Abstract

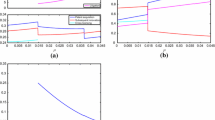

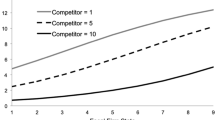

Big companies and small innovation factories possess different advantages in a patent contest. While large firms typically have better access to product markets, small firms often have a superior R&D efficiency. These distinct advantages immediately lead to the question of cooperations between firms. In this paper, we model a patent contest with heterogeneous firms. In a pre-contest acquisition game large firms bid sequentially for small firms to combine respective advantages. Sequential bidding allows the first large firms to bid strategically to induce a reaction of its competitor. For high efficiencies both large firms prefer to acquire immediately leading to a symmetric market structure. For low efficiencies strategic waiting of the first large firm leads to an asymmetric market structure even though the initial situation is symmetric. We also discuss two different timing setups of the acquisition stage. In all setups, acquisitions increase the chances for a successful innovation.

Similar content being viewed by others

Notes

See Roberts (1980) for a description of 3M’s R&D strategy.

See for example Tele Atlas’ press release under: http://www.teleatlas.com/WhyTeleAtlas/Pressroom/PressReleases/TA_CT018103.

See for example Nokia’s press release under: http://www.nokia.com/A4136002?newsid=-6233.

As α i is smaller than 1 there is a chance that no firm will win the patent contest.

This assumption is made to keep the model analytically tractable and it is clearly restricting. However, from our results tendencies for more general cases can be deviated. If overall efficiency is different, the efficiency effect of an acquisition is increased.

Important for our way of modeling is that the small firm still performs R&D in the same way as before the acquisition. Otherwise, the superior R&D efficiency would be lost.

Without efficiencies investment of the merged firm is smaller than combined investment of the two former independent firms. The result is comparable to the output reduction and subsequent reduced profit of a merged firm in the Salant et al. (1983) model without cost efficiencies.

This externality is also comparable to Salant et al. (1983). Without cost efficiencies, the outsider reacts to the output reduction of the merged firm with an expansion of her own output and therefore her profits rise.

The resulting market structure in equilibrium is the same for most parameter values if the acquisition game is simplified in a way that large firms just pay the current expected profits of small firms when they want to acquire. That is, if small firms do not expect further changes in the market structure and act myopic in the acquisition game.

We use the indices S, L, and M to denote small, large, and merged firms respectively.

If a large firm is indifferent concerning acquiring and not acquiring, we assume it is acquiring; if a small firm is indifferent concerning accepting and denying an offer, we assume it is accepting.

Note that \(p_N\leq p_O \Leftrightarrow x\leq 1.5\). Thus, small firms only prefer p N to p O for very high efficiencies.

We abstract from the coordination problem which small firm is acquired by which large firm.

This is equivalent to an analysis with a bidding price p 0 if the other large firm acquires and a price p N if the other large firm does not acquire.

There is also an equilibrium in mixed strategies which is not of particular interest in this analysis.

As we neglect all other projects by small firms, this is equivalent to exclusive licensing of the innovation to one large firm.

If x > 2, large firms investment is z L = 0 and we use only Eq. 5.

We would like to thank an anonymous referee for the suggestion of interpreting our model in this way.

Either acquired by L 2 for x ≥ 1.05678 or x < 1.0333 or as an independent firm in a triopoly for 1.05678 > x ≥ 1.0333.

References

Acs ZJ, Audretsch DB (1987) Innovation, market structure, and firm size. Rev Econ Stat 69:567–574

Acs ZJ, Audretsch DB (1990) Innovation and small firms. MIT, Cambridge

Arrow KJ (1962) Economic welfare and the allocation of resources for invention. In: Nelso RR (ed) The rate and direction of inventive activity. Princeton University Press, Princeton, pp 609–626

Audretsch DB, Vivarelli M (1996) Firm size and R&D spillovers: evidence from Italy. Small Bus Econ 8:249–258

Blonigen BA, Taylor CT (2000) R&D intensity and acquisitions in high technology industries: evidence from the US electronic and electrical equipment industries. J Ind Econ 48:47–70

Coase RH (1937) The nature of the firm. Economica 4:386–405

Cohen WM, Levin RC (1989) Empirical studies of innovation and market structure. In: Schmalensee R, Willig RD (eds) Handbook of industrial organization. Elsevier Science, Amsterdam, pp 1059–1107

Competition Commission (2004) Carl zeiss jena GmbH and bio-rad laboratories inc. A report on the proposed acquisition of the microscope business of Bio-Rad Laboratories Inc

Denicolò V (1996) Patent races and optimal patent breadth and length. J Ind Econ 3:249–265

