Abstract

The outbreak of the COVID-19 in January 2020 has had a profound impact on the global economy, so it is important to study the impact of the pandemic on the housing market. To investigate the impact of the pandemic on the housing market and the response of the housing market, this paper first uses the hedonic price model to compile the second-hand housing price index in Wuhan and its neighboring capital cities and then uses the difference-in-difference (DID) model to conduct a comprehensive study on new commercial housing and second-hand housing market. In addition, this paper also uses the VAR model to explore the housing market’s response to the epidemic situation. The results show that the negative impact of the pandemic on the housing market is mainly reflected in the volume and area of housing transactions, with little impact on housing prices. Second, the reported cases of COVID-19 have a negative impact on the housing market in the short term, which gradually weakens with time and disappears after three weeks. This paper’s findings indicate that the epidemic’s impact on the housing market is mainly due to the real estate enterprises stopping selling houses and local governments implementing home quarantine measures, which affect normal housing transactions. However, the COVID-19 pandemic did not greatly negatively impact consumers’ demand and confidence in buying houses, so the house prices remained stable overall.

Similar content being viewed by others

Introduction

In December 2019, several unexplained pneumonia cases were reported in Wuhan, which was subsequently confirmed to be caused by coronavirus disease 2019 (COVID-19). On January 21, 2021, the World Health Organization sent an expert group to Wuhan to confirm that COVID-19 can sustain transmission among people. Compared with the SARS virus, the COVID-19 is more infectious and has a more extended incubation period, with a basic reproduction number (R0) close to 3 (Liu and Tang 2021) and a longer incubation period of up to 37 days.Footnote 1 On January 20, 2020, the cumulative number of confirmed cases in China was 291. Moreover, this number rose to 830 in just three days.

In the first quarter of 2020, enterprises had to close factories and delay their return to work, which damaged China’s economy. According to the bulletin issued by China’s National Bureau of Statistics, from January to February, the total profit of industrial enterprises above the national scale dropped 38.3% year on year. In terms of real estate, on January 26, 2020, the China Real Estate Association issued a call for property developments nationwide to suspend sales activities at their sales offices temporarily. Some real estate enterprises such as Evergrande and Greenland have transformed their marketing from offline to online. However, not all have online trading platforms, and only a few well-funded real estate enterprises have their online marketing platforms. As a result, the real estate development investment and sales area in this period were affected. According to China’s National Bureau of Statistics, the national real estate development investment from January to February was 101.15 billion yuan, a year-on-year decrease of 16.3%. The total sales area of commercial housing was 84.75 million square meters, down 39.9% year-on-year.

During this period, to maintain the housing market’s stability, the central government acted on the principle that houses are for living in, not for speculation. The local governments introduced various policies to stabilize the housing market, mainly focusing on relaxing the time limit for real estate enterprises to pay land transfer fees and taxes. According to China’s National Bureau of Statistics, the price index of new commercial housing in 70 large and medium-sized cities in China rose by 0.3% in January.

With the lockdown of Wuhan city on January 23, 2020, the pandemic relatively heavily influenced February’s house price. In terms of new homes, the number of cities with year-on-year price increases in February was 21, a significant decrease of 26 compared to 47 in January. For second-hand homes, the number of cities with year-on-year price increases in February was 14, down sharply from 33 in January. From March to April 2020, the housing market gradually picked up with the effective control of the epidemic. According to the National Bureau of Statistics of China, the price index of new commercial housing in 70 large and medium-sized cities in China rose by 0.1% in March from a year earlier and by 5.4% year-on-year.

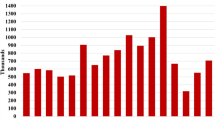

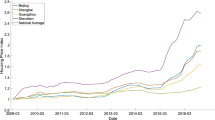

Therefore, the housing market responded keenly to epidemic events. The timeline of COVID-19 events is shown in Fig. 1. From January to February 2020, the housing market was most seriously affected by the COVID-19 pandemic. In March and April, with the effective control of the epidemic and the unblocking of Wuhan, the housing market gradually picked up. Moreover, from Figs. 2 and 3, we can see the trend of new commercial housing transaction volume, transaction area, and second-hand housing price movement in Wuhan City from December 2018 to September 2019 and from December 2019 to September 2020. Figures 2 and 3 show that the epidemic had a significant negative impact on the second-hand housing price and new commercial housing transactions in the first quarter, but the second-hand housing price began to pick up after April 2020 and even achieved a slight year-on-year growth. However, although the transaction volumes and area of new commercial houses began to recover gradually after April, there was a year-on-year decline.

