Abstract

We study minimal conditions for competitive behavior with few agents. We adapt a price-quantity strategic market game to the indivisible commodity environment commonly used in double auction experiments, and show that all Nash equilibrium outcomes with active trading are competitive if and only if there are at least two buyers and two sellers willing to trade at every competitive price. Unlike previous formulations, this condition can be verified directly by checking the set of competitive equilibria. In laboratory experiments, the condition we provide turns out to be enough to induce competitive results, and the Nash equilibrium appears to be a good approximation for market outcomes. Subjects, although possessing limited information, are able to act as if complete information were available in the market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Contrasting the conventional requirement of infinitely many traders for perfect competition, laboratory experiments using the double auction mechanism observe the convergence to competitive equilibrium and attainment of full efficiency with as few as eight traders (Smith 1962, 1982). Theories on strategic market games, which organize the market using a static double auction mechanism, have also verified the competitiveness of Nash equilibria outcomes with few traders in certain scenarios (Dubey 1982; Simon 1984; Benassy 1986, DSB hereafter). This paper reconciles the laboratory results with theories on strategic market games. We propose a strategic market game applicable to markets with indivisible commodities as in most double auction experiments, we derive conditions for the equivalence between Nash and competitive equilibrium that require as few as four traders, and we test the equivalence in the laboratory.

In a strategic market game, buyers and sellers submit price-quantity pairs to a clearing house, which acts as a profit-maximizing middleman, and allocates trades accordingly. Like in a double auction, priorities are given to higher bids and lower asks in a strategic market game, inducing a price competition between traders. In line with Bertrand’s argument, DSB prove that having two active sellers and two active buyers in a Nash equilibrium is sufficient to make the outcome competitive in certain strategic market games.

This paper addresses a few differences between the settings of the aforementioned strategic market games and the double auction mechanism. Firstly, the divisibility of the commodities. Proofs in DSB rely on the divisibility of commodities; in a conventional double auction market setting, there is an indivisible commodity for trade with divisible money. Analogous to what Mas-Colell (1977) finds when all but one commodities in the general equilibrium model become indivisible, we show that the “main results ...with divisible commodities and convex preferences remain valid” in the double auction setting. Unlike Mas-Colell (1977), we do not assume a continuum of traders.

The condition DSB provide is a sufficient one for the competitiveness of outcomes from a Nash equilibrium, thus is not informative on the Nash equilibria where it is not met. We provide a necessary and sufficient condition for equivalence between the outcomes of the Nash equilibrium and the competitive equilibrium with indivisible commodities. Essentially, our condition requires that on each side of the market there are two inframarginal traders, in the sense that they are willing to trade at every competitive price.Footnote 1 Unlike previous work, our condition relies on the characteristics of the set of competitive equilibria, and place no requirement on Nash equilibria other than the occurrence of trade. Notably, our equivalence result includes contestable markets, in which a single active seller sells in the market at the competitive price.Footnote 2

Different from the common measures for market power such as residual demand elasticity or market concentration, the condition in DSB, which we show also holds in the indivisible setting, uses the minimum number of active traders as an indicator for the attainment of a competitive outcome. Our condition further differentiates the market structures that admit of monopolistic outcomes in the Nash equilibria and the ones that do not. When our condition is not met, i.e. a market structure allows for exploitation of market power in the equilibrium, it does not rule out the possibility of achieving a competitive outcome in a different equilibrium. Indeed, there always exists a Nash equilibrium with competitive outcome. Hence, when there is a monopoly in the market, whether the outcome is competitive can be a result of equilibrium selection. This helps to explain the convergence to competitive outcomes in some monopolistic markets in Smith and Williams (1990). Our condition is general and met in double auction markets such as in Smith (1962, 1976, 1982), as well as the stress-tests that yield supportive evidence for the institution’s robust convergence to competitive outcomes [for example, duopoly markets, swastika design and box design in Smith and Williams (1990), and swastika design in Smith (1965) and Holt et al. (1986)].Footnote 3 Parallel to the asymptote competitiveness in Cournot competition, when traders’ reservation values are independently drawn from certain distributions, our condition is more likely to be met as the number of traders grows.Footnote 4 While an exact model for the dynamic double auction institution remains absent, in our experiment, we examine the effectiveness of our condition in providing reference for the double auction markets.Footnote 5

Another important feature of the double auction is its demonstration of “the economy of knowledge with which it operates, or how little the individual participants need to know in order to be able to take the right action” (Hayek 1945, p. 527). To resemble the limited information each trader possesses in real markets, double auction experiments provide traders with private information of their own values of the commodity. However, when incomplete information solution concepts such as Bayesian Nash equilibrium are used in another strand of models for the double auction, the k-double auction, the attainment of full efficiency requires infinitely many traders (for literature reviews, see Satterthwaite and Williams 1993; Zheng 2020). As suggested by previous results from the experiments, “although traders’ information ...is far from complete, it is possible for them to learn to use the relevant ‘complete information’ strategies” (Friedman and Ostroy 1995, p. 23).

To check whether the Nash equilibrium provides a good description of outcomes under the standard double auction settings, we run a laboratory experiment in which traders are informed about their own valuations but not about the valuations of other traders. We consider two market institutions: the clearing house institution, which is exactly the strategic market game we model, and a double auction following the rules of Smith (1962). These two institutions are static/dynamic versions of each other—the clearing house institution is indeed a call market with a pay-as-bid feature.Footnote 6 The double auction institution is known to facilitate learning of the relevant information for traders when compared to call markets (see e.g. Smith 1982; Smith et al. 1982). Under the clearing house institution, we provide traders with feedback on the trading prices and quantities at the end of each round, to check whether this information is enough for them to learn to act as-if there is complete information in the market as Hayek hypothesized.

Each market in our experiment consists of two buyers and two sellers—the minimal size allowing for the equivalence of Nash equilibrium and competitive equilibrium outcomes, and thus adequate for a stringent test. Under each institution, we consider two market environments: one in which the two buyers and the two sellers are inframarginal, so that all Nash equilibrium outcomes are competitive, and one in which the two buyers but only one of the sellers are inframarginal (i.e. there is monopoly power) so that some Nash equilibrium outcomes are non-competitive.

In the absence of monopoly power, the results from our experiment confirm the double auction institution’s convergence to competitive outcomes, though we have fewer traders than previous experiments.Footnote 7 Efficiency under the clearing house institution remains below efficiency under the double auction, but seemingly converges over time, in line with the results obtained by Smith et al. (1982) and Friedman and Ostroy (1995) for larger numbers of traders. Under both institutions, trading prices lay mostly in the competitive range in the absence of monopoly power, consistent with equilibrium predictions.

When monopoly power exists, higher trading price, lower trading volume and an efficiency loss can be observed under the double auction compared to the environment without monopoly, as expected. Under the clearing house institution, trading volume is lower compared to the environment without monopoly, but the efficiency loss is not significant, and prices seem to converge to competitive levels over time. This surprising result may be either a consequence of the inability of the monopolist to gather enough information about the other side of the market to exploit monopoly power under the clearing house institution, or a consequence of coordination on a low-price outcome, which remains a Nash equilibrium outcome under monopolistic conditions. It is an interesting and open question whether the convergence to competitive outcomes for the clearing house institution even in the presence of monopoly power is robust to learning with a longer horizon and to variations in the parameters describing the economy.

