Abstract

The corporate governance literature has shown that firms with better governance exhibit higher abnormal returns. In this paper, we examine the effect of cash flow concentration and excess control on equity pricing in France, a country with relatively weak protection for investors. Using hand-collected data on publicly-listed French firms over the period from 2002 to 2011, we find that firms, in which controlling shareholders hold a major proportion of cash flow rights, have higher market performance. Cash flow concentration is a useful monitoring tool for firms to address agency problems. In contrast, a higher level of discrepancy between the control and cash-flow rights of the ultimate controlling shareholders is associated with lower market performance. Control-ownership wedge increases the incentive of the controlling shareholders to act corruptly or unethically. These findings support both incentives hypothesis arising from the cash flow concentration and the expropriation effects arising from the excess control rights. These findings have strong implications for market participants and portfolio investment.

Similar content being viewed by others

Notes

La Porta et al. (1999) show that more than 60% of large corporations in 27 richest countries have dominant shareholders.

Several studies document a significant concentration of ownership among the United States (Morck et al. 1988) Holderness et al. 1999), nine East Asian countries (Claessens et al. 2000) 13 Western European countries (Faccio and Lang 2002) and Germany (Franks and Mayer 1995).

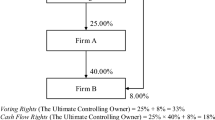

A recent study of 464 firms conducted by Institutional Investor Services (2007) in 16 European countries report that the most frequent control-enhancing mechanisms in Europe are pyramids (27% of companies) and dual-class shares (24%). Multiple-voting shares are one of the primary devices used in France (58%) to enhance control. For additional evidence on the prevalence of Ownership disproportionality and the deviations from one share-one vote for Western Europe, see Faccio and Lang (2002).

The first empirical research on the relationship between governance index and equity prices in US was carried out by Gompers et al. (2003). The authors find that an investment strategy that consists of buying well-governed firms and selling poorly-governed yields an abnormal return of around 8.5% per year. After them, this pattern was supported by the findings of Cremers and Nair (2005) and Core et al. (2006) Apart from the US, the positive relationship between corporate governance and firm performance was also reported for Russian (Black 2001); Korean (Black et al. 2006); and German public firms (Drobetz et al. 2004). However, another group of researchers pointed out that this positive relation might not hold. For example, Johnson et al. (2009) show that long-term abnormal stock returns are not affected by the quality of governance and attribute the abnormal return of the hedge portfolio to industry clustering. Cremers and Ferrell (2009) and more recently Bebchuk et al. (2013) documents the disappearance of the governance-return correlation. They provide evidence that the correlation between abnormal returns and corporate governance dos not persist for long term due to the market participants' learning.

For example, Belkhir et al. (2013) report that agency problems between large and minority shareholders increase with the degree of separation of cash-flow and control rights, which reduces a firm's attractiveness to outside investors and encourages the largest controlling shareholders to take their firms private in France. In the same vein, Boubaker et al. (2014), document that shareholder wealth gains from going private increases in firms that exhibits a higher separation of cash-flow and control rights of its ultimate owner.

References

Arnott, R. D., & Ryan, R. J. (2001). The death of the risk premium. The Journal of Portfolio Management, 27(3), 61–74.

Attig, N., Fischer, K. P., & Gadhoum, Y. (2004, March). On the determinants of pyramidal ownership: Evidence on dilution of minority interests. In Efa 2004 maastricht meetings paper (No. 4592).

Attig, N., Fong, W. M., Gadhoum, Y., & Lang, L. H. (2006). Effects of large shareholding on information asymmetry and stock liquidity. Journal of Banking & Finance, 30(10), 2875–2892.

Barontini, R., & Caprio, L. (2006). The effect of ownership structure and family control on firm value and performance. European Financial Management: In Evidence from Continental Europe.

Bebchuk, L. A. (1999). A rent-protection theory of corporate ownership and control (No. w7203). New York: National Bureau of Economic Research.

