Abstract

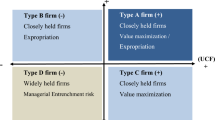

This paper examines liquidity commonality is caused by correlation in institutional herding and shareholder disputes due to irrational investors over the period from 2007 to 2017 in China. Consistent with the fund liquidity hypothesis, we find that shareholders dispute is negatively associated with liquidity commonality and that this negative relationship is more pronounced in firms with more excess control rights and desirability of liquidity for governance. We conclude that it is important to consider not only control-ownership divergence, which has been shown to be a supply-side factors as institutional herding from foreign investors, but also liquidity commonality in information environment. The block holders can cause the liquidity when shareholder disputes are governed by block holders to intervene and sell their stake to exit by threaten, or disagreement trade against the mispricing. This work contributes to the growing literature by analyzing the impacts of controlled ownership divergency on commonality in liquidity as well as the impact of investor sentiment related to the information environment.

Similar content being viewed by others

Notes

Domestic investors in China cannot invest in foreign financial assets and foreign investors cannot invest in the Chinese A-share market. The Qualified Foreign Institutional Investors (QFII) program is a securities investment mechanism that was implemented prior to the complete opening-up of the Chinese capital market to foreign investments. Foreign investors may remit a certain amount of foreign currency and convert it into local currency with the approval of relevant authorities. China launched the QFII program to allow licensed investors in local securities to make investments through special purpose accounts and vice versa.

As shown in Chordia et al. (2011).

The equation for \(\Lambda\) can be decomposed into two parts as follows:

$$\begin{aligned} & \Lambda_{t} = \left[ {\frac{1}{{\left( {k - 1} \right)\sigma \left( {B_{k,t} } \right)\sigma \left( {B_{k,t - 1} } \right)}}} \right]\sum\limits_{k = 1}^{k} {\left[ {\sum\limits_{i = 1}^{{I_{k,t} }} {\left[ {\frac{{\left( {D_{i,k.t} - E\left( {B_{t} } \right)\left( {D_{i,k,t - 1} - E\left( {B_{t - 1} } \right)} \right)} \right)}}{{I_{k,t} I_{k,t - 1} }}} \right]} } \right]} \\ & \quad + \left[ {\frac{1}{{\left( {k - 1} \right)\sigma \left( {B_{k,t} } \right)\sigma \left( {B_{k,t - 1} } \right)}}} \right]\sum\limits_{k = 1}^{k} {\left[ {\sum\limits_{i = 1}^{{I_{k,t} }} {\sum\limits_{j = 1,j \ne i}^{{I_{k,t - 1} }} {\frac{{\left( {D_{i,k,t} - E\left( {B_{t} } \right)\left( {D_{i,k,t - 1} - E\left( {B_{t - 1} } \right)} \right)} \right)}}{{I_{k,t} I_{k,t - 1} }}} } } \right]} \\ \end{aligned}$$INHD denotes the time-series average of the correlation coefficients and the first-term on the right-hand side of this equation represents the magnitude of the proportion of non-herding (NH) as adjusted to their own portfolio through trading or selling or buying for institutional investors; \({\text{I}}_{k,t}\) is the number of institutional investors trading industry k on the trading day t; Di, k, t is a dummy variable that is equal to one if investor i is a buyer in this industry on trading day t and zero if investor is a seller. Dj, k, t-1 is a dummy variable that is equal to one if investor j is a buyer in industry k on trading day t-1 and zero if investor \(i \ne j\) is a seller of industry k on trading day t.

Using the Shapley value measure, each shareholder will have 1/3 the Shapley value, for example, the major shareholders hold 49%, 49%, or 2% of voting rights (total 100%), meaning that each shareholder is equally important in deciding firm policy, because to reach a majority requires at least two of them to vote together.

To mitigate the impact of the split share structure reform implemented in April 2005, the sample period used in our primary analysis commences in 2005.

The liquidity investor will halt decisions to trade when the liquidity is sufficiently low and the transaction costs sufficiently high. However, liquidity traders may trade regardless of transaction costs and as a consequence returns may be nonzero. The LOT model is rooted in the adverse selection framework (Glosten & Milgrom, 1985; Kyle, 1985) and treats zero returns as evidence that the transaction cost threshold has not been exceeded by the liquidity traders. \({\text{LOT}}_{i,t} = \frac{{\sum\nolimits_{j = 1}^{t} {R\_ZERO_{i,j} } }}{{N_{t} }}\).

