Abstract

The study has been inspired by the emergence of technology-based assets, namely, FinTech, Robotics, and Blockchain in the 4th Industrial Revolution. We are examining diversification opportunities with nonconventional technology funds based on FinTech, Robotics, and Blockchain while investing in MSCI Emerging Markets Index, and finally gauging the most resilient fund during the pre-and post-outbreak of COVID-19. The five technology-driven funds considered are ARK FinTech Innovation Exchange Traded Funds (ARKF), Global X FinTech Exchange Traded Funds (FINX), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), Global X Robotics and Artificial Intelligence (BOTZ), and Ishares Robotics and Artificial Intelligence (IRBO) to investigate diversification opportunities with MSCI Emerging Markets Index. The time-varying dynamic spillover using the Vector Auto Regression Model for average, low, and high volatility quantiles and the network of volatility connectedness based on quantile VAR have been applied to capture diversification and identifying the most resilient fund. The study found that ARKF and FINX provide diversification opportunities. In each quantile, these two funds are evidence of diversification, and BOTZ, also shows diversification evidence. Moreover, FINX is the throughout resilient fund, and ARKF is the most resilient in extreme quantiles. Throughout the quantiles, it is perceived a significant impact of COVID-19 on the total connectedness of Funds with the emerging market index.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The need for portfolio diversification has been accentuating significantly after the advent of the financial crisis [14]. Investors are interested in safe-haven instruments during the turmoil period. It has been found that correlations among financial assets increased during the crisis due to interdependencies, contagion, and herding behavior of investors [31]. After the financial crisis, the need for diversification and identifying the best hedging opportunities triggered significantly after the outbreak of COVID-19 [6, 8, 37, 40].

In the 4th industrial revolution, investors are showing interest in alternative asset classes, in general and technology-based asset classes, in particular [21, 26, 27]. Among technology-based assets, several studies have been done on Bitcoin and found it a safe investment in a period of turmoil [12, 17, 19]. Cryptocurrency as an asset class created a mixed picture as a financial asset. The peculiar behavior of Bitcoin is backed by its unique structure and is considered a speculative asset class Gronwald [18]. In this paper, we examine FinTech, Robotics, Artificial Intelligence, and Blockchain-based funds to identify diversification opportunities and find the most resilient tech-based index during the pre-and post-outbreak of COVID-19.

Blockchain technology is the outcome of the advent of Bitcoin in 2009 [32]. A Blockchain is a decentralized ledger that initially facilitates peer-to-peer transactions and is now popularised as a smart contract. Blockchain-based smart contracts help to mitigate the trust problem through peer-to-peer networking and public-key cryptography [13]. The Blockchain-based smart contract changed the complete landscape of the traditional production system and created trust within the ecosystem [3]. It has been used robustly in various industries, from the financial sector to healthcare [2, 30, 33, 35]. The trend of Blockchain hovers with a big bang in general, particularly in the various sectors of emerging countries [34]. Artificial Intelligence (AI), Robotics, and FinTech are the outcomes of the 4th Industrial revolution era. AI and Robotics are the disrupted technologies that change the production processes. The adoption of AI and robotics by business processes have increased significantly [16]. Nowadays, robotics technologies facilitate the forecasting of demands and production planning. It is in healthcare, agriculture, hospitality, manufacturing, and the military. Henceforth, the shipment of robots has increased by 150% from 2010 to 2016 [16]. Artificial Intelligence (AI) helps to make strategic business decisions and expedite business operations. It has been shifting businesses that have been proven by the successes of Ola, Uber, Amazon, etc. They used instrument state-of-the-art business models [15]. AI offers huge opportunities in Emerging Markets to lower the cost of production and innovate cutting-edge business models that are resilient and sustainable [39]. FinTech is the advent of technology in the financial world that changed the complete ecosystem. FinTech is the representative of companies that provides digital-based financial services to its customer that is user-friendly, decentralized, efficient, and transparent [26, 27]. Moreover, the FinTech industry is acting as a trigger to promote sustainable economic growth. It ensures financial sustainability of businesses and their financial inclusion. FinTech can promote the funds used in green projects [10]. Both sectors that are sustainable finance and FinTech have many common aspects. FinTech has the potential to complement it and thus provide interesting synergies and great potential [28]. FinTech triggers financial inclusion that ensures sustainable balanced development, which is in tune with UN Sustainable Development Goals (SDGs) [5]. The potential of FinTech to strengthen SDGs will be realized by strengthening the infrastructure to support digital financial transformation [4]. There is enormous scope for FinTech firms in emerging or developing markets. Henceforth, capturing relationships with technology-based assets with the traditional financial market is worth analyzing [27].

