Abstract

Entrepreneurial ecosystems (EEs) are viewed as the combination or interaction of elements producing shared innovative and cultural values that support entrepreneurial activities within a territory. The literature has mainly taken a static view of the concept and has analyzed these ecosystems at national or at NUTS-2 regional level. This paper proposes the NUTS-3 provincial level as a spatial unit for measuring EEs in a dynamic perspective and focuses on the Italian case using data for the 2000–2018 period. The choice of NUTS-3 provinces is supported by theoretical arguments and it is confirmed by empirical results, which show some degree of heterogeneity in the level of EEs across provinces and some spatial patterns that would have been ignored using larger spatial units. The temporal dimension also reveals some intra-distribution mobility in the cross-sectional values of the provincial EE index. The paper contributes to advancing the research on EEs, has implications for policymakers and practitioners, and suggests directions for future studies.

Similar content being viewed by others

Notes

NUTS (Nomenclature of Territorial Units for Statistics) is the geocode standard for referencing the subdivision of countries for statistical purposes, adopted by the EU. The NUTS hierarchical classification divides territories into three levels, where the NUTS 1 level identifies larger socio-economic regions, the NUTS 2 level indicates basic regions, often considered in the definition of regional policies, and the NUTS 3 level identifies the smaller regions, which can be considered for specific analyses (https://ec.europa.eu/eurostat/web/nuts/background). In the rest of the paper, we refer to NUTS-1 as “geographical macro-areas”, NUTS-2 as “regions”, and NUTS-3 as “provinces”. Moreover, we use the generic term “local” to define a small area, a limited place, a place generally within a city or a province.

The min–max method normalizes indicators to have an identical range [0, 10] by subtracting the minimum value and dividing by the range of the indicator values (Nardo et al., 2005).

In 2011, the National Institute of Statistics classified 611 LLS with an average population of 97 thousand (ISTAT 2014).

Lines in the two dimensional plot connect points at the same height on the three-dimensional plot, that is, points with the same density.

An analytical description of the nonparametric estimation of the density function and the stochastic kernel is in the Appendix.

The Moran’s I correlation coefficient range between − 1 and 1: the value 1 means perfect positive spatial autocorrelation (high values or low values cluster together), while -1 suggests perfect negative spatial autocorrelation, and’0’ implies perfect spatial randomness. To quantify the connections between provinces a weighting matrix W is used. More details on the W selected is in footnote 16.

In 2018, the number of Italian NUTS-3 provinces is 110 and the number of NUTS-2 regions is 20. However, during the period 2000–2013, the number, and the political and geographical structure of Italian provinces changed. To keep the number of provinces constant over the period of analysis, we use data for 103 provinces and 20 regions.

Data for the dependent variable are not available for more recent years.

This indicator refers to the birth of an enterprise that has at least one employee in the birth year and of an enterprise that existed before the year in consideration but were below the threshold of one employee (OECD and of the European Communities 2008).

This is defined as number of firms with average growth in the number of employees greater than 20 percent per year over a three-year period and with ten or more employees at the beginning of the period (OECD and of the European Communities 2008).

The Hausmann test suggests the random effect is preferred to the fixed effect model, while the likelihood ratio test shows that the panel-level variance component in the random effects model is significant.

Model selection was based on testing the constraint of the spatial parameters (Belotti et al., 2017).

We select the 2000, 2008, and 2018 years for reason of space. 2008 is selected as the year when the financial crisis started.

The maps of all the components and of all the years are available from the authors upon request.

In order to keep the results more comparable across spatial units, we do not use a distance based matrix, but we select at both provincial and regional level a queen first-order contiguity weighting matrix. This spatial matrix selects clusters that shared the same borders. The two islands, i.e., the region of Sardinia and Sicily, are excluded when the analysis is conducted at regional level. Results are robust to different weighting matrices.

Results are available from the authors upon request.

Similar results are found with the number of high growth enterprises as dependent variable. These results are available from the authors upon request.

For more details see http://www.gemconsortium.org/images/media/gem-neci-background-notes-1613753990.pdf for the GEM NECI and https://thegedi.org/regional-gedi/ and Ortega Argiles et al., (2014) for the REDI.

For more details on the methodology used to construct the social capital index see Section b) Index construction and robustness, in this Appendix.

The parameters(γ, ψ1, ψ2) are from Ciccone et al. (2006), who estimated an earning function using the Survey of Household Income and Wealth conducted by the Bank of Italy. As common in the literature, we assume these parameter to be time invariant and provincial specific (Aiello and Scoppa 2000, Di Giacinto and Nuzzo 2006, and Conti 2009).

In the Italian school system, the number of years required to complete the primary, the lower secondary, and the upper secondary education is 5, 8, and 13 respectively. Finally, although there are different degrees and academic qualifications, in this paper we assume that to obtain a university degree the number of years required is 18.

For more details see https://thegedi.org/regional-gedi/ and Ortega Argiles et al., (2014).

References

Ács, Z. J., Autio, E., & Szerb, L. (2014). National Systems of entrepreneurship: measurement issues and policy implications. Research Policy, 43(3), 476–494. https://doi.org/10.1016/j.respol.2013.08.016

Acs, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1–10. https://doi.org/10.1007/s11187-017-9864-8

Adler, P. S., & Kwon, S.-W. (2002). Social capital: prospects for a new concept. The Academy of Management Review, 27(1), 17. https://doi.org/10.2307/4134367

Ahmad, N., & Hoffman, A. (2008). A framework for addressing and measuring entrepreneurship. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1090374

Aiello, F., Scoppa, V. (2000). Uneven regional development in Italy: explaining differences in productivity levels. Giornale degli economisti e annali di economia, 60(2), 270–298. http://www.jstor.org/stable/41954956

Alvedalen, J., & Boschma, R. (2017). A critical review of entrepreneurial ecosystems research: towards a future research agenda. European Planning Studies, 25(6), 887–903. https://doi.org/10.1080/09654313.2017.1299694

Anselin, L. (1995). Local indicators of spatial association—LISA. Geographical Analysis, 27(2), 93–115. https://doi.org/10.1111/j.1538-4632.1995.tb00338.x

Anselin, L. (2002). Under the hood issues in the specification and interpretation of spatial regression models. Agricultural Economics., 27, 247–267. https://doi.org/10.1016/S0169-5150(02)00077-4

Arbia, G. (2012). Spatial data configuration in statistical analysis of regional economic and related problems vol. 14. Springer Science & Business Media.

Armington, C., & Acs, Z. J. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36(1), 33–45. https://doi.org/10.1080/00343400120099843

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030–1051. https://doi.org/10.1007/s10961-016-9473-8

Audretsch, D. B., Cunningham, J. A., Kuratko, D. F., Lehmann, E. E., & Menter, M. (2019). Entrepreneurial ecosystems: economic, technological, and societal impacts. The Journal of Technology Transfer, 44(2), 313–325. https://doi.org/10.1007/s10961-018-9690-4

Audretsch, D., Heger, D., & Veith, T. (2015b). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219–230.

