Abstract

Entrepreneurial ecosystems (EE) are particular systems of interdependent actors and relations that directly or indirectly support the creation and growth of new ventures. EE can vary a lot, based on a unique and dynamic combination of several elements whose relevance can differ across regions. Most studies acknowledged, or ex-ante assumed, that EE elements are all relevant to the same extent, yet others suggest that some EE elements are more important in creating the environmental conditions necessary to foster entrepreneurship in a specific territory. In this paper, we contend that research should provide evidence on this territory-specific matter. Specifically, more evidence is needed on the relevance of each EE element at regional level—as we lack empirical analysis that discriminates between EE types according to elements’ importance. To fill this gap, we assess and characterize the existence of EE types at the regional level in Italy. Our findings suggest that four EE types exist, and they are characterized by a balanced combination of EE elements. On the basis of our results, we generate propositions providing insights that may be useful for future research and policymaking.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This study conceptualizes and empirically investigates on the existence of two alternative entrepreneurial ecosystems’ (EE) configurations: “balanced” (i.e., EE with a balanced combination of EE elements) versus “polarized” EE (i.e., EE with one/or more dominant EE elements).

EE are a “set of interdependent actors and factors coordinated in such a way that they enable productive entrepreneurship within a particular territory” (Stam, 2015, p. 5). Leading political institutions and scholars are currently devoting a great deal of attention to understanding how to build a supportive environment for new ventures. The task is somewhat complex and suffers from high generalization limits. For instance, Isenberg (2010, p. 3), in his "stop emulating Silicon Valley", argued that it is impossible and wrong to try to re-create a "Silicon Valley" type of EE elsewhere. Part of the reason for this is that the emergence of such a specific EE has several (controllable and uncontrollable) elements, that is, a unique set of circumstances that make it hard for those who endeavour to imitate it. Isenberg (2010) also suggest to policymakers that for EE to grow and evolve each element is relevant and need to be reinforced. His position implicitly led several EE studies to assume that EE elements are all relevant to the same extent in creating the environmental conditions necessary to foster entrepreneurship in a specific territory (Leendertse et al., 2022; OECD, 2016; Stam, 2018; Stam & Van de Ven, 2021). Yet not all scholars agree with this. Some consider it an oversimplification which is not entirely adherent with reality. For instance, Corrente et al. (2019) provides a method that takes into account the variability of weights for each EE element in an objective way. Colombelli et al. (2019) shows how the evolving pathway of an EE can be characterized by a dominant element operating as an “anchor tenant” at local level. According to Charron et al. (2014), EE often struggle to develop in Europe, due to the heterogeneity of the EE elements across regions. In line with this perspective, different combination of EE elements will lead to different EE types (Kapturkiewicz, 2021). Therefore, identifying the “…typology of EE can become an important tool to diagnose why..” this happens, as pointed out by (Audretsch & Belitski, 2021).

Given the above arguments, we deem that research should provide data evidence on how different EE elements’ combination may lead to different EE typologies and related outcomes. EE are a local, territory-specific phenomenon (Cavallo et al., 2019; Colombelli et al., 2019; Gueguen et al., 2021; Stam, 2015), and considering all EE’s elements as equally relevant might be right or not depending on the specific regional context. Yet, the literature still lacks empirical evidence at local level (Leendertse et al., 2022). Empirical investigations are often conducted through a qualitative approach—whose results have generalizability issues (Alaassar et al., 2021; Cavallo et al., 2020; Hernández-Chea et al., 2021; Kapturkiewicz, 2021; Mack & Mayer, 2016; Spigel, 2017), with a few exceptions, all of which have leveraged on quantitative methods at a national level (Ács et al., 2014; Radosevic & Yoruk, 2013; Raza et al., 2020). Also leading institutions like the Global Economic Monitor (GEM) have devoted to the cause of measuring EE at national level. However, their efforts are difficult to scale down on a local level (Corrente et al., 2019).

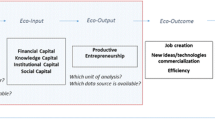

Therefore, following recent research calls (e.g., Audretsch & Belitski, 2021; Cavallo et al., 2019; Leendertse et al., 2022), we here provide the results of an empirical investigation conducted at regional level. We employed a sound measurement instrument for EE assessment, proposed by Stam (2015) and later further developed as a measurement model in Stam (2018) and Stam and Ven (2021) to assess and characterize the existence of different EE elements’ combination and EE types at the regional level in Italy.

Enhancing our knowledge on the existence of different EE elements’ combination and EE types at a regional level is important for at least two reasons. First, it is widely accepted, in the literature, that all the elements of EE are equally important in order to develop a productive EE (Ács et al., 2014; Isenberg, 2010). Although in principle, we agree with this argument, we deem that it is time to empirically test the relevance of each EE element in a regional context. Extant empirical investigations have ex-ante assumed (instead of proving) that all EE elements are equally important (e.g., Stam, 2018; Stam & Van de Ven, 2021). However, in practice, EE types may have some factors more dominant than others (“polarized” EE) and still be highly productive in the birth and growth of new ventures (Colombelli et al., 2019). More, there might be a case where polarized EE are the rule rather than the exception in specific regions, as it could be the opposite when the majority of EE present a balanced combination of EE elements (“balanced” EE). The fact is that we don’t really know it in general, as it can vary across regions at local level.

Second, previous studies have identified EE types by employing qualitative case studies (Kapturkiewicz, 2021; Spigel, 2017), or have focused on large geographical regions (NUTS1-2 level) (Bruns et al., 2017; Corrente et al., 2019). Although we agree on the need for a multileveled view on EE (Stam, 2015), a regional focus "across smaller geographical units" could be instrumental in advancing our understanding of EE (Bruns et al., 2017, p. 31). According to Feldman (2001), entrepreneurship is primarily a regional event. Relevant institutions, as well as the presence of universities and research institutes, cultures and skills, are regionally bounded (Andersson & Henrekson, 2015; Perugini, 2023).

Given these arguments, this paper addresses the following overarching questions: What types of EE elements’ combination and EE exist across regions? Are “balanced” EE more frequent than “polarized” EE or vice-versa at regional level?

In order to answer such research questions, the present analysis has focused on the identification of the framework and systemic conditions that characterize Italian NUTS 3 regions (Italian provinces), using the Italian provinces as the unit of analysis to identify and describe the ecosystems and to trace and measure them. More precisely, we perform a factor analysis and a cluster analysis on data collected for all of the 107 Italian provinces, in order to map the different EE types. The NUTS3 analysis level seems to be appropriate for several reasons. First, starting from the observation that ecosystems are geographically bounded, it is necessary to use a delimitation, such as a province, to analyze them. Second, the Italian territory is particularly heterogeneous, from a socio-economic point of view, and using a small unit of analysis, i.e., a province, could therefore reduce intra-regional differences (Bruns et al., 2017). Our results contribute to the EE’s debate by providing empirical evidence on the existence of four EE’ types, all of which presenting a balanced combination of EE’s elements.

The remainder of this paper is structured as it follows. In the next section, we position our paper in the literature. The methodological design of the article is presented in Sect. 3. Section 4 presents the results of the factor and cluster analysis. Finally, the final section sets out the conclusions and discusses the contributions of the study, as well as the implications for practice and policymaking.

