Abstract

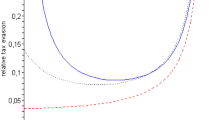

Conventional wisdom is that higher competition, implying more active firms, benefits consumers but hurts producer surplus. Under unit taxation/subsidy, we find that the entry of efficient firms improves consumer welfare, while the entry of inefficient firms hurts consumer surplus with network externalities. The entry of efficient firm raises industry profit if the degree of network externalities is relatively high. The latter result is at odds with the conventional wisdom and showed another channel for the possibility of a profit-raising entry. Our results suggest that the strength of network effects should be considered for designing taxation/subsidy and competition policies concurrently.

Similar content being viewed by others

Notes

In a successive oligopoly, Matsushima (2006) showed that when upstream firms compete in quantity and freely enter the input markets, the industry profits of downstream firms competing in quantity may increase with the number of downstream firms. Wang and Lee (2015) further allow R&D and knowledge spillover in the downstream sector and showed that an increase in the number of firms lowers industry profit may not hold in vertical structure of production.

In this paper, we do not consider the degree of compatibility between network goods. Please see the works considering network compatibility issues, Toshimitsu (2020) and Basak and Pertrakis (2021).

References

Dinda S, Mukherjee A (2014) A note on the adverse effect of competition on consumers. J Public Econ Theory 16:157–163

Fanti L, Buccella D (2017) Profit raising entry in network industries with corporate social responsibility. Econ Bus Lett 6(3):59–68

Hoernig S (2012) Strategic delegation under price competition and network effects. Econ Lett 117:487–489

Lahiri S, Ono Y (1988) Helping minor firms reduces welfare. Econ J 98:1199–1202

Matsushima N (2006) Industry profits and free entry in input markets. Econ Lett 93:329–336

Mukherjee, A., 2019, ‘Profit raising entry in a vertical structure,’ Econ Lett, 183, Article 108543.

Mukherjee A, Broll U, Mukherjee S (2009) The welfare effects of entry: the role of the input market. J Econ 98:189–201

Mukherjee A, Zhao L-X (2017) Profit raising entry. J Ind Econ 65:214–219

Toshimitsu T (2020) Note on the excess entry theorem in the presence of network externalities. J Ind Bus Econ-Econ e Politica Industriale 47(2):271–282

Wang LFS, Zeng C, Zhang Q (2019a) Indirect taxation and undesirable competition. Econ Lett 181:104–110

Wang, L. F. S.; Zeng, C. and Zhang, Q., 2019b, ‘Indirect taxation and consumer welfare in an asymmetric Stackelberg oligopoly,’ North Am J Econ Finance, 50, Article 101034.

Wang LFS, Lee J-Y (2015) Profit-raising entry in vertically related markets. Manag Decis Econ 36:401–407

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

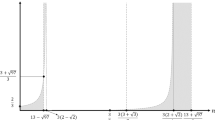

1.1 Proof for Lemma 1

1.2 Proof for Proposition 1

Based on equations \(\frac{ds}{dm}\) and\(\frac{dQ}{dm}\), \(\frac{d{q}_{i}}{dm}\) implies that an increase in the number of inefficient firms increases the outputs of efficient and inefficient firms. Alternatively, given\(\frac{d{q}_{j}}{dn}\), the effects of an increase in the number of efficient firms on the outputs are not unidirectional because \(\frac{ds}{dn}>0\) and \(\frac{dQ}{dn}\).

1.3 Proof for Proposition 2

Given \(\frac{d{q}_{i}}{dm}\), the effect of an increase in the number of inefficient firms on the industry profit is positive.\(\frac{d\Pi }{dm}=2n{q}_{i}\frac{d{q}_{i}}{dm}+{{q}_{j}}^{2}+2m{q}_{j}\frac{d{q}_{j}}{dm}>0.\)

Similarly, using \(\frac{d{q}_{i}}{dn}\), we represent the following effect of an increase in the number of efficient firms:

We can derive the following relationship:

where \(A=a(m+n)-c((2-\lambda )m+\lambda n+(1-\lambda )m(m+n)\)).

Using the assumption in the model, i.e., \(a>(1+(1-\lambda )n)c\), it holds that.

\(a(m+n)>(1+(1-\lambda )n)c(m+n\)).

The following relationship arises:

\((1+(1-\lambda )n)(m+n\)) > ( <)\(((2-\lambda )\mathrm{m}+\lambda n+(1-\lambda )m(m+n))\leftrightarrow (n-m)(m+n+1)>(<)0\).

Similarly,

1.4 Proof for Proposition 3

Rights and permissions

About this article

Cite this article

Zhang, Q., Wang, L.F.S. Taxation, Network Externalities, Consumer Suffering, and Profit-Raising Entry: A Cautionary Note. J Ind Compet Trade 22, 225–231 (2022). https://doi.org/10.1007/s10842-022-00381-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-022-00381-z