References

Agarwal, V., Jiang, W., Tang, Y., & Yang, B. (2013). Uncovering hedge fund skill from the portfolio holdings they hide. The Journal of Finance, 68(2), 739–783.

Aggarwal, R., Chen, X., & Yur-Austin, J. (2011). Currency risk exposure of Chinese corporations. Research in International Business and Finance, 25(3), 266–276.

Aggarwal, R., Erel, I., Ferreira, M., & Matos, P. (2011). Does governance travel around the world? Evidence from institutional investors. Journal of financial economics, 100(1), 154–181.

Amihud, Y., Hameed, A., Kang, W., & Zhang, H. (2015). The illiquidity premium: International evidence. Journal of Financial Economics, 117(2), 350–368.

Amihud, Y., & Mendelson, H. (1991). Liquidity, maturity, and the yields on US Treasury securities. The Journal of Finance, 46(4), 1411–1425.

Attig, N., Fong, W. M., Gadhoum, Y., & Lang, L. H. (2006). Effects of large shareholding on information asymmetry and stock liquidity. Journal of Banking and Finance, 30(10), 2875–2892.

Attig, N., Guedhami, O., & Mishra, D. (2008). Multiple large shareholders, control contests, and implied cost of equity. Journal of Corporate Finance, 14(5), 721–737.

Back, K., Li, T., & Ljungqvist, A. (2015). Liquidity and governance. ECGI-Finance Working Paper (388).

Baker, M., & Stein, J. C. (2004). Market liquidity as a sentiment indicator. Journal of Financial Markets, 7(3), 271–299.

Bebchuk, L. A., Brav, A., & Jiang, W. (2015). The long-term effects of hedge fund activism. Columbia Law Review, 115(5), 1085–1154.

Bena, J., Ferreira, M. A., Matos, P., & Pires, P. (2017). Are foreign investors locusts? The long-term effects of foreign institutional ownership. Journal of Financial Economics, 126(1), 122–146.

Bennett, J. A., Sias, R. W., & Starks, L. T. (2003). Greener pastures and the impact of dynamic institutional preferences. The Review of Financial Studies, 16(4), 1203–1238.

Boubaker, S., Mansali, H., & Rjiba, H. (2014). Large controlling shareholders and stock price synchronicity. Journal of Banking and Finance, 40, 80–96.

Boulatov, A., Hendershott, T., & Livdan, D. (2013). Informed trading and portfolio returns. Review of Economic Studies, 80(1), 35–72.

Brav, A., Jiang, W., & Kim, H. (2010). Hedge fund activism: A review. Foundations and Trends® in Finance, 4(3), 185–246.

Brockman, P., & Chung, D. Y. (2002). Commonality in liquidity: Evidence from an order-driven market structure. Journal of Financial Research, 25(4), 521–539.

Brockman, P., Chung, D. Y., & Pérignon, C. (2009). Commonality in liquidity: A global perspective. Journal of Financial and Quantitative Analysis, 44(4), 851–882.

Brunnermeier, M. K., & Pedersen, L. H. (2008). Market liquidity and funding liquidity. The Review of Financial Studies, 22(6), 2201–2238.

Brunnermeier, M. K., & Pedersen, L. H. (2009). Market liquidity and funding liquidity. The review of financial studies, 22(6), 2201-2238.

Cai, F., Han, S., Li, D., & Li, Y. (2019). Institutional herding and its price impact: Evidence from the corporate bond market. Journal of Financial Economics, 131(1), 139–167.

Campello, M., Ribas, R. P., & Wang, A. Y. (2014). Is the stock market just a side show? Evidence from a structural reform. The Review of Corporate Finance Studies, 3(1–2), 1–38.

Chakraborty, I., & Gantchev, N. (2013). Does shareholder coordination matter? Evidence from private placements. Journal of Financial Economics, 108(1), 213–230.

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: An international perspective. Journal of Banking and Finance, 24(10), 1651–1679.

Chen, G., Firth, M., & Xu, L. (2009). Does the type of ownership control matter? Evidence from China’s listed companies. Journal of Banking and Finance, 33(1), 171–181.

Chen, Q., Chen, X., Schipper, K., Xu, Y., & Xue, J. (2012). The sensitivity of corporate cash holdings to corporate governance. The Review of Financial Studies, 25(12), 3610–3644.

Chen, Y. F., Wang, C. Y., & Lin, F. L. (2008). Do qualified foreign institutional investors herd in Taiwan’s securities market? Emerging Markets Finance and Trade, 44(4), 62–74.