Audretsch, D. B., Link, A. N., Walshok, M., Stam, E., & Bosma, N. (2015a). Local Policies for High-Growth Firms. Oxford University Press.

Audretsch, D., Mason, C., Miles, M. P., & O’Connor, A. (2021). Time and the dynamics of entrepreneurial ecosystems. Entrepreneurship & Regional Development, 33(1–2), 1–14. https://doi.org/10.1080/08985626.2020.1734257

Audretsch, D. B., & Vivarelli, M. (1996). Determinants of new-firm startups in Italy. Empirica, 23(1), 91–105. https://doi.org/10.1007/BF00925009

Autio, E., Kenney, M., Mustar, P., Siegel, D., & Wright, M. (2014). Entrepreneurial innovation: the importance of context. Research Policy, 43(7), 1097–1108. https://doi.org/10.1016/j.respol.2014.01.015

Autio, E., Nambisan, S., Thomas, L. D. W., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95. https://doi.org/10.1002/sej.1266

Baldini, N., Fini, R., & Grimaldi, R. (2015). The Transition toward Entrepreneurial Universities: an Assessment of Academic Entrepreneurship in Italy. University of Chicago Press. https://doi.org/10.7208/chicago/9780226178486.003.0008

Barbini, F. M., Corsino, M., & Giuri, P. (2021). How do universities shape founding teams? Social proximity and informal mechanisms of knowledge transfer in student entrepreneurship. The Journal of Technology Transfer, 46(4), 1046–1082. https://doi.org/10.1007/s10961-020-09799-1

Barro, R. J., & Sala-I-Martin, X. (1992). Regional growth and migration: a Japan-United States comparison. Journal of the Japanese and International Economies, 6(4), 312–346. https://doi.org/10.1016/0889-1583(92)90002-L

Belotti, F., Hughes, G., & Mortari, A. P. (2017). Spatial panel-data models using stata. The Stata Journal, 17(1), 139–180. https://doi.org/10.1177/1536867X1701700109

Bils, M., & Klenow, P. J. (2000). Does schooling cause growth? American Economic Review, 90(5), 1160–1183. https://doi.org/10.1257/aer.90.5.1160

Bjørnskov, C. (2006). The multiple facets of social capital. European Journal of Political Economy, 22(1), 22–40. https://doi.org/10.1016/j.ejpoleco.2005.05.006

von Bloh, J., Broekel, T., Özgun, B., & Sternberg, R. (2020). New(s) data for entrepreneurship research? an innovative approach to use big data on media coverage. Small Business Economics, 55(3), 673–694. https://doi.org/10.1007/s11187-019-00209-x

Bolzani, D., Fini, R., Grimaldi, R., & Sobrero, M. (2014). University spin-offs and their impact: longitudinal evidence from Italy. Economia e Politica Industriale. https://doi.org/10.3280/POLI2014-004011

Bosma, N., Content, J., Sanders, M., & Stam, E. (2018). Institutions, entrepreneurship, and economic growth in Europe. Small Business Economics, 51(2), 483–499. https://doi.org/10.1007/s11187-018-0012-x

Bosma, N., & Sternberg, R. (2014). Entrepreneurship as an urban event? empirical evidence from European cities. Regional Studies, 48(6), 1016–1033. https://doi.org/10.1080/00343404.2014.904041

Bourdieu, P. (1986). The forms of capital. Handbook of Theory and Research for the Sociology of Education. https://doi.org/10.1002/9780470755679.ch15

Briant, A., Combes, P.-P., & Lafourcade, M. (2010). Dots to boxes: do the size and shape of spatial units jeopardize economic geography estimations? Journal of Urban Economics, 67(3), 287–302. https://doi.org/10.1016/j.jue.2009.09.014

Brito, S. D., & Leitão, J. (2021). Mapping and defining entrepreneurial ecosystems: a systematic literature review. Knowledge Management Research & Practice, 19(1), 21–42. https://doi.org/10.1080/14778238.2020.1751571

Bronzini, R., Piselli, P. (2009). Determinants of long-run regional productivity with geographical spillovers: The role of R&D, human capital and public infrastructure. Regional Science and Urban Economics, 39(2), 187–199. https://econpapers.repec.org/RePEc:eee:regeco:v:39:y:2009:i:2:p:187-199

Brown, R., & Mason, C. (2017). Looking inside the spiky bits: a critical review and conceptualisation of entrepreneurial ecosystems. Small Business Economics, 49(1), 11–30. https://doi.org/10.1007/s11187-017-9865-7

Bruns, K., Bosma, N., Sanders, M., & Schramm, M. (2017). Searching for the existence of entrepreneurial ecosystems: a regional cross-section growth regression approach. Small Business Economics, 49(1), 31–54. https://doi.org/10.1007/s11187-017-9866-6

Burger van, M. J., van der Oort, F. G., & Kamp, B. (2010). A treatise on the geographical scale of agglomeration externalities and the MAUP. Scienze Regionali, 9(1), 19–40. https://doi.org/10.3280/SCRE2010-001002

Calcagnini, G., & Perugini, F. (2019). Social capital and well-being in the Italian provinces. Socio-Economic Planning Sciences, 68, 100668. https://doi.org/10.1016/j.seps.2018.11.005

Calcagnini, G., & Perugini, F. (2019). Income distribution dynamics among Italian provinces the role of bank foundations. Applied Economics, 51(29), 3198–3211. https://doi.org/10.1080/00036846.2019.1572866

Cantner, U., Cunningham, J. A., Lehmann, E. E., & Menter, M. (2021). Entrepreneurial ecosystems: a dynamic lifecycle model. Small Business Economics., 57(1), 407–423. https://doi.org/10.1007/s11187-020-00316-0

Cao, Z., & Shi, X. (2020). A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Business Economics. https://doi.org/10.1007/s11187-020-00326-y

Cartocci, R. (2007). Mappe del tesoro. Atlante del capitale sociale in Italia.

Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: present debates and future directions. International Entrepreneurship and Management Journal, 15(4), 1291–1321. https://doi.org/10.1007/s11365-018-0526-3

Chiarello, M.A., Fini, R., Ghiselli, S., Girotti, C., Meoli, A., Sobrero, M. (2021). Student and Graduate Entrepreneurship in Italy - Report 2020. SSRN Electronic Journal.

