Abstract

In this paper, a new measure for uncertainty that affects the economy is proposed, constructed, and applied to an emerging economy, Türkiye. We have constructed an index of economic country-specific uncertainty (ECSU) that is in line with the methodology used in constructing economic policy uncertainty indexes. As the economic uncertainty is of the Knightian type, the essence of measuring it lies in counting the frequency of joint appearances of words related to economics and uncertainty in Turkish-language newspapers. The uncertainty index constructed using local language sources- Turkish performs significantly better in measuring country-specific uncertainty in Türkiye. However, some indexes use English language sources to measure uncertainty in Türkiye- did not make them country-specific. The ECSU was tested by evaluating the dynamic real effects of the uncertainty. This evaluation was performed by the analysis of impulse responses from uncertainty to some economic variables in a vector autoregressive model describing the economy of Türkiye. We find that an unexpected increase in uncertainty in the Turkish-language press is related to decreases in industrial production, employment, and trade. If the uncertainty measure is based on the articles from the English-language press only, no such relationship can be confirmed. We also find that an increase in uncertainty leads to increase in inflation and stock and oil prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction: why measure uncertainty

Earlier version of this paper is presented in the seminar ‘Geopolitical Uncertainty and Its Macroeconomic Effects: The Case of Turkey’, which was held on January 16, 2017, at Vistula University (AFiBV) in Warsaw, Poland. To our knowledge, it was, at that time, the first countryspecific (Turkish Language) uncertainty index. I secondly presented in the Bamberg Research Group on Behavioral Macroeconomics (BaGBeM) Brownbag Seminar to the research group of Prof. Dr. Christian R. Proaño at Otto-Friedrich-University of Bamberg in Germany. The presentation with the title ‘Macroeconomic Uncertainty: Introduction to the problem and literature’ took place on April 13, 2018. I thirdly presented in the workshop ‘Measuring Economic Policy Uncertainty in Turkey’ to the research group of Prof. Dr. Peter Winker at the Justus-Liebig University of Giessen in Germany on February 6, 2019. I fourthly presented ‘Geopolitical Uncertainty and its Macroeconomic Effects on the Economic Performance of Germany’ at the Academics in Solidarity (AiS) Network Conference and Skills Workshop on 30-31 October 2019 at Cologne University in Germany. I finally presented at the Academics in Solidarity (AiS) Network Conference: ‘Regaining Lost Knowledge-Connecting Research at Home and in Exile’ at Berlin Freie University on 21-22 November 2019 in Germany.

The concept of uncertainty is potentially ubiquitous. It is of concern to analysts, consumers, economists, financial investors, and politicians. Uncertainty in macroeconomics has been measured by the distribution of discrepancies between a group of professional economic forecasters or forecast errors or computing either the conditional volatility of some macroeconomic variables, or by coding an algorithm with advanced artificial intelligence techniques to search keywords related to uncertainty in natural language processing (NLP). While conditional volatility is represented by the standard deviation or variance or mean of the variable given, uncertainty, which is immeasurable in advance, is not the same as what the volatility is or what it measures. Given this, volatility and uncertainty completely measure different phenomena. The problem is they were confusingly employed instead of one another in the literature of empirical economics. To clarify the obvious difference between them, we decided to analyse their relationship in the recent history of macroeconomics.

In the post global financial crisis (GFC) era, the economic development of the European and US economies has seen quite little volatility, understood in the conventional sense of variation over time in the main macroeconomic indicators like inflation, industrial production, exchange rates, unemployment rates, and so forth (see e.g. Fig. 9 in Appendix). However, at the same time, there has been a substantial increase in uncertainty caused by various economic, financial, and geopolitical shocks. This meant the GFC, the Eurozone crisis, the Syrian crisis, the Brexit vote, the refugee crisis, the election of Trump, terrorist attacks, the Coronavirus (COVID-19) pandemic, the oil price war crisis, and recently Russia-Ukraine war.

The problem we observed in the literature is many economists have analysed the concept of uncertainty using indirect proxies that contain the variation of main macroeconomic indicators, and these indicators have been indicating evidently more moderate volatility since the GFC until 2020s (see e.g. a number of papersFootnote 2). At the same time, economic uncertainty increased substantially. More precisely, the volatility in inflation and output was long used to measure uncertainty before the GFC (see e.g. a number of papersFootnote 3), but they do not seem the optimal measures as less volatile macroeconomic indicators could not be the best measure of uncertainty anymore (Jurado et al. 2015; Bloom 2014; Baker and Bloom 2013).

All these issues lead us to that there has been a need to develop methods of measuring this uncertainty that is unobservable at the macroeconomic scale. We understood that uncertainty should be measured in a different way than volatility (conditional variances of a given variable like output or exchange rate or stock price or inflation).

We aim to fill this gap by introducing a pioneer approach in measuring uncertainty. In this paper, we constructed a new economic country-specific uncertainty (ECSU) index for Türkiye by following the methodology of Baker et al. (2016). We then compare it with the TUI index by Ahir et al. (2022). Specifically, the TUI has a single source of specific event coverage in English from January 2008 onwards. It measures economic uncertainty using text search methods of counting the frequency of words ‘uncertain’, ‘uncertainty’, and ‘uncertainties’ in the 172 EIU country reports related to the economy alone. However, the ECSU index has multiple sources in Turkish as using eight major newspapers in Türkiye since January 2006. For the ECSU, we screened just about one and a half million articles. It also consists of some augmented term sets, meaning 30 keywords for economy descriptor and 94 keywords for uncertainty descriptor. So, all descriptors were expanded with several keywords, relevant for cultural and linguistic understanding to make our uncertainty indexes country-specific. So, as in Ghirelli et al. (2019), we expanded some relevant features of the TUI, namely: (i) we use a multiple source of eight national language newspapers; (ii) we increase the total number of keywords from 3 to 124; (iii) we run a longer sample period from January 2006 onwards; (iv) we count a number of articles (about 1.5 million articles) of newspapers rather than country reports (172 EIU country reports); and (v) we estimate the real macroeconomic effects of uncertainty shocks. More precisely, the ECSU accurately estimates the effect of uncertainty on the economy in Türkiye, proving that an unexpected increase in uncertainty can cause permanent declines in industrial production, employment, and trade and generate persistent increases in the stock and oil prices in Türkiye. However, this result may not appear when uncertainty is measured by English sources (e.g. by the index from the EIU). It has also been found that an increase in uncertainty, measured using Turkish press sources, leads to an increase in inflation and vice versa.

The methodology of the index we created is different and concentrates on discussing the three points as follows: (i) there is heavy censorship or another type of control on the local media, which might cause bias in reporting. For instance, information about economic uncertainty might be suppressed for political reasons. An extreme example might be North Korea; should we believe their press, there is never economic uncertainties or similar phenomena. In such a case, English language indexes might be more accurate; (ii) there are linguistic or sociological particularities that may cause using some words related to uncertainty, might be used much more rarely (or more frequently) in one language than in the other. For example, reporting football matches in some countries seems like reporting from a battlefield, while in other countries, reports from the same game might be toned down, and sounded like a real game; and (iii) in resource-dependent economies (e.g. oil-exporting), the main source of economic uncertainty is turbulences in the world markets. Such information is sometimes more accurate and precise in the English-language press than in the local-language press. We argue that the three arguments mentioned above might not be valid for Türkiye’s case. Our contribution brings a different angle to the literature; maybe it is better to question indexes like the economic uncertainty generated for countries, where their native language differs from English, while press in the local language in those countries is strong enough.

The further structure of this article is as follows. Next, we discuss literature, data, and empirical findings. Section 3 expresses constructing our forward-looking economic uncertainty index in detail. Section 4 discusses the negative correlation between the uncertainty indexes. Section 5 describes the testing of the hypotheses for Türkiye. In this section, we have estimated by fitting stationary six-equation bivariate vector autoregressive models. Section 6 is a robustness check of the estimated impact of economic uncertainty on the economic activity. It means we compared the empirical results from estimations from English and Turkish language-based measures of economic uncertainty for Türkiye. Given this, we estimated a multiple-variable-vector autoregressive model to see the robustness of each uncertainty measure constructed for Türkiye separately. Section 7 provides the concluding remarks. Section 8 contains appendixes. Section 9 is a list of the references.