Cheung, W., Lam, K. S., & Tam, L. H. (2012). Blockholding and market reactions to equity offerings in China. Pacific-Basin Finance Journal, 20(3), 459–482.

Choi, N., & Sias, R. W. (2009). Institutional industry herding. Journal of Financial Economics, 94(3), 469–491.

Chordia, T., Roll, R., & Subrahmanyam, A. (2000). Commonality in liquidity. Journal of Financial Economics, 56(1), 3–28.

Chordia, T., Roll, R., & Subrahmanyam, A. (2001). Market liquidity and trading activity. The Journal of Finance, 56(2), 501–530.

Chordia, T., Sarkar, A., & Subrahmanyam, A. (2011). Liquidity dynamics and cross-autocorrelations. Journal of Financial and Quantitative Analysis, 46(3), 709–736.

Chu, X., Liu, Q., & Tian, G. G. (2015). Does control-ownership divergence impair market liquidity in an emerging market? Evidence from China. Accounting and Finance, 55(3), 881–910.

Chung, K. H., Elder, J., & Kim, J. C. (2010). Corporate governance and liquidity. Journal of Financial and Quantitative Analysis, 45(2), 265–291.

Chung, K. H., & Kim, J. K. (1999). Corporate ownership and the value of a vote in an emerging market. Journal of Corporate Finance, 5(1), 35–54.

Chung, D. Y. (1999). The informational effect of corporate lobbying against proposed accounting standards. Review of Quantitative Finance and Accounting, 12(3), 243–270.

Claessens, S., Djankov, S., & Lang, L. H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1–2), 81–112.

Coughenour, J. F., & Saad, M. M. (2004). Common market makers and commonality in liquidity. Journal of Financial Economics, 73(1), 37–69.

Demirguc-Kunt, A., & Maksimovic, V. (1999). Institutions, financial markets, and firm debt maturity. Journal of Financial Economics, 54(3), 295–336.

Deng, B., Li, Z., & Li, Y. (2018). Foreign institutional ownership and liquidity commonality around the world. Journal of Corporate Finance, 51, 20–49.

Domowitz, I., Hansch, O., & Wang, X. (2005). Liquidity commonality and return co-movement. Journal of Financial Markets, 8(4), 351–376.

Edmans, A. (2009). Blockholder trading, market efficiency, and managerial myopia. The Journal of Finance, 64(6), 2481–2513.

Edmans, A., & Manso, G. (2011). Governance through trading and intervention: A theory of multiple blockholders. The Review of Financial Studies, 24(7), 2395–2428.

Edmans, A., Fang, V. W., & Zur, E. (2013). The effect of liquidity on governance. The Review of Financial Studies, 26(6), 1443–1482.

Fabre, J., & Frino, A. (2004). Commonality in liquidity: Evidence from the Australian stock exchange. Accounting and Finance, 44(3), 357–368.

Fahlenbrach, R., & Stulz, R. M. (2011). Bank CEO incentives and the credit crisis. Journal of Financial Economics, 99(1), 11–26.

Fan, J. P., Wong, T. J., & Zhang, T. (2013). Institutions and organizational structure: The case of state-owned corporate pyramids. The Journal of Law, Economics, and Organization, 29(6), 1217–1252.

Fang, V. W., Tian, X., & Tice, S. (2014). Does stock liquidity enhance or impede firm innovation?. The journal of Finance, 69(5), 2085–2125.

Fang, V. W., Maffett, M., & Zhang, B. (2015). Foreign institutional ownership and the global convergence of financial reporting practices. Journal of Accounting Research, 53(3), 593–631.

Fang, Y., Hu, M., & Yang, Q. (2018). Do executives benefit from shareholder disputes? Evidence from multiple large shareholders in Chinese listed firms. Journal of Corporate Finance, 51, 275–315.

Faure-Grimaud, A., & Gromb, D. (2004). Public trading and private incentives. Review of Financial Studies, 17(4), 985–1014.

Ferreira, M. A., Massa, M., & Matos, P. (2009). Shareholders at the gate? Institutional investors and cross-border mergers and acquisitions. The Review of Financial Studies, 23(2), 601–644.

Ferreira, M. A., & Matos, P. (2008). The colors of investors’ money: The role of institutional investors around the world. Journal of Financial Economics, 88(3), 499–533.

Firth, M., Lin, C., & Zou, H. (2010). Friend or foe? The role of state and mutual fund ownership in the split share structure reform in China. Journal of Financial and Quantitative Analysis, pp. 685–706.

