Abstract

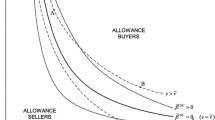

We model the climate change issue as a pollution control game with the purpose of comparing two possible departures from the business as usual (BAU) where countries noncooperatively choose their emission levels. In the first scenario, players have to agree on a global emission cap (GEC) that is enforced by a uniform taxation scheme. They still behave strategically when choosing emission levels but are now subject to the coupled constraint imposed by the cap. The second scenario consists of the implementation of an international cap and trade (ICT) system. In this case, players decide on their emission quotas, and emission trading is allowed. A three heterogenous player quadratic game serves as a basis for the analysis. When the cap is binding, among all the coupled constraints Nash equilibria, we select a particular normalized equilibrium by solving a variational inequality. Comparing the normalized equilibrium with the Nash equilibria of the BAU and the ICT, we first show that if the cap is appropriately chosen, then the GEC system improves all players’ payoffs, relative to the BAU. The GEC system may thus be unanimously approved whereas the ICT is not, because moving from the BAU to the ICT is costly for one player. Second, for some values of the cap, all players get a higher payoff under the GEC than under the ICT. Therefore, the GEC outperforms the ICT both in terms of feasibility and efficiency.

Similar content being viewed by others

Notes

Targets were defined with respect to the reference year 1990 and had to be reached during the first period of commitment 2008–2012.

This difficulty explains why international negotiations fail to achieve an efficient agreement.

By definition, the taxation rule remains nonoperating as long as the constraint is satisfied. So, this is a true incentive mechanism.

Actually, their purpose is to compare three scenarios: the Nash equilibrium, the normalized equilibrium, and the cooperative solution. The present work also shares similarities with Drouet et al. [8] who introduce a global emission cap in a game of climate negotiations. Our approach is however different because, in their dynamic framework with an exogenous GEC, they use a numerical approach by implementing an algorithm while we use an analytical approach to compare the different scenarios for a range of values of the cap.

The payoff function thus does not exhibit a term reflecting consumers’ welfare. This is a simplifying assumption made in the related literature (i.e., in most papers quoted in the introduction). However, it is sufficient to capture the basic tradeoff, faced by the policy maker when choosing the emission level, between benefits and costs of emissions.

As for the properties of the Nash equilibrium, it is worth recalling that a first existence theorem is due to [28] in the case of continuous payoffs. Then, several authors have investigated the existence of equilibria when the payoffs are not necessarily continuous (see among others, [5, 29, 33]). Moreover, a sufficient condition for uniqueness of the equilibrium has been obtained by [30] for smooth payoffs.

In a recent paper, Martimort and Sand-Zantman [25] develop a mechanism design approach to the climate change issue. Even if their framework is pretty different from ours (they notably deal with asymmetric information), it is interesting to note that there are many similarities between their paper and the present one. Indeed, they impose the equivalent of our individual rationality condition which is called, in the principal-agent theory, the participation constraint. They also assume that in the absence of unanimous agreement, one natural fall-back option is the Nash equilibrium in which countries yield a best response to the other players’ emission strategies.

These conditions will be satisfied by the class of quadratic games considered in Section 3.

The author then has a different but equivalent approach to characterizing the \(\bar {r}\)-normalized equilibrium. Solving the problem with variational inequalities, we do not explicitly work with multipliers. However, one can easily retrieve the equilibrium value of the joint multiplier (when the constraint is binding) because it must satisfy: \(\lambda ^{R}=r_{1}\partial _{e_{1}}W_{1}(\bar {e}^{R}(\alpha ,\bar {r}))=...=r_{n}\partial _{e_{n}}W_{n}(\bar {e}^{R}(\alpha ,\bar {r}))\).

Of course, the question of the historical responsibility is intimately linked to the one of the responsibility of the constraint satisfaction. Thus, it directly refers to the definition of the weights \(r_{i}\).

The analysis can be extended to a larger number of countries but, for tractability purposes, we concentrate on this situation.