2 Related literature on the concept: measuring uncertainty

The seed of the new measure comes from the concept of macroeconomic uncertainty, as distinct from risk, which can be traced back to Knight (1921). In this pioneering publication, Knight stated that uncertainty, unlike risk, is not directly measurable ex-post.Footnote 4 The concept of Knightian uncertainty is a macroeconomic aggregate. It cannot be regarded as being directly measurable ex-post, as its ‘realisations’ are not known. However, ex-anteFootnote 5 proxies can be proposed for it to reflect the general change in sentiment in the climate in which economic decisions are taken. According to Knight (1921), non-Knightian uncertainty should be called risk like a known probability distribution.

More intensively, we categorised ‘economic uncertainty’ into two types: (1) non-Knightian uncertainty or realised risk or bias or parametric uncertainty and (2) Knightian uncertainty. Risk, which is non-Knightian uncertainty, consists of being measured (i) uncertainty from forecaster disagreements and experts’ assessments, (ii) uncertainty from forecast errors, (iii) the combined measures of uncertainty: i and ii, and (iv) distributions of uncertainty: different approaches. However, Knightian uncertainty can be represented by (i) the Jurado-Ludvigson-Ng approach, (ii) the media-based measures like Economic Policy Uncertainty (EPU) and Geopolitical Risk (GPR) Indexes, (iii) internet-search index, and (iv) other measures of Knightian uncertainty: VIX and sentiment indexes.

2.1 Measuring risk (non-Knightian uncertainty)

-

(i)

Uncertainty caused by disagreements and by experts’ assessments means that the common approximation for the extent of uncertainty could be represented by several measures of the distribution of discrepancy among professional forecasters who make their individual uncertainty judgments about particular macroeconomic indicators like inflation and exchange rates or the unemployment rate in the survey (see e.g. a number of papersFootnote 6). They mainly argued a substantial problem with this concept in which economists have long concentrated on discrepancy-related uncertainty measures, but clearly disagreed on whether disagreement is a good or reliable proxy for uncertainty. Patton and Timmermann (2010) worked only on a disagreement between the professional forecasters but did not concentrate on the relationship between disagreement and uncertainty. Another problem is related to combining point forecasts of economic and financial variables (see e.g. Diebold et al. 1999; Clements and Harvey 2011; Clements 2013, 2014; Lahiri et al. 2015, and so on).

There are some papers that address another crucial problem of uncertainty and the participation in the European Central Bank’s Survey of Professional Forecasters are those by López-Pérez (2015, 2016b), who claims that higher uncertainty decreases the participation in the survey about macroeconomic expectations. We would like to draw attention to the density forecast of the participants (López-Pérez 2016a) in the following surveys such as the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters (the SPF), the European Central Bank’s Survey of Professional Forecasters (ECB’s SPF) and the Bank of England’s Survey of External Forecasters. In these surveys, the panel of professional forecasters varies from one survey to the next. This might cause a misleading evaluation of the measure of uncertainty over time. With this in mind, such surveys might be variously biased politically, economically, financially, demographically, and so on (Souleless 2004; Makarova 2014).

-

(ii)

Uncertainty from forecast errors is to estimate the probabilities for inflation forecasts in essence. Dowd, (2007) developed a conceptually simple method for showing inflation forecasts in future as an inflation-fan chart. It is generally used to visualise uncertainty in the forecast of macroeconomic variables. It was developed to show uncertainty-related forecast errors one to three years ahead. The limitations of the fan chart that are levels of ‘economic uncertainty’ were indicated in the horizon.

Clements and Hendry (2001) approximate a historical perspective on forecast errors in UK output. Clements, (2004) concentrated on the forecast errors in the forecast performance of the Monetary Policy Committee (MPC). Elder et al. (2005) claimed that the fan charts are a good guide for the uncertainty and risk that monetary policy committee of central banks face and they assessed these fan chart projections. Clements (2013, 2014) was the first to compare the ex-post-realised- and ex-ante uncertainties in literature. Meanwhile, the concept of inflation forecast uncertainty was first estimated by measuring as in either the ex-ante or the ex-post sense, meaning that the relationship between the histogram measures-based ex-ante forecast uncertainty and the realised risk as ex-post uncertainty was investigated.

Charemza et al. (2014) proposed a new weighed skew normal (WSN) distribution in which the parameters reflect comments about targeted monetary policy actions. Charemza et al. (2017) argue more strongly that inflation forecast errors are able to give us much more intuition for the state of the economy than the other works do. The statistical distribution of ex-post uncertainty is not, in fact, affected only by monetary policy. However, there are a number of factors that might be economic or non-economic, such as geopolitical, financial, political bias, and other factors. These factors can have an effect on the distribution.

Imperfect knowledge holds a crucial role in identifying the inflation forecast and targeting. Inflation targeting has some advantages, like the ex-post measurement of monetary policy performance (Svensson 1997; Eusepi and Preston 2018).

-

(iii)

Combined measures of uncertainty consist of the previous two concepts (i) uncertainty from the disagreement between forecasters and expert assessments and (ii) uncertainty from forecast errors to construct probabilistic forecasts by economic forecasters.

In this respect, there are several papers, for instance, Makarova, (2014) concentrated on several central banks, including those of Canada, Chile, Czechia, Hungary, and Sweden, and the European Central Bank. They applied the measures, and there are some papersFootnote 7 on this concept: the combined measures of uncertainty. Lahiri et al. (2015), Patton and Timmermann (2011), Lahiri and Sheng (2010), Söderlind (2009), Ang et al. (2007) also applied in the combined measure of ex-ante and ex-post uncertainty.

-

(iv)

An important approach, which is uncertainty by distribution: different approaches, is the distribution of ex-post forecast errors, but which is not clearly supported by economic theory. However, it is popular among experts, particularly central bankers (Makarova 2014). For example, a distribution-related measure of uncertainty is the variance of distribution of the ex-post forecast errors. Clements, (2002, 2004, 2008, 2013, 2014), Clements and Harvey (2011), Jordà et al. (2013), Charemza et al. (2014, 2015), Knüppel (2009, 2018) have also applied such different approaches to measure uncertainty from distributions.

In this study, we analyse a substantial problem in which something appears to be confusingly mixed into the uncertainty and volatility by explaining their relations with autoregressive conditional heteroskedastic volatility (ARCH/GARCH). This was the common method of measuring uncertainty used by earlier studies. Such papers were fully concentrated on GARCH components, such as the conditional variance and mean of the variable to quantify the uncertainty (see e.g. a number of papersFootnote 8).

The conditional volatility which is derived from the ARCH or GARCH process is not able to control uncertainty phenomenon in the literature properly. The various non-Knightian measures on uncertainty revealed that many economic and financial time series involve conditional volatility or variance, which changes over time. When there are frequently large changes, then there are highly volatile periods, but when there are frequently rather smaller changes, then there are periods with low volatility. In essence, the unconditional variance is constant, and the conditional variance is only changing in the ARCH/GARCH processes. This means it is not very good to measure the changing uncertainty over time.

In other words, we do not regard the GARCH approach as appropriate for the uncertainty modelling, due to the imposed assumption of the constant (unconditional) variance which, in the case of the uncertainty modelling, is not realistic. Meanwhile, the ARCH/GARCH is a historical, or lagged, backward-looking measure of the variance function, but uncertainty is forward-looking with the vector autoregressive (VAR) model. Volatility and uncertainty are two different matters in economics, and it is wiser if they are not used instead of one another. So, these days actual uncertainty is much bigger in magnitude than it is measured. Unfortunately, uncertainty is still not being measured properly despite the recent technological developments.

2.2 Measuring Knightian uncertainty: general problems

Knightian uncertainty is, by definition, not measurable. However, the substantial change in macroeconomic volatility after 2008 in a Knightian way has called for a measure to be developed that can reflect aggregate changes in macroeconomic sentiment that result mainly from changing geopolitical factors rather than from economic ones. One of the main problems of constructing a Knightian index is related to any verifying ex-post variables.