Gode and Sunder (1993) show the attainment of high efficiency when the double auction market is populated by simulated zero-intelligence traders who submit random non-loss-incurring bids and asks.Footnote 8 Our model helps to complete the story by focusing on the factor they omitted, the strategic behavior in the market, and how it may lead to the competitive outcome in double auction with a small number of traders. The convergence to competitive price by budget-constrained zero-intelligent agents was helped by a “Marshallian path,” i.e. trading occurring first to those who have more to gain from trade (Gode and Sunder 1993; Brewer et al. 2002). Given the static nature of our clearing house institution, the Marshallian path cannot have an impact within a round. However, there may be a similar effect through learning across rounds. Low cost and high value units are more frequently traded.Footnote 9 Based on previous transaction prices, traders may improve coordination and further narrow down the price range (Fig. 8).

In the competitive environment under the double auction institution, we observe the Marshallian path to hold better in earlier rounds, as corresponds to a phenomenon linked to market learning out of equilibrium. Under the double auction institution, Coasian dynamics would prevent the monopolist seller from selling to the highest valuation buyer at above competitive prices since a buyer would anticipate that the monopolist would be willing to lower the price afterwards to trade with the other buyer. We do find some evidence of the monopolist occasionally lowering the price to sell a second unit. However, trading volume remains on average below competitive levels, and estimated price asymptotes suggest higher than competitive prices in the monopolistic environment under the double auction.

In previous experimental work on market games, Duffy et al. (2011) explore a quantity strategic market game with divisible commodities, where traders retain market power. They compare outcomes with two and with ten traders per side, and obtain higher efficiency and more coherence to competitive behavior if there are more traders. Dufwenberg and Gneezy (2000) also obtain—somewhat surprisingly—a beneficial effect of the number of traders in an experiment on Bertrand competition, comparing outcomes with two, three, and four traders per side. We differ from both as we explore the boundary between competitive and noncompetitive environments.

This paper is also closely related to Friedman and Ostroy (1995), which compares a strategic market game institution with double auction under various structural parameters with divisible commodities and larger number of traders, and draws a connection between DSB and results from double auction experiments. With the conditions we obtain for the equivalence of Nash and competitive equilibria outcomes, we are able to carry out a stringent test on their as-if complete information theory in the lab.

The rest of the paper is organized as follows. Section 2 gives a formal description of the economy. Section 3 gives a detailed explanation of the strategic market mechanism. Section 4 contains the theorems of coincidence of Nash equilibrium and competitive equilibrium. Section 5 presents the experimental design and hypotheses. Section 6 describes the results. Section 7 concludes. Proofs are collected in “Online Appendix 1”, and experimental instructions and quizzes are collected in “Online Appendix 2”.

2 The economy

We describe a general equilibrium model related to laboratory experiments. Our notation follows Friedman and Ostroy (1995). There are two goods, a divisible ‘money’ and a traded good that can only be traded in indivisible units. Let \(I = B \cup S\) be the set of individuals, classified as either buyers (B) or sellers (S). Each \(i \in I\) is defined by a vector \((r_{i1},\ldots ,r_{ik})\), where \(r_{ij}\) indicates the reservation value for the \(j_{th}\) unit of the traded good. The parameter \(k \ge 1\) indicates the maximum number of units of the traded good that an individual can buy or sell. For each \(i \in B\), reservation values decrease with the quantity demanded: \(r_{i1} \ge \cdots \ge r_{ik} \ge 0\). For each \(i \in S\), reservation values increase with the quantity supplied \(0 \le r_{i1} \le \cdots \le r_{ik}\).

Each trader’s utility is given by

where \(q_i \in Q_i\) is the quantity of the good traded by i and \(m_i \in \Re\) are the money holdings of i. We let \(Q_i = \{0,1,\ldots ,k\}\) if \(i \in B\) and \(Q_i = \{0,-1,\ldots ,-k\}\) if \(i \in S\), so that supply is described as negative demand. We assume that initial endowment of money of each individual is equal to 0; note that individuals are allowed negative money holdings.

Keeping fixed the sets of buyers and sellers and k, an economy \(r \in \Re _+^{k|I|}\) is described by a set of vectors of reservation values that are weakly decreasing for each buyer and weakly increasing for each seller, as described above. Given an economy r, an allocation (of the indivisible good) is a vector \(q=(q_i) \in \times _{i \in I} Q_i\) and an outcome is a vector (q, m) where q is an allocation and \(m \in \Re ^{|I|}\).

Denote by \(\xi (r)\) the set of competitive equilibria for an economy r. A competitive equilibrium \((p,q)\in \xi (r)\) is a price \(p \in \Re _+\) and an allocation q such that

-

1.

(utility maximization) for each i, \(u_i(q_i,-p q_i) \ge u_i(q'_i,-p q'_i)\) for all \(q'_i \in Q_i\).

-

2.

(market clearance) \(\sum _{i \in I} q_i = 0\). By utility maximization, if (p, q) is a competitive equilibrium for economy r, then

-

for every \(i \in B\), either \(q_i = 0\) and \(r_{i1} \le p\), or \(0< q_i < k\) and \(r_{iq_i} \ge p \ge r_{i,q_i+1}\), or \(q_i = k\) and \(r_{ik} \ge p\).

-

for every \(i \in S\), either \(q_i = 0\) and \(r_{i1} \ge p\), or \(-k< q_i < 0\) and \(r_{i|q_i|} \le p \le r_{i,|q_i|+1}\), or \(q_i = -k\) and \(r_{ik} \le p\).

-

Note that (p, q) induces the outcome \((q,m)=(q,(-p q_i))\).

It is easy to prove that for any economy r, there is a competitive equilibrium. We can order the units that sellers can supply in ascending order according to their reservation values, and the units that buyers can demand in descending order according to their reservation values, to obtain the familiar supply and demand curves. Equilibrium prices and allocations can be obtained by the crossing of the supply and demand curves. As it is well-known for economies with quasi-linear preferences, the set of competitive allocations is the set of solutions to the problem of maximizing social surplus, that is

where \(Q = \{q: q_i \in Q_i, \sum _i q_i = 0\}\) is the set of feasible allocations.

Trade is positive in every competitive equilibrium if and only if

As we will see, an important condition for the equivalence between competitive equilibrium outcomes and the outcomes of a strategic game is that there are at least two trading individuals on each side of the market.

Related works on price-quantity strategic market games feature divisible commodities under the usual assumptions of continuous, increasing marginal costs for each seller, and continuous, decreasing marginal utility of consumption for each buyer. Note that in economies with divisible units active traders compete “at the margin,” in the sense that in a competitive equilibrium the marginal utility of consumption and the marginal cost of production for the last unit are equated to the price for all active traders. Our results illustrate that competition at the margin is unnecessary for the equivalence between competitive and strategic outcomes.