Emerging Markets is always in priority of investment for foreign institutional investors [22]. The market backed by high growth and weak efficiencies makes a lucrative investment for investors. The limited literature is available to capture the diversification opportunities in emerging financial markets with technology-based non-conventional assets [26, 27]. The novelty of the current research is based on the scant literature on diversification opportunities with non-conventional asset classes and finding the most resilient asset during the pre- and post-outbreak of COVID-19. The three major studies were on technology-based assets with a blend of conventional assets that are Le et al. [27], Huynh et al. [21] and Le et al. [26]. The study of Le et al. [26], to the best of my knowledge, is the only one to capture the impact of COVID-19 among technology-based assets with other asset classes. Additionally, none of the studies has been done exclusively on tech-based assets that are on FinTech, AI, Robotics, and Blockchain while investing in emerging markets.

With the above discussion, the study tries to reach answers to the following two questions:

-

Q1. Identifying the impact of COVID-19 on Tech-Based Funds and finding the diversification opportunities for the investors investing in Emerging Markets?

-

Q2. Capturing Tech-Based Funds that are the most resilient during the Pre and Post outbreak of COVID-19?

To reach these research questions, the study has taken innovative tech-based funds that are capturing the companies that are broadly investing in Blockchain, Robotics, Artificial Intelligence (AI), and FinTech. The five funds considered in the study are ARK FinTech Innovation ETF (ARKF), Global X FinTech ETF (FINX), First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT), Global X Robotics and Artificial Intelligence (BOTZ), and ishares Robotics and Artificial Intelligence (IRBO). The study is unique in identifying the impact of the outbreak of COVID-19. For this, the study has divided the time-period into two windows that are pre- outbreak (from 11th March 2019 to 11th March 2020) and the post- outbreak of COVID-19 (from 12th March 2020 to 11th March 2021). Time-Varying Dynamic Spillover using the Vector Auto Regression (VAR) Model for average, low, and high volatilities quantiles and the network of the volatility connectedness based on quantile VAR. Finally, the pre- and post-volatility connectedness has been analyzed. The results capture that ARKF and FINX provide diversification opportunities throughout the quantiles, and BOTZ has shown diversification evidence. FINX is the throughout resilient fund, and ARKF is the most resilient in extreme quantiles. It has captured a significant impact of COVID-19 on the total connectedness of Funds with MSCI Emerging Markets Index in all quantiles.

The rest of the paper is organized as follows. Section 2 presents literature on the diversification of nonconventional assets with emerging markets and a specific discussion on the diversification of Technology-based assets with emerging markets. Section 3 outlines the empirical methods used in the study. Section 4 discusses the data and empirical results of the volatility transmissions, identifies diversification opportunities, then explores the most resilient tech-based fund, and lastly, the overall impact of the outbreak of COVID-19 has been addressed. Section 5 provides concluding remarks and policy suggestions.

2 Literature review

Table 1 captured the detailed literature review based on diversification with tech-based assets that are crypto market, FinTech, Artificial Intelligence, and Blockchain. This section highlights the very recent studies on diversification and identified the similarities and gaps that provide the need and urgency for the current study.

From the above discussion, it has been found that a very limited strand of literature is available to capture the diversification opportunities in emerging financial markets with technology-based nonconventional assets during the pre and post-outbreak of COVID-19. To the best of my knowledge only one study done by Le et al. [26] captured the impact of COVID-19 among technology-based assets with other asset classes. Additionally, none of the studies has been done exclusively on tech-based assets that include FinTech, Artificial Intelligence (AI), Robotics, and Blockchain while investing in emerging markets, and finding the most resilient asset class during times of vulnerabilities, provides scope for the current study.

3 Empirical methods

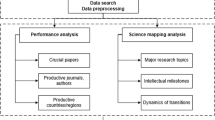

The empirical strategies are outlined in this section. First, the quantile VAR model is discussed briefly. Second, the quantile generalized forecast error variance decomposition is used to form the volatility spillovers between technologically based funds and MSCI emerging market index.

3.1 The quantile VAR model

In quantile regression, we may estimate the dependence of \(z_{t}\) on \(y_{t}\) at each quantile \(\tau\) of the conditional distribution of \(z_{t} \left| {y_{t} } \right.\) [25]. It can be shown as:

In Eq. (1), \(Q_{\tau }\) is the \(\tau \,\,th\) conditional quantile function of \(z_{t}\); each quantile range is between 0 and 1 and represented by the symbol \(\tau\); \(y_{t}\) is a vector of explanatory variable and \(\beta (\tau )\) presents the dependency link between \(y_{t}\) and the \(\tau \,\,th\) conditional quantile of \(z_{t}\). In general, the parameter vector \(\beta (\tau )\) is estimated at the \(\tau \,\,th\) conditional quantile \(\tau\) via the following expression:

Consequently, the n-variable quantile VAR process of the pth order is computed as follows:

where \(z_{t}\) is the n-vector of a dependent variable, \(e(\tau )\) and \(\varepsilon_{t} (\tau )\) represent the n-vector of constant and residuals at quantile \(\tau\) respectively. \(A_{i} (\tau )\) denotes the lagged coefficient matrix at quantile \(\tau\). In order to compute the \(A_{i} (\hat{\tau })\) and \(e(\hat{\tau })\), it is assumed that the residual confirms the population quantile restriction, \(Q_{\tau } \left( {\varepsilon_{t} (\tau )\left| {z_{t - 1} , \ldots ,z_{t - p} } \right.} \right) = 0\). Under this restriction, the computed values of the dependent variable \(z_{t}\) at each quantile are estimated as:

3.2 The quantile connectedness measures

The connectedness measures at each quantile \(\tau\) are estimated by following the original work of Ando et al. [1] which is the extended version of mean-based measurement of Diebold and Yilmaz [11].

