Abstract

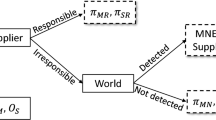

In our model two divisions negotiate over type-dependent contracts to determine an intrafirm transfer price for an intermediate product. Since the upstream division’s (seller’s) costs and downstream division’s (buyer’s) revenues are supposed to be private information, we formally consider cooperative bargaining problems under incomplete information. This means that the two divisions consider allocations of expected utility generated by mechanisms that satisfy (interim) individual rationality, incentive compatibility and/or ex post efficiency. Assuming two possible types for buyer and seller each, we first establish that the bargaining problem is regular, regardless whether or not incentive and/or efficiency constraints are imposed. This allows us to apply the generalized Nash bargaining solution to determine fair transfer payments and transfer quantities. In particular, the generalized Nash bargaining solution tries to balance divisional profits, while incentive constraints are still in place. In that sense a fair profit division is generated. Furthermore, by means of illustrative examples we derive general properties of this solution for the transfer pricing problem and compare the model developed here with the models existing in the literature. We demonstrate that there is a tradeoff between ex post efficiency and fairness.

Similar content being viewed by others

Notes

The performance of the division might be used as an indicator to evaluate the abilities and effort of the division managers. Thus, each division manager is supposed to maximize his divisional profit.

For simplicity, we denote a type profile \((t_1,t_2)\) by \(t_1 t_2\).

We use the terms type-dependent contract and mechanism interchangeably.

Alternatively, \(Q_t\) can be interpreted as the fraction of a maximally tradeable quantity \({\bar{Q}}\). In that case, \(R_H\) is the revenue from selling \({\bar{Q}}\) on the external market. Similarly, \(Q_t\) can be interpreted as a transfer probability with which the unit of the product is traded. Our assumptions of linear pricing and marginal costs then translate to having risk-neutral divisions.

The elements described constitute a Bayesian bargaining problem

$$\begin{aligned} \varGamma =(D,(0,0),T_1,T_2,u_1,u_2,P) \end{aligned}$$with \(D\subseteq {\mathbb {R}}^2\), a convex polyhedron in the sense of Myerson (1979). We refer to it here as the transfer pricing game.

Compare Holmström and Myerson (1983) for further notions of efficiency for mechanisms.

Note that depending on the values of \(R_H,R_L,C_H,C_L\) some \({{\mathcal {M}}}^i\) might be empty.

To be precise, this is what each one does, provided that the other division reports truthfully.

That means there is no mechanism \({\hat{\mu }}^{(Y,Q)}\) such that each agent’s conditional expected utility is no worse than in \(\mu ^{(Y,Q)}\) and some agent is strictly better off.

We thank an anonymous referee for adding this point.

Recall that the Nash solution results from maximization of the Nash product.

(Wagenhofer 1994, Proposition 6) shows that the “equal-split sealed-bid” mechanism implements the first best solution if \((1-\varepsilon )(R_H-R_L) \le \varepsilon (R_H-C_H)\) and \(\delta (C_H-C_L) \le (1-\delta )(R_L-C_L)\) hold.

Recall that maximizing F or its logarithm results in the same set of maximizing mechanisms.

References

Baldenius T (2000) Intrafirm trade, bargaining power, and specific investments. Rev Account Stud 5(1):27–56. https://doi.org/10.1023/A:1009612901910

Baldenius T, Reichelstein S, Sahay S (1999) Negotiated versus cost-based transfer pricing. Rev Account Stud 4(2):67–91. https://doi.org/10.1023/A:1009638001487

de Clippel G (2012) Egalitarianism in mechanism design. unpublished

Edlin AS, Reichelstein S (1995) Specific investment under negotiated transfer pricing: an efficiency result. Account Rev 70(2):275–291. https://www.jstor.org/stable/248306

Göx RF, Schiller U (2006) An economic perspective on transfer pricing. In: Chapman CS, Hopwood AG, Shields MD (eds) Handbooks of management accounting research, vol 2. Elsevier, Amsterdam, pp 673–695. https://doi.org/10.1016/S1751-3243(06)02009-8

Haake CJ, Martini JT (2013) Negotiating transfer prices. Group Decis Negot 22(4):657–680. https://doi.org/10.1007/s10726-012-9286-6

Harris M, Kriebel CH, Raviv A (1982) Asymmetric information, incentives and intrafirm resource allocation. Manag Sci 28(6):604–620. https://doi.org/10.1287/mnsc.28.6.604

Harsanyi JC (1967) Games with incomplete information played by “Bayesian” players, I–III. Part I. The basic model. Manag Sci 14(3):159–182. https://doi.org/10.1287/mnsc.14.3.159

