Abstract

Ongoing fiscal support is a crucial assurance for achieving green development, while the increasingly prominent fiscal expenditure stress has been subjected to a great challenge in achieving green transformation. Based on China’s education authority reform as a quasi-natural experiment, this study uses green total factor productivity to represent urban green development, which has been widely used in the literature, and reveals how local government fiscal expenditure stress affects green total factor productivity. It is found that local fiscal stress significantly decreases the green total factor productivity of cities. This effect is particularly pronounced for resource-based cities, cities with laxer environmental regulations, and cities under greater pressure to promote and develop their economies. Moreover, it is confirmed that it is not the revenue-raising effect but rather the expenditure reduction effect that is at play. Specifically, local governments have reduced environmental protection expenditures and green subsidies, leading to a decline in the green innovation capacity of cities and corporations. Finally, based on the above findings, policy implications are provided to reduce the risk of green transformation from the perspective of policymakers.

Similar content being viewed by others

Notes

Data source: The World Bank. Available at https://data.worldbank.org.cn/indicator/NY.GDP.MKTP.KD.ZG.

Data source: The World Bank. Available at https://data.worldbank.org.cn/indicator/EN.ATM.CO2E.KT.

Data source: China National Bureau of Statistics. The results are calculated by the authors.

The calculation of GTFP requires that there are no missing values for the input and output data for each city. Therefore, we had to exclude those cities with missing values.

We also examine the relationship between education expenditure and GTFP in Appendix B.

In fact, this policy was proposed by the central government in July 2010. For a local government, its budgeted expenditures have already been prepared in the previous year (2009), and there is little possibility for the local government to immediately change the scale and structure of its fiscal expenditures in the current year.

The ML index has the following advantages over parametric methods: first, it does not need to give the specific statistical distribution of decision-making units (DMUs). Second, it can handle small sample data and categorical variables. Third, it does not need to introduce time trends into the data analysis and can thus avoid the phenomenon of smoothing productivity changes that is inherent in most parametric methods.

Following Young (2003), the fixed assets stock of the first period is estimated to be 10 times the fixed asset investment in 2007. The calculations are as follows:

$${K}_{2007}={I}_{2007}*10$$$${K}_{t+1}={K}_{t}*(1-\theta )+{I}_{t+1}$$Specifically, \({K}_{2007}\) is the fixed capital stock in the base year, 2007; \({I}_{2007}\) is the total fixed assets investment of the whole city in 2007; \({K}_{t+1}\) and \({K}_{t}\) are the fixed capital stock in year t + 1 and t;\(\theta\) is the depreciation rate; and \({I}_{t+1}\) is the total fixed assets investment of the whole city in year t + 1.

GDP per capita pressures = GDP per capita of prefecture-level cities ranked one place ahead in the same province/GDP per capita of this prefecture-level city; similarly, fixed asset investment pressures = fixed asset investment of prefecture-level cities ranked one place ahead in the same province/fixed asset investment of this prefecture-level city.

We do so because local governments do not know where their city ranks this year in terms of economic development compared to other cities in the province, and local governments’ behavior in the current year is heavily influenced by the previous year’s economic development pressures. This approach of lagging one period can avoid the effects of endogeneity and yield a reasonable result.

Firm-level control variables include firm size, leverage, cash ratio, city GDP, and city fiscal expenditure size. Specifically, firm size is measured by the logarithm of total assets, leverage is measured by the ratio of total liabilities to total assets, cash ratio is measured by the ratio of total liabilities to total assets, city GDP is measured by the logarithm of GDP and city fiscal expenditure size is measured by the logarithm of fiscal expenditure.

The pilot area includes the provinces of Guangdong, Liaoning, Hubei, Shaanxi and Yunnan and the cities of Tianjin, Chongqing, Shenzhen, Xiamen, Hangzhou, Nanchang, Guiyang and Baoding.