To compute the connectedness measures at each quantile, we rewrite Eq. (3) as an infinite order vector moving average process:

with

where \(z_{t}\) denotes the summation of residuals \(\upsilon_{t} (\tau )\).

Next, the H-step ahead generalized forecast error variance decomposition (GFEVD) is computed to show how a shock in one variable j affects another variable k:

Equation (7), \(\theta_{jk}^{g} (H)\) shows the role of the kth variable to the variance of forecast error of the variable jth to horizon H, \(\sum\) explains the variance matrix of the vector of errors, \(\sigma_{kk}\) represents the kth diagonal element of the \(\sum\) matrix and \(\upsilon_{j}\) represents a vector of value 1 for the ith element and 0 otherwise. Afterward, the variance decomposition matrix is normalized using the following expression:

In the next step, GFEVD is used to formulate four estimates of connectedness at each quantile. The quantile total spillover index (\(Q_{TSI}\)) is computed as:

Quantile directional spillover index (\(QDSI\)) from asset j to assets k (represented by TO) is:

Quantile directional spillover index (\(QDSI\)) from asset k to assets j (represented by FROM) is:

The net quantile spillover index (\(N_{QSI}\)) is:

4 Empirical discussion

4.1 Data and preliminary analysis

In the study, we are identifying the diversification opportunities among technology funds that are based on Artificial Intelligence, Blockchain, FinTech, and Robotics and emerging markets from 11th March 2019 to 11th March 2021. The study has considered five nonconventional-tech based funds that are: ARK FinTech Innovation ETF (ARKF), Global X FinTech ETF (FINX), First Trust NASDAQ Artificial Intelligence and Robotics ETF (ROBT), Global X Robotics & Artificial Intelligence (BOTZ), and ishares Robotics and Artificial Intelligence (IRBO). The MSCI Emerging Markets Index is a proxy of emerging markets. Furthermore, to study the impact of the outbreak of COVID-19 on technology funds, the data is divided into two sub-windows that are pre-outbreak of COVID-19 (from 11th March 2019 to 11th March 2020)[1] and post-outbreak of COVID-19 (from 12th March 2020 to 11th March 2021). The daily closing price data of select indices has been fetched from www.investing.com.

The empirical analysis starts from the preliminary analysis, visualization of the charts, and descriptive analysis. Figure 1 captures the visualization of prices and returns of tech-based funds and the MSCI Emerging Markets Index from 11/03/2019 to 11/03/2021.

Time series plots of closing prices and returns of ARKSM, BOTZ, FINX, IRBO, ROBT, and MSCI Emerging Markets Index. Note Closing Prices (in Blue) and Log transformed returns (in Red) of select Tech-based assets i.e. ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index from 11th March 2019 to 11th March 2021

The figures captured a sharp decline in the prices of all asset classes due to the outbreak of COVID-19. However, the negative impact was sharp with short duration, followed by a quick recovery, the inferences are aligned with the studies of Harjoto et al. [20], Chemka et al. [9], Disli et al. [12], Guo et al. [19], and Le et al. [26]. The price patterns are almost similar across all tech funds, but the MSCI Emerging Markets Index is a relatively different set of patterns. The volatility of returns has also increased in the post-pandemic period, and it persists more in ARKF and IRBO, whereas the rest had shown the same patterns of volatilities. The leverage effects have also been captured in the returns of the select asset class. It means the negative spikes are more volatile than the positive, and during the period of crisis, the leverage effect has increased compared to during the non-pandemic period.

Table 2 shows the descriptive statistics of the returns of the asset class. The maximum average returns are shown by ARKF (20%), followed by IRBO (13%), then 11% returns fetched by BOTZ, FINX, and ROBT. MSCI Emerging Markets Index provides an average yield of 6%. Across the asset class, all mean returns are less than median returns, thus the skewness is negative ranging from − 1.65 to − 0.85. The negative skewness provides evidence of the probability of getting negative returns. Kurtosis is more than the threshold level ranging from 10.35 to 16.08, showing the distribution is leptokurtic, and thus investors perceive the assets are volatile. The normality of returns is addressed by JB-Test, providing significant evidence that the returns varied from normality. However, the ADF-Test, test of stationarity reflects that the returns are stationary, the mean and variance are constant over time, and thus the returns series are suitable for further analysis.

Figure 2 Capturing the unconditional correlation between Technology-based funds and MSCI Emerging Markets Index. The results showed that tech-based funds correlation is significant at a 1% level, with the MSCI Emerging Markets Index ranging from 0.86 to 0.81. The maximum correlation was found with IRBO, followed by ROBT, then by BOTZ, and the most minor correlated assets are ARKF and FINX.