Harsanyi JC (1968a) Games with incomplete information played by “Bayesian” players, I–III. Part II. Bayesian equilibrium points. Manag Sci 14(5):320–334. https://doi.org/10.1287/mnsc.14.5.320

Harsanyi JC (1968b) Games with incomplete information played by “Bayesian”, I–III. Part III. The basic probability distribution of the game. Manag Sci 14(5):486–502. https://doi.org/10.1287/mnsc.14.7.486

Harsanyi JC, Selten R (1972) A generalized Nash solution for two-person bargaining games with incomplete information. Manag Sci 18(5):80–106. https://doi.org/10.1287/mnsc.18.5.80

Holmström B, Myerson RB (1983) Efficient and durable decision rules with incomplete information. Econometrica 51(6):1799–1819. https://doi.org/10.2307/1912117

Leng M, Parlar M (2012) Transfer pricing in a multidivisional firm: a cooperative game analysis. Oper Res Lett 40(5):364–369. https://doi.org/10.1016/j.orl.2012.04.009

Matsuo T (1989) On incentive compatible, individually rational and ex post efficient mechanisms for bilateral trading. J Econ Theory 49(1):189–194. https://doi.org/10.1016/0022-0531(89)90074-4

Myerson RB (1979) Incentive compatibility and the bargaining problem. Econometrica 47(1):61–73. https://doi.org/10.2307/1912346

Myerson RB, Satterthwaite MA (1983) Efficient mechanisms for bilateral trading. J Econ Theory 29(2):265–281. https://doi.org/10.1016/0022-0531(83)90048-0

Nash JF (1950) The bargaining problem. Econometrica 18(2):155–163. https://doi.org/10.2307/1907266

Nash JF (1953) Two-person cooperative games. Econometrica 21(1):128–140. https://doi.org/10.2307/1906951

Rajan MV, Reichelstein S (2004) A perspective on “asymmetric information, incentives and intrafirm resource allocation”. Manag Sci 50(12):1615–1623. https://doi.org/10.1287/mnsc.1040.0285

Vaysman I (1998) A model of negotiated transfer pricing. J Account Econ 25(3):349–384. https://doi.org/10.1016/S0165-4101(98)00029-9

Wagenhofer A (1994) Transfer pricing under asymmetric information. Eur Account Rev 3(1):71–103. https://doi.org/10.1080/09638189400000004

Weidner F (1992) The generalized Nash bargaining solution and incentive compatible mechanisms. Int J Game Theory 21(2):109–129. https://doi.org/10.1007/BF01245455

Acknowledgements

This work was partially supported by the German Research Foundation (DFG) within the Collaborative Research Centre “On-The-Fly Computing” (SFB 901). We are grateful to an anonymous referee and an associate editor for constructive suggestions and comments. We would like to thank the participants of the Conference on Economic Design 2013, July 23–27, 2013, in Lund, Sweden and the Workshop on Game Theory and Economic Applications, July 25–31, 2014, in São Paulo, Brazil, for their comments. An earlier version of this article can be found as Working Paper No. 2013-07, CIE Center for International Economics Working Papers, University of Paderborn.

Funding

Funding was provided by Deutsche Forschungsgemeinschaft (Grant No. SFB901).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

A Proofs of Propositions

Proof

(Proof of Proposition 2) The proof is analogous to the proof of Proposition 1 by Matsuo (1989). \(\square \)

Proof

(Proof of Proposition 3) We show regularity in the three cases by defining a mechanism that satisfies the IR constraints with strict inequality and obey the remaining restrictions.

Case 1 In the presence of IR and IC constraints, consider the mechanism \(\mu ^{(Y,Q)}\) with

Case 2.1 In the presence of IR, IC, and EPE constraints and additionally inequality (1) is strict, implying \(\varepsilon \delta R_H +(1-\varepsilon )R_L > \delta C_H + (1-\delta )(1-\varepsilon )C_L\), use the following mechanism \(\mu ^{(Y,Q)}\) with

Case 2.2 In the presence of IR, IC, and EPE constraints and additionally inequality (1) is not strict, implying \(\varepsilon \delta R_H +(1-\varepsilon )R_L \le \delta C_H + (1-\delta )(1-\varepsilon )C_L\), we show that no strictly individually rational mechanism exists. To see this we first add constraint (IC2) multiplied by \((1-\varepsilon )\) to constraint (IC3) multiplied by \(\delta \) and obtain:

Rearranging yields

If constraint (IR1) holds with strict inequality, we have \(Y_{HH}>C_H\). Hence, we have

Therefore, \(Y_{LL}>R_L\), which contradicts the strict inequality of constraint (IR4).