Considering a quadratic payoff is really standard in the literature on the economics of climate change. Beyond obvious tractability considerations, it ensures that when solving firms’ objective, in the absence of any pollution control or damage, one has an interior solution. This is a desirable feature of the firm’s optimization problem, which is not satisfied when one considers other functions, like the logarithmic. It is also useful for the remainder of the analysis because the country with the largest (lowest) \(\kappa _{i}>0\) will be viewed as the country that faces the highest (lowest) domestic demand. Indeed, straightforward computations show that firms’ optimal production level, that feeds the demand, is increasing in \(\kappa _{i}\).

Note that emissions are also continuous at the critical boundaries \(\hat { \alpha }\) and \(\tilde { \alpha }\).

Again, we are not interested in determining which value of the cap is the “best one,” given a certain efficiency criterion. But we can provide some elements of discussion about this issue. Indeed, we may simply assume that countries cooperate to decide on the global cap but behave noncooperatively when choosing the amount of emissions. This is very much in the line with d’Aspremont and Jacquemin’s duopoly model with cooperation in R&D investment [6]. In our particular framework, this would consist in maximizing the unweighted sum of payoffs under the constraint that no player is worse off under the GEC.

The comparison between the two scenarios have been done using: \(\kappa _{1}=\kappa _{2}=1.5\), \(\kappa _{3}=1\), \(\gamma _{1}=6/7\) and \(\gamma _{2}=\gamma _{3}=4/7\), theses values being compatible with the nonnegativity conditions imposed in our three scenarios.

As a last remark, we would like to mention that, for the sake of comprehensiveness, we have also carefully studied the scenario in which the GEC is introduced together with the ICT. The analysis of this GEC+ICT scenario and how it compares respectively to the GEC and the ICT can be found in [26].

Denoting by \(e_{-i\setminus 2}^{R}\) the strategy of player other than i and 2.

References

Aubin, J.-P. (1993). Optima and equilibria. Berlin, Heidelberg, New York: Springer.

Bahn, O., & Haurie, A. (2008). A class of games with coupled constraints to model international GHG emission agreements. International Game Theory Review, 10, 337–362.

Baiocchi, C., & Capelo, A. (1984). Variational and quasivariational inequalities, applications to free boundary problems. New-York: Wiley.

Boucekkine, R., Krawczyk, J., Vallée, T. (2010). Towards an understanding of tradeoffs between regional wealth, tightness of a common environmental constraint and the sharing rules. Journal of Economic Dynamics and Control, 34, 1813–1835.

Dasgupta, P., & Maskin, E. (1986). The existence of equilibrium in discontinuous economic games, I: Theory. Review of Economic Studies, 53, 1–26.

d’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R&D in duopoly with spillovers. The American Economic Review, 78(5), 1133–1137.

Debreu, G. (1952). A social equilibrium existence theorem. Proceedings of the National Academy of Sciences of the United States of America, 38, 886–893.

Drouet, L., Haurie, A., Vial, J.-P., Vielle, M. (2011). A game of international climate policy solved by a homogeneous oracle-based method for variational inequalities. Annals of the International Society of Dynamic Games, 11(5), 469–488.

Facchinei, F., & Kansow, C. (2010). Generalized Nash equilibrium problems. Annals of Operation Research, 175, 177–211.

Godal, O., & Holtsmark, B. (2011). Permit trading: merely an efficiency-neutral redistribution away from climate-change victimsThe Scandinavian Journal of Economics, 4, 784–797.

Harker, P.T., & Pang, J.S. (1990). Finite-dimensional variational inequality and non linear complementarity problems: a survey of theory, algorithms and applications. Mathematical Programming, 48, 171–220.

Haurie, A., & Krawczyk, J. (1997). Optimal charges on river effluent from lumped and distributed sources. Environmental Modeling and Assessment, 2(3), 93–106.

Haurie, A., & Zaccour, G. (1995). Differential game models of global environmental management. Annals of the International Society of Dynamic Games, 2, 3–24.