Plots of the distribution and the pair-wise correlations of ARKF, BOTZ, FINX, IRBO, ROBT, and MSCI Emerging Markets Index. Note Captures Karl Pearson's coefficient of correlation among the Log transformed returns of select Tech-based assets, i.e., ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index. ***Indicates significance at 1%

Figure 3. showed the pairwise correlations network analysis among tech-based funds and MSCI Emerging Markets Index. The two clusters captured, first is among MSCI Emerging Markets Index, RBOT, and ARKF, and the second is among RBOT, BOTZ, and FINX. The formation of clusters showed correlation magnitude based on the absolute values of correlations. The proximity or closeness of the variables reflects the overall magnitude of the correlation between the two variables.

A network analysis of the pairwise correlations among ARKSM, BOTZ, FINX, IRBO, ROBT, and MSCI Emerging Markets. Note Network analysis of the pairwise correlations, and the partial contemporaneous and partial directed correlations among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index

Figure 4 provides the visualization of partial contemporaneous correlations and partial causal correlations. The results of partial contemporaneous correlations are in the consensus of the above plot. The partial directed/causal correlations captured, the significant negative causality from MSCI Emerging Markets Index to ARKF, and mild negative causality to FINX. The previous results showed that both were the least correlated, and with the results of partial causal correlation, the negative relations were established. Henceforth, it provides evidence of diversification and hedging opportunities. The results of diversification with tech-based assets are in consensus with the study done by Bouri et al. [7], Hyunh et al. [21], and not by Jiang et al. [23] and Le et al. [26, 27].

Plots of the partial contemporaneous and partial directed correlations. Note Network analysis of the pairwise correlations, and the partial contemporaneous and partial directed correlations among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets

4.2 Empirical results and discussion

4.2.1 Time-varying dynamic spillover using the VAR model for average, low, and high volatilities quantiles

The findings presented in Tables 3, 4, and 5 demonstrate the time-varying dynamic spillover using the VAR model for the average volatility (50th), extremely low volatility (5th), and extremely high volatility (95th) quantiles. Sequentially we have examined the pattern of time-varying volatilities.

Table 3 provides the results of time-varying connectedness in the average volatility quantile. The result shows the total connectedness index (TCI) is 79.2%. It means that the system is well integrated. The 20.8% is idiosyncratic shock derived from others, out side the system. The standalone spillover was captured diagonally. We found that tech-based funds' volatilities range from 19.7 to 20.8%, the maximum volatility captured in MSCI Emerging Markets Index. MSCI Emerging Markets Index contributes the maximum to the volatilities of BOTZ (14.5%) and contributes the least to the volatilities of ARKF (13.7%) and FINX (13.7%). Henceforth both tech-driven funds are providing diversification opportunities with MSCI Emerging Markets Index. The results are in the consensus of the previous studies done by Bouri et al. [7], and Hyunh et al. [21], and not by Jiang et al. [23] and Le et al. [27]. However, the funds contributing least to the volatility of the MSCI Emerging Markets Index are ARKF (14.4%), followed by FINX (15.1%). The results further strengthen the previous evidence. The least contributing/transmitter tech fund in the overall market is ARKF (76.9%), followed by BOTZ (77.8%) and FINX (80.2%). However, the asset class receiving maximum volatilities from others within the system are IRBO (80.3%) and ARKF (79.2%), whereas BOTZ (79.2%) and FINX (79.3%) are the most miniature volatilities receivers. Finally, ARKF and BOTZ are net receivers, whereas FINX, IRBO, and ROBT are net transmitters.

Figure 5. captures the total dynamic volatility spillover in the average quantile VAR. The results perceived the impact of the outbreak of COVID-19 on the connectedness of the assets in the sample. The volatilities have increased significantly after the outbreak of COVID-19. The total volatility connectedness before the outbreak of CIVID-19 ranged from 80 to 83%. However, during the post-outbreak of COVID-19, the connectedness ranges from 76 to 88%. Gradually, the volatility reduces. The results are in consensus with Chemka et al. [9], Disli et al. [12], Guo et al. [19], and Le et al. [26].