The other main problem related to further expanding the idea of using the media has not yet been researched fully, and this is the issue that uncertainty measures are based on English language sources. If national language sources are not considered to construct an uncertainty index for the country, the fact that using English language sources alone might cause bias and fail to identify some issues has been documented by Öztürk and Sheng (2018), Huang and Luk (2020), and Kılıç (2021).

-

(i)

The Jurado-Ludvigson-Ng approach: Macroeconomic uncertainty has been defined by Jurado et al. (2013, 2015) as ‘the conditional volatility of a disturbance that is unforecastable from the perspective of economic agents’. In the terminology proposed in this paper, the difference between Knightian and non-Knightian uncertainty is that the latter might be observable ex-post through inflation or economic growth or unemployment expectations, as statistical data for these indicators are available.

-

(ii)

The media-based measures: The first attempt to construct a such type of measures appeared in the paper of Baker et al. (2013), which is based on the articles of the English language press. The idea of stating Knightian uncertainty by counting the frequency of uncertainty-related keywords in newspapers was introduced by constructing the Economic Policy Uncertainty (EPU) Index. The essence of measuring the country-specific uncertainty lies in counting the frequency of joint appearances of words related to uncertainty, policy, and economy in national or local-language newspapers. The seminal paper in this respect is that of Baker et al. (2016) introducing the EPU Index. Due to its easy availability and transparency, it has already led to a substantial number of follow-on papers. Since the first EPU index was based on English-language media sources, the further interest in the EPU followers has advanced in constructing similar indexes for different countries. There are two ways to measure and evaluate uncertainty for non-English speaking countries. The first is to translate the descriptors defined by the English language into a local or national language and search for articles published in that language. This has been using in the EPU and among others. The second one is to tally the descriptors in English-language newspapers for articles concerning a country. EPU indexes were constructed for a number of countries using digital searches of the local language newspapers. The news-based EPU index considers the number of articles that include following descriptors like ‘economy’, ‘policy’, and ‘uncertainty’ in ten major US newspapers from 1985. This index is updated every day and is available with all features at (www.policyuncertainty.com).

The idea of expressing Knightian uncertainty by counting the frequency of uncertainty-related phrases in newspapers and on the internet quickly found followers. The most relevant development seems to be the monthly geopolitical risk (GPR) index created by Caldara and Iacoviello (2016, 2018, 2022), which is based on the results of internet search of eights principal terms pertaining geopolitical factors. The GPR index has been constructed using English sources for a number of advanced and developing countries, including Türkiye.

There is a new uncertainty index by Ahir et al. (2018, 2022) that has been constructed using English sources of the quarterly Economist Intelligence Unit (EIU) country reports for advanced and emerging market economies from 1952 onwards. The EIU report discusses the main economic, financial, and political trends in the country it covers, and the resulting World Uncertainty Index (WUI) covers 143 countries, including Türkiye. There is also a monthly dataset for 71 countries from January 2008 onwards. In short, the WUI index consists of economic uncertainty indexes of various countries selected.

Altig et al. (2020) analysed several forward-looking indicators of economic uncertainty for the US and UK before and during the COVID-19 pandemic. These indicators are stock market volatility, newspaper-based uncertainty measures, twitter-based economic uncertainty, subjective measures of uncertainty computed from the survey of business uncertainty (SBU) about future business growth, and disagreement among professional forecasters about future GDP growth.

With these uncertainty indexes in mind, there are also some seminal papers (see e.g. Alexopoulos and Cohen (2009), Haddow et al. (2013), Ferreira et al. (2019), and Pan et al. (2022)), to measure ‘economic uncertainty’. Such papers counted following term sets ‘economy and its variant’ and ‘uncertainty and its variant’ to construct uncertainty index. Given that, we also applied the same term sets for our uncertainty index to Türkiye.

-

(iii)

Internet-search index: Eckley (2015) concentrated on the Knightian uncertainty phenomenon of news and media data to measure aggregate economic uncertainty using textual data from two million Financial Times articles contain terms like ‘uncertainty and its synonyms’ as key phrases. Another internet-search index was developed using Google Trend (GT), where several keywords on uncertainty were counted by Bontempi et al. (2016), who methodologically combined several components, like the news-based measure from internet searches, the CBOE volatility index-VIX, the corporate bond spreads, the forecast-based future macroeconomic indexes, and the disagreement between professional forecasters.

-

(iv)

Other measures of Knightian uncertainty: VIX and sentiment indexes: A sort of visualisation of the volatility in the index has been created by the Chicago Board Options Exchange (CBOE) and is called VIX. This is one of the most popular measures of volatility, and the current VIX concept indicates a theoretical expectation of stock market volatility in the near future, so the VIX index calculates the value for expected annualised change in the S&P 500 index over the next 30 days computed from options-based theory and current options-market data.

The formulation and financial instruments of a volatility index were first developed in an academic paper by Brenner and Galai (1986), who called their volatility index the Sigma Index, which has been regularly updated and used as the underlying asset for futures and options.

Mankiw et al. (2003) also found a discrepancy between economic agents in their expectations for future inflation by using various survey data from different sources like the Michigan Survey, the Livingston Survey, and the Survey of Professional forecasters (SPF). The Livingston and the SPF include several experts who are central bank economists and professional forecasters in the industry. The discrepancy dispersion represented by The Michigan Consumer Sentiment Index of the University of Michigan is a survey of individual consumer confidence that depicts whether consumers are willing to spend money on economic activity. These indexes aim to represent volatility in relation to developments in uncertainty within the horizon.

Consequently, we constructed an economic uncertainty index for Türkiye to confirm empirically the main theoretical hypotheses that link uncertainty to economics, these being (i) the Bloom (2014) hypothesis about the countercyclical nature of Knightian uncertainty; (ii) the Friedman–Ball hypothesis (Ball 1992; Friedman 1977) that positive causality goes from inflation to uncertainty; and (iii) the Cukierman–Meltzer hypothesis Cukierman and Meltzer (1986) that the causality is from uncertainty to inflation. For a non-English speaking country, a properly constructed measure of this type should be based on media sources in the local language and in national circulation, such as electronically available newspapers, rather than on the English-language media. We verify these hypotheses for the case of Türkiye.

3 Construction of the economic country-specific uncertainty (ECSU) index for Türkiye

The main methodological problem with constructing a Knightian index of economic uncertainty is that it cannot be verified ex-post. The ex-ante measures can be based on either an evaluation of disagreements about the future or the count of explicit evaluations or assessments of uncertainty by experts or by the media. We apply the latter approach in our work. More specifically, a text mining based Knightian uncertainty index that applies machine learning was developed to analyse uncertainty in the Turkish economy.

We aim to construct a monthly uncertainty-related index for Türkiye, producing the economic country-specific uncertainty (abbreviated ECSU further on) index by following the methodology of Baker et al. (2016). The ECSU was constructed to measure the uncertainty phenomenon by focusing on the Turkish economy only. This might have a considerable effect on the economy and finance, that is why we tried to measure economic uncertainty in its country specific Knightian essence. Furthermore, the ECSU index aims to measure economic uncertainty around macroeconomic developments, so it represents important developments in the economy. The uncertainty phenomenon captured by this index is successfully perceived by the Turkish press and covers the relationships between domestic and foreign interests.

To achieve this, we accessed the digital archives of six leading newspapers, namely Cumhuriyet, Dünya, Hürriyet, Milliyet, Sabah, and Zaman, to obtain the sets of terms for the horizon between January 2006 and December 2016 from the Turkish media. Since the publication of Zaman was closed down by government forces in the middle of July 2016, we replaced Zaman with Habertürk from 28 July 2016 to 31 December 2016. For the horizon between January 2017 and April 2022, we accessed the digital archives of six leading Turkish newspapers, say Cumhuriyet, Dünya, Hürriyet, Milliyet, Sabah, and Sözcü. Consequently, we constructed the index by counting the terms used each day in these newspapers,Footnote 9 looking at how many newspaper articles contain the keywords from the descriptors below.