References

Aghion P, Dechezleprêtre A, Hemous D, Martin R, Van Reenen J (2016) Carbon taxes, path dependency, and directed technical change: evidence from the auto industry. J Polit Econ 124(1):1–51. https://doi.org/10.1086/684581

Ahmed Z, Asghar MM, Malik MN, Nawaz K (2020) Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour Policy 67:101677. https://doi.org/10.1016/j.resourpol.2020.101677

Aldag AM, Warner ME, Kim Y (2017) What causes local fiscal stress? What can be done about it. Department of City and Regional Planning, Cornell University Ithaca, NY

Aldag AM, Kim Y, Warner ME (2019) Austerity urbanism or pragmatic municipalism? Local government responses to fiscal stress in New York State. Environ Plan a: Econ Space 51(6):1287–1305. https://doi.org/10.1177/0308518X19844794

Almeida H, Hsu PH, Li D (2013) Less is more: Financial constraints and innovative efficiency. Available at SSRN 1831786. https://doi.org/10.2139/ssrn.1831786

Arjomandi A, Gholipour HF, Tajaddini R, Harvie C (2022) Environmental expenditure, policy stringency and green economic growth: evidence from OECD countries. Appl Econ. https://doi.org/10.1080/00036846.2022.2094883

Asghari M (2013) Does FDI promote MENA region’s environment quality? Pollution halo or pollution haven hypothesis. Int J Sci Res Environ Sci 1(6):92–100

Bai J, Lu J, Li S (2019) Fiscal pressure, tax competition and environmental pollution. Environ Resource Econ 73(2):431–447. https://doi.org/10.1007/s10640-018-0269-1

Bargain O, Aminjonov U (2020) Trust and compliance to public health policies in times of COVID-19. J Public Econ 192:104316. https://doi.org/10.1016/j.jpubeco.2020.104316

Bekun FV (2022) Mitigating emissions in India: accounting for the role of real income, renewable energy consumption and investment in energy. Int J Energy Econ Policy 12(1):188–192. https://doi.org/10.32479/ijeep.12652

Bloch C (2005) R&D investment and internal finance: The cash flow effect. Econ Innov New Technol 14(3):213–223. https://doi.org/10.1080/1043859042000312710

Borsatto JMLS, Amui LBL (2019) Green innovation: unfolding the relation with environmental regulations and competitiveness. Resour Conserv Recycl 149:445–454. https://doi.org/10.1016/j.resconrec.2019.06.005

Borsatto JMLS, Bazani CL (2021) Green innovation and environmental regulations: a systematic review of international academic works. Environ Sci Pollut Res 28(45):63751–63768. https://doi.org/10.1007/s11356-020-11379-7

Breitung J, Das S (2005) Panel unit root tests under cross-sectional dependence. Stat Neerl 59(4):414–433. https://doi.org/10.1111/j.1467-9574.2005.00299.x

Brown JR, Martinsson G, Petersen BC (2012) Do financing constraints matter for R&D? Eur Econ Rev 56(8):1512–1529. https://doi.org/10.1016/j.euroecorev.2012.07.007

Burns JP, Wang XQ (2010) Civil service reform in China: impacts on civil servants’ behaviour. China Q 201:58–78. https://doi.org/10.1017/S030574100999107X

Cai G, Zhang X, Yang H (2022) Fiscal stress and the formation of zombie firms: evidence from China. China Econ Rev 71:101720. https://doi.org/10.1016/j.chieco.2021.101720

Catalano M, Forni L (2021) Fiscal policies for a sustainable recovery and a green transformation. Policy research working paper; no. 9799. World Bank, Washington

Chai J, Hao Y, Wu H, Yang Y (2021) Do constraints created by economic growth targets benefit sustainable development? Evidence from China. Bus Strateg Environ 30(8):4188–4205. https://doi.org/10.1002/bse.2864

Chen SX (2017) The effect of a fiscal squeeze on tax enforcement: evidence from a natural experiment in China. J Public Econ 147:62–76. https://doi.org/10.1016/j.jpubeco.2017.01.001

Chen Z, Kahn ME, Liu Y, Wang Z (2018) The consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485. https://doi.org/10.1016/j.jeem.2018.01.010

Darvas Z, Wolff GB (2022) How to reconcile increased green public investment needs with fiscal consolidation. Bruegel-Blogs

Du K, Li P, Yan Z (2019) Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol Forecast Soc Chang 146:297–303. https://doi.org/10.1016/j.techfore.2019.06.010

