Abstract

The COVID-19 pandemic has drastically affected the socioeconomic activities and peoples’ daily life, resulting in a change in locational preferences in the real estate markets. Although enormous efforts have been devoted to examining the housing price impacts of the COVID-19 pandemic, little is known about the responses of the real estate markets to the evolving pandemic control measures. This study investigates the price gradient effects of various pandemic-related policy shocks using a hedonic price model on the district-level property transaction data in Shanghai, China over a 48-month period from 2018 to 2021. We found that these shocks have significantly altered the bid-rent curves. The price gradient for residential property units decreased in absolute value to − 0.433 after Wuhan’s lockdown, demonstrating peoples’ preferences to avoid the high infection risks in districts closer to the city center. However, in the post-reopening and post-vaccine periods, the price gradient increased to − 0.463 and − 0.486, respectively, implying rational expectations of a recovering real estate market for the low infection and mortality rates. In addition, we discovered that Wuhan’s lockdown has steepened the price gradient for commercial property units, suggesting a decline in business volumes and an increase in operating costs in the low-density districts imposed by the strict pandemic control measures. This study contributes to the empirical literature on the price gradient effects of the COVID-19 pandemic by extending the study period to the post-vaccine era.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Coronavirus disease 2019 (COVID-19) is a newly emerged respiratory disease caused by a novel coronavirus. The COVID-19 outbreaks have severely challenged global public health since the disease was initially reported in December 2019 (Fauci et al., 2020). By October 2022, there have been approximately 0.6 billion cumulative confirmed cases, causing over 6.5 million deaths worldwide (World Health Organization, 2022). In this context, the pandemic and its control measures have led to substantial economic losses in the world’s major economies, such as the United States (Cutler & Summers, 2020), China (World Bank, 2022), European Union (European Commission, 2022), etc.

Against this background, the economic impacts of COVID-19 have been widely investigated from various aspects with a goal of devising mitigating measures. In the labor market, for example, the COVID-19 pandemic has contributed to massive employment losses, especially among the disadvantaged groups (Albanesi & Kim, 2021; Cortes & Forsythe, 2020). COVID-19 and its control measures have also been regarded as a major culprit of the recessions of various industries, including the retail sales (Lee et al., 2021), manufacturing (Deb et al., 2020), transportation (Nundy et al., 2021), energy (Fu & Shen, 2020), exporting and importing (Mou, 2020), and financial industries (Baker et al., 2020; Mazur et al., 2021).

Given a strong connection between the macroeconomic conditions and the real estate market, an increasing body of literature has explored the impacts of COVID-19 on the property market. For example, a group of studies focusing on the impacts of spread of COVID-19 on the housing and land markets has observed declines in housing and residential land prices associated with an increasing number of confirmed COVID-19 cases in China (Qian et al., 2021; Tian et al., 2021), the United States (Kuk et al., 2021) and Australia (Hu et al., 2021).

Another group of studies has explored the price gradient effects of COVID-19 in connection with peoples’ location choices. Among these, a flattening housing price gradient associated with households’ preferences is indicated due to an avoidance of high infection risks and a preference for work-from-home (WFH) arrangement during the pandemic in the United States (Brueckner et al., 2021; Gupta et al., 2022; Liu & Su, 2021; Ramani & Bloom, 2021) and China (Cheung et al., 2021; Huang et al., 2022). However, these studies mainly focused on the pre-2021 period when infection risks and mortality rates were high, with the potential impacts of pandemic-related policy shocks (e.g. lockdowns, reopenings and vaccination promotion) on the real estate market having been largely neglected. Thus, our study is motivated to fill this gap.

This study adopts a bid-rent theory to examine the price gradient effects of pandemic-related policy shocks. The bid-rent theory posits a negative association between property price and the distance to the city center, which hypothesizes that increased commuting costs in the urban peripheries are compensated by lower land prices (Alonso, 1964; Mills, 1967; Muth, 1969; Wheaton, 1977). Based on this theory, any changes in commuting/traveling behaviors in response to the policy shocks would consequently affect the property price gradient. For the analysis, we apply a hedonic price model to a 48-month (January 2018–December 2021) panel dataset of 16 districts in Shanghai, China. We select Shanghai for two reasons. First, as an international financial center, Shanghai has a large population with flourishing economic growth, ensuring sufficient transactions in the real estate market even during the pandemic period. Second, Shanghai has experienced different stages of pandemic severity, allowing us to test the responses of the real estate market at different COVID-19 pandemic stages.

The remainder of this study is structured as follows. Section 2 comprises three literature review sections on the pandemic control measures, the property market responses to public health crises, and the impacts of COVID-19 on the bid-rent curve. The methodology and data are articulated in Sect. 3. Section 4 explains the model results and Sect. 5 discusses the policy implications and limitations of our study. Finally, conclusions are drawn in Sect. 6. The goal of this study is twofold. The first is to introduce the bid-rent theory to the literature on the real estate market effects of the COVID-19 pandemic. The second goal is to empirically examine the changes in the property price gradient associated with various pandemic-related policy shocks.

2 Literature review

2.1 COVID-19 pandemic control measures

After the first case of COVID-19 infection was reported in late 2019 in Wuhan, China, the COVID-19 pandemic rapidly spread throughout China and the rest of the world, which significantly threatened global public health. Since then, various pandemic control measures have been implemented in different countries. In the earlier stages of the pandemic, control measures were mainly designed to contain the transmission of disease and mitigate the corresponding infections. For example, in China, aggressive containment strategies combined with tremendous efforts of medical workers and Chinese citizens significantly contributed to containing COVID-19 within the first two months after Wuhan’s initial lockdown (Cheng et al., 2021). In particular, two pandemic control measures, viz. the suspension of intra-city public transport and closures of entertainment venues, helped significantly reducing the number of confirmed cases in China within 50 days, reflecting the effectiveness of China’s national emergency responses in curbing the spread of COVID-19 (Tian et al., 2020).