2 Research background

Promoting entrepreneurship is considered a key activity for economic development (Audretsch et al., 2020; Shane & Venkataraman, 2000). Entrepreneurial agents are at the core of entrepreneurial action, but a favourable environment is (at least) equally relevant (Shane, 2003; Shane & Venkataraman, 2000). The concept of this conducive environment, defined ecosystem, has been derived from earlier works in the literature concerning science and technology parks (Saxenian, 1994), regional innovation systems and industrial districts (Becattini, 1979), all of which helped to lay the groundwork for the concept of a local context where entrepreneurs operate, i.e., an entrepreneurial ecosystem (EE). In recent years, a considerable body of entrepreneurship literature has focused on entrepreneurial ecosystems, starting from the seminal works by Isenberg (2010), Cohen (2006) and Feld (2012), which mainly focused on identifying the key actors and elements of EE. Isenberg formulates one of the earliest definitions of an ecosystem and what makes it up Isenberg (2010, 43) maintained that "The entrepreneurship ecosystem consists of a set of individual elements—such as leadership, culture, capital markets, and open-minded customers—that combine in complex ways." Later Feld (2012, p. 186) proposed a list of nine crucial attributes for a successful entrepreneurship ecosystem: leadership, intermediaries, network density, government, talent, support services, engagement, companies, and capital. Cohen (2006), for instance, explored how components of the informal and formal network, culture and physical infrastructure can contribute to a sustainable entrepreneurial ecosystem. Since the second half of the 2000s, the EE model consisting of 10 elements, proposed by Stam and later embraced by others (Leendertse et al., 2022; Spigel, 2017; Stam, 2015; Stam & Van de Ven, 2021), has been established. Also, recently, Raza et al. (2020) find evidence of the relevance of formal institution for entrepreneurial activity. Isenberg (2010) introduced the main dimensions of an entrepreneurial ecosystem and included relevant guidelines on how to start an "entrepreneurial revolution". The attention of scholars to this topic has contributed to the enrichment of the entrepreneurial ecosystem construct, which considers the characteristics of a context as a result of public and private decisions, and the interactions between institutions and the industrial network as the embodiment of the local ecosystems (Acs et al., 2018; Brown & Mason, 2014). The need to investigate this new construct arises from the limits of the regional innovation system, a recognized antecedent of EE. In fact, EE are known to differ from regional innovation systems, as regional innovation systems are embedded in specific industrial sectors, while ecosystems are not industry bounded nor technology specific. Like other forms of clusters investigated in regional development literature, EE are considered conducive environment for knowledge exchanges (and spillovers) among multiple agents (Jaffe, 1986; Audretsch & Belitski, 2021; Colombelli et al., 2019). Yet, EE feature distinctive types of knowledge spillover. Different constructs covered in the regional development and strategy literature, such as clusters, regional innovation systems or innovative mielius vary in terms of knowledge spillover nature, their directionality, and the mechanisms that facilitate such spillovers. For instance, considering an industry-specific cluster consisting in a regional agglomeration of firms organized along a value chain, vertical and voluntary knowledge spillovers in dyadic relationship user-producer are the dominant form of spillovers (Bathelt et al., 2004; Maskell, 2001). Conversely, EE are characterized by horizontal, voluntary knowledge spillovers among networked firms that “compete vertically against other incumbents that operate outside the cluster” (see for details Autio et al., 2018, p. 79). Moreover, EE are different from other types of ecosystems, such as the innovation ecosystem (Acs et al., 2023; Cavallo et al., 2019; Daymond et al., 2023). The main aim of an EE is new venture creation and growth, while it is the introduction of new technology and innovation in an innovation ecosystem (Berman et al., 2021; Huo et al., 2022). In particular, EE are generally focused on the creation of new ventures (Spigel & Harrison, 2018) in a cross-industry environment. In other words, and borrowing from Stam (2015, p. 5), EE are a “set of interdependent actors and factors coordinated in such a way that they enable productive entrepreneurship within a particular territory”. This definition has been widely accepted in literature because of its comprehensive nature (Acs et al., 2018; Cavallo et al., 2019) and specifically refers to innovative and growth-oriented entrepreneurship.

After the early development of EE literature, which was mostly focused on building a proper taxonomy of the field, research has flourished and taken valuable directions. Some scholars have investigated the digital-related aspect of EE, proposed new perspectives and stressed the role of digital technologies and infrastructure as well as affordances and the development of an EE (Autio et al., 2018; Bandera & Thomas, 2018; Elia et al., 2020; Sussan & Acs, 2017). Other scholars have focused on theory building by leveraging on extant theories taken from complex science (Roundy et al., 2018), or technology re-emergence (Roundy, 2021), intended as “the resurgence of substantive and sustained demand for a legacy technology following the introduction of a new dominant design” (Raffaelli, 2019, p. 576). Theory building in an early phase of development of a research field often warrants a qualitative case study. This is also the case of EE literature. Several works have focused on specific regions, including Silicon Valley (Kenney & Patton, 2005; Saxenian, 1994), Washington DC (Feldman, 2001) and Kyoto (Aoyama, 2009). Investigating EE as a whole can be rather challenging, given the complex and dynamic nature of EE when not bounded geographically. Indeed, as suggested by Cavallo et al. (2019), scholars have researched such sub-systems of EE as incubators (Bouslama, 2020; Hernández-Chea et al., 2021; Theodoraki et al., 2020; van Rijnsoever, 2020) or universities (Dameri & Demartini, 2019; Secundo et al., 2019) to reduce complexity and make their studies more feasible. Research has also provided quantitative investigation and measurement models for EE. Ács et al. (2014), for instance, used quantitative methods to analyze several strong entrepreneurial ecosystems at a national level. Liguori et al. (2019) proposed perceptual measures of entrepreneurial ecosystems. Cavallo et al. (2020) suggested an original approach for the assessment of EE based on extant theories and constructs, such as business models, and strategic and value networks. Yearworth (2010) leveraged system dynamics methods, while others made use of network analysis (Neumeyer et al., 2017). Stam & Van de Ven (2021) have recently proposed a comprehensive measurement model grounded on established EE contributions for quantitative investigations. A central assumption of their model is that all the elements of EE are equally important, and thus, have the same weight in the measurement instrument. In general, we agree with this assumption, which is based on the common—albeit theoretical—belief in EE research (e.g., Ács et al., 2014; Isenberg, 2010). Some studies challenge this mainstream view suggesting that different configurations with dominant EE elements may exist and lead to productive entrepreneurship (Corrente et al., 2019; Spigel, 2017). The debate is open and we deem it is relevant to allow the data to speak for themselves to reveal whether this theoretical assumption is correct and, if so, under what circumstances. In fact, it may be possible to find evidence of balanced EE types or unbalanced/polarized EE types at a local level, where some EE elements are more dominant than others (Bruns et al., 2017). EE literature still lacks empirical studies in this direction at regional level (Leendertse et al., 2022).

Therefore, we answer such a recent research call by empirically assessing and characterizing the existence of different entrepreneurial ecosystem (EE) types at a regional level, an aspect which could yield important implications for entrepreneurs, their stakeholders, and their ventures.

3 Methodology

3.1 Italian case study

As specified in the previous sections, our aim has been to identify different types of EE through the measurement of all the elements derived from the literature review. Italy is an interesting case study for understanding how different elements that characterize the entrepreneurial ecosystem coexist and work together to ensure entrepreneurial and local development. This nation has numerous small and medium-sized cities, a limited number of large cities, connected industrial regions, and clusters centered on medium- and high-tech industries (Lazzeroni & Piccaluga, 2015). A significant part of the Italian economy is based on locally born and grown industries with their own characteristics (Camuffo & Grandinetti, 2011; Grimaldi et al., 2021). In this context of territorial distinctiveness, regional inequality persists even after various public policies have sought to reduce per capita income differentials between different areas of the country. The study of entrepreneurial ecosystems concerns areas with characteristics that ensure the interconnections that develop and promote entrepreneurial activity. Our intent is to test the hypothesis of the existence of different patterns of ecosystems characterized by elements with different intensities and capable of stimulating entrepreneurship. The Italian case lends itself well to this study, and the methodology applied ensures its replicability. For this reason, the unit of analysis for this study was the NUTS 3 geographic area. The NUTS classification (Nomenclature of Territorial Units for Statistics) is a hierarchical system used to subdivide the economic territory of the EU. According to this nomenclature, EU countries are divided into geographical units at three levels of aggregation: NUTS 1, large socio-economic regions; NUTS 2, basic regions for the application of regional policies; NUTS 3, small regions for specific diagnoses. In Italy, NUTS 3 regions correspond to administrative units (provinces) that group several neighboring municipalities. This administrative unit generally includes a city and its satellite municipalities. A NUTS 3 geographic area is characterized by the presence of frequent economic interactions. For example, almost every Italian NUTS 3 region has a Chamber of Commerce and a labor association. For this reason, this unit of analysis in this country was considered the most appropriate to define the regional boundary of business activities.

Considering the effect of Law Decree,Footnote 1 approved by the Italian Ministry of Economic Development at the end of 2012, on the creation and development of innovative startups, we considered that year as the starting point of our period of analysis and the innovative startups registered at Chamber of Commerce as a sample.

Figure 1Footnote 2 shows the concentration of enterprises throughout the national territory. The value of the indicators was obtained considering the number of active enterprises registered in each province and registered in the Italian business register between the years 2012 and 2016, weighted on the total number of enterprises at a national level and then considering the average number. Excluding the main provinces of Rome, Naples, Milan and Turin, where the values are visibly higher than the others, it can be seen that the provinces belonging to the northern area of the country present the highest values of active enterprises and are evenly spread throughout the area.

In order to better understand the entrepreneurial environment, Fig. 2 shows the geographical distribution of the innovative startups across the Italian NUTS3 regions. Considering the new legislation on startups, which came into force in Italy at the end of 2012, we decided to consider startups (innovative) registered at the Chamber of Commerce from 2013. The indicator shows the average number of startups registered in a time horizon of 5 years, that is, from 2013 to 2018, weighting on the total number of startups at a national level. The most intensive entrepreneurial activities are found in the areas of Milan, Rome and Turin. As far as the other provinces are concerned, what is evident is a rather homogeneous distribution of the number of startups throughout the country, which is far removed from the territorial polarization that can be seen for businesses (see Fig. 1).