Helm, C. (2003). International emission trading with endogenous allowance choices. Journal of Public Economics, 87, 2737–2747.

Hoel, M., & Karp, L. (2002). Taxes versus quotas for a stock pollutant. Resource and Energy Economics, 24, 367–384.

Ichiishi, T. (1983). Game theory for economic analysis. New York: Academic.

Karp, L., & Zhang, J. (2005). Regulation of stock externalities with correlated abatement costs. Environmental and Resource Economics, 32, 273–299.

Karp, L., & Zhang, J. (2012). Taxes versus quantities for a stock pollutant with endogenous abatement costs and asymmetric information. Economic Theory, 49, 371–409.

Krawczyk, J. (2000). An open-loop Nash equilibrium in an environmental game with coupled constraints. In 2000 Symposium of the international society of dynamic games, Adeilade, South Australia, symposium proceedings (pp. 325–339).

Krawczyk, J. (2005). Coupled constraint Nash equilibria in environmental games. Resource and Energy Economics, 27, 157–181.

Krawczyk, J., & Uryasev, S. (2000). Relaxation algorithms to find Nash equilibria with economic applications. Environmental Modeling and Assessment, 5, 63–73.

Lignola, M.B., & Morgan, J. (1997). Convergence of solutions of quasi-variational inequalities and applications. Topological Methods in Nonlinear Analysis, 10, 375–385.

Lignola, M.B., & Morgan, J. (2002). Existence for optimization problems with equilibrium constraints in reflexive banach spaces. Optimization in Economics, Finance and Industry, Datanova, Milano, 15–35.

Liski, M. (2002). Taxing average emissions to overcome the shutdown problem. Journal of Public Economics, 85, 363–384.

Martimort, D., & Sand-Zantman, W. (2011). A mechanism design approach to climate agreements. Toulouse School of Economics Working Papers, 11–251.

Morgan, J., & Prieur, F. (2011). Global emission ceiling versus international cap and trade: what is the most efficient system when countries act non-cooperatively? Centre for Studies in Economics and Finance Working Papers, 275.

Morgan, J., & Romaniello, M. (2006). Generalized quasi-variational inequalities: duality under perturbations. Journal of Mathematical Analysis and Applications, 324, 773–784.

Nash, J. (1950). Equilibrium points in n-person games. Proceedings of the National Academy of Sciences of the United States of America, 36, 48–49.

Reny, P.J. (1999). On the existence of pure and mixed strategy Nash equilibria in discontinuous games. Econometrica, 67, 1026–1056.

Rosen, J.B. (1965). Existence and uniqueness of equilibrium points for concave n-person games. Econometrica, 33(3), 520–534.

Tidball, M., & Zaccour, G. (2005). An environmental game with coupling constraints. Environmental Modeling and Assessment, 10(2), 153–158.

Tidball, M., & Zaccour, G. (2008). A differential game with coupling constraints. Optimal Control, Applications and Methods, 30(2), 197–207.

Vives, X. (1990). Nash equilibrium with strategic complementaries. Journal of Mathematical Economics, 19, 305–321.

von Heusinger, A., & Kanzow, C. (2009). Optimization reformulations of the generalized nash equilibrium problem using nikaido-isoda-type functions. Computational Optimization and Applications, 43, 353–377.

Author information

Authors and Affiliations

Corresponding author

Appendix A

Appendix A

1.1 A.1 Proof of Theorem 1

\( \bar {e} ^{R}(\alpha ,\bar {r}) = \big (e_{1}^{R}(\alpha ,\bar {r}),\ldots , e_{n}^{R}(\alpha , \bar {r})\big ) \in \mathcal {E(\alpha )}\) is a \(\bar {r}\)-normalized equilibrium for the pseudogame \( {\Gamma }(\alpha )\) if and only if:

that is, if and only if: \(\bar {e}^{R}(\alpha ,\bar {r})\) is a fixed point of the set-valued function \(L_{\alpha }\) defined on \(\mathcal {E(\alpha )}\) by:

For \(\alpha > 0\), \(\mathcal {E(\alpha )}\) and \(L_{\alpha }\) satisfy the assumptions of Kakutani’s theorem which guarantees the existence of such a fixed point.