3 The strategic market game

Each individual submits a price-quantity offer \(({\widetilde{p}}_i,{\widetilde{q}}_i)\) to the clearing house, where \({\widetilde{p}}_i \ge 0\) and \({\widetilde{q}}_i \in Q_i\). Intuitively, each individual offers to trade up to \(|{\widetilde{q}}_i|\) units of the traded good at the price \({\widetilde{p}}_i\). Denote the set of feasible offers for individual i by

Given an offer profile \(w\in W =\times _{i\in I} W_i\), the set of feasible allocation vectors for the clearing house is

Note that Y(w) is a finite set. Conditions (3.1) and (3.2) guarantee that trade is voluntary, i.e. individuals do not end up trading more than what they offered. Condition (3.3) ensures that the market clears and the clearing house keeps no inventory. Condition (3.4) conveys the assumption that the good is indivisible.

After the clearing house chooses an allocation \(y = (y_1,\ldots ,y_n) \in Y(w)\), individual i receives \(y_i\) units of the traded good and earns an amount of money equal to \(-{\widetilde{p}}_iy_i\). We assume that the clearing house allocates trade to maximize the arbitrage profit, \(\sum _{i\in I} y_i{\widetilde{p}}_i\), as if the clearing house buys units from the sellers and sells them to buyers at the agents’ proposed prices. Thus, given an offer profile w, the resulting allocation y must satisfy

Intuitively, as in Dubey (1982), buying offers are ranked in a descending order by price while the quantities offered are accumulated to form the demand curve, and selling offers are ranked in an ascending order by price while the quantities offered are accumulated to form the supply curve. Since goods are traded at their proposed prices, the clearing house extracts the surplus between the supply and demand, as Fig. 1 illustrates. That is, the clearing house chooses a competitive equilibrium allocation for a fictitious economy \({{\tilde{r}}}\) given by

and appropriates the revealed social surplus.

In scenario (a) of Fig. 1, \(\Pi (w)\) is a singleton set. To maximize the arbitrage profit, the clearing house would fulfill all demand and supply to the left of the dashed line. The dotted area is the profit for the clearing house, and the profit is positive in this case. In scenario (b), \(\Pi (w)\) contains two allocations if units A and B are offered by different sellers, depending on which of the two sellers is allowed to sell the last unit. In scenario (c), the clearing house gets the same profit allocating \(q_1\) or \(q_2 >q_1\) units. Similarly, in scenario (d), buying and selling q units gives the same profit for the clearing house as making no trade.

To make trade happen whenever possible, following Simon (1984), we assume that the clearing house chooses an allocation from the set

That is, the clearing house does not choose allocations that are ray-dominated. Then in scenario (c), \(q_2\) units will be bought and sold, and in scenario (d), q units will be traded. We still have two allocations in F(w) in scenario (b) if units A and B are offered by different sellers. We assume that the clearing house chooses randomly according to the distribution \(\mu _w\) that gives probability \(\mu _w(y) >0\) to each allocation \(y \in F(w)\) and probability \(\mu _w(y) =0\) to every other allocation in Y(w) such that \(\sum _{y\in F(w)}\mu _w(y)=1\). Propositions 1–6 in the Online Appendix provide a characterization on F(w).

Given this market mechanism, define an active trader given offer profile w as a trader that has positive probability to trade. In other words, agent i is an active trader given offer profile w if there exists \(y\in F(w)\) such that \(y_i\ne 0\). Furthermore, denote by AS(w) the set of active sellers, and AB(w) the set of active buyers given offer profile w.

4 Nash equilibrium and competitive outcomes

Note that each offer profile \(w \in W\) induces a lottery over outcomes. Each outcome \((y,(-\widetilde{p_i}y_i))\) is realized with probability \(\mu _w(y)>0\) if \(y \in F(w)\), and \(\mu _w(y)=0\) if not. Given an offer profile \(w\in W\), the expected utility for each trader is,

A (pure strategy) Nash equilibrium for an economy r is an offer profile \(w^*\in W\) such that for every \(i\in I\),

As in other price-quantity strategic market games, every competitive equilibrium outcome can be reached with probability one by at least one Nash equilibrium offer profile, and all the positive probability outcomes of a Nash equilibrium are competitive as long as in the Nash equilibrium there are at least two active traders on each side of the market.

Theorem 1

For every competitive equilibrium, there is a Nash equilibrium that induces the same outcome with probability one.

To prove the theorem, we consider an offer profile such that each agent offers the trading price and quantity she obtains in the competitive equilibrium, and show that such offer profile is a Nash equilibrium and yields exactly the same outcome as in the competitive equilibrium. Agents have no incentive to deviate from the proposed offer profile: since the quantity offered in the profile is utility-maximizing given the competitive price, obtaining a different quantity at the same price does not increase the payoff for the individual; given other agents are offering the same price, increasing offer price as a seller or decreasing offer price as a buyer, regardless of the quantity offered, reduce the chance of trade to 0, and thus cannot be payoff-improving; decreasing offer price as a seller or increasing offer price as a buyer reduces the payoff for sure as the new price is less preferred to the competitive price, even at its corresponding utility-maximizing quantity.

As long as condition (A) is satisfied (which is, of course, the case of interest), there are Nash equilibria that induce noncompetitive allocations. For instance, any offer profile such that \({\widetilde{q}}_i = 0\) for all i, or such that \(\min _{i \in S} {\widetilde{p}}_i > \max _{h \in B} r_{h1}\) and \(\max _{i \in B}{\widetilde{p}}_i < \min _{h \in S} r_{h1}\), is a Nash equilibrium. Those Nash equilibria result in no trade. We restrict our attention on Nash equilibria such that trade happens with positive probability, so that AS(w) and AB(w) are nonempty. We have

Theorem 2

In every Nash equilibrium with at least two active traders on each side, every positive probability outcome is competitive.

To prove Theorem 2, we first show that in any given Nash equilibrium, all active traders offer the same price. Then we show that in every allocation induced by a Nash profile, the quantity that an active trader is allocated is utility-maximizing given the Nash price. The intuition is that if an active buyer/seller does not get the utility-maximizing quantity at the Nash price, the buyer/seller can always obtain a more preferable quantity by offering a slightly higher/lower price.

Note that there is a gap between the statement of Theorem 2 and the no-trade examples preceding the statement of the theorem. Theorem 2 leaves open the possibility that there are Nash equilibria with active trading but with noncompetitive outcomes and in which there is only one active trader in at least one of the two sides of the market. In the proof of the theorem, we rely on two or more active sellers in order to show that there is no Nash equilibrium in which one seller produces less than the competitive allocation requires. Intuitively, these situations would correspond to the single active seller behaving as a monopolist and charging a price above the competitive level. Similarly, there could be situations in which there is a single active buyer behaving as a monopsonist and charging a price below the competitive level. Finally, there could be situations in which there is a single active buyer and a single active seller, and competitive outcomes are not reached even if the price is competitive because of a coordination failure: both the buyer and the seller offer suboptimal quantities.

