Abstract

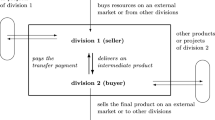

We consider a team-investment setting in which transfer prices between two divisions are negotiable. Investments are made independently and simultaneously after the bargaining stage, i.e. with a given transfer price ‘on the table’. Both divisions’ investments jointly affect the sales price of the final product and total revenue. We analyze two transfer-pricing schemes and their corresponding bargaining problems. Both bargaining settings exhibit non-transferable utility because the transfer price not only allocates corporate profit but also affects corporate profit through the incentives it creates for the divisions’ investment and quantity decisions. In particular, we discuss how concepts from bargaining theory can be use used to determine a ‘fair’ agreement concerning the transfer price.

Similar content being viewed by others

References

Baldenius T (2000) Intrafirm trade, bargaining power, and specific investments. Rev Acc Stud 5(1): 27–56

Baldenius T, Reichelstein S, Sahay SA (1999) Negotiated versus cost-based-transfer pricing. Rev Acc Stud 4(2): 67–91

Böckem S, Schiller U (2008) Option contracts in supply chains. J Econ Manag Strategy 17(1): 219–245

Ben-Shahar O, White JJ (2006) Boilerplate and economic power in auto manufacturing contracts. Mich Law Rev 104(5): 953–982

Brandenburger A, Stuart H (2007) Biform games. Manag Sci 53(4): 537–549

Cachon GP (2003) Supply chain coordination with contracts. In: de Kok A, Graves SC (eds) Supply chain management: design, coordination and operation, Chap. 6. Elsevier, Amsterdam, pp 229–339

Chwolka A, Simons D (2003) Impacts of revenue sharing, profit sharing, and transfer pricing on quality-improving investments. Eur Acc Rev 12(1): 47–76

Chwolka A, Martini JT, Simons D (2010) The value of negotiating cost-based transfer prices. BuR-Bus Res 3(2): 113–131

Dikolli SS, Vaysman I (2006) Information technology, organizational design, and transfer pricing. J Acc Econ 41(1-2): 201–234

Drury C (2004) Management and cost accounting, 6th edn. Thomson Learning, London

Eccles RG (1985) The transfer pricing problem: a theory for practice. Lexington Books, Lexington

Edlin AS, Reichelstein S (1995) Specific investment under negotiated transfer pricing: an efficiency result. Acc Rev 70(2): 275–291

Edlin AS, Reichelstein S (1996) Holdups, standard breach remedies, and optimal investment. Am Econ Rev 86(3): 478–501

Haake CJ, Martini JT (2011) Negotiating transfer prices. Working paper, http://ssrn.com/abstract=1297203

Hanany E, Kilgour DM, Gerchak Y (2007) Final-offer arbitration and risk aversion in bargaining. Manag Sci 53(11): 1785–1792

Hart O, Moore J (1988) Incomplete contracts and renegotiation. Econometrica 56(4): 755–785

Hart O, Moore J (1999) Foundations of incomplete contracts. Rev Econ Stud 66(1): 115–138

Hirshleifer J (1956) On the economics of transfer pricing. J Bus 29(3): 172–184

Holmstrom B, Tirole J (1991) Transfer pricing and organizational form. J Law Econ Organ 7(2): 201–228

Hoogaard JL, Tvede M (2003) Nonconvex n-person bargaining: efficient maxmin solutions. Econ Theory 21: 81–95

Johnson NB (2006) Divisional performance measurement and transfer pricing for intangible assets. Rev Acco Stud 11(2/3): 339–365

Kalai E, Smorodinsky M (1975) Other solutions to nash’s bargaining problem. Econometrica 43: 513–518

Nagarajan M, Sošić G (2008) Game-theoretic analysis of cooperation among supply chain agents: review and extensions. Eur J Oper Res 187(3): 719–745

Nash JF (1950) The bargaining problem. Econometrica 18(1): 155–162

Nash JF (1953) Two-person cooperative games. Econometrica 21(1): 128–140

Peters HJM (1992) Axiomatic bargaining game theory, theory and decision library (Series C), vol 9. Kluwer, Dordrecht

Rawls J (2005) A theory of justice. Harvard University Press, reissue edition

Rosenmüller J (2000) Game theory: stochastics, information, strategies, and cooperation. Kluwer, Boston

Schmalenbach E (1909) Über Verrechnungspreise. Zeitschrift für handelswissenschaftliche Forschung 1908/1909(3):165–185

Smith M (2002) Ex ante and ex post discretion over arm’s length transfer prices. Acc Rev 77(1): 161–184

Tang RYW (1993) Transfer pricing in the 1990s: tax and management perspectives. Quorum Books, Westport

Tirole J (1999) Incomplete contracts: where do we stand. Econometrica 67(4): 741–781

Vaysman I (1998) A model of negotiated transfer pricing. J Acc Econ 25(3): 349–384

Wagenhofer A (1994) Transfer pricing under asymmetric information: an evaluation of alternative methods. Eur Acc Rev 3(1): 71–103

Waterhouse P (1984) Transfer pricing practices of american industry. Price Waterhouse, New York

Wielenberg S (2000) Negotiated transfer pricing, specific investment, and optimal capacity choice. Rev Acc Stud 5(3): 197–216

Williamson OE (1985) The economic institutions of capitalism: firms, markets, relational contracting. The Free Press, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors thank Hermann Jahnke, Ulf Schiller, and Stefan Wielenberg for helpful comments on an earlier version of the paper. Two anonymous referees and the editor William F. Samuelson helped to clarify the paper significantly.

Rights and permissions

About this article

Cite this article

Haake, CJ., Martini, J.T. Negotiating Transfer Prices. Group Decis Negot 22, 657–680 (2013). https://doi.org/10.1007/s10726-012-9286-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10726-012-9286-6