Similar measures were also adopted in other countries. In European countries such as Germany, Spain, France, Italy and the UK, pandemic control measures like isolating suspected and confirmed cases, closing schools and universities, encouraging social distancing, banning mass gatherings, as well as complete lockdowns, were implemented at varying degrees since March 2020 (Aquino et al., 2020). In February 2020, the United States, as one of the first countries to impose a border control measure, suspended the entry of foreigners who had visited China within the previous 14 days (Lai & Cheong, 2020). However, other transmission control measures and government responses were relatively delayed in the United States, leading to an exponential growth in infections (Dandekar & Barbastathis, 2020).

Since the availability of the COVID-19 vaccine in early 2021, various governments had shifted their strategy to promoting vaccination and subsequently changed their pandemic-related policies. Although vaccines cannot prevent transmission of the virus that causes COVID-19, their effectiveness in protecting the infected population from severe health impacts is well-proven (Duckett et al., 2021). By September 2022, approximately 110 million US citizens had been fully vaccinated (Centers for Disease Control & Prevention, 2022), and the US president, Joe Biden, declared the end of the COVID-19 pandemic in the United States (Williams, 2022). In Australia, the national cabinet approved a national reopening plan after implementing successful vaccination policies (Angeles et al., 2022). In China, over 88% of the population were fully vaccinated as of October 2022, and the dynamic zero COVID-19 policy, which requires mass testing and strict quarantine measures, is still China’s central COVID-19 control strategy at the time this paper was published (Burki, 2022).

With a decreasing mortality rate due to the extensive vaccinationprogram, discussions about a balance between public health and economic growth have received growing attention from the public and policymakers. Despite the importance of this topic in the context of policymaking, relevant studies on the socioeconomic impacts of pandemic-related policies are relatively sparse, with their findings being inconclusive. Guan et al. (2020) asserted that stricter initial lockdowns could minimize economic losses and bring substantial positive externality to the whole world. Contrastingly, a study focusing on 46 countries suggested that strict containment measures would result in smaller economic gains, while the vaccination rate is positively associated with the economic activities (Deb et al., 2022). In China, the real estate market has been heavily affected during the COVID-19 pandemic (Cheung et al., 2021; Tian et al., 2021). However, to the best of our knowledge, there is a lack of relevant studies to explore the impacts of vaccination and other pandemic control measures on the real estate market. Therefore, this study is motivated to fill this gap.

2.2 Public health crises and real estate market

Few studies in the literature explored the impact of public health crises prior to the COVID-19 pandemic on the real estate market. This is partially due to the speedy containment of these incidents and the incomplete historical transaction records. We only identify three studies on this topic, and all documented a negative association between the public health incidents and housing prices. Of the three studies, two focused on the severe acute respiratory syndrome (SARS), suggesting a housing price decline of 1.0–7.1% associated with the SARS outbreak in the Hong Kong Special Administrative Region, China (Lu et al., 2022; Wong, 2008). Another study conducted in European countries explored the impacts of plague and cholera on housing prices in Amsterdam and Paris, respectively (Francke & Korevaar, 2021). The SARS outbreak in Hong Kong was rapidly contained without causing a long-term economic impact, while the studied infectious diseases in Europe remained local due to relatively less international mobility in the seventeenth and nineteenth centuries. In contrast, the COVID-19 pandemic has lasted for nearly three years, resulting in long-lasting impacts on the real estate markets worldwide. This reveals an urgent need for an enhanced understanding of the real estate market impacts brought by COVID-19.

Numerous recent studies have examined the impacts of COVID-19 outbreaks on property prices worldwide. For example, a decline in housing rental prices in 49 metropolitan areas in the United States is observed after a local spread of COVID-19 (Kuk et al., 2021). In Australia, when newly confirmed COVID-19 cases in a state were doubled, the housing returns were found to have decreased by 1.26% (Hu et al., 2021). In China, Qian et al. (2021) found a 2.47% nationwide decrease in housing prices associated with the confirmed COVID-19 cases, using a difference-in-differences model. Similarly, Tian et al. (2021) indicated a 13.7% decline in urban residential land prices with a unit percent increase in epidemic severity in the Yangtze River Delta of China. However, these estimates only investigated the short-term responses of the real estate market to the COVID-19 pandemic. There is a lack of studies focusing on the middle- or long-term impacts of the pandemic in connection to location choices.

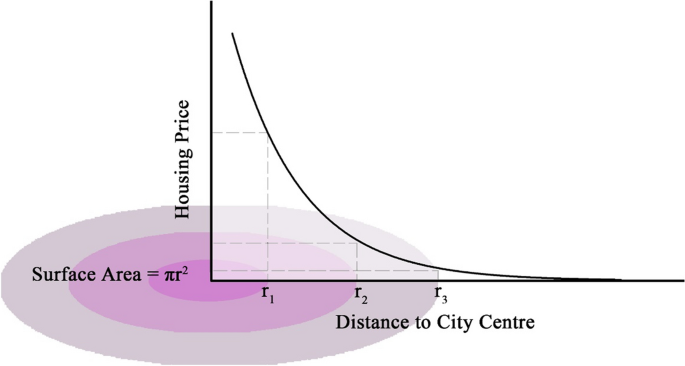

2.3 COVID-19 and the bid-rent curve

The bid-rent curve has long been used to examine households’ locational preferences in the land and real estate markets. Theoretical works on the bid-rent theory by Alonso (1960, 1964), Mills (1967), and Muth (1969) propose a downward-sloping price gradient from the city center, as illustrated in Fig. 1, assuming that households make a trade-off between the transport costs and housing costs when there is scarcer land supply near the city center. Since then, the Alonso–Muth–Mills model of the bid-rent theory has been extensively applied in empirical studies to examine the changes in housing price gradients associated with urban developments (Huai et al., 2021), urban industrial transition (Ahlfeldt & Wendland, 2013), and transportation infrastructure supply (Chang & Murakami, 2019; Yiu & Wong, 2005; Zheng & Kahn, 2008). In this sense, estimating the bid-rent curves can help understand the formation of the urban spatial structure and housing price differentials. This is of great use to policymakers when formulating various urban policies or public infrastructure development strategies and to homebuyers or private property developers when making investment decisions.