Dynamic volatility spillover in the quantile VAR (median quantile Tau = 0.5). Note This Figure shows the rolling-window version of total volatility connectedness at the 50th quantile among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets

Table 4 provides the results of time-varying connectedness in low volatility quantile. The result shows the total connectedness index (TCI) is 82%. It means that the system is well integrated, and 18% is the idiosyncratic shock from others. Among tech-based funds, ARKF (18.2%) is the most volatile, followed by BOTZ (17.9%) and FINX (17.9%). The results of low volatilities depart from the average quantile volatilities. MSCI Emerging Markets Index contributes the maximum to the volatilities of BOTZ (16%) and FINX (16%) and least in the volatilities of ARKF (15.6%). The result regarding the maximum contribution of the MSCI Emerging Markets Index does not agree with the previous results. However, the funds contributing to the volatilities of the MSCI Emerging Market Index, again ARKF (16%), followed by FINX (16.2%), are the least contributing funds. The results further strengthen the inferences drawn from average quantile time-varying volatilities. ARKF (81.5%), followed by FINX (82%), and BOTZ (82%) are the least contributing tech funds in the volatilities of the others in the system. The results are in consensus with the previous. However, the asset class receiving the least volatilities from others within the system is ARKF (81.8%), followed by BOTZ (82.1%), and FINX (82.1%) are the least volatilities receivers. Finally, ARKF, BOTZ, and FINX are net receivers, whereas IRBO, and ROBT are net transmitters. The results consistently provide evidence of diversification with ARKF and FINX. The results of diversification of the stock market with tech-based assets are in consensus with Bouri et al. [7] and Hyunh et al. [21], and not with Jiang et al. [23] and Le et al. [27].

Figure 6 shows the total dynamic volatility spillover in the lowest quantile VAR. The visibility of high connectedness among asset classes has been captured significantly during the post-outbreak of COVID-19. The results perceived the impact of the outbreak of COVID-19 on the total connectedness of the assets in the sample, is in consensus with the average quantile. The total connectedness index varied before the outbreak of COVID-19 from 73 to 77%, and post COVID-19 index from 70 to 82%. The figure captures that after the outbreak of COVID-19, the overall connectedness has increased sharply, and gradually it was reduced. The results are in consensus with studies were done by Harjoto et al. [20], Chemka et al. [9], Disli et al. [12], Guo et al. [19] and Le et al. [26].

Dynamic volatility spillover in the quantile VAR (extreme low quantile Tau = 0.05). Note This Figure shows the rolling-window version of total volatility connectedness at the 5th quantile among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics & Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index

In Table 5, TCI is 81.8%, the most volatile quantile in time-varying connectedness. It means 18.2% of idiosyncratic shock received from others that are outside the system. The highest volatile funds are ARKF and FINX. The MSCI Emerging Markets Index contribute maximum to the volatilities of IRBO (15.7%) and BOTZ (15.7%) and least contributing to the volatilities of FINX (15.4%) and followed by ARKF (15.5%). However, the least contributing funds in the volatilities of the MSCI Emerging Markets Index are ARKF (81.3%), followed by BOTZ (81.4%) and then by FINX (82%). ARKF and FINX provide diversification opportunities consistently with MSCI Emerging Markets Index and some evidence captured with BOTZ. The results of diversification with tech-based assets are in consensus with Bouri et al. [7] and Hyunh et al. [21], and not with Jiang et al. [23] and, Le et al. [27]. The ARKF (-0.6) and BOTZ (− 0.6) are net receivers, whereas the rest are net transmitters. Among tech-based funds, the overall least contributing fund is ARKF (81.3%), followed by BOTZ (81.4%) and FINX (82%). The least volatilities receiver fund from the system are ARKF (81.8%), followed by FINX (81.9%), and then BOTZ (82%).

Figure 7 shows increased volatility during the post-outbreak of COVID-19. Before COVID-19, it ranges from 77 to 81%, whereas post-COVID-19 ranges from approx. 76–87.5%. The results throughout the average, low and high quantiles are consistent. The results are in agreement with the previous studies were done by Harjoto et al. [20], Chemka et al. [9], Disli et al. [12], Guo et al. [19] and Le et al. [26].

Dynamic volatility spillover in the quantile VAR (extreme high quantile Tau = 0.95). Note This Figure shows the rolling-window version of total volatility connectedness at the 95th quantile among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index

4.2.2 Network pairwise directional spillover in average, low, and high quantiles

After the discussion on dynamic connectedness, next, the network diagrams of pairwise directional spillover in Figs. 8, 9, and 10 in average, low, and high quantiles, respectively. Figure 8A portrays the network of volatility connectedness based on average quantile VAR. The results show that the MSCI Emerging Markets Index is connected with IRBO and ROBT, whereas less connected with ARKF, FINX, and BOTZ. However, in the volatility spillover based on lower quantiles VAR, the network connectedness with ARKF, and BOTZ are significant. Interestingly, the risk spillover in extreme high quantile where a strong network connectedness captured with IRBO, ROBT, and BOTZ and comparatively less connected with FINX.ARKF is the most resilient during high volatilities. Henceforth, ARKF is less connected throughout with MSCI Emerging Markets Index, followed by FINX and BOTZ. The results of diversification with tech-based assets are in consensus with Bouri et al. [7] and Hyunh et al. [21], and not with Jiang et al. [23] and Le et al. [27].