Wuhan second-hand housing price index. a The trend of the second-hand housing price index (b) year-on-year change in price index. Figure (a) shows the daily price index of second-hand houses in Wuhan compiled by the hedonic price model and BOX-COX method. The Experimental group represents the price index from December 2019 to September 2020, and the Control group represents the price index from December 2018 to September 2019. Figure (b) shows the trend of the single difference result of the second-hand housing price index between the experimental and control groups

Wuhan new commercial housing transaction volumes. a The trend of the transaction volumes of new commercial houses (b) year-on-year change of the transaction volumes (c) the trend of the transaction area of new commercial houses (d) year-on-year change of the transaction area. Figures (a, c) show the daily transaction volumes, area of new commercial houses in Wuhan.The Experimental group represents the transaction volumes, area from December 2019 to September 2020, the Control group represents the transaction volumes, area from December 2018 to September 2019, respectively. Figures (b, d) show the trend of the single difference result of the transaction volumes, area of new commercial houses between the experimental, control groups, respectively

So, what is the overall impact of the pandemic on the housing market? Has the housing market responded to the reported cases of COVID-19? Both of these questions need to be addressed and discussed. Scholars often have discussed the short-term and long-term economic impact of public crises such as pandemics on the economy, but they have not reached a consensus.

Some studies suggest that public crises such as pandemics have a short-term negative impact on the real estate market but that the effects fade in the long term. For example, Deng et al. (2015) studied the impact of the Wenchuan earthquake in China on the prices of low-floor and high-floor housing in Chengdu and surrounding counties and showed that the relative price of low-floor housing relative to high-floor housing increased significantly in the short term, but that this relative price increase tended to weaken in the long term until it disappeared. Huang et al. (2020) found that house prices in the vicinity fell by an average of 24% following the 2015 explosion at Tianjin port in China but returned to normal within a few months. Wong (2008) analyzed the impact of the 2003 SARS epidemic on weekly property prices in Hong Kong and found that all properties fell by 1.6% due to the outbreak, but housing prices in Hong Kong rose rapidly in the ten years following the epidemic. Francke and Korevaar (2021) showed that the pandemic led to a significant drop in house prices. In the first six months of the pandemic, the decline in house prices was substantial in the worst affected areas. However, these price shocks were temporary, and house prices quickly returned to their original levels.

On the other hand, some studies have shown a long-term negative impact of the epidemic on the real estate market. Ambrus et al. (2020) studied the impact of a cholera epidemic on housing prices in London in the nineteenth century. The findings showed that housing prices decreased significantly just inside the catchment area of the water pump where the disease was transmitted. Moreover, the difference in housing prices lasts the following 160 years. Trilla et al. (2008) showed that the Spanish flu caused not only 40 million infections but also a sharp decline in US house prices after World War I, and despite a gradual economic recovery, the housing market remained chronically depressed.

Some scholars have studied the short-term and medium-term impacts of the COVID-19 pandemic on the housing market. D’Lima et al. (2020) studied the impact of the work stoppage on the US housing market and showed that the work stoppage reduced the value of the US housing market by an average of 1.2%. Del Giudice et al. (2020) used a predator–prey model to assess the impact on house prices in the Campania region of Italy by the COVID-19 pandemic and showed that house prices fell by 4.16% in the short term 6.49% in the medium term (late 2020 to early 2021). Qian et al. (2021) found a reduction of 2.47% in housing prices in communities with confirmed cases of COVID-19. This effect lasted for three months and became more remarkable over time. Tian et al. (2021) found that the COVID-19 pandemic had a significant dampening effect on the average residential land and housing price in the Yangtze River Delta cities of China. Cheung et al. (2021) used a hedonic price model and a price gradient model to show a 4.8% and 5.0–7.0% year-on-year decline in house prices immediately following a pandemic.

Through literature review, it can be found that some scholars have studied the impact of the COVID-19 pandemic on the housing market. However, there are limitations to these studies. For example, Yang and Zhou (2021) used monthly average house prices when studying the impact of the COVID-19 pandemic on the Yangtze river delta region and do not control the characteristics of different houses.Footnote 2 In addition, in studying the impact of COVID-19 reported cases on the housing market, D’Lima et al. (2020) found that the increase of each percentage point in newly reported confirmed cases of COVID-19 caused a reduction of approximately 4.4% in the housing market prices, but their deficiency lied in the lack of further research on the time and path of the impact. Therefore, referring to Yoruk’s (2020) research, this study uses the difference-in-difference (DID) model to study the impact of COVID-19 on the housing market by compiling the daily second-hand housing price index of Wuhan and its surrounding capital cities. Second, this paper uses the VAR model to discuss the housing market’s response to reported epidemic cases.

