Abstract

This study investigates how American adults’ personality and financial self-efficacy (FSE) beliefs contributed to how they used their COVID-19 CARES Act Economic Impact Payment (EIP) for spending needs, spending wants, and financial transactions (save, invest, debt repayment). The results from a sample of 1172 Amazon MTurk users collected in July 2020 suggest that both personality traits and FSE beliefs were associated with EIP use. Specifically, this study finds that FSE and conscientiousness emerged as the most robust predictors of EIP use across all categories of financial behavior with a greater allocation of EIP funds to saving and less to spending needs and debt repayment. Additionally, greater FSE is associated with investing, while greater conscientiousness is connected to more spending on wants. The results suggest that saving habits associated with personality and FSE persist in a crisis environment, and pre-crisis preparedness may allow for greater spending flexibility on wants. Significant relationships were also found for openness, extraversion, agreeableness, and neuroticism. The findings highlight how people use unexpected financial windfalls during crises and uncertainty and how personal characteristics contribute to this decision making.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The COVID-19 health pandemic has had a jarring and far-reaching impact on all areas of life that has spurred an immediate need to cope, recover, and build resilience financially, psychologically, and socially (Polizzi et al., 2020). While multi-faceted coping strategies are necessary to contend with the level and extent of the economic and psychosocial disruption caused by COVID-19 (Polizzi et al., 2020), this study focuses on financial coping during the crisis and the psychological characteristics that shape the financial choices people make. This study hones in on decision making for government-provided financial support in the form of stimulus payments and how psychological characteristics relate to using this windfall-type money for spending needs, wants, and wealth-building behaviors such as saving, investing, and debt repayment. Given the abrupt personal, family, and economic shock delivered by COVID-19 and swift governmental response with initial financial support in Spring 2020 under the CARES Act, people likely did not have an opportunity to plan for impending financial disruption. Therefore, people likely perceived the stimulus payment as an unexpected windfall (Asebedo et al., 2020; Shefrin & Thaler, 1988) that evoked behavior reflecting their level of financial preparedness and sense of control and resilience over their financial situation both before and during the crisis.

The life cycle hypothesis considers money as fungible and, therefore, treated the same way over the life cycle regardless of its source (Ando & Modigliani, 1963). However, the behavioral life cycle hypothesis explains behavioral deviations from life cycle hypothesis expectations because people treat money differently depending on its source and associated marginal propensity to consume that source (e.g., income, current asset, and future income). Therefore, Shefrin and Thaler (1988) posited that money is nonfungible with its use dependent upon framing, mental accounting, and self-control. Furthermore, the behavioral life cycle hypothesis suggests that people likely framed the CARES Act EIP as a current income windfall with a high marginal propensity to consume the EIP given the unexpected nature of COVID-19, the quick onset of financial disruption, and prompt governmental support (Shefrin & Thaler, 1988). Therefore, the CARES Act EIP likely induced personal characteristics (e.g., self-control, biases, and framing) that resulted in financial decisions during the time of EIP receipt that people otherwise might not have made absent the windfall.

While most people tend to focus on necessities and basic needs during tumultuous times (Loxton et al., 2020), researchers discovered that the use of stimulus payment money during the COVID-19 health pandemic has varied. For example, some stimulus payment recipients chose to spend their payment on wants over needs or used it for saving, investing, or debt repayment (Asebedo et al., 2020; Coibion et al., 2020). The primary purpose of stimulus payment programs is to increase consumer spending; however, people do not always use this money as policymakers intend. Therefore, it is essential to generate an understanding of the characteristics associated with those that do not behave as anticipated for future legislation. Researchers have generated evidence for the economic and sociodemographic attributes associated with COVID-19 EIP use within a variety of samples: (a) Amazon MTurk (Asebedo et al., 2020), (b) Nielsen Homescan panel, consisting of adults who track and report their daily purchases (Coibion et al., 2020), (c) The Household Pulse Survey experimental data system, administered by the U.S. Census Bureau (Garner et al., 2020), and (d) Facteus, private transaction-level debit card panel data from government agencies (Karger & Rajan, 2020). This study builds upon this existing EIP research by investigating a new dimension—psychological characteristics—associated with COVID-19 EIP use across spending and saving-oriented categories. Additionally, this study gathered primary data consisting of psychological characteristics and sociodemographic and economic variables using a general sample of 1172 American adults derived from Amazon’s MTurk platform, consistent with Asebedo et al. (2020).

Research and theory suggest that fundamental personal dispositions (personality) in addition to self-efficacy—control, resilience, influence, and confidence—serve a pivotal role in self-regulatory behavior, particularly amid adversity, uncertainty, new situations, and circumstances with daunting obstacles (Bandura, 1991, 1997; Bleidorn et al., 2019; Stajkovic et al., 2018). Therefore, personality traits and financial self-efficacy beliefs might explain variation in how stimulus payment recipients under the CARES Act used their unexpected funds. This combined research and theory form the impetus for this study: to investigate how American adults used their COVID-19 economic stimulus relief payment (specifically referred to as an economic impact payment; EIP) and how their personality and financial self-efficacy (FSE) beliefs contributed to their decision-making. This study raises awareness of how people use unexpected financial windfalls during crises and uncertainty and how personal psychological characteristics relate to those decisions. Because of the high cost of stimulus payment programs, policymakers are interested in how people use these funds and what factors contribute to their choices. In addition, and perhaps most importantly, this study contributes to understanding the underlying psychological characteristics associated with creating financial resilience during times of stability such that individuals can cope effectively with future financial disruptions with a greater sense of control, confidence, and hope.

Literature Review

Economic Stimulus Payment Programs

In response to adverse economic environments, policymakers enact economic stimulus programs to address two significant challenges: individual economic hardship and stimulation of the broader economy (Kaplan & Violante, 2014). The Economic Growth and Tax Relief Reconciliation Act of 2001 is one example of this policy instrument that provided tax rebate checks of up to $600 for U.S. households during the 2001 economic recession. Similarly, policymakers codified the Economic Stimulus Act (ESA) of 2008 in response to the 2007–2009 recession to bolster consumer spending, alleviate the effects of the recession, and boost the economy. The ESA included a broad tax rebate program that provided (subject to income limitations) $300 to $600 per individual with an additional $300 per qualifying child.

More recently, policymakers have implemented economic stimulus payment programs in response to the economic impact of the COVID‐19 health pandemic. The U.S. federal government passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) on March 27th, 2020, that allotted $2.2 trillion to provide swift and direct economic assistance for American households, businesses, industries, and state and local governments (U.S. Department of the Treasury, 2021). According to the CARES Act, a single U.S. citizen, permanent resident, or qualifying resident alien received a maximum one-time economic impact payment (EIP) of $1200, phased out with income between $75,500 and $146,500; married couples filing joint received a $2400 EIP, phased out with income between $150,000 and $198,000; additionally, households with children under 17 received $500 per child (U.S. Department of the Treasury, 2021). The government issued a second stimulus payment in January and February 2021 under the Coronavirus Response and Relief Supplemental Appropriations Act with the same income guidelines as the CARES Act. However, the base amount was half as much ($600) as the first round of payments (U.S. Department of the Treasury, 2021). Last, policymakers approved the third payment in March 2021 of $1400 for each eligible individual, including dependents (U.S. Department of the Treasury, 2021). Given the multiple rounds of stimulus payments targeting the COVID-19 health pandemic, it is important to note that this study is concerned with only the first set of payments issued in 2020 under the CARES Act.