Elheddad M, Djellouli N, Tiwari AK, Hammoudeh S (2020) The relationship between energy consumption and fiscal decentralization and the importance of urbanization: evidence from Chinese provinces. J Environ Manage 264:110474. https://doi.org/10.1016/j.jenvman.2020.110474

Gray M, Barford A (2018) The depths of the cuts: the uneven geography of local government austerity. Camb J Reg Econ Soc 11(3):541–563. https://doi.org/10.1093/cjres/rsy019

Han L, Kung JKS (2015) Fiscal incentives and policy choices of local governments: evidence from China. J Dev Econ 116:89–104. https://doi.org/10.1016/j.jdeveco.2015.04.003

Hoopes JL, Mescall D, Pittman JA (2012) Do IRS audits deter corporate tax avoidance? Acc Rev 87(5):1603–1639. https://doi.org/10.2308/accr-50187

Huang Z, Liao G, Li Z (2019) Loaning scale and government subsidy for promoting green innovation. Technol Forecast Soc Chang 144:148–156. https://doi.org/10.1016/j.techfore.2019.04.023

Hui C, Shen F, Tong L, Zhang J, Liu B (2022) Fiscal pressure and air pollution in resource-dependent cities: evidence from China. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.908490

Innes D, Tetlow G (2015) Delivering fiscal squeeze by cutting local government spending. Fisc Stud 36(3):303–325. https://doi.org/10.1111/j.1475-5890.2015.12056

Jiang SS, Li JM (2021) Do political promotion incentive and fiscal incentive of local governments matter for the marine environmental pollution? Evidence from China’s coastal areas. Mar Policy 128:104505. https://doi.org/10.1016/j.marpol.2021.104505

Kassouri Y (2022) Fiscal decentralization and public budgets for energy RD&D: a race to the bottom? Energy Policy 161:112761. https://doi.org/10.1016/j.enpol.2021.112761

Katengeza SP, Holden ST (2021) Productivity impact of drought tolerant maize varieties under rainfall stress in Malawi: a continuous treatment approach. Agric Econ 52(1):157–171. https://doi.org/10.1111/agec.12612

Kim Y (2019) Limits of property taxes and charges: city revenue structures after the great recession. Urban Aff Rev 55(1):185–209. https://doi.org/10.1177/1078087417697199

Kim Y, Warner ME (2021) Pragmatic municipalism or austerity urbanism? Understanding local government responses to fiscal stress. Local Gov Stud 47(2):234–252. https://doi.org/10.1080/03003930.2020.1729751

Kim Y, Aldag AM, Warner ME (2020) A balanced view: us local government managers’ perceptions of fiscal stress. Public Adm Q 44(2):172–200. https://doi.org/10.37808/paq.44.2.2

Kong D, Zhu L (2022) Governments’ fiscal squeeze and firms’ pollution emissions: evidence from a natural experiment in China. Environ Resource Econ 81(4):833–866. https://doi.org/10.1007/s10640-022-00656-3

Kuai P, Yang S, Tao A, Khan ZD (2019) Environmental effects of Chinese-style fiscal decentralization and the sustainability implications. J Clean Prod 239:118089. https://doi.org/10.1016/j.jclepro.2019.118089

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evidence from China. Energy Econ 107:105863. https://doi.org/10.1016/j.eneco.2022.105863

Li T, Du T (2021) Vertical fiscal imbalance, transfer payments, and fiscal sustainability of local governments in China. Int Rev Econ Financ 74:392–404. https://doi.org/10.1016/j.iref.2021.03.019

Li P, Ouyang Y (2020) Technical change and green productivity. Environ Resour Econ 76(2):271–298. https://doi.org/10.1007/s10640-020-00424-1

Li H, Zhou LA (2005) Political turnover and economic performance: the incentive role of personnel control in China. J Public Econ 89(9–10):1743–1762. https://doi.org/10.1016/j.jpubeco.2004.06.009

Li L, Liu KZ, Nie Z, Xi T (2021) Evading by any means? VAT enforcement and payroll tax evasion in China. J Econ Behav Organ 185:770–784. https://doi.org/10.1016/j.jebo.2020.10.012