The subsequent parts of the article are organized as follows. The second part is the study design, including data introduction, a compilation of second-hand housing price indices, and DID and VAR model settings. The third part is the analysis and robustness test of the empirical results, and the last part is the discussion and conclusion.

Study design

Data introduction

The data covers two periods from December 1, 2018, to September 30, 2019, and from December 1, 2019, to September 30, 2020. Second-hand housing transaction data comes from the transaction records of HomeLink Real Estate (namely “Lianjia” in Chinese), the largest online real estate agency in China. Each transaction record includes detailed information on the characteristics of the sold housing units: transaction date, transaction price, unit characteristics (e.g., size, decoration, and orientation of the apartment), the name of the residential district where the unit is located, and the residential district’s geographic location (latitude and longitude). There are 6255 residential districts in the data sample (including 1214 in Wuhan, 921 in Hefei, 865 in Xi’an, 885 in Changsha, 930 in Zhengzhou, and 1440 in Chongqing) and a resident district contains hundreds or thousands of housing units. Point of Interest (POI) data comes from the Baidu map API platform, including schools, banks, restaurants, parks, hospitals, and supermarkets. In addition, the data on the volume and area of new commercial housing transactions in Wuhan come from the official website of the Wuhan Housing Security and Management Bureau.Footnote 3 Data on reported cases of COVID-19 (including confirmed cases and newly-added death cases) come from the official website of the Hubei Provincial Health Committee.

In this paper, we focus on the impact of the COVID-19 pandemic on prices in the second-hand housing market. First, second-hand housing prices reflect market supply and demand more than new commercial housing prices. Second, online real estate agencies such as Homelink have not published the transaction records of new commercial houses at present, so it is impossible to compile the corresponding price index for research. The classification, definition, and descriptive statistics of the variables are shown in Table A.1.

Compilation of second-hand housing price indices

Fleming and Nellis (1984) argued that any two dwellings were not the same. Therefore, a quality adjustment is required to remove the price variation caused by quality differences. Many studies show that the hedonic price model is superior to other quality adjustment methods (Mark and Goldberg 1984; Goh et al. 2012). Therefore, this study uses a hedonic price model to compile the price indices. Specifically, time dummy variables are introduced into the hedonic price model for different periods by controlling for the residential characteristic to remain constant across periods while allowing for changes in the intercept term. The change in the intercept term represents the change in housing prices over time. The specific model is as follows:

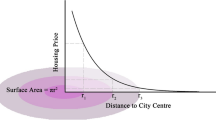

where Pi variable denotes the price of ith second-hand housing per unit of floor area, a is the constant term of the regression equation, xi is ith second-hand housing characteristics variable sets, which includes architectural characteristics (area, decorate), location characteristics (d_cbd, subway, bus), neighborhood characteristics (school, living_f, living_c, park), and environmental characteristics (air_p). βi is the marginal willingness to pay for housing characteristics. dummyt is a time dummy variable, with 0 for the base period and 1 for the house transaction date. εi is the random residual term. The time dummy variable coefficient δt reflects the average price change in period t compared to the base period.

The housing price index for period t is the ratio of the quality-adjusted average price in the reporting period to the quality-adjusted average price in the base period. Assuming that the number of housing transactions in the base period and the reporting period are represented by n and m respectively, and \(\hat{p}^{a}\) is the quality-adjusted price, the housing price index for period t is:

Setting an accurate hedonic price model requires selecting appropriate explained and explanatory variables and choosing the correct functional form. Therefore, this study also adopts log-linear and Box-Cox conversion apart from the linear function form of model (1).

The average effect of the COVID-19 pandemic on the housing market

As COVID-19 affects the whole country simultaneously, it is hard to find a control group that has not suffered from the pandemic (Yoruk 2020). In addition, to maintain the housing market’s stability, local governments have issued a series of different policies. There are also differences in the implementation time and types of quarantine measures in different cities (Cheung et al. 2021). Therefore, traditional causal inference methods, such as the synthetic control method (Abadie 2021), can not identify the net effect of the COVID-19 pandemic on the housing market. Moreover, some scholars use the copulas method to study the impact of the crisis on housing prices (Zimmer 2012; Ho et al. 2016), but the lack of housing transaction data from March to April 2020 makes the method inappropriate for this study, and this method cannot eliminate the interference of other time factors such as Chinese Spring Festival.