Behavioral Characteristics and Stimulus Payment Use

Because policymakers often issue stimulus payments in response to adverse circumstances to stimulate the economy and help people cope with stressors, it is important to consider behavioral characteristics (in addition to socioeconomic and demographic factors) that underpin decision making when investigating how people use that money. Behavioral economics seeks to understand the psychological attributes relevant to stimulus payment spending that explain seemingly irrational behaviors that often contradict alternative rational choices (Mullainathan & Thaler, 2000). For example, though individuals intend to set goals that benefit their future self, a lack of self-regulation can lead to failure in executing those goals (Bandura, 2005; Shefrin & Thaler, 1988). Behavioral characteristics can also explain variant spending behaviors on items such as health (King et al., 2013), food selection (French et al., 2001), and drinking (Vuchinich & Tucker, 1983). Behavioral characteristics also underpin differences in financial behaviors for debt (Stone & Maury, 2006), savings, and investment (Thaler & Benartzi, 2004). Furthermore, risk tolerance (Finke & Huston, 2003), future planning (Shaffer, 2020), and financial self-efficacy (Chatterjee et al., 2011) are all behavioral characteristics that relate positively to an individual’s financial stability and net worth. As people become aware of and harness their behavioral characteristics to achieve financial stability and increase wealth, they can more comfortably take care of needs such as food and shelter, satisfy desires by consuming wants, and save more for the future.

Behavioral characteristics are particularly salient during adverse environmental conditions. For example, during a recession, people are more vulnerable to psychological distress and financial instability, which results in weakened cognitive ability and poor financial decision making (Mani et al., 2013; Marjanovic et al., 2013; Shah et al., 2012). Risk aversion, depression, anxiety, suicide ideation, and perceived financial threat also increase (Chiang & Xiao, 2017; Marjanovic et al., 2013; Tefft, 2011). Financial and generalized self-efficacy also tend to diminish as individuals perceive increased financial threat and loss of control (Greenglass & Mara, 2012; Marjanovic et al., 2013). Moreover, the effect of economic distress is not equal across all participants in the economy due to behavioral characteristics. For example, those who hold a relatively positive outlook of the economy more readily take financial risk, participate in the stock market, spend, and invest while gambling less, and perceive lower levels of financial threat (Bailey & Kinerson, 2005; Hurd & Rohwedder, 2010; Nagel, 2012; Smeral, 2010; Wohl et al., 2014). Within the COVID-19 health pandemic environment, Asebedo et al. (2020) found behavioral characteristics related to stimulus payment use under the 2020 CARES Act, such as economic recovery outlook, financial-risk-taking attitude, consulting with others, and recession and stock market expectations.

An additional behavioral characteristic that affects financial behavior, particularly amid adverse circumstances, is financial self-efficacy (FSE). FSE is the sense of control, resilience, influence, and confidence a person perceives over their financial situation (Asebedo et al., 2019; Bandura, 1997). FSE moderates perceived financial threats and the relationship between market volatility and financial satisfaction (Asebedo & Payne, 2019; Greenglass & Mara, 2012). According to Bandura (1991), self-efficacy is a protective psychological trait that mitigates stress and depression and creates resiliency as people cope with environmental conditions. Therefore, FSE may be central to coping with the financial consequences of the COVID-19 environment and, specifically, the use of CARES Act EIP funds. Given the financial preparedness characteristics and ability to cope with adverse circumstances associated with greater FSE, those with greater FSE would likely have entered the COVID-19 environment with greater financial stability. This greater financial stability would create more flexibility to allocate more EIP funds to spending wants and less to needs. Furthermore, a sense of control, market volatility resilience (Asebedo & Payne, 2019), and a savings habit might result in those with greater FSE perpetuating their savings behavior by allocating more significant proportions of their EIP to saving and investing. Furthermore, because greater FSE is associated with less debt (Farrell et al., 2016), it is less likely that someone with greater FSE will need to use their EIP for debt reduction.

Personality and Stimulus Payment Use

In addition to FSE, personality traits are influential to human behavior and mobilize in response to situations or tasks that seem daunting or impossible to overcome (Stajkovic et al., 2018). Therefore, personality characteristics may also explain variation in how people used their CARES Act EIP within the context of the COVID-19 health pandemic. The American Psychological Association (APA, 2021) defines personality as “individual differences in characteristic patterns of thinking, feeling, and behaving.” Researchers have found personality traits to explain individual differences in financial behaviors such as investing, spending, debt usage, and consumption decisions (Brown & Taylor, 2014; Duckworth & Weir, 2011; Gladstone et al., 2019). While several personality frameworks exist, the Big Five personality trait taxonomy is the most widely used in personality psychology that is broad and generalizable yet sufficiently nuanced to reflect variation in individual differences (Bleidorn et al., 2019). Each Big Five trait is associated with a variety of financial behaviors. Because this study focuses on how people used their CARES Act EIP for spending needs, wants, and wealth accumulation-oriented financial transactions (save, invest, pay repayment), this section will provide a brief overview of how each Big Five personality trait connects to these areas.

Openness

Greater openness to experience is associated with having more debt (Brown & Taylor, 2014), a higher likelihood of owning stock (Liu, 2020), and more willingness to take financial risks (Liu, 2020). Furthermore, those with greater openness tend to exhibit more impulsive buying behaviors (Shahjehan et al., 2012), save less and spend more (Duckworth & Weir, 2011), and experience more incidents of unemployment (Viinikainen & Kokko, 2012). Within the context of the COVID-19 pandemic, greater openness might associate with more EIP use for spending needs due to less financial preparedness and less prudent money management before the pandemic. This diminished preparedness would likely create a greater need to use EIP money for necessities or debt reduction while having a diminished capacity to allocate EIP funds to financial transactions. However, when examining the financial transaction subcategories, a greater risk tolerance combined with existing investing behavior associated with the openness trait may result in investing a portion of the EIP. Furthermore, less prudent money management practices, greater impulsivity, and less financial preparedness might result in those with a stronger openness trait using less of their EIP funds for spending wants because of greater demands on their needs and debt load.

Conscientiousness

Those with greater conscientiousness are more likely to save (Gladstone et al., 2019), invest (Mosca & McCrory, 2016), have less debt (Brown & Taylor, 2014), and have greater wealth (Duckworth et al., 2007). They tend to exhibit money management behaviors (such as budgeting for future needs), exercise financial self-control, and plan and save effectively (Donnelly et al., 2012). Individuals with a stronger conscientiousness trait tend to exhibit controlled spending behavior as evidence suggests they are not compulsive buyers (Mowen & Spears, 1999). Even though conscientiousness is associated with investing and wealth accumulation behavior, those with a stronger conscientiousness trait are less likely to own stocks outside of retirement plans and are less willing to take financial risks (Liu, 2020). It may be that conscientiousness facilitates controlled spending and saving behavior that produces greater wealth over time and counterbalances a lesser allocation to stock.

When considering CARES Act EIP use, greater conscientiousness will likely be associated with more EIP funds allocated to financial transactions. However, when examining the financial transaction subcategories, those with greater conscientiousness will likely associate positively with saving a portion of their EIP with less allocated to debt reduction and investing given their typical controlled spending, low debt level, saving habit, and lower tolerance for risk. On the other hand, it is also possible that those with greater conscientiousness do not save a portion of their EIP because their pre-crisis financial preparation created a lesser need to save during the COVID-19 pandemic due to existing savings. However, given the abrupt and ambiguous onset of the COVID-19 pandemic in which the government distributed EIP funds, it is likely that an individual’s instincts and habits persisted through this uncertainty and informed their immediate behavior (Bleidorn et al., 2019; Stajkovic et al., 2018), and in this case their saving tendency. Thus, the expectation is that those with greater conscientiousness will likely save a portion of their EIP despite the possibility that they may not need to save in the first place. While most people defer wants in a financial crisis, pre-crisis control can create financial strength that may allow individuals to spend on wants to satisfy higher-order needs in a pandemic (Loxton et al., 2020). Therefore, because those with greater conscientiousness are likely to have entered the COVID-19 pandemic with financial preparedness, they would likely have the financial flexibility to allocate more of their EIP funds for spending wants.

Extraversion

Individuals with greater extraversion have higher incomes and net worth (Nabeshima & Seay, 2015; Viinikainen et al., 2010) and fewer unemployment gaps (Viinikainen & Kokko, 2012). They also exhibit impulsive buying behavior and spend more on social activities, such as social dining and drinking (Gladstone et al., 2019; Verplanken & Herabadi, 2001). Those with greater extraversion tend to hold higher debt levels (Brown & Taylor, 2014), own stock, and are more willing to take financial risks (Liu, 2020). In light of the COVID-19 pandemic, greater extraversion will likely associate positively with more EIP use for financial transactions due to a stronger financial position entering the pandemic that created the capacity to save and invest (e.g., higher income, consistent employment, greater wealth). However, when examining the financial transaction subcategories, extraversion is likely associated with a greater EIP allocation to debt reduction and less to saving, given greater impulsivity and the tendency to accumulate debt. When considering investing behavior, greater tolerance for risk will likely result in observed investing behavior for a portion of the EIP. Moreover, a larger net worth might create a lesser need to spend EIP funds on needs, thereby generating a greater capacity for spending more EIP funds on wants.

