Abstract

Incorporating fluency theory into a user experience design framework, this study utilises design considerations, drawing on complementary angles of the two theoretical domains, as a foundation with the ultimate goal of creating beneficial mobile payment experiences. An exploratory approach is deployed through semi-structured interviews to provide insights into experience design considerations utilising sensory elements and risk perception, a combination which has thus far received little attention. Research participants consist of senior managers that work for companies that create, facilitate, or accept mobile payment apps or processes. A conceptual framework is proposed with design as a starting point, including aesthetics and the need for a simplified experience, along with sensory elements that replicate familiar visual, audio, and haptic stimuli. These lead to a more usable experience that is perceived as easy to use through a frictionless experience. Usefulness is increased as exposure increases, and new app or process features can be added once prior features become familiar through repeated use. Key trade-offs include a simplified experience versus feature-rich experience, and frictionless experiences versus security risks, with key practical suggestions on how these can be approached.

Similar content being viewed by others

1 Introduction

Conducting a payment is typically the last step of a consumer completing a purchase, and directly contributes towards the overall experience perceptions [14]. The importance of a positive customer payment experience is particularly important in omni-channel management, to ensure that the payment component fits into that whole customer journey [14]. The need for designing meaningful experiences has been raised with a focus on brand experiences [45], web navigation [23] and mobile user experiences [4], highlighting the need for an experience considering variants on risk, functionality, and enjoyment. Given the subjective responses customers have to any interactions with a company [10, 58], the payment component of a shopping experience is particularly relevant as a critical part of the direct interactions’ customers have with a company. Arguably, the point of conducting a payment can be considered as less pleasant, functional interactions for various reasons, with the need to make this aspect more enjoyable [8].

Smartphone mobile technology potentially solves multiple user problems, with a multitude of offerings in the form of applications (apps) to increase utility, making such devices indispensable [9] and with positive affect with use [1]. Due to the extensive array of apps for any particular use, there is a need for a specific app to add value in some way, while also competing with non-mobile technology alternatives. For a product or service on offer to act as a viable alternative to existing offerings, there is a need for that to be either easier to use, create more enjoyment, to offer more utility or is to be more cost effective [37]. The financial costs for consumers of using a mobile payment system is in most instances the same as almost every other means of payment, as most mobile payment systems link existing bank accounts, debit cards or credit cards [87], and so the focus needs to be placed on an easier process, or greater utility or hedonic aspects, which may include design considerations.

Existing research on mobile payments considering design perspectives include an experimental study on hedonic and utilitarian factors [47], testing for user tolerance to response rates [96] and investigating factors that enhanced the user experience during the Covid19 pandemic [78]. Little attention has been placed on studies that explore how to improve user experiences, especially on how sensory elements could be included to improve the overall experience, along with means to decrease risk perceptions. To investigate these aspects, a qualitative approach is utilised in this study to yield subjective opinions [51, 66, 85] with there being a need to go beyond retail perceptions, which has been the theme for research on this topic [51, 66, 85]. Doing so enables going beyond adoption research and extent research on mobile payment use as well as broader considerations on hedonic/utilitarian factors and risk considerations from a consumer/user perspective, to include intentions from a design perspective. The intent is therefore to yield responses from multiple stakeholders on process design, including those who create (mobile payment application designers), facilitate (banks and other payment facilitators) and those who accept mobile technology (merchants). The aim is to incorporate elements that may improve the user experience from a design perspective and to explore the role hedonic and risk considerations play to answer the research question: how fluency theory can improve a user experience, with mitigating factors of sensory elements and risk perceptions, as determined by key design stakeholders. Insights add to the extent literature on user design, fluency theory, sensory/touch, as well as risk with practical implications to improve user experiences.

2 Literature review

The literature suggests three considerations as being relevant to ensure an effectively designed experience relevant for mobile technology, consisting of fluency, risk consideration and sensory elements. The current state of knowledge is explored, predominantly from a consumer perspective, with the intent to provide a foundation for insights from a design perspective.

2.1 Fluent experience design

User experience design depends on the interaction between users, machines, and the surroundings the user is in while the experience takes place [43], with the foundation of user experience design on user perception of usefulness and usability of the experience [28]. The (initial) perception on the offering can be evaluated prior to a purchase [34] or prior to downloading an application, which might involve a commitment in time and exposure to potential risks as opposed to a direct financial cost. Key considerations from studies proposing models to measure usability, have a particular focus on simplicity of design, task complexity, visual aesthetics, and interactive design [15, 86]. Interaction design is how a system behaves when users engage with it [40], and visual design is how a product looks in terms of colours, fonts, images, icons, and other graphics [39]. There is considerable overlap between visual design, which builds a positive and consistent brand image communicating the right information to its users [39], and interaction design, which intends to give users a desired experience at every touchpoint using aesthetics, motion, and sound amongst others [69, 40], to make interactions with users pleasant and meaningful. If done effectively, this leads to useable experiences, as well as allowing for ease of processing of relevant stimuli [69], such as visual, audio or haptic cues. Processing fluency theory of aesthetic pleasure [69] is a useful mechanism to explore the effectiveness of visual and interactive design. The theory measures interaction between a viewer and an object, focusing on the end user experience and perceptions, as opposed to design on the basis of artistic merit [41]. The importance of aesthetic judgment is critical, correlating the perceiver’s prior exposure to fluently process an object [69, 70]. Processing fluency relates to the subjective feelings of ease of use that people may experience upon being exposed to a stimulus [94, 95]. Little research is available on applying fluency theory to the intricacies of mobile interfaces, beyond a conference paper by Minikkovic and De Angeli [59]. Given the smaller screen of mobile devices, numerous applications attempting similar outcomes, and external distractions competing for the user’s attention, the focus on fluent user experiences is particularly relevant to mobile application interfaces, with the importance of visual impressions, initial impressions, aesthetics, and the need for a decrease in complexity.

2.2 Simplicity versus feature loading

Mobile technology competes with offerings already available to consumers in one form or another, with mobile payments competing with cash, debit and credit cards as well as digital currencies [22]. The offering must therefore create value beyond the functional aspects of the experience [19]. User experience literature [30, 31, 35] focuses on utility and useability to satisfy human needs, while augmenting to offer hedonic qualities. Emotionally satisfying elements have the potential to augment the experience creating a competitive advantage [30] over competing offerings, with Hassenzahl [29] using the term ‘be-goals’ as a means for users to attain self-fulfilment by attaching hedonic attributes. Fluency theory focuses on augmenting experiences to improve the processing of stimuli and the ease of interpreting meanings [69], garnering positive affect in the process, specifically if the ease of processing is unexpected. Essentially, the use of a certain technology feels right because the process is perceived as fluent, with disfluency raising a cognitive alarm, pressing users to stop and reassess the situation [69, 71]. This is particularly relevant for mobile interfaces where visual impressions, initial impressions, aesthetics, and complexity are of importance given the smaller screen and level of competition, highlighting the need for simplicity given the external distractions that compete for the user’s attention.

