Abstract

We estimate new indices measuring financial and economic uncertainty in the euro area, Germany, France, the United Kingdom and Austria, following the approach of Jurado et al. (Am Econ Rev 105:1177–1216, 2015), which measures uncertainty by the degree of predictability. We perform an impulse response analysis in a vector error correction framework, where we focus on the impact of both local and global uncertainty shocks on industrial production, employment and the stock market. We find that global financial and economic uncertainties have significant negative effects on local industrial production, employment, and the stock market, while we find hardly any influence of local uncertainty on these variables. In addition we perform a forecasting analysis, where we assess the merits of uncertainty indicators for forecasting industrial production, employment and the stock market, using different performance measures. The results suggest that financial uncertainty significantly improves the forecasts of the stock market in terms of profit-based measures, while economic uncertainty gives, in general, more insight when forecasting macroeconomic variables.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the aftermath of the 2008 financial crisis and the Great Recession, the interest of economists and policymakers has been markedly focused on the analysis of tools and techniques to assess the strengths and vulnerabilities of financial systems and, in particular, on measuring financial uncertainty and its effect on the economy. Also before the crisis, however, episodes of financial instability had highlighted the importance of continuous monitoring of financial systems in order to prevent crises. The International Monetary Fund, for example, had identified a broad set of prudential and macroeconomic variables that are relevant for assessing financial soundness (see International Monetary Fund 2002), which was later reduced to a subset including both aggregate bank balance sheet and income statement information and aggregate indicators of financial fragility of nonfinancial firms and nonbank financial markets. These indicators are referred to as financial soundness indicators and have, more recently, been examined with respect to their ability to predict financial sector distress (see Pietrzak 2021). The European Central Bank (ECB) has introduced a family of composite indicators of systemic stress (CISS) which are based on five categories—the financial intermediaries sector, money markets, equity markets, bond markets and foreign exchange markets—and which are supposed to measure a country’s financial stability.Footnote 1

Other indicators which are (closely) related to the indicators of financial stability are so-called uncertainty indices. Because uncertainty is unobserved, a number of proxies have been proposed in the literature. Traditional methods include, for example, the disagreement among professional forecasters, see Zarnowitz and Lambros (1987) and Bomberger (1996). Another measure of financial uncertainty, which has become very popular, is the realized and implied stock market volatility, see Bloom (2009). A big advantage of this measure is that realized volatility, based on observed stock market returns, is readily available for almost all countries.

More recently, alternative measures using a more formal econometric framework have been introduced. Jurado et al. (2015) suggest that uncertainty relates to whether the economy is more or less predictable, i.e., less or more uncertain. The authors propose to use as uncertainty measure the common variation in forecast errors for a broad range of macroeconomic and financial variables. Rossi and Sekhposyan (2015) agree with Jurado et al. (2015) that uncertainty relates to whether the economy is more or less forecastable. The uncertainty index they propose is the percentile in the historical distribution of forecast errors associated with the realized forecast error. They distinguish between upside and downside uncertainty, because these uncertainties may affect the economy in different ways. Carriero et al. (2018) deal with common variation in the residual volatilities in a large vector autoregression model and estimate measures of uncertainty jointly with assessing its impact on the macroeconomy. Chuliá et al. (2017) propose an index of time-varying stock market uncertainty. The index is constructed by first removing the common variations in the series, based on identifying expected variation (risk) and unexpected variation (uncertainty). Baker et al. (2016) develop an index of economic policy uncertainty based on the frequency of key uncertainty-related terms that occur in newspaper articles. Böck et al. (2021) examine the merits of sovereign CDS volatility as an indicator of economic policy uncertainty, which, however, is not available for all countries. Scotti (2016) uses “surprises” from Bloomberg forecasts to construct measures of economic uncertainty. In contrast to most measures of uncertainty, which deal with common shocks, Bijapur (2021) proposes an indicator of firm-level uncertainty, which is composed of idiosyncratic shocks. Bloom (2014) surveys related literature.

Interest in financial and economic uncertainty has been spurred by a growing body of evidence that uncertainty rises sharply in recessions. In most of the literature, measures of uncertainty are estimated in a first step and then used as if they were observable data series in the following econometric analysis of its impact on macroeconomic variables. Most of the above cited studies include at least a small analysis on the effects of uncertainty on the economy. The authors include their preferred uncertainty measure, together with a small set of macroeconomic variables like industrial production, inflation and employment, in a vector autoregression model and examine the responses of the macroeconomic variables to the uncertainty shock. Uncertainty usually rises in economic downturns; but is uncertainty a source of business cycles or is it rather an endogenous response to them, and does the type of uncertainty matter? Ludvigson et al. (2021) find that higher macroeconomic uncertainty in recessions is often an endogenous response to output shocks, while financial uncertainty is a likely source of output fluctuations.

We propose to use financial and economic uncertainty indicators in the spirit of Jurado et al. (2015) in order to measure financial and economic (in)stability in the euro area, Germany, France, the United Kingdom and Austria. We thus follow the approach to remove the forecastable component of the variation of the variables under consideration and focus on the conditional expectation of the squared forecast errors. The data we use to compute our financial uncertainty index cover the main financial market segments: money market, equity market, (sovereign) bond market, and foreign exchange market. These data are available at a daily frequency and we transform them to monthly data (using monthly averages), because we propose to estimate financial uncertainty at a monthly frequency. The data we use to estimate our economic uncertainty index include sentiment indicators, data on employment, retail sales, manufacturing, orders, price indices, and survey data related order books, production expectations, employment expectations, etc. We construct both financial and economic uncertainty indices for the same countries, and examine the resulting differences.

First we assess the impact of both local (country specific) and global (US) financial and economic uncertainty on the economy by estimating a vector error correction (VEC) model and analysing the responses of main macroeconomic variables (industrial production, employment) and the stock market to a shock in uncertainty. Furthermore we examine the role of both local and global financial and economic uncertainty indices in forecasting. We also consider the ECB’s new composite indicator of systemic stress (CISS) as an alternative measure of financial instability. We use different VEC models including or excluding uncertainty indices and assess the respective forecasts. In doing so we employ both traditional loss-based performance measures (root mean squared error and mean absolute error) and profit-based measures (directional accuracy/hit rate and directional value).

The remainder of this paper is organized as follows. Section 2 revises the methodology used to estimate uncertainty. Section 3 describes the data and presents the resulting indices of financial and economic uncertainty. Section 4 describes the impulse response analysis and the forecasting analysis, and presents the corresponding results. All analyses are performed for the euro area, Germany, France, the United Kingdom and Austria. Section 5 summarizes and concludes.

2 Methodology

Econometric studies on measuring uncertainty and its effects on the economy started with the seminal paper by Bloom (2009). Other relevant contributions include, among others, Bachmann et al. (2013), Baker et al. (2016), Basu and Bundick (2017), Berger et al. (2016), Caggiano et al. (2014), Chuliá et al. (2017), Carriero et al. (2018), Gilchrist et al. (2014), Jurado et al. (2015), and Scotti (2016),Bloom (2014) surveys related work.