Each descriptor consists of a set of search terms. The selected term sets are essentially the descriptors for the index. When the economic country-specific uncertainty index in Turkish was constructed, two basic descriptors were used. These are:

-

a.

Descriptor {Economy}

To construct an uncertainty index, we use 30 language-specific keywords which directly relate to the ‘economy and its synonyms’. In considering the Turkish media or press and the language, we sought such terms as economic, economics, supply, demand, GDP, GDP per capita, inflation, growth, employment, commerce, commercial, labour force, industry, and so on.

-

b.

Descriptor {Uncertainty}

Uncertainty is shown by words like a slowdown, indeterminateness, collapse, risk, shock, crisis, fluctuation, questionable, unclear, balloon, stagnation, insure, expectation, ambiguity, and so forth in both the Turkish language and the jargon of the media and press in Türkiye. Equally, ‘uncertainty’ was recorded as a crisis, risk, unclear, vagueness, shock, stagnation, fluctuation, and so on in the Turkish media.

Thus, we extend the ‘uncertainty’ descriptor to 94 uncertainty-related keywords in the language and the media and press. If we only used the Turkish words meaning ‘uncertain’ or ‘uncertainty’ or ‘uncertainties’, our measure might reflect superficial inference due to the language feature. However, it is possible to obtain quite substantial results for the country-specific perspective of various word structures in the Turkish language and culture.

The uncertainty index we created, aims to capture the timing and intensity of macroeconomic uncertainty in the Turkish economy. This index has been obtained by counting some terms in major daily newspapers in Türkiye from January 2006 to April 2022. We counted the terms in the descriptors of {economy} and {uncertainty} for the ECSU index. The primary purpose of this is to cover the uncertainty caused by policymakers and the methods they use. One descriptor we excluded is {policy} for Türkiye because there are two reasons: (1) we avoid the potential effects of political censorship and its simple bias for our measurement, and (2) the word ‘policy’ is more in touch with politics rather than economic policies in the Turkish language. When one says the policy, he/she means mostly political issues rather than economic policy.

The Turkish language comes from a family of languages where there can be possible variations in word meanings so that some words might indicate uncertainty indirectly with various affixes. Another problem is the jargon of the media and newspapers, where a journalist can give several important messages that are culture and language-specific. All these factors are crucial for determining a proper term set for the measure of uncertainty in Turkish. In this case, language-specific ‘uncertainty’ terms are applied in this descriptor particularly.

We assert that the newspaper-based uncertainty indexes constructed in the way discussed above may not fully measure the substantial increase in uncertainty during the pandemic. To quantify uncertainty related to the coronavirus crisis, we expand ‘uncertainty’ descriptors to cover words describing the pandemic. Thus, we added some selected terms in our algorithm to estimate to what extent the last developments in uncertainty affected the economy for the horizon after the 1st of January 2020. The termsFootnote 10 are covid-19, corona, coronavirus, pandemic, and epidemic as similar to that of Charemza et al. (2022), Ahir et al. (2022), and an extent of Baker et al. (2020). Consequently, such terms are a distinctive feature of our uncertainty index (the ECSU) than those indexes constructed under the methodology of the newspaper-based uncertainty measures. With that in mind, ECSU is also different from existing uncertainty indexes for Türkiye in the literature for the following reason; when we were deciding to select keywords for the descriptors of the index, we not only used dictionary equivalence of them but also applied a survey to give the final shape to keywords in each descriptor for some university professors and editors of economy services in the newspapers in Türkiye. In the survey, we tallied responses for each questionFootnote 11. After that, we wrote our augmented keywords in descriptors with respect to the survey contributions as seen in our idiosyncratic algorithm in Table 1. Given that, the ECSU is the first index to measure economic uncertainty for Türkiye in the literature.

In order to construct the ECSU Index as an economic uncertainty measure for Türkiye, the duple of ‘economy’ and ‘uncertainty’ was searched in each newspaper for each day as Alexopoulos and Cohen (2009), Haddow et al. (2013), Ferreira et al. (2019), and Pan et al. (2022) counted. We coded ECSU = 1 in the index if at least one term from each descriptor in this duple was counted in the same edition of a newspaper on one day. These were our criteria in essence. For the index, there is an algorithm related to the search query about our criteria above in the monitor of Structured Query Language (SQL) in Table 1.

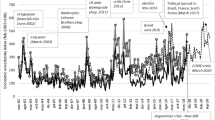

In total, we screened just about one and a half million articles for the ECSU index. The keywords that matched our criteria were tallied in each article using the SQL programming. This gave us a raw count for each index, so we standardise and normalise the raw counts and plug them into Fig. 1. For the standardisation and normalisation, we applied the methodology in Baker et al. (2016).

Figure 1 contains monthly ECSU index from 2006 to 2022. The index shows the peaks of the Central Bank of the Republic of Türkiye (hereafter CBRT) foreign exchange interventions, stock market volatility, net capital inflows, foreign direct investment (FDI), the global financial crisis (GFC), the revaluation of the Turkish lira (TRY), political developments, and a considerable decrease in tourism, construction, and the FDI.

The peaks indicating an increase in uncertainty are identified as corresponding to the events in the economy:

-

1.

The CBRT sold foreign exchange three times in June 2006, according to the CBRT figures.

-

2.

Net capital inflows in foreign direct investment decreased by 24.1 per cent from 2007 to a record 15.1 billion dollars in 2008, according to the economic development figures of the development ministry.

-

3.

In the first eight months of 2009, net capital inflows in foreign direct investment were down by 58.9 per cent on the same period of the previous year at 4.0 billion dollars, according to the economic development figures of the development ministry.

-

4.

There was a decrease in the average interest rates applied by the banks on vehicle and residential loans and on commercial credit in September 2010, according to the economic development figures of the development ministry.

-

5.

Coronavirus disease (COVID-19) is a variant of SARS-COV-2 that first began in Wuhan, China in December 2019. It has then rapidly spread all over China and the world, meaning that the first case in Türkiye was recorded on 11 March 2020.

The sources of the Ministry of Development in Türkiye, the Central Bank of the Republic of Türkiye (CBRT), the Turkish Statistical Institute (TURKSTAT), the BBC, and Bloomberg were employed to record the dates for the peaks indicating uncertainty.

As shown in Fig. 1, there are economic fluctuations related to uncertainty in the Turkish economy. These fluctuations were directly caused by uncertainty since an unexpected change in uncertainty is likely to induce changes in inflation, investment, the exchange rate, industrial production, the trade deficit, the current account deficit, the interest rate, and some noneconomic and geopolitical events as analysed above. Such a relation between uncertainty and economic indicators is typical of the countercyclical nature of uncertainty (Bloom 2014).

4 Comparison of the national-language and English-language press uncertainty indexes

To be a benchmark, we alternatively used English language sources instead of Turkish ones under the same methodology we have already discussed in detail above. This is the Türkiye uncertainty index (abbreviated TUI further on) from the dataset of Economist Intelligence Unit (EIU) country reports constructed by Ahir et al. (2022). The EIU is a research and analysis division around a group of analysts and economists under the Economist Group (including The Economist newspaper), producing monthly country reports, industry reports, country risk service reports, and 5-year country economic forecasts regularly for 189 countries since 1946. With this in mind, the EIU dataset has massive data available for economists, analysts, and data scientists on a range of emerging and advanced countries.

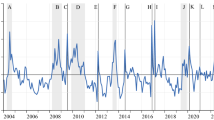

These are crucial differences between the English-language text-based uncertainty index and the Turkish-language text-based uncertainty index for Türkiye and they can create discrepancies in the analysis. To compare the Turkish language press index (ECSU) with the English language press index for Türkiye (TUI), the uncertainty indexes were illustrated in Figure 2.

We also applied the standardisation process of the raw counts of the words related to uncertainty to compare these series across time reasonably. More precisely, we obtained the monthly time series of the TUI by scaling the raw counts by the total number of pages in each report (Ahir et al. 2022).