Volatility spillovers based on quantile VAR (Median Tau = 0.5): The network of volatility connectedness. Note The network volatility connectedness among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index based on quantile VAR (Median Tau = 0.5), quantile VAR (Low Tau = 0.05), and quantile VAR (High Tau = 0.95) respectively

Volatility spillovers based on quantile VAR (Low Tau = 0.05): The network of volatility connectedness. Note The network volatility connectedness among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics & Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index based on quantile VAR (Median Tau = 0.5), quantile VAR (Low Tau = 0.05), and quantile VAR (High Tau = 0.95) respectively

Volatility spillovers based on quantile VAR (High Tau = 0.95): the network of volatility connectedness. Note The network volatility connectedness among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics & Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index based on quantile VAR (Median Tau = 0.5), quantile VAR (Low Tau = 0.05), and quantile VAR (High Tau = 0.95) respectively

4.2.3 Volatility spillovers, connectedness, and TSI before and after the outbreak of COVID-19

Figures 11 and 12 captured the volatility spillovers based on average, lowest and highest quantile VAR and partial contemporaneous and partial directed correlations, respectively, subdivided into two samples pre-and post-outbreak of COVID-19. Figure 11 volatility spillovers in median quantile, during pre-outbreak of COVID-19, MSCI Emerging Markets Index is less connected with FINX and BOTZ and during post-outbreak of COVID-19, less connected with ARKF, FINX, and BOTZ. In the lowest quantile and during pre-COVID-19, MSCI Emerging Markets Index least connected with FINX only, and during post-outbreak of COVID-19, MSCI was less connected with ARKF, FINX, and BOTZ. In the extreme high quantile and pre-pandemic, the MSCI Emerging Markets Index is highly connected with ROBT and IRBO and less comparatively connected with ARK, BOTZ, and FINX. However, in extreme high quantile and post-outbreak of COVID-19, less connected with ARKF followed by FINX and BOTZ and directly connected with ROBT and IRBO. Thus, it has been concluded that ROBT and IRBO are not providing diversification with MSCI Emerging Markets Index in both pre-and post-outbreak of COVID-19. Whereas FINX is resilient, and ARKF has shown its resilience during extreme volatile quantiles. The results strengthen the previous results of diversification.

Volatility spillovers based on quantile VAR—sub-sample analysis. Note Segregated into two sub-windows i.e. pre-Outbreak of COVID-19 (11th March 2019 to 11th March 2020) and post-outbreak of COVID-19 (from 12th March 2020 to 11th March 2021) and shows the network volatility connectedness among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index based on quantile VAR (median Tau = 0.5), quantile VAR (Low Tau = 0.05), and quantile VAR (High Tau = 0.95) respectively

Plots of the partial contemporaneous and partial directed correlations—sub-sample analysis. Note Segregated into two sub-windows i.e. Pre-Outbreak of COVID-19 (11th March 2019 to 11th March 2020) and post-outbreak of COVID-19 (from 12th March 2020 to 11th March 2021), and shows the partial contemporaneous and partial directed correlations among ARK Fintech Innovation Exchange Traded Funds (ARKF), Global X Robotics and Artificial Intelligence (BOTZ), Global X FinTech Exchange Traded Funds (FINX), ishares Robotics, and Artificial Intelligence (IRBO), First Trust NASDAQ Artificial Intelligence and Robotics Exchange Traded Funds (ROBT), and MSCI Emerging Markets Index

Furthermore, Fig. 12 plots the partial contemporaneous and partial directed correlations during the pre and post-outbreak of COVID-19. Again, it strengthens the previous results, and we found that MSCI Emerging Market Index is least correlated with ARKF and FINX during pre and post-outbreak of COVID-19, and thus found the most resilient funds. Henceforth, the investors looking for emerging markets can put their funds in these two tech-based funds. The results of diversification with tech-based assets are in consensus with Bouri et al. [7] and Hyunh et al. [21], and not with Jiang et al. [23] and Le et al. [27].

5 Conclusion and policy implications

The study identifies the diversification opportunities in the era of the 4th Industrial revolution among Technology-based funds dedicated to Blockchain, FinTech, and AI during the pre-and post-outbreak of COVID-19. The study has innovated methodologically in the literature on diversification with Tech-based funds by employing Time-Varying Dynamic spillover using the VAR Model for average, low, and high volatilities quantiles and the volatility connectedness-based network on quantile VAR. The preliminary analysis captures a sharp decline in the prices of all asset classes due to the outbreak of COVID-19. However, the negative impact is strong and captured the quick recovery; the result is in consensus with the studies done by Harjoto et al. [20], Chemka et al. [9], Disli et al. [12], Guo et al. [19], and Le et al. [26]. We have found that technology-based funds are outperforming. In the results of unconditional correlation, we have captured the maximum correlation found with IRBO, followed by ROBT, then by BOTZ, and the low correlated assets are ARKF and FINX. The results of partial directed/causal correlations are found to have negative and significant causality from MSCI Emerging Markets Index to ARKF and mild negative causality to FINX. The results of time-varying dynamic spillover using the VAR Model for average, low, and high volatilities quantiles, explain that ARKF and FINX provide diversification opportunities. In each quantile, these two funds are suitable for diversification, and BOTZ is also showing diversification evidence. FINX is resilient throughout, and ARKF is the most resilient in extreme quantiles.