Agreeableness

Agreeableness is associated with less wealth (Nabeshima & Seay, 2015), more debt (Brown & Taylor, 2014), less stock (Jadlow & Mowen, 2010; Liu, 2020), and a lower willingness to take financial risks (Liu, 2020). Greater agreeableness is also connected to more donations (Gladstone et al., 2019) and compulsive buying tendencies (Mowen & Spears, 1999). Within the COVID-19 environment, agreeableness will likely operate similarly to openness, with less EIP funds used for financial transactions and less for the saving subcategory. In comparison, people might use more EIP funds for spending needs and debt reduction. Contrary to openness, agreeableness is connected to a lesser willingness to take financial risks, and therefore a negative relationship with investing will likely be observed. Moreover, less financial preparedness entering the pandemic (e.g., more debt and less wealth) may create a greater need to use EIP money for spending on necessities. As with openness, less prudent money management practices, greater impulsivity, and less financial preparedness might result in those with a stronger agreeableness trait using less of their EIP funds for spending wants because of greater demands on their needs and debt requirements.

Neuroticism

Those high in neuroticism have more debt (Nyhus & Webley, 2001), hold less risky assets (Oehler et al., 2018), and exhibit lower changes in net worth over time (Asebedo et al., 2019). They also exhibit more compulsive (Mowen & Spears, 1999) and impulsive (Shahjehan et al., 2012) spending behaviors. Thus, similar to openness and agreeableness, individuals high in neuroticism are more likely to enter the COVID-19 crisis with low savings and higher debt levels due to a lack of consistent pre-crisis money management, leading to a reliance on EIP windfall funds to provide for necessities and debt repayment. These financial constraints might also reduce the capacity to allocate a portion of EIP funds towards spending wants, saving, and investing.

Sociodemographic and Economic Characteristics

The pandemic has disproportionately affected women, low-income workers, and people of color (Kantamneni, 2020). Therefore, it is critical to account for fundamental differences in sociodemographic and economic conditions when investigating stimulus payment use. Researchers have conducted emerging research to investigate how individuals spent their 2020 CARES Act EIP (Asebedo et al., 2020; Baker et al., 2020; Chetty et al., 2020; Coibion et al., 2020; Li et al., 2020). Specifically, Asebedo et al. (2020) found that those with a lesser net worth (compared to high net worth) allocated less of their EIP to financial transactions, more of their EIP to debt repayment in addition to spending needs and wants. Asebedo et al.’s findings are consistent with studies that found lower-income households facing liquidity constraints were more likely to spend their EIP, as well as other recent research about EIP spending among low-income households (Baker et al., 2020; Chetty et al., 2020; Coibion et al., 2020). However, Coibion et al. (2020) did not incorporate spending categories, while Asebedo et al. (2020) found that those with low to moderate wealth levels (compared to higher wealth) used more of their EIP for transportation and clothing.

The pandemic has had a disproportionate effect on women (Alon et al., 2020a). Unlike other recessions, the COVID-19 pandemic has led to more pronounced unemployment for women than for men (Alon et al., 2020b; Bick & Blandin, 2020; Kalenkoski & Pabilonia, 2020). Asebedo et al. (2020) found that a greater proportion of women allocated most or all of their EIP to spending needs than spending wants or saving, investing, or debt repayment. Men were significantly more likely to spend EIPs on durable goods and less likely to spend EIPs on clothing (Asebedo et al., 2020), food, health/beauty aids, household products, and medical care than females (Coibion et al., 2020).

Moreover, Karpman et al. (2020) found that low-income Hispanic and Black individuals were more likely to reduce spending on food or use savings and increased credit card debt during the COVID-19 pandemic. White individuals allocated less of their EIP to food and transportation wants (Asebedo et al., 2020), and African-Americans used more of their EIP to pay off debt (Coibion et al., 2020). In general, individuals with low education were more likely to spend their EIP (Coibion et al., 2020). Those with a higher education allocated less of their EIP to debt repayment and spending needs, while they saved more of their EIP and allocated more of their EIP to travel and education as well as health care (Asebedo et al., 2020). Moreover, being married is connected to spending more on housing and children-related items (Asebedo et al., 2020).

Furthermore, employed individuals allocated less EIP spending for housing, while those who experienced a job change during the pandemic were more likely to spend their EIP (Coibion et al., 2020). Specifically, those out of the labor force or who changed jobs during the pandemic allocated less of their EIP to financial transactions, spending wants, and donations; while allocating more of their EIP to debt repayment, spending needs, and food wants (Asebedo et al., 2020). Those with smaller EIPs (indicative of higher income or smaller households) spent more on healthcare wants but less towards financial transactions, transportation needs, and food wants than those with larger EIPs (Asebedo et al., 2020).

Last, older individuals were more likely to spend and less likely to save their EIP (Coibion et al., 2020). Regarding specific categories, older individuals allocated less of their EIP on housing, clothing, travel, hobby and recreation, and education, while they spent more on donations, health care, and transportation (Asebedo et al., 2020).

Theory and Hypotheses

Bandura’s (1991) social cognitive theory of self-regulation provides the theoretical lens for this study because of the self-regulation inherent in saving and spending decisions. According to Asebedo et al. (2020), the CARES Act EIP is a current income windfall with a high marginal propensity to consume. This income type requires greater control to negotiate the conflict between the doer focused on current period consumption and the planner primarily concerned with lifetime utility maximization (Shefrin & Thaler, 1988). According to Bandura, self-efficacy is central to successful self-regulation as it creates greater resiliency, effort, and motivation, particularly when confronted with stressors and failures. Those with greater self-efficacy also tend to set aspiration goals and persist in achieving them. It is not difficult to see how self-efficacy might be a critical psychological asset to navigating daily stressors amid the COVID-19 health pandemic (Polizzi et al., 2020). Self-efficacy beliefs are domain-specific (Bandura, 1997). Thus, how efficacious someone feels about their health may differ from how they feel about their finances. Consequently, financial self-efficacy (FSE) is the primary theoretical construct of interest. It captures the level of control, confidence, and resilience over a person's financial situation that is cardinal to functioning in times of financial abundance and adversity.

Moreover, Stajkovic et al. (2018) posited that both personal dispositions (personality) and situation-specific efficacy beliefs influence self-regulatory behavior and that each in isolation form an incomplete picture. Stajkovic et al. noted further that it is essential to account for personality traits and self-efficacy beliefs, particularly when executing behavior under trying conditions. Bleidorn et al. (2019) also suggested that personality traits affect life outcomes, most notably when operating in ambiguous, new, or unusual circumstances. The COVID-19 health pandemic has been just that—trying, ambiguous, new, and unusual—with adverse effects spanning the health, psychosocial, and economic spectrums (Polizzi et al., 2020). Thus, the psychology of CARES Act EIP use within the context of the COVID-19 health pandemic ought to consider both situation-specific financial self-efficacy beliefs (FSE) and personality traits, defined as context invariant and innate tendencies that lead to measurable thoughts, feelings, and observable behaviors (Bleidorn et al., 2019; Stajkovic et al., 2018). Following Stajkovic et al. this study integrates the social cognitive theory of self-regulation (Bandura, 1991) and Big Five trait theory (personality; John & Srivastava, 1999) to investigate the psychology of CARES Act EIP use.