In Fig. 2, the ECSU correlates with the TUI at − 0.0914 according to Pearson Correlation Coefficients. This correlation may open a door for analysts to consider events using uncertainty as expressed in the Turkish language. However, the ECSU index is weakly correlated with the TUI for several reasons:

Source: ECSU: Authors’ own computation, and the raw data of the TUI: Obtained directly from https://worlduncertaintyindex.com/data/

Turkish Language-based Uncertainty Measure (ECSU) and English Language-based Uncertainty Measure (TUI), January 2008-April 2022, Monthly.

English sources may present international news about economic, financial, and political developments in Türkiye where such news is more directly related to events in neighbouring countries including Syria, Iran, Iraq, the Black Sea countries, or Mediterranean and Aegean countries. More precisely, such sources contain news related mainly to the zone, including Türkiye. This means that measurements of uncertainty based on information from the English-speaking press about Türkiye may be affected by measurement error.

The weak correlation between the two series might arise from the fact that the TUI could not be prepared properly for Türkiye. This is because the term sets of the TUI cover only international economic developments, but the ECSU index captures uncertainty-related economic developments in Türkiye. This means the country-specific index contains more everyday news about economic events in Türkiye. These factors could combine to cause a weak correlation between these indexes for Türkiye.

Overall, the reasons explained above and the big discrepancies between the index we created and the TUI make us believe that both indexes might provide contradicting results in explaining the economic variables in Türkiye. In the following two subSects. 5.2. and 5.3, we will test these indexes under different economic hypotheses.

5 Verification of the Bloom, Cukierman–Meltzer, and Friedman–Ball hypotheses for Türkiye

5.1 The methodological problem

The Bloom, Cukierman–Meltzer, and Friedman–Ball hypotheses are important for understanding the dynamics of economic processes because the current uncertain conditions triggered rather more negative developments in these processes. The uncertainty in the economy causes a rise in the uncertainty of macroeconomic indicators, so does the inflation uncertainty. With that in mind, this uncertainty period causes considerable fluctuations in macroeconomic indicators like inflation rates, particularly in emerging countries. The hypothesis of Cukierman and Meltzer (1986) states that higher inflation uncertainty leads to a rise in inflation. However, both Friedman (1977) and Ball (1992) hypotheses indicate a relationship between inflation and inflation uncertainty, where a rise in the inflation boosts the inflation uncertainty. Low inflation brings lower uncertainty whereas the higher inflation leads to more uncertainty due to the mismatch between policy makers decisions and consumers preferences.

In the countercyclicality hypothesis, Bloom (2014) indicates that higher uncertainty induces reductions in industrial production, trade, investment, employment, and consumption. This means an unexpected increase in uncertainty leads to decreases in industrial production, trade, investment, employment, and consumption in this hypothesis. We consequently aim to analyse economic uncertainty and to check whether the real macroeconomic effects of this uncertainty have had a significant impact on the Turkish economy.

An example justifying the hypotheses about existing empirical evidence for various countries is that Baker et al. (2016) found that an unexpected increase in uncertainty induces a sharp drop in industrial production and a steep rise in the unemployment rate for twelve countries, which were Canada, China, France, Germany, India, Italy, Japan, Korea, Russia, Spain, the UK, and the US.

Another example is Öztürk and Sheng (2016), who estimated that an unexpected increase in ‘country-specific’, ‘idiosyncratic’, and ‘common’ uncertainty causes significant decreases in industrial production and employment, and an unexpected increase in such uncertainty induces significant increases in unemployment for the US. They also indicated that an unexpected increase in both idiosyncratic and common uncertainty induces a drop in industrial production for France, and an unexpected increase in idiosyncratic uncertainty reduces industrial production for Japan, where an unexpected increase in common uncertainty increases industrial production. Furthermore, industrial production in Germany, Italy, the UK, and the USA decreases under an unexpected increase in common uncertainty and rises under an unexpected increase in idiosyncratic uncertainty. For Canada, an unexpected increase in these two uncertainties induces a slight rise in industrial production.

One of the biggest methodological problems is the use of English language-based newspapers to construct an uncertainty index for the countries English is not the native language, because an increase in the uncertainty that is evidently expressed in the English-language press could cause a seriously misleading result. This is evidently true for many emerging economies, including Türkiye.

Consequently, we try to verify these hypotheses by employing our new uncertainty index-ECSU and the TUI of Ahir et al. (2022). In particular, since the uncertainty index we created is based on local language sources, we are more successful in measuring country-specific uncertainty in Türkiye. However, the TUI uses English language sources for Türkiye, making the index not entirely country specific. It is rather more connected to uncertainty for Türkiye with an international dimension so the uncertainty measured by the TUI that affect not only Türkiye but perhaps also Syria, Iraq, and Iran in the Middle East. This means that any conclusion obtained by analysing the model in which the uncertainty index is built using data published in national languages may be different from any conclusion obtained when the uncertainty index is constructed using English-language data.

To verify the hypotheses formulated above and compare these two indexes, six-equation bivariate VAR models were estimated using monthly dataFootnote 12. In each of these models, one of the variables is the uncertainty index, either the TUI from English-language sources or the ECSU from Turkish-language sources, and the other represents the industrial production index, the employment rate, or inflation.

These models were estimated by employing monthly data from the period January 2008–February 2022. The results of the Phillips–Perron (PP) and Augmented Dickey–Fuller (ADF) tests showed the time series analysed to be stationary in levels, as shown in Table 2 in the Appendix. To select the optimum lag length, we consider applying the most frequently used information criteria like the Akaike information criterion (AIC), the Schwarz Bayesian information criterion (BIC), and the Hannan-Quinn information criterion (HQ). We have at the same time considered two additional criteria like Final Prediction Error (FPE) and Sequential Modified LR Test Statistic, when we need to choose alternative lag order.

The Bloom, Cukierman–Meltzer, and Friedman–Ball hypotheses are verified by analysing the responses of industrial production, the employment rate, and inflation to positive shocks to the uncertainty indexes. The three hypotheses can be verified by testing the occurrence of Granger causality. The Bloom hypothesis is verified by examining the significance of the negative values of the impulse response functions of industrial production and employment to a positive shock in uncertainty. Friedman–Ball hypothesis is verified by examining the significance of the positive values of the impulse response function of the inflation response to a positive shock in uncertainty; the Cukierman–Meltzer hypothesis is verified by examining the significance of the positive values of the impulse response function of the uncertainty response to a positive shock in inflation.

5.2 Verification of Bloom’s hypothesis

We estimated two bivariate VARs for industrial production (IPI) and different uncertainty (UNC) indexes (our computation uncertainty index and the TUI, separately):

UNC indicates English language press-based uncertainty index like Türkiye Uncertainty Index (TUI) and new Turkish language press-based uncertainty index, (ECSU). In the level forms, the variables are stationary I(0) as it is presented in Table 2.

Figure 3, measures how a standard deviation shock from the error term of the white noise process in the equation above affects the other variable in the VAR system. Figure 3 shows the impulse responses of industrial production to positive shocks in the uncertainty expressed by these two variables. It is assumed here that the shock is defined as an increase in uncertainty by one standard deviation of the time series of the orthogonalized model residuals.

Impulse-Responses (Irs) from the Bivariate VAR (the levels of output and the uncertainty index): Responses to Cholesky One SD. Innovations ± 2 SE. Panel A: Endogenous Variables: Output and Uncertainty in Cholesky Ordering. Response of industrial production to unexpected changes in uncertainty in the Turkish-language press (ECSU). Response of industrial production to unexpected changes in uncertainty in the English-language press (TUI). Panel B: Endogenous Variables: Uncertainty and Output in Cholesky Ordering. Panel C: Endogenous Variables: Output and Uncertainty in Cholesky Ordering, and Including a Control (Exogenous) Variable: VIX or GEPU or WUI.

Figure 3 consists of three Panels, in which Panel A shows two endogenous variables -the output and uncertainty- in Cholesky ordering, Panel B depicts the reverse ordering of Panel A, and Panel C analyses the same variables of Panel A including an additional control variable (Exogenous) to isolate the effects of a country-specific ‘economic uncertainty shock’. Such exogenous variableFootnote 13 is the CBOE Volatility (^VIX) Index or Global Economic Policy Uncertainty-based on purchasing power parity (GEPU_ppp) Index or World Uncertainty Index (WUI) based on GDP weighted average.Footnote 14 With that in mind, in panels A and B, there is no additional exogenous variable in the VAR ordering as the variable included in Panel C.