In all quantiles, it has been perceived that there is a significant impact of COVID-19 on the total connectedness of funds with MSCI Emerging Markets Index. The results of network pairwise directional spillover in average, low, and high quantiles have also strengthened the previous results that ARKF is the throughout less connected with MSCI Emerging Markets Index, followed by FINX and BOTZ. The results of diversification with tech-based assets are in consensus with Bouri et al. [7], and Hyunh et al. [21], and not with Jiang et al. [23] and Le et al. [27].

Finally, to capture the impact of COVID-19 and identify the most resilient fund pre- and post-outbreak of COVID-19, we found a sharp decline in the prices of all asset classes due to the outbreak of COVID-19. However, the negative impact was significant and further captured the recovery, this inference is in consensus with the results of Harjoto et al. [20], Chemka et al. [9], Disli et al. [12], Guo et al. [19], and Le et al. [26]. The results of volatility spillovers based on average, lowest, and highest quantile VAR, the ARKF is less connected with MSCI Emerging Markets Index, followed by FINX and BOTZ. The partial contemporaneous and partial directed correlations during the pre-and post-outbreak of COVID-19 again strengthen the previous results. We found that the MSCI Emerging Market Index is low correlated with ARKF and FINX during the pre-and post-outbreak of COVID-19.

We found diversification opportunities for investors investing in emerging markets with technology-based funds . We captured MSCI Emerging Markets Index is least correlated with ARKF and FINX during the pre- and post-outbreak of COVID-19, and thus found the most resilient funds. Henceforth the investors investing in emerging markets and looking to make their portfolio with tech funds can put their funds in these two tech-based funds.

The technology-based diversification opportunities provide significant implications to emerging market policymakers. The diversification opportunities with the tech funds offer a greater probability of investments that assist the infusion of capital that reinforces growth. Past studies support that capital markets are closely linked to economic growth. Henceforth, these diversification opportunities lead to increase in emerging markets. The policy decision to endorse or promote investments in technology-based funds would help to promote economic growth.

References

Ando, T., Greenwood-Nimmo, M., Shin, Y. (2018). Quantile connectedness: Modelling tail behavior in the topology of financial networks. Available at SSRN 3164772.

Agbo, C. C., Mahmoud, Q. H., & Eklund, J. M. (2019). Blockchain technology in healthcare: a systematic review. Healthcare, 7(2), 56.

Ahram, T., Sargolzaei, A., Sargolzaei, S., Daniels, J., & Amaba, B. (2017). Blockchain technology innovations. In 2017 IEEE technology & engineering management conference (TEMSCON) (pp. 137–141). IEEE.

Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2019). Sustainability, FinTech and Financial Inclusion.

Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and financial inclusion. European Business Organization Law Review, 21(1), 7–35.

Bouri, E., Cepni, O., Gabauer, D., & Gupta, R. (2021). Return connectedness across asset classes around the COVID-19 outbreak. International Review of Financial Analysis, 73, 101646.

Bouri, E., Shahzad, S. J. H., Roubaud, D., Kristoufek, L., & Lucey, B. (2020). Bitcoin, gold, and commodities as safe havens for stocks: New insight through wavelet analysis. The Quarterly Review of Economics and Finance, 77, 156–164.

Chakrabarti, P., Jawed, M. S., & Sarkhel, M. (2021). COVID-19 pandemic and global financial market interlinkages: A dynamic temporal network analysis. Applied economics, 53(25), 2930–2945.

Chemkha, R., BenSaïda, A., Ghorbel, A., & Tayachi, T. (2021). Hedge and safe haven properties during COVID-19: Evidence from Bitcoin and gold. The Quarterly Review of Economics and Finance. https://doi.org/10.1016/j.qref.2021.07.006

Chueca Vergara, C., & Ferruz Agudo, L. (2021). Fintech and Sustainability: Do They Affect Each Other? Sustainability, 13(13), 7012.

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of forecasting, 28(1), 57–66.

Disli, M., Nagayev, R., Salim, K., Rizkiah, S. K., & Aysan, A. F. (2021). In search of safe haven assets during COVID-19 pandemic: An empirical analysis of different investor types. Research in International Business and Finance, 58, 101461.

Efanov, D., & Roschin, P. (2018). The all-pervasiveness of the blockchain technology. Procedia Computer Science, 123, 116–121.

Elsayed, A. H., Nasreen, S., & Tiwari, A. K. (2020). Time-varying co-movements between energy market and global financial markets: Implication for portfolio diversification and hedging strategies. Energy Economics, 90, 104847.

Fountaine, T., McCarthy, B., & Saleh, T. (2019). Building the AI-powered organization. Harvard Business Review, 97(4), 62–73.

Furman, J., & Seamans, R. (2019). AI and the economy. Innovation Policy and the Economy, 19(1), 161–191.

Goodell, J. W., & Goutte, S. (2021). Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Finance Research Letters, 38, 101625.