Furthermore, because EIP use unfolded amidst a crisis, it is essential to consider pre-crisis behaviors that produce financial preparedness and, therefore, flexibility to decide how to use EIP windfall funds. Loxton et al. (2020) found that people focused their general spending predominantly on essential and basic needs during the early months of the COVID-19 pandemic, representing spending behavior that reflects historical periods of crisis and uncertainty. However, Asebedo et al. (2020) found variation in spending behavior across both wants and needs when analyzing EIP windfall money, which suggests individual differences in prioritizing needs and wants in response to unexpected financial resources are present in the population. Based on the social cognitive theory of self-regulation (Bandura, 1991), Big Five trait theory (personality; John & Srivastava, 1999), and empirical research connecting personality traits to financial behavior, it is likely that individual differences in personality traits and FSE might partially explain this variability in spending on needs and wants during the pandemic.

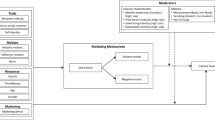

Overall, the general expectation is that greater FSE and personality traits associated with controlled and wealth accumulation-oriented behaviors that are likely to produce pre-crisis preparedness and capacity for spending flexibility are associated with (a) a greater allocation of EIP funds to financial transactions in general, in addition to the saving subcategory based upon an instinctual saving habit, (b) less to debt repayment due to a behavioral tendency to accumulate less debt, and (c) less spending on needs due to pre-crisis planning behaviors and preparedness that creates capacity and flexibility for spending more on wants. Additionally, a relationship between investing and EIP use will likely connect with greater FSE and personality traits associated with a greater willingness to take financial risk. Tables 1 and 2 summarize the hypotheses outlined further below.

Financial Self-efficacy

Given the connection between self-efficacy and the self-regulatory process, it is expected that FSE is significantly related to how Cares Act EIP recipients used their windfall funds due to stronger control associated with greater FSE combined with pre-crisis financial management practices. These positive financial attributes likely lead to more savings and less debt that create psychological and financial resilience, resulting in less EIP spending for needs, a greater capacity to spend on wants, more EIP funds allocated to saving and investing, and less EIP funds allocated to debt reduction due to less debt entering the pandemic:

H1:

Greater FSE is associated with less CARES Act EIP funds allocated to spending behaviors for needs.

H2:

Greater FSE is associated with more CARES Act EIP funds allocated to spending behaviors for wants.

H3:

Greater FSE is associated with more CARES Act EIP funds allocated to financial transactions.

H3a:

Greater FSE is associated with more CARES Act EIP funds allocated to saving.

H3b:

Greater FSE is associated with more CARES Act EIP funds allocated to investing.

H3c:

Greater FSE is associated with less CARES Act EIP funds allocated to debt repayment.

Big Five Personality

Given the literature connecting the Big Five personality traits to financial behavior as outlined above, respondents exhibiting traits connected to prudent financial behavior and wealth accumulation tendencies might continue to portray these characteristics within the context of the COVID-19 health environment.

Openness

H4:

Greater openness to experience is associated with more CARES Act EIP funds allocated to spending behaviors for needs.

H5:

Greater openness to experience is associated with less CARES Act EIP funds allocated to spending behaviors for wants.

H6:

Greater openness to experience is associated with less CARES Act EIP funds allocated to financial transactions.

H6a:

Greater openness to experience is associated with less CARES Act EIP funds allocated to saving.

H6b:

Greater openness to experience is associated with more CARES Act EIP funds allocated to investing.

H6c:

Greater openness to experience is associated with more CARES Act EIP funds allocated to debt repayment.

Conscientiousness

H7:

Greater conscientiousness is associated with less CARES Act EIP funds allocated to spending behaviors for needs.

H8:

Greater conscientiousness is associated with more CARES Act EIP funds allocated to spending behaviors for wants.

H9:

Greater conscientiousness is associated with more CARES Act EIP funds allocated to financial transactions.

H9a:

Greater conscientiousness is associated with more CARES Act EIP funds allocated to saving.

H9b:

Greater conscientiousness is associated with less CARES Act EIP funds allocated to investing.

H9c:

Greater conscientiousness is associated with less CARES Act EIP funds allocated to debt repayment.

Extraversion

H10:

Greater extraversion is associated with less CARES Act EIP funds allocated to spending behaviors for needs.

H11:

Greater extraversion is associated with more CARES Act EIP funds allocated to spending behaviors for wants.

H12:

Greater extraversion is associated with more CARES Act EIP funds allocated to financial transactions.

H12a:

Greater extraversion is associated with less CARES Act EIP funds allocated to saving.

H12b:

Greater extraversion is associated with more CARES Act EIP funds allocated to investing.

H12c:

Greater extraversion is associated with more CARES Act EIP funds allocated to debt repayment.

Agreeableness

H13:

Greater agreeableness is associated with more CARES Act EIP funds allocated to spending behaviors for needs.

H14:

Greater agreeableness is associated with less CARES Act EIP funds allocated to spending behaviors for wants.

H15:

Greater agreeableness is associated with less CARES Act EIP funds allocated to financial transactions.

H15a:

Greater agreeableness is associated with less CARES Act EIP funds allocated to saving.

H15b:

Greater agreeableness is associated with less CARES Act EIP funds allocated to investing.

H15c:

Greater agreeableness is associated with more CARES Act EIP funds allocated to debt repayment.

Neuroticism

H16:

Greater neuroticism is associated with more CARES Act EIP funds allocated to spending behaviors for needs.

H17:

Greater neuroticism is associated with less CARES Act EIP funds allocated to spending behaviors for wants.

H18:

Greater neuroticism is associated with less CARES Act EIP funds allocated to financial transactions in general.

H18a:

Greater neuroticism is associated with less CARES Act EIP funds allocated to saving.

H18b:

Greater neuroticism is associated with less CARES Act EIP funds allocated to investing.

H18c:

Greater neuroticism is associated with more CARES Act EIP funds allocated to debt repayment.

Methods

Data and Sample

The sample consisted of 1172 American adults aged 18 and over who were eligible to receive an Economic Impact Payment (EIP) under the 2020 CARES Act (first round). Participants were recruited through Amazon’s MTurk platform. MTurk is a crowdsourcing marketplace that facilitates efficient data collection for various purposes, including research, from a sample more diverse than typical convenience samples (Berinsky et al., 2011). The sample consisted of respondents from 49 states, with nearly half of the sample residing in California, Texas, Florida, New York, Illinois, North Carolina, Pennsylvania, and Georgia. Survey respondents received $1.50 after completing the survey. Eligibility for the survey was restricted to those who completed at least 500 surveys and had at least a 95% HIT (Human Intelligence Task) rating.

Approval for the use of human subjects was given by the [Institution Texas Tech University] Human Research Protection Program (IRB number 2020-508).

Measurement

Dependent Variables

Effects were estimated for three dependent variables for the main analyses: (a) spending needs, (b) spending wants, (c) and financial transactions; an additional analysis was conducted for those that used at least a little of their EIP for financial transactions to determine how respondents allocated their EIP to (d) savings, (e) investing, and (f) debt reduction. Each dependent variable was estimated in a separate model (six total models) and was measured on a five-point Likert scale: (1) none at all, (2) a little, (3) some, (4) most, and (5) all. Respondents reported the proportion of their EIP used in each area. Therefore, one respondent can be present in multiple models if they reported they used a portion of their EIP in multiple areas. Criteria and skip logic were employed in Qualtrics to mitigate the possibility of respondents reporting they spent most or all of their EIP in multiple areas. See the Online Appendix for a detailed list of the survey questions and response categories.

Personality Traits

The Big Five personality trait measures were drawn from the Health and Retirement Study Psychosocial and Lifestyle Questionnaire (Smith et al., 2017). Each trait was estimated as a latent construct and included openness to experience, conscientiousness, extraversion, agreeableness, and neuroticism. The indicators for each latent construct were derived from Midlife in the United States (MIDUS; Brim et al., 1995–1996) and the International Personality Item Pool (IPIP, 2019; Lachman & Weaver, 1997; Smith et al., 2017). MIDUS is a collaborative, interdisciplinary investigation of patterns, predictors, and consequences of midlife development in the areas of physical health, psychological well-being, and social responsibility (Brim et al., 1995–1996). The International Personality Item Pool is a Scientific Collaboratory for developing advanced measures of personality traits and other individual differences (IPIP, 2019). Each indicator was measured on an eleven-point Likert-type scale, with higher scores indicating greater identification with each trait.

