Abstract

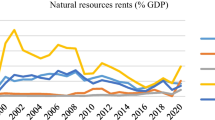

Promoting inclusive finance is crucial for governments worldwide to drive inclusive economic growth and development. This study investigates the relationship between natural resource rent and inclusive finance, considering the role of institutional quality. Using a comprehensive dataset spanning 109 countries from 1996 to 2020, our research unveils novel insights in the field of inclusive finance. The findings from our fixed-effect regression and two-stage least squares regression analysis reveal that natural resource rent has a significant negative impact on inclusive finance, supporting the resource curse theory. Moreover, we observe that the effect of natural resource rent on inclusive finance is contingent upon the level of institutional quality. Specifically, in the presence of robust institutions, there is a positive association between natural resource rent and inclusive finance. However, in weaker institutional context, the relationship becomes negative. These findings withstand a series of robustness tests, underscoring their reliability. These findings also have significant policy implications for stakeholders and policymakers involved in promoting inclusive finance in resource-rich economies.

Similar content being viewed by others

Notes

Natural resource stocks measure the net present value of natural resources under the ground, in constant 2014 US dollars. Data are available for every fifth year since 1995, and we use averaged per capita resource stock over the full period to maximize country coverage. The data are taken from World Bank’s Wealth Accounts database.

On the basis of WGI ranking.

References

Acemoglu D, Johnson S (2005) Unbundling institutions. J Polit Econ 113(5):949–995. https://doi.org/10.1086/432166

Adams P, Wang W (2016) Accounting for natural capital in productivity of the mining and oil and gas sector. Productivity and efficiency analysis. Springer, Cham

Ali A, Ramakrishnan S, Faisal F, Sulimany HG, Bazhair AH (2022) Stock market resource curse: the moderating role of institutional quality. Resour Policy 78:102929. https://doi.org/10.1016/j.resourpol.2022.102929

Asiamah O, Agyei SK, Bossman A, Agyei EA, Asucam J, Arku-Asare M (2022) Natural resource dependence and institutional quality: evidence from Sub-Saharan Africa. Resour Policy 79:102967. https://doi.org/10.1016/j.resourpol.2022.102967

Asif M, Khan KB, Anser MK, Nassani AA, Abro MMQ, Zaman K (2020) Dynamic interaction between financial development and natural resources: evaluating the ‘Resource curse’ hypothesis. Resour Policy 65:101566. https://doi.org/10.1016/j.resourpol.2019.101566

Asongu SA (2012) Government quality determinants of stock market performance in African countries. J Afr Bus 13(3):183–199. https://doi.org/10.1080/15228916.2012.727744

Auty R, Warhurst A (1993) Sustainable development in mineral exporting economies. Resour Policy 19(1):14–29. https://doi.org/10.1016/0301-4207(93)90049-S

Badeeb RA, Lean HH, Smyth R (2016) Oil curse and finance–growth nexus in Malaysia: the role of investment. Energy Econ 57:154–165. https://doi.org/10.1016/j.eneco.2016.04.020

Baloch MA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638

Beck T, Poelhekke S (2023) Follow the money: Does the financial sector intermediate natural resource windfalls? J Int Money Financ 130:102769. https://doi.org/10.1016/j.jimonfin.2022.102769

Beck T, Demirguc-Kunt A, Levine R (2004) Finance, inequality, and poverty: cross-country evidence. National Bureau of Economic Research Cambridge, USA

Beck T, Demirgüç-Kunt A, Levine R (2007) Finance, inequality and the poor. J Econ Growth 12(1):27–49. https://doi.org/10.1007/s10887-007-9010-6

Beck T, Demirgüç-Kunt A, Levine R (2010) Financial institutions and markets across countries and over time: the updated financial development and structure database. World Bank Econ Rev 24(1):77–92