Dixit AK (1987) Strategic behavior in contests. Am Econ Rev 77:891–898

Dorazelski U (2003) An R&D race with knowledge accumulation. Rand J Econ 1:20–42

Ernst H, Vitt J (2000) The influence of corporate acquisitions on the behaviour of key inventors. R&D Management 30:105-119

Fumagalli E, Nilssen T (2008) Waiting to merge. SSRN Working paper series available at SSRN http://ssrn.com/abstract=1233503

Gilbert RJ, Newbery DMG (1982) Preemptive patenting and the persistence of monopoly. Am Econ Rev 72:514-526

Hanan M (1969) Corporate growth through internal spin-outs. Harvard Bus Rev 55–66

Harris C, Vickers J (1985) Patent races and the persistence of monopoly. J Ind Econ 33:461-481

Hörner J (2004) A perpetual race to stay ahead. Rev Econ Stud 71:1065–1088

Jost PJ, van der Velden C (2006) Mergers in patent contest models with synergies and spillovers. Schmalenbach Bus Rev 58:157–179

Kamien MI, Schwartz NL (1975) Market structure and innovation: a survey. J Econ Lit 13:1–37

Lindholm A (1996a) An economic system of technology-related acquisitions and spin-offs. University of Cambridge, ESRC Centre for Busines Research, Working paper 33

Lindholm A (1996b) Acquisition and growth of technology-based firms. University of Cambridge ESRC Centre for Busines Research, Working paper 47

Link AN, Rees J (1990) Firm size, university based research and the returns to R&D. Small Bus Econ 2:25–31

Mazzucato M (2000) Firm size, innovation and market structure. Edward Elgar, Aldershot

Nilssen T, Sørgard L (1998) Sequential horizontal mergers. Eur Econ Rev 42:1683–1702

Reinganum J (1989) The timing of innovation: research, development and diffusion. In: Schmalensee R, Willig R (eds) Handbook of industrial organization. North Holland, New York, pp 849–908

Roberts EB (1980) New ventures for corporate growth. Harvard Bus Rev 58:134–142

Roberts EB, Berry CA (1985) Entering new businesses: selecting strategies for success. Sloan Manage Rev 26:3–17

Rothwell R, Zegveld W (1982) Innovation and the small and medium-sized firm. Frances Pinter, London

Rothwell R (1989) Small firms, innovation and industrial change. Small Bus Econ 1:21–38

Salant SW, Switzer S, Reynolds RJ (1983) Losses from horizontal merger: the effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Q J Econ 98:185–199

Santarelli E, Sterlacchini A (1990) Innovation, formal vs. informal R&D, and firm size: some evidence from Italian manufacturing firms. Small Bus Econ 2:223–228

Scherer FM (1965) Firm size, market structure, opportunity, and the output of patented inventions. Am Econ Rev 55:1097–1125

Scherer FM (1991) Changing perspectives on the firm size problem. In: Acs ZJ, Audretsch DB (eds) Innovation and technological change: an international comparison. University of Michigan Press, Ann Arbor, pp 24–38

Van Dijk B, den Hertog R, Menkveld B, Thurik AR (1997) Some new evidence on the determinants of large- and small-firm innovation. Small Bus Econ 9:335–343

Veugelers R, Cassiman B (1999) Make and buy in innovation strategies: evidence from Belgian manufacturing firms. Res Policy 28:63–80

Zachau U (1987) Mergers in the model of an R&D race. University of Bonn, Sonderforschungsbereich 303, Discussion paper no A 139

Author information

Authors and Affiliations

Corresponding author

Additional information

I am grateful to Norbert Schulz for continuous guidance, encouragement, and assistance.

I would also like to thank Peter Welzel, Jay Pil Choi, an anonymous referee and seminar participants at the 4th BGPE research workshop and the graduate student seminar at Michigan State University for helpful comments.

Appendix

Appendix

Proof of Proposition 1

To prove Proposition 1, the acquisition game is solved by backward induction, taking optimal decisions in the R&D stage as given.

At decision point 16 S 2 has to decide whether to accept the price \(p_{22}^C\) offered by L 2 or denying the offer and getting a payoff of \(\frac{\alpha V }{16}\). Thus, S 2 accepts every offer \(p_{22}^C\geq p_N\) and denies any other offer.

Expecting this decision from S 2, L 2 makes her offer in decision point 14. If S 2 denies the offer, the game ends without any acquisition and L 2 gets the payoff \(\frac{\alpha V}{16}\). If S 2 accepts, L 2 gets the payoff of R&D game 8, the triopoly with one merged, one small, and one large firm. If L 2 decides to acquire, it makes the lowest offer S 2 accepts, i.e., \(p_{22}^C=p_N\). Thus, L 2 decides to make an offer if

This inequality holds for x ≥ 1.0333.