Bebchuk, L., Cohen, A., & Ferrell, A. (2009). What matters in corporate governance? The Review of Financial Studies, 22, 783–827.

Bebchuk, L. A., Cohen, A., & Wang, C. C. (2013). Learning and the disappearing association between governance and returns. Journal of Financial Economics, 108(2), 323–348.

Bebchuk, L. A., Kraakman, R., & Triantis, G. (2000). Stock pyramids, cross-ownership, and dual class equity: the mechanisms and agency costs of separating control from cash-flow rights. Concentrated corporate ownership (pp. 295–318). Chicago: University of Chicago Press.

Belkhir, M., Boubaker, S., & Derouiche, I. (2014). Control–ownership wedge, board of directors, and the value of excess cash. Economic Modelling, 39, 110–122.

Belkhir, M., Boubaker, S., & Rouatbi, W. (2013). Excess control, agency costs and the probability of going private in France. Global Finance Journal, 24(3), 250–265.

Ben-Nasr, H., Boubaker, S., & Rouatbi, W. (2015). Ownership structure, control contestability, and corporate debt maturity. Journal of Corporate Finance, 35, 265–285.

Bennedsen, M., & Nielsen, K. (2010). Incentive and entrenchment effects in European ownership. Journal of Banking & Finance, 34, 2212–2229.

Berk, J. B., & DeMarzo, P. M. (2007). Corporate finance. New York: Pearson Education.

Berle, A., & Means, G. (1932). The Modern Corporation and Private Property Macmillan. New York, 2(3), 45–53.

Black, B. (2001). The corporate governance behavior and market value of Russian firms. Emerging Markets Review, 2(2), 89–108.

Black, B. S., Jang, H., & Kim, W. (2006). Predicting firms’ corporate governance choices: Evidence from Korea. Journal of Corporate Finance, 12(3), 660–691.

Bloch, L., & Kremp, E. (1999). Ownership and voting power in France.

Blondel, C., Rowell, N., & Van der Heyden, L. (2002). Prevalence of patrimonial firms on Paris stock exchange: analysis of the top 250 companies in 1993 and 1998. INSEAD.

Bolton, P., & Von Thadden, E. L. (1998). Blocks, liquidity, and corporate control. The Journal of Finance, 53(1), 1–25.

Boubaker, S. (2007). Ownership-control discrepancy and firm value: Evidence from France. Multinational Finance Journal, 11(3/4), 211–252.

Boubaker, S., Cellier, A., & Rouatbi, W. (2014a). The sources of shareholder wealth gains from going private transactions: The role of controlling shareholders. Journal of Banking & Finance, 43, 226–246.

Boubaker, S., Derouiche, I., & Lasfer, M. (2015). Geographic location, excess control rights, and cash holdings. International Review of Financial Analysis, 42, 24–37.

Boubaker, S., & Labégorre, F. (2008a). Ownership structure, corporate governance and analyst following: A study of French listed firms. Journal of Banking & Finance, 32(6), 961–976.

Boubaker, S., & Labégorre, F. (2008b). Le recours aux leviers de contrôle: Le cas des sociétés cotées françaises. Finance Contrôle Stratégie, 11(3), 96–124.

Boubaker, S., & Labégorre, F. (2009). Ownership and control structure of french listed firms. Bankers, Markets & Investors, 101, 5–19.

Boubaker, S., Mansali, H., & Rjiba, H. (2014b). Large controlling shareholders and stock price synchronicity. Journal of Banking & Finance, 40, 80–96.

Carhart, M. M. (1997). On persistence in mutual fund performance. The Journal of Finance, 52(1), 57–82.

Claessens, S., Djankov, S., Fan, J. P., & Lang, L. H. (2002). Disentangling the incentive and entrenchment effects of large shareholdings. The Journal of Finance, 57(6), 2741–2771.

Claessens, S., Djankov, S., & Lang, L. H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1–2), 81–112.