In fact:

-

1.

\(\mathcal {E(\alpha )}\) is a nonempty, convex and compact subset of \( \mathbf {R}^{n}\);

-

2.

\(L_{\alpha }\) has closed graph;

-

3.

\(L_{\alpha }(\bar {u})\) is a nonempty and convex subset of \(\mathcal {E(\alpha )}\) for all \(\bar {u} \in \mathcal {E(\alpha )}.\)

The proofs is as follows:

-

1.

The first point is obvious.

-

2.

Let us show that, for all \(\alpha >0\), \(L_{\alpha }\) has a closed graph over \(\mathcal {E(\alpha )}\).

Let \((u_{1,k}, \ldots ,u_{n,k})_{k \in \bf N}\) be a sequence such that \(\bar {u}_{k}=(u_{1,k}, \ldots ,u_{n,k}) \in \mathcal {E(\alpha )}\) for all \({k \in \bf N}\) and such that \(\bar {u}_{k}\) converges to \(\bar {u}\) in \(\mathcal {E(\alpha )}\) as \(k \to \infty \). Then, for all \( i \in N, u_{i,k}\) converges to \(u_{i}\) as \(k \to \infty \) and, since \(\mathcal {E(\alpha )}\) is a closed set, \(\bar {u}=(u_{1},\ldots , u_{n}) \in \mathcal {E(\alpha )}\).

Moreover, let \((e^{R}_{1,k}, \ldots ,e^{R}_{n,k})_{k \in \bf N}\) be a sequence such that:

$$\begin{array}{rll} \bar{e}^{R}_{k}&=& \big(e^{R}_{1,k}, \ldots,e^{R}_{n,k}\big)\,\, \mbox{converges to}\, \,\, \bar{e}^{R} \\&=&\big (e^{R}_{1}, \ldots, e^{R}_{n}\big)\,\,\, \mbox{as}\, k \to \infty \,\,\,\,\mbox{and} \end{array} $$(25)$$\bar{e}^{R}_{k}\in L_{\alpha}( \bar{u}_{k}), \, \mbox{for all} \; k \in \bf N. $$(26)Then, for all \(i \in N\), \(e^{R}_{i,k}\) converges to \(e^{R}_{i}\) as \(k \to \infty \).

One has to prove that \(\big (e_{1}^{R},\ldots \,, e_{n}^{R}\big ) \in L_{\alpha }(u_{1},\ldots \;, u_{n})\), that is:

$$ \bar{e}^{R}=\big(e_{1}^{R},\ldots \,, e_{n}^{R}\big) \in \mathcal{E(\alpha)} \,\,\,\mbox{and}\\ $$(27)$$\begin{array}{rll}\bar{e}{\kern-2.5pt}={\kern-2.5pt}(e_{1}, \ldots \,, e_{n}){\kern-2.2pt}\in{}\mathcal{E{}({}\alpha{})} {} \;{} &\Longrightarrow &\;{} \sum\limits_{i=1}^{n}r_{i}W_{i}\big(e^{R}_{i}, \bar{u}_{-i}\big)\\&\geq& \sum\limits_{i=1}^{n}r_{i}W_{i}(e_{i}, \bar{u}_{-i})\\ \end{array} $$(28)Due to Eq. (25) and Eq. (26), we obtain condition Eq. (27) using a limit process.