3.2 Data

The research methodology adopted in this paper mainly follows an empirical approach. Specifically, we collected several data to construct an original database that could be used to run our empirical analysis, which was then followed by a qualitative analysis to identify the different EE types. In order to identify the boundaries of entrepreneurial clusters, it is necessary to define a unit of analysis, and in this work the considered unit is the NUTS3 geographical area. The NUTS classification (Nomenclature of Territorial Units used for Statistics) is a geographical classification that is used to subdivide the economic territories of the European Union (EU) into regions at three different levels (NUTS 1, 2 and 3). According to this classification, Europe is divided into geographical units, and the smallest level of aggregation is NUTS3, which, in Italy, corresponds to "province" administrative units and usually includes the main city in the area and similar neighbouring municipalities grouped together. The economic interactions and the social homogeneity of the NUTS3 area make it the most appropriate starting point to define the boundaries of ecosystems.

The entire analysis was carried out using an original, ad hoc created database, in which information from different sources: ISTAT,Footnote 3 Eurostat, the Company Register of the Italian Chamber of Commerce, the European Patent Office and ETER,Footnote 4 was combined. The data were all collected for the 107 Italian NUTS3 regions, for the years between 2012 and 2016, except for the data about patent applications, which instead refer to the period between 2008 and 2012. The variation in the total number of provinces, from 110 to 107 in 2016, due to the new law decree, has been managed by considering the suppressed provinces as already being part of the new “South Sardinia”.Footnote 5

In order to run the factor analysis, the data were all cross actioned to a single year, considering the mean value, and were then normalized (between 0 and 1).

Unfortunately, not all the necessary data were available for each variable and for each region, and the sample was therefore reduced to 73 provinces. The 34 excluded regions had an impact on the total gross domestic product population and number of startups, of 15%, 17% and 9%, respectively. For this reason, we decided to proceed with the analysis of the other 73 NUTS3 regions. The data analysis consisted of three stages, the first of which was the factor analysis, which was used to group the selected variables into macro-dimensions; we ran the factor analysis for the Demand, Entrepreneurial Culture, Institutions, Infrastructure, Human Capital and New Knowledge factors. The Finance, Leadership and Support factors were composed of a single indicator. The Innovation factor was excluded from the cluster analysis, as later explained.

3.3 Elements

As constituting elements of EE, we considered a widely recognized framework of 10 elements originally proposed in Stam (2015) and later further developed as a measurement model in Stam (2018) and Stam & Van de Ven (2021). By using such framework, it is possible to map and measure all the characteristics needed for an entrepreneurial ecosystem to be performing. We adopted the Stam’s framework (2015), as it builds on previous academic studies that already for years have debated on how to conceptualize EE and what are the constituting elements of EE (since Isenberg, 2010). In particular, it integrates and provides a synthesis of previous reference models (e.g., World Economic Forum, 2013; Feld, 2012) suggesting to include, for a more comprehensive overview, both system conditions and framework conditions. Following we present in detail the ten elements identified and the indicators used to measure them.

3.3.1 Demand

The presence of demand is an important element of the entrepreneurial ecosystem. Income and purchasing power in a region are both a cause and an effect of entrepreneurship in a region (Berkowitz & DeJong, 2005). At the same time, multiculturalism also signals cultural enrichment, growing and heterogeneous demand.

We measured this factor as being composed of market demand and disposable income. We expressed market demand as the size of the population, the share of foreign resident citizens and the number of employed workers. We used the GDP and annual average remuneration to describe disposable income. We used Eurostat and ISTAT as data sources.

3.3.2 Entrepreneurial culture

Entrepreneurial culture can be described as the extent to which entrepreneurship is present and stimulated in a society (Fritsch & Wyrwich, 2014). The local context can have a substantial effect on entrepreneurship, both in terms of businesses already in the area and in terms of potential new entrepreneurs.

We measured the value of entrepreneurship at a society level (Minola et al., 2019) using the rate of new venture creation to the number of actual active companies registered in the Registro Imprese (Register of Companies), as well as the rate of self-employment and the Percentage of the population between 20 and 39 years old to the total population in the province (taken from ISTAT), as we expected that individuals in this age group would have a higher propensity to entrepreneurship (Kerr & Glaeser, 2009).

3.3.3 Formal institutions

Formal institutions play a key role in fostering the emergence of enterprises and their survival (Estrin et al., 2013; Fard, 2020).

We considered this indicator as a measure of the Government’s and political support to entrepreneurs and citizens in general (Belitski et al., 2021). We collected data about five main groups of activity to investigate the main public services: Health, Safety, Politics & Governmental bodies, Public Services, and Education.

Health included an indicator on the rate of mortality and the number of private and public hospitals in the province.

Safety and corruption, indicates the level of safety and corruption in the NUTS3 regions. Several works estimate the effect of corruption, showing significant correlation between corruption and economic growth in Italian regions (NUTS2 level) (Fiorino et al., 2012; Pinotti, 2015).

To attempt a more granular investigation, in terms of local coverage, other works have studied how the presence of illegal phenomena influences the allocation of resources in the economy. Specifically, by studying the relationship between local crime rates and the availability of credit. The results suggest that crime not only directly affects economic activity, but also but negatively affects investment by distorting the allocation of credit (Bonaccorsi di Patti, 2009).

Corruption also has an effect on entrepreneurship, but to different degrees depending on the firm. In fact, it has been shown that the effect is greater on established entrepreneurs, while nascent entrepreneurs (start-uppers) are less likely to be targeted by corruption (Goel & Nelson, 2021; Goel & Saunoris, 2019). All these works demonstrate the existence of a widespread phenomenon, in a more or less heterogeneous manner, in Italy, as in other countries. Since there are therefore different dynamics and different intensities that lead to corruption, we also expect that this impact differently on entrepreneurship. By measuring different ecosystems at the provincial level, we expect these corruption phenomena to impact differently depending on their intensity and thus contribute to characterizing different ecosystem models within the national territory. We introduced at NUTS3 level a proxies for criminality and corruption, (the rate number of thefts, robberies, pickpocketing and homicides) andin terms of city life and public order we included traffic safety, road mortality and the road accident rate.

Politics & Governmental bodies referred to the participation of the population during elections and the number of women employed in municipal administration activities, but these variables were excluded from the analysis.

The Public services indicator collected services that were useful for the citizens in the area: the density of cycle paths and pedestrian areas, social services, the pollution level, the quantity of municipal waste (recycling and not), and the motorization rate. We took the data about Health, Safety, Politics & Governmental bodies, and Public Services from ISTAT.

We built an indicator of the education level to obtain a measure of the educational support given to citizens (Hahn et al., 2020), which expresses the number of public and private institutes at all levels, from kindergarten (from ISTAT) to university (data taken from MIUR), and the number of employed full professors in each NUTS3 region, as taken from the ETER database.

3.3.4 Physical infrastructure

Therefore, the availability and quality of traditional and alternative transportation also play a role in the growth of an entrepreneurial ecosystem in a geographic location (Cohen, 2006).

The presence of physical infrastructure has a positive effect on knowledge exchange and entrepreneurship. Entrepreneurs often have the choice to start their businesses where they prefer, often choosing to locate in strategic locations that are easily accessible or have good quality transportation. Therefore, the availability and quality of traditional and alternative transportation also play a role in the growth of an entrepreneurial ecosystem in a geographic location (Cohen, 2006).

Easy access to physical resources and well-connected region is essential to foster communication and innovation (Yan & Guan, 2019). The physical infrastructure factor was used to obtain a numerical idea of transport intensity in terms of passengers and infrastructure concentration. We measured the accessibility and use of infrastructure such as air transport, taking into account the movements and number of passenger flights, the presence of metro lines, the density of bus systems and the annual number of passengers on public transport. The data were taken from ISTAT.

3.3.5 Human capital

Human capital refers to the intangible value that resides in the people competencies (Secundo et al., 2017). We considered the number of individuals with higher education levels (i.e., from bachelor to Ph.D.) as a proxy of available talent in a specific area (NUTS3 regions). We considered the mobility of Italian graduates (25–39 years) within NUTS3 as an indicator of the local attractivity for young talent and the number of graduate students in the ISCEDFootnote 6 classification at the ISCED6, ISCED7 and ISCED8 levels, as taken from ETER.