2.3 Sensory experience

Visual perceptions go beyond what we see with our eyes and brains, it is how our minds predominantly interpret stimuli, which can take different shapes through conditions which might be cultural, based on preconceptions or various other aspects [63]. The sensory experience is likely derived from multiple modalities, with auditory and haptic processing supplementing the visual components, triggering action [41]. This is also key for mobile technology, with visual, audio and tactile prompts possible and feasible to facilitate the experience [69, 70, 88], going beyond the stimuli attached to alternative payment mechanisms such as physical cards. Schneider et al. [77] proposed the use of haptic experience design (HaXD) to enhance user experiences, with related subsequent research [72] proposing to use tangible ways to allow for an enhanced user experience. Key to the design of sensory experiences is the effective integration and to ensure the features interact seamlessly with the entire system’s design [77], with sensory cues used to create a familiar experience, adding more meaning and credibility to the experience [64]. The sensory experience is derived from multiple modalities, with the auditory and haptic processing supplementing the visual components, triggering action [16, 32].

The expectation is therefore that auditory stimuli as part of mobile technology will lead to habitual motor responses [89] as had been found with full sensory experience having enhanced art exhibits [18], product judgement [65], advertising [42] and improved task performance [12]. For mobile payments this occurs at the payment confirmation, which in most instances is the only interaction a user has with a mobile payment platform utilising NFC (near field communication) launching automatically when held in proximity to a payment terminal [46]. Under these circumstances, in addition to being a means to potentially reduce risk perceptions, knowing that the phone has successfully connected with the reader can lead to positive affect, essentially making a functional experience one that is affective [44, 65]. Tactile cues can shape perceptions on material information including texture [27, 62] providing a mental imagery of physical aspects and increasing perceptions of control. Designing user experiences can therefore be founded on tactile feedback when tapping, scrolling, expanding certain features along with the replication of familiar audio cues, such as tapping or scrolling audio cues [24, 57, 81].

2.4 Familiarity and risk considerations to enhance the user experience

Jacoby and Dallas [36] identified a correlation between repeated exposures through processing fluency and an increase in favourable opinions towards the process. This has been tested and affirmed in design literature [25], considering user experiences for elders [72] as well as while utilising virtual reality [3]. Familiarity to create a desire and potentially to decrease risk is of particular relevance for a mobile offering and considering financial risk factors [59], with a potential interaction of hedonic and utilitarian aspects as opposed to being a trade-off.

The impact of risk as a means to decrease perceptions towards user experiences has previously been investigated in terms of privacy [92], security [97], cross-cultural variation [53] and from a generational perspective [5]. The need for a designed experience that suits the environment has been highlighted [19] with a decrease in the risk perception improving perceptions. Vitale et al. [92] have highlighted the need for a transparent interface that communicates privacy policies to decrease privacy concerns, ultimately increasing usability. For this study, the same consideration is proposed with there being a need to control risk considerations to increase the user experience [92, 97].

As a user experience is created with considerations including processing fluency and ease of use, the risk perception is reduced as part of a more fluent process [83, 95]. There will also be limitations to the extent to which a more fluent experience can decrease risk perceptions and to what extent this can influence cognitive factors, with Winkielman et al. [95] having concluded that in terms of subjective experiences, there are instances when high fluency has the potential to lead to negative evaluations. If familiarity or prototypicality is associated with danger, a subjective negative experience of processing fluency can arise. For mobile technology and particularly mobile payments, high levels of fluency may be negatively related to perceived risk, such as data breaches or social risks associated with payments being unsuccessful. If a process is therefore deemed as being too fluent in the absence of familiarity, this could lead to negative perceptions. The perception of risk is ultimately impacted by individual factors [80] with cognitive factors, such as media coverage [33] influencing the risk perception. However, affective factors [11] beyond the control of marketers may lead to the need to purposely decrease the level of fluency to decrease risk perceptions. A more fluent experience may therefore decrease the risk perception to the point where the experience becomes too fluent (too easy to use, perhaps paying for unintended items), and in the absence of familiar feedback elements, increasing risk perceptions.

3 Methodology

This research is exploratory, with inductive reasoning incorporating premises viewed as supplying evidence for the validity of the conclusion, with said validity being probable based on evidence provided [17, 52]. The study has been designed to get insights into the current state of technology as well as perspectives on the process of the consumer experience using a qualitative approach [79]. Collection of data was undertaken by conducting semi-structured interviews to keep the respondents on topic, but a pre-determined list of questions was not actively pursued to allow the respondents to explore the topics deemed to be important to them [49]. The structure of the questions was derived on the basis of the literature review, with additional items iteratively added as interviews progressed [49]. The initial intent was to conduct these interviews either online (based on geographical constraints) or face-to-face, with a preference to conducting face-to-face interviews given research on methodological approaches had highlighted face-to-face interviews to be more effective to ensure validity and rigour [52, 56]. Extensive ethics considerations gave (potential) respondents more confidence in the research, particularly given representatives from large companies were invited to take part in this research [52]. The definition of mobile payment systems was focused on physical retail-based mobile payments applications, which might consist of ApplePay, Google-/Android-Pay, WeChatPay or Alipay.

A purposive sampling approach was applied [52], with known international mobile payment technology creators, all major international retail banks operating in New Zealand and large nationwide merchants with physical locations invited to participate in this research. Different means of contact have been tested [52], [67], notably commencing with (more) established methods including to formally write to companies followed by connecting to key people in specific companies through LinkedIn and Facebook as described in Table 1. The initial intent was to commence the data collection with technology creators with concerns that facilitators (banks) would be less likely to participate due to privacy reasons [38]. As the data collection commenced, facilitators (banks) were willing to participate, with technology creators hesitant to take part in formal interviews due to concerns relating around disclosing sensitive information, while merchants were otherwise occupied with issues relating to lengthy store closures associated with Covid19 lockdowns. The data collection commenced in early 2020, a time when free movement was considerably restricted due to Covid19 lockdowns. Therefore, all interviews took place online, however these interviews were as close to being face-to-face interviews as possible with the video function switched on and sessions recorded [20]. Interviews were held in a well-lit and quiet space with due care placed on the camera angle to ensure the video was clear, there being no interruptions and to have the ability to project body language and facial expression. Options were offered to participants on their preference of videoconferencing tool with selections stated in Table 1, as some participants had objections towards some platforms due to privacy concerns. There is a possibility that participants might have felt more comfortable to share details while being in the comfort of their own home providing reprieve from what was a difficult situation being confined to one’s home for long periods of time [20]. Theoretical saturation was determined to have been reached after an initial analysis of the interviews with twelve participants [75]. The research incorporated responses from twelve industry experts: four representatives from mobile payment technology creators, five representatives from facilitators (banks/payment processors) and three representatives from major merchants.