Li C, Qi Y, Liu S, Wang X (2022) Do carbon ETS pilots improve cities’ green total factor productivity? Evidence from a quasi-natural experiment in China. Energy Econ 108:105931. https://doi.org/10.1016/j.eneco.2022.105931

Lin B, Zhu J (2020) Policy effect of the Clean Air Action on green development in Chinese cities. J Environ Manage 258:110036. https://doi.org/10.1016/j.jenvman.2019.110036

Liu Y, Alm J (2016) “Province-Managing-County” fiscal reform, land expansion, and urban growth in China. J Hous Econ 33:82–100. https://doi.org/10.1016/j.jhe.2016.05.002

Liu Y, Mao J (2019) How do tax incentives affect investment and productivity? Firm-level evidence from China. Am Econ J Econ Pol 11(3):261–291. https://doi.org/10.1257/pol.20170478

Liu Y, Yang Y, Li H, Zhong K (2022) Digital economy development, industrial structure upgrading and green total factor productivity: empirical evidence from China’s cities. Int J Environ Res Public Health 19(4):2414. https://doi.org/10.3390/ijerph19042414

Makowsky MD, Stratmann T, Tabarrok A (2019) To serve and collect: the fiscal and racial determinants of law enforcement. J Leg Stud 48(1):189–216. https://doi.org/10.1086/700589

Männasoo K, Hein H, Ruubel R (2018) The contributions of human capital, R&D spending and convergence to total factor productivity growth. Reg Stud 52(12):1598–1611. https://doi.org/10.1080/00343404.2018.1445848

Martínez-Zarzoso I, Bengochea-Morancho A, Morales-Lage R (2019) Does environmental policy stringency foster innovation and productivity in OECD countries? Energy Policy 134:110982. https://doi.org/10.1016/j.enpol.2019.110982

Meng H, Huang X, Yang H, Chen Z, Yang J, Zhou Y, Li J (2019) The influence of local officials’ promotion incentives on carbon emission in Yangtze River Delta, China. J Clean Prod 213:1337–1345. https://doi.org/10.1016/j.jclepro.2018.12.036

Neves SA, Marques AC, Patrício M (2020) Determinants of CO2 emissions in European Union countries: Does environmental regulation reduce environmental pollution? Econ Anal Policy 68:114–125. https://doi.org/10.1016/j.eap.2020.09.005

Nicolas JP, Bouvard A, Million F, Homocianu M, Toillier F, Zucarello P (2008) La localisation des activités économiques au sein de l’Aire Urbaine de Lyon. Rapport technique 6, Laboratoire d’Economie des Transports

Nunn N, Qian N (2011) The potato’s contribution to population and urbanization: evidence from a historical experiment. Q J Econ 126(2):593–650. https://doi.org/10.1093/qje/qjr009

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83(4):727–731. https://doi.org/10.1162/003465301753237803

Peng F, Peng L, Mao J, Lu P (2021) The short-run effect of a local fiscal squeeze on pollution abatement expenditures: evidence from China’s VAT pilot program. Environ Resour Econ 78(3):453–485. https://doi.org/10.1007/s10640-021-00539-z

Pesaran MH (2004) General diagonist tests for cross section dependence in panels. Mimeo, University of Cambridge

Pirgmaier E (2017) The neoclassical Trojan horse of steady-state economics. Ecol Econ 133:52–61. https://doi.org/10.1016/j.ecolecon.2016.11.010

Qi Y, Zhang J, Chen J (2023) Tax incentives, environmental regulation and firms’ emission reduction strategies: evidence from China. J Environ Econ Manag 117:102750. https://doi.org/10.1016/j.jeem.2022.102750

Qian N (2008) Missing women and the price of tea in China: the effect of sex-specific earnings on sex imbalance. Q J Econ 123(3):1251–1285. https://doi.org/10.1162/qjec.2008.123.3.1251

Qian X, Wang D, Wang J, Chen S (2021) Resource curse, environmental regulation and transformation of coal-mining cities in China. Resour Policy 74:101447. https://doi.org/10.1016/j.resourpol.2019.101447

Qiu S, Wang Z, Geng S (2021) How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J Environ Manage 287:112282. https://doi.org/10.1016/j.jenvman.2021.112282

