Abstract

Inefficient competition in emissions taxes for foreign direct investment creates benefits from international cooperation. In the presence of cross-border pollution, proximate (neighboring) countries have greater incentives to cooperate than distant ones as illustrated by a model of tax competition for mobile capital. Spatial econometrics is used to estimate participation in 110 international environmental treaties by 139 countries over 20 years. Empirical evidence of increased cooperation among proximate countries is provided. Furthermore, strategic responses in treaty participation vary across country groups between OECD and non-OECD countries and are most evident in regional agreements.

Similar content being viewed by others

Notes

See Mason (2005) for a recent overview of the evidence of cross-border pollution.

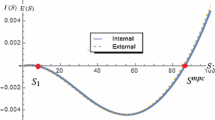

Note that even the definition of the optimal level is subject to debate since the optimal tax depends on where the mobile firms’ profits accrue. If a social planner is maximizing a function of the host countries’ welfares, then she will not necessarily include the profits from FDI as a benefit from investment. This would then tend to lead to a tax rate greater than that which would be set if FDI profits accrue to the citizens of one of the host countries. This is why we use the term “optimal” rather than Pareto efficient since our model does not include FDI profits in the social planner’s objective function.

Their model differs in two key ways. First, they assume that the pollution is ‘perfectly’ cross-border implying the same pollution level is faced by the two countries. Second, their model does not involve any competition for capital. Instead, in their model equilibrium pollution abatement is too low because neither country can trust the neighbor to choose the higher, globally more efficient, level of pollution abatement.

For a detailed discussion on the workings of spatial econometrics, see Anselin (1988).

Antweiler et al. (2001) find little evidence of an effect of FDI on SO2 concentrations. Brunnermeier and Levinson (2004) provide a literature review of the studies considering the effect of host country environmental regulations on FDI. More recent studies include Jeppesen et al. (2002), Fredriksson et al. (2003), List et al. (2003), Javorcik and Wei (2004), Henderson and Millimet (2007), and Rose and Spiegel (2009). A recent working paper by Drukker and Millimet (2007) looks at the effects of U.S. states’ inbound FDI as a function of home environmental regulation as well as neighboring states regulation. The evidence of the effect of environmental stringency on investment decisions has been mixed. In contrast to the FDI literature, Antweiler et al. (2001), Dean (2002), Harbaugh et al. (2002), Frankel and Rose (2005), Cole and Elliott (2003) and Naughton (2010) find that openness to trade improves the environment.

For a review of empirical tax competition studies see Brueckner (2003).

Congleton (1992) is one of the early studies looking at international environmental treaty formation. He focuses on one treaty and ignores possible strategic interactions between countries.

A related literature on preferential trade agreements finds a significant negative effect of distance on preferential trade agreements (PTAs). See Magee (2003), for example. The reason for strong effects of distance on PTAs would almost certainly be driven by trade costs which increase with distance—if trade costs are high (distance is high) then there would be less reason for trade and, thus, for trade agreements. In another line of literature on cross-border pollution effects, Sigman (2002) reveals evidence of free riding effects in river pollution emissions. In a later study, Sigman (2004) finds that bilateral trade between upstream and downstream countries reduces free riding, implying the presence of strategic trade effects.

Alternatively, these transportation costs could be increasing costs of hiring local factors such as labor. If the wage is an increasing convex function of labor hired, as would occur if other sectors use labor, then it is possible to derive labor cost functions as they depend on K and K ∗ that are comparable to these transport cost functions. This approach could also provide a link between these and the benefits of hosting. However, in the interest of simplicity and in order to better link the theory and empirics, we use this trade cost approach.

For simplicity, we assume that both λ and a are the same across countries. While the first is not necessary for our results, the second is useful in determining properties for the social planner’s desired taxes as discussed below.

Note that we could also consider a step function where it is only after emissions in a given location exceed a certain level that the marginal damages become increasing. However, since this complication does not aid us in providing a model to describe the empirical question, we omit it here.

The unambiguous nature of this result comes from the assumption that damages are additively separable across countries. If this is not the case, as for example when damages are (K+aK ∗)θ, in addition to the effect discussed above, a rise in a implies a rise in the marginal damages from domestic investment as well. As discussed in relation to (7), this tends to lead to an increase in the best response tax. Combining these results in an ambiguous effect that depends, among other things, on θ, which governs the degree of non-linearity.