We estimate the model by fitting a monthly VAR from January 2008 to February 2022. We use identification based on the lags with 90 per cent confidence bands obtained by Hall’s bootstrap applied to the residuals of the VAR model for 1000 resampling impulses and a Cholesky decomposition with the following ordering: the level forms of industrial production and the uncertainty index, which are stationary according to the p-values of the Augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) stationarity tests. We used two months of lags for industrial production and the ECSU (or the TUI) variables, according to the Bayesian Information Criteria (BIC) results.

The analysis of Panel A of Fig. 3 shows the results obtained by using the English and Turkish-language indexes are contrary to each other. In the TUI, an unexpected increase in uncertainty (the shock) increases industrial production by about 0.21 per cent on average in the second month after the shock in the right-hand side of Panel A of Fig. 3. This contradicts Bloom’s hypothesis about the countercyclical nature of uncertainty. This effect is also not statistically significant, as the lower values of the confidence interval are less than zero. In other words, for most periods, the confidence interval from fitting the VAR includes zero, meaning that the true values of impulse-responses are statistically zero.

In the uncertainty measured by the ECSU index meanwhile, Bloom’s hypothesis is confirmed; a positive orthogonal shock to uncertainty, or an unexpected increase in uncertainty, results in an expected decreases in industrial production of 3.10 per cent after three months and of 3.80 per cent after five months. The effect estimated is still persistent of about 1.10 per cent at the end of the horizon. This effect is statistically significant, as both the lower and upper values of the confidence interval are less than zero in the left-hand side of Panel A of Fig. 3. Frankly, this persistent effect of uncertainty calls ‘countercyclicality’, which is higher uncertainty induces permanent decreases in industrial production, trade, investment, employment, and consumption. It also cripples the monetary and fiscal stabilisation arguments. It reduces the productivity of growth and consumers spending on durable goods. Equally, productive firms were negatively affected by higher uncertain climate, so they would not be willing to decide about a potential production attempt. Instead, they simply decide to wait during the uncertain climate and then see alternative solutions to cope with uncertainty. So, they would prefer the tactic of wait and see and decide which information would be stronger (more sufficient) for such productions (Bloom 2014).

In Panel B, the empirical findings show that the shocks that come from the uncertainty measures have similar effects to those findings estimated in Panel A. It means such shocks appear to be mitigated only in the first four months. In Panel C, the shocks from the ECSU measure including exogenous variables in the VAR affect the production more persistent each time presented in Panel C, respectively. However, such shocks from the TUI measure are completely different. For instance, the shocks from the TUI measure by including the GEPU as an exogenous variable cause the production to rise in the first two months and are outright insignificant, which converges to zero in the responses on the middle right of Panel C in Fig. 3. While the shocks from the WUI show similar effects to those in Panel A, the effects of shock from the VIX are greater than the other shocks in Panel C of Fig. 3.

At the end, it cannot be assumed that the result obtained using the TUI is reliable. It overturns the economic theory of Bloom’s hypothesis and is based on highly fragmented press data in English language, which is rarely circulated in Türkiye. The results based on the ECSU index have both theoretical and statistical justifications.

To verify Bloom’s hypothesis further, two bivariate VAR models were also estimated, where the employment rate was used instead of industrial production. The results are presented in Fig. 4. We estimated two bivariate VARsFootnote 15 for employment and the different uncertainty indexes, using our computation uncertainty index (ECSU) and the TUI separately. The series we considered are stationary I(0) in the level forms in Table 2.

Impulse-Responses (Irs) from the Bivariate VAR (the levels of employment and the uncertainty index): Responses to Cholesky One SD. Innovations ± 2 SE. Panel A: Endogenous Variables: Employment and Uncertainty in Cholesky Ordering. Response of employment to unexpected changes in uncertainty in the Turkish- language press (ECSU). Response of employment to unexpected changes in uncertainty in the English-language press (TUI). Panel B: Endogenous Variables: Uncertainty and Employment in Cholesky Ordering. Panel C: Endogenous Variables: Employment and Uncertainty in Cholesky Ordering, and Including a Control (Exogenous) Variable: VIX or GEPU or WUI.

We estimate the model above by fitting a monthly VAR from January 2008 to February 2022. We use identification based on the months of lags with 90 per cent confidence bands obtained by Hall’s bootstrap applied to the residuals of the VAR model for 1000 resampling impulses and a Cholesky decomposition with the following ordering: the level form of employment and the uncertainty index, which are stationary according to the p-values of the Augmented Dickey–Fuller (ADF) and the p-values of the Phillips–Perron (PP) test. We used eight months of lags for employment and the ECSU (or the TUI) variables according to information criteria suggestions of the Sequential Modified LR Test Statistic.

Right-hand side of Panel A of Fig. 4 shows that the unexpected change in uncertainty expressed in the English-language press (the TUI) can cause a temporary increase in employment of about 0.15 per cent on average in the fifth month after the shock. However, the model from TUI indicates that after a transition period, a long-term decrease in employment follows an unexpected increase in uncertainty. More precisely, this effect is not statistically significant- as the lower values of the confidence interval are less than zero in all periods. In other words, for all periods, the confidence interval from fitting the VAR includes zero, meaning that the true values of impulse-responses are statistically zero- it does not make economic sense. However, theoretically and empirically speaking, the increase in uncertainty would lead to a decrease in employment, not an increase (Moore 2017; Bloom 2009; Schaal 2017). Employing ECSU yields better results.

Uncertainty and employment relationships can be observed better when we employ the ECSU (left-hand side of panel A). Uncertainty expressed in the Turkish-speaking media (the ECSU variable), shows that the unexpected change in uncertainty measured by ECSU is likely to cause a drop in employment of about 0.22 per cent on average in the tenth month after the shock.

The negative impact of ECSU on employment increases till the twelfth month and starts to go up, however, still significant. The impacts are of about 0.28 per cent on average in the twelfth month and of about 0.19 per cent on average in the twenty fourth month. The real impact of uncertainty on employment has lagged impact as shown in the left panel for two country-specific reasons. Unlike other OECD economies, shutting down a business is considered a failure in society (Simmons et al. 2014) and therefore Turkish businesses choose to resist uncertainty and carry on with risk for a while. Second, again unlike other OECD economies, the real wages in Türkiye are relatively low compared to the cost of capital, therefore businesses would like to hold labour power as long as possible. These factors can be considered in explaining the lag impact of ECSU on employment.

The empirical findings in Panel B show similar effects to those findings estimated in Panel A. Furthermore, we separately added the following exogenous variables like VIX, GEPU, and WUI to isolate the effects of a country-specific ‘economic uncertainty shock’ in the VAR equation in Panel A of Fig. 4. The most significant decrease in employment was respectively caused by the variables GEPU, WUI, and VIX in response to an unexpected increase in uncertainty in Panel C of Fig. 4. We also draw an interesting result, meaning that employment increased by about 0.15 per cent in the fifth month after the shock in response to an unexpected increase in uncertainty measured by the TUI. This empirical result is statistically significant as both the lower and upper values of the confidence interval are greater than zero on the bottom right-hand side of Panel C of Fig. 3. However, it does not make sense theoretically because the result contradicts the economic theory we have already discussed in the countercyclicality above. Overall, employing the ECSU as an uncertainty index yields a reliable and intuitive relationship between two series, consistent with the Bloom hypothesis.

5.3 Verification of the Cukierman–Meltzer, and Friedman–Ball hypotheses

According to the Friedman–Ball hypothesis, a positive uncertainty shock, or an unexpected increase in uncertainty, should be seen after an increase in inflation after a certain period. This means inflation impacts changes in uncertainty. To verify this hypothesis, two parallel VAR models were estimated, where one variable is the inflation rate, and the other is the TUI or alternatively the ECSU. Figure 5 presents the orthogonal impulses of the inflation response to shocks in uncertainty. The impulse effects are similar in both models.