Ciccone, A., Cingano, F., & Cipollone, P. (2006). The private and social return to schooling in Italy. SSRN. https://doi.org/10.2139/ssrn.895463

Coad, A., Daunfeldt, S.-O., Hölzl, W., Johansson, D., & Nightingale, P. (2014). High-growth firms: introduction to the special section. Industrial and Corporate Change, 23(1), 91–112. https://doi.org/10.1093/icc/dtt052

Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1–14. https://doi.org/10.1002/bse.428

Coleman, J. S. (1988). Social capital in the creation of human-capital. American Journal of Sociology, 94, S95–S120. https://doi.org/10.1086/228943

Colombelli, A., Paolucci, E., & Ughetto, E. (2019). Hierarchical and relational governance and the life cycle of entrepreneurial ecosystems. Small Business Economics, 52(2), 505–521. https://doi.org/10.1007/s11187-017-9957-4

Content, J., Bosma, N., Jordaan, J., & Sanders, M. (2020). Entrepreneurial ecosystems, entrepreneurial activity and economic growth: new evidence from European regions. Regional Studies, 54(8), 1007–1019. https://doi.org/10.1080/00343404.2019.1680827

Conti, M. (2009). The Italian Productivity Decline: Evidence From Regional Data. Giornale degli Economisti e Annali di Economia, 68 (Anno 1(3), 269–309. http://www.jstor.org/stable/41955001

Credit, K., Mack, E. A., & Mayer, H. (2018). State of the field: Data and metrics for geographic analyses of entrepreneurial ecosystems. Geography Compass, 12(9), e12380. https://doi.org/10.1111/gec3.12380

Cunningham, J. A., Menter, M., & Wirsching, K. (2019). Entrepreneurial ecosystem governance: a principal investigator-centered governance framework. Small Business Economics, 52(2), 545–562. https://doi.org/10.1007/s11187-017-9959-2

Dana, L.P., Demartini, P., Ramadani, V., Schiuma, G. (2019). Special Issue: Social Capital, Entrepreneurship & Entrepreneurial Ecosystems. Piccola Impresa / Small Business, 0(3). https://doi.org/10.14596/pisb.369

Dapena, A. D., Vázquez, E. F., & Morollón, F. R. (2016). The role of spatial scale in regional convergence: the effect of MAUP in the estimation of $$\beta $$-convergence equations. The Annals of Regional Science, 56(2), 473–489. https://doi.org/10.1007/s00168-016-0750-0

Di Giacinto, V., & Nuzzo, G. (2006). Explaining labour productivity differentials across Italian regions: the role of socio-economic structure and factor endowments. Papers in Regional Science, 85(2), 299–320. https://econpapers.repec.org/RePEc:bla:presci:v:85:y:2006:i:2:p:299-320

Durlauf, S., & Quah, D. T. (1999). The new empirics of economic growth. In J. B. Taylor & M. Woodford (Eds.), Handbook of Macroeconomics (1st ed., Vol. 1, Part A, pp. 235–308). Elsevier. https://econpapers.repec.org/RePEc:eee:macchp:1-04

Faggian, A., Rajbhandari, I., & Dotzel, K. R. (2017). The interregional migration of human capital and its regional consequences: a review. Regional Studies, 51(1), 128–143. https://doi.org/10.1080/00343404.2016.1263388

Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. John Wiley & Sons.

Feldman, M., & Lowe, N. (2015). Triangulating regional economies: realizing the promise of digital data. Research Policy, 44(9), 1785–1793. https://doi.org/10.1016/j.respol.2015.01.015

Fingleton, B., López-Bazo, E. (2003). Explaining the Distribution of Manufacturing Productivity in the EU Regions. In B. Fingleton (Ed.), European Regional Growth 375–409. Berlin, Heidelberg: Springer Berlin Heidelberg. https://doi.org/10.1007/978-3-662-07136-6_14

Florida, R., Mellander, C., & Stolarick, K. (2008). Inside the black box of regional development: human capital, the creative class and tolerance. Journal of Economic Geography, 8(5), 615–649.

Fotheringham, A. S., Wong, D.W.S. (1991). The modifiable areal unit problem in multivariate statistical analysis. Environment and Planning A, 23(7), 1025–1044. https://econpapers.repec.org/RePEc:pio:envira:v:23:y:1991:i:7:p:1025-1044

Fritsch, M. (2013). New Business Formation and Regional Development: A Survey and Assessment of the Evidence. Foundations and Trends(R) in Entrepreneurship, 9(3), 249–364. https://econpapers.repec.org/RePEc:now:fntent:0300000043

Galor, O. (1996). Convergence? Inferences from Theoretical Models. Economic Journal, 106(437), 1056–1069. https://econpapers.repec.org/RePEc:ecj:econjl:v:106:y:1996:i:437:p:1056-69

Giudici, G., Guerini, M., & Rossi-Lamastra, C. (2018). Reward-based crowdfunding of entrepreneurial projects: the effect of local altruism and localized social capital on proponents’ success. Small Business Economics, 50(2), 307–324. https://doi.org/10.1007/s11187-016-9830-x

Glückler, J. (2007). Economic geography and the evolution of networks. Journal of Economic Geography, 7(5), 619–634.

Grimaldi, R., Kenney, M., & Piccaluga, A. (2021). University technology transfer, regional specialization and local dynamics: lessons from Italy. The Journal of Technology Transfer, 46(4), 855–865. https://doi.org/10.1007/s10961-020-09804-7

Guzman, J., & Stern, S. (2020). The state of American entrepreneurship: new estimates of the quantity and quality of entrepreneurship for 32 US States, 1988–2014. American Economic Journal: Economic Policy, 12(4), 212–243. https://doi.org/10.1257/pol.20170498

Hundt, C., & Sternberg, R. (2016). Explaining new firm creation in Europe from a spatial and time perspective: a multilevel analysis based upon data of individuals, regions and countries. Papers in Regional Science, 95(2), 223–257. https://doi.org/10.1111/pirs.12133

Hyndman, R. J., Bashtannyk, D. M., & Grunwald, G. K. (1996). Estimating and Visualizing Conditional Densities. Journal of Computational and Graphical Statistics, 5(4), 315–336. http://www.jstor.org/stable/1390887

ISTAT. (2014). I sistemi locali del lavoro 2011. Roma.

Iacobucci, D., & Perugini, F. (2020b). Entrepreneurial Ecosystems in Italy, 2, 239–267. https://doi.org/10.1430/97564

Iacobucci, D., & Perugini, F. (2020a). Entrepreneurial ecosystems in Italy. L’industria, Rivista Di Economia e Politica Industriale, 2, 239–267. https://doi.org/10.1430/97564

Iacobucci, D., Micozzi, A. (2014). Territorial Differences in Entrepreneurial Dynamics in Italy. L’industria, (1), 49–68. https://econpapers.repec.org/RePEc:mul:j0hje1:doi:https://doi.org/10.1430/77263:y:2014:i:1:p:49-68

Iansiti, M., & Levien, R. (2004). Strategy as ecology. Harvard Business Review, 82(3), 68–78.