Given its impacts on peoples’ daily routines, the COVID-19 pandemic has significantly affected consumer preferences for location choices and may potentially change the bid-rent curve for the following reasons. First, a higher infection risk near the city center due to higher population density and more socioeconomic activities may lower households’ preference for living closer to the city center (Cheung et al., 2021). Second, a rising trend of remote working during the pandemic may also contribute to a decreased housing demand and prices in city centers, as explained by the reduced price premiums for shorter commuting distances (Brueckner et al., 2021).

Several empirical studies have examined the price gradient effects of the COVID-19 pandemic (Table 1). Five US-based studies discovered the flattening of bid-rent curves affected by the COVID-19 pandemic. Brueckner et al. (2021) identified a flattened intra-city housing price gradient associated with a rising trend of WFH. Ramani and Bloom (2021) asserted a “donut effect” in 12 metropolitans in the United States, suggesting the decreased rents and housing values in high-density areas after the pandemic. Similarly, Gupta et al. (2022) and Liu and Su (2021) concluded a declining trend in housing prices associated with an increasing distance to city centers and population density in the US metropolitan areas during the pandemic. According to a more recent study focusing on commercial units, the rent price premium associated with employment density substantially drops during the pandemic in 89 urban areas in the United States (Rosenthal et al., 2022).

In China, studies on this topic are relatively sparse; however, empirical evidence in support of the flattening of the bid-rent curve still exists. Using housing transaction data from January 2019 to July 2020 in Wuhan, Cheung et al. (2021) reported a 4.8–7.0% drop in housing prices due to the COVID-19 pandemic, with corresponding districts closer to the epicenter experiencing a greater decline in housing prices than suburban districts. Another study by Huang et al. (2022) also observed a 2% decrease in housing prices 35 days after the 2020 Chinese Lunar Festival among the 60 Chinese cities, where a flattened housing price gradient is also explicitly exhibited. However, these studies’ which primarily focused on the pre-2021 period may not reflect the long-term impacts of COVID-19 control measures on housing prices, and this calls for the urgent need to extend the study period.

China’s strict pandemic-related policies have led to consistently low infection rates and a slow economic recovery of the country, particularly after Wuhan’s reopening and vaccination program (Tian, 2021). Given the rational expectation of a recovering housing market associated with the low infection risk and vaccine availability, we hypothesize a steepened bid-rent curve for the post-reopening and post-vaccine periods.

3 Methodology

3.1 Study area and data sources

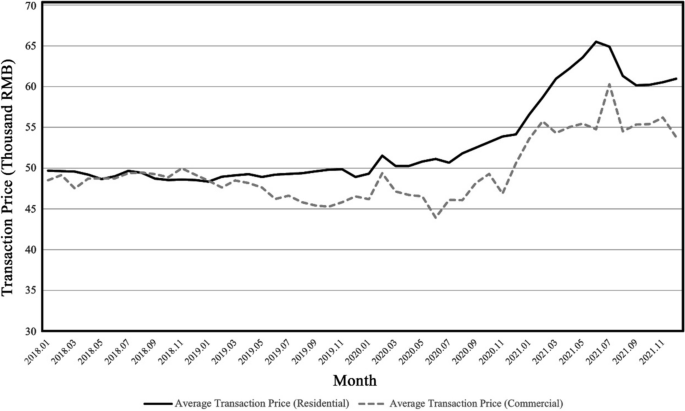

Shanghai, an international financial center in eastern China, has a metropolitan area of over 6,340 km2. As of the end of 2020, the population of Shanghai was approximately 25 million, with a GDP per capita of 22,600 USD (Shanghai Bureau of Statistics, 2022). The large population and strong economic performance have ensured Shanghai’s booming real estate markets. During the study period, the property prices for residential and commercial units share a similar trend, with them being relatively stable during the pre-2021 period, followed by a gradual increase in early 2021 after vaccine became available (Fig. 2). This offers a favorable environment to test the price gradient effects of the pandemic-related shocks for the residential and commercial real estate markets, where drastic fluctuations in the supply and price with a potential to incur biased estimates are not observed during the study period.

Source: Created by the author from Xitai data (2022)

Monthly average transaction prices for residential and commercial units during the study period.

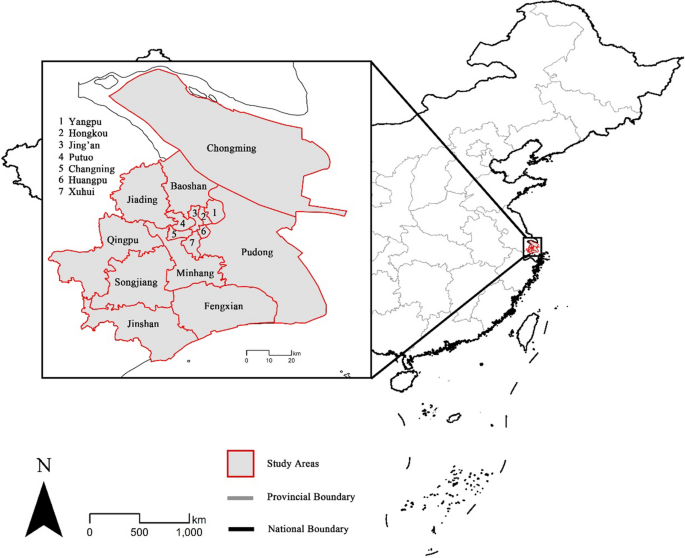

Our 48-month panel dataset for the 16 districts in Shanghai was constructed from three primary sources (See Fig. 3 for spatial distribution of districts in Shanghai). The transaction data for residential and commercial property units, aggregated at the district level, including the supply volume and average selling prices, were obtained from the Xitai database—one of the largest online Chinese real estate transaction databases (Xitai Data, 2022). The population density data were extracted from the Shanghai Statistical Yearbook (Shanghai Bureau of Statistics, 2022). Other density measures, such as the hospital, retail and school density, were computed based on the point of interest data collected from the OpenStreetMap dataset (OpenStreetMap, 2022). The descriptive statistics for all tested variables are summarized in Table 2.