In order to formally assess uncertainty we follow the approach focusing on unforecastable components of the variation of variables under consideration (see, e.g., Carriero et al. 2018; Chuliá et al. 2017; Jurado et al. 2015, later referred to as JLN). Below we briefly sketch the approach used in JLN, where the notion of uncertainty is formalized as follows: Let \(y_{jt} \in Y_t \equiv \{ y_{1t}, \ldots , y_{Nt} \}\) be a variable and let \(Y_t\) be the set of variables describing a certain sector, e.g., the financial sector, where we intend to measure uncertainty. Its \(h-\)period ahead uncertainty, \({\mathcal {U}}_{jt}(h)\), is the conditional volatility of the purely unforecastable component of the future value of a given variable. Namely,

where \(I_t\) is information available at t.Footnote 2 If the expectation at t of the squared error in forecasting \(y_{j,t+h}\) rises then uncertainty in the variable rises. Uncertainty in the whole sector, approximated by the elements of \(Y_t\), is an aggregate of individual uncertainties

with the aggregation weights \(w_j\) and the implicit assumption that the law of large numbers holds. The econometric framework of JLN, which we adopt, is based on the following main steps:

-

(i)

The conditional expectation of the forecast error in (1), and thus \({{\mathbb {E}}}[y_{j,t+h} | I_t]\),Footnote 3 is approximated by forecasts of diffusion indices (common factors). Common factors are estimated from a large set of predictors, \(x_{it}\), \(i=1, \ldots , N^x\). The information (in more technical terms the \(\sigma\)-field) generated by these predictors is assumed to approximate \(I_t\) as closely as possible. In addition we assume that the conditional expectation is linear in \(x_{it}\), \(i=1, \ldots , N^x\). The common factors will be treated as known later on. Forecasts of both real activity and financial returns can be substantially improved by augmenting best-fitting conventional forecasting equations with common factors estimated from large datasets (see Ludvigson and Ng 2007, 2009; Stock and Watson 2006, among others)

$$\begin{aligned} y_{j,t+1}=\Phi _j^y(L) y_{jt}+\gamma _j^F(L) {\hat{\textbf{F}}}_t + \gamma _j^W (L) {\textbf{W}}_t + \nu _{j,t+1} \end{aligned}$$(3)where \(\Phi _j^y(L)\), \(\gamma _j^F(L)\) and \(\gamma _j^W(L)\) are finite-order polynomials in the lag operator L,Footnote 4 and \({\hat{\textbf{F}}}_t\) is the \(k_F-\)dimensional vector of estimates of latent common factors of the predictors \({\textbf{X}}_t=(x_{1t}, \ldots , x_{N^xt})'\) available for the analysis, which thus have the following factor structure

$$\begin{aligned} x_{it}=(\Lambda _i^F)' {\textbf{F}}_t+e_{it} \end{aligned}$$(4)\({\textbf{F}}_t\) is the \(k_F\)-dimensional vector of latent common factors, \(\Lambda _i^F\) is the \(k_F\)-dimensional vector of factor loadings and \(e_{it}\) is the idiosyncratic error. The number of factors, \(k_F\), is much smaller than the number of series \(N^x\). Finally, the \(k_W\)-dimensional vector \({\textbf{W}}_t\) contains additional predictors such as squares of \({\hat{F}}_{1t}\) and factors in \(x_{it}^2\) to capture possible nonlinearities and potential effects that conditional volatilities might have on \(y_{jt}\).Footnote 5 Time varying volatilities of \(y_{j,t+1}\), the factors and additional predictors are allowed. The estimation of the factors uses the method of static principal components. Factors are selected on the basis of potential predictive power, see (Bai and Ng 2002, 2006, 2008).

-

(ii)

The conditional expectation of the squared forecast errors in (1) is computed from a parametric stochastic volatility model for the one-step-ahead predictive errors for both \(y_{jt}\) and the factors.Footnote 6 The conditional volatility for \(h>1\) steps ahead is computed recursively, and through this procedure additional unforecastable variation is created via time varying volatility in the errors of the predictor variables (factors). In more detail, when allowing for the autoregressive dynamics in the factors and introducing notation \(Y_{jt} \equiv \left( y_{jt},y_{jt-1},\dots ,y_{jt-q+1} \right) ' \in {\mathbb {R}}^q\), \({\textbf{Z}}_t \equiv \left( \hat{{\textbf{F}}}_t', {\textbf{W}}_t' \right) ' \in {\mathbb {R}}^{k}\), where \(k= k_F+k_W\), and \({\mathcal {Z}}_t \equiv \left( {\textbf{Z}}_t', \ldots , {\textbf{Z}}_{t-q+1}' \right) ' \in {\mathbb {R}}^{kq}\), then we can obtain forecasts using the companion form

$${\mathcal {Y}}_{jt} \equiv \underbrace{ \left[ \begin{array}{l} {\mathcal {Z}}_t \\ Y_{jt} \end{array} \right] }_{(k+1)q \times 1} = \left[ \begin{array}{ll} \underbrace{ \Phi ^{{\mathcal {Z}}} }_{kq \times kq} & \underbrace{0}_{kq \times q} \\ \underbrace{\Lambda_j^{\prime } }_{q \times kq} & \underbrace{\Phi _j^Y}_{q \times q} \end{array} \right] \left[ \begin{array}{c} {\mathcal {Z}}_{t-1} \\ Y_{j,t-1} \end{array} \right] + \left[ \begin{array}{c} {\nu }_t^{{\mathcal {Z}}} \\ {\nu }_{jt}^{Y} \end{array} \right]$$(5)where \(\Lambda _j\) and \(\Phi _j^Y\) are functions of the coefficients in the lag polynomials in (3) and \(\Phi ^{{\mathcal {Z}}}\) records coefficients of the components in \({\mathcal {Z}}_t\). In addition, stationarity of the corresponding time series is assumed.Footnote 7 Let \(\Omega _{jt}(h) \equiv {{\mathbb {E}}}_t \left( {\mathcal {Y}}_{j,t+h}-{{\mathbb {E}}}_t \left( {\mathcal {Y}}_{j,t+h} \right) \right) \left( {\mathcal {Y}}_{j,t+h}-{{\mathbb {E}}}_t \left( {\mathcal {Y}}_{j,t+h}\right) \right) '\), be the forecast error variance of \({\mathcal {Y}}_{jt}\) modelled in (5) which evolves as

$$\begin{aligned} \Omega _{jt}(1)= {{\mathbb {E}}}_t \left( {\mathcal {Y}}_{j,t+1}^{\nu } \left( {\mathcal {Y}}_{j,t+1}^{\nu } \right) ' \right) \end{aligned}$$(6)and