In what follows, we provide necessary and sufficient conditions for all the outcomes of every Nash equilibrium with trade to be competitive. Define the buyers’ marginal value, \(v_b\), as the maximum of the lowest reservation value for buyers’ units traded in competitive equilibria, that is,

Similarly, define the sellers’ marginal value, \(v_s\), as the minimum of the highest reservation value for sellers’ units traded in competitive equilibria, that is,

In economies such that (A) is satisfied, \(v_b\) and \(v_s\) are well-defined, since in every competitive equilibrium at least some \(i' \in S\) with the minimum cost (i.e. \(r_{i'1} =\min _{i \in S} r_{i1}\)) must have \(q_{i'}<0\), and at least some \(i'' \in B\) with the maximum reservation value (i.e. \(r_{i''1} =\max _{i \in B} r_{i1}\)) must have \(q_{i''}>0\). As shown in the Online Appendix, \(v_b\) and \(v_s\) are equal, respectively, to the lowest reservation value of buyers’ traded unit(s) and the highest reservation value of sellers’ traded unit(s) in any competitive equilibrium with the smallest number of transactions. Moreover, if (A) is satisfied, we must have \(v_b>v_s\), because if there is a competitive equilibrium such that both the marginal buyer and the marginal seller are indifferent (i.e. \(\min _{q_i>0} {r_{i,q_i}}= p =\max _{q_i<0}{r_{i,|q_i|}}\)), there is another competitive equilibrium in which one fewer unit is traded.

Denote by \({{\overline{p}}}\) and \({\underline{p}}\) the highest and lowest competitive price respectively. It is easy to check that

The first and third inequalities above follow from the fact that for every equilibrium \((p,q) \in \xi (r)\) we must have \(\max _{q_i<0}{r_{i,|q_i|}} \le p \le \min _{q_i>0} {r_{i,q_i}}\).

We say that \(i \in B\) is an inframarginal buyer if \(r_{i1}\ge v_b\). Similarly, we say that \(i \in S\) is an inframarginal seller if \(r_{i1}\le v_s\). Intuitively, an inframarginal trader is someone who is willing to trade at every competitive equilibrium price. Note that in economies satisfying (A), there is at least one inframarginal trader on each side of the market, since every seller with the minimum cost and every buyer with the maximum reservation value is inframarginal.

We say that \(i \in B\) is a weakly inframarginal buyer if \(r_{i1}>v_s\) and \(r_{i1}\ge {\underline{p}}\). Similarly, we say that \(i \in S\) is a weakly inframarginal seller if \(r_{i1}<v_b\) and \(r_{i1}\le {{\overline{p}}}\). Intuitively, a weakly inframarginal trader is someone who would generate positive social surplus if matched in pairwise trade with an inframarginal trader on the other side of the market. Using \(v_b>v_s\) and \(v_s \le {\underline{p}} \le {{\overline{p}}} \le v_b\), it is easy to check that, in economies satisfying (A), all inframarginal traders are also weakly inframarginal (justifying our nomenclature).

If an economy has competitive equilibria in which only one unit is traded, then all outcomes of every Nash equilibrium profile with trade are efficient.Footnote 10 From here on, we focus on economies such that all competitive equilibria involve trading two or more units, which is a more demanding condition than (A).

We have

Theorem 3

In economies such that all competitive equilibria involve trading two or more units, every positive probability outcome from every Nash equilibrium with active trade is competitive if and only if there are at least two inframarginal traders on one side of the market, and at least two weakly inframarginal traders on the other side.

Intuitively, rivalry between two traders on the same side of the market who can exploit mutually advantageous trades with at least two traders on the other side of the market both eliminates monopoly and monopsony power and precludes coordination failures. In the coordination failure example proposed above, we have \(v_s=1\), \(v_b=3\), and all traders are weakly inframarginal but only one seller and one buyer are inframarginal.

The condition \(r_{i1}\ge {\underline{p}}\) for \(i\in B\) and \(r_{i1}\le {{\overline{p}}}\) for \(i\in S\) to be a weakly inframarginal trader ensures that the trader has a value “close enough” to the competitive range, so that the trader weakly prefers to trade in the competitive equilibrium. Without this condition, there may be noncompetitive Nash equilibrium outcomes. Consider the economy \(S=\{1,2\}\), \(B=\{3,4\}\), \(k=3\), and \(r_{11}=r_{21}=1\), \(r_{12}=r_{13}=r_{22}=r_{23}=4\), \(r_{31}=r_{32}=r_{33}=3\), \(r_{41}=r_{42}=r_{43}=1\). Seller 1, seller 2, and buyer 3 are inframarginal traders, while buyer 4 satisfies one of the conditions to be weakly inframarginal but not \(r_{i1}\ge {\underline{p}}\). Here buyer 4 strictly prefers not to trade in the competitive equilibrium, and the range for Nash equilibrium prices is [2, 3], including prices that are not competitive.

It is worth noticing that Theorem 3 includes the contestable market scenario (Baumol et al. 1982), in which there is only one active seller but all outcomes from Nash equilibria are competitive. An example is the economy \(S=\{1,2\}\), \(B=\{3,4\}\), \(k=2\), and \(r_{11}=r_{12}=r_{21}=r_{22}=2\), \(r_{31}=4\), \(r_{41}=3\), \(r_{32}=r_{42}=1\). The competitive equilibrium price is 2 in this economy, and two units are traded in every competitive equilibrium. We have \(v_b=3\) and \(v_s=2\) for this economy, so all traders are inframarginal and the condition in Theorem 3 holds. One of the Nash equilibria in this economy is \(w=((2,-2),(2,0),(2,1),(2,1))\), in which seller 1 is the only active seller, but the outcome is competitive. The presence of seller 2, a non-active seller in the Nash equilibrium, brings enough competition to the market to make the outcome competitive.

5 Experimental design and hypotheses

5.1 Experimental design

We test the predictive ability of our market game model in laboratory experiments. We consider two markets with indivisible commodities. Each market has two buyers \(B=\{B1, B2\}\) and two sellers \(S=\{S1, S2\}\), and each trader can either buy or sell two units. We assign the first and third highest demand reservation values to one buyer, and the second and fourth to the other buyer. By assigning the units to sellers in different ways, we create a market that satisfies the condition in Theorem 3, and a market that does not. This design is similar to one implemented by Davis and Holt (1994).

In our competitive market, the two supply units that can be traded in competitive equilibrium are assigned each to each one of the two sellers. Thus, as shown in the left part of Fig. 2, there are two inframarginal traders on each side of the market. By Theorem 3, the Nash equilibrium outcomes with trading of the strategic market mechanism coincide with competitive equilibrium outcomes. That is, both units with lowers costs should be traded, and the price should be in the competitive price range, $15–$19. Correspondingly, efficiency (as a percentage of the maximum possible surplus) should be \(100\%\).

In our monopoly market, instead, the two low cost units are assigned to the same seller, as shown in the right part of Fig. 2. The set of Nash equilibrium outcomes with trade includes the set of competitive equilibria just described, as well as monopolistic market equilibria in which only the unit with the lowest cost is traded, and the price is between $19 and $30. Efficiency of monopolistic equilibria is \((32-2)/(32 - 2 + 19 -15)\), that is approximately \(88\%\).

In the experiment, we compare the performance of our strategic market mechanism (Clearing House, or CH hereafter) with the continuous time double auction (Double Auction, or DA hereafter), in the two markets.