Interviews ranged from 60 to 90 min in length for mobile technology creators and facilitators, with merchant interviews lasting an average of 40 min. All interviews were voice recorded following signed consent [13] having been received from each respondent prior to the commencement of each scheduled interview. Following the interview, the recordings were uploaded to an artificial intelligence application [61] that did an initial transcription followed by the interviewer going through the generated transcript and comparing it verbatim to the recording. The transcript was anonymised and sent to the respective interviewee for checking and (signed) approval [13].

4 Findings and analysis

All transcripts were analysed for word frequencies using nVivo and read repeatedly, followed by a thematic analysis and a code-recode procedure to ensure dependability of data [21]. Each transcript was analysed and coded using key user experience and fluency themes from the literature, with similar terms then cross-referenced across transcripts along with further read-throughs to determine sub-themes. Five themes were identified, consisting of risk, value, fluency, familiarity, and sensory cues. As part of the interviews, sequences were identified on what is required in order to attain next steps on the basis of which the findings are portrayed.

4.1 Making designed experiences usable

The need to have a simplified offering was identified, with respondents affirming that the focus needs to be on creating an experience that is superior to that of the incumbent. The design of mobile payment technology centres around what consumers deem as necessary when compared to competing offerings, while making that process as simple as possible. “For us, it was the product itself which motivated people to use it, and then it just came down to—we did user testing, core user experience and made it simple, made it really as simple a process as you can.” (Technology Creator 3, November 2020). If there are numerous alternative means of payment available, the question is whether ‘pulling out’ a phone and tapping it on the terminal is easier or simpler then ‘pulling out’ a card and tapping it on the terminal. Therefore, there is a need to simplify the process, while attempting to make it a pleasurable experience, with the trade-off between simplicity versus adding functions favouring simplicity in the early stages. Technology creators highlighted the need for more functionality and adding features to their mobile payment offering. However, the consensus was to initially opt for a simpler design while adding more services to the application as users familiarise themselves with the experience and processes being perceived as fluent, which will ultimately make the experience more useable.

For the process to be deemed as fluent, the system would need to entail less friction when compared to the incumbent, notably card payments through a terminal with no requirement for a pin or signature. One aspect to this is the perceived usability, whereby cognitive effort influences the extent to which the process is being perceived as fluent [2]. A reduction of cognitive effort is universally described by respondents to decrease friction, which in turn makes the process more fluent. Frictions were identified by respondents from the sign-up process to the actual payment process noting that,“There’s a small amount of effort, although Apple Pay and Google pay have done a lot of work to try to remove the friction from doing that initial signup.” (Facilitator 1, May 2020). As part of the sign-up process, the key focus is on simplification but there being a legal requirement to ‘KYC’ (know your customer) to comply with anti-money laundering regulations, potentially leading to a decrease in affect and an increased (perception of) usability.

The simplification of processes in most instances is likely to be perceived only on the basis of a process being familiar and therefore of the technology creators emulating a process that users are familiar with [82]. Technology creators affirmed the importance of this with the need to have a familiar process as a means to facilitate for a frictionless (fluent) experience with one respondent noting; “so, when our product is released, it’s not all completely foreign and there are some familiar aspects of it.” (Technology Creator 1, July 2020). Similarly, technology creators that utilise the QR code approach to mobile payments talked about how government instigated applications that allow for virtual check-ins for physical sites, such as for retailers, have the ability to drive adoption on the basis of users becoming familiar with the process. One respondent highlighted how; “through Covid, we’re kind of learning that people don’t like QR codes, but they’re begrudgingly doing it. I think it’ll become a familiar process.” (Technology Creator 2, September 2020). There is however the question to what extent learnings of behaviour that have a negative sentiment to it influences the willingness of using such processes in the future with positive outcomes in terms of attitude. [48] have suggested that negative attitudes were a larger predictor towards future use compared to positive predictors. Facilitators and merchants focused on the actual payment process as opposed to components as part of mobile payment technology, noting the fact that willingness to use mobile payment technology is centred around a change in mindset, with muscle memory largely driving the need to use a process that for most consumers has been commonplace to reach for a wallet to make a payment. Specifically, one respondent noted that; “we’re conscious that consumers just have a preference, [and] some people will by muscle memory take their card out.” (Merchant 1, October 2020).

P1

An effectively designed experience will lead to a more usable payment experience.

4.2 Making usable experiences desirable

To reduce complexity as part of mobile applications, responses from interviewees centred around the need for increased integration with supplementary aspects that are part of a payment. The thought process on that basis focuses on reducing frictions on the entire payment process as opposed to reducing friction on the payment mode only. When referring to mobile payments, most respondents mentioned that there is slightly more friction notably on the number of steps as well as the sign-up process in using a mobile payment as opposed to using the nearest alternative being tap-and-go cards, with respondents specifying that this disincentivises the use of mobile payments. Other considerations on that are that additional convenience is yielded by the user already having their phone in their hand (as opposed to their card) with the payment process being a fluent (learnt) experience with most users having experienced tap-and-go technology. The key determination centres on the fact that in most instances, mobile payments incorporate debit/credit cards to be ‘loaded’ onto the phone, hence the payment means being identical, with only the form differing. All respondents mentioned that there is a need to extent the value offering beyond just facilitating payments to drive adoption and the perception of value.

One key aspect to that are issues related to the user still having to use their wallet for loyalty card with all research participants concurring for there to be a need to integrate loyalty cards into a successful mobile payment app in order to ensure the adoption of mobile payments, highlighting a need to decrease cognitive effort in order to increase willingness to use a certain technology. “Yes, you can do the loyalty integration and everything but if your core functionality which is payments already has more friction, than the incumbent and you try to take on the incumbent then… it doesn’t quite make sense in my head.” (Technology Creator 2, September 2020). Further comments centred around there not being a real incentive to use mobile payments given other components are needed that are stored in the wallet including loyalty cards and identification making the wallet indispensable. Notably, facilitators and merchants spoke of the potential relating to simplified payment processes that is frictionless with the integration of all aspects relating to the payment process integrating multiple steps with one participant stating, “I actually see, the most powerful part that the phone brings is this whole authentication and once we have genuine digital identities, then there is no need for the wallet.” (Facilitator 4, January 2021). Every technology creator that took part in this study mentioned that they have aspects incorporated into their payment offering that go beyond traditional payment means or are working on incorporating such considerations including included ‘buy now pay later’ options, open-banking, additional security features, facial recognition to verify users, the integration of loyalty cards into apps, social aspects to make the payment experience more of a social experience as well as numerous aspects to gamify mobile payment applications. Similarly, facilitators and retailers who partook in this study mentioned there was a need thereof to ensure uptake.