$$\begin{aligned} \Omega _{jt}(h)= \Phi _j^{{\mathcal {Y}}} \left[ \Omega _{jt}(h-1) \right] \left( \Phi _j^{{\mathcal {Y}}} \right) ' + {{\mathbb {E}}}_t \left( {\mathcal {Y}}_{j,t+h}^{\nu } \left( {\mathcal {Y}}_{j,t+h}^{\nu } \right) ' \right) \ \ \textrm{for} \ \ h>1 \end{aligned}$$(7)see Eq. (9) in JLN, where \({\mathcal {Y}}_{j,t}^{\nu }=\left( ({\nu }_t^{{\mathcal {Z}}})', ({\nu }_{jt}^{Y})' \right) '\) and

$$\begin{aligned} \Phi _j^{{\mathcal {Y}}}= \left[ \begin{array}{cc} \Phi ^{{\mathcal {Z}}} & 0 \\ \Lambda _j^{\prime } & \Phi _j^Y \end{array} \right] \end{aligned}$$(8)Thus, the expected forecast uncertainty of \(y_{j,t+h}\) is the square root of the corresponding scalar on the diagonal of \(\Omega _{jt}(h)\), i.e.,

$$\begin{aligned} {\mathcal {U}}_{jt}(h)= \sqrt{e_j' \, \Omega _{jt}(h) e_j} \end{aligned}$$(9)where \(e_j\) is the corresponding selection vector. In addition, stochastic volatility of \(y_{jt}\) and the factors is assumed, i.e., \(\nu _{j,t+1}=\sigma _{j,t+1} \varepsilon _{j,t+1}\) with \(\varepsilon _{j,t+1} \sim N(0,1)\) and

$$\begin{aligned} \log \left( \sigma _{j,t+1}^2 \right) = \alpha _j + \beta _j \log \left( \sigma _{jt}^2 \right) + \tau _j \eta _{j,t+1}, \ \ \eta _{j,t+1} \sim N(0,1) \end{aligned}$$(10)which affects the time variation in uncertainty (7) (see JLN, page 1187). Equation (10) can be estimated using Markov Chain Monte Carlo (MCMC) methods, following Kastner and Frühwirth-Schnatter (2014) and Kastner (2016).

-

(iii)

The aggregate uncertainty, \({\mathcal {U}}_{t}^Y(h)\), is estimated from individual uncertainty measures \({\mathcal {U}}_{jt}(h)\). We consider two kinds of weights: equal weights and weights based on the common factors in the individual measures of uncertainty. As the implied uncertainty indices are very similar, we use the simpler version based on equal weights in this paper.

We use slightly modified versions of the codes provided by Jurado et al. (2015) to compute our financial and economic uncertainty indices.

3 Data and uncertainty indices

The following subsections describe the data used for estimating the uncertainty indices and present graphs of the estimated financial and economic uncertainty indices, for the euro area (EA), Germany (DE), France (FR), the United Kingdom (UK), and Austria (AT).

3.1 Data

The financial data we use in order to estimate the financial uncertainty index include monthly observations on interest rates, yields on government bonds, yields on corporate bonds, interest rate swaps, overnight interest rates, spreads between different yields and/or rates, stock indices, bond indices, foreign exchange rates, dividend-price ratios, earnings-price ratios, and volatilities of stock/bond indices and foreign exchange returns. We consider different maturities for the rates/yields and use averages of the daily observations to compute monthly values. In total we have 74 financial variables for the euro area and Germany, 72 for France, 76 for the UK, and 77 for Austria, when we compute the financial uncertainty indices. The data set which is used to extract the factors used for forecasting the conditional volatilities for the financial variables, consists of both the financial variables just described and additional macroeconomic variables. The macroeconomic variables include sentiment indicators, data on employment, retail sales, manufacturing, orders, price indices, and survey data for twelve industries related to important economic questions concerning order books, production trend observed in recent months, production expectations, employment expectations, etc.Footnote 8 Note that the macroeconomic data are not real-time but ex-post (possibly revised) time series.Footnote 9 The macroeconomic data set includes 122 time series for the euro area and Austria, 120 for Germany, and 114 times series for France and the UK, respectively.Footnote 10 All data range from January 2000 until December 2020, i.e., we have 252 observations per variable. Details on the data used and a list of all variables considered for the euro area can be found in Appendix A. When we compute the macroeconomic uncertainty indicator we use again the macroeconomic and the financial data to extract the factors, but we forecast conditional volatilities for the macroeconomic variables (not for the financial variables). In doing so we follow Jurado et al. (2015) to group some variables which are originally included in the financial variables with the macroeconomic variables. In this case \(N=135\) for the euro area, \(N=134\) for Germany, \(N=128\) for France and the UK, respectively, and \(N=138\) for Austria.

In a prior version of this article we also use aggregate banking data to construct alternative versions of the financial uncertainty indices (for the euro area and Austria), in order to detect potential differences and, in particular, to analyze whether banking data improve the predictive properties of financial uncertainty. We find that, overall, banking data do not seem to improve the forecast performance. For more details, see Fortin et al. (2021).

3.2 Uncertainty indices

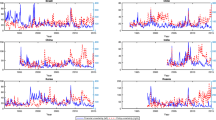

Figure 1 presents the financial and economic uncertainty indices for the euro area, showing three indices in each case, relating to forecast horizons of one, three and twelve months. While the level of uncertainty clearly increases with the forecast horizon (on average), the variability of uncertainty decreases, at least with the larger forecast horizon of twelve months.Footnote 11 This is also true for the country specific uncertainty indices, see Fig. 2, which shows the country indices for financial and economic uncertainty, for forecast horizons of one and twelve months. Financial uncertainty indices in the euro area, Germany, France and Austria show very similar developments and reveal spikes around the bursting of the dot-com bubble 2000–2001, the global financial crisis 2007–2008, the European sovereign debt crisis 2010–2011, as well as around the outbreak of the Covid-19 crisis in early 2020. The UK is a bit different. The European sovereign debt crisis 2010–2011 is obviously not reflected in the UK financial uncertainty index, the most pronounced spike here corresponds to the global financial crisis (2007–2008), and the peak around the Covid-19 crisis is larger than in other countries. In all countries and the euro area economic uncertainty exhibits both a smaller level (on average) and a significantly smaller variability than financial uncertainty. Economic uncertainty in the euro area exhibits two peaks, one around the global financial crisis (great depression) and one around the outbreak of the Covid-19 crisis in 2020. Albeit rather similar, the development of economic uncertainty is more diverse among the countries than that of financial uncertainty.Footnote 12 In particular the spikes around the global financial crisis are not so clearly pronounced in all countries. Further, the Covid-19 crisis suggests an exceptionally large increase in economic uncertainty in the UK, like for financial uncertainty, for a forecast horizon of one month, and there is another peak in the UK after the Brexit referendum in June 2016.

