Abstract

This paper examines the interactions between financial development, economic growth and (macro)prudential policy on a sample of 12 euro area countries. Our main takeaway is that active (macro)prudential policy supports the positive finance-growth nexus instead of disrupting it. These benefits are found to be more likely to materialize during tightening of (macro)prudential policy measures and not during easing. This result is conditional on the ability of (macro)prudential policy to curb excess credit growth and mitigate systemic risk, which would otherwise disrupt the market. Moreover, we assert that when analysing the effects of (macro)prudential policy, it is important to account for the direction of (macro)prudential measures, not just for the frequency at which they are implemented.

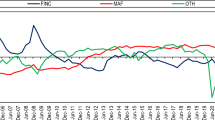

Source: World Bank, Svirydzenka (2016), own elaboration. Note: The shaded regions mark the area between the first and third quartile and minimum and maximum of the cross-country distribution. The solid red line denotes the mean and the dashed blue line the median. The sample size is 12 countries

Similar content being viewed by others

Notes

Bekaert and Popov (2019) argue in favour of using rolling windows to compute average GDP growth over a given period (typically three to five years). This is to correct for relative heterogeneity of sample countries. Given that our sample is a relatively homogeneous monetary union, we pursue our analysis using annual growth rates, but we use the averages in our robustness check section.

Note that for both indexes, we assign the same weights to the different measures. This allows us to investigate the overall effectiveness of (macro)prudential tools.

The capital-based measures are limits on domestic and foreign currency loans, time-varying/dynamic loan-loss provisioning, reserve requirements, limits on interbank exposures, concentration limits, capital requirements, capital buffers, leverage ratio and capital surcharge on SIFIs,

In both indexes, loan-to-value ratio limit is the only borrower-based (macro)prudential instrument.

The instruments used in the System-GMM regression are lagged levels (two periods) of the dependent variable. For the level equation the instruments are the lagged differences (one period). The exogenous covariates and the crisis dummy are instrumented by themselves in the differenced and level equations.

The control variables were chosen in line with previous studies on the finance-growth nexus. For a detailed overview of the use of control variables in such studies, please refer to the dataset of the meta-analysis by Biljsma et al. (2017).

The MCI combines 14 different variables in four categories, namely interest rates, monetary aggregates, balance sheet items and the exchange rate. This enables us to capture the effects of both conventional and unconventional monetary policies, which is essential in the post-crisis period. For details on the calculation of the MCI, please refer to Malovana and Frait (2017) and the "Appendix 2".

In this case, a reverse causality would imply a situation where faster economic growth would lead to greater use of (macro)prudential policies. In fact, it also motivates the use of GVA growth side by side with GDP and GDPPC growth. GVA corrects for excess growth just on account of increased tax collection due to better compliance/coverage.

For example, several countries argue that the counter-cyclical capital buffer should be set at non-zero value for a normal risk environment (ESRB, 2020b).

The original macroprudential policy index of Cerutti et al. (2017b) ends in 2014.

Our findings are in line with Agénor et al. (2018) who also find a positive effect of (macro)prudential tightening on economic growth of around 0.7 pp.

For example, the Czech Republic is graded 1 (fully compliant), as the central bank (CB) is the macroprudential authority. On the other hand, countries like Finland are graded 0.25 (materially non-compliant), because a financial stability authority separate to the CB is tasked with macroprudential policy.

References

Abiad A, Balakrishnan R, Brooks PK, Leigh D (2009) What’s the damage? Medium-term output dynamics after banking crises, IMF Working Paper No. 09/245, International Monetary Fund

Agénor P-R, Gambacorta L, Kharroubi E, Pereira da Silva LA (2018) The effects of prudential regulation, financial development and financial openness on economic growth, BIS Working Papers No 752, Bank for International Settlements

Aiyar S, Calomiris CW, Wieladek T (2014) Does macro-prudential regulation leak? Evidence from a UK policy experiment. J Money Credit Bank 46(s1):181–214

Akinci O, Olmstead-Rumsey J (2018) How effective are macroprudential policies? An empirical investigation. J Financ Intermed 33:33–57

Ampudia M, Lo Duca M, Farkas M, Perez-Quiros G, Rünstler G, Tereanu E (2021) On the effectiveness of macroprudential policy. ECB Working Paper No. 2559, European Central Bank

Araujo JD, Patnam M, Popescu MA, Valencia MF, Yao W (2020) Effects of macroprudential policy: evidence from over 6,000 estimates. IMF Working Paper No.20/67, International Monetary Fund

Arcand JL, Berkes E, Panizza U (2015) Too much finance? J Econ Growth 20(2):105–148

Arestis P, Chortareas G, Magkonis G (2015) The financial development and growth nexus: a meta-analysis. J Econ Surv 29(3):549–565

Bagehot W (1873) Lombard street: a description of the money market. HS King&Company

Bai J, Philippon T, Savov A (2016) Have financial markets become more informative? J Financ Econ 122(3):625–654

Ball L (2014) Long-term damage from the great recession in OECD countries. Eur J Econ Econ Policies: Interv 11(2):149–160

Balta N, Vašíček B (2020) Financial channels and economic activity in the euro area: a large-scale Bayesian VAR approach. Empirica 47(2):431–451

Beck T, Degryse H, Kneer C (2014) Is more finance better? Disentangling intermediation and size effects of financial systems. J Financ Stab 10:50–64

Bekaert G, Popov A (2019) On the Link between the Volatility and Skewness of Growth. IMF Econ Rev 67(4):746–790

Bell S, Hindmoor A (2018) Are the major global banks now safer? Structural continuities and change in banking and finance since the 2008 crisis. Rev Int Poli Econ 25(1):1–27

Bengtsson E (2020) Macroprudential policy in the EU: a political economy perspective. Glob Financ J 46:100490.

Bernier M, Plouffe M (2019) Financial innovation, economic growth, and the consequences of macroprudential policies. Res Econ 73(2):162–173

Bianchi J, Mendoza EG (2018) Optimal time-consistent macroprudential policy. J Polit Econ 126(2):588–634

Biljsma M, Cool K, Non M (2017) The effect of financial development on economic growth: a meta-analysis, CPB Discussion Paper No 340, CPB Netherlands Bureau for Economic Policy Analysis

Bivens J, Mishel L (2013) The pay of corporate executives and financial professionals as evidence of rents in top 1 percent incomes. J Econ Perspect 27(3):57–78

Blackburn K, Hung VT (1998) A theory of growth, financial development and trade. Economica 65(257):107–124

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Boar C, Gambacorta L, Lombardo G, Pereira da Silva LA (2017) What are the effects of macroprudential policies on macroeconomic performance? BIS Q Rev Sept

Budnik KB, Kleibl J (2018) Macroprudential Regulation in the European Union in 1995–2014: Introducing a New Data Set on Policy Actions of a Macroprudential Nature, ECB Working Paper No 2123, European Central Bank

Bun MJG, Windmeijer F (2010) The weak instrument problem of the system GMM estimator in dynamic panel data models. Economet J 13(1):95–126

Caprio G Jr, D’Apice V, Ferri G, Puopolo GW (2014) Macro-financial determinants of the great financial crisis: Implications for financial regulation’. J Bank Financ 44:114–129

Cecchetti SG, Kharroubi E (2012) Reassessing the impact of finance on growth (No. 381). BIS Working Papers No 381, Bank for International Settlements

Cecchetti SG, Kharroubi E (2019) Why does credit growth crowd out real economic growth? Manch Sch 87:1–28

Cerra V, Saxena SC (2008) Growth dynamics: the myth of economic recovery. Am Econ Rev 98(1):439–457

Cerutti E, Claessens S, Laeven L (2017a) The use and effectiveness of macroprudential policies: new evidence. J Financ Stab 28:203–224

Cerutti E, Correa R, Fiorentino E, Segalla E (2017b) Changes in prudential policy instruments—a new cross-country database. Int J Cent Bank 13(1):477–503

Claessens S, Ghosh SR, Mihet R (2013) Macro-prudential policies to mitigate financial system vulnerabilities. J Int Money Financ 39:153–185

Creel J, Hubert P, Labondance F (2015) Financial stability and economic performance. Econ Model 48:25–40

Čihák M, Sahay R (2020) Finance and Inequality, IMF Staff Discussion Notes 20/01, International Monetary Fund

De Vos I, Everaert G, Ruyssen I (2015) Bootstrap-based bias correction and inference for dynamic panels with fixed effects. Stand Genomic Sci 15(4):986–1018

Deli YD, Hasan I (2017) Real effects of bank capital regulations: global evidence. J Bank Financ 82:217–228

ESRB (2011) Recommendation of the European Systemic Risk Board of 22 December 2011 on the Macro-prudential Mandate of National Authorities. ESRB/2011/3, European Systemic Risk Board

ESRB (2014) Recommendation on the Macro-Prudential Mandate of National Authorities (ESRB/2011/3), Follow-up Report—Overall assessment, ESRB/2011/3, European Systemic Risk Board

ESRB (2016) A Review of Macro-prudential Policy in the EU in 2015. European Systemic Risk Board, Frankfurt am Main

ESRB (2020) Overview of National Macroprudential Measures. www.esrb.europa.eu/national_policy/shared/pdf/esrb.measures_overview_macroprudential_measures.xlsx.

Fidrmuc J, Lind R (2020) Macroeconomic impact of basel III: evidence from a meta-analysis. J Bank Financ 112(C)

Fendoğlu S (2017) Credit cycles and capital flows: Effectiveness of the macroprudential policy framework in emerging market economies. J Bank Financ 79:110–128

FitzGerald J (2015) Problems interpreting national accounts in a globalised economy- ireland, quarterly economic commentary: special articles. Economic & Social Research Institute

French KR (2008) Presidential address: the cost of active investing. J Financ 63(4):1537–1573

Gadatsch N, Mann L, Schnabel I (2018) A new IV approach for estimating the efficacy of macroprudential measures. Econ Lett 168:107–109

Gaffeo E, Garalova P (2014) On the finance-growth nexus: additional evidence from Central and Eastern Europe countries. Econ Chang Restruct 47(2):89–115

Galati G, Moessner R (2013) Macroprudential policy—a literature review. J Econ Surv 27(5):846–878

Goldsmith RW (1969) Financial Structure and Development. Yale University Press

Gurley JG, Shaw ES (1967) Financial structure and economic development. Econ Dev Cult Change 15(3):257–268

Hasan I, Horvath R, Mares J (2018) What type of finance matters for growth? Bayesian model averaging evidence. World Bank Econ Rev 32(2):383–409

Hodula M, Melecky A, Machacek M (2020) Off the radar: factors behind the growth of shadow banking in Europe. Econ Syst 44(3):100808

Jarrow RA (2014) Financial crises and economic growth. Q Rev Econ Financ 54(2):194–207

Jordà O, Schularick MH, Taylor AM (2011) When credit bites back: leverage. Business Cycles, and Crises, NBER Working Papers No. 17621, National Bureau of Economic Research

Jung WS (1986) Financial development and economic growth: international evidence. Econ Dev Cult Change 34(2):333–346

Khan A (2001) Financial development and economic growth. Macroecon Dyn 5(3):413–433

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108(3):717–737

Kiviet JF (1995) On bias, inconsistency, and efficiency of various estimators in dynamic panel data models. J Econom 68(1):53–78

Koetter M, Wedow M (2010) Finance and growth in a bank-based economy: is it quantity or quality that matters? J Int Money Financ 29(8):1529–1545

Kolcunová D, Malovaná S (2019) The Effect of higher capital requirements on bank lending: the capital surplus matters. CNB Working Paper 2/2019, Czech National Bank

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77

Lim CH, Krznar MI, Lipinsky MF, Otani MA, Wu MX (2013) The macroprudential framework: policy responsiveness and institutional arrangements. IMF Working Paper No. 13/166, International Monetary Fund

Lo Duca M, Koban A, Basten M, Bengtsson E, Klaus B, Kusmierczyk P, Lang JH (2017) A new database for financial crises in European Countries, ESRB Occassional Paper Series No. 13, European Systemic Risk Board

Loayza NV, Ranciere R (2006) Financial development, financial fragility, and growth. J Money Credit Bank 1051–1076

Malovana S, Frait J (2017) Monetary policy and macroprudential policy: rivals or teammates? J Financ Stab 32:1–16

Masciandaro D, Volpicella A (2016) Macro prudential governance and central banks: facts and drivers. J Int Money Financ 61:101–119

McKinnon RI (1973) Money and Capital in Economic Development. Brookings Institution

Mendoza EG, Quadrini V, Rios-Rull JV (2009) Financial integration, financial development, and global imbalances. J Polit Econ 117(3):371–416

Patrick HT (1966) Financial development and economic growth in underdeveloped countries. Econ Dev Cult Change 14(2):174–189

Philippon T, Reshef A (2012) Wages and human capital in the US finance industry: 1909–2006. Q J Econ 127(4):1551–1609

Plantin G (2015) Shadow banking and bank capital regulation. Rev Financ Stud 28(1):146–175

Prochniak M, Wasiak K (2017) The impact of the financial system on economic growth in the context of the global crisis: empirical evidence for the EU and OECD countries. Empirica 44(2):295

Reinhart CM, Rogoff KS (2008) This time is different: a panoramic view of eight centuries of financial crises. NBER Working Paper No. 13882, National Bureau of Economic Research

Rioja F, Valev N (2004) Does one size fit all?: A reexamination of the finance and growth relationship. J Dev Econ 74(2):429–447

Romero-Ávila D (2007) Finance and growth in the EU: new evidence from the harmonisation of the banking industry. J Bank Finance 31(7):1937–1954

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in stata. Stand Genomic Sci 9(1):86–136

Rousseau PL, Wachtel P (2011) What is happening to the impact of financial deepening on economic growth? Econ Inq 49(1):276–288

Sánchez AC, Röhn O (2016) How do policies influence GDP tail Risks? OECD Economics Department Working Papers No. 1339, Organisation for Economic Co-operation and Development

Schumpeter JA (1952) Theorie der wirtschaftlichen Entwicklung: Eine Untersuchung über Unternehmergewinn, Kapital, Kredit, Zins und den Konjunkturzyklus

Smets F (2014) Financial stability and monetary policy: how closely interlinked? Int J Cent Bank 10(2):263–300

Svirydzenka K (2016) Introducing a new broad-based index of financial development. IMF Working Paper No. 16/05, International Monetary Fund

Valickova P, Havranek T, Horvath R (2015) Financial development and economic growth: a meta-analysis. J Econ Surv 29(3):506–526

Acknowledgements

We would like to thank two anonymous referees for valuable comments. We are gratefull to Simona Malovaná, Michal Franta, Roman Horváth, Jan Frait, Zuzana Rakovská, Jan Libich, Lukáš Pfeifer, Jiří Gregor and Peter Molnár for comments on an earlier version of the paper. The views expressed in this paper are those of the authors and not necessarily those of the Czech National Bank or its management.

Funding

The authors acknowledge the financial support provided by the Technical University of Ostrava Grant SP2020/110 and the project APVV under Grant APVV-20–0499. Ngoc Anh Ngo declares that this paper has been elaborated in the framework of the grant programme "Support for Science and Research in the Moravian-Silesian Region 2021" (RRC/10/2021), financed from the budget of the Moravian-Silesian Region.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflicts of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Responsible Editor: Jesus Crespo Cuaresma.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Appendix 1: Data

In order to provide more information, Table 8 reports all our variables, their summary statistics and their data sources.

1.2 Appendix 2: Monetary conditions index estimation procedure

There are a number of approaches that allow a large number of time series to be combined into a single composite index. In the case of the indicator presented in this paper, we use a factor model estimate. Consider an n-dimensional vector of stationary observable variables \(X={\left({X}_{1},\dots ,{X}_{n}\right)}^{^{\prime}}\) that are linearly dependent on an m-dimensional vector of originally unobservable factors \(F=\left({F}_{1},\dots ,{F}_{m}\right)\). The baseline factor model then takes the following form:

where \(\Lambda\) is a matrix of factor loadings, \({A}_{i}\) is a matrix of autoregression coefficients for \(p\) lags and \({\varepsilon }_{t},{u}_{t}\) are i.i.d. Gaussian error terms. We use the maximum likelihood method to estimate the factor model. While more complicated to calculate, the maximum likelihood method, unlike the principal components method, makes it possible to test whether the number of common factors selected is sufficient. The optimal number of factors to estimate is primarily based on parallel analysis. The optimal number of lags is chosen based on the Schwarz information criterion. For our data, results of statistical tests prefer a factor model with 3 estimated factors and 1 lag. The robustness and sensitivity analysis of the selected model specification to calculate MCI was performed with respect to the number of lags used, number of factors estimated, the estimation period, and the variables included in the estimation.

Table 9 summarizes the set of 15 variables that reflect the monetary conditions in the euro area. Variables in respective blocks were treated as follows: (1) interest rates enter the estimation in levels; (2) monetary aggregates are expressed in year-on-year change and in reciprocal values (switched sign) so that that an increase would correspond to a monetary tightening, as for interest rates; (3) ECB balance sheet items are expressed in year-on year change with a negative sign for all these variables; and (4) exchange rate is transformed into a year-on-year change with the sign left unchanged.

To save space, we do not report all the robustness checks performed; they are available upon request. Figure

4 (left-hand graph) shows the relative contribution of each of the estimated factors to the final index. The figure also plots the MCI as normalized using the mean and standard deviation of the 3-month EURIBOR. The right-hand graph shows results of a simulation exercise in which the index was estimated multiple times, each time with one variable excluded from the input data set. This approach is very similar to a more formal bootstrapping proposed by Gospodinov and Ng (2013).

1.3 Appendix 3: Dating of financial crises in the Euro area

In identifying crisis-type events, we rely on a financial crises database for European countries maintained by the ESRB. The dates, presented in Table 10, were selected by the ESRB based on a quantitative identification approach, which had been cross-checked with expert judgement from national and European authorities (qualitative approach). This expert judgement was sought by the ESRB whenever the adopted quantitative approach did not identify event dates included in Laeven and Valencia (2013) and Babecky et al. (2014). In such cases, the dates were submitted to national authorities for revision in order to assess the most appropriate dates to be included in the dataset.

1.4 Appendix 4: Additional estimates

Section 4 discussed several additional empirical specifications. Results are reported below in Tables 11, 12, 13. The first reports estimates of the interaction term from Eq. 2 using richer lag structure. The second contains estimates of the interaction term from Eq. 2 for various sample perturbations. The final table reports the estimates of the model as specified in Eq. 2 using alternative estimator (Table 14).

1.5 Appendix 5: The index of macroprudential authority strength

We use the ESRB (2014) assessment of the implementation of the ESRB's Recommendation on the macro-prudential mandate of national authorities to set up a macroprudential authority strength index. In 2014, the ESRB evaluated the degree to which EU member states are compliment with the Recommendation. We are interested in the assessment related to the Sub-recommendation B.3. which requires that the central bank plays a leading role in macro-prudential policy, given their institutional and functional strengths.

Table 15 summarizes the extent of the central bank’s role in the macro-prudential policy of individual countries. The ESRB grades countries according to their efforts to implement the ESRB Recommendation on a zero to one scale (0 = Non-compliant; Materially non-compliant = 0.25; 0.5 = Partially compliant; 0.75 = Largely compliant; 1 = Fully compliant). Table 16 show the standards as set by the ESRB regarding grading the Sub-recommendation B.3.

Figure 5 shows the index values for our sample countries. Since the ESRB performed its assessment in 2014, we re-do the assessment for 2017 to check for any changes in the institutional setup.

Source: ESRB (2014); assessment for the year 2017 was performed by the authors

Overview of \(INS{T}_{i,t}\) Values for the Sample of Countries.

Rights and permissions

About this article

Cite this article

Hodula, M., Ngo, N.A. Finance, growth and (macro)prudential policy: European evidence. Empirica 49, 537–571 (2022). https://doi.org/10.1007/s10663-022-09537-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-022-09537-w