Therefore, in this article, we use DID model to study. It is worth noting that the DID specification is different from the traditional setting where experimental and control groups experienced contemporaneous changes. Referring to the studies of Qian et al. (2021), Yang and Zhou (2021), firstly, we divide the data samples into two groups, in which the data samples from December 1, 2018, to September 30, 2019, is taken as the control group and the data samples from December 1, 2019, to September 30, 2020, is taken as the experimental group. Second, referring to Yang and Zhou (2021), this paper takes the lockdown time of Wuhan as the division of epidemic intervention time. The specific model is as follows:

where ln (housej,t) is the set of housing variables for city j in day t, which includes second-hand housing price index (bpindex), second-hand housing transaction units (stran_num), second-hand housing transaction area (stran_area), new commercial housing transaction units (tran_num), new commercial housing transaction area (tran_area).Footnote 4C0 is a constant term. The dummy variable EHt denotes the outbreak of COVID-19, which equals one for observations after the lockdown of Wuhan (January 23, 2020), and zero otherwise. Tk is a dummy variable that equals one for experimental group observations and zero for control group observations, and k denotes the experimental or control group status. The coefficient (β) of the intervention term Tk × EHt represents the effect of the COVID-19 outbreak on the housing market. φm(t) denotes month fixed effects that absorb all month-specific nationwide shocks such as seasonality in the housing market (Ngai and Tenreyro 2014). εkjt is the error term.

Epidemic shocks and housing market responses

Qian et al. (2021), Liu and Tang (2021) showed that housing prices in communities with confirmed cases of COVID-19 decreased significantly. D’Lima et al. (2020) found that an increase in newly reported confirmed cases of COVID-19 led to a decrease in housing market prices. Therefore, this paper uses a VAR model to study the epidemic shocks and housing market responses. Specifically, we focus on the response to the epidemic of second-hand housing prices, the volume and area of new commercial housing transactions in Wuhan from December 1, 2020, to April 30, 2020 (the first quarter).

To avoid pseudo-regression, this paper uses ADF unit root to test the stability of variables. As shown in Table A.2, except for the confirmed cases variable is non-stationary, and all other variables meet the stationarity test at the 1% significance level. In addition, the first-order difference of the confirmed cases variable also passes the ADF unit root test, which shows that the first-order difference of the confirmed case variable is also stable.

Moreover, the autocorrelation figure (ACF) and partial autocorrelation figure (PACF) of the second-hand housing price index and the new commercial housing transaction volumes variables are shown in Fig. A.1. It can be seen from Fig. A.1a and b that the fifth-order autocorrelation and partial autocorrelation coefficients of the second-hand housing price index variable are not zero at the 5% significance level, and there are truncated tails in both the autocorrelation and partial autocorrelation coefficients, so the time series models are initially set to AR(5) and MA(5). Similarly, from Fig. A.1c and d, it can be seen that the autocorrelation coefficients and partial autocorrelation coefficients of the new commercial housing transaction volumes variable are tailed. Therefore, the time series model is initially set to ARMA (1, 2).Footnote 5

To set the best model form, the results of the information criterion test are shown in Table A.3. As can be seen from Table A.3, the values of AIC and BIC for AR (2, 3, 5) are significantly smaller in the time series model of the second-hand housing price index variable, and therefore the AR (2, 3, 5) model outperforms the other models. In the time series model of the new commercial housing transaction volumes variable, the values of the AIC and BIC information criteria for ARMA (1, 2) model are smaller than those of the ARMA (1, 1) model, and therefore the ARMA (1, 2) model is superior to the ARMA (1, 1) model. Therefore, the specific model is as follows:

where bpindext denotes the price index of second-hand houses converted by the Box-Cox method. The tran_numt denotes the new commercial housing transaction volumes. caset denotes the COVID-19 reported case variable, including the first-order difference between the confirmed case variable (d_confirmed) and the new death case variable (new_death).

Empirical results and analysis

Results from different forms of hedonic price model

The regression results of the hedonic price model in three forms of linear, log-linear, and Box-Cox conversion for the Wuhan second-hand housing price index are shown in Table 4.Footnote 6 As shown in Table 4, the housing architectural characteristics, location characteristics, neighborhood characteristics, and environmental characteristics variables significantly impact second-hand housing prices. The signs of the regression coefficients of the variables are consistent with expectations except for the environmental characteristic variable, which indicates that the selected housing characteristics variables are valid and that the second-hand housing price index compiled in this study can accurately reflect price fluctuations caused purely by market changes.