3.2 Empirical model

The hedonic price model, which assumes that a commodity’s explicit price is the composite of the implicit prices of its attributes (Rosen, 1974), has been widely adopted to examine the prices of various housing attributes, both inherently and extrinsically, such as the number of rooms (Fletcher et al., 2000; Li & Brown, 1980), transit accessibility (Yang et al., 2020, 2022, 2023) and environmental (dis)amenities (Nam et al., 2022; Ou et al., 2022). This model has also been applied to examine the price gradient effects, given its ability to estimate the marginal willingness to pay for the locational attributes regarding the distance to the city center and population density (Brander & Koetse, 2011; Chen & Hao, 2008).

In this study, we first estimate a baseline hedonic price model to capture the average price gradient in Shanghai during the study period. The full-log fixed-effects model is given in Eq. (1), where \(y_{it}\) is the average selling or rental price in district i at month t; \(d_{i}\) is a locational attribute; \(x_{it}\) is a control variable of the housing unit supply; \(\beta_{0}\), \(\beta_{1}\), and \(\beta_{2}\) are parameters to be estimated; \(\alpha_{i}\) and \(\gamma_{t}\) are the district and time fixed effects, respectively; and \(\varepsilon_{it}\) is the error term.

We tested two locational attributes for \(d_{i}\) in this model. One is the distance to the city centre (DTC), where the city centre is defined as the location of the Shanghai Municipal Government Office. The other is the district-level population density in 2019 (POP_D). These two locational attributes are used to capture the distance price gradient and density price gradient, respectively.

To examine the impacts of several pandemic-related shocks on the housing price gradient, we additionally introduced a vector, \({\mathbf{T}}_{it}\), to Eq. (2), which includes the interaction terms between time dummies and \({\text{ln}}\left( {d_{i} } \right)\) with the model. All other notations remain identical to those as defined in Eq. (1).

Three time dummies were included, namely post-COVID (T1), post-reopening (T2), and post-vaccine (T3). The T1 period, starting from January 23, 2020, is used to test the real estate market impacts associated with the lockdown of Wuhan, given that semi-lockdown measures, such as social distancing and quarantine interventions, were also imposed in Shanghai since February 2020 to contain the spread of COVID-19 (Leung et al., 2020; Qiu et al., 2020). In comparison, the T2 (April 8, 2020) and T3 (February 5, 2021) periods were applied to test the respective real estate market responses to the reopening of Wuhan and vaccine availability associated with the rational expectations of low infection risk and the return to pre-pandemic daily life.

4 Results

4.1 Price gradient models

Our baseline hedonic price model results suggest positive housing price impacts of the proximity to the city center and population density during the study period (Table 3). As shown in Model [1], the coefficient of − 0.457 for our key explanatory variable is significant at the 1% level, suggesting that housing prices decrease by 0.457% with a 1% increase in the distance to the city center. Accordingly, the results presented in Model [2] reveal that housing prices rise by 0.513% for every 1% increase in population density. These findings confirm an overall downward bid-rent curve in Shanghai during the study period.

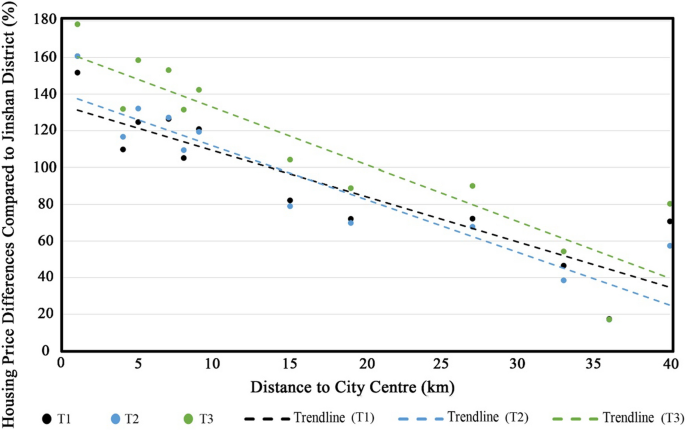

The results of the price gradient models with interaction terms show that COVID-19 pandemic-related shocks have significantly affected housing price gradients; however, their impacts, in terms of sign, tend to be divergent (Table 4). As shown in Model [1], all three interaction terms are significant at 10% or higher levels, with the first interaction term (T1) having a positive sign and the remaining two (T2 and T3) having negative signs. The base elasticity of − 0.445 for months before the pandemic first declined in absolute values to − 0.433 during the lockdown of Wuhan. It then increased to − 0.463 and − 0.486 after the reopening of Wuhan and after the vaccine availability, respectively. This trend is also confirmed by the bid-rent curves drawn from the three different periods (Fig. 4), with the steepness of the curves increasing over time.

Source: Created by the authors from Xitai data (2022)

Bid-rent curves for T1, T2, and T3 periods.

Similar results are also reported in Model [2]. The density gradient declined from 0.505 to 0.490 after Wuhan’s lockdown, bounced back to 0.519 during the post-reopening period and further increased to 0.544 during the post-vaccine period. On the one hand, the flattened bid-rent curve observed during Wuhan’s lockdown is consistent with the findings of existing empirical studies (Cheung et al., 2021; Huang et al., 2022), reflecting homebuyers’ housing preferences in avoiding higher infection risk in the city center with a higher population density. On the other hand, an increase in price premium for proximity to the city center for the post-reopening and post-vaccine periods may be understood in two ways. First, a high infection risk and a rising trend of remote working, which flatten the price gradient, no longer exist under China’s stringent pandemic control and vaccination policies. Second, public service and medical resources with greater price premiums are concentrated in more developed high-density areas during the pandemic (Yang & Zhou, 2022). Additionally, a higher elasticity measured in absolute value for the post-vaccine period compared to the post-reopening period reflects that the expectations for long-term recovery associated with vaccine availability bring homebuyers greater confidence in the housing market than the short-term recovery associated with the dynamic zero COVID-19 strategies.