Regarding implication Eq. (28), let \(\bar {e} = (e_{1}, \ldots \,, e_{n}) \in \mathcal {E(\alpha )}\). From Eq. (26), one has:

$$ \sum\limits_{i=1}^{n}r_{i}W_{i}\big(e_{i,k}^{R}, \bar{u}_{-i,k}\big)\geq \sum\limits_{i=1}^{n}r_{i}W_{i}(e_{i}, \bar{u}_{-i,k}) \\ $$The function \(W_{i}\) is continuous on \(\mathbf {R}^{n}_+\), for all \( i \in N\), therefore

$$\begin{array}{lll}&& \sum\limits_{i=1}^{n} r_{i}\lim_{k \to \infty} W_{i}(e_{i,k}^{R}, \bar{u}_{-i,k})\\ &&\quad\; \geq\sum\limits_{i=1}^{n}r_{i}\lim\limits_{k \to \infty}W_{i}(e_{i}, \bar{u}_{-i,k}) \end{array} $$This implies

$$ \sum\limits_{i=1}^{n}r_{i}W_{i}\big(e^{R}_{i}, \bar{u}_{-i}\big)\geq \sum\limits_{i=1}^{n}r_{i}W_{i}(e_{i}, \bar{u}_{-i}) $$(29)This is true for all \(\bar {e} = (e_{1}, \ldots \,, e_{n}) \in \mathcal {E(\alpha )}\). Therefore, \(L_{\alpha } \) has closed graph over \(\mathcal {E(\alpha )}\).

-

3.

For all \(\bar {u} \in \mathcal {E(\alpha )}, L_{\alpha }(\bar {u})\) is a nonempty set since \(\mathcal {E(\alpha )}\) is compact and, for all \(i \in N\), the function \(W_{i}\) is continuous \(\mathbf {R}^{n}_+\).

For all \(\bar {u} \in \mathcal {E(\alpha )}, L_{\alpha }(\bar {u})\) is a convex set since the function defined by \(F_{\bar {u}}(\bar {e})=\sum _{i=1}^{n} \; r_{i}W_{i}(e_{i}, \bar {u}_{-i})\) is assumed to be quasiconcave.

1.2 A.2 Proof of Theorems 2 and 3

Let \(\alpha > 0\) and \(\alpha _{k} \in \mathbf {R}_+\) such that \(\alpha _{k} \rightarrow \alpha \) as \(k \to \infty \). We have to show that \(\bar {e}^{R}(\alpha _{k},\bar {r}) \rightarrow \bar {e}^{R}(\alpha ,\bar {r})\) as \(k \to \infty \).

-

There exists a compact set \(K_{\alpha } \subset \mathbf {R}^{n}_+\) such that \( \mathcal {E}(\alpha _{k}) \subset K_{\alpha }\) for all \(k \in \bf N\) sufficiently large. So there exists a subsequence \((\bar {e}^{R}(\alpha _{k_{j}},\bar {r}))_{j \in \bf N}\) and a vector \(\bar {e}^{R} \in K_{\alpha }\) such that: \(\bar {e}^{R}(\alpha _{k_{j}},\bar {r}) \rightarrow \bar {e}^{R} \). Since \(\bar {e}^{R}(\alpha _{k_{j}},\bar {r}) \in \mathcal {E}(\alpha _{k_{j}})\), for all \(k_{j}\), and \(\alpha _{k_{j}} \rightarrow \alpha \), we have: \(\bar {e}^{R} \in \mathcal {E(\alpha )}.\)

-

Now, let \(\bar {e} \in \mathcal {E(\alpha )}\). Then, for all \(j \in \bf N\), there exists \(\bar {e_{j}} = (e_{1,j}, \cdots \,,e_{n,j}) \in \mathcal {E}(\alpha _{k_{j}})\) such that \(\bar {e_{j}} \rightarrow \bar {e}\) as \( j \to \infty \). But \(\bar {e}^{R}(\alpha _{k_{j}},\bar {r})\) satisfies:

$$\begin{array}{rll} \sum\limits_{i=1}^{n}r_{i}W_{i}\big(\bar{e}^{R}(\alpha_{k_{j}},\bar{r})\big)&\geq& \sum\limits_{i=1}^{n}r_{i}W_{i}\big(f_{i}, \bar{e}_{-i}^{R}(\alpha_{k_{j}},\bar{r})\big)\;\\ &&{}\mbox{for all} \; \bar{f}= (f_{1},...,f_{n}) \in \mathcal{E}(\alpha_{k_{j}}) \end{array} $$Then:

$$\sum\limits_{i=1}^{n}r_{i}W_{i}\big(\bar{e}^{R}(\alpha_{k_{j}},\bar{r})\big)\geq \sum\limits_{i=1}^{n}r_{i}W_{i}\big(e_{i,j}, \bar{e}_{-i}^{R}(\alpha_{k_{j}},\bar{r})\big).$$Passing to the limit for \(j \to \infty \), we obtain:

$$\sum\limits_{i=1}^{n}r_{i}W_{i}\big(\bar{e}^{R}\big)\geq \sum\limits_{i=1}^{n}r_{i}W_{i}\big(e_{i}, \bar{e}_{-i}^{R}\big). $$But this is true for all \(\bar {e} \in \mathcal {E(\alpha )}\) then \(\bar {e}^{R}\) coincides with \(\bar {e}^{R}(\alpha ,\bar {r})\), the unique \(\bar {r}\)-normalized equilibrium and we have:

$$\bar{e}^{R}(\alpha_{k_{j}},\bar{r}) \rightarrow \bar{e}^{R}(\alpha,\bar{r})\, \,\mbox{as} \,\, j \to \infty. $$ -

This is true for all convergent subsequences of \(\bar {e}^{R}(\alpha _{k},\bar {r})\) so one can prove that this is true for the sequence \((\bar {e}^{R}(\alpha _{k},\bar {r}))_{k \in N}\) and at the end we obtain:

$$\bar{e}^{R}(\alpha_{k},\bar{r}) \rightarrow \bar{e}^{R}(\alpha,\bar{r}) \,\mbox{as} \, k \to \infty, \,\mbox{for all}\, \alpha_{k} \to \alpha $$which completes the proof.

1.3 A.3 Proof of Proposition 1

The proof follows directly from the comparison between (a) Eqs. (13) and (15) and (b) Eqs. (10) and (15). Indeed, \(\omega _{i}^{N}<e_{i}^{*}(\omega ^{N})\Leftrightarrow \gamma _{-i}-2\gamma _{i}<0\) and \(\omega _{i}^{N}<e_{i}^{N}\Leftrightarrow \gamma _{-i}-2\gamma _{i}<0\). The same inequality is involved in the two comparisons. Under assumption (9), this inequality is satisfied for player 1 whereas the converse holds for players 2 and 3.

1.4 A.4 Proof of Proposition 2

One obtains the Nash equilibrium payoffs in the two scenarios, \(W_{i}^{N}\) and \(V_{i}^{N}\), by substituting respectively the solutions Eqs. (10) and (15) in Eqs. (8) and (14). Then, one can verify that \(W_{i}^{N}<V_{i}^{N}\Leftrightarrow -\alpha ^{2}(\gamma _{-i}-2\gamma _{i})^{2}<4\alpha (\gamma _{-i}-2\gamma _{i})(\kappa _{i}+\kappa _{-i}-2\alpha )\). Under assumption (9), this inequality is satisfied for players 2 and 3 but not for player 1. In addition, \(W^{N}=\sum W_{i}^{N}<V^{N}=\sum V_{i}^{N}\) always holds.

1.5 A.5 Proof of Proposition 3

Consider \(\bar {e}\) such that \(e_{i}+e_{-i}= \alpha \Leftrightarrow e_{-i}^{R}-e_{-i}=-(e_{i}^{R}-e_{i})\) and use this relation to remove \(e_{2}\) and \(e_{2}^{R}\) from the variational inequality Eq. (19), then:Footnote 20

If the equation \(\kappa _{i}-\kappa _{2}+(2+\gamma _{2}-\gamma _{i})\alpha -4e_{i}^{R}-2e_{-i \setminus 2}^{R}=0\) holds for \(i=1,3\), then using the feature that \(e_{2}^{R}=\alpha -e_{-2}^{R}\), one gets the interior solution