Among the architectural characteristic variables, the area and decorate variables are significantly positive, indicating that the larger the area and the better the decoration, the higher the housing price. Among the location characteristic variables, the regression coefficient of the d_cbd variable is negative, and the subway and bus variables are significantly positive, which indicates that the closer to the central business district and the more convenient transportation, the higher the housing price. Among the neighborhood characteristics variables, school, living_f, living_c, and park variables are significantly positive, indicating that the more perfect the surrounding facilities, the higher the housing price. The above regression results are consistent with the expectations. Among the environmental characteristic variable, the air_p variable is significantly positive, which is not in line with expectations. Because if residents have a higher marginal willingness to pay for air quality, the better the air quality around the house, the higher the housing price will be. However, the reality is that to reduce the garbage transportation cost, the Wuhan government has set up a waste incineration plant around the city center. For example, the Wuhan Hankou North Municipal solid waste incineration plant is only about 11.70 km from Wangjiadun CBD, Jianghan District. Therefore, if the resident’s willingness to pay for the housing location characteristics is greater than the environmental characteristics, the housing price will still be higher despite the poor air quality around the housing.

Impact of the COVID-19 outbreak on the housing market

Table 1 reports the average impact of the COVID-19 pandemic on the new commercial housing and second-hand housing market in Wuhan and its surrounding provincial capitals. The results of Panel A (1), (2), and (6) show that the second-hand housing prices in Wuhan, Hefei, and Chongqing were negatively affected by the COVID-19 pandemic. Second-hand housing prices in Wuhan, Hefei, and Chongqing dropped by 4.6%, 3.4%, and 5.3%. In addition, the second-hand housing prices in Xi’an, Changsha, and Zhengzhou were barely affected by the COVID-19 epidemic, and the second-hand housing price in Changsha increased slightly.

Moreover, the results in columns (1) to (6) of Panel B and C show that COVID-19 had a significant negative impact on the volume and area of second-hand housing transactions in Wuhan and its surrounding provincial capitals, causing the volume and area of second-hand housing transactions to decline by more than 35% on average. Specifically, the volume and area of second-hand housing transactions in Wuhan decreased by 48.7.0% and 51.2%, respectively; the volume and area of second-hand housing transactions in Hefei decreased by 42.7% and 43.2%, respectively; the volume and area of second-hand housing transactions in Xi’an decreased by 40.2% and 40.8%, respectively; the volume and area of second-hand housing transactions in Changsha decreased by 35.6% and 36.0%, respectively. In Zhengzhou, the volume and area of second-hand housing transactions decreased by 38.7% and 39.0%, and in Chongqing, the volume and area of second-hand housing transactions decreased by 45.4% and 46.2%, respectively.

In addition, although the second-hand housing transaction volumes of Homelink Real Estate Agency account for a high proportion of the overall housing market, it does not reflect the whole real transaction volume. Since the Wuhan Housing Security and Management Bureau publishes the daily volume and area of new commercial housing transactions, the data can more truly reflect the overall transaction situation of the entire new commercial housing market in Wuhan City. Therefore, we studied the impact of COVID-19 on the volume and area of new commercial housing transactions in Wuhan. The sub-column on the left of column (1) in Panels B and C shows that COVID-19 had a significant negative impact on the volume and area of new commercial housing transactions in Wuhan, causing the volume and area of new commercial housing transactions to decrease by 52.0% and 52.5%, respectively.

Housing market response to reported cases of COVID-19

Table A.2 shows that bpindex, d_confirmed, and new_death variables reject the null hypothesis of the existence of a unit root, indicating that the variables are stable and, therefore, can be tested for Granger causality. Table 2 reports the results of the Granger causality test for the COVID-19 reported cases on the second-hand housing price index variable. As shown in Table 2, the newly-added death cases variable is the Granger cause of the second-hand housing price index variable, while the confirmed cases variable is not. To better depict the dynamic impact of the COVID-19 reported cases on the second-hand housing price index, this study produces impulse response plots and sets the period of the impulse response at 30 days.

As shown in Fig. 4a and b, the COVID-19 reported case variables have a negative impact on the second-hand housing price index variable. However, this negative effect gradually diminishes and almost disappears after three weeks. It is worth noting that the timing and path of the impact of confirmed cases and newly-added death cases on the second-hand housing price index are not consistent. Confirmed cases first have a significant negative shock on the second-hand housing price index variable and then fade to zero, with this impact lasting around 15 days. Newly-added death cases also initially cause a significant negative shock to the second-hand housing price index, but the path of its impact on the second-hand housing price index decreases in an undulating folding pattern until it disappears, and the shock lasts for about 20 days. Finally, the results of the variance decomposition of the impact of COVID-19 reported cases on the second-hand housing price index are shown in Table 3.Footnote 7 As shown in Table 3, the variance contribution of the second-hand housing price index comes mainly from its own. In periods 1 and 2, the own contribution rate is upwards of 90%. In periods 29 and 30, its contribution drops to around 82.97%. Second, the contribution of newly-added death cases to the second-hand housing price index variance is 5.47% in period 2. In periods 29 and 30, the contribution rises to about 14.42%. The contribution rate of confirmed cases to the second-hand housing price index variance is relatively low, at only 0.01% in period 2 and about 2.61% in periods 29 and 30. The abovementioned results suggest that the newly-added death cases variable has a more significant negative impact on the second-hand housing price index than the confirmed cases variable, consistent with the results in Fig. 4.