Isenberg, D. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economy policy: principles for cultivating entrepreneurship. Babson Entrepreneurship Ecosystem Project, Babson College.

Johnson, P. A. (2005). A continuous state space approach to “Convergence by Parts.” Economics Letters, 86(3), 317–321. https://doi.org/10.1016/j.econlet.2004.06.023

Lange, B., & Schmidt, S. (2020). Entrepreneurial ecosystems as a bridging concept? a conceptual contribution to the debate on entrepreneurship and regional development. Growth and Change., 52(2), 790–807. https://doi.org/10.1111/grow.12409

LeSage, J., Pace, R.K. (2009). Introduction to Spatial Econometrics (1st ed.). Chapman and Hall/CRC. https://doi.org/10.1201/9781420064254

Lee, S. Y., Florida, R., & Acs, Z. (2004). Creativity and entrepreneurship: a regional analysis of new firm formation. Regional Studies, 38(8), 879–891. https://doi.org/10.1080/0034340042000280910

Leendertse, J., Schrijvers, M.T., Stam, F.C. (2020). Measure twice, cut once : entrepreneurial ecosystem metrics. https://ideas.repec.org/p/use/tkiwps/2001.html

Lowe, N. J., & Feldman, M. P. (2017). Institutional life within an entrepreneurial region. Geography Compass, 11(3), e12306. https://doi.org/10.1111/gec3.12306

Mack, E., & Mayer, H. (2016). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53(10), 2118–2133. https://doi.org/10.1177/0042098015586547

Mahroum, S. (2016). Black Swan Start-ups: Understanding the Rise of Successful Technology Business in Unlikely Places. Palgrave Macmillan UK. https://books.google.it/books?id=srkUjwEACAAJ

Malecki, E. J. (2011). Connecting local entrepreneurial ecosystems to global innovation networks: open innovation, double networks and knowledge integration. International Journal of Entrepreneurship and Innovation Management, 14(1), 36–59.

Malecki, E. J. (2018). Entrepreneurship and entrepreneurial ecosystems. Geography Compass, 12(3), e12359. https://doi.org/10.1111/gec3.12359

Mankiw, N. G., Romer, P. M., & Weil, D. N. (1992). A contribution to the empirics of economic growth author. The Quarterly Journal of Economics, 107(2), 407–437. https://doi.org/10.2307/2118477

Marvel, M. R., Davis, J. L., & Sproul, C. R. (2016). Human capital and entrepreneurship research: a critical review and future directions. Entrepreneurship Theory and Practice, 40(3), 599–626. https://doi.org/10.1111/etap.12136

Mason, C., & Brown, R. (2014). Entrepreneurial ecosystems and growth oriented entrepreneurship. OECD.

Messina, G. (2007). Un nuovo metodo per misurare la dotazione territoriale di infrastrutture di transporto. Banca d’Italia.

Micucci, G., Nuzzo, G. (2003). Measuring social capital: evidence from italy. In Local Economies and Internationalization in Italy Conference. 159–185. https://doi.org/10.2139/ssrn.2160456

Mincer, J. (1974). Schooling, Experience, and Earnings. National Bureau of Economic Research, Inc. https://econpapers.repec.org/RePEc:nbr:nberbk:minc74-1

Minola, T., Criaco, G., & Cassia, L. (2014). Are youth really different? New beliefs for old practices in entrepreneurship. International Journal of Entrepreneurship and Innovation Management, 18(2/3), 233–259. https://doi.org/10.1504/IJEIM.2014.062881

Moran, P.A.P. (1948). The Interpretation of Statistical Maps. Journal of the Royal Statistical Society. Series B (Methodological), 10(2), 243–251. http://www.jstor.org/stable/2983777

Motoyama, Y., & Knowlton, K. (2016). From resource munificence to ecosystem integration: the case of government sponsorship in St Louis. Entrepreneurship & Regional Development, 28(5–6), 448–470.

Motoyama, Y., & Knowlton, K. (2017). Examining the Connections within the Startup Ecosystem: A Case Study of St Louis. Entrepreneurship Research Journal, 7(1), 20160011. https://doi.org/10.1515/erj-2016-0011

Nardo, M., Saisana, M., Saltelli, A., Tarantola, S., Hoffman, A., Giovannini, E. (2005). Handbook on constructing composite indicators. OECD Statistics Working Papers. https://doi.org/10.1787/533411815016

OECD of the European Communities, S. O. (2008). Eurostat-OECD Manual on Business Demography Statistics. https://doi.org/10.1787/9789264041882-en

Openshaw, S. (1981). The modifiable areal unit problem (pp. 60–69). Quantitative geography: A British view.

Ortega Argiles, R., Acs, Z. J., Szerb, L., Autio, E., & Komlosi, E. (2014). REDI: The regional entrepreneurship and development index –measuring regional entrepreneurship final report. Publications Office of the European Union. https://doi.org/10.2776/79241

O’Connor, A., Reed, G. (2015). South Australia’s entrepreneurial ecosystem: voice of the customer research report. http://researchoutputs.unisa.edu.au/11541.2/131747

Parker, S. (2004). The Economics of Self-Employment and Entrepreneurship. Cambridge University Press.

Piras, R. (2013). Can the Augmented Solow Model with Migration Explain the Italian Internal Brain Drain? Labour, 27(2), 140–163. https://econpapers.repec.org/RePEc:bla:labour:v:27:y:2013:i:2:p:140-163

Pittz, T. G., White, R., & Zoller, T. (2019). Entrepreneurial ecosystems and social network centrality: the power of regional dealmakers. Small Business Economics. https://doi.org/10.1007/s11187-019-00228-8

Plummer, L. A. (2010). Spatial dependence in entrepreneurship research: challenges and methods. Organizational Research Methods, 13(1), 146–175. https://doi.org/10.1177/1094428109334199

Pugh, R., Soetanto, D., Jack, S. L., & Hamilton, E. (2019). Developing local entrepreneurial ecosystems through integrated learning initiatives: the lancaster case. Small Business Economics. https://doi.org/10.1007/s11187-019-00271-5

Putnam, R.D. (1993). Making democracy work. Civil traditions in modern Italy. Princeton University Press. https://doi.org/10.2307/2620793

Quah, D. T. (1997). Empirics for growth and distribution: stratification, polarization, and convergence clubs. Journal of Economic Growth, 2(1), 27–59.

Quah, D. (1993). Galton’s fallacy and tests of the convergence hypothesis. The Scandinavian Journal of Economics, 427–443.

