Abstract

In the realm of online retail, third-party sellers (TPSs) are progressively being permitted to offer their products on various platforms, often in exchange for a commission fee. This dynamic creates a natural competitive environment between the platforms and the TPSs. An increasingly prevalent strategy to enhance product competitiveness is the utilization of coupon promotions, which both platforms and TPSs have adopted. This study developed a theoretical model to study the dynamics of a retail system wherein an online platform facilitates the sale of products by a TPS, while simultaneously introducing products of differing quality levels. Four distinct promotion scenarios, based on whether the platform and TPS implement coupon offerings, are examined. The analysis outcomes reveal that coupon promotions initiated by both the platform and TPS result in reduced actual payments from consumers, particularly when the platform’s product holds a quality advantage. Surprisingly, in cases where the TPS’s product boasts a quality advantage, consumer actual payments may be higher in a promotion scenario compared to a non-promotional one. Furthermore, we demonstrate that the platform can leverage the TPS’s promotion efforts, particularly when commission fees and incremental purchases are on the higher side. Intriguingly, in situations where the TPS’s product holds a quality advantage, a co-promotion strategy, as opposed to a sole TPS-promotion approach, emerges as the optimal choice, especially when commission fees are substantial and incremental purchases are limited.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

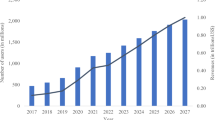

Online retail platforms, driven by the surge of the platform economy, have experienced rapid growth in recent years. The economy of online retail platforms connects upstream suppliers with downstream customers, compelling them to engage in sales transactions. In the initial operational practices, platforms and suppliers typically establish wholesale contracts, where platforms procure products in bulk from suppliers and then set a retail price for the product [48, 55]. As the platform economy has evolved, platforms have gradually permitted third-party sellers (TPSs) to establish official flagship stores for the direct sale of their products. The platforms then levy a commission fee, referred to as the direct selling or agency model [1]. It is worth noting that TPSs accounted for 52% of units sold on Amazon.com during the first quarter of 2020.Footnote 1 Moreover, a notable portion of these sales can be attributed to special promotions.

The adoption of a direct selling model diversifies the product categories available on the platforms, enhancing their appeal to online customers and fostering customer retention. Concurrently, TPSs can reap the benefits of increased customer traffic on the platforms, expanding their reach in the consumer market [18]. However, the allowance for TPSs to offer substitute products can lead to intense competition and potentially cannibalize the sales of the platform’s own products [47]. Consequently, platforms and TPSs are actively seeking competitive strategies to optimize revenue sharing without undermining the benefits of their collaborative efforts.

Coupon promotions are important marketing tools in B2C [29, 32] and serve as a prevalent price discrimination tool in market competition [39]. Coupons have the capacity to enhance product visibility, foster brand loyalty, and promote user retention, ultimately increasing consumers’ inclination to return for additional purchases [45]. According to a report by Valassis, 92% of consumers use coupons to secure better prices, and over 45% of consumers frequently utilize coupons.Footnote 2 Many online retail platforms and TPSs, such as Amazon.com and Alibaba.com, have launched coupon promotion campaigns [10, 37], particularly during promotional events like Black Friday, Double 11, and Double 12.

In a platform retail system, the pricing authority and interest relationship between the platforms and the TPSs are distinct, leading to significant differences in price regulation and market competition facilitated by coupons. Consequently, the platforms and TPSs exhibit distinct promotional motivations. When one participant in the system initiates coupon promotions, others must decide whether to join in [26]. For example, Taobao.com launched promotional activities during Double 11. In this scenario, TPSs must choose whether to participate in the platform’s promotion, either by providing coupons themselves or by partaking in the platform’s promotion. Moreover, when TPSs promote seasonal commodities, the platforms determine whether to offer coupons for specific types of products based on the sales situation. According to Feldman et al. [16], approximately 250,000 TPSs offered coupon discounts on Taobao.com as of March 2018. While markets and benefits can be derived from participating in platforms’ or TPSs’ promotions, there is a significant disparity in the revenue sharing received by participants. Promotional inputs may not necessarily yield the expected output, leading many participants to be hesitant about engaging in promotional cooperation. For example, players in the fashion industry such as Coach, Michael Kors, and Longchamp abstain from participating in platform promotional activities. This phenomenon prompts us to address the following questions:

-

Q1: What is the impact of coupon promotions on the pricing of a retail system that consists of online retail platforms and TPSs?

-

Q2: Do coupon promotions lead to increased revenue, and how is revenue affected when platforms and TPSs implement different promotion scenarios?

-

Q3: What is the optimal coupon promotional decision accounting for product competition?

To address the abovementioned issues, we have developed a theoretical model to study the coupon promotional competition of a retail system in which an online retail platform permits a TPS to sell substitute products based on the platform’s offerings. We have designed four coupon promotion scenarios based on whether the platform and the TPS engage in coupon promotions. Consumers who redeem coupons benefit from a price discount and are more inclined to make additional purchases. We have employed utility theory to determine consumer product selection and have implemented a Stackelberg game to unveil the competition dynamics among participants. Additionally, we have taken into account the coupon redemption rate and consumer valuations to explore the robustness of the model. This analysis has yielded some significant implications, which will be outlined in the following section.

Performance of coupon promotion: Coupon promotions by the platform and TPS lead to reduced actual payments for consumers when the platform’s product boasts a quality advantage. Conversely, consumers may end up making higher actual payments when the TPS’s product is of higher quality. In a platform-promotion scenario, the platform benefits more from conducting coupon promotions, while the TPS has an opportunity to generate higher revenue under specific conditions. In a TPS-promotion case, the platform can “free-ride” on the TPS’s promotion when the commission fee and incremental purchases are substantial. In a co-promotion scenario, both the platform and the TPS find themselves in a mutually beneficial situation, especially when incremental purchases are sufficiently high.

Optimal promotional competition for participants: For the platform, a co-promotion strategy is most effective when both incremental purchases and commission fees are high. This encourages online retail platforms like Amazon.com and JD.com to incentivize sellers to partake in their promotional activities. Conversely, for the TPS, a self-promotion strategy outperforms a platform-promotion strategy when incremental purchases are substantial enough. Interestingly, in cases where the TPS’s product holds a quality advantage, a co-promotion strategy, rather than a sole TPS-promotion approach, emerges as the optimal choice, especially when commission fees are significant and incremental purchases are limited.

Additionally, model extensions demonstrate that the outcomes of the basic model remain consistent, confirming the model’s robustness. Furthermore, with an influx of low-value consumers entering the market, the platform should opt for a co-promotion strategy, while the TPS should conduct promotions independently. In cases of high coupon redemption rates, the optimal strategy for the platform is to promote unilaterally, whereas the TPS should consider adopting a co-promotion strategy if its product holds a quality advantage.

The paper’s contribution can be outlined in three main aspects. Firstly, we introduce a model with dual decision variables, encompassing both price and coupon considerations within the retail system. This marks a departure from prior research, which predominantly focused on a single pricing strategy. Secondly, we delve into operational strategies within a competitive environment, where a platform and a TPS offer products of varying quality. In contrast, existing literature primarily tackled homogeneous products sourced from a common supplier. Thirdly, we delve into the potential coupon promotion strategies employed by participants, outlining key determinants such as consumer type, commission fees, redemption rates, and incremental purchases within the retail system. Prior studies have tended to be limited to a unilateral promotion scenario, neglecting to comprehensively address these critical determinants.

The remainder of this paper is structured as follows: Sect. 2 provides a review of pertinent literature. In Sect. 3, we articulate the research problem and construct our model. A thorough analysis of the model is conducted in Sect. 4. Subsequently, Sect. 5 explores various extensions. Finally, in Sect. 6, we conclude the paper and propose management insights.

2 Literature review

The field of platform pricing has seen extensive research on various aspects, including platform services [52], consumer preferences [46], platform information [35], promotional efforts [14, 15, 54], and network externalities [9]. In the literature, scholars have focused on deriving optimal pricing strategies by characterizing various system attributes. For instance, Gabszewicz and Wauthy [19] explored cross-network externalities in online retail platforms, discussing pricing strategies in monopoly and duopoly scenarios and outlining the advantages of each case. Feng et al. [17] investigated the impact of message dissemination on pricing strategies in duopoly platforms, albeit with a focus on the effectiveness of message dissemination.

Moreover, platform pricing strategies are observed across various platform types, including social media platforms [30], group purchase platforms [2], online ride-hailing platforms [56], and crowdfunding platforms [43]. Among the literature, pricing strategy is closely associated with the characteristics of the platform type.

Several scholars have investigated platform pricing strategies in two-sided markets [4, 14, 44]. This line of research focuses on facilitating effective coordination between suppliers and consumers, leveraging the intermediary role of the platform. Network externalities and bilateral theory are often employed to analyze these strategies. For instance, Armstrong [3] examined a two-sided system involving upstream suppliers, platforms, and downstream customers, analyzing equilibrium pricing strategies under scenarios of platform monopoly, single-homing, and multi-homing. Liu et al. [36] evaluated the impact of consumers’ single-homing and multi-homing behavior on platform innovation strategies. Additionally, Duan et al. [14] scrutinized the influence of information levels on optimal pricing in a two-sided market, revealing that platforms strategically adjust pricing based on information disclosure levels, affecting user demand.

While platform pricing strategies have received significant attention, most studies have focused on single-price models. There has been less emphasis on joint promotional strategies combining both price and coupons, often assuming a monopoly setting and overlooking competitive operational strategies. This paper contributes uniquely to the literature by examining competition within a retail platform for heterogeneous products offered by both the platform and TPS.