P2

A usable experience will lead to a more desirable experience.

4.3 Payment feedback

Respondents affirmed the importance of payment feedback partially due to (social) risk perceptions that payments were not successful with specifically facilitators noting the perceived risk of the transaction not going through with one respondent noting; “How do you know that you’ve paid apart from the merchant saying, you’ve paid, it’s good, off you go. What are the other methods? So, we have to think about that from a usability perspective.” (Facilitator 3, June 2020). Therefore, feedback is critical, with facilitators noting potential social factors and a general unwillingness to ensure repeated use if there are issues with the payment, including the need to use an alternative means of payment. Receiving a notification that the payment has been successful has the potential to make payment processes perceived as more fluent by means of consumer confidence as the confirmation has been obtained that the process is complete with the sensory experience adding an emotionally stimulating experience [7], [18]. Favourable comments have been made by respondents, notably on the audio feedback playing a familiar sequence of tones, leading to a familiar experience when paying, adding to the favourable affective perception towards the payment experience. “Everybody loved the little Ding that your phone makes when the payment is processed. And the same on the watch, and the way it vibrates as well. So that was, I think, sort of part of really the actual payment experience, like people really appreciated that.” (Facilitator 2, May 2020). This point was reiterated extensively by merchants, who noted the positive effects of audio signatures, how this contributes towards feelings of familiarity and how this leads to positive emotions; if you use Apple Pay a lot you get accustomed to the Apple Pay ‘Ding’, and there must be some research that says it does, because MasterCard are working on their own audio signature.” (Merchant 1, October 2020). This supports the notion of designing familiar experiences, with a supplementary auditory sensory experience that supports visual perceptions [93] to convert experiences that serve a functional purpose into one that is an enjoyable affective experience.

Most respondents commented on the salience of visual feedback over audio and haptic feedback. Particularly technology creators believed that users want to see the process and what the current status of the transaction is, while facilitators believed users just want to see whether the transaction has gone through or not with merchants more skewed towards sensory experiences and enhancing the touchpoint experience the user has. There is therefore somewhat of a divergence between functionality and enjoyment, with one respondent acknowledging that different experiences would suit differing requirements; “Sound, vision and vibration are all methods that can be used to do that, as long as we get high levels of customers knowing what happened in a manner that suits them.” (Facilitator 1, May 2020). However, facilitators affirmed that, especially with future innovation involving proximity payments, haptics would be invaluable, as phones do not need to be taken out. “Part of the benefit of what we did with proximity payments and with the camera payments is that you don’t actually have to take your device out of your pocket. So therefore, how do you know that you’ve paid apart from the merchant saying, you’ve paid, it’s good, off you go.” (Facilitator 3, June 2020). This is likely to become more relevant as payments disappear into the background, becoming a less conscious consideration based on consumer acceptance, therefore being able to increase the fluency of the payment process. Users may therefore no longer hold their phones in their hand, as the augmented experience supersedes the visual experience. This becomes increasingly relevant as experiences such as those witnessed through (automated) cashier-less stores such as Amazon Go (Polacco and Backes, 2018), which do not actively involve a phone, whereby an audio and/or haptic cue replaces the acknowledgment of either a physical person or other visible cues.

P3

Multisensory payment feedback will make an experience a more usable experience.

4.4 Security and the perception of risk

All respondents affirmed that the use of mobile payments leads to a more secure experience (to the incumbent), given the additional layer of security that requires biometrics. As to whether this might translate into an increased uptake, responses varied ranging from the consideration that users have nothing to gain from added security; “Some people would, some people don't really care about security, they care more about convenience. I think there's also a perception that well, if there's fraud on my account, then the bank would’- and it's not your fault—then the bank will set me right.”, (Facilitator 2, May 2020) to the fact that some users would be willing to conduct additional steps to attain a higher perception of security. There is a significant trade-off between designing a simple process and reducing the amount of risk. Participants of the research highlighted that although there is one additional step when using mobile payments, the step is to scan the users’ finger (or face), which leads to reduced risk, something that research participants assumed (potential) users are willing to do to mitigate risks. Although the process has been designed to increase the perception of (financial) security, a threshold seems to have been reached, where increased security will be detrimental to the overall experience [84]. Respondents supported this notion stating that an entirely frictionless experience is quite feasible making the process fluent with the phone intrinsically ‘knowing’ the user “…by the speed that you walk, by the way we type into it. Obviously, there's the biometrics, there's all sorts of capabilities that the phone can say, this is not just one factor, or two factor transactions, we could build five or six factors into really effective mobile payment’, and it's almost certain that it is you.” (Facilitator 4, January 2021). One technology creator explained how a completely frictionless (fluent) experience is perfectly feasible using facial recognition technology in-store. A technology creator outlined results of a trial conducted on that with confusion and concerns arising due to the process having been too easy, with the need to either have processes in place to explain to the user (live) what security measures are currently being applied or to insert a physical step, which ultimately increases friction but decreases perceived risk. Numerous comments from respondents centred around the trade-off between risk and fluency, the need for ‘physical assurance’ and means to decrease risk perceptions as summarised in Table 2.

Facilitators commented on social risks noting the need for fluency, supporting earlier arguments on this to keeping the process simple and focused, potentially at the expense of added value. Key considerations are the need to avoid embarrassment, which respondents feared would happen should the transaction not be fluent if there was a lack of understanding of the process. Respondents feared that should there be an occurrence where the process does not work in at least one of the earlier attempts, users would not continue to use the payment method long term, negatively influencing the outcome. This highlights the need for ensuring the process is right from the outset, while reiterating the need for familiar components to be built into the process to increase fluency as a means to attain positive experiences. Further, respondents highlighted established product adoption processes sighting early adopters utilising mobile payments, leading to the normalisation on the use of technology. It is therefore likely that as the technology is being utilised more frequently, social risk turns from consumers not willing to use a certain technology due to the risk of failing, to feeling the need to use a certain technology to conform to social cohesion and move in synchrony. This is likely to be at a notable turning point when the technology is widely available and considered to be more superior to existing technology, particularly relating to time taking to transact. At this point, the utilisation of older technology would slow down processes leading to non-users being perceived as disrupting societal fluency.

P4

Familiar elements will make a usable experience more desirable.

P5a

A fluent experience will decrease perceived risk making the experience more desirable.

P5b

An experience deemed as too fluent will increase perceived risk making the experience less desirable.