Furthermore, McAusland (2002) and Eerola (2004) find that, due to the exclusion of multinational firm profits from the countries’ objective functions that taxes are inefficiently high compared to the global welfare maximum. Similarly, since our combined welfare measure does not include multinational profits optimal taxes are higher than those that would arise from maximizing the sum of Y,Y ∗, and the firm’s profits.

When emissions damages are strictly convex and investment levels differ due to differing trade costs, in addition to the above tradeoffs, the social planner chooses to set different taxes in order mitigate emissions costs by setting a higher tax in the low cost country (since investment, and thus marginal emission damages, will be higher here). Similar incentives arise when transfer coefficients differ between countries. When the transfer coefficient rises, marginal emissions cost rise, increasing the incentive to use a tax wedge to discourage investment in the low trade cost location. The net impact on taxes is ambiguous. We omit a full treatment of this situation to conserve space for the empirical analysis.

An alternative modeling choice would be to have the transfer coefficient represent the percent of emissions that “land” in the overseas country, leaving only (1−a)K emissions in home. This yields similar results regarding Nash equilibrium taxes compared to the social planner’s taxes since as a rises, a country’s incentive to attract FDI rises since its pollution costs fall. Under this assumption, however, worldwide pollution damages are invariant to the transfer coefficient, implying that the social planner’s desired taxes do not change when a changes. Nevertheless, here too the gains from cooperation rise as the distance between countries falls.

For an overview of international environmental treaties see Mitchell (2003).

The appendices provide participation information for the individual treaties and the countries in the sample.

We found similar results when using all possible treaties. These results are available on request.

Note that countries that initially sign treaties must also ratify the treaty to become a party. We use ratification as this brings policy that much closer to actual implementation with economically meaningful impacts. Further note that some environmental treaties may be negotiated but never actually make it to the ratification stages. Therefore, our dependent variable excludes these treaties. It is likely that some environmental treaties in our sample also faced difficult times during negotiations but were ratified after the end of the sample. With no data on treaties that may have been negotiated but never signed, it is difficult to determine what the effect of these treaties would be on the estimated models.

Because different treaties deal with different environmental problems and some may have a stronger impact on national environmental policy than others, this measure is best considered a proxy for the strictness of a country’s overall environmental policy. While this underlying latent variable can be thought of as cardinal, the proxy itself is ordinal since it measures the number of treaties in which a given country participates. Assuming that the two are positively correlated, a change in an exogenous parameter that increases treaty participation would tend to increase environmental stringency. An earlier version of the paper using the non-logged number of treaties found comparable results. In addition, the earlier version estimated the regression separately for treaties that applied to water, air, or other types of pollution. The results for the different categories were broadly similar to those reported here.

Our treaty participation variable is the log of 1 + the number of treaties a country has ratified. The reason for adding one is that there are two observations at the start of our sample for which no treaties were ratified. If we exclude these two observations and do not add one to the number of ratified treaties, comparable results are found.

A negative spatial lag suggests that an increase in proximate countries’ treaty participation would reduce treaty participation. This type of dynamic could arise if the emissions tax response functions are strategic substitutes (i.e. best responses have a negative slope). As discussed above, generalized versions of emissions tax competition show that this is indeed a theoretical possibility although one contradicted by most of our estimates.

This measure was used by Neumayer (2002) in his study of environmental treaty participation. When it was found significant, the estimates suggest that more open countries participate in more agreements.

Managi et al. (2009) also include this measure of trade openness in estimating the determinants of treaty participation.

A previous version of the paper included additional control variables including export diversification and unemployment. This was achieved at the cost of reducing the number of countries. Qualitatively similar results were found however. In addition, that version of the paper excluded country fixed effects from some estimates but included time-invariant variables such as the area of a country. Here, these are captured by the country fixed effects which are used in all regressions. These alternative results are available on request.

One possible concern is that this measure is capturing proximity to large markets that may present future economic opportunities. As such, a country may choose to use environmental policy today in an attempt to attract and lock-in FDI for the future. A similar issue could arise for market potential. Although this is potentially controlled for by the country and year effects, in unreported results we also included the distance-weighted population or GDP growth rates of other countries as an additional control variable. These were never significant and did not alter the main findings.

In unreported results, we instead used the distance-weighted average of political freedom rather than one of these two weighted averages and obtained qualitatively similar results. Inclusion of all three weighted averages resulted in rejection of valid overidentification restrictions; hence we do not include it in the reported results even though comparable estimates are found. These regression results are available upon request.