Several studies show that education significantly increases the probability of entrepreneurship for both male and female graduates (Iyortsuun et al., 2021; Rosti & Chelli, 2009). The phenomenon of gender entrepreneurship is also considered in the studies proposed by The AlmaLaurea Inter-University Consortium, the AlmaLaurea database collects around 90 per cent of information on graduates in Italy. These studies aim to provide an in-depth analysis of students and graduates’ entrepreneurship in Italy, showing that among graduate firm founders, men account for 53.9% and women for 46.1% of the total. In Italy female entrepreneurship is relatively low (22%) compared to the rest of European countries, but this figure changes if we consider graduates, the measure we use in our analysis. The AlmaLaurea survey, in fact, claims that graduates do business equally, with little difference in terms of gender, so that the phenomenon can be measured without the bias of the gender gap by using an aggregated measure.

3.3.6 Innovation

Innovation is a fundamental pillar of new firm creation creation and economic growth (Audretsch et al., 2020; Roche et al., 2020), and one of the widely used proxies for measuring innovation in an area is the number of patents filed in that area (Colombelli et al., 2021). Through patent intensity and patent collaborations, we measure both the level of innovation in a given area and also the number of collaborations between different inventors, following the knowledge spillover theory (Audretsch & Feldman, 1996; Colombelli, 2016; Jaffe, 1986). In fact, through those variables we take into account the mechanisms of knowledge exchange and creation of new ideas, facilitated by informal collaboration processes.

We considered the patent applications (i.e. the demand for patents), the patent intensity, as calculated from the patent releases and co-patenting information, and the number of co-assigned patents. (The authors’ elaboration of REGPATFootnote 7). While we acknowledge that relying solely on the number of patents as a measure of innovation has its limitations and may not encompass all aspects, we recognize its prevalence in existing research (Acs & Audretsch, 1989; Caviggioli et al., 2023; Pavitt, 1985). Therefore, we decided to utilize it as an approximation for innovation when evaluating the entrepreneurial ecosystem.

3.3.7 New knowledge

Our intention was to measure this dimension from a technological point of view, considering the IPC.Footnote 8 Classification of the technology level between 1 and 4, that is, from low to high technology, and we assigned 0 when technology was absent.

We collected the number of patents for five categories: no tech, low tech, low-medium tech, medium–high tech and high tech, used as a proxy of the level of new technological knowledge produced in a region (The authors' elaboration of REGPAT).

3.3.8 Finance

The accessibility of finance for startups and small firms is probably the main condition that can guarantee their growth and even their creation, and easy access to finance can provide incentives for entrepreneurial activities (Wiklund & Shepherd, 2005). We used the ISTAT “Funding risk” indicator, considered as the percentage of firms that have applied for bank loans and also received this, with reference to the Capital market and corporate finance fields.

3.3.9 Leadership

The development of an entrepreneurial culture requires the presence of mentors and successful entrepreneurs, but also actors with marked research leadership and managerial responsibilities. In order to provide guidance and direction for collective action, we measured leadership as the presence of innovation project leaders and participants in a region; we considered the province of the leaders and participants to establish the number of projects in each NUTS3. (The authors’ elaboration of REGPAT).

3.3.10 Support

The presence of local incubators and accelerators plays an important role in supplying and supporting the development of innovation and the creation of new startups (Sansone et al., 2020; Theodoraki et al., 2020). Using the number of certified incubators collected in the Registro Imprese, we created the Support indicator to map the presence of this kind of support throughout the Italian territory.

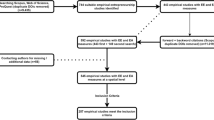

3.4 Methodology: factor and cluster analysis

As previously mentioned, the data analysis consisted of three stages. We performed a confirmatory factor analysis as the first step to establish which of the selected variables were best able to describe the factors that compose EE, as theorized by Stam (2015, 2018). As the variables were related to the factor, we adopted the approach to run a factor analysis on the selected variables for each of the ten factors. We elaborated the variables into a factor by computing the weighted averages, where the weights were the scoring coefficient of the factor extracted from the factor analysis. In this way, the most closely related items had a greater weight on the definition of the factors. We used an internal-consistency method, the Cronbach coefficient test, to check the reliability of the items grouped together and to test the ability of the analysis to measure the same construct (Forza, 2002).

The second step of the analysis involved searching for patterns across the NUTS3 classification; we employed a two-step cluster analysis, that is, hierarchical clustering and k-means, to position each province along the spectrum of factors and to elaborate the taxonomy of the different types of activities performed by the provinces in their ecosystems. We used hierarchical clustering, and Ward’s method in particular, to determine the number of clusters. Thanks to this method, it was possible to draw dendrograms and to apply Calinski stopping rules, which resulted in six clusters being established.

The third stage involved confirming the quantitative results of the prior stages through a qualitative approach, and this resulted in the different EE types.

This research design enabled us to use the quantitative findings related to the variables and elements to identify entrepreneurial ecosystems and EE types, which we then had to further validate and to identify the entrepreneurial best practices of the universities.

4 Results

We carried out a correlation analysis on the variables related to each of the hypothesized ten factors to run the cluster analysis. As “Appendix 1 to 7” show, the correlations among the variables are high for each group. The Finance, Leadership and Support factors are described by a small number of variables, and for this reason, we excluded them from the factor analysis and considered them as three stand-alone factors, each composed of its own variable, except for finance, for which we used the average of the variables. In the subsequent analysis, we referred to Finance, Leadership and Support as Factor 8, Factor 9 and Factor 10, respectively. The first iteration revealed high factor loadings for all the variables of the seven factors, except for Factor 1 and Factor 3 (see “Appendix 8”). A second iteration was necessary for these two factors in which any variables with a factor loading of less than 0.300 were removed, as shown in “Appendix 9”.

We used Cronbach’s alpha (α), to check the reliability of the analysis, on the obtained factors and obtained acceptable values (higher than 0.6) for all of the seven extracted factors, according to Nunnally (1978) and Taber (2016), as shown in Table 1.

The value of the KMO Measure of Sampling Adequacy was adequate for most of the factors (see Table 1), except for Factor 6, which had a value of less than 0.5; the larger KMO is, the more suitable the sampling for factor analysis, and for this reason, Factor 6 was excluded from the subsequent analysis.

The two-step cluster analysis involved all of the six factors obtained from the factor analysis and the three variables considered as factors per se (Fig. 3). The analysis revealed the presence of five different clusters, involving 73 provinces for a heterogeneous number of observations (“Appendix 10”).

The provinces involved in the analysis are shown in “Appendix 11”.

4.1 The EE types

In order to characterize the obtained clusters and to define different entrepreneurial ecosystem types, we divided the five obtained clusters into seven different categories, which were divided equally in terms of the value of the performances (see Table 2) of the factors in Table 3.

Moreover, we collected the average number of innovative startups founded between 2012 and 2016 for each province as a measure of the entrepreneurial output. Table 4, which considers the 5 obtained clusters and the provinces excluded from the cluster analysis, shows the average number of startups found for each cluster and the variance value.

In order to identify and characterize the emergence of different EE types, it is necessary to look at the combinations of cluster performance in terms of input factors, as well as the related entrepreneurial output. In this regard, Table 4, which is based on Tables 2 and 3, provides a comprehensive overview. We now describe each of the EE types, which differ from each other in terms of input and output performances, in greater detail (Table 5).

As Table 4 shows, it is possible to identify and characterize four main types of EE. Cluster 5 represents a strong EE model, in terms of both input and output, and it is followed by Cluster 1, which can be considered a medium–high EE model, and Cluster 2, which is a medium–low EE model. Finally, Clusters 3 and 4 present low performances in both input and output.

No particular polarization emerges for such EE types around a specific factor or a set of EE factors. They all appear balanced, in terms of input performance and, consistently, the EE types that score higher in input performance also show greater performances in terms of new venture creation. It is worth highlighting that we found evidence of an intra-cluster variance in terms of entrepreneurial output, which means that provinces belonging to the same cluster and with similar input scores may generate different entrepreneurial output performances. We discuss the implications of such evidence in the next section.

5 Discussion and conclusion

In this paper, we argue that different types of EE may exist and should emerge from the considered data as empirical evidence. Research is needed to empirically test the relevance of each EE element that may generate different types of EE together with input and output performances at a regional level to advance our current knowledge on EE. Finding evidence could confirm or disprove the mainstream view in EE research concerning the same relevance of each input factor in developing a productive EE.