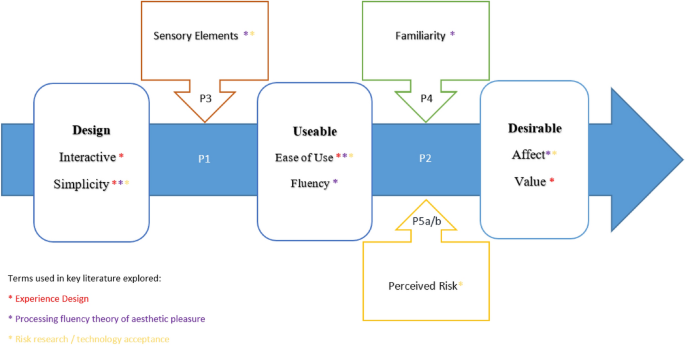

5 Proposed mobile payment user experience design model

A proposed model of the mobile payment user experience (Fig. 1) is partially derived from an existing model using useability, usefulness and desirability [76]. The proposed sequence of design as an antecedent to useability has been widely supported as per the interview responses, with simplicity in design being the key driver. Representatives from technology creators stressed the need for simplicity to make the experience useable with considerations on enhancing the aesthetic experience deemed important but not a primary goal. Considerations on aesthetics further enhance value, which is a critical step to further increase the usefulness of the experience. Similarly, respondents concluded that sensory elements, including visual elements, are a major part of the design consideration, making it key to increase useability for an experience, and consequently, sensory elements are shifted from increasing useability to being part of the design. Key considerations as part of the sensory elements include replicating elements the user has already been exposed to (such as commonly recognised confirmation sounds and images. making the process more fluent [69, 70], leading to elements of familiarity (priming) proposed as a moderator. This therefore suggests that usability increases as payment confirmation is yielded through an auditory or haptic confirmation on the basis of classical conditioning. Respondents to this research contend that the visual affirmation of payment completion is key, with other sensory elements such as audio to increase in importance as technology evolves. with the eventuality of no longer needing to physically hold a phone. Refinement of sensory elements in conjunction with elements not yet incorporated would therefore be critical as a means to increase desirability.

If the experience is effectively designed, usability increases with ease of use and processing fluency, which was a key part of each interview with respondents affirming the importance of a frictionless experience aided by design considerations. An experience with less friction is constructed based on both simplicity and elements that do not just rely on only one sense [65]. The frictionless experience and associated habitual motor responses [89] through stimulating learnt experiences further mitigate the need for familiarity as a moderator with this element instead incorporated into the main framework. As propositioned and affirmed by respondents, ease of use will lead to an increase in desirability towards the technology, as was there an affirmation that should a process be too fluent, this will ultimately lead to technology being perceived as more risky and less usable, and ultimately less useful [95]. However, this is likely mitigated based on elements that make experiences usable and desirable, such as facial or fingerprint verification replacing PIN codes, with processes becoming more familiar through repeated exposure creating familiarity. Therefore, risk considerations are eased on the basis of simplicity of design leading to a useable experience, which is enhanced with features, leading to increased affect as users become familiar with processes.

Respondents affirmed an eagerness to build more features into mobile payment platforms with suggestions to increase desirability in such platforms incorporating identification, loyalty cards as well as other elements that align with payments. There were also suggestions that elements relating to security could be simplified significantly without compromising actual security. In order to take these steps to increase value, there is a need to align this with increased exposure in order to not compromise desirability and usability. Finding a balance between complexity and desirability [74] in experience design can positively impact user perceptions towards the experience.

5.1 Theoretical implications

This study offers important implications for theory by yielding insights from key stakeholders on design considerations, to determine divergences between real life reflections and those drawn based on academic research. This includes a triangulation of responses from key stakeholders that operate in different positions in the value chain. The result was a study that provides a holistic ‘behind the scenes’ view garnering insights from key stakeholders that are part of the creation of the experience, implementation, delivery, or a combination thereof. The continually developing mobile payment market presents theoretical and practical opportunities to investigate aspects beyond initial adoption behaviours with a focus on assessments as the market starts to mature.

The study extends on extant mobile payment research beyond initial adoption behaviour of mobile payment applications with theoretical insights from technology adoption models [22, 46]. Instead, the study proposes a new technology design framework on the basis of experience design theory [6, 50, 76] using fluency theory as a starting point. As part of the framework, it is proposed that users are attracted to technology because of a simple experience that is complemented by sensory elements to create a familiar experience. Along with the intent of making an experience easy to use, the importance of decreasing frictions has been established. This aligns with established theory [15, 86] and extends on early research by [26] and Rotliman and Schwarz [73] suggesting that those who were more likely to consider themselves at having high risk perceptions were less likely to rely on ease of use. However as was suggested by Winkielman et al. in [95], this study proposes to find a balance in not excessively focusing on a frictionless experience to assure the user of perceived security measures. This research proposes the need to restrict features and potentially temporarily increase frictions to get users acquainted to the technology prior to implementing a more frictionless process.

The study also extends on user experience design literature and research on the processing fluency theory of aesthetic pleasure which align well given there are numerous complementary angles. Fluency theory as well as user experience design look into the interactions between a user/viewer and an object with a focus on prototypicality [69, 70, 90]. While user experience design literature explores interaction designs between users and products with a focus on test results rather than aesthetic preferences and opinions [96], fluency theory incorporates hedonic considerations incorporating affective qualities as well as aesthetic appreciations to make evaluative judgements [69, 70]. This is particularly useful when looking at what is currently in place versus what is possible going forward, as repeated exposure helps make the experience more desirable allowing for more feature-rich designs in line with an increase in familiarity.

5.2 Managerial implications

As to how experiences should be designed and possible perceptions towards said (designed) experiences are an ongoing challenge not just for mobile payment applications but technology in general. This is particularly relevant as demand for contactless payments increase for which mobile payments play a major role. Contactless transactions increased significantly in 2020 with further increases expected due to ongoing Covid19 fears along with more terminals enabled to accept contactless payments as a result of increased consumer demand [60]. Reasons cited as to why consumer uptake on mobile payments remained slow for some include the experience not being seamless and experiences being inconsistent, no incentives offered, the infrastructure not being in place, security concerns as well as ingrained consumer behaviour [54]. Therefore, to encourage consumers to switch. a superior payment experience needs to be in place that considers security, learnt behaviour as well as offering value that supersedes current offerings to consumers. Initial design considerations revolve around the extent of value offered in order to create a superior experience versus keeping the experience simple, representing a trade-off between attracting users on the basis of features versus ensuring the experience is usable. Respondents to this research affirmed that there are extensive opportunities to broaden services around mobile payments including opportunities to incorporate identification, loyalty cards and other reasons to use a wallet into a mobile payment application. However, this would increase complexity with this research proposing that processes are to be kept simple and requiring exposure to create (learnt) consumer habits. This may well be complemented by sensory elements that stimulate familiar elements of past experiences leading to the perception that the experience is easy to use. As existing elements become more familiar, value can be added, which is something that has taken place across new mobile offerings over the years. Notably, other mobile based technology utilised similar processes starting from simplicity to feature-rich applications that might be unrecognisable to early users [55].