Bems R, de Carvalho Filho I (2011) The current account and precautionary savings for exporters of exhaustible resources. J Int Econ 84(1):48–64. https://doi.org/10.1016/j.jinteco.2011.02.004

Bhattacharyya S, Hodler R (2010) Natural resources, democracy and corruption. Eur Econ Rev 54(4):608–621. https://doi.org/10.1016/j.euroecorev.2009.10.004

Bhattacharyya S, Hodler R (2014) Do natural resource revenues hinder financial development? the role of political institutions. World Dev 57:101–113. https://doi.org/10.1016/j.worlddev.2013.12.003

Brückner M, Ciccone A (2010) International commodity prices, growth and the outbreak of civil war in Sub-Saharan Africa. Econ J 120(544):519–534. https://doi.org/10.1111/j.1468-0297.2010.02353.x

Buchanan JM, Tollison RD, Tullock G (1980) Toward a theory of the rent-seeking society. Texas A & M University, College Station

Chambers D, Munemo J (2019) Natural resource dependency and entrepreneurship: Are nations with high resource rents cursed? J Int Dev 31(2):137–164. https://doi.org/10.1002/jid.3397

Collier P, Hoeffler A (2004) Greed and grievance in civil war. Oxf Econ Pap 56(4):563–595. https://doi.org/10.1093/oep/gpf064

Corrado G, Corrado L (2017) Inclusive finance for inclusive growth and development. Curr Opin Environ Sustain 24:19–23. https://doi.org/10.1016/j.cosust.2017.01.013

Deacon RT, Rode A (2015) Rent seeking and the resource curse. In: Companion to the political economy of rent seeking. Edward Elgar Publishing, Cheltenham, UK, pp 227–247

Dunning T (2005) Resource dependence, economic performance, and political stability. J Confl Resolut 49(4):451–482

Dwumfour RA, Ntow-Gyamfi M (2018) Natural resources, financial development and institutional quality in Africa: Is there a resource curse? Resour Policy 59:411–426. https://doi.org/10.1016/j.resourpol.2018.08.012

Ebeke C, Omgba LD, Laajaj R (2015) Oil, governance and the (mis)allocation of talent in developing countries. J Dev Econ 114:126–141. https://doi.org/10.1016/j.jdeveco.2014.12.004

Eregha PB, Mesagan EP (2016) Oil resource abundance, institutions and growth: evidence from oil producing African countries. J Policy Model 38(3):603–619. https://doi.org/10.1016/j.jpolmod.2016.03.013

Francois J, Manchin M (2006) Institutional quality, infrastructure, and the propensity to export. World Bank policy working paper, 4152. World Bank, Washington DC

Greene W (2005) Reconsidering heterogeneity in panel data estimators of the stochastic frontier model. J Econom 126(2):269–303. https://doi.org/10.1016/j.jeconom.2004.05.003

Grohmann A, Klühs T, Menkhoff L (2018) Does financial literacy improve financial inclusion? Cross country evidence. World Dev 111:84–96. https://doi.org/10.1016/j.worlddev.2018.06.020

Guan J, Kirikkaleli D, Bibi A, Zhang W (2020) Natural resources rents nexus with financial development in the presence of globalization: Is the “resource curse” exist or myth? Resour Policy 66:101641. https://doi.org/10.1016/j.resourpol.2020.101641

Gylfason T (2001) Natural resources, education, and economic development. Eur Econ Rev 45(4):847–859. https://doi.org/10.1016/S0014-2921(01)00127-1

Gylfason T, Zoega G (2006) Natural resources and economic growth: the role of investment. World Econ 29(8):1091–1115. https://doi.org/10.1111/j.1467-9701.2006.00807.x

Hajilee M, Niroomand F (2019) On the link between financial market inclusion and trade openness: an asymmetric analysis. Econ Anal Policy 62:373–381. https://doi.org/10.1016/j.eap.2018.10.001