Impulse response of COVID-19 reported cases to the second-hand housing price index. a Confirmed cases to the second-hand housing price index (b) newly-added death cases to the second-hand housing price index. The impulse variable in Fig. (a) is d_confirmed, and the response variable is bpindex. The impulse variable in Fig. (b) is new_death, and the response variable is bpindex.

Similarly, the following continued to study the impact of COVID-19 reported cases on the volume and area of new commercial housing transactions. Since the volume and area trends of new commercial housing transaction variables are highly consistent, the impulse response plots and variance decomposition results are not significantly different. Therefore, the following shows the results of the volume of new commercial housing transactions, but the conclusion is also applicable to the area of new commercial housing transactions.

Table 4 shows that the confirmed cases variable is the Granger cause of the volume of new commercial housing transactions, but the causal relationship is insignificant. The newly-added death cases variable is not the Granger cause of the volume of new commercial housing transactions.

Moreover, as shown in Figs. 4a and 5a, the impulse response results of confirmed cases to the second-hand housing price index and the volume of new commercial housing transactions are similar, which causes a significant negative shock at first, and then gradually decrease to zero. As shown in Figs. 4b and 5b, the impulse response results of newly-added death cases to the second-hand housing price index and the volume of new commercial housing transactions differ significantly. The newly-added death cases first positively impact the volume of new commercial housing transactions, then gradually decrease, causing a negative impact and finally disappearing.

Impulse response of COVID-19 reported cases to the new commercial housing transaction volumes. a Confirmed cases to the transaction volumes of new commercial houses (b) newly-added death cases to the transaction volumes of new commercial houses. The impulse variable in Fig. (a) is d_confirmed, and the response variable is tran_num. The impulse variable in Fig. (b) is new_death, and the response variable is tran_num

The variance decomposition results of the volume of new commercial housing transactions are shown in Table 5. As shown in Table 5, the contribution of the variance decomposition of the number of new commercial housing units traded is also mainly derived from its own. In periods 1 and 2, the own contribution rate is above 90%. In periods 29 and 30, its contribution drops to about 74.83%. Second, the contribution of confirmed cases is 2.28% in period 2. In periods 29 and 30, the contribution rate rises to approximately 24.57%. The contribution of newly-added death cases is only 0.21% in period 2, rising to about 0.60% in periods 29 and 30. These results suggested that the confirmed cases variable has a more significant negative impact on the volume and area of new commercial housing transactions than the newly-added death cases variable, consistent with the results in Fig. 5.

Robustness test analysis

The impulse response and variance decomposition results of the VAR model depend on the order of the Cholesky decomposition. This section re-estimates by changing the order of the Cholesky decomposition to see whether the findings are consistent with those above. If the new Cholesky decomposition order’s results are not significantly different from the above results, this suggests that the results of the VAR model are robust. The order of the Cholesky decomposition above is bpindex → d_confirmed → new_death and tran_num → d_confirmed → new_death, respectively. This study determines a new Cholesky decomposition order through cross-correlation diagrams, linkage of variables, and practical implications between variables: d_confirmed → new_death → bpindex and d_confirmed → new_death → tran_num. The variables are intrinsically linked in that confirmed cases occur first, followed by newly-added death cases. An increase in newly-added death cases can cause consumer panic and ultimately affect the housing market.

The new Cholesky decomposition order’s impulse response and variance decomposition results are shown in Fig. 6 and Table 6. Comparing the results in Fig. 6 with those in Figs. 4 and 5 above, it can be seen that the difference is small. Furthermore, as shown in Table 6, it can be found that the impact of COVID-19 reported cases on the second-hand housing price index and the volume of new commercial housing transactions is also heterogeneous. The newly-added death cases variable has a significant negative impact on the second-hand housing price index, and the confirmed cases variable has a significant negative impact on the volume and area of new commercial housing transactions. Therefore, changing the Cholesky decomposition order does not change the conclusions of this paper.

Impulse response of the new Cholesky decomposition order. a Confirmed cases to the second-hand housing price index (b) newly-added death cases to the second-hand housing price index (c) confirmed cases to the transaction volumes of new commercial houses (d) newly-added death cases to the transaction volumes of new commercial houses. The impulse variable in Fig. (a) is d_confirmed, and the response variable is bpindex. The impulse variable in Fig. (b) is new_death, and the response variable is bpindex. The impulse variable in Fig. (c) is d_confirmed, and the response variable is tran_num. The impulse variable in Fig. (d) is new_death, and the response variable is tran_num.