The model predicts that trade costs matter when setting environmental policy because of how they influence investment behavior and output. Thus, the realized outcome is what is important, i.e. the exports factoring into trade openness, not merely the potential for exporting (excepting the issue raised in Footnote 30). Thus, after controlling for actual trade, market potential should be excludable.

Wang and Lee (2013a, 2013b) compare different spatial autoregressive estimators (including some using imputed values for missing dependent variables). In our case, however, we also have missing data for explanatory variables (for example, as is the case with former members of the USSR prior to independence). As such, this approach is not feasible in our data.

We opted for Fuller rather than JN2SLS as the Fuller estimator was less computationally demanding.

As reported at the bottom of the table, we reject the null that FDI should be considered exogenous.

The standard deviation of the spatial lag with weight ω 1 is 0.51 and 0.51∗0.15=0.0765.

Note that Stock and Yogo (2005) only provide critical values for up to two endogenous variables. Thus in this and subsequent tables, we do not report these test statistics.

The test statistics for this comparison are found at the bottom of the table.

References

Anselin, L. (1988). Spatial econometrics: methods and models. Boston: Kluwer Academic.

Antweiler, W., Copeland, B. R., & Taylor, M. S. (2001). Is free trade good for the environment? The American Economic Review, 91, 877–908.

Barba Navaretti, G., & Venables, A. J. (2006). Multinational firms in the world economy. Princeton: Princeton University Press.

Barrett, S. (1994). Strategic environmental policy and international trade. Journal of Public Economics, 54, 325–338.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2003). Instrumental variables and GMM: estimation and testing. Stata Journal, 3, 1–31.

Beron, K. J., Murdoch, J. C., & Vijverberg, W. P. M. (2003). Why cooperate? Public goods, economic power, and the Montreal Protocol. Review of Economics and Statistics, 85, 286–297.

Blonigen, B. A., & Davies, R. B. (2004). The effects of bilateral tax treaties on US FDI activity. International Tax and Public Finance, 11, 601–622.

Blonigen, B. A., Davies, R. B., Waddell, G. R., & Naughton, H. (2007). FDI in space: spatial autoregressive relationships in foreign direct investment. European Economic Review, 51, 1303–1325.

Blonigen, B. A., & Piger, J. M. (2011). Determinants of foreign direct investment. (National Bureau of Economic Research working paper series, working paper 16704). Cambridge, MA.

Brunnermeier, S. B., & Levinson, A. (2004). Examining the evidence on environmental regulations and industry location. The Journal of Environment & Development, 13, 6–41.

Brueckner, J. K. (2003). Strategic interaction among governments: an overview of empirical studies. International Regional Science Review, 26, 175–188.

CEPII (2009). Distance database online. http://www.cepii.fr/. Accessed October 2009.

Chander, P., & Tulkens, H. (1995). A core-theoretic solution for the design of cooperative agreements on transfrontier pollution. International Tax and Public Finance, 2, 279–293.

Chander, P., & Tulkens, H. (2006). The core of an economy with multilateral environmental externalities. In P. Chander, J. Drèze, C. K. Lovell, & J. Mintz (Eds.), Public goods, environmental externalities and fiscal competition (pp. 153–175). New York: Springer.

Cole, M. A., & Elliott, R. J. (2003). Determining the trade-environment composition effect: the role of capital, labor and environmental regulations. Journal of Environmental Economics and Management, 46, 363–383.

Cole, M. A., Elliot, R. J., & Fredriksson, P. G. (2006). Endogenous pollution havens: does FDI influence environmental regulations? Scandinavian Journal of Economics, 108, 157–178.

Congleton, R. D. (1992). Political institutions and pollution control. Review of Economics and Statistics, 74, 412–421.

Cremer, H., & Gahvari, F. (2004). Environmental taxation, tax competition, and harmonization. Journal of Urban Economics, 55, 21–45.

Davies, R. B., & Vadlammanti, K. C. (2013). A race to the bottom in labor standards? An empirical investigation. Journal of Development Economics, 103, 1–14.

Dean, J. M. (2002). Does trade liberalization harm the environment? A new test. Canadian Journal of Economics, 35, 819–842.

Dellink, R. B., Finus, M., & Olieman, N. J. (2008). The stability likelihood of an international climate agreement. Environmental & Resource Economics, 39, 357–377.

Devereux, M., Lockwood, B., & Redoano, M. (2008). Do countries compete over corporate tax rates. Journal of Public Economics, 92, 1210–1235.