The financial uncertainty indices for different forecast horizons, for the euro area and the countries, are highly correlated (above 0.96). This is true across different forecast horizons, and also across the regions, if the UK is not considered. Clearly, UK financial uncertainty is not so highly correlated with financial uncertainty in the other countries or the euro area (around 0.6). Also the economic uncertainty indices are positively correlated within the countries (above 0.65 and mostly larger), however, at a lower degree across the countries (0.2\(-\)0.7). With economic uncertainty the correlation across countries increases with the forecast horizon, in particular for euro area countries, see Fig. 2. The descriptive statistics suggest that all uncertainty indices exhibit a (strongly) positive skewness.Footnote 13 This implies that the distribution is not symmetric and, in particular, that the right tail of the distribution is longer and the mass of the distribution is concentrated on the left. The kurtosis is mostly around three, which is the value for the Gaussian distribution, only for economic uncertainty in the euro area and the UK the numbers are around/above ten. This suggests that the underlying distribution produces more extreme realizations than the normal distribution. When looking at Figs. 1 and 2 we observe particularly sharp increases in economic uncertainty during the Covid-19 crisis for the euro area and the UK. This might be one of the drivers of excess kurtosis for economic uncertainty. Indeed, when estimating the kurtosis of economic uncertainty for the subsample excluding the Covid-19 crisis (May 2000 to December 2019), we obtain values which are much lower than for the total sample.

4 Empirical analysis

The data sample covers monthly observations for the period ranging from May 2000 through December 2020. We do not start earlier because our uncertainty indices can only be created from May 2000 onwards, due to data availability of the predictors and the autoregressive structure of (3), where the number of lags is four. For all countries under consideration we perform an impulse response analysis to quantify the dynamic responses of macroeconomic variables (industrial production, employment) and stock market indices to uncertainty shocks (of both financial and economic nature). We use the Cholesky decomposition to identify the structural shocks, in the vector error correction (VEC) model

where \(\left( {\textbf{y}}_{t} \right)\) is an \(n-\)dimensional stochastic process, t denotes the time dimension, and \({\textbf{c}}\) is an \(n-\)dimensional vector of intercept terms. The parameter matrix \({\varvec{\alpha }}\) is of dimension \(n \times r\), while the matrix of cointegrating vectors \({\varvec{\beta }}\) is an \(n \times r\) matrix, where n is the number of variables and r is the number of cointegrating relationships. For matrix \({\varvec{\beta }}\) we apply the usual normalization such that \({\varvec{\beta }}_{1:r,1:r}\) is the r-dimensional identity matrix. The short-run dynamics are described by the \(n \times n\) matrices \({\varvec{\Gamma }}_{j}\), \(j=1,\dots ,p\). Finally, \({\textbf{u}}_{t}\) is a white noise process with mean zero and covariance matrix \(\varvec{\Sigma }\).Footnote 14

Our VEC model contains the following (endogenous) variables: the global (US) financial or economic uncertainty index, \(x_t^{US}\), the corresponding local (country specific) uncertainty index, \(x_t^{j}\), and the country specific variables: industrial production, \(ip_t^{j}\), employment, \(empl_t^{j}\), the consumer price index, \(cpi_t^{j}\), the short-term interest rate, \(ir_t\), and the stock market index, \(stm_t^j\), where \(j \in \left\{ \text {EA}, \text {DE}, \text {FR}, \text {UK}, \text {AT} \right\}\), \(ir=\) 3 m-Euribor for euro area countries, \(ir=\) 3 m-Libor for the UK, and the stock market indices are the Euro Stoxx 50, the DAX 30,Footnote 15 the CAC 40, the FTSE 100 and the ATX. Hence, \(n=7\) and \({\textbf{y}}_t^j= \left( x_t^{US}, x_t^{j}, ip_t^{j}, empl_t^{j}, cpi_t^{j}, ir_t^j, stm_t^j \right) '\). All variables except the uncertainty indices and the interest rate enter in log levels. To describe global (financial and economic) uncertainty we use the US financial and economic uncertainty indicators as calculated by Jurado et al. (2015).Footnote 16 For all financial and economic uncertainty indices we use the one-month ahead uncertainties.

The number of lags p is chosen based on the Schwarz information criterion.Footnote 17 The application of the error correction model (11) is supported as follows: For the time series considered, except for the uncertainty indices, the null hypothesis of a unit root cannot be rejected at the 5% significance level, using augmented Dickey-Fuller tests. To deal with stationary variables in the VEC model we follow Lütkepohl (2005)[page 250] on the restrictions of cointegrating vectors in \({\varvec{\beta }}\). That is, the first two coordinates of \({\textbf{y}}_t\) are global and local (stationary) uncertainty indices, \(x_t^{US}\) and \(x_t^j\), and thus the first two cointegrating vectors are the corresponding canonical basis vectors.Footnote 18 We perform Johansen cointegration tests among all integrated endogenous variables and obtain evidence of one additional cointegrating vector, for each country j and the euro area. Thus, we have three cointegrating vectors, i.e., \({\hat{r}}=3\).

In the current specification of the VEC model (11) all the variables considered are assumed to be endogenous. Assuming that the model is correctly specified, the parameters can be estimated consistently (see, e.g., Lütkepohl 2005). Note that the current specification allows to estimate the impact and the reverse impact of the global uncertainty index, approximated by \(x_t^{US}\), and of the local uncertainty index, \(x_t^j\). At least for larger countries and the euro area, effects in both directions cannot be ruled out a priori. Therefore, also the global uncertainty index is modelled endogenously within our VEC model. To investigate the stability of our modelling approach, as a robustness check, we include the S &P 500 index or US industrial production as exogenous variables.Footnote 19 When comparing the impulse response functions of (11) with those obtained when including US industrial production or the S&P 500 index, we see that the differences are neglectable, which supports to proceed with the VEC model as defined in (11).Footnote 20

4.1 Impulse response analysis

To identify the impact of an uncertainty shock on macroeconomic variables and the stock market we employ an impulse response analysis based on the Cholesky decomposition. We present results of estimated impulse responses of logged values of industrial production, employment and the stock market to one standard deviation increases (“shocks”) of either the financial or the economic uncertainty index, over the next 60 months, where we consider both global and local indices, respectively.Footnote 21 Fig. 3 shows the graphs for the euro area, Figs. 6, 7, 8 and 9 (in Appendix B.1) present results for the other countries.

The first row of graphs in Fig. 3 shows the estimated impact of an increase in the euro area (local) financial uncertainty. Given the 95% confidence bounds shown by the shaded areas, we do not observe any significant impact of local financial uncertainty on industrial production and employment, nor on the Euro Stoxx 50. The second row shows the effects of an increase in global financial uncertainty. In this case, contrary to the situation before, we do see statistically significant decreases of industrial production, employment and the stock market. Global financial uncertainty thus seems to be a more influential factor for economic activity and the stock market than local financial uncertainty. The third row considers the impact of an increase in local economic uncertainty, and we observe a significant albeit short-run decrease for industrial production, while for employment we see a small and significant permanent decline; however, there is no significant impact of local economic uncertainty on the stock market. Finally, the fourth row considers the impact of an increase in global economic uncertainty, and here we see statistically significant negative effects upon all three variables considered.