Rahman MM, Nepal R, Alam K (2021) Impacts of human capital, exports, economic growth andenergy consumption on CO2 emissions of a cross-sectionally dependent panel: evidence from the newly industrialized countries (NICs). Environ Sci Policy 121:24–36. https://doi.org/10.1016/j.envsci.2021.03.017

Raihan A, Pavel MI, Muhtasim DA, Farhana S, Faruk O, Paul A (2023) The role of renewable energy use, technological innovation, and forest cover toward green development: evidence from Indonesia. Innov Green Dev 2(1):100035. https://doi.org/10.1016/j.igd.2023.100035

Rath BN, Akram V, Bal DP, Mahalik MK (2019) Do fossil fuel and renewable energy consumption affect total factor productivity growth? Evidence from cross-country data with policy insights. Energy Policy 127:186–199. https://doi.org/10.1016/j.enpol.2018.12.014

Ren S, Hao Y, Wu H (2022) How does green investment affect environmental pollution? Evidence from China. Environ Resource Econ 81(1):25–51. https://doi.org/10.1007/s10640-021-00615-4

Safi F, Ben Hassen L (2017) Private health expenditures and environmental quality. Economics 11(1):20170003. https://doi.org/10.5018/economics-ejournal.ja.2017-3

Skidmore M, Scorsone E (2011) Causes and consequences of fiscal stress in Michigan cities. Reg Sci Urban Econ 41(4):360–371. https://doi.org/10.1016/j.regsciurbeco.2011.02.007

Song M, Du J, Tan KH (2018) Impact of fiscal decentralization on green total factor productivity. Int J Prod Econ 205:359–367. https://doi.org/10.1016/j.ijpe.2018.09.019

Wang R, Zhang Q (2017) Local governments’ fiscal pressure and the dependence on polluting industries in China. Chin World Econ 25(4):109–130. https://doi.org/10.1111/cwe.12209

Wang H, Cui H, Zhao Q (2021a) Effect of green technology innovation on green total factor productivity in China: evidence from spatial durbin model analysis. J Clean Prod 288:125624. https://doi.org/10.1016/j.jclepro.2020.125624

Wang M, Xu M, Ma S (2021b) The effect of the spatial heterogeneity of human capital structure on regional green total factor productivity. Struct Chang Econ Dyn 59:427–441. https://doi.org/10.1016/j.strueco.2021.09.018

Wang J, Wang W, Ran Q, Irfan M, Ren S, Yang X et al (2022) Analysis of the mechanism of the impact of internet development on green economic growth: evidence from 269 prefecture cities in China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16381-1

Warner ME, Aldag AM, Kim Y (2021) Pragmatic municipalism: US local government responses to fiscal stress. Public Adm Rev 81(3):389–398. https://doi.org/10.1111/puar.13196

Xiao C (2020) Intergovernmental revenue relations, tax enforcement and tax shifting: evidence from China. Int Tax Public Financ 27(1):128–152. https://doi.org/10.1007/s10797-019-09546-9

Xie RH, Yuan YJ, Huang JJ (2017) Different types of environmental regulations and heterogeneous influence on “green” productivity: evidence from China. Ecol Econ 132:104–112. https://doi.org/10.1016/j.ecolecon.2016.10.019

Xie R, Fu W, Yao S, Zhang Q (2021) Effects of financial agglomeration on green total factor productivity in Chinese cities: insights from an empirical spatial Durbin model. Energy Econ 101:105449. https://doi.org/10.1016/j.eneco.2021.105449

You D, Zhang Y, Yuan B (2019) Environmental regulation and firm eco-innovation: evidence of moderating effects of fiscal decentralization and political competition from listed Chinese industrial companies. J Clean Prod 207:1072–1083. https://doi.org/10.1016/j.jclepro.2018.10.106

Zhuo C, Xie Y, Mao Y, Chen P, Li Y (2022) Can cross-regional environmental protection promote urban green development: zero-sum game or win-win choice? Energy Econ 106:105803. https://doi.org/10.1016/j.eneco.2021.105803