Quah, D.T. (1996). Convergence Empirics across Economies with (Some) Capital Mobility. Journal of Economic Growth, 1(1), 95–124. http://www.jstor.org/stable/40215883

Romano, M., Nicotra, M., Schillaci, C. (2017). Nascent Entrepreneurship and Territorial Social Capital: Empirical Evidences from Italy. In J. A. Cunningham & C. O’Kane (Eds.), Technology-Based Nascent Entrepreneurship: Implications for Economic Policymaking. 71–93. New York: Palgrave Macmillan US. https://doi.org/10.1057/978-1-137-59594-2_4

Roundy, P. T., & Fayard, D. (2019). Dynamic capabilities and entrepreneurial ecosystems: the micro-foundations of regional entrepreneurship. The Journal of Entrepreneurship, 28(1), 94–120. https://doi.org/10.1177/0971355718810296

Ryan, P., Giblin, M., Buciuni, G., & Kogler, D. F. (2020). The role of MNEs in the genesis and growth of a resilient entrepreneurial ecosystem. Entrepreneurship & Regional Development, 33(1–2), 36–53. https://doi.org/10.1080/08985626.2020.1734260

Scholman, G., Van Stel, A., & Thurik, R. (2015). The relationship among entrepreneurial activity, business cycles and economic openness. International Entrepreneurship and Management Journal, 11(2), 307–319.

Schwab, A., & Zhang, Z. (2019). A new methodological frontier in entrepreneurship research: big data studies. Entrepreneurship Theory and Practice, 43(5), 843–854. https://doi.org/10.1177/1042258718760841

Sciarelli, M., Landi, G. C., Turriziani, L., & Tani, M. (2021). Academic entrepreneurship: founding and governance determinants in university spin-off ventures. The Journal of Technology Transfer, 46(4), 1083–1107. https://doi.org/10.1007/s10961-020-09798-2

Sforzi, F. (2009). The Empirical Evidence of Industrial Districts in Italy. In A Handbook of Industrial Districts. Edward Elgar Publishing. https://econpapers.repec.org/RePEc:elg:eechap:12736_25

Shwetzer, C., Maritz, A., & Nguyen, Q. (2019). Entrepreneurial ecosystems: a holistic and dynamic approach. Journal of Industry-University Collaboration, 1(2), 79–95. https://doi.org/10.1108/JIUC-03-2019-0007

Silverman, B. W. (1986). Density Estimation for Statistics and Data Analysis. Chapman & Hall.

Spiekermann, K., & Wegener, M. (2006). Accessibility and spatial development in Europe. Scienze Regionali., 2(2), 2.

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49–72. https://doi.org/10.1111/etap.12167

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: a sympathetic critique. European Planning Studies. https://doi.org/10.1080/09654313.2015.1061484

Stam, E., & van de Ven, A. (2021). Entrepreneurial ecosystem elements. Small Business Economics, 56(2), 809–832. https://doi.org/10.1007/s11187-019-00270-6

Stam, E. (2018). Measuring Entrepreneurial Ecosystems. In A. O’Connor, E. Stam, F. Sussan, D.B. Audretsch (Eds.), Entrepreneurial Ecosystems: Place-Based Transformations and Transitions. 173–197. Cham: Springer International Publishing. https://doi.org/10.1007/978-3-319-63531-6_9

Stam, E., Spigel, B. (2018). The SAGE Handbook of Small Business and Entrepreneurship. 55 City Road: SAGE Publications Ltd. https://doi.org/10.4135/9781473984080

Stangler, J., Bell-Masterson, J. (2015). Measuring an Entrepreneurial Ecosystem. Ewing Marion Kauffman Foundation, Kansas City, MO.

Sternberg, R. (2009). Regional Dimensions of Entrepreneurship. Foundations and Trends(R) in Entrepreneurship, 5(4), 211–340. https://econpapers.repec.org/RePEc:now:fntent:0300000024

Sternberg, R., Bloh Von, J., Coduras, A. (2019). A new framework to measure entrepreneurial ecosystems at the regional level. Zeitschrift für Wirtschaftsgeographie (=The German Journal of Economic Geography), 1–15. https://doi.org/10.1515/zfw-2018-0014

Stokey, N.L., Lucas, R.E., Prescott, E.C. (1989). Recursive Methods in Economic Dynamics. Harvard University Press. http://www.jstor.org/stable/j.ctvjnrt76

Stuart, T.E., Sorenson, O. (2005). Social Networks and Entrepreneurship. In S. A. Alvarez, R. Agarwal, O. Sorenson (Eds.), Handbook of Entrepreneurship Research: Interdisciplinary Perspectives (pp. 233–252). Boston, MA: Springer US. https://doi.org/10.1007/0-387-23622-8_11

Theil, H. (1971). Economics and Information Theory. Elsevier. https://books.google.it/books?id=ZYujPAAACAAJ

Theodoraki, C., Messeghem, K., & Rice, M. P. (2018). A social capital approach to the development of sustainable entrepreneurial ecosystems: an explorative study. Small Business Economics, 51(1), 153–170. https://doi.org/10.1007/s11187-017-9924-0

Thomas, L. D. W., & Autio, E. (2014). The fifth facet: the ecosystem as an organizational field. Academy of Management Proceedings, 2014(1), 10306. https://doi.org/10.5465/ambpp.2014.10306abstract

Toniolo, G. (Ed.). (2013). The Oxford Handbook of the Italian Economy Since Unification. Oxford University Press. https://econpapers.repec.org/RePEc:oxp:obooks:9780199936694

Tsvetkova, A. (2015). Innovation, entrepreneurship, and metropolitan economic performance: empirical test of recent theoretical propositions. Economic Development Quarterly, 29(4), 299–316. https://doi.org/10.1177/0891242415581398

Veneri, P., Murtin, F. (2016). Where is inclusive growth happening? Mapping multi dimensional living standards in OECD regions. OECD Statistics Working Papers. https://doi.org/10.1787/5jm3nptzwsxq-en

Villani, E., & Lechner, C. (2021). How to acquire legitimacy and become a player in a regional innovation ecosystem? the case of a young university. The Journal of Technology Transfer, 46(4), 1017–1045. https://doi.org/10.1007/s10961-020-09803-8

Wong, D. W. (2009). Modifiable Areal Unit Problem. In R. Kitchin & N. Thrift (Eds.), International Encyclopedia of Human Geography. 169–174. Oxford: Elsevier. https://doi.org/10.1016/B978-008044910-4.00475-2

Wurth, B., Stam, E., & Spigel, B. (2021). Toward an entrepreneurial ecosystem research program. Entrepreneurship Theory and Practice, March. https://doi.org/10.1177/1042258721998948

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 (1) Building the Entrepreneurial Ecosystem (EE) index

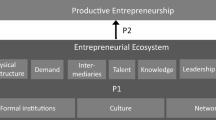

Our measure of the EE follows the theoretical framework proposed by Stam (2018) and builds an index of EEs at the NUTS-3 provincial level by modifying the version of Iacobucci and Perugini (2020a, 2020b), adjusted to account for the temporal dimension of the data. Stam’s (2018) framework is focused on the conditions of a region to promote and sustain EEs. Accordingly, the EE is viewed as the interaction of systemic conditions and framework conditions. The former, such as networks of entrepreneurs, leadership, finance, talent, knowledge, and support services, are at the heart of Stam’s (2018) EE, while the latter entail a social context (informal and formal institutions) that enables or constrains human interaction.