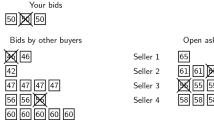

In the clearing house institution, each trader submits a price-quantity pair to the clearing house. The clearing house then decides trade by the rules described in Sect. 3, and reports the trader’s own transaction price and quantity, together with the price and quantity traded in the market. We let \(\mu _w(y)=1 / |F(w)|\) for all \(y\in F(w)\) in the experiment; that is, the clearing house assigns equal probability to all arbitrage-maximizing allocations. When making decisions, traders are given their own values, but not other traders’ values or offers.

In the double auction institution, the traders buy/sell the good unit by unit, i.e. after a trader has traded his/her first unit, he/she can submit offers for the second unit. Valid offers are listed on the screen in real time as public information for all traders in the market. Bids are ranked from high to low, and asks are ranked from low to high. Each offer is a limit order for one unit. We implement the bid/ask improvement rule such that each offer has to reduce the bid-ask spread to be valid. A transaction happens automatically if a valid bid is no lower than a valid ask. In each transaction, a bid will always be matched with the highest-ranked ask, and an ask will be traded with the highest-ranked valid bid. In case of unequal bid and ask in a transaction, the trading price will be the price in the pair that was submitted later.Footnote 11 The double auction institution follows a soft-close rule. A round ends if no new valid offer shows up in 20 seconds.

The experiment was conducted in the Interdisciplinary Center for Economic Science (ICES) lab in George Mason University. In total, 240 subjects participated in the 18 sessions, and each session lasted for no more than 100 minutes.Footnote 12 Each subject participated in only one treatment, playing the same role (B1, B2, S1 or S2) in the same market for 20 rounds. The final payoffs ranged from $5 to $36. The average payoff is $11.25 including a $5 show-up fee.

The experiment was computerized, and programmed in oTree (Chen et al. 2016).Footnote 13 At the beginning of the session, the participants were seated at partitioned computer stations and allowed 10 minutes to read the instructions on their own. Then an experimenter read the instructions out loud to all participants. Afterward, a quiz was handed out, and the experiment began after each participant gave correct answers to all the questions in the quiz. Then the role a participant had in the experiment was revealed to him/her, and the participants were given a practice round before the formal rounds began. There were 20 formal rounds, one of which was randomly chosen for payment. After the 20 formal rounds, each participant was informed of the round chosen for payment and his/her own payoff. The payment was made privately.

5.2 Hypotheses

Our first set of empirical hypotheses correspond to treatment effects. Because the set of equilibria under monopolistic conditions includes inefficient outcomes with prices above competitive levels, we expect treatments with competitive markets to exhibit lower prices and higher efficiency, together with higher trading volume, higher surplus for buyers and lower surplus for sellers. And given the advantage of learning under the double auction institution, we expect treatments under the double auction institution to exhibit higher efficiency.

-

(H1)

Under the double auction institution, prices and sellers’ total surplus are lower, and efficiency, trading volume and buyers’ total surplus are higher, in competitive markets than in monopolistic markets.

-

(H2)

Under the clearing house institution, prices and sellers’ total surplus are lower, and efficiency, trading volume and buyers’ total surplus are higher, in competitive markets than in monopolistic markets.

-

(H3)

In competitive markets, efficiency under the double auction institution is higher than under the clearing house institution.

-

(H4)

In monopolistic markets, efficiency under the double auction institution is higher than under the clearing house institution.

Our second set of empirical hypotheses correspond to the convergence to competitive prices in the long run if the market has a competitive structure under both institutions.

-

(H5)

Under the double auction institution, prices converge to the competitive range in competitive markets.

-

(H6)

Under the clearing house institution, prices converge to the competitive range in competitive markets.

6 Results

6.1 Treatment effects

6.1.1 Overview

Table 1 presents treatment effects using the last ten rounds.Footnote 14 Efficiency is defined as the percentage of the maximum social surplus realized. Trading volume is defined as the number of units traded divided by two (the number of inframarginal units), in percentage. Buyers’ and sellers’ surplus are defined as percentage of the maximum possible social surplus. In agreement with H1, under the double auction institution, trading prices are lower, and efficiency, trading volume, and buyers’ surplus are significantly higher in competitive markets than in monopolistic markets. Average sellers’ surplus is higher in monopolistic markets but the difference is not significant. In agreement with H2, under the clearing house institution, trading volume and buyers’ surplus are significantly higher in competitive markets than in monopolistic markets. Differences in trading prices, efficiency, and sellers’ surplus are not significant. In agreement with H3, in competitive markets, efficiency, trading volume, buyers’ surplus, and sellers’ surplus are higher under the double auction than under the clearing house institution. In agreement with H4, in monopolistic markets, efficiency, trading volume, and sellers’ surplus are higher under the double auction than under the clearing house institution. Average buyers’ surplus is higher under the double auction but the difference is not significant. Summing up, there is significant evidence in favor of H1 and H3, and some evidence in favor of H2 and H4.

6.1.2 Prices

Figure 3 shows average trading prices in each round in the four treatments. Two inferences can be drawn from it. First, average prices adjust over time and stay in the competitive price range in the second half of the experiment in all treatments (average trading prices range from $15.73 to $18.18). The learning process takes longer under the clearing house institution: the average price starts low, and reaches the competitive range over time. The upward sloping trend is not as strong under the double auction institution: the average trading price starts within the competitive range. Second, compared to competitive markets, monopolistic markets bring forth a higher average trading price under the double auction institution, but not as clearly under the clearing house institution.

6.1.3 Efficiency

Figure 4 plots the average efficiency in each round in the four treatments. Efficiency is defined as the percentage of the maximum social surplus realized. Similar to what is shown in Fig. 3, learning takes longer under the clearing house institution; hence, average efficiency under the clearing house institution presents a stronger upward trend over time. Under the clearing house institution, the average efficiencies start at levels lower than under the double auction institution, and remain statistically lower in the second half of the experiment. Nevertheless, we can observe from Fig. 4 that the upward trend of the efficiencies in clearing house treatments persist over time, and at the end of the experiment, the efficiency levels from the two institutions are close.

Compared to the clearing house institution, the dynamic feature of the double auction institution facilitates traders’ decision making in two ways. Firstly, decisions are more informed, as traders can bid/ask based on the offers they observed in real time. Under the clearing house institution, coordination on trading prices is more difficult since traders do not know how much traders on the other side of the market would adjust at the same time. Secondly, offer adjustments are possible within a round. As long as the bid/ask improvement rule is respected, a trader can revise the price he/she submitted when it is not traded. Under the clearing house institution, the experimentation is more costly since each offer determines the payoff for a round. As a result, traders may adjust bids/asks more conservatively or not experiment enough under the clearing house institution, and it takes more rounds for a market to settle in a steady state.

Figure 5 shows the distribution of surplus/efficiency in the market, with surplus obtained by the supply side (in red) aligned to the bottom, and surplus obtained by the demand side (in blue) aligned to the top. The height of the box represents the maximum social surplus in the market, i.e. 100% of efficiency. One particular trend under the clearing house institution is the increasing surplus for both buyers and sellers over time, a sign that there is ongoing learning to coordinate on prices throughout the experiment. The decreasing profit for the clearing house in Fig. 5 and the increasing trading volume over time as shown in Fig. 6 in the next section also support the conclusion that there is increasing coordination under the clearing house institution over time. Under the double auction institution, while coordination on prices is easier and high efficiency is achieved in the early rounds, the distribution of the surplus fluctuates over time, likely a result from traders’ bargaining over time. The dynamic feature of the double auction institution facilitates learning, but also the exploitation of the monopoly power, as suggested by the lower efficiency and higher price when the market is monopolistic.