Openness to experience was estimated as a latent construct from seven indicators: creative, imaginative, intelligent, sophisticated, adventurous, curious, and broad-minded. Conscientiousness was estimated as a latent construct from seven indicators: organized, thorough, hardworking, self-disciplined, responsible, cautious, and thrifty. Extraversion was estimated as a latent construct from five indicators: outgoing, talkative, friendly, lively, and active. Agreeableness was estimated as a latent construct from five indicators: caring, softhearted, sympathetic, helpful, and warm. Neuroticism was estimated as a latent construct from four indicators: worrying, nervous, moody, and not calm. Indicators were parceled according to recommended methodology (see Table 5; Little, 2013).

Behavioral Variables

Financial Self-efficacy

FSE was a primary theoretical variable of interest. It was estimated as a latent construct with eight indicators from Magendans et al. (2017) that measured the extent to which participants felt confidence, control, and resilience over their financial situation. Each indicator was measured on an eleven-point Likert-type scale with higher scores indicating greater identification with perceptions of financial self-efficacy. Indicators were parceled according to recommended methodology (see Table 5; Little, 2013).

Economic Outlook

Economic outlook was measured as a categorical variable from the question: “How long do you think it will take the U.S. economy to recover from COVID‐19 once restrictions are lifted?” Possible responses were less than 12 months, 1–3 years, and longer than 3 years. This variable was coded such that higher values represent a more positive economic outlook.

Recession Expectations

Recession expectation was measured as a categorical variable from the question: “How likely do you think that the U.S. economy will experience a recession in the next 12 months?” Possible responses were not likely at all, somewhat likely, and very likely. This variable was coded such that higher values represent a higher likelihood of experiencing a recession in the next 12 months.

Financial-Risk-Taking Attitude

Financial-risk-taking attitude was measured as a categorical variable based on an eleven-point Likert-type scale from the responses to the question from Dohmen et al. (2011): “How willing are you to take risks in financial matters?” Higher scores indicate a greater perceived willingness to take financial risk,

Control Variables

The model employed these control variables: gender, education, net worth, race, coupled status, religion, work status, change in labor force status, stimulus amount, health status, and age. Age was measured as a continuous variable. The gender was a dichotomous variable that takes a value of 1 if the respondent is female and 0 if the respondent is male. The race variable takes a value of 1 if the respondent is White and 0 if the respondent is non-White. Education is a dichotomous variable that takes a value of 1 if the respondent has a bachelor’s or higher degree and 0 if otherwise. Coupled status takes a value of 1 if the respondent is married or living with a partner and 0 if the respondent is single. Religion (Christian) takes a value of 1 if the respondent is either protestant, roman catholic, Church of Jesus Christ of Latter-Day Saints, Greek orthodox, or Russian orthodox; and 0 if the respondent is either Jewish, Muslim, Buddhist, Hindu, atheist, agnostic, or have no or other religious faith. Work status takes a value of 1 if the respondent is working full-time, part-time, or partly retired, and 0 if the respondent is either unemployed, retired, disabled, or other. Change in labor force status takes a value of 1 if the respondent’s labor force status changed during the pandemic and 0 if the respondent’s labor force status did not change. Health status was measured on an eleven-point Likert-type scale, with higher scores indicating better perceived health. The net worth variable was estimated with four categories: less than or equal to $0, $1–$99,999, $100,000–$249,000, and greater than $250,000. The stimulus amount variable was estimated with four categories: less than $500, $500–$1200, $1201–$3400, and more than $3400.

Data Analysis

This study employs six cross-sectional structural equation models with a confirmatory factor analysis measurement model. The structural equation models with a confirmatory factor analysis measurement model construct the latent variables from the specified observed variables using confirmatory factor analyses and simultaneously regresses the outcome variable on the predictors. Compared to more traditional econometric techniques, this process makes the model statistically more robust, given that the model fit indices meet the thresholds for at least an acceptable model fit. Models one, two, and three estimate the three broad EIP use categories as the outcome variables, respectively: (a) spending needs, (b) spending wants, and (c) financial transactions; models four, five, and six estimate three financial transaction subcategories as the outcome variables, respectively: (d) saving, (e) investing, and (f) debt repayment. All six models incorporate the big-five personality traits (openness, conscientiousness, extraversion, agreeableness, and neuroticism) and FSE along with three other behavioral variables (positive economic outlook, expectation of recession, and risk-taking attitude) as the predictors. All six analyses controlled for the respondents’ age, gender, race, level of education, current labor force status, change of labor force status due to pandemic, net worth, stimulus amount received, couple status, and health status as the covariates. The covariate influences were controlled by applying the semi-partial control method (Little, 2013). Non-significant pathways were pruned, and all indicators of latent constructs were parceled.

Results

Descriptive Statistics

The full sample (n = 1172) consisted of approximately 51% women and 49% men. A majority of the sample was White (71%), educated at the college level (65%), employed (81%), and did not have a change in labor force status (85%). About half of the sample identified as Protestant, Roman Catholic, Church of Jesus Christ of Latter-Day Saints, or Greek Orthodox. The average age of respondents was about 41 years old (range 18–82). Conscientiousness scores were the lowest on average (mean = 3.77; range 1–11) compared to the other Big Five personality traits, while neuroticism was the highest (mean = 7.16; range 1–11). Financial self-efficacy scores were slightly higher than average at 6.79 (range 1–11). There were 756 respondents who reported using at least a little or more of their EIP for saving, investing, or debt reduction (financial transactions) that were included in the financial transaction subcategory models. Tables 3 and 4 provide additional descriptive statistics. See the Online Appendix for a summary of the confirmatory factor analysis of the latent variables.

Model One: Spending Needs

Table 5 and Fig. 1 provide the results and model fit indices for the spending needs model. With a Comparative Fit Index (CFI) of 0.929, which is above 0.90, and a Root Mean Squared Error of Approximation (RMSEA) of 0.075, which is less than 0.08, the overall model fit was acceptable (Little, 2013). In support of Hypothesis 1, higher levels of FSE are negatively associated with spending more EIP funds on needs. Among the personality traits, higher openness and neuroticism levels are positively associated, and higher conscientiousness and extraversion levels are negatively associated with allocating more EIP funds for spending needs, consistent with Hypotheses 4, 7, 10, and 16. Evidence in favor of Hypothesis 13 was not found as there was no association observed between agreeableness and EIP allocation for spending needs.

Model-1 (pruned; spending needs as the outcome variable). All paths shown are significant at *p < 0.05 or less. Model Fit Indices: χ2 (df 328) = 2008.286, p = < 0.001; RMSEA = 0.075, 90% CI [.073, .082], CFI = 0.929, TLI = 0.878; SRMR = 0.066. All results were computed in R (Lavaan) with a maximum likelihood (ML) estimator. Parameter estimates are in standardization. The structural model was estimated with indicators from the measurement model for the latent variables and included control variables according to the semi-partial method (Little, 2013): age, gender, race, religion, education, net worth, couple status, labor force status, change in labor force status due to pandemic, and self-reported health status

Among the other behavioral variables, higher levels of positive economic outlook are positively associated with allocating higher proportions of EIP for spending needs. No association is found between recession expectations or financial-risk-taking attitude and EIP allocation for spending needs. Among the control variables, lower levels of net worth, currently being in the labor force, change of labor force status due to the pandemic, lower levels of stimulus amount, and lower age are positively associated with spending higher proportions of EIP funds for needs.

Model Two: Spending Wants

Table 6 and Fig. 2 summarize the results and model fit indices for the spending wants model. With a Comparative Fit Index (CFI) of 0.946, which is above 0.90, and a Root Mean Squared Error of Approximation (RMSEA) of 0.077, which is less than 0.08, the overall model fit was acceptable (Little, 2013). FSE was not associated with spending wants, and therefore no evidence was generated in favor of Hypothesis 2. The results were mixed among the personality traits: In support of Hypothesis 8, higher levels of conscientiousness are positively associated with higher proportions of EIP spending for wants. Consistent with Hypothesis 17, greater neuroticism is negatively associated with spending higher proportions of EIP funds for wants. However, contrary to Hypothesis 14, higher levels of agreeableness are positively associated with allocating higher proportions of EIP funds for spending wants. The results did not reveal any evidence supporting Hypotheses 5 or 11, as an association between openness or extraversion and EIP spending for wants was not observed.