Acknowledgements

We acknowledge the financial support from the National Social Science Foundation of China (Grant No. 18ZDA064), National Natural Science Foundation of China (Grant Nos. 72273038, 72271080, 71803035 and 71801068), and the Fundamental Research Funds for the Central Universities of China (#JZ2021HGTB0067).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest exists in the submission of this manuscript, and manuscript is approved by all authors for publication. I would like to declare on behalf of my co-authors that the work described was original research that has not been published previously, and not under consideration for publication elsewhere, in whole or in part. All the authors listed have approved the manuscript that is enclosed. There are no financial conflicts of interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Specifically, the ML productivity index is based on the directional distance function denoted by \(\vec{D}\left( {L,K,E,Y,CO2} \right) = sup\left\{ {\beta :\left( {\left( {L,K,E,Y,CO2} \right) + g \cdot \beta } \right) \in T} \right\}\). T is the production technology, and g is the vector of direction. In this study, we set \(g = \left( {Y, - CO2} \right)\), which means desirable output is pursued to increase and undesirable output is pursued to decrease. The output-oriented Malmquist–Luenberger (ML) productivity index is as follows:

Specifically, and respectively denote the inputs, desirable output as well as undesirable output in adjacent periods t and t + 1. means the efficiency increases, and means the efficiency decreases. The Malmquist–Luenberger productivity index can be decomposed into two components, and, measure the efficiency change and technology change, respectively.

Appendix B

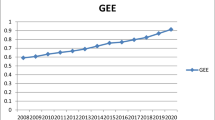

We examine the relationship between education expenditure and GTFP and the result is shown in Fig.

5. Figure 5 shows GTFP is negatively associated with the ratio of education expenditure to fiscal expenditure, indicating that cities have lower levels of green development when local government spend more on education. What’s more, we also examine the relationship between the scale of environmental expenditures and GTFP in Fig.

6, finding that a larger scale of environmental expenditures is beneficial to urban green transformation. Our explanation of the results in Figs. 5 and 6 is shown below.

First of all, according to the theoretical logic of this paper, the increase of education expenditure target has caused a steep increase of fiscal expenditure pressure in the short term, and in order to cope with the increase of education expenditure, under the condition of limited “open source” of fiscal revenue, “cutting down” of fiscal expenditure and adjusting the structure of fiscal expenditure will be important channels. This paper finds that education expenditure is negatively correlated with GTFP and environmental expenditure is positively correlated with GTFP. The logic is that in order to cope with the pressure of education expenditure, local governments may reduce environmental protection expenditure, thus reducing GTFP.

Second, our results do not imply that we deny that human capital promotes GTFP. We would like to declare that the role of human capital in promoting GTFP is not equivalent to the role of education expenditure. On the one hand, it takes a long time for education investment to promote human capital upgrading, and the short-term growth of education expenditure, which is the focus of this paper, can hardly play a long-term role in human capital upgrading, and thus can hardly provide human capital support for GTFP enhancement. According to Ahmed et al. (2020), there is a strong correlation between human capital and sustainable development over a sizable period of time (1970–2016).

Third, China, as a developing country, has a bias in educational investment toward primary education rather than higher education. Wang et al. (2023) find that not all human capital contributes to GTFP, only higher education human capital contributes to GTFP, and primary education human capital even reduces GTFP. The National Medium- and The National Medium- and Long-Term Education Reform and Development Plan (2010–2020) stipulates that compulsory education is fully included in the scope of financial protection, and local governments at all levels are responsible for its implementation. Higher education implements a mechanism to raise funds mainly by the organizers' input, the recipients' reasonable share of training costs, and the schools' establishment of funds to accept social donations. In other words, the growth target of education expenditure of local governments reflects more the requirement for the growth of primary education investment, thus finding a negative correlation between education expenditure and GTFP growth. And it should be emphasized that this paper focuses on the relationship between education expenditures pressure and GTFP rather than the relationship between education expenditures and GTFP.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Peng, F., Zhou, S., Ding, T. et al. Impact of fiscal expenditure stress on green transformation risk: evidence from China education authority reform. Econ Change Restruct 56, 4565–4601 (2023). https://doi.org/10.1007/s10644-023-09567-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09567-9