Drukker, D. M., & Millimet, D. L. (2007). Assessing the pollution haven hypothesis in an interdependent world. Southern Methodist University working paper, working paper number 0703. Faculty of Economics, Southern Methodist University.

Eaton, J., & Tamura, A. (1994). Bilateralism and regionalism in Japanese and US trade and direct foreign investment patterns. Journal of the Japanese and International Economies, 8, 478–510.

Ederington, J., & Minier, J. (2003). Is environmental policy a secondary trade barrier? An empirical analysis. Canadian Journal of Economics, 36, 137–154.

Eerola, E. (2004). Environmental tax competition in the presence of multinational firms. International Tax and Public Finance, 11, 283–298.

Egger, P., Jessberger, C., & Larch, M. (2011). Trade and investment liberalization as determinants of multilateral environmental agreement membership. International Tax and Public Finance, 18, 605–633.

Eliste, P., & Fredriksson, P. G. (2004). Environmental regulations, transfers, and trade: theory and evidence. Journal of Environmental Economics and Management, 43, 234–250.

Frankel, J. A., & Rose, A. K. (2005). Is trade good or bad for the environment? Sorting out the causality. Review of Economics and Statistics, 87, 85–91.

Fredriksson, P. G., & Millimet, D. L. (2002). Strategic interaction and the determination of environmental policy across US states. Journal of Urban Economics, 51, 101–122.

Fredriksson, P. G., List, J. A., & Millimet, D. L. (2003). Bureaucratic corruption, environmental policy and inbound US FDI: theory and evidence. Journal of Public Economics, 87, 1407–1430.

Fredriksson, P. G., List, J. A., & Millimet, D. L. (2004). Chasing the smokestack: strategic policymaking with multiple instruments. Regional Science and Urban Economics, 34, 387–410.

Freedom House (2005). Freedom in the world country rankings: 1972–2005 dataset online. http://www.freedomhouse.org. Accessed October 2002.

Fuller, W. A. (1977). Some properties of a modification of the limited information estimator. Econometrica, 45, 939–954.

Gresik, T. A. (2001). The taxing task of taxing transnationals. Journal of Economic Literature, 39, 800–838.

Hahn, J., Hausman, J., & Kuersteiner, G. (2004). Estimation with weak instruments: accuracy of higher-order bias and MSE approximations. Econometrics Journal, 7, 272–306.

Harbaugh, W. T., Levinson, A., & Wilson, D. M. (2002). Reexamining the empirical evidence for an environmental Kuznets curve. Review of Economics and Statistics, 84, 541–551.

Henderson, D. J., & Millimet, D. L. (2007). Pollution abatement costs and foreign direct investment inflows to US states: a nonparametric reassessment. Review of Economics and Statistics, 89, 178–183.

Heston, A., Summers, R., & Aten, B. (2002). Penn world table version 6.1, Center for International Comparisons at the University of Pennsylvania (CICUP). https://pwt.sas.upenn.edu. Accessed October 2002.

Hoel, M. (1997). Environmental policy with endogenous plant locations. Scandinavian Journal of Economics, 99, 241–259.

Javorcik, B. S., & Wei, S. (2004). Pollution havens and foreign direct investment: dirty secret or popular myth? Contributions to Economic Analysis & Policy, 3, 8.

Jeppesen, T., List, J. A., & Folmer, H. (2002). Environmental regulations and new plant locations: evidence from a meta-analysis. Journal of Regional Science, 42, 19–49.

Kelejian, H. H., & Prucha, I. R. (1998). A generalized spatial two-stage least squares procedure for estimating a spatial autoregressive model with autoregressive disturbances. Journal of Real Estate Finance and Economics, 17, 99–121.

Klemm, A., & van Parys, S. (2012). Empirical evidence on the effects of tax incentives. International Tax and Public Finance, 19, 393–423.

Levinson, A. (2001). An industry adjusted index of state environmental compliance costs. In C. Carraro & G. E. Metcalf (Eds.), Behavioral and distributional effects of environmental policy (pp. 131–158). Chicago: University of Chicago Press.

Levinson, A. (2003). Environmental regulatory competition: a status report and some new evidence. National Tax Journal, 56, 91–106.

List, J. A., Millimet, D. L., Fredriksson, P. G., & McHone, W. W. (2003). Effects of environmental regulations on manufacturing plant births: evidence from a propensity score matching estimator. Review of Economics and Statistics, 85, 944–952.