4.2 Robustness tests

We designed robustness tests to examine the sensitivity of the price gradient regarding the measure of density. For this purpose, we replaced the population density with school, mall, and hospital densities which often explain the patterns of population distribution associated with education, shopping, and healthcare purposes (Bao et al., 2022). As demonstrated in Table 5, the key findings still hold, with the coefficients for density measures and their interaction terms in all three models showing identical signs and being significant at the 5% or higher levels.

The base estimates for the three models presented in Table 5 range within [0.468, 0.526], presenting acceptable differences in the absolute value between 4.2 and 7.3% from the referenced base estimate of 0.505. The most significant difference of 7.3% is found in Model [3] when the population density is replaced by the hospital density, showing the lowest base elasticity of 0.468 among all the three models. This is probably due to the dual effects of hospital accessibility on housing prices. Healthcare services with high accessibility could positively affect the housing prices, while higher infection risks in the vicinity of hospitals during the pandemic would negatively affect the housing prices (Cheung et al., 2021).

4.3 Commercial real estate market

Another interesting question on this topic is whether the price gradient for commercial units has a different response to the pandemic-related policy shocks compared to residential ones. Theoretically, the steepness of the bid-rent curves for residential and commercial property markets is determined by different factors, which may be affected by various impacts of the pandemic-related shocks. According to Alonso (1960), three factors affecting the residential location choices are the budget constraints, commuting distances and living spaces, while location decisions made by firms are based on their business volumes and operating costs. In this study, we limited our discussion to the commercial units, given a lack of observations for the office units in Shanghai’s Chongming, Jinshan and Fengxian districts.

The results of the price gradient models for commercial units are summarized in Table 6. The baseline results for commercial units presented in Models [1] and [3] are consistent with residential units in terms of the sign and statistical significance for DTC and POP_D. In Model [1], the coefficient of − 0.274 for DTC is significant at the 1% level, suggesting that the selling price for commercial units will drop by 0.27% with every 1% increase in the distance to the city center. Similarly, the coefficient of 0.281 presented in Model [3] demonstrates a 0.28% increase in selling price associated with a 1% increase in population density. However, the estimates of base elasticity for commercial units are lower in absolute value than those for residential units. One possible explanation for the lower price gradient for commercial units is that some district-specific advantages (e.g. better access to education and healthcare services) provided in the urban core districts may attract local residents more than commercial entities. As shown in Table 7, both the school and hospital densities strongly correlate with population density and distance to the city center, suggesting that education and healthcare resources favored by local residents are concentrated in urban core districts with a high population density. Also, the strong negative correlations between DTC and other density measures reflect the monocentric structure of Shanghai, validating our use of the bid-rent model.Footnote 1

Interestingly, Table 6 shows that Wuhan’s lockdown seems to have opposite impacts on the price gradients for commercial and residential units in Shanghai. As presented in Models [2] and [4], the coefficients of − 0.003 and 0.027 for the first interaction term (T1) are significant at the 1% level, suggesting a steeper bid-rent curve for commercial units after Wuhan’s lockdown. This result indicates that disruptions in the public transit systems and in the daily lives of residents during the semi-lockdown in Shanghai posed stronger negative impacts on business volumes in the low-density districts than in high-density ones. Similar findings are also reported in the United States, with more job opportunities being concentrated in the urban cores shortly after the pandemic (Delventhal et al., 2022). For the post-vaccine period, the distance and density price gradients for commercial units increase in absolute values to − 0.284 and 0.318, respectively. A similar trend is also found for residential units, reflecting the common expectations of a pre-pandemic lifestyle associated with low infection and mortality risks.

5 Discussion

Overall, our results on the flattening bid-rent curve during the lockdown period from February to April 2020 in Shanghai are consistent with the findings drawn from other cities in China (Cheung et al., 2021; Huang et al., 2022) and in the US (Brueckner et al., 2021; Gupta et al., 2022; Liu & Su, 2021; Ramani & Bloom, 2021; Rosenthal et al., 2022), confirming people’s infection-avoidance behaviors and a shift towards remote working during the COVID-19 pandemic. However, by extending the study period to the post-vaccine era, we find that the reopening of Wuhan and the promotion of vaccination tend to steepen the bid-rent curve, reflecting people’s growing confidence in the recovery of the real estate markets associated with dynamic zero COVID-19 strategies and vaccine availability in China. These findings enhance the current understanding of the price gradient impacts of COVID-19 and carry rich policy implications. The following subsections discuss policy implications drawn from the findings and potential limitations underlying our data and methods.

5.1 Policy implications

This study conveys several policy implications. First, it gives insight into land and housing policymaking in the post-2020 period. Our results show a steeper bid-rent curve since the reopening of Wuhan, reflecting an oversupply of housing units associated with a shrinking housing demand in urban peripheries after the pandemic. Second, the steep price gradients shown in our results also reflect an uneven distribution of public service resources and job opportunities in the post-2020 period in Shanghai. This suggests that policymakers should increase public service provisions in districts farther away from the city center, as uneven access to public services and job opportunities could threaten sustainable economic growth (World Economic Forum, 2014). Finally, our results of evolving bid-rent curve in response to multiple policy shocks shed light on the potential real estate market impacts of public health policies. Although China dropped its dynamic zero COVID-19 strategies on December 7, 2022 (Dyer, 2023), the promotion of vaccination is expected to have long-lasting effects on the real estate market since COVID-19 still exists. In addition, the steeper bid-rent curve found during the reopening period provides some new insights into the potential real estate market responses to the recent abandonment of dynamic zero COVID-19 strategies, given the common features these two policies shared with each other.