Fong, K. Y., Holden, C. W., & Trzcinka, C. A. (2017). What are the best liquidity proxies for global research? Review of Finance, 21(4), 1355–1401.

Gillan, S., & Starks, L. (2003). Corporate governance, corporate ownership, and the role of institutional investors: A global perspective. Journal of Applied Finance, 13, 4–22.

Glosten, L. R., & Milgrom, P. R. (1985). Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics, 14(1), 71–100.

Gompers, P. A., & Metrick, A. (2001). Institutional investors and equity prices. The Quarterly Journal of Economics, 116(1), 229–259.

Gorton, G. B., & Pennacchi, G. G. (1993). Security baskets and index-linked securities. Journal of Business, 66, 1–27.

Grier, P., & Zychowicz, E. J. (1994). Institutional investors, corporate discipline, and the role of debt. Journal of Economics and Business, 46(1), 1–11.

Hasbrouck, J., & Seppi, D. J. (2001). Common factors in prices, order flows, and liquidity. Journal of Financial Economics, 59(3), 383–411.

He, C., Wright, R., & Zhu, Y. (2015). Housing and liquidity. Review of Economic Dynamics, 18(3), 435–455.

Hoitash, R., & Krishnan, M. M. (2008). Herding, momentum and investor over-reaction. Review of Quantitative Finance and Accounting, 30(1), 25–47.

Hong, H., & Rady, S. (2002). Strategic trading and learning about liquidity. Journal of Financial Markets, 5(4), 419–450.

Huberman, G., & Halka, D. (2001). Systematic liquidity. Journal of Financial Research, 24(2), 161–178.

Hung, W., Lu, C. C., & Lee, C. F. (2010). Mutual fund herding its impact on stock returns: Evidence from the Taiwan stock market. Pacific-Basin Finance Journal, 18(5), 477–493.

Jiang, F., Kim, K. A., Nofsinger, J. R., & Zhu, B. (2017). A pecking order of shareholder structure. Journal of Corporate Finance, 44, 1–14.

Kamara, A., Lou, X., & Sadka, R. (2008). The divergence of liquidity commonality in the cross-section of stocks. Journal of Financial Economics, 89(3), 444–466.

Kang, J. K., & Kim, J. M. (2010). Do foreign investors exhibit a corporate governance disadvantage? An information asymmetry perspective. Journal of International Business Studies, 41(8), 1415–1438.

Kang, W., & Zhang, H. (2014). Measuring liquidity in emerging markets. Pacific-Basin Finance Journal, 27, 49–71.

Karolyi, G. A., Lee, K. H., & Van Dijk, M. A. (2012). Understanding commonality in liquidity around the world. Journal of Financial Economics, 105(1), 82–112.

Kim, J. B., & Cheong, H. Y. (2009). Does auditor designation by the regulatory authority improve audit quality? Evidence from Korea. Journal of Accounting and Public Policy, 28(3), 207–230.

Koch, A., Ruenzi, S., & Starks, L. (2016). Commonality in liquidity: A demand-side explanation. The Review of Financial Studies, 29(8), 1943–1974.

Kyle, A. S. (1985). Continuous auctions and insider trading. Econometrica: Journal of the Econometric Society, pp. 1315–1335.

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of Financial Economics, 32(1), 23–43.

Lang, M., & Maffett, M. (2011). Transparency and liquidity uncertainty in crisis periods. Journal of Accounting and Economics, 52(2–3), 101–125.

Larrain, B., & Urzúa, F. (2013). Controlling shareholders and market timing in share issuance. Journal of Financial Economics, 109(3), 661–681.

Lesmond, D. A., Ogden, J. P., & Trzcinka, C. A. (1999). A new estimate of transaction costs. The Review of Financial Studies, 12(5), 1113–1141.

Liu, Q., & Siu, A. (2011). Institutions and corporate investment: Evidence from investment-implied return on capital in China. Journal of Financial and Quantitative Analysis, 46(6), 1831–1863.

Luong, H., Moshirian, F., Nguyen, L., Tian, X., & Zhang, B. (2017). How do foreign institutional investors enhance firm innovation? Journal of Financial and Quantitative Analysis, 52(4), 1449–1490.

Maug, E. (1998). Large shareholders as monitors: Is there a trade-off between liquidity and control? The Journal of Finance, 53(1), 65–98.

McCahery, J. A., Sautner, Z., & Starks, L. T. (2016). Behind the scenes: The corporate governance preferences of institutional investors. The Journal of Finance, 71(6), 2905–2932.

Milnor, J. W., & Shapley, L. S. (1978). Values of large games II: Oceanic games. Mathematics of Operations Research, 3(4), 290–307.