Our study reveals evidence of the existence of four main EE cluster models (EE types). The interesting aspect of such evidence is that no “polarized” EE type emerges, where one or more elements are dominant (i.e., a higher score than the other factors). The EE cluster types are instead balanced, which means that, for instance, a strong EE (such as Cluster 7) shows high scores for each EE element. Several EE scholars have in fact suggested that all the elements of an EE are important (e.g., Isenberg, 2010; Raza et al., 2020; Stam, 2015), often assuming ex-ante same weights for such elements in EE development (Stam & Van de Ven, 2021). Yet, no empirical confirmation exists in this regard. Empirical confirmation is often undervalued in research while being at the basis of the very scientific approach. In practice and in a territory-specific environment, there might (or might not) be one or more dominant factor/s that can trigger the birth and growth of new ventures. Some scholars shows that some peculiar configuration may exist with dominant elements (Muñoz et al., 2022; Spigel, 2017). Corrente et al., 2019 uses a quantitative approach focusing on national level with a focus on Europe. Spigel (2017) uses a qualitative approach when suggesting that different configurations may exist. Bruns et al. (2017) and Audretsch and Belitski (2021) emphasized the need to identify the typologies of EE as a way of diagnosing why EE develop in some regions and not in others. However, both types of studies suffer from certain limits. Bruns et al. (2017) focused on larger regions at a NUTS1-2 level and explicitly highlighted that choosing large regions is a limit as EE can vary across smaller geographical units (e.g. NUTS 3), while Audretsch and Belitski (2021) have theoretically hypothesized the existence of four different types of EE (i.e., Global EE, Specialized creative EE, Specialized manufacturing EE and Regional EE). Our empirical results extend the extant knowledge on this topic by conducting an empirical assessment of the existence of different types of EE, with a balanced combination of EE elements, focusing on smaller geographical units (NUTS 3) as few studies have done so far.

Our findings suggest that the types of EE that have stronger input factors also show greater performances in EE output. This finding is not surprising per se, but advancing empirical knowledge is equivalent to advancing our overall awareness of EE-related aspects, which at present are considered too simplistic.

Moreover, this study adds nuance to the existing literature on knowledge spillover theory (Audretsch & Feldman, 1996; Jaffe, 1986) and substantiates the significance of local knowledge heterogeneity. It supports the notion that the recombinant knowledge hypothesis holds true, wherein knowledge is generated through the fusion of diverse sources found within specific local contexts.

Overall, we suggest that research on EE types should not stop here. Our empirical evidence is regionally bounded, in line with the widely accepted attribute of EE as being territory-specific (Cavallo et al., 2019; Dameri & Demartini, 2019). However, what is true for the Italian context might not be true for other contexts. Moreover, although we leveraged Stam (2018) and Stam & Van de Ven (2021), different measurement models are available in the literature (see, for example, Liguori et al., 2019, for an alternative method). However, researchers have not yet found a dominant model. All the models appear to have equal research dignity, strengths and weaknesses, as recognized by the previously mentioned authors (Liguori et al., 2019; Stam & Van de Ven, 2021). Therefore, we encourage scholars to adopt different measurement models and possibly explore new ones to enrich the field with empirical evidence. Most of the research on the different types of EE has adopted a qualitative approach (Kapturkiewicz, 2021; Spigel, 2017). In line with Leendertse et al., (2022), we contend that there is still a need for more quantitative studies to obtain a comprehensive understanding of EE in different regional contexts. At a practical level, our results seem to support the view that policymakers in EE should act in parallel on several constituting elements in order to generate and reinforce a virtuous cycle that would lead to the new firm formation (Isenberg, 2010; Stam, 2015; Cavallo et al., 2019).

Another implication of having identified different EE types with a balanced combination of EE elements pertains to the interdependent nature of EE (Stam, 2015). A balanced ecosystem can be expected when a complex and dynamic system is considered (Simon, 1962; Sterman, 2001), such as that of EE (Cavallo et al., 2019; Roundy et al., 2018). The fact that we have not found any polarized EE—where one factor or a set of factors is prevalent over others—adds empirical support to the argument of interdependence that characterizes EE elements. This result is in line with the recent empirical work of Leendertse and colleagues (2022). However, as the literature on complex systems suggests, the creation of any ecosystem starts with triggering actions on specific trigger points/elements, which in turn enable a re-enforcing cycle on other elements of the system and contribute to the overall development of the system (Roundy et al., 2018; Sterman, 2001). This matter was beyond the scope of the present study, but we suggest that investigating the evolutive dynamics of an EE is a potentially relevant avenue for advancing EE research. Cross-section studies help to provide a snapshot of EE, but do not capture the dynamics of a system. Leendertse et al. (2022), using a principal component and network analysis, have made a first attempt to find whether there is a sub-set of EE elements that play a more central role in EE. Nevertheless, more empirical investigations are needed to further explore the evolutive dynamics of EE, due to the relevance of both theory and practice. From a policymakers’ perspective, since public resources are often limited, acting in support of all an EE’s elements may result be hard to accomplish. Conversely, identifying fewer trigger points may help guide policymakers in making an accurate decision. Finally, a further implication has emerged from the cross-comparing of the clusters through an intra-cluster analysis. The intra-cluster analysis suggests that NUTS3 regions (or provinces) belonging to the same EE cluster model, and thus with similar combinations of balanced EE elements, may differ in terms of entrepreneurial output, and such a variance is more marked for stronger EE. This evidence may suggest that there are certain determinant factors of productive entrepreneurship that have escaped the extant measurement models and established frameworks. This is not an invitation to start another redundant race to develop new representative frameworks and the related measurement models. We instead suggest that not all the external conditions have been analyzed sufficiently. Recent theoretical developments in entrepreneurship (Davidsson, 2015; von Briel et al., 2018), together with the pandemic, have pointed out how new technologies, regulatory changes, demographic trends, and changes in the sociocultural, macroeconomic, political, and natural environment enable the creation of new ventures (Davidsson, 2015). The question remains: Is it possible to capture such change dynamics, which may be different and make the difference in entrepreneurial output at a local level? The possibility of capturing these complex socio-technical interactions in a quantitative analysis may be unrealistic. Therefore, we suggest that a qualitative case study might be a suitable research method to better understand the underlining reasons of intra-cluster variation at a regional level. Extending the knowledge on such a topic is relevant for all the stakeholders of an EE, for the managers, entrepreneurs, venture capitalists, business angels, and policy-makers, as it would help increase their awareness of the local development of entrepreneurship.

In conclusion, given the findings and the above proposed arguments, we advance the following proposition:

Proposition 1

Four main EE types exist, and they have a balanced combination of EE elements that are highly interdependent on each other.

Proposition 2

(Inter-EE cluster analysis): Only the balanced EE Clusters that perform better for all the entrepreneurial input factors perform better for the entrepreneurial output factors.

Proposition 3

(Intra-EE cluster analysis). Provinces belonging to the same EE Cluster model may have different entrepreneurial outputs, and the variance is higher in stronger EE Cluster models, that is, those that perform better in all the entrepreneurial factor models.

Our propositions should not be considered as "endpoints” and are instead provided to stimulate further research and to encourage researchers to challenge such propositions. Our research specifically targeted Italy as it possesses distinct characteristics that make it an ideal subject for examining diverse entrepreneurial ecosystem patterns, as outlined earlier in the text. As a further development, it would be valuable to expand the study to countries that share similar structures and characteristics. Such an extension could potentially reinforce our propositions, although the outcomes may vary. Additionally, it would be beneficial to test the methodology and propositions by considering countries that differ structurally from Italy, such as those with a lower number of SMEs and larger corporations, or with less regional heterogeneity.

Notes

“Further urgent measures for Italy's economic growth''.

All figures were created using Tableau software.

The Italian National Institute of Statistics.

Law no. 2 of 4 February 2016 pertaining to the Sardinia Region and the subsequent resolution of Regional Council law no. 23/5 of 20 April 2016 approved the setting up of new regional territorial planning authorities, whereby the provinces of Carbonia-Iglesias, Medio Campidano, Ogliastra and Olbia-Tempio were abolished, the new South Sardinia province and the metropolitan city of Cagliari were established, and the provinces of Sassari, Nuoro and Oristano were modified, thus returning them to the situation prior to Regional Law no. 9/2001. With reference to all the official statistical surveys, the statistical codes of the administrative units became valid on 1 January 2017 and are adapted according to the new territorial structures in force.

International Standard Classification of Education.

The OECD REGPAT database.

International Patent Classification.

References

Acs, Z. J., & Audretsch, D. B. (1989). Patents as a measure of innovative activity. Kyklos, 42(2), 171–180.

Ács, Z. J., Autio, E., & Szerb, L. (2014). National Systems of Entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476–494. https://doi.org/10.1016/j.respol.2013.08.016

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Business Economics, 51(2), 501–514. https://doi.org/10.1007/s11187-018-0013-9

Acs, Z. J., Lafuente, E., & Szerb, L. (2023). The entrepreneurial ecosystem: A global perspective. Springer.

Alaassar, A., Mention, A. L., & Aas, T. H. (2021). Ecosystem dynamics: Exploring the interplay within fintech entrepreneurial ecosystems. Small Business Economics, 58(4), 2157–2182.