To summarize, the impact of global uncertainty, both financial and economic, on euro area industrial production, employment and on the Euro Stoxx 50 is always significant, while this is never the case for local financial uncertainty. Note that the impact of global financial uncertainty exceeds the impact of global economic uncertainty. However, the impact of local economic uncertainty on the macroeconomic variables is also significant, albeit much smaller in size and persistence than that of global economic uncertainty. Somewhat surprisingly, although local uncertainty indices are constructed on the basis of local data, our impulse response analysis mainly identifies global uncertainty as a key driving factor of economic and financial activity.

As local and global uncertainty indicators enter the corresponding VEC models we can also investigate how local and global uncertainty indices influence each other. Interestingly we observe a strong significant impact of global on local economic uncertainty for approximately 2.5 years, while the impact of global on local financial uncertainty is barely significant, and only observable for about a year, see Fig. 4. However, we hardly see any significant impact of euro area uncertainty upon global uncertainty, neither for financial nor for economic uncertainty, although this could possibly be the case for a large area like the euro area.

Looking at individual countries (see Figs. 6, 7, 8 and 9 in Appendix B.1), the impulse response results are roughly similar as for the euro area. Local stock markets seem to be influenced mainly by global uncertainty. Both global financial and global economic uncertainty show significant effects on all local stock markets, where the impact of financial uncertainty is found to be stronger (in magnitude and/or persistence). Note that the long-term impact of global financial uncertainty upon local stock markets is largest for Austria and smallest for the UK. On the other hand, local uncertainty (neither financial nor economic) does not seem to be an important factor for stock markets. Among all countries considered (including the euro area), only in the UK the local stock market responds significantly, albeit only very shortly (four quarters), to a shock in local financial uncertainty.

Also country specific industrial production seems to be influenced more by global than by local uncertainty, where the magnitude of the effect is usually larger for global economic than global financial uncertainty (except for France and Austria). Local financial uncertainty does never significantly impact industrial production; local economic uncertainty, however, shows a significant but short-term effect for Germany (six quarters) and the UK (two quarters). The impulse response results for employment are very similar.

Impulse responses of industrial production, employment and the Euro Stoxx 50 to a one standard deviation shock of financial uncertainty (first block) and of economic uncertainty (second block) for the euro area and \(h=1\), with 95% confidence intervals. In each block the first row shows the effect of euro area (financial/economic) uncertainty, the second row shows the effect of global (financial/economic) uncertainty

Effect of global uncertainty on euro area uncertainty and the other way round. The graphs show the effect of global uncertainty upon euro area uncertainty (left) and the effect of euro area uncertainty upon global uncertainty (right). The first row shows the case for financial uncertainties, the second row shows the case for economic uncertainties

4.2 Forecasting analysis

To analyze the value added of our uncertainty indices for forecasting industrial production, employment and the stock market, we compare the forecast performance of the VEC models forecasting these variables when the uncertainty indices are included and when they are omitted. In addition, we consider the forecast performance of a VEC model when the uncertainty index is replaced by the CISS, and we examine two benchmark models, the random walk (RW) and the univariate autoregressive model of order one, DAR(1).Footnote 22

We consider rolling-window estimation for our analysis, i.e., we keep the size of the estimation sample constant and equal to eighty months, and move forward the sample by one month, re-estimating the model parameters. The out-of-sample period, in which we evaluate the forecast performance, ranges from January 2007 to December 2020. In order to evaluate different forecasts we do not only employ traditional loss measures, like root mean squared error (RMSE) and mean absolute error (MAE), but also profit-based measures like directional accuracy (DA) and directional value (DV). The directional accuracy, or hit rate, is a binary variable measuring whether the direction of a variable change was correctly forecasted. The directional value additionally incorporates the economic value of directional forecasts by assigning to each correctly predicted change its magnitude. The loss-based and profit-based performance measures are formally defined as follows

where \(z_{t}\) is the variable we want to forecast, namely \(z_t \in \left\{ ip_t^j, empl_t^j, stm_t^j \right\}\) at time t, for country \(j \in \left\{ \text {EA}, \text {DE}, \text {FR}, \text {UK}, \text {AT} \right\}\), and \({\hat{z}}_{t+h|t}\) is the forecast of the variable for time \(t+h\) conditional on the information available at time t, i.e., h is the forecast horizon, and \({\mathbb {I}} (\cdot )\) is the indicator function. The aggregate performance measures for each model are calculated over the out-of-sample period for a given forecast horizon as follows

where \(T_1=\) January 2007 and \(T_2=\) December 2020. We compare the forecast performance of the VEC models for the cases with: (i) both local (country driven) and global (US) financial uncertainty indices, (ii) both local and global economic uncertainty indices, (iii) the local financial uncertainty index, (iv) the local economic uncertainty index, (v) the country specific CISS,Footnote 23 (vi) no uncertainty and no CISS indices, and for two benchmark models,Footnote 24 (vii) autoregressive model of order one in differences, DAR(1), and (viii) random walk (RW). We consider forecast horizons of one and twelve months.

4.2.1 Euro area

Table 1 presents the forecast performance of the different models described above for the euro area. The first, second and third blocks present the forecast performance for industrial production, employment and the stock market, respectively. When forecasting industrial production, the best performance regarding loss measures (RMSE and MAE) is achieved by the random walk for both forecast horizons. With respect to profit-based measures and a forecast horizon of one month, the best hit rate is implied by the model including the CISS, while the best directional value (DV) is achieved by the model with both local and global economic uncertainty indices. For a forecast horizon of twelve months the best model with respect to the hit rate is the one with local economic uncertainty and with respect to the directional value it is the model with the CISS.

Regarding the forecast performance for employment we observe that uncertainty indices improve the forecast performance regarding loss measures. For a forecast horizon of one month, the model with CISS gives the smallest RMSE and the model with both global and local financial uncertainty indices implies the smallest MAE (which, however, is only marginally lower than for other models). For a forecast horizon of twelve months, the model with local economic uncertainty yields the smallest RMSE, while the model with local financial uncertainty yields the smallest MAE. Regarding profit-based measures, the model with the CISS always performs best.

Finally, we observe the following pattern in the forecast performance for the Euro Stoxx 50. While benchmark models provide the lowest RMSE and MAE, the model with both local and global financial uncertainty yields the largest hit rate and directional value, for forecast horizons of one and twelve months.

While Table 1 presents forecast performance criteria over the total out-of-sample period (January 2007–December 2020) it is also interesting to look at the forecast performance in sub-periods, to get an idea about which model performs best in which sub-period. Figure 5 shows the RMSE over rolling windows of six months for forecasting industrial production in the euro area, and the directional value over rolling windows of twelve months for forecasting the Euro Stoxx 50, for a forecast horizon of one month. For industrial production we show the time-changing RMSE implied by the models including both local and global economic uncertainties, including only local economic uncertainty and including no uncertainty. For the Euro Stoxx 50 we present the time-changing DV implied by the models including both local and global financial uncertainties, including only local financial uncertainty and including no uncertainty. Note that in the case of industrial production the model with both local and global economic uncertainties provides the lowest RMSE in the period of global financial crisis,Footnote 25 while the same model yields the worst performance in the period of the European sovereign debt crisis. Thus considering global economic uncertainty improves forecasts during the global financial crisis but does not seem to be helpful in the euro area crisis. However, the model including both local and global financial uncertainties yields the largest DV for the Euro Stoxx 50 most of the time, including the period of the global financial crisis.