Iacobucci and Perugini (2020a, 2020b) applied this framework to the Italian case and built the EE for the year 2011. In this paper we extend this analysis to the 2000–2018 period and build the EE following the conditions selected by Stam (2018). However, in the construction of the index we also take into account how the domains and features characterizing EEs have been selected by the literature (Isenberg, 2011; Mason C.& Brown 2014; Ortega Argiles et al., 2014; Stangler J. Bell-Masterson 2015; Sternberg et al., 2019). For instance, we include the “Firm survival” condition in our EE index. The conditions are: (1) Social capital; (2) Entrepreneurship Culture; (3) Physical Infrastructure; (4) Value Added; (5) Finance; (6) New knowledge; (7) Business services; (8) Firm survival; (9) Human capital; (10) Migration flow; (11) Population structure. Due to data availability, we dropped formal and informal institutions from Stam’s (2018) selection. To proxy these variables/conditions, we gathered data from different sources (see Table 1 in the paper).

1.1.1 (a) Description of the selected variables

1.2 (1) Social capital

The literature on social capital and its positive impact on economic development, innovation, productivity, well-being and other socio-economic aspects of life is extensive (see, for instance, Bjørnskov, 2006, among others). More recently, studies have provided evidence of a beneficial effect on entrepreneurial activities. Indeed, social capital, which includes personal relationships, trust, and civic norms, allows entrepreneurs to benefit from positive externalities (Dana et al., 2019; Pittz et al., 2019; Theodoraki et al., 2018). It is argued that formal or informal relationships with family and friends, or networking between groups of people is particularly important in providing intangible resources and competencies of various kinds, such as technological, commercial, administrative and organisational capabilities, to nascent entrepreneurs (Romano et al., 2017). Also, relations with the community and the territory are equally important because they can facilitate the procurement of financial resources, through mechanisms such as, for instance, crowdfunding (Giudici et al., 2018). The literature also shows that a stable environment, in which trust is an essential element, is favourable to the transfer of knowledge and capabilities among members (Iansiti & Levien, 2004; Theodoraki et al., 2018). When relationships are based on trust, members are more willing to cooperate and exchange information, thus facilitating entrepreneurial activities. Moreover, to build trust within an ecosystem, shared norms of behaviour are also a powerful tool (Thomas & Autio, 2014).

Social capital is defined and measured in various ways (Bourdieu, 1986; Coleman, 1988; Putnam, 1993). For these reasons a precise and widely accepted definition is still not available (Adler & Kwon, 2002). The lack of a common definition of social capital has given rise to different measures and a variety of applied empirical works. Generally, these studies classify social capital into several dimensions, which are then reduced to a single index. In this paper, we construct a measure of social capital taking into account those dimensions that have been identified in the literature to be relevant elements for promoting entrepreneurial activities. More specifically, we normalize using the min–max method and aggregate with the arithmetic mean three variables that are proxy for social networks, civic norms, and trust respectively: a) the number of employees in social cooperatives over total employees; b) the percentage of municipal waste object of separate collection on total municipal waste; and c) the number of protests on ordinary bills, drafts and bank checks over the resident population.Footnote 20 The source of this data is ISTAT.

Even though our selection was constrained by the lack of data at NUTS-3 provincial level for the period under observation (2000–2018), the geographical distribution of the obtained social capital index shows the expected results, i.e., provinces located in the North and the Centre of Italy have a greater endowment of social capital than Southern provinces. This result is in line with previous findings (Cartocci, 2007; Micucci & Nuzzo, 2003). For instance, the Spearman rank correlation coefficients of our social capital index and the social capital index computed by Cartocci (2007), a widely cited work in the social capital literature, is 0.69. For robustness exercise we also compute the social capital index with the principal component analysis. Results do not show sensible changes.

1.3 2) Entrepreneurship Culture

This variable measures the degree to which entrepreneurship is valued in society (Stam, 2018). The literature often used the share of small businesses or average firm size as a proxy for the entrepreneurial climate (Armington & Acs, 2002; Lee et al., 2004). We use the number of start-ups per thousands of inhabitants. Data are from Movimprese, which is a regular survey of the demography of Italian companies conducted by the Unioncamere, the Italian Chamber of Commerce.

1.4 3) Physical infrastructure

The important role of transport infrastructure for economic development has been widely investigated in the literature (see, for instance, Audretsch, Heger, et al., 2015; Audretsch, Link, et al., 2015; Spiekermann & Wegener, 2006). It is generally argued that areas with better access to the locations of input materials and markets will be more productive, more competitive and hence more successful than more remote and isolated areas. Our measure of physical infrastructure is an accessibility index. The index takes into account transport infrastructure such as total length of roads, motorways and rail lines in the province itself, but also the connectivity of transport networks, i.e., activities and opportunities that can be reached by the network itself. In other words, we also consider how easily destinations can be reached in terms of travel time, cost or inconvenience. A recent measure of accessibility index for the Italian provinces, which is used in this paper, is provided by Messina (2007).

1.5 4) Value Added

The spatial dimension of market location is an influential factor that has an impact on entrepreneurial activities. The relevance of the market may also vary in relation to specific products (Sternberg et al., 2019). Stam (2018) measures demand as a composite index consisting of per capita disposable income, population, and an indicator of potential market demand. In this paper we use per-capita Value Added. Value Added at provincial level is from ISTAT and it is measured at current prices. To deflate Value Added we use the consumer price index, which is measured in the main cities of provinces and in regions.

1.6 5) Finance

The supply and accessibility of finance for firms is vital for firms' growth and survival (Ortega Argiles et al., 2014; Parker, 2004). Without a large and efficient credit market to supply firms, some entrepreneurs will face a financial barrier making it impossible to seize opportunities. We use the amount of loans to households and firms as a share of Value Added. Data are from the Bank of Italy and ISTAT.