Andersson, M., & Henrekson, M. (2015). Local competitiveness fostered through local institutions for entrepreneurship. In The Oxford handbook of local competitiveness (pp. 145–190).

Aoyama, Y. (2009). Entrepreneurship and regional culture: The case of Hamamatsu and Kyoto. Japan. Regional Studies, 43(3), 495–512.

Audretsch, D. B., & Belitski, M. (2021). Towards an entrepreneurial ecosystem typology for regional economic development: The role of creative class and entrepreneurship. Regional Studies, 55(4), 735–756.

Audretsch, D. B., Colombelli, A., Grilli, L., Minola, T., & Rasmussen, E. (2020). Innovative start-ups and policy initiatives. Research Policy, 49, 104027. https://doi.org/10.1016/j.respol.2020.104027

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. The American Economic Review, 86(3), 630–640.

Autio, E., Nambisan, S., Thomas, L. D. W., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95. https://doi.org/10.1002/sej.1266

Bandera, C., & Thomas, E. (2018). The role of innovation ecosystems and social capital in startup survival. IEEE Transactions on Engineering Management, 66(4), 542–551.

Bathelt, H., Malmberg, A., & Maskell, P. (2004). Clusters and knowledge: Local buzz, global pipelines and theprocess of knowledge creation. Progress in Human Geography, 28(1), 31–56.

Becattini, G. (1979). Dal settore industriale al distretto industriale. Alcune considerazioni sull’unità di indagine dell’economia industriale. Il Mulino.

Belitski, M., Grigore, A.-M., & Bratu, A. (2021). Political entrepreneurship: Entrepreneurship ecosystem perspective. International Entrepreneurship and Management Journal, 17(4), 1973–2004. https://doi.org/10.1007/s11365-021-00750-w

Berkowitz, D., & DeJong, D. N. (2005). Entrepreneurship and post-socialist growth. Oxford Bulletin of Economics and Statistics, 67(1), 25–46.

Berman, A., Cano-Kollmann, M., & Mudambi, R. (2021). Innovation and entrepreneurial ecosystems: fintech in the financial services industry. Review of Managerial Science, 1–20.

Bonaccorsi di Patti, E. (2009). Weak institutions and credit availability: The impact of crime on bank loans. Bank of Italy Occasional Paper, 52.

Bouslama, S. (2020). Join Edmonton Global at World Summit AI. Edmonton Global. https://edmontonglobal.ca/join-edmonton-global-at-the-world-summit-ai/

Brown, R., & Mason, C. (2014). Entrepreneurial ecosystems and growth oriented entrepreneurship. 72(11–12), 421–428

Bruns, K., Bosma, N., Sanders, M., & Schramm, M. (2017). Searching for the existence of entrepreneurial ecosystems: A regional cross-section growth regression approach. Small Business Economics, 49(1), 31–54. https://doi.org/10.1007/s11187-017-9866-6

Cavallo, A., Ghezzi, A., Colombelli, A., & Casali, G. L. (2020). Agglomeration dynamics of innovative start-ups in Italy beyond the industrial district era Content courtesy of Springer Nature, terms of use apply. Rights reserved. Content courtesy of Springer Nature, terms of use apply . Rights reserved . 239–262.

Camuffo, A., & Grandinetti, R. (2011). Italian industrial districts as cognitive systems: are they still reproducible? Entrepreneurship & Regional Development, 23(9–10), 815–852.

Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: Present debates and future directions. International Entrepreneurship and Management Journal, 15(4), 1291–1321.

Caviggioli, F., Colombelli, A., De Marco, A., Scellato, G., & Ughetto, E. (2023). The impact of university patenting on the technological specialization of European regions: A technology-level analysis. Technological Forecasting and Social Change, 188, 122216. https://doi.org/10.1016/j.techfore.2022.122216

Charron, N., Dijkstra, L., & Lapuente, V. (2014). Regional governance matters: Quality of government within European Union member states. Regional studies, 48(1), 68–90.

Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1–14. https://doi.org/10.1002/bse.428

Colombelli, A. (2016). The impact of local knowledge bases on the creation of innovative start-ups in Italy. Small Business Economics, 47(2), 383–396. https://doi.org/10.1007/s11187-016-9722-0

Colombelli, A., De Marco, A., Paolucci, E., Ricci, R., & Scellato, G. (2021). University technology transfer and the evolution of regional specialization: The case of Turin. Journal of Technology Transfer, 46(4), 933–960. https://doi.org/10.1007/s10961-020-09801-w

Colombelli, A., Paolucci, E., & Ughetto, E. (2019). Hierarchical and relational governance and the life cycle of entrepreneurial ecosystems. Small Business Economics, 52, 505–521.

Corrente, S., Greco, S., Nicotra, M., Romano, M., & Schillaci, C. E. (2019). Evaluating and comparing entrepreneurial ecosystems using SMAA and SMAA-S. The Journal of Technology Transfer, 44(2), 485–519. https://doi.org/10.1007/s10961-018-9684-2

Dameri, R. P., & Demartini, P. (2019). Knowledge transfer and translation in cultural ecosystems. Management Decision, 57(12), 3226–3257.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: A re-conceptualization. Journal of Business Venturing, 30(5), 674–695.

Daymond, J., Knight, E., Rumyantseva, M., & Maguire, S. (2023). Managing ecosystem emergence and evolution: Strategies for ecosystem architects. Strategic Management Journal, 44(4), O1–O27.

Elia, G., Margherita, A., & Passiante, G. (2020). Digital entrepreneurship ecosystem: How digital technologies and collective intelligence are reshaping the entrepreneurial process. Technological Forecasting and Social Change, 150, 119791.

Estrin, S., Mickiewicz, T., & Stephan, U. (2013). Entrepreneurship, social capital, and institutions: Social and commercial entrepreneurship across nations. Entrepreneurship Theory and Practice, 37(3), 479–504.

Fard, R. G. (2020). Factors affecting small businesses in developing economies: The role of formal institutions. Southern New Hampshire University.

Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. Wiley.

Feldman, M. P. (2001). The entrepreneurial event revisited: Firm formation in a regional context. Industrial and Corporate Change, 10(4), 861–891.

Fiorino, N., Galli, E., & Petrarca, I. (2012). Corruption and growth: Evidence from the Italian regions. European Journal of Government and Economics (EJGE), 1(2), 126–144.

Forza, C. (2002). Survey research in operations management: A process-based perspective. International Journal of Operations & Production Management, 22(2), 152–194.

Fritsch, M., & Wyrwich, M. (2014). The long persistence of regional levels of entrepreneurship: Germany, 1925–2005. Regional Studies, 48(6), 955–973.

Goel, R. K., & Nelson, M. A. (2021). Corrupt encounters of the fairer sex: Female entrepreneurs and their corruption perceptions/experience. The Journal of Technology Transfer, 46(6), 1973–1994. https://doi.org/10.1007/s10961-020-09836-z

Goel, R. K., & Saunoris, J. W. (2019). International corruption and its impacts across entrepreneurship types. Managerial and Decision Economics, 40(5), 475–487.

Grimaldi, R., Kenney, M., & Piccaluga, A. (2021). University technology transfer, regional specialization and local dynamics: Lessons from Italy. The Journal of Technology Transfer, 46, 855–865.

Gueguen, G., Delanoë-Gueguen, S., & Lechner, C. (2021). Start-ups in entrepreneurial ecosystems: the role of relational capacity. Management Decision, 59, 115–135.

Hahn, D., Minola, T., Bosio, G., & Cassia, L. (2020). The impact of entrepreneurship education on university students’ entrepreneurial skills: A family embeddedness perspective. Small Business Economics. https://doi.org/10.1007/s11187-019-00143-y

Hernández-Chea, R., Mahdad, M., Minh, T. T., & Hjortsø, C. N. (2021). Moving beyond intermediation: How intermediary organizations shape collaboration dynamics in entrepreneurial ecosystems. Technovation, 108, 10233.

Huo, L., Shao, Y., Wang, S., & Yan, W. (2022). Identifying the role of alignment in developing innovation ecosystem: Value co-creation between the focal firm and supplier. Management Decision, 60(7), 2092–2125. https://doi.org/10.1108/MD-03-2021-0433

Isenberg, D. J. (2010). How to start an entrepreneurial revolution. Harvard Business Reivew, 88(6), 40–50.

Iyortsuun, A. S., Goyit, M. G., & Dakung, R. J. (2021). Entrepreneurship education programme, passion and attitude towards self-employment. Journal of Entrepreneurship in Emerging Economies, 13(1), 64–85.