Model-2 (pruned; spending wants as the outcome variable). All paths shown are significant at *p < 0.05 or less. Model Fit Indices: χ2 (df 74) = 584.784, p = < 0.001; RMSEA = 0.077, 90% CI [.071, .083], CFI = 0.946, TLI = 0.900; SRMR = 0.058. All results were computed in R (Lavaan) with a maximum likelihood (ML) estimator. Parameter estimates are in standardization. The structural model was estimated with indicators from the measurement model for the latent variables and included control variables according to the semi-partial method (Little, 2013): age, gender, race, religion, education, net worth, couple status, labor force status, change in labor force status due to pandemic, and self-reported health status

Similarly, associations between the other behavioral variables and EIP allocation for spending wants were not observed. Among the control variables, change of labor force status due to the pandemic is negatively associated with allocating higher proportions of EIP for spending wants.

Model Three: Financial Transactions

Table 7 and Fig. 3 provide the results and model fit indices for the combined financial transactions model. The model demonstrated a Comparative Fit Index (CFI) of 0.911, which is above 0.90, and a Root Mean Squared Error of Approximation (RMSEA) of 0.084, which is very close to but not below 0.08. Even though the CFI meets and the RMSEA narrowly misses the threshold for a good model fit, the overall model fit was acceptable (Little, 2013). Supporting Hypothesis 3, greater FSE is connected with allocating higher proportions of EIP funds towards financial transactions in general (combined saving, investing, and debt reduction). Among the personality traits, only conscientiousness is significant, with evidence in favor of Hypothesis 9: higher levels of conscientiousness are positively associated with allocating higher proportions of EIP funds for financial transactions. The analysis did not uncover any evidence for Hypotheses 6, 12, 15, or 18, as an association was not observed between openness, extraversion, agreeableness, or neuroticism and EIP allocation for financial transactions. While the results were limited for personality traits when examining the combined financial transactions model, a more nuanced analysis of the subcategories—saving, investing, and debt repayment—revealed additional findings outlined below.

Model-3 (pruned; financial transactions as the outcome variables). All paths shown are significant at *p < 0.05 or less. Model Fit Indices: χ2 (df 108) = 1008.003, p = < 0.001; RMSEA = 0.084, 90% CI [.080, .089], CFI = 0.911, TLI = 0.848; SRMR = 0.070. All results were computed in R (Lavaan) with a maximum likelihood (ML) estimator. Parameter estimates are in standardization. The structural model was estimated with indicators from the measurement model for the latent variables and included control variables according to the semi-partial method (Little, 2013): age, gender, race, religion, education, net worth, couple status, labor force status, change in labor force status due to pandemic, and self-reported health status

Among the other behavioral variables, financial-risk-taking attitude is positively associated, and higher levels of positive economic outlook are negatively associated with allocating higher proportions of EIP funds for financial transactions. No association is found between recession expectations and EIP allocation for financial transactions. Among the control variables, no change of labor force status due to the pandemic, higher levels of stimulus amount, and higher age are positively associated with allocating higher proportions of EIP for financial transactions.

Model Four: Financial Transactions Subcategory—Saving

Table 8 and Fig. 4 provide the results and model fit indices for the saving model (a subcategory of financial transactions). With a Comparative Fit Index (CFI) of 0.94, which is above 0.90, and a Root Mean Squared Error of Approximation (RMSEA) of 0.080, which is equal to the threshold for a good model fit, the overall model fit was acceptable (Little, 2013). Consistent with Hypotheses 3a and 9a, and with the combined financial transaction category findings, greater FSE, and greater conscientiousness were positively associated with allocating a higher proportion of EIP funds towards saving. While neuroticism was not connected to the broader financial transaction category, the subcategory analysis revealed that greater neuroticism is negatively associated with allocating higher proportions of EIP funds for saving, thereby supporting Hypothesis 18a. Consistent with the combined financial transaction analysis, an association was not observed between openness (H6a), extraversion (H12a), or agreeableness (H15a) and EIP allocation to saving.

Model-4 (pruned; saving as the outcome variables). All paths shown are significant at *p < 0.05 or less. Model Fit Indices: χ2 (df 77) = 451.641, p = < 0.001; RMSEA = 0.080, 90% CI [.073, .087], CFI = 0.940, TLI = 0.893; SRMR = 0.0070. All results were computed in R (Lavaan) with a maximum likelihood (ML) estimator. Parameter estimates are in standardization. The structural model was estimated with indicators from the measurement model for the latent variables and included control variables according to the semi-partial method (Little, 2013): age, gender, race, religion, education, net worth, couple status, labor force status, change in labor force status due to pandemic, and self-reported health status

Among the other behavioral variables, lower levels of financial-risk-taking attitude are positively associated with allocating higher proportions of EIP for saving. No association is found between positive economic outlook or expectation of recession and EIP allocation for saving. Among the control variables, having a college or higher degree and currently not being in the labor force are positively associated with allocating higher proportions of EIP for saving.

Model Five: Financial Transactions Subcategory—Investing

Table 9 and Fig. 5 summarize the results and model fit indices for the investing model (a subcategory of financial transactions). With a Comparative Fit Index (CFI) of 0.901, which is above 0.90, and a Root Mean Squared Error of Approximation (RMSEA) of 0.078, which is less than 0.08, the overall model fit was acceptable (Little, 2013). Consistent with Hypothesis 3b and the broad financial transaction category results, greater FSE is associated with allocating higher proportions of EIP funds for investing. Contrary to the broad financial transaction category results, only agreeableness (H15b) was associated with investing a greater proportion of EIP dollars (hypothesized less) with no association found for openness (H6b), conscientiousness (H9b), extraversion (H12b), or neuroticism (H18b) and EIP allocation to investing.

Model-5 (pruned; investing as the outcome variables). All paths shown are significant at *p < .05 or less. Model Fit Indices: χ2 (df 90) = 823.844, p = < 0.001; RMSEA = 0.078, 90% CI [.075, .082], CFI = 0.901, TLI = 0.851; SRMR = 0.090. All results were computed in R (Lavaan) with a maximum likelihood (ML) estimator. Parameter estimates are in standardization. The structural model was estimated with indicators from the measurement model for the latent variables and included control variables according to the semi-partial method (Little, 2013): age, gender, race, religion, education, net worth, couple status, labor force status, change in labor force status due to pandemic, and self-reported health status

Among the other behavioral variables, financial-risk-taking attitude is positively associated with allocating higher proportions of EIP for investing. No association is found between positive economic outlook or recession expectations and EIP allocation for investing. Among the control variables, higher levels of net worth and lower age are positively associated with allocating higher proportions of EIP for investing.

Model Six: Financial Transactions Subcategory—Debt Repayment

The results and model fit indices for the debt repayment model (a subcategory of financial transactions) are provided in Table 10 and Fig. 6. The model demonstrated a Comparative Fit Index (CFI of 0.901, which is above 0.90, and a Root Mean Squared Error of Approximation (RMSEA) of 0.088, very close to but not below 0.08. Even though the CFI meets and the RMSEA narrowly misses the threshold for a good model fit, the overall model fit was acceptable (Little, 2013). Consistent with Hypothesis 3c and results for the broad financial transaction category, greater FSE was negatively associated with allocating higher proportions of EIP funds for debt repayment. Among the personality traits, the results for openness, neuroticism, and conscientiousness were consistent with the hypotheses: higher levels of openness (H6c) and neuroticism (H18c) are positively associated, and higher levels of conscientiousness (H9c) are negatively associated with allocating higher proportions of EIP for debt repayment. Contrary to expectations, greater agreeableness (H15c) is negatively associated with allocating more EIP funds for debt repayment. An association was not found between extraversion and EIP allocation for debt repayment (H12c).