If S 2 accepts the offer in decision point 12, it gets the payoff \(p_{12}^C\). If not, it either gets \(p_{22}^C=p_N\) if x ≥ 1.0333 resulting from an acceptable offer by L 2 or \(\frac{\alpha V}{16}\) if x < 1.0333 as an independent firm in R&D game 9. Thus, S 2 accepts any offer by L 1 that is greater or equal than p N .

In decision point 9 L 1 has to offer at least \(p_{12}^C=p_N\) if it wants S 2 to accept. If S 2 accepts the bid, L 1’s payoff is

If S 2 denies the offer, L 1 gets the payoff of an outsider in R&D game 8 when x ≥ 1.0333, i.e., in the situation where L 2 decides to acquire in decision point 14. This payoff is

If x < 1.0333, S 1 gets \(\frac{\alpha V}{16}\) as payoff. Consider first the case x ≥ 1.0333: L 1 acquires if

This inequality holds for x ≥ 1.10933. In the case x < 1.0333 L 1 acquires if

This inequality never holds since x < 1.0333. Thus, L 1 decides to acquire in decision point 9 if x ≥ 1.10933.

In decision point 15 S 2 gets the payoff of an outsider in R&D game 7 if it denies the offer. Therefore S 2 accepts every offer \(p_{22}^B\geq p_O.\)

In decision point 13 L 2 has already acquired S 1 for p 21. If L 2 acquires S 1, the situation is an asymmetric duopoly where L 2 has acquired both small firms. L 2’s payoff if it acquires is

where \(p_{22}^B=p_O\) is the lowest offer S 2 accepts. If L 2 does not acquire, its payoff is the payoff of the merged firm in R&D game 7 minus the price paid for S 1:

Thus, L 2 acquires if

This inequality holds for every x ≥ 1 and therefore L 2 always bids \(p_{22}^B= p_O\) and acquires S 2 in decision point 13.

In decision point 11 S 2 accepts any offer \(p_{12}^B \geq p_O.\)

In decision point 8 L 1 has to offer at least \(p_{12}^B=p_O\) if it wants S 2 to accept. If S 2 accepts, the resulting situation is R&D game 4, a symmetric duopoly. If S 2 denies the offer, L 1 gets the profit of an outsider in an asymmetric duopoly in R&D game 6 since L 2 always makes an offer that S 2 accepts in decision point 13. L 1 therefore decides to offer \(p_{12}^B=p_O\) and to acquire S 2 if

This inequality holds for x ≥ 1.18731.

If S 1 denies the offer in decision point 6, the acquisition game ends in an asymmetric triopoly (where S 1 is an outsider) for x ≥ 1.0333 and in R&D game 9 for x < 1.0333. Thus, S 1 accepts every offer p 21 ≥ p O for x ≥ 1.0333 and every offer p 21 ≥ p N for x < 1.0333.

If L 2 decides to acquire S 1 in decision point 4, the acquisition game ends in R&D game 4 for x ≥ 1.18731 and in R&D game 6 for x < 1.18731. If L 2 does not acquire S 1, the acquisition game ends in R&D game 5 for x ≥ 1.10933, in R&D game 8 for 1.10933 > x ≥ 1.0333, and in R&D game 9 for x < 1.0333. Consider first the case x ≥ 1.18731: The payoff for L 2 in R&D game 4 is \(\frac{\alpha x V }{4}-p_{21};\) in R&D game 5 it is \(\frac{\alpha V}{(1+2x)^2}.\) The payoff in R&D game 4 is larger for the lowest accepted offer p 21. For x ≥ 1.18731 L 2 therefore bids p 21 = p O and acquires S 1. The next case to consider is 1.18731 > x ≥ 1.10933: The payoff for L 2 if it acquires S 1 is given by R&D game 6 and is thus \(\frac{\alpha x^3V}{(1+x)^2}-p_{21}-p_{22}^B,\) where \(p_{22}^B=p_O\) and the lowest accepted offer is p 21 = p O . If L 2 does not acquire, its payoff is given by R&D game 5 and it is \(\frac{\alpha V}{(1+2x)^2}.\) Thus, L 2 acquires if

This inequality holds for every 1.18731 > x ≥ 1.10933. The third case is 1.10933 > x ≥ 1.0333: The payoff for L 2 if it acquires is the same as in the previous case. If L 2 does not acquire, its payoff is given by R&D game 8 and it is \(\frac{\alpha x V}{(1+2x)^2}(2x-1)^2-p_{22}^C\) with \(p_{22}^C=p_N\). Thus, L 2 acquires if

This inequality holds for x ≥ 1.05678. The last case to consider is x < 1.0333. The payoff for L 2 if it acquires is again given by R&D game 6, but L 2 only has to pay p 21 = p N to make S 1 accept the offer. If L 2 does not acquire, its payoff is given by R&D game 9 and it is \(\frac{\alpha V}{16}\). Thus, L 2 acquires if

This inequality holds for every x < 1.0333. Thus, in decision point 4 L 2 bids p 21 = p O and acquires S 1 for x ≥ 1.05678, does not acquire S 1 for 1.05678 > x ≥ 1.0333, and bids p 21 = p N and acquires S 1 for x < 1.0333.