Another key consideration that entails a trade-off is the need to have a seamless experience while adhering to security concerns. As part of this study, respondents stated that a truly frictionless experience is perfectly feasible as was outlined by respondents representing technology creators whereby users can order food and leave with said food without touching their phone or other means of payment with charges taking place automatically. Results from these experiments were that consumers felt uncomfortable and confused as to whether the payment took place leading to artificial friction with consumers returning to check if they had paid and remaining in the vicinity of the store until the payment confirmation had been received. Similarly, one respondent stated that there really is no need for passwords or security aspects relating to payment confirmations given due to machine learning, a phone could identify the user based on how the phone is picked up, how the user moves and how the user utilises the phone. Therefore, an entirely frictionless experience is perfectly feasible, however may lead to security concerns hence requiring creating friction to assure the user of perceived security measures.

To successfully implement the proposed mobile payment user experience design model (Fig. 1), there is a need to have an interactive mobile payment platform with an intuitive payment process, including a complementary combination of visual, audio, and haptic sensory elements. The sensory elements can be key to evoking a feeling of familiarity, be it in relation to a familiar audio tune and/or a known haptic feedback alert. This decreases risk perceptions, making the experience more enjoyable (affective). Once there is significant adoption and familiarity has been established, value can be generated by adding further features, such as identification and loyalty cards, in order to make the experience more desirable.

5.3 Limitations and directions for future research

This research provides a platform for understanding perceptions from key stakeholders of the supply side and what considerations they think is important as part of the rollout of mobile payment technology. The main limitations of this study are around the relatively small sample size, restrictions being placed on what can be discussed due to confidentiality reasons as well as a number of companies not willing to take part in the research citing commercial sensitivity. However, although especially some larger technology creators were unwilling to take part in the research, due to the very small number of technology creators, a replication of the study would most likely not add significant added value as theoretical saturation had been achieved. Future research directions could include a consumer study to determine divergences between the intent of the supply side and perceptions of consumers. Overall, results of this research provide support for future research that seeks to look at consumer perceptions relating to fluency considerations particularly relating to risk and feedback in mobile technology. The rapid development of mobile technology allows for payments to disappear into the background entirely, allowing for a redesign of the shopping experience. Extensive consumer research is needed to determine what factors might be required to get consumers to this point using empirical research [91]. This could include structural equation modelling to determine interaction effects between the elements, and potentially multigroup modelling to distinguish varying impacts of familiarity and/or risk on consumer perceptions of current processes. Experimental testing could be used to determine the extent to which users perceive process fluency, or to determine how consumer perception is altered as features are added.

References

Aguilera, A., & Boutueil, V. (2018). Urban mobility and the smartphone: Transportation, travel behavior and public policy. Elsevier.

Alter, A. L., & Oppenheimer, D. M. (2009). Uniting the tribes of fluency to form a metacognitive nation. Personality and Social Psychology Review, 13(3), 219–235.

Arrighi, G., See, Z. S., & Jones, D. (2021). Victoria Theatre virtual reality: A digital heritage case study and user experience design. Digital Applications in Archaeology and Cultural Heritage, 21, e00176.

Ballard, B. (2007). Designing the mobile user experience. Wiley.

Baird, D. E., & Fisher, M. (2005). Neomillennial user experience design strategies: Utilizing social networking media to support “always on” learning styles. Journal of Educational Technology Systems, 34(1), 5–32.

Bauer, S. R., & Mead, P. (1995). After you open the box: Making smart products more usable, useful, and desirable through interactive technology. Design Management Journal (Former Series), 6(4), 21–26.

Berliner, T. (2017). Hollywood aesthetic: Pleasure in American cinema. Oxford University Press.

Berry, L. L., Carbone, L. P., & Haeckel, S. H. (2002). Managing the total customer experience. MIT Sloan Management Review, 43(3), 85–89.

Blumberg, F. C., & Brooks, P. J. (Eds.). (2017). Cognitive development in digital contexts. Academic Press.

Bolton, R. N., Gustafsson, A., McColl-Kennedy, J., Sirianni, N. J., & Tse, D. K. (2014). Small details that make big differences: A radical approach to consumption experience ’s a firm’s differentiating strategy. Journal of Service Management, 25(2), 253–274.

Brell, T., Philipsen, R., & Ziefle, M. (2019). sCARy! Risk perceptions in autonomous driving: The influence of experience on perceived benefits and barriers. Risk Analysis, 39(2), 342–357.

Brewster, S., Chohan, F., & Brown, L. (2007). Tactile feedback for mobile interactions. In Proceedings of the SIGCHI conference on Human factors in computing systems (pp. 159–162).

Brod, M., Tesler, L. E., & Christensen, T. L. (2009). Qualitative research and content validity: Developing best practices based on science and experience. Quality of Life Research, 18(9), 1263–1278.

Chatterjee, P., & Kumar, A. (2017). Consumer willingness to pay across retail channels. Journal of Retailing and Consumer Services, 34, 264–270.

Choi, J. H., & Lee, H. J. (2012). Facets of simplicity for the smartphone interface: A structural model. International Journal of Human-Computer Studies, 70(2), 129–142.

Cochin, S., Barthelemy, C., Roux, S., & Martineau, J. (1999). Observation and execution of movement: Similarities demonstrated by quantified electroencephalography. European Journal of Neuroscience, 11(5), 1839–1842.

Copi, I., Cohen, C., & Flage, D. (2016). Essentials of logic. Taylor & Francis.

Davis, N. (2015). Don’t just look – smell, feel, and hear art. Tate’s new way of experiencing paintings. The Guardian. https://www.theguardian.com/artanddesign/2015/aug/22/tate-sensorium-art-soundscapes-chocolates-invisible-rain

Diller, S., Shedroff, N., & Rhea, D. (2005). Making meaning: How successful businesses deliver meaningful customer experiences. New Riders.

Dodds, S., & Hess, A. (2020). Adapting research methodology during COVID-19: Lessons for transformative service research. Journal of Service Management, 32(2), 203–217.

Ezzy, D. (2013). Qualitative analysis. Routledge.

Falk, T., Kunz, W. H., Schepers, J. J., & Mrozek, A. J. (2016). How mobile payment influences the overall store price image. Journal of Business Research, 69(7), 2417–2423.

Fleming, J., & Koman, R. (1998). Web navigation: designing the user experience (p. 166). Oreilly.

Ganapathy, S. (2013). Design guidelines for mobile augmented reality: User experience. Human factors in augmented reality environments (pp. 165–180). Springer.