Under the clearing house institution, there is no significant difference between the trading price or efficiency in the two environments. As the markets still evolve until the end of the experiment, whether this indifference would persist in the long run remains an open question. However, the clearing house makes a higher profit when the market is monopolistic (an average of 8.08% in the last 10 rounds, compared to 2.32% in competitive markets) while the trading volume is lower. This may be caused by monopolists trying to bargain hard as there is less competition in the market, which results in a lower trading volume and unwillingness to adjust offers, or traders adjusting offers more conservatively and leaving more money to the clearing house as the chance for trade is lower in the monopolistic market. Since traders under the clearing house institution can only learn about the market from previous transaction prices, the other inframarginal seller in the competitive market not only brings more competition on the supply side, but also provides additional results from his/her experimentation of offer prices over rounds, which are helpful for other traders’ learning. The higher price variance and lower trading volume in the monopolistic market could be a result of some monopolists’ ability to exercise market power, while others need more experimentation to gather information on tradable prices given the absence of another inframarginal seller.

Inefficiency in the market can come from supramarginal trades or failed inframarginal trades, which will be discussed in the Trading volume section.

6.1.4 Trading volume

In our setting, supramarginal trade occurs if a seller sells a unit with a cost of 30, or if a buyer buys a unit with a valuation of 4. In our experiment, in the last ten rounds, supramarginal trade occurred in 3 out of 199 trades in the CH Competitive treatment and in 4 out of 149 trades in the DA Monopoly treatment, and did not occur in other treatments. Thus, trading volume reflects inframarginal trading. Figure 6 and Table 1 illustrate that in the second half of the experiment, under both institutions, there are fewer trades in the monopolistic markets than in the competitive markets. Under the double auction, lower trading in monopolistic markets explains the advantage of competitive markets in terms of social efficiency and corroborates our hypotheses H1 and H2. As Fig. 6 and Table 1 show, the clearing house institution results in less trade than the double auction institution, corroborating our hypotheses H3 and H4.

6.2 Convergence to competitive prices

Following Noussair et al. (1995), we estimate

for each treatment, where \(p_{it}\) is the average price in market i at round t, \(D_i\) is an indicator for a specific market, which equals 1 if the market is i and 0 otherwise, \(\beta\) is the asymptote for the average price in the treatment, and \(\epsilon _{it}\) is an error term. In using this statistical model, we assume that although each market has its own pattern of convergence, there is a common asymptote by treatment.

Table 2 lists the estimated \(\beta\) for each treatment. For competitive markets, the 95% confidence interval for long run prices is contained in the competitive price range under both the double auction and the clearing house institution, providing corroborating support for H5 and H6. For monopolistic markets, the 95% confidence interval for long run prices is contained in the competitive price range for the clearing house institution but not for the double auction. In fact, the confidence intervals are nested under the clearing house institution but are disjoint under the double auction.

Figure 7 shows the distribution of trading prices in the last 10 rounds in different treatments. The DA Monopoly treatment has a heavy right tail outside of the competitive price range but within the Nash equilibrium range for that environment. In the CH Monopoly treatment, instead, most of the trading price within the Nash equilibrium range is also in the competitive price range. In both competitive treatments, trading prices cluster in the competitive price range.

Except for the DA Competitive treatment, all treatments have a heavy left tail. The heavy left tail may be due to slow learning, due to (i) lack of within-round feedback under the clearing house institution, and (ii) less experimentation about possible prices when there is only one rather than two inframarginal sellers. Prices below the competitive equilibrium level were also observed by Smith and Williams (1990) in two monopolistic markets, perhaps for a similar reason.

6.3 Price adjustments over time

This section considers the learning and price adjustment process under the two institutions. Since there is only one call in the sealed-bid market in each round under the clearing house institution, we check how bids and asks adjust over rounds. For the double auction institution, we are able to look at price adjustment within rounds as well.

6.3.1 Clearing house institution

As reservation values are private information, the transaction price(s) provided at the end of each round serves as “a mechanism for communicating information”(Hayek 1945, p. 526) under the clearing house institution. Boxplots in Fig. 8 depict the quartiles of bids (in blue) and asks (in red) by player role over time. In both treatments, bids and asks are more clustered in later rounds, except for asks from supramarginal sellers in monopolistic markets. This trend is more obvious for traders with advantageous reservation values, i.e. Buyer 1 (in deep blue) and Seller 1 (in deep red). Learning from the transaction prices in their own groups, inframarginal traders in these treatments adjust their offers toward the competitive range over time.

6.3.2 Marshallian path

Under the double auction institution, previous experimental work (Cason and Friedman 1996; Plott et al. 2013) points to a Marshallian path during price convergence to equilibrium levels, which helps to achieve efficient trading even if prices are out of equilibrium. In particular, the buyer with the highest value and the seller with the lowest cost have more advantage in the market and therefore are likely to trade first. Although the first trading price may be outside of equilibrium range, the next tradable price, bounded by the next highest value and lowest cost, is closer to the equilibrium. With transactions happening in this order, the trading prices exhibit a converging pattern toward the equilibrium.

We test the Spearman’s rank correlation between transaction order and surplus from trade, buyer’s value, and seller’s cost respectively for our competitive markets under the double auction institution. If the trades exhibit a Marshallian path, surplus from trade is higher, buyer’s value is higher, and seller’s cost is lower in the earlier transactions. The results from Table 3 are in line with this prediction, except that in the second half of the experiment, buyers might have learned enough about equilibrium prices, and the effect of the Marshallian path is no longer significant for the buyer’s value.

6.3.3 Coasian dynamics

We consider the possibility of Coasian dynamics in DA monopoly treatment. The monopoly under the double auction institution in our experiment faces a problem similar to the durable goods monopoly in Coase (1972). After selling one unit at above competitive prices, it is in the monopolist seller’s best interest to lower the price and sell another unit. Expecting this, buyers may withhold purchases until the price is at a competitive level. Nonetheless, the seller could have extracted a higher profit if he/she committed to selling only one unit at a high enough price. A weak version of Coasian dynamics is that during the adjustment toward equilibrium, the monopolist should experiment by offering the second unit at a lower price and thus be able to sell two units. A stronger version of Coasian dynamics should imply selection of a competitive outcome under the double auction even under monopolistic conditions.

The monopolist’s ability to exercise market power varies in double auction markets in laboratory experiments (Smith 1981; Smith and Williams 1990). Cason and Sharma (2001) find corroborating experimental evidence for Coasian dynamics in a two-period setting in which a monopoly sells durable goods to two buyers, each of whom has a privately known value for one unit. To see if Coasian dynamics is present in our data, we check whether the second transaction price in a round is lower than the first, and whether the monopoly sells more than one unit. The MWW test of whether the second transaction price is lower has a p-value of .050, on the edge of rejecting the null hypothesis that trading prices are at the same level. The one-sided Wilcoxon signed rank test for whether more than one unit is sold yields the p-value of .005, rejecting the null hypothesis that the trading volume is 50% in the DA monopolistic market. Therefore, there is some evidence of Coasian dynamics in our double auction experiments. The estimated price asymptote, however, is not competitive in DA monopolistic markets.