Jaffe, A. B. (1986). Technological opportunity and spillovers of R&D: Evidence from firms’ patents, profits and market value. National Bureau of Economic Research

Kapturkiewicz, A. (2021). Varieties of entrepreneurial ecosystems: A comparative study of Tokyo and Bangalore. Research Policy, 51, 104377. https://doi.org/10.1016/j.respol.2021.104377

Kenney, M., & Patton, D. (2005). Entrepreneurial geographies: Support networks in three high-technology industries. Economic Geography, 81(2), 201–228.

Kerr, W. R., & Glaeser, E. L. (2009). Local industrial conditions and entrepreneurship: How much of the spatial distribution can we explain? Journal of Economics and Management Strategy, 18(3), 623–663. https://doi.org/10.1111/j.1530-9134.2009.00225.x

Lazzeroni, M., & Piccaluga, A. (2015). Beyond ‘Town and Gown’: The role of the university in small and medium-sized cities. Industry and Higher Education, 29(1), 11–23. https://doi.org/10.5367/ihe.2015.0241

Leendertse, J., Schrijvers, M., & Stam, E. (2022). Measure twice, cut once: Entrepreneurial ecosystem metrics. Research Policy, 51(9), 104336. https://doi.org/10.1016/j.respol.2021.104336

Liguori, E., Bendickson, J., Solomon, S., & McDowell, W. C. (2019). Development of a multi-dimensional measure for assessing entrepreneurial ecosystems. Entrepreneurship and Regional Development, 31(1–2), 7–21. https://doi.org/10.1080/08985626.2018.1537144

Mack, E., & Mayer, H. (2016). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53(10), 2118–2133. https://doi.org/10.1177/0042098015586547

Maskell, P. (2001). Knowledge creation and diffusion in geographic clusters. International Journal of Innovation Management, 5(02), 213–237.

Minola, T., Hahn, D., & Cassia, L. (2019). The relationship between origin and performance of innovative start-ups: The role of technological knowledge at founding. Small Business Economics, 56, 553–569.

Muñoz, P., Kibler, E., Mandakovic, V., & Amorós, J. E. (2022). Local entrepreneurial ecosystems as configural narratives: A new way of seeing and evaluating antecedents and outcomes. Research Policy, 51(9), 104065.

Neumeyer, X., He, S., & Santos, S. C. (2017). The social organization of entrepreneurial ecosystems. In IEEE technology & engineering management conference (TEMSCON) (pp. 1–6).

Nunnally, J. (1978). Psychometric theory. McGraw-Hill.

OECD. (2016). Entrepreneurship at a glance. OECD Publishing. https://doi.org/10.1787/entrepreneur_aag-2016-en

Pavitt, K. (1985). Patent statistics as indicators of innovative activities: Possibilities and problems. Scientometrics, 7(1–2), 77–99.

Perugini, F. (2023). Space–time analysis of entrepreneurial ecosystems. The Journal of Technology Transfer, 48(1), 240–291. https://doi.org/10.1007/s10961-021-09906-w

Pinotti, P. (2015). The economic costs of organised crime: Evidence from Southern Italy. The Economic Journal, 125(586), F203–F232.

Radosevic, S., & Yoruk, E. (2013). Entrepreneurial propensity of innovation systems: Theory, methodology and evidence. Research Policy, 42(5), 1015–1038.

Raffaelli, R. (2019). Technology reemergence: Creating new value for old technologies in Swiss mechanical watchmaking, 1970–2008. Administrative Science Quarterly, 64(3), 576–618.

Raza, A., Muffatto, M., & Saeed, S. (2020). Cross-country differences in innovative entrepreneurial activity: An entrepreneurial cognitive view. Management Decision, 58(7), 1301–1329. https://doi.org/10.1108/MD-11-2017-1167

Roche, M. P., Conti, A., & Rothaermel, F. T. (2020). Different founders, different venture outcomes: A comparative analysis of academic and non-academic startups. Research Policy, 49(10), 104062. https://doi.org/10.1016/j.respol.2020.104062

Rosti, L., & Chelli, F. (2009). Self-employment among Italian female graduates. Education + Training., 51, 526–540.

Roundy, P. T. (2021). Technology rewind: The emergence of the analog entrepreneurial ecosystem. Journal of General Management, 1, 15.

Roundy, P. T., Bradshaw, M., & Brockman, B. K. (2018). The emergence of entrepreneurial ecosystems: A complex adaptive systems approach. Journal of Business Research, 86, 1–10.

Sansone, G., Andreotti, P., Colombelli, A., & Landoni, P. (2020). Are social incubators different from other incubators? Evidence from Italy. Technological Forecasting and Social Change, 158(June), 120132. https://doi.org/10.1016/j.techfore.2020.120132

Saxenian, A. (1994). Regional networks: industrial adaptation in Silicon Valley and route 128.

Secundo, G., Elena Perez, S., Martinaitis, Ž, & Leitner, K. H. (2017). An Intellectual Capital framework to measure universities’ third mission activities. Technological Forecasting and Social Change, 123, 229–239. https://doi.org/10.1016/j.techfore.2016.12.013

Secundo, G., Ndou, V., Del Vecchio, P., & De Pascale, G. (2019). Knowledge management in entrepreneurial universities: A structured literature review and avenue for future research agenda. Management Decision, 57, 3226–3257.

Shane, S. (2003). A general theory of entrepreneurship: The individual-opportunity nexus. Edward Elgar Publishing.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Simon, H. A. (1962). New developments in the theory of the firm. The American Economic Review, 52(2), 1–15.

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship: Theory and Practice, 41(1), 49–72. https://doi.org/10.1111/etap.12167

Spigel, B., & Harrison, R. (2018). Toward a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 151–168. https://doi.org/10.1002/sej.1268

Stam, E. (2018). Measuring entrepreneurial ecosystems. In Entrepreneurial ecosystems: Place-based transformations and transitions (pp. 173–197).

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769. https://doi.org/10.1080/09654313.2015.1061484

Stam, E., & Van de Ven, A. (2021). Entrepreneurial ecosystem elements. Entrepreneurial Ecosystem Elements. Small Business Economics, 56(2), 809–832.

Sterman, J. D. (2001). System dynamics modeling. California Management Review, 43(4), 8.

Sussan, F., & Acs, J. (2017). The digital entrepreneurial ecosystem. Small Business Economics, 49(1), 55–73.

Taber, K. S. (2016). The use of Cronbach’s alpha when developing and reporting research instruments in science education. Research in Science Education, 48(6), 1273–1296. https://doi.org/10.1007/s11165-016-9602-2

Theodoraki, C., Messeghem, K., & Audretsch, D. B. (2020). The effectiveness of incubators’ co-opetition strategy in the entrepreneurial ecosystem: Empirical evidence from France. IEEE Transactions on Engineering Management., 69(4), 1781–1794.

van Rijnsoever, F. J. (2020). Meeting, mating, and intermediating: How incubators can overcome weak network problems in entrepreneurial ecosystems. Research Policy, 49(1), 103884.

von Briel, F., Davidsson, P., & Recker, J. (2018). Digital technologies as external enablers of new venture creation in the it hardware sector. Entrepreneurship: Theory and Practice, 42(1), 47–69. https://doi.org/10.1177/1042258717732779

Wiklund, J., & Shepherd, D. (2005). Entrepreneurial orientation and small business performance: A configurational approach. Journal of Business Venturing, 20(1), 71–91.

Yan, Y., & Guan, J. (2019). Entrepreneurial ecosystem, entrepreneurial rate and innovation: The moderating role of internet attention. International Entrepreneurship and Management Journal, 15(2), 625–650. https://doi.org/10.1007/s11365-018-0493-8

Yearworth, M. (2010). Inductive modelling of an entrepreneurial system. In Proceedings of the 28th international conference of the system dynamics society (pp. 25–29).