Model-6 (pruned; debt repayment as the outcome variables). All paths shown are significant at *p < 0.05 or less. Model Fit Indices: χ2 (df 105) = 719.835, p = < 0.001; RMSEA = 0.088, 90% CI [.082, .093], CFI = 0.902, TLI = 0.858; SRMR = 0.078. All results were computed in R (Lavaan) with a maximum likelihood (ML) estimator. Parameter estimates are in standardization. The structural model was estimated with indicators from the measurement model for the latent variables and included control variables according to the semi-partial method (Little, 2013): age, gender, race, religion, education, net worth, couple status, labor force status, change in labor force status due to pandemic, and self-reported health status

There was no association between positive economic outlook, recession expectations, or financial-risk-taking attitude and EIP allocation for debt repayment. Among the control variables, not having a college or higher degree and currently being in the labor force are positively associated with allocating higher proportions of EIP funds for debt repayment.

Discussion

Table 11 summarizes the relationships between the theoretical variables of interest (FSE and the Big Five personality traits) and EIP allocation for each dependent variable. Overall, the analyses produced consistent results supporting the theoretical expectations across the models and the psychological constructs except for the agreeableness personality trait.

The results were consistent for spending needs: characteristics typically associated with planning behaviors, preparedness, controlled money management practices, and wealth accumulation—FSE, conscientiousness, and extraversion—were negatively associated with spending more EIP funds on needs, whereas traits that exhibit more impulsive tendencies, less financial preparedness, and less prudent money management practices—openness and neuroticism (no relationship observed for agreeableness)—were connected positively to spending more. FSE and conscientiousness are the quintessential financial preparedness and planning traits and consistently demonstrate a robust relationship with productive financial behavior (Asebedo, 2018; Lown, 2011). On the other hand, extraversion is indicative of wealth accumulation success through higher income and consistent employment. Thus, those with greater FSE, conscientiousness, and extraversion might have entered the COVID-19 pandemic with greater wealth, endured it with stable employment and income, and therefore did not need to use their EIP for spending needs.

Consistent with the social cognitive theory of self-regulation, greater control, resilience, and confidence over the financial environment (FSE) may have also shaped respondents’ financial preparedness and vantage point such that they did not have or perceive any immediate financial needs or threats and could instead allocate their funds to other areas. The spending wants model results generally align with this position as those with greater conscientiousness allocated more of their EIP to wants, while greater neuroticism was linked to less. However, respondents with greater agreeableness also spent more of their EIP on wants, contrary to expectations. The results for financial transactions also fit this theoretical narrative with FSE and conscientiousness associated positively with a greater EIP allocation towards financial transactions in general, and specifically to saving (FSE and conscientiousness) and investing (FSE only). The investing results were mixed with greater FSE linked to using more EIP funds for investing, consistent with the research hypothesis and evidence that market volatility is not associated with financial satisfaction for those with greater FSE (Asebedo & Payne, 2019). However, the positive relationship between investing and EIP use for agreeableness contradicts existing evidence for the relationship between agreeableness and willingness to take financial risks (Liu, 2020).

The expectations for EIP use for debt repayment also align with the notion that those entering the pandemic with characteristics typically associated with preparedness, wealth accumulation, and sound financial management (FSE and conscientiousness) entered the pandemic with greater financial stability such that they likely did not need to use their EIP for debt repayment. Although extraversion predicts greater wealth, there was no relationship found between extraversion and debt repayment.

Overall, the results aligned with expectations except for agreeableness: those with greater agreeableness spent more of their EIP on wants (hypothesized less), invested more of their EIP (hypothesized less), and used less of their EIP for debt repayment (hypothesized more). These contrary results could be the result of two potential causes that require further research. First, it is possible that those with greater agreeableness entered the COVID-19 pandemic with a stronger financial position than expected and had the capacity and flexibility to use their EIP for spending wants or investing and did not need to use it for debt repayment or needs. Alternatively, it may be that they entered the pandemic with a lower level of financial stability yet felt a greater need to help others with their EIP funds and perceived that help as a want. The relationship between agreeableness and investing is curious as it contradicts theory and existing personality research. Therefore, the results should be interpreted with caution.

Limitations

Several limitations should be noted: First, the sample was drawn from Amazon’s MTurk population and may not represent the broader U.S. population that received an EIP under the 2020 CARES Act (Goodman et al., 2013). However, MTurk did allow for prompt and efficient collection of a sample more diverse than typical convenience samples (Berinsky et al., 2011). Overall, our sample consists of more White and educated adults than the broader U.S. adult population, and thus, the results cannot be generalized beyond the study sample. Another concern with MTurk data is that individuals might misidentify themselves to qualify for the study (Sharpe Wessling et al., 2017). U.S. Census Household Pulse Survey data from July 2nd to July 7th, 2020, show only 14% had not received or expected to receive their stimulus payment, limiting this concern. This misidentification issue is present but mitigated in this study, given that the vast majority of the sample had likely received their EIP by the time of the survey. In addition, the first survey question asked about EIP eligibility and removed participants who indicated they were not eligible. Second, this study focused on the first round of stimulus payments issued during the COVID-19 pandemic and did not capture the combined effects from the second and third payments; this limitation is an unavoidable function of timing and uncertainty as policy and economic assistance concurrently unfolded. Therefore, more research is needed to investigate the combined effects of all stimulus payments delivered in response to the pandemic. Furthermore, this study does not generate evidence for causality given the use of cross-sectional data. Third, although the analysis controls for unemployment status and change in work status, this study does not capture the influence of enhanced unemployment benefits for unemployed individuals received under the CARES Act from April 5, 2020, until July 31, 2020. This gap is an unfavorable limitation given the influence of additional unemployment benefits on households’ financial resources and, likely, their spending and saving decisions. Fourth, objective measures of wealth and financial preparedness were not possible to obtain before the pandemic; therefore, respondents’ financial stability entering the pandemic is hypothesized based on their psychological characteristics (personality and FSE) and existing literature that connects those characteristics to financial behavior. Fifth, this study does not capture how people used existing resources for spending needs, wants, and financial transactions. Hence, the results must be interpreted within a financial windfall framework and not in the context of regular spending, saving, and investing. Last, saving and investing were presented to respondents as alternatives within financial transaction subcategories; however, the definition for saving was weak. The survey did not specify that saving meant placing the EIP funds in a cash reserve as an alternative choice to investing. Thus, there is potential for respondents to confuse the saving and investing categories, and results should be interpreted with this possibility in mind.

Implications and Conclusion

The purpose of this study is to investigate the psychological characteristics associated with CARES Act EIP use. While research suggests most people focus on basic needs during a crisis (Loxton et al., 2020), there is evidence of a more nuanced phenomenon with EIP fund use during the COVID-19 pandemic, as research has shown variability of use across spending needs and wants, in addition to saving, investing, and debt repayment (Asebedo et al., 2020; Coibion et al., 2020). Given the psychosocial and economic stressors associated with COVID-19 (Polizzi et al., 2020), psychological characteristics likely serve a fundamental role in explaining this variability in human behavior.

Consistent with Stajkovic et al. (2018), this study found that personality traits and financial self-efficacy (FSE) beliefs were relevant to EIP use within an adverse, novel, and ambiguous environment. A notable finding was that FSE and conscientiousness emerged as the most robust predictors of EIP use across all categories of financial behavior, which is consistent with existing research for FSE & financial behavior (e.g., Asebedo, 2018; Lown, 2011). Therefore, FSE and conscientiousness are important psychological characteristics relevant to financial behavior that may lead to greater financial preparedness and capacity for spending flexibility during crisis and uncertainty. While personality traits are relatively stable, they are not immune to intervention and change, such that those low in conscientiousness might exhibit more conscientious behavior with their money over time (Bleidorn et al., 2019). FSE can also be cultivated and strengthened through intervention (Bandura, 1997). Last, while the COVID-19 pandemic has had a disproportionate effect on the population (Kantamneni, 2020), psychological characteristics remained significant within the analysis after controlling for these sociodemographic and economic attributes. Therefore, consistent with Stajkovic et al. (2018) and Bleidorn et al. (2019), this study contributes to the literature with evidence that personality traits and FSE explain differences in human behavior that persist within a crisis environment and potentially affect how individuals cope with financial disruptions and challenging circumstances.