5.2 Limitations and future research

There are a few limitations of this study, which demand further improvements in future studies. First, the property price data used in this study was aggregated at the district level due to constrained data availability, limiting our study to focus only on a few district-level locational attributes, such as distance to the city center and population density. However, some community-level attributes, such as urban green space and public service accessibilities, which may also be affected by pandemic control measures (Nanda et al., 2021), are largely neglected. Therefore, we recommend future studies use unit-level transaction data combined with community-level locational attributes when data becomes available. Second, our findings were derived from Shanghai; however, it is unclear whether similar findings can also be drawn from other Chinese cities since China’s uneven regional economic development may contribute to heterogeneous property market responses to pandemic-related policy shocks, which is also considered as an inevitable weakness for case study research (Bao, 2023; Bao et al., 2023; Bao & Lu, 2023). For this reason, we suggest that future studies conduct cross-regional analyses to explore inter-regional variations. Finally, although our revealed preference model with direct market data successfully captures the changes in price gradient associated with pandemic-related policy shocks, the underlying mechanisms may not be explicitly demonstrated. Given the evolving COVID-19 pandemic and the variety of pandemic control measures, it is important to understand the rationales behind the changes in consumer preferences. We recommend future studies attempt using the stated preference methods to explore the causes of changing market behaviors during the pandemic.

6 Conclusion

The COVID-19 pandemic flattened the bid-rent curve in real estate markets during its earlier stages due to its strong influence on people’s preferences for locational attributes. However, there is a lack of empirical evidence on how consumer preferences respond to the evolving pandemic-related policies at different stages of the pandemic. To fill this gap, we examined the impacts of various pandemic control measures and vaccine availability on property price gradients in Shanghai, using a fixed-effects hedonic price model on a 48-month panel dataset.

Our results show that pandemic-related shocks have significant impacts on both distance and density price gradients, and the price gradient effects of different shocks tend to be divergent. Before the lockdown of Wuhan, a unit percent increase in the distance to the city center was associated with a 0.45% decrease in housing prices in Shanghai. The elasticity drops in absolute value to − 0.433 during Wuhan’s lockdown, bounced back to − 0.463 after Wuhan’s reopening and further increases to − 0.486 after vaccine availability. A similar pattern is also observed for the density price gradient. The elasticity first decreased to 0.490, then increased to 0.519 and 0.544 during the three study periods, exhibiting households’ preference for low-density areas to avoid high infection risk at the beginning of the pandemic and a transition associated with the expectations for a recovery in the housing market under stringent COVID-19 control measures after Wuhan’s reopening and vaccine availability.

We also found inconsistency in the price gradient effects of the pandemic-related shocks between residential and commercial units in Shanghai. The density price gradient increased by approximately 10% for commercial units after Wuhan’s lockdown, in contrast to a 3% decrease for residential units during the same period. This phenomenon could be attributed to a sharper decline in business volumes and a more significant increase in operating costs in low-density areas associated with semi-lockdown measures.

There are two main contributions of this study. From an academic perspective, our study enriches the existing empirical literature on the price gradient impacts of pandemic-related shocks by exploring consumer preferences for vaccine availability. Existing studies focused primarily on the short-term property market responses to the outbreaks of COVID-19. By extending this study to cover the post-vaccine period, our study reflects the market effects in the post-pandemic stage. From a policy perspective, our results, which show a steeper bid-rent curve in Shanghai associated with the reopening of Wuhan and vaccination promotion, reveal a need for policy interventions to address the oversupply of residential and commercial units in the urban peripheries and an undersupply in the urban core areas in Shanghai in the post-reopening and post-vaccine periods. Our results also provide a new angle to understand the socioeconomic impacts of various COVID-19 pandemic control measures.

References

Ahlfeldt, G. M., & Wendland, N. (2013). How polycentric is a monocentric city? Centers, spillovers and hysteresis. Journal of Economic Geography, 13(1), 53–83.

Albanesi, S., & Kim, J. (2021). Effects of the COVID-19 recession on the US labor market: Occupation, family, and gender. Journal of Economic Perspectives, 35(3), 3–24.

Alonso, W. (1960). A theory of the urban land market. Papers in Regional Science, 6, 149–157.

Alonso, W. (1964). Location and land use; toward a general theory of land rent.

Angeles, M. R., Wanni Arachchige Dona, S., Nguyen, H. D., Le, L. K. D., & Hensher, M. (2022). Modelling the potential acute and post-acute burden of COVID-19 under the Australian border reopening plan. BMC Public Health, 22(1), 1–13.

Aquino, E. M., Silveira, I. H., Pescarini, J. M., Aquino, R., Souza-Filho, J. A. D., Rocha, A. D. S., & Lima, R. T. D. R. S. (2020). Social distancing measures to control the COVID-19 pandemic: Potential impacts and challenges in Brazil. Ciencia & Saude Coletiva, 25, 2423–2446.

Baker, S. R., Bloom, N., Davis, S. J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies, 10(4), 742–758.

Bao, Z., Ou, Y., Chen, S., & Wang, T. (2022). Land use impacts on traffic congestion patterns: A tale of a Northwestern Chinese City. Land, 11(12), 2295.

Bao, Z., & Lu, W. (2023). Applicability of the environmental Kuznets curve to construction waste management: A panel analysis of 27 European economies. Resources, Conservation and Recycling, 188, 106667.

Bao, Z. (2023). Developing circularity of construction waste for a sustainable built environment in emerging economies: New insights from China. Developments in the Built Environment, 13, 100107.

Bao, Z., Lu, W., Peng, Z., & Ng, S. T. (2023). Balancing economic development and construction waste management in emerging economies: A longitudinal case study of Shenzhen, China guided by the environmental Kuznets curve. Journal of Cleaner Production, 396, 136547.

Brander, L. M., & Koetse, M. J. (2011). The value of urban open space: Meta-analyses of contingent valuation and hedonic pricing results. Journal of Environmental Management, 92(10), 2763–2773.

Brueckner, J., Kahn, M. E., & Lin, G. C. (2021). A new spatial hedonic equilibrium in the emerging work-from-home economy? (No. w28526). National Bureau of Economic Research.