7 Conclusions

In this paper, we aim to fill a gap in the theoretical and experimental literature about markets with few participants and indivisible commodities. First, we provide a necessary and sufficient condition for the equivalence of Nash equilibria of price-quantity strategic market games and competitive equilibrium outcomes. Second, we conduct market experiments in a competitive environment and in a monopolistic environment. We consider two market institutions, the clearing house institution, following closely the rules of the market game, and a double auction, which has been known to be successful in inducing competitive outcomes and prices in the lab.

Our lab experiments involve the minimum number of traders using the double auction that we know of. Figure 9 compares the efficiency level in our double auction markets with a few double auction markets in previous studies (Smith et al. 1982; Smith 1982; Smith and Williams 1990; Kachelmeier and Shehata 1992; Friedman and Ostroy 1995; Kimbrough and Smyth 2018). Double auction markets conducted in previous studies are mostly used for testing the robustness of the mechanism, so disturbances may have been introduced during the session, and different settings have been used in these studies. Efficiency in thicker markets is higher than in our four-trader market, although the difference is not large when markets are competitive.

Under the clearing house institution, efficiency is below that under the double auction in our experimental competitive markets. We interpret the advantage of the double auction as a result of better opportunities for learning. Nevertheless, the efficiency of the clearing house institution increases over time and gets closer to the double auction institution as traders in the market learn gradually. The approximation to competitive equilibrium outcomes is obtained without traders’ knowledge of others’ values under both institutions. Our results provide supportive evidence for the Hayek hypothesis (Hayek 1945; Smith 1982) in a limit setting with few traders: using appropriate institutions, markets can work with very limited information. Under the clearing house institution, the only information revealed to each trader other than their own value are transaction prices. This information appears to be sufficient to achieve equilibrium outcomes, although it may need a few trial runs.

In our experimental monopolistic markets, buyers’ surplus and trading volume remains below that in our experimental competitive markets under both the double auction and the clearing house institution. The loss of total surplus in monopolistic markets is significant under the double auction although not under the clearing house institution. Tantalizingly, under the clearing house institution, prices are not on average higher in monopolistic than in competitive markets. Whether these observations about long-run prices can be generalized is left as an open question. Learning enough to behave as if possessing complete information is seemingly much harder in monopolistic than in competitive markets. Another note is that with the anonymity in the computerized experiment, the monopolies in our experiment are under less social pressure to share profit, compared to a hand-run session where bids and asks are cried out.

The fixed group and fixed value setting in our experiment provides a constant environment for participants to learn about their markets. However, in a repeated game setting, a trader may play a hard bargainer and “teach” others what prices to offer, assuming some other traders would adjust according to what they have learned in the previous rounds.Footnote 15 In our experiment, this behavior is hindered by various factors in different treatments. In a competitive market, the other trader on the same side could take over the market by offering a slightly less profitable price, and reduce the other side’s willingness to further improve on the price in the future rounds. In a monopolistic market, the ability to execute the monopoly power is constrained by the Coasian dynamics under the double auction institution, and a monopoly may not find out his/her market power or find it too costly to bargain due to the limited experimentation under the clearing house institution. The anonymity of offers in our experiment also makes it harder to tell how much each trader on the other side of the market learns, hence it is more difficult to implement a strategic teaching. Using randomly matched groups in each round may further reduce the advantage of strategic teaching. When traders are randomly matched each round, they may carry their experience from previous groups to the new ones. Whether learning across groups changes the outcome remains to be explored. Using a random value setting may hurdle the strategic teaching behavior as well; other value structure, such as swastika demand and supply, could be used as another boundary test.

Notes

Our exact condition, spelled precisely in the statement of Theorem 3, is slightly weaker.

An exception is the market-power-design in Holt et al. (1986), half of the markets had prices higher than the competitive level. Plott (1989) provides a discussion on this. Some experiments featuring random reservation values also have markets in which our condition is met. For example, with probability 0.5 a four-buyer–four-seller market in Cason and Friedman (1996) satisfies our condition. Efficiency level and value structure of individual markets were not reported in the paper, but the average efficiency in these eight-trader markets with inexperienced traders are rather high (88.4%).

We thank a referee for pointing this out.

Given that different market institutions have their specific characteristics, further assessment is needed before applying this condition to other settings.

In accordance with our strategic market game, the clearing house institution here applies a discriminatory-price rule, although conventionally uniform-price is presumed. The essential feature of the institution is that it is a centralized market that collects orders and allocates trades in discrete time, in contrast to the continuous-time feature of the double auction institution. Our discriminatory price clearing house has precedents in the literature, for instance DSB and McAfee (1992), and resembles the old US Treasury (one sided) primary auction used till 1992. We owe these references to a reviewer. For more examples of discriminatory-price auctions in practice, see Brenner et al. (2009) and Cason and Plott (1996).

See Fig. 9 for a comparison between efficiency in our experiment and others in the literature.

In the competitive markets, the average probability the lowest cost unit is traded in a round is 71.47%, compared to 28.53% for the second lowest cost unit; the highest value unit is traded 62.65% of the time, with the second highest unit traded 36.18% of the time. The probabilities in the monopoly markets are 80.94%, 10%, 60%, 30% for the lowest cost, second lowest cost, highest value and second highest value units respectively.

The reason is that if one unit is traded in a given outcome induced by an equilibrium profile, both the active buyer and the active seller must be offering the same price. If any buyer has a reservation price higher than the Nash price and is not trading, the buyer can offer a price that is slightly higher and grab the trade, so that in equilibrium the buyer who trades must be the one with the highest reservation price. A similar argument applies on the supply side. (However, the trading price may not be competitive in the Nash equilibrium.)

To make a transaction, a trader submits an offer that is tradable with a listed bid/ask. All offers are shown in real time, which implies that transactions respect time priority, i.e. a traded bid/ask is removed from the valid offer list once the first tradable offer is received, and no longer valid for later transactions. We let the transaction price be the price the accepting party submits, so traders indicate a real willingness to transact in each offer. Otherwise a trader may try to accept a listing offer by submitting a price worse than he/she is willing to transact at, and ends up with an undesirable transaction when his/her offer arrives marginally later than another trader’s. This feature is not necessary, but the problem is negligible since a profit-seeking trader would refrain from submitting any price different from the desired listed offer, and consequently the transaction price would be the same as the listed offer.

For the CH competitive treatment, there were three sessions with 16 and one session with 20 participants; for the CH monopoly treatment, there were four sessions with 16 participants; for the DA competitive treatment, there was one session with 8 and three sessions with 16 participants; and for the DA monopoly treatment, there were five sessions with 8 and one session with 12 participants.

Our double auction program is adapted from Chapkovski and Kujansuu (2019).

Since it may take some rounds for participants to learn about their markets, we focus on the second half of the experiment for statistics related to equilibrium prediction, and include the results from the first half of the experiment when studying participants’ learning behavior.

For a more detailed discussion and survey of strategic teaching in repeated games, see Camerer and Ho (2015).