Gronwald, M. (2019). Is Bitcoin a commodity? On price jumps, demand shocks, and certainty of supply. J. Int. Money Finance, 97(1), 86–92.

Guo, X., Lu, F., & Wei, Y. (2021). Capture the contagion network of bitcoin–Evidence from pre and mid COVID-19. Research in International Business and Finance, 58, 101484.

Harjoto, M. A., Rossi, F., Lee, R., & Sergi, B. S. (2021). How do equity markets react to COVID-19? Evidence from emerging and developed countries. Journal of Economics and Business, 115, 105966.

Huynh, T. L. D., Hille, E., & Nasir, M. A. (2020). Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technological Forecasting and Social Change, 159, 120188.

Jena, S. K., Tiwari, A. K., Hammoudeh, S., & Shahbaz, M. (2020). Dynamics of FII flows and stock market returns in a major developing country: How does economic uncertainty matter? The World Economy, 43(8), 2263–2284.

Jiang, Y., Lie, J., Wang, J., & Mu, J. (2021). Revisiting the roles of cryptocurrencies in stock markets: A quantile coherency perspective. Economic Modelling, 95, 21–34.

Kliber, A., Marszałek, P., Musiałkowska, I., & Świerczyńska, K. (2019). Bitcoin: Safe haven, hedge or diversifier? Perception of bitcoin in the context of a country’s economic situation—A stochastic volatility approach. Physica A: Statistical Mechanics and its Applications, 524, 246–257.

Koenker, R., & Ng, P. (2005). A Frisch-Newton algorithm for sparse quantile regression. Acta Mathematicae Applicatae Sinica, 21(2), 225–236.

Le, L. T. N., Yarovaya, L., & Nasir, M. A. (2021). Did COVID-19 change spillover patterns between Fintech and other asset classes? Research in International Business and Finance, 58, 101441.

Le, T. L., Abakah, E. J. A., & Tiwari, A. K. (2021). Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technological Forecasting and Social Change, 162, 120382.

Macchiavello, E.; Siri, M. (2020). Sustainable finance and fintech: Can technology contribute to achieving environmental goals? A preliminary assessment of ‘Green FinTech’. European Company and Financial Law Review, 71.

Mai, F., Bai, Q., Shan, Z., Wang, X., & Chiang, R. (2018). How does social media impact Bitcoin value? A test of the silent majority hypothesis. Journal of Management Information Systems, 35(1), 19–52.

McGhin, T., Choo, K. K. R., Liu, C. Z., & He, D. (2019). Blockchain in healthcare applications: Research challenges and opportunities. Journal of Network and Computer Applications, 135, 62–75.

Mostafa, M. Z. P., & Stavroyiannis, S. (2016). BRIC dynamic conditional correlations, portfolio diversification and rebalancing after the global financial crisis of 2008–2009. Global Business and Economics Review, 18(1), 28–40.

Nakamoto, S. 2008. A peer-to-peer electronic cash system. Unpublished manuscript, Available at https://bitcoin.org/bitcoin.pdf

Nguyen, Q. K. (2016). Blockchain-a financial technology for future sustainable development. In 2016 3rd International conference on green technology and sustainable development (GTSD) (pp. 51–54). IEEE.

Nguyen, Q. K., & Dang, Q. V. (2018). Blockchain technology-opportunities for emerging economies. In 2018 4th International Conference on Green Technology and Sustainable Development (GTSD) (pp. 478–482). IEEE.

Polyviou, A., Velanas, P., & Soldatos, J. (2019). Blockchain technology: Financial sector applications beyond cryptocurrencies. Multidisciplinary Digital Publishing Institute Proceedings, 28(1), 7.

Shahzad, S. J. H., Bouri, E., Roubaud, D., Kristoufek, L., & Lucey, B. (2019). Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis, 63, 322–330.

Sharma, G. D., Tiwari, A. K., Talan, G., & Jain, M. (2021). Revisiting the sustainable versus conventional investment dilemma in COVID-19 times. Energy Policy, 156, 112467.

Stensas, A., Nygaard, M. F., Kyaw, K., & Treepongkaruna, S. (2019). Can Bitcoin be a diversifier, hedge or safe haven tool? Cogent Economics and Finance, 7, 1593072.

Strusani, D., & Houngbonon, G. V. (2019). The role of artificial intelligence in supporting development in emerging markets.

Tiwari, A. K., Abakah, E. J. A., Le, T. L., & Leyva-de la Hiz, D. I. (2021). Markov-switching dependence between artificial intelligence and carbon price: The role of policy uncertainty in the era of the 4th industrial revolution and the effect of COVID-19 pandemic. Technological Forecasting and Social Change, 163, 120434.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sharma, S., Tiwari, A.K. & Nasreen, S. Are FinTech, Robotics, and Blockchain index funds providing diversification opportunities with emerging markets?Lessons from pre and postoutbreak of COVID-19. Electron Commer Res 24, 341–370 (2024). https://doi.org/10.1007/s10660-022-09611-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-022-09611-2