Mitchell, M., & Pulvino, T. (2001). Characteristics of risk and return in risk arbitrage. The Journal of Finance, 56(6), 2135–2175.

Morck, R., Yeung, B., & Yu, W. (2000). The information content of stock markets: Why do emerging markets have synchronous stock price movements? Journal of Financial Economics, 58, 215–260.

Moshirian, F., Qian, X., Wee, C. K. G., & Zhang, B. (2017). The determinants and pricing of liquidity commonality around the world. Journal of Financial Markets, 33, 22–41.

Ng, L., Wu, F., Yu, J., & Zhang, B. (2016). Foreign investor heterogeneity and stock liquidity around the world. Review of Finance, 20(5), 1867–1910.

Nofsinger, J. R., & Sias, R. W. (1999). Herding and feedback trading by institutional and individual investors. The Journal of Finance, 54(6), 2263–2295.

Pasquariello, P., & Vega, C. (2013). Strategic cross-trading in the US stock market. Review of Finance, 19(1), 229–282.

Poon, S. H., Rockinger, M., & Stathopoulos, K. (2013). Market liquidity and institutional trading during the 2007–8 financial crisis. International Review of Financial Analysis, 30, 86–97.

Prommin, P., Jumreornvong, S., & Jiraporn, P. (2014). The effect of corporate governance on stock liquidity: The case of Thailand. International Review of Economics and Finance, 32, 132–142.

Pukthuanthong-Le, K., & Visaltanachoti, N. (2009). Commonality in liquidity: Evidence from the stock exchange of Thailand. Pacific-Basin Finance Journal, 17(1), 80–99.

Qian, X., Tam, L. H., & Zhang, B. (2014). Systematic liquidity and the funding liquidity hypothesis. Journal of Banking and Finance, 45, 304–320.

Rubin, A., & Smith, D. R. (2009). Institutional ownership, volatility and dividends. Journal of Banking and Finance, 33(4), 627–639.

Sadka, R., & Scherbina, A. (2007). Analyst disagreement, mispricing, and liquidity. The Journal of Finance, 62(5), 2367–2403.

Schmidt, C., & Fahlenbrach, R. (2017). Do exogenous changes in passive institutional ownership affect corporate governance and firm value? Journal of Financial Economics, 124(2), 285–306.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737–783.

Sias, R. W. (2004). Institutional herding. The Review of Financial Studies, 17(1), 165–206.

Syamala, S. R., Reddy, V. N., & Goyal, A. (2014). Commonality in liquidity: An empirical examination of emerging order-driven equity and derivatives market. Journal of International Financial Markets, Institutions and Money, 33, 317–334.

Tripathi, A., & Dixit, A. (2021). Liquidity commonality in extreme quantiles: Indian evidence. Finance Research Letters, 38, 101448.

Vayanos, D. (2004). Flight to quality, flight to liquidity, and the pricing of risk (No. w10327). National bureau of economic research.

Wang, X., & Wei, S. (2021). Does the investment horizon of institutional investors matter for stock liquidity? International Review of Financial Analysis, 74, 101648.

Wei, Z., Xie, F., & Zhang, S. (2005). Ownership structure and firm value in China’s privatized firms: 1991–2001. Journal of Financial and Quantitative Analysis, 40(1), 87–108.

Yuan, R., Xiao, J. Z., & Zou, H. (2008). Mutual funds’ ownership and firm performance: Evidence from China. Journal of Banking and Finance, 32(8), 1552–1565.

Acknowledgements

The author is grateful to anonymous referee, Douglas Cumming, Gary Tian, Xuan Tian, Geoffrey Wood, Cynthia Clark, Luigi Zingales, Anthony Saunders, L. Hung, Yu-Jane Liu, and seminar participants in numerous institutions and conferences for helpful comments and suggestions. Some data for this study were collected while G. Lin was a professor of the Chengchi University for financial statement studies, and additional data were assembled during a visit to the National Taiwan University who is excellent acknowledged. We also thank the econometric analysis from those fellows of Taiwan Econometric Society. Any remaining errors are the author’s own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Wang, MS. Shareholder Disputes and Commonality in Liquidity: Evidence from the Equity Markets in China. Asia-Pac Financ Markets 29, 291–325 (2022). https://doi.org/10.1007/s10690-021-09350-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-021-09350-8

Keywords

- Commonality in liquidity

- Funding constraint hypothesis

- Funding liquidity hypothesis

- Shareholder disputes

- Institutional herding