Burki, T. (2022). Dynamic zero COVID policy in the fight against COVID. The Lancet. Respiratory Medicine.

Centers for Disease Control and Prevention. (2022). COVID Data Tracker. https://covid.cdc.gov/covid-data-tracker/#vaccinations_vacc-people-additional-dose-totalpop

Chen, J., & Hao, Q. (2008). The impacts of distance to CBD on housing prices in Shanghai: A hedonic analysis. Journal of Chinese Economic and Business Studies, 6(3), 291–302.

Chang, Z., & Murakami, J. (2019). Transferring land-use rights with transportation infrastructure extensions. Journal of Transport and Land Use, 12(1), 1–19.

Cheng, Z. J., Zhan, Z., Xue, M., Zheng, P., Lyu, J., Ma, J., & Sun, B. (2021). Public health measures and the control of COVID-19 in China. Clinical Reviews in Allergy & Immunology, 1–16.

Cheung, K. S., Yiu, C. Y., & Xiong, C. (2021). Housing market in the time of pandemic: A price gradient analysis from the COVID-19 epicentre in China. Journal of Risk and Financial Management, 14(3), 108.

Cortes, G. M., & Forsythe, E. (2020). Heterogeneous labor market impacts of the COVID-19 pandemic. ILR Review, 00197939221076856.

Cutler, D. M., & Summers, L. H. (2020). The COVID-19 pandemic and the $16 trillion virus. JAMA, 324(15), 1495–1496.

Dandekar, R., & Barbastathis, G. (2020). Neural Network aided quarantine control model estimation of global Covid-19 spread. arXiv preprint arXiv:2004.02752.

Deb, P., Furceri, D., Ostry, J. D., & Tawk, N. (2020). The economic effects of COVID-19 containment measures.

Deb, P., Furceri, D., Jimenez, D., Kothari, S., Ostry, J. D., & Tawk, N. (2022). The effects of COVID-19 vaccines on economic activity. Swiss Journal of Economics and Statistics, 158(1), 1–25.

Delventhal, M. J., Kwon, E., & Parkhomenko, A. (2022). JUE Insight: How do cities change when we work from home? Journal of Urban Economics, 127, 103331.

Duckett, S., Wood, D., Coates, B., Mackey, W., Crowley, T., & Stobart, A. (2021). Race to 80: our best shot at living with COVID (No. Grattan Institute Report No. 2021-09). Grattan Institute.

Dyer, O. (2023). Covid-19: China stops counting cases as models predict a million or more deaths.

European Commission. (2022). Jobs and economy during the coronavirus pandemic. https://ec.europa.eu/info/live-work-travel-eu/coronavirus-response/jobs-and-economy-during-coronavirus-pandemic_en

Fauci, A. S., Lane, H. C., & Redfield, R. R. (2020). Covid-19—navigating the uncharted. New England Journal of Medicine, 382(13), 1268–1269.

Fletcher, M., Gallimore, P., & Mangan, J. (2000). Heteroscedasticity in hedonic house price models. Journal of Property Research, 17(2), 93–108.

Francke, M., & Korevaar, M. (2021). Housing markets in a pandemic: Evidence from historical outbreaks. Journal of Urban Economics, 123, 103333.

Fu, M., & Shen, H. (2020). COVID-19 and corporate performance in the energy industry. Energy Research Letters, 1(1), 12967.

Guan, D., Wang, D., Hallegatte, S., Davis, S. J., Huo, J., Li, S., & Gong, P. (2020). Global supply-chain effects of COVID-19 control measures. Nature Human Behaviour, 4(6), 577–587.

Gupta, A., Mittal, V., Peeters, J., & Van Nieuwerburgh, S. (2022). Flattening the curve: Pandemic-induced revaluation of urban real estate. Journal of Financial Economics, 146(2), 594–636.

Hu, M. R., Lee, A. D., & Zou, D. (2021). COVID-19 and housing prices: Australian evidence with daily hedonic returns. Finance Research Letters, 43, 101960.

Huai, Y., Lo, H. K., & Ng, K. F. (2021). Monocentric versus polycentric urban structure: Case study in Hong Kong. Transportation Research Part a: Policy and Practice, 151, 99–118.

Huang, N., Pang, J., & Yang, Y. (2022). JUE insight: COVID-19 and household preference for urban density in China. Journal of Urban Economics, 103487.

Kuk, J., Schachter, A., Faber, J. W., & Besbris, M. (2021). The COVID-19 pandemic and the rental market: Evidence from Craigslist. American Behavioral Scientist, 65(12), 1623–1648.

Lai, J. W., & Cheong, K. H. (2020). Superposition of COVID-19 waves, anticipating a sustained wave, and lessons for the future. BioEssays, 42(12), 2000178.

Lee, B. P., Dodge, J. L., Leventhal, A., & Terrault, N. A. (2021). Retail alcohol and tobacco sales during COVID-19. Annals of Internal Medicine, 174(7), 1027–1029.

Leung, K., Wu, J. T., Liu, D., & Leung, G. M. (2020). First-wave COVID-19 transmissibility and severity in China outside Hubei after control measures, and second-wave scenario planning: A modelling impact assessment. The Lancet, 395(10233), 1382–1393.

Li, M. M., & Brown, H. J. (1980). Micro-neighborhood externalities and hedonic housing prices. Land Economics, 56(2), 125–141.

Liu, S., & Su, Y. (2021). The impact of the COVID-19 pandemic on the demand for density: Evidence from the US housing market. Economics Letters, 207, 110010.

Lu, S., Wang, C., Wong, S. K., & Shi, S. (2022). Is this time the same? Housing Market Performance during SARS and COVID-19. Housing Market Performance during SARS and COVID-19 (August 31, 2022).

Mazur, M., Dang, M., & Vega, M. (2021). COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Research Letters, 38, 101690.

Mills, E. S. (1967). An aggregative model of resource allocation in a metropolitan area. The American Economic Review, 57(2), 197–210.