Forecasting industrial production and the Euro Stoxx 50 in the euro area with both local and global (economic/financial) uncertainties, with only local (economic/financial) uncertainty and with no uncertainty, for \(h=1\). The RMSE and the DV are shown for rolling windows over six and twelve months, respectively

4.2.2 Other countries

We present the results related to the forecast performance for Germany, France, the UK and Austria in Tables 5, 6, 7 and 8 in Appendix B.2.

4.2.3 Industrial production

In all countries we observe that models including economic uncertainty provide the best forecast performance for industrial production in terms of the RMSE and DV, for a forecast horizon of one month. In addition, we observe that both local and global financial uncertainties are important in forecasting industrial production, especially in Germany and France. For Germany this model yields the largest hit rate for a forecast horizon of one month and the largest DV for a forecast horizon of twelve months, while for France this model implies the largest hit rate and DV for a forecast horizon of twelve months. To summarize, the models with both local and global economic or financial uncertainties yield the best profit-based performance when forecasting industrial production, over the short and the long forecast horizons for Germany and France, while for the UK and Austria models with only economic uncertainty improve the forecast performance for a forecast horizon of one month.

4.2.4 Employment

Unlike with industrial production, only models with economic (not financial) uncertainty provide the best forecast performance when forecasting employment. For Germany this is the case for the RMSE and for profit measures, for a forecast horizon of one month. For a forecast horizon of twelve months, however, the model with no uncertainty yields the best forecast performance with respect to all measures. For France the models with economic uncertainty yield the smallest RMSE and MAE over both horizons. For the UK models with economic uncertainty imply smallest loss measures only for the longer forecast horizon, but largest profit measures for both the short and long forecast horizons.Footnote 26 For Austria the model with only local economic uncertainty implies the largest DV for a forecast horizon of one month. In all other cases the benchmark models yield the best performance. All in all, the models with both local and global economic uncertainty dominate the best models when forecasting employment. This holds for all countries but Austria, where the model with only local economic uncertainty seems to perform better.

4.2.5 Stock market

We observe a similar pattern in the forecast performance of stock market indices for Germany, France, the UK and Austria as in the euro area. Models with both local and global financial uncertainty yield the largest hit rates and directional values, while benchmark models provide the lowest RMSE and MAE, over both forecast horizons. For Austria, the model with both local and global financial uncertainty also yields the lowest RMSE, for a forecast horizon of one month.

In order to find out whether certain models forecast significantly better than others (with respect to a given performance measure), we perform the Diebold-Mariano test of equal forecast accuracy (see Diebold and Mariano 1995). We are particularly interested in whether models including uncertainty indices achieve significantly better forecasts than models without uncertainty indices. More precisely, we test whether the model including both local and global (financial or economic) uncertainties provides a significantly better forecast performance (at the 10% level) than the model with only local uncertaintyFootnote 27 or the model with no uncertainty. In addition we test whether the model including (only) local uncertainty provides better forecasts than the model with no uncertainty. Our main results are as follows. We find significant differences between models only when forecasting stock market indices, considering profit-based measures. First, the models including both local and global financial uncertainties significantly outperform, except for Germany, the models including no uncertainty for forecast horizons of one and twelve months.Footnote 28 Second, models with both local and global financial uncertainties significantly outperform models with only local financial uncertainty, for a forecast horizon of one month.Footnote 29 This implies that for short-term forecasting global uncertainty seems to be more important than local uncertainty. Third, for all countries but Germany, models with only local financial uncertainty significantly outperform models with no uncertainty, for a forecast horizon of twelve months. Local financial uncertainty thus seems to be more important when forecasting over longer than over short horizons.

5 Conclusions

In this paper we obtain new indices measuring financial and economic uncertainty in the euro area, Germany, France, the UK and Austria, following the approach of Jurado et al. (2015), which measures uncertainty by the degree of predictability. We use monthly data comprising roughly 200 time series for the euro area and each country to construct our financial and economic uncertainty indices. The data cover the time span from January 2000 to December 2020.

After estimating the financial and economic uncertainty indices, we perform impulse response analyses in a vector error correction framework, where we focus on the impact of both local (country specific) and global (US) uncertainty shocks on industrial production, employment and the stock market, for the euro area, Germany, France, the UK and Austria. First, we observe significant negative effects of global financial uncertainty on industrial production, employment and the stock market, for the euro area and all countries considered. Second, for global economic uncertainty, we mostly observe a negative and statistically significant impact on the economic variables considered. Third, local financial uncertainty hardly shows statically significant effects on local industrial production, employment and the stock market. Forth, also for local economic uncertainty the effects are hardly significant. Only for the euro area, Germany and the UK local economic uncertainty shows a significant negative impact on the macroeconomic variables, however, only in the short run (Germany, UK).

In addition, we perform a forecasting analysis with respect to both loss-based and profit-based performance measures, where we assess the value added of our uncertainty indices in forecasting industrial production, employment and the stock market, for forecast horizons of one and twelve months. I.e., we compare the forecast performance of models including both local and global uncertainties, models including only local uncertainty and models including no uncertainty. We find that financial and/or economic uncertainty can improve the forecasting performance. Models including economic uncertainty improve the forecast performance for industrial production in the short run, while for the euro area, Germany and France models with financial uncertainty provide a value added for longer forecast horizons (twelve months). Regarding the forecasting of employment, models with economic uncertainty are among the best ones. Finally, a clear pattern can be observed when forecasting stock markets, considering profit-based performance measures. Models including both local and global financial uncertainties significantly outperform models including no uncertainty. In addition, models with both local and global financial uncertainties significantly outperform models with only local financial uncertainty, for a forecast horizon of one month, i.e., in the short-run global financial uncertainty seems to be more important than local uncertainty, when forecasting the stock market. Finally, for all countries but Germany, models with only local financial uncertainty significantly outperform models with no uncertainty, for a forecast horizon of twelve months.

Notes

The ECB’s indicators use different weighting schemes to aggregate individual variables or subindices into one index: weights reflecting the time-varying cross-correlation structure (CISS) or equal weights (new CISS), see Holló et al. (2012). The CISS is computed for the euro area as a whole on a weekly basis, the new CISS is computed for the euro area as a whole and for all euro area countries on a daily basis.

The proper measurement of uncertainty requires removing the forecastable component \({{\mathbb {E}}}\left( y_{j,t+h} | I_t \right)\) before computing conditional volatility. Otherwise the forecastable variation would be (falsely) classified as uncertain.

To simplify notation we use \({{\mathbb {E}}}_t (\cdot)\) to denote \({{\mathbb {E}}}[\cdot | I_t]\).

Following JLN, we choose polynomials of order four for \(\Phi _j^y(L)\) and polynomials of order two for \(\gamma _j^F(L)\) and \(\gamma _j^W(L)\).