Han J, Raghutla C, Chittedi KR, Tan Z, Koondhar MA (2022) How natural resources affect financial development? Fresh evidence from top-10 natural resource abundant countries. Resour Policy 76:102647. https://doi.org/10.1016/j.resourpol.2022.102647

Hussain M, Ye Z, Bashir A, Chaudhry NI, Zhao Y (2021) A nexus of natural resource rents, institutional quality, human capital, and financial development in resource-rich high-income economies. Resour Policy 74:102259. https://doi.org/10.1016/j.resourpol.2021.102259

Kara A, Zhou H, Zhou Y (2021) Achieving the United Nations’ sustainable development goals through financial inclusion: a systematic literature review of access to finance across the globe. Int Rev Financ Anal 77:101833. https://doi.org/10.1016/j.irfa.2021.101833

Kennedy P (2003) A guide to econometrics Cambridge. The MIT Press, Cambridge

Khan MA, Khan MA, Abdulahi ME, Liaqat I, Shah SSH (2019a) Institutional quality and financial development: the united states perspective. J Multinatl Financ Manag 49:67–80. https://doi.org/10.1016/j.mulfin.2019.01.001

Khan MA, Kong D, Xiang J, Zhang J (2019b) Impact of institutional quality on financial development: cross-country evidence based on emerging and growth-leading economies. Emerg Markets Financ Trade. https://doi.org/10.1080/1540496X.2019.1588725

Khan A, Chenggang Y, Hussain J, Bano S, Nawaz A (2020a) Natural resources, tourism development, and energy-growth-CO2 emission nexus: a simultaneity modeling analysis of BRI countries. Resour Policy 68:101751. https://doi.org/10.1016/j.resourpol.2020.101751

Khan MA, Gu L, Khan MA, Oláh J (2020b) Natural resources and financial development: the role of institutional quality. J Multinatl Financ Manag 56:100641. https://doi.org/10.1016/j.mulfin.2020.100641

Khan MA, Khan MA, Ali K, Popp J, Oláh J (2020c) Natural resource rent and finance: the moderation role of institutions. Sustainability 12(9):3897. https://doi.org/10.3390/su12093897

Khan MA, Khan MA, Ali K, Popp J, Oláh J (2020d) Natural resource rent and finance: the moderation role of institutions. Sustainability 12(9):3897

Khan MA, Gu L, Khan MA, Bhatti MI (2022) Institutional perspective of financial sector development: a multidimensional assessment. Econ Syst 46(4):101041. https://doi.org/10.1016/j.ecosys.2022.101041

Khan MA, Khan MA, Khan MA, Alhumoudi H, Haddad H (2023) Natural resource rents and access to finance. J Multinatl Financ Manag. https://doi.org/10.1016/j.mulfin.2023.100821

Kinda T, Mlachila M, Ouedraogo R (2018) Do commodity price shocks weaken the financial sector? World Econ 41(11):3001–3044. https://doi.org/10.1111/twec.12667

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Financ 52(3):1131–1150. https://doi.org/10.1111/j.1540-6261.1997.tb02727.x

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1998a) Law and Finance. J Polit Econ 106(6):1113–1155. https://doi.org/10.1086/250042

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1999) The quality of government. J Law Econ Organ 15(1):222–279. https://doi.org/10.1093/jleo/15.1.222

Lashitew AA, Werker E (2020) Do natural resources help or hinder development? Resource abundance, dependence, and the role of institutions. Resour Energy Econ 61:101183. https://doi.org/10.1016/j.reseneeco.2020.101183

Li Z, Rizvi SKA, Rubbaniy G, Umar M (2021) Understanding the dynamics of resource curse in G7 countries: the role of natural resource rents and the three facets of financial development. Resour Policy 73:102141. https://doi.org/10.1016/j.resourpol.2021.102141

Lu W, Niu G, Zhou Y (2021) Individualism and financial inclusion. J Econ Behav Organ 183:268–288. https://doi.org/10.1016/j.jebo.2021.01.008