1.7 6) New knowledge

Investments in new knowledge are an important source of entrepreneurial opportunities (Mason C.& Brown 2014). New knowledge can be measured in different ways, from patents, innovation projects or expenditure in R&D. The indicator of new knowledge used in this paper is the capital stock of R&D by public and private firms over Value Added. The National Institute of Statistics (ISTAT) provides only data on R&D expenditure at regional level. To construct the stock of R&D expenditure at provincial level we first update the time series of regional capital stock of R&D from Bronzini and Piselli (2009), using the perpetual inventory method. At regional level, this time series is highly correlated with other economic variables such as the Value Added, the number of graduated students, and the number of firms in high tech industries. In the worst case, that is in the case of the number of graduated students, the correlation coefficient with the stock of R&D is above 0.65. Therefore, we use the province average shares of these three variables to apportion the regional data of the R&D capital stock. Data on expenditure in R&D at regional level are from ISTAT.

1.8 7) Business services

Business services are an important driver of the knowledge-based economy and a key element for establishing enterprises (Feld, 2012). The growing trend in outsourcing has increased the demand for business services, especially for some core activities such as the recruitment services, ICT development, and administrative activities. The availability of such specific intermediate business services can lower the barrier to firm creation (Stam, 2018). We measure intermediate services as the percentage of active firms in the professional, scientific and technical activities (that are within the M section under the Nace Rev. 2 classification of economic activities) and in the administrative and support service activities (N) in the population of active firms in the business service sector (G-O). Data are from Movimprese.

1.9 8) Firm survival

The capacity of a firm to survive within a defined area is another important element that shapes an EE. Indeed, the empirical literature shows that if firms belong to a vibrant ecosystem than it increases its odds of survival (Ahmad & Hoffman, 2008). We use the survival rate, which is defined as the percentage of start-up firms at time t-3 that survived at time t and the number of start-up firms at time t-3. Data are from ISTAT.

1.10 9) Human capital

A relevant explanatory factor of the entrepreneurial activity is to possess the skills and knowledge required to create new companies. The literature shows that these human capital outcomes are vital to discover and create entrepreneurial opportunities, and to assist in the accumulation of new knowledge and the creation of advantages for new firms (Marvel et al., 2016). In the literature it is common to measure human capital with the number of graduated students or with the educational attainment of the resident population. However, work experience it is also assumed to be an important element for entrepreneurial activities. Therefore, in this paper we combine these two elements, and we construct a measure of human capital by considering both formal education and work experience of the resident population. For this purpose, we used the earnings functions of education proposed by Mincer (1974) and estimate the returns to investment in education as follows:

Accordingly, the log of the worker's wage (\({\text{logW}}_{{\text{i}}}\)) in province \({\text{i}}\) depends on the years of schooling (S) and labour experience (T), which enters the equation with an additional quadratic term. The parameters \({\upgamma }\) measure private returns from investment in education while \({\uppsi }_{1}\), \({\uppsi }_{2}\) the return from the accumulated labor experience.Footnote 21 The calculation of years of schooling (\({\text{S}}_{{\text{i}}}\)) is obtained by the number of years required to reach a certain level of qualification, weighted by the relative province educational qualifications.Footnote 22 With regard to labor experience (\({\text{T}}_{{\text{i}}}\)), we follow the specification provided by Bils and Klenow (2000):

\({\text{T}}_{{\text{i}}} = ({\text{Age}}_{{\text{i}}} - {\text{S}}_{{\text{i}}} - 6)(1 - {\text{u}}_{{\text{i}}}\)).

It is assumed that the years of labor experience are given by the difference between an individual’s age \(\left( {{\text{Age}}} \right)\) and his/her years of schooling (after subtracting 6 years, since schooling in Italy usually starts at the age of 6). In addition, we add the unemployment rate (\(u_{i}\)) to adjust for the possibilities of not accumulating years of labor experience when one is unemployed. Data for both the years of schooling (S) and the labor experience (T) are available from ISTAT for the years 2001 and 2011 only, that is when the national census was carried out. To get a value for the remaining years we assume constant rate of growth, that is a linear interpolation of the data between 2000 and 2018, as in Conti (2009), and Di Giacinto and Nuzzo (2006). Finally, we follow Bils and Klenow (2000) to construct the human capital stock of the resident population (H) in province i. This is proportional to an exponential function of the schooling and work experience:

1.11 10) Migration flows

In recent years there has been an increase in internal migration flows of human capital, mostly from the Southern to the Northern-Centre regions (Faggian et al., 2017). On average these migrants have higher educational attainment and work experience than the population of origin, so migration flows had profound implications for the economy of the local territories (Piras, 2013). Entrepreneurial activities can also take advantages of migration flows, especially if these are of qualified human capital, because it is another way of increasing the pool of capable entrepreneurs. Moreover, migration flows, by providing a mix of people and ideas, help to strengthen entrepreneurial vitality (Florida et al., 2008). We measure "long-distance" migration flows, i.e., the difference between immigrants and emigrants to provinces outside the same NUTS-2 region, over resident population. Data on inter-provincial migration flows are taken from ISTAT, Migratory movements of resident population, registrations and cancellations to the registry office (Movimento Migratorio della Popolazione Residente. Iscrizioni e Cancellazioni Anagrafiche).

1.12 11) Population structure

Another element that may foster an entrepreneurial ecosystem is the presence of an innovative and entrepreneurship culture. The literature suggests that young people have higher motivation and attitudes for entrepreneurship than older people (Minola, T. Criaco, G. Cassia 2014). However, data on the age of entrepreneurs are not available from ISTAT. Therefore, we use the share of young population, i.e., those aged within the 24–39 bracket, over total population, to proxy how the entrepreneurship culture is spread at provincial level. Data are from ISTAT.

b) Index construction and robustness.

Once the suitable variables have been selected, we define the normalization process, the weights, and the aggregation methods in order to construct the composite EE index. First of all, to ensure comparability and given that the variables have different measurement units, data have been normalized on a 0–10 scale using the min–max method, with higher values representing better performance:

where \(x_{p}\) denotes the observed value of the variable in province p. In the second step, the 0–10 variable scores are averaged using equal weight to obtain an aggregate index of EE. For more comparability of provincial rankings, we further normalize the EE index using the min–max method so that the range of the EE index varies between 0 and 10. For robustness check we also use the standardization method, which converts the variables to a common scale with a mean of zero and standard deviation of one. Indicators with extreme values thus have a greater effect on the composite indicator. However, results do not show substantial changes. The Spearman rank correlation coefficients with our base EE index is 0.97.

We then select the weighting method using equal weights on the variables. It should be noted that no consensus exists on this issue. The selection of the weights implies that a judgement should be being made in terms of the relative importance of each indicator. Equal weights have some limits that can be mainly associated to its simplicity. However, equal weight is the most common scheme used in the development of composite indicators. This is especially the case when there are no statistical or empirical grounds for choosing different weights (Nardo et al., 2005). Moreover, equal weights might be a valid approach compared to other alternative weighting schemes that are based on statistical methods, such as the principal component analysis, or on subjective judgement, where weights are assigned by the researchers or by a participatory methods that involve various stakeholders, experts, citizens or politicians (see Nardo et al., 2005). Indeed, the former has some limitations especially when the variables are not highly correlated, like for some variables in our cases, while the latter requires the involvement of experts and stakeholders and the collection of their opinion on the importance of each variable. For these reasons we use equal weights to aggregate our variables.