Core, J. E., Guay, W. R., & Rusticus, T. O. (2006). Does weak governance cause weak stock returns? An examination of firm operating performance and investors’ expectations. The Journal of Finance, 61(2), 655–687.

Cremers, K. M., & Nair, V. B. (2005). Governance mechanisms and equity prices. The Journal of Finance, 60(6), 2859–2894.

Cremers, M., & Ferrell, A. (2009). Thirty years of corporate governance: Firm valuation & stock returns. Working Paper, Yale University and Harvard University.

Cronqvist, H., & Nilsson, M. (2003). Agency costs of controlling minority shareholders. Journal of Financial and Quantitative analysis, 38(4), 695–719.

Davies, J. R., Hillier, D., & McColgan, P. (2005). Ownership structure, managerial behavior and corporate value. Journal of Corporate Finance, 11(4), 645–660.

Demsetz, H. (1983). The structure of ownership and the theory of the firm. The Journal of Law and Economics, 26(2), 375–390.

Demsetz, H., & Lehn, K. (1985). The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93(6), 1155–1177.

Demsetz, H., & Villalonga, B. (2001). Ownership structure and corporate performance. Journal of Corporate Finance, 7(3), 209–233.

Denis, D. K., & McConnell, J. J. (2003). International corporate governance. Journal of Financial and Quantitative Analysis, 38(1), 1–36.

Derouiche, I., Hassan, M., & Amdouni, S. (2018). Ownership structure and investment-cash flow sensitivity. Journal of Management and Governance, 22(1), 31–54.

Drobetz, W., Schillhofer, A., & Zimmermann, H. (2004). Corporate governance and expected stock returns: Evidence from Germany. European Financial Management, 10(2), 267–293.

Dyck, A., & Zingales, L. (2004). Private benefits of control: An international comparison. The Journal of Finance, 59(2), 537–600.

Faccio, M., & Lang, L. H. (2002). The ultimate ownership of Western European corporations. Journal of Financial Economics, 65(3), 365–395.

Faccio, M., Marchica, M. T., & Mura, R. (2011). Large shareholder diversification and corporate risk-taking. The Review of Financial Studies, 24(11), 3601–3641.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1–22.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325.

Fan, J. P., & Wong, T. J. (2002). Corporate ownership structure and the informativeness of accounting earnings in East Asia. Journal of Accounting and Economics, 33(3), 401–425.

Franks, J., & Mayer, C. (1995). Ownership and control.

Ginglinger, E. (2002). L’actionnaire comme contrôleur. Revue Française de Gestion, 5, 37–55.

Ginglinger, E., & Hamon, J. (2012). Ownership, control and market liquidity. Finance, 33(2), 61–99.

Gomes, A. (2000). Going public without governance: managerial reputation effects. The Journal of Finance, 55(2), 615–646.

Gompers, P., Ishii, J., & Metrick, A. (2003). Corporate governance and equity prices. The Quarterly Journal of Economics, 118(1), 107–156.

Gompers, P. A., Ishii, J., & Metrick, A. (2004). Incentives vs. control: An analysis of US dual-class companies (No. w10240). National Bureau of Economic Research.

Gompers, P. A., Ishii, J., & Metrick, A. (2010). Extreme governance: An analysis of dual-class firms in the United States. Review of Financial Studies, 23(3), 1051–1088.

Grossman, S. J., & Hart, O. D. (1980). Takeover bids, the free-rider problem, and the theory of the corporation. The Bell Journal of Economics, 11, 42–64.

Grossman, S. J., & Hart, O. D. (1988). One share-one vote and the market for corporate control. Journal of Financial Economics, 20, 175–202.

Harris, M., & Raviv, A. (1988). Corporate governance: Voting rights and majority rules. Journal of Financial Economics, 20, 203–235.

Holderness, C. G. (2003). A survey of blockholders and corporate control. Economic Policy Review, 9, 1.