Funding

Open access funding provided by Politecnico di Torino within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The Authors declare that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Factor 1—demand

Factor 1 | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

(1) Population | 1.000 | ||||

(2) Employment | 0.9621* | 1.000 | |||

(3) GDP | 0.9268* | 0.9758* | 1.000 | ||

(4) Remuneration | 0.2850* | 0.4276* | 0.4497* | 1.000 | |

(5) Foreign | 0.2494* | 0.2673* | 0.3076* | − 0.0641 | 1.000 |

Appendix 2: Factor 2—entrepreneurial culture

Factor 2 | (1) | (2) | (3) |

|---|---|---|---|

(1) New_ventures | 1.000 | ||

(2) Self-employment | 0.5855* | 1.000 | |

(5) Population_20-39 | 0.2835* | 0.4058 * | 1.000 |

Appendix 3: Factor 3—institutions

Factor 3 | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

|---|---|---|---|---|---|---|---|---|---|---|---|

(1) Hospitals | 1.000 | ||||||||||

(2)Women_adm | − 0.1016 | 1.000 | |||||||||

(3) Pollution | 0.2814* | 0.2071 | 1.000 | ||||||||

(4) Cycle_path | 0.1601 | 0.2003 | 0.2826* | 1.000 | |||||||

(5)Pedestrian | − 0.0355 | 0.1052 | 0.1292 | 0.1616 | 1.000 | ||||||

(6) Criminality | − 0.1044 | 0.7117 | 0.2502 | − 0.1017 | 0.0337 | 1.000 | |||||

(7) Social_services | 0.0357 | 0.1785 | 0.1607 | 0.0725 | − 0.0449 | 0.2646* | 1.000 | ||||

(8) Municipal_waste | 0.8252* | 0.0709 | 0.2465 | 0.1968 | 0.0697 | − 0.0647 | − 0.0160 | 1.000 | |||

(9) Motorization | − 0.1103 | 0.2143 | 0.0455 | − 0.1099 | − 0.1502 | 0.3750* | 0.0387 | − 0.0573 | 1.000 | ||

(10) Professors | 0.8504* | − 0.0583 | 0.1616 | 0.0299 | 0.0615 | − 0.0755 | − 0.0412 | 0.8804* | − 0.0514 | 1.000 | |

(11) Institutes | 0.8912* | − 0.1840 | 0.3467* | 0.0847 | − 0.0224 | − 0.0670 | − 0.0036 | 0.6727* | − 0.1400 | 0.7367* | 1000 |

Appendix 4: Factor 4—infrastructure

Factor 4 | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

(1) Air_transport | 1.000 | |||

(2) Air_passengers | 0.9925* | 1.000 | ||

(3) Pub_transport | 0.7615* | 0.7171* | 1.000 | |

(4) Pub_passengers | 0.9433* | 0.9483* | 0.7059* | 1.000 |

Appendix 5: Factor 5–human capital

Factor 5 | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

(1) Graduate_mobility | 1.000 | |||

(2) Graduate_rate | 0.3616* | 1.000 | ||

(3) Graduate_bachelor | 0.3548* | 0.4027* | 1.000 | |

(4) Graduate_master | 0.3378* | 0.3786* | 0.9956* | 1.000 |

Appendix 6: Factor 6—innovation

Factor 6 | (1) | (2) | (3) |

|---|---|---|---|

(1) Patents_appl | 1000 | ||

(2) Patents_intensity | 0.6266* | 1.000 | |

(3) Co-patenting | 0.8506* | 0.3287* | 1000 |

Appendix 7: Factor 7—new knowledge

Factor 7 | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

(1) No_tech | 1.000 | ||||

(2) Low_tech | 0.9342* | 1.000 | |||

(3) MediumLow_tech | 0.8975* | 0.9414* | 1.000 | ||

(4) MediumHigh_tech | 0.9558* | 0.9530* | 0.9410* | 1.000 | |

(5) High_tech | 0.8832* | 0.7834* | 0.7389* | 0.8139* | 1.000 |

Appendix 8: First iteration

Variables | Factor 1 | Uniqueness |

|---|---|---|

(1) Population | 0.9500 | 0.0975 |

(2) Employment | 0.9962 | 0.0077 |

(3) GDP | 0.9850 | 0.0297 |

(4) Remuneration | 0.4213 | 0.8225 |

(5) Foreign | 0.9325 |

Variable | Factor 2 | Uniqueness |

|---|---|---|

(1) New_ventures | 0.7324 | 0.4636 |

(2) Self-employment | 0.4720 | 0.7772 |

(3) Population_20-39 | 0.6611 | 0.5629 |

Variable | Factor 3 | Uniqueness |

|---|---|---|

(1) Hospitals | 0.9573 | 0.0836 |

(2)Women_adm | 0.9883 | |

(3) Pollution | 0.9123 | |

(4) Cycle_path | 0.9756 | |

(5) Pedestrian | 0.9989 | |

(6) Criminality | 0.9829 | |

(7) Social_services | 0.9997 | |

(8) Municipal_waste | 0.8817 | 0.2227 |

(9) Motorization | 0.9833 | |

(10) Professors | 0.8987 | 0.1923 |

(11) Institutes | 0.8771 | 0.2300 |

Variable | Factor 4 | Uniqueness |

|---|---|---|

(1) Air_transport | 0.9967 | 0.0066 |

(2) Air_passengers | 0.9880 | 0.0238 |

(3) Pub_transport | 0.7698 | 0.4074 |

(4) Pub_passengers | 0.9465 | 0.1042 |

Variable | Factor 5 | Uniqueness |

|---|---|---|

(1) Graduate_mobility | 0.5706 | 0.6744 |

(2) Graduate_rate | 0.6070 | 0.6316 |

(3) Graduate_bachelor | 0.9391 | 0.1180 |

(4) Graduate_master | 0.9398 | 0.1168 |

Variable | Factor 6 | Uniqueness |

|---|---|---|

(1) Patents_appl | 0.9609 | 0.0766 |

(2) Patents_intensity | 0.6042 | 0.6349 |

(3) Co-patenting | 0.8424 | 0.2903 |

Variable | Factor 7 | Uniqueness |

|---|---|---|

(1) No_tech | 0.9792 | 0.0412 |

(2) Low_tech | 0.9647 | 0.0693 |

(3) MediumLow_tech | 0.9408 | 0.1149 |

(4) MediumHigh_tech | 0.9795 | 0.0406 |

(5) High_tech | 0.8506 | 0.2765 |

Appendix 9: Second iteration

Variable | Factor 1 | Uniqueness |

|---|---|---|

(1) Population | 0.9498 | 0.0978 |

(2) Employment | 0.9963 | 0.0074 |

(3) GDP | 0.9804 | 0.0389 |

(4) Remuneration | 0.4309 | 0.8143 |

Variable | Factor 3 | Uniqueness |

|---|---|---|

(1) Hospitals | 0.9569 | 0.0843 |

(8) Municipal_waste | 0.8829 | 0.2205 |

(10) Professors | 0.9111 | 0.1700 |

(11) Institutes | 0.8612 | 0.2583 |

Appendix 10: Clusters

Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 | Cluster 5 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Obs | Mean | S.D | Obs | Mean | S.D | Obs | Mean | S.D | Obs | Mean | S.D | Obs | Mean | S.D | |

F1—Demand | 3 | 2.005 | 1.721 | 20 | 0.663 | 0.588 | 17 | − 0.149 | 0.288 | 31 | − 0.290 | 0.258 | 2 | 5.692 | 0.0440 |

F2—Entr.Culture | 3 | − 0.497 | 0.016 | 20 | − 0.144 | 0.678 | 17 | − 0.575 | 0.281 | 31 | 0.772 | 0.610 | 2 | 0.251 | 0.4476 |

F3—Institutions | 3 | 1.496 | 1.151 | 20 | 0.569 | 0.775 | 17 | − 0.168 | 0.234 | 31 | − 0.052 | 0.401 | 2 | 5.499 | 2.459 |

F4—Infrastructure | 3 | 0.954 | 0.231 | 20 | 0.341 | 0.566 | 17 | − 0.224 | 0.164 | 31 | − 0.197 | 0.266 | 2 | 6.606 | 1.135 |

F5—Human Capital | 3 | 18.657 | 0.325 | 20 | 0.318 | 0.462 | 17 | − 0.149 | 0.306 | 31 | − 0.442 | 0.296 | 2 | 4.917 | 0.0258 |

F7—Innovation | 3 | 2.840 | 0.286 | 20 | 0.801 | 0.754 | 17 | − 0.110 | 0.342 | 31 | − 0.435 | 0.208 | 2 | 4.611 | 2.278 |

F8—New Knowledge | 3 | 1.651 | 0.814 | 20 | 0.184 | 0.471 | 17 | − 0.144 | 0.220 | 31 | − 0.254 | 0.056 | 2 | 6.158 | 274.14 |

F9—Finance | 3 | 2.03 | 1.055 | 20 | 0.239 | 0.572 | 17 | − 0.009 | 0.351 | 31 | − 0.272 | 0.251 | 2 | 5.799 | 3.467 |

F10—Leadership | 3 | − 0.907 | 0.452 | 20 | − 0.287 | 0.724 | 17 | − 0.765 | 0.702 | 31 | 0.885 | 0.607 | 2 | − 0.9317 | 0.538 |

Appendix 11: Provinces (NUTS3)

Province | Cluster | Province | Cluster | Province | Cluster | Province | Cluster | Excluded |

|---|---|---|---|---|---|---|---|---|

Turin | 1 | Ravenna | 3 | Terni | 4 | Milan | 5 | Treviso |

Bologna | 1 | Trieste | 3 | Pescara | 4 | Rome | 5 | Siracusa |