Furthermore, our study contributes to the research stream on coupon promotions. Early research on coupons primarily focused on their impact on consumer purchasing behavior. For example, Wierich and Zielke [50] empirically analyzed how coupon attributes affect customer loyalty and purchase decisions. They argued that personalized coupons have a greater influence on consumer loyalty than the face value of coupons and are more likely to encourage redemption.

Other research focused on coupons as a tool for price discrimination [39]. Jiang et al. [25] examined the pricing strategy of bundled products in the context of coupon promotions and proposed optimal strategies for bundled discounts and coupon face values. Reimers and Xie [45] investigated whether coupons could facilitate price discrimination and attract new consumers. They suggested that coupon promotions can expand market sizes, allowing retailers to implement higher pricing strategies.

Recent research has also explored coupons as a competitive tool for supply chain and channel integration. For instance, Bauner et al. [5] studied the promotional effects of supply chains, emphasizing how a diverse range of products can enhance a manufacturer’s promotional incentives. Li et al. [33] examined a dual-channel supply chain where manufacturers and retailers unilaterally or simultaneously provide coupons. They found that retailer coupon promotions can benefit manufacturers in a two-stage promotional process. Additionally, Li et al. [29, 31, 32] investigated coupon promotions and channel conversion strategies within the context of omnichannel retailing, focusing on the integration effect of coupons across channels.

Despite this body of research, prior studies related to coupon promotions have primarily discussed them in the context of price discrimination in supply chain and channel operation decisions. The coupon promotion strategy within a platform competition market remains a relatively unexplored area. Given the widespread use of coupon promotions on platforms, there is an urgent need to explore platform coupon promotion strategies from a theoretical perspective to inform practice.

Several studies have focused on platform promotions. For example, Cao et al. [8] delved into rebate strategies, encompassing gift cards and cash coupons, for business-to-consumer platforms. Jiang et al. [24] studied the coupon promotion strategy for a physical retailer selling products through both third-party and self-operated platforms. Tong et al. [49] investigated the impact of monetary and gift promotions on sales. Furthermore, Liu [34] empirically investigated dynamic coupon targeting strategies in livestream platforms. However, these promotional strategies predominantly involve the selection of promotional models or the channel strategy of self-run and third-party stores. In a recent study, Feng et al. [18] examined an online retail platform selling both first-party and TPS’s products, asserting that both the platform and TPS can benefit from coupon promotions. Nevertheless, they did not delve into the dynamic interaction between price and coupon face value, nor did they differentiate between the quality of first-party products and TPS’s products. Table 1 provides a summary of the research gaps addressed in this paper.

3 The model

3.1 System structures

We examine a retail system that consists of a leading online platform and a TPS, illustrated in Fig. 1a. The platform sells its own products (called product R), which have retail price pr. Meanwhile, the platform allows the TPS to sell substitute products (called product S) and charges a fraction r, 0 < r < 1, of the TPS’s revenues as commission fee [1]. In line with Tian et al. [48] and Hu et al. [23], we assume that r is exogenously given. This setting ensures that the platform charges a common commission fee for the entire product category of the TPS, which is predetermined before negotiating sales contracts. The TPS decides the retail price ps for product S.

Further, we assume that the products sold by the platform and the TPS are substitutes. In line with Gu and Tayi [21], the consumer’s perceived value of the product depends on two dimensions: the horizontal dimension indicating the base functionality of the product and the vertical dimension indicating the quality differentiation. Quality differentiation is characterized by individual product designs (e.g., style, color, size, and product type). Consumers have a common valuation for the base functionality and are heterogeneous in evaluating their preferences for quality differentiation [28]. Therefore, we assume that consumers have a valuation kR β when purchasing product R and a valuation kS β when purchasing product S. Here, β (0 < β < 1) characterizes the common valuation perception for products (i.e., the base functionality), and kR and kS characterize consumers’ heterogeneity preferences for quality differentiation of products R and S. Given that consumers may have a higher or lower perceived value for product S compared to product R,Footnote 3 we let kR = 1 and kS = k, where k is uniformly distributed over (0,2) and k ≠ 1.Footnote 4 We set the upper limit such that product S may have higher quality than product R, and the proportional relationship is symmetrical. When k is located at the threshold (0,1), consumers have a lower perceived value of product S than product R; the opposite is the case when k is located at the threshold (1,2).

To expand market share, the platform and the TPS announce that they will provide coupons based on the normal price, as shown in Fig. 1b–d. The coupons are displayed with the product on the website and consumers can redeem the coupons immediately when they make a purchase, ensuring that consumers have convenience in redeeming coupons whether platform coupons or TPS coupons. We suppose that one participant conducts a promotional activity and the other decides whether to participate in the current promotion, resulting in the situations that RN = {the platform promotes, the TPS does not participate}, NS = {the platform does not participate, the TPS promotes}, and RS = {the platform and TPS promote simultaneously}. If the platform or/and the TPS promote, the platform offers coupons for product R that have a face value fr (pr > fr > 0) and the TPS provides coupons for product S that have a face value fs (ps > fs > 0). The consumer’s payment in redeeming a coupon fi (i = r,s) turns to (pi − fi). Similarly to Choudhary and Shivendu [11], we suppose that the coupon distribution and redemption costs are normalized to 0, which allows us to focus on the coupon value and its impact on the price competition strategy. Moreover, both the platform and TPS offer coupons as a form of full-reduction promotion, which means consumers can only redeem coupons once the value of their purchased products reaches a specific threshold. For instance, Amazon typically implements a full-reduction promotion policy (e.g., $20 off for every $100 purchase). In cases where the value of the expected product is $90, consumers may make an additional purchase of $10 to qualify for the $100 coupon, even if this additional purchase was not initially intended. Thus, coupon promotions have a market expansion effect, that is, the promotional activity generates additional purchases for the coupon issuers [8, 18, 42]. We assume that consumers derive equal utility from making additional purchases to obtain the promotional discount from the platform as from the TPS. Although platforms such as Amazon typically offer a wider assortment of product, many TPS also offer a wide range of products. This ensures that consumers can easily make additional purchases through TPS, thereby maintaining parity in the redemption dimensions between platform and TPS coupons. We use ξ and ζ to denote the incremental profits generated by the platform’s and the TPS’s promotions, respectively. Table 2 summarizes the notations that are used in this paper.

3.2 Game scenario and sequence of events

The platform’s and the TPS’s promotional decisions lead to four possible configurations:

-

Scenario NN {fr = 0, fs = 0}—no coupon is provided by the platform and the TPS.

-

Scenario RN {pr > fr > 0, fs = 0}—only the platform conducts a coupon promotion.

-

Scenario NS {fr = 0, ps > fs > 0}—only the TPS conducts a coupon promotion.

-

Scenario RS {pr > fr > 0, ps > fs > 0}—the platform and TPS simultaneously conduct coupon promotions.

The timing of this game is as follows. First, the platform and the TPS announce coupon promotions. Second, the platform decides the price of product R and the coupon value. Third, the TPS sets the price of product S and the coupon value. Last, consumers choose product R or S according to their utilities.

3.3 Demand specification and decision model

3.3.1 Scenario NN: {f r = 0, f s = 0}

In this scenario, consumer utilities for product R and product S are Ur = β − pr and Us = βk − ps. Suppose that Ui > 0 (i = r,s) always holds, which ensures that each consumer has a unit demand. Consumers strategically select product R or product S according to max{Ur, Us}. There are two sub-scenarios (i.e., Scenario NN-I and Scenario NN-II) since the TPS may sell product S with lower or higher quality compared with product R. The market for the platform and the TPS is as shown in Fig. 2. The marginal consumer, located at k1 and k2, is indifferent about purchasing product R or product S.Footnote 5

Depending on the market segmentation, we have qr = (β + ps − pr)/β and qs = (pr − ps)/β in Scenario NN-I and qr = (ps − pr)/β and qs = (β + pr − ps)/β in Scenario NN-II. Note that the expression of the revenue function is the same in the cases k ∈ (0,1) and k ∈ (1,2), except that qr and qs refer to different content. The decision problem is:

3.3.2 Scenario RN: {pr > fr > 0, fs = 0}

In this situation, the utility for product R turns to Ur = β − pr + fr. Thus, we have Fig. 3.

Consumers, located at k1 in k ∈ (0,1) and k2 in k ∈ (1,2), are indifferent about purchasing product R or S. To compete in the market of the TPS, the platform conducts coupon promotions and captures the market intervals [k1, k3] and [k2, k4]. We assume that the platform has the ability to accurately identify customers’ preferences and provide targeted coupons in these intervals [11] (The same holds for the case below). Consumers in these intervals purchase product R because the platform’s promotion is high enough to compensate for their strong preferences for product S. Those consumers will buy product R at (pr − fr). Note that the consumers located at [0, k1] and [0, k2] will buy product R with pr because those consumers have sufficient preferences for product R (or product R is of sufficiently high quality), leading to a high willingness to pay. Accordingly, we have qr−1 = (β + ps − pr)/β, qr−2 = fr/β, and qs = (pr − fr − ps)/β in Scenario RN-I; and qr−1 = (ps − pr)/β, qr−2 = fr/β, and qs = (β + pr − fr − ps)/β in Scenario RN-II. Through coupon promotions the platform earns incremental revenue ξqr−2 [18]. The decision problem is:

3.3.3 Scenario NS: {fr = 0, ps > fs > 0}

In this situation, the utility for product S is Us = βk − ps + fs. Thus, we have Fig. 4.