We choose the factor in \(x_{it}^2\) corresponding to the largest eigenvalue.

To estimate stochastic volatility in the forecast errors we use the ‘stochvol’ R package (see Kastner 2016).

Following JLN, we choose an order of four in the autoregressive dynamics of the factors to coincide with the order of polynomial \(\Phi _j^y(L)\), i.e., \(q=4\).

In total, the survey data cover seven questions relating to (i) production trend observed in recent months, (ii) order books, (iii) export order books, (iv) stocks of finished products, (v) production expectations, (vi) selling price expectations, (vii) employment expectations, and one overall variable, the industrial confidence indicator.

For more details on real-time macroeconomic data see, for example, Croushore and Stark (2000).

Thus, \(N^x=196\) for the euro area, \(N^x=194\) for Germany, \(N^x=186\) for France, \(N^x=190\) for the UK, and \(N^x=199\) for Austria.

Note that the forecast tends to the unconditional mean as the forecast horizon tends to infinity.

Less diversity among the financial uncertainty indices is mainly due to the fact that a lot of financial variables are identical over all countries except the UK, as they are related to the euro area, e.g., money market interest rates and exchange rates.

The descriptive statistics for the euro area and all countries under consideration can be obtained upon request.

To simplify notation we drop the country index from Eq. (11).

In 2021 the DAX 30 was redesigned to include 40 stocks and is now called DAX 40.

We use total financial uncertainty and total macro uncertainty, see https://www.sydneyludvigson.com/macro-and-financial-uncertainty-indexes.

In most cases the lag length was one, i.e., \({\hat{p}}=1\). Hence we proceeded with a lag of one for all models, also due to the curse of dimensionality.

The first vector has one as the first component and zeros elsewhere and the second vector has one as the second component and zeros elsewhere.

However, with larger models some of the results seem to become unstable. This would also be the case if we included all financial and economic (global and local) uncertainty indices in one large model.

For the impulse response analysis and the forecasting analysis we use EViews 13.

We thank an anonymous referee for the idea to include a global uncertainty indicator to get a better picture of the influence of global and/or local uncertainty.

As all forecasted variables are integrated of order one, we apply the AR(1) model on log differences of the underlying variable.

Note that in case when only one uncertainty index is included, or the CISS (see cases (iii)–(v)) the number of stationary variables in (11) reduces to one and number of cointegrating vectors reduces to two, i.e., \({\hat{r}}=2\), where the first cointegrating vector is the first canonical basis vector.

In this case all variables in (11) are integrated of order one and \({\hat{r}}=1\).

The model with the lowest RMSE over the total period, the random walk, performs much worse than any of the three models during the global financial crisis.

The only exception for the UK is the largest DV for a forecast horizon of twelve months, which is achieved by the random walk model.

Thus, whether including global uncertainty improves the forecast performance.

For Germany this applies only for a forecast horizon of one month.

For Austria this is also true when considering the RMSE, for a one-month forecast horizon. This is the only case when we find a significant result for a loss measure.

Two variables of the survey data, employment expectations, are not available for the euro area because the data only start later than January 2000. These are the series related to the industries beverages and wood.

References

Bachmann R, Steffen E, Sims ER (2013) Uncertainty and economic activity: evidence from business survey data. Am Econ J Macroecon 5:217–249

Bai J, Ng S (2002) Determining the number of factors in approximate factor models. Econometrica 70:191–221

Bai J, Ng S (2006) Confidence intervals for diffusion index forecasts and inference for factor-augmented regressions. Econometrica 74:1133–1150

Bai J, Ng S (2008) Forecasting economic time series using targeted predictors. J Econom 146:304–317

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Quart J Econ 131:1593–1636

Basu S, Bundick B (2017) Uncertainty shocks in a model of effective demand. NBER working paper No. 18420

Berger T, Grabert S, Kempa B (2016) Global and country-specific output growth uncertainty and macroeconomic performance. Oxford Bull Econ Stat 78:694–716

Bijapur M (2021) Granular uncertainty shocks. SSRN working paper

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77:623–685

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28:153–175

Bomberger WA (1996) Disagreement as a measure of uncertainty. J Money Credit Bank 28:381–392

Böck M, Feldkircher M, Raunig B (2021) A view from outside: Sovereign CDS volatility as an indicator of economic uncertainty. OeNB WP No. 233

Caggiano G, Castelnuovo E, Groshenny N (2014) Uncertainty shocks and unemployment dynamics: an analysis of post-WWII US recessions. J Monet Econ 67:78–92

Carriero A, Clark TE, Marcellino M (2018) Measuring uncertainty and its impact on the economy. Rev Econ Stat 100:799–815

Chuliá H, Guillén M, Uribe JM (2017) Measuring uncertainty in the stock market. Int Rev Econ Financ 48:18–33

Croushore D, Stark T (2000) A funny thing happened on the way to the data bank: A real-time data set for macroeconomists. Federal Reserve Bank of Philadelphia Business Review

Diebold FX, Mariano RS (1995) Comparing predictive accuracy. J Bus Econ Stat 13:253–263

Fortin I, Hlouskova J, Sögner L (2021) Financial instability and economic activity. IHS working paper No. 36

Gilchrist S, Sim JW, Zakrajsek E (2014) Uncertainty, financial frictions, and investment dynamics. NBER WP No. 20038

Holló D, Kremer M, Lo Duca M (2012) CISS – A composite indicator of systemic stress in the financial system. European Central Bank Working Paper No. 1426

International Monetary Fund (2002) Financial soundness indicators: Analytical aspects and country practices. Occasional paper 212

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev 105:1177–1216

Kastner G (2016) Dealing with stochastic volatility in time series using the R package stochvol. J Stat Softw 69:1–30

Kastner G, Frühwirth-Schnatter S (2014) Ancillarity-sufficiency interweaving strategy (ASIS) for boosting MCMC estimation of stochastic volatility models. Comput Stat Data Anal 76:408–423

Ludvigson SC, Ma S, Ng S (2021) Uncertainty and business cycles: Exogenous impulse or endogenous response? Am Econ J 13:369–410

Ludvigson SC, Ng S (2007) The empirical risk-return relation: a factor analysis approach. J Financ Econ 83:171–222

Ludvigson SC, Ng S (2009) Macro factors in bond risk premia. Rev Financ Stud 22:5027–5067

Lütkepohl H (2005) New introduction to multiple time series analysis. Springer-Verlag, Berlin, Heidelberg

McLachlan GJ, Krishnan T (2008) The EM algorithm and extensions, 2nd edn. Wiley Series in Probability and Statistics. Wiley, New York

Pietrzak M (2021) Can financial soundness indicators help predict financial sector distress? IMF Working Paper WP/21/197

Rossi B, Sekhposyan T (2015) Macroeconomic uncertainty indices based on nowcast and forecast error distributions. Am Econ Rev 105:650–655

Seong B, Ahn SK, Zadrozny PA (2013) Estimation of vector error correction models with mixed-frequency data. J Time Ser Anal 34:194–205

Shumway RH, Stoffer DS (1982) An approach to time series smoothing and forecoasting using the EM algorithm. J Time Ser Anal 3:253–264

Scotti C (2016) Surprise and uncertainty indexes: Real-time aggregation of real activity macro surprises. J Monet Econ 82:1–19

Stock JH, Watson MW (2006) Forecasting with many predictors. In: Pesaran HM, Weale M (eds) Handbook of forecasting. Elsevier, Amsterdam, pp 515–554

Zarnowitz V, Lambros LA (1987) Consensus and uncertainty in economic prediction. J Polit Econ 95:591–621

Funding

Open access funding provided by Institute for Advanced Studies Vienna. This study was funded by Oesterreichische Nationalbank (OeNB) under Anniversary Grant No. 18115.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Human and animal rights

This study did not involve any experiments with humans or animals.

