Abstract

In this study, we develop and test the hypothesis that because of opacity, the stock prices of financial firms will cluster on round fractions more than the stock prices of non-financial firms. Indeed, we find that the stock prices of opaque financial firms round on nickels and quarters more than the stock prices of less opaque non-financial firms. These results are robust to a battery of robustness tests that include measuring clustering at different frequencies, different econometric specifications, and different matched sample techniques. To draw stronger causal inferences, we use the passing of the Sarbanes-Oxley (SOX) Act as an exogenous shock to the level of transparency in the financial services sector. We find that price clustering decreases more for financial firms than for non-financial firms during the post-SOX regulation period. We also show that, relative to less opaque financial firms, those financial firms that are more opaque experienced the greatest decline in price clustering during the post-SOX period.

Similar content being viewed by others

Notes

Other explanations exist for the presence of price clustering. For instance, Niederhoffer and Osborne (1966) and Ikenberry and Weston (2008) argue that prices tend to cluster on round increments because of behavioral reasons. Since individuals typically think in round numbers, they are more likely to trade on round fractions. Therefore, prices may cluster on round numbers because investors are attempting to mitigate cognitive processing costs.

Since many of the rules and regulations associated with the SOX Act affected how companies report earnings and financial statements, we wanted to examine at least a quarter before and after the passing of the Act. We note that the results are stronger as we lengthen the event window surrounding SOX.

We have expanded our set of stock characteristics (i.e. additional k variables, such as spread, illiq, volatility, turnover, and volume) and the results are robust.

The results are robust to the inclusion of day-fixed effects.

We note that Akhibe and Martin (2008) measure opacity using disclosure variables, such as the degree of independence of the audit committee, existence of an independent financial expert on the audit committee, and degree of disclosure through financial footnotes.

Andrade et al. (2014) use Credit Default Swap (CDS) spreads and a structural CDS pricing model to measure firm-level corporate opacity.

The pre-treatment trends in price clustering between financial and non-financial firms are similar, which satisfies the parallel trend assumption for consistent difference-in-difference estimation.

We have replicated the analysis that follows and define opacity using the median and the 90th percentile and find similar results.

References

Akhigbe A, Martin AD (2006) Valuation impact of Sarbanes–Oxley: evidence from disclosure and governance within the financial services industry. J Bank Financ 30(3):989–1006

Alexander GJ, Peterson MA (2007) An analysis of trade-size clustering and its relation to stealth trading. J Financ Econ 84(2):435–471

Alizadeh S, Brandt MW, Diebold FX (2002) Range-based estimation of stochastic volatility models. J Financ 57(3):1047–1091

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5(1):31–56

Anderson S, Beard TR, Kim H, Stern LV (2016) The short-turn pricing behavior of closed-end funds: bond vs. Equity Funds. Journal of Financial Services Research 50:363–386

Andrade SC, Bernile G, Hood III FM (2014) SOX, corporate transparency, and the cost of debt. J Bank Financ 38:145–165

Babbel DF, Merrill C (2005) Real and illusory value creation by insurance companies. Journal of Risk and Insurance 72(1):1–22

Ball CA, Torous WN, Tschoegl AE (1985) The degree of price resolution: the case of the gold market. J Futur Mark 5(1):29–43

Berlin M, Loeys J (1988) Bond covenants and delegated monitoring. J Financ 43(2):397–412

Bessembinder H (2003) Trade execution costs and market quality after decimalization. J Financ Quant Anal 38(4):747–777

Blau BM, Griffith TG (2016) Price clustering and the stability of stock prices. J Bus Res 69(10):3933–3942

Blau BM, Brough TJ, Griffith TG (2017) Bank opacity and the efficiency of stock prices. J Bank Financ 76:32–47

Campbel TS, Kracaw WA (1980) Information production, market signaling, and the theory of financial intermediation. J Financ 35(4):863–882

Chen Q, Goldstein I, Jiang W (2007) Price informativeness and investment sensitivity to stock price. Rev Financ Stud 20(3):619–650

Chung KH, Zhang H (2014) A simple approximation of intraday spreads using daily data. J Financ Mark 17:94–120

Colquitt LL, Hoyt RE, McCullough KA (2006) The impact of Asbestos and environmental reserves increases on shareholder wealth. North American Actuarial Journal 10(3):17–31

Copeland TE, Galai D (1983) Information effects on the bid-ask spread. J Financ 38(5):1457–1469

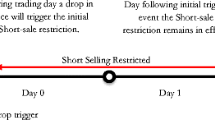

Davis RL, Jurich SN, Roseman BS, Watson E (2018) Short-Sale restrictions and Price clustering: evidence from SEC rule 201. J Financ Serv Res 54:345–367