Impulse-Responses (Irs) from the Bivariate VAR (the levels of inflation and the uncertainty index): Responses to Cholesky One SD. Innovations ± 2 SE. Panel A: Endogenous Variables: Inflation and Uncertainty in Cholesky Ordering. Response of inflation to unexpected changes in uncertainty in Turkish- language press (ECSU). Response of inflation to unexpected changes in uncertainty in English- language press (TUI). Panel B: Endogenous Variables: Uncertainty and Inflation in Cholesky Ordering. Panel C: Endogenous Variables: Inflation and Uncertainty in Cholesky Ordering, and Including a Control (Exogenous) Variable: VIX or GEPU or WUI.

We estimate two bivariate VARsFootnote 16 for inflation and the different uncertainty indexes, ECSU and TUI separately. These series are stationary as results are presented in Table 2.

We estimate the model by fitting a monthly VAR from January 2008 to February 2022. We use identification based on the lags with 90 per cent confidence bands obtained by Hall’s studentized double bootstrap applied to the residuals of the VAR model for 1000 resampling generalised impulses and a Cholesky decomposition with the following ordering: the level forms of inflation and the uncertainty index, which are stationary according to the p values of the Augmented Dickey–Fuller (ADF) and the p-value of the Phillips–Perron (PP) test. We used seven months of lags for inflation and the ECSU according to the Akaike information criterion (AIC), the Final Prediction Error (FPE), and the Sequential Modified LR Test Statistic suggestions. However, we then used five months of lags for inflation and the TUI according to the Akaike information criterion (AIC), the Final Prediction Error (FPE), and the Sequential Modified LR Test Statistic suggestions.

In the model with the TUI variable, which is the uncertainty index for Türkiye based on English-speaking data, a positive uncertainty shock from the English-speaking media is the reason for an expected increase in inflation between the second and fifth months after the shock. This result is not statistically significant. However, for the ECSU variable, using the Turkish-language data, an inflation response that is statistically significant occurs in the first forty days, and thereafter, unlike the uncertainty in the English press (TUI) estimates the ranging from 0.11 per cent to − 0.04 per cent in the fifth and sixth months, with markedly more strength than in the results for the TUI. Both effects are converging to zero and are outright insignificant at the end of the period.

In Panel B of Fig. 5, the variables considered in Panel A are used to estimate in reverse ordering. The empirical findings are close to each other in both panels A and B. However, we have added in the VAR equation following exogenous variables VIX, GEPU, and WUI to analyse the economic uncertainty effect in more detail. Panel C depicts such relationships between these variables. Given this, the variables have a crucial role in estimating the uncertainty effects in the case of modelling the ECSU. Its effects are statistically significant, but there are no such effects in the case of modelling the TUI.

The effect of Knightian uncertainty measured by the Turkish-language media is evidently different from the effects of the uncertainty measured by the English-language media. English-speaking media shows a relatively quicker response may be because the information on Türkiye provided in this media is more retrospective and analytical, and because of information delays. The information is usually slightly outdated, which gives the impression that the response is less delayed.

The statistical significance of the results confirms the Friedman–Ball hypothesis that inflation has a positive causal effect, in the sense of a Granger effect, on uncertainty. This effect is occurred in time by about a half quarter a year. The reason for this inference might be the inertia associated with high average stock levels in the economy, the cost of price changes in the ‘menu effect’, or fiscal constraints.

Friedman (1977) and Ball (1992) argue that higher inflation leads to increases in uncertainty. The main message behind the ‘inflation and uncertainty’ is that high inflation leads to mismatches between monetary policy and consumer preferences (demand changes). Since accurate forecasting of inflation is crucial, economists have been dealing the relationship between uncertainty and inflation, because it helps to understand to what extent inflation is detrimental in the future. Thus, we estimate that an uncertainty shock from the ECSU is likely to cause persistent increases in inflation as in Figure 5, meaning that our empirical findings obtained by the ECSU is in line with the Friedman–Ball hypothesis. In other words, the statistical significance of the results confirms Friedman–Ball’s hypothesis that there is a positive causal effect of inflation on uncertainty.

With this in mind, the Cukierman–Meltzer hypothesis was tested by examining the significance of positive values of the impulse response function of uncertainty response to a positive shock in inflation. To verify the hypothesis, we considered the VAR was already estimated in Fig. 5. The difference is here that we presented the positive causality goes from the uncertainty (the ECSU or TUI variable) to an unexpected change in inflation, as can be seen in Figure 6.

An unexpected change in inflation may cause increases in uncertainty measured by using Turkish-language media (ECSU) of about 26.79 per cent on average in the third month after the shock. This result is statistically significant, meaning that the lower and upper values of the confidence interval are greater than zero. This means that the hypothesis that the true values of impulse-responses are equal to zero can be rejected. The response of uncertainty (ECSU) in inflation occurs ranging from 21.81 per cent to 13.13 per cent after the fourth and fifth months and from 28.35 per cent to 14.39 per cent after the sixth and seventh months. The response is thereafter statistically significant at the end of the horizon as can be seen in Fig. 6 (left-hand side of panel A). The statistical significance of the results confirms the Cukierman–Meltzer hypothesis that uncertainty has a positive causal effect, in the sense of a Granger effect, on inflation. Specifically, we estimated that an increase in the variance of an inflation uncertainty shock leads to rises in the inflation in Türkiye, meaning that the Cukierman and Meltzer (1986) hypothesis was successfully tested by the estimation in Fig. 6.

Impulse-Responses (Irs) from the Bivariate VAR (the uncertainty index and the levels of inflation): Responses to Cholesky One SD. Innovations ± 2 SE. Panel A: Endogenous Variables: Uncertainty and Inflation in Cholesky Ordering. Response of uncertainty in Turkish- language press (ECSU) to unexpected changes in inflation. Response of uncertainty in English- language press (TUI) to unexpected changes in inflation. Panel B: Endogenous Variables: Inflation and Uncertainty in Cholesky Ordering. Panel C: Endogenous Variables: Uncertainty and Inflation in Cholesky Ordering, and Including a Control (Exogenous) Variable: VIX or GEPU or WUI.

Different from the previous two hypotheses, the IR of TUI on inflation has significant effects, except for the first two months in the right-hand side of panel A of Fig. 6. While testing the previous hypothesis, we observe that the TUI effect on both employment and industrial production is either not significant or against the hypothesis discussed above. Such observation was also the same while testing the Friedman–Ball hypothesis. However, such significant effect is far from confirming the Cukierman–Meltzer hypothesis because the effect has negative values in the right-hand sides of panels A and B of Fig. 6.

Interestingly, there is a result we estimated in line with theoretical and empirical confirmation for the Cukierman–Meltzer hypothesis after adding some exogenous variables in the VAR, respectively. More precisely, the responses after the seventh month on the middle right of Panel C in Fig. 6 indicate that we have better results for the TUI impact on Türkiye’s inflation for a good reason. Since the majority of the materials in industrial production are imported from abroad, the change in import prices with the fluctuations in the exchange rates are the driven reasons for the inflation in Türkiye, named imported inflation. In particular, the fluctuations in oil prices lead to big changes in Türkiye’s inflation due to the increase in production costs. Considering that the TUI shocks influence oil prices (Su et al. 2019; Gu et al. 2021), we are able to say that the shocks might be more directly related to Türkiye’s inflation. This might be a reason to understand the response in uncertainty in the English language press (TUI) to unexpected changes in inflation.

Consequently, Cukierman and Meltzer (1986) claim that a higher inflation uncertainty leads to rises in inflation. More precisely, an unexpected increase in the variance of an inflation uncertainty shock might raise the variance of inflation. Such relation is confirmed by our empirical results from uncertainty measured by the ECSU in Fig. 6. With this in mind, the analysis of the quality of monetary control is one of the main components of the Cukierman–Meltzer hypothesis. Imperfect information to control monetary policy causes increases in uncertainty related to applying the most effective control tool for inflation. Thus, the policymakers indirectly support increasing uncertainty as ambiguity. In case of imperfect information to control inflation in Türkiye, the economy has long been suffering from high inflation uncertainty. This induces increases in inflation in Türkiye. When inflation is high, policymakers have a dilemma like that if they agree on the disinflation, then they fear to result in a recession.