Case 3 In the presence of IR and EPE constraints, consider the mechanism defined in Proposition 4, which we will not repeat here.

In the three cases, 1, 2.1 and 3, tedious, yet straightforward calculations show that the given mechanism is strictly individually rational.Footnote 14 Therefore, Theorem 3 in Myerson (1979) for regular bargaining problems can be applied showing the existence and uniqueness of the generalized Nash bargaining solution in terms of the agents’ expected utilities. \(\square \)

Proof

(Proof of Proposition 4) To prove Proposition 4, we make use of a technical lemma that can be found Appendix C. We may apply Lemma 1 to the transfer pricing game f being the generalized Nash product, where the \(x_i\)’s are the agents’ conditional utilities resulting from the mechanism \(\mu ^{(Y,Q)}\) and the \(l_i\)’s are the type probabilities. The constraint in the lemma is satisfied with

since

is bounded by c. Actually, (4) holds because all transfer quantities are no greater than 1. Therefore, it holds with equality for EPE mechanisms. Moreover, the variables (expected utilities) are assumed to be nonnegative. It follows that the domain of the maximization problem includes all EPE and IR mechanisms. From Lemma 1, we know that the optimal solution exhibits the same coordinates, meaning that all conditional utilities are equal. This constitutes a system of linear equations. Straightforward calculations show that \(\mu ^{*(Y,Q)}\) is a solution to that system. Now, as \(\mu ^{*(Y,Q)}\) is IR and EPE, and is a maximizer of the maximization problem, it must be the generalized Nash bargaining solution when IR and EPE constraints are active. \(\square \)

Proof

(Proof of Proposition 5) To show (i), we demonstrate that \(Q_{LH}<1\) leaves some room for a Pareto improvement. Since for any transfer payment between \(R_H\) and \(C_L\) both the selling and the buying division are always willing to trade, we further specify that \(Q_{LH}\) needs to be 1.

Consider a mechanism \(\mu ^{(Y,Q)}\) with \(Q_{LH}<1\) and define a new mechanism \({\tilde{\mu }}^{({\tilde{Y}},{\tilde{Q}})}\) by

where \(\gamma \) is chosen such that \({\tilde{Q}}_{LH}=1\). This mechanism \({\tilde{\mu }}^{({\tilde{Y}},{\tilde{Q}})}\) still satisfies the IR and IC constraints and gives both divisions at least the same expected utility for both their types and at least one division is strictly better off. The expected utilities from the mechanism \({\tilde{\mu }}^{({\tilde{Y}},{\tilde{Q}})}\) are

We obtain for the IR constraints

and for the IC constraints

Thus, for any mechanism \(\mu ^{(Y,Q)}\) with \(Q_{LH}<1\) we can construct a mechanism \({\tilde{\mu }}^{({\tilde{Y}},{\tilde{Q}})}\) that Pareto dominates \(\mu ^{(Y,Q)}\).

To prove (ii), we use the axiomatization in Weidner (1992) stating that the generalized Nash bargaining solution is Pareto optimal. Precisely, any mechanism for which the Nash product F is maximal cannot be Pareto dominated. Hence, by part (i), \(Q_{LH} = 1\). \(\square \)

Proof

(Proof of Proposition 6) We first show that constraints (IC2) and (IC3) are binding in the generalized Nash bargaining solution. In the next step, we identify conditions under which both constraints (IC1) and (IC2) (and analogously (IC3) and (IC4)) cannot be binding simultaneously. Let the generalized Nash bargaining solution be attained by a mechanism \(\mu ^{*(Y,Q)}\).

Step 1 We first establish that if (IC2) is not binding we have

This can be seen as follows:

Hereby, the strict inequality comes from the strict inequality of (IC2).

Analogously, if (IC3) is not binding then

We establish that if the incentive constraints (IC2) and (IC3) are not both binding simultaneously, then for given transfer quantities \(Q_{HH}\), \(Q_{LH}\) and \(Q_{LL}\) we can modify the transfer payments \(Y_{HH}\), \(Y_{LH}\) and \(Y_{LL}\) in such a way that IR and IC constraints are still met, but the generalized Nash product increases. We distinguish the two cases in which (IC2) or (IC3) are not binding, respectively.