Demsetz H (1968) The cost of transacting. Q J Econ 82(1):33–53

Diamond DW (1989) Reputation acquisition in debt markets. J Polit Econ 97(4):828–862

Diamond DW (1991) Monitoring and reputation: the choice between bank loans and directly placed debt. J Polit Econ 99(4):689–721

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Financ 25(2):383–417

Flannery MJ, Kwan SH, Nimalendran M (2004) Market evidence on the opaqueness of banking firms’ assets. J Financ Econ 71(3):419–460

Flannery MJ, Kwan SH, Nimalendran M (2013) The 2007–2009 financial crisis and bank opaqueness. J Financ Intermed 22(1):55–84

Friedman M (1977) Nobel lecture: inflation and unemployment. J Polit Econ 85(3):451–472

Goldstein I, Guembel A (2008) Manipulation and the allocational role of prices. Rev Econ Stud 75(1):133–164

Glosten LR, Milgrom PR (1985) Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. J Financ Econ 14(1):71–100

Griffith TG, Roseman BS (2019) Making cents of tick sizes: the effect of the 2016 US SEC tick size pilot on limit order book liquidity. J Bank Financ 101:104–121

Gwilym O, Alibo E (2003) Decreased price clustering in FTSE100 futures contracts following a transfer from floor to electronic trading. Journal of Futures Markets: Futures, Options, and Other Derivative Products 23(7):647–659

Gwilym O, Clare A, Thomas S (1998a) Price clustering and bid-ask spreads in international bond futures. J Int Financ Mark Inst Money 8(3–4):377–391

Gwilym O, Clare A, Thomas S (1998b) Extreme price clustering in the London equity index futures and options markets. J Bank Financ 22(9):1193–1206

Harris L (1991) Stock price clustering and discreteness. Rev Financ Stud 4(3):389–415

Hayek FA (1945) The use of knowledge in society. Am Econ Rev 35(4):519–530

Hirtle B (2006) Stock market reaction to financial statement certification by bank holding company CEOs. Journal of Money, Credit and Banking, pp 1263–1291

Huizinga H, Laeven L (2012) Bank valuation and accounting discretion during a financial crisis. J Financ Econ 106(3):614–634

Ikenberry DL, Weston JP (2008) Clustering in US stock prices after decimalisation. Eur Financ Manag 14(1):30–54

Jones JS, Lee WY, Yeager TJ (2012) Opaque banks, price discovery, and financial instability. J Financ Intermed 21(3):383–408

Kwan, S.H. and Willard, T., Carleton, 1998, Financial contracting and the choice between private placement and publicly offered bonds. Unpublished working paper

Kyle AS (1985) Continuous auctions and insider trading. Journal of the Econometric Society, Econometrica, pp 1315–1335

Morgan DP (2002) Rating banks: risk and uncertainty in an opaque industry. Am Econ Rev 92(4):874–888

Ni SX, Pearson ND, Poteshman AM (2005) Stock price clustering on option expiration dates. J Financ Econ 78(1):49–87

Niederhoffer V, Osborne MFM (1966) Market making and reversal on the stock exchange. J Am Stat Assoc 61(316):897–916

Niederhoffer V (1966) A new look at clustering of stock prices. J Bus 39(2):309–313

Osborne MF (1962) Periodic structure in the Brownian motion of stock prices. Oper Res 10(3):345–379

Pavlov A, Wachter S, Aevelev AA (2016) Transparency in the mortgage market. J Financ Serv Res 49:265–280

Rindi B, Werner IM (2017) US Tick Size Pilot. The Ohio State University, Working Paper

Sopranzetti BJ, Datar V (2002) Price clustering in foreign exchange spot markets. J Financ Mark 5(4):411–417

Stoll HR (1989) Inferring the components of the bid-ask spread: theory and empirical tests. J Financ 44(1):115–134

Veldkamp LL (2006) Information markets and the comovement of asset prices. Rev Econ Stud 73(3):823–845

Wyckoff, P., 1963. The psychology of stock market timing. Prentice-Hall

Zhang T, Cox LA, Van Ness RA (2009) Adverse selection and the opaqueness of insurers. Journal of Risk and Insurance 76(2):295–321

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Baig, A., Blau, B.M. & Griffith, T.G. Firm Opacity and the Clustering of Stock Prices: the Case of Financial Intermediaries. J Financ Serv Res 60, 187–206 (2021). https://doi.org/10.1007/s10693-020-00341-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-020-00341-w