6 Robustness checks

6.1 Evidence from the multiple-variable-VAR

In order to test our uncertainty measure by applying some robustness checks and also to support our main empirical findings further, a nine-variable VAR, as in Caldara and Iacoviello (2018), is estimated in this section where we evaluate the impact of economic uncertainty shocks on real economic activity. More specifically, we have estimated the matrixesFootnote 17 of impulse-responses from VARs with bootstrap confidence intervals.

We do not use exactly same VAR but instead include similar variables to cover the close sources of variation in the variables.Footnote 18 To analyse the impulse-responses (Irs) from a 9-variable-VAR (abbreviated VAR-9 further on), we consider a Cholesky decomposition to recover orthogonal shocks with the following ordering:

We show the dynamic responses of the macro variables to a one standard deviation uncertainty shock in the VAR-9. To our baseline VAR specification, the optimal lag of the VAR-9 we decided is two months of lags of all variables suggested by the Akaike information criterion (AIC) and the Final Prediction Error (FPE) suggestions.

Figure 7 represents responses of consumer confidence, industrial production, employment, trade, stock price, oil price, and inflation for unexpected increase in uncertainty evident by estimating the orthogonal impulse-responses (Irs) from the VAR-9 together with bootstrap confidence intervals around the orthogonal shocks, all identified with a standard Cholesky decomposition.

Specifically, we estimate the model by fitting a monthly VAR from January 2008 to February 2022. We use identification based on the lags with 90 and 68 per cent confidence bands obtained by Hall’s bootstrap applied to the residuals of the VAR model for 1000 resampling impulses and a Cholesky decomposition with the ordering in VAR-9 above, which are stationary according to the p-values of the stationarity tests in Table 2.

As shown in Fig. 7, an unexpected increase in economic uncertainty measured by the ECSU leads to decreases in industrial production, employment, and trade. Such empirical results are statistically significant and in line with the theory (countercyclicality: Bloom hypothesis) that was already tested previous section related to bivariate VARs. However, the results from the TUI measure are in contradiction with the countercyclicality. With that in mind, an unexpected increase in uncertainty measured by the ECSU causes to significant increases in stock and oil prices in Türkiye. In case of uncertainty measured by the TUI, such relationships were not confirmed, except for the first two months of the stock and oil prices responses and the last 2 months of trade responses. Consumer confidence decreased in response to an increase in uncertainty measured by ECSU in the first 2 months after the shock. Then, it begins to increase significantly according to the confidence bands between the fifth and twelfth months, when it decreases in response to an increase in uncertainty measured by the TUI in the first 10 months after the shock.

In Fig. 8, we alter the order of uncertainty indexes and put them as the first two variables instead of the last two variables in the Cholesky ordering from Fig. 7. More specifically, when uncertainty indexes are in the first two variables, we found that an uncertainty shock generates increases in inflation and vice versa. This means that we successfully tested the Friedman–Ball and the Cukierman–Meltzer hypotheses and verified them in case of uncertainty measured by the ECSU variable. The TUI has over again the controversial results for testing such hypotheses. The empirical findings from the ECSU in Figs. 7 and 8 are robust and successfully confirm the theory according to the estimation of the VAR-9.

However, our empirical inferences are not in line with the findings of Andres‑Escayola et al. (2023), where constructing text-mining-based uncertainty indexes for some selected Latin American economies using local (Spanish and Portuguese) or foreign (English) newspapers yielded quite similar empirical results. This means that we could not replicate these results by employing Turkish and English language sources for Türkiye. Consequently, our empirical findings suggest researchers should spot the results obtained by national news- (local language) and international news- (Anglo-Saxon) sources from one another and also rely on sources of the local language alone, before constructing text-mining-based country-specific measures of uncertainty because the results in Figs. 3, 4, 5, 6, 7, and 8 of our case are not similar to those results documented in Andres‑Escayola et al. (2023).

7 Concluding remarks

Uncertainty is countercyclical for some economic variables like industrial production, trade, investment, employment, and consumption. We have constructed an economic country-specific uncertainty (ECSU) index for the first time in the literature. A novel methodology was documented in this paper with the theories that underline the adverse economic effects of uncertainty shocks. We estimated that an unexpected increase in uncertainty could cause permanent declines in industrial production, employment, and trade and permanent rises in stock and oil prices in Türkiye. This result is clear and statistically significant, but only if the uncertainty is measured using media sources published in the local languages. Using English as the medium language for the resources- TUI produces controversial results while testing the theory of Bloom's hypothesis. Given this, the uncertainty indicators calculated for Türkiye using Turkish-language materials are more useful tools for estimating macroeconomic uncertainty and its real impact. These measures can also be useful for monetary and fiscal policymakers, investors, and risk and policy analysts, and using them can give a more transparent assessment of macroeconomic uncertainty in economic practice, especially for long-term contracts, which can in turn mean lower transaction costs than those following an incorrect assessment of uncertainty.

We also verify the Friedman–Ball hypothesis about the impact on inflation of the dynamic increase in uncertainty. This is a methodologically new conclusion. So far, the Friedman–Ball hypothesis has been verified using the relatively narrow concept of inflation forecasting uncertainty, or in Knight’s terminology, inflation risk. Our approach, where we used the Knight approximation of uncertainty instead of inflationary risk, is more general. We also positively verified the Cukierman–Meltzer hypothesis for the effects on the uncertainty of the unexpected increase in inflation.

Creating countries-specific indexes using local resources, as the ECSU we created, might yield more reliable indexes. Countries that have media in the local language (apart from English) can generate better results in predicting country-specific uncertainty. So, relying on indexes created from English resources only would not be as trustworthy as we showed in this paper. The results of this study may serve as a basis for further research, extending and deepening the results we obtained. Comparative studies can be carried out for other countries to determine whether the differences between the quality of indexes created based on English and national-language media sources -as it is done for Türkiye- will be confirmed for other countries as well.

Notes

Holland (1995), Batchelor and Dua (1996), Grier and Perry (1998), Speight (1999), Nas and Perry (1999, 2000), Fountas (2001), Hwang (2001), Henry and Olekalns (2002), Apergis (2004), Fountas et al. (2004) Kontonikas (2004), Conrad and Karanasos (2005), Karanasos and Kim (2005), Fountas and Karanasos (2006), Fountas et al. (2006), Henry et al. (2007), Karanasos and Schurer (2008), Thornton (2007, 2008).

Ex-post is based on considering actual results rather than forecasts. It is related to past performance.

Ex-ante, as opposed to ex-post, means forecasts, or expected changes or activity than the actual results in an economy. It is associated with the future.

Zarnowitz (1969), Zarnowitz and Lambros (1987), Batchelor and Dua (1996), Bomberger (1996, 1999), Rich and Butler (1998), Giordani and Söderlind (2003), Lahiri and Liu (2006a, b), Boero et al. (2008), Clements (2008), Conflitti (2010, 2012), Rossi et al. (2016), Öztürk and Sheng (2018), Conrad et al. (2022), Conrad and Lahiri (2023), and among others.

Apergis (2004), Bouoiyour and Selmi (2014), Conrad and Karanasos (2005), Daniela et al. (2014), Doğru (2014), Erkam (2008), Fountas (2000, 2001, 2010), Fountas and Karanasos (2006), Fountas et al. (2004, 2006), Grier and Perry (1998, 2000), Henry and Olekalns (2002), Henry et al. (2006, 2007), Holland (1995), Hwang (2001), Javed et al. (2012), Karanasos and Kim (2005), Karanasos and Schurer (2007, 2008), Karahan (2012), Kontonikas (2004), Nas and Perry (1999, 2000), Neanidis and Savva (2011), Speight (1999), Thornton (2007, 2008), Yılmaz et al. (2017), Kasal and Tosunoğlu (2022), many among others.