Discussion and conclusion

The findings of this study indicate that the COVID-19 pandemic has a small negative impact on second-hand housing prices and a large negative impact on the volume and area of the housing market. Specifically, the COVID-19 pandemic caused the second-hand housing prices in Wuhan, Hefei, and Chongqing to drop by 4.6%, 3.4%, and 5.3%, respectively, and the volume and area of second-hand housing transactions in Wuhan and its surrounding provincial capitals dropped by more than 35%.

These results may indicate that the Chinese central government’s principle that houses for living in and not for speculation has worked, and the COVID-19 pandemic has little impact on consumers’ willingness to buy houses, and there is no panic or speculation in the housing market. According to a survey released by data intelligence analyst Zero, 97.6% of consumers who had plans to buy a home would not cancel their plans despite a pandemic, with 47.5% expecting to buy as initially planned, 39.0% choosing to wait and see before buying and 11.1% buying after the pandemic. The findings of this article are in line with that survey. However, the shutdowns and delayed starts of real estate enterprises and construction sites, as well as quarantine measures, have significantly dampened housing transactions.

In addition, the Granger causality test and impulse response results show that the COVID-19 reported cases have a negative impact on the housing market in the short term, but this impact gradually weakens until it disappears. The results confirm that consumer economic confidence during the pandemic is characterized by short-term depression and a long-term improvement (Xin et al. 2020). Moreover, this is also consistent with the findings of Deng et al. (2015), who studied the impact of the Wenchuan earthquake on the housing market. In the short term, the unexpected events create fear among consumers, which fades over time and eventually manifests itself in return to the original housing market prices.

Finally, the results of variance decomposition and impulse response show that the time and path of the impact of COVID-19 reported cases on the volume and area of new commercial housing transactions and the second-hand housing price index are heterogeneous. The confirmed cases have a great negative impact on the volume and area of new commercial housing transactions, and the impact lasts for about 15 days. The newly-added death cases significantly negatively impact the second-hand housing prices, with the shock lasting around 20 days. According to Maslow’s hierarchy of needs theory, the results can be explained that safety is the second level of need after physiology. Under the influence of empathy, the newly-added death cases will make consumers think their safety is threatened, thus causing panic and delaying housing consumption. The increase of confirmed cases means that the epidemic is not over yet. The uncertainty of the ending time of the epidemic will affect the investment and decision-making of real estate companies and consumers in the housing market.

The implications of this study are as follows. To reduce the negative impact of the pandemic on the housing market, real estate companies need to develop and improve their online trading platforms as soon as possible. The government should provide specific financial incentives and policy supports for real estate companies that cannot develop their online trading platform. Real estate companies need to combine and take full advantage of online and offline sale modes. It is also wise to stabilize consumer confidence and avoid adding leverage or other aggressive buying behavior.

Availability of data and material

The datasets generated during and/or analysed during the current study are available in the figshare repository, https://doi.org/10.6084/m9.figshare.17889200.v1.

Code availability

StataSE 15, Python 3.9.2.

Notes

Basic reproduction number (R0) is the epidemiological average of the number of individuals who would transmit an infectious disease to other individuals without external intervention and with no immunity. A larger number of R0 indicates that the epidemic is more difficult to control.

Housing is a completely differentiated product, which needs quality adjustment to eliminate the price difference caused by different architectural characteristics. Otherwise, the price difference cannot fully reflect the price changes caused by market fluctuations.

Due to data limitations, this paper only studies the volume and area of new commercial housing transactions in Wuhan.

Since the trends of the volume and area of new commercial housing transactions variables are highly consistent. Therefore, this study follows up with an analysis of the new commercial housing transaction volumes variable, but the conclusions drawn are applicable to the new commercial housing transaction area variable.

Regression results for Xi’an, Hefei, Zhengzhou, Chongqing, and Changsha are omitted here, contact the authors if needed. In addition, the regression results of the time dummy variable part are omitted because there are more time dummy variables in the regression results.

Due to the limitation of layout, we only list the first and later periods of the results of variance decomposition.