Mou, J. (2020, July). Research on the Impact of COVID19 on Global Economy. In IOP Conference Series: Earth and Environmental Science (Vol. 546, No. 3, p. 032043). IOP Publishing.

Muth, R. F. (1969). Cities and housing: the spatial pattern of urban residential land use.

Nam, K. M., Ou, Y., Kim, E., & Zheng, S. (2022). Air Pollution and housing values in Korea: A hedonic analysis with long-range transboundary pollution as an instrument. Environmental and Resource Economics, 82(2), 383–407.

Nanda, A., Thanos, S., Valtonen, E., Xu, Y., & Zandieh, R. (2021). Forced homeward: The COVID-19 implications for housing. Town Plan. Rev, 92, 25–31.

Nundy, S., Ghosh, A., Mesloub, A., Albaqawy, G. A., & Alnaim, M. M. (2021). Impact of COVID-19 andemic on socioeconomic, energy-environment and transport sector globally and sustainable development goal (SDG). Journal of Cleaner Production, 312, 127705.

OpenStreetMap. (2022). OpenStreetMap data for Chinat. https://download.geofabrik.de/asia/china.html. Accessed 15 Sept 2022.

Ou, Y., Zheng, S., & Nam, K. M. (2022). Impacts of air pollution on urban housing prices in China. Journal of Housing and the Built Environment, 37(1), 423–441.

Qian, X., Qiu, S., & Zhang, G. (2021). The impact of COVID-19 on housing price: Evidence from China. Finance Research Letters, 43, 101944.

Qiu, Y., Chen, X., & Shi, W. (2020). Impacts of social and economic factors on the transmission of coronavirus disease 2019 (COVID-19) in China. Journal of Population Economics, 33, 1127–1172.

Ramani, A., & Bloom, N. (2021). The Donut effect of COVID-19 on cities (No. w28876). National Bureau of Economic Research.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Rosenthal, S. S., Strange, W. C., & Urrego, J. A. (2022). JUE insight: Are city centers losing their appeal? Commercial real estate, urban spatial structure, and COVID-19. Journal of Urban Economics, 127, 103381.

Shanghai Bureau of Statistics. (2022). 2021 Shanghai statistical yearbook. https://tjj.sh.gov.cn/tjnj/20220309/0e01088a76754b448de6d608c42dad0f.html. Accessed 15 Sept 2022.

Tian, H., Liu, Y., Li, Y., Wu, C. H., Chen, B., Kraemer, M. U., & Dye, C. (2020). An investigation of transmission control measures during the first 50 days of the COVID-19 epidemic in China. Science, 368(6491), 638–642.

Tian, C., Peng, X., & Zhang, X. (2021). COVID-19 pandemic, urban resilience and real estate prices: The experience of cities in the Yangtze River Delta in China. Land, 10(9), 960.

Tian, W. (2021). How China managed the COVID-19 pandemic. Asian Economic Papers, 20(1), 75–101.

Wheaton, W. C. (1977). Income and urban residence: An analysis of consumer demand for location. The American Economic Review, 620–631.

Williams, M. (2022). Why Biden's premature COVID ending could help it surge. The Hill. https://thehill.com/opinion/healthcare/3658032-why-bidens-premature-covid-ending-could-help-it-surge/

Wong, G. (2008). Has SARS infected the property market? Evidence from Hong Kong. Journal of Urban Economics, 63(1), 74–95.

World Bank. (2022). COVID-19 Outbreaks and Headwinds Have Disrupted China's Growth Normalization. https://www.worldbank.org/en/news/press-release/2022/06/08/covid-19-outbreaks-and-headwinds-have-disrupted-china-s-growth-normalization-world-bank-report

World Economic Forum. (2014). Global Risks 2014.

World Health Organization. (2022). WHO Coronavirus (COVID-19) Dashboard. https://covid19.who.int/

Xitai Data. (2022). Shanghai housing price dataset. https://www.creprice.cn/urban/sh.html. Accessed 15 Sept 2022.

Yang, M., & Zhou, J. (2022). The impact of COVID-19 on the housing market: Evidence from the Yangtze river delta region in China. Applied Economics Letters, 29(5), 409–412.

Yang, L., Chau, K. W., Szeto, W. Y., Cui, X., & Wang, X. (2020). Accessibility to transit, by transit, and property prices: Spatially varying relationships. Transportation Research Part d: Transport and Environment, 85, 102387.

Yang, L., Liang, Y., He, B., Lu, Y., & Gou, Z. (2022). COVID-19 effects on property markets: The pandemic decreases the implicit price of metro accessibility. Tunnelling and Underground Space Technology, 125, 104528.

Yang, L., Liang, Y., He, B., Yang, H., & Lin, D. (2023). COVID-19 moderates the association between to-metro and by-metro accessibility and house prices. Transportation Research Part d: Transport and Environment, 114, 103571.

Yiu, C. Y., & Wong, S. K. (2005). The effects of expected transport improvements on housing prices. Urban Studies, 42(1), 113–125.

Zheng, S., & Kahn, M. E. (2008). Land and residential property markets in a booming economy: New evidence from Beijing. Journal of Urban Economics, 63(2), 743–757.

Acknowledgements

The study was supported by the Collaborative Research Fund (CRF) (Project Number: C7080-21GF) from the Research Grants Council of Hong Kong Government, SAR.

Author information

Authors and Affiliations

Contributions

Y.O. Conceptualization; Data curation; Formal analysis; Investigation; Methodology; Project administration; Writing—original draft preparation. Z.B.: Funding acquisition; Resources; Supervision; Validation; Visualization; Writing—review & editing. S.T.N.: Data curation; Investigation; Validation; Visualization. J.X.: Funding acquisition; Resources; Writing—review & editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ou, Y., Bao, Z., Ng, S.T. et al. Do COVID-19 pandemic-related policy shocks flatten the bid-rent curve? Evidence from real estate markets in Shanghai. J Hous and the Built Environ (2023). https://doi.org/10.1007/s10901-023-10033-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10901-023-10033-1