We then proceed with the aggregation of the variables. To this purpose we choose the arithmetic mean, which is the most used aggregation method. However, we perform some robustness check by calculating the index with the geometric mean, which rewards those provinces with higher scores. Results show that changes in provincial rankings across weighting schemes are very small. The Spearman rank correlation coefficient with our base EE index is 0.98.

We perform some robustness check on the final EE index. More specifically we focus on the dimensionality issue, that is we assess to what extent the final EE index is sensitive to the inclusion/exclusion of a single variable (Nardo et al., 2005). To this purpose, given that our EE index derived from the aggregation of k dimensions (k = 11), we construct k EE index by excluding one dimension at a time. The analysis shows that in all cases the Spearman’s rank correlation coefficient with the original EE index is above 0.95, suggesting that the EE index is well-balanced in all dimensions.

Finally, we compare our EE index with a previous index calculated at the Italian NUTS-1 level, i.e., the REDI (Regional Entrepreneurial Development Index) from the national GEI (Global Entrepreneurship Index).Footnote 23 For the Italian administrative classification NUTS-1 corresponds to 4 geographical units: North-West, North-East, Centre, and South and Islands. When we aggregate our index at this spatial scale level the correlation coefficient with the REDI index calculated in the year 2007 is very high, 0.93. Also, the Spearman rank correlation coefficient is high, 0.80. This results suggests that our EE measure is well-defined.

Table 7 shows the values of the EE index for the year 2000 and 2018 at provincial level.

1.13 3) Data and descriptive statistics for model in Eq. 1

1.13.1 4) The distribution dynamics approach

This section summarizes the distribution dynamics approach developed by Quah (1993, 1996, 1997). This approach works in two steps. First, the probability density function of the EE index is estimated by using a kernel function (Silverman, 1986). Let \(x_{i} , \ldots , x_{n}\) be a sample of \(n\) independent and identically distributed observations on a random variable \(X\). The density value \(\hat{f}\left( x \right)\) at a given point \(x\) is estimated by the following kernel density estimator:

where \(\hat{f}\left( x \right)\) the density estimation of the variable \(x\), h is the bandwidth (smoothing parameter) of the interval around x, and \(K\left( \bullet \right)\) is the smooth and symmetric kernel function integrated to unity. Finally, \(\parallel \bullet \parallel \) is the Euclidean distance. The kernel estimator assigns a weight to each observation in the interval around x with the weight being inversely proportional to the distance between the observation and x. The density estimate consists of the vertical sum of frequencies at each observation. The resulting smooth curve allows us to visualize the shape of the distribution of provincial per-capita income and detect the presence of convergence clubs represented by modes.

Second, the dynamics of the distribution and intra-distributional mobility of provinces is estimated by the stochastic kernel, which maps the density of a random variable at one point in time into the density in a subsequent period, where the density functions have been calculated through kernel density estimators (Stokey et al., 1989). In other words, the stochastic kernel describes the law of motion of a sequence of distributions and it serves to retrieve the evolution of the probability distribution of a random variable along time.

The stochastic kernel is merely the counterpart of a transition probability matrix where the number of states (the values taken by the EE index) tends to infinity. Assuming that the frequency of the distribution follows a first order Markov process, in a transition probability matrix M each element indicates the probability that a province that was in state i in period t ends up in state j at t + 1. Therefore, given the distribution of the EE index across provinces at time t \(\left( {EE_{t} } \right)\) then the evolution of EE can be described by the law of motion: \(EE_{t + 1} = M*EE_{t}\).

Similarly to the transition probability matrix, the stochastic kernel provides the likelihood of transiting from one place in the range of values of the EE index to the others in a continuous state-space setting (Durlauf & Quah, 1999). More formally, let \(f_{t} \left( {x_{t} } \right)\) and \(f_{t + s} \left( {x_{t + s} } \right)\) denote the distribution of provincial EE at time t and t + s, respectively. Then the stochastic kernel that maps the distribution \(f_{t} \left( {x_{t} } \right)\) into \(f_{t + s} \left( {x_{t + s} } \right)\) is defined as follows:

where the conditional density function \(g\left( {x_{t + s} |x_{t} } \right)\) (the stochastic kernel) describes the probability of the transition to a certain state in t + s given the initial state in t. In line with (Hyndman et al., 1996), the conditional density is estimated using a kernel estimator given by:

where \(\hat{f}\left( {x_{t} } \right)\) is the marginal density from Eq. (1), and \(\hat{z}\left( {x_{t + s} |x_{t} } \right)\) is the joint density given by:

with b and h denoting the bandwidth parameters of the interval around x and y respectively and K is the kernel function. Finally, if the law of motion of Eq. (2) is time-invariant, then we can compute the ergodic (long-run) distribution (Johnson, 2005):

Equation (5) describes the convergence to a steady state distribution independent of the initial distribution. Accordingly, the ergodic distribution allows to analyze the long-run tendencies of provincial EE assuming that the observed dynamics continue to hold. This long-run equilibrium distribution plays a central role in the analysis of provincial convergence. At any point of time, the distribution \(f_{t + s} \left( {x_{t + s} } \right)\) may reflect disequilibrium due to short-run external shocks. In the long-run, however, the ergodic distribution, \(f_{\infty } \left( {x_{t + s} } \right)\), remains invariant and all transitionary effects disappear. Moreover, a tendency of \(f_{\infty } \left( {x_{t + s} } \right)\) towards a unique mode, means distributional convergence. On the other hand, a divergent tendency of \(f_{\infty } \left( {x_{t + s} } \right)\) towards bimodality (or multimodality), means polarization (convergence clubs) (Galor, 1996).

Finally, the stochastic kernel can also be used to describe movements between two distributions, i.e. an actual unconditional distribution and a conditional distribution (Quah, 1996). The latter is the distribution that prevails when other variables affect future values of the EE index. In this case, when the mass of probability lies along the main diagonal the conditioning factor is not responsible for the variation in the actual distribution. In contrast, when a factor is responsible for most of the dispersion, conditioning out its effect will result in a kernel parallel to the unconditional distribution (so that provinces share similar values of the EE index when the effect of the factor is removed, regardless of their position in the original distribution).

Rights and permissions

About this article

Cite this article

Perugini, F. Space–time analysis of entrepreneurial ecosystems. J Technol Transf 48, 240–291 (2023). https://doi.org/10.1007/s10961-021-09906-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-021-09906-w