Gaitan, C. (2021). Implementing a user experience design approach in Melbourne’s public transport system: the case of wayfinding and customer information design at flinders street station. Advancing a design approach to enriching public mobility (pp. 143–159). Cham: Springer.

Grayson, C. E., & Schwarz, N. (1999). Beliefs influence information processing strategies: Declarative and experiential information in risk assessment. Social Cognition, 17, 1–18.

Guest, S., & Spence, C. (2003). What role does multisensory integration play in the visuotactile perception of texture? International Journal of Psychophysiology, 50(1–2), 63–80.

Hartson, R., & Pyla, P. S. (2012). The UX book: Process and guidelines for ensuring a quality user experience. Elsevier.

Hassenzahl, M. (2008). User experience (UX) towards an experiential perspective on product quality. In Proceedings of the 20th conference on l'interaction homme-machine (pp. 11–15).

Hassenzahl, M., Diefenbach, S., & Göritz, A. (2010). Needs, affect, and interactive products–facets of user experience. Interacting with Computers, 22(5), 353–362.

Hassenzahl, M. (2013). User experience and experience design. The Encyclopedia of Human-Computer Interaction, 2, 1–14.

Haueisen, J., & Knösche, T. R. (2001). Involuntary motor activity in pianists evoked by music perception. Journal of Cognitive Neuroscience, 13(6), 786–792.

Hertwig, R., Pachur, T., & Kurzenhäuser, S. (2005). Judgments of risk frequencies: Tests of possible cognitive mechanisms. Journal of Experimental Psychology: Learning, Memory, and Cognition, 31(4), 621.

Hume, M., Mort, G. S., Liesch, P. W., & Winzar, H. (2006). Understanding service experience in non-profit performing arts: Implications for operations and service management. Journal of Operations Management, 24(4), 304–324.

Hsu, C. L., & Chen, M. C. (2018). How does gamification improve user experience? An empirical investigation on the antecedences and consequences of user experience and its mediating role. Technological Forecasting and Social Change, 132, 118–129.

Jacoby, L. L., & Dallas, M. (1981). On the relationship between autobiographical memory and perceptual learning. Journal of Experimental Psychology: General, 110(3), 306.

Kim, K. J., & Shin, D. H. (2015). An acceptance model for smart watches. Internet Research, 25, 527–541.

Knapik, M. (2006). The qualitative research interview: Participants’ responsive participation in knowledge making. International Journal of Qualitative Methods, 5(3), 77–93.

Knight, W. (2019). The importance of visual design. UX for developers (pp. 103–126). A Press.

Kolko, J. (2010). Thoughts on interaction design. Morgan Kaufmann.

Körner, A., Topolinski, S., & Strack, F. (2015). Routes to embodiment. Frontiers in Psychology, 6, 940.

Krishna, A., Cian, L., & Sokolova, T. (2016). The power of sensory marketing in advertising. Current Opinion in Psychology, 10, 142–147

Kujala, S., Roto, V., Väänänen-Vainio-Mattila, K., Karapanos, E., & Sinnelä, A. (2011). UX Curve: A method for evaluating long-term user experience. Interacting with Computers, 23(5), 473–483.

Kuniavsky, M. (2010). Smart things: Ubiquitous computing user experience design. Elsevier.

Landa, R. (2005). Designing brand experience: Creating powerful integrated brand solutions. Cengage Learning.

Lerner, T. (2013). Mobile payment. Springer Fachmedien Wiesbaden.

Li, M., Dong, Z. Y., & Chen, X. (2012). Factors influencing consumption experience of mobile commerce: A study from experiential view. Internet Research, 22(2), 120–141.

Lindner, P., Miloff, A., Zetterlund, E., Reuterskiöld, L., Andersson, G., & Carlbring, P. (2019). Attitudes toward and familiarity with virtual reality therapy among practicing cognitive behavior therapists: a cross-sectional survey study in the era of consumer VR platforms. Frontiers in psychology, 10, 176.

Longhurst, R. (2003). Semi-structured interviews and focus groups. Key Methods in Geography, 3(2), 143–156.

Mager, B., & Sung, T. J. D. (2011). Special issue editorial: Designing for services. International Journal of Design, 5(2), 24.

Mallat, N., & Tuunainen, V. K. (2008). Exploring merchant adoption of mobile payment systems: An empirical study. E-service Journal, 6(2), 24–57.

Malhotra, N., Hall, J., Shaw, M., & Oppenheim, P. (2006). Marketing research: An applied orientation. Pearson Education Australia.

Marcus, A. (2006). Cross-cultural user-experience design. In International conference on theory and application of diagrams (pp. 16–24). Springer, Berlin, Heidelberg.

Martin, J. A. (2016). 7 reasons mobile payments still aren’t mainstream. CIO. https://www.cio.com/article/238260/7-reasons-mobile-payments-still-arent-mainstream.html#:%7E:text=Mobile%20payments%20haven’t%20become,debit%20cards%20with%20embedded%20chips

Matemba, E. D., & Li, G. (2018). Consumers’ willingness to adopt and use WeChat wallet: An empirical study in South Africa. Technology in Society, 53, 55–68.

McCoyd, J. L., & Kerson, T. S. (2006). Conducting intensive interviews using email: A serendipitous comparative opportunity. Qualitative Social Work, 5(3), 389–406.

Mendoza, A. (2013). Mobile user experience: Patterns to make sense of it all. Newnes.

Meyer, C., & Schwager, A. (2007). Understanding customer experience. Harvard Business Review, 85(2), 116.

Miniukovich, A., & De Angeli, A. (2014) Visual impressions of mobile app interfaces. In Proceedings of the 8th nordic conference on human-computer interaction: Fun, fast, foundational (pp. 31–40).

New Zealand payments stats–2020 in review 2021. Payments NZ. https://www.paymentsnz.co.nz/resources/articles/new-zealand-payments-stats-2020-in-review/

Otter Voice Meeting Notes. (2016). Otter voice meeting notes. [Online] Available at: <https://otter.ai/>. (Accessed 28 June 2021).

Overmars, S., & Poels, K. (2015). Online product experiences: The effect of simulating stroking gestures on product understanding and the critical role of user control. Computers in Human Behavior, 51, 272–284.

Palmer, S. E. (1999). Color, consciousness, and the isomorphism constraint. Behavioral and Brain Sciences, 22(6), 923–943

Park, S.J., MacDonald, C.M., & Khoo, M. (2012) Do you care if a computer says sorry? User experience design through affective messages. In Proceedings of the designing interactive systems conference (pp. 731–740).

Peck, J., & Childers, T. L. (2003). Individual differences in haptic information processing: The “need for touch” scale. Journal of Consumer Research, 30(3), 430–442.