Case 1 Suppose (IC2) is not binding. We increase the transfer payment \(Y_{HH}\), decrease \(Y_{LH}\) and leave \(Y_{LL}\) unchanged. This is done in such a way that the l.h.s. of the incentive constraint (IC3) does not change. Therefore, while increasing \(Y_{HH}\) by \(\frac{k}{\delta \varepsilon }\) we decrease \(Y_{LH}\) by \(\frac{k}{\delta (1-\varepsilon )}\) for small \(k>0\). It can be easily seen that the remaining incentive constraints (IC1) and (IC4) as well as the IR constraints (IR1) to (IR4) are not violated for k small enough. In order to show that the generalized Nash product F increases, we take the corresponding directional derivative of its logarithm.Footnote 15 Formally, this amounts to

which holds by (5).

Case 2 Suppose (IC3) is not binding. Now we increase the transfer payment \(Y_{LH}\), decrease \(Y_{LL}\) and leave \(Y_{HH}\) unchanged so that (IC2) is unaltered and the remaining IC and IR conditions are still valid. Precisely, increase \(Y_{LH}\) by \(\frac{k}{\delta (1-\varepsilon )}\) and decrease \(Y_{LL}\) by \(\frac{k}{(1-\delta )(1-\varepsilon )}\) for small enough \(k>0\). To see that the generalized Nash product F increases, we again take the directional derivative of its logarithm and use (6), to get

Taking the two cases together, both incentive constraints (IC2) and (IC3) have to be binding for the maximizer of the generalized Nash product under IR and IC constraints.

Step 2 Consider first (IC1) and (IC2) and suppose both constraints are binding. Adding (IC1) and (IC2) and rearranging implies

As \(C_H>C_L\) and \(Q_{LH}=1\) hold in the generalized Nash bargaining solution, the above equation is satisfied if and only if \(Q_{HH}=1\) and \(Q_{LL}=0\). Therefore, if \(Q_{HH}<1\) or if \(Q_{LL}>0\), (IC1) and (IC2) cannot be binding simultaneously. Hence in this case, (IC1) cannot be binding as we already established in Step 1 that (IC2) binds. Conversely, if \(Q_{HH}=1\) and \(Q_{LL}=0\) hold, then it is easily verified that (IC1) is satisfied if and only if (IC2) holds. Since (IC2) is binding in the Nash solution, this establishes the first equivalence in part (ii) of the proposition.

Analogous arguments demonstrate the second equivalence on constraints (IC3) and (IC4). Note that if both are binding, their sum amounts to

which is the analogue to (7).

We summarize the above observations. At least one of the two constraints (IC1) and (IC4) is not binding in the generalized Nash bargaining solution. Put differently, at least two incentive constraints, namely (IC2) and (IC3), and at most three incentive constraints, namely either (IC2), (IC3), (IC1) or (IC2), (IC3), (IC4), are binding in the generalized Nash bargaining solution.

We close the proof with the remark that the subsequent examples (Examples 1, 2) demonstrate that the equivalence in part (ii) is not trivial in the sense that exactly two or three IC constraints might be binding.\(\square \)

B Remarks on the Proof of Proposition 3

Remark 3

(Regularity: IR and IC mechanisms) The mechanism of the proof for Proposition 3 (Case 1) is the convex combination (with equal coefficients \(\frac{1}{3}\)) of the following three mechanisms:

-

\(\mu ^{(Y^1,Q^1)}\) with the transfer payments and quantities:

$$\begin{aligned} (Y^1_{HH},Q^1_{HH})&=\left( \frac{\left( 1-\varepsilon \right) Y^1_{LL}+\delta R_H}{\delta },1\right) , \qquad (Y^1_{HL},Q^1_{HL}) =\left( 0,0\right) , \\ (Y^1_{LH},Q^1_{LH})&=\left( \frac{\left( \delta -\varepsilon \right) Y^1_{LL}+\delta R_H}{\delta },1\right) , \qquad (Y^1_{LL},Q^1_{LL}) =\left( -\delta \left( R_H-C_H\right) ,0\right) , \end{aligned}$$ -

\(\mu ^{(Y^2,Q^2)}\) with the transfer payments and quantities:

$$\begin{aligned} (Y^2_{HH},Q^2_{HH})&=\left( \frac{\left( 1-\varepsilon \right) Y^2_{LL}-(1-\varepsilon )C_L}{\delta },0\right) ,\qquad (Y^2_{HL},Q^2_{HL})=\left( 0,0\right) ,\\ (Y^2_{LH},Q^2_{LH})&=\left( \frac{\left( \delta -\varepsilon \right) Y^2_{LL}+\varepsilon C_L}{\delta },1\right) , \qquad (Y^2_{LL},Q^2_{LL})=\left( \frac{R_L+C_L}{2},1\right) . \end{aligned}$$ -