Additional information

Responsible Editor: Harald Oberhofer.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors would like to thank Robert Kunst, participants of the 15th International Conference on Computational and Financial Econometrics and two anonymous referees for helpful comments and suggestions. The authors gratefully acknowledge financial support from Oesterreichische Nationalbank under Anniversary Grant No. 18115.

Appendices

Appendix A: Financial and macroeconomic data

In the following, we provide details on the financial and macroeonomic data for the euro area and the corresponding transformations, which we use for computing the financial and economic uncertainty indices. Similar data and transformations are used for Germany, France, the United Kingdom and Austria. The data are available either at monthly frequencies or at daily frequencies, where daily are transformed to monthly frequencies by taking monthly averages. The employment data for the euro area and France are only available at a quarterly frequency. We construct monthly data from these quarterly series by estimating the missing values, following Shumway and Stoffer (1982) and Seong et al. (2013). A formal description is provided in the appendix of a prior version of this article, see Fortin et al. (2021). We consider 74 financial variables and 122 macroeconomic variables for the euro area. For Germany we use 74/120 financial/macroeconomic variables, for France 72/114, for the United Kingdom 76/114, and for Austria 77/122.

In order to ensure stationarity we perform various transformations. With respect to the financial data, we compute first differences (first diff) for interest rates, and spreads, i.e., differences (diff), for rates/yields. We calculate returns for stock/bond indices and foreign exchange rates in two ways: first we calculate returns of a month with respect to the previous month and annualize the results (monthly returns, m/m-1 (a)), second we calculate returns of a month with respect to the previous year (yearly returns, m/m-12). Finally we compute volatilities, namely stochastic volatilities (stoch vola), for the monthly returns of stock/bond indices and foreign exchange rates. We transform the macroeconomic data by taking yearly growth rates (m/m-12), the survey data are given in balances (difference between positive and negative answering options, measured as percentage points of total answers) and are not transformed.

The macroeconomic data include eight questions from the industry survey data collected by the DG ECFIN, for twelve different industries; hence, in total, 96 variables.Footnote 30 The industries are beverages, wood (wood and wood and cork products except furniture, straw and plaiting materials), paper (paper and paper products), printing (printing and reproduction of recorded media), chemicals (chemicals and chemical products), rubber (rubber and plastics products), other minerals (other non-metallic mineral products), basic materials, fabricated metals (fabricated metal products except machinery and equipment), machinery (machinery and equipment N.E.C.), motor vehicles (motor vehicles, trailers and semi-trailers), and other manufacturing. The questions relate to the industrial confidence indicator, the production trend observed in recent months, order books, export order books, stocks of finished products, production expectations, selling price expectations, and employment expectations. The data used for calculating financial uncertainty indices are monthly and range from January 2000 to December 2020, i.e., 252 observations per variable.

Tables 3 and 4 list the financial and macroeconomic variables used for constructing the financial and economic uncertainty indices for the euro area. Similar data are used for Germany, France, the United Kingdom and Austria. Table 2 lists the abbreviations used in Tables 3 and 4.

When we compute the macroeconomic uncertainty indicator for the euro area the following financial variables are grouped with the macroeconomic variables, not with the financial variables: Euribor, 3 m; Euribor, 6 m; Euribor, 12 m; Government bond yield, EA, 5–7y; Government bond yield, EA, 7–10y; Government bond yield, EA, > 10y; Euro Stoxx index, m/m-1 (a); Euro Stoxx dividend yield; Euro Stoxx price earnings ratio; growth rates, m/m-1 (a), of USD/EUR, JPY/EUR, CHF/EUR, and GBP/EUR.

The variable bank loans to non-financial corporations is created by summing the three variables bank loans to non-financial corporations < 1 year (EMEBMC0.A), bank loans to non-financial corporations 1–4 years (EMEBMC1.A), and bank loans to non-financial corporations > 4 years (EMEBMC5.A), and then computing growth rates. Two variables of the survey data relating to employment expectations are not available for the euro area because the data only start later than January 2000. These are the series related to beverages (EK11.7.BQ) and wood (EK16.7.BQ).

Appendix B: Empirical results

1.1 Impulse response analysis

In the following, we present graphs showing the impulse response functions for Germany, France, the United Kingdom and Austria. We present the responses of local industrial production, employment and the stock market to one standard deviation shocks in (i) the local and global financial uncertainty indices, and (ii) the local and global economic uncertainty indices (Figs. 6, 7, 8, 9).

Impulse responses of industrial production, employment and the DAX 30 to a one standard deviation shock of financial uncertainty (first block) and of economic uncertainty (second block) for Germany and \(h=1\), with 95% confidence intervals. In each block the first row shows the effect of German (financial/economic) uncertainty, the second row shows the effect of global (financial/economic) uncertainty

Impulse responses of industrial production, employment and the CAC 40 to a one standard deviation shock of financial uncertainty (first block) and of economic uncertainty (second block) for France and \(h=1\), with 95% confidence intervals. In each block the first row shows the effect of French (financial/economic) uncertainty, the second row shows the effect of global (financial/economic) uncertainty

Impulse responses of industrial production, employment and the FTSE 100 to a one standard deviation shock of financial uncertainty (first block) and of economic uncertainty (second block) for the United Kingdom and \(h=1\), with 95% confidence intervals. In each block the first row shows the effect of UK (financial/economic) uncertainty, the second row shows the effect of global (financial/economic) uncertainty

Impulse responses of industrial production, employment and the ATX to a one standard deviation shock of financial uncertainty (first block) and of economic uncertainty (second block) for Austria and \(h=1\), with 95% confidence intervals. In each block the first row shows the effect of Austrian (financial/economic) uncertainty, the second row shows the effect of global (financial/economic) uncertainty

1.2 Forecasting analysis

In the following, we present forecast performance measures for Germany, France, the UK and Austria, when forecasting industrial production, employment and the stock market (Tables 5, 6, 7 and 8).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fortin, I., Hlouskova, J. & Sögner, L. Financial and economic uncertainties and their effects on the economy. Empirica 50, 481–521 (2023). https://doi.org/10.1007/s10663-023-09570-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-023-09570-3