Petrova, K., & Wang, B. (2013). Retailer adoption of mobile payment: A qualitative study. Journal of Electronic Commerce in Organizations (JECO), 11(4), 70–89.

Qu, S. Q., & Dumay, J. (2011). The qualitative research interview. Qualitative Research in Accounting & Management, 8(3), 238–264.

Reber, R. (2012). Processing fluency, aesthetic pleasure, and culturally shared taste. Aesthetic Science: Connecting Minds, Brains, and Experience, 2012, 223–249.

Reber, R., Schwarz, N., & Winkielman, P. (2004). Processing fluency and aesthetic pleasure: Is beauty in the perceiver’s processing experience? Personality and Social Psychology Review, 8(4), 364–382.

Reber, R., Wurtz, P., & Zimmermann, T. D. (2004). Exploring “fringe” consciousness: The subjective experience of perceptual fluency and its objective bases. Consciousness and Cognition, 13(1), 47–60.

Rennekamp, K. (2012). Processing fluency and investors’ reactions to disclosure readability. Journal of Accounting Research, 50(5), 1319–1354.

Rodríguez, I., Karyda, M., Lucero, A., & Herskovic, V. (2018). Exploring tangible ways to evaluate user experience for elders. In Extended abstracts of the 2018 CHI conference on human factors in computing systems (pp. 1–6).

Rotliman, A. J., & Schwarz, N. (1998). Constructing perceptions of vulnerability: Personal relevance and the use of experiential information in health judgments. Personality and Social Psychology Bulletin, 24(10), 1053–1064.

Rousi, R., & Silvennoinen, J. (2018). Simplicity and the art of something more: A cognitive–semiotic approach to simplicity and complexity in human–technology interaction and design experience. Human Technology, 14, 67–95.

Saunders, B., Sim, J., Kingstone, T., Baker, S., Waterfield, J., Bartlam, B., & Jinks, C. (2018). Saturation in qualitative research: exploring its conceptualization and operationalization. Quality & Quantity, 52, 1893–1907.

Schmidt, A., & Etches, A. (2014). Useful, usable, desirable. ALA Editions.

Schneider, O., MacLean, K., Swindells, C., & Booth, K. (2017). Haptic experience design: What hapticians do and where they need help. International Journal of Human-Computer Studies, 107, 5–21.

Shishah, W., & Alhelaly, S. (2021). User experience of utilising contactless payment technology in Saudi Arabia during the COVID-19 pandemic. Journal of Decision Systems, 30, 1–18.

Silverman, D. (Ed.). (2020). Qualitative research. Sage Publications Limited.

Sjöberg, L. (2020). Explaining risk perception: An empirical evaluation of cultural theory. Risk Management: Volume I: Theories, Cases, Policies and Politics, 2(2), 127.

Simpson, A., Walsh, M., & Rowsell, J. (2013). The digital reading path: Researching modes and multidirectionality with iPads. Literacy, 47(3), 123–130.

Sohn, S. (2017). Consumer processing of mobile online stores: Sources and effects of processing fluency. Journal of Retailing and Consumer Services, 36, 137–147.

Song, H., & Schwarz, N. (2008). Fluency and the detection of misleading questions: Low processing fluency attenuates the Moses illusion. Social Cognition, 26(6), 791–799.

Suh, B., & Han, I. (2003). The impact of customer trust and perception of security control on the acceptance of electronic commerce. International Journal of Electronic Commerce, 7(3), 135–161.

Taylor, E. (2016). Mobile payment technologies in retail: a review of potential benefits and risks. International Journal of Retail & Distribution Management, 44, 159–177.

Thielsch, M. T., & Niesenhaus, J. (2017). User experience, gamification, and performance. The wiley blackwell handbook of the psychology of the internet at work (pp. 79–102). Chichester: Wiley-Blackwell.

Thomas, D. (2016). Payment solutions including apple pay. The FinTech book: The financial technology handbook for investors, entrepreneurs and visionaries (pp. 125–127). Wiley.

Topolinski, S., & Strack, F. (2009). The architecture of intuition: Fluency and affect determine intuitive judgments of semantic and visual coherence and judgments of grammaticality in artificial grammar learning. Journal of Experimental Psychology: General, 138(1), 39.

Tran, J.A., Yang, K.S., Davis, K., & Hiniker, A. (2019). Modeling the engagement-disengagement cycle of compulsive phone use. In Proceedings of the 2019 CHI conference on human factors in computing systems (pp. 1–14).

Tuch, A. N., Bargas-Avila, J. A., Opwis, K., & Wilhelm, F. H. (2009). Visual complexity of websites: Effects on users’ experience, physiology, performance, and memory. International Journal of Human-Computer Studies, 67(9), 703–715.

Velte, P., & Stawinoga, M. (2017). Integrated reporting: The current state of empirical research, limitations and future research implications. Journal of Management Control, 28, 275–320.

Vitale, J., Tonkin, M., Herse, S., Ojha, S., Clark, J., Williams, M.A., Wang, X., & Judge, W. (2018). Be more transparent and users will like you: A robot privacy and user experience design experiment. In Proceedings of the 2018 ACM/IEEE international conference on human-robot interaction (pp. 379–387).

Vroomen, J., & Gelder, B. D. (2000). Sound enhances visual perception: Cross-modal effects of auditory organization on vision. Journal of Experimental Psychology: Human Perception and Performance, 26(5), 1583.

Winkielman, P., & Cacioppo, J. T. (2001). Mind at ease puts a smile on the face: Psychophysiological evidence that processing facilitation elicits positive affect. Journal of Personality and Social Psychology, 81(6), 989.

Winkielman, P., Schwarz, N., Fazendeiro, T., & Reber, R. (2003). The hedonic marking of processing fluency: Implications for evaluative judgment. The Psychology of Evaluation: Affective Processes in Cognition and Emotion, 189, 217.

Yu, M., Zhou, R., Cai, Z., Tan, C. W., & Wang, H. (2020). Unravelling the relationship between response time and user experience in mobile applications. Internet Research, 30(5), 1353–1382.

Zagouras, P., Kalloniatis, C., & Gritzalis, S., (2017). Managing user experience: Usability and security in a new era of software supremacy. In International conference on human aspects of information security, privacy, and trust (pp. 174–188). Cham: Springer.

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No funding has been received as part of this research with there being no conflict of/or competing interest that the authors are aware.

Ethical approval

Full ethics approval was granted for this research by the Massey University Human Ethics Committee (NOR 20/04).

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mahler, M., Murphy, A. Risk of desirable user experiences: insights from those who create, facilitate and accept mobile payments. Electron Commer Res (2024). https://doi.org/10.1007/s10660-024-09835-4

Accepted:

Published:

DOI: https://doi.org/10.1007/s10660-024-09835-4