In decision point 10 S 2 accepts every offer that gives it a higher payoff than the payoff as an outsider in R&D game 3. Thus, S 2 accepts every offer \(p_{12}^A \geq p_O.\)

In decision point 7 L 1 has already acquired S 1 for p 11. If L 1 acquires S 2, L 1 is the merged firm in R&D game 2 and has a payoff \(\frac{\alpha x^3V}{(1+x)^2}-p_{12}^A-p_{11},\) where the lowest accepted offer is \(p_{12}^A=p_O.\) If it decides not to acquire, its payoff is the one of the merged firm in a triopoly, i.e, \(\frac{\alpha x V}{(1+2x)^2}(2x-1)^2-p_{11}.\) Thus, L 1 acquires if

This inequality always holds and thus L 1 always bids \(p_{12}^A =p_O\) and acquires S 2 in decision point 7.

In decision point 5 S 2 accepts every offer \(p_{22}^A \geq p_O.\)

In decision point 3 L 2 has to decide whether to acquire S 2 and create a symmetric duopoly in R&D game 1 or not to acquire S 2 and become the outsider in the asymmetric duopoly in R&D game 2. If L 2 acquires, its payoff is \(\frac{\alpha x V }{4}-p_{22}^A\), where the lowest accepted offer is \(p_{22}^A = p_O.\) If L 2 does not acquire, its payoff is \(\frac{\alpha V}{(1+x)^2}\). Thus, L 2 acquires if

This inequality holds for x ≥ 1.18731 and therefore L 2 acquires S 2 for x ≥ 1.18731 in decision point 3.

If S 1 denies the offer in decision point 2, the acquisition game ends with a payoff of \(\frac{\alpha V}{(1+2x)^2}\) for S 1.Footnote 22 Thus, S 1 accepts every offer p 11 ≥ p O .

If L 1 decides to acquire in decision point 1, the acquisition game ends with R&D game 1 for x ≥ 1.18731 and with R&D game 2 if x < 1.18731. If L 1 decides not to acquire, the acquisition game ends with R&D game 4 for x ≥ 1.18731, with R&D game 6 for 1.18731 > x ≥ 1.05678 or x < 1.0333 and with R&D game 8 for 1.05678 > x ≥ 1.0333. Consider first the case x ≥ 1.18731: L 1’s payoff if it acquires is then given by R&D game 1 minus the price p 11 paid for S 1. The lowest price accepted by S 1 is p O . If L 1 decides not to acquire in decision point 1, the game ends in R&D game 4 where L 1’s expected profit is the same and the price paid to acquire S 2 is p O . Thus, for x ≥ 1.18731 L 1 is indifferent between acquiring now or later and due to our assumption given in footnote 14 L 1 acquires S 1 for p 11 = p O . For all other cases L 1’s payoff if it acquires is given by R&D game 2 and L 1 has to pay \(p_{11}=p_{12}^A =p_O.\) Thus, L 1’s payoff if it acquires is

L 1’s payoff if it decides not to acquire depends on x. If 1.18731 > x ≥ 1.05678 or x < 1.0333, L1’s payoff is given by R&D game 6 and it is

This is larger than the payoff given by Eq. 7 for x < 1.22364. If 1.05678 > x ≥ 1.0333, L 1’s payoff is given by R&D game 8 and it is

This is larger than the payoff given by Eq. 7 for x < 1.09021. Thus, in decision point 1 L 1 bids p 11 = p O and acquires S 1 for x ≥ 1.18731 and does not acquire S 1 for x < 1.18731. □

Proof of Proposition 3

If all firms remain active in the innovation market (x ≤ 2), the probability of a successful innovation is

Comparing this to the initial situation leads to

If large firms quit the innovation market, the probability of a successful innovation is the same as in the symmetric duopoly and \(p_{\rm ges}^1>p_{\rm ges}^4\) (see Proposition 2). □

Rights and permissions

About this article

Cite this article

Kleer, R. Acquisitions in a Patent Contest Model with Large and Small Firms. J Ind Compet Trade 9, 307–328 (2009). https://doi.org/10.1007/s10842-009-0055-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-009-0055-4