References

Abadie A (2021) Using synthetic controls:feasibility, data requirements, and methodological aspects. J Econ Lit 59(2):391–425. https://doi.org/10.1257/jel.20191450

Ambrus A, Field E, Gonzalez R (2020) Loss in the time of cholera: long-run impact of a disease epidemic on the urban landscape. Am Econ Rev 110(2):475–525. https://doi.org/10.1257/aer.20190759

Cheung KS, Yiu CY, Xiong C (2021) Housing market in the time of pandemic: a price gradient analysis from the COVID-19 epicentre in China. J Risk Financ Managt 14(3):108. https://doi.org/10.3390/jrfm14030108

D’Lima W, Lopez LA, Pradhan A (2020) COVID-19 and housing market effects: evidence from US shutdown orders. Real Estate Econ 50(2):303–339. https://doi.org/10.1111/1540-6229.12368

Del Giudice V, De Paola P, Del Giudice FP (2020) COVID-19 infects real estate markets: short and mid-run effects on housing prices in Campania region (Italy). Soc Sci 9(7):114. https://doi.org/10.3390/socsci9070114

Deng G, Gan L, Hernandez MA (2015) Do natural disasters cause an excessive fear of heights? Evidence from the Wenchuan earthquake. J Urban Econ 90:79–89. https://doi.org/10.1016/j.jue.2015.10.002

Fleming MC, Nellis J (1984) The Halifax house price index: technical details, Halifax Building Society.

Francke M, Korevaar M (2021) Housing markets in a pandemic: evidence from historical outbreaks. J Urban Econ 123:103333. https://doi.org/10.1016/j.jue.2021.103333

Goh YM, Costello G, Schwann G (2012) Accuracy and robustness of house price index methods. Housing Stud 27(5):643–666. https://doi.org/10.1080/02673037.2012.697551

Ho AT, Huynh KP, Jacho-Chávez DT (2016) Flexible estimation of copulas: an application to the US housing crisis. J Appl Econ 31(3):603–610. https://doi.org/10.1002/jae.2437

Huang Y, Yip TL, Liang C (2020) Risk perception and property value: evidence from Tianjin Port explosion. Sustainability 12(3):1169. https://doi.org/10.3390/su12031169

Liu Y, Tang Y (2021) Epidemic shocks and housing price responses: evidence from China’s urban residential communities. Reg Sci Urban Econ. https://doi.org/10.1016/j.regsciurbeco.2021.103695

Mark JH, Goldberg MA (1984) Alternative housing price indices: an evaluation. Real Estate Econ 12(1):30–49. https://doi.org/10.1111/1540-6229.00309

Ngai LR, Tenreyro S (2014) Hot and cold seasons in the housing market. Am Econ Rev 104(12):3991–4026. https://doi.org/10.1257/aer.104.12.3991

Qian X, Qiu S, Zhang G (2021) The impact of COVID-19 on housing price: evidence from China. Financ Res Lett. https://doi.org/10.1016/j.frl.2021.101944

Tian C, Peng X, Zhang X (2021) COVID-19 pandemic, urban resilience and real estate prices: the experience of cities in the Yangtze River Delta in China. Land 10(9):960. https://doi.org/10.3390/land10090960

Trilla A, Trilla G, Daer C (2008) The 1918 “spanish flu” in spain. Clin Infect Dis 47(5):668–673. https://doi.org/10.1086/590567

Wong G (2008) Has SARS infected the property market? Evidence from Hong Kong. J Urban Econ 63(1):74–95. https://doi.org/10.1016/j.jue.2006.12.007

Xin ZQ, Li ZH, Yang ZX (2020) People’s economic confidence, financial values, and willingness to expend during the outbreak of COVID-19 in China. J Central Univ Financ Econ 06:118–128

Yang M, Zhou J (2021) The impact of COVID-19 on the housing market: evidence from the Yangtze river delta region in China. Appl Econ Letters. https://doi.org/10.1080/13504851.2020.1869159

Yoruk B (2020) Early effects of the COVID-19 pandemic on housing market in the United States. Available at SSRN 3607265. https://ssrn.com/abstract=3607265

Zimmer DM (2012) The role of copulas in the housing crisis. Rev Econ Stat 94(2):607–620. https://doi.org/10.1162/REST_a_00172

Acknowledgements

The authors thank the anonymous reviewers for their revision suggestions. All remaining errors are ours.

Funding

This research is funded by the National Natural Science Foundation of China (Funding No. 72174220), a research grant in Humanities and Social Sciences by the Ministry of Education of China (21YJAZH104).

Author information

Authors and Affiliations

Contributions

SZ performed material preparation, data collection, and analysis. SZ wrote the first draft of the manuscript. The revision and guidance of the manuscript were by CY.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Zeng, S., Yi, C. Impact of the COVID-19 pandemic on the housing market at the epicenter of the outbreak in China. SN Bus Econ 2, 53 (2022). https://doi.org/10.1007/s43546-022-00225-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-022-00225-2