From a personal finance perspective, the combined findings point to the need for holistic financial and psychological interventions during times of stability to strengthen conscientious financial behavior and financial literacy—a combination of financial knowledge, financial skill, and financial self-efficacy (Warmath & Zimmerman, 2019)—so that families can absorb financial shocks, weather adversity, and have the flexibility for decision making (e.g., spend vs. save) during crisis and uncertainty. From a policy perspective, this study raises awareness that psychological attributes explain variability in stimulus payment use, which points to two potential policy implications. First, research shows that those with greater conscientiousness tend to have more available financial resources due to habitual saving behaviors (e.g., Brown & Taylor, 2014; Donnelly et al., 2012; Duckworth et al., 2007; Gladstone et al., 2019; Mosca & McCrory, 2016). In this study, those with a stronger conscientiousness trait exhibited more variation in their EIP use. They were associated with spending on wants, less on needs, and saving and debt reduction behaviors. This result, combined with existing research that shows those with a more positive economic outlook were more likely to spend (Asebedo et al., 2020), suggests a two-pronged policy approach might effectively generate more consumer EIP spending: (a) strengthen policy and research funding for holistic (financial and psychological) financial literacy interventions that reach a broad population of U.S. adults to improve households’ financial resources and flexibility during a stable environment, and (b) during crisis environments, implement policy and public messaging that instill a sense of confidence in personal economic security and recovery. The second implication suggests that policymakers should not expect the broader population to behave as expected to reactionary policy delivered in a crisis environment given population variance in psychological attributes and financial circumstances. Therefore, pre-crisis intervention, policy, and planning are necessary to generate more predictable behaviors from stimulus payment programs when a crisis inevitably unfolds in the future.

References

Alon, T., Doepke, M., Olmstead-Rumsey, J., & Tertilt, M. (2020a). The impact of COVID-19 on Gender equality. Policy file. Institute for Policy Research, Northwestern University.

Alon, T., Doepke, M., Omstead-Rumsey, J., & Tertilt, M. (2020b). This time it’s different: The role of women’s employment in a pandemic recession. Policy file. Institute for Policy Research, Northwestern University.

American Psychological Association. (2021). Personality. https://www.apa.org/topics/personality#:~:text=Personality%20refers%20to%20individual%20differences,such%20as%20sociability%20or%20irritability. Accessed 10 Nov 2021.

Ando, A., & Modigliani, F. (1963). The “life cycle" hypothesis of saving: Aggregate implications and tests. The American Economic Review, 53(1), 55–84.

Asebedo, S. D. (2018). Personality and financial behavior. In C. Chaffin (Ed.), CFP board, client psychology. Wiley.

Asebedo, S. D., & Payne, P. (2019). Market volatility and financial satisfaction: The role of financial self-efficacy. Journal of Behavioral Finance, 20(1), 42–52. https://doi.org/10.1080/15427560.2018.1434655

Asebedo, S. D., Wilmarth, M. J., Seay, M. C., Archuleta, K., Brase, G. L., & MacDonald, M. (2019). Personality and saving behavior among older adults. The Journal of Consumer Affairs, 53(2), 488–519. https://doi.org/10.1111/joca.12199

Asebedo, S. D., Liu, Y., Gray, B., & Hasan Quadria, T. (2020). How Americans used their COVID-19 economic impact payments. Financial Planning Review, 3(4), 1–47. https://doi.org/10.1002/cfp2.1101

Bailey, J. J., & Kinerson, C. (2005). Regret avoidance and risk tolerance. Financial Counseling and Planning, 16(1), 23–28.

Baker, S. R., Farrokhnia, R. A., Meyer, S., Pagel, M., & Yannelis, C. (2020). Income, liquidity, and the consumption response to the 2020 economic stimulus payments (No. w27097). National Bureau of Economic Research.

Bandura, A. (1991). Social cognitive theory of self-regulation. Organizational Behavior and Human Decision Processes, 50(2), 248–287. https://doi.org/10.1016/0749-5978(91)90022-L

Bandura, A. (1997). Self-efficacy: The exercise of control. W.H. Freeman and Company.

Bandura, A. (2005). The evolution of social cognitive theory. Great minds in management (pp. 9–35). Oxford University Press.

Berinsky, A. J., Huber, G. A., & Lenz, G. S. (2011). Using mechanical Turk as a subject recruitment tool for experimental research. Submitted for review.

Bick, A., & Blandin, A. (2020). Real-time labor market estimates during the 2020 coronavirus outbreak. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3692425

Bleidorn, W., Hill, P. L., Back, M. D., Denissen, J. J., Hennecke, M., Hopwood, C. J., Jokela, M., Kandler, C., Lucas, R. E., Luhmann, M., Orth, U., Wagner, J., Wrzus, C., Zimmermann, J., & Roberts, B. (2019). The policy relevance of personality traits. American Psychologist, 74(9), 1056. https://doi.org/10.1037/amp0000503

Brim, O. G., Baltes, P. B., Bumpass, L. L., Cleary, P. D., Featherman, D. L., Hazzard, W. R., Kessler, R. C., Lachman, M. E., Markus, H. R., Marmot, M. G., Rossi, A. S., Ryff, C. D., Shweder, R. A. (1995–1996). Midlife in the United States (MIDUS 1). Inter-university consortium for political and social research [distributor]. https://doi.org/10.3886/ICPSR02760.v19

Brown, S., & Taylor, K. (2014). Household finances and the ‘Big Five’personality traits. Journal of Economic Psychology, 45, 197–212. https://doi.org/10.1016/j.joep.2014.10.006

Chatterjee, S., Finke, M., & Harness, N. (2011). The impact of self-efficacy on wealth accumulation and portfolio choice. Applied Economics Letters, 18(7), 627–631. https://doi.org/10.1080/13504851003761830

Chetty, R., Friedman, J. N., Hendren, N., Stepner, M., & The Opportunity Insights Team. (2020). How did COVID-19 and stabilization policies affect spending and employment? A new real-time economic tracker based on private sector data (pp. 1–109). National Bureau of Economic Research.

Chiang, T., & Xiao, J. J. (2017). Household characteristics and the change of financial risk tolerance during the financial crisis in the United States. International Journal of Consumer Studies, 41(5), 484–493. https://doi.org/10.1111/ijcs.12356

Coibion, O., Gorodnichenko, Y., & Weber, M. (2020). How did US consumers use their stimulus payments? (No. w27693). National Bureau of Economic Research.

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9(3), 522–550. https://doi.org/10.1111/j.1542-4774.2011.01015.x

Donnelly, G., Iyer, R., & Howell, R. T. (2012). The Big Five personality traits, material values, and financial well-being of self-described money managers. Journal of Economic Psychology, 33(6), 1129–1142. https://doi.org/10.1016/j.joep.2012.08.001

Duckworth, A., & Weir, D. (2011). Personality and response to the financial crisis. Michigan retirement research center research paper No. WP, 260.

Duckworth, A. L., Peterson, C., Matthews, M. D., & Kelly, D. R. (2007). Grit: Perseverance and passion for long-term goals. Journal of Personality and Social Psychology, 92(6), 1087. https://doi.org/10.1037/0022-3514.92.6.1087

Farrell, L., Fry, T. R., & Risse, L. (2016). The significance of financial self-efficacy in explaining women’s personal finance behaviour. Journal of Economic Psychology, 54, 85–99. https://doi.org/10.1016/j.joep.2015.07.001

Finke, M. S., & Huston, S. J. (2003). The brighter side of financial risk: Financial risk tolerance and wealth. Journal of Family and Economic Issues, 24(3), 233–256. https://doi.org/10.1023/A:1025443204681

French, S., Story, M., Neumark-Sztainer, D., Fulkerson, J., & Hannan, P. (2001). Fast food restaurant use among adolescents: Associations with nutrient intake, food choices and behavioral and psychosocial variables. International Journal of Obesity, 25(12), 1823–1833. https://doi.org/10.1038/sj.ijo.0801820

Garner, T. I., Safir, A., & Schild, J. (2020). Receipt and use of stimulus payments in the time of the Covid-19 pandemic. Beyond the Numbers: Prices and Spending, Bureau of Labor Statistics, 9(10), 1–18.