\(\mu ^{(Y^3,Q^3)}\) with the transfer payments and quantities:

$$\begin{aligned} (Y^3_{HH},Q^3_{HH})&=\left( \frac{\left( 1-\varepsilon \right) Y^3_{LL}+\delta (1-\varepsilon )\left( C_H-C_L\right) }{\delta },0\right) , \qquad (Y^3_{HL},Q^3_{HL})=\left( 0,0\right) ,\\ (Y^3_{LH},Q^3_{LH})&=\left( \frac{\left( \delta -\varepsilon \right) Y^3_{LL}+\left( 1-\varepsilon \right) \delta C_H+\varepsilon \delta C_L}{\delta },1\right) ,\\ (Y^3_{LL},Q^3_{LL})&=\left( -\varepsilon \delta \left( C_H-C_L\right) ,0\right) . \end{aligned}$$

Remark 4

(Regularity: IR, IC and EPE mechanisms) The mechanism of the proof for Proposition 3 (Case 2.1) is a convex combination (with equal factors \(\frac{1}{2}\)) of the following two mechanisms:

-

\(\mu ^{(Y^4,Q^4)}\) with the transfer payments and quantities:

$$\begin{aligned} (Y^4_{HH},Q^4_{HH})&=\left( C_H,1\right) , \qquad (Y^4_{HL},Q^4_{HL})=\left( 0,0\right) ,\\ (Y^4_{LH},Q^4_{LH})&=\left( \frac{\varepsilon (1-\delta )R_H + (1-\delta )(1-\varepsilon )C_L+(\delta -\varepsilon )C_H}{1-\varepsilon },1\right) ,\\ (Y^4_{LL},Q^4_{LL})&=\left( \frac{(1-\delta )(1-\varepsilon )C_L+\delta C_H-\delta \varepsilon R_H}{1-\varepsilon },0\right) . \end{aligned}$$We observe using \(\mu ^{(Y^4,Q^4)}\) that the constraints (IR2) to (IR4) hold with strict inequality while (IR1) is equal to zero.

-

\(\mu ^{(Y^5,Q^5)}\) with the transfer payments and quantities:

$$\begin{aligned} (Y^5_{HH},Q^5_{HH})&=\left( \frac{\delta \varepsilon R_H+(1 - \varepsilon )R_L-(1-\delta )(1-\varepsilon ) C_L}{\delta },1\right) ,\quad (Y^5_{HL},Q^5_{HL})=\left( 0,0\right) ,\\ (Y^5_{LH},Q^5_{LH})&=\left( \frac{\delta \varepsilon R_H+(\delta - \varepsilon )R_L+(1-\delta )\varepsilon C_L}{\delta },1\right) , \qquad (Y^5_{LL},Q^5_{LL})=\left( R_L,0\right) . \end{aligned}$$We observe using \(\mu ^{(Y^5,Q^5)}\) that the constraints (IR1) to (IR3) hold with strict inequality while (IR4) is equal to zero. Therefore, taking a convex combination (e.g., with \(\frac{1}{2}\)) of \(\mu ^{(Y^4,Q^4)}\) and \(\mu ^{(Y^5,Q^5)}\) yields a mechanism that is strictly individually rational.

C Lemma 1 Used in the Proof of Proposition 4

Lemma 1

Let \(f:{\mathbb {R}}_+^n \rightarrow {\mathbb {R}}_+\) be defined by

and consider the constrained maximization problem

with \(c\in {\mathbb {R}}_+\). Then there is a unique maximizer \((x_1^*,\ldots ,x_n^*)\) and \(x^*\) satisfies \(x_1^*=\ldots =x_n^*\).

Proof

(Proof of Lemma 1) Inserting the constraint

into the objective function leads to

The function does not depend on \(x_n\). We obtain for \(j \ne n\) the first order condition

Thus, in order to obtain a maximum we need to have for all \(j \ne n\)

Since the right-hand side will be the same for each \(x_j\) and is equal to \(x_n\), we have for the maximizer \((x_1^*,\ldots ,x_n^*)\) of \(f(x_1,\ldots ,x_n)\) under the constraint \(\sum _{i=1}^n l_i \cdot x_i=c\) that \(x_1^*=\ldots =x_n^*\) holds. \(\square \)

Rights and permissions

About this article

Cite this article

Haake, CJ., Recker, S. The Generalized Nash Bargaining Solution for Transfer Price Negotiations Under Incomplete Information. Group Decis Negot 27, 905–932 (2018). https://doi.org/10.1007/s10726-018-9592-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10726-018-9592-8