References

Baumol, W., Panzar, J. C., & Willig, R. D. (1982). Contestable markets and the theory of industry structure. San Diego: Harcourt Brace Jovanovich.

Benassy, J.-P. (1986). On competitive market mechanisms. Econometrica, 54(1), 95–108.

Brenner, M., Galai, D., & Sade, O. (2009). Sovereign debt auctions: Uniform or discriminatory? Journal of Monetary Economics, 56(2), 267–274.

Brewer, P. J. (2008). Zero-intelligence robots and the double auction market: A graphical tour. Handbook of Experimental Economics Results, 1, 31–45.

Brewer, P. J., Huang, M., Nelson, B., & Plott, C. R. (2002). On the behavioral foundations of the law of supply and demand: Human convergence and robot randomness. Experimental Economics, 5(3), 179–208.

Camerer, C. F., & Ho, T.-H. (2015). Behavioral game theory experiments and modeling. Handbook of Game Theory with Economic Applications, 4, 517–573.

Cason, T. N., & Friedman, D. (1996). Price formation in double auction markets. Journal of Economic Dynamics and Control, 20(8), 1307–1337.

Cason, T. N., & Plott, C. R. (1996). Epa’s new emissions trading mechanism: a laboratory evaluation. Journal of Environmental Economics and Management, 30(2), 133–160.

Cason, T. N., & Sharma, T. (2001). Durable goods, Coasian dynamics, and uncertainty: Theory and experiments. Journal of Political Economy, 109(6), 1311–1354.

Chapkovski, P., & Kujansuu, E. (2019). Real-time interactions in otree using django channels: Auctions and real effort tasks. Journal of Behavioral and Experimental Finance, 23, 114–123.

Chen, D. L., Schonger, M., & Wickens, C. (2016). oTree–An open-source platform for laboratory, online, and field experiments. Journal of Behavioral and Experimental Finance, 9, 88–97.

Coase, R. H. (1972). Durability and monopoly. Journal of Law and Economics, 15(1), 143–149.

Davis, D. D., & Holt, C. A. (1994). Market power and mergers in laboratory markets with posted prices. Rand Journal of Economics, 25(3), 467–487.

Dubey, P. (1982). Price-quantity strategic market games. Econometrica, 50(1), 111–126.

Duffy, J. (2006). Agent-based models and human subject experiments. Handbook of Computational Economics, 2, 949–1011.

Duffy, J., Matros, A., & Temzelides, T. (2011). Competitive behavior in market games: Evidence and theory. Journal of Economic Theory, 146(4), 1437–1463.

Dufwenberg, M., & Gneezy, U. (2000). Price competition and market concentration: An experimental study. International Journal of Industrial Organization, 18(1), 7–22.

Friedman, D., & Ostroy, J. (1995). Competitivity in auction markets: An experimental and theoretical investigation. Economic Journal, 105(428), 22–53.

Gode, D. K., & Sunder, S. (1993). Allocative efficiency of markets with zero-intelligence traders: Market as a partial substitute for individual rationality. Journal of Political Economy, 101(1), 119–137.

Hayek, F. A. (1945). The use of knowledge in society. American Economic Review, 35(4), 519–530.

Holt, C. A., Langan, L. W., & Villamil, A. P. (1986). Market power in oral double auctions. Economic Inquiry, 24(1), 107–123.

Kachelmeier, S. J., & Shehata, M. (1992). Culture and competition: A laboratory market comparison between China and the West. Journal of Economic Behavior & Organization, 19(2), 145–168.

Kimbrough, E. O., & Smyth, A. (2018). Testing the boundaries of the double auction: The effects of complete information and market power. Journal of Economic Behavior & Organization, 150, 372–396.

Mas-Colell, A. (1977). Indivisible commodities and general equilibrium theory. Journal of Economic Theory, 16(2), 443–456.

McAfee, R. P. (1992). A dominant strategy double auction. Journal of Economic Theory, 56(2), 434–450.

Noussair, C. N., Plott, C. R., & Riezman, R. G. (1995). An experimental investigation of the patterns of international trade. American Economic Review, 85(3), 462–491.

Plott, C., Roy, N., & Tong, B. (2013). Marshall and Walras, disequilibrium trades and the dynamics of equilibration in the continuous double auction market. Journal of Economic Behavior & Organization, 94, 190–205.

Plott, C. R. (1989). An updated review of industrial organization: Applications of experimental methods. Handbook of industrial organization, 2, 1109–1176.

Satterthwaite, M. A., & Williams, S. R. (1993). The Bayesian theory of the \(k\)-double auction. In Friedman, D. & Rust, J. (Eds.), The double auction market: Institutions, theories, and evidence, Chapter 4, (pp. 99–123). Routledge.

Simon, L. K. (1984). Bertrand, the Cournot paradigm and the theory of perfect competition. Review of Economic Studies, 51(2), 209–230.

Smith, V. L. (1962). An experimental study of competitive market behavior. Journal of Political Economy, 70(2), 111–137.

Smith, V. L. (1965). Experimental auction markets and the walrasian hypothesis. Journal of Political Economy, 73(4), 387–393.

Smith, V. L. (1976). Bidding and auctioning institutions: Experimental results. In Amihud, Y. (Eds.), Bidding and Auctioning for Procurement and Allocation: Proceedings of a Conference at the Center for Applied Economics, (pp. 43–64). New York University Press.

Smith, V. L. (1981). An empirical study of decentralized institutions of monopoly restraint. In Horwich, G., & Quirk, J. (Eds.), Essays in Contemporary Fields of Economics in Honor of Emanuel T. Weiler (1914–1979), pp. 83–106. West Lafayette: Purdue University Press.

Smith, V. L. (1982). Markets as economizers of information: Experimental examination of the “Hayek hypothesis”. Economic Inquiry, 20(2), 165–179.

Smith, V. L., & Williams, A. W. (1990). The boundaries of competitive price theory: Convergence, expectations, and transaction costs. In Green, L. & Kagel, J. H. (Eds.), Advances in behavioral economics, vol. 2, Chapter 2, (pp. 31–53). New York: Ablex Publishing.

Smith, V. L., Williams, A. W., Bratton, W. K., & Vannoni, M. G. (1982). Competitive market institutions: Double auctions vs. sealed bid-offer auctions. American Economic Review 72(1), 58–77.

Zheng, W. (2020). Three essays on market institutions. Ph. D. thesis, George Mason University.

Acknowledgements

We thank the editor, two anonymous referees, Dan Houser, Kevin McCabe, Thomas Stratmann, Maurice Kugler, Marian Moszoro, Daniel Friedman, Mark Isaac, and several audiences for helpful comments. This research was financed by the Interdisciplinary Center for Economic Science (ICES) at George Mason University. The replication material for the study is available at https://doi.org/10.5281/zenodo.6980094.

Funding

Open access funding provided by European University Institute - Fiesole within the CRUI-CARE Agreement. This research was financed by the Interdisciplinary Center for Economic Science at George Mason University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Martinelli, C., Wang, J. & Zheng, W. Competition with indivisibilities and few traders. Exp Econ 26, 78–106 (2023). https://doi.org/10.1007/s10683-022-09772-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-022-09772-9