Holderness, C. G., Kroszner, R. S., & Sheehan, D. P. (1999). Were the good old days that good? Changes in managerial stock ownership since the great depression. The Journal of Finance, 54(2), 435–469.

Holderness, C. G., & Sheehan, D. P. (1988). The role of majority shareholders in publicly held corporations: An exploratory analysis. Journal of Financial Economics, 20, 317–346.

Holmström, B., & Tirole, J. (1993). Market liquidity and performance monitoring. Journal of Political Economy, 101(4), 678–709.

Hou, K., Xue, C., & Zhang, L. (2015). Digesting anomalies: An investment approach. The Review of Financial Studies, 28(3), 650–705.

Institutional Shareholder Services. (2007). Proportionality between ownership and control in EU listed companies: External study commissioned by the European Commission.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48(1), 65–91.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Johnson, S. A., Moorman, T. C., & Sorescu, S. (2009). A reexamination of corporate governance and equity prices. The Review of Financial Studies, 22(11), 4753–4786.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471–517.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2000). Investor protection and corporate governance. Journal of Financial Economics, 58(1–2), 3–27.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2002). Investor protection and corporate valuation. The Journal of Finance, 57(3), 1147–1170.

Laeven, L., & Levine, R. (2008). Complex ownership structures and corporate valuations. The Review of Financial Studies, 21(2), 579–604.

Lemmon, M. L., & Lins, K. V. (2003). Ownership structure, corporate governance, and firm value: Evidence from the East Asian financial crisis. The Journal of Finance, 58(4), 1445–1468.

Lin, C., Ma, Y., Malatesta, P., & Xuan, Y. (2011b). Ownership structure and the cost of corporate borrowing. Journal of Financial Economics, 100(1), 1–23.

Lin, C., Ma, Y., & Xuan, Y. (2011a). Ownership structure and financial constraints: Evidence from a structural estimation. Journal of Financial Economics, 102(2), 416–431.

Lins, K. V. (2003). Equity ownership and firm value in emerging markets. Journal of Financial and Quantitative Analysis, 38(1), 159–184.

Masulis, R. W., Wang, C., & Xie, F. (2009). Agency problems at dual-class companies. The Journal of Finance, 64(4), 1697–1727.

Maury, B., & Pajuste, A. (2005). Multiple large shareholders and firm value. Journal of Banking & Finance, 29(7), 1813–1834.

McConnell, J. J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27(2), 595–612.

Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20, 293–315.

Morck, R., Wolfenzon, D., & Yeung, B. (2005). Corporate governance, economic entrenchment, and growth. Journal of Economic Literature, 43(3), 655–720.

Nenova, T. (2003). The value of corporate voting rights and control: A cross-country analysis. Journal of Financial Economics, 68(3), 325–351.

Peng, W. Q., Wei, K. J., & Yang, Z. (2011). Tunneling or propping: Evidence from connected transactions in China. Journal of Corporate Finance, 17(2), 306–325.

Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3 Part 1), 461–488.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737–783.

Stulz, R. (1988). Managerial control of voting rights: Financing policies and the market for corporate control. Journal of Financial Economics, 20, 25–54.

Thomsen, S., & Pedersen, T. (2000). Ownership structure and economic performance in the largest European companies. Strategic Management Journal, 21(6), 689–705.

Tirole, J. (2010). The theory of corporate finance. Princeton: Princeton University Press.

Villalonga, B., & Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80(2), 385–417.

Wei, K. J., & Zhang, Y. (2008). Ownership structure, cash flow, and capital investment: Evidence from East Asian economies before the financial crisis. Journal of Corporate Finance, 14(2), 118–132.

Wiwattanakantang, Y. (2001). Controlling shareholders and corporate value: Evidence from Thailand. Pacific-Basin Finance Journal, 9(4), 323–362.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Barka, Z., Hamza, T. The effect of large controlling shareholders on equity prices in France: monitoring or entrenchment?. J Manag Gov 24, 769–798 (2020). https://doi.org/10.1007/s10997-019-09484-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10997-019-09484-y