Majbouri M (2016) Oil and entrepreneurship. Energy Policy 94:10–15. https://doi.org/10.1016/j.enpol.2016.03.027

McKillop D, Wilson J (2007) Financial exclusion. Publ Money Manag 27(1):9–12

Mlachila M, Ouedraogo R (2020) Financial development curse in resource-rich countries: The role of commodity price shocks. Q Rev Econ Financ 76:84–96. https://doi.org/10.1016/j.qref.2019.04.011

Mousavi A, Clark J (2021) The effects of natural resources on human capital accumulation: a literature survey. J Econ Surv 35(4):1073–1117. https://doi.org/10.1111/joes.12441

Murphy KM, Shleifer A, Vishny RW (1993) Why is rent-seeking so costly to growth? Am Econ Rev 83(2):409–414

Sachs JD, Warner AM (2001) The curse of natural resources. Eur Econ Rev 45(4):827–838. https://doi.org/10.1016/S0014-2921(01)00125-8

Sharma C, Paramati SR (2022) Resource curse versus resource blessing: new evidence from resource capital data. Energy Econ 115:106350. https://doi.org/10.1016/j.eneco.2022.106350

Stulz RM, Williamson R (2003) Culture, openness, and finance. J Financ Econ 70(3):313–349. https://doi.org/10.1016/S0304-405X(03)00173-9

Sugawara N (2014) From volatility to stability in expenditure: Stabilization funds in resource-rich countries. IMF Working Papers 2014(043). https://doi.org/10.5089/9781475515275.001

Sun Y, Ak A, Serener B, Xiong D (2020) Natural resource abundance and financial development: a case study of emerging seven (E−7) economies. Resour Policy 67:101660. https://doi.org/10.1016/j.resourpol.2020.101660

Svirydzenka K (2016) Introducing a new broad-based index of financial development. IMF Working Papers 2016(005). https://doi.org/10.5089/9781513583709.001

Tang C, Irfan M, Razzaq A, Dagar V (2022) Natural resources and financial development: role of business regulations in testing the resource-curse hypothesis in ASEAN countries. Resour Policy 76:102612. https://doi.org/10.1016/j.resourpol.2022.102612

Tollison RD (2012) The economic theory of rent seeking. Publ Choice 152(1):73–82. https://doi.org/10.1007/s11127-011-9852-5

Torvik R (2002) Natural resources, rent seeking and welfare. J Dev Econ 67(2):455–470. https://doi.org/10.1016/S0304-3878(01)00195-X

van der Ploeg F (2010) Why do many resource-rich countries have negative genuine saving?: anticipation of better times or rapacious rent seeking. Resour Energy Econ 32(1):28–44. https://doi.org/10.1016/j.reseneeco.2009.07.002

Zeqiraj V, Sohag K, Hammoudeh S (2022) Financial inclusion in developing countries: Do quality institutions matter? J Int Financ Markets Inst Money 81:101677. https://doi.org/10.1016/j.intfin.2022.101677

Funding

This research was supported by 2022 Scientific Research Capacity Improvement Project of Key Construction Subject of Department of Education of Guangdong Province (Fund no. 2022ZDJS37).

Author information

Authors and Affiliations

Contributions

JY contributed to conception and design of the study. JY and XL organized the database, performed the statistical analysis, and wrote the first draft of the manuscript. JY and XL wrote various sections of the manuscript. XL received the funding. NZ was responsible for the supervision. All authors who contributed to the manuscript approved the submitted version.

Corresponding author

Ethics declarations

Conflict of interest

Authors have no other know competing financial or non-financial interests that could influence the work reported in this paper.

Ethical approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, X., Yang, J. & Zeng, N. Natural resource rent and inclusive finance: an institutional perspective. Econ Change Restruct 57, 45 (2024). https://doi.org/10.1007/s10644-024-09593-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09593-1