Magee, C. S. (2003). Endogenous preferential trade agreements: an empirical analysis. Contributions to Economic Analysis & Policy, 2, 15.

Managi, S., Hibiki, A., & Tsurumi, T. (2009). Does trade openness improve environmental quality. Journal of Environmental Economics and Management, 58, 346–363.

Markusen, J. R., Morey, E. R., & Olewiler, N. (1995). Competition in regional environmental policies when plant locations are endogenous. Journal of Public Economics, 56, 55–77.

Mason, M. (2005). The new accountability: environmental responsibility across borders. London: Earthscan.

McAusland, C. (2002). Cross-hauling of polluting factors. Journal of Environmental Economics and Management, 44, 448–470.

Mitchell, R. B. (2002–2008). International environmental agreements database project (version 2007.1). http://iea.uoregon.edu/. Date accessed: February 2009.

Mitchell, R. B. (2003). International environmental agreements: a survey of their features, formation, and effects. Annual Review of Environmental Resources, 28, 429–461.

Murdoch, J. C., Sandler, T., & Vijverber, W. P. M. (2003). The participation decisions versus the level of participation in an environmental treaty: a spatial probit analysis. Journal of Public Economics, 87, 337–362.

Naughton, H. T. (2010). Globalization and emissions in Europe. European Journal of Comparative Economics, 7, 503–519.

Neumayer, E. (2002). Does trade openness promote multilateral environmental cooperation? The World Economy, 25, 815–832.

Rauscher, M. (1995). Environmental regulation and the location of polluting industries. International Tax and Public Finance, 2, 229–244.

Rauscher, M. (1997). International trade, factor movements, and the environment. Oxford: Clarendon.

Roberts, J. T., Parks, B. C., & Vasquez, A. A. (2004). Who ratifies environmental treaties? Institutionalism, structuralism and participation by 192 nations in 22 treaties. Global Environmental Politics, 4, 22–64.

Rose, A. K., & Spiegel, M. M. (2009). Noneconomic engagement and international exchange: the case of environmental treaties. Journal of Money, Credit, and Banking, 41, 337–363.

Sigman, H. (2002). International spillovers and water quality in rivers: do countries free ride? The American Economic Review, 92, 1152–1159.

Sigman, H. (2004). Does trade promote environmental coordination? Pollution in international rivers. Contributions to Economic Analysis & Policy, 3, 2.

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In J. H. Stock & D. W. K. Andrews (Eds.), Identification and inference for econometric models: essays in honor of Thomas J. Rothenberg (pp. 80–108). Cambridge: Cambridge University Press.

UNCTAD (2012). Foreign direct investment database online. http://www.unctad.org. Accessed February 2009.

Wang, W., & Lee, L. (2013a). Estimation of spatial autoregressive models with randomly missing data in the dependent variable. Econometrics Journal, 16, 73–102.

Wang, W., & Lee, L. (2013b). Estimation of spatial panel data models with randomly missing data in the dependent variable. Regional Science and Urban Economics, 43, 521–538.

Wilson, J. D. (1986). A theory of interregional tax competition. Journal of Urban Economics, 19, 296–315.

Wilson, J. D. (1999). Theories of tax competition. National Tax Journal, 52, 269–304.

World Bank (2009). The little green data book 2009. Washington: World Bank.

Acknowledgements

We acknowledge Erica Birk for her excellent research assistance. We thank two anonymous referees, Glen Waddell, Bruce Blonigen, Trudy Cameron, Dan McMillen, Arik Levinson, Ronald Mitchell, seminar participants at Miami University, University College Dublin, Trinity College Dublin, National University of Ireland at Maynooth, University of Iceland, Mannheim University, Tilburg University, the University of Strathclyde, Georg-August Universität, University of Alberta, Lawrence University, Deakin University, Monash University, University of Montana, University of Colorado at Denver, Public Policy Institute of California, University of Maryland, Colorado State University, Oklahoma State University, State University of New York at Plattsburgh, and conference participants at the 2005 Association of the Pacific Rim Universities, the 2005 European Trade Study Group, and the 2006 Asia Pacific Economic Association conferences, 2007 Oregon Ad hoc Workshop in Environmental and Resource Economics, and 2008 10th Occasional Workshop on Environmental and Resource Economics. Any errors or omissions are the responsibilities of the authors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Davies, R.B., Naughton, H.T. Cooperation in environmental policy: a spatial approach. Int Tax Public Finance 21, 923–954 (2014). https://doi.org/10.1007/s10797-013-9280-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-013-9280-1