The logic of market segmentation is similar to the platform-promotion case. Thus, we have qr = (β + ps − fs − pr)/β, qs−1 = (pr − ps)/β, qs−2 = fs/β in Scenario NS-I; and qr = (ps − fs − pr)/β, qs−1 = (β + pr − ps)/β, qs−2 = fs/β in Scenario NS-II. The decision problem of the retail system is:

3.3.4 Scenario RS: {pr > fr > 0, ps > fs > 0}

In this case, consumer utilities with coupons are Ur = β − pr + fr and Us = βk − ps + fs. Thus, we get Fig. 5.

When no coupon is provided, the segments in the intervals 0-k1 and 1-k2 are loyal to the platform and the segments in the intervals k1–1 and k2–2 are loyal to the TPS. The platform targets coupons for the intervals k1–1 and k2–2 and the TPS targets coupons for the intervals 0-k1 and 1-k2. The platform can capture the intervals k1-k3 and k2-k4 and the TPS can capture the intervals k5-k1 and k6-k2 if coupon promotions provide sufficient utility for consumers to transfer to competitive products. Note that, for the segments k5-k1 and k6-k2, although consumers may prefer product R, the TPS’s promotion is sufficiently high such that consumers will purchase product S. The same logic applies to the segments k1-k3 and k2-k4. A similar setting can be found in Kosmopoulou et al. [27]. Then we have qr−1 = (β + ps − fs − pr)/β, qr−2 = fr/β, qs−1 = (pr − fr − ps)/β, qs−2 = fs/β in Scenario RS-I, and qr−1 = (ps − fs − pr)/β, qr−2 = fr/β, qs−1 = (β + pr − fr − ps)/β, qs−2 = fs/β in Scenario RS-II (k ∈ (1,2)). The decision problem is:

We derive the equilibrium solutions through backward induction. To preserve space, the derivation and the equilibrium solutions are provided in Table A1 of Online Appendix A.

4 Equilibrium analysis

4.1 Pricing strategy with coupon promotions

In this subsection, we study the impact of coupon promotions on pricing by comparing the cases with and without coupons (answering the first question proposed in the Introduction section). We also investigate the magnitude of coupon face value in different promotional cases. Then, we have the following corollaries.

Corollary 1

When product R has a higher quality level than product S, namely, within k ∈ (0,1),

-

(i)

\(p_{r}^{RN - I*} > p_{r}^{NN - I*};\) \(p_{r}^{NS - I*} < p_{r}^{NN - I*};\) \(p_{r}^{RS - I*} > p_{r}^{NN - I*}\) when \(\xi > \frac{{\beta \left( {2 + 3r - 3r^{2} } \right) + 3\zeta \left( {2 - 3r + 3r^{2} } \right)}}{{3\left( {2 - 3r + 3r^{2} } \right)}}\).

-

(ii)

\(p_{s}^{RN - I * } < p_{s}^{NN - I * }\); \(p_{s}^{NS - I * } > p_{s}^{NN - I * }\); \(p_{s}^{RS - I*} > p_{s}^{NN - I*}\) when \(\zeta > \frac{{\beta \left( {1 - r} \right) + \xi \left( {2 - r} \right)}}{2 - r}\).

-

(iii)

\(\left( {p_{r}^{RN - I*} - f_{r}^{RN - I*} } \right) < p_{r}^{NN - I*}\); \(\left( {p_{s}^{NS - I * } - f_{s}^{NS - I * } } \right) < p_{s}^{NN - I * }\); \(\left( {p_{r}^{RS - I*} - f_{r}^{RS - I*} } \right) < p_{r}^{NN - I*}\); \(\left( {p_{s}^{RS - I*} - f_{s}^{RS - I*} } \right) < p_{s}^{NN - I*}\).

Corollary 1 sheds light on several pricing strategies when conducting coupon promotions. First, in a unilateral promotion case (i.e., Scenarios RN and NS), coupon promotions lead to an increased retail price, namely, prRN−I* > prNN−I* and psNS−I* > psNN−I*. This result matches our theoretical prediction that merchants charge a higher price before promotion. For example, consumers buy Honor Magic 3 mobile phones on JD.com, where the pre-sale price is CNY600, which is higher than that in a normal sales season. We also find that coupon promotions lead to a lower price for the competing product, namely, prNS−I* < prNN−I* and psRN−I* < psNN−I*. It is easy to infer that a lower price should be set to compete with the product that is conducting promotions. However, in a co-promotion case, high incremental purchases (i.e., ξ or ζ) encourage the platform and the TPS to charge a higher retail price. The underlying reason is that the platform and the TPS become competitors over their promotions. Thus, a strong promotion is adopted and, following this, a high-price strategy is designed.

Interestingly, Corollary 1(iii) shows that consumer’s actual payments with coupon promotions (pij−I − fij−I; i = r,s; j = RN,NS,RS) are lower than those without coupons. This implies that consumers enjoy a price discount even though the retail price of the product is high (note that coupon promotions lead to higher prices). In this situation, consumers obtain higher utilities and buy more. This is the main logic behind the idea that merchants, like Amazon, JD, and Alibaba, can expand the market and consumers are willing to consume more with coupons.

Corollary 2

When product R has a lower quality level than product S, namely, within k ∈ (1,2),

-

(i)

\(p_{r}^{RN - II*} > p_{r}^{NN - II*}\) when \(\xi > \frac{{\beta \left( {2r - 1} \right)}}{{2\left( {2 - r} \right)}}\); \(p_{r}^{NS - II*} < p_{r}^{NN - II*}\); \(p_{r}^{RS - II*} > p_{r}^{NN - II*}\) when \(\xi > \frac{{\beta \left( {4 + r - 3r^{2} } \right) + 3\zeta \left( {2 - 3r + r^{2} } \right)}}{{3\left( {2 - 3r + r^{2} } \right)}}\).

-

(ii)

\(p_{s}^{RN - II * } < p_{s}^{NN - II * }\) when \(\xi > \frac{{\beta \left( {2r - 1} \right)}}{{2\left( {2 - r} \right)}}\); \(p_{s}^{NS - II * } > p_{s}^{NN - II * }\); \(p_{s}^{RS - II*} > p_{s}^{NN - II*}\) when \(\zeta > \frac{{2\xi \left( {2 - r} \right) - \beta \left( {1 + r} \right)}}{{2\left( {2 - r} \right)}}\).

-

(iii)

\(\left( {p_{r}^{RN - II*} - f_{r}^{RN - II*} } \right) < p_{r}^{NN - II*}\). when \(\xi > \frac{{\beta \left( {2r - 1} \right)}}{{2\left( {2 - r} \right)}}\); \(\left( {p_{s}^{NS - II * } - f_{s}^{NS - II * } } \right) < p_{s}^{NN - II * }\); \(\left( {p_{r}^{RS - II*} - f_{r}^{RS - II*} } \right) < p_{r}^{NN - II*}\), \(\left( {p_{s}^{RS - II*} - f_{s}^{RS - II*} } \right) < p_{s}^{NN - II*}\)

Corollary 2 shows that when the platform conducts promotions unilaterally (i.e., Scenario RN-II), the platform raises the price and the TPS drops the price if the incremental purchases ξ are large enough. Recall from Corollary 1 that the platform raises the price and the TPS drops the price given any value of ξ. The critical insight from this finding is that the platform becomes more cautious in designing a high-price strategy and the TPS tends to be confident to compete with the platform when the TPS’s product has a quality advantage.

Another noteworthy issue relates to the consumer’s actual payment in Scenario RN-II. Consumers’ actual payments may be greater in the promotional case than in the non-promotional case (i.e., prRN−II* − frRN−II* > prNN−II*), which is the opposite of Corollary 1. By comparing the market of the platform, we find that consumers buy more even though they make a higher actual payment (i.e., qrRN−II* > qrNN−II* with ξ > β(2r − 1)/(2(2 − r)). This finding reveals an interesting business phenomenon that although merchants provide price discounts with coupons, the actual payment from consumers may not be reduced. Consumers may pay a higher actual payment and, surprisingly, are willing to buy more. In this case, merchants receive an increased unit payment and capture more sales with coupon promotions. For example, FILA, a global clothing brand, often raises its retail prices before offering coupons during events like Double 11 promotions. As a result, consumers may pay a higher price, even after redeeming the coupon. This phenomenon can also be found in the case of another brand, such as Converse.

Corollary 3

The platform and the TPS conduct promotions with differential levels for different promotion cases,

-

(i)

\(f_{r}^{RN - I*} > f_{s}^{NS - I*}\) within \(r \in \left[ {0,r_{1} } \right)\); \(f_{r}^{RN - II*} > f_{s}^{NS - II*}\) within \(r \in \left[ {0,r_{2} } \right)\).

-

(ii)

\(f_{r}^{RS - I*} > f_{r}^{RN - I*}\) within \(r \in \left( {0,\frac{\beta + 2\xi - 7\zeta }{{\beta + \xi - 4\zeta }}} \right]\); \(f_{r}^{RS - II*} < f_{r}^{RN - II*}\) always hold.

-

(iii)

\(f_{s}^{RS - I*} > f_{s}^{NS - I*}\) within \(r \in \left( {\frac{3\beta + 6\xi - \zeta }{{3\beta + 3\xi }},1} \right]\); \(f_{s}^{RS - II*} > f_{s}^{NS - II*}\) within \(r \in \left( {\frac{6\xi + \beta - \zeta }{{3\beta + 3\xi }},1} \right]\).

-

(iv)

\(f_{r}^{RS - I*} > f_{s}^{RS - I*}\) within \(r < \frac{1}{3}\); \(f_{r}^{RS - II*} < f_{s}^{RS - II*}\) always hold.

The definitions of r1 and r2 are provided in Table A2 in Online Appendix A. Figure 6 provides an intuitive summary of Corollary 3.

Corollary 3 and Fig. 6 suggest several findings that are associated with promotion level and promotion response. First, Corollary 3(i) and Fig. 6a, b show that when the platform receives a low commission fee (i.e., r is low), the platform may set the promotion level for product R to capture market share, namely, frRN−I* > fsNS−I*. In contrast, the TPS will increase the promotion level if it offsets a high commission fee (a high r or a low 1 − r). Given a high r, the TPS can seize the opportunity to make more profits only if it strengthens coupon promotions.

Corollary 3(ii) and Fig. 6c, d characterize the platform’s promotion response during the TPS’s promotion. This is because the comparison between frRS−n*and frRN−n* (n = I,II) indicates the changes to the platform’s promotional plan in the face of the TPS’s promotion. Similarly, Corollary 3(iii) and Fig. 6e, f characterize the TPS’s promotional response strategy when confronted with the platform’s promotion. We find that within k ∈ (0,1), the platform raises the promotion level during the TPS’s promotion when r is low. Conversely, within k ∈ (1,2), the platform reduces the promotion level if r is low. It follows that coupon promotions may be costly for the platform if product R is less quality-competitive (i.e., k ∈ (1,2)). In this situation, the platform may reduce the promotion level and focus on commission revenue. We also find that the TPS will strengthen its promotions to compete with the platform when the commission fee is high (or 1 − r is low). This result matches our expectation that a strong promotion allows the TPS to improve profit. Those results enable us to conclude that the platform can strategically adjust its coupon promotional deciss according to the profitability of products R and S, whereas the optimal choice for the TPS is conducting promotions when (1 − r) is low.

In addition, Corollary 3(iv) and Fig. 6g, h show the promotion level between the platform and the TPS in a co-promotion case. We find that when product R has a quality advantage, the platform is less motivated than the TPS to conduct promotions when r is high. This is because the platform can benefit from the TPS’s promotion. When r is high, the platform is less likely to conduct an intense promotion and instead encourages the TPS to hold promotions. However, the TPS has a higher incentive to conduct promotions when product S has a quality advantage. Those findings suggest that in a co-promotion case, the platform should reduce its promotional efforts and benefit from the TPS’s promotion when the platform’s product has a quality advantage. However, the platform should increase its promotional efforts if it obtains a low commission fee. The optimal strategy for the TPS is to increase its promotions to compete with the platform when the TPS’s product has a quality advantage.

4.2 Performance of coupon promotion

In this section, we analyze the performances of promotional cases to answer the second question (i.e., Do coupon promotions lead to revenue improvement, and how does the revenue relationship change between promotional strategies?). We introduce win–win, win–lose, lose–win, and lose–lose situations (the former refers to the platform; the latter to the TPS) to show the game strategies.

Proposition 1

When the platform implements coupon promotions,

-

(i)

within k ∈ (0,1), \(\Pi_{R}^{RN - I * } > \Pi_{R}^{NN - I * }\) and \(\Pi_{S}^{RN - I * } < \Pi_{S}^{NN - I * }\)

-

(ii)

within k ∈ (1,2), \(\Pi_{R}^{RN - II * } > \Pi_{R}^{NN - II * }\); \(\Pi_{S}^{RN - II * } > \Pi_{S}^{NN - II * }\) when \(\xi < \frac{{\beta \left( {2r - 1} \right)}}{{2\left( {2 - r} \right)}}\) and \(r > \frac{1}{2}\).

Figure 7 provides an intuitive summary of Proposition 1.

Proposition 1 and Fig. 7 provide several interesting insights into the profitability of coupon promotions. The platform is better off when implementing promotions regardless of product quality. This finding proves the economic benefits of coupon promotions. Nevertheless, a less-expected result is that when the TPS’s product has a quality advantage (i.e., within k ∈ (1,2)), the TPS may gain higher revenue during the platform’s promotion if ξ is low and r is large (i.e., a win–win situation). This is because the promotional effect is weak for a low ξ and the platform is cautious about conducting coupon promotions. Thus, the TPS has an opportunity to capture a larger market and to raise its price when its product has a quality advantage (i.e., dqsRN−II*/dξ < 0, dqsRN−II*/dr > 0; dpsRN−II*/dξ < 0, dpsRN−II*/dr > 0). In this instance, the TPS may be better off. Plainly, it is important for the TPS to identify an appropriate scenario to design a high-price strategy when faced with the platform’s promotion.

Proposition 2

When the TPS implements coupon promotions,

-

(i)

within k ∈ (0,1), \(\Pi_{R}^{NS - I * } > \Pi_{R}^{NN - I * }\) when \(\zeta > \zeta_{1} = \frac{3\beta - 3\beta r + 2\sqrt 3 \beta }{{1 + 6r - 3r^{2} }}\); \(\Pi_{S}^{NS - I * } > \Pi_{S}^{NN - I * }\) when \(\zeta > \zeta_{2} = \frac{{\sqrt {3\left( {16\beta^{2} - 12r\beta + 3r^{2} \beta^{2} } \right)} - 3\beta }}{{13 - 12r + 3r^{2} }}\).

-

(ii)

within k ∈ (1,2), \(\Pi_{R}^{NS - II * } > \Pi_{R}^{NN - II * }\) when \(\zeta > \zeta_{3} = \frac{{\beta - 3r\beta + \beta \sqrt {3\left( {1 + r} \right)^{2} } }}{{1 + 6r - 3r^{2} }}\); \(\Pi_{S}^{NS - II * } > \Pi_{S}^{NN - II * }\) when \(\zeta > \zeta_{4} = \frac{{\beta \sqrt {3\left( {17 - 8r + 2r^{2} } \right)} - 5\beta }}{{13 - 12r + 3r^{2} }}\).

Figure 8 provides an intuitive summary of Proposition 2.

From Proposition 2 and Fig. 8, we find that in a TPS-promotion case, both the platform and the TPS will be better off (i.e., a win–win situation) when ξ is high. Unlike the logic of the platform-promotion case, the platform and the TPS can simultaneously benefit from coupon promotions because the platform obtains a commission revenue from the TPS. Although the revenue generated from product R may be lower, product S’s revenue is large enough to offset this loss. However, the platform may be worse off when faced with the TPS’s promotion in a low ξ and r (including the lose–win and lose–lose situations). Therefore, increasing the commission fee r and encouraging the TPS to hold promotions could be a strategy for the platform to improve profit, especially when product R is less competitive. Another noteworthy result is that the platform and TPS are more likely to be better off when the TPS introduces a high-quality product (i.e., Fig. 8b) compared to when the platform’s product has a higher quality (i.e., Fig. 8a). Essentially, in a TPS-promotion case, the platform shares a higher commission revenue from the TPS’s high-quality product. Free riding on the TPS’s promotion may be an optimal option, since the platform should compete with the TPS’s promotion decision even if the platform’s product has a higher quality.

Proposition 3

When the platform and the TPS conduct coupon promotions simultaneously,

-

(i)

within k ∈ (0,1), \(\Pi_{R}^{RS - I*} > \Pi_{R}^{NN - I*}\) when \(\xi > \xi_{1} = \frac{{ - 6\beta + 9r\beta - 3r^{2} \beta + 2\zeta - r\zeta + \sqrt {\Phi_{1} } }}{{3\left( {2 - r} \right)^{2} }}\); \(\Pi_{S}^{RS - I*} > \Pi_{S}^{NN - I*}\) when \(\zeta > \zeta_{5} = \frac{{ - 48\beta + 96r\beta - 60r^{2} \beta + 12r^{3} \beta + 24\xi - 48r\xi + 30r^{2} \xi - 6r^{3} \xi + \sqrt {\Phi_{2} } }}{{2\left( {112 - 344r + 416r^{2} - 250r^{3} + 75r^{4} - 9r^{5} } \right)}}\).

-

(ii)

within k ∈ (1,2), \(\Pi_{R}^{RS - II*} > \Pi_{R}^{NN - II*}\) when \(\xi > \xi_{2} = \frac{{ - 4\beta + 14r\beta - 6r^{2} \beta + 4\zeta - 2r\zeta + \sqrt {\Phi_{3} } }}{{2\left( {12 - 12r + 3r^{2} } \right)}}\); \(\Pi_{S}^{RS - II*} > \Pi_{S}^{NN - II*}\) when \(\zeta > \zeta_{6} = \frac{{ - 96\beta + 96r\beta - 24r^{2} \beta + 24\xi - 24r\xi + 6r^{2} \xi + \sqrt {\Phi_{4} } }}{{2\left( {112 - 232r + 184r^{2} - 66r^{3} + 9r^{4} } \right)}}\).

Φx (x = 1,2,3,4) are provided in Online Appendix. Figure 9 provides an intuitive summary of Proposition 3.

In a co-promotion case, a win–win situation happens only if ξ is sufficiently large. The reason for this is similar to the abovementioned situation, that is, greater incremental purchases lead to greater additional revenue. Furthermore, the platform’s performance is better than that of the TPS when ξ is in an intermediate range in Scenario RS-I (see the win–lose region in Fig. 9a), whereas the performance of the TPS is better than that of the platform when r is in a high range in Scenario RS-II (see the lose–win region in Fig. 9b). The key factor shaping these results is the difference in quality between product R and product S. A higher-quality product allows the coupon issuers to enjoy a competitive advantage, which subsequently leads to a winning situation.

Of specific interest is the TPS’s revenue in Scenario RS-II. In general, the TPS has less revenue when it pays a high r to the platform. However, the TPS may be better off when r is large (see the win–win region in Fig. 9b). This is because the platform is less enthusiastic about promotions and it raises the retail price for product R (i.e., dfrRS−II*/dr < 0, dprRS−II*/dr > 0), which results in lower sales for product R. In contrast, the TPS is motivated to conduct promotions for product S (i.e., dfsRS−II*/dr > 0), which allows it to capture more market share, resulting in higher revenue. An important lesson from this result is that the platform should avoid an overreliance on the promotional benefits from the TPS even when it receives a large commission fee. Rather, the platform should enhance its promotional efforts to remain competitive and avoid losing product competitiveness.

4.3 Optimal promotional decision for platform and for third-party sellers

In this section, we explore the optimal promotional decision for when the platform and/or the TPS conducts coupon promotions, which answers the third question (i.e., what is the optimal promotional competition decision?). Given that incremental purchases have a common effect on revenue, we assume that ζ = ξ (a common setting; see [18]), which allows us to focus on the game strategy and to ensure the compatibility of the results.

Proposition 4

When the platform and/or the TPS conduct coupon promotions, the optimal coupon competition decisions for the platform in Scenarios RN, NS, and RS are as follows:

-

(i)

within k ∈ (0,1), \(\Pi_{R}^{RN - I * } > \Pi_{R}^{NS - I * }\); \(\Pi_{R}^{RS - I*} > \Pi_{R}^{NS - I*}\); \(\Pi_{R}^{RS - I*} > \Pi_{R}^{RN - I*}\) when \(\xi > \tilde{\xi }_{1}\).

-

(ii)

within k ∈ (1,2), \(\Pi_{R}^{RN - II * } > \Pi_{R}^{NS - II * }\); \(\Pi_{R}^{RS - II*} > \Pi_{R}^{NS - II*}\); \(\Pi_{R}^{RS - II*} > \Pi_{R}^{RN - II*}\) when \(\xi > \tilde{\xi }_{2}\).

\(\Pi_{S}^{RN - I} \left( {p_{s} } \right) = p_{s} \left( {1 - r} \right)\;{{\left( {p_{r} - f_{r} - p_{s} } \right)\;} \mathord{\left/ {\vphantom {{\left( {p_{r} - f_{r} - p_{s} } \right)\;} \beta }} \right. \kern-0pt} \beta }\)(x = 1,2) are provided in Online Appendix. Figure 10 provides an intuitive summary of Proposition 4.

There are several noteworthy findings that are revealed in Proposition 4 and Fig. 10. First, the platform collects a higher revenue in the self-promotion and the co-promotion cases than in the TPS-promotion case. It is easy to infer that the self-promotion case outperforms the TPS-promotion case. In regard to the co-promotion case, the platform has changed its strategy from a non-coupon to a coupon promotion when it implements co-promotion according to the TPS promotion. Thus, it is expected that the co-promotion case outperforms the TPS-promotion case because of the additional promotion. However, the platform-promotion case (Scenario RN-n; n = I,II) is not definitely better or worse than the co-promotion case (Scenario RS-n; n = I,II). Specifically, Scenario RS-n outperforms Scenario RN-n when ξ and r are high (see the red area in Fig. 10). This is because the platform can obtain the premium that is paid by the TPS. If the benefit is high enough to offset the loss because of the reduced sales, the platform is better off allowing the TPS to join its promotion. In business practice, online retail platforms, such as Amazon.com, stimulate TPSs to participate in the platforms’ promotional activities. Consumers not only enjoy the platform’s price discount but also an additional discount that is provided by the TPS. In this situation, platforms can gain a free ride from the TPS’s promotional activities.

Proposition 5

When the platform and/or the TPS conduct coupon promotions, the optimal coupon competition decisions for the TPS in Scenarios RN, NS, and RS are as follows:

-

(i)

within k ∈ (0,1), \(\Pi_{S}^{NS - I * } > \Pi_{S}^{RN - I * }\) when \(\xi > \hat{\xi }_{1}\); \(\Pi_{S}^{NS - I*} > \Pi_{S}^{RS - I*}\); \(\Pi_{S}^{RS - I*} > \Pi_{S}^{RN - I*}\) when \(\xi > \hat{\xi }_{2}\).

-

(ii)

within k ∈ (1,2), \(\Pi_{S}^{NS - II * } > \Pi_{S}^{RN - II * }\) when \(\xi > \hat{\xi }_{3}\); \(\Pi_{S}^{NS - II*} > \Pi_{S}^{RS - II*}\) when \(r < \frac{1}{3}\) or \(r > \frac{1}{3}\) and \(\xi > \frac{{\beta \left( {3r - 1} \right)}}{5 - 3r}\); \(\Pi_{S}^{RS - II*} > \Pi_{S}^{RN - II*}\) when \(\xi > \hat{\xi }_{4}\).

\(\Pi_{S}^{RN - II} \left( {p_{s} } \right) = p_{s} \left( {1 - r} \right)\;{{\left( {\beta + p_{r} - f_{r} - p_{s} } \right)\;} \mathord{\left/ {\vphantom {{\left( {\beta + p_{r} - f_{r} - p_{s} } \right)\;} \beta }} \right. \kern-0pt} \beta }\) (x = 1,2,3,4) are provided in Online Appendix. Figure 11 provides a summary of Proposition 5.

Unlike the promotional strategy of the platform, the TPS collects a higher revenue in a self-promotion case than in a platform-promotion case but only when ξ is large enough (recall from Proposition 4 that the platform inevitably collects a higher revenue in a self-promotion case than in a TPS-promotion case). The rationale is that stronger promotional efforts are required for the game follower (i.e., the TPS) to achieve profitability. Furthermore, within k ∈ (0,1), a unilateral promotion case outperforms a co-promotion case (i.e., ΠSNS−I* > ΠSRS−I*), which verifies the expectation that the platform’s promotion hurts the TPS. However, within k ∈ (1,2), the co-promotion case may be the optimal option for the TPS when r is large and ξ is small (see the red area in Fig. 11b). This is because the platform may reduce its promotion level and set a high price for product R in the co-promotion case. In contrast, the TPS has a higher promotion level for product S. As a result, the TPS may be better off in a co-promotion case. This result verifies the findings of Proposition 3. The potential managerial implication of this result is that when product S has a quality advantage, the promotional activity of the platform may not hurt the TPS. Rather, the TPS still has two ways to improve revenue: (i) enhance its bargaining power to reduce the commission fee (i.e., reduce r or raise 1 − r) and (ii) make full use of the high-price strategy and the low-promotion willingness of the platform to carry out high-level promotional activities.

More interestingly, the platform-promotion case is the optimal choice for the TPS when the incremental purchases are low enough (see the gray region in Fig. 11a and b). This result is driven by two factors. First, the promotional activity becomes uneconomical for the TPS when the promotional effect is weak. Thus, the TPS will stop having coupon promotions to avoid reduced revenue. Second, the platform weakens coupon promotions when incremental purchases are low enough, especially when the TPS’s product has a quality advantage. In this situation, the TPS captures a competitive advantage and gains revenue. This is the reason that the TPS may abandon coupon promotion but encourage the platform to do so. Our results reveal the business phenomenon that a lot of brands, such as Coach, Michael Kors, and Longchamp, do not participate in the promotional activities of Taobao.com.Footnote 6 Table 3 summarizes and clarifies the optimal coupon competition decisions for the retail system.

Table 3 indicates that when the incremental purchases that are generated from coupons are low, it is best for the platform to design a platform-promotion strategy (i.e., Strategy RN). However, when incremental purchases are high, the platform should encourage the TPS to participate in its promotional activity (i.e., Strategy RS). Meanwhile, for the TPS, a unilateral promotional strategy (i.e., Strategy NS) is the optimal option when the incremental purchases are large enough. The TPS should encourage the platform to join its promotional activity when incremental purchases are in an intermediate range and the commission fee is high (i.e., Strategy NS). In this case, the platform is motivated to join the TPS’s promotion because it receives a high commission fee.

4.4 Strategy difference considering product quality

In this section, we study the impact of product quality on equilibrium prices and revenues.

Corollary 4

Quality differential leads to a difference in terms of price and coupon value,

-

(i)

Price (j = NN,RN,NS,RS): \(p_{r}^{j - II*} < p_{r}^{j - I*}\); \(p_{s}^{j - II*} > p_{s}^{j - I*}\)

-

(ii)

Coupon face value (j = NN,RN,NS,RS): \(f_{r}^{j - II*} < f_{r}^{j - I*}\); \(f_{s}^{j - II*} > f_{s}^{j - I*}\).

Corollary 4 indicates that when the TPS introduces a high-quality product, the TPS has a pricing advantage and will raise the price for product S. The TPS has a higher incentive to promote, and will capture more market share. Nevertheless, the platform must reduce the price for product R to compete with the TPS. In this scenario, the platform has less incentive to promote. These findings are in line with the fact that (i) high product quality enables merchants to charge a high price and (ii) coupon face value is positively correlated to price.

Proposition 6

Quality differential leads to a difference in terms of revenue,

-

(i)

For the platform: \(\Pi_{R}^{NN - II * } > \left( { = \; < } \right)\;\Pi_{R}^{NN - I * }\) when \(r > \left( { = \; < } \right)\;\frac{3}{4}\).

\(\Pi_{R}^{RN - II * } > \left( { = \; < } \right)\;\Pi_{R}^{RN - I * }\) when \(r > \left( { = \; < } \right)\;\frac{\xi + 3\beta }{{4\beta }}\).

\(\Pi_{R}^{NS - II * } > \left( { = \; < } \right)\;\Pi_{R}^{NS - I * }\) when \(r > \left( { = \; < } \right)\;\frac{2\beta - \zeta }{{3\beta }}\).

\(\Pi_{R}^{RS - II*} > \left( { = \; < } \right)\;\Pi_{R}^{RS - I*}\) when \(r > \left( { = \; < } \right)\;\frac{2\beta + \xi - \zeta }{{3\beta }}\).

-

(ii)

For the TPS (j = NN,RN,NS,RS): \(\Pi_{S}^{j - II * } > \Pi_{S}^{j - I * }\).

Proposition 6 shows that the platform is not definitely better off or worse off when the TPS introduces a higher-quality product. The platform may collect a higher revenue when it gains a high commission fee. Although the revenue that the platform obtains from product R may be reduced (i.e., prj−II* < prj−I*), the increased revenue from the commission fee is large enough to offset the losses. Furthermore, the TPS can benefit from a high-price strategy and collect a higher revenue when product S has a quality advantage. Consequently, it can be deduced that the platform, when faced with a high-quality TPS product, should use a low-price strategy or increase its commission fee. Conversely, the TPS should strive to improve product quality to compete with the platform.

5 Extension

5.1 Consumer type

In the basic model, we assume that all consumers would redeem the coupons. However, consumers who have a high desire for the product are less motivated to redeem a coupon (e.g., [18]). These consumers may be price insensitive and pay attention to other factors, such as time cost and brand loyalty. Therefore, we extend our model to the case where there are two types of consumers (we use E1 to denote this case), namely, high-valuation consumers, with proportion μ (1 > μ > 0) (called H-type) and low-valuation consumers (called L-type). H-type consumers have a higher valuation than L-type consumers, that is, βH > βL. To simplify calculations, we let βH = 1, βL = β ∈ (0,1). H-type consumers pay the regular price pi (i = r, s), whereas L-type consumers redeem coupons when they are available and pay the promotional price (pi − fi) [5, 53].

The H-type consumers obtain utility Urh = 1 − pr and L-type consumers obtain utility Url = β − pr + fr for product R. Meanwhile, H-type consumers obtain utility Ush = k − ps and L-type consumers obtain utility Usl = kβ − ps + fs for product S. H-type consumers buy product R or product S depending on max{Urh, Ush} = max{1 − pr, k − ps} and L-type consumers buy product R or product S depending on max{Url, Usl} = max{β − pr + fr, kβ − ps + fs}. We explore four scenarios, that is, {fr = 0, fs = 0}, {fr > 0, fs = 0}, {fr = 0, fs > 0}, and {fr > 0, fs > 0}. Therefore, the market segmentation, using Scenario E1-RS as an example, is shown in Fig. 12, where the items of kx (x = 1,2,…,6) are the same as in the basic model.

We provide the derivation of the market demand in Online Appendix B. The decision problem of the retail system is as follows.

-

Scenario E1-NN

$$\left\{ \begin{gathered} \mathop {\max }\limits_{{p_{r} }} \Pi_{R}^{E1 - NN} \left( {p_{r} } \right) = \underbrace {{\underbrace {{\mu p_{r} q_{rh} }}_{H - type} + \underbrace {{(1 - \mu )p_{r} q_{rl} }}_{L - type}}}_{revenue\;of\;product\;R} + \underbrace {{\underbrace {{\mu p_{s} rq_{sh} }}_{H - type} + \underbrace {{(1 - \mu )p_{s} rq_{sl} }}_{L - type}}}_{commission\;fee} \hfill \\ s.t.\quad \mathop {\max }\limits_{{p_{s} }} \Pi_{S}^{E1 - NN} \left( {p_{s} } \right) = \underbrace {{\underbrace {{\mu p_{s} (1 - r)q_{sh} }}_{H - type} + \underbrace {{(1 - \mu )p_{s} (1 - r)q_{sl} }}_{L - type}}}_{revenue\;of\;product\;S} \hfill \\ \end{gathered} \right.$$(5) -

Scenario E1-RN

$$\left\{ {\begin{array}{*{20}l} \begin{aligned} \mathop {\max }\limits_{{p_{r} ,f_{r} }} \Pi_{R}^{E1 - RN} \left( {p_{r} ,f_{r} } \right) & = \underbrace {{\underbrace {{\mu p_{r} q_{rh} }}_{H - type} + \underbrace {{(1 - \mu )(p_{r} q_{rl - 1} + (p_{r} - f_{r} )q_{rl - 2} + \xi q_{rl - 2} )}}_{L - type}}}_{revenue\;\,of\;product\;R} \\ & \quad + \underbrace {{\underbrace {{\mu p_{s} rq_{sh} }}_{H - type} + \underbrace {{(1 - \mu )p_{s} rq_{sl} }}_{L - type}}}_{commission\;fee} \\ \end{aligned} \hfill \\ {s.t.\quad \mathop {\max }\limits_{{p_{s} }} \Pi_{S}^{E1 - RN} \left( {p_{s} } \right) = \underbrace {{\underbrace {{\mu p_{s} (1 - r)q_{sh} }}_{H - type} + \underbrace {{(1 - \mu )p_{s} (1 - r)q_{sl} }}_{L - type}}}_{revenue\,\;of\;product\;S}} \hfill \\ \end{array} } \right.$$(6) -

Scenario E1-NS

$$\left\{ {\begin{array}{*{20}l} \begin{aligned} \mathop {\max }\limits_{{p_{r} }} \Pi_{R}^{E1 - NS} \left( {p_{r} } \right) & = \underbrace {{\underbrace {{\mu p_{r} q_{rh} }}_{H - type} + \underbrace {{(1 - \mu )p_{r} q_{rl} }}_{L - type}}}_{revenue\;\,of\;product\;R} \\ & \quad + \underbrace {{\underbrace {{\mu p_{s} rq_{sh} }}_{H - type} + \underbrace {{(1 - \mu )(p_{s} rq_{sl - 1} + (p_{s} - f_{s} )rq_{sl - 2} + \zeta rq_{sl - 2} )]}}_{L - type}}}_{commission\;fee} \\ \end{aligned} \hfill \\ \begin{gathered} s.t.\quad \mathop {\max }\limits_{{p_{s} ,f_{s} }} \Pi_{S}^{E1 - NS} \left( {p_{s} ,f_{s} } \right) \hfill \\ \quad = \underbrace {{\underbrace {{\mu p_{s} (1 - r)q_{sh} }}_{H - type} + \underbrace {{(1 - \mu )(p_{s} (1 - r)q_{sl - 1} + (p_{s} - f_{s} )(1 - r)q_{sl - 2} + \zeta (1 - r)q_{sl - 2} )}}_{L - type}}}_{revenue\;of\;product\;S} \hfill \\ \end{gathered} \hfill \\ \end{array} } \right.$$(7) -

Scenario E1-RS

$$\left\{ {\begin{array}{*{20}l} \begin{aligned} \mathop {\max }\limits_{{p_{r} ,f_{r} }} \Pi_{R}^{E1 - RS} \left( {p_{r} ,f_{r} } \right) & = \underbrace {{\underbrace {{\mu p_{r} q_{rh} }}_{H - type} + \underbrace {{(1 - \mu )(p_{r} q_{rl - 1} + (p_{r} - f_{r} )q_{rl - 2} + \xi q_{rl - 2} )}}_{L - type}}}_{revenue\;of\;product\;R} \\ & \quad + \underbrace {{\underbrace {{\mu p_{s} rq_{sh} }}_{H - type} + \underbrace {{(1 - \mu )(p_{s} rq_{sl - 1} + (p_{s} - f_{s} )rq_{sl - 2} + \zeta rq_{sl - 2} )]}}_{L - type}}}_{commission\;fee} \\ \end{aligned} \hfill \\ \begin{gathered} s.t.\quad \mathop {\max }\limits_{{p_{s} ,f_{s} }} \Pi_{S}^{E1 - RS} \left( {p_{s} ,f_{s} } \right) \hfill \\ \quad = \underbrace {{\underbrace {{\mu p_{s} (1 - r)q_{sh} }}_{H - type} + \underbrace {{(1 - \mu )(p_{s} (1 - r)q_{sl - 1} + (p_{s} - f_{s} )(1 - r)q_{sl - 2} + \zeta (1 - r)q_{sl - 2} )}}_{L - type}}}_{revenue\;of\;product\;S} \hfill \\ \end{gathered} \hfill \\ \end{array} } \right.$$(8)

The derivation of the equilibrium solutions is provided in Online Appendix B. We continue to employ the abovementioned parameter sets to check the robustness. Then we get the following results.

From Figs. B1–B6 (see Online Appendix B), we find that most of the results in the basic model hold, which shows the robustness of the model. Moreover, we find additional results associated with consumer type. The higher the proportion of H-type consumers, the less likely the platform and the TPS are to reach a win–win situation and the more likely both are to fall into a lose–lose situation. This is because H-type consumers do not redeem coupons even if they have one. The coupon promotion becomes uneconomical because the platform and the TPS raise their prices when they implement promotions (losing H-type consumers). The platform and the TPS should abandon their promotions when more H-type consumers enter the market. In this regard, Choudhary and Shivendu [11] also argued that the optimal strategy for merchants is to target coupons at L-type consumers.

Figures B5–B6 also show that when more L-type consumers enter the market, the platform should encourage the TPS to participate in its promotion, whereas the TPS should conduct coupon promotions unilaterally. Meanwhile, the TPS should conduct a co-promotion strategy when (i) more L-type consumers enter the market, (ii) the commission fee is high, and (iii) product S has a quality advantage. The underlying logic is that the platform may reduce its promotional efforts with a large commission fee, which allows the TPS to capture those L-type consumers if product S has a quality advantage.

This model extension considers consumers’ characteristics and their decisions about using a coupon. The objective is to study the ways that consumer types affect promotional strategies to propose accurate promotional strategies. However, consumers may fail to redeem a coupon because they forget to do so or because they have lost the coupon [7, 33, 38]. Consumers may switch to a competing product if they fail to redeem the current product’s coupon or they may buy the current product if they fail to redeem the competing product’s coupon, which has a direct impact on switching between products. The main question here is how to design a coupon competition strategy to avoid consumer switching. Therefore, we explore another extension that explicitly models coupon redemption rates.

5.2 Coupon redemption rate

We extend the basic model to the case that only a proportion of consumers redeem coupons. We use φ (0 < φ < 1) to characterize the coupon redemption rate for the platform product and ϕ (0 < ϕ < 1) for the coupon redemption rate of the TPS. Thus, the submarket receiving coupons can be divided into two partsFootnote 7: (i) the proportion of φ (ϕ) coupons redeemed for the platform (the TPS) product that have payment pr − fr (ps − fs) and (ii) the remainder of the proportion of 1 − φ (1 − ϕ) of unredeemed coupons for the platform (the TPS) product that switch to the TPS (the platform) product. Therefore, the market segmentation, using Scenario E2-RS as an example, is shown in Fig. 13 (E2 indicates the current extension case).

In a co-promotion case, the market of the platform consists of three parts: (i) the loyal market (qr−1), (ii) the market attracted by the TPS’s coupon promotion but who do not redeem it (qr−2), and (iii) the market captured by the platform’s promotion (qr−3). The same logic applies to the market of the TPS. To preserve space, we provide the derivation of the market demand and the equilibrium solutions in Online Appendix C. The decision problem of the retail system is as follows.

-

Scenario E2-NN

$$\left\{ \begin{gathered} \mathop {\max }\limits_{{p_{r} }} \Pi_{R}^{E2 - NN} \left( {p_{r} } \right) = \underbrace {{p_{r} q_{r} }}_{revenue\;of\;product\;R} + \underbrace {{r(p_{s} q_{s} )}}_{commission\;fee} \hfill \\ s.t.\quad \mathop {\max }\limits_{{p_{s} }} \Pi_{S}^{E2 - NN} \left( {p_{s} } \right) = \underbrace {{(1 - r)(p_{s} q_{s} )}}_{revenue\;of\;product\;S} \hfill \\ \end{gathered} \right.$$(9) -

Scenario E2-RN

$$\left\{ \begin{gathered} \mathop {\max }\limits_{{p_{r} ,f_{r} }} \Pi_{R}^{E2 - RN} \left( {p_{r} ,f_{r} } \right) = \underbrace {{p_{r} q_{r - 1} + (p_{r} - f_{r} )q_{r - 2} + \xi q_{r - 2} }}_{revenue\;of\;product\;R} + \underbrace {{p_{s} r(q_{s - 1} + q_{s - 2} )}}_{commission\;fee} \hfill \\ s.t.\quad \mathop {\max }\limits_{{p_{s} }} \Pi_{S}^{E2 - RN} \left( {p_{s} } \right) = \underbrace {{p_{s} (1 - r)(q_{s - 1} + q_{s - 2} )}}_{revenue\;of\;product\;S} \hfill \\ \end{gathered} \right.$$(10) -

Scenario E2-NS

$$\left\{ \begin{gathered} \mathop {\max }\limits_{{p_{r} }} \Pi_{R}^{E2 - NS} \left( {p_{r} } \right) = \underbrace {{p_{r} (q_{r - 1} + q_{r - 2} )}}_{revenue\;of\;product\;R} + \underbrace {{p_{s} rq_{s - 1} + (p_{s} - f_{s} )rq_{s - 2} + \zeta rq_{s - 2} }}_{commission\;fee} \hfill \\ s.t.\quad \mathop {\max }\limits_{{p_{s} ,f_{s} }} \Pi_{S}^{E2 - NS} \left( {p_{s} ,f_{s} } \right) = \underbrace {{p_{s} (1 - r)q_{s - 1} + (p_{s} - f_{s} )(1 - r)q_{s - 2} + \zeta (1 - r)q_{s - 2} }}_{revenue\;of\;product\;S} \hfill \\ \end{gathered} \right.$$(11) -

Scenario E2-RS

$$\left\{ {\begin{array}{*{20}l} \begin{aligned} \mathop {\max }\limits_{{p_{r} ,f_{r} }} \Pi_{R}^{E2 - RS} \left( {p_{r} ,f_{r} } \right) & = \underbrace {{p_{r} (q_{r - 1} + q_{r - 2} ) + (p_{r} - f_{r} )q_{r - 3} + \xi q_{r - 3} }}_{revenue\;of\;product\;R} \\ & \quad + \underbrace {{p_{s} r(q_{s - 1} + q_{s - 2} ) + (p_{s} - f_{s} )rq_{s - 3} + \zeta rq_{s - 3} }}_{commission\;fee} \\ \end{aligned} \hfill \\ {s.t.\quad \mathop {\max }\limits_{{p_{s} ,f_{s} }} \Pi_{S}^{E2 - RS} \left( {p_{s} ,f_{s} } \right) = \underbrace {{p_{s} (1 - r)(q_{s - 1} + q_{s - 2} ) + (p_{s} - f_{s} )(1 - r)q_{s - 3} + \zeta (1 - r)q_{s - 3} }}_{revenue\;of\;product\;S}} \hfill \\ \end{array} } \right.$$(12)

The derivation of the equilibrium solutions are provided in Online Appendix C. We continue to employ the abovementioned parameter sets to check the robustness. Then we get the following results.

From Figs. C1– C6 (see Online Appendix C), we find that most of the results in the basic model continue to hold, which shows the robustness of the model. Furthermore, additional results associated with the redemption rate are revealed. First, the coupon value increases with the redemption rate. This result matches our expectation that a high redemption rate indicates that a larger proportion of the market is captured by coupon promotions, which motivates the platform and the TPS to use coupons. Second, the higher the redemption rate, the more likely the platform and the TPS are to reach a win–win situation. Normally, a high redemption rate suggests that more consumers are attracted by coupons. When the revenue from the incremental market is sufficiently large to offset the loss from the reduced profit margin (because of higher price discounts), the platform and the TPS will gain a higher profit. We also find that within k ∈ (1,2) the platform and the TPS tend to run into a lose–win situation and are less likely to reach a win–lose situation when the redemption rate is high. This indicates that a high redemption rate is more advantageous for the TPS in the current extension model. The key reason for this result is that the TPS has a stronger motivation to promote than the platform when k ∈ (1,2). Increasing the coupon redemption rate is more important for the TPS when it has a quality advantage.

In addition, Figs. B5– C6 show that when the redemption rate is high, the optimal strategy for the platform is to use coupon promotions unilaterally rather than in a co-promotion. However, when product S has a quality advantage, the platform should encourage the TPS to join its promotional activity and charge a higher commission fee. This is because the revenue that is generated from the TPS is large enough to increase profit. In regard to the TPS’s promotional strategy, when product S has a quality advantage, a co-promotion strategy is the optimal option when the redemption rate is high. The implication is that the TPS should participate in the platform’s promotional activity if its product has a quality advantage and it can encourage more consumers to redeem coupons.

6 Conclusion

We theoretically examine a retail system wherein an online retail platform not only sells its own products but also allows a Third-Party Seller to offer substitute products on its platform, albeit at a commission fee. We model four scenarios to analyze the optimal promotional strategies of the platform and the TPS. Our study examines the pricing and coupon competition decisions of both entities within the retail system, providing valuable managerial insights into the competitive landscape.

Pricing strategy with coupon promotion. Regarding the pricing strategy coupled with coupon promotions, when the platform’s product boasts a quality advantage, coupon promotions result in lower actual payments for consumers. In this scenario, the platform is inclined to increase the level of promotion, even in the face of TPS competition, even if the commission fee is low. Conversely, when the TPS’s product has a quality advantage, consumers might offset a higher actual payment with a coupon promotion. In business practice, FILA often raises it retail prices before offering coupons during events like the Double 11 promotions. This suggests that consumers may end up paying higher actual amounts and, surprisingly, may even purchase more with coupon promotions. Here, the platform may reduce the promotion level with a low commission fee, whereas the TPS may increase promotions, even if it pays a high commission fee. In a co-promotion scenario, the TPS is more incentivized to promote when their product holds higher quality.

Performance of coupon promotion. Regarding the performance of coupon promotions, in a platform-promotion scenario, the platform stands to benefit more. Simultaneously, the TPS may achieve higher revenue if their product boasts higher quality and the platform’s promotion is weak. In a TPS-promotion scenario, the platform can ride along with the TPS’s promotion, especially when the commission fee and incremental purchases are high. In a co-promotion case, both the platform and the TPS can find themselves in a mutually beneficial situation, especially if incremental purchases are substantial. Intriguingly, the TPS might fare better when the commission fee is high. This is because the platform is less likely to hold a promotion but raises the retail price, whereas the TPS is motivated to conduct promotions, leading to increased sales and higher revenue.

As for the optimal coupon competition decisions for participants, for the platform, both self-promotion and co-promotion strategies outperform the TPS-promotion approach. Furthermore, a co-promotion strategy is optimal for the platform when both incremental purchases and the commission fee are high. In practice, large-scale retail platforms, like Amazon.com, eBay.com, and JD.com, are motivated to encourage TPSs to partake in their promotions. In this sense, retail platforms could free-ride on the promotion of the TPSs. For the TPS, a self-promotion case outperforms a platform-promotion case if incremental purchases are high. When the TPS’s product has superior quality, a co-promotion emerges as the best option, particularly when the commission fee is high and incremental purchases are low. Interestingly, in scenarios where incremental purchases are sufficiently low, opting for platform-promotion emerges as the optimal choice for the TPS. However, TPSs should selectively carry out promotional activities. For example, many brands like Coach, Michael Kors, and Longchamp refrain from participating in platform promotions.

Furthermore, our model extensions reveal that as more L-type consumers enter the market, the platform should encourage the TPS to join in its promotional activities, while the TPS should independently run a coupon promotion. However, a co-promotion strategy can be optimal for the TPS when the commission fee is high and their product holds a quality advantage. When only a portion of consumers redeeming coupons, and when the coupon redemption rate is high, the platform should run promotions independently. Nevertheless, the platform should adopt a co-promotion strategy when the TPS’s product excels in quality and the commission fee is high. Meanwhile, a co-promotion, rather than a unilateral promotion strategy, becomes the optimal choice for the TPS when their product holds a quality advantage and the redemption rate is high. Table 4 provides a decision support system for the platform and the TPS to design coupon competition decisions.

While this paper provides recommendations for platforms and TPSs in designing coupon competition strategies, it does possess certain limitations. Firstly, we assume a platform-selling contract between the platform and the TPS. However, the platform may opt to purchase the TPS’s products at a wholesale price and subsequently resell them to consumers. Future research could comprehensively explore scenarios involving reselling and platform-selling contracts.

Secondly, coupon promotions may entail costs for consumers, the platform, and the TPS. Additionally, there might be a functional relationship between the promotion cost and redemption rate, which could impact market share and promotion strategies. Therefore, greater attention should be devoted to the promotion cost.

Thirdly, consumers may invest time searching for coupons, and there might be a time frame within which consumers can redeem a coupon. This dynamic influences consumers’ decisions regarding coupon redemption and, correspondingly, the coupon promotion strategies of issuers. Therefore, a potential avenue for exploration could involve investigating the time duration of coupon redemption.

Fourthly, platforms and TPSs may devise distinct coupon promotional strategies for different product categories. Moreover, the impact of coupon promotion may vary across specific regional markets. These factors can lead to differing coupon competition decisions. Consequently, a logical extension would involve examining precise coupon promotion strategies based on the segmentation of product categories and market attributes.

Fifthly, this paper focuses on a retail system featuring a single platform and one TPS. However, platforms may permit multiple TPSs to vend products through their marketplace, or TPSs may opt for different platforms for product sales. Future research should explore the dynamics of co-opetition and promotional strategy with multiple participants.

Finally, future research is needed to empirically validate the results of our theoretical model. A possible approach involves partnering with a platform, as demonstrated by Feldman et al. [16], who collaborated with Alibaba’s online marketplaces, Tmall and Taobao. In their study, they conducted a large-scale field experiment to assess the efficacy of two methods for selecting the optimal assortment of products to present to visitors on these platforms. Over a span of two weeks, they randomly allocated website visitors to one of the two conditions and measured the revenue generated by each method.

Implementing such an approach necessitates an experimental design incorporating systematic variations in coupon promotions over time for both the platform and the TPS. Specifically, the platform and the TPS should remain price the same at levels PR and PS respectively, while varying the presence of a coupon. This will result in four conditions: NN where neither the platform nor the TS offer a coupon; RN where only the platform offers a coupon; NS where only the TPS offers a coupon; and RS where both simultaneously offer a coupon. The value of the coupon and the commission charged by the platform should remain constant across the different conditions.

The self-selection of shoppers into different conditions presents a challenge in field experiments like these, as randomizing treatments may not be feasible [22]. Nevertheless, it may be viable to tackle this issue by individually targeting consumers with different coupon promotions (e.g., [34]). This can be accomplished by randomly assigning visitors to the website to one out of the four conditions.

Alternatively, researchers could gather sales and coupon promotion data from both the platform and their TPSs. Econometric analyses have often been employed to evaluate the efficacy and profitability of competitive coupon promotions (e.g., [40, 41]). To evaluate the long-term effectiveness of coupon promotions, researchers may employ persistence analysis, utilizing time series methods such as vector autoregressive methods [12]. This would entail collecting sales and promotional data from both the platform and third-party sellers over time across various product categories.

Lastly, to evaluate the influence of coupon promotions on price levels, researchers could consider employing quasi-experiments or natural field experiments [20]. This would require collecting data on sales and price levels both before and after the implementation of coupon promotions by TPSs.

Notes

k = 1 indicates that products R and S are complete substitutes. In this case, the platform and TPS will set a price equal to the margin cost and their profits will be 0, which is called Bertrand Paradox [6]. To avoid this case, we let k ≠ 1.

The magnitude of (ps, pr) in k1 differs from that in k2. When k ∈ (0,1), pr > ps will always hold because β > βk; when k ∈ (1,2), pr < ps will always hold because β < βk. Therefore, the pricing strategy in k ∈ (0,1) and k ∈ (1,2) is different but depends on the perceived quality k. Thus, we discuss the market segmentation between those two scenarios separately.

There is another submarket that does not receive coupons or belong to a loyal market. They will still buy the original product.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2016). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280. https://doi.org/10.1287/mnsc.2015.2230

Ando, T. (2018). Merchant selection and pricing strategy for a platform firm in the online group buying market. Annals of Operations Research, 263(1–2), 209–230. https://doi.org/10.1007/s10479-015-2036-9

Armstrong, M. (2006). Competition in two-sided markets. Rand Journal of Economics, 37(3), 668–691. https://doi.org/10.1111/j.1756-2171.2006.tb00037.x

Bardhan, A. K., & Ashraf, S. (2022). More buyers or more sellers: On marketing resource allocation strategies of competing two-sided platforms. Electronic Commerce Research. https://doi.org/10.1007/s10660-022-09643-8

Bauner, C., Jaenicke, E., Wang, E., & Wu, P. (2019). Couponing strategies in competition between a national brand and a private label product. Journal of Retailing, 95(1), 57–66. https://doi.org/10.1016/j.jretai.2018.11.002

Bertrand, J. (1883). Theorie mathematique de la richesse sociale. Journal des Savants, 67, 499–508.

Besharat, A., Nardini, G., & Roggeveen, A. L. (2021). Online daily coupons: Understanding how prepayment impacts spending at redemption. Journal of Business Research, 127(1), 364–372. https://doi.org/10.1016/j.jbusres.2021.01.047

Cao, K., Xu, X., Bian, Y., & Sun, Y. (2019). Optimal trade-in strategy of business-to-consumer platform with dual-format retailing model. Omega, 82, 181–192. https://doi.org/10.1016/j.omega.2018.01.004

Chatterjee, P., & Zhou, B. (2021). Sponsored content advertising in a two-sided market. Management Science, 67(12), 7560–7574. https://doi.org/10.1287/mnsc.2020.3873

Chioveanu, I., & Zhou, J. (2013). Price competition with consumer confusion. Management Science, 59(11), 2450–2469.

Choudhary, V., & Shivendu, S. (2017). Targeted couponing in online auctions. Information Systems Research, 28(3), 490–510. https://doi.org/10.1287/isre.2017.0688

Dekimpe, M. G., & Hanssens, D. M. (1995). The persistence of marketing effects on sales. Marketing Science, 14(1), 1–21. https://doi.org/10.1287/mksc.14.1.1

Dong, S., Qin, Z., & Yan, Y. (2022). Effects of online-to-offline spillovers on pricing and quality strategies of competing firms. International Journal of Production Economics, 244, 108376. https://doi.org/10.1016/j.ijpe.2021.108376

Duan, Y. R., Liu, P., & Feng, Y. X. (2022). Pricing strategies of two-sided platforms considering privacy concerns. Journal of Retailing and Consumer Services, 64, 102781. https://doi.org/10.1016/j.jretconser.2021.102781

Duan, Y., Liu, T., & Mao, Z. (2022). How online reviews and coupons affect sales and pricing: An empirical study based on e-commerce platform. Journal of Retailing and Consumer Services, 65, 102846.

Feldman, J., Zhang, D. J., Liu, X., & Zhang, N. (2021). Customer choice models vs. machine learning: Finding optimal product displays on Alibaba. Operations Research, 70(1), 309–328. https://doi.org/10.1287/opre.2021.2158

Feng, L. A., Du, T. C., & Ying, W. C. (2019). Offensive pricing strategies for online platforms. International Journal of Production Economics, 216, 287–304. https://doi.org/10.1016/j.ijpe.2019.06.009

Feng, N., Chen, J. J., Feng, H. Y., & Li, M. Q. (2022). Promotional pricing strategies for platform vendors: Competition between first- and third-party products. Decision Support Systems, 151, 113627. https://doi.org/10.1016/j.dss.2021.113627

Gabszewicz, J. J., & Wauthy, X. Y. (2014). Vertical product differentiation and two-sided markets. Economics Letters, 123(1), 58–61. https://doi.org/10.1016/j.econlet.2013.12.031