Otherwise, it is possible to obtain corner solutions with \(e_{i}^{R}(\alpha )=0\) or \(e_{i}^{R}(\alpha )=\alpha \). Note that, by definition, \(e_{2}(\alpha )\in [0,\alpha ]\) when \(e_{1}(\alpha )\) and \(e_{3}(\alpha )\) also lie in the interval \([0,\alpha ]\). From assumption (12), one can easily check that \(e_{1}(\alpha )\geq 0\) and \(e_{3}(\alpha )\leq \alpha \) for all \(\alpha \in (0,\bar {\alpha }]\). Define two boundaries \(\hat { \alpha }\) and \(\tilde { \alpha }\) as:

these boundaries satisfy: \(0<\hat { \alpha }<\tilde { \alpha }<\bar { \alpha }\). Putting all these elements together, one obtains the strategies as defined by Eq. (20).

1.6 A.6 Proof of Proposition 4

To give the proof of proposition 4, expressions of individual payoffs in both scenarios are needed.

Using the property that strategies, and consequently individual payoffs, are continuous at the critical bound \(\bar {\alpha }\), \(e_{i}^{R}(\bar {\alpha })=e_{i}^{N}\), one obtains

with \(W_{i}^{R}(\bar {\alpha })=W_{i}^{N}\) and expressions are symmetric for players \({-i}\).

The proof then uses the features of the value function \(W_{i}^{R}(\alpha )\) in the neighborhood of the critical bound \(\bar {\alpha }\). For the sake of simplicity, attention is paid to the interval \([\tilde {\alpha },\bar {\alpha }]\). Properties of \(W_{i}^{R}(\alpha )\): \((W_{i}^{R})'(\alpha )\geq 0\Leftrightarrow \alpha \leq \alpha _{i}\) with \(\alpha _{i}= \frac {(2(1-\gamma _{i})+\gamma _{-i})(\kappa _{i}+\kappa _{-i})}{(2(1-\gamma _{i})+\gamma _{-i})^{2}+18\gamma _{i}}\). In addition, \(\alpha _{i}<\bar {\alpha }\Leftrightarrow -\gamma _{-i}+2\gamma _{i} +4>0\), which holds under assumptions (9) and (12) for all i. The function \(W_{i}^{R}(\alpha )\) is decreasing in the neighborhood of \(\bar {\alpha }\) and, since it is continuous at \(\bar {\alpha }\), \(\exists I_{i}\subseteq [\tilde {\alpha },\bar {\alpha }]\) such that \(\forall \alpha \in I_{i}\), \(W_{i}^{R}(\alpha )\geq W_{i}^{N}\). This feature holds for \(i=1,2,3\). Finally notice that \(\cap I_{i} \neq \phi \).

1.7 A.7 Proof of Proposition 5

Here, we also need the expression of player i’s payoff at the Nash equilibrium of the ICT system:

with \(\bar {\alpha }\) the BAU aggregate emission level as defined by Eq. (18).

Let us first compute the difference between the maximum possible payoff under the GEC alone, \(W_{i}^{R}(\alpha _{i})\), and the payoff at the Nash equilibrium of BAU, \(W_{i}^{N}=W_{i}^{R}(\bar {\alpha })\)

Next, compute the difference between the Nash equilibrium payoffs of the BAU and the ICT system:

To complete the proof, it is sufficient to impose \(W_{i}^{R}(\alpha _{i})>V_{i}^{N}\) which is equivalent to Eq. (22). This implies that there exist values of \(\alpha \) such that players 2 and 3 are better off under the GEC system alone.

Rights and permissions

About this article

Cite this article

Morgan, J., Prieur, F. Global Emission Ceiling Versus International Cap and Trade: What is the Most Efficient System to Solve the Climate Change Issue?. Environ Model Assess 18, 493–508 (2013). https://doi.org/10.1007/s10666-013-9361-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-013-9361-7

Keywords

- Environmental game

- Climate change

- International cap and trade system

- National emission quotas

- Global emission ceiling

- Normalized equilibria

- Variational and quasi-variational inequalities