, G. (1996). Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strategic Management Journal, 17(S2), 27–43. https://doi.org/10.1002/smj.4250171105

Teece, D. J. (1977). Technology transfer by multinational firms: The resource cost of transferring technological know-how. The Economic Journal, 87(346), 242. https://doi.org/10.2307/2232084

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18, 509–533.

Therneau, T. M. (2015). A Package for Survival Analysis in S (Version R package survival version 2.44–1.1) [Computer software]. https://CRAN.R-project.org/package=survival

Tokatli, N. (2015). Single-firm case studies in economic geography: Some methodological reflections on the case of Zara. Journal of Economic Geography, 15(3), 631–647. https://doi.org/10.1093/jeg/lbu013

von Hippel, E. (1994). “Sticky Information” and the Locus of Problem Solving: Implications for Innovation. Management Science, 40(4), 429–439. https://doi.org/10.1287/mnsc.40.4.429

von Zedtwitz, M., & Gassmann, O. (2002). Market versus technology drive in R&D internationalization: Four different patterns of managing research and development. Research Policy, 31(4), 569–588.

Wang, F., Chen, J., Wang, Y., Lutao, N., & Vanhaverbeke, W. (2014). The effect of R&D novelty and openness decision on firms’ catch-up performance: Empirical evidence from China. Technovation, 34(1), 21–30. https://doi.org/10.1016/j.technovation.2013.09.005

Wasserstein, R. L., Schirm, A. L., & Lazar, N. A. (2019). Moving to a World Beyond “ p < 0.05”. The American Statistician, 73(sup1), 1–19. https://doi.org/10.1080/00031305.2019.1583913

Wickham, H., Averick, M., Bryan, J., Chang, W., McGowan, L., François, R., Grolemund, G., Hayes, A., Henry, L., Hester, J., Kuhn, M., & Pedersen, Miller, E., Bache, S., Müller, K., Ooms, J., Robinson, D., Seidel, D., Spinu, V., … Yutani, H., T. (2019). Welcome to the Tidyverse. Journal of Open Source Software, 4(43), 1686. https://doi.org/10.21105/joss.01686

WIPO. (2023). Statistics Database. https://www.wipo.int/en/ipfactsandfigures/patents

Yin, R. K. (2014). Case study research: Design and methods (5. edition). SAGE.

Acknowledgements

We acknowledge funding from the German Academic Exchange Service. We would like to thank Guido Bünstorf, Anne Otto and Kerstin Nolte for methodological feedback on the quantitative section of the paper. Moreover, we would like to thank Zoe Vercelli and Kerry Jago for proofreading. All remaining errors are our own.

Author information

Authors and Affiliations

Contributions

CRediT: Kerstin J. Schaefer: Conceptualization, Methodology, Software, Validation, Formal Analysis, Investigation, Resources, Funding Acquisition, Project administration, Data Curation, Visualization, Writing—Original Draft, Writing—Review & Editing. Stefan Hennemann: Conceptualization, Data Curation, Writing—Original Draft. Ingo Liefner: Conceptualization, Funding Acquisition, Writing – Original Draft.

Corresponding author

Ethics declarations

Competing Interests

The research leading to these results received funding from the German Academic Exchange Service under Grant Agreement No 91656142.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Guidelines for semi-structured interviews

1.1.1 Experts

Where did you work/study before?

Why did the company hire you?

What is your main task at Huawei? Is it different from tasks at your former employer?

1.1.2 Locations

Is there a difference in tasks between offshore and domestic locations?

1.1.3 Cooperation

Do you (regularly) work with colleagues from different locations at Huawei?

If yes: how closely do you work with Chinese expatriates at your location / offshore experts at other offshore locations / Chinese employees at locations in China?

1.1.4 Knowledge distribution

Do you share newly created technologies within the company? If yes: how?

Do people from other R&D locations contact you with questions/collaboration requests?

How much knowledge exchange usually takes place between different locations? (Tables 7, 8, 9, 10, 11, 12, 13, 14).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Schaefer, K.J., Hennemann, S. & Liefner, I. Give us ideas! Creating innovativeness through strategic direction of reverse technology transfers. J Technol Transf (2024). https://doi.org/10.1007/s10961-024-10092-8

Accepted:

Published:

DOI: https://doi.org/10.1007/s10961-024-10092-8

Keywords

- Global R&D organization

- Innovation capability

- Reverse technology